Market Feasibility Analysis

Farmington Hills III Apartments

Winder, Barrow County, Georgia

Prepared for:

TBG Residential

Effective Date: July 14, 2020

Site Inspection: July 14, 2020

Farmington Hills III | Table of Contents

Page i

TABLE OF CONTENTS

1. EXECUTIVE SUMMARY.................................................................................................... 1

2. INTRODUCTION .............................................................................................................. 8

A. Overview of Subject..............................................................................................................................................8

B. Purpose of Report.................................................................................................................................................8

C. Format of Report ..................................................................................................................................................8

D. Client, Intended User, and Intended Use .............................................................................................................8

E. Applicable Requirements......................................................................................................................................8

F. Scope of Work ......................................................................................................................................................8

G. Report Limitations ................................................................................................................................................9

3. PROJECT DESCRIPTION.................................................................................................. 10

A. Project Overview ................................................................................................................................................10

B. Project Type and Target Market .........................................................................................................................10

C. Building Types and Placement............................................................................................................................10

D. Detailed Project Description...............................................................................................................................11

1. Project Description.....................................................................................................................................11

2. Other Proposed Uses .................................................................................................................................12

3. Proposed Timing of Development .............................................................................................................12

4. SITE EVALUATION ......................................................................................................... 13

A. Site Analysis ........................................................................................................................................................13

1. Site Location...............................................................................................................................................13

2. Existing and Proposed Uses .......................................................................................................................14

3. General Description of Land Uses Surrounding the Subject Site ...............................................................15

4. Land Uses Surrounding the Subject Site ....................................................................................................16

B. Neighborhood Analysis.......................................................................................................................................17

1. General Description of Neighborhood .......................................................................................................17

2. Neighborhood Planning Activities..............................................................................................................17

3. Public Safety...............................................................................................................................................17

C. Site Visibility and Accessibility ............................................................................................................................18

1. Visibility......................................................................................................................................................18

2. Vehicular Access.........................................................................................................................................18

3. Availability of Public Transit .......................................................................................................................19

4. Availability of Inter-Regional Transit..........................................................................................................19

5. Accessibility Improvements under Construction and Planned ..................................................................19

6. Environmental Concerns ............................................................................................................................19

D. Residential Support Network..............................................................................................................................19

1. Key Facilities and Services near the Subject Site........................................................................................19

2. Essential Services .......................................................................................................................................20

3. Commercial Goods and Services ................................................................................................................21

4. Location of Low Income Housing ...............................................................................................................22

E. Site Conclusion ...................................................................................................................................................22

5. MARKET AREA .............................................................................................................. 23

A. Introduction........................................................................................................................................................23

B. Delineation of Market Area ................................................................................................................................23

6. COMMUNITY DEMOGRAPHIC DATA.............................................................................. 25

A. Introduction and Methodology ..........................................................................................................................25

B. Trends in Population and Households................................................................................................................25

1. Recent Past Trends.....................................................................................................................................25

2. Projected Trends ........................................................................................................................................25

3. Building Permit Trends...............................................................................................................................25

C. Demographic Characteristics..............................................................................................................................27

Farmington Hills III | Table of Contents

Page ii

1. Age Distribution and Household Type .......................................................................................................27

2. Household Trends by Tenure .....................................................................................................................28

3. Renter Household Characteristics..............................................................................................................29

4. Income Characteristics ...............................................................................................................................30

7. EMPLOYMENT TRENDS ................................................................................................. 33

A. Introduction........................................................................................................................................................33

B. Labor Force, Resident Employment, and Unemployment..................................................................................33

1. Trends in County Labor Force and Resident Employment.........................................................................33

2. Trends in County Unemployment Rate......................................................................................................33

C. Commutation Patterns .......................................................................................................................................33

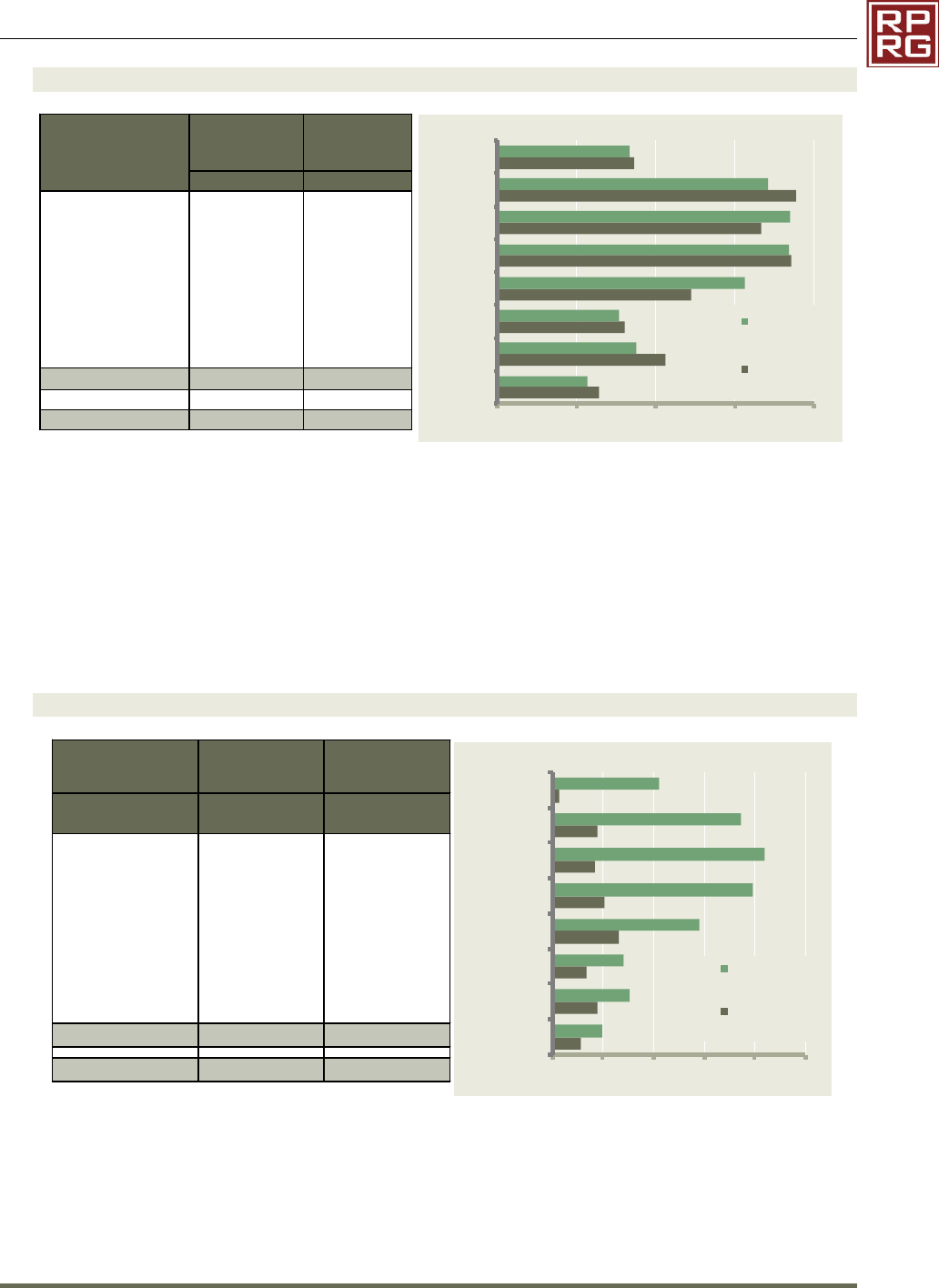

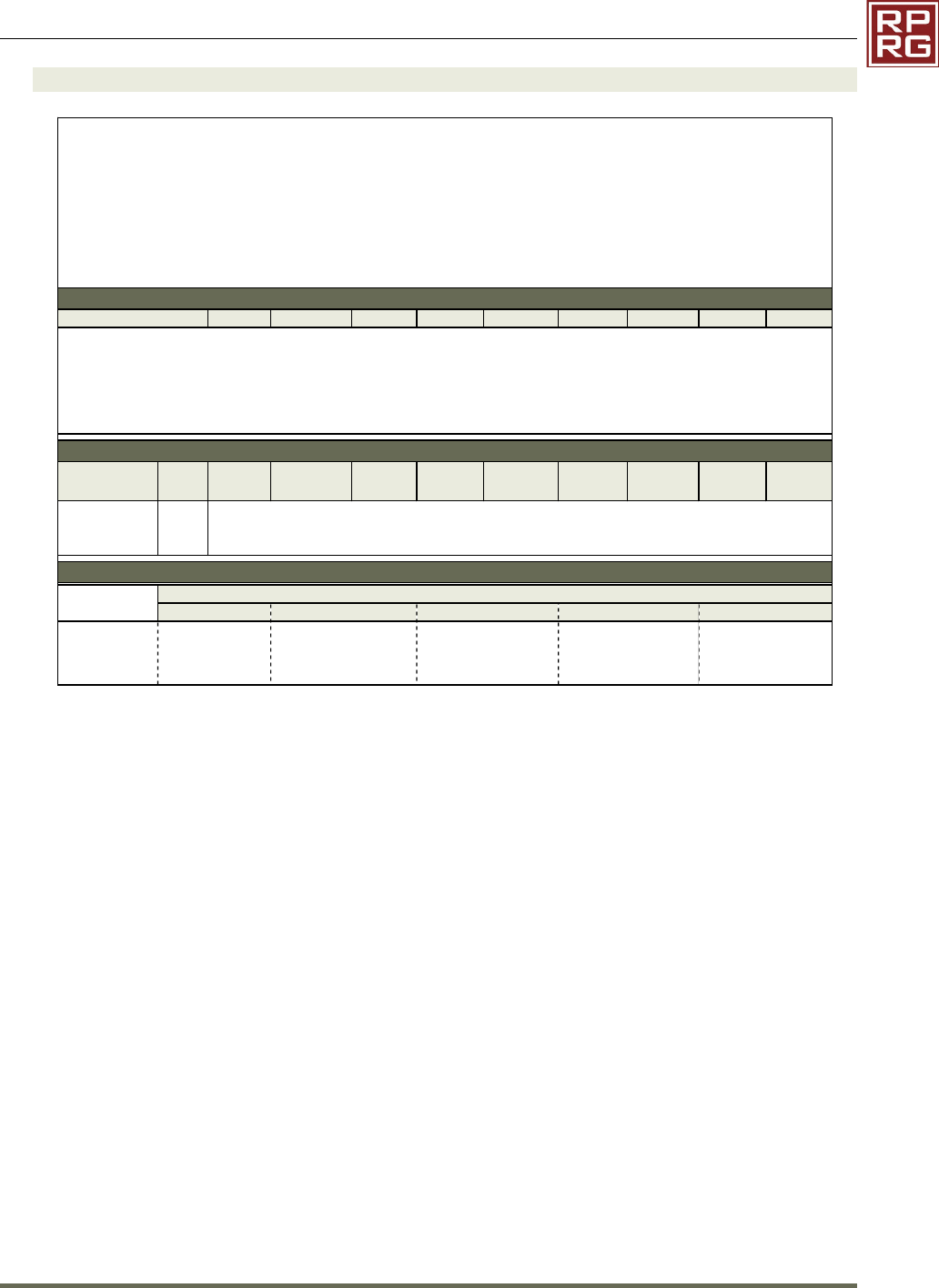

D. At-Place Employment .........................................................................................................................................35

1. Trends in Total At-Place Employment........................................................................................................35

2. At-Place Employment by Industry Sector...................................................................................................36

3. Major Employers ........................................................................................................................................37

4. Recent Economic Expansions and Contractions ........................................................................................38

E. Conclusions on Local Economics.........................................................................................................................38

8. PROJECT-SPECIFIC AFFORDABILITY & DEMAND ANALYSIS ............................................. 39

A. Affordability Analysis ..........................................................................................................................................39

1. Methodology..............................................................................................................................................39

2. Affordability Analysis .................................................................................................................................40

3. Conclusions of Affordability .......................................................................................................................42

B. Demand Estimates and Capture Rates ...............................................................................................................42

1. Methodology..............................................................................................................................................42

2. Demand Analysis........................................................................................................................................42

3. DCA Demand Conclusions ..........................................................................................................................43

9. COMPETITIVE RENTAL ANALYSIS................................................................................... 44

A. Introduction and Sources of Information ...........................................................................................................44

B. Overview of Market Area Housing Stock............................................................................................................44

C. Survey of General Occupancy Rental Communities ...........................................................................................46

1. Introduction to the Rental Housing Survey................................................................................................46

2. Location......................................................................................................................................................46

3. Size of Communities...................................................................................................................................47

4. Age of Communities...................................................................................................................................47

5. Structure Type............................................................................................................................................47

6. Vacancy Rates ............................................................................................................................................47

7. Rent Concessions .......................................................................................................................................47

8. Absorption History .....................................................................................................................................48

D. Analysis of Product Offerings .............................................................................................................................48

1. Payment of Utility Costs.............................................................................................................................48

2. Unit Features..............................................................................................................................................48

3. Community Amenities................................................................................................................................48

4. Unit Distribution.........................................................................................................................................49

5. Effective Rents ...........................................................................................................................................49

6. Scattered Site Rentals ................................................................................................................................50

7. DCA Average Market Rent .........................................................................................................................51

E. Multi-Family Pipeline..........................................................................................................................................52

F. Housing Authority Data ......................................................................................................................................52

G. Existing Low Income Rental Housing ..................................................................................................................53

H. Impact of Abandoned, Vacant, or Foreclosed Homes ........................................................................................54

10. FINDINGS AND CONCLUSIONS ................................................................................... 55

A. Key Findings ........................................................................................................................................................55

1. Site and Neighborhood Analysis ................................................................................................................55

2. Economic Context ......................................................................................................................................55

Farmington Hills III | Table of Contents

Page iii

3. Population and Household Trends.............................................................................................................56

4. Demographic Analysis................................................................................................................................56

5. Competitive Housing Analysis....................................................................................................................56

B. Product Evaluation .............................................................................................................................................57

C. Price Position ......................................................................................................................................................58

11. ABSORPTION AND STABILIZATION RATES .................................................................. 61

A. Absorption Estimate ...........................................................................................................................................61

B. Impact on Existing and Pipeline Rental Market..................................................................................................61

12. INTERVIEWS.............................................................................................................. 62

13. CONCLUSIONS AND RECOMMENDATIONS................................................................. 63

14. APPENDIX 1 UNDERLYING ASSUMPTIONS AND LIMITING CONDITIONS ..................... 64

15. APPENDIX 2 ANALYST CERTIFICATIONS ..................................................................... 66

16. APPENDIX 3 NCHMA CERTIFICATION ......................................................................... 67

17. APPENDIX 4 ANALYST RESUMES ............................................................................... 68

18. APPENDIX 5 DCA CHECKLIST ..................................................................................... 71

19. APPENDIX 6 RENTAL COMMUNITY PROFILES ............................................................. 76

TABLES, FIGURES AND MAPS

Table 1 Detailed Unit Mix and Rents, Farmington Hills III ..........................................................................................11

Table 2 Unit Features and Community Amenities ......................................................................................................11

Table 3 Key Facilities and Services..............................................................................................................................20

Table 4 Population and Household Projections..........................................................................................................26

Table 5 Persons per Household, Farmington Hills Market Area.................................................................................26

Table 6 Building Permits by Structure Type, Bi-County Market Area.........................................................................27

Table 7 Age Distribution .............................................................................................................................................27

Table 8 Households by Household Type......................................................................................................................28

Table 9 Households by Tenure, 2000-2020 .................................................................................................................29

Table 10 Households by Tenure, 2020-2022 ...............................................................................................................29

Table 11 Renter Households by Age of Householder ................................................................................................30

Table 12 Renter Households by Household Size .........................................................................................................30

Table 13 Household Income ........................................................................................................................................31

Table 14 Household Income by Tenure, Farmington Hills Market Area......................................................................31

Table 15 Rent Burdened and Substandard Housing, Farmington Hills Market Area...................................................32

Table 16 Labor Force and Unemployment Rates........................................................................................................34

Table 17 Commutation Data, Farmington Hills Market Area ......................................................................................34

Table 18 Major Employers, Barrow County................................................................................................................37

Table 19 Total and Renter Income Distribution, Farmington Hills Market Area ........................................................39

Table 20 LIHTC Income and Rent Limits, Atlanta-Sandy Springs-Roswell, GA HUD Metro FMR Area ......................40

Table 21 Affordability Analysis, Farmington Hills III ...................................................................................................41

Table 22 Overall Demand Estimates, Farmington Hills III..........................................................................................43

Table 23 Demand Estimates by Floor Plan, Farmington Hills III ................................................................................43

Table 24 Dwelling Units by Structure and Tenure ......................................................................................................45

Table 25 Dwelling Units by Year Built and Tenure......................................................................................................45

Table 26 Value of Owner Occupied Housing Stock......................................................................................................45

Table 27 Rental Summary, Surveyed Communities.....................................................................................................47

Table 28 Utility Arrangement and Unit Features.......................................................................................................48

Table 29 Community Amenities ..................................................................................................................................49

Table 30 Unit Distribution, Size, and Pricing................................................................................................................50

Table 31 Scattered Site Rentals, Farmington Hills Market Area..................................................................................51

Table 32 Average Rents ...............................................................................................................................................51

Table 33 Average Market Rent and Rent Advantage Summary .................................................................................52

Farmington Hills III | Table of Contents

Page iv

Table 34 Affordable Communities, Farmington Hills Market Area.............................................................................53

Table 35 Foreclosure Rate, ZIP Code 30680, May 2020 .............................................................................................54

Table 36 Recent Foreclosure Activity, ZIP Code 30680...............................................................................................54

Figure 1 Site Plan .........................................................................................................................................................10

Figure 2 Views of Subject Site......................................................................................................................................14

Figure 3 Satellite Image of Subject Site .......................................................................................................................15

Figure 4 Views of Surrounding Land Uses ...................................................................................................................16

Figure 5 Farmington Hills Market Area Households by Tenure 2000 to 2020...........................................................28

Figure 6 At-Place Employment, Barrow County .........................................................................................................35

Figure 7 Total Employment by Sector.........................................................................................................................36

Figure 8 Employment Change by Sector, 2011-2019..................................................................................................37

Figure 9 Price Position .................................................................................................................................................59

Map 1 Site Location ....................................................................................................................................................13

Map 2 Crime Index Map .............................................................................................................................................18

Map 3 Location of Key Facilities and Services ............................................................................................................21

Map 4 Farmington Hills Market Area .........................................................................................................................24

Map 5 Major Employers, Barrow County ....................................................................................................................38

Map 6 Surveyed Rental Communities ........................................................................................................................46

Map 7 Affordable Rental Communities ......................................................................................................................53

Farmington Hills III | Executive Summary

Page 1

1. EXECUTIVE SUMMARY

TBG Residential has retained Real Property Research Group, Inc. (RPRG) to conduct a comprehensive

market feasibility analysis of Farmington Hills III, the third phase of an affordable multi-family rental

community in Winder, Barrow County, Georgia. Farmington Hills III will be newly constructed and

financed in part with four percent Low Income Housing Tax Credits (LIHTC) allocated by the Georgia

Department of Community Affairs (DCA). Farmington Hills III will offer 180 LIHTC rental units targeting

households earning up to 40 percent, 60 percent, and 80 percent of the Area Median Income (AMI),

adjusted for household size.

1. Project Description

The subject site is on the north side of Haymon Morris Road, northeast of the second phase

of Farmington Hills, roughly six miles southwest of downtown Winder, Barrow County,

Georgia. . Farmington Hills III will offer 180 newly constructed general occupancy LIHTC rental

units targeting households earning up to 40 percent, 60 percent, and 80 percent of the Area

Median Income (AMI). The first two phases of Farmington Hills combine for 144 units and

were built in 2012-2014. The community is fully occupied with a waiting list of 8+ months.

Farmington Hills III will target very low to moderate income renter households with a unit mix

of 54 one-bedroom units (30 percent), 90 two-bedroom units (50 percent), and 36 three-

bedroom units (20 percent). Farmington Hills III’s one and two-bedroom units will primarily

target singles, couples (both young professionals and empty nesters), and roommates while

the three-bedroom units will primarily target larger households including those with children.

A detailed summary of the newly constructed subject property, including the rent and unit

configuration, is shown in the table below. Although Farmington Hills III will accept Housing

Choice Vouchers (HCV), it does not have project based rental assistance.

Farmington Hills III will offer a dishwasher, range/oven, refrigerator, microwave, ceiling fans,

and washer and dryer connections which is comparable to the surveyed LIHTC communities

including The Exchange which offers both LIHTC and market rate units. The subject property’s

Unit Mix/Rents

Type Bed Bath

Income

Target

#

Heated Sq.

Feet

Net

Rent

Utility

Allowance

Gross

Rent

LIHTC 1 1 40% 18 800 $515 $105 $620

LIHTC 1 1 60% 18 800 $820 $105 $925

LIHTC 1 1 80% 18 800 $969 $105 $1,074

Subtotal 54 30.0%

LIHTC 2 2 40% 30 1,000 $616 $129 $745

LIHTC 2 2 60% 30 1,000 $987 $129 $1,116

LIHTC 2 2 80% 30 1,000 $1,104 $129 $1,233

Subtotal 90 50.0%

LIHTC 3 2 40% 12 1,200 $697 $163 $860

LIHTC 3 2 60% 12 1,200 $1,122 $163 $1,285

LIHTC 3 2 80% 12 1,200 $1,387 $163 $1,550

Subtotal 36 20.0%

Total 57.8% 180

Rents include: trash removal Source: TBG Residential

Farmington Hills III | Executive Summary

Page 2

unit features will be superior to most of the market rate communities given only one of five

of these communities offer a microwave. The proposed unit features will be competitive in

the market among both LIHTC and market rate communities.

Farmington Hills III will offer a clubhouse/community room, fitness center, swimming pool,

playground, business/computer center, and laundry facilities which is comparable to the

existing LIHTC communities in the market area including The Exchange which offers the

highest-priced market rate units in the market area. The proposed amenities are far superior

to those at the older market rate communities, most of which offer no amenities. The

subject’s amenities will be competitive with the LIHTC communities and will result in a

competitive advantage compared to existing market rate communities in the market area.

2. Site Description / Evaluation

The subject site is a suitable location for affordable rental housing as it is compatible with surrounding

land uses and has access to amenities, services, employers, and transportation arteries.

The subject site is generally flat and is primarily cleared with wooded land along the perimeter

of the site; a single-family home is in the northern portion of the site and will be moved prior

to development.

The subject site is on the north side of Haymon Morris Road, adjacent to the second phase of

Farmington Hills. Surrounding land uses are compatible with affordable rental housing

including primarily well-maintained single-family detached homes and the first two phases of

the subject property. The subject’s designated schools are grouped within one mile to the

west of the site and a concentration of commercial uses including Barrow Crossing (shopping

destination) are within one mile to the east.

The overall Farmington Hills development has visibility from Haymon Morris Road. The first

two phases of the subject property are fully occupied indicating sufficient visibility. The site

is within one-half mile of State Highway 316/U.S. Highway 29 which connects the site to the

region including Athens to the east and the Atlanta Metro Area to the west. State Highway

81 is just east of the site and provides access to downtown Winder roughly five miles to the

north while Interstate 85 is within 15 miles north of the site and Interstate 20 is roughly 28

miles to the south.

The positive aspects of the site are proximity to traffic arteries, neighborhood services, and

convenient access to employment; RPRG did not identify any negative attributes.

Neighborhood amenities are convenient to the site including shopping, a convenience store,

a grocery store, a pharmacy, and schools within one mile while medical facilities and

additional shopping opportunities are within 2.5 miles. Barrow Crossing offers retailers

including Target, TJ Maxx, PetSmart, and Belk within one mile.

The subject site’s CrimeRisk is above the national average (100). This crime risk is comparable

to the crime risk of nearly all surveyed comparable communities in the market area.

Furthermore, the first two phases of the subject property are fully occupied with a waiting

list. Based on this data and field observations, we do not expect crime or the perception of

crime to negatively impact the subject property’s marketability.

The subject site is suitable for the proposed development. RPRG did not identify any negative

land uses that would affect the proposed development’s viability in the marketplace.

3. Market Area Definition

The Farmington Hills Market Area consists of census tracts in central Barrow County (including

all or portions of Winder, Bethlehem, and Auburn) and one tract in eastern Gwinnett County

Farmington Hills III | Executive Summary

Page 3

(including a portion of Dacula). The Farmington Hills Market Area focuses on the portions of

Barrow and Gwinnett Counties that are most comparable to the immediate area surrounding

the subject site and is focused on the State Highway 316/U.S. Highway 29 corridor. State

Highway 316 roughly bisects the market area from east to west while State Highway 11

connects the site to Winder to the north and several other state highways provide additional

connectivity. The Farmington Hills Market Area includes the most comparable multi-family

rental communities and residents of these areas would likely consider the subject site as an

acceptable shelter location. Residents along the State Highway 316 corridor would likely

consider the subject site for rental housing given convenient access to employment in the

region. The market area is bound to north and south by county lines and does not extend

further east due to distance. The tract in Gwinnett County is included due to convenient

access via State Highway 316.

The boundaries of the Farmington Hills Market Area and their approximate distance from the

subject site are Jackson County to the north (8.0 mile), Bowman Mill Road SE / Hog Mountain

Road to the east (7.0 miles), Walton County to the south (3.6 miles), and Alcovy River to the

west (9.1 miles).

4. Community Demographic Data

The Farmington Hills Market Area grew significantly from 2000 to 2010; growth slowed but

remained strong from 2010 to 2020. Growth is expected to remain strong over the next two

years.

The Farmington Hills Market Area added 21,967 net people (52.5 percent) and 6,757

households (45.8 percent) from 2000 to 2010; annual growth was 2,197 people (4.3 percent)

and 676 households (3.8 percent) over this period. Annual growth over the past 10 years was

1,718 people (2.4 percent) and 556 households (2.3 percent), reaching 80,988 people and

27,055 households in 2020.

Annual growth in the Farmington Hills Market Area is expected to remain strong from 2020

to 2022 at 1,736 people (2.1 percent) and 567 households (2.1 percent).

The median age of the Farmington Hills Market Area’s population is 35 years with Adults ages

35 to 61 representing the largest population age cohort in the market area at 35.6 percent

while 29.0 percent of the population are Children/Youth under 20 years old. Young Adults

ages 20 to 34 comprise 20.3 percent of the Farmington Hills Market Area’s population while

Seniors ages 62 and older account for 15.1 percent.

Approximately 82 percent of Farmington Hills Market Area households were multi-person

households including 45.0 percent of households with children. Single-person households

accounted for 17.9 percent of Farmington Hills Market Area households.

Roughly 23 percent of households in the Farmington Hills Market Area rent in 2020 compared

to 27.4 percent in the Bi-County Market Area. The market area added 2,878 net renter

households over the past 20 years accounting for 23.4 percent of net household growth. Esri

projects renter households to account for 19.0 percent of net household growth over the next

two years with the net addition of 215 renter households.

The Farmington Hills Market Area includes a range or renter households by size with 46.0

percent having one or two people, 34.9 percent having three or four people, and 19.0 percent

having five people.

The 2020 median household income in the Farmington Hills Market Area is $66,718 which is

similar to the $67,083 median in the Bi-County Market Area. RPRG estimates that the median

income of renter households in the Farmington Hills Market Area is $47,083. One-third of

Farmington Hills III | Executive Summary

Page 4

renter households in the Farmington Hills Market Area earn less than $35,000 including 22.7

percent earning less than $25,000 while 37.2 percent earn moderate incomes of $35,000 to

$74,999.

Foreclosures and abandoned homes are not expected to impact the demand for the subject

property or its ability to achieve and maintain stabilized occupancy.

5. Economic Data

Barrow County’s economy is performing well with job growth in seven of the past eight years and a

decreasing unemployment rate that is lower than the state rate.

The county’s unemployment rate dropped in each of the past nine years to a low 2.8 percent

in 2019 which is below both state (3.4 percent) and national (3.7 percent) rates. Barrow

County’s unemployment rate has been below the state rate since 2011.

Barrow County added jobs in seven of the past eight years with the net addition of 5,486 jobs

since 2012, roughly 2.7 times the jobs lost during the recession-era (2008-2011), reaching an

all-time high At-Place Employment in 2019. The county added an annual average of 804 jobs

over the past three years.

Trade-Transportation-Utilities is the largest sector in the county by far accounting for 32.9

percent of jobs compared to 18.6 percent of jobs nationally. The Government,

Manufacturing, Education-Health, and Leisure-Hospitality sectors each account for roughly

10-15 percent of the county’s jobs.

Commuting data suggests that the residents of the Farmington Hills Market Area work

throughout the region with more than half of workers employed outside their county of

residence.

RPRG did not identify any major job expansions or contractions in Barrow County over the

past two years.

Barrow County’s economy is performing well with job growth in seven of the past eight years

and a decreasing unemployment rate that is below state and national levels. These factors

will continue to have a positive impact on housing demand in the county. Available economic

data do not reflect the impact of the ongoing and evolving COVID-19 related business

closures. The county has had significant job growth since the previous national economic

downturn in the late 2000’s.

6. Project Specific Affordability and Demand Analysis:

Farmington Hills III will contain 180 LIHTC units reserved for households earning at or below

40 percent, 60 percent, or 80 percent of the Area Median Income (AMI).

The proposed units at 40 percent AMI will target renter householders earning from $21,257

to $35,760. The 60 proposed units at 40 percent AMI would need to capture 5.6 percent of

the 1,070 income-qualified renter households to lease-up.

The proposed units at 60 percent AMI will target renter householders earning from $31,714

to $53,640. The 60 proposed units at 60 percent AMI would need to capture 3.5 percent of

the 1,716 income-qualified renter households to lease-up.

The proposed units at 80 percent AMI will target renter householders earning from $36,823

to $71,520. The 60 proposed units at 80 percent AMI would need to capture 2.9 percent of

the 2,101 income-qualified renter households to lease-up.

Farmington Hills III | Executive Summary

Page 5

All affordability capture rates are acceptable indicating sufficient income-qualified

households will exist in the market area to support the proposed units at Farmington Hills III.

DCA demand capture rates for the subject property are 13.3 percent for the 40 percent AMI

units, 10.5 percent for the 60 percent AMI units, 6.8 percent for the 80 percent AMI units,

and the project’s overall capture rate is 14.7 percent. Farmington Hills III's capture rates by

floor plan within each income target range from 3.3 percent to 24.8 percent and the capture

rates by floor plan are 5.8 for all one-bedroom units, 13.5 percent for all two-bedroom units,

and 8.6 percent for all three-bedroom units.

All demand capture rates are well within acceptable levels indicating sufficient demand in the

market area to support the proposed subject property and the comparable pipeline DCA

community.

7. Competitive Rental Analysis

RPRG surveyed seven multi-family rental communities in the Farmington Hills Market Area including

two LIHTC communities. The rental market is performing well with limited vacancies including at LIHTC

communities.

The surveyed communities range in size from nine to 144 units and average 77 units. The

two LIHTC communities are the largest surveyed communities with 130 units (The

Exchange) and 144 units (Farmington Hills) while the market rate communities range from

nine to 102 units.

The surveyed communities have nine vacancies among 539 combined units for an

aggregate vacancy rate of 1.7 percent. Five of seven communities are fully occupied

including the first two phases of the subject property (Farmington Hills – LIHTC). The

remaining LIHTC community (The Exchange) has five vacancies among 130 units for a

vacancy rate of 3.8 percent.

The Exchange (mixed-income LIHTC community) opened in January 2018 and leased all

130 units by August 2018 for an average monthly absorption of 18.6 units.

Among the surveyed communities, net rents, unit sizes, and rents per square foot were

as follows:

o One-bedroom effective rents average $751 per month. The average one-

bedroom unit size is 801 square feet, resulting in a net rent per square foot of

$0.94.

o Two-bedroom effective rents average $845 per month. The average two-

bedroom unit size is 1,078 square feet, resulting in a net rent per square foot of

$0.78.

o Three-bedroom effective rents average $1,056 per month. The average three-

bedroom unit size is 1,318 square feet, resulting in a net rent per square foot of

$0.80.

Sixty percent AMI LIHTC rents at both LIHTC communities are among the existing market rate

rents in the market area and the market rate rents at The Exchange (mixed-income LIHTC

community) are the highest rents in the market area by a wide margin.

The “average market rent” is $970 for one-bedroom units, $1,105 for two-bedroom units,

and $1,450 for three-bedroom units. The proposed 40 percent AMI rents have rent

advantages of at least 79 percent and the proposed 60 percent AMI rents have rent

advantages of at least 12.0 percent. All proposed 80 percent AMI rents are below average

market rents. The project’s overall weighted average rent advantage is 35.4 percent.

Farmington Hills III | Executive Summary

Page 6

One comparable general occupancy LIHTC community was identified as proposed (River’s

Edge) in the Farmington Hills Market Area. River’s Edge recently applied for four percent

tax credits for 156 units targeting households earning up to 60 percent AMI just inside the

market area in the Dacula area. This community will be directly comparable to the subject

property. One age restricted LIHTC community (Wimberly Manor) received an allocation

of nine percent tax credits for 73 units in Winder but this community will not be

comparable to the subject property given a difference in age targeting.

8. Absorption/Stabilization Estimate

Based on the product to be constructed and the factors discussed through the report, we

expect Farmington Hills III units to lease-up at a rate of 18 units per month. At this rate, the

subject property will reach a stabilized occupancy of at least 93 percent within roughly nine

to 10 months.

Given the strong rental market in the Farmington Hills Market Area (including a waiting list at

the first phases of the subject property) and the projected renter household growth over the

next two years, we do not expect Farmington Hills III to have a negative impact on existing or

proposed rental communities in the Farmington Hills Market Area including those with tax

credits.

9. Overall Conclusion / Recommendation

Based on projected household growth trends, affordability and demand estimates, rental market

conditions, and socio-economic and demographic characteristics of the Farmington Hills Market Area,

RPRG believes that the subject property will be able to successfully reach and maintain a stabilized

occupancy of at least 93 percent following its entrance into the rental market; the first two phases of

the subject property are fully occupied with a waiting list. The subject property will be competitively

positioned with existing rental communities in the Farmington Hills Market Area and the units will be

well received by the target market.

This market study was completed based on the most recent available data, which does not reflect the

potential impact of the COVID-19 pandemic on demographic and economic trends as well as housing

demand. At this stage, we do not believe demand for affordable rental housing will be reduced in the

long term due to economic losses related to COVID-19. Demand for rental housing, especially

affordable housing, is projected to increase over the next several years.

We recommend proceeding with the project as planned.

DCA Summary Table:

Income/Unit Size Income Limits

Units

Proposed

Renter Income

Qualification %

Total

Demand

Large Household

Size Adjustment

(3+ Persons)

Adjusted

Demand

Supply

Net

Demand

Capture

Rate

Average

Market Rent

Market

Rents Band

Proposed

Rents

40% AMI $21,257 - $35,760

One Bedroom Units 18 6.6% 182 182 0 182 9.9% $970 $970 $515

Two Bedroom Units 30 4.4% 121 121 0 121 24.8% $1,105 $1,105 $616

Three Bedroom Units 12 6.7% 185 54.0% 100 0 100 12.0% $1,450 $1,450 $697

60% AMI $31,714 - $53,640

One Bedroom Units 18 9.8% 271 271 72 199 9.0% $970 $970 $820

Two Bedroom Units 30 8.8% 243 243 72 171 17.6% $1,105 $1,105 $987

Three Bedroom Units 12 10.5% 290 54.0% 157 12 145 8.3% $1,450 $1,450 $1,122

80% AMI $36,823 - $71,520

One Bedroom Units 18 20.0% 550 550 0 550 3.3% $970 $970 $969

Two Bedroom Units 30 16.9% 466 466 0 466 6.4% $1,105 $1,105 $1,104

Three Bedroom Units 12 12.1% 334 54.0% 180 0 180 6.7% $1,450 $1,450 $1,387

By Bedroom

One Bedroom Units 54 36.4% 1,003 1,003 72 931 5.8%

Two Bedroom Units 90 26.8% 738 738 72 666 13.5%

Three Bedroom Units 36 29.0% 800 54.0% 432 12 420 8.6%

Project Total $21,257 - $71,520

40% AMI $21,257 - $35,760 60 16.4% 452 0 452 13.3%

60% AMI $31,714 - $53,640 60 26.3% 725 156 569 10.5%

80% AMI $36,823 - $71,520 60 32.2% 887 0 887 6.8%

Total Units $21,257 - $71,520 180 50.1% 1,380 156 1,224 14.7%

Farmington Hills III | Executive Summary

Page 7

S

UMMARY

T

ABLE

:

Development Name:

Farmington Hills III

Apartments

Total # Units:

180

Location:

Haymon Morris Road

,

Winder

,

Barrow

County

, GA

#

LIHTC

Units:

180

PMA Boundary:

North: Jackson County, East: Bowman Mill Road SE / Hog Mountain Road, South: Walton

County

, W

est:

Alcovy River

Farthest Boundary Distance to

Subject:

9.1

miles

R

ENTAL

H

OUSING

S

TOCK

–

(found on pages 11, 47, 51-52)

Type # Properties Total Units Vacant Units Average

Occupancy

All Rental Housing

7

539

9

98.

3

%

Market

-

Rate Hous

ing

5

265

4

98.5

%

Assisted/Subsidized Housing not to

include LIHTC

LIHTC

2

274

5

9

8.2

%

Stabilized

Comps

7

5

39

9

98.3

%

Properties in construction & lease up

Subje

ct Development

Average

Market Rent

Highest Unadjusted

Comp Rent*

#

Units

#

Bedrooms

#

Baths

Size (SF)

Proposed

Tenant Rent

Per Unit Per SF Advantage Per Unit Per SF

18 1 1 800 $515 $970 $1.19 88.3% $970 $1.19

18

1

1

800

$

820

$

9

70

$

1

.

19

18.3

%

$

970

$

1

.

19

18

1

1

800

$

969

$

9

70

$

1

.

19

0.1

%

$

970

$

1.

19

30

2

2

1,000

$

616

$1,

105

$

1.00

79.4

%

$

1

,

105

$

1.

06

30 2 2 1,000 $987 $1,105 $1.00 12.0% $1,105 $1.06

30

2

2

1

,000

$

1,104

$1,

105

$

1.00

0.1

%

$

1,

105

$

1.

06

12

3

2

1,200

$

697

$1,

450

$

0.97

108.0

%

$

1,4

50

$

1.

09

1

2

3

2

1,200

$

1,122

$1,

450

$

0.97

29.2

%

$

1,4

50

$

1.

09

12

3

2

1,200

$

1,387

$1,

450

$

0.97

4.5

%

$

1,4

50

$

1.

09

NOTE: 70% or 80% unit designations are not allowed where 70% and 80% rents are at or above market rents.

C

APTURE

R

ATES

(

found

on

page

43

)

Targeted Population

4

0

%

AMI

60%

AMI

80% AMI

Ov

erall

Capture Rate

13.3% 10.5% 6.8% 14.7%

Farmington Hills III | Introduction

Page 8

2. INTRODUCTION

A. Overview of Subject

The subject of this report is Farmington Hills III, the third phase of an affordable multi-family rental

community in Winder, Barrow County, Georgia. Farmington Hills III will be newly constructed and

financed in part with four percent Low Income Housing Tax Credits (LIHTC) allocated by the Georgia

Department of Community Affairs (DCA). Farmington Hills III will offer 180 LIHTC rental units targeting

households earning up to 40 percent, 60 percent, and 80 percent of the Area Median Income (AMI),

adjusted for household size.

B. Purpose of Report

The purpose of this market study is to perform a market feasibility analysis through an examination

of the economic context, a demographic analysis of the defined market area, a competitive housing

analysis, a derivation of demand, and an affordability analysis.

C. Format of Report

The report format is comprehensive and conforms to DCA’s 2020 Market Study Manual. The market

study also considered the National Council of Housing Market Analysts’ (NCHMA) recommended

Model Content Standards and Market Study Index.

D. Client, Intended User, and Intended Use

The Client is TBG Residential (Developer). Along with the Client, the Intended Users are DCA, potential

lenders, and investors.

E. Applicable Requirements

This market study is intended to conform to the requirements of the following:

DCA’s 2020 Market Study Manual and Qualified Allocation Plan (QAP).

The National Council of Housing Market Analysts’ (NCHMA) Recommended Model Content.

F. Scope of Work

To determine the appropriate scope of work for the assignment, we considered the intended use of

the market study, the needs of the user, the complexity of the property, and other pertinent factors.

Our concluded scope of work is described below:

Please refer to Appendix 5 for a detailed list of DCA requirements as well as the corresponding

pages of requirements within the report.

Connor Hild (Research Associate) conducted a site visit on July 14, 2020. Tad Scepaniak

(Managing Partner) visited the site for a prior market study.

Primary information gathered through field and phone interviews was used throughout the

various sections of this report. The interviewees included rental community property

managers, Lydia Skeppstrom with the Winder Planning Department, Dan Shultz with the

Barrow County Planning and Community Development Department, Susan Owen with the

Gwinnett County Planning Department, Michelle Yawn with the Winder Housing Authority,

and staff with the City of Dacula.

Farmington Hills III | Introduction

Page 9

All pertinent information obtained was incorporated in the appropriate section(s) of this

report.

G. Report Limitations

The conclusions reached in a market assessment are inherently subjective and should not be relied

upon as a determinative predictor of results that will occur in the marketplace. There can be no

assurance that the estimates made or assumptions employed in preparing this report will in fact be

realized or that other methods or assumptions might not be appropriate. The conclusions expressed

in this report are as of the date of this report, and an analysis conducted as of another date may

require different conclusions. The actual results achieved will depend on a variety of factors, including

the performance of management, the impact of changes in general and local economic conditions,

and the absence of material changes in the regulatory or competitive environment. Reference is

made to the statement of Underlying Assumptions and Limiting Conditions contained in Appendix I of

this report.

Farmington Hills III | Project Description

Page 10

3. PROJECT DESCRIPTION

A. Project Overview

Farmington Hills III will border the existing Farmington Hills apartment community to the north, just

south of U.S. Highway 29 (University Parkway) and roughly six miles southwest of downtown Winder,

Barrow County. The overall Farmington Hills apartment development is on the north side of Haymon

Morris Road within one-quarter mile west of Carl-Bethlehem Road. Farmington Hills III will offer 180

newly constructed general occupancy LIHTC rental units targeting households earning up to 40

percent, 60 percent, and 80 percent of the Area Median Income (AMI). The first two phases of

Farmington Hills combine for 144 units and were built in 2012-2014. The community is fully occupied

with a waiting list of 8+ months.

B. Project Type and Target Market

Farmington Hills III will target very low to moderate income renter households with a unit mix of 54

one-bedroom units (30 percent), 90 two-bedroom units (50 percent), and 36 three-bedroom units (20

percent). Farmington Hills III’s one and two-bedroom units will primarily target singles, couples (both

young professionals and empty nesters), and roommates while the three-bedroom units will primarily

target larger households including those with children.

C. Building Types and Placement

Farmington Hills III’s 180 rental units will be contained within 11 garden-style buildings with two or

three stories and a mixture of brick and HardiPlank siding exteriors (Figure 1). The community will be

accessible via the existing Farmington Hill entrance on Haymon Morris Road with an alternate

entrance to the east on the same road. The community access road will form a loop with the

residential buildings along the road and surface parking adjacent to each building; a smaller loop will

be in the northern portion of the site. Community amenities will be in the southern portion of the

site near the two entrances.

Figure 1 Site Plan

Source: TBG Residential

Farmington Hills III | Project Description

Page 11

D. Detailed Project Description

1. Project Description

Farmington Hills III will offer 54 one-bedroom units, 90 two-bedroom units, and 36 three-bedroom

units. Sixty units will target households earning up 40 percent of the Area Median Income (AMI), 60

units will target 60 percent AMI, and 60 units will target 80 percent AMI (Table 1).

One-bedroom units will have one bathroom and 800 square feet.

Two-bedroom units will have two bathrooms and 1,000 square feet.

Three-bedroom units will have two bathrooms and 1,200 square feet.

The proposed rents will include the cost of trash removal. Tenants will bear the cost of all

other utilities.

Proposed unit features and community amenities are detailed in Table 2.

Table 1 Detailed Unit Mix and Rents, Farmington Hills III

Table 2 Unit Features and Community Amenities

Unit Features

Community Amenities

Kitchens with stove/oven, refrigerator,

dishwasher, and microwave.

Washer and dryer connections.

Ceiling fans.

Window blinds.

Central heating and air-conditioning.

Clubhouse/community room.

Fitness center.

Swimming pool.

Playground.

Picnic Pavilion.

Computer room.

Laundry facilities.

Unit Mix/Rents

Type Bed Bath

Income

Target

#

Heated Sq.

Feet

Net

Rent

Utility

Allowance

Gross

Rent

LIHTC 1 1 40% 18 800 $515 $105 $620

LIHTC 1 1 60% 18 800 $820 $105 $925

LIHTC 1 1 80% 18 800 $969 $105 $1,074

Subtotal 54 30.0%

LIHTC 2 2 40% 30 1,000 $616 $129 $745

LIHTC 2 2 60% 30 1,000 $987 $129 $1,116

LIHTC 2 2 80% 30 1,000 $1,104 $129 $1,233

Subtotal 90 50.0%

LIHTC 3 2 40% 12 1,200 $697 $163 $860

LIHTC 3 2 60% 12 1,200 $1,122 $163 $1,285

LIHTC 3 2 80% 12 1,200 $1,387 $163 $1,550

Subtotal 36 20.0%

Total 57.8% 180

Rents include: trash removal Source: TBG Residential

Farmington Hills III | Project Description

Page 12

2. Other Proposed Uses

None.

3. Proposed Timing of Development

Farmington Hills III is expected to begin construction in February 2021 with first move-ins and

construction completion in June 2022. The subject property’s anticipated placed-in-service year is

2022 for the purposes of this report.

Farmington Hills III | Site Evaluation

Page 13

4. SITE EVALUATION

A. Site Analysis

1. Site Location

The subject site is on the north side of Haymon Morris Road, northeast of second phase of Farmington

Hills, roughly six miles southwest of downtown Winder, Barrow County (Map 1). The site is within

one-half mile south of State Highway 316 (University Highway) which is a major traffic artery in the

region.

Map 1 Site Location

Farmington Hills III | Site Evaluation

Page 14

2. Existing and Proposed Uses

The subject site is generally flat and is

primarily cleared with wooded land along

the perimeter of the site; a single-family

home is in the northern portion of the site

and will be moved prior to development

(Figure 2). Farmington Hills III will offer 180

general occupancy apartments.

Figure 2 Views of Subject Site

Site facing northeast from the current terminus of

Farmington Hills’s access road.

Site facing south.

Site facing northeast.

Site facing east.

Northern portion of the site facing west.

Farmington Hills III | Site Evaluation

Page 15

3. General Description of Land Uses Surrounding the Subject Site

The subject site is in a residential neighborhood just south of State Highway 316, a major traffic artery

in the region. Well-maintained single-family detached homes are to the south and west while the first

two phases of Farmington Hills Apartments border the site to the south and southwest (Figure 3).

Tracts of undeveloped land are common within one-half mile of the site especially to the north and

east. The Home Depot and several other commercial uses are within one-half mile southeast of the

site while Apalachee High School, Haymon-Morris Middle School, and Yargo Elementary School are

roughly one mile to the west. A small pocket of light industrial uses is north of State Highway 316

along Tucker Road.

Figure 3 Satellite Image of Subject Site

Farmington Hills III | Site Evaluation

Page 16

4. Land Uses Surrounding the Subject Site

Nearby land uses surrounding the subject

site include (Figure 4):

North: Single-family detached homes and

State Highway 316.

East: Undeveloped land and The Home

Depot.

South: Farmington Hills Phase II and single-

family detached homes.

West: Undeveloped land and single-family

detached homes.

Figure 4 Views of Surrounding Land Uses

Apalachee High School to the west.

Ashbrook neighborhood to the south.

The Home Depot to the east.

Haymon Estates neighborhood to the west.

Farmington Hills Apartments to the south.

Farmington Hills III | Site Evaluation

Page 17

B. Neighborhood Analysis

1. General Description of Neighborhood

The site’s neighborhood is primarily residential with well-maintained single-family detached homes

the most common land use within several miles of the site. The two newest multi-family rental

communities in the region (Farmington Hills and The Exchange) are within three miles of the site with

the first two phases of Farmington Hills adjacent to the site. A concentration of commercial uses is

along the State Highway 316 corridor to the east including much of the newest development in the

area. Barrow Crossing which includes Publix, Belk, T.J. Maxx, Kirkland’s, Five Below, and many other

smaller retailers is roughly two miles east of the site on Carl-Bethlehem Road while much of the

newest development in the area (including The Exchange Apartments (LIHTC), medical facilities, a

hotel, and several restaurants) are on the north side of State Highway 316 along Exchange Boulevard

within three miles east of the site.

2. Neighborhood Planning Activities

RPRG did not identify significant planning or redevelopment efforts in the subject site’s immediate

area. Several new for-sale single-family detached home neighborhoods are under construction within

three miles of the site with homes generally priced in the $200,000’s.

3. Public Safety

CrimeRisk is a census tract level index that measures the relative risk of crime compared to a national

average. AGS analyzes known socio-economic indicators for local jurisdictions that report crime

statistics to the FBI under the Uniform Crime Reports (UCR) program. An index of 100 reflects a total

crime risk on par with the national average, with values below 100 reflecting below average risk and

values above 100 reflecting above average risk. Based on detailed modeling of these relationships,

CrimeRisk provides a detailed view of the risk of total crime as well as specific crime types at the

census tract level. In accordance with the reporting procedures used in the UCR reports, aggregate

indexes have been prepared for personal and property crimes separately as well as a total

index. However, it must be recognized that these are un-weighted indexes, in that a murder is

weighted no more heavily than purse snatching in this computation. The analysis provides a useful

measure of the relative overall crime risk in an area but should be used in conjunction with other

measures.

The 2019 CrimeRisk Index for the census tracts in the general vicinity of the subject site are color

coded with the site’s census tract being green, indicating a crime risk (100 to 199) above the national

average (100) (Map 2). This crime risk is comparable to the crime risk of nearly all surveyed

comparable communities in the market area. Furthermore, the first two phases of the subject

property are fully occupied with a waiting list. Based on this data and field observations, we do not

expect crime or the perception of crime to negatively impact the subject property’s marketability.

Farmington Hills III | Site Evaluation

Page 18

Map 2 Crime Index Map

C. Site Visibility and Accessibility

1. Visibility

The overall Farmington Hills development has visibility from Haymon Morris Road which has light to

moderate traffic. The first two phases of the subject property are fully occupied with a waiting list

illustrating sufficient visibility.

2. Vehicular Access

Farmington Hills III will share an entrance with the first two phases of the subject property to the

southwest on Haymon Morris Road with a secondary entrance in the southeast portion of the site.

Haymon Morris Road has light to moderate traffic with sufficient breaks in traffic; RPRG does not

anticipate problems with accessibility. Haymon Morris Road connects to Carl-Bethlehem Road one-

tenth mile to the east which provides access to State Highway 316 within one-half mile north of the

proposed entrance.

Farmington Hills III | Site Evaluation

Page 19

3. Availability of Public Transit

Barrow County does not offer public transportation.

4. Availability of Inter-Regional Transit

From a regional perspective, the site is within one-half mile of State Highway 316/U.S. Highway 29

which connects to Athens roughly 25 miles to the east and Interstate 85 roughly 20 miles to the west.

Access to Interstate 85 is also within 13 miles north of the site via State Highway 211 while Interstate

20 is roughly 26 miles to the south via State Highway 11. Additional state and U.S. highways are within

five miles of the site and Interstate 285 is roughly 30 miles to the west. These major thoroughfares

connect the site to the region including Athens and the Atlanta Metro Area. Hartsfield-Jackson

International Airport is roughly 52 miles southwest of the subject site in Atlanta.

5. Accessibility Improvements under Construction and Planned

Roadway Improvements under Construction and Planned

RPRG reviewed information from local stakeholders to assess whether any capital improvement

projects affecting road, transit, or pedestrian access to the subject site are currently underway or

likely to commence within the next few years. Observations made during the site visit contributed to

the process. Improvements along State Route 316 are ongoing that will transition the highway into a

freeway-style corridor which is expected to improve traffic flow and reduce the number of accidents.

State Route 316/U.S. Highway 29 is roughly one-half mile north of the site. The improvements extend

from Gwinnett County to Oconee County and are expected to be completed by 2027

Transit and Other Improvements under Construction and/or Planned

None.

6. Environmental Concerns

RPRG did not identify any visible environmental site concerns.

D. Residential Support Network

1. Key Facilities and Services near the Subject Site

The appeal of any given community is often based in part to its proximity to those facilities and

services required daily. Key facilities and services and their distances from the subject site are listed

in Table 3 and their locations are plotted on Map 3.

Farmington Hills III | Site Evaluation

Page 20

Table 3 Key Facilities and Services

2. Essential Services

Health Care

Northeast Georgia Medical Center Barrow is the closest major medical center at 6.2 miles northwest

of the site near downtown Winder. This 56-bed hospital offers services including emergency

medicine, surgery, imaging, stroke care, orthopedics, heart and vascular, and general medicine.

Piedmont Physicians and Northeast Georgia Physicians Group offer family medicine services within

2.5 miles east of the site along Exchange Boulevard.

Education

The Barrow County School System serves the site and has 16 learning sites with an enrollment of

roughly 14,400 students. School age children residing at the subject property will attend Yargo

Elementary School (1.0 mile), Haymon-Morris Middle School (1.0 mile), and Apalachee High School

(0.8 mile).

The University of Georgia with an enrollment of nearly 40,000 students is roughly 26 miles east of the

site via U.S. Highway 29 while the Atlanta Metro Area is home to many colleges and universities within

30 miles of west and southwest of the site.

Establishment Type Address City

Driving

Distance

Exxon Convenience Store 925 Loganville Hwy. Bethlehem 0.7 mile

Publix Grocery 916 Loganville Hwy. Bethlehem 0.8 mile

Target General Retail / Grocery 916 Loganville Hwy. Bethlehem 0.8 mile

Barrow Crossing Shopping 916 Loganville Hwy. Bethlehem 0.8 mile

CVS Pharmacy 916 Loganville Hwy. Bethlehem 0.8 mile

Apalachee High School Public School 851 Haymon Morris Rd. Winder 0.8 mile

Yargo Elementary School Public School 1000 Haymon Morris Rd. Winder 1 mile

Haymon-Morris Middle School Public School 1008 Haymon Morris Rd. Winder 1 mile

BP Convenience Store 830 Loganville Hwy. Bethlehem 1.2 miles

Piedmont Physicians Doctor/Medical 340 Exchange Blvd Bethlehem 1.7 miles

Barrow County Fire Department Fire 1036 Carl-Bethlehem Rd. Winder 1.8 miles

Dollar General General Retail 1257 Loiganville Hwy. Bethlehem 1.9 miles

Northeast Georgia Physicians Group Doctor/Medical 726 Exchange Blvd. Bethlehem 2.5 miles

United States Postal Service Post Office 820 Christmas Ave. Bethlehem 3.7 miles

BB&T Bank 43 S Broad St. Winder 4.6 miles

Wells Fargo Bank 25 E May St. Winder 5 miles

Winder Police Department Police 25 E Midland Ave. Winder 5 miles

Winder Public Library Library 189 Bellview St. Winder 5.8 miles

NGMC Barrow Hospital 316 N Broad St. Winder 6.2 miles

Source: Field and Internet Research, RPRG, Inc.

Farmington Hills III | Site Evaluation

Page 21

Map 3 Location of Key Facilities and Services

3. Commercial Goods and Services

Convenience Goods

The term “convenience goods” refers to inexpensive, nondurable items that households purchase on

a frequent basis and for which they generally do not comparison shop. Examples of convenience

goods are groceries, fast food, health and beauty aids, household cleaning products, newspapers, and

gasoline.

A convenience store (Exxon), a grocery store (Publix), Target (grocery), and a pharmacy are within one

mile of the site at or near Barrow Crossing (shopping destination) on Carl-Bethlehem Road. An

additional convenience store (BP) is 1.2 miles from the site on Loganville Highway while two banks

(BB&T and Wells Fargo) are roughly five miles to the northeast near downtown Winder.

Farmington Hills III | Site Evaluation

Page 22

Shoppers Goods

The term “shoppers goods” refers to larger ticket merchandise that households purchase on an

infrequent basis and for which they usually comparison shop.

Barrow Crossing is an outdoor shopping destination less than one mile east of the site and includes

Target, Publix, Hibbett Sports, PetSmart, Belk, TJ Maxx, Kirkland’s, Famous Footwear, Five Below, and

many smaller retailers. The Home Depot is roughly one-half mile east of the site on Carl-Bethlehem

Road.

4. Location of Low Income Housing

A list and map of existing low-income housing in the Farmington Hills Market Area are provided in the

Existing Low Income Rental Housing section of this report, starting on page 53.

E. Site Conclusion

The subject site is in a growing exurban neighborhood with convenient access to State Highway

316/U.S. Highway 29 which is one of the region’s primary thoroughfares connecting the site to

employment. The site is within one mile of neighborhood amenities at Barrow Crossing including

shopping, a grocery store, a pharmacy, a convenience store, and restaurants. Residential uses are the

most common land use within three miles of the site including the two newest multi-family rental

communities in Barrow County (The Exchange and Farmington), both LIHTC communities. The site

will appeal to households living and working throughout the region.

Farmington Hills III | Market Area

Page 23

5. MARKET AREA

A. Introduction

The primary market area for Farmington Hills III is defined as the geographic area from which future

residents of the community would primarily be drawn and in which competitive rental housing

alternatives are located. In defining the market area, RPRG sought to accommodate the joint interests

of conservatively estimating housing demand and reflecting the realities and dynamics of the local

rental housing marketplace.

B. Delineation of Market Area

The Farmington Hills Market Area consists of census tracts in central Barrow County (including all or

portions of Winder, Bethlehem, and Auburn) and one tract in eastern Gwinnett County (including a

portion of Dacula) (Map 4). The Farmington Hills Market Area focuses on the portions of Barrow and

Gwinnett Counties that are most comparable to the immediate area surrounding the subject site and

is focused on the State Highway 316/U.S. Highway 29 corridor. State Highway 316 roughly bisects the

market area from east to west while State Highway 11 connects the site to Winder to the north and

several other state highways provide additional connectivity. The Farmington Hills Market Area

includes the most comparable multi-family rental communities and residents of these areas would

likely consider the subject site as an acceptable shelter location. Residents along the State Highway

316 corridor would likely consider the subject site for rental housing given convenient access to

employment in the region. The market area is bound to north and south by county lines and does not

extend further east due to distance. The tract in Gwinnett County is included due to convenient access

via State Highway 316.

The boundaries of the Farmington Hills Market Area and their approximate distance from the subject

site are:

North: Jackson County ................................................................................ (8.0 miles)

East: Bowman Mill Road SE / Hog Mountain Road .................................. (7.0 miles)

South: Walton County ....................................................................... (3.6 miles)

West: Alcovy River .................................................................................... (9.1 miles)

The Farmington Hills Market Area is compared to a Bi-County Market Area comprising Barrow and

Walton counties, which is presented as a secondary market area for demographic purposes. Demand

estimates are based only on the Farmington Hills Market Area.

Farmington Hills III | Market Area

Page 24

Map 4 Farmington Hills Market Area

Farmington Hills III | Community Demographic Data

Page 25

6. COMMUNITY DEMOGRAPHIC DATA

A. Introduction and Methodology

RPRG analyzed recent trends in population and households in the Farmington Hills Market Area and

Bi-County Market Area using several sources. For small area estimates, we examined projections of

population and households prepared by Esri, a national data vendor. We compared and evaluated

data in the context of decennial U.S. Census data from 2000 and 2010 as well as building permit trend

information. Demographic data is presented for 2010, 2020, and 2022 per DCA’s 2020 Market Study

Guide.

Esri recently released estimates and projections for 2020 and 2025. Although we believe it is too early

to quantity the impacts of the pandemic definitively, the most likely changes will be slower household

growth in at least the short term, a high propensity to rent, and likely a decrease in income. The

demographic projections have not been altered, but RPRG will discuss the impact of these potential