Casualty Accumulation Risk

October 2015

Authors:

Brad Fischtrom (AIG)

Luc de Lignières (Axa)

Tim Jandeck (Generali)

Michael Brauner (Munich Re)

Guillaume Ominetti (Scor)

Eric Schuh, Andrea Scascighini and Sabrina Wulf (Swiss Re, workgroup lead)

CRO Forum Secretariat:

Kuba Szczygielski

CRO Forum – October 2015 3

Contents

1 Executive summary 6

2 Understanding casualty accumulation risk 8

2.1 Defining casualty accumulation risk 11

–

Classic clash 11

–

Serial aggregation 12

–

Systemic loss 12

2.2 Examples of historical accumulation losses 13

–

Asbestos 13

–

Deepwater Horizon oil spill 14

–

The medical malpractice crisis in France 15

–

Economic, societal and legal environments 15

2.3 Casualty accumulation matters in an interconnected and fast evolving society 16

–

Cyber 18

–

Pandemic 20

–

Nanotechnology 20

–

E-cigarettes 21

–

Concussions 21

–

Climate change 22

2.4 Embedding casualty risks in the overall accumulation risk 23

–

Crossing the lines of business 23

–

Accumulation with the asset side of the balance sheet 24

3 Assessing the potential effects of uncontrolled casualty accumulation 25

3.1 Why is casualty accumulation risk more challenging to assess and model than

property catastrophe accumulation risk? 25

–

Impact on insurers 26

3.2 Scenario-based modelling 27

–

The unfolding of a liability disaster 27

–

The scenario approach to quantification 28

–

Mapping scenarios to portfolio exposures 28

3.3 A forward-looking approach 28

–

Limitations of current actuarial techniques 28

–

Studying loss generation: from natural catastrophe modelling to liability exposures 29

–

Considerations on modelling for solvency purposes 30

4 Towards an effective management of the casualty accumulation risk 32

4.1 The role of Enterprise Risk Management 32

– Data quality and risk identification 32

–

Risk quantification / prioritization 32

–

Governance 32

–

Incentives 33

–

Mitigating actions 33

CRO Forum – October 2015 4

4.2 Managing the assumed risk 33

–

Monitoring of risk exposures 33

–

Management actions on underwriting 33

–

Risk transfer solutions 33

4.3 Increasing understanding to shape the industry 34

–

Why is increased market transparency the future? 34

–

Internal need for better data 35

–

Industry data standards for measuring casualty accumulation 35

–

Possible external demand for more information and thorough understanding 35

4.4 External stakeholders 35

–

Risk transfer market 35

–

Shareholders 36

–

Rating agencies & regulators 36

5 Conclusions 38

6 References 39

CRO Forum – October 2015 6

1 Executive summary

Casualty accumulation is the concentration of insured risks or insurance coverages that may be

affected by events or circumstances that cause substantial losses under several insurance policies,

and potentially over multiple years and geographies. In the past, casualty accumulation has led to

well-known claims complexes such as asbestos, the Mont Blanc Tunnel accident and the

Deepwater Horizon event.

The increased interconnectivity and interdependency of the world due to globalization, technology

advances, regulatory changes and macro-economic factors heightens the challenges faced by the

re/insurance industry in terms of detecting and managing accumulation potential within the casualty

portfolio. As supply chains span countries and companies, and new technologies develop, the risk of

casualty accumulation increases. Monitoring these developments is a priority for a Chief Risk

Officer.

Casualty catastrophes can be classified into three categories:

■ Sudden and accidental events, which we call classic clash, (eg, Mont Blanc/Deepwater Horizon).

■ Serial aggregation losses, where multiple insurance policies are triggered out of one single

defect, such as losses linked to the hazardous properties of diacetyl.

■ Systemic losses, where a repeatable process/procedure or industry/business practice results in

a series of losses, such as IPO laddering practices in the financial industry.

Exposure analysis of a portfolio should include two aspects. Firstly, past/known loss complexes

need to be managed and can serve as guidance for what could happen in the future. Secondly, the

Chief Risk Officer has to keep in mind that past events have less predictive power, compared to

property, towards assessing future casualty catastrophes. Asbestos is not going to be the "next

asbestos"!

In property re/insurance, accumulation risk is geographically defined and easier to model. Casualty

accumulation

1

risk modelling and assessment is more challenging. Current methodologies are based

on statistical analysis of triangles, expert judgement and top-down calibrations. Modelling casualty

accumulation is difficult in view of time dimensions of the exposures and also because societal

trends can significantly alter the risk landscape. However new technologies like big data and new

forward-looking modelling techniques have matured to a point where it may become possible to

significantly improve the accuracy, prediction power and quality of casualty accumulation models.

This trend should enable additional risk-taking activities, without loss of control over systemic and

accumulating exposures. In parallel, in a deterministic approach, the industry has to build

sophisticated and standardized scenarios for monitoring accumulation. These scenarios will help the

industry better understand casualty accumulation risk, and allow it to test sensitivities aimed at

setting limits for the risk.

Most re/insurers manage casualty accumulation risk by limiting coverage in their policy forms and

keeping track and limiting aggregate exposure. The Chief Risk Officer can enable a controlled risk

taking by sponsoring improvements in modelling techniques, and also by fostering better

understanding of casualty risks by capturing essential exposure information and key coverage

aspects on a standardized basis for the whole portfolio. Improved understanding of assumed

1

Insurance ERM (2015), “A new breed of casualty cat model” Retrieved from https://www.insuranceerm.com/analysis/a-

new-breed-of-casualty-cat-models.html

CRO Forum – October 2015 7

exposure through more complete data and better risk monitoring by building standard scenarios will

support the development of new products. In turn, that will enhance the ability of the re/insurance

industry to better-address earlier the casualty insurance needs of a fast evolving society.

CRO Forum – October 2015 8

2 Understanding casualty accumulation risk

Large, devastating catastrophes do not often generate big headlines about casualty insurance. But

there is a real risk associated with the possible build up – or accumulation – of known and unknown

casualty exposures. It is essential that a Chief Risk Officer fully understands this risk, both from an

historical perspective and in terms of the exposures and potential losses that could materialise in

the future. By nature, casualty risks are correlated with the general economy and societal

developments and, potentially, also with the investment portfolio of a re/insurance company.

The World Economic Forum Risk Report 2014 indicates that "over the past decade, risk

management has assumed a much more important role in many firms across different industry

sectors. In general, there is a trend away from technical planning for individual risks and towards

holistic planning for a range of unspecified risks. A spate of crises and extreme events in recent

years has convinced many companies that the benefits of globalization have been accompanied by a

much greater degree of interdependency and interconnectedness, bringing new vulnerabilities from

unexpected directions." In other words, casualty catastrophes (ie, large loss events due to

accumulating risks) are set to increase, and this will require the attention of Chief Risk Officers.

In this chapter the authors define a framework for classifying casualty accumulation risk and provide

examples of large – and potentially catastrophic – casualty losses emanating from undesired

concentration of risks. We review well known casualty-loss events from an accumulation

perspective to show the broad spectrum of potential scenarios. In order to help Chief Risk Officers

assess the future in a holistic way, we also discuss the implications of some emerging exposure

scenarios.

CRO Forum – October 2015 9

The global casualty market

The size of the global casualty insurance market per 2014 is estimated at a premium income for

primary insurance of USD 640bn. About USD 330bn, or 52%, is motor third party liability

insurance, general liability is USD 160bn, whereas accident, including workers' compensation, is

USD 150bn.

Source: Swiss Re Economic Research & Consulting

Global liability direct premiums totalled around USD 160bn both in 2013 and 2014, with 90%

coming from developed and 10% from emerging markets. Liability premiums are expected to

grow at a compound annual growth rate (CAGR) of 5% in developed markets and by 12% in

emerging markets over the next decade, to a total of around USD 280bn by 2025.

Commercial Liability, 2013

Premiums & GDP (USD billions) Percentage shares

Rank

Liability Total non-life GDP Liability/total non-life Liability/GDP

1

US

84.0

531.2

16,802

15.8%

0.50%

2

UK

9.1

99.2

2,521

9.2%

0.36%

3

Germany

7.8

90.4

3,713

8.7%

0.21%

4

France

6.8

83.1

2,750

8.2%

0.25%

5

Japan

6.0

81.0

4,964

7.3%

0.12%

6

Canada

5.2

50.5

1,823

10.3%

0.29%

7

Italy

5.0

47.6

2,073

10.6%

0.24%

8

Australia 4.8 32.7 1,506 14.8% 0.32%

9

China

3.5

105.5

9,345

3.3%

0.04%

10

Spain

2.2

31.0

1,361

7.0%

0.16%

Top 10

135

1,152

46,857

11.7%

0.29%

World

160

1,550

61,709

10.3%

0.26%

Note: Non-life excludes health insurance.

Source: Swiss Re Economic Research & Consulting, sigma 4/2014.

Within the casualty sector, accident (including personal accident and workers' compensation,

health business is removed where reported separately) is an important line of business, with

global premiums of USD 145bn in 2014. More than 80% came from developed markets,

although growth in the developed markets is projected to slow and even turn negative in the

next 10 years. In the emerging markets, premiums could grow by a CAGR of more than 16%.

Global accident premiums are forecast to reach USD 190bn by 2025, with over half coming from

Motor

TPL

52%

Liability

25%

Accident

23%

Global Casualty Market

Premiums, 2014: USD 640bn

CRO Forum – October 2015 10

The US casualty market

The US is by far the largest casualty market in the world, due to the size of the US economy and

the high penetration of liability insurance (0.5% of GDP). In 2013, US businesses spent USD 84bn

on commercial liability covers, of which USD 50bn was on general liability, including USD 12bn on

errors and omissions (E&O) and USD 5.4bn on directors and officers (D&O) policies. US

businesses spent another USD 13bn on the liability portion of commercial multi-peril policies, USD

9.5bn on medical malpractice, and USD 3bn on product liability covers.

By line of business, auto liability direct premiums written in the US were USD 138bn in 2014, 51%

was casualty sector premiums and about 25% was US P&C market premiums. The majority (84%)

of auto liability premiums came from personal lines

The "other liability" line is the second largest category, with USD 58bn in premiums in 2014. It

refers to the definition in the "schedule P" US reporting standards and includes umbrella business

as the biggest segment not allocated to a specific line of business. Other liability is closely

followed in size by workers' compensation with USD 56bn, each comprising approximately 21% of

US casualty premiums. The remainder were from medical professional liability (USD 10bn),

accident & health (USD 6bn) and product liability (USD 3.5bn).

Source: AM Best, Swiss Re Economic Research & Consulting

Medical professional

liability

4%

Product Liability

1%

Workers'

Compensation

21%

Accident & Health

2%

Other Liability

21%

Auto Liability

51%

US Casualty Direct Premiums Written, by Line of Business (2014)

CRO Forum – October 2015 11

2.1 Defining casualty accumulation risk

Casualty accumulation risk originates from the concentration of insured risks or coverages that may

be affected by events or circumstances that cause substantial losses under several insurance

policies,

2

and potentially over multiple years and geographies. Such events are called "casualty

catastrophes." They can be a single event, a complex of losses, or systemic events that generate

large losses. In the following, we define these different types of scenarios and provide examples.

Classic clash

This is when multiple claims are generated by (a) sudden accident(s), occurrence(s) or event(s) such

as the unexpected collapse of a building. The collapse can spark general liability, employers' liability

and professional indemnity claims from a single insured across multiple classes, and/or multiple

insureds across single or multiple classes.

2

There could be a liability catastrophe market loss which is not insured, but for our purposes, we're concerned with insured

losses.

Mont Blanc tunnel accident

The Mont Blanc tunnel connects Italy and France. On 24 March 1999, a truck transporting flour and

margarine caught fire in the middle of the tunnel, creating intense heat and toxic fumes. The fire

lasted 53 hours, 39 lives were lost and the economic damages were significant. Several parties

involved in the catastrophe were sued and many motor third party, general liability and product

liability claims were triggered. This example shows how easy it is for multiple parties including

municipalities, security authorities, operators of the tunnel and manufacturers to be involved in the

same casualty catastrophe.

Deepwater Horizon

On 20 April 2010, while drilling at the Macondo Prospect in the Gulf of Mexico, an explosion on the

Deepwater Horizon rig killed 11 crew members. The resulting fire could not be extinguished and,

on 22 April 2010, Deepwater Horizon sank leaving the well gushing oil onto the seabed and

causing the largest spill ever in US waters. Multiple general, employer, product and environmental

liability and also D&O insurance policies for multinational corporations were triggered to cover the

resulting economic and environmental losses.

CRO Forum – October 2015 12

Serial aggregation

This is where a series of losses can be linked back to one problem. For example a defect in the

design or manufacture of a product causes multiple losses, which can all be clearly linked back to

the faulty product or a single corporate failure, out of which multiple professional indemnity and

D&O losses could arise. Cases involving a single insured and single class are more likely to be serial

aggregations than clash losses.

Systemic loss

Here, a repeatable process/procedure or industry/business practice, rather than a faulty product,

results in a series of losses.

Diacetyl and the "popcorn workers'" lung disease

Diacetyl is a volatile organic chemical compound added to food to give a butter flavour. Workers

in popcorn factories who have inhaled diacetyl for long periods have been found to suffer from a

rare lung disease, bronchiolitis obliterans. The large number of companies producing and using

diacetyl, and the relative young age of the work force exposed to it gives rise to a broad

aggregation issue scenario. This is called the serial aggregation loss complex, triggered by one

defect, in this case the production and use of diacetyl.

The Parmalat default

The bankruptcy of Parmalat is one of the most significant financial events in Europe. Driven by a

mis- and non-transparent representation of the company's financial conditions, leading to a

USD 20bn hole in its accounts, several banks, auditors and Parmalat itself have been involved in

litigations. The example shows that even outside the US (with its high propensity to sue

environment), a bankruptcy can be a casualty catastrophe event given the resulting accumulation

of D&O and professional lines claims.

IPO laddering

An example of a systemic loss scenario is Initial Public Offering (IPO) laddering, which arose in

the late 1990s as the tech bubble and stock market speculation fuelled a boom in IPOs.

Laddering describes one particular type of claim against the practice of investment banks in

which, as a condition for receiving an allocation of shares in an IPO, they get investors involved in

another offering. With time, laddering has become a more generic label for a number of other

claims arising from IPOs and the payment of undisclosed commissions to investors in exchange

for preferential share allocation, or the obligation for investors to buy further shares in an issuing

company post IPO. The common factor in laddering claims is the creation of a false market for

shares. This has given rise to repeated claims by investors and regulatory actions against issuing

companies and investment banks.

CRO Forum – October 2015 13

The above examples for casualty accumulation risk and casualty catastrophes align well with

accumulation insurance products and risk management scenarios. A classic clash is similar in spirit

to the standard per risk and per event casualty reinsurance treaties common in Europe and Asia.

Serial aggregation is usually dealt with by batch clauses in insurance policies and also by product

failure risk management scenarios, the best example being any asbestos-related claims scenario. A

business disaster is sometimes used to model the capital requirements for D&O and professional

liability business in view of correlation with market risk.

For the Chief Risk Officer, the key observation is that losses from casualty accumulations can arise

from multiple sources and cover a wide spectrum of insurance situations. A proactive, open minded

and visionary approach is needed to anticipate and avoid the next big surprise.

2.2 Examples of historical accumulation losses

Multi-billion casualty catastrophe cases are rare but over time, there have been a number of

different events that together have caused billions of US dollars in insured losses. According to

Towers Watson, since 1950 there have been around 300 casualty catastrophes that have resulted

each in insurance industry losses of more than USD 100mn. Together these have generated more

than USD 500bn in total costs for re/insurers.

3

This section reviews some of these events.

Asbestos

Asbestos is the largest insurance industry loss event in history, with total losses in the US Property

& Casualty (P&C) sector alone estimated to be more than USD 85bn.

4

Asbestos falls under the

serial aggregation type of casualty catastrophe. The economic damages arising out of occupational

and general public exposure to asbestos and its resulting deadly disease, mesothelioma, consist of

many of the characteristics global re/insurers consider to be a worst-case scenario. For centuries,

asbestos was widely used in industrial and consumer applications until, and even after, scientific

studies proved that it was harmful to humans. Claims arose across a wide spectrum of industries,

with plaintiffs bringing litigation against multiple companies in many different industry sectors (eg,

asbestos fibre manufacturers, asbestos product manufacturers, asbestos product distributors). In

addition to the accumulation of losses across hundreds of companies spanning multiple industries,

claims also accumulated over time. Due to the cumulative, multi-year nature of the manifestation of

mesothelioma, courts awarded damages to plaintiffs spanning decades of products and policy years.

Even today, plaintiff lawyers continue to find new ways to litigate on asbestos claims.

5

3

Ball, M., Jing, Y, and Sullivan, L. (2011). “The Need for Casualty Catastrophe Models: A Way to Prepare for the ‘Next

Asbestos’” . Retrieved from https://www.towerswatson.com/en/Insights/Newsletters/Global/emphasis/2011/The-Need-for-

Casualty-Catastrophe-Models-A-Way-to-Prepare-for-the-Next-Asbestos

4

A.M. Best Special Report (2015). “U.S. Insurers Continue Funding of Asbestos & Environmental Liabilities Despite Elusive

End Game” Retrieved from http://news.ambest.com/presscontent.aspx?altsrc=14&refnum=22066

5

Swiss Re Webinar (August, 2013). "What’s Next For Asbestos“ Retrieved from

http://www.swissre.com/clients/newsletters/2013_08_claims_webinar.html

CRO Forum – October 2015 14

Cumulative Incurred Asbestos Losses – U.S. Property Casualty Insurers

Source: Towers Watson analysis of annual statement data compiled by A.M. Best and other industry data

The accumulation of losses across industries and time, the latency of mesothelioma and the long

time it took the insurance industry to react with policy exclusions, has caused an annuitized drag on

insurance industry profitability over the course of many years. As a result, highly accumulating mass

tort risks as exemplified by the case of asbestos should remain a top concern for re/insurers and

their Chief Risk Officers.

Deepwater Horizon oil spill

A blowout and explosion on the Deepwater Horizon drilling rig in the Gulf of Mexico on 20 April

2010 killed 11 workers and led to an ensuing 85 days of oil spillage, the largest marine oil spill event.

The accident was tragic from many different perspectives. For the insurance industry it forced a re-

think of the approach to managing sudden-event accumulation.

The explosion and spill generated claims across a wide suite of P&C products. For example:

1. commercial/marine property policies for property damage and business interruption;

2. workers' compensation cover for injuries/deaths

6

;

3. public/excess liability policies for bodily injury;

4. property damage liability, including damages arising out of pollution in certain cases;

5. economic damages to shareholders of directly and indirectly implicated companies prompted

D&O liability claims; and

6. Cameron, the manufacturer of the blowout preventer used on the rig was named in multiple

product liability lawsuits.

The spill attracted contractors from many industries to the Gulf-region to assist with the clean-up

effort, creating additional workers' compensation and public liability exposures. In addition, had the

oil slick moved more closely to the shore, contingent business interruption claims could have

emerged across a broad geographic area.

Tracking the linkages between geographical locations of casualty exposures is almost impossible

without overly-burdensome data collection, storage and analysis. Nonetheless, individual re/insurers

need to ensure they are not overly exposed to industrial explosion disaster events. Geographical

6

There were 11 deaths in the blowout and explosion, of BP and Schlumberger employees.

0

10

20

30

40

50

60

70

80

90

1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

$ billions

Cumulative paid ($52 billion)

Case and IBNR reserves ($23 billion)

A.M. Best ultimate ($85 billion)

CRO Forum – October 2015 15

concentration is a key consideration in the management of classic clash losses, and geographic

information portals and maps can help ensure accumulation risk is properly reviewed.

The medical malpractice crisis in France

A recurring pattern in casualty insurance is that key legal decisions change the risk landscape, and

often come in times of economic stress. For victims, liability insurance could be a potential source

of revenue as the state legislates in favour of consumer rights in response to a particular situation,

and at the expense of insurance companies.

The French medical malpractice market was historically written on occurrence triggers with

unlimited coverage. In the early 2000s, this business was unprofitable and a landmark judgment

passed in November 2000 by the Cours de Cassation in plenary session, called "arrêt Perruche",

threatened to make medical malpractice uninsurable. The High Court awarded damages to a 19-year

old teenager born severely disabled because his condition had not been properly diagnosed prior to

birth. Payment for prejudice to be born disabled was thus acknowledged.

The whole market was hit by the decision and medical malpractice cover suddenly became very

expensive, if at all available. Insurers with high concentration in medical malpractice faced difficult

times and a series of reserve increases to cope with the new jurisprudence. To solve insurability

problems and to ensure cover was available, at the end of 2002 the French government introduced

several measures (laws called “Kouchner” and “About”), including establishing legal minimum

limits of insurance cover for practitioners, and a move to a claims-made trigger. Finally, pools

(Groupement Temporaire d'Assurance Médicale, GTAM, for insurance and Groupement Temporaire

de REassurance Médicale, GTREM, for reinsurance) were created to share the most delicate and

exposed risks. Since then obstetricians, anaesthetists and surgeons, those practitioners most

exposed, are required by law to be insured. Premiums remain high, anything up to EUR 10mn, given

that damages awarded in medical malpractice claims are significant.

Economic, societal and legal environments

Claims inflation

7

is one of the greatest risks for casualty insurers. Most re/insurers’ reserves assume

historical average inflation rates for the claims payments expected to be made in 10-, 20- or even 30

years or more into the future. Periods of high inflation, both medical and general, can have a direct

influence on claim outcomes. For example, the last period of prolonged high Consumer Price Index

(CPI) inflation in the US was from 1974 to 1982. Many factors, including the US legal environment,

influenced casualty incurred losses over that time period. However, in the late 1970s, there were

significant reserve movements across the industry in the US, which could be partially linked to high

CPI inflation.

Periods of high claims inflation (eg, medical, court rulings) can however also be disconnected from

CPI inflation, making future insurance claims even more difficult to predict. For example, in France

CPI inflation decreased over the period of 2002 to 2008 yet claims inflation for insurers was

increasing significantly due to favourable court rulings for victims in bodily injury cases. More

recently, most developed markets have gone through a period of low CPI inflation. However, cases

of claims inflation can still be observed, for example driven by increasing bodily injury costs. The

potential remains for a spike in costs that would cause accumulation of casualty reserve increases

across the industry and globally.

7

Claims inflation is not necessarily closely linked to widely published inflation indices like the CPI. Indeed, inflation of

liabilities is often more strongly impacted by legal, social, medical and fiscal changes, and portfolio effects than by pure CPI

inflation.

CRO Forum – October 2015 16

Casualty insurance products fundamentally cover litigation outcomes and costs. Therefore, casualty

insurance books are particularly exposed to systemic changes in the legal environments within the

countries in which their insureds do business. The time leading up to the mid-1980s was a

historically significant period of increase in tort costs in the US. Thereafter many US states enacted

tort reform laws which implemented various changes in their Justice systems to directly reduce tort

litigation and damages. There was a clear trend downward in market prices post-1986, when many

tort reform acts were passed.

8

Total Premium Share – U.S. Property Casualty

Source: Wang, Major, Pan, Leong (2010)

Similar trends, either upward or downward, will likely follow in other countries. There have already

been cases outside of the US where legal changes have impacted casualty business. These cases

have also demonstrated legal risk as a key driver of accumulation exposure. For example, the Courts

Act 2003 and the 2008 court decision in the Thompstone vs Tameside case in the UK changed the

landscape of compensation of bodily injuries entirely, moving away from structured settlements to

periodic payments without the consent of either party, and with the use of an adjustment index in

excess of the retail price index. The impact on the re/insurance industry has been significant and

long lasting.

2.3 Casualty accumulation matters in an interconnected and fast evolving society

As our environment changes and evolves, casualty accumulation risk is steadily growing. The

following Global Risks Interconnection Map visualizes the increasing cross-border interconnectivity

and interdependency due to globalization, technology advances, regulatory changes and

macroeconomic factors. These all increase potential accumulation risk.

8

Nockleby, J.T., & Curreri, S. (2005) “100 Years of Conflic: The Past and Future of Tort Retrenchment” Retrieved from

http://digitalcommons.lmu.edu/cgi/viewcontent.cgi?article=2467&context=llr

3.0%

3.2%

3.4%

3.6%

3.8%

4.0%

4.2%

4.4%

4.6%

4.8%

1965 1970 1975 1980 1985 1990 1995 2000 2005 2010

Total Premium Share = Net Written Primium / Private Sector GDP

Calendar Year

CRO Forum – October 2015 17

Source: Global Risks Perception Survey 2013-2014

With more connections between industries, insureds and countries, there is larger potential for

casualty catastrophe events. Globalisation blurs the boundaries of countries and industries. For

example, companies span continents, and the rise or fall of one currency can be felt within a

company globally. Supply chains also span countries and companies and their growing complexity

and interdependency magnifies the impact of small disturbances. As claimants seek compensation,

they may try to sue every point in the supply chain, leading to an event which could spread across

industries and insurance lines. The continuous aim to optimize and shift business processes down

the value chain, including to outsourcing partners, can result in increased exposure for casualty

insurers.

Technological and scientific advances are changing at lightning pace. As technology develops, it

gives unprecedented access to information. Scientific advances also result in uncertainty around the

long-term effects on and potential for risk accumulation in liability insurance. Alongside these

increasingly interconnected risks, new forms of litigation make courts more accessible (eg, class

litigations actions outside of the US may rise), which can rapidly change the risk landscape.

Insurers have learnt from past experience and introduced some key mitigants against accumulation

risk in their products. Examples are the reduction of policy stacking risk, the use of claims-made or

occurrence-notified triggers, and the adaptation of exclusionary language. Yet, the risk of a casualty

CRO Forum – October 2015 18

catastrophe has not disappeared. On the contrary, the risk is ever heightened by the fast changes in

society and the way people do business and live their lives.

Asbestos as discussed earlier is the classic example of risk accumulation, but what could the next

big thing be? We do not have a crystal ball but we are convinced that Chief Risk Officers should

encourage their organizations to be opened minded about potential future scenarios. To spark

discussion we will now look at some current hot topics and scenarios that could potentially be

casualty catastrophe events in the years to come.

Cyber

Cyber-risk is defined as “the risk of doing business (in the widest sense) in the cyber environment

or internet. This risk is evolving rapidly with technological changes, particularly as organisations

compete to reach customers through the internet. As the environment becomes increasingly

interconnected and complex, so the tools and sophistication needed to exploit vulnerabilities

become simpler. Given the many ways that cyber-risk can affect the operations of a business, the

costs and impact are uncertain and increasingly substantial.”

9

The potential for accumulation in cyber-risk stems from the highly interconnected IT systems that

run the world today. This risk needs to be addressed if a successful insurance market to help

manage the exposure is to be developed. The interconnectivity of IT systems hinders the ability to

measure and monitor an insurer's cyber-risk accumulation exposure because a cyber-attack can

trigger several insurance products and independent policies in a chain mechanism, similar to

contingent business interruption. The challenge is further exacerbated by second- and third-order

linkages, which are particularly difficult to identify and analyse.

In the CRO Forum paper "Cyber Resilience: the Cyber Risk Challenge and the Role of Insurance"

written in November 2014 the accumulation potential of cyber risk was highlighted. The present

paper "Casualty accumulation risk" proposes re/insurance risk management tools to address such

accumulation challenges, therefore the cyber-risk case is highlighted again here. A key component is

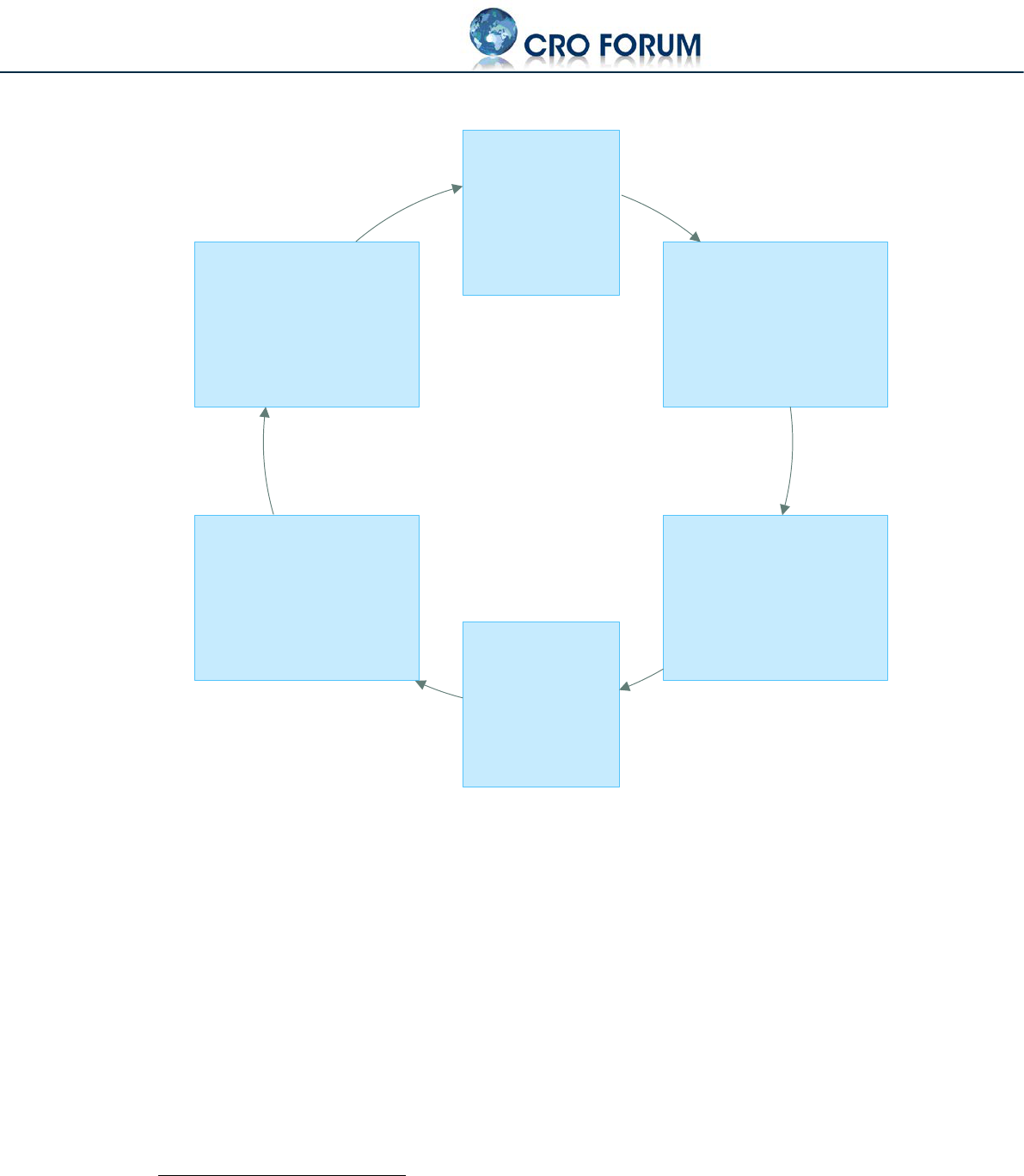

the development of scenarios to help understand the accumulation exposure, keeping in mind the

factors that will influence the probability/severity of losses and accumulation potential. The diagram

below sets out a process that can be used to establish and maintain a cyber-risk exposure

accumulation framework.

9

CRO Forum (November, 2014).“Cyber Resilience: the Cyber Risk Challenge and the Role of Insurance” Retrieved from

http://www.thecroforum.org/cyber-resilience-cyber-risk-challenge-role-insurance.

CRO Forum – October 2015 19

Source: CRO Forum (2014)

10

Key steps in the process involve:

■ The development of realistic cyber-risk scenarios.

■ An analysis of which insurance products are affected by which scenario, and to what extent.

■ A catalogue of cause-effect impact maps to help insurers visualise the types of cyber-risks to

which they are exposed and the damage that can be caused.

The cyber-risk landscape is not static. Developments in IT, dependency on IT services, the

development of instruments and tools to identify and use system vulnerabilities, the motivation of

hackers, and legislation/litigation may all change the results of an assessment of accumulation

exposure. The framework must therefore be sufficiently dynamic to allow for regular scenario

updates and for cyber-risk accumulation exposure to be monitored on an ongoing basis.

10

CRO Forum (November, 2014).“Cyber Resilience: the Cyber Risk Challenge and the Role of Insurance” Retrieved from

http://www.thecroforum.org/cyber-resilience-cyber-risk-challenge-role-insurance.

Establish a network

of subject matter

specialists from

across the company

including IT, Risk

management,

Underwriting and

Claim departments

Set up cross functional

workshops with internal

subject matter specialists and

potentially external cyber risk

experts to collate information

on cyber risk exposure

Use information gathered in

the workshops to compile

databases of historical events,

underwriting and claims

information (eg limits,

attachment points, premiums,

losses, insurance wordings ad

endorsements)

Monitor the effects of the

changing cyber environment

on the cause-effects-impacts

landscape and underwriting

needs

Apply scenarios to insurance

portfolios so that it is clear

how and to what extent an

insurance portfolio is affected

by a scenario.

Develop realistic

cyber risk scenarios

and map cause

effect impact to

asset potential

accumulation of

losses

CRO Forum – October 2015 20

The diagram below illustrates the different lines of business that can be affected by cyber-risk, to

various degrees depending on the scenario.

Source: CRO Forum (2014)

11

Pandemic

Pandemics are also a potential source of casualty accumulation risk. They occur when a strain of

virus that can infect humans, cause serious sickness and is easily transmissible emerges or re-

emerges. In a hospital, accumulation risk can stem from the institution's suite of professional and

medical liability policies which are triggered if failures in protocol implementation result in new

contaminations to staff or patients.

A pandemic outbreak also leads to higher medical expenses and healthcare costs. Business

interruption and contingent business interruption policies can be indirectly affected by a pandemic

outbreak as transport, cross-border trade, supply chains and tourism could become disrupted.

Operational costs could rise to ensure business continuity, and a loss of new business could be

expected. Further casualty exposures could arise from accident & health policies with sickness

extensions or through workers' compensation, depending on the specific regulatory framework

around occupational diseases.

12

Nanotechnology

Nanotechnology is the engineering or manipulation of matter on a molecular scale. Products

manufactured with some form of nano-engineered materials are becoming increasingly common.

11

CRO Forum (November, 2014).“Cyber Resilience: the Cyber Risk Challenge and the Role of Insurance” Retrieved from

http://www.thecroforum.org/cyber-resilience-cyber-risk-challenge-role-insurance.

12

Boggs, C.J. (2014). “Is Ebola Compensable Under Workers’ Compensation.” Retrieved from

http://www.insurancejournal.com/news/national/2014/10/10/343250.htm.

CRO Forum – October 2015 21

Nano-manufacturing processes can improve structures and properties of materials, making them

stronger, water repellent, more durable, lighter, self-cleaning and more. Due to these properties, the

use of nanotechnology can be expected to grow significantly. There may in the future be some

similarities with asbestos, which for a long time was also considered "white gold" due to its superior

properties. No link between nanotechnology and a specific adverse health outcome has yet been

established, but should it turn out that some adverse health implications are connected with

nanotechnology once the long-term effects are better known, the potential accumulation loss could

be very significant.

E-cigarettes

E-cigarettes (as well as e-cigars and e-pipes) are a growing trend around the world. Available with or

without nicotine, e-cigarettes are marketed as a cigarette alternative, smoking cessation aid, and as

healthy and non-toxic. They are being used extensively across the US, Europe, and Asia. E-

cigarettes are not strongly regulated and laws governing use and sale vary widely. In some cases,

there are no regulations for product classification, product safety and quality, use in public places,

youth protection and advertising. There are two major risks for the insurance industry: the technical

component (battery, cartridge, etc.) and the chemical component (the liquids).

Currently, it is difficult to conduct a thorough risk assessment of e-cigarettes and the long-term

health impacts are unknown. A loss-accumulation scenario could arise though if e-cigarettes are

proven to be more harmful to health than presumed today. Respiratory diseases or other health

problems may increase, triggering liability claims similar to tobacco claims already seen.

Concussions

Concussions are traumatic brain injuries that occur when a blow to the head or body causes shaking

of the brain. Repeated concussions that are not identified and managed correctly have been linked

to Chronic Traumatic Encephalopathy (CTE), a degenerative brain disease. It has been estimated

that in the US, there are between 1.6 million and 3.8 million sports and recreation-related traumatic

brain injuries each year.

13

This number is increasing each year as the number of young people

playing contact sports grows and as many athletes become bigger and stronger.

In 2011 the first lawsuit was filed claiming that the National Football League (NFL) and Riddell – the

"official helmet of the NFL" were failing to protect players from brain injuries and concealing the

long-term dangers of concussions. Additional lawsuits have since come forward. On 22 April 2015,

the Federal judge approved a settlement agreement which could cost the NFL USD 1bn in

compensation payments to retired players.

14

The cases against Riddell are still pending.

Concussion safety laws related to youth sports have been passed in 49 states in the US. So, unlike

before, concussions are no longer seen as minor injuries. It might very well be that advances in

medical science may lead to new liabilities as the link between other injuries and concussions is

made. At present, this is more a hot topic in the US than elsewhere, but there could be a spill-over

to Europe and other regions. The large number of potential victims, including high-earning

professional athletes or young players, could create a perfect storm and casualty accumulation risk

scenario.

13

Center for Disease Control and Prevention (CDC). “Facts for Physicians” Retrieved from

http://www.cdc.gov/headsup/pdfs/providers/facts_for_physicians_booklet-a.pdf

14

Associated Press. “US NFL Concussion Lawsuit”. Retrieved

http://hosted.ap.org/dynamic/stories/U/US_NFL_CONCUSSION_LAWSUIT?SITE=AP&SECTION=HOME&TEMPLATE=DEFA

ULT

CRO Forum – October 2015 22

Climate change

According to the US Environmental Protection Agency (EPA) "climate change refers to any

significant change in the measures of climate lasting for an extended period of time. In other words,

climate change includes major changes in temperature, precipitation, or wind patterns, among other

effects, that occur over several decades or longer." Man-made climate change in simple terms

refers to the rise in the earth atmospheric temperature as a result of trapped CO2, methane and

nitrous oxide. For the past 10 years, carbon dioxide emissions have grown by an average of 2.5%

per annum.

15

This could amplify the risk for catastrophic weather events, like excessive heat,

drought, rains or storms, a rise in sea levels and a thawing of permafrost.

Categorization of climate risk

Source: Carbon Disclosure Project(2007)

16

To date there have been several climate-change related lawsuits in the US, but none have been

successful. Potential liability cases could include failure to build or maintain infrastructure (eg, dikes,

dams, well-functioning water ways, waste water/sewage systems, adequate staffing and material –

direct-link liability

17

) to mitigate the risks posed by severe weather events. There could also be

legislative actions to limit CO2 emissions (indirect-link liability), for which public and private sector

parties could be held liable. In the current legal environment, it seems unlikely that indirect-link

liability will be approved in court but if it is, the result would be a critical loss accumulation.

In the US, the direct-link liability is a reality and the potential for casualty accumulation after a natural

catastrophe can be dealt with by the insurance industry. For example, following floods and

hurricanes, pollution cases have been observed, and several cases of liability for construction or

utility companies have already been seen. Amongst other reasons a greater willingness to hold

15

Carbon Disclosure Project (2007). “Carbon Disclosure Project Report 2007” Retrieved from

https://www.cdp.net/CDPResults/CDP5_FT500_Report.pdf

16

Refer to footnote above.

17

Definition from Coping with climate change risks and opportunities for insurers, The Chartered Insurance Institute 2009

Direct risks

Physical risks –

extreme

weather events

Weather pattern

changes

Indirect risks

Regulatory

risks

Regulatory

risk

Litigation

risk

Other risks

Credit

risk

Market

price

risk

Reputa-

tion

risk

Operat-

ional

risk

Sector / Corporate

CRO Forum – October 2015 23

other parties liable following a natural catastrophe as well as better investigation of cause due to the

advances of science, increase the probability of liability claims after a natural catastrophe.

18

As an example of an extreme weather event, a large wildfire started on 20 October 2007 in

Southern California and continued for 19 days. Over 1200 homes were damaged. After

investigation, it was found that improperly maintained and designed power lines ignited the fire and

that the utility company was liable for the damages. The liability insurance tower was exhausted.

This is a typical example of a loss where liability insurance towers cover for mainly natural

catastrophes and where an accumulation potential is possible.

2.4 Embedding casualty risks in the overall accumulation risk

Casualty accumulation is rarely limited solely to casualty insurance losses. All the examples referred

to in this publication may have implications on other P&C lines, life/annuity products, investments

and to a lesser degree, operational impacts. These enterprise-wide implications require that casualty

accumulation risk is not managed within a silo. Business-unit executives should be held accountable

for considering firm-wide exposures in the context of their unit's business plans, portfolios and

individual account underwriting. Casualty accumulation quantification efforts should factor in all

material sources of risk across all liabilities and assets.

As described later in this paper, Enterprise Risk Management (ERM) plays a critical role in identifying

and quantifying firm-wide accumulation risks and concentrations. Most companies maintain

separate functions and management hierarchies for different insurance businesses (eg, P&C vs.

Life), business functions (eg, Asset Management vs. Underwriting), and regions. These silos are not

naturally focused on accumulation and correlations outside of their remit given incentive structures

and general areas of focus. The emergence of ERM functions in recent decades is evidence of

financial institutions’ recognition of risk correlation across disparate business units and regions, and

it is ERM’s remit to ensure firm-wide accumulations are well managed.

Crossing the lines of business

Casualty insurance payouts are often linked to multi-line events, and this dependence should not be

underestimated. A few examples of real and potential dependencies and correlations are:

■ Catastrophes involving property fire policies, marine and casualty insurance, as in the

Deepwater Horizon case.

■ Several very long tail lines of business, like workers' compensation in the US and motor third

party in countries which compensate bodily injuries by means of period payments, are exposed

to longevity risk factors, in a similar way to Life & Health (L&H) business. For example, in certain

European countries, the regulator mandates the use of specific mortality tables to the

capitalization of periodic payments. Changes in these actuarial assumptions occur regularly and

reflect changes in assumptions that spans across to L&H products.

■ Natural and man-made catastrophes result in damage to property and people. The damage is

covered through workers' compensation or accident & health policies, creating cross-line

accumulation.

18

Stevens, J., & Knuesli, D. “Property Events create emerging risks for casualty insurers” Retrieved from

http://www.carriermanagement.com/features/2014/05/18/123020.htm

CRO Forum – October 2015 24

Casualty risks are important on their own and as a first step, the exposure should be assessed on a

standalone basis. However, it remains essential that the Chief Risk Officer considers the

correlations and dependencies across all underwriting areas.

Accumulation with the asset side of the balance sheet

Casualty accumulation of liabilities can be correlated to risks on the asset side of the balance sheet.

These correlations can manifest through mutual sensitivities to macroeconomic factors or through

classic clash events.

The influence of externalities/macro-economic factors on asset prices has been studied for decades.

Macroeconomic factors which adversely impact asset valuations should be analysed for correlations

across all sources of risk, including casualty, as part of a strong asset liability management (ALM)

program. Selected key questions for re/insurers to address are:

■ Can a severe spike in general inflation impact the firm’s casualty reserves and fixed income

assets via rising interest rates?

■ Can equity market volatility or a rise in credit spreads lead to asset devaluation in concert with

an increase in D&O liability claims?

■ Do recessions or periods of high unemployment have an influence on workers' compensation or

other casualty line losses?

■ How do changes in gross domestic product (GDP) growth influence asset classes and top-/

bottom-line performance of the casualty portfolio?

■ How do real estate prices influence professional liability claims?

A detailed understanding of structural drivers of asset and liability risk can enable a re/insurer to

optimize its portfolio and facilitate resilience to financial crises.

In addition to macroeconomic factors, classic clash events can impact assets and casualty liabilities

simultaneously. As referenced earlier, the Deepwater Horizon event caused clash across a variety of

insurance contracts. Had the event been severe enough to result in a BP default, the losses could

have also crept into the asset portfolio via corporate bonds, equity, or other credit exposures such

as captive-fronting arrangements. Likewise, a cyber-attack could lead to financial distress in an

individual firm or industry sector, causing correlated losses across assets and liabilities. Finally, a

global pandemic would increase L&H and P&C insurance claims, and could also wreak havoc on the

financial markets.

Re/insurers need to comprehensively analyse correlated asset and casualty risks. There are perhaps

other lessons to be learnt from asset management within the casualty accumulation risk space. For

example, concentration risk and diversification are concepts well-known to financial risk managers,

but may not be properly deployed for casualty accumulation. Ensuring that an asset portfolio is not

overly concentrated in one industry or geography can help prevent outsized losses under adverse

circumstances. The same concept can be applied to casualty insurance. Firms should analyse

concentrations of exposure by geography, court jurisdiction, industry sector, insurance product line,

supply chains and other dimensions to provide protection against unforeseen catastrophes.

Analysing risk concentrations in this manner requires significant investment in data and technology,

but can yield very powerful tools with which to manage casualty accumulation.

CRO Forum – October 2015 25

3 Assessing the potential effects of uncontrolled casualty accumulation

The modelling and assessment of the casualty accumulation risk is complex and requires skills and

modelling techniques that go beyond the more-established means of assessing natural catastrophe

accumulation risk. In this section we set out the issues encountered when modelling extreme

events in long tail business and present some ways to go forward.

3.1 Why is casualty accumulation risk more challenging to assess and model than property

catastrophe accumulation risk?

Casualty accumulation risk differs from property catastrophe accumulation risk for the following

main reasons:

■ Its underlying drivers are intrinsically different. Property catastrophe risk is mainly driven by the

random occurrences of natural perils and the vulnerability of properties hit by an event. Hence

an analysis of past events, an assessment of how vulnerable a property might be and also of the

associated costs of repair allow the formulation of probabilistic laws for property catastrophe

losses in the future.

– Natural catastrophe property risks are fundamentally governed by physical laws. Casualty

accumulation risk, on the other hand, is linked to human behaviour, the political, legal and

economic environment, and social standards. Casualty lines are also usually characterized by

a far higher legal risk (eg, stacking or date of loss or applicability of exclusions). As a result,

the risk is constantly evolving. Because of its changing nature, the assessment of casualty

accumulation risk is difficult and more subjective. Lessons from the past are less directly

applicable to modelling the future than in natural catastrophe risk.

– As the past may be considered a partial indicator of the future, assessing the plausibility of a

specific type of casualty accumulation occurring in the future also relies on expert judgment.

It requires asking questions such as:

■ What could be the next products/substances to harm the environment or humans?

■ What is the likelihood or plausibility of these products/substances resulting in mass

litigation?

■ Which policies and particular lines of business of an insurance portfolio could be exposed

in such a scenario, and to what extent?

– Furthermore it requires knowing how different industries are connected, inasmuch as a

court ruling resulting in a mass litigation could potentially have an impact throughout the

value creation chain / lifecycle of an allegedly harmful product or substance. Understanding

the types of trading connections through which clients in an insurance portfolio do business

is hence also a key aspect of assessing more fully the potential for risk accumulation.

■ Casualty exclusively relates to longer-tail lines of business and it takes far longer for the risks to

be identified than in the natural catastrophe space. The long-term nature also means that

multiple underwriting years are likely to be affected in a severe accumulation scenario, and that

portfolio steering and actions to mitigate or manage the risk take time to become effective.

■ In the case of an extreme tail accumulation scenario, casualty may allow for less diversification

benefits than natural catastrophe cover. Geographical diversification, a key feature of natural

catastrophe risk, may not hold for casualty because the spread of an event underlying the

accumulation may not be confined to a particular area. It could even have a worldwide span.

■ Casualty catastrophes have a lesser impact on liquidity than property events. Extreme property

events are paid out quickly and require strong liquidity.

CRO Forum – October 2015 26

■ Under solvency regimes, property risks are mainly linked to premium charges. In casualty, the

exposures are covered through the reserve risk.

In the last two decades, the re/insurance industry has focused on developing increasingly

sophisticated stochastic models for property catastrophe risk. These models have traditionally

focused almost exclusively on earthquakes, windstorms and cyclones hitting so-called "peak

markets," in other words markets with high concentration of property assets/value and where

insurance penetration is high (the US, Europe and Japan). Today a number of new risk models that

cover wider geographical areas and a broader range of perils (eg, floods, tsunamis, droughts) are

being developed. The strong developments in property catastrophe risk modelling has made the

associated risk management easier and more systematic, and facilitated the development of

concepts now familiar to every stakeholder in the re/insurance sector, such as being able to set a

return period for a CAT event.

The same progress in modelling has not happened in casualty accumulation risk, even though the

loss potentials could be as high as or in excess of those resulting from severe natural catastrophe

events. The challenges to identifying and assessing casualty accumulation risk already discussed

likely explain why this is. The current approach to modelling casualty accumulation risk is usually

based on deterministic extreme-scenarios whose specifications reflect expert views on plausible tail

events (eg, the new asbestos, a financial crisis like in 2008). It does not use the probabilistic

dimensions common in property catastrophe modelling. Both the quality and availability of data are

key aspects for the impact assessment of any casualty accumulation scenario analysis.

Impact on insurers

Accumulation management is a driver of re/insurance company profitability. The volatility of

individual account-level risks tends to diversify as the size of a portfolio grows. In aggregate,

accumulation events and trends drive portfolio outcomes. Uncontrolled casualty accumulation can

impact re/insurers, as happened in the asbestos scenario described earlier, which resulted in a multi-

decade drag on industry profitability in the US and was a capital-level event for many insurers.

The unknown quantification of accumulation risk, due to long-tail and uncertain nature of casualty

can cause adverse outcomes for re/insurers in two ways:

■ It can cause casualty insurers to add more cumulative risk to their portfolio each year on an

occurrence policy form to finally generate potentially huge hidden accumulations.

■ Lack of quantification and understanding of accumulation can also lead to missed opportunities.

The re/insurance industry often reacts swiftly to issues in the public eye or that are trending in

scientific literature by placing exclusions on policy forms. In certain cases, the accumulation may

in fact be within the firm’s risk appetite, and there may be an opportunity to write the business

at the right price. But the reverse happens. For example, the liability policies for industries in

which people are exposed to electro-magnetic fields (EMF), such as telecoms, often exclude

this risk. Yet as of today, no causal link between bodily injuries and EMF has been proven.

Rather than exclude, an insurer could develop and leverage a deeper and more accurate

understanding of EMF exposure to write more telecoms business.

At moderate levels of severity, casualty accumulation events tend to result in earnings volatility.

Re/insurance industry stakeholders expect a certain degree of volatility for adverse events due to

the nature of the risks in a casualty insurance portfolio, so these moderate events do not have much

impact in the long run. However, if an individual re/insurer has a disproportionately large share of a

loss for an event relative to the rest of the market, the firm may well be subject to questions

regarding risk selection and accumulation management practices.

CRO Forum – October 2015 27

Very severe events threaten the solvency of re/insurers with lower levels of policyholder surplus and

more limited diversification across business lines. History has shown that casualty accumulation

events can be large enough to cause capital-reduction level losses. For this reason, casualty

accumulation management is critical for proper risk management in the eyes of all stakeholders.

3.2 Scenario-based modelling

Casualty accumulation risk is a concern for enterprise risk management. In an environment strongly

shaped by solvency frameworks and internal risk models, casualty accumulation requires a robust

approach for monitoring and quantification.

The unfolding of a liability disaster

The below graph is the authors' attempt to summarise the evolution of a potential liability disaster.

We shall use it to guide us through the sequence of steps to develop a quantitative risk model.

Unfolding of a liability catastrophe

Source: Swiss Re

A long period during which some harmful phenomenon might occur, followed by a number of years

during which the legal system determines liability and defines compensation, is characteristic of the

potential complexity of a casualty accumulation catastrophe event. Long after the original exposure,

effects will become manifest and some underlying causal link will be postulated. Over time, that link

will become more established, and eventually re/insurers will set an initial provision for future

claims. For a major catastrophe, there will likely be still much uncertainty in the form of pessimistic

estimates to counter optimistic denials of liability. A lengthy path through the courts will uncover

more evidence, leading to upward (or downward) changes in ultimate estimates.

A large portion of the loss to the insurer could be the legal defence transaction costs. The case of

asbestos in the US gives indication of the potential size of these: out of the total losses of USD

85bn, USD 21bn have been cited as being defence costs

19

.

19

Carroll, Stephen J. et al (2005). "Asbestos Litigation" Retrieved from

http://www.rand.org/content/dam/rand/pubs/monographs/2005/RAND_MG162.pdf

Initial reserve

is set

Court decisions lead to changed estimates

Effects

become

apparent

time

Payments (incl. Cost)

Policies affected

Exposure to harmful phenomenon

Impact duration

Loss emergence

CRO Forum – October 2015 28

The scenario approach to quantification

There are typically two ways to quantify a random event. The first is based on statistical analysis of

past experience. Standard actuarial reserving techniques fall into this category. This approach is

relevant also for casualty accumulation risk, especially for large and mature portfolios. However, the

unique nature and complexity of potential catastrophes, and the lack of history on large-scale

events, limits the effectiveness of this method in quantifying accumulation exposure.

Alternatively, a scenario-based approach can accommodate different views about potential future

developments. Underwriters, claims managers, lawyers and scientific experts use their knowledge

and imagination to construct specific hypothetical case studies. These scenarios provide a better

understanding of which components in the chain – from the initial exposure, to some harmful event,

to eventual settlement – might lead to a disastrous accumulation. They can also give indication of

which types of business are more dangerous, and of how expensive things may get.

The long time that an unfolding of a liability catastrophe takes exposes participants to changes in

legal and societal conditions. All risk models have to cover aleatory and epistemic uncertainty. In

casualty accumulation risk modelling, epistemic uncertainty is particularly relevant.

The split between these two ways of addressing the problem is not absolute. The loss experience

of the past can be adapted in some way to reflect more recent developments. Similarly, some

components of scenario may need to be quantified based on what has been observed before. Once

a set of scenarios is established and quantified, they need to be evaluated for their relevance.

However comprehensive it might seem to be, the highly unspecific nature of casualty accumulation

catastrophes leads us to suspect the existence of some unexpected and negative surprise events,

which could be characterised as “black swans”.

Mapping scenarios to portfolio exposures

The losses that the company has to bear should a scenario materialise depend on its portfolio of

re/insurance policies. To be useful, the link between scenario and policies has to be modelled.

Obviously, one could ask the experts defining the scenario to include an estimate of the company’s

share of the market loss into their considerations. However, a simple model based on market share

makes it difficult to track the evolution of the exposure to a scenario over time, as it does not

directly model the impact of the portfolio composition. We advocate the development of a clear

model that maps the scenario to the underlying portfolio and exposure based on clear metrics.

Since no (quasi-)standardized exposure measure for casualty catastrophe risk exists, additional

assumptions will have to be introduced to be able to construct such an exposure measure. In

general, it will depend on both the scenario to be assessed and the portfolio information available.

One of the challenges of a casualty catastrophe is the extent to which past underwriting years might

be involved in the accumulation of losses. Finality is a concept not well defined in this context. But

even besides this fundamental issue, there is the reduced availability of contract data from old

years, and also the possibility that certain soft properties of contracts (like the use of certain clauses)

not captured in the exposure measure underwent substantial changes.

3.3 A forward-looking approach

Limitations of current actuarial techniques

Liability exposure is a moving target. Risks are characterized by extremely heterogeneous

exposures, high uncertainty and a vast array of risk drivers. Changes in local legislation,

technological advances and societal trends such as urbanization, can fundamentally alter the risk

CRO Forum – October 2015 29

landscape, and have to be taken into account where historical data is available. For other casualty

lines, mostly motor, more data is available but the risk of change remains.

Current predictive modelling techniques address this problem only partially as their structure is

necessarily constrained. For example, they can quantify the impact of changes to the levels of

certain variables on a loss frequency basis. But they fail to cope where societal trends alter the

relationship between dependent and independent variables. In using exposure to predict loss

directly, traditional actuarial and predictive modelling techniques fail to fully utilize the information of

the loss-generating process. Differently put, they lack insight into the cause-effect chain from

exposure to loss.

Studying loss generation: from natural catastrophe modelling to liability exposures

The systematic integration of the cause-effect chain characterises the new era of natural

catastrophe modelling. It has allowed insurers to evaluate these risks with greater precision, transfer

findings from data-rich geographies to others with more sparse empirics, and to improve models

continuously as new events change and enhance understanding of loss-generating dynamics.

Whereas the loss- generating process for natural catastrophes such as an earthquake can be

defined in a relatively contained manner, for liability events the influencing factors – or risk drivers –

affecting loss frequency and severity are less distinct, more numerous and, consequently, less-

easily defined.

Risk Drivers in Property vs Casualty

Source: Swiss Re

While the challenge is substantial, given their global perspective re/insurers are well-positioned to

gain insight into the drivers of liability risk and to utilize their data sources, and also their expert

resources to identify and monitor relevant dynamics. Modelling the cause-effect chain and its driving

properties overcomes the direct dependency of predictive models on the availability of big data sets,

and also their limitations in the face of a changing risk landscape. These forward-looking models

(FLMs) often use a scenario-based approach, and their structural form allows for more complex

relationships between observable risk drivers and loss.

Liability event= rules of life (typically more individual company sources)

Hazard Vulnerability Values Conditions

Conditions

Legal

system

Social

standards

Macro

environment

etc.

Loss

Frequency

Earthquake

Loss

Frequency

Liability

?

?

?

+ + +

Cat event= laws of physics (typically more common to all firms)

….

CRO Forum – October 2015 30

Parameterization of FLMs is a difficult task as the number of parameters is high and not all can be

assessed based purely on data, either because data is not available or because the risk driver

concerned such as the general level of litigiousness within a jurisdiction, escapes objective

quantification. In principle, FLM could be set up in a way that each risk driver can be measured in an

objective observable. However, this would require data for initial calibration beyond what

re/insurers currently have at their disposal. As such, expert assessment still plays an important role

in FLM parameterization.

Back-testing remains a challenge for similar reasons. FLMs can be fully back-tested and anchored in

data-rich contexts (geographies, industries, severity ranges), but when transferring FLMs to a data-

sparse context like in some emerging markets, there is often no historic data available for back-

testing at all. For classical predictive models, this is a hard limitation. The structure of FLMs allows

the incorporation of predictive modelling techniques such as generalized linear models (GLMs)

where data availability allows, say to quantify the effects of some risk drivers, but to transcend their

limitations. FLMs base their key value proposition on the assumption that a cause-effect chain can

be established based on observations in a data-rich context and transferred to a data sparse one,

and that only the risk drivers having to be re-assessed for new geographies/industries.

FLM approaches are still nascent and more years of historic data are required before their

performance in adequately predicting loss frequency and severity can be judged. From a conceptual

standpoint, FLM approaches provide three new areas of opportunity in risk accumulation

assessment:

1. Their cause-effect approach could increase risk understanding and also help further improve

visibility and awareness.

2. As both data and expert judgment are used in calibrating their parameters allows for the findings

of FLMs to retain validity as they are transferred from data-rich to data-sparse contexts.

3. Their higher level of structural sophistication – which, granted, poses a risk of the models

becoming "black boxes" to many – allows FLMs to account for more complex trends. They can

preserve their predictive power also in light of changing legal, economic, societal and

technology dynamics.

Casualty is a long-term business. Once the FLM approach is developed and adapted, it should be

able to decompose the time steps from the first exposure or occurrence all the way to payout

patterns. It could allow the study of risk drivers working on these components which can reveal

accumulation risk not only for the current underwriting year, but also from past exposures for today

and in the future.

Considerations on modelling for solvency purposes

A quantitative model for casualty accumulation risk needs to be integrated in the economic one-year

framework of a re/insurer's internal solvency model. Despite this one-year view, re/insurers will take

into account the ultimate risk horizon when making management decisions (see chapter 4 on

effective management of the casualty accumulation risk). One of the characteristics of a liability

disaster is its gradual unfolding over a number of years. For a long time, neither a reliable estimate

of ultimate claims, nor of the timing of the payout, will be available. Asbestos is an obvious reminder

of how long this period of uncertainty might be. And again, it is clear that neither the initial reserve

estimate, nor some individual reserve strengthening will be a good proxy for the ultimate economic

impact of a liability disaster. Even before a court has established the existence of liability, market

perception could severely affect a company that is deemed to be involved.

Given the large uncertainty about the casualty scenario, no re/insurer will want to abandon the one-

year approach, just to be forced to introduce new unjustifiable assumptions that would be required

for quantifying the contingent evolution of the catastrophe over many years. Rather, a much-

CRO Forum – October 2015 31

reduced simple evaluation rule that assigns an estimated economic one-year impact to the scenario

will be employed. The reasoning behind such a rule will depend on the kind of scenario considered.

Solvency is determined on the legal entity level. Therefore the casualty scenario has to be evaluated

jointly with all other sub-models impacting the (economic) balance sheet. In other words, re/insurers

must think about whether potential dependencies with other risk categories have to be quantified

and modelled.

CRO Forum – October 2015 32

4 Towards an effective management of the casualty accumulation risk

In the view of the authors, managing casualty accumulation risk should remain a strategic priority for

every Chief Risk Officer. The impact of a mismanaged long-tail exposure can have dramatic

consequences.

20

The complexity of potential scenarios and the related modelling challenges are

reflected in the complexity of how to best manage the long-tail accumulation risk. In this chapter we

present some key aspects of the role of the Chief Risk Officer in this respect, and provide a way

forward based on increased visibility into the underlying exposures and risk metrics.

4.1 The role of Enterprise Risk Management

The Enterprise Risk Management (ERM) function in a re/insurance company articulates the firm’s

risk appetite and risk limits, identifies key risks (including emerging ones), quantifies/prioritises

material risks, and determines strategy on mitigating actions. Strong firm-wide risk management

requires an ability to continually identify and assess accumulation risks, including casualty and

exposure correlations with other risk factors, such as market and credit risk or the risks posed via

other Property & Casualty insurance products.

Data quality and risk identification