(Form Date: 04/01/2015; updated 03/28/2021) FRM_IntlPathnderApplication_INTEN | Page 1 of 5

INTERNATIONAL PATHFINDER

APPLICATION

DIVISION: UNION:

FIRST NAME: SURNAME:M.I. TELEPHONE NUMBER:

CONTACT INFORMATION:

CLUB NAME NUMBER OF PARTICIPANTS SELECT INSURANCE OPTION SEE TABLE BELOW

AUTHORISING SIGNATURE OF CHURCH OFFICIAL: DATE MM/DD/YYYY:

ELIGIBILITY

Class 1: All active members, leaders and committee members of the Participating International Pathnders Club attending any regularly approved unit activity as a group under

direct supervision of the duly designated leader.

Class 2: All active members, leaders and committee members of the Participating Clubs attending any regularly approved unit activity as a group under direct supervision of the duly

designated leader.

Please list Participant Clubs below (attach additional sheets as needed)

COVERAGE: Sponsored Activities including travel to and from home, Owned, Leased or Controlled Aircraft including business Travel without Personal

Deviation for Travel on the following covered aircraft; as on le with the company.

RETURN THIS FORM TO ADVENTIST RISK MANAGEMENT®, INC.

PLACEMENT SERVICES: 12501 Old Columbia Pike | Silver Spring, MD 20904 | path[email protected]

CLIENT CARE: 119 St. Peters Street, St. Albans | Hertfordshire, AL1 AEY, England | FAX: 44 (1727) 864578

CONFERENCE:

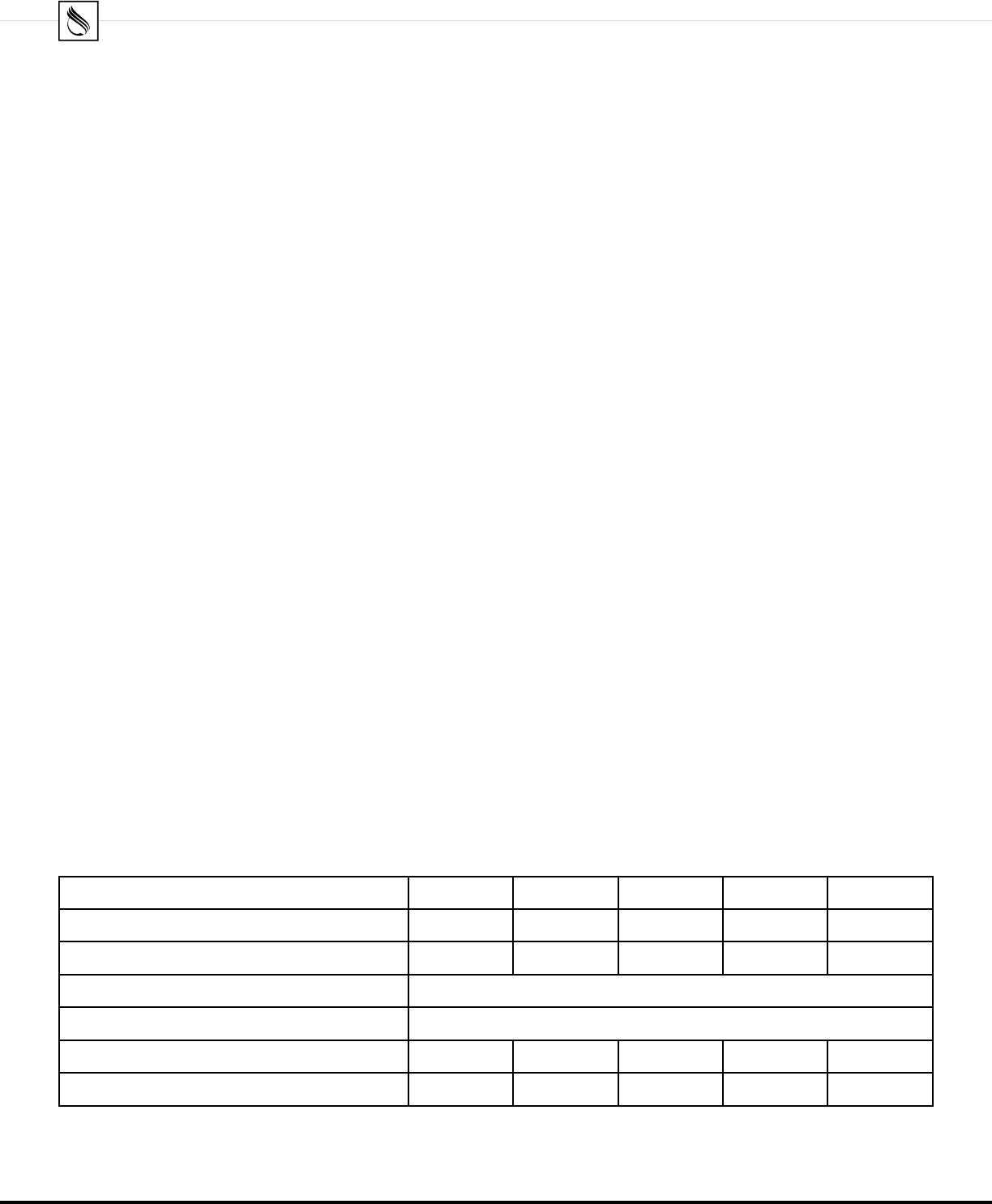

Option I Option 2 Option 3 Option 4 Option 5

Accidental Death and Dismemberment

$5,000 Max $5,000 Max $10,000 Max $20,000 Max $10,000 Max

Accident Medical Expenses – Deductible $0

$3,000 $4,000 $3,000 $4,000 $5,000

Evacuation & Repatriation

100% of Covered Expenses

Dental Expenses

Subject to $1,500 Maximum

Pathnders Rate per person $1.00 $1.70 $1.30 $2.00 $2.80

Youth Clubs Rate per person $1.15 $1.95 $1.40 $2.25 $3.20

-

Option 1Option 2Option 3Option 4Option 5

-

Option 1Option 2Option 3Option 4Option 5

-

Option 1Option 2Option 3Option 4Option 5

-

Option 1Option 2Option 3Option 4Option 5

-

Option 1Option 2Option 3Option 4Option 5

-

Option 1Option 2Option 3Option 4Option 5

-

Option 1Option 2Option 3Option 4Option 5

(Form Date: 04/01/2015; updated 03/28/2021)

INTERNATIONAL PATHFINDER

APPLICATION

FRM_IntlPathnderApplication_INTEN | Page 2 of 5

INTERNATIONAL PATHFINDERS CLUB MASTER ACCIDENT POLICY

Underwritten by ACE American Insurance Company

Policy Number: PTP N04822699

Accident Benets for General Conference Corporation of the Seventh-day Adventists and their aliated organisations

You are a Covered Party and eligible for coverage under the plan, if you are in the eligible class dened below. For benets to be payable the Policy must be in force, the required premium must

be paid, and you must be engaging in one of the Covered Activities described below.

CLASS DESCRIPTION:

Class 1: All active members, leaders and committee members of the Participating International Pathnders Club attending any regularly approved unit activity as a group under direct

supervision of the duly designated.

Class 2: All active members, leaders and committee members of the Participating Club attending any regularly approved unit activity as a group under direct supervision of the duly

designated leader.

Period of Coverage: You will be insured on the later of the Policy Eective Date or the date that you become eligible. Your coverage will end on the earliest of the date: 1) the Policy

terminates; 2) you are no longer eligible; or 3) the period ends for which the required premium is paid.

COVERED ACTIVITIES

Sponsored Activities: The Covered Accident must take place: 1) on the premises of the Policyholder during normal hours of operation; or 2) on the premises of the Policyholder during

other periods, if attending or participating in a Covered Activity; or 3) away from the premises of the Policyholder while attending or participating in a Covered Activity at its scheduled site. The

Covered Activity includes travel without deviation or interruption between home and the site of the Covered Activity.

Owned, Leased, or Controlled Aircraft: The Covered Accident must take place while: 1) you are travelling aboard or boarding or embarking a covered aircraft; or 2) as a result

of you being struck by a covered aircraft. 3) away from the Policyholder’s premises in your city of permanent assignment; 4) on business for the Policyholder; and 5) in the course of the

Policyholder’s business.

This coverage will start at the actual start of the trip. It does not matter whether the trip starts at your home, place of work, or other place. It will end on the rst of the following dates to occur:

1) the date you return to your home; 2) the date you return to your place of work; or 3) the date you make a Personal Deviation. “Personal Deviation” means: 1) an activity that is not reasonably

related to the Policyholder’s business; and 2) not incidental to the purpose of the trip. An aircraft will be deemed “controlled” by the Policyholder if the Policyholder may use it for more than 10

straight days, or more than 15 days in any year.

Aircraft Restrictions: If the Covered Accident happens while you are riding in, or getting on or o of, an aircraft, We will pay benets, but only if: 1) if you are riding as a passenger only, and

not as a pilot or member of the crew (except as provided by the Policy); and 2) the aircraft has a valid certicate of airworthiness; and 3) the aircraft is own by a pilot with a valid license; and 4) the

aircraft is not being used for: (i) crop dusting, spraying, or seeding; reghting; skywriting; skydiving or hang gliding; pipeline or power line inspection; aerial photography or exploration; racing,

endurance tests, stunt or acrobatic ying; or (ii) any operation which requires a special permit from the FAA, even if it is granted (this does not apply if the permit is required only because of the

territory own over or landed on). 5) the aircraft is a military transport aircraft own by the U.S. Military Airlift Command (MAC), or similar air transport service of another country.

Aggregate Limit: We will not pay more than $500,000 per Covered Accident for all losses. If, in the absence of this provision, we would pay more than this amount for all losses under the

policy, then the benets payable to each person with a valid claim will be reduced proportionately.

Benets/Limits - Maximums:

Option I Option 2 Option 3 Option 4 Option 5

Accidental Death and Dismemberment

$5,000 Max $5,000 Max $10,000 Max $20,000 Max $10,000 Max

Accident Medical Expenses – Deductible $0

$3,000 $4,000 $3,000 $4,000 $5,000

Evacuation & Repatriation

100% of Covered Expenses

Dental Expenses

Subject to $1,500 Maximum

Pathnders Rate per person $1.00 $1.70 $1.30 $2.00 $2.80

Youth Clubs Rate per person $1.15 $1.95 $1.40 $2.25 $3.20

(Form Date: 04/01/2015; updated 03/28/2021)

INTERNATIONAL PATHFINDER

APPLICATION

FRM_IntlPathnderApplication_INTEN | Page 3 of 5

Accidental Death and Dismemberment Benets:

If your injury results within 180 days from the date of a Covered Accident in any on the losses shown below, we will pay the Benet Amount shown on the next page for that loss. Your Principal Sum of

$5,000 or $10,000 or $20,000 depends on the Option you have selected. If multiple losses occur, only one Benet Amount, the largest will be paid for all losses due to the same Covered Accident.

Life 100% of the Principal Sum

Two or more Members 100% of the Principal Sum

One Member 100% of the Principal Sum

Quadriplegia 100% of the Principal Sum

Paraplegia 100% of the Principal Sum

Hemiplegia 100% of the Principal Sum

Thumb and Index Finger of the Same Hand 25% of the Principal Sum

Uniplegia 25% of the Principal Sum

“Quadriplegia” means total Paralysis of both upper and lower limbs. “Hemiplegia” means total Paralysis of the upper and lower limbs on one side of the body. “Uniplegia” means total

Paralysis of one lower limb or one upper limb. “Paraplegia” means total Paralysis of both, lower limbs or both upper limbs. “Paralysis” means total loss of use. A Doctor must determine the

loss of use to be complete and not reversible at the time the claim is submitted.

“Member” means Loss of Hand or Foot, Loss of Sight, Loss of Speech and Loss of Hearing. “Loss of Hand or Foot” means complete Severance through or above the wrist or ankle joint. “Loss of

Sight” means the total, permanent Loss of Sight of one eye. “Loss of Speech” means total and permanent loss of audible communication that is irrecoverable by natural, surgical or articial

means. “Loss of Hearing” means total and permanent Loss of Hearing in both ears that is irrecoverable and cannot be corrected by any means. “Loss of a Thumb and Index Finger of the

Same Hand” means complete Severance through or above the metacarpophalangeal joints of the same hand (the joints between the ngers and the hand). “Severance” means the complete

separation and dismemberment of the part from the body.

Accident Medical Expense Benets:

We will pay for Covered Expenses that result directly, and from no other cause, from a Covered Accident. These benets must be incurred within 180 days from the date of the Covered Accident

and are subject to a $0 Deductible. The Maximum Benet for all Accident Medical Expense Benets is dependent on the Option you have chosen. The Maximum for Dental Expenses is $1,500.

These benets are only payable: 1) for Usual and Customary Charges incurred after the Deductible has been met; 2) for those Medically Necessary Covered Expenses that you receive; and 3)

if the rst incurred expenses are within 90 days from the date of the Covered Accident. No benets will be paid for any expenses incurred that, in Our judgment, are in excess of Usual and

Customary Charges. In addition to the General Exclusions, W e will not pay Accident Medical Expense Benets for any loss, treatment or services resulting from or contributed to by:

• Treatment by persons employed or retained by the Policyholder, or by any Immediate Family or member of your household

• Treatment of sickness, disease or infections except pyogenic infections or bacterial infections that result from the accidental ingestion of contaminated substances.

• Treatment of hernia, Osgood-Schlatter’s Disease, osteochondritis, appendicitis, osteomyelitis, cardiac disease or conditions, pathological fractures, congenital weakness, detached retina unless

caused by an Injury, or mental disorder or psychological or psychiatric care or treatment (except as provided in the Policy), whether or not caused by a Covered Accident.

• Pregnancy, childbirth, abortion or any complications of any of these conditions.

• Mental and nervous disorders (except as provided in the Policy).

• Damage to or loss of dentures or bridges, or damage to existing orthodontic equipment (except as specically covered by the Policy)

• Expenses incurred for treatment of temporomandibular or craniomandibular joint dysfunction and associated myofascial pain (except as provided by the Policy).

• Injury covered by Workers’ Compensation, Employer’s Liability Laws or similar occupational benets or while engaging in activity for monetary gain from sources other than the Policyholder.

• Injury or loss contributed to by the use of drugs unless administered by a Doctor.

• Cosmetic surgery, except for reconstructive surgery needed as the result of an Injury.

• Any elective treatment, surgery, health treatment, or examination, including any service, treatment or supplies that: (a) are deemed by us to be experimental; and (b) are not recognized and

generally accepted medical practices in the United States.

• Eyeglasses, contact lenses, hearing aids, wheelchairs, braces, appliances, examinations or prescriptions for them, or repair or replacement of existing articial limbs, orthopedic braces, or

orthotic devices.

• Expenses payable by any automobile insurance Policy without regard to fault. (This exclusion does not apply in any state where prohibited).

• Conditions that are not caused by a Covered Accident.

• Participation in any activity or hazard not specically covered by the Policy.

• Any treatment, service or supply not specically covered by the Policy.

Emergency Medical Benets:

We will pay up to $10,000 for Covered Expenses incurred for emergency medical services to treat you if you: 1) suer a Medical Emergency during the course of a Trip; and 2) are traveling 100

miles or more away from your place of permanent residence. Covered Expenses include expenses for guarantee of payment to a medical provider, Hospital or treatment facility. Benets for

these Covered Expenses will not be payable unless the charges incurred: 1) are Medically Necessary and do not exceed the charges for similar treatment, services or supplies in the locality

where the expense is incurred; and 2) do not include charges that would not have been made if there were no insurance. Benets will not be payable unless We authorise in writing, or by an

authorised electronic or telephonic means, all expenses in advance, and services are rendered by Our assistance provider.

Emergency Medical Evacuation Benet:

We will pay 100% of Covered Expenses incurred for your medical evacuation if you: 1) suer a Medical Emergency during the course of the Trip; 2) require Emergency Medical Evacuation; and

3) are traveling 100 miles or more away from your place of permanent residence. Covered Expenses; 1) Medical Transport: expenses for transportation under medical supervision to a dierent

(Form Date: 04/01/2015; updated 03/28/2021)

INTERNATIONAL PATHFINDER

APPLICATION

FRM_IntlPathnderApplication_INTEN | Page 4 of 5

hospital, treatment facility or to your place of residence for Medically Necessary treatment in the event of your Medical Emergency and upon the request of the Doctor designated by Our assistance

provider in consultation with the local attending Doctor. 2) Dispatch of a Doctor or Specialist: the Doctor’s or specialist’s travel expenses and the medical services provided on location, if, based on the

information available, your condition cannot be adequately assessed to evaluate the need for transport or evacuation and a doctor or specialist is dispatched by Our service provider to your location to

make the assessment. 3) Return of Dependent Child(ren): expenses to return each Dependent child who is under age 18 to his or her principal residence if a) you are age 18 or older; and b) you are the

only person traveling with the minor Dependent child(ren); and c) you suer a Medical Emergency and must be admitted to a Hospital. 4) Escort Services: expenses for an Immediate Family Member

or companion who is traveling with you to join you during your emergency medical evacuation to a dierent hospital, treatment facility or your place of residence.

Benets for these Covered Expenses will not be payable unless: 1) the Doctor ordering the Emergency Medical Evacuation certies that the severity of your Medical Emergency requires an

Emergency Medical Evacuation; 2) all transportation arrangements made for the Emergency Medical Evacuation are by the most direct and economical conveyance and route possible; 3) the

charges incurred are Medically Necessary and do not exceed the Usual and Customary Charges for similar transportation, treatment, services or supplies in the locality where the expense is

incurred; and 4) do not include charges that would not have been made if there were no insurance.

Benets will not be payable unless W e authorise in writing, or by an authorised electronic or telephonic means, all expenses in advance, and services are rendered by Our assistance provider. In

the event that you refuse to be medically evacuated, we will not be liable for any medical expenses incurred after the date medical evacuation is recommended.

Repatriation of Remains Benet:

We will pay 100% of Covered Expenses for preparation and return of your body to your home if you die as a result of a Medical Emergency while traveling 100 miles or more away from your place of

permanent residence. Covered expenses include: 1) expenses for embalming or cremation; 2) the least costly con or receptacle adequate for transporting the remains; 3) transporting the remains;

and 4) Escort Services which include expenses for an Immediate Family Member or companion who is traveling with you to join your body during the repatriation to your place of residence.

All transportation arrangements must be made by the most direct and economical route and conveyance possible and may not exceed the Usual and Customary Charges for similar

transportation in the locality where the expense is incurred. Benets will not be payable unless We authorise in writing, or an authorised electronic or telephonic means, all expenses in

advance, and services are rendered by Our assistance provider.

Exclusions and Limitations:

We will not pay benets for any loss or Injury that is caused by, or results from:

• Intentionally self-inicted Injury.

• Suicide or attempted suicide.

• War or any act of war, whether declared or not (except as provided by the Policy).

• A Covered Accident that occurs while on active duty service in the military, naval or air force of any country or international organisation. Upon Our receipt of proof of service, We will

refund any premium paid for this time. Reserve or National Guard active duty training is not excluded unless it extends beyond 31 days.

• Sickness, disease, bodily or mental inrmity, bacterial or viral infection, or medical or surgical treatment thereof, except for any bacterial infection resulting from an accidental external

cut or wound or accidental ingestion of contaminated food.

• Piloting or serving as a crewmember in any aircraft (except as provided by the Policy).

• Commission of, or attempt to commit, an oence.

• The Covered Person being legally intoxicated as determined according to the laws of the jurisdiction in which the Injury occurred.

• Injury or loss contributed to the use of drugs, unless administered by a Doctor.

This insurance does not apply to the extent that trade or economic sanctions or regulations prohibit Us from providing insurance, including, but not limited to, the payment of claims.

Denitions:

“Covered Accident” means an accident that occurs while coverage is in force for you and results directly of all other causes in a loss or Injury covered by the Policy for which benets are payable.

“Covered Person” means any eligible person for whom the required premium is paid. “Injury” means accidental bodily harm sustained by you that results directly from all other causes from

a Covered Accident. All injuries sustained by one person in any one Covered Accident, including all related conditions and recurrent symptoms of these injuries, are considered a single Injury.

“Medical Emergency” means a condition caused by an Injury or Sickness that manifests itself by symptoms of sucient severity that a prudent layperson possessing an average knowledge

of health and medicine would reasonably expect that failure to receive immediate medical attention would place the health of the person in serious jeopardy. “Sickness” means an illness,

disease or condition that causes a loss for which you incur medical expenses while covered under this Policy. All related conditions and recurrent symptoms of the same or similar condition will

be considered one Sickness. “Trip” means travel by air, land, or sea from your Home Country. “We, Our, Us” means the insurance company underwriting this insurance or its authorised agent.

You must notify us within 90 days of an Accident or Loss. If notice cannot be given within that time, it must be given as soon as reasonably possible. This notice should identify you, the

Policyholder, and the Policy Number PTP N0482269.

Contact Information:

For eligibility verication or claims information, contact Adventist Risk Management at:

Phone: 1-301-453-7400 option # 1 (Outside and inside USA) | 1-888-951-4276 option # 1 (Inside USA) | Fax: 1-301-453-7060

Email: cla[email protected]

Mail claims to:

Adventist Risk Management, Attention: Claims

12501 Old Columbia Pike

Silver Spring, MD 20904-6600

(Form Date: 04/01/2015; updated 03/28/2021)

INTERNATIONAL PATHFINDER

APPLICATION

FRM_IntlPathnderApplication_INTEN | Page 5 of 5

Emergency Assistance Program:

In addition to the insurance protection provided by this plan, Internation SOS provides you with access to its travel assistance services around the world. These services include:

• Medical Assistance including referral to a doctor or medical specialist, medical monitoring when you are admitted to hospital, emergency medical evacuation to an adequate facility,

medically necessary repatriation, and return of mortal remains.

• Personal Assistance including pre-trip medical referral information and while you are on a trip: emergency medication, embassy and consular information, lost document assistance,

emergency referral to a lawyer, translator or interpreter access, medical benets verication, and medical claims assistance.

• Travel Assistance including emergency travel arrangements, arrangements for the return of your traveling companion or dependents, and vehicle return.

For medical referrals, evacuation, repatriation, security, and other services, contact International SOS at:

App: International SOS Assistance App (iOS and Android)

Phone: +1 215-942-8226

Email: phil[email protected]

Member Number: 11BCAM749125

Identify yourself as being with the Seventh-day Adventist Church.

This Description of Coverage is a brief description of the important features of the insurance plan. It is not a contract of insurance. The terms and conditions of coverage

are set forth in the Policy issued to the Policyholder. The Policy is subject to the laws of the state (in the United States) in which it was issued. Coverage may not be

available in all states or certain terms or conditions may be dierent if required by state law. Please keep this information as a reference.