Important Disclaimer

This checklist is provided to assist churches in fulfilling the requirement of Book of

Order provision G-10.0400, 4, d. The Book of Order does not require that the

annual review of the financial records of a congregation be conducted by a

professional accountant or attorney. Completion of this checklist should satisfy the

requirement of the Book of Order. The Office of Stewardship is not rendering

legal, accounting, or other professional services. If accounting or legal advice is

necessary or required, the services of a competent professional advisor should be

sought.

Copyright Information

© 2001 Presbyterian Church (U.S.A.). Significant portions of this document are

copyrighted by and used with the permission of the General Council on Finance

and Administration of the United Methodist Church.

1

INTRODUCTION

This document is intended as a guide to assist Presbyterian churches with their

compliance with the minimum standards of financial procedure specified in the

Constitution of the PC(USA), Part II, known as the Book of Order.

Section G-10.0401 of the Book of Order outlines the church finance

responsibilities and required financial procedures. Items 4a, 4b, and 4c discuss

minimum standards for daily operations, record keeping and financial reporting

throughout the year. Item 4d requires the local church to carry out the following:

A full financial review of all books and records relating to finances

once each year by a public accountant or public accounting firm or a

committee of members versed in accounting procedures. Such

auditors should not be related to the treasurer (or treasurers).

Terminology in this section is meant to provide general guidance and

is not intended to require specific audit procedures or practices as

understood within the professional accounting community.

As the Book of Order states,

"Such auditors should not be related to the treasurer (or treasurers)."

This document presents guidelines for such a committee of members as described

above. It is assumed that some churches are able and do hire professional

accountants to conduct a formal audit of the churches’ finances. These auditors are

well versed in the procedures that are necessary. It is the congregation not able to

hire a professional that this document primarily addresses (though it may be useful

and serve as a guide for any church no matter its size.) For the congregations that

use it, this document discusses the many aspects of planning, carrying out, and

documenting a financial review as required by the Book of Order.

The financial review of a congregation, regardless of the size of its membership or

budget, would typically include, but not be limited to, the steps included in this

guide.

2

Nature of the Review

The purpose of the review is not to catch someone in the act of misusing or stealing

funds. Though it may protect a congregation and treasurer from these things, the

primary purpose of the review is to insure good financial procedures and to help

the congregation have confidence and trust in the stewardship of their

contributions. A financial review includes becoming familiar with every aspect of

the church’s financial procedures. The committee should evaluate the church’s

financial operations, reports, policies, and procedures. The committee should use

interviews and firsthand observations to determine, to the best of its ability, the

answers to the following questions. The answers received and the judgment of the

committee will then affect the sample size of transactions and documentation

selected for examination and independent verification.

The checklist is a way of identifying areas that are strong and those that need

attention. An explanation of the items in the checklist appears at the end. It is

expected that the checklist be used before the instructions and explanation section

is consulted. This sequence speeds up the process and increases efficiency. The

section on instructions and explanations is not designed to be exhaustive.

3

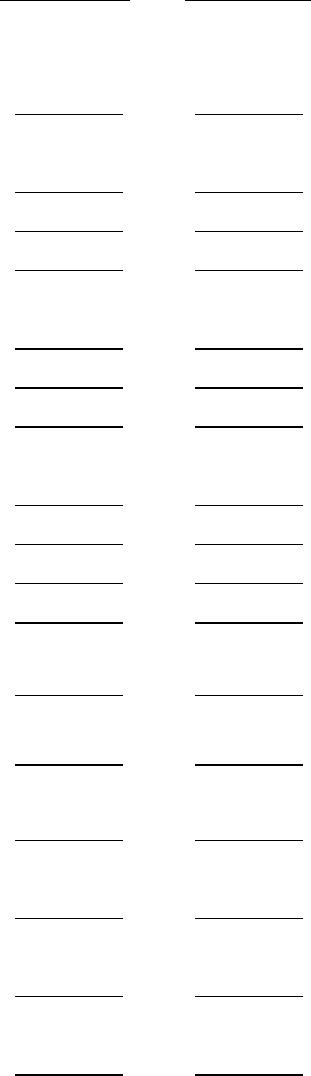

FINANCIAL REVIEW CHECKLIST

____________________________________PRESBYTERIAN CHURCH

For the Fiscal Year Ended

Date

Committee Member’s Signature

Date Completed Initials

Reconciliation of Bank & Investment Accounts

Operating bank account #

Month

Bank account #

Month

Bank account #

Are bank accounts balanced monthly?

Verification of beginning and ending year balance

BANK & INVESTMENT

Account signatories verified

Telephone or other transfer verified

Safe deposit box access checked

Account balances confirmed by Bank/Company

(see attached forms)

Name __________ Confirmation Sent & Returned

Name __________ Confirmation Sent & Returned

Name __________ Confirmation Sent & Returned

Name __________ Confirmation Sent & Returned

4

Date Completed

Initials

A. INCOME

Offering counted by two unrelated persons

Funds deposited in timely fashion

Financial secretary’s and treasurer’s

records compared against deposits

Transactions checked against postings to GL

Other income processes verified

Designated funds directed to restricted accounts

Pledges recorded on donor records

Confirmations sent to donors

#sent _______

(Keep a list)

# returned ________

Differences researched & cleared

Finance secretary’s records reviewed

Finance secretary’s records agree with general ledger

NOTES:

5

Date Completed

Initials

B. DISBURSEMENTS

Invoices properly approved

Canceled checks examined to verify that disbursements

were actually paid to the proper parties

Check number and date noted

All checks, used and voided, accounted for

Purchase order system, if applicable, functioning

appropriately

Accounts to charge noted on invoice

Any invoices to vendors over 30 days in arrears

Per capita and mission apportionments

paid per session direction

Interest & service charges recorded

General ledger balances equal daily transaction

A procedure in place to account for restricted gifts

Procedure in place to distribute gifts regularly

(Confirm with receiving agency in Presbytery)

Designated gifts paid out on a timely basis

(Confirm with receiving agency in Presbytery)

Canceled checks matched to invoice

for appropriateness

Disbursement of petty cash funds given

proper approval

Reimbursements to the petty cash fund

properly made

Maximum figure for individual approval of payments

established and followed

NOTES:

6

Date Completed

Initials

C. REPORTS

Complete financial picture provided by reports

Reports made helpful to committee members

Approved budget included in reports

Over-budget expenditure approvals in order

Controls for over expenditures provided

Policies for restricted funds reviewed

Restricted funds used according to policy

Regular reports provided on pledge giving to

finance committee and pastor

Reports provided in timely fashion

Reports distributed to the appropriate people

Both a balance sheet and a statement of income

and expense prepared

NOTES:

7

Date Completed

Initials

D. GENERAL LEDGER

Restricted funds separated appropriately

Internal controls for receipts reviewed

(see separate document for understanding of internal controls)

Internal controls for disbursements reviewed

Other asset accounts reviewed

(equipment, buildings, contracts, etc.)

Accounts payable reviewed

Accounts receivable reviewed

Prepaid expense account reviewed

Any related party/employee loans noted

Unearned Income account reviewed

Fund balance from prior year correct

Correct fund balance carried into next year

NOTES:

8

Date Completed

Initials

E. ADMINISTRATIVE

Church Employer Identification Number obtained

File for EIN and tax filings safeguarded

Deed to church property and/or mortgage safeguarded

Insurance policies safeguarded

Insurance coverage appears to be adequate

Prior year insurance policies safeguarded

Church has separate bond for persons

handling money

Where and how documents are safeguarded noted

Persons with access noted

NOTES:

9

Date Completed

Initials

F. PAYROLL

Personnel files kept on individuals

Personnel files safeguarded and confidential

Salaries paid according to approval

Tax forms issued to clergy persons, employed

persons, and government

Payroll tax deposits and timely remittances

to government made

Time sheets filed and approved

(not by treasurer)

Employee benefits paid and current

pension _____ other _____

Any salary reduction plans noted

Session/committee approval noted and

written documentation in file

Amount paid to persons on contract/

honorarium verified

Proper 1099 filing of approvals for persons paid

for over $600 paid on contract/honorarium

Other

NOTES:

10

REPORT OF THE ANNUAL FINANCIAL REVIEW

The Session is required to provide for an annual audit of the records of all financial

officers, including the financial secretary and/or church business manager and/or

treasurers of the church and all its organizations and shall report to the Session.

____________________________________________________________Church

_________________________________________________________ Presbytery

For the period beginning ___________________________________, _________

and ending _________________________________________, _________.

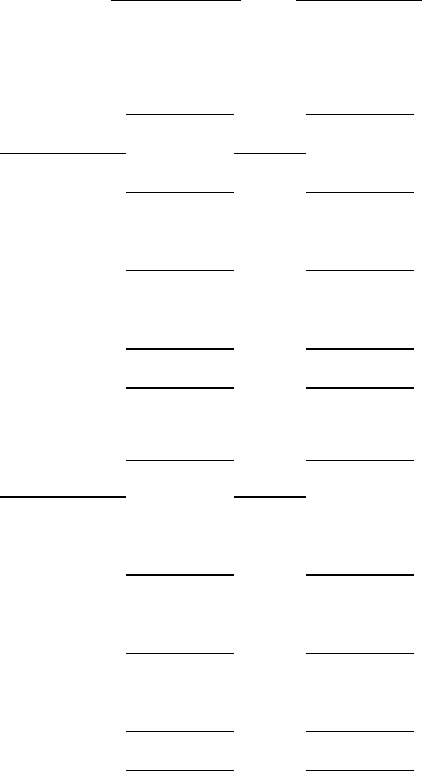

I. RECEIPTS, DISBURSEMENTS, AND BALANCES

Local Church Funds

(Use those applicable to your church)

( a )

Balance

at Beginning

of Period

( b )

Cash

Received &

Recorded

( c )

Total

Disbursements

for Period

( d )

For

Transfers

+(-)

( e )

Balance

at End

of Period

General Fund

$$$ $$

Benevolence Fund

Building or Improvement Fund

Board of Trustee’s Fund

Presbyterian Women

Presbyterian Men

Church School

Other Fund Organizations

Name:

Name:

Name:

Name:

Name:

Total amount of cash in

ALL treasuries of the church

$$$ $$

11

THE FINANCIAL REVIEW CHECKLIST

INSTRUCTIONS and EXPLANATIONS

A. Confirmation

After the books are closed for the year but before the financial review

begins, the committee should prepare confirmations for banks, insurance

companies, and donors. Those confirmations are essential for providing

independent confirmation of bank account balances and authorized

signatures, the coverage level(s) and related premiums(s) for all insurance

policies, and, on a test basis, donor contributions.

1. Bank Confirmations

For each bank and investment account, request the balance as of year

end and a list of person(s) authorized to sign on each account.

(See

items on Checklist, under Bank and Investment.)

2. Insurance Company Confirmations

Request the confirmation of the policy number, the level of coverage

and the anniversary date and premium.

(See insurance items on Checklist,

under (E.) Administrative.)

3. Pledge and Donation Confirmations

On a test basis (a representative sample), confirm the amounts

received from donors and the period for which the donation is to be

booked. Copies of year-end statements may be used to facilitate this

process.

(See items related to donors on Checklist, under (A.) Income.)

These confirmations constitute an essential piece of the reviewing

process. Second requests may be required if confirmations are not

responded to in a timely fashion. The responses should be sent

directly to the reviewer(s), not in care of the church.

12

B. Cash

Two categories of cash need to be audited at year end: bank or savings

accounts held in the name of the church, and any petty cash accounts held in

the office of the church. At this time the reviewer must have the list of all

bank accounts and person(s) authorized to sign on each, a copy of all the

financial statements for each month being reviewed, and the bank account

statements and reconciliations for that same period. (See items on Checklist,

under (A.) Income)

Z

Review the bank confirmations to see that the ending balance as stated

by the bank is the same figure used in the last statement of the fiscal

year, then check to see that the current authorized signers as listed by

the bank are the same names listed within church records. If the lists

fail to match, inform the treasurer, who should investigate any

differences.

Z

Review all bank reconciliations to see that the beginning balance of

one month is the same as the ending balance of the previous month.

Note whether the book balance as listed on the bank reconciliation is

the same balance presented on the financial statements.

Z

Pick a month and actually perform a bank reconciliation for each

account using the original books of entry, the financial secretary’s

records and any subsidiary journals. If you find a discrepancy

between your reconciliation of the month and the reconciliation

provided by the treasurer(s), research the discrepancy to find an

explanation or an error.

Z

The reviewer should do an independent count of all petty cash

accounts. This count should tie to the books. Review expense types

for their appropriate charging to program area or administrative

accounts. Ascertain suitableness and adherence to policies.

13

C. Income/Receipts

Determine if the deposits as listed by the financial secretary and the treasurer

match those listed on the bank statement. Verify, on a test basis, the deposits for

Sundays during the calendar year.

(See items on Checklist, under (A.) Income.)

Z

Test (a random sample, not to exceed 10 items) the counter’s

documentation versus the Sunday receipt deposit slips and bank

statements. Review original book of entry for correct posting of

Sunday deposits.

Z

Using the donor confirmations, determine whether the amount paid as

reported by the donor is the same as recorded and received by the

financial secretary. If there is a difference, research for a timing

difference, inaccurate recording, or some other explanation.

Z

Review the original books of entry to determine if other income has

been recorded accurately (i.e., appropriate account, correct amount,

unrestricted or designated vs. restricted, etc.). Trace the entries to the

financial statements.

14

D. Disbursements

(See items on Checklist, under (B.) Disbursements.)

Z

Review the Finance Committee and other committee minutes, as

appropriate, for actions concerning disbursements, including

benevolent and per capita payments. Reconcile those actions with any

actual payments made.

Z

Test to ensure that all of the disbursements have been properly

authorized.

Z

Review the original books of entry and disbursements journal to

ensure that all disbursements have been recorded appropriately.

Z

For the insurance premium disbursements, check to see whether the

amount disbursed is the same as that listed by the insurance company

as premiums due.

Z

Verify that income designated for special mission purposes has been

distributed or allocated accordingly.

If there is a purchase order system in conjunction with disbursements,

note whether the purchase orders have been authorized and approved

by the appropriate person(s) and matched against the actual

disbursement or invoice.

15

E. Payroll and Tax Records

(See items on Checklist, under (B.) Payroll)

Z

Reconcile all payroll with tax records and tax payments made.

Z

Verify that the appropriate amounts have been reported on the 941s,

W-2s and 1099s and that the forms have been transmitted to the

federal, state and local tax authorities on a timely basis. Also verify

the existence of current W-4s and I-9s for all staff. The church may

not

do Social Security withholding for clergy but can make voluntary

income tax withholding pursuant to a W-4 form, at the pastor=s

request.

Z

Test that the appropriate amount of taxes have been deducted from the

paychecks and can be tracked back to the W-4 as submitted by each

staff person.

Z

If the church is not using an accountable reimbursement plan for

clergy, or other staff, the appropriate allowances need to be recorded

on the W-2 form (or 1099 form, if it is still being used) issued by the

church to the clergy.

Z

Track the payroll and tax records to the actual disbursements made

and recorded with the original books of entry.

Z

If irregularities exist, research to determine (error) or cause.

Z

If there are Tax Deferred Annuities (TDAs), Section 125, or other

salary reduction agreements, verify existence of signed agreement and

proper tax withholding applied.

Z

Verify pension contribution with pension board. If there is a salary

reduction agreement, review documents for accuracy and verify that

agreements have been approved by Session.

Z

Verify that housing allowance resolutions are in place and have been

properly applied to reduce clergy’s reportable 941 and W-2 income.

16

I. RECOMMENDATIONS

The Auditors/Auditing Committee

(circle one)

has examined the accounts listed on

the front side, reviewed procedures of counting and accounting under the current

Book of Order G-10.0401d, reconciled receipts and disbursements with bank

deposits and bank balances, and has found the balances displayed correctly,

presented fairly, with proper procedures, and records properly kept, except as noted

below:

Signed: ______________________________________ Date ________________

Financial Review Committee Chair or Auditor

COPIES OF THIS REPORT SHOULD BE DISTRIBUTED TO

THE MODERATOR OF SESSION, CLERK OF SESSION, AND ALL SESSION MEMBERS,

COMMITTEE ON FINANCE AND/OR BOARD OF TRUSTEES