Illinois

UNDERWRITING/RATES

12 This information applies for plan effective dates of April 1, 2013 - December 1, 2013

Underwriting and Rate Information

2013 New Sales in Illinois

The following section applies to Illinois. Rates and Underwriting vary by state. Please refer to the appropriate state-

specific handbook for information specific to a beneficiary’s residence state.

Medicare Beneficiaries Age 65 and Older

Underwriting and Rate Summary

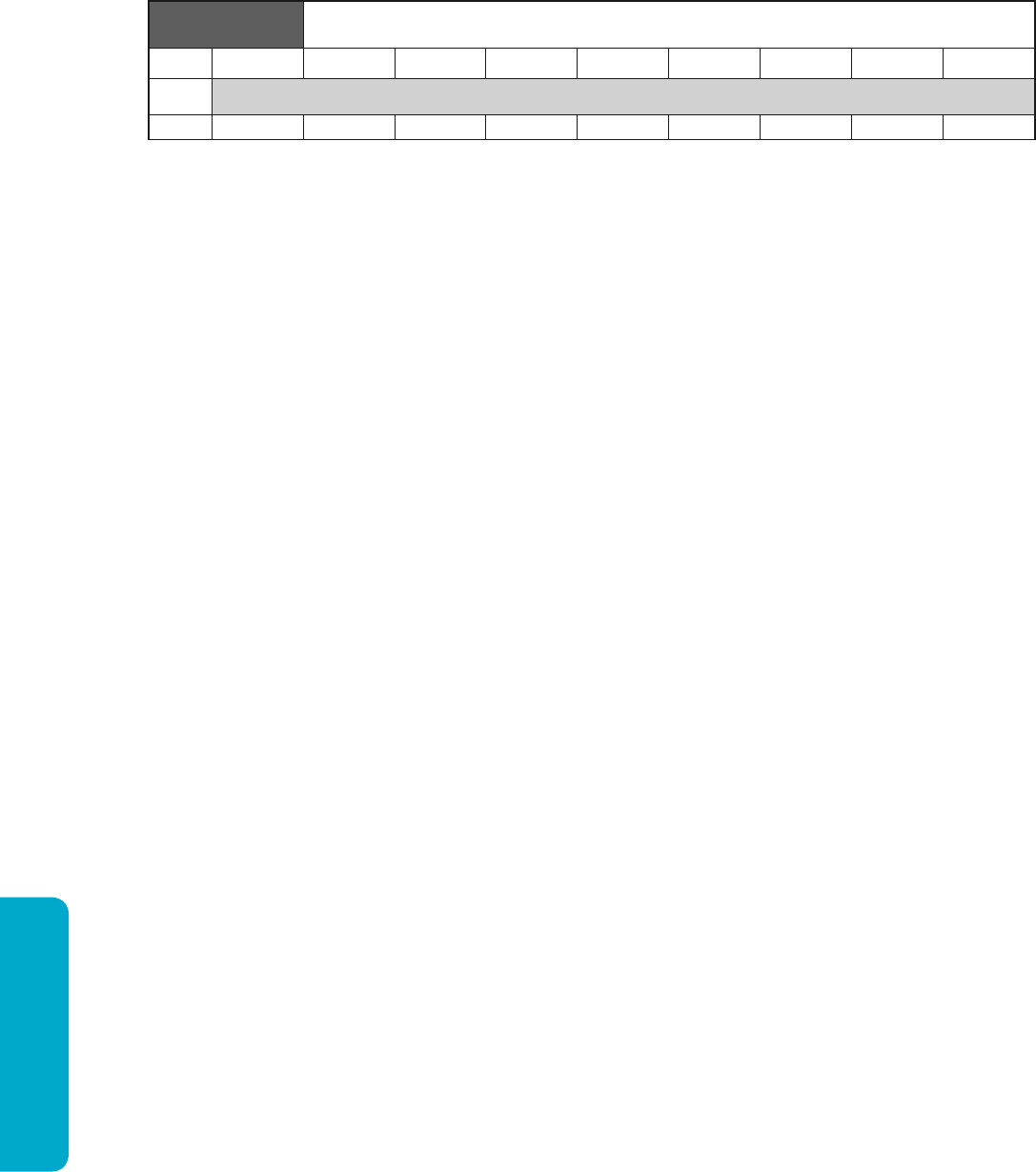

Underwriting requirements and rates for the AARP Medicare Supplement Insurance Plans vary based on the time

that has elapsed from the applicant’s 65th birthday or Medicare Part B effective date, if it is later. The following

chart provides a summary of the underwriting requirements and applicable rates:

Time since 65th birthday or Medicare Part B Effective Date, if later

0 to < 7 months 7 months to < 3 years 3 years to < 6 years 6 years or more

Underwriting

1

No Underwriting

Open Enrollment Period

Eligibility Underwriting

2

Eligibility Underwriting

2

Underwriting to set rates

3

Rate

4

Standard Rate with Enrollment Discount

5

Standard Rate with

Enrollment Discount

5,6

Level 1 Rate

6

Level 2 Rate

7

Level 2 Rate

7

Rate Group

(see Appendix III)

Group 1 Group 2 Group 3

1

Does not apply to applicants who meet guaranteed issue requirements.

2

Applicants must answer the two eligibility questions in Section 5 on the application. Applicants who answer “yes”

to either question are not eligible for coverage.

3

Applicants must complete Section 6 on the application. This information is needed to determine their rate.

4

Refer to Appendix III for rates and Appendix IV for lists of ZIP Codes applicable to each area. All members (except

those who meet open enrollment or guaranteed issue requirements) who respond “yes” to the tobacco use question

on the application will pay the tobacco use version of the rate shown in the chart.

5

For details about the Enrollment Discount program, refer to the next section entitled “Enrollment Discount.” Note:

applicants age 75 and older are not eligible for the Enrollment Discount and will pay the standard rate.

6

Applies to applicants who do not have any of the medical conditions listed in Section 6 of the application.

7

Applies to applicants who have any of the medical conditions listed in Section 6 of the application.

Refer to the appendix for:

Appendix I — Underwriting conditions glossary

Appendix II — Preliminary quote

Appendix III - Rate page

Appendix IV — Area rating ZIP Code listing

Illinois

UNDERWRITING/RATES

13This information applies for plan effective dates of April 1, 2013 - December 1, 2013

Enrollment Discount*

The Enrollment Discount is available to applicants age 65 and over only.

Eligibility

Applicants are eligible for the Enrollment Discount if their

age on their plan effective date is:

• 65 to 67, OR

• 68 to 74 AND their plan effective date is within 3 years

of their Medicare Part B effective date, OR

• 68 to 74 AND their plan effective date is 3 or more

years but less than 6 years from their Medicare Part B

effective date

AND they do not have any medical condition that

qualifies for the Level 2 Rate

Applicants age 75 and over are not eligible for the

Enrollment Discount.

Discount Percentage and Duration

• If applicants are eligible for the Enrollment Discount, the

discount percentage is applied to the Standard Rate.

• The first-year discount percentage and the duration of

the discount program will vary based on applicant’s age

as of the plan effective date (see table below).

• The discount percentage amount changes on the

anniversary date of the plan as members move through

the discount program.*

• After the eligible discount duration expires, applicants

will pay the Standard Rate.

Enrollment Discount — Discount Percentages and Duration

Discount

Year

Age as of Plan Effective Date

65 66 67 68 69 70 71 72 73 74 75+

1

30% 27% 24% 21% 18% 15% 12% 9% 6% 3% 0%

2

27% 24% 21% 18% 15% 12% 9% 6% 3% 0%

3

24% 21% 18% 15% 12% 9% 6% 3% 0%

4

21% 18% 15% 12% 9% 6% 3% 0%

5

18% 15% 12% 9% 6% 3% 0%

6

15% 12% 9% 6% 3% 0%

7

12% 9% 6% 3% 0%

8

9% 6% 3% 0%

9

6% 3% 0%

10

3% 0%

11

0%

*Note: Rates generally change annually. If the Standard Rate changes, the discounted monthly premium will be

adjusted accordingly.

Illinois

UNDERWRITING/RATES

14 This information applies for plan effective dates of April 1, 2013 - December 1, 2013

Other Rate Discounts

Multi-Insured Discount

5 percent off the monthly premium if two members are on the same AARP membership household account and

each is insured under an AARP-branded supplemental insurance policy with UnitedHealthcare. (Does not apply to

AARP

®

MedicareRx Plans or AARP

®

MedicareComplete

®

plans.)

Electronic Funds Transfer (EFT) Discount

$2.00 per household per month when the entire household pays their premium through Electronic Funds Transfer.

Annual Payer Discount

$24.00 per household per year for insureds who pay their entire calendar year premium in January.

NOTE: Electronic Funds Transfer (EFT) discount and Annual Payer discount cannot be combined.

Rating Information

Community Rating with Areas

Community rating means all members in the same

rating class pay the same rate (excludes discounts and

surcharges). In an area rated state, all members in the

same class in the same area pay the same rate (excludes

discounts and surcharges).

Refer to Appendix IV for lists of ZIP Codes applicable to

each area.

Tobacco Use

Members who have smoked cigarettes or used any

tobacco product at any time within the past 12 months

will pay the tobacco use version of the rate for which

they qualify. This does not apply to applicants who meet

open enrollment or guaranteed issue requirements.

Rate Guarantee

New members receive a 6-month rate guarantee from

their initial plan effective date. Members will not receive

an additional rate guarantee when switching from one

AARP Medicare Supplement Plan to another.

Rate Changes

UnitedHealthcare’s monthly premium generally changes

once a year. However, enrolled members may see their

premium change at other times due to:

• the Enrollment Discount changing on their policy

anniversary

• rate guarantee ending, or

• moving into a different area or state

Illinois

UNDERWRITING/RATES

15This information applies for plan effective dates of April 1, 2013 - December 1, 2013

Underwriting Information

• Who needs to be underwritten? Applicants

outside of their open enrollment period and who do

not qualify for guaranteed issue are underwritten to

determine eligibility and rate (depending on the time

since their 65th birthday or Medicare Part B effective

date, if later).

• Does underwriting vary for different AARP

Medicare Supplement Plans? No.

• Can applicants be denied for coverage? If

applicants need to be underwritten, the only medical

reasons for denial are:

– End Stage Renal Disease (ESRD)

– Dialysis is required

– Applicants have been admitted to a hospital within

the past 90 days

– Within the past two years a medical professional has

recommended or discussed as a treatment option

any of the following that has not been completed:

• Hospital admittance as an inpatient

• Organ transplant

• Back or spine surgery

• Joint replacement

• Surgery for cancer

• Heart surgery

• Vascular surgery

The above medical reasons can be found on Section 5

of the application. If applicants answer “yes” to either

question in Section 5, they will be denied coverage.

Everyone has the right to apply. Applicants can continue

the application process even if they may not qualify.

• If an applicant was in the hospital overnight for

“observation,” is this considered “inpatient”? The

applicant should contact the hospital and ask if they

were admitted as an inpatient.

• If a doctor recommended or discussed one

of the surgeries listed on the application and

the surgery hasn’t been completed, does it

matter where the surgery will be done? No. The

application does not ask where the surgery will be

done. If a doctor recommended or discussed one of

the surgeries in the two years prior to applying, the

applicant is ineligible for coverage.

• When do applicants need to complete other

medical questions in Section 6 of the

application? If their effective date is 3 or more years

since their 65th birthday (or Medicare Part B effective

date, if it is later) and they do not qualify for guaranteed

issue, applicants must complete the other medical

questions on the application. This information is necessary

to determine their rate.

• What about the applicant’s health history more

than two years ago? The application asks if the

applicant had, was diagnosed or treated for the medical

conditions listed during the past two years only.

• What if additional medical information is

needed? The underwriter may contact applicants or their

physician to clarify the information before reaching a

decision.

• What if the applicant’s medical condition isn’t

listed on the application? A limited number of

medical conditions (not all medical conditions) are

listed on the application. Only medical conditions

listed on the application are used to determine the

applicant’s rate. If the applicant is unsure if their

condition relates to a condition on the application,

they should check with their doctor.

• What if applicants are unsure about their

medical conditions? If applicants are unsure about

their medical conditions, their uncertainty should be noted

on the application and submitted to underwriting for review

along with available information.

Note that Appendix I includes a glossary with short

definitions of the medical conditions listed on the

application. This may assist you if applicants are

unsure about a listed medical condition.

• Can an insured applicant change to a different

AARP Medicare Supplement Plan?

– A change from an AARP Medicare Supplement Plan

with an effective date of 6/1/2010 and later to

another is usually permitted without underwriting.

The new plan must be available at the applicant’s

current age and area of residence.

– A change from an AARP Medicare Supplement

Plan with an effective date of 5/1/2010 or prior

will require new rating and underwriting (same

requirements as new sales).

UnitedHealthcare reserves the right to deny a plan

change request at any time. If applicants are denied

a plan change request, they can remain with their

current plan, with no effect to their current rates.

Please ensure that the application has been completed in full. Material mistakes or incomplete

responses on applications may subject applicants to re-evaluation of their rate or loss of coverage.

Illinois

UNDERWRITING/RATES

16 This information applies for plan effective dates of April 1, 2013 - December 1, 2013

Medicare Beneficiaries Age 50 (or an AARP Member’s Spouse Under Age 50)

Underwriting and Rate Summary

The following chart provides a summary of the underwriting requirements and applicable rate:

Time since Medicare Part B Effective Date

0 to < 7 months 7 months or more

Underwriting

No Underwriting

Open Enrollment Period

No Underwriting

(Plans are only available to applicants who

meet Guaranteed Issue requirements)

Rate* Disabled Rate

Rate Group (see Appendix III) Group 4

*Refer to Appendix IV for lists of ZIP Codes applicable to each area and rate amounts.

Rate Discounts

Multi-Insured Discount

5 percent off the monthly premium if two members are on the same AARP membership household account and

each is insured under an AARP-branded supplemental insurance policy with UnitedHealthcare. (Does not apply to

AARP

®

MedicareRx Plans or AARP

®

MedicareComplete

®

plans.)

Electronic Funds Transfer (EFT) Discount

$2.00 per household per month when the entire household pays their premium through Electronic Funds Transfer.

Annual Payer Discount

$24.00 per household per year for insureds who pay their entire calendar year premium in January.

NOTE: Electronic Funds Transfer (EFT) discount and Annual Payer discount cannot be combined.

Rating Information

Community Rating with Areas

Community rating means all members in the same

rating class pay the same rate (excludes discounts and

surcharges). In an area rated state, all members in the

same class in the same area pay the same rate (excludes

discounts and surcharges).

Refer to Appendix IV for lists of ZIP Codes applicable to

each area.

Rate Guarantee

New insured receive a 6-month rate guarantee from their

initial plan effective date. Insureds will not receive an

additional rate guarantee when switching from one AARP

Medicare Supplement Plan to another.

Rate Changes

UnitedHealthcare’s monthly premium generally changes

once a year. However, enrolled members may see their

premium change at other times due to:

• rate guarantee ending, or

• moving into a different area or state

Underwriting Information

There is no underwriting for beneficiaries age 50 to 64. Plans are only available to beneficiaries age 50

to 64 if they meet open enrollment or guaranteed issue requirements.

Illinois

UNDERWRITING/RATES

17This information applies for plan effective dates of April 1, 2013 - December 1, 2013

Current AARP Medicare

Supplement Plan

Effective Date

Underwriting

Requirements

Rating

Requirements

Submit

New Application?

5/1/2010 or prior

Same as new sales

(refer to Underwriting and

Rate Summary Chart)

1

Same as new sales

(refer to Underwriting and

Rate Summary Chart)

A new application is required

for all applicants who want to

change to a new plan

6/1/2010 or later

None

2

Same rate level as

current plan

3,4

A new application may be

submitted but it is not required.

5

Applicants may call customer

service to request a plan change

over the phone.

1

If the current plan held is a Medicare Select Plan, no underwriting is required. Applicants do not need to answer health questions in Sections 5

or 6 on the enrollment application.

2

Applicants do not need to answer health questions in Sections 5 or 6 on the enrollment application.

3

Discounts for which the applicant is currently eligible will continue to apply, assuming no other changes have occurred that affect eligibility for

the discount.

4

If applicants are receiving an Enrollment Discount, advise them that they will continue to receive the balance of the discount program from the

time they enrolled in the original plan.

5

An application is required if changing to a Medicare Select Plan. Applicants do not need to answer health questions in Sections 5 or 6 on the

enrollment application.

Plan Change Situations

The following charts outline the rating and underwriting requirements for applicants who want to change

from one AARP Medicare Supplement Plan to another AARP Medicare Supplement Plan.

Insured members age 50 and over who are currently enrolled in an AARP Medicare Select Plan can

change to any AARP non-select Medicare supplement plan available without underwriting, regardless of

the Select plan’s effective date.

Insured Members Age 50 to 64

1

Plans Available

Underwriting

Requirements

Rating Requirements Submit New Application?

All

2

None Disabled Rate

A new application may be submitted

but it is not required.

3

Applicants

may call customer service to request

a plan change over the phone.

1

Applicants ages 50 to 64 can change plans only if they meet open enrollment or guaranteed issue criteria or if they are currently enrolled in an

AARP Medicare Select Plan.

2

When an insured member turns age 65, they may plan change to any available plan during their Medicare Open Enrollment Period (that begins at

age 65) without underwriting.

3

An application is required if changing to a Medicare Select Plan.

Note: Members will not receive an additional rate guarantee when switching from one AARP Medicare Supplement

Plan to another.

UnitedHealthcare reserves the right to deny a plan change request at any time. If applicants are denied a plan change

request, they can remain with their current plan, with no effect to their current rates.

Insured Members Age 65 and Older

Rating and underwriting requirements vary based on the effective date of the applicant’s current AARP Medicare

Supplement Plan:

APPENDIX

Illinois 29This information applies for plan effective dates of April 1, 2013 - December 1, 2013

Appendix I

Completing the Application: Medical Terms and Conditions Glossary

• This glossary has brief descriptions for terms and medical conditions that may be helpful for the applicant in

completing the application. It also includes other names that may be used for some medical conditions.

• Medical terms and conditions listed below generally appear in the order they appear on the application. Some of

these medical terms or conditions don’t appear on all applications.

• The applicant is responsible for making sure that all answers to application questions are accurate and completed

in full.

• This glossary is provided for informational purposes ONLY. The applicant should consult his or her physician if they

need help answering medical questions on the application form.

Terms found on the application What those terms generally mean

End Stage Renal (Kidney) Disease

(ESRD)

A complete or almost complete failure of the kidneys to function,

requiring dialysis or a kidney transplant to live.

Dialysis A process of cleansing your blood by passing it through a machine

(hemodialysis), or putting special fluid into the abdominal cavity and

draining it out (peritoneal dialysis). This is necessary when the kidneys are

not able to filter blood.

Recommended or discussed as a

treatment option

You talked to a medical professional about one or more of the treatment

options listed on the application which has not been completed.

Medically diagnosed You have seen a medical professional who found a medical condition by

its signs, symptoms, and/or results of tests or procedures.

Received treatment You had tests, surgery, therapy or other medical care, or were told to take

medication by a medical professional.

APPENDIX

Illinois30 This information applies for plan effective dates of April 1, 2013 - December 1, 2013

Terms found on the application What those terms generally mean

Heart or Vascular Conditions

Vascular relates to blood vessels, including arteries, veins and capillaries.

Blood vessels, as a group, are referred to as the vascular system.

Aneurysm An abnormal widening or bulging in the wall of an artery or blood vessel.

Arteriosclerosis or Atherosclerosis A hardening or narrowing of the arteries. Same as Artery or Vein Blockage.

Artery or Vein Blockage A hardening or narrowing of the arteries. Same as Arteriosclerosis or

Atherosclerosis.

Atrial Fibrillation or Atrial Flutter A heart rhythm disorder that causes the upper chambers of the heart

(atria) to beat in an abnormal or disorganized way (often rapid and

irregular). Also known as A-Fib.

Cardiomyopathy A weakening of the heart muscle for any reason.

Carotid Artery Disease Main arteries in the neck become blocked or narrowed.

Congestive Heart Failure (CHF) Weakness of the heart muscle, causing decreased blood flow and a

build-up of fluid in the lungs and body tissues. Also known as congestive

heart disease, left heart failure, right heart failure.

Coronary Artery Disease (CAD) A narrowing of blood vessels that supply blood and oxygen to the heart.

Also known as coronary heart disease.

Heart Attack Occurs when the blood supply to part of the heart is interrupted, causing

damage to the heart muscle. Also known as myocardial infarction (MI).

Peripheral Vascular Disease (PVD) Includes all conditions involving poor blood flow to the arms, hands, legs

or feet. Also known as PVD and peripheral artery disease (PAD).

Claudication A cramp-like pain in the legs or arms caused by poor blood flow.

Stroke, Transient Ischemic Attack (TIA),

or mini-stroke

Loss of blood flow to an area of the brain, which may result in the sudden

onset of permanent (stroke) or temporary (TIA) symptoms. Also known as

cerebrovascular accident (CVA).

Ventricular Tachycardia A rapid or "racing" heart beat starting in one of the ventricular chambers

of the heart. Also known as V-Tach.

Diabetes

With any of the following complications:

The body does not regulate blood sugar levels properly.

Circulatory problems A decreased blood flow to organs and/or arms, hands, legs or feet. Also

known as PVD.

Kidney problems Kidney is unable to filter blood efficiently.

Retinopathy Damage to the retina of the eye. Also known as wet retina or

macular edema.

APPENDIX

Illinois 31This information applies for plan effective dates of April 1, 2013 - December 1, 2013

Terms found on the application What those terms generally mean

Lung/Respiratory Conditions

Chronic Obstructive Pulmonary Disease

(COPD)

A lung disease, including emphysema and chronic obstructive bronchitis,

that makes it difficult to breathe or catch your breath. Also known as

COPD, chronic obstructive lung disease (COLD) and chronic obstructive

airway disease (COAD).

Emphysema A lung disease usually caused by smoking or exposure to harmful chemicals.

Cancer or Tumors

Cancer (other than skin cancer) A malignant growth caused when cells multiply uncontrollably. Some

types of cancer include carcinoma, lymphoma, leukemia, myeloma,

neoplasm, or sarcoma.

Leukemia A blood or bone marrow cancer causing abnormal blood cell production

(usually white blood cells). Also known as AML, ALL, CML or CLL.

Lymphoma An immune system cancer that often starts in the lymph nodes as

a malignant tumor. Also known as non-Hodgkin’s lymphoma (NHL) or

Hodgkin’s (HL).

Melanoma A malignant tumor caused by uncontrolled growth of pigment cells,

usually originating in the skin or eye(s).

Kidney Conditions

Chronic Renal Failure (CRF) or

Insufficiency (CRI)

A chronic loss of the ability of the kidneys to remove waste from the

blood. Also known as CRF or CRI.

Polycystic Kidney Disease An inherited disorder in which multiple cysts form in or on the kidneys,

causing them to enlarge. Also known as PKD or PCKD.

Renal Artery Stenosis A blockage or narrowing of the artery supplying blood to the kidney.

Liver Condition

Cirrhosis of the Liver Loss of liver function due to chronic inflammation and scarring.

Transplants

Bone marrow transplant A surgical procedure in which defective or cancerous bone marrow is

replaced with healthy bone marrow, either from the patient or a donor.

Organ transplant A surgical procedure in which a damaged or failing organ is replaced with

a healthy organ, either from a donor site or the patient’s own body.

APPENDIX

Illinois32 This information applies for plan effective dates of April 1, 2013 - December 1, 2013

Terms found on the application What those terms generally mean

Gastrointestinal Conditions

Chronic Pancreatitis Recurring or ongoing inflammation of the pancreas that may lead to

scarring and loss of function.

Esophageal Varices Veins in the esophagus become wider than normal, often resulting

in bleeding.

Musculoskeletal Conditions

Amputation due to disease When a diseased body extremity is removed by surgery.

Rheumatoid Arthritis (RA) A disorder in which the immune system attacks the body’s joints and/or

organs. Also known as RA.

Spinal Stenosis A narrowing of the spinal canal, putting pressure on the spinal cord

and nerves.

Substance Abuse

Alcohol Abuse or Alcoholism Any use of alcohol which causes physical, mental, social or legal

problems. Also known as ETOH or alcohol dependence.

Drug Abuse or use of illegal drugs Any use of prescribed, non-prescribed or illegal drug(s) for non-

therapeutic or non-medical reasons.

Brain or Spinal Cord Conditions

Paraplegia Inability to move the lower portion of the body and of both legs.

Quadriplegia Inability to move both arms and both legs.

Hemiplegia Inability to move one side of the body.

Psychological/Mental Conditions

Bipolar or Manic Depressive A mental disorder in which a person experiences severe mood changes

from very high-energy (manic) to extreme lows of depression.

Schizophrenia A mental disorder in which it is difficult for a person to tell the difference

between real and unreal experiences, to think logically, to have normal

emotional responses to others, and to behave normally in social situations.

Eye Condition

Macular Degeneration An eye disorder affecting the macula, which is part of the retina

responsible for central vision. Also known as AMD or ARMD.

APPENDIX

Illinois 33This information applies for plan effective dates of April 1, 2013 - December 1, 2013

Terms found on the application What those terms generally mean

Nervous System Conditions

Amyotrophic Lateral Sclerosis (ALS) A disorder of the nerve cells in the brain or spinal cord that control

voluntary muscle movements. Also known as ALS or Lou Gehrig’s disease.

Alzheimer’s Disease The most common form of dementia. Dementia is a brain disease that

destroys memory and thinking skills beyond normal aging.

Dementia A brain disease that destroys memory and thinking skills beyond

normal aging.

Multiple Sclerosis (MS) A disease affecting the brain and spinal cord, sometimes progressing to

physical and mental disability. Also known as MS.

Parkinson’s Disease A chronic brain disorder that impairs body movement through rigidity,

slowing of movement and/or tremors.

Systemic Lupus Erythematosus (SLE) A disorder in which the immune system attacks the body's tissues and/or

organs, causing inflammation and damage. Also known as SLE.

Immune System Conditions

AIDS The stage of HIV disease in which a person's immune system is damaged

and susceptible to infections and tumors.

HIV Positive A person diagnosed as infected with HIV (human immunodeficiency virus).

APPENDIX

Illinois34 This information applies for plan effective dates of April 1, 2013 - December 1, 2013

Medicare Beneficiaries Age 50 to 64

Rate

Disabled Rate

Rate Group

Group 4 (See Appendix III)

Medicare Beneficiaries Age 65 and Older who meet Open Enrollment Criteria

Rate

Standard Rate with Enrollment Discount

Rate Group

Group 1 (See Appendix III)

Medicare Beneficiaries Age 65 and Older who meet Guaranteed Issue Criteria

Enrollment Time*: Rate Rate Group

Less than 3 years Standard Rate with Enrollment Discount 1 (See Appendix III)

3 years to < 6 years Standard Rate with Enrollment Discount 2 (See Appendix III)

6 years or more Level 1 Rate 3 (See Appendix III)

*Time difference between the applicant’s 65th birthday (or Medicare Part B effective date, if later) to the AARP

Medicare Supplement Plan effective date.

Medicare Beneficiaries Age 65 and Older who are Underwritten

(Do not meet Open Enrollment or Guaranteed Issue Criteria)

Enrollment Time*: Rate Rate Group

Less than 3 years Standard Rate with Enrollment Discount 1 (See Appendix III)

3 years to < 6 years

Standard Rate with Enrollment Discount

1

2 (See Appendix III)

Level 2 Rate

2

2 (See Appendix III)

6 years or more

Level 1 Rate

1

3 (See Appendix III)

Level 2 Rate

2

3 (See Appendix III)

*Time difference between the applicant’s 65th birthday (or Medicare Part B effective date, if later) to the AARP

Medicare Supplement Plan effective date.

Rate Quote Disclaimer (must be read to all applicants):

“Rates are subject to change. Actual rate will be determined upon acceptance into the program based

upon eligibility criteria and your medical conditions, if applicable.”

1 The applicant does not have any of the medical conditions listed in Section 6 of the application.

2 The applicant has one or more of the medical conditions listed in Section 6 of the application.

Appendix II

Providing a Preliminary Quote

New Sales in Illinois

Things to remember:

Before quoting rates, be sure to review

requirements in this handbook for:

• Eligibility

• Open Enrollment

• Guaranteed Issue

• Plan Availability

• Underwriting and Rates

To determine the exact rate, remember the following:

• Use the correct page for Tobacco or non-Tobacco rates

• Applicant’s Area – use their ZIP code to find the area

in Appendix IV

• Use the tables below to find the applicant’s rate group

• Always quote the rate disclaimer

Important Note:

This 2013 Producer Handbook contains rates

which apply to plan effective dates

April 1, 2013 through December 1, 2013.

SA25364ST

APPENDIX

Illinois 35This information applies for plan effective dates of April 1, 2013 - December 1, 2013

Appendix III

Group 1

Applies to individuals whose plan effective date will be within three years

following their 65th birthday or Medicare Part B effective date, if later.

Age

1

Plan A Plan B Plan C

Select C

2

Plan F

Select F

2

Plan K Plan L Plan N

Standard Rates with Enrollment Discount

3

for individuals ages 65-74

65

$79.10 $119.17 $150.67 $124.07 $151.37 $124.77 $62.82 $87.85 $106.05

66

$82.49 $124.28 $157.13 $129.39 $157.86 $130.12 $65.51 $91.61 $110.59

67

$85.88 $129.39 $163.59 $134.71 $164.35 $135.47 $68.21 $95.38 $115.14

68

$89.27 $134.49 $170.04 $140.02 $170.83 $140.81 $70.90 $99.14 $119.68

69

$92.66 $139.60 $176.50 $145.34 $177.32 $146.16 $73.59 $102.91 $124.23

70

$96.05 $144.71 $182.96 $150.66 $183.81 $151.51 $76.28 $106.67 $128.77

71

$99.44 $149.82 $189.42 $155.98 $190.30 $156.86 $78.98 $110.44 $133.32

72

$102.83 $154.92 $195.87 $161.29 $196.78 $162.20 $81.67 $114.20 $137.86

73

$106.22 $160.03 $202.33 $166.61 $203.27 $167.55 $84.36 $117.97 $142.41

74

$109.61 $165.14 $208.79 $171.93 $209.76 $172.90 $87.05 $121.73 $146.95

Standard Rates for ages 75 and older

75+

$113.00 $170.25 $215.25 $177.25 $216.25 $178.25 $89.75 $125.50 $151.50

Cover Page - Rates for Illinois - Area 1

Non-Tobacco Monthly Plan Rates

AARP

®

Medicare Supplement Insurance Plans insured by UnitedHealthcare Insurance Company

Group 2

Applies to individuals whose plan effective date will be between 3 years and less than

6 years following their 65th birthday or Medicare Part B effective date, if later.

Age

1

Plan A Plan B Plan C

Select C

2

Plan F

Select F

2

Plan K Plan L Plan N

Standard Rates with Enrollment Discount

3

for individuals ages 68-74 who do

not have any of the medical conditions on the application.

4

68

$89.27 $134.49 $170.04 $140.02 $170.83 $140.81 $70.90 $99.14 $119.68

69

$92.66 $139.60 $176.50 $145.34 $177.32 $146.16 $73.59 $102.91 $124.23

70

$96.05 $144.71 $182.96 $150.66 $183.81 $151.51 $76.28 $106.67 $128.77

71

$99.44 $149.82 $189.42 $155.98 $190.30 $156.86 $78.98 $110.44 $133.32

72

$102.83 $154.92 $195.87 $161.29 $196.78 $162.20 $81.67 $114.20 $137.86

73

$106.22 $160.03 $202.33 $166.61 $203.27 $167.55 $84.36 $117.97 $142.41

74

$109.61 $165.14 $208.79 $171.93 $209.76 $172.90 $87.05 $121.73 $146.95

Standard Rates for individuals ages 75 and older who do not have any of the medical conditions on the application.

4

75+

$113.00 $170.25 $215.25 $177.25 $216.25 $178.25 $89.75 $125.50 $151.50

Level 2 Rates for individuals ages 68 and older who have one or more of the medical conditions on the application.

4

68+

$169.50 $255.37 $322.87 $265.87 $324.37 $267.37 $134.62 $188.25 $227.25

Group 3

Applies to individuals whose plan effective date will be 6 or more years

following their 65th birthday or Medicare Part B effective date, if later.

Age

1

Plan A Plan B Plan C

Select C

2

Plan F

Select F

2

Plan K Plan L Plan N

Level 1 Rates for individuals ages 71 and older who do not have any of the medical conditions on the application.

4

71+

$124.30 $187.27 $236.77 $194.97 $237.87 $196.07 $98.72 $138.05 $166.65

Level 2 Rates for individuals ages 71 and older who have one or more of the medical conditions on the application.

4

71+

$169.50 $255.37 $322.87 $265.87 $324.37 $267.37 $134.62 $188.25 $227.25

The rates above are for plan effective dates from April - December 2013 and may change.

MRP0004 ILA 4-13

APPENDIX

Illinois36 This information applies for plan effective dates of April 1, 2013 - December 1, 2013

Cover Page - Rates for Illinois - Area 1

Tobacco Monthly Plan Rates

AARP

®

Medicare Supplement Insurance Plans insured by UnitedHealthcare Insurance Company

The rates above are for plan effective dates from April - December 2013 and may change.

MRP0004 ILA 4-13

Group 1

Applies to individuals whose plan effective date will be within three years

following their 65th birthday or Medicare Part B effective date, if later.

Age

1

Plan A Plan B Plan C

Select C

2

Plan F

Select F

2

Plan K Plan L Plan N

Standard Rates with Enrollment Discount

3

for individuals ages 65-74

65

$87.01 $131.08 $165.73 $136.47 $166.50 $137.24 $69.10 $96.63 $116.65

66

$90.73 $136.70 $172.84 $142.32 $173.64 $143.13 $72.06 $100.77 $121.65

67

$94.46 $142.32 $179.94 $148.17 $180.78 $149.01 $75.02 $104.91 $126.65

68

$98.19 $147.94 $187.04 $154.02 $187.91 $154.89 $77.98 $109.05 $131.65

69

$101.92 $153.56 $194.15 $159.87 $195.05 $160.77 $80.95 $113.20 $136.65

70

$105.65 $159.17 $201.25 $165.72 $202.18 $166.65 $83.91 $117.34 $141.65

71

$109.38 $164.79 $208.35 $171.57 $209.32 $172.54 $86.87 $121.48 $146.65

72

$113.11 $170.41 $215.46 $177.42 $216.46 $178.42 $89.83 $125.62 $151.65

73

$116.84 $176.03 $222.56 $183.27 $223.59 $184.30 $92.79 $129.76 $156.65

74

$120.57 $181.65 $229.66 $189.12 $230.73 $190.18 $95.75 $133.90 $161.65

Standard Rates for ages 75 and older

75+

$124.30 $187.27 $236.77 $194.97 $237.87 $196.07 $98.72 $138.05 $166.65

Group 2

Applies to individuals whose plan effective date will be between 3 years and less than

6 years following their 65th birthday or Medicare Part B effective date, if later.

Age

1

Plan A Plan B Plan C

Select C

2

Plan F

Select F

2

Plan K Plan L Plan N

Standard Rates with Enrollment Discount

3

for individuals ages 68-74 who do

not have any of the medical conditions on the application.

4

68

$98.19 $147.94 $187.04 $154.02 $187.91 $154.89 $77.98 $109.05 $131.65

69

$101.92 $153.56 $194.15 $159.87 $195.05 $160.77 $80.95 $113.20 $136.65

70

$105.65 $159.17 $201.25 $165.72 $202.18 $166.65 $83.91 $117.34 $141.65

71

$109.38 $164.79 $208.35 $171.57 $209.32 $172.54 $86.87 $121.48 $146.65

72

$113.11 $170.41 $215.46 $177.42 $216.46 $178.42 $89.83 $125.62 $151.65

73

$116.84 $176.03 $222.56 $183.27 $223.59 $184.30 $92.79 $129.76 $156.65

74

$120.57 $181.65 $229.66 $189.12 $230.73 $190.18 $95.75 $133.90 $161.65

Standard Rates for individuals ages 75 and older who do not have any of the medical conditions on the application.

4

75+

$124.30 $187.27 $236.77 $194.97 $237.87 $196.07 $98.72 $138.05 $166.65

Level 2 Rates for individuals ages 68 and older who have one or more of the medical conditions on the application.

4

68+

$186.45 $280.90 $355.15 $292.45 $356.80 $294.10 $148.08 $207.07 $249.97

Group 3

Applies to individuals whose plan effective date will be 6 or more years

following their 65th birthday or Medicare Part B effective date, if later.

Age

1

Plan A Plan B Plan C

Select C

2

Plan F

Select F

2

Plan K Plan L Plan N

Level 1 Rates for individuals ages 71 and older who do not have any of the medical conditions on the application.

4

71+

$136.73 $205.99 $260.44 $214.46 $261.65 $215.67 $108.59 $151.85 $183.31

Level 2 Rates for individuals ages 71 and older who have one or more of the medical conditions on the application.

4

71+

$186.45 $280.90 $355.15 $292.45 $356.80 $294.10 $148.08 $207.07 $249.97

APPENDIX

Illinois 37This information applies for plan effective dates of April 1, 2013 - December 1, 2013

Group 4

Applies to individuals under the age of 65 who are

eligible for Medicare by reason of disability

Age

1

Plan A Plan B Plan C

Select C

2

Plan F

Select F

2

Plan K Plan L Plan N

Non-Tobacco Rates

50-64

$169.49 $255.36 $322.86 $265.86 $324.36 $267.36 $134.61 $188.24 $227.24

Cover Page - Rates for Illinois - Area 1

Under 65 Monthly Plan Rates

AARP

®

Medicare Supplement Insurance Plans insured by UnitedHealthcare Insurance Company

MRP0004 ILA 4-13

The rates above are for plan effective dates from April - December 2013 and may change.

1 Your age as of your plan effective date.

2 You must use a network hospital with Select Plans C and F.

3 The Enrollment Discount is available to ap

plicants age 65 and over. You may qualify for an Enrollment Discount

based on your age and your Medicare Part B effective date.

The Enrollment Discount is applied to the current Standard Rate. The Standard Rates usually change each year. The

discount you receive in your first year of coverage depends on your age on your plan effective date. The discount

percentage reduces 3% each year on the annive

rsary date of your plan until the discount runs out.

4 Refer to Section 6 of the application.

APPENDIX

Illinois38 This information applies for plan effective dates of April 1, 2013 - December 1, 2013

Group 1

Applies to individuals whose plan effective date will be within three years

following their 65th birthday or Medicare Part B effective date, if later.

Age

1

Plan A Plan B Plan C

Select C

2

Plan F

Select F

2

Plan K Plan L Plan N

Standard Rates with Enrollment Discount

3

for individuals ages 65-74

65

$75.25 $113.40 $143.32 $117.95 $144.02 $118.65 $59.67 $83.47 $100.80

66

$78.47 $118.26 $149.46 $123.00 $150.19 $123.73 $62.23 $87.05 $105.12

67

$81.70 $123.12 $155.61 $128.06 $156.37 $128.82 $64.79 $90.63 $109.44

68

$84.92 $127.98 $161.75 $133.11 $162.54 $133.90 $67.34 $94.20 $113.76

69

$88.15 $132.84 $167.89 $138.17 $168.71 $138.99 $69.90 $97.78 $118.08

70

$91.37 $137.70 $174.03 $143.22 $174.88 $144.07 $72.46 $101.36 $122.40

71

$94.60 $142.56 $180.18 $148.28 $181.06 $149.16 $75.02 $104.94 $126.72

72

$97.82 $147.42 $186.32 $153.33 $187.23 $154.24 $77.57 $108.51 $131.04

73

$101.05 $152.28 $192.46 $158.39 $193.40 $159.33 $80.13 $112.09 $135.36

74

$104.27 $157.14 $198.60 $163.44 $199.57 $164.41 $82.69 $115.67 $139.68

Standard Rates for ages 75 and older

75+

$107.50 $162.00 $204.75 $168.50 $205.75 $169.50 $85.25 $119.25 $144.00

Cover Page - Rates for Illinois - Area 2

Non-Tobacco Monthly Plan Rates

AARP

®

Medicare Supplement Insurance Plans insured by UnitedHealthcare Insurance Company

Group 2

Applies to individuals whose plan effective date will be between 3 years and less than

6 years following their 65th birthday or Medicare Part B effective date, if later.

Age

1

Plan A

Plan B

Plan C

Select C

2

Plan F

Select F

2

Plan K

Plan L

Plan N

Standard Rates with Enrollment Discount

3

for individuals ages 68-74 who do

not have any of the medical conditions on the application.

4

68

$84.92

$127.98

$161.75

$133.11

$162.54

$133.90

$67.34

$94.20

$113.76

69

$88.15

$132.84

$167.89

$138.17

$168.71

$138.99 $69.90

$97.78

$118.08

70

$91.37

$137.70

$174.03

$143.22

$174.88

$144.07

$72.46

$101.36

$122.40

71

$94.60

$142.56

$180.18

$148.28

$181.06

$149.16

$75.02

$104.94

$126.72

72

$97.82

$147.42

$186.32

$153.33

$187.23

$154.24 $77.57

$108.51

$131.04

73

$101.05

$152.28

$192.46

$158.39

$193.40

$159.33

$80.13

$112.09

$135.36

74

$104.27

$157.14

$198.60

$163.44

$199.57

$164.41

$82.69

$115.67

$139.68

Standard Rates for individuals ages 75 and older who do not have any of the medical conditions on the application.

4

75+

$107.50

$162.00

$204.75

$168.50

$205.75

$169.50 $85.25

$119.25

$144.00

Level 2 Rates for individuals ages 68 and older who have one or more of the medical conditions on the application.

4

68+

$161.25

$243.00

$307.12

$252.75

$308.62

$254.25

$127.87

$178.87

$216.00

Group 3

Applies to individuals whose plan effective date will be 6 or more years

following their 65th birthday or Medicare Part B effective date, if later.

Age

1

Plan A Plan B Plan C

Select C

2

Plan F

Select F

2

Plan K Plan L Plan N

Level 1 Rates for individuals ages 71 and older who do not have any of the medical conditions on the application.

4

71+

$118.25 $178.20 $225.22 $185.35 $226.32 $186.45 $93.77 $131.17 $158.40

Level 2 Rates for individuals ages 71 and older who have one or more of the medical conditions on the application.

4

71+

$161.25 $243.00 $307.12 $252.75 $308.62 $254.25 $127.87 $178.87 $216.00

The rates above are for plan effective dates from April - December 2013 and may change.

MRP0004 ILB 4-13

APPENDIX

Illinois 39This information applies for plan effective dates of April 1, 2013 - December 1, 2013

Cover Page - Rates for Illinois - Area 2

Tobacco Monthly Plan Rates

AARP

®

Medicare Supplement Insurance Plans insured by UnitedHealthcare Insurance Company

The rates above are for plan effective dates from April - December 2013 and may change.

MRP0004 ILB 4-13

Group 1

Applies to individuals whose plan effective date will be within three years

following their 65th birthday or Medicare Part B effective date, if later.

Age

1

Plan A Plan B Plan C

Select C

2

Plan F

Select F

2

Plan K Plan L Plan N

Standard Rates with Enrollment Discount

3

for individuals ages 65-74

65

$82.77 $124.74 $157.65 $129.74 $158.42 $130.51 $65.63 $91.81 $110.88

66

$86.32 $130.08 $164.41 $135.30 $165.21 $136.10 $68.45 $95.75 $115.63

67

$89.87 $135.43 $171.16 $140.86 $172.00 $141.70 $71.26 $99.68 $120.38

68

$93.41 $140.77 $177.92 $146.42 $178.79 $147.29 $74.07 $103.62 $125.13

69

$96.96 $146.12 $184.68 $151.98 $185.58 $152.88 $76.89 $107.55 $129.88

70

$100.51 $151.47 $191.43 $157.54 $192.37 $158.48 $79.70 $111.49 $134.64

71

$104.06 $156.81 $198.19 $163.10 $199.16 $164.07 $82.51 $115.42 $139.39

72

$107.60 $162.16 $204.95 $168.66 $205.95 $169.66 $85.33 $119.36 $144.14

73

$111.15 $167.50 $211.70 $174.22 $212.74 $175.26 $88.14 $123.29 $148.89

74

$114.70 $172.85 $218.46 $179.78 $219.53 $180.85 $90.95 $127.23 $153.64

Standard Rates for ages 75 and older

75+

$118.25 $178.20 $225.22 $185.35 $226.32 $186.45 $93.77 $131.17 $158.40

Group 2

Applies to individuals whose plan effective date will be between 3 years and less than

6 years following their 65th birthday or Medicare Part B effective date, if later.

Age

1

Plan A Plan B Plan C

Select C

2

Plan F

Select F

2

Plan K Plan L Plan N

Standard Rates with Enrollment Discount

3

for individuals ages 68-74 who do

not have any of the medical conditions on the application.

4

68

$93.41 $140.77 $177.92 $146.42 $178.79 $147.29 $74.07 $103.62 $125.13

69

$96.96 $146.12 $184.68 $151.98 $185.58 $152.88 $76.89 $107.55 $129.88

70

$100.51 $151.47 $191.43 $157.54 $192.37 $158.48 $79.70 $111.49 $134.64

71

$104.06 $156.81 $198.19 $163.10 $199.16 $164.07 $82.51 $115.42 $139.39

72

$107.60 $162.16 $204.95 $168.66 $205.95 $169.66 $85.33 $119.36 $144.14

73

$111.15 $167.50 $211.70 $174.22 $212.74 $175.26 $88.14 $123.29 $148.89

74

$114.70 $172.85 $218.46 $179.78 $219.53 $180.85 $90.95 $127.23 $153.64

Standard Rates for individuals ages 75 and older who do not have any of the medical conditions on the application.

4

75+

$118.25 $178.20 $225.22 $185.35 $226.32 $186.45 $93.77 $131.17 $158.40

Level 2 Rates for individuals ages 68 and older who have one or more of the medical conditions on the application.

4

68+

$177.37 $267.30 $337.83 $278.02 $339.48 $279.67 $140.65 $196.75 $237.60

Group 3

Applies to individuals whose plan effective date will be 6 or more years

following their 65th birthday or Medicare Part B effective date, if later.

Age

1

Plan A Plan B Plan C

Select C

2

Plan F

Select F

2

Plan K Plan L Plan N

Level 1 Rates for individuals ages 71 and older who do not have any of the medical conditions on the application.

4

71+

$130.07 $196.02 $247.74 $203.88 $248.95 $205.09 $103.14 $144.28 $174.24

Level 2 Rates for individuals ages 71 and older who have one or more of the medical conditions on the application.

4

71+

$177.37 $267.30 $337.83 $278.02 $339.48 $279.67 $140.65 $196.75 $237.60

APPENDIX

Illinois40 This information applies for plan effective dates of April 1, 2013 - December 1, 2013

Group 4

Applies to individuals under the age of 65 who are

eligible for Medicare by reason of disability

Age

1

Plan A Plan B Plan C

Select C

2

Plan F

Select F

2

Plan K Plan L Plan N

Non-Tobacco Rates

50-64

$161.24 $242.99 $307.11 $252.74 $308.61 $254.24 $127.86 $178.86 $215.99

Cover Page - Rates for Illinois - Area 2

Under 65 Monthly Plan Rates

AARP

®

Medicare Supplement Insurance Plans insured by UnitedHealthcare Insurance Company

MRP0004 ILB 4-13

The rates above are for plan effective dates from April - December 2013 and may change.

1 Your age as of your plan effective date.

2 You must use a network hospital with Select Plans C and F.

3 The Enrollment Discount is available to a

pplicants age 65 and over. You may qualify for an Enrollment Discount

based on your age and your Medicare Part B effective date.

The Enrollment Discount is applied to the current Standard Rate. The Standard Rates usually change each year. The

discount you receive in your first year of coverage depends on your age on your plan effective date. The discount

percentage reduces 3% each year on the anniv

ersary date of your plan until the discount runs out.

4 Refer to Section 6 of the application.

APPENDIX

Illinois 41This information applies for plan effective dates of April 1, 2013 - December 1, 2013

Appendix IV Illinois - ZIP Code Directory for Area Rating

ILLINOIS Area 1 ZIP Codes, Effective August 1, 2012

The ZIP Codes Below Apply to Rates Included on the Page Headed “Cover Page – Rates”

SA25163 ILA (08-12) Page 1 of 1

60001

60002

60004

60005

60006

60007

60008

60009

60010

60011

60012

60013

60014

60015

60016

60017

60018

60019

60020

60021

60022

60025

60026

60029

60030

60031

60033

60034

60035

60037

60038

60039

60040

60041

60042

60043

60044

60045

60046

60047

60048

60050

60051

60053

60055

60056

60060

60061

60062

60064

60065

60067

60068

60069

60070

60071

60072

60073

60074

60075

60076

60077

60078

60079

60081

60082

60083

60084

60085

60086

60087

60088

60089

60090

60091

60093

60094

60095

60096

60097

60098

60099

60101

60102

60103

60104

60105

60106

60107

60108

60109

60110

60116

60117

60118

60119

60120

60121

60122

60123

60124

60126

60128

60130

60131

60132

60133

60134

60136

60137

60138

60139

60140

60141

60142

60143

60144

60147

60148

60151

60152

60153

60154

60155

60156

60157

60159

60160

60161

60162

60163

60164

60165

60168

60169

60170

60171

60172

60173

60174

60175

60176

60177

60179

60180

60181

60183

60184

60185

60186

60187

60188

60189

60190

60191

60192

60193

60194

60195

60196

60197

60199

60201

60202

60203

60204

60208

60209

60290

60301

60302

60303

60304

60305

60399

60401

60402

60403

60404

60406

60408

60409

60410

60411

60412

60415

60417

60419

60421

60422

60423

60425

60426

60428

60429

60430

60431

60432

60433

60434

60435

60436

60438

60439

60440

60441

60442

60443

60445

60446

60448

60449

60451

60452

60453

60454

60455

60456

60457

60458

60459

60461

60462

60463

60464

60465

60466

60467

60468

60469

60471

60472

60473

60475

60476

60477

60478

60480

60481

60482

60484

60487

60490

60491

60499

60501

60502

60503

60504

60505

60506

60507

60510

60511

60513

60514

60515

60516

60517

60519

60521

60522

60523

60525

60526

60527

60532

60534

60539

60540

60542

60544

60546

60554

60555

60558

60559

60561

60563

60564

60565

60566

60567

60568

60572

60585

60586

60598

60599

60601

60602

60603

60604

60605

60606

60607

60608

60609

60610

60611

60612

60613

60614

60615

60616

60617

60618

60619

60620

60621

60622

60623

60624

60625

60626

60628

60629

60630

60631

60632

60633

60634

60636

60637

60638

60639

60640

60641

60642

60643

60644

60645

60646

60647

60649

60651

60652

60653

60654

60655

60656

60657

60659

60660

60661

60664

60666

60668

60669

60670

60673

60674

60675

60677

60678

60680

60681

60682

60684

60685

60686

60687

60688

60689

60690

60691

60693

60694

60695

60696

60697

60701

60706

60707

60712

60714

60799

60803

60804

60805

60827

60958

APPENDIX

Illinois42 This information applies for plan effective dates of April 1, 2013 - December 1, 2013

ILLINOIS Area 2 ZIP Codes, Effective August 1, 2012

The ZIP Codes Below Apply to Rates Included on the Page Headed “Cover Page – Rates”

SA25163 ILB (08-12) Page 1 of 3

60111

60112

60113

60115

60129

60135

60145

60146

60150

60178

60407

60416

60420

60424

60437

60444

60447

60450

60460

60470

60474

60479

60512

60518

60520

60530

60531

60536

60537

60538

60541

60543

60545

60548

60549

60550

60551

60552

60553

60556

60557

60560

60901

60910

60911

60912

60913

60914

60915

60917

60918

60919

60920

60921

60922

60924

60926

60927

60928

60929

60930

60931

60932

60933

60934

60935

60936

60938

60939

60940

60941

60942

60944

60945

60946

60948

60949

60950

60951

60952

60953

60954

60955

60956

60957

60959

60960

60961

60962

60963

60964

60966

60967

60968

60969

60970

60973

60974

61001

61006

61007

61008

61010

61011

61012

61013

61014

61015

61016

61018

61019

61020

61021

61024

61025

61027

61028

61030

61031

61032

61036

61037

61038

61039

61041

61042

61043

61044

61046

61047

61048

61049

61050

61051

61052

61053

61054

61057

61059

61060

61061

61062

61063

61064

61065

61067

61068

61070

61071

61072

61073

61074

61075

61077

61078

61079

61080

61081

61084

61085

61087

61088

61089

61091

61101

61102

61103

61104

61105

61106

61107

61108

61109

61110

61111

61112

61114

61115

61125

61126

61130

61131

61132

61201

61204

61230

61231

61232

61233

61234

61235

61236

61237

61238

61239

61240

61241

61242

61243

61244

61250

61251

61252

61254

61256

61257

61258

61259

61260

61261

61262

61263

61264

61265

61266

61270

61272

61273

61274

61275

61276

61277

61278

61279

61281

61282

61283

61284

61285

61299

61301

61310

61311

61312

61313

61314

61315

61316

61317

61318

61319

61320

61321

61322

61323

61324

61325

61326

61327

61328

61329

61330

61331

61332

61333

61334

61335

61336

61337

61338

61340

61341

61342

61344

61345

61346

61348

61349

61350

61353

61354

61356

61358

61359

61360

61361

61362

61363

61364

61367

61368

61369

61370

61371

61372

61373

61374

61375

61376

61377

61378

61379

61401

61402

61410

61411

61412

61413

61414

61415

61416

61417

61418

61419

61420

61421

61422

61423

61424

61425

61426

61427

61428

61430

61431

61432

61433

61434

61435

61436

61437

61438

61439

61440

61441

61442

61443

61447

61448

61449

61450

61451

61452

61453

61454

61455

61458

61459

61460

61462

61465

61466

61467

61468

61469

61470

61471

61472

61473

61474

61475

61476

61477

61478

61479

61480

61482

61483

61484

61485

61486

61488

61489

61490

61491

61501

61516

61517

61519

61520

61523

61524

61525

61526

61528

61529

61530

61531

61532

61533

61534

61535

61536

61537

61539

61540

61541

61542

61543

61544

61545

61546

61547

61548

61550

61552

61553

61554

61555

61558

61559

61560

61561

61562

61563

61564

61565

61567

61568

61569

61570

61571

61572

61601

61602

61603

61604

61605

61606

61607

61610

61611

61612

61613

61614

61615

61616

61625

61629

61630

61633

61634

APPENDIX

Illinois 43This information applies for plan effective dates of April 1, 2013 - December 1, 2013

ILLINOIS Area 2 ZIP Codes CONTINUED

Page 2 of 3

61635

61636

61637

61638

61639

61641

61643

61650

61651

61652

61653

61654

61655

61656

61701

61702

61704

61705

61709

61710

61720

61721

61722

61723

61724

61725

61726

61727

61728

61729

61730

61731

61732

61733

61734

61735

61736

61737

61738

61739

61740

61741

61742

61743

61744

61745

61747

61748

61749

61750

61751

61752

61753

61754

61755

61756

61758

61759

61760

61761

61764

61769

61770

61771

61772

61773

61774

61775

61776

61777

61778

61790

61791

61799

61801

61802

61803

61810

61811

61812

61813

61814

61815

61816

61817

61818

61820

61821

61822

61824

61825

61826

61830

61831

61832

61833

61834

61839

61840

61841

61842

61843

61844

61845

61846

61847

61848

61849

61850

61851

61852

61853

61854

61855

61856

61857

61858

61859

61862

61863

61864

61865

61866

61870

61871

61872

61873

61874

61875

61876

61877

61878

61880

61882

61883

61884

61910

61911

61912

61913

61914

61917

61919

61920

61924

61925

61928

61929

61930

61931

61932

61933

61936

61937

61938

61940

61941

61942

61943

61944

61949

61951

61953

61955

61956

61957

62001

62002

62006

62009

62010

62011

62012

62013

62014

62015

62016

62017

62018

62019

62021

62022

62023

62024

62025

62026

62027

62028

62030

62031

62032

62033

62034

62035

62036

62037

62040

62044

62045

62046

62047

62048

62049

62050

62051

62052

62053

62054

62056

62058

62059

62060

62061

62062

62063

62065

62067

62069

62070

62071

62074

62075

62076

62077

62078

62079

62080

62081

62082

62083

62084

62085

62086

62087

62088

62089

62090

62091

62092

62093

62094

62095

62097

62098

62201

62202

62203

62204

62205

62206

62207

62208

62214

62215

62216

62217

62218

62219

62220

62221

62222

62223

62225

62226

62230

62231

62232

62233

62234

62236

62237

62238

62239

62240

62241

62242

62243

62244

62245

62246

62247

62248

62249

62250

62252

62253

62254

62255

62256

62257

62258

62259

62260

62261

62262

62263

62264

62265

62266

62268

62269

62271

62272

62273

62274

62275

62277

62278

62279

62280

62281

62282

62284

62285

62286

62288

62289

62292

62293

62294

62295

62297

62298

62301

62305

62306

62311

62312

62313

62314

62316

62319

62320

62321

62323

62324

62325

62326

62329

62330

62334

62336

62338

62339

62340

62341

62343

62344

62345

62346

62347

62348

62349

62351

62352

62353

62354

62355

62356

62357

62358

62359

62360

62361

62362

62363

62365

62366

62367

62370

62373

62374

62375

62376

62378

62379

62380

62401

62410

62411

62413

62414

62417

62418

62419

62420

62421

62422

62423

62424

62425

62426

62427

62428

62431

62432

62433

62434

62435

62436

62438

62439

62440

62441

62442

62443

62444

62445

62446

62447

62448

62449

62450

62451

62452

62454

62458

62459

62460

62461

62462

62463

62464

62465

62466

62467

62468

62469

62471

62473

62474

62475

62476

62477

62478

62479

62480

62481

62501

62510

62512

62513

62514

62515

APPENDIX

Illinois44 This information applies for plan effective dates of April 1, 2013 - December 1, 2013

ILLINOIS Area 2 ZIP Codes CONTINUED

Page 3 of 3

62517

62518

62519

62520

62521

62522

62523

62524

62525

62526

62530

62531

62532

62533

62534

62535

62536

62537

62538

62539

62540

62541

62543

62544

62545

62546

62547

62548

62549

62550

62551

62553

62554

62555

62556

62557

62558

62560

62561

62563

62565

62567

62568

62570

62571

62572

62573

62601

62610

62611

62612

62613

62615

62617

62618

62621

62622

62624

62625

62626

62627

62628

62629

62630

62631

62633

62634

62635

62638

62639

62640

62642

62643

62644

62649

62650

62651

62655

62656

62659

62660

62661

62662

62663

62664

62665

62666

62667

62668

62670

62671

62672

62673

62674

62675

62677

62681

62682

62683

62684

62685

62688

62689

62690

62691

62692

62693

62694

62695

62701

62702

62703

62704

62705

62706

62707

62708

62711

62712

62715

62716

62719

62721

62722

62723

62726

62736

62739

62756

62757

62761

62762

62763

62764

62765

62766

62767

62769

62776

62777

62781

62786

62791

62794

62796

62801

62803

62806

62807

62808

62809

62810

62811

62812

62814

62815

62816

62817

62818

62819

62820

62821

62822

62823

62824

62825

62827

62828

62829

62830

62831

62832

62833

62834

62835

62836

62837

62838

62839

62840

62841

62842

62843

62844

62846

62848

62849

62850

62851

62852

62853

62854

62855

62856

62858

62859

62860

62861

62862

62863

62864

62865

62866

62867

62868

62869

62870

62871

62872

62874

62875

62876

62877

62878

62879

62880

62881

62882

62883

62884

62885

62886

62887

62888

62889

62890

62891

62892

62893

62894

62895

62896

62897

62898

62899

62901

62902

62903

62905

62906

62907

62908

62909

62910

62912

62914

62915

62916

62917

62918

62919

62920

62921

62922

62923

62924

62926

62927

62928

62930

62931

62932

62933

62934

62935

62938

62939

62940

62941

62942

62943

62946

62947

62948

62949

62950

62951

62952

62953

62954

62955

62956

62957

62958

62959

62960

62961

62962

62963

62964

62965

62966

62967

62969

62970

62971

62972

62973

62974

62975

62976

62977

62979

62982

62983

62984

62985

62987

62988

62990

62992

62993

62994

62995

62996

62997

62998

62999

The following ZIP codes are no longer recognized by the U.S. Post Offi ce: 62805 and 62857