DISASTER RISK FINANCE - A TOOLKIT

May 2019

GIZ ACRI+ Commissioned Report

Authored by:

Conor Meenan, Risk Management Solutions (RMS)

John Ward, Pengwern Associates

Robert Muir-Wood, Risk Management Solutions (RMS)

3CONTENTS

CONTENTS

EXECUTIVE SUMMARY 05

INTRODUCTION 09

Why we need disaster risk management 10

A toolkit for disaster risk finance: report structure 13

DISASTER RISK FINANCE TOOLKIT 15

1. Risk audit 16

2. Disaster risk management actions 20

3. Dimensions of instrument design 22

3.1. Risk Holder 23

3.2. Purpose 26

3.3. Timing 27

3.4. Risk Level 29

4. Disaster risk finance instruments 30

4.1 Risk Reduction 31

Loans 31

Micro-credit 32

Bonds 33

Grants, subsidies, & tax breaks 34

Crediting 35

Impact bonds 36

4.2. Risk Retention 37

Budget contingency 40

Reserve Funds 41

Contingent loans 42

4.3. Risk Transfer Instruments 43

Micro-insurance 44

Agriculture insurance 45

Takaful & mutual insurance 46

Insurance & reinsurance 47

Catastrophe bonds 48

Risk pools 49

5. Risk management strategy 50

5.1. Complementarity 50

5.2. Risk Layering 53

6. Illustrative urban use case 57

This page intentionally left blank.

EXECUTIVE SUMMARY 5

Executive

Summary

DISASTER RISK FINANCE – A TOOLKIT6

EXECUTIVE SUMMARY

e impacts of climate-related disaster risks are growing.

e Intergovernmental Panel on Climate Change

identies that the frequency and severity of climate-

related hazards are already increasing due to climate

change, and that this will worsen in the future. e

damage that events cause is also growing, as people and

assets continue to concentrate in vulnerable locations and

inadequate measures are taken to reduce the vulnerability

of people and assets to these risks.

ese risks disproportionately aect developing countries.

is is driven both by their greater exposure to risks and

their greater vulnerability once risks materialize. 90 per

cent of those who have been killed by disasters since

the 1990s live in either Africa or Asia, while the direct

economic losses from disasters are 14 times higher in low–

income countries than high–income countries.

ere is an imperative to reduce and better manage these

risks. A key element to achieving this is the development

of disaster risk management plans. ese plans, developed

ahead of a specic disaster arising, can specify what

actions to undertake to reduce risks and also who will do

what, taking account of what evidence, after a disaster.

To be eective, these plans need to be developed in an

inclusive way, with particular focus on the needs of the

poor and vulnerable. ey require the participation of a

large number of stakeholders through processes that can

often be facilitated by development and humanitarian

partners.

However, disaster risk management plans only work when

accompanied by nance. is nance facilitates and

incentivizes activities that reduce risk. It also means that

sucient and reliable resources are available to respond

when remaining risks materialize. Ensuring this nance is

available in a timely fashion after a disaster is crucial for

reducing the human cost of disasters.

Much uncertainty surrounds the dierent nancial

instruments for disaster risk that are available to

governments, municipalities, communities and

households – as well as the development and

humanitarian partners who support them. Dierent

instruments can play dierent roles, providing dierent

amounts of resources to dierent actors at dierent

speeds. is means that dierent instruments are more or

less appropriate to use in dierent circumstances. It also

means that, in most cases, a combination of instruments

will be required to eciently and comprehensively

manage disaster risk.

e purpose of this disaster risk toolkit is to provide

practical guidance on how to choose which disaster risk

nance instruments for which circumstance. e main

audience is policymakers in developing countries who

are responsible for disaster risk management, at national,

regional and local levels. It is also intended to assist

the development and humanitarian community who

support developing country policymakers in disaster

risk management and who, sometimes, either implicitly

or explicitly, also hold some of the risks associated with

disasters in these countries. It is structured as a series of

steps that those actors who hold risk, and the partners

who support them in this role, can follow to better

understand, reduce and manage these risks, and nance

activities accordingly.

EXECUTIVE SUMMARY 7

Step 1: Risk Audit. is involves developing a sound

understanding of the underlying risk in order to shape

the subsequent nancing strategy. is consists of four

phases (i) dening the exposure at risk – both in terms

of people and assets - to understand what needs to be

managed; (ii) identifying what perils and hazards can

impact that exposure, (iii) quantifying the expected

frequency and severity of impact from those perils,

ideally using a probabilistic risk analysis, and; (iv)

setting a resilience target to identify the extent to

which risks will be explicitly managed.

Step 2: Determining disaster risk management actions.

is requires identifying actions that can be taken to cost

eectively reduce the risks that are faced. is will be

determined based on specic circumstances and requires

both sound economic analysis and engaged, participatory

processes. In relation to the remaining risks, a decision

needs to be taken as to which will be retained (the

nancial consequences of the risk materializing are borne

by those who face the risk) and which will be transferred

(the nancial consequences of the risk materializing are

passed to a third party, usually in return for a premium

payment).

Step 3: Understanding the dimensions of the financing

need. Risk reduction, retention and transfer can be

achieved by using a range of nancial instruments.

However, before these instruments can be selected,

a basic situational analysis should be undertaken to

understand the nancial needs associated with these

activities in more detail. is can be structured around

answering four key questions:

– What is the capacity and need of the risk holder?

e risks of disasters fall on a wide range of actors,

from individuals to communities, municipalities

and sovereign governments. ere may also be cases

where the humanitarian and development community

choose to hold risks, in order to reduce the human

suering that events will otherwise cause. Dierent

risk holders will have dierent capacities and nancial

ability to make use of dierent nancial instruments.

– What will the funds be spent on? e ultimate purpose

of disaster risk nance instruments is to fund or

facilitate resource ows towards a diverse range of

activities that make disasters less damaging for people.

is can be further disaggregated between funding

directed towards protecting and managing the impacts

of risk on lives and livelihoods; funding directed at

reducing the damage that events cause on assets and

facilitating the reconstruction of assets,

and the services they provide, after a destructive event;

and funding covering the immediate operational and

humanitarian needs after a disaster strikes.

– When is funding needed? Funding for risk reduction

is required in advance of disaster impact, and can be

independent of any particular event, or based on long

or near-term event forecasts. After an event strikes,

funding needs spike and there is an urgent need

for additional resources, followed by a longer term,

typically larger, but less urgent, need for funding to

support reconstruction. Dierent nancial instruments

are more or less valuable in meeting funding needs at

dierent timescales.

– What level of risk is being addressed? Some risks

manifest themselves on a frequent basis, even annually.

Other risks are much less frequent but, when they do

arise, cause more severe levels of impact. e prole

of risk has an important bearing on which nancial

instruments might be desirable.

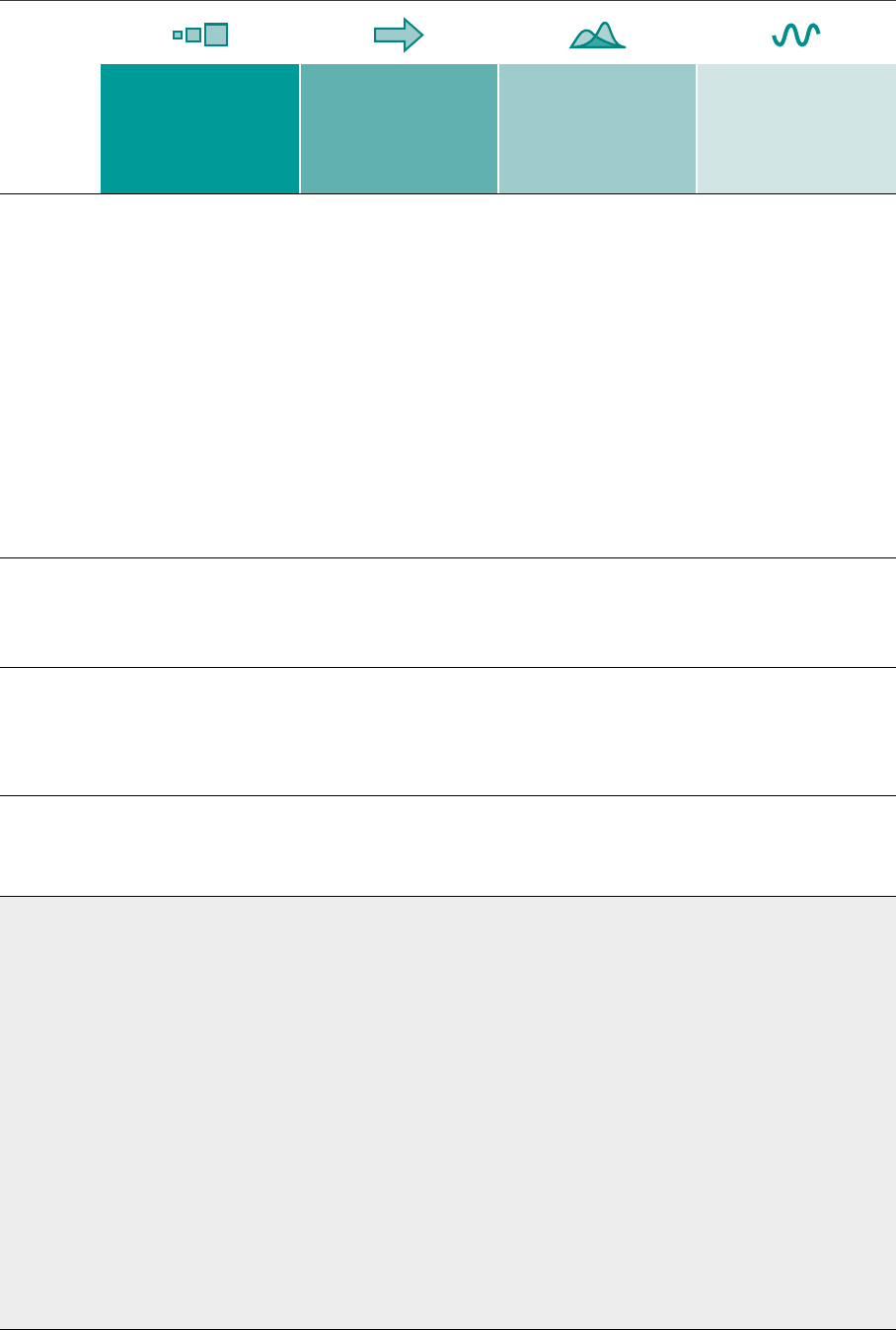

Step 4: Selecting disaster risk financing instruments.

is involves understanding the range of nancial

instruments available, their strengths and weaknesses and

applicability to dierent dimensions of nancing needs.

To support risk reduction activities, the key instruments

and incentives that can be considered are loans; micro-

credit; bonds; grants, subsidies and tax breaks; crediting

and impact bonds. e key nancing instruments for

risk retention are budget contingencies, reserve funds

and lines of contingent credit. Risk transfer instruments

include insurance – and its dierent forms including

mutual insurance, Takaful, microinsurance, agriculture

insurances and risk pools – as well as catastrophe bonds.

Many of these instruments have a range of variants

that alter their suitability in dierent circumstances. In

particular, risk retention and risk transfer instruments

where dierent ‘trigger’ mechanisms can be used to

determine whether and how much funding is released

following a disaster. Figure 1 illustrates how these

dierent instruments map on to the dimensions of

nancing need identied in step 3.

FINANCE & INSURANCE TOOLKIT For the Renewable Energy Sector in Barbados8

Figure 1. Taxonomy of DRF instruments

Risk Holder Purpose Timing Risk Level

What is the capacity and need

of the risk holder?

What will funds be spent on? When is funding needed? What level of risk is being

addressed? (return period)

Action Instrument Individual Community Municipality Sovereign Life &

Livelihood

Operational Physical

Assets

Preparation Response Recovery Annual 1-10

year

10-50

year

50+

year

Risk Reduction

Loan

• • • • • • • • • •

Micro-credit

• • • • • • • •

Bonds

• • • • • • • • •

Grants, subsidies,

& tax breaks

• • • • • • • • • • •

Crediting

• • • • • • • • • • •

Impact Bonds

• • • • • • • • • • • • •

Risk Retention

Budget

Contingency

• • • • • •

Reserve Funds

• • • • • • • • • • •

Contingent Loans

• • • • • •

Risk Transfer

Micro-insurance

• • • • • • • • •

Agriculture

Insurance

• • • • • • • •

Takaful & Mutual

Insurance

• • • • • • • • • • • •

Insurance &

Reinsurance

• • • • • • • • • • • •

Catastrophe Bonds

• • • • • • • • •

Risk Pools

• • • • • • • • •

Step 5: Combining disaster risk financing instruments

to create a disaster risk finance strategy. A coherent

disaster risk nancing strategy will involve more than one

instrument. e possibility of combining instruments

opens up a range of further issues that risk holders and

their partners need to consider. Risk reduction activities

reduce the residual risk, and therefore the expected costs

associated with risk retention and risk transfer. Focus is

growing on how to capture this risk reduction in a way

that increases the incentive to reduce risks. As regards risk

retention and risk transfer instruments, a risk-layering

strategy can reduce costs and improve the reliability

of funding. is involves combining risk retention

instruments for high-probability, low impact events with

risk transfer instruments for the lower probability, higher

impact events.

To practically illustrate these steps, the nal section of

the paper presents a hypothetical use case of an urban

environment in South East Asia and shows how these

steps might be followed and the possible implications

that may result.

INTR ODUCTION 9

Introduction

DISASTER RISK FINANCE – A TOOLKIT10

INTRODUCTION

Why we need disaster risk management

Natural systems contain extremes, whether in the

motions of the atmosphere, the concentration of

precipitation, or the accumulation and release of

strain along faults. e gradients of temperature in the

atmosphere can generate vortex storms. e runo from

extreme rainfall can overow river systems. e absence

of rain over many months itself causes drought and can

exacerbate wildre. e continents are being pushed

and pulled by the convective currents within the earth.

Human induced climate change threatens to make

many of these extreme events more likely. e

Intergovernmental Panel on Climate Change

1

identies

that the frequency and severity of climate-related hazards

are already increasing due to climate change, and that

this will worsen in the future. In particular it warns that

we can expect an increased frequency and intensity of

heatwaves; an increased frequency of heavy precipitation

events, resulting in greater risk of ooding at the regional

scale; and an increased frequency and intensity of extreme

sea level events, such as those caused by storm surges.

e impact of these extreme events depends critically

on both the exposure and vulnerability of potentially

aected people and assets. Exposure relates to the

extent to which people, communities and assets are

located in areas that are prone to hazards. For example,

exposure increases when decisions are taken that lead

to people living in ood prone areas (or, alternatively,

when decisions that might prevent people from living in

ood prone areas fail to be taken). Vulnerability relates

to the social, economic and environmental factors which

increase the susceptibility of people, communities or

assets to the impact of a hazard. For example, people who

lack the knowledge or resources to undertake preventative

actions ahead of a disaster arising are more vulnerable

to the impacts of that disaster. Unsurprisingly, the poor

and socially disadvantaged are typically also the most

vulnerable to disasters, lacking access to public services

and with restricted availability or aordability of water,

food and other consumption items.

Both exposure and vulnerability help to explain why the

impact of disasters is far more damaging in developing

countries than in developed ones. According to the

INFORM Index for Risk Management

2

, 9 out of the 10

countries most exposed to natural hazards are developing

countries – while developing countries account for

all of the top 70 positions in the same organization’s

vulnerability index. Correspondingly, 90 per cent of

those who have been killed by disasters between 1990 and

2013 lived in low or middle income countries

3

, while the

direct economic losses from disasters, when expressed as

a percentage of GDP, are 14 times higher in low–income

countries than high–income countries

4

.

Policymakers and humanitarian actors increasingly

recognize the need to respond to these growing risks,

especially in developing countries. As the Box A below

explains, the Sendai Framework

5

and the Warsaw

International Mechanism for Loss and Damage

6

are

multilateral initiatives that reect the urgency that

the international community attaches to reducing and

managing disaster risks while the Agenda for Humanity

7

also places a strong focus on managing disaster risks in

developing countries.

Responding to these risks requires information,

planning and nancial resources, along with an

appropriate enabling environment. ere is little that

can be done to control how hard the wind blows, but it

is possible to assess how much damage it might cause in

which locations. Similarly, it is possible to understand

how the design of the built environment will inuence the

damage caused by wind, ood, re, and ground shaking.

is information allows the development of disaster risk

management plans to better reduce and manage these

risks. ese plans can identify risk-informed actions to

reduce risks – both a long time in advance of a disaster,

and through anticipatory actions taken immediately

before a disaster strikes – and how these actions will

be nanced. ey can also identify what will happen

after a disaster strikes, who will undertake what actions

to respond and recover from an event and where the

associated nancial resources will come from. By making

plans ahead of time, identifying and clarifying roles

and responsibilities (both nancial and otherwise), the

devastating impacts of disasters can be reduced

8

. ese

plans are easier to develop and implement when there is

political consensus on their value – so that they can be

developed through a technocratic, apolitical process –

and when backed by an enabling legal framework.

INTR ODUCTION 11

e success of disaster risk management plans depend

critically on the involvement of all key stakeholders:

policymakers, international actors, humanitarian

agencies, non-governmental actors and community

groups. It is particularly important for plans to be

developed in active consultation with those who are

most vulnerable to disasters – such as disabled, elderly,

women, slum dwellers and indigenous groups. Typically

these groups bear the brunt of any disaster impact but

can be too easily excluded from decisions over what

should be done and where. Only with the full and

active participation of these groups can the devastating

impact of disasters on lives, livelihoods and economic

development potential be reduced and managed

eectively.

e Integrated Climate Risk Management (ICRM)

approach from GIZ’s ACRI+ project provides a

framework for the development and execution of

disaster risk management plans. It emphasizes both the

traditional role of disaster risk management in responding

to growing climate risks, as well as the important role of

risk retention and risk transfer mechanisms. It explains

how the latter could be particularly important as the

adverse eects of climate change pose new forms of risks

that are currently dicult to predict. Figure 2 illustrates

the framework.

Figure 2. Integrated Climate Risk Management (ICRM) Approach.

risk reduction

measures

pre-disaster

financing

emergency

management

relief

post-disaster

financing

rehabilitation

building

back

better

risk

analysis

RESILIENCE

©

G

I

Z

/

M

C

I

I

2

0

1

7

P

r

e

v

e

n

t

i

o

n

R

e

t

e

n

t

i

o

n

&

T

r

a

n

s

f

e

r

P

r

e

p

a

r

e

d

n

e

s

s

R

e

c

o

v

e

r

y

R

e

s

p

o

n

s

e

DISASTER RISK FINANCE – A TOOLKIT12

e development of disaster risk management plans

according to this framework is a substantial exercise –

this Toolkit focuses on the nancial instruments that

can facilitate their implementation. e development

of disaster risk management plans requires consideration

of a wide number of factors including what activities

to undertake and when, and how to ensure active

participation of all key stakeholders. is report does not

seek to discuss all of these issues. Rather, recognizing

the emphasis that the ICRM framework places on risk

retention and transfer, which typically require dedicated

nancial instruments, it has a more focused purpose: to

i While this is partly motivated by the specialised financial instruments associated with risk retention and transfer, it also

considers financial instruments that can be used for all elements of a disaster risk management plan.

examine the nancial instruments that allow the delivery

of disaster risk management plans

1

. Often this is seen as

a technical, somewhat impenetrable, issue. But, it has a

crucial role: the delivery of nance through appropriate

instruments is indispensable for the cost-eective

implementation of any plan. is report aims to provide

a practical disaster risk nance toolkit for policymakers,

humanitarian actors and practitioners to understand the

wide range of nancial instruments that are available;

their characteristics, strengths and weaknesses; and how

they can be combined within a disaster risk management

plan to develop a coherent, cost-eective approach.

Box A. Multilateral initiatives to address disaster risk

The Sendai Framework is a 15-year (from the year of its adoption in 2015), voluntary, non-binding agreement

which recognizes that the State has the primary role to reduce disaster risk but that this responsibility should

be shared with other stakeholders including local government, the private sector and other stakeholders.

It aims for: ‘The substantial reduction of disaster risk and losses in lives, livelihoods and health and in the

economic, physical, social, cultural and environmental assets of persons, businesses, communities and countries’.

This objective is encapsulated in seven targets – relating to, for example, global disaster mortality and direct

disaster loss – to be delivered through four priorities for action. These priority areas are:

• Understanding disaster risk

• Strengthening disaster risk governance

• Public and private investment in disaster risk reduction; and

• Enhancing disaster preparedness for effective response and to Build Back Better

The Warsaw International Mechanism for Loss and Damage associated with Climate Change Impacts

has been mandated with promoting implementation of approaches to address loss and damage associated

with the adverse effects of climate change. It has three main functions:

• To enhance knowledge and understanding of comprehensive risk management approaches to address loss

and damage

• To strengthen dialogue, coordination, coherence and synergies among relevant stakeholders

• To enhance action and support, including finance, technology and capacity-building, to address loss

and damage associated with the adverse effects of climate change

The Agenda for Humanity, arising from the World Humanitarian Summit sets out five major areas to address and

reduce humanitarian need, risk and vulnerability, and 24 key transformations that will help achieve these five

major areas. It places a strong emphasis on managing disaster risk with one of the key transformations being to

anticipate crises, using data and risk analysis to take early action and thereby prevent and mitigate crises.

It also calls for, among other things, international frameworks and regional cooperation to ensure that countries

in disaster-prone regions are prepared to receive and protect those displaced across borders; greater support

for Small Island Developing States to prevent, reduce and address disasters resulting from climate change;

increasing domestic resources for risk management, including by expanding tax coverage, increasing expenditure

efficiency, setting aside emergency reserve funds, dedicating budget lines for risk-reduction activities and taking

out risk insurance; and for developed countries to dedicate at least 1 per cent of official development assistance

(ODA) to disaster risk reduction and preparedness activities by 2020.

INTR ODUCTION 13

A Toolkit for Disaster Risk Finance: Report Structure

e below schematic provides an overview of the

structure of the Toolkit. Disaster risk nancing (DRF)

instruments exist to fund the various costs of managing

disaster risk and set incentives for a behavioral change.

However, instruments dier signicantly in their cost,

how much nance they provide and how quickly they

can mobilise resources.

is implies, critically, that disaster risk nancing

instruments should not be chosen without an

understanding of the underlying disaster risk. is can

be achieved through a risk audit, as explained in section

1. Once the risk is understood, there are a range of

dierent actions that can be undertaken to manage that

risk: the risk can be reduced, the risk can be retained

with resources set aside to manage it, or the risk can be

transferred to others. Section 2 describes these options

in more detail, recognizing that the appropriate mix will

depend on the specic circumstances. Once the actions

have been chosen, they often require a range of dierent

nancial instruments and/or policy mechanisms. But

these nancial instruments and policy mechanisms vary

across a number of important dimensions. Section 3

explains the criteria that can be used to choose between

dierent instruments. Section 4 sets out the dierent

nancial instruments and evaluates them against the

criteria identied in section 3. Section 5 then explains

how instruments do not work in isolation and how

a disaster risk management strategy needs to

combine various instruments, and sets out the key

interdependencies between dierent types of

instruments and the action they facilitate.

Figure 3. A toolkit for disaster risk finance.

1 Risk Audit

Exposure Definition

Quantify risk and define

resilience target to enable

risk-informed action.

Peril Identification

Risk Quantification

Resilience Targeting

2 Disaster Risk Management Actions

Risk Reduction

Design a DRM plan,

consisting of risk reduction,

risk retention, and risk

transfer actions.

Risk Retention

Risk Transfer

3 Dimensions of Instrument Design

Risk Holder

Use situational analysis

to define underlying need

and inform instrument

requirements.

Purpose

Timing

Risk Level

4 Disaster Risk Finance Instruments

Taxonomy

Select appropriate DRF

instruments.

5 Risk Management Strategy

Complementarity

Combine DRF instruments to

create an efficient DRM strategy

using a risk layering approach.

Risk Layering

This page intentionally left blank.

DISASTER RISK FINANCE TOOLKIT: 1. Risk Audit 15

Disaster

Risk Finance

Toolkit

DISASTER RISK FINANCE – A TOOLKIT16

1. RISK AUDIT

A sound understanding of the underlying risk is

fundamental to eective risk management. Risk

managers – those people who implicitly or explicitly bear

the consequences if a risk materialises, and which can

include individuals, governments, and humanitarian

actors – should collectively undertake a risk auditing

process as the rst step towards developing an eective

risk management strategy.

Risk auditing consists of four phases; (i) dene the

exposure at risk to understand what needs to be managed;

(ii) identify what perils and hazards can impact that

exposure, (iii) quantify the expected frequency and

severity of impact from those perils, ideally using a

probabilistic risk analysis, and; (iv) set a resilience target

to identify the extent to which risks will be explicitly

managed.

is risk auditing process provides the foundation to

make eective risk-informed decisions. e phases are

summarised in Figure 4.

Figure 4. Risk auditing process.

Exposure

Definition

Define the exposure to risk in terms of its key characteristics:

• Location

• Vulnerability

• Value

Value can be quantified in a range of ways, for example in terms of number

of people or asset replacement cost, but also in terms of value to society,

or criticality for dependent systems.

Hazard

Identification

Identify the range of possible event types (perils), and the associated hazards.

Peril types may include:

• Shock events: rapid-onset events (e.g. tropical cyclone, flood, earthquake)

• Strain events: slow-onset events (e.g. drought, pandemic)

• Systemic events: events that occur as a result of multiple factors

(e.g. conflict, migration)

Risk

Quantification

Risk analysis is fundamental for developing a targeted risk management strategy.

For a given set of exposure and hazard types - risk models allow a quantified

understanding of the probability and severity of disaster impact to guide

decision-making.

Resilience

Targeting

Some events are so infrequent and severe that it would be prohibitively expensive

to

aim to manage, in advance, the entirety of the impact.

The resilience target describes the threshold between actively managed risk, and

unmanaged ‚residual‘ risk. As residual risk is ultimately retained by the risk holder,

the objective of a risk management strategy is to reduce the residual risk to a

‘tolerable’ level.

The resilience target can be measured in terms of ‘return-period’ impact,

for example a resilience target may be to actively manage risk up to the

1 in 250-year return period impact.

DISASTER RISK FINANCE TOOLKIT: 1. Risk Audit 17

e process of risk auditing should be approached in

an outcome-oriented manner. e data collection and

modeling exercises should therefore aim to provide t-for-

purpose information to support decision making.

is consideration is particularly important in regions

where there is an apparent lack of reliable exposure and

hazard data, and limited catastrophe risk model coverage.

In these cases, simple assumptions can greatly support

risk management, utilising lessons learned in analogous

regions to enhance the risk auditing process.

Furthermore, while risk modelling has relied on extracting

useful insights from large amounts of historical data

for a long time, new ‘big data’ and articial intelligence

techniques opens up the opportunity of utilising more

data sources and processing that information more

quickly and at lower cost

9

.

Importantly, risk management is an iterative process – the

dierence between no risk-information and some simple

risk-information generated using basic assumptions can

be signicant. As a rst step, an order of magnitude

level risk audit, combined with an appreciation of

assumptions and limitations, still allows risk managers

to make substantially more informed decisions. Simple

assumptions might include local estimates of population,

property construction types and values, and historical

or scenario-based impact assessments. ese simpler

analyses can provide good initial insight, and pave the

way for more advanced data collection and risk modeling

exercises.

An illustrative scenario is provided in

→ Box B to show

how risk auditing can be applied in practice.

DISASTER RISK FINANCE – A TOOLKIT18

Box B. Illustrative Risk Audit

Scientific research and observations from previous disaster impacts provide the data necessary to build catastrophe

risk models, which estimate the probability and severity of potential disaster impact. Catastrophe models provide a

framework in which it is possible to quantify and compare the risk from a range of perils, enabling greater insight into

the drivers of risk.

The below table outlines the application of a risk auditing process of definition, identification, quantification, and

targeting, using a state-of-the-art catastrophe risk model to create an illustrative risk analysis.

The modelled risk analysis results for a set of assets are shown in Figure 5 using an ‘exceedance probability’ (EP)

curve.

EXPOSURE DEFINITION

What is at risk?

The analysis covers commercial-type properties in a Southeast Asian country.

The data includes information about:

• The location of people

• The location of assets (including residential property, business and commercial

properties and infrastructure)

• Key determinants of the vulnerability of people – including:

– Gender

– Age

– Proportion affected by disabilities

– Other vulnerable groups

• Key asset characteristics, which inform their vulnerability – including:

• Construction (dominant material used in constructing the building frame/structure)

• Occupancy (typical use of the building)

• Year built (captures building practices/regulation and deterioration)

• Number of stories

• Replacement value – in relation to assets, describes the cost to rebuild,

including both the structure and value of contents.

PERIL IDENTIFICATION

What can cause impact?

The analysis focuses on two climate-related peril (typhoon, and inland flood) and one

seismic peril (earthquake). The secondary hazards associated with these perils include:

• Typhoon: wind, coastal flooding from storm surge, typhoon-induced coastal and

inland flooding

• Inland food: non-typhoon pluvial and fluvial flooding from excess rainfall

• Earthquake: ground shaking

RISK QUANTIFICATION

What is the frequency and

severity of impact?

Catastrophe risk models can quantify the risk of direct damage and loss to assets.

The risk analysis results are presented in an exceedance probability curve (→ Figure 5).

Of course, direct physical damage is only one component of a disaster impact with

loss of lives and livelihoods and downstream impacts also of crucial importance.

Physical damage is, however, often a good indicator for the total potential impact

from all sources, including direct and downstream impacts. ‘Disaster Impact’ is

used to describe all potential impacts.

RESILIENCE TARGETING

What is the risk tolerance

level?

Resilience targeting sets the threshold between the risk which will be actively

managed using a DRM strategy, and the level of ‘residual risk’, which falls beyond

active risk management.

The level of the resilience target depends on the risk tolerance of the risk holder,

and other practical considerations including available budget and regulatory

requirements. An example resilience target is shown at the 200-year return

period impact.

DISASTER RISK FINANCE TOOLKIT: 1. Risk Audit 19

Figure 5. Aggregate Exceedance Probability (AEP) curve for illustrative scenario (source: RMS).

Exceedance Probability Explainer

The exceedance probability curve is an analytical tool used to describe the frequency-severity distribution of

disaster impact. There is typically an inverse relationship between disaster severity and frequency of occurrence,

i.e. the more severe an event, the less frequently it is expected to occur.

• Frequency (x-axis): ‘Return Period’ thresholds are used to describe the frequency of occurrence.

The Return Period (year) is equivalent to

1

⁄

(Exceedance Probability (year

-1

)

.

• Severity (y-axis): ‘Disaster Impact’ is used to describe the total annual aggregate disaster impact. Direct physical

damage and loss is used here as an indicator for total disaster impact (including indirect impacts). Severity is

often measured in financial terms ($ loss), though other metrics can also be used as appropriate (e.g. number of

casualties, storm category, flood extent).

Any point along the exceedance probability curve can be read as “there is a 1 in X-year annual probability of

exceeding a disaster impact of Y”. Note that while the combined exceedance probability curve consists of the risk

from all three perils, is not equivalent to the sum of the independent peril exceedance probability curves. This is

expected due to the methods used to calculate AEPs.

DISASTER RISK FINANCE – A TOOLKIT20

2. DISASTER RISK MANAGEMENT ACTIONS

Once the risks are understood, it is possible to develop a risk

management strategy around three core categories of actions:

(1) risk reduction; (2) risk retention, and; (3) risk transfer.

Figure 6 describes these actions in more detail.

Figure 6. Risk management actions.

Risk

Reduction

Any ex-ante action that reduces the severity of disaster impact. Risk reduction

activities include physical interventions such as building flood defences and

retrofitting property, but also planning activities such as risk-based site selection

for new developments, and evacuation and response plans. It can also include

activities taken immediately before an event impacts such as the distribution of

hygiene kits and water purification tablets, or preparatory actions taken based on

near or long-term forecasts.

The decisions about which risk reduction activities to undertake, in which localities

and to the benefit of which groups should be taken following a combination of

economic feasibility assessments and participatory processes that allow opportunity

for all voices to be heard.

Risk reduction has benefits for all severities of disaster - however the relative size

of the benefit in terms of reduced impact can vary depending on event severity.

Risk

Retention

After an event has occurred, some costs can be financed directly by the risk holder

using funds that are readily available. Risk retention mechanism are a relatively

reliable source of funds, and they are therefore most appropriate to support more

frequent disaster costs, such as those that are expected to occur every 10 years or

less.

In order for funds to flow quickly, the rules concerning how the resources associated

with risk retention mechanisms are allocated should be determined prior to the event,

and, as far as possible, be informed by data. The rules should be determined in an

open, consultative manner.

Risk retention mechanism have longer term cost implications, in that the costs are

held and repaid by the risk holder, potentially for years after an event has occurred.

Risk

Transfer

For lower-frequency higher-severity disasters, it is relatively more uneconomical

to use risk retention mechanisms. Risk transfer mechanisms remove a portion of

disaster risk in return for an annual premium payment. As such, they redistribute the

infrequent and unmanageable total cost of disaster, into an equivalent manageable

annual cost (premium). After an event, if the payment terms of the instrument are

met, funds are paid by the risk transfer provider to the risk holder.

As with risk retention, decisions as to how the resources associated with the use of

risk transfer instruments (after they are triggered) should ideally be taken in advance

(as far as possible) and following an open, participatory consultation process.

DISASTER RISK FINANCE TOOLKIT: 2. Disaster risk management actions 21

Risk reduction is core to disaster risk management, as it

directly reduces the severity of potential disaster impacts,

saving lives and reducing the destruction of homes and

critical infrastructure. However, in reality risk reduction

activities alone are unlikely to be able to reduce residual

risk to meet resilience targets.

Risk retention and risk transfer tools provide additional

options to manage any residual disaster risk. In all

three cases, the decisions as to who should benet from

these dierent actions, and how the actions should be

implemented, need to be taken in a participatory fashion

that provides full representation for those most exposed

and vulnerable to the risks.

ese three actions should be applied in combination

in order to meet dened resilience targets. e specic

combination of actions this requires will be context

specic, and informed by both cost benet analysis

as well as through participatory engagement processes

with local communities, especially the most vulnerable.

→ Section 5 discusses how to combine DRM actions and

DRF instruments eciently and eectively.

ese three types of action are also part of the ACRI+

and International Red Cross and Red Crescent Movement

(ICRM) disaster risk management ‘cycle’. However, this

toolkit separates risk retention and risk transfer whereas

the ACRI+ cycle combines these two elements. In

addition, the framework in this paper distinguishes how

the risk is managed, from the time at which actions are

taken (which is discussed in section

→ 3.2) whereas the

ACRI+ cycle combines these elements. is distinction

between which actions are taken and when they are

taken is powerful when explaining the dierences

between dierent nancial instruments. However, both

frameworks essentially incorporate the same elements.

DISASTER RISK FINANCE – A TOOLKIT22

3. DIMENSIONS OF INSTRUMENT DESIGN

Disaster Risk Financing (DRF) instruments exist to

support the various funding needs associated with disaster

risk management. In practical terms, these instruments

fund or facilitate risk reduction, risk retention, or risk

transfer actions. Dierent instruments are more or less

suited to these dierent actions.

However, DRF instruments also vary according to a range

of other criteria. ese include; (i) the needs and capacity

of the risk-holder (individuals, sovereigns or somewhere

in-between, as well as development and humanitarian

actors); (ii) the ultimate purpose for the funds, (iii) the

required timing of support relative to a disaster; and;

(iv) the level of risk that they help support.

A basic situational analysis can be performed by asking

the following questions.

Figure 7. Instrument design dimensions.

Risk Holder What is the capacity and need of the risk holder?

Purpose What will funds be spent on?

Timing When is funding needed?

Risk Level What level of risk is being addressed?

e answers to these questions can help to inform the

risk holder about which DRF instruments are most

appropriate for the underlying need. ey can also help

articulate the design requirements for individual DRF

instruments. However, the factors which inuence

DRF instrument design are complex and often

interlinked and, as a result, the criteria share some

intersecting themes. e following sections discuss

each of these dimensions in more detail.

DISASTER RISK FINANCE TOOLKIT: 3. Dimensions of Instrument Design 23

3.1. Risk Holder

Disasters impact people and organisations at all scales,

from the farmer to the nance minister.

e needs of the risk holder vary across this range of scales,

as does the nancial and technical capacity to purchase

and maintain DRF instruments as outlined below:

Figure 8. overview of needs and typical technical and financial capacity of risk holders.

Risk Holder Overview

INDIVIDUAL

(personal, household,

smallholder, SME)

At an individual level people are responsible for the wellbeing of themselves and

their families, property including homes and possessions, and their livelihoods. This

might include individual households, smallholders and small and medium-sized

enterprises (SME).

This risk holder has a limited budget, and less need to access sophisticated DRF

instruments.

The types of DRF suitable at an individual level are typically standard consumer

products, including property & life insurance, and loans. Micro-finance has been

developed to address those with limited capacity to pay, especially in developing

countries.

COMMUNITY

(groups of individuals

or businesses,

towns, villages)

The pooling of individual risk and resource increases the range of DRF instruments

that are available to fund DRM at a local level.

Coordinated groups of individuals and businesses, and local authorities have greater

purchasing power and can carry out resilience actions on a greater scale.

The range of responsibilities also increases to include restoration of services,

in order to minimise impacts on population or employees.

Community level DRM initiatives may be supported by external entities, who can

provide greater technical support, more funding, and access to a wider range of DRF

instruments.

MUNICIPALITY

(cities, sub-national

government)

Municipalities are often responsible for supporting large urban populations.

This includes the provision of critical and essential services such as power, water and

waste management, transport, education, emergency, social and healthcare services.

Municipalities can receive income through taxation, and often have independent risk

management capacity, and additional technical and financial support from national

governments.

Municipalities have capacity to purchase a broad range of DRF instruments, across

a range of markets. They can also coordinate and incentivise DRM activities at the

individual and community level, as well as influence national DRM practices.

SOVEREIGN

(state, supra- national

entity, international body)

Sovereign entities are ultimately responsible for the welfare of their populations,

development outcomes, and for near and long-term economic productivity.

The financing needs at a sovereign level are significant, but so are the available

DRM activities and DRF instruments. Sovereign entities can employ budgeting

mechanisms and issue debt, build disaster reserves, and implement risk management

policy and regulation among other activities.

Sovereigns can benefit from international financial, technical and operational support

from supra-national agencies, development banks, as well as international aid.

DISASTER RISK FINANCE – A TOOLKIT24

A discussion of dierent potential risk-holders raises

important questions about the role of humanitarian

actors. is is discussed further in Box C.

Box C. Stakeholders

Humanitarian actors receive funds from public donors and private sources, to enhance, support or substitute

for in-country responses to a population in crisis. They include local and international non-governmental

organizations, UN humanitarian agencies, the International Red Cross and Red Crescent Movement, host

government agencies and authorities, and donor agencies. Humanitarian actors work according to four key

principles:

• HUMANITY: human suffering must be addressed wherever it is found. The purpose of humanitarian action

is to protect life and health and ensure respect for human beings.

• NEUTRALITY: humanitarian actors must not take sides in hostilities or engage in controversies of a political,

racial, religious or ideological nature.

• IMPARTIALITY: humanitarian action must be carried out based on need alone, giving priority to the most urgent

cases of distress and making no distinctions on the basis of nationality, race, gender, religious belief, class or

political opinions.

• INDEPENDENCE: humanitarian action must be autonomous from the political, economic, military or other

objectives that any actor may hold regarding areas where humanitarian action is being implemented.

Historically, the role of humanitarian actors has been to step in following a crisis, when a risk holder has not

been identified, or when the magnitude of the risks overwhelm the ability of a purported risk holder to respond

to the realisation of that risk. In these cases, humanitarian actors provide indispensable services and support

to minimise the human cost of the event.

While this still represents a core role for humanitarian actors, in recent years, there has been a deliberate

attempt to move beyond this role. At least three additional roles can be identified:

• To support national actors to better understand the risks that they face and develop disaster risk management

plans, and associated financing strategies. The Agenda for Humanity

7

encourages humanitarian actors to work

alongside development partners, national governments and other partners with the aim of ‘strengthening local

and national response in risk-prone countries outside of crises’ It recognises that ‘Investment in data and risk

analysis should be increased and action taken early to prevent and mitigate crises.’ This is a key area in which

humanitarian and development actors have sought to work more closely.

• To explicitly become one of the actors within the plans developed ahead of crises – in other words to become

an explicitly identified risk-holder that ex ante commits to provide resources when risks materialise, and/or as

important actors in implementing risk reduction, response and recovery activities. This is broadly similar to the

‘traditional’ role played by these actors, but in a way that is explicitly incorporated within a broader disaster

risk management plan. This has been associated with a shift towards anticipatory finance, as discussed below.

• To encourage greater societal participation in decisions about disaster risk management strategies, recognising

that humanitarian actors can often play a crucial role in ensuring that otherwise marginalised and vulnerable

people can have their needs taken into account

10

.

DISASTER RISK FINANCE TOOLKIT: 3. Dimensions of Instrument Design 25

Red Cross Red Crescent and its role in anticipatory finance

The Red Cross Red Crescent Climate Centre (RCCC) has applied lessons learned from pilot projects to inform

the development of a model of providing humanitarian finance in anticipation of an extreme event

11

.

This involves identifying triggers, Early Action Protocols (EAPs) and an associated financing mechanism.

1

TRIGGERS

Region-specific “impact levels” are identified based on the detailed risk analysis of relevant natural

hazards, impact assessments of past disaster events, and vulnerability data. A trigger model then

determines priority areas where the impact of an extreme weather event is anticipated to be most severe.

Box D in section 4 explores the use of this sort of trigger mechanism, compared to those conventionally

used for disaster risk finance in more detail.

2

EARLY ACTIONS

Once a forecast exceeds the trigger, a pre-agreed set of early actions, specified in an Early Action

Protocol, are undertaken. These actions are aimed at reducing the impact of the predicted event on human

lives, by providing assistance to people at risk and helping them to protect their families and livelihoods.

This can include, for instance, providing veterinary kits, tying down house roofs, providing food and clean

water, as well as transferring cash.

3

FINANCING MECHANISM

A Forecast-based Action Fund automatically allocates funding once a forecast reaches a pre-agreed

danger level to enables the implementation of the Early Action Protocol.

DISASTER RISK FINANCE – A TOOLKIT26

3.2 Purpose

e ultimate purpose of DRF is to fund or facilitate

resource ows towards activities that make disasters less

impactful for people.

is can be achieved by minimising the risks to

populations through reduction in vulnerability and

volume of exposure; reduction frequency and severity

of hazard; strengthening of disaster preparedness and

response plans; and increasing the speed and eectiveness

of recovery, among other activities.

Disaster risk nance provides the funds which enable

these disaster risk management activities. e specic

purpose for the funds has implications for which DRF

instruments are appropriate, and further for the design

of individual instruments (instrument mechanics).

It can be challenging to clearly segment and dene

purpose, given that disaster management costs are diverse

and interconnected. In reality funds from individual DRF

instruments are often used for a mix of activities, and

instruments can be designed to accommodate multiple

purposes.

Nevertheless, the exercise of ‘purpose mapping’ can

help to guide both DRF selection and design processes.

e following three categories are selected to capture

the main purpose groups.

Figure 9. DRF Purpose groups.

Purpose Overview

Life and

Livelihood

Injury, death, and disruption resulting from disaster are the most immediate and pressing

impacts of a disaster. There are immediate impacts for those directly affected, but also for

municipalities and sovereigns who have responsibilities for the wellbeing of their populations.

The costs required to fund life and livelihood impacts are diverse, and relatively challenging

to quantify ahead of an event.

DRF instruments designed to support this purpose should be flexible enough to reflect impact

and needs assessments.

Operations

Disaster management activities have a range of implementation costs, including costs of

personnel and resources required both before and after a disaster. Ensuring that these are met

is crucial both to reducing the impact of a disaster and to ensuring that any negative impacts

from a disaster are quickly dealt with, and helping to avoid detrimental impacts for longer-term

economic and developmental outcomes.

Funding to support operations must be readily available at the point of need. Prior to an event

funding for operations can be directed towards disaster response and contingency planning.

In the time-critical phase leading up to, during, and immediately following a disaster, rapid

access to sufficient levels of funding for operations can significantly mitigate the overall

severity of impact.

Capital liquidity and certainty of payout are key considerations when designing DRF for operational

costs.

Physical

Assets

Physical assets are exposures that can be directly damaged. This damage can have drastic

impacts on the ability of people to meet their basic needs and access essential services such

as water and sanitation, education, or health services. The costs associated with physical

assets include the costs of development, maintenance, repair, replacement of property such

as buildings and infrastructure, property, machinery, and environmental assets.

The costs and risk associated with physical assets are typically most easily quantified.

Catastrophe models are designed to capture direct physical damage, and the downstream

impacts from damage such as business interruption and casualty losses.

DRF to fund physical assets should aim to closely match the total financial needs of the DRM

action, be it the cost of construction or retrofit, or rebuild/ replacement costs following damage.

DISASTER RISK FINANCE TOOLKIT: 3. Dimensions of Instrument Design 27

3.3 Timing

Dierent instruments facilitate access to funds at dierent

speeds, and to varying levels of funding. is means that

they are more or less appropriate for use at dierent times

relative to a disaster event.

is analysis distinguishes between three phases

ii

:

– A preparatory phase where it is not urgent to access

funding immediately but where relatively small

amounts of funding can signicantly reduce the

direct and downstream impacts of a disaster, both

in terms of the lives that will be aected, and the

asset damage that may be realised.

– A response phase where funding needs are urgent

in order to reduce the overall impact of the event,

especially the impact on lives and livelihoods. During

this time critical period it is important that risk

management activities are not dependent on DRF

instruments which take a long time to release funds.

– A recovery phase during which funding needs can

be substantial, especially if there has been signicant

damage to physical assets and infrastructure, but the

urgency of accessing that funding is not so great.

Figure 10 provides a stylised representation of the scale

and timing of these needs. Figure 11 outlines the types

of activities that occur within each phase.

Figure 10. Schematic of Illustrative timing and volumes of funding associated with each phase.

Response

Recovery

Preparation

Disaster Impact

time

DISASTER RISK FINANCE – A TOOLKIT28

Figure 11. example activities associated with preparation, response, and recovery phases.

Timing Activities

Preparation

– Continuous costs of disaster reduction

– Preceding a forecast event impact (using near or long-term forecast data)

·

Evacuation

·

Deploying defences

·

Initiating disaster response plans

Response

– Immediately following disaster impact

·

Search and rescue

·

Humanitarian services

·

Restoration of essential services

Recovery

– Longer-term post-disaster

·

Reconstruction

·

Social support

DISASTER RISK FINANCE TOOLKIT: 3. Dimensions of Instrument Design 29

3.4 Risk Level

e relative cost eectiveness of DRM actions and

DRF instruments vary according to the frequency-severity

prole of the underlying risk.

e following risk level bands are indicative only –

a comprehensive risk audit and expert guidance is

ideally used to provide context-specic guidance

for selecting risk-appropriate DRF solutions.

FIGURE 12. Indicitive risk levels.

Risk Level Overview

Annual

Risk holders who are responsible for large volumes of risk from multiple sources, such

as municipalities and sovereigns, can expect to incur at least some level of disaster

impact on an annual basis.

This type of yearly (‘attritional’) risk can be measured based on previous experience,

and so should be accounted for using established annually recurring DRF instruments.

Budgeting mechanisms and allocated disaster funds are an efficient and effective

means of managing yearly costs.

Risk reduction actions (including maintenance, simple retrofit, and planning, as well

as early actions immediately prior to an event such as preparation of emergency

shelters), can also be very effective in managing attritional disaster impacts.

HIGH-FREQUENCY

LOW-SEVERITY

(1 to 10-year

return period)

For less frequent events which cause impacts in excess of the yearly expected level,

annual budgeting may not be the most cost-effective option for managing risk.

Disasters which occur on a return period of up to 10 years are still relatively frequent.

In isolation, and depending on the country context, the levels of loss they cause might

fall within a ‘manageable’ level relative to the risk holder’s capacity to pay using

ex-post mechanisms. However, the uncertainty associated with disaster occurrence

can easily make potentially manageable losses very unmanageable if events occur

in succession.

MODERATE-FREQUENCY

MODERATE-SEVERITY

(10 to 50-year

return period)

Moderate severity event impacts typically fall beyond a risk holder’s capacity to pay

using available capital reserves. For less-frequent events more sophisticated DRF is

required to manage the potentially significant levels of impact.

Funding may have to be sourced from external providers, including international lenders.

Risk reduction activities must also be more robust to significantly reduce the risk for

more severe impacts.

LOW-FREQUENCY

HIGH-SEVERITY

(50+ year return period)

Low-frequency high-severity events can cause catastrophic impacts which generate

significant funding needs for large risk holders.

This level of impact is likely to far exceed a risk holder’s ability to build sufficient

disaster reserves. Risk transfer offers an effective means of moving risk off the risk

holder’s balance sheet.

Depending on the local context, the international reinsurance and capital markets may

offer the most affordable risk transfer options. The bundling of risk in sovereign-level

risk pools can also be effective.

DISASTER RISK FINANCE – A TOOLKIT30

4. DISASTER RISK FINANCE INSTRUMENTS

is section explores a range of nancial instruments

and policy mechanisms that can be used within a

disaster risk management strategy.

Building on the discussion above, it categorises these

instruments and policy mechanisms into those that

can fund or facilitate risk reduction (in relation to

climate-change related risks, this represents ‘adaptation’

to climate change); those used for risk retention;

and risk transfer instruments.

e taxonomy also characterises appropriate risk

holders, timing, purpose, and risk levels that each DRF

instrument or policy is tailored to support. In doing

this, it recognises that the instruments often have a

range of structural options, which will vary depending

on the specic needs and circumstances of the user.

Dierent options mean that some instruments or policy

mechanisms can be used across a range of scales and

purposes and can be structured to respond to dierent

requirements associated with timing and risk level.

Finally, it also provides examples of how the instruments

have been used in practice, drawing, in particular, on

examples from developing countries.

e taxonomy presented in Figure 13 summarises the

appropriate range of application for each of the DRF

instruments.

Figure 13. Taxonomy of disaster risk finance instruments, categorized by risk management action and design criteria

Risk Holder Risk Level Timing Purpose

What is the capacity and need

of the risk holder?

What level of risk is being

addressed? (return period)

When is funding needed? What will funds

be spent on?

Action Instrument Individual Community Municipality Sovereign Life &

Livelihood

Operational Physical

Assets

Preparation Response Recovery Annual 1-10

year

10-50

year

50+

year

Risk Reduction

Loan

• • • • • • • • • •

Micro-credit

• • • • • • • •

Bonds

• • • • • • • • •

Grants, subsidies,

& tax breaks.

• • • • • • • • • • •

Crediting

• • • • • • • • • • •

Impact Bonds

• • • • • • • • • • • • •

Risk Retention

Budget

Contingency

• • • • • •

Reserve Funds

• • • • • • • • • • •

Contingent Loans

• • • • • •

Risk Transfer

Micro-insurance

• • • • • • • • •

Agriculture

Insurance

• • • • • • • •

Takaful & Mutual

Insurance

• • • • • • • • • • • •

Insurance &

Reinsurance

• • • • • • • • • • • •

Catastrophe Bonds

• • • • • • • • •

Risk Pools

• • • • • • • • •

DISASTER RISK FINANCE TOOLKIT: 4. Disaster Risk Finance Instruments 31

4.1. Risk Reduction

is section consists of two components: rst it considers

a range of nancial instruments that are commonly

used to structure the ow of capital into investments

that will reduce the risks that disasters cause; then it

explores a range of policy mechanisms that governments

or development partners can use to make it more

economically attractive to undertake such investments,

using various types of nancial instrument.

Risk Reduction: Financial Instruments

Loans

Individual

to sovereign

Primarily to reduce

risks to physical assets but

can also be used

to reduce risks to

lives and livelihoods

Preparedness

activities plus

recovery

Most effective

at reducing risks

from frequent

(annual or up to

1 in 10-year events)

OVERVIEW

Bank loans are one of the most common instruments for channelling capital into risk-reduction,

and other types of, investments. They can be made by either public or private financial institutions

(FI) and provided to companies, households or other institutions. They are primarily used to finance

investments that reduce risk in preparation of a disaster event but can also be used to finance

reconstruction after a disaster event (where risk reduction is achieved by a commitment to ‘build back

better’). Loans supporting investments that reduce risks are likely to be proportionally more effective

at reducing risks from high-probability, low-severity events; more extreme events are typically so

devastating that risk-reduction investment is less effective

12

.

Regardless of use, the borrower is expected to repay the loan, plus make interest payments on the

balance of the loan that has not been repaid. On some occasions, the FI advancing the loan will

receive the capital to make the loan through a credit-line provided by an International Financial

Institution (IFI). This credit line will provide resources to the FI on more favourable terms than it

could otherwise access, on condition that loans are advanced for a particular purpose.

DESIGN

OPTIONS

The key design characteristics influencing the nature of the loan are the amount advanced; the

duration (tenor) of the loan; the repayment schedule; whether the loan is secured on the asset that

it finances (or other collateral) such that the FI can claim the asset in the event that the borrower

defaults; and the interest rate, and other pricing, charged on the loan. In cases where loans are

supported by IFI credit lines, the IFI may require that the loans offered to the final borrower are

priced on more favourable terms than would otherwise be available in the market.

CHALLENGES

Loans are a very well-known financial instrument used to finance a wide range of capital investments.

As such, the potential challenges in using the instrument are well known. Most importantly, if the

borrower is unable to repay the loan, either because the asset does not perform or otherwise, then

this can cause problems of indebtedness for the borrower and reduces the profitability of the financial

institution, making it more reluctant to lend in the future. Some households and businesses can

also find it difficult to access loans, either because the FI finds it difficult to judge the likelihood of

repayment, or because the distribution channel of the FI does not reach those who would like a loan.

REQUIRE-

MENTS

FIs need to be licensed by, and are subject to supervision from, the national bank authorities in

the countries in which they make loans, influenced by international bodies such as the Bank for

International Settlements‘ Basel Committee on Banking Supervision.

EBRD CLIMADAPT

The European Bank for Reconstruction and Development’s (EBRD) ClimAdapt programme in Tajikistan provides

a good example of how loans, supported by an IFI credit line, can support risk reduction investment

13

. In this

initiative, the EBRD, with the support of various donors, has advanced a $10m credit line to a selection of banks,

who then provide loans to local businesses and households to invest in projects that reduce climate-related risks.

At the time of writing, more than 3500 projects had been supported, with investments in water efficient

technologies, energy efficiency and sustainable land management practices.

DISASTER RISK FINANCE – A TOOLKIT32

MICRO-CREDIT

Individual

and community

Lives and livelihoods,

and small scale

physical assets

Preparedness

activities

plus recovery

Most effective at

reducing risks from

frequent (annual or up

to 1 in 10-year events)

OVERVIEW

Micro-credit involves the provision of relatively low value, frequent repayment loans to individuals,

households, SMEs and communities. The product arose as a reaction to the difficulty that

conventional FIs are unable or unwilling to provide loans to this target customer group. Micro-credit

is typically provided by dedicated micro-finance institutions (MFIs) who are financed by commercial

lenders and for-profit investors, multilateral and bilateral development banks, and donors. Donors

and IFIs may also provide additional support to specific microfinance programs to reduce costs or risks.

A typical characteristic of microfinance is the engagement of the community within the loan appraisal

and monitoring process through, for example, joint liability or peer monitoring. Microfinance also

often specifically targets women. On many occasions, loans are one of a series of financial products

the MFI offers, others include micro-insurance (see discussion on microinsurance below).

MFIs are beginning to consider the use of some of the risk transfer instruments described below,

or alternatively donor support, so that they are in a better position to extend loans quickly after

a climate shock – so called recovery lending. Early results suggest promise

14

.

DESIGN

OPTIONS

There are a number of design elements that influence the microfinance loan. These include whether

the loans must be used for specific activities, the duration (tenor) of the loan, the interest rate

charged and the distribution channel. There is an increasing interest in using mobile banking

solutions to improve access to microcredit by lowering distribution costs.

CHALLENGES

Researchers have extensively analysed the impact of microfinance with conflicting results. Various

studies find no significant impact on poverty or other development indicators; while there are also

concerns about the potential indebtedness of consumers. On the other hand, microfinance (including

microcredit) has been associated with an enhanced ability of poor people to deal with shocks, but

this is not universal

15

.

Microfinance programs specifically targeted at reducing climate risks are in their early stages.

They offer significant potential, although there are challenges in enhancing awareness regarding

the value of risk reduction investments across all stakeholders, finding distribution models that

reach the most climate vulnerable and, when programs are supported by public funds, ensuring

loan repayments.

REQUIRE-

MENTS

Most countries have introduced regulation to license and supervise microfinance institutions,

especially in cases where the MFIs take deposits as well as advance credit.

JAMAICA PPCR AND OTHER EXAMPLES

In Jamaica, the Pilot Program for Climate Resilience (PPCR), working through the Inter-American Development

Bank, has underwritten microfinance loans extended to farmers and small enterprises in the tourism and

agricultural sector

16

. These loans have, among other things, supported farmers in installing dams and grass

and live vegetation barriers.

However, even in cases where micro-credit is not explicitly targeted at investments that reduce climate

risks, they can be an important tool to build livelihoods and assets that enhance broader adaptive capacity

to climate risks

15

.

The investments supported by micro-credit are most likely to be effective at reducing frequent, relatively

low-intensity events.

DISASTER RISK FINANCE TOOLKIT: 4. Disaster Risk Finance Instruments 33

BONDS

Municipality and

sovereign (plus

large corporates)

Physical assets

Preparedness

activities

plus recovery

Can be used to fund

more significant

infrastructure projects (all

risk levels)

OVERVIEW

Bonds are issued by national and local governments, and other quasi-public organisations, as well

as large companies, to finance investment. In exchange for the payment of the bond by the purchaser,

the issuer agrees to pay the purchaser interest payments on a set schedule, and repay the principal

at maturity. As such, they are a form of debt instrument. They are attractive to investors as low-

risk securities, depending on the sponsor, that can be easily traded. Due to their expense (see

below), bonds are typically used for financing large scale capital infrastructure, either supporting

preparedness by reducing risks prior to an event, or for less time-sensitive reconstruction of assets.

Bonds can be classified according to who issues the bond (government, municipal, corporate) as

well as according to the use of proceeds from the bond sale. In recent years, there has been a

significant growth in green bonds: bonds that are explicitly issued in order to finance projects that

are environmentally sustainable or support the mitigation of or resilience to climate change. Climate

Bonds Initiative reports that, as of 2018, there were around $1.45 trillion of bonds that claim links

to addressing climate change, although less than 0.1% have an explicit focus on reducing risks to

climate change

17

.

DESIGN OPTIONS

A number of features define the specific characteristics of the bond. These include: size; the use

of proceeds; whether repayment will come from general sources (either corporate cashflow or tax

revenues) or from the specific revenues generated by the financed asset(s); the duration of the bond;

and the interest rate (coupon) that will be paid to investors.

For green bonds, the Green Bond Principles (GBP) provide voluntary process guidelines to issuers for

launching a credible Green Bond. The Principles cover defining criteria for a green project, defining

the processes for selecting green projects, the systems used to trace the green bond proceeds, and

reporting guidelines. The principles also identify that issuers have the option to ask third parties to

certify their green bond, using organisation such as the Climate Bonds Initiative. These organisations

will assess the bonds against pre-agreed criteria, especially related to how the proceeds will be

used. This increases the green credentials of a bond among investors, but also increases transaction

costs

18

.

CHALLENGES

Bonds are expensive to structure, with transaction costs typically of 1% or more of the principal

raised. They take several months to structure. These costs and time increase further if the bond is

certified. This tends to mean that it is only somewhat richer developing countries that issue sovereign

bonds, although the IMF reports that in the 10 years to 2013, Rwanda, Tanzania, Senegal and Cote

d’Ivoire all issued sovereign bonds19 while Nigeria and Fiji have recently issued sovereign green bonds.

REQUIRE-

MENTS

Bond issuance is typically regulated by the capital market authorities in the country where the bond

is issued. The economic aspects of this regulation might, for instance, place nationality restrictions

on who is allowed to issue or purchase bonds within a jurisdiction, whether or not a prospective

bond issuer meets necessary standards; and taxation rules. Prudential regulation focuses on investor

protection and avoiding systemic risks, by identifying principles for, for example, issuance standards

or trading norms.

GROWING GREEN BOND MARKET