Consultation Paper

CP19/23**

July 2019

Signposting to travel insurance for consumers

with medical conditions

2

CP19/23

Financial Conduct Authority

Signposting to travel insurance for consumers with medical conditions

How to respond

We are asking for comments on

this Consultation Paper (CP) by

15 September 2019.

You can send them to us using

the form on our website at:

www.fca.org.uk/cp19-23-response-form

Or in writing to:

Hannah Regan

Consumer Strategy & Policy

Financial Conduct Authority

12 Endeavour Square

London E20 1JN

Email:

signpostingtotravelinsurance@fca.org.uk

Contents

1 Summary 3

2 The wider context 7

3 Signposting rules and additional guidance 9

Annex 1

Questions in this paper 15

Annex 2

Annex 3

Compatibility statement 28

Annex 4

Abbreviations used in this paper 32

Appendix 1

Draft Handbook text

Search

How to navigate this document

returns you to the contents list

takes you to helpful abbreviations

takes you to the previous page

takes you to the next page

prints document

email and share document

3

CP19/23

Chapter 1

Financial Conduct Authority

Signposting to travel insurance for consumers with medical conditions

1 Summary

1.1 We want to help consumers with pre-existing medical conditions (PEMCs) who can

sometimes struggle to access affordable travel insurance that covers their conditions.

This consultation sets out our proposals for doing this and we are asking for your views.

Why we are consulting

1.2 We propose introducing measures to help consumers better navigate the market and

find firms that can offer travel insurance products that cover their PEMCs, and we

would like input from our stakeholders on these proposals.

Who this applies to

1.3 This consultation will be of interest to:

•

agents, intermediaries, and appointed representatives¹

•

• insurance industry trade associations

• charities, in particular medical charities

• consumer organisations

• consumers, primarily those with PEMCs

The wider context of this consultation

1.4 Over the past four years we have worked on issues affecting vulnerable consumers

and access to financial services. We have found that consumers with PEMCs can

sometimes face problems navigating the travel insurance market and finding

affordable cover for their conditions.

1.5 In June 2017, we issued a Call for Input (CfI) to gather further evidence. We focused on

those consumers with, or recovering from, cancer.

1.6 In July 2018, we outlined the feedback we received to the CfI. This indicated that

consumers with more serious PEMCs can struggle to identify firms that can provide

affordable cover for their PEMC. Consumers often give up their search after their

initial unsuccessful attempts. In some cases, this is because their application for travel

insurance is declined. Others are offered a policy containing exclusions for PEMCs or at

what they consider to be an unreasonably high premium.

and banks), and appointed representatives

Search

4

CP19/23

Chapter 1

Financial Conduct Authority

Signposting to travel insurance for consumers with medical conditions

1.7 This means some consumers are travelling without cover for their PEMC, cancelling

trips or paying significantly more for policies than they could with alternative firms.

Issues were prevalent across all PEMCs, not just cancer.

1.8 Nearly all consumers with a PEMC can get cover if they are able to find the right

provider. And often, if they can, the premium may also be more affordable. We know

it can be challenging to navigate the market to find more specialist providers. So we

have mainly looked at helping consumers effectively navigate the market and access all

providers.

1.9

purchase travel insurance each year. Of these consumers, approximately 0.7% were

declined cover, and 11% bought a policy that excluded their PEMC (see table 1 in Annex

2- Cost Benefit Analysis). A proportion of consumers who are offered a policy may

benefit from shopping around to find more affordable cover with a different provider.

We are unable to estimate the number of consumers in this group.

1.10 Since issuing the feedback statement, we have engaged extensively with stakeholders

through bilateral meetings and larger roundtable events. This has helped us to explore

the options available, test our proposals and establish a viable package that we believe

addresses the harm in a proportionate and practical way. We recognise that industry

and trade associations (such as BIBA and the ABI) have been engaged with this issue,

but our proposals aim to bring greater consistency across the industry.

What we want to change

1.11 This consultation seeks views on the following proposed changes to our Handbook:

•

to cover consumers with more serious PEMCs. The content and controls around

the directory will be developed by the FCA with the intention that the directory will

be hosted by the Money and Pensions Service (MAPS).

•

PEMCs

1.12 We are also looking to introduce a package of proposals to work together to achieve

optimal outcomes for consumers. We will work with:

• MAPS to improve consumer understanding of travel insurance policies for those

reiterate the importance of insurance; and

• our stakeholders to improve the wording used in the medical screening process,

aiming to make the process as easy as possible for consumers

1.13 These additional supporting remedies are discussed in more detail in 1.21 – 1.22 below.

Search

5

CP19/23

Chapter 1

Financial Conduct Authority

Signposting to travel insurance for consumers with medical conditions

Outcomes we are seeking

1.14 We want to improve the travel insurance market by helping consumers with PEMCs

have better access to travel insurance products that cover their conditions. Our

proposals aim to increase consumer confidence and trust in the travel insurance

market by reducing the number of:

• consumers who feel frustrated and unable to navigate the market

• uninsured consumers, who are currently faced with a choice of not travelling or

running the risk of incurring significant costs, including medical bills, abroad

• consumers with PEMCs who are over-paying significantly for travel insurance

Measuring success

1.15 If we introduce these proposals, we will evaluate their impact using a range of evidence.

1.16 We will get feedback from stakeholders, including consumer organisations, charities

and consumers themselves, which will be extremely valuable in measuring the success

of the proposals. However, we have limited baseline data to give us an overview of how

the market is operating currently for consumers with PEMCs. This will make it difficult

to measure the success of the proposals against the current position in quantitative

terms.

1.17 We will work with MAPS to establish ways to collect data from the directory to show not

only how many consumers use the directory, but also the outcomes after using it. We

will also use information from our supervision of firms, including product governance

processes. These give insight into how travel insurance products reach their target

market and perform.

Next steps

Consultation

1.18 We are seeking your views on the proposals in this paper. Please send your comments

to us by 15 September 2019 using the online response form or by writing to us at the

address on page 2.

1.19 We will consider the feedback and publish a Policy Statement with our response to the

consultation feedback along with final rules, subject to responses to this consultation.

Supporting proposals

1.20 To complement the proposals that we are consulting on in this paper, we will work with

MAPS and our other stakeholders on 2 additional initiatives:

1. Consumer information

1.21 We want to ensure that consumers have access to relevant information to make

better informed decisions. We will work with stakeholders to try to improve consumer

understanding of the travel insurance market and will work with MAPS to produce

Search

CP19/23

Chapter 1

Financial Conduct Authority

Signposting to travel insurance for consumers with medical conditions

material for consumers with PEMCs. This will help consumers understand the

implications of travelling with exclusions, and how factors such as the country of

destination can affect medical costs and so affect travel insurance premiums.

2. Medical screening

1.22 Some of the wording used in the medical screening process² can be outdated

and uncomfortable for consumers to respond to, and there may be other ways of

wording questions that would still add value to the risk assessment. We are working

with stakeholders to decide how to improve this. We are working collaboratively with

charities and consumer organisations, as well as the medical screening companies.

Other related FCA work

1.23 The responses to our CfI highlighted some other concerns from our stakeholders in

relation to pricing practices within general insurance. While our proposals do not focus

on these concerns or this specific feedback, we are conducting other work on pricing

practices, the outcomes of which may be relevant to the travel insurance market:

• Our launched a debate on

assessing the fairness of a given pricing practice. Our approach here will apply to all

feedback statement later this summer.

• We are also conducting a General insurance pricing practices market study into how

existing and new consumers are charged for motor and home insurance and plan

health, pet and travel insurance are not included in the scope of the market study.

But, where possible, we will identify lessons from this study that are relevant to

other markets that we regulate, including travel insurance.

if the consumer may have a PEMC. If the answers to this/these questions indicate that they may have a PEMC, the consumer is

Search

7

CP19/23

Chapter 2

Financial Conduct Authority

Signposting to travel insurance for consumers with medical conditions

2 The wider context

The harm we are trying to reduce/prevent

2.1 Our work has identified 2 key issues for consumers:

• Access

capability and appetite to cover more serious PEMCs are often not on price-

policies with high premium rates can lead to consumers believing it is not possible

• Understanding – feedback from our stakeholders has shown that consumers may

quoted premium. We have also seen a general lack of understanding around the

impact of PEMC exclusions. This can result in consumers buying policies without

understanding the extent of their cover and/or feeling unfairly treated. A broader

lack of understanding of the market can also result in a lack of access to the entire

range of travel insurance providers available.

How it links to our objectives

Consumer protection

2.2 Our proposals are intended to protect consumers with PEMCs by reducing the number

of uninsured consumers, those with PEMC exclusions, and those who are unable to

access affordable insurance that covers their conditions. We aim to protect these

consumers from potentially having to pay large costs, including medical costs.

Market integrity

2.3 Our proposals aim to increase consumer confidence and trust in the travel insurance

market, with more consumers better able to find appropriate insurance cover for

Wider effects of this consultation

2.4 Annex 2 sets out our analysis of the associated costs and benefits to both firms and

consumers from our proposals.

2.5 Our proposals may also promote competition between travel insurance firms by

improving consumer access and awareness, increasing their ability and propensity to

shop around.

Search

8

CP19/23

Chapter 2

Financial Conduct Authority

Signposting to travel insurance for consumers with medical conditions

Equality and diversity considerations

2.6 We have considered the equality and diversity issues that may arise from the proposals

in this Consultation Paper.

2.7

ability to carry out normal day to day activities.

2.8 The proposals are designed to assist consumers who have, or have had, PEMCs

to access travel insurance products that cover their conditions. This will include

consumers who are classed as disabled under the Equality Act, as well as many

PEMCs that are not considered a disability under the Act. Our proposal to improve

consumer understanding in this market also aims to assist consumers with PEMCs.

These proposals are intended to equip consumers with relevant information and help

them make more informed decisions, and to improve the process of buying insurance,

reducing unnecessary distress throughout the journey.

2.9 Overall, we consider that the proposals will positively impact the groups with protected

characteristics under the Equality Act 2010. However, we recognise that there is a risk

that the directory could be overwhelming to some consumers who use it, many of

whom will be vulnerable. We will work with MAPS to minimise this risk when developing

the directory.

2.10 We will continue to consider the equality and diversity implications of the proposals

during the consultation period, and will revisit them when making the final rules.

Search

9

CP19/23

Chapter 3

Financial Conduct Authority

Signposting to travel insurance for consumers with medical conditions

3 Signposting rules and additional

guidance

3.1 We are consulting on changes to our Handbook designed to make it easier for

consumers with PEMCs to access affordable travel insurance that covers their

conditions.

3.2 We are proposing:

1.

This directory will have the content and controls set by the FCA but the intention

is that it will be hosted by the Money and Pensions Service (MAPS). There is more

detail about this in paras 3.32-3.39.

2. Additional guidance to our existing rules, including on:

a. communicating with consumers about travel insurance policies with exclusions

for PEMCs and

b.

results of those assessments and/or the resulting premiums to consumers.

Signposting rule

3.3 We propose requiring all firms to give details of the directory to consumers that notify,

or have previously notified, a firm of a PEMC, in the following circumstances:

• Declines:

cover cancelled mid-term, due to a PEMC.

• Exclusions:

cannot be removed.

• Additional premiums:

loading³ to their base premium due to their PEMC.

3.4 The requirements would apply across all types of consumer journey (online, telephone,

or by other means) and to all firms providing or distributing retail travel insurance to

consumers in the UK

4

. If a consumer cannot access the internet, the firm must give

them a hard-copy version of the directory.

Additional premiums

3.5 We want to make sure that details of the directory are given to those consumers who

will most benefit from further shopping around and not those who are unlikely to

benefit.

3 An additional loading is a cost built into the insurance premium to cover additional risk that the insurer will suffer losses during the

period of cover.

4 Subject to any Directive restrictions.

Search

10

CP19/23

Chapter 3

Financial Conduct Authority

Signposting to travel insurance for consumers with medical conditions

3.6 If a consumer has been declined cover, or received a quote with a PEMC exclusion,

further shopping around is clearly likely to be beneficial. But if they have a quote

including cover for their condition, further shopping around will not always help. For

some, shopping around could result in a significant reduction in premium, while for

others, the initial provider may offer the best rates.

3.7 It is difficult to identify a trigger point for disclosing the directory information that

is both proportionate for firms to implement and which maximises getting the

information to those consumers most likely benefit, reducing consumer harm to the

greatest extent. We are proposing that all consumers with an additional loading to their

premium are notified of the directory. We considered the following options, some of

which were suggested by our stakeholders, for triggering the notification:

a. A medical screening score threshold, above which the notication is triggered.

This provides an objective test to trigger the disclosure. Also, the severity of a

new entrants to the market.

b. A premium amount threshold, above which the notication is triggered.

(a) in deciding on an appropriate threshold. Some stakeholders suggested that

signposting could be triggered at the price point above which only a very small

of consumers, then they should consider if they are meeting their wider regulatory

c. All consumers who declare a PEMC are notied. This also provides an objective

test, but would capture a large number of consumers who have no loading to their

premium (approximately 12% of those medically screened go on to receive no

additional loading, and a further 27% get a very low screening score and so could be

d. All consumers who receive an additional loading to their base premium, due to

a PEMC, are notied.

implement. It should also ensure that the disclosure is made to those consumers

shopping around further. But, on balance, we believe that this is the best option.

3.8 We want to limit the risk that consumers with a minimal loading (often due to a very

we propose that when signposting the consumer to the directory, firms indicate which

consumers are more likely to benefit from using it and state the potential benefits

of accessing it. They can explain it is likely to be more helpful for consumers with

condition.

Search

11

CP19/23

Chapter 3

Financial Conduct Authority

Signposting to travel insurance for consumers with medical conditions

3.9 We are aware this could put some onus on the consumer to decide whether their

believe the notification will help consumers to understand whether it may be of benefit

to them to access the directory rather than remain on their existing journey.

3.10 If the firm cannot ascertain whether premiums carry an additional loading due to a

PEMC it must disclose the details of the directory to consumers anyway.

Renewals and packaged bank accounts

3.11 Around 78% of policies sold are annual multi-trip policies (ABI, Mintel). Consumers can

choose to purchase another annual policy with another provider but often continue

with the same provider at point of renewal.

3.12 Packaged bank accounts (PBAs) are one of the most common ways of obtaining travel

blanket exclusion for all PEMCs. Consumers can go through medical screening, which

could result in the exclusion being removed. This might result in an additional loading to

the premium depending on the severity of the condition.

3.13 We are proposing that, for annual policyholders and PBA consumers, if a PEMC has

been declared leading to an additional premium or an exclusion (or if a blanket PEMC

exclusion has been applied and cannot be removed), firms must disclose details of

the directory. If an exclusion has been applied to a policy, regardless of the consumer

declaring any medical conditions, then the firm should disclose to the consumer

whether it can be removed from the policy, and if so, how it can be removed.

Existing industry initiatives

3.14 We are aware there are already many industry initiatives, and more still being

developed, to help consumers with PEMCs. These include firms referring consumers

with PEMCs to more specialist firms and other signposting.

3.15 Our proposals aim to introduce a consistent minimum standard for consumers across

the whole industry. But we welcome and encourage additional arrangements to

help consumers. Supplying details of the directory does not stop firms innovating to

improve the process.

3.16 Whilst we welcome industry initiatives, we are reminding firms of their obligations

under competition law. These include not disclosing any commercially sensitive

information to competitors such as pricing or price planning, customer or market

information or company strategy.

3.17 If firms refer consumers to one or more specific firms as well as providing them with

information about the directory, they should ensure that they comply with Principle 7

(Communications with Clients). This is to make sure that the status and utility of the

directory is made clear and consumers are not misled into believing the specific firm(s)

they are referred to is the only or best option available. It is also important for firms to

satisfy themselves that they are complying with Principle 8 (Conflicts of Interest) and

our rules, including ICOBS 2.2.2R, ICOBS 2.3, ICO BS2.5-1R and, where applicable, SYSC

19F about the arrangements they have with any specific firms they refer consumers

to. Firms should also ensure they comply with competition law requirements, in

particular the sharing of non-public information.

Search

12

CP19/23

Chapter 3

Financial Conduct Authority

Signposting to travel insurance for consumers with medical conditions

Additional guidance

Exclusions

3.18 Some consumers may be buying policies with PEMC exclusions without being made

awareness of their options.

3.19 Our rules already require firms to disclose ‘appropriate information about a policy … so

Information Document, information about the main exclusions where claims cannot

3.20 We propose to introduce guidance that firms selling travel insurance policies that

exclude PEMCs should tell consumers whether and how PEMC exclusions can be

removed. This applies to new and existing consumers. Existing consumers should get

this information in their renewal notice or annual PBA eligibility statement.

High premiums

3.21 Stakeholders have suggested that consumers with PEMCs can sometimes receive

very high quotes from a provider.

3.22

happen if the firm lacks the experience or expertise to assess the risk accurately. It

may be better for consumers for firms not to offer a quote in those circumstances

and explain to consumers why a quote is not being provided. We also query whether

quote, they should provide an explanation to the consumer and details of the directory.

3.23 Consumers who receive very high premium quotations may incorrectly assume they

are unable to get affordable travel insurance due to their condition. Firms should

consider whether it would be fairer and more beneficial for the consumer to not offer a

quote and explain why.

3.24 Under PROD 4, products must be designed for an identified target market.

Manufacturers may identify groups of consumers for whose needs, characteristics

and objectives the insurance product is generally not compatible (PROD 4.2.18).

Furthermore, where firms distribute products that they do not manufacture they must

have adequate arrangements to understand the characteristics and identified target

market of each product (PROD 4.3.2).

3.25 We propose to add guidance saying that where firms offer cover to some consumers

at very high premiums, they should consider to what extent this is because those

consumers fall outside their target market. We expect those firms to consider whether

their offer is very expensive and may mislead the consumer, deterring them from

shopping around further. Alternatively, firms should consider whether their offer is very

expensive due to their lack of experience or ability to assess the risk in a way that will be

fair and beneficial to a consumer. The guidance will set out our expectations that:

Search

13

CP19/23

Chapter 3

Financial Conduct Authority

Signposting to travel insurance for consumers with medical conditions

•

•

requirements referred to above

3.26 In both circumstances, firms should consider whether not offering a quote would be

should also explain to consumers why they are not giving a quote.

Equality Act 2010

3.27 Firms are also reminded of their obligations under the Equality Act 2010, in

circumstances where the PEMC would amount to a disability under that Act.

3.28 There is an exception to certain prohibitions against disability discrimination in the

Equality Act that allows insurers to differentiate prices based on the risk that different

consumers present, where it is reasonable to do so. Firms are reminded that this must

be based on relevant and reliable information.

Demands and needs

3.29 We are concerned that some consumers with PEMCs take out travel insurance which

excludes cover for their condition.

3.30 Firms are reminded that, when proposing a contract of insurance, they must ensure it

ICOBS 5.2.2BR).

3.31 Where a firm is dealing with a consumer with a PEMC and proposes a policy which

excludes cover for that PEMC, the firm should consider how this meets its obligation

Directory

3.32 We propose to require firms to signpost consumers to a directory that:

•

provide insurance policies for consumers with more serious PEMCs

•

•

informed initial selection about which might meet their needs

•

3.33 We are working closely with MAPS on the development of the directory, with the

intention that it will be hosted on its website.

Search

14

CP19/23

Chapter 3

Financial Conduct Authority

Signposting to travel insurance for consumers with medical conditions

3.34 To be featured in the directory, firms will have to answer a series of questions

confirming that they have the appetite and screening capability to provide insurance

policies for consumers with more serious PEMCs. The FCA and MAPS will carry out

an initial joint validation process. To ensure that the information on the directory

information is kept up to date.

3.35 Consumers could also be referred to the directory by other organisations such as

charities and consumer bodies.

3.36 Information displayed on the directory should be broad enough to be useful for

consumers, but succinct enough to not be overwhelming. Suggestions for display are:

•

•

•

• any age limits

•

phone

•

treatment

•

3.37 There will be user testing of the directory, to ensure the format is practical and user-

friendly.

3.38 Firms which enter the market after the directory is in operation will be eligible for

inclusion if they satisfy the validation process.

3.39 There will be an opportunity for firms to submit applications to be listed on the

directory. We expect a relatively small number of firms to apply to be listed. We will

publish details of how to apply following the result of our consultation.

Implementation period

3.40 We propose to give firms 3 months to implement any changes from the time the rules

are made, by which time we expect the directory to be available.

Search

15

CP19/23

Chapter 3

Financial Conduct Authority

Signposting to travel insurance for consumers with medical conditions

Annex 1

List of questions

Q1: Do you agree with our signposting proposals?

Q2: If you disagree, what would be your proposed approach

and why?

Q3:

Do you agree with our proposal for the trigger points for

disclosure for consumers with PEMCs?

Q4:

If you disagree, what would be your proposed approach

and why?

Q5:

Do you agree with our proposed guidance on exclusions?

Q6: Do you agree with our proposed guidance on high

premiums?

Q7:

Do you agree with our proposals for the directory?

Q8: What do you think is an adequate time to implement the

rule changes after we publish our nal rules and policy

statement, and why?

Search

CP19/23

Annex 1

Financial Conduct Authority

Signposting to travel insurance for consumers with medical conditions

Annex 2

Cost benefit analysis

Introduction

1. FSMA requires us to publish a cost benefit analysis (CBA) of our proposed rules.

Specifically, it requires us to publish an analysis of the costs and benefits we expect will

arise if our proposed rules are made and an estimate of those costs and benefits.

2. However, FSMA also provides that if the costs or benefits cannot reasonably be

estimated or it is not reasonably practicable to produce an estimate, then we need

not estimate them. In the cases in this CBA where we have not estimated costs or

benefits, this is due to it not being reasonably practicable to do so.

3. This CBA presents our analysis of the expected impacts of a proposal to: create a

directory of specialist

5

travel insurance firms; and to require firms to signpost to this

the harm faced by some consumers with pre-existing medical conditions (PEMCs)

when looking for travel insurance. We provide monetary estimates for the impacts

where we believe we can reasonably estimate them and it is reasonably practicable to

do so. Otherwise, where possible, we provide estimates on the potential number of

consumers affected.

4. The CBA has the following sections:

• Data used and limitations

• Problem and rationale for our Proposal

• Our Proposal

• Baseline and key assumptions

•

•

• Costs

Data used and limitations

5. For the purposes of this CBA we have not conducted a formal data request from firms

in the market. Our Proposal has a relatively small expected cost per firm and we have

already obtained information (both data and qualitative information) from firms during

our Call for Input and engagement with firms.

In these circumstances, we believe

it would not have been proportionate to undertake a formal data request, with the

burden of doing so falling on firms.

with more serious medical conditions.

30 firms on this area of work.

Search

17

CP19/23

Annex 2

Financial Conduct Authority

Signposting to travel insurance for consumers with medical conditions

6. However, the data we have are limited at times in terms of detail and are from a small

number of firms (8). Whilst we have tried to ensure that the data used represent a

range of different firms with different business models, the limited amount of data

means our estimates are more indicative and sensitive to outliers than they would

otherwise be. We welcome feedback on the estimates we provide.

Problem and rationale for our Proposal

The harm and drivers of harm

7. In our Feedback Statement on our Call for Input on Access to Insurance (FS18/1) we

outlined how it can be difficult for some consumers who have, or have had, cancer

to find affordable travel insurance with appropriate cover. Some responses to the

initial Call for Input and wider feedback from stakeholders suggested that this

harm is not specific to cancer, and that consumers with other PEMCs experience

8. The 3 key harms we identified in FS18/1 and through further engagement with firms

and consumer organisations are that some consumers with PEMCs are:

• not able to obtain insurance

• able to obtain insurance but without cover for their PEMC (i.e. with an exclusion)

•

than they could get elsewhere in the market

9. The main driver of these harms is that consumers with PEMCs lack awareness of

specialist travel insurance firms as well as the potential to remove exclusions for

PEMCs. An additional driver of harm for consumers who may be paying a significantly

higher price is them finding it difficult to assess and compare the value of different

products, for example prices and associated cover between mainstream and

Consumers cannot get cover or can only obtain cover with an exclusion for

theirPEMC

10. In FS18/1 we found that some consumers with PEMCs are not aware that there are

alternative travel insurance firms, which are able to offer insurance to consumers with

the risk appetite of mainstream travel insurance firms, these consumers often cannot

find cover. This can be through not being offered insurance at all, by being offered

insurance that excludes cover for their PEMC or because they are quoted a premium

for insurance that would cover their PEMC which they deem as unreasonably high.

11. Consumers not being able to access cover results in consumer harm as they then

choose between travelling without cover, and bear the financial risk associated with

this, or not travelling at all. The impact of this is not necessarily mitigated by traditional

shopping around, such as using a price comparison website, as most mainstream firms

use a similar approach to medical screening and specialist firms are not always on price

comparison websites. Other consumers may not attempt to shop around as they may

consider a high premium, or a decline to provide cover from a mainstream firm, is a

reflection of their ability to obtain cover more generally.

Search

18

CP19/23

Annex 2

Financial Conduct Authority

Signposting to travel insurance for consumers with medical conditions

12. Additionally, it is sometimes possible for consumers to remove the exclusion on

their offered policy from the mainstream firm in exchange for an increased premium.

However, consumers are often unaware that this is possible. This can be the case for

travel insurance that comes with packaged bank accounts, where a PEMC exclusion

often comes as standard.

Consumers can obtain cover however pay signicantly more than ecient costs

13. In those cases where mainstream firms are prepared to offer insurance to consumers with

more serious PEMCs, feedback to our work has suggested that in some circumstances,

they may charge a relatively high price, compared to more specialist firms.

14. We understand that this difference in prices offered is due to these individuals being

firms may have limited experience of these risks and do not price the risk as accurately

as more specialist firms, or they may attempt to deter the consumer from purchasing

the policy by offering a very high premium rather than declining the risk.

7

This,

consumers paying higher prices than they could elsewhere for similar levels of cover.

Our Proposals

15. To address the harms identified above, we are proposing to require firms to signpost

some consumers to a directory of firms who specialise in providing cover for PEMCs,

particularly for more serious conditions. The signposting will be required where the

consumer: is declined or not offered cover or has their cover cancelled mid-term; is

offered cover with an exclusion for a PEMC; or offered a policy with additional loading

applied to their base premium due to their PEMC. Firms will be required to indicate

which consumers are more likely to benefit from using it and state the potential

benefits of accessing it.

16. We are working closely with MAPS around the development of the directory to provide

a range of information on specialist firms, such as the types of medical conditions

they cover and how they can be contacted by consumers. Firms listed on the directory

would be validated jointly by the FCA and MAPS, with firms being audited periodically.

17. Figure 1 outlines how we expect the signposting requirement to improve consumer

outcomes.

7 Firms may be obliged to offer cover up to a certain level of medical condition in order to be shown on a price comparison website.

If the firm does not wish to take on the risk around this medical condition cut-off, one way to do so whilst not contravening their

obligation is to offer a relatively high price.

Search

19

CP19/23

Annex 2

Financial Conduct Authority

Signposting to travel insurance for consumers with medical conditions

Figure 1 – How we expect our Proposal to improve consumer outcomes

MAPS develop a directory of specialist

providers who are better able to cover PEMCs

The FCA requires rms to signpost to the

public directory of specialist providers

Consumers with more serious PEMCs who usually use mainstream rms become more aware of

the presence of specialist providers in the market

Consumers with more serious PEMCs use the public directory to nd specialist providers who

are better suited to cover their PEMC

Consumers who do not receive

oers from mainstream

providers, or can’t aord them,

now seek quotes from

specialist providers

Consumers who only receive

oers which exclude coverage

for their PEMC now seek quotes

from specialist providers

Consumers who receive oers

from mainstream providers

compare these with those

from specialist providers

Increased coverage for

consumers with PEMCs who

previously weren’t able to

obtain coverage

Increased coverage for

consumers with PEMCs who

previously were only able to

obtain coverage with

exclusions

Lower prices for consumers

with PEMCs who previously

paid ‘high’ prices for insurance

from mainstream providers

Consumers who previously did not travel due to lack of cover

now travel, whilst consumers who previously travelled without

cover now travel with cover

18. The signposting requirement will be complemented by proposed guidance to firms

clarifying that, where an exclusion is applied due to a PEMC, firms should inform the

consumer whether the exclusion can be removed and, if so, how this can be done.

Furthermore, additional guidance is proposed setting out FCA expectations for firms

that offer cover to consumers at very high premiums (and that firms should calculate

medical condition premiums by reference to reliable information that is relevant to the

assessment of the risk).

19. It will also be complemented by a package of other proposals, including:

• Working with MAPS to improve consumer understanding of travel insurance policies

their pricing, and reiterate the importance of insurance; and

• Working collaboratively with our stakeholders to improve the wording used in the

medical screening process, aiming to make the journey as easy as possible for

consumers.

20. Further details on the proposals can be found in Chapter 3 of the Consultation Paper.

Search

20

CP19/23

Annex 2

Financial Conduct Authority

Signposting to travel insurance for consumers with medical conditions

Baseline and key assumptions

Baseline

21. The starting point for our baseline is the current level for each of the outcomes we are

interested in improving, as illustrated in Figure 1. Where we hold estimates of these,

we have listed them in Table 1 below. We use these estimates later in the CBA to help

inform our estimates of costs and benefits.

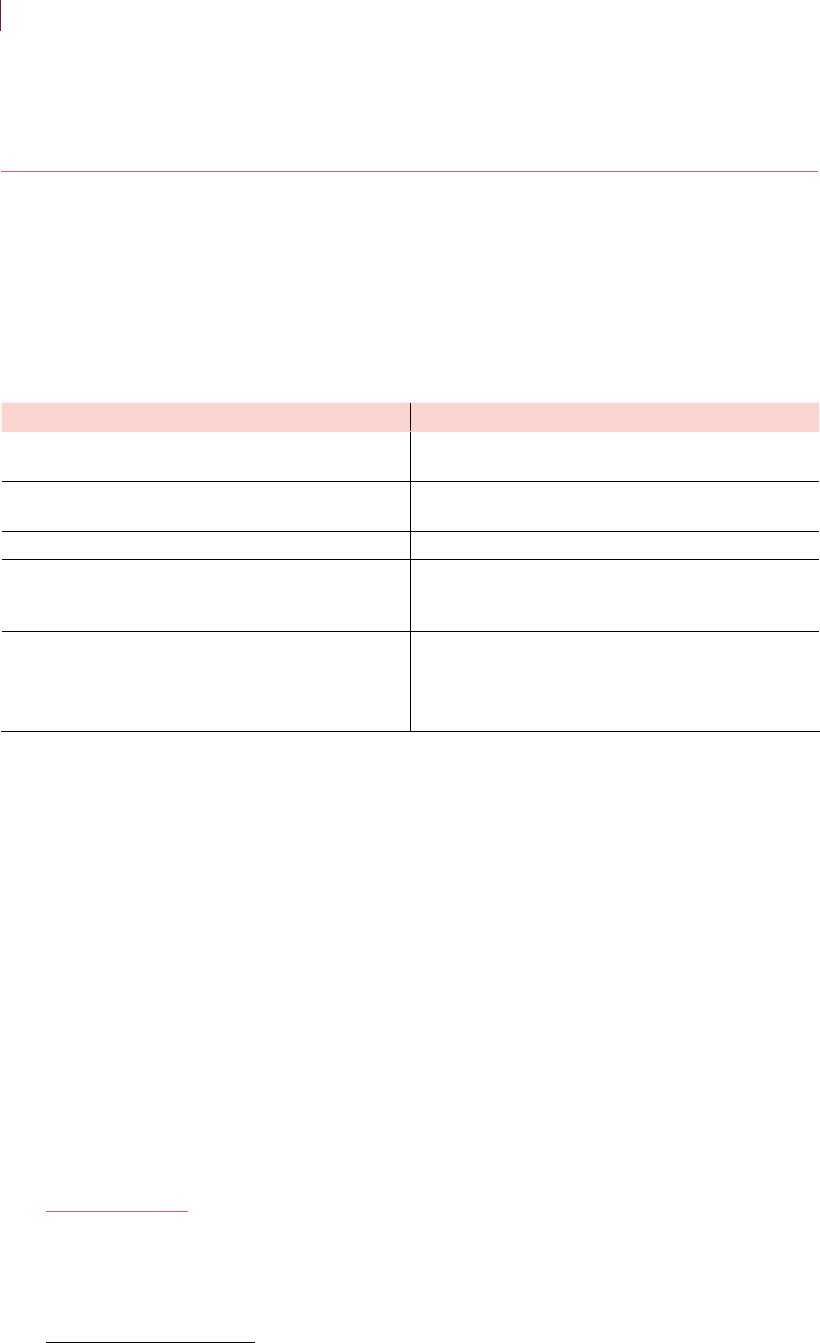

Table 1 – Baseline for key outcomes

8

Outcome of interest Estimate % (and absolute amount)

Consumers who undergo medical screening due to

having a PEMC

9

10

Consumers with PEMCs who have insurance that

excludes cover for their PEMC

11

Consumers declined cover due to a PEMC 0.3% (94,000-105,000)

12

Consumers who have a high

13

medical screening

Proposal

Average premium paid by consumers for insurance

that covers their PEMC

more serious PEMCs: £1,500

serious PEMCs: £900

14

Source: ABI, ONS, Mintel, firm data, FCA calculations

22. Following engagement with firms, we understand that some firms are starting to put

in place arrangements to refer consumers on to more specialist firms where they

are unable to offer cover themselves. This will impact on our baseline, although it is

difficult to estimate by how much. The estimated costs of implementing our proposal

may decrease as the number of firms that are starting to put in place signposting

arrangements increases.

15

However, there will also be an associated decrease in

benefits.

Key assumptions

23. In Table 2 we set out: the main assumptions used when conducting the CBA; their

reasoning; and potential consequences if they do not hold.

24. In our analysis, we have assumed that the firms for which we have data are

representative of the wider market. We have scaled up their data, where possible

and appropriate, based on their size and market share. These firms may not be

8 Numbers presented in the table are rounded. The underlying calculations use un-rounded numbers. Therefore, using the numbers in

the table to re-create estimates may result in small errors.

methodologies to improve the robustness of our estimates. Thus, subsequent calculations based on this number will have a range

that reflects this. This estimate is based on the best information available to us and we welcome feedback on our estimates.

10 Travel Insurance: UK, February 2019, Mintel estimates that around 40% of travel insurance consumers undergo medical screening.

11

This estimate is based on data from a limited number of firms. We believe that it may not fully account for exclusions that apply on

packaged bank accounts. As such, this should be taken as an estimate of the lower bound.

12

This percentage estimate is based on data from 1 large firm. This may include double counting of consumers who are rejected by

more than one firm when seeking cover or who initially seek multi-trip cover but then take single trip cover. As such, it should be

taken as an upper estimate.

13

There are different medical screening firms in the market, who score using different methodologies. As such, we have not listed what

this score would be. However, based on the data provided to us, this captures only the most severe of conditions.

14

These estimates are sourced from only 1 larger firm, thus are highly indicative.

15 If firms are able to implement our proposals at the same time as implementing their own signposting arrangements then we would

expect costs to decrease given the overlap of these two bits of implementation would decrease fixed costs.

Search

21

CP19/23

Annex 2

Financial Conduct Authority

Signposting to travel insurance for consumers with medical conditions

representative of the wider market and thus we may over or under estimate the costs

and benefits of our Proposal, but we consider this is a reasonable approach to take for

the reasons set out in the “Data used and limitations” section.

Table 2 – Assumptions and rationale

Assumption Rationale

Consequence of

assumption not holding

The travel insurance

market stays the same size

Market research companies estimate that

the market has seen little growth over

the past 5 years and we cannot foresee

anything that might change this

We under or over-estimate

The specialist market

is competitive with no

No evidence was provided to us as part

of our Call for Input that suggested a lack

of competition in the specialist market

was an issue. We also have evidence that

prices in the specialist market are lower

than the mainstream market

Some of the estimated

lower prices will be taken by

The ability of consumers

with PEMCs to access

insurance will not

improve in the absence of

regulatory interventions

We are not aware of any market

developments, or proposed

comprehensive service, that will

consumers with PEMC to access

insurance

of our Proposal

Summary of costs and benefits

25. Table 3 sets out a summary of the main costs and benefits we expect as a result of our

Proposal.

This indicates that market power is not being exploited.

Search

22

CP19/23

Annex 2

Financial Conduct Authority

Signposting to travel insurance for consumers with medical conditions

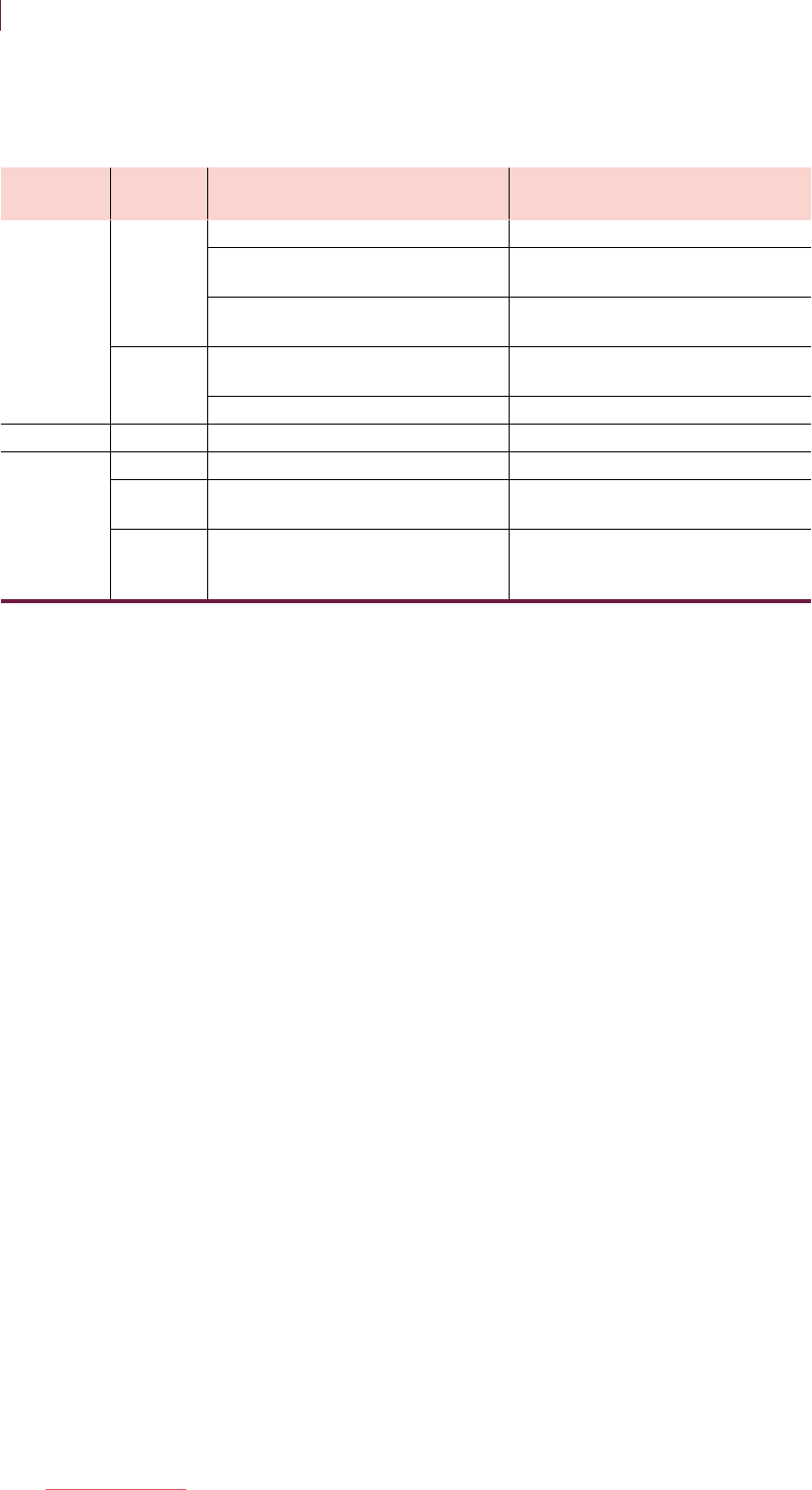

Table 3 – Summary of costs and benets

One-o/

annual

Costs Benets

Firms

•

£225,000

• Costs of implementing and

complying with our Proposal –

£12.2 million

• Application to directory of

Annual

• Loss of revenue (net of transfers) –

• Costs of implementing and

complying with our Proposal –

• Increased sales to consumers

insurance – Not monetised, but

estimated at 2,700-3,100 sales

• Improved trust in the travel

insurance market – Not estimated

Consumers Annual

• Increased search costs (new

consumers) – Not estimated

•

• Improved cover of PEMCs for those

who already have insurance – Not

consumers)

• Access to cover for those who

consumers)

• Decreased search costs (existing

consumers) – Not estimated

Source: ABI, ONS, Mintel, firm data, FCA calculations

26. Based on the costs and benefits estimated above, as well as the number of consumers

likely to be affected (for the impacts that are not monetised) we can estimate the per-

27. This takes into account that we have already estimated some benefits for consumers

from lower prices paid, which is offset by lost revenue to firms. We estimate this break-

even amount using a 10-year net present value methodology.

17

28. Our break-even analysis estimates that the average benefit per affected consumer

would need to be £90-100 per year to offset the estimated costs of our Proposal over

a 10-year period.

29. Additionally, we note that the consumers we aim to assist with our Proposal have a

pre-existing medical condition. As such, they are more likely to be vulnerable and the

benefits to them of improved cover are likely to be higher than the average consumer.

We also consider the value of the transfer from firms to consumers of reduced prices

to be greater for these consumers, and this would reduce the break-even estimates

above (of £90-100) if we weighted benefits to reflect this.

17 This combines the one-off cost and each of the ongoing costs over the next 10 years, discounted back to their net present value.

To do this we use a discount rate of 3.5%, as recommended by the HMT Green Book. It then compares this against the accumulated

number of expected affected consumers over the 10-year period.

Search

23

CP19/23

Annex 2

Financial Conduct Authority

Signposting to travel insurance for consumers with medical conditions

Benefits

30. Below we set out in more detail the benefits we expect to arise for firms and

consumers. These are all on an ongoing basis. A summary can be found in Table 4

below.

Table 4 – Summary of benets

Benet type Benet estimate (annual)

Firms

Increased sales to consumers who

Not monetised – estimated increase

in sales of 2,700-3,100

Improved trust in the travel insurance

market

Not estimated

Consumers

Lower prices paid by existing consumers

Improved cover of PEMCs for those who

already purchase insurance but with

exclusions for their PEMCs

Increased access to insurance and cover

of PEMCs for those who previously

2,700-3,100 consumers

Decreased search costs for consumers

who already purchase

Not estimated

Source: ABI, ONS, Mintel, firm data, FCA calculations

Benets to rms

31. We expect some firms (e.g. specialist firms) to benefit from increased sales as a result

of our Proposal. However, this benefit will be at the expense of losses to other firms, so

will net out. This is discussed under the “Costs to firms” section.

32.

now purchase insurance as a result of our proposed signposting. This will be a benefit

to firms as these sales previously did not take place. We estimate the potential number

of sales in the “Benefits to consumers” section below. These are estimated at an

additional 2,700-3,100 sales annually.

33. An additional benefit to firms we expect due to our Proposal is improved trust in the

travel insurance market. Consumers being made aware of, and using, specialist firms

that provide them with appropriate cover will decrease the incidence of unexpected

shocks when consumers attempt to claim. This will increase consumers trust in the

travel insurance market and potentially lead to increased purchasing. We have not

attempted to quantify the impact of this as we consider it not practicable to do so.

Benets to consumers

34. We expect the benefits to consumers to all be ongoing. We group these into two main

categories:

1. Lower prices for consumers with PEMCs who are already able to obtain insurance.

2. Increased cover for those who previously were not able to get cover for their PEMC.

35. The estimates we provide below will be higher if the effectiveness of signposting in

getting a consumer with a PEMC to follow through and purchase from a better placed

specialist firm is higher than a 2.9% increase (which is the effectiveness we use in our

estimates).

Search

24

CP19/23

Annex 2

Financial Conduct Authority

Signposting to travel insurance for consumers with medical conditions

36. We also expect our Proposal to lead to decreased search costs (i.e. saved time) for

those consumers who would have searched for specialist firms irrespective of our

Proposal. However, due to the small size of potential benefits we consider it not

practicable to estimate them.

Lower prices for consumers who already obtain insurance

37.

18

to mainstream firms now pay a lower price for the same level of cover to a specialist firm.

This is a result of these consumers seeing the signposting after being offered a high

price by mainstream firms, going to the directory of specialist firms and then purchasing

38. To estimate this, we use data from Table 1 on the number of consumers who have

more serious PEMCs, and thus are likely to face higher prices, and data we received

from 1 firm on the impact of their own signposting.

20,21

Our data estimates that around

1.1% of consumers have a serious PEMC meaning they are likely to face a high price

from mainstream firms. Data on the impact of signposting estimates that, of those

who are signposted, around 2.9% go on to purchase from the specialist firm

22

at a

price that is around £1,200

23

less than they were originally quoted. Thus, we estimate

prices.

24

This estimate assumes that all consumers with more serious PEMCs currently

purchase from mainstream firms, and is therefore likely to be an upper bound estimate

of these benefits.

39. In addition to the benefits estimated above, there are potential benefits from lower

prices for those with less serious PEMCs. To provide an indication of the size of this

group, 5.5% of consumers (1.7-1.9 million) have a medical screening score where firms

on a price comparison website are not obliged to offer cover.

25,

However, we would

expect the effectiveness of the signposting, and savings available per consumer, to

decrease as the severity of the PEMC decreases. It is not practicable to estimate these

potential benefits with a reasonable degree of accuracy.

18 Feedback to our work suggests that some consumers with more serious PEMCs can face relatively high prices from some

mainstream firms when compared to specialist firms. This was not suggesting mainstream firms are exercising market power, rather

they have different risk modelling approaches and tolerances.

19

See row 4.

20 We cannot provide further information on the firm for confidentiality reasons, however we have no reason to believe that the data

provided to us is not representative of the broader market.

21

The data provided is on the effectiveness of a firm signposting to a specialist firm where the offered premium to a consumer with a

PEMC is above a given threshold. This is likely to correspond with the consumer having a more serious PEMC.

22

The small proportion that go on to purchase from the specialist firm is small due to only a small number going through the medical

screening process with the specialist firm (around 10% of those who see the signposting). Around 50% of those who follow the

signposting and undergo medical screening are offered coverage.

23

This is based on data from 1 firm who conducts their own signposting.

24

x effectiveness of signposting (2.9%) x saving from purchasing policy from a specialist firm (£1,200)/average number of consumers

per policy (1.7).

25

For a firm to sell through a price comparison website, they are usually required to offer coverage for consumers who have a medical

screening score below a given level. We think that consumers with scores above this level will be more likely to benefit from our

Proposal.

This includes those with more serious PEMCs.

Search

25

CP19/23

Annex 2

Financial Conduct Authority

Signposting to travel insurance for consumers with medical conditions

Increased cover for consumers who previously did not have cover for their

PEMC

40. We expect consumers to benefit from increased cover in the following ways:

a. Consumers who previously purchased insurance from a mainstream provider with

an exclusion on their PEMC now purchase insurance with cover for their PEMC after

being signposted to the directory of specialist providers.

b.

41. We are unable to monetise these benefits due to data limitations and it not being

practicable for us to do so. We do not have data on: consumers travelling with an

exclusion on their PEMC; consumers choosing not to travel due to the exclusion; how

many consumers were not offered cover; or how many consumers could not afford the

offered cover.

42. However, we can estimate how many consumers we think will be affected by our

Proposal and thus stand to benefit.

43. For a), we estimate 11.2%

27

on their policy for their PEMC. If our proposed signposting has the same impact as it

has on those who face a relatively high price (i.e. 2.9% respond), then we would expect

excluded from their cover.

44. For b), we estimate around 0.7%

28

of consumers with a PEMC (94,000-105,000) are

not offered cover. If our proposed signposting has the same impact as it has on those

who face a relatively high price (i.e. 2.9% respond), then we would expect 2,700-3,100

consumers to benefit annually from now being able to access cover.

Costs

45. Below we set out the costs we expect to arise for firms, consumers and the Money and

Pensions Service (MAPS) on a one-off and ongoing basis. A summary can be found in

Table 5 below.

27 This is estimated using data from 2 firms who provided information on sales and exclusions. Based on feedback to our work in this

area, we expect this percentage to be higher given the number of packaged bank accounts and the fact that they normally come

with an exclusion for PEMC coverage as standard.

28

This is estimated using data from 1 firm. This firm has a significant market presence. Additionally, we have benchmarked this piece of

data against ad hoc data provided by smaller firms in the market.

Search

CP19/23

Annex 2

Financial Conduct Authority

Signposting to travel insurance for consumers with medical conditions

Table 5 – Summary of costs

One-o/

ongoing

Cost type Cost estimate

Firms

£225,000

Rule implementation costs (i.e. IT

changes, training, governance)

£12 million

Application to directory of specialist

Minimal

Ongoing

Rule implementation costs (i.e. IT

changes, training, governance)

£4 million

Loss of revenue (net of transfers)

Consumers Ongoing Increased search costs Not estimated

MAPS

Development of directory Within existing resources

be on the directory

Within existing resources

Ongoing

the directory and validation of new

entrants

Within existing resources

Source: ABI, ONS, Mintel, firm data, FCA calculations

Costs to rms

46. We consider both one-off and ongoing costs to firms. For our cost estimates, we have

received data from 4 firms to estimate the impact on larger firms, whilst information

from a trade body suggests the costs faced by smaller firms will be minimal.

47. Using our understanding of the market, and information received as part of our Call for

Input, we estimate there to be around 130 larger firms in the market.

One o costs

48. There will be costs to firms to familiarise themselves with the new rules and conduct

estimator tool to estimate these for all firms in the market (both large and small). We

estimate these at £225,000.

49. We also expect firms to incur IT, staff training, sales process and documentation

change costs to update their systems and documents to be compliant with our new

rules, and ensure their frontline and phone staff are appropriately implementing them.

Applying the average of cost estimates provided by 4 firms to the 130 firms, we expect

these to be around £12.2 million.

29

50. For specialist firms specifically, we expect there to be a time cost associated with

applying to be admitted to the directory. However, we expect this cost to be minimal

when considered in the context of their broader compliance and governance

processes.

Ongoing costs

51. We expect firms to incur ongoing staff training, longer documentation and increased

frontline staff costs associated with our Proposal. Applying the average of cost

estimates provided by 4 firms to the 130 firms, we expect these to be around £4 million

annually.

29 The average estimated one-off cost for a large firm is £94,000. This will vary by firm type, size and business model.

Search

27

CP19/23

Annex 2

Financial Conduct Authority

Signposting to travel insurance for consumers with medical conditions

52. We expect some firms (mainstream firms who do not specialist in PEMCs) will lose

revenue as result of our Proposal. However, some of this will be a transfer to other

firms (those who specialise in PEMCs) whilst the remainder of this will be a transfer to

consumers in the form of lower prices.

53. We estimate the net cost to firms. This is the lost revenue, once adjusting for gains

to some firms. As discussed in the “Benefits to consumers” section, we expect

our proposed signposting requirement to lead to some consumers who previously

purchased from mainstream firms to now purchase from more specialist firms. As

specialist firms offer a given level of cover for a lower price for those with more serious

PEMCs, this will lead to an overall decrease in the revenue of firms.

54. This decrease in net revenue for firms will be equal in magnitude to the benefit to

consumers from lower prices estimated above. To estimate this, we use our estimate

from the “Benefits to consumers” section on the benefits to consumers from lower

in that section, the true cost to firms could be lower if a large number of consumers

with serious PEMCs already purchase from specialist firms whilst it could be higher if

consumers with less serious PEMCs also take advantage of the signposting.

55. Additionally, we expect that the signposting to the directory of specialist firms will lead

to some consumers who previously would have purchased cover with an exclusion for

their PEMC from a mainstream firm to now purchase cover without an exclusion from a

specialist firm.

56. It is difficult to estimate the impact this will have on overall firm revenues as consumers

may pay more but for a higher level of cover or less for a similar level of cover. As such,

it is not practicable to estimate the impact of this.

Costs to consumers

57. We expect there will be ongoing costs to consumers but no one-off costs.

58.

spend more time shopping around, discussing their medical condition and needs, and

comparing cover. We have not estimated this as the additional time will be specific to

Costs to MAPS

59. We expect there to be some one-off resource costs for MAPS in developing the

directory and in validating firms who want to be on the directory. We expect there to be

ongoing resource required to validate new entrants to the market and periodically audit

those already on the directory.

60. We expect these costs to be met by MAPS from within their current budget. The FCA

will assist MAPS with this process, with this also met from within our current resourcing.

Search

28

CP19/23

Annex 2

Financial Conduct Authority

Signposting to travel insurance for consumers with medical conditions

Annex 3

Compatibility statement

Compliance with legal requirements

1.

reasons for concluding that our proposals in this consultation are compatible with

certain requirements under the Financial Services and Markets Act 2000 (FSMA).

2. When consulting on new rules, the FCA is required by section 138I(2)(d) FSMA to

include an explanation of why it believes making the proposed rules is (a) compatible

with its general duty, under s. 1B (1) FSMA, so far as reasonably possible, to act in a

way which is compatible with its strategic objective and advances one or more of its

operational objectives, and (b) its general duty under s. 1B(5)(a) FSMA to have regard

to the regulatory principles in s. 3B FSMA. The FCA is also required by s. 138K (2) FSMA

to state its opinion on whether the proposed rules will have a significantly different

impact on mutual societies as opposed to other authorised persons.

3.

the duty on the FCA to discharge its general functions (which include rule-making) in

a way which promotes effective competition in the interests of consumers (s. 1B (4)).

This duty applies in so far as promoting competition is compatible with advancing the

4. In addition, this Annex explains how we have considered the recommendations made

by the Treasury under s. 1JA FSMA about aspects of the economic policy of Her

duties.

5. This Annex includes our assessment of the equality and diversity implications of these

proposals.

6.

determining general policies and principles and giving general guidance (but not when

exercising other legislative functions like making rules). This Annex sets out how we

have complied with requirements under the LRRA.

Search

29

CP19/23

Annex 3

Financial Conduct Authority

Signposting to travel insurance for consumers with medical conditions

The FCA’s objectives and regulatory principles: Compatibility

statement

7.

market integrity objectives.

8. Our proposals are designed to improve the way the travel insurance market operates

by:

• Protecting consumers with PEMCs – by providing information about the availability

of travel insurance for consumers with PEMCs this will improve access to travel

insurance, reducing the number of uninsured consumers and consumers travelling

with exclusions for PEMCs

• Increasing market integrity – by enabling more consumers with PEMCs to access

9.

ensuring that the relevant markets function well because our proposals will improve

strategic objective, “relevant markets” are defined by s. 1F FSMA.

10. In preparing the proposals set out in this consultation, the FCA has had regard to the

regulatory principles set out in s. 3B FSMA.

The need to use our resources in the most ecient and economic way

11. We have worked closely with a range of stakeholders to identify a solution to improve

access to travel insurance for consumers with PEMCs. We are working closely with

MAPS around the development of the directory of providers and consider this to be

the most efficient and economic way for the directory to be set up.

The principle that a burden or restriction should be proportionate to

the benets

12. By working closely with stakeholders, we have sought to ensure, as far as possible, that

the burden to firms is proportionate to the benefits. However, in some cases we have

not estimated costs of benefits where we consider it is not reasonably practicable to

do so.

The desirability of sustainable growth in the economy of the United

Kingdom in the medium or long term

13. We do not consider that the proposals are inconsistent with this principle, and they are

expected to increase the number of consumers with PEMCs who purchase appropriate

travel insurance.

The general principle that consumers should take responsibility for

their decisions

14. Our proposals are consistent with the principle that consumers should take

responsibility for their decisions, but rather provide affected consumers with more

information to make more informed decisions about choosing travel insurance.

Search

30

CP19/23

Annex 3

Financial Conduct Authority

Signposting to travel insurance for consumers with medical conditions

The responsibilities of senior management

15. Our proposals do not impact on the responsibilities of senior management.

The desirability of recognising dierences, and objectives of,

businesses carried on by dierent persons including mutual societies

and other kinds of business organisation

16. We do not believe that our proposals discriminate against any particular business

model or approach in the travel insurance market. There is wide support across

different businesses to take action to improve access to travel insurance.

The principle that we should exercise of our functions as transparently

as possible

17. We believe that by consulting on our proposals we are acting in accordance with this

principle.

18. In formulating these proposals, the FCA has had regard to the importance of taking

action intended to minimise the extent to which it is possible for a business carried on

(i) by an authorised person or a recognised investment exchange; or (ii) in contravention

of the general prohibition, to be used for a purpose connected with financial crime (as

required by s. 1B(5)(b) FSMA).

Expected effect on mutual societies

19. The FCA does not expect the proposals in this paper to have a significantly different

impact on mutual societies. We have worked with mutual societies through our

engagement with stakeholders to develop and refine our proposals.

Compatibility with the duty to promote effective competition

in the interests of consumers

20. In preparing the proposals as set out in this consultation, we have had regard to the

that by signposting consumers with PEMCs to a directory of more specialist providers,

competition for some consumers with PEMCs may increase.

21. We expect this as, under our proposal, consumers with PEMCs will be directed to a

directory where they can find, and subsequently compare offers from, a larger range

Equality and diversity

22. We are required under the Equality Act 2010 in exercising our functions to ‘have

any other conduct prohibited by or under the Act, advance equality of opportunity

between persons who share a relevant protected characteristic and those who do not,

Search

31

CP19/23

Annex 3

Financial Conduct Authority

Signposting to travel insurance for consumers with medical conditions

to and foster good relations between people who share a protected characteristic and

those who do not.

23. As part of this, we ensure the equality and diversity implications of any new policy

proposals are considered. The outcome of our consideration in relation to these

matters in this case is stated in paragraph [2.9] of the Consultation Paper.

Legislative and Regulatory Reform Act 2006 (LRRA)

24. We have had regard to the principles in the LRRA for the parts of the proposals that

consist of general policies, principles or guidance. We consider that our proposal is:

• Transparent: We are consulting on our proposed rules and guidance

• Accountable: By consulting we are seeking feedback on our proposed approach

• Proportionate: We consider that our proposals are proportionate and have sought

to minimise costs to achieve the outcomes we are seeking

•

• Targeted only at cases in which action is needed: Our proposed signposting targets

improved access to insurance.

25.

of general policies, principles or guidance. We consider that the proposals will be

effective in helping firms understand and meet regulatory requirements more easily,

in a manner that leads to improved outcomes for consumers and addresses the issues

identified in this market.

Search

32

CP19/23

Annex 3

Financial Conduct Authority

Signposting to travel insurance for consumers with medical conditions

Annex 4

Abbreviations used in this paper

CBA Cost Benefit Analysis

CfI Call for Input

CP Consultation Paper

FS Feedback Statement

LRRA

MAPS Money and Pensions Service

PBA Packaged Bank Accounts

PEMCs Pre-existing medical conditions

We have developed the policy in this Consultation Paper in the context of the existing UK and EU

regulatory framework. The Government has made clear that it will continue to implement and apply

EU law until the UK has left the EU. We will keep the proposals under review to assess whether any

amendments may be required in the event of changes in the UK regulatory framework in the future.

We make all responses to formal consultation available for public inspection unless the respondent

request for non-disclosure.

Act 2000. We may consult you if we receive such a request. Any decision we make not to disclose the

response is reviewable by the Information Commissioner and the Information Rights Tribunal.

All our publications are available to download from www.fca.org.uk. If you would like to receive this

or write to: Editorial and Digital team, Financial Conduct Authority, 12 Endeavour Square, London

E20 1JN

Search

33

CP19/23

Annex 4

Financial Conduct Authority

Signposting to travel insurance for consumers with medical conditions

Appendix 1

Draft Handbook text

Search

FCA 2019/XX

INSURANCE: CONDUCT OF BUSINESS SOURCEBOOK (ACCESS TO

TRAVEL INSURANCE) INSTRUMENT 2019

Powers exercised

A. The Financial Conduct Authority (“the FCA”) makes this instrument in the exercise

of the powers and related provisions in or under:

(1) the following sections of the Financial Services and Markets Act 2000 (“the

Act”):

(a) section 137A (The FCA’s general rules);

(b) section 137T (General supplementary powers);

(c) section 139A (Power of the FCA to give guidance); and

(2) the other powers and related provisions listed in Schedule 4 (Powers

exercised) to the General Provisions of the Handbook.

B. The rule-making powers listed above are specified for the purpose of section 138G

(Rule-making instruments) of the Act.

Commencement

C. This instrument comes into force on [date].

Amendments to the Handbook

D. The Glossary of definitions is amended in accordance with Annex A to this

instrument.

E. The Insurance: Conduct of Business sourcebook (ICOBS) is amended in accordance

with Annex B to this instrument.

Citation

F. This instrument may be cited as the Insurance: Conduct of Business Sourcebook

(Access to Travel Insurance) Instrument 2019.

By order of the Board

[date]

FCA 2019/XX

Page 2 of 7

Annex A

Amendments to the Glossary of definitions

Insert the following new definitions in the appropriate alphabetical positions. The text is not

underlined.

medical condition

exclusion

an exclusion in respect of one or more medical conditions.

medical condition

premium

any amount of premium relating to the risk associated with one or more

specific medical conditions.

medical cover firm

directory

a publicly available directory:

(a) that lists firms that provide or arrange travel insurance policies

that cover more serious medical conditions;

(b) that does not prevent firms from being listed based on any

membership of any association;

(c) that provides detailed information about each listed firm,

including:

(i) the name and contact details of the firm;

(ii) whether it specialises in covering any specific medical

conditions;

(iii) any specific medical conditions that the firm is likely not

to cover;

(iv) any age limits;

(v) whether the firm can discuss medical conditions with

consumers either online or by phone;

(vi) whether the firm can offer cover to consumers who are

currently undergoing treatment;

(vii) whether the firm can offer cover to consumers with a

terminal prognosis;

(d) where the operator verifies the information in (a) and (c) and

keeps the information up-to-date.

travel insurance

policy

(in ICOBS 6.1.7-AG, ICOBS 6.5.1AG and ICOBS 6A.4 (Travel

insurance and medical conditions)) a non-investment insurance

FCA 2019/XX

Page 3 of 7

contract which covers risks connected with travelling or the making of

travel arrangements, including connected travel insurance contracts.

FCA 2019/XX

Page 4 of 7

Annex B

Amendments to the Insurance: Conduct of Business sourcebook (ICOBS)

In this Annex underlining indicates new text, unless otherwise stated.

1 Annex 1 Application (see ICOBS 1.1.2R)

…

Part 2: What?

Modifications to the general application rule according to type of firm

…

5 Travel insurance contracts

5.1 R The provisions in ICOBS 6.1.7-AG, ICOBS 6.5.1AG and ICOBS 6A.4 apply to

all incoming firms (including those providing cross border services) other than:

(1) an incoming firm in respect of that part of its business that was carried

on as an electronic commerce activity from another EEA State; or

(2) an incoming firm where the state of the risk is an EEA State to the extent

that the EEA State in question imposes measures of like effect.

…

5 Identifying client needs and advising

5.1 General

…

Eligibility to claim benefits: policies arranged as part of a packaged bank account

…

5.1.3

C

R …

(3) The statement (provided under ICOBS 5.1.3CR(1)) must not:

(a) include any information other than that required under this rule,

ICOBS 6.1.7-AG and ICOBS 6A.4.3R; or

…

FCA 2019/XX

Page 5 of 7

…

6 Product Information

6.1 Providing product information to customers: general

…

Appropriate information regarding medical condition exclusions in travel insurance

policies

6.1.7-

A

G When a firm provides a consumer with: