PUBLIC

Document Version: SAP S/4HANA 1909 FPS02 – 2020-05-06

Central Finance

© 2020 SAP SE or an SAP aliate company. All rights reserved.

THE BEST RUN

Content

1 Central Finance............................................................. 4

1.1 Replication Scenarios in Central Finance.............................................6

1.2 Central Processes.............................................................7

1.3 System Landscape............................................................8

1.4 Postings Excluded from Transfer..................................................11

1.5 Conguring Your Central Finance Scenario.......................................... 12

Getting Started with Central Finance............................................12

Installing Central Finance....................................................20

Conguration in Central Finance System: Set Up Systems.............................27

Error Handling............................................................29

Data Mapping............................................................37

Conguration Consistency Check..............................................55

EC-PCA Postings..........................................................63

Material Cost Estimates Replication.............................................70

Activity Rates ............................................................71

Cost of Goods Sold Splitting in Central Finance.....................................75

Price Dierence Splitting in Central Finance.......................................77

Account Determination of Condition Types for Protability Analysis (CO-PA)................79

Replication of Commitments................................................. 80

Conguration in SAP Landscape Transformation Replication Server......................82

Initial Load.............................................................. 87

Replicate Individual Cost Objects and CO Documents................................119

Delete Replicated Documents................................................120

Comparison Reports.......................................................124

Activation of Clearing Transfer and Handling of Open Items........................... 129

Special Business Transactions: Additional Information...............................136

Additional Settings and Enhancements..........................................137

Display Information from Central Finance in the Source Systems.......................138

Accounting View of Logistics Information (AVL): Overview............................144

1.6 Central Payment............................................................150

Settings for Central Payment in Source Systems...................................153

Activation of Central Payment for Company Codes.................................153

Handling of Historical Open Items.............................................155

Guidance for Dependent Processes............................................156

Cross-System Process Control for Central Payment................................ 168

Down Payment Integration with SD.............................................171

2

P U B L I C

Central Finance

Content

Down Payment Integration with MM............................................175

SEPA Mandate Replication...................................................177

1.7 Central Tax Reporting........................................................ 184

Central Tax Reporting: Prerequisites............................................185

Conguration Consistency Checks.............................................186

Tax Reporting Based on Postings from the Initial Load...............................188

Overview of Supported Reports...............................................189

Deferred Tax.............................................................191

Withholding Tax..........................................................191

External Tax Calculation....................................................194

Input Tax from Parked Documents.............................................194

Support of Tax Reports in Mode “Update of Documents”.............................195

1.8 Central Projects (WBS) - Reporting Scenario........................................195

Central Projects (WBS) - Reporting Scenario: Conguration in Source System..............197

Central Projects (WBS) - Reporting Scenario: Conguration for SAP AIF..................199

Central Projects (WBS) - Reporting Scenario: Conguration in the Central Finance System

.....................................................................200

Central Projects (WBS) - Reporting Scenario: Check Settings for Replication of Projects...... 202

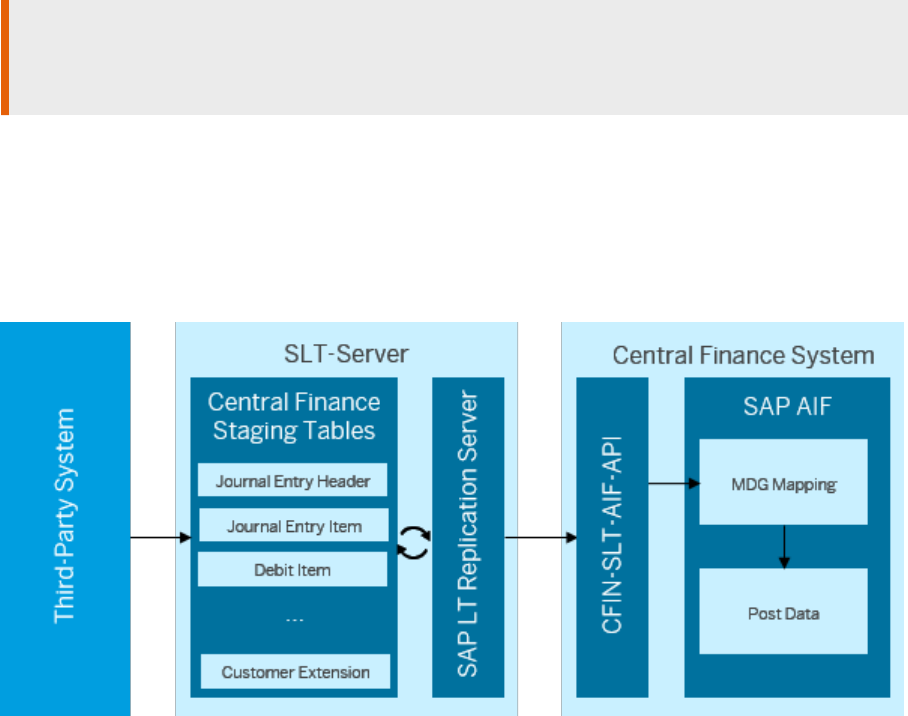

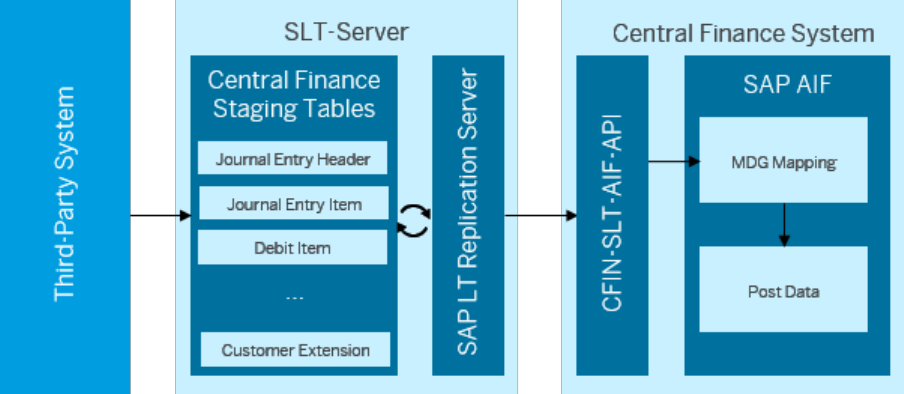

1.9 Third-Party System Interface to Central Finance: Process and Architecture..................203

Replicating Data Using the Third-Party System Interface to Central Finance............... 204

Installing Financial Data Structures on SAP LT Replication Server.......................213

Error Handling in SAP Application Interface Framework (SAP AIF).......................214

Conguring SAP Central Finance..............................................216

MDG Data Mapping....................................................... 216

Third-Party System Interface to Central Finance: Extensibility......................... 219

SAP Central Finance Transaction Replication by Magnitude for SAP S/4HANA..............220

1.10 Advanced Compliance Reporting: Country/Region-Specic Reports in Central Finance..........220

1.11 Read Access Logging Congurations in Central Finance................................ 231

Central Finance

Content

P U B L I C 3

1 Central Finance

With Central Finance, you can transition to a centralized SAP S/4HANA on-premise edition without disruption

to your current system landscape, which can be made up of a combination of SAP systems of dierent releases

and accounting approaches and non-SAP systems.

This allows you to establish a Central Reporting Platform for FI/CO with the option of creating a common

reporting structure. Additionally, selected nancial processes can be executed centrally in this system. To

prepare common reporting structures, you can map the dierent accounting entities (for example, account,

prot center, or cost center) in your source systems to one common set of master data in the Central Finance

system. You can then replicate nancial accounting and management accounting postings to your Central

Finance system.

In your SAP S/4HANA system, FI documents and CO postings are combined into one document; the universal

journal entry. In addition, all cost elements are part of the chart of accounts. Before you replicate CO postings

to the Central Finance system, you need to make sure that accounts are available for all cost elements. You can

also replicate certain cost objects (for example, internal orders) to the Central Finance system.

In a typical set-up, multiple source systems are connected to one System Landscape Transformation

Replication Server which in turn is connected to one Central Finance system.

4

P U B L I C

Central Finance

Central Finance

Where can I nd more information?

● https://help.sap.com/doc/b870b6ebcd2e4b5890f16f4b06827064/1909.002/en-US/

WN_OP1909_FPS02_EN.pdf [https://help.sap.com/doc/

b870b6ebcd2e4b5890f16f4b06827064/1909.002/en-US/WN_OP1909_FPS02_EN.pdf]

● https://help.sap.com/viewer/029944e4a3b74446a9099e8971c752b9/1909.002/en-US/

87c29fd0279242d68d889be7d501c3.html [https://help.sap.com/viewer/

029944e4a3b74446a9099e8971c752b9/1909.002/en-US/87c29fd0279242d68d889be7d501c3.html]

● Replication Scenarios in Central Finance [page 6]

● Getting Started with Central Finance [page 12]

● Central Tax Reporting [page 184]

● Central Payment [page 150]

● Third-Party System Interface to Central Finance: Process and Architecture [page 203]

● Central Projects (WBS) - Reporting Scenario [page 195]

Note

Terminology: Journal Entry vs. Accounting Document

Please note that the following information applies only to English.

In SAP S/4HANA, the term journal entry replaced accounting document following a change in the

underlying nancial architecture. While the basic concept – the accounting record for a business

transaction – is the same, journal entries enable a true integrated accounting system.

Central Finance

Central Finance

P U B L I C 5

You may notice that you still see document or accounting document on the user interface and in the

documentation. Nevertheless, these accounting documents are actually journal entries since they are

based on the new architecture.

1.1 Replication Scenarios in Central Finance

Central Finance supports the following replication scenarios:

● FI/CO replication

The replication of FI postings encompasses a certain scope. For a list of postings that are not replicated to

Central Finance, see Postings Excluded from Transfer [page 11].

For more information about clearings and open items, see Activation of Clearing Transfer and Handling of

Open Items [page 129].

For information about further business transactions, see Special Business Transactions: Additional

Information [page 136].

Also see SAP Note 2184567 , which answers frequently asked questions about Central Finance.

● CO replication

Replication of CO postings that do not ow in via FI (for example, cost center allocation) (actuals only:

value types 04 and 11) – for supported business transactions, see SAP note 2103482 .

● Cost object replication

For additional information and scope, see SAP Note 2180924 .

● Commitment replication

Replication of commitments and commitment updates for purchase requisitions and purchase orders.

For additional information, see SAP note 2554827 .

● Replication of EC-PCA postings

For additional information, see Replication of EC-PCA Internal Postings [page 63].

● Replication of Material Cost Estimates

For additional information, see Material Cost Estimates Replication [page 70].

● Replication of Activity Rates

For additional information, see Replication of Activity Rates [page 71].

● Replication of projects

For additional information, see Central Projects (WBS) - Reporting Scenario [page 195].

● Replication of a dened subset of logistics data relating to sales orders and customers invoices within the

Accounting View of Logistics Information component.

For additional information, see Accounting View of Logistics Information (AVL): Overview [page 144].

The following features are also supported:

Replication of Document Changes

Changes to nancial documents (for example via transaction FB02) are replicated from the source system to

the Central Finance system.

Replication into Accounts Receivables and Accounts Payables

Financials postings update FI-AP/AR if postings or clearings on customer or vendor accounts are replicated.

For restrictions and more information, see Activation of Clearing Transfer and Handling of Open Items [page

129].

6

P U B L I C

Central Finance

Central Finance

Replication of Changes to Cost Objects, Depending on the Scenario Denition

Replication of changes to cost objects from the source systems to the Central Finance system is possible for

those with 1:1 cardinality in the scenario denition. The attributes marked as “Derive from Local” and “CO

relevant” can be replicated automatically in the Central Finance system, and the replication of common critical

statuses is supported.

Replication of Commitments

Commitment replication supports not only commitments from the creation of purchase requisitions and

purchase orders but also updates to commitments triggered by changes to purchase requisitions and

purchase orders, including goods issue and invoice receipt for the purchase order.

For detailed information about conguring Central Finance, see Getting Started with Central Finance [page

12].

1.2 Central Processes

Central Finance allows you to centralize the following processes in your SAP S/4HANA system:

Central Payment

Central Payment for SAP Central Finance allows you to make centralized payments and perform centralized

clearing activities in the Central Finance system instead of each source system. Please be aware that all

dependent processes based on open item management must take place in the Central Finance system (for

more information, see SAP Note 2346233 ).

It has the following main features:

● Activate Central Payment by company code.

● For company codes that are activated for Central Payment, the invoices posted in the source systems are

technically cleared. The invoices are replicated to the Central Finance system and are paid there.

● For company codes that are not activated for Central Payment, the invoices posted in source systems stay

open and are paid in the source systems. The invoices and payment or clearing documents are replicated

to the Central Finance system for reporting purposes. The replicated invoices are ruled out from the

payment or clearing transactions in the Central Finance system. This avoids duplicate payments (as

payments are to be processed in the source systems).

● Mandate replication between source systems and the Central Finance system is automated meaning that

SEPA direct debit is supported in the Central Finance system.

Note

Central Payment for SAP Central Finance is released with functional restrictions, which are described in

SAP Note 2346233 . To activate this product, create an incident on component FI-CF-APR. Before

making productive use of the product, please make sure that you fully understand the restrictions and have

thoroughly tested the product so that you won’t be impacted by the restrictions.

Note also the restrictions relating to Central Tax Reporting (see below).

Central Finance

Central Finance

P U B L I C 7

Central Tax Reporting

Central Finance supports tax reporting out of the Central Finance system for a certain scope.

Please read the section Central Tax Reporting [page 184] which describes the supported scope.

Please also take into account the referenced SAP Notes which are required to support certain aspects of tax

reporting out of the Central Finance system.

For further information, see SAP Note 2509047 .

Central Projects (WBS) - Reporting Scenario

Central Finance supports the Central Projects scenario, where you are creating and editing projects in a source

system and want to do the project reporting on costs and revenues posted to WBS elements in the Central

Finance system.

For further information, see Central Projects (WBS) - Reporting Scenario [page 195]

1.3 System Landscape

Central Finance

The gure above illustrates the way in which Central Finance is used in conjunction with SAP Landscape

Transformation Replication Server (SAP LT Replication Server), SAP Master Data Governance (SAP MDG) and

error handling.

8

P U B L I C

Central Finance

Central Finance

SAP LT Replication Server

SAP LT Replication Server collects data written to databases in the source systems and feeds this data into the

corresponding Central Finance accounting interface.

The following replication scenarios are supported:

● Replication of FI/CO postings

● Replication of CO internal postings

● Replication of cost objects

● Replication of commitments

● Replication of EC-PCA postings

● Replication of material cost estimates

● Replication of activity rates

● Replication of a dened subset of logistics data from purchase orders, sales orders, customer invoices

(billing documents), supplier invoices (Accounting View of Logistics Information (AVL)

Please also check Replication Scenarios in Central Finance [page 6] for additional information about the

replication scenarios.

SAP LT Replication Server is also used for the initial load of CO internal postings and cost objects. The initial

load of FI data is managed via Customizing activities in the Central Finance system. You can access these

Customizing activities in the Implementation Guide (IMG) by starting transaction SPRO and then choosing

Financial Accounting Central Finance Central Finance: Target System Settings Initial Load Initial Load

Execution for Financial Accounting .

Central Monitoring and Alerting Capabilities

You can connect to your SAP LT Replication Server from an SAP Solution Manager system, enabling you to

monitor aggregated information on job, trigger, and table status.

For more information, see Conguration in SAP Landscape Transformation Replication Server [page 82].

Master Data Governance (SAP MDG)

Central Finance oers integration to Master Data Governance (MDG) to access available mapping information

there. Even if MDG is not in use, in the background Central Finance uses the MDG mapping tables that are

available without installing MDG. This does not require an MDG license. The MDG license is only required if the

MDG application is used. If you use MDG to distribute master data throughout your system landscape, it is

likely that MDG will already contain a lot of information on how master data maps to each other in the dierent

systems. This information can be accessed and does not have to be maintained again manually.

Dierent types of master data are mapped in dierent ways:

● Master data, such as G/L accounts, customers, and vendors, must be either mapped manually as part of

your Customizing or using SAP Master Data Governance.

Central Finance

Central Finance

P U B L I C 9

● Master data relating to cost objects, such as production orders and internal orders, is mapped using the

cost object mapping framework.

Recommendation

To map master data, SAP suggests you use SAP MDG. If you are mapping short-living cost objects, you

should use SAP MDG in conjunction with the cost object mapping framework.

Master Data Consolidation

Master Data Consolidation enables you to determine an initial set for key mapping. For more information, see

the section Key Mapping in Conguration in Central Finance System: Mapping [page 39].

Document Relationship Browser

Using the Document Relationship Browser, you can see the document ow of an FI document. For example, you

can navigate back from an FI document to the original sales order. You can also search for the reposted FI

document using the company code, original document number, or scal year from the source system.

Note

All business documents related to a transaction are available in the Document Relationship Browser,

provided the source system is an SAP system.

To navigate to the Document Relationship Browser, you can use the following transactions:

● Controlling Documents: Actual (KSB5), then choose Environment Relationship Browser

● Display Document (FB03), then choose Environment Document Environment Relationship

Browser

Drillback from Fiori App - Manage Journal Entries

To enable drillback to a source document from the Fiori app Manage Journal Entries you must carry out the

conguration settings described in the SAP Note 2507089 .

Error Handling

After the data is mapped, the system uses error handling functions to log the details of any errors encountered.

You can choose to make corrections and repost the item or process the item again after, for example, you

correct the mapping rule or adjust incorrect values in the document.

10

P U B L I C

Central Finance

Central Finance

SAP HANA

The internal accounting interface posts Financial Accounting (FI)/Management Accounting (CO) documents to

SAP HANA as a universal journal entry.

1.4 Postings Excluded from Transfer

Some postings cannot be transferred as part of the initial load and ongoing replication.

Postings Excluded from Transfer

CO-FI Postings and Clearings

A CO document in the source system triggers the creation of an FI document of the type CO-FI in the source

system. This document is not transferred to the Central Finance system. Instead, the replicated CO document

in Central Finance also triggers the creation of a document of the type CO-FI.

Note: CO documents should only be replicated if the G/L Reconciliation ag has not been set in the

customizing activity General Replication Settings (VCFIN_SOURCE_SET). This ag is only available in SAP ERP

source systems.

A clearing that attempts to clear a CO-FI posting of this type is transferred via the FI interface and the system

cannot identify which posting it is related to because the CO-FI posting itself doesn’t contain any information

about the corresponding source document. Therefore, subsequent processes such as CO-FI clearings will run

into errors.

The following types of posting are not transferred as part of the initial load and ongoing replication:

● Postings to CO-FI reconciliation ledger (GL Reconciliation Postings)

Note

For ERP Source Systems. For the initial load only you should note that, if you have enabled replication

of CO postings, postings to CO-FI reconciliation ledger (GL reconciliation postings) will be transferred

via CO. Therefore, you must not set the GL Reconciliation Postings Transferred ag in the Customizing

activity General Replication Settings. For more information about this activity, see Conguration in

Source System: Initial Load [page 92].

● Year-end closing postings where the reference transaction (AWTYP) is GLYEC

● Clearings are not transferred as part of the initial load but you can activate the transfer of clearings via

ongoing replication. For more information see Activation of Clearing Transfer and Handling of Open Items

[page 129].

● Clearing resets are not transferred as part of the initial load but you can activate the transfer of clearing

resets via ongoing replication. For more information see Activation of Clearing Transfer and Handling of

Open Items [page 129].

● Recurring entries

● Sample documents

● Noted items (apart from downpayment requests and payment requests)

● Parked documents

Central Finance

Central Finance

P U B L I C 11

● Balance carryforward items

● Closing operations (These comprise processes and functions performed at the end of the scal year in

certain countries.)

Note

Long texts - on both header and item level - and attachments are not replicated during the creation of

documents or when those documents are changed.

Note

Transactional data that is stored in supplementary tables in the source system is not replicated to Central

Finance.

Therefore, processes that rely upon this supplementary data are not supported, for example, Nota Fiscal

(Brazil).

Documents created via ALE in the source system cannot be replicated correctly to the Central Finance system.

In the ALE scenarios, postings are processed in a simplied manner, which is not compatible with the Central

Finance scenario and could result in missing or inconsistent postings in the Central Finance system. Project

master data is an exception to this. For more information about Central Projects, see

Central Projects (WBS) -

Reporting Scenario [page 195].

1.5 Conguring Your Central Finance Scenario

1.5.1 Getting Started with Central Finance

The following chapters contain information explaining how to congure the dierent systems involved in your

Central Finance scenario.

Before you start conguring your systems, carefully read not only the information provided here, but also the

SAP Notes 2148893 - Central Finance: Implementation and Conguration and 2184567 - Central Finance:

Frequently Asked Questions.

In addition, ensure that you have installed the latest support package and apply the most recent notes on

component FI-CF and its subcomponents to avoid encountering problems which have already been solved.

1.5.1.1 Prerequisites

SAP ERP Releases for Source Systems

In Central Finance, you can use all SAP ERP releases as source systems that are still in maintenance starting

from SAP ERP 6.0. Instructions on how to implement Central Finance with these source system releases are

12

P U B L I C

Central Finance

Central Finance

available either as SAP Notes or are contained in the support packages for these systems. For releases SAP

R/3 4.6C to SAP ECC 5.0, contact SAP Product Management by creating an incident on the component FI-CF.

Replication from Third-Party Systems

For information about connecting non-SAP ERP systems to Central Finance, see SAP Note 2713300 .

For more information on conguration of the third-party system interface to Central Finance, see Third-Party

System Interface to Central Finance: Process and Architecture [page 203].

Licensing

Required Software

You must have a license for the following:

● Central Finance

Contact your SAP Account Executive to verify if you need to purchase this license.

Optional Software

● External Tax Calculation Engine

If you are using an external tax calculation engine in your source system, you should connect the same

external tax calculate engine to your Central Finance system. This is because after tax calculation, tax

checks are carried out in both systems.

● SAP BusinessObjects Analysis, edition for Microsoft Oce

In addition to classic SAP ERP reports such as nancial statements, cash ow, or protability reports, you

can use SAP BusinessObjects Analysis, edition for Microsoft Oce for reporting. SAP BusinessObjects

Analysis, edition for Microsoft Oce integrates with Microsoft Excel and helps you to gain insight into

business data and make intelligent decisions that impact corporate performance.

For more information about SAP BusinessObjects Analysis, see SAP Help Portal at http://help.sap.com

Analytics Business Intelligence Analysis .

Contact your SAP Account Executive to verify if you need to purchase a license.

Releases

The add-on DMIS 2011_1_700 (or higher depending on the release of the system) is installed on all source

systems and on the SLT server.

Note

The minimum support package (SP) level for the steps described in this document is SP08.

For the Central Finance – Business Integration Scenario, SP09 is required.

Central Finance

Central Finance

P U B L I C 13

SAP S/4HANA Cloud as a Source System

● You can use an SAP S/4HANA Cloud system as a source system from which to replicate content to Central

Finance. You can nd more information in the SAP Best Practices Explorer, scope item https://

rapid.sap.com/bp/scopeitems/1W4

.

For more information, see the product assistance for SAP S/4HANA Cloud on the SAP Help Portal at

https://help.sap.com/viewer/p/SAP_S4HANA_CLOUD under Product Assistance <choose your

language> Finance Accounting and Financial Close Integration of SAP S/4HANA Cloud Source

System with Central Finance .

● You can replicate project master data from a SAP S/4HANA Cloud system as a source system to the

Central Finance (SAP S/4HANA on-premise) system.

For more information, see the product assistance for SAP S/4HANA Cloud on the SAP Help Portal at

https://help.sap.com/viewer/p/SAP_S4HANA_CLOUD under Product Assistance <choose your

language> Finance Accounting and Financial Close Replicating Project Data from SAP S/4HANA

Cloud to Central Finance

.

Authorizations

The authorization SAP_IUUC_REPL_REMOTE has been assigned to the RFC user in the source system.

The following authorizations have been assigned to the conguration user in the SAP LT Replication Server

system:

● SAP_IUUC_REPL_ADMIN

● SAP_MWB_PROJECT_MANAGER

Business Functions

You have activated the Central Finance (FINS_CFIN) business function in the Switch Framework (transaction

SFW5).

Web Dynpro Applications

For security reasons, the services delivered for Web Dynpro applications are delivered in an inactive state. You

must activate the services you want to use.

For Central Finance you need the service MDG_BS_WD_ID_MATCH_SERVICE.

To activate the services:

1. On the Maintain Services screen (transaction SICF), make sure that the hierarchy type SERVICE is

selected, enter the service name, and choose Execute.

2. Choose Service/Host Activate , to activate the service.

14

P U B L I C

Central Finance

Central Finance

Note

You have to perform the procedure for each service that you want to activate.

Once you have activated a service it cannot be reset to inactive.

General Prerequisites

You have ensured that the Central Finance system contains harmonized organizational data and master data

for all the accounting entities that you intend to include in your accounting document.

You have created the master data which is needed to repost the existing FI and CO documents from the source

system.

You have completed the activities relating to mapping in Customizing of your Central Finance system under:

● Key Mapping

● Value Mapping

● Cost Object Mapping

Please note that (in contrast to SAP ERP source systems) cost elements are now G/L Accounts in SAP S/

4HANA. While attributes of cost elements can be maintained with certain validity dates, G/L Accounts are not

time-dependent. This is important to take into account during the initial load, if attributes of cost elements

have been changed during the time frame for which the initial load is being carried out.

G/L Account Mapping

Please be aware that inaccurate G/L account mapping will lead to errors during replication. Open-item

managed G/L accounts from the source system must be mapped to open-item managed G/L accounts in the

Central Finance system. This is required with the initial load if you require activation of Clearing Transfer, even

at a later stage.

If tax is included in your postings, you must ensure that the compatible tax category is congured in the

corresponding accounts.

Constraints

You cannot use Central Finance together with Amount Field Length Extension (AFLE). For details, please see

SAP Note 2643282 .

Central Finance

Central Finance

P U B L I C 15

1.5.1.2 Related Information

Planning Information

For more information about topics not covered in this guide, see the following content on the SAP Help Portal:

● SAP S/4HANA

● SAP Landscape Transformation Replication Server

Before you Start your Implementation

We strongly recommend that you read SAP Note 2148893 . This note provides additional information and

documentation about the installation and conguration of Central Finance and lists all relevant notes that need

to be implemented in either the source systems or the Central Finance system.

Also read SAP Note 2184567 – Central Finance: Frequently Asked Questions.

In addition, ensure that you have installed the latest support package and apply the most recent notes on

component FI-CF and its subcomponents to avoid encountering problems which have already been solved.

Make sure that you have the up-to-date version of each SAP Note, which you can nd at https://

support.sap.com/en/my-support/knowledge-base.html .

Upgrade Information

If you are upgrading either one of your source systems or your Central Finance system to a new release or

feature pack, you may need to perform manual activities in order to use the new functions that are delivered.

For information on these upgrade activities, see SAP Note 2713590 , which is updated regularly.

Important SAP Notes for Source Systems

When an FI or CO document is posted in the source system, additional data has to be stored temporarily and

sent to the Central Finance system. The following SAP note provides an overview of all the SAP notes that are

relevant for the source system and that contain the most recent information on the installation, as well as

corrections to the installation documentation, and need to be implemented in order to enable the document

transfer from the source systems to the Central Finance system using the SAP LT Replication Server. Before

16

P U B L I C

Central Finance

Central Finance

you start working with Central Finance, ensure that you have implemented all notes that are relevant for the

scope of your scenario:

SAP Note Number Title Description

2323494

Overview of Notes Relevant for

Source System

Collective note for notes relevant for source

systems

Important SAP Notes for the Central Finance System

Note

We strongly recommend that you upgrade to the latest support package stack to ensure that your system

includes all the latest xes.

Staying on an older support package stack signicantly increases the risk of running into issues that have

already been solved. Upgrading to the latest support package stack also mitigates risk due to the

decreased need to implement SAP Notes and a reduction in the necessary manual activities related to note

implementation.

SAP Note Number Title Description

2217711

Currency Handling Fix of CO Posting in

Central Finance

Improvement for currency handling

2178157

Central Finance: Collective Note for

SAP Simple Finance on-premise edition

1503 SPS1508 – CO part

Relevant for Central Finance System

Contains corrections and improve

ments; shipped with SAP Simple Fi

nance, on-premise edition 1503 SPS

1508.

2179826

DDIC object for note 2178157 Relevant for Central Finance System

Contains information on objects re

quired for SAP Note

2178157 but not

supported by SNOTE

2229985

Unjustied syntax error for ABAP type

check for internal tables

Relevant for Central Finance System.

Contains information on how to prevent

syntax check errors.

2225086

Enabling Central Finance Business

Mapping without the Need to Set Up

System Landscape Directory (SLD)

Relevant for Central Finance System.

Contains information about dening

business systems in your Central Fi

nance scenario.

Central Finance

Central Finance

P U B L I C 17

SAP Note Number Title Description

2298936

Central Finance: Error Handling in AIF

for Simulation of Initial Load for CO

Documents and Cost Objects

Relevant for Central Finance System.

Contains information on using SAP AIF

as the error handling tool in Central Fi

nance to simulate the initial load of cost

objects mapping and CO postings.

2554827

Central Finance: Commitment Posting

on Purchase Requisition and Purchase

Order

Relevant for Central Finance System.

SAP Notes for SAP Application Interface Framework

Note

See SAP Note 1530212 for information about the installation and setup of AIF.

To use SAP Application Interface Framework (AIF) with Central Finance you must have implemented SAP

Note 2213557 or the relevant support package for AIF.

The required AIF conguration settings are delivered with the SAP notes listed in the following table:

SAP Note Number Title Description

2196783

Central Finance: Error handling with

AIF

Mandatory for the following notes:

2202650

Central Finance: Error Handling in AIF

for Replication of FI Documents

Error Handling in AIF for Replication of

FI Documents

2202691

Central Finance: Error Handling in AIF

for Replication of CO documents and

Cost Objects

Error Handling in AIF for Replication of

CO documents and Cost Objects

Further Important SAP Notes

SAP Note Number Title Description

2223621

Central Finance: Interface for Business

Integration

Describes the steps involved in imple

menting the Central Finance Business

Integration Scenario

2224363

Repository Objects required for Note

2223621

Creation of repository objects (for ex

ample, database tables and structure)

for note 2223621

18 P U B L I C

Central Finance

Central Finance

2228844

Central Finance: Reversal of Active In

voice is not Transferred

The cancellation of an SD invoice in the

sender system is not transferred to the

Central Finance system.

2184391

Structure Label for Node of Table Type

Does Not Work

Mandatory for Central Finance

2179803

Register Functions: Add Custom-Spe

cic Functions to Views in /AIF/ERR

Mandatory for Central Finance

2213557

Implementation of BC Sets for AIF Error when activating BC set for AIF

2223801

SLT-Central Finance Enable the Central Finance Business In

tegration Scenario in SLT

2124481

SLT (2011 – SP08) – Correction 03 Relevant for SAP LT Replication Server

2154420

SAP LT Replication Server for SAP Cen

tral Finance

Relevant for SAP LT Replication Server

Contains information about new devel

opments for the SAP LT Replication

Server.

2180924

Supported scenarios in cost object

mapping framework

Contains information on the supported

scenarios of cost object mapping

framework.

2183951

Data Link: Field info get lost Relevant for SAP Application Interface

Framework

2178720

Error Handling: restricted to include

standard structure

Relevant for SAP Application Interface

Framework

Mandatory, if SAP AIF 702 SP02 is not

installed, otherwise error monitor in

SAP AIF will not work.

1946054

SAP Simple Finance, on-premise edi

tion: Transaction codes and programs -

Comparison to EHP7 and EHP8 for SAP

ERP 6.0

Relevant if one of your source systems

is an SAP Simple Finance system.

2103482

Features for Function Module

FINS_CFIN_CO_CENTRAL_POSTING

Function module

FINS_CFIN_CO_CENTRAL_POSTING is

the CO secondary posting interface

which can replicate CO documents

from source system to central system.

2225086

Enabling Central Finance Business

Mapping without the need to set up

Systems Landscape Directory

Relevant for Central Finance system

Central Finance

Central Finance

P U B L I C 19

Further Useful Links

The following table lists further useful links:

Content Location

Information about creating error messages

http://support.sap.com/incidents

SAP Notes search

http://support.sap.com/notes

SAP Software Distribution Center (software download and

ordering of software)

http://support.sap.com/swdc

SAP Analysis for Microsoft Oce

http://help.sap.com/boao

1.5.2 Installing Central Finance

This chapter gives you an overview of the process steps required to use Central Finance. It also provides

references to the documentation required for the process steps.

Before you start the installation process, read SAP Note 2184567 - Central Finance: Frequently Asked

Questions (FAQ), which is updated regularly.

In addition, ensure that you have installed the latest support package and apply the most recent notes on

component FI-CF and its subcomponents to avoid encountering problems which have already been solved.

Find Out More

This image is interactive. Hover over each section for a description. Click the highlighted sections for more

information.

● Data Mapping [page 37]

● Initial Load [page 87]

20

P U B L I C

Central Finance

Central Finance

● Error Handling [page 29]

● Comparison Reports [page 124]

1.5.2.1 Overview of Activities

The following is an overview of the tasks that you need to carry out in order to implement Central Finance.

Phase Topic Task System Responsible

More Informa

tion

Before You Start Support Package and

SAP Notes

Install the latest

support package

and apply the rele

vant SAP Notes on

component FI-CF

and its subcompo

nents

Source Systems

and Central Fi

nance System

System Adminis

trator

Related Informa

tion

Assign Authoriza

tions

Source

System/SAP

Landscape

Transformation

Server

System Adminis

trator

Prerequisites

Set Up Systems

(Central Finance:

Target System

Settings)

Activate Business

Function

FINS_CFIN

Central Finance

System

System Adminis

trator

Prerequisites

Congure Error

Handling

Application Con

sultant

Error Handling

Assign AIF Runtime

Conguration

Group to Replica

tion Object

Central Finance

System

System Adminis

trator

Set Up RFC Destina

tion for Source Sys

tems

Central Finance

System

System Adminis

trator

Conguration in

Central Finance

System: General

Settings

Dene Logical Sys

tem for Source and

Central Finance

Systems

Source Systems

and Central Fi

nance Systems

System Adminis

trator

Conguration in

Central Finance

System: General

Settings

Central Finance

Central Finance

P U B L I C 21

Phase Topic Task System Responsible

More Informa

tion

Maintain RFC As

signments and Set

tings for Source

Systems

Source Systems System Adminis

trator

Conguration in

Central Finance

System: General

Settings

Assign RFC Destina

tion for Displaying

Objects from

Source Systems

Central Finance

System

System Adminis

trator

Conguration in

Central Finance

System: General

Settings

Check Logical Sys

tem Assignment for

Central Finance Cli

ent

Central Finance

System

System Adminis

trator

Conguration in

Central Finance

System: General

Settings

Activate Tax Consis

tency Check for

Company Codes

Central Finance

System

Dene Decimal Pla

ces for Currencies

in Source Systems

Central Finance

System

System Adminis

trator

Dene Decimal Pla

ces for Currencies

in Source Systems

Central Finance

System

System Adminis

trator

Dene Handling of

Reconciliation Ac

counts per Com

pany Code

Central Finance

System

System Adminis

trator

General Prepara

tions

Carry out Customiz

ing activities for FI

and CO

Central Finance

System

Application Con

sultant

Create master data

in Central Finance

Central Finance

System

Application Con

sultant

Mapping (Cus

tomizing)

Dene Technical

Settings for All In

volved Systems

Central Finance

System OR Sys

tem Landscape

Directory

System Adminis

trator

Conguration in

Central Finance

System: Map

ping

Dene Mapping Ac

tions for Mapping

Entities

Central Finance

System

Application Con

sultant

Conguration in

Central Finance

System: Map

ping

22 P U B L I C

Central Finance

Central Finance

Phase Topic Task System Responsible

More Informa

tion

Dene Key Mapping

(ID Mapping)

Create and Edit Key

Mapping

Application Con

sultant

Conguration in

Central Finance

System: Map

ping

Dene Value Mapping

(Code Mapping)

Assign Code Lists to

Elements and

Structures

Application Con

sultant

Conguration in

Central Finance

System: Map

ping

Maintain Value Map

ping

Application Con

sultant

Conguration in

Central Finance

System: Map

ping

Dene Cost Object

Mapping

Dene Scenarios for

Cost Object Map

ping

Central Finance

System

Application Con

sultant

Conguration in

Central Finance

System: Map

ping

Dene Mapping

Rules for Cost Ob

ject Mapping Sce

narios

Central Finance

System

Application Con

sultant

Conguration in

Central Finance

System: Map

ping

Optional: Correct

Cost Object Map

ping

Optional: Delete

Cost Object Map

ping and Cost Ob

jects

CO-PA Mapping Dene CO-PA Map

ping

Mapping: Ad

vanced Settings

Enhanced Business

Mapping

Central Finance

System

Application Con

sultant

Enhance Busi

ness Mapping

Dene Mapping En

tities (Enhanced

Conguration)

Central Finance

System

Application Con

sultant

Enhance Busi

ness Mapping

Central Finance

Central Finance

P U B L I C 23

Phase Topic Task System Responsible

More Informa

tion

Conguration in

SLT

Dene conguration

between source and

target systems

SLT System Adminis

trator

Conguration in

SAP System

Landscape Repli

cation Server

Clearing Transfer

Activate Clearing

Transfer for Source

Systems

Central Finance

System

System Adminis

trator

Handling of

Open Items

Initial Load Initial Load Settings Choose Logical Sys

tem

Central Finance

System

System Adminis

trator

Settings for the

Initial Load of FI

Documents

Dene Clearing and

Substitution Ac

counts

Central Finance

System

Application Con

sultant

Settings for the

Initial Load of FI

Documents

Make Conguration

Settings in Source

Systems

Initial Load Prepara

tion for Management

Accounting

Prepare for and

Monitor the Initial

Load of CO Postings

Preparation for the

Initial Load of Com

mitments

Smoke Test for Cost

Object Mapping and

CO Document Repli

cation

Simulation of Initial

Load for Cost Ob

ject Mapping

Simulation of Initial

Load for Manage

ment Accounting

Document

Prepare for the Ini

tial Load

Source System Application Con

sultant

Prepare for the

Initial Load in

Source System

24 P U B L I C

Central Finance

Central Finance

Phase Topic Task System Responsible

More Informa

tion

Initial Load of Cost Ob

jects

Simulation, Execu

tion and Monitoring

SLT System Adminis

trator

Initial Load

Analyze replication

errors in AIF

Central Finance

System

Application Con

sultant

Only relevant if

you are using AIF

for error han

dling.

Initial Load of Commit

ments

Execution Central Finance

System

System Adminis

trator

Analyze replication

errors in AIF

Central Finance

System

Application Con

sultant

Source System Con

guration

Make Conguration

Settings in Source

System

Source System Application Con

sultant

Conguration in

Source System:

Initial Load

Initial Load Execution

(FI Postings)

Simulation, Execu

tion and Monitoring

Central Finance

System

Application Con

sultant

Execute Initial

Load

Replication of FI Post

ings

SLT System Adminis

trator

Execute Initial

Load

Analyze replication

errors in AIF

Central System Application Con

sultant

Replication of CO In

ternal Posting Objects

Simulation, Execu

tion and Monitoring

SLT System Adminis

trator

Initial Load

Analyze replication

errors in AIF

Central System Application Con

sultant

After the Initial

Load

Compare Actual

and Expected CO

Postings in Central

Finance

Application Con

sultant

After the Initial

Load

Run reports and

carry out checks

Central Finance

System

Application Con

sultant

After the Initial

Load

Replication Set

tings for Prot

Center Accounting

Preparation (in source

systems)

Source Systems

Settings for Source

Systems

Central Finance

System

Central Finance

Central Finance

P U B L I C 25

Phase Topic Task System Responsible

More Informa

tion

Settings for Company

Codes

Central Finance

System

EC-PCA: Execute Ini

tial Load

Central Finance

System

BAdIs: Central Fi

nance

Central Finance

System and

Source Systems

Application Con

sultant

For a complete

list of BAdIs see

BAdIs in Central

Finance [page

26].

1.5.2.1.1 BAdIs in Central Finance

The following BAdIs are available in Customizing for Central Finance under Financial Accounting Central

Finance Central Finance: Source System Settings BAdIs: Central Finance or Financial Accounting

Central Finance Central Finance: Target System Settings BAdIs: Central Finance :

Source System

● BAdI: Add Information from Source System to Central Finance Documents

● BAdI: Enhance Inbound Processing of Reverse Mapping for SD Down Payment

Target System

● BAdI: Determine Mapping Action

● BAdI: Enhance Standard Mapping

● BAdI: Preparation for Initial Load of Commitments

● BAdI: Enhance Standard Processing of Posting Data

● BAdI: Enhance Standard Processing of CO Secondary Posting

● BAdI: Mapping of Cost Object Master Data

● BAdI: Enhance Processing and Output of Comparison Reports

● BAdI: Enhance Processing of Checks for Manage Mappings

● BAdI: Enhance Processing of Posting Data from Third-Party Systems

● BAdI: Adjust Decimals

● BAdI: Protability Analysis Posting Interface

● BAdI: Additional Mapping for Protability Analysis

● BAdI: Enhance Processing of Project Data

● BAdI: Enhance Outbound Processing of Reverse Mapping for SD Down Payment

For more information about each BAdI, see the documentation in the system.

26

P U B L I C

Central Finance

Central Finance

1.5.3 Conguration in Central Finance System: Set Up

Systems

Use

The following activities are carried out in Customizing for Central Finance under Financial Accounting

Central Finance Central Finance: Target System Settings Set Up Systems .

For detailed information about each activity, see the system documentation.

1. Activate Business Function

The business function Central Finance (FINS_CFIN) must be activated. If the business function has not

been activated, activate it in the Switch Framework (transaction SFW5).

2. Congure Error Handling

3. Assign AIF Runtime Conguration Group to Replication Object

4. Set up RFC Destination for Source Systems

In this activity, you dene technical parameters for RFC destinations. These parameters are used for

remote function calls (RFC) to other systems. RFC connections are needed for reading data from the

connected source systems to Central Finance and to navigate to accounting documents in the source

systems.

For specic functions or use cases there are predelivered business role templates that you can copy and

assign to your business users. This allows you to use these role templates to grant access for dierent

business users that can then use dierent business functions. For details on the specic functions and the

business role templates, please read the SAP note 2677866 .

5. Dene Logical System for Source and Central Finance Systems

In this activity, you dene one logical system for each connected source system client and one logical

system for the receiving Central Finance client. A logical system identies the client of the connected

source systems in the accounting documents.

Note

The name of the logical system must be the same in the source system and the Central Finance

system.

We recommend that you use the following naming convention for logical systems:

<System ID> CLNT <Client Number>, for example Q91CLNT800.

6. Maintain RFC Assignments and Settings for Source Systems

In this activity, you make settings for the source systems and maintain RFC destinations for the source

systems (logical systems). These settings are used for remote function calls (RFC) from the Central

Finance system into the source system.

7. Assign RFC Destination for Displaying Objects from Source Systems

In this activity, you assign RFC destinations to logical systems for each connected source system for

displaying objects from the source system.

8. Check Logical System Assignment for Central Finance Client

In this activity, you check the logical system assignment for the Central Finance system client.

Central Finance

Central Finance

P U B L I C 27

Note

These settings cannot be transported. When a new system is being set up, these settings must be

made after the system installation has been completed.

9. Activate Tax Consistency Check for Company Codes

In this activity, you activate the tax conguration checks for individual company codes. which you have

activated for Central Payment. Before you activate Central Payment you must familiarise yourself with

Central Tax Reporting [page 184].

10. Dene Decimal Places for Currencies in Source Systems

In this activity you set the number of decimal places for currencies of the source system, if they are dened

dierently than in the Central Finance system.

Bear in mind that several scenarios, such as Clearing Transfer, Central Tax, and Central Payment, do not

allow a smaller number of decimals in the Central Finance system. In particular, once ongoing replication

has been started, decreasing the number of decimals will lead to errors.

11. Dene Handling of Reconciliation Accounts per Company Code

In this activity, you make settings for each company code that dene how the system handles

reconciliation accounts.

1.5.3.1 Customizing Settings for Asset Documents

Procedure

The replication of asset documents requires specic conguration in the Central Finance system.

Note

Replicated FI documents which originate from asset postings in the source system are not posted to Fixed

Asset Accounting (FI-AA) in the Central Finance system. Instead they are only posted to General Ledger

(FI-GL) in the Central Finance system using posting keys 40 and 50.

Before this type of document is posted in the Central Finance system, the asset information is deleted from

asset-related elds of the FI documents, for example from the elds ANLN1 and ALN2. You can use a

Business-Add-In (BAdI) to transfer the asset information to customer-dened elds. You can nd the BAdI

in Customizing under Financial Accounting Central Finance Central Finance: Target System Settings

BAdIs: Central Finance BAdI: Enhance Standard Processing of Posting Data .

1. Asset Accounts in the Source System

In the source system, the G/L accounts to which acquisition and production costs (APC) are posted, as

well as the G/L accounts for the cumulated depreciation, are dened as reconciliation accounts for xed

assets. You can see this setting in the transaction FS00, on the Control Data tab for the G/L account in

question.

G/L accounts are assigned to an account determination rule, which is the entered in the asset master

records. You can check the account determination for the Fixed Asset Accounting (FI-AA) in Customizing:

Financial Accounting Asset Accounting Integration with General Ledger Accounting Assign G/L

Accounts .

2. Asset Accounts in the Central Finance System

28

P U B L I C

Central Finance

Central Finance

In the Central Finance system, all asset accounts for APC and cumulated depreciation must either be set

up as a non-reconciliation balance sheet account or mapped to a non-reconciliation balance sheet

account.

In transaction FS01, on the Control Data tab, leave the eld Recon. Account for Acct Type empty.

More Information

If you encounter the errors FAA_POST 007 and FAA_POST 006, see the SAP Note 2239900 .

1.5.4 Error Handling

If errors occur during replication, they can be handled with the error handling tool, SAP AIF.

1.5.4.1 About Error Handling

Use

Sometimes, it is not possible to post an accounting document to Central Finance, for example, if the posting

period is not yet open, a cost center is blocked, or master data is mapped incorrectly.

Process

Error Handling for the Initial Load

Errors relating to the initial load can be accessed as follows:

● Initial load of cost objects and initial load of CO internal postings

These are handled in the Central Finance system using the SAP Application Interface Framework (SAP

AIF).

● Initial load of FI postings

If the errors relate to the initial load of FI postings linked to CO documents (which is carried out in the

Central Finance system), then the errors are displayed in the Customizing activity Monitor Posting under

Financial Accounting Central Finance Central Finance: Target System Settings Initial Load Initial

Load Execution for Financial Accounting

Initial Load Execution for All Company Codes or Initial Load

Execution for Selected Company Codes

Error Correction with AIF

SAP AIF allows you to distribute messages to dierent users, use alerts, and carry out reporting. For Central

Finance, details about errors are displayed in SAP AIF in the Central Finance namespace /FINCF.

Central Finance

Central Finance

P U B L I C 29

In addition to errors relating to, for example, the initial load for cost objects, errors relating to ongoing

replication from all scenarios (cost objects, FI postings, and CO internal postings) can be handled in the Central

Finance system using SAP AIF.

Before you Start

There are two ways in which you can install Central Finance conguration content for AIF in your system:

● Via pre-delivered AIF content (for SAP S/4HANA systems)

● Via BC set (for SAP Simple Finance systems)

Pre-Delivered AIF Content

1. In your on-premise system, you trigger the activation of AIF content manually in transaction /AIF/

CONTENT_EXTRACT for the relevant scenarios.

Note

If you do not want to register the content for automatic updates, you need to set the ag No automatic

registration.

2. Choose the corresponding AIF interface in Monitoring and Error Handling (transaction /AIF/ERR) for the

Central Finance namespace FINCF.

The following table lists the relevant AIF interfaces and scenario IDs for each category of replicated data, plus

the release from which the content can be installed using this method.

Category of Repli

cated Data Scenario ID

AIF Interface

(namespace /FINCF)

Scenario ID Descrip

tion

Release

Accounting View of

Sales Order

FINCF_AV_SO AV_SO 1 Central Finance: Ac

counting View of Sales

Order

1809 FPS0

Accounting View of

Customer Invoice

FINCF_AV_CI AV_CI 1 Central Finance: Ac

counting View of Cus

tomer Invoice

1809 FPS0

Update PO History SAP_AIF_0014 UPDT_PO 1 Central Finance: Ac

counting View of Pur

chase Order

1809 FPS2

Activity Rate SAP_AIF_0023 CC_AR 1 Central Finance: Ac

counting View of Sup

plier Invoice

1909 FPS0

Material Cost Estimate SAP_AIF_0018 CE_MAT 1 Central Finance: Up

date PO history

1909 FPS0

Accounting Docu

ments

SAP_AIF_0017

AC_DOC 2

AC_DOC_CHG 2

Central Finance Ac

counting Documents

1809 FPS2

30 P U B L I C

Central Finance

Central Finance

Category of Repli

cated Data

Scenario ID

AIF Interface

(namespace /FINCF)

Scenario ID Descrip

tion

Release

Accounting Document

(3rd Party)

SAP_AIF_0026 AC_DOC_EX 2 Central Finance: Ac

counting Document -

External Interface

1909 FPS0

BC Sets

● To install BC-Sets:

1. Start transaction SCPR3 in the Central Finance system, upload or select the corresponding BC set and

choose Goto Activation Transaction and click Activate BC set.

2. Start transaction FINS_CFIN_AIF_SETUP, select Complete conguration and execute.

Install the following BC sets available in your Central Finance system:

Topic

AIF Interface BC Set Name Additional Information

Commitment Documents

/FINCF CMT_DOC 1

/FINCF CMT_SIM 1

FINS_CFIN_AIF_CMT

CO Objects and Documents

/FINCF CO_DOC 1

/FINCF CO_DOC_SIM 1

/FINCF CO_OBJ 1

/FINCF CO_OBJ_SIM 1

FINS_CFIN_AIF_CO

Central Finance COPA Post

ing

/FINCF CO_PAPOST 1 FINS_CFIN_AIF_COPA_DOC

Accounting Document

Changes

/FINCF AC_DOC_CHG 1 FINS_CFIN_AIF_DOC_CHG

Accounting Document Post

ings

/FINCF AC_DOC 1 FINS_CFIN_AIF_DOC_POST

Accounting Document Post

ing - Multi Index Serialization

/FINCF AC_DOC 2

/FINCF AC_DOC_CHG 2

FINS_CFIN_AIF_DOC_SER Replaces

FINS_CFIN_AIF_DOC_POST

and

FINS_CFIN_AIF_DOC_CHG

Central Finance AIF Congu-

ration - General

FINS_CFIN_AIF_GEN General content denitions

(for example, namespace,

applications, etc.)

PCA Internal Postings /FINCF PCA_DOC 1 FINS_CFIN_AIF_PCA

PCA Internal Postings - Simu

lation

/FINCF PCA_DOC_SM 1 FINS_CFIN_AIF_PCA_SIM

Project System IDoc /FINCF PS_OBJ 1 FINS_CFIN_AIF_PS

Central Finance

Central Finance

P U B L I C 31

Topic AIF Interface BC Set Name Additional Information

SEPA Mandate

/FINCF ISEPA_CH 01

/FINCF ISEPA_CR 01

/FINCF ISEPA_SR 01

FINS_CFIN_AIF_SEPA

External (3rd Party) Interface /FINCF AC_DOC_EX 1 FINS_CFIN_EX_AIF_DOC_PO

ST

External (3rd Party) Interface

Version 2

/FINCF AC_DOC_EX 2 FINS_CFIN_EX_AIF_DOC_PO

ST_V2

● If you want to use the transactions Interface Monitoring (/AIF/IFMON) and Monitoring and Error

Handling (Web) (/AIFX/ERR_WEB) and receive alerts via email, you must rst make the following settings:

● Assign the business user who is responsible for analyzing errors in AIF a user based on the role template

SAP_AIF_USER. For more information about role templates, see the Master Guide for SAP AIF on the SAP

Help Portal.

● Register the user for the scenarios that you want to analyze the errors for.

You can register for using the SAP Menu under Cross-Application Components SAP Application

Interface Framework Administration Conguration Recipients of a User or by using

transaction /AIF/RECIPIENTS.

Enter the name of the user and create a new entry for the following:

○ Namespace: /FINCF

○ Recipient for Alert: CFIN_RECIPIENT

○ Message Type: Application Error or Technical Error

○ Select the Include on Overview Screen checkbox

Using AIF

From the Interface Monitor (transaction /AIF/IFMON), you should see the Central Finance - /FINCF node as

the top node of the tree. You can expand this node to see the dierent interfaces including the number of

messages, warnings, and errors for each of the interfaces. By clicking on the number of errors, you can

navigate to display where and when the errors occurred and when you click on a posting you can display the

error messages for that posting.

The following interfaces exist:

Interface Name Version Description

AC_DOC 2 Accounting Document

AC_DOC_CHG 2 Accounting Document Changes

AC_DOC_EX 2 Accounting Document - External Inter

face

AV_CI 1 Accounting View of Customer Invoice

AV_PO 1 Accounting View of Purchase Order

32 P U B L I C

Central Finance

Central Finance

Interface Name Version Description

AV_SI 1 Accounting View of Supplier Invoice

AV_SO 1 Accounting View of Sales Order

CC_AR 1 Cost Center Activity Rate Replication

CE_MAT 1 Material Cost Estimate Replication

CMT_DOC 1 Commitment Document

CMT_SIM 1 Commitment Document Simulation

CO_DOC 1 Controlling Document

CO_DOC_SIM 1 Controlling Document Simulation

CO_OBJ 1 Cost Object Replication

CO_OBJ_SIM 1 Cost Object Simulation

ISEPA_CH 01 Interface for SEPA Mandate Change

ISEPA_CR 01 Interface for SEPA Mandate Creation

ISEPA_SR 01 Interface for SEPA Mandate Save Repli

cation

PCA_DOC 1 Prot Center Accounting

PCA_DOC_SM 1 Prot Center Accounting Simulation

PS_OBJ 1 Central Finance Project System Master

Data

UPDT_PO 1 Central Finance: Update PO history

Alternatively, you can use Monitoring and Error Handling (transaction /AIF/ERR) to view the details of the

error.

You can also display the message structure for the replicated document and check the values that were

replicated.

In most cases, documents cannot be posted because of an invalid mapping rule, missing Customizing, or

master data. Once the mapping, Customizing, or master data is corrected the document can be reprocessed

by clicking the Restart button.

Selection Criteria In AIF - Monitoring and Error Handling - Interfaces AC_DOC and AC_DOC_CHG

You can search for a message relating to a specic document in AIF - Monitoring and Error Handling by

entering additional selection criteria under More Specic Selection:

Central Finance

Central Finance

P U B L I C 33

To nd the values that you need to enter, open the document header in the source system and copy the

following information to AIF:

● The reference transaction

Copy this value into the eld Reference procedure.

● The reference key

Copy the rst 10 characters into the eld Reference document and the remaining characters into the eld

Reference org. unit.

● The logical system

Note

The reference document is only the same as the document number for certain types of reference

procedure. Therefore, to ensure that you nd the document you are looking for, you should search using the

values in the reference key as described above and not using the document number.

Emergency Correction Mode

Note

To use Emergency Correction Mode in AIF, the authorization object /AIF/EMC must be assigned to your

user.

Depending on your Customizing settings, you can also change values directly in the SAP AIF tool. If you change

values using SAP AIF, you can repost the document with the changed values by choosing Repost with user

changes.

To change values directly in Monitoring and Error Handling:

1. Press return to make the Emergency Correction check box visible and select the check box.

2. Select the message in question.

3. Select the structure in which you want to change a value, for example, for FI, the Account Document Item

Information.

4. In the structure, double-click the eld you want to change. A pop-up window is displayed in which you can

change the value

5. Choose Save.

6. Once you have changed all required elds, choose Repost with User Changes.

Caution

If you choose the Restart button, you discard the manual changes.

For more information on SAP AIF, see SAP Library for SAP Application Interface Framework 3.0 on the SAP

Help Portal at http://help.sap.com/aif . For information about authorizations, see the Security Information,

which is also available at the above address.

Recommendation

Making changes to posting data that has been transferred from a source system to the Central Finance

system can lead to serious inconsistencies. If errors have occurred in the Central Finance system during

posting, rst check if it is really necessary to make corrections to the posting data. If the errors have been

caused by incorrect or incomplete settings (for example, for conguration or mapping of attributes),

correct these settings and then restart message processing by clicking the Restart button.

34

P U B L I C

Central Finance

Central Finance

If the procedure described above is not possible and you still want to continue with the Repost with User

Changes action, you should be aware that the document will be posted as shown.

Serialization in AIF for Accounting Document and Accounting Document

Change

Serialization in AIF ensures that FI transactions that are dependent on one another are not processed

simultaneously as this could lead to errors.

It ensures that documents are processed in the correct sequence; for example that a cancellation is not posted

before the original document that the cancellation refers to.

If you have paused or deactivated SLT replication to Central Finance or have started replication via SLT initial

load you may encounter problems with serialization. To solve these issues carry out the steps described in SAP

Note

2679070 .

Error Correction with SAP LT Replication Server

Errors from all the replication scenarios are handled in the Central Finance System using SAP AIF.

Severe technical errors, for example, connectivity problems between the systems, can be found in the

application log of the SAP LT Replication Server (transaction LTRC - SAP LT Replication Server - Cockpit).

1.5.4.2 AIF - Performance Improvements

Performance improvements can be achieved by implementing archiving and compression and bulk

processing of XML messages as described here.

Archiving XML Messages

AIF uses XML messages to record the processing of every document transferred from source systems to the

Central Finance system (via SLT), whether that document triggers an error message or not.

These XML messages are stored in AIF in the table /AIF/PERS_XML. Because messages relating to all

documents are stored in this table, it can grow in size very rapidly, consuming a large amount of disk space.

Therefore, you should implement archiving for XML messages relating to documents which have been

processed successfully or with warnings.

Note

Messages that are in process or with errors cannot be archived and deleted. Furthermore, we recommend

that you do not archive messages with the status cancelled.

To implement archiving, use the function Data Archiving, transaction SARA. In this transaction, you dene

settings per archiving object. The table

/AIF/PERS_XML is part of the archiving object /AIF/PERSX.

Central Finance

Central Finance

P U B L I C 35

Note

To ensure the consistency of the application data, other tables which are part of the archiving object are

also deleted.

For more information about data archiving, see the documentation on Executing Data Archiving on the SAP

Help Portal.

Compressed Message Storage

It is also possible to implement compression of AIF messages before they are stored in the database. For more

information, see the SAP Note

2274361 .

In addition it is possible to implement compression of existing messages. To do this, implement SAP Note

2279909 once you have installed SAP Note 2274361 .

AIF Bulk Processing

As a default, AIF uses a separate background job to process each document that is transferred from the source

system. In certain situations where a large number of documents are transferred in a short timeframe, such as

the SLT initial load, this can lead to performance issues because not enough work processes for background

jobs are available for other tasks.

A correction for this issue is available in SAP Note 2291942 . Once you have implemented this note, you must

also dene runtime conguration groups and assign them to the replication objects by doing the following:

1. Dene runtime conguration groups in the Central Finance namespace /FINCF.

A runtime conguration group in AIF denes how AIF messages relating to replication objects are

processed, for example if they are processed synchronously or asynchronously, and how many messages

are processed in one run.

You do this in transaction /AIF/PERS_CGR under SAP Application Interface Framework Administration

Conguration Runtime Conguration Group.

2. Assign runtime conguration group to replication objects.

You do this in the Customizing activity Assign AIF Runtime Conguration Group to Replication Object under

Central Finance Central Finance: Target System Settings Set Up Systems . Here, you specify the AIF

runtime conguration groups that you want to use for processing data replicated to Central Finance. You

can specify separate runtime conguration groups for the replication objects available in Central Finance

(FI/CO postings, CO internal postings, and cost objects). For further details about the runtime

conguration group and its attributes, see the AIF documentation.

3. Download the new SLT content for bulk processing and copy it to your conguration as described in SAP

Note 2154420 .

Note

If no runtime conguration groups are dened in this activity, the data is processed using the default

conguration, in which a separate background job is run for each AIF message.

36

P U B L I C

Central Finance

Central Finance

AIF Runtime Object ID – Number Range Object

During the initial load, due to the large volume of data, you may encounter performance issues caused by the

number range object of the AIF runtime object ID. To improve performance, run transaction SNRO, choose

number range object

/AIF/RUN, and change the value in the eld No. of Numbers in Buer from 10 to 5000.

Change the Frequency of Report /AIF/SAP_AIF_CORRECTION

As a default in SAP S/4HANA, the report /AIF/SAP_AIF_CORRECTION is scheduled to run every six hours.

The frequency with which this report is run can lead to high memory consumption and therefore performance

issues.

If you are using only the CFIN interface in AIF we recommend that you either change the frequency of the job or

disable it completely. You can also run it as required, when a user deletes project IDocs via transaction WE11.

For detailed information about changing the frequency of reports or deactivating them, see SAP Note 2190119.

1.5.5 Data Mapping

Before you start any of the replication scenarios in Central Finance you typically perform mappings.

1.5.5.1 Introduction to Data Mapping

When accounting documents are posted in Central Finance, business mapping is used to harmonize the

master data in the documents. Identiers and codes in the documents must be mapped, that is, the

relationship between an identier or code used in the source system and one used in Central Finance must

have been dened. This is necessary because sometimes dierent identiers or codes are used for the same

entity. For example, in the source system, a customer may have the ID 28900 whereas in the Central Finance

system, the same customer has the ID 13700. Codes and identiers may also be dierent across the various

systems of your existing system landscape.

Mapping must be dened for the following categories:

● Mapping for business object identiers (for example, customer ID, vendor ID, or material ID).