NORTH AMERICAN DIVISION

Healthcare Assistance Plan

Ascend to Wholeness Plans

SUMMARY PLAN DESCRIPTION (SPD)

JANUARY 01, 2021

TO WHOLENESS

HEALTHCARE PLANS

4818-5448-8033.1

2

ASCEND TO WHOLENESS PLANS / SUMMARY PLAN DESCRIPTION

4844-9924-9405.10

PLAN ADMINISTRATOR

North American Division of Seventh-day Adventists with duties delegated to:

Adventist Risk Management, Inc.

12501 Old Columbia Pike

Silver Spring, MD 20904

www.adventistrisk.org

MEMBER AND PROVIDER SERVICE

1-888-276-4732

benets@adventistrisk.org

PREFERRED PROVIDER ORGANIZATION (PPO) NETWORK (MEDICAL AND DENTAL)

Aetna Signature Administrators PPO by Aetna (except Oakwood University, see App. C)

https://asalookup.aetnasignatureadministrators.com

MEDICAL, DENTAL, AND VISION CLAIMS PROCESSING

WebTPA

P.O. Box 99906

Grapevine, TX 76099-9706

EDI: 75261

1-888-276-4732

PRESCRIPTION CLAIMS PROCESSING

Express Scripts

1-800-841-5396

UTILIZATION REVIEW MANAGER

(MEDICAL NECESSITY, PRE-CERTIFICATION, AND APPEALS)

Adventist Health Benets Administration

2625 SE 98

th

Ave.

Portland, OR 97266

1-888-276-4732

If you (and/or your dependents) have Medicare or will become eligible for Medicare in the

next 12 months, a Federal law gives you more choices about your prescription drug coverage.

Please see page 106 for more details.

3

ASCEND TO WHOLENESS PLANS / SUMMARY PLAN DESCRIPTION

4844-9924-9405.10

Welcome

Translation Services are Available

Key Plan Information

Schedule of Benets

Denitions

Eligibility, Enrollment and End of Coverage

Employee-Share Contribution

Pre-Certication Program

Providers and Facilities Available Under the Plan

General Benet Rules

Benets Description - Medical

Benets Description - Dental

Benets Description - Vision

Benets Description – Prescription Drugs

Benets Description – Complementary and Alternative

Limitations and Exclusions

Claims Procedures

Benets Available from Other Sources

Coordination of Benets

General Plan Information

Health Insurance Portability and Accountability Act Provisions (HIPAA Privacy Policy)

Medicare Part D Notice

Premium Assistance Under Medicaid and the Children’s Health Insurance Program (CHIP)

APPENDIX A – List of Covered Preventive Services

APPENDIX E – Care During the COVID-19 Pandemic

APPENDIX F – Extension of Certain Plan Deadlines During the COVID-19 Pandemic

4

4

5

7

19

30

39

40

47

49

50

60

63

64

69

70

74

89

93

98

102

106

108

111

121

122

TABLE OF CONTENTS

4

ASCEND TO WHOLENESS PLANS / SUMMARY PLAN DESCRIPTION

4844-9924-9405.10

Welcome

This Plan is intended to be, and has been since its establishment, a church plan within the meaning of Internal

Revenue Code Section 414(e) and ERISA Section 3(33). The North American Division of Seventh-day Adventists

established this Plan for its participating employers, which are Seventh-day Adventist Organizations, inclusive of

the General Conference of Seventh-day Adventists and its subsidiaries and aliates, that participate in the Plan

for their eligible employees based in the United States and certain included territories (Guam and the Northern

Mariana Islands), and the employees’ eligible dependents in order to fulll a key tenet of the Seventh-day Adventist

Church (the “Church”) in furthering the healing ministry of Jesus and, through his love and healing power,

promoting prevention, whole-person care, and physical, mental, and spiritual health. As a church plan, the Plan is

exempt from ERISA and is subject to the Church Plan Parity and Entanglement Prevention Act of 1999.

The Plan provides a broad range of benets for medical, vision, dental, and prescription expenses which you

and your eligible dependents may incur in the United States (and, if you are stationed in an included territory, also

provides benets for covered services received in an included territory). The Plan also pays a portion of the cost

of emergency medical expenses incurred anywhere in the world for outpatient care, hospital care, surgery,

preadmission services, and prescription drugs. Non-emergency services received outside of the United States are

excluded from coverage (except if received in an included territory if you are stationed in an included territory).

The Plan is self-funded by means of employer and employee contributions. Each participating employer is

responsible for funding only the claims of its own employees and its own employees’ dependents. Each

participating employer (including your employer) has designated the North American Division of Seventh-day

Adventists to administer the Plan, which it does via its delegate Adventist Risk Management, Inc. (which is part

of the Church). The North American Division of Seventh-day Adventists (the plan administrator of this Plan), its

delegate Adventist Risk Management, Inc. (“ARM”), and ARM’s representatives and delegates administer the Plan.

When the term “plan administrator” is used in this Plan, it generally refers to ARM as the delegate of the North

American Division of Seventh-day Adventists.

This Summary Plan Description (SPD) is designed to provide you with important information about your Plan’s

benets, limitations and procedures. Benets described in this document are eective January 1, 2021. This SPD is

also the Plan document. This SPD describes the benets available to all enrollees of the Plan; however, depending

on your state or territory of residence, you may be entitled to additional benets by state or territory law.

Your benets are aected by certain limitations and conditions, which require you to be a wise consumer of

health services and to use only those services you need. Also, benets are not provided for certain kinds of

treatments or services, even if your health care provider recommends them. Many items are not covered by the

Plan even though they may provide signicant patient convenience or personal comfort. The Plan does not, and

is not intended to, cover all healthcare services and products that are available, particularly treatment that is not

medically necessary.

In order to participate in this Plan, you are required to make “employee-share contributions,” which you may think

of as premiums. However, this Plan is not an insurance program or policy.

In this SPD, the terms, “you” and “your” refer to the covered employee. The terms “we,” “us” and “our” refer to the plan

administrator.

Questions about the Plan should be directed to Customer Service at 888-276-4732 or to your plan administrator by

email at bene[email protected]g. Thank you for choosing us as your healthcare plan.

Translation Services are Available

Spanish (Español): Para obtener asistencia en Español, llame al 888-276-4732.

Tagalog (Tagalog): Kung kailangan ninyo ang tulong sa Tagalog tumawag sa 888-276-4732.

Chinese (中文): 如果需要中文的帮助,请拨打这个号码: 如如如如如如如如如如如如如如如如如 888-276-4732.

Navajo (Dine): Dinek’ehgo shika at’ohwol ninisingo, kwiijigo holne’ 888-276-4732.

5

ASCEND TO WHOLENESS PLANS / SUMMARY PLAN DESCRIPTION

4844-9924-9405.10

Key Plan Information

Plan Name:

Healthcare Assistance Plan for Employees of Seventh-day Adventist Organizations of the North American

Division Aka Ascend To Wholeness Healthcare Plans (the “Plan”)

Plan Sponsor/Plan Administrator:

The Plan is sponsored by the North American Division of Seventh-day Adventists. For the purposes of both

(i) the privacy obligations under Health Insurance Portability and Accountability Act of 1996 (“HIPAA”), and

(ii) Plan nancial liability, your participating employer is the plan sponsor for its piece of the Plan. As such,

any obligation to you as an enrollee arising from this Plan is a general asset obligation of your participating

employer.

The Plan is administered by the North American Division of Seventh-day Adventists, which has delegated its

plan administrative duties to Adventist Risk Management:

Adventist Risk Management, Inc.

12501 Old Columbia Pike

Silver Spring, MD 20904

www.adventistrisk.org

benets@adventistrisk.org

(888) 276-4732

When the term “plan administrator” is used in this Plan, it generally refers to Adventist Risk Management as

the delegate of the North American Division of Seventh-day Adventists.

The plan administrator reserves the right to monitor telephone conversations and e-mail communications

between its employees and its customers for legitimate business purposes as determined by the plan

administrator. The monitoring is to ensure the quality and accuracy of the service provided by employees of

the plan administrator to their customers.

The plan administrator has the discretionary authority to administer the Plan in all of its details, including

determining eligibility for benets and construing all terms of the Plan. The plan administrator has the

discretion to determine all questions of fact and/or law that may arise in connection with the administration

of the Plan. The plan administrator may assign its duties to others, and the plan administrator has assigned its

duties to Adventist Risk Management and has granted Adventist Risk Management the authority to delegate

its plan administrative duties to other entities on its behalf.

Funding Medium and Type of Plan Administration: The Plan is self-funded by means of employer and

employee contributions. The portion the employee pays toward the total contribution is at a rate determined

by the participating employer. Each participating employer funds the Plan only for its own employees and their

dependents. The plan administrator provides claim processing and other administrative services to the Plan.

The plan administrator may delegate its duties to third parties. This is not an insured plan.

Plan Year: January 1 through December 31

Medical, Dental, and Vision Claims Processing:

WebTPA

P.O. Box 99906

Grapevine, TX 76099-9706

EDI: 75261 (888) 276-4732

www.AscendToWholeness.org

6

ASCEND TO WHOLENESS PLANS / SUMMARY PLAN DESCRIPTION

4844-9924-9405.10

Medical Necessity Pre-Certication/Utilization Review/Care Management:

Adventist Health Benets Administration

2625 SE 98th Ave.

Portland, OR 97266

(888) 276-4732

Amendment and Termination

This Plan may be terminated or this SPD may be changed or replaced at any time without notice, by a

resolution of the North American Division Committee of the General Conference of Seventh-day Adventists,

by the North American Division Risk Management Committee, or by the delegate of North American Division

of Seventh-day Adventists, which is Adventist Risk Management, or any authorized representative of the

North American Division of Seventh-day Adventists or its delegate, Adventist Risk Management. The right

to amend/terminate includes the right to curtail or eliminate coverage for any treatment, procedure, or

service, regardless of whether any covered employee is receiving such treatment for an injury, defect, illness,

or disease contracted prior to the eective date of the amendment/termination. Amendments may be made

retroactively.

7

ASCEND TO WHOLENESS PLANS / SUMMARY PLAN DESCRIPTION

4844-9924-9405.10

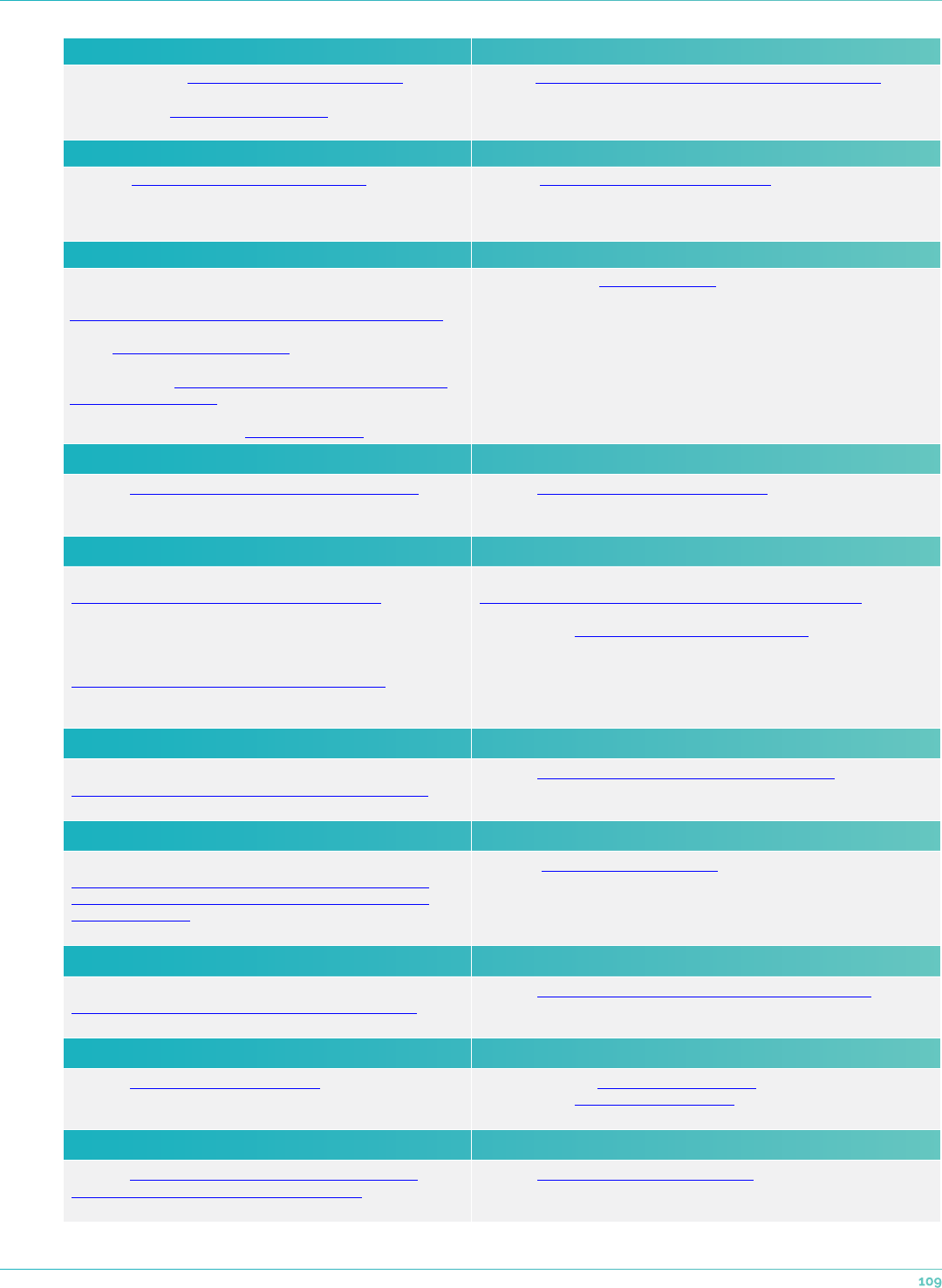

Schedule of Benets

The tables below summarize your Plan benets under your Plan election (Accelerate Plan or Access Plan),

applicable deductibles, the annual out-of-pocket maximums, and the co-payments and co-insurance

applicable to your coverage. This section only provides a summary of benets available. For a complete

discussion of the services covered under the Plan, as well as applicable benet limitations, exclusions from

coverage, and conditions of service that apply to your coverage, please refer to the subsequent chapters in

this SPD.

If you do not follow the procedures set forth in the Pre-Certication Program section

of the , no benets will be provided. Additionally, the expenses you incur due to not following the

Pre-Certication Program procedures will not be applied to your deductibles or out-of-pocket maximums.

( is not required for routine health care performed in a provider’s oce,

, emergency room, or via .)

Plan Coverage Levels – PPO Network

Generally, the Plan only covers services rendered by PPO facilities and PPO providers. Exceptions to this rule

are detailed in the Schedule of Benets.

Deductibles and Annual Out-of-Pocket Maximum

Deductible

A deductible is the amount of covered service expenses you must pay each year before the Plan will consider

expenses for reimbursement. An additional deductible applies for each enrollee you cover (except as limited

by the Plan’s out-of-pocket maximum). The annual deductible amount for each enrollee is shown in the table

below. Expenses incurred for services that are not covered services, even if received from a PPO provider, do

not count toward your deductible. There is a separate deductible for dental expenses.

There are deductibles for most medical and dental services. Certain benets are not subject to a deductible

and the expenses incurred for such benets do not count toward your deductible. The benets that are not

subject to a deductible are those listed in the Ancillary Medical Benets chart, oce/telehealth visits, urgent

care center visits, emergency room visits that do not result in hospital admission, preventive care services,

hospice, vision, and prescription drug expenses.

Please note that xed dollar co-payments do not apply toward your annual deductible.

The individual deductible is the amount of an individual’s covered expenses for dates of service within the

Plan Year period that must be paid by the enrollee before benets are paid by the Plan for that enrollee. Each

individual enrollee is subject to a separate deductible until the family deductible is reached. The family

deductible is the amount of the family’s collective covered expenses for dates of service within the Plan Year

period that must be paid by the enrollee before benets are paid by the Plan.

Deductible responsibilities are calculated and accrued based on dates of service, not dates paid. Benet

reductions due to non-compliance with the Plan or policy guidelines will not be credited toward the

deductibles.

Annual Out-of-Pocket Maximum

The annual out-of-pocket maximum is the most you pay during the year (January 1 through December 31)

before the Plan begins to pay 100% of the cost of covered services. The Plan maintains separate out-of-

pocket maximums for medical benets and pharmacy benets. Each out-of-pocket maximum is listed in the

Schedules of Benets below.

Generally, payments you make toward Plan coverage and benets, such as co-payments, co-insurance and

8

ASCEND TO WHOLENESS PLANS / SUMMARY PLAN DESCRIPTION

4844-9924-9405.10

expenses incurred in meeting deductibles, apply toward the applicable annual out-of-pocket maximum.

However, the following amounts do not apply toward the annual out-of-pocket maximums:

• Your required employee-share contributions

• Disallowed charges

• Balance billed charges (that is, amounts above the usual, reasonable, and customary charge

billed by an out-of-network provider directly to an enrollee)

• Amounts paid or credited for SaveonSP specialty drugs, listed at www.saveonsp.com/

adventistrisk (unless you are stationed in an included territory), and any other amounts paid

or credited for any drug under a drug manufacturer patient assistance program; for example,

copay coupons (these are not true out-of-pocket costs)

• Amounts you pay for services listed in the Schedule of Benets under “Ancillary Medical

Benets,” such as alternative therapies, refractive eye surgery, hearing aids, and infertility

treatment

• Amounts you pay for dental and vision benets (except that amounts you pay for an under age

19 pediatric annual eye examination and one pair of standard, clear-lens, prescription glasses

per child will apply toward your out-of-pocket maximum)

• Benet reductions due to non-compliance with policy guidelines and expenses incurred due

to non-compliance with pre-certication.

You will be required to continue paying your employee-share contributions even after the Plan’s annual

out-of-pocket maximums are reached.

Out-of-pocket maximums are applied to each individual, regardless of whether the coverage is self-only or

other than self-only (family coverage). For example, if one individual in a family reaches the individual out-

of-pocket maximum, then the Plan will cover any additional costs for that individual’s covered services for the

remainder of the plan year. The remaining members of the family will still be subject to their own individual

out-of-pocket maximums until the total family out-of-pocket maximum has been reached, at which point the

Plan will cover the costs of covered services for all of the members of the family for the remainder of the plan

year.

Co-Insurance and Co-Payments

For PPO providers and PPO facilities, the usual, reasonable, and customary charge is the negotiated network

rate. For out-of-network providers and out-of-network facilities, there is no negotiated fee. Therefore, if you

use an out-of-network provider or out-of-network facility in one of the limited circumstances in which out-of-

network services are covered, please note that you might be “balance-billed” by the out-of-network provider

or facility (i.e., charged more than the usual, reasonable, and customary charge) and therefore could owe more

than your co-payment plus your co-insurance.

After you pay your deductible, the Plan will pay 100% of the usual, reasonable, and customary charge for

covered services less your required co-insurances and co-payments.

The percentages the Plan pays apply only to covered service expenses that do not exceed usual, reasonable

and customary charges. You are responsible for all non-covered service expenses and any amount that

exceeds the usual, reasonable and customary charge for covered service expenses.

The Schedule of Benets lists your co-insurance percentage of the cost of covered services (up to the usual,

reasonable, and customary charge). Co-insurance percentages are the portions of covered service expenses

paid by you after satisfaction of any applicable deductible. For example, if the listed percentage in the below

9

ASCEND TO WHOLENESS PLANS / SUMMARY PLAN DESCRIPTION

4844-9924-9405.10

chart is 20%, then for in-network providers your co-insurance would be 20% of the network rate.

Co-payments are xed dollar amounts of covered service expenses to be paid by the enrollee. Co-payments

apply per visit/admission/occurrence. If the usual, reasonable, and customary charge is less than the co-

payment, then the co-payment is usual, reasonable, and customary charge. Please note that xed dollar

co-payments do not apply toward your annual deductible. Co-payments accumulate towards annual

member out-of-pocket annual maximums.

Lifetime and Annual Maximum Dollar Benet Amounts

Lifetime maximum benets are the maximum dollar amount of covered Plan benets for certain categories

of services that will be paid on behalf of each Member by the Plan in the Member’s lifetime while covered by

the Plan. Annual maximum benets are the maximum amount of covered Plan benets for certain categories

of services that will be paid on behalf of each Member by the Plan in the Plan Year while covered by the Plan.

Examples of services that are subject to annual maximums are certain dental and vision benets.

Lifetime and annual maximum benets apply only to the specic benets so stated in the Schedules of

Benets, and they do not apply to essential health benets, as dened by Federal regulations under the

Aordable Care Act of 2010.

Please see the Schedules of Benets for the specic benet categories with lifetime and annual dollar limits

and their respective maximum payable benet amounts.

10

ASCEND TO WHOLENESS PLANS / SUMMARY PLAN DESCRIPTION

4844-9924-9405.10

SCHEDULE OF BENEFITS

NOTE: For all Plan benets, the following apply:

• Co-payments do not accrue toward deductible and apply only to the oce visit charge.

• All other Usual, Reasonable, & Customary (U&C) charges for covered services apply to

deductible and out-of-pocket maximum unless otherwise noted.

• After you pay your deductible, the Plan will pay 100% of the U&C for covered services less your

required co-insurances and co-payments until you reach the Plan out-of-pocket maximum.

• Pre-certication is required for some services, and expenses incurred due to non-compliance

do not accrue toward deductible or out-of-pocket maximum.

• Out-of-network services are only covered in very limited circumstances. Where the below

chart says “not covered” in the Out-of-Network column, services will not be covered without

an approved Unavailable Service Request Form (“USRF”). The services listed in the “Ancillary

Medical Benets” chart are covered both in-network and out-of-network.

• Charges in excess of the Usual, Reasonable, & Customary Charge are member responsibility.

This means if you get care from an out-of-network provider, you may owe amounts in excess

of your co-payment and co-insurance.

• The Schedule of Benets is only a brief summary. You should read the appropriate Plan

sections for additional information about your coverage.

See the Pre-Certication Program section for details regarding services that require .

For employees stationed in the included U.S. territories and their eligible dependents only, out-of-network services

rendered in the included territories will be covered at the in-network cost sharing level. However, using an out-of-

network provider/facility may expose enrollees to balance billing, so using a provider/facility contracted with the

Plan is still advised, if available. (Please call Customer Service at 888-276-4732 for assistance.)

MEDICAL BENEFITS

Benefits

Accelerate Access

Out-of-Network

Usually Not Covered. Even

If Covered, You May Be

Subject To Balance Billing.

MEMBER RESPONSIBILITY

DEDUCTIBLE

• Individual/Family

• Services subject to deductible are marked with (D)

$300 / $600 $600 / 1200

Coverage level

is same as plan

selected, if

applicable.

CO-INSURANCE (AFTER DEDUCTIBLE) PAID BY

MEMBER

20%, unless

otherwise noted

20%, unless

otherwise noted

Out-of-network services

usually not covered. When

covered, co-insurance will

be 20% unless otherwise

noted (and you may be

subject to balance billing).

OUT-OF-POCKET MAXIMUMS

• Individual/Family

$2,750 / $5,500 $5,600 / $11,200

Same, but applies only

when services are covered;

depends on selected plan

option

PREVENTIVE SERVICES 0% 0% Not covered

11

ASCEND TO WHOLENESS PLANS / SUMMARY PLAN DESCRIPTION

4844-9924-9405.10

Benefits

Accelerate Access

Out-of-Network

Usually Not Covered. Even

If Covered, You May Be

Subject To Balance Billing.

MEMBER RESPONSIBILITY

FACILITY / AMBULATORY SERVICES

OUTPATIENT SERVICES (INCLUDES SERVICES/

SUPPLIES RECEIVED AT OFFICE VISITS BEYOND

OFFICE VISIT CHARGE)

• Pre-certication required for some outpatient

services (see the “Services Requiring Pre-

Certication” section)

20%

(D)

20%

(D)

Not covered

INPATIENT / OUTPATIENT HOSPITAL STAYS /

MATERNITY DELIVERY

OFFICE / AMBULATORY SURGICAL PROCEDURES

• Pre-certication required for all inpatient

surgeries/stays (except for observation only

and normal delivery in a PPO facility by a PPO

provider)

• Pre-certication required for most outpatient/

ambulatory procedures (see the “Services

Requiring Pre-Certication” section)

20%

(D)

20%

(D)

Not covered

ORGAN/TISSUE TRANSPLANTS

• Pre-certication required

20%

(D)

20%

(D)

Not covered

PHYSICIAN/PROVIDER SERVICES

OFFICE VISIT (APPLIES ONLY TO OFFICE VISIT

CHARGE)

$25 copay $50 copay Not covered

SURGEON FEES AND PHYSICIAN FEES BEYOND

OFFICE VISIT CHARGE

• Pre-certication required for all inpatient

surgeries

• Pre-certication required for most outpatient/

ambulatory procedures (see the “Services

Requiring Pre-Certication” section)

20%

(D)

20%

(D)

Not covered

THERAPEUTIC SERVICES

Physical Therapy

Occupational Therapy

Speech Therapy

• Maximum of 60 visits for any therapeutic

category per Plan Year

• Maximum of 90 visits collectively for all

therapeutic categories per Plan Year

• Pre-certication required after 12 visits per

condition/incident (but this pre-certication only

needs to be done once per condition being

treated, and does not need to be renewed each

year)

20%

(D)

20%

(D)

Not covered

VISION THERAPY

• Maximum of 30 visits per Plan Year

• Pre-certication required

20%

(D)

20%

(D)

Not covered

TELEHEALTH

• Telehealth may be accessed through the

Plan’s telehealth vendor (Amwell) or from a

PPO provider (as long as the PPO provider is

appropriately licensed and has the appropriate

technology to provide and bill for the covered

service)

$0 copay $0 copay

Any provider who is

neither an Amwell

provider nor a PPO

provider is not covered.

MATERNITY & OBSTETRICS 20%

(D)

20%

(D)

Not covered

12

ASCEND TO WHOLENESS PLANS / SUMMARY PLAN DESCRIPTION

4844-9924-9405.10

Benefits

Accelerate Access

Out-of-Network

Usually Not Covered. Even

If Covered, You May Be

Subject To Balance Billing.

MEMBER RESPONSIBILITY

EMERGENCY CARE

EMERGENCY ROOM

• Deductible does not apply if not admitted to the hospital*

• If admitted, deductible applies, but co-payment is

waived

• Emergency room visits are only covered when there is

an emergency medical condition

20% after

$100 copay

(D)*

20% after

$100 copay

(D)*

20% after

$100 copay

(D)*

EMERGENT IN-PATIENT HOSPITAL ADMISSION

• Out-of-network services are only covered until the

patient’s medical condition is stable, at which point

the patient must consent to a transfer to an in-network

facility

20%

(D)

20%

(D)

20% until stable;

then not covered

(D)

AMBULANCE SERVICES

• Pre-certication required for nonemergency ground

transportation and for any air transportation (unless

the utilization review manager determines that ground

transportation would have endangered the life of the

enrollee)

20%

(D)

20%

(D)

20%

(D)

URGENT CARE CENTERS

• May be paid as either an ofce visit or as an

Emergency room visit according to provider

contract

• Deductible does not apply regardless of how billed

• Facility fees for ofce visits are not paid

$25 – Ofce Visit/

UC POS

$100 + 20% – ER

$50 – Ofce Visit/

UC POS

$100 + 20% – ER

$25 or $50 – Ofce Visit/

UC POS, copay

depends on

selected plan option

$100 + 20% – ER

EQUIPMENT / SUPPLIES

DURABLE MEDICAL EQUIPMENT

• Benets include purchase or rental, not to exceed the

purchase price of the equipment.

• Pre-certication required for any CPM devices/machines

and Dynaplints.

• Pre-certication required for other durable medical

equipment or repair with billed charges of $2,000 or more

• Pre-certication required for any custom orthotics and for

orthotics/prosthetics with billed charges of $2,000 or more

20%

(D)

20%

(D)

Not covered

BREAST PUMP

• Pre-certication required for breast pump expenses of

$2,000 or more

0% 0% 0%

WIG AS A RESULT OF RADIATION, CHEMOTHERAPY,

OR PATHOLOGICAL CHANGE IN THE BODY

• Plan year maximum benet $1,000

20%

(D)

20%

(D)

20%

(D)

MENTAL HEALTH / SUBSTANCE ABUSE

MENTAL HEALTH COUNSELING SESSIONS

$25 $50

$25 or $50, copay depends

on selected plan option

MENTAL HEALTH OUTPATIENT SERVICES / PARTIAL

HOSPITALIZATION

• Pre -certication required for intensive outpatient

programs and some other outpatient services (see the

“Services Requiring Pre-Certication” section).

• Pre-certication required for partial hospitalization.

20%

(D)

20%

(D)

Not covered

MENTAL HEALTH INPATIENT SERVICES

• Pre-certication required

20%

(D)

20%

(D)

Not covered

RESIDENTIAL CARE AND TREATMENT

• Pre-certication required

20%

(D)

20%

(D)

Not covered

13

ASCEND TO WHOLENESS PLANS / SUMMARY PLAN DESCRIPTION

4844-9924-9405.10

Benefits

Accelerate Access

Out-of-Network

Usually Not Covered. Even

If Covered, You May Be

Subject To Balance Billing.

MEMBER RESPONSIBILITY

SUBSTANCE ABUSE/CHEMICAL DEPENDENCY

COUNSELING SESSIONS $25 $50

$25 or $50, copay,

depends on selected

plan option

SUBSTANCE ABUSE/CHEMICAL DEPENDENCY

OUTPATIENT SERVICES

• Pre-certication required for intensive outpatient

programs and some other outpatient services (see the

“Services Requiring Pre-Certication” section)

20%

(D)

20%

(D)

Not covered

SUBSTANCE ABUSE/CHEMICAL DEPENDENCY

INPATIENT TREATMENT

• Pre-certication required

20%

(D)

20%

(D)

Not covered

TELEHEALTH

• Telehealth counseling sessions for mental health

and substance abuse/chemical dependency may

be accessed through the Plan’s telehealth vendor

(Amwell) or from a PPO provider or an out-of-

network provider (as long as the professional

provider is appropriately licensed and has the

appropriate technology to provide and bill for the

covered service)

$0 copay $0 copay $0 copay

OTHER SERVICES

HEARING CARE PROFESSIONAL TESTING/

SCREENING

20%

(D)

20%

(D)

Not covered

HOME HEALTH CARE

• Maximum of 120 visits per Plan Year

• Pre-certication required

• Home health care plan submission required

20%

(D)

20%

(D)

Not covered

SKILLED NURSING FACILITY

• Pre-certication required

20%

(D)

20%

(D)

Not covered

HOSPICE CARE

• Pre-certication required

• Deductible does not apply

0% 0%

0%, but only covered

with approval from the

plan administrator via a

completed Unavailable

Services Request Form

OUTPATIENT DIABETES SELF-MANAGEMENT

TRAINING (DSMT)

• Up to 10 hours (1 hour private and 9 hours group)

training from a certied DSMT provider in the rst Plan

Year and then up to 2 hours of follow-up training in

subsequent Plan Years

0% 0% 0%

NUTRITIONAL COUNSELING

• Five visit annual limit (additional visits may be

authorized by the utilization review manager)

$0 copay $10 copay

Same, depends on

selected plan option

UNAVAILABLE SERVICES

UNAVAILABLE SERVICES

• Only covered with approved Unavailable Service

Request Form

• Deductible applies if it would apply to the same service if

rendered in-network*

N/A N/A

20% if approved;

otherwise not covered

(D)*

COST SHARING WILL BE WAIVED FOR COVID-19 TESTING AND TREATMENT,

SUBJECT TO THE CONDITIONS IN APPENDIX E

14

ASCEND TO WHOLENESS PLANS / SUMMARY PLAN DESCRIPTION

4844-9924-9405.10

ANCILLARY MEDICAL BENEFITS

Benefits

Accelerate Access

MEMBER RESPONSIBILITY

(Deductible does not apply)

ALTERNATIVE THERAPIES

For Accelerate Plan, benets are bundled and have a collective limit of 45 alternative therapy visits per Plan Year, with no single therapy

category to exceed 30 visits per Plan Year. For Access Plan, only Chiropractic Services are covered and there is a maximum of 30 visits

per Plan Year.

CHIROPRACTIC SERVICES

• Does not apply to Plan Year deductible or out-of-pocket maximum

20% 50%

ACUPUNCTURE THERAPY

• Does not apply to Plan Year deductible or out-of-pocket maximum

• No acupuncture benets for enrollees under age 18

50% Not covered

MASSAGE THERAPY

• Maximum allowable charge is $90 per visit

• Does not apply to Plan Year deductible or out-of-pocket maximum

• No massage therapy benets for enrollees under age 18

50% Not covered

REFRACTIVE EYE SURGERY

• Lifetime maximum payable benet of $2,400

• Does not apply to Plan Year deductible or out-of-pocket maximum

20% 50%

HEARING AIDS

• Plan Year annual maximum payable benet of $3,200

• Does not apply to Plan Year deductible or out-of-pocket maximum

20% 20%

INFERTILITY TREATMENT

• Lifetime maximum benet $16,000

• Does not apply to Plan Year deductible or out-of-pocket maximum

20% 50%

LIFESTYLE PROGRAMS

• 1 completed session/program per Plan Year

• Physician prescription required with claim submission

• Member will be reimbursed upon producing a receipt for covered service

• Does not apply to Plan Year deductible or out-of-pocket maximum

CHIP (Complete Health Improvement Program)

WEIGHT WATCHERS – GROUP MEETINGS ONLY

0% with proof of

80% completion

Only CHIP is covered

(with 0% member cost-

sharing with proof of

80% completion)

No other lifestyle

programs are covered.

15

ASCEND TO WHOLENESS PLANS / SUMMARY PLAN DESCRIPTION

4844-9924-9405.10

DENTAL BENEFITS – ACCELERATE PLAN

Benefits

In-Network Out-of-Network

MEMBER RESPONSIBILITY

PLAN YEAR DEDUCTIBLE

• Individual/Family

• Deductibles accumulate separately for in-network and out-of-network services.

$100 / $300 $150 / $450

CO-INSURANCE (AFTER DEDUCTIBLE) 20% 25%

ANNUAL MAXIMUM PAYABLE BENEFIT PER PLAN YEAR

• Individual/Family

$2,500 / $7,500

DENTAL CARE

PREVENTIVE CARE

• Deductible does not apply

• Does apply to Plan Year annual maximum payable benet, except for

pediatric (under age 19) preventive dental care

0% 0%

DENTAL CARE

RESTORATIVE CARE

• Applies to correlating Plan Year deductible

20% 25%

ORTHODONTIC CARE

• $2,300 maximum lifetime payable

• Eligible up to age 26 (through age 25)

50%

VISION BENEFITS – ACCELERATE PLAN

Benefits

NO NETWORK REQUIRED

MEMBER RESPONSIBILITY

VISION CARE

• No deductible

• Plan Year annual maximum payable benet $450 per member

• Annual maximum payable does not apply to pediatric (under age 19) annual

eye examination and one pair of standard, clear-lens, prescription glasses per

Plan Year

20%

16

ASCEND TO WHOLENESS PLANS / SUMMARY PLAN DESCRIPTION

4844-9924-9405.10

PRESCRIPTION BENEFITS – ACCELERATE PLAN

Prescription Drug

Out-of-Pocket Maximums

Individual/Family

$1,250 / $2,500

Prescription co-payment responsibility*

RETAIL – 30 DAY SUPPLY MAIL ORDER – 90 DAY SUPPLY

(via Walgreen’s Smart90, Express Scripts Home Delivery, or

Accredo Specialty Pharmacy)

Generic – Tier 1 $10

Brand (Preferred) – Tier 2 $20

Non-Formulary – Tier 3 $40

Generic – Tier 1 $20

Brand (Preferred) – Tier 2 $40

Non-Formulary – Tier 3 $80

• This benet only covers services/supplies received from Express Scripts (ESI) or from a pharmacy

contracted with ESI

• Brand (also known as “preferred” or “formulary”) drugs can be obtained from ESI or from a pharmacy

contracted with ESI

• Prescription co-payments apply to the prescription benet out-of-pocket maximum

• Penalties for non-compliance do not apply toward Plan Year out-of-pocket maximum

• The Plan pays 100% (and Members pay $0) for preventive prescription drugs received from ESI

or from a pharmacy contracted with ESI (as described in the section of this document entitled

PREVENTIVE PRESCRIPTION DRUGS)

Out-of-pocket for prescription benets will be tracked by Express Scripts. Your pharmacy will be notied if you

reach the Plan Year out-of-pocket maximum.

Specialty Drugs

Specialty drugs can only be lled via mail order through Accredo Specialty Pharmacy (see www.accredo.

com for details). For most specialty drugs, the co-payments listed in the chart above will apply (but see the

SaveonSP Specialty Drugs Program section below for exceptions). Certain infusion or injectable specialty

drugs are available only through the Medical Channel Management Program (see the Benets Description –

Prescription Drugs chapter for details).

SaveonSP Specialty Drugs Program

A list of SaveonSP Specialty Drugs may be found at www.saveonsp.com/adventistrisk

Co-payments for these drugs will uctuate depending on the amount of drug manufacturer assistance that is

available. However, if you sign up for the SaveonSP Program, your

If you do not sign up for the SaveonSP Program, then you will not have your out-of-pocket cost set by the

Plan at $0, you will have to pay a high co-payment for the drug (which is eligible for assistance from the drug

manufacturer), and any amount you pay will not apply to your Plan deductible or your Plan prescription drug

out-of-pocket maximum (because drugs eligible for the SaveonSP Program are not considered ACA essential

health benets).

17

ASCEND TO WHOLENESS PLANS / SUMMARY PLAN DESCRIPTION

4844-9924-9405.10

DENTAL BENEFITS – ACCESS PLAN

Benefits

In-Network Out-of-Network

MEMBER RESPONSIBILITY

PLAN YEAR DEDUCTIBLE

• Individual/Family

• Deductibles accumulate separately for in-network and out-of-network services.

$250 / $750 $500 / $1,500

CO-INSURANCE (AFTER DEDUCTIBLE) 20% 50%

ANNUAL MAXIMUM PAYABLE BENEFIT PER PLAN YEAR

• Individual/Family

$2,500 / $7,500

DENTAL CARE

PREVENTIVE CARE

• Does not apply to Plan Year deductible

• Does apply to Plan Year annual maximum payable benet, except for pediat-

ric (under age 19) preventive dental care

0% 0%

DENTAL CARE

RESTORATIVE CARE

• Applies to correlating Plan Year deductible

20% 50%

ORTHODONTIC CARE

• $2,300 maximum lifetime payable

• Eligible up to age 26 (through age 25)

50%

* For employees (and their dependents) stationed in the included U.S. territories, “in-network” includes all dental

professional providers rendering services within the scope of their license within the included territories.

VISION BENEFITS – ACCESS PLAN

Benefits

NO NETWORK REQUIRED

MEMBER RESPONSIBILITY

VISION CARE

• No deductible

• Plan Year annual maximum payable benet $225 per member

• Annual maximum payable does not apply to pediatric (under age 19) annual

eye examination and one pair of standard, clear-lens, prescription glasses per

Plan Year

20%

18

ASCEND TO WHOLENESS PLANS / SUMMARY PLAN DESCRIPTION

4844-9924-9405.10

PRESCRIPTION BENEFITS – ACCESS PLAN

Prescription Drug

Out-of-Pocket Maximums

Individual/Family

$1,550 / $3,100

Prescription co-payment responsibility*

RETAIL – 30 DAY SUPPLY MAIL ORDER – 90 DAY SUPPLY

(via Walgreen’s Smart90, Express Scripts Home Delivery, or

Accredo Specialty Pharmacy)

Generic – Tier 1 $10

Brand (Preferred) – Tier 2 $50

Non-Formulary – Tier 3 $100

Generic – Tier 1 $20

Brand (Preferred) – Tier 2 $100

Non-Formulary – Tier 3 $200

• This benet only covers services/supplies received from Express Scripts (ESI) or from a pharmacy

contracted with ESI

• Brand (also known as “preferred” or “formulary”) drugs can be obtained from ESI or from a pharmacy

contracted with ESI

• Prescription co-payments apply to the prescription benet out-of-pocket maximum

• Penalties for non-compliance do not apply toward Plan Year out-of-pocket maximum

• The Plan pays 100% (and Members pay $0) for preventive prescription drugs received from ESI

or from a pharmacy contracted with ESI (as described in the section of this document entitled

PREVENTIVE PRESCRIPTION DRUGS)

• See below for co-payments for certain drugs oered through the SaveonSP Specialty Drugs Program

(not applicable to employees stationed in the U.S. territories and their dependents; co-payments in

the chart above will apply to such enrollees)

• The Walgreens Smart90 retail program and SaveonSP Program are not available for employees

stationed in the U.S. territories (and their dependents)

• Mail order through the Accredo Specialty Pharmacy and use of the Medical Channel Management

Program are not required for employees stationed in the U.S. territories (and their dependents)

Out-of-pocket for prescription benets will be tracked by Express Scripts. Your pharmacy will be notied if you

reach the Plan Year out-of-pocket maximum.

Specialty Drugs

Specialty drugs can only be lled via mail order through Accredo Specialty Pharmacy (see www.accredo.

com for details). For most specialty drugs, the co-payments listed in the chart above will apply (but see the

SaveonSP Specialty Drugs Program section below for exceptions). Certain infusion or injectable specialty

drugs are available only through the Medical Channel Management Program (see the Benets Description –

Prescription Drugs chapter for details).

SaveonSP Specialty Drugs Program

A list of SaveonSP Specialty Drugs may be found at www.saveonsp.com/adventistrisk

Co-payments for these drugs will uctuate depending on the amount of drug manufacturer assistance that

is available. However, if you sign up for the SaveonSP Program, your cost will be set by the

at $0 and you will not be required to pay anything for the drug.

If you do not sign up for the SaveonSP Program, then you will not have your out-of-pocket cost set by the

Plan at $0, you will have to pay a high co-payment for the drug (which is eligible for assistance from the drug

manufacturer), and any amount you pay will not apply to your Plan deductible or your Plan prescription drug

out-of-pocket maximum (because drugs eligible for the SaveonSP Program are not considered ACA essential

health benets).

19

ASCEND TO WHOLENESS PLANS / SUMMARY PLAN DESCRIPTION

4844-9924-9405.10

Denitions

The following are denitions of some important terms used in this SPD. Wherever used in this SPD, unless the

context provides otherwise, whether italicized, highlighted, capitalized, or not, the terms have the meaning

set forth in this section.

means The Patient Protection and Aordable Care Act (PPACA) – also known as the

Aordable Care Act or ACA.

means as follows: (1) If you are an ACA ongoing employee, you will be an ACA full-

time employee for the plan year if your hours of service during the applicable standard measurement period

when divided by 12 are equal to or greater than 130. (2) If you are an ACA new variable-hour employee or

an ACA new part-time employee, you will be an ACA full-time employee for your initial stability period, if your

hours of service during your initial measurement period were equal to or greater than 130 hours per month.

This denition applies to all employees, including employees who are classied by their human resources

department as either temporary or per diem.

means an employee who has been continuously employed for at least one complete

standard measurement period.

means a new employee whom, based on the facts and circumstances on

the employee’s rst day of active employment, the employer reasonably expects to be employed by that

participating employer on average less than 130 hours of service per month during the employee’s initial

measurement period.

means a new employee for whom, based on the facts and circumstances

on the employee’s rst day of active employment, the employer cannot determine whether the employee is

reasonably expected to be employed by that participating employer on average at least 130 hours of service

per month during the initial measurement period because the employee’s hours of service are variable or

otherwise uncertain.

. You are considered to be actively at work when performing in the

customary manner all of the regular duties of your occupation with a participating employer, either at one

of the participating employer’s regular places of business or at some location to which the participating

employer’s business requires you to travel to perform your regular duties or other duties assigned by your

participating employer. You are also considered to be actively at work on each day of a regular paid vacation

or non-working day but only if you are performing in the customary manner all of the regular duties of your

occupation with the participating employer on the immediately preceding regularly scheduled work day. You

are also considered to be actively at work if you are absent from work due to your injury, illness, disability or

other medical condition. However, if coverage under the Plan is available from your rst day of employment,

you must actually start work in order for coverage to begin.

is the name of the delegated medical necessity pre-certication

utilization review manager for non-prescription drug benets for the Plan. Adventist Health Benets

Administration also handles non-prescription drug appeals of adverse benet determinations involving medical

judgment.

Adventist Health Benets Administration

2625 SE 98th Ave.

Portland, OR 97266

Phone: (888) 276-4732

Fax: (503) 261-6741

20

ASCEND TO WHOLENESS PLANS / SUMMARY PLAN DESCRIPTION

4844-9924-9405.10

. An adverse benet determination is any of the following (i) a denial, reduction,

or termination of a Plan benet, (ii) a failure to provide or make payment (in whole or in part) for a Plan benet,

or (iii) a rescission of coverage (whether or not the rescission has an adverse eect on any particular Plan

benet at the time of the rescission).

are support services provided to a patient in the course of care. They include such services

as laboratory and radiology.

means any leave of absence that is approved by your employer. Approved leave includes

summer vacation and other similar vacation periods for an employee working for a participating employer who

is a school, college, university, or other educational institution, until such employee is terminated.

means (i) an individual named on a completed Appointment of Authorized

Representative form that is submitted by a claimant, (ii) a physician or professional provider with knowledge

of the claimant’s medical condition (e.g., the claimant’s treating physician) or the facility where the claimant is/

was treated, unless the claimant provides specic written direction otherwise, and (iii) an employee for his or

her covered dependent who is under age 18. See the Claims Procedures chapter for more information.

means (1) a natural child; (2) a step-child (i.e., the child of an employee’s spouse); (3) a child

who has been legally adopted by the employee or the employee’s spouse, or placed for adoption with the

employee or the employee’s spouse, by either a court of competent jurisdiction or appropriate state agency;

(4) an individual for whom an employee or the employee’s spouse has been awarded legal guardianship by a

court; and (5) an individual for whom the employee is required to provide coverage pursuant to the terms of

a Qualied Medical Child Support Order (“QMCSO”) as dened in applicable federal law originally enacted as

part of the Child Support Performance and Incentives Act of 1998 [PL 105-200, 7/16/1998; Section 401(f)(1)].

means any request for a Plan benet or benets made in accordance with the Claims Procedures. A

communication regarding benets that is not made in accordance with the procedures will not be treated as

a claim.

is an individual who has made a claim in accordance with the Claims Procedures.

means the plan year or portion thereof.

means the Center for Medicare and Medicaid Services, the agency that administers Medicare, Medicaid,

and Child Health Insurance Program.

means the shared percentage cost of covered services that the enrollee pays.

means the xed dollar amounts of covered services to be paid by the enrollee.

means a medical condition.

means services or supplies which are not otherwise benets of the Plan, but

which plan administrator determines, in its sole discretion, to be medically necessary and cost eective.

means an eligible dependent of a covered employee of a participating employer whose

application has been accepted by the plan administrator and who has elected to cover such eligible

dependent.

means an eligible employee of a participating employer who is covered by this Plan

following acceptance by the plan administrator of that person’s application. For new employees, coverage

is contingent upon enrolling within 30 days (or a longer period if required by state law) of the rst day the

employee is eligible to participate in the Plan. (See Waiting Period and Eective Date section.) See the Open

Enrollment section below for the rules applicable to ongoing employees beginning and maintaining coverage.

For both new employees and ongoing employees, if you do not timely enroll in accordance with this SPD, you

will be required to wait until the next open enrollment period unless either the Change in Status section or the

21

ASCEND TO WHOLENESS PLANS / SUMMARY PLAN DESCRIPTION

4844-9924-9405.10

HIPAA Special Enrollment Rights section applies.

is a service or supply that is specically described as a benet of this Plan.

means care that helps a person conduct such common activities as bathing, eating, dressing

or getting in and out of bed. It is care that can be provided by people without medical or paramedical

certication or license. Custodial care also includes care that is primarily for the purpose of separating a

patient from others, or for preventing a patient from harming himself or herself. Custodial care and services

are services and supplies that are furnished mainly to train or assist a person in personal hygiene and

other activities of daily living rather than to provide therapeutic treatment. Activities of daily living includes

such things as bathing, feeding, dressing, walking, and taking oral medicines and any other services which

can safely and adequately be provided by persons without the technical skills of a nurse or healthcare

professional. Such care is considered to be custodial regardless of who recommends, provides or directs the

care, where the care is provided and whether or not the individual family member can be or is being trained

to care for him or herself. The Plan also considers any care or services to be custodial if they are or would be

considered custodial for Medicare purposes.

, when used in the Claims Procedures, means calendar day.

means a device specially designed to be placed surgically within or on the mandibular

or maxillary bone as a means of providing for dental replacement; endosteal (endosseous); eposteal

(subperiosteal); transosteal (transosseous).

means a judgment (i) of dissolution or annulment of a marriage or (ii) for legal separation

of the spouses in a marriage as ordered by a court of competent jurisdiction. The eective date of a divorce

for purposes of the Plan is the later of the divorce or separation eective date set by the court in its divorce/

separation order or the date on which the order is entered.

is equipment and related supplies which the Plan determines (1) are able to

stand repeated use, and be of a type that could normally be rented and used by successive patients, (2)

are used primarily and customarily to serve a medical purpose (e.g., not items like humidiers, exercise

equipment, gel pads, water mattresses, heat lamps, etc.), (3) are not generally useful to a person in the

absence of an injury or illness, (4) are appropriate for home use, and (5) meet the guidelines used by the CMS.

Examples of durable medical equipment include a wheelchair, a hospital-type bed and oxygen tanks.

means your spouse and/or child who is eligible for coverage under this medical Plan. The

eligibility provisions are set forth in the Eligibility, Enrollment and End of Coverage chapter.

means a literature evangelist who meets the qualications required by his or her

participating employer according to North American Division Working Policy Section FP 70.

means a seminary student who meets the qualications required by his or her

participating employer.

means a medical condition that manifests itself by acute symptoms of sucient

severity, including severe pain, that a prudent layperson possessing an average knowledge of health and

medicine would reasonably expect that failure to receive immediate medical attention would (i) place the

health of the individual (or, with respect to a pregnant woman, the health of the woman or her unborn child)

in serious jeopardy, (ii) cause serious impairment to bodily functions or (iii) cause serious dysfunction of any

bodily organ or part.

means, as provided in 26 CFR §54.9815-2719A, or any successor law or regulation, with

respect to an emergency medical condition, a medical screening examination which is within the capability

of the emergency department of a hospital, including ancillary services routinely available to the emergency

department to evaluate such emergency medical condition, and such further medical examination and

treatment, to the extent they are within the capabilities of the sta and facilities available at the hospital, as

are required to stabilize the patient (including in-patient services). For purposes of this section, the term “to

22

ASCEND TO WHOLENESS PLANS / SUMMARY PLAN DESCRIPTION

4844-9924-9405.10

stabilize,” with respect to an emergency medical condition, means to provide such medical treatment of the

condition as may be necessary to assure, within reasonable medical probability, that no material deterioration

of the condition is likely to result from or occur during the transfer of the individual from a facility, or, with

respect to a pregnant woman who is having contractions, to deliver (including the placenta).

means an individual who is engaged by the employer to perform services for the employer in a

relationship that the employer characterizes as an employment relationship. The following individuals are not

employees:

• Individuals working for the employer under a lease arrangement.

• Individuals who are engaged by the employer to perform services for the employer in a relationship

that the employer characterizes as other than an employment relationship. For example, individuals

engaged to perform services in a relationship which the employer characterizes as that of an

“independent contractor” with respect to the employer.

• Any individual described in this denition as not an employee is not eligible to participate in the Plan

even if a determination is made by the Internal Revenue Service, the United States Department of

Labor, another governmental agency, a court or other tribunal that the individual is an employee of

the employer. An individual who has not met the denition of employee shall become an employee

eligible to participate in the Plan (subject the individual’s meeting all other eligibility requirements

of the Plan) eective on the date the employer characterizes the individual as an employee in the

employer’s employment records.

means the contribution you must make for coverage under the Plan. This

amount is separate from the deductible and any co-payments or co-insurance you are required to pay for

covered services. See the Employee-Share Contribution chapter for further discussion.

means the participating employer at which you work.

(enrolled, enrolling, enrollment) means to submit, and be accepted by the plan administrator, a complete

and signed application for Plan coverage in accordance with the rules in the Eligibility, Enrollment and End of

Coverage chapter.

means a covered employee or a covered dependent.

means a hospital, hospice facility, skilled nursing facility, or mental health or substance abuse

residential facility.

means the Plan’s adverse benet determination made after

considering the nal internal appeal of a denial of a claim.

means an employee who is classied by his or her employer as a full-time, exempt or

non-exempt, regular employee either working in his or her position or on an approved leave of absence. A

full-time employee also includes regular employees working for two or more participating employers whose

total number of hours equals or exceeds the number of hours per week required to be considered full time.

(Such employees will enroll through one participating employer, but the participating employers will share

the employer portion of the cost of coverage.) The nal determination of whether an employee is a full-time

employee under the terms of the Plan will be made by the plan administrator.

means information about genes, gene products, and inherited characteristics that

may derive from the individual or a family member. This includes information regarding carrier status and

information derived from laboratory tests identify mutations in specic genes or chromosomes, physical

medical examinations, family histories, and direct analysis of genes or chromosomes.

means a program licensed and operated according to the law, which is approved by the

attending physician to provide palliative, supportive and other related care in the home for a covered person

23

ASCEND TO WHOLENESS PLANS / SUMMARY PLAN DESCRIPTION

4844-9924-9405.10

diagnosed as terminally ill.

a public or private organization, licensed and operated according to the law, primarily

engaged in providing palliative, supportive, and other related care for a covered person diagnosed as

terminally ill. The facility must have an interdisciplinary medical team consisting of at least one physician, one

registered nurse, one social worker, one volunteer and a volunteer program. A hospice facility is not a facility or

part thereof which is primarily a place for rest, custodial care, the aged, drug addicts, alcoholics or a hotel or

similar institution.

means a facility that is licensed as an acute care general hospital and provides in-patient surgical

and medical care to persons who are acutely ill. Additionally, the facility’s services must be under the

supervision of a sta of licensed physicians and must include 24-hour-a-day nursing service by registered

nurses. Facilities that are primarily rest, old age or convalescent homes are not considered to be hospitals.

Facilities operated by agencies of the federal government are not considered hospitals. However, the Plan will

cover expenses incurred in facilities operated by the federal government where benet payment is mandated

by law.

means each hour for which you are paid, or entitled to payment, for the performance of duties

for your employer, any entity that is treated as a single employer with your employer under Internal Revenue

Code section 414(b), (c), (m), or (o), or any other participating employer; and each hour for which you are paid,

or entitled to payment by your employer, any entity that is treated as a single employer with your employer

under Internal Revenue Code section 414(b), (c), (m), or (o), or any other participating employer for a period of

time during which no duties are performed due to vacation, holiday, illness, incapacity (including disability),

layo, jury duty, military duty or leave of absence. Your hours of service during an unpaid leave of absence will

be calculated in accordance with 26 CFR § 54.4980H-3(d)(6)(i). The term “hour of service” will be interpreted in

a manner consistent with Code Section 4980H and its regulations.

means a disease or bodily disorder.

means a material inserted or grafted into tissue.

means any request for Plan benets that is not made in accordance with the Claims

Procedures.

or means the United States territories covered

by this Plan, which are Guam and the Northern Mariana Islands.

means an entity that conducts independent external reviews of

adverse benet determinations in accordance with the Patient Protection and Aordable Care Act of 2010 and

associated regulations and is accredited by URAC or a similar nationally-recognized accrediting organization

to conduct external review.

is the administration of uids, nutrients or medications by means of a catheter or needle into

a vein. Infusion therapy is not the same as an injection.

(except where otherwise dened by your participating employer) means the

2-calendar-month period beginning immediately after an ACA new variable-hour employee’s or ACA new part-

time employee’s initial measurement period. The initial administrative period also includes any days from an

ACA new variable-hour employee’s or ACA new part-time employee’s rst day of active employment to the start

of the employee’s initial measurement period.

(except where otherwise dened by your participating employer) means the

11-calendar-month period beginning on the rst day of the month coincident with or following an ACA new

variable-hour employee’s or ACA new part-time employee’s rst day of active employment.

(except where otherwise dened by your participating employer) means the 12-month

period beginning immediately after an ACA new variable-hour employee’s or ACA new part-time employee’s

24

ASCEND TO WHOLENESS PLANS / SUMMARY PLAN DESCRIPTION

4844-9924-9405.10

initial administrative period.

means a personal bodily injury to you or your covered dependent.

- The terms network and in-network refer to PPO providers and PPO facilities.

means a hospital, hospice facility, skilled nursing facility, or mental health or substance

abuse residential facility that is a PPO facility.

means a physician or professional provider who is a PPO provider.

means any condition of an enrollee resulting from illness, injury (whether or not the injury is

accidental), pregnancy or congenital malformation. However, genetic information is not a medical condition.

– Determinations involving medical judgment include, but are not limited to, those based

on the Plan’s requirements for medical necessity, appropriateness, health care setting, level of care, or

eectiveness of a covered benet; the Plan’s determination that a treatment is experimental or investigational;

whether an enrollee is entitled to a reasonable alternative standard for a reward under a wellness program;

or whether the Plan is complying with the nonquantitative treatment limitation provisions of Code Section

9812 and Regulation Section 54.9812 (which generally require, among other things, parity in the application of

medical management techniques).

refers to obtaining the utilization review manager’s determination in

advance that proposed medical services requiring pre-certication are medically necessary, appropriate, and

neither Experimental nor Investigational Procedures as dened in the Limitations and Exclusions chapter.

means those services and supplies that are required for diagnosis or

treatment of illness or injury and which, in the judgment of the utilization review manager, are:

• Appropriate and consistent with the symptoms or diagnosis of the enrollee’s condition.

• Appropriate with regard to standards of good medical practice in the area in which they are provided

as supported by peer reviewed medical literature.

• Not primarily for the convenience of the enrollee or a physician or provider of services or supplies.

• The least costly of the alternative supplies or levels of service that can be safely provided to the

enrollee. This means, for example, that care rendered in a hospital inpatient setting is not medically

necessary if it could have been provided in a less expensive setting, such as a skilled nursing facility,

or by a nurse in the patient’s home without harm to the patient.

• Likely to enable the enrollee to make reasonable progress in treatment.

Please Note: The fact that or provider prescribes, orders, recommends or approves a

service or supply does not, of itself, make the service or a .

Member means enrollee.

for the purposes of this Plan means those conditions listed in the “Diagnostic and

Statistical Manual of Mental Disorders Fifth Edition” (DSM-5), or any successor volumes, except as stated

herein, and no other conditions. Mental health conditions include Severe Mental Illness and Serious Emotional

Disturbances of a child but do not include any services related to the following:

(i) Diagnosis or treatment of conditions represented by V codes in the DSM-5 (i.e., diagnoses related to

family problems, illegal behavior, low income, loneliness, abuse, neglect, deployment, imprisonment,

discrimination, lifestyle, etc.), or any successor volumes.

25

ASCEND TO WHOLENESS PLANS / SUMMARY PLAN DESCRIPTION

4844-9924-9405.10

(ii) Diagnosis or the treatment of any conditions with the following ICD-10 Classication of Mental and

Behavioral Disorders codes: F06.0, F06.8, F60.9, F65.4, F65.1, F65.2, F64.2, R37, F52.0, F52.21, F528,

F52.31, F52.32, F52.4, F52.6, F52.1, F65.0, F65.3, F65.51, F65.52, F64.1, F65.81, F66, F65.9, F98.4, F63.3,

R45.1, F91.9, F63.9, F63.0, F63.2, F63.1, F63.81, F81.0, F81.2, F81.81, F81.89, F80.89, F54.

means services provided to treat a mental health condition.

– The terms network and in-network refer to PPO providers and PPO facilities.

– The network rate is the negotiated amount for each service/supply that is pre-contracted and

agreed upon between the PPO Network and its participating providers and facilities. A network rate is also

known as a “negotiated rate.”

means an approved leave that is not a protected

leave. See the Reinstatement of Coverage and Special Situations, Extension of Coverage sections in the

Eligibility, Enrollment and End of Coverage chapter for special rules pertaining to coverage during and

following a non-protected leave.

refers to any health care facility that is not an in-network facility. With the exception

of emergency services, urgent care, and approved Unavailable Service Request Form services, care received

at out-of-network facilities is not covered.

refers to physicians and professional providers that are not in-network providers.

Except for the following exceptions, services received from out-of-network providers are not covered:

(i) Emergency services including emergency ground ambulance transportation, and including

emergency air ambulance transportation (but only with pre-certication or when ground transportation

would endanger the life of the member),

(ii) Urgent care,

(iii) Approved Unavailable Service Request Form (“USRF”) services, and

(iv) Service received at an in-network facility that is prescribed by a PPO provider (in which case the

service will be covered at the PPO level even if performed by an out-of-network provider).

(v) Service received in an included territory by an employee stationed in an included territory (or the

employee’s eligible dependent).

The Plan recognizes at times the Medical/Dental PPO Networks may not have PPO Providers accessible

to members that deliver needed medical/dental care. There are times members through the Unavailable

Services Request Form (USRF) Pre-Certication process will receive approval for medical services from

an Out-of-Network Provider or Out-of-Network Facility. Similarly, the USRF process may be used to

obtain approval to use an Out-of-Network dental provider with In-Network cost sharing-requirements.

While the following is not an exhaustive list, these are guidelines the Plan will use in determining

approval of USRF.

• Medical Necessity

• Availability of providers who are in the PPO relative to the members home or work address

o For rural areas the distances of Medical/Dental PPO Network Providers within

approximately 25 miles, or approximately 35-40 minutes driving.

o For metropolitan areas the distance of Medical/Dental PPO Network Providers within

approximately 10 miles or approximately 35-40 minutes of driving.

means surgery that does not require an inpatient admission or overnight stay.

means an employee who is not a full-time employee. The nal determination of whether

an employee is a part-time employee will be made by the plan administrator.

26

ASCEND TO WHOLENESS PLANS / SUMMARY PLAN DESCRIPTION

4844-9924-9405.10

means the Seventh-day Adventist Organizations, inclusive of the General Conference

of Seventh-day Adventists and its subsidiaries and aliates, that participate in the Plan. All participating

employers are required to be listed in the most recent version of the Adventist Organizational Directory or the

most recent version of the Seventh-day Adventist Yearbook. Participating employer entities are added and

subtracted from time-to-time by amendment. If you are unsure as to whether your employer is a participating

employer, please call the plan administrator at (888) 276-4732.

means a doctor of medicine or osteopathy.

means this Healthcare Assistance Plan aka Ascend to Wholeness Plans for Employees of the Seventh-day

Adventist Church Organizations based in the United States, Guam, and the Northern Mariana Islands.

means the North American Division of Seventh-day Adventists. The plan administrator

shall have full discretionary power to administer the Plan and to interpret, construe, and apply all of its

provisions, determine eligibility, and adjudicate claims as provided herein. The plan administrator may

delegate any of these duties as it deems reasonable and appropriate, and the plan administrator has

delegated its plan administrative duties to Adventist Risk Management (“ARM”) and has authorized ARM to

further delegate plan administrative duties to other entities. In administering the Plan, the plan administrator

(including its delegate, ARM, and ARM’s delegates) shall be guided by and adhere to the teachings and tenets

of the Seventh-day Adventist Church. When the term “plan administrator” is used in this Plan, it generally

refers to ARM in its role as the delegate of the North American Division of Seventh-day Adventists.

is the North American Division of Seventh-day Adventists; however, for the purposes of both (i)

the privacy obligations under the Health Insurance Portability and Accountability Act of 1996 (“HIPAA”), and (ii)

Plan nancial liability, your participating employer is the plan sponsor for its piece of the Plan.

means a calendar year (January 1 through December 31) or portion thereof. See denition for Claim

Determination Period.

means a hospital, hospice facility, skilled nursing facility, or mental health or substance abuse

residential facility that is a participating provider in the PPO Network.

means the preferred provider networks arranged by Aetna Signature Administrators PPO for

medical services and Aetna Dental Administrators for your Plan (for a list of contracted providers and facilities,

please go to www.aetna.com/asa or call 888-276-4732). (Employees of Oakwood University refer to Appendix

C for PPO Network information.) For employees (and their dependents) stationed in the included territories (and

for other enrollees receiving emergency services in the included territories), the term “PPO Network” includes

providers and facilities with which the Plan has contracted directly to provide covered services to Plan

enrollees (for help locating such providers and facilities, please call 888-276-4732 or go to

www.ascendtowholeness.org).

means a physician or professional provider who is in the PPO Network.

refers to obtaining approval

from the utilization review manager prior to the date of service for services that have been ordered by a

physician or professional provider.

means a licensed professional, when providing medically necessary services within

the scope of their license. In all cases, the services must be covered services under this Plan to be eligible for

benets.

means an approved leave during which your employer is required by state or federal law

to continue to oer you health plan coverage for a statutorily specied period of time. A leave is a protected

leave only during the time period during which health plan coverage is statutorily required to be maintained.

See the Reinstatement of Coverage and Special Situations, Extension of Coverage sections in the Eligibility,

Enrollment and End of Coverage chapter for special rules pertaining to coverage during and following

a protected leave. A workers’ compensation leave of absence does not meet the denition of protected

27

ASCEND TO WHOLENESS PLANS / SUMMARY PLAN DESCRIPTION

4844-9924-9405.10

leave. However, an employee who is o on a workers’ compensation leave is treated exactly the same as an

employee who is o on a comparable non-workers’ compensation leave.

refers to one of the following events:

• Marital Status: Your legal marital status changes for reasons of marriage, death of a spouse, divorce,

legal separation, or annulment.

• Dependents: Your number of eligible dependents changes due to birth, adoption, placement for

adoption, or death of an eligible dependent.

• Employment Status: You or your eligible dependent experience a change in employment status,

including: commencement or termination of employment, a change from part-time to full-time, or

full-time to part-time status, commencement or return from an unpaid leave of absence, or any other

change in employment status that aects benets eligibility.

• Change in Dependent Status: Your dependent satises or ceases to satisfy the eligibility requirements

for coverage.

• Residence: You or your eligible dependent change geographic residence provided that the change in

residence aects your or your eligible dependent’s eligibility for coverage under this Plan or another

plan or policy.

• Change in Coverage of Eligible Dependents. Your eligible dependent is entitled to make a change

to his or her coverage (or the coverage of another of your eligible dependents) under his or her

employer’s plan due to a permitted election change or during his or her plan’s annual enrollment

period, if dierent from the Plan’s annual enrollment period.

• Overall Reduction in Benets: You or your eligible dependent experience a signicant overall reduction

or termination of benets under the Plan or under another employer’s plan, as determined in the sole

discretion of the plan administrator. In general, for a group health plan, a signicant overall reduction