FASB's Simplification

Initiative and New GAAP

Changes

7 CPE Hours

PDH Academy

PO Box 449

Pewaukee, WI 53072

www.pdhacademy.com

888-564-9098

IMPORTANT NOTE: In order to search this doucment, you can use the CTRL+F to locate

key terms. You just need to hold down the control key and tap f on your keyboard. When

the dialogue box appears, type the term that you want to find and

tap your Enter key.

2

FASB'S Simplification Initiative and New GAAP Changes

Table of Contents

Chapter 1: FASB'S Simplification Initiative

Background

ASU 2015-03: Interest—Imputation of Interest (Subtopic 835-30) Simplifying the Presentation of Debt

Issuance Costs

Objective

Background

Definitions

Rules

Presentation – ASU 2015-03:

Implementation of ASU 2015-03

ASU 2015-15: Interest—Imputation of Interest (Subtopic 835-30) Presentation and Subsequent

Measurement of Debt Issuance Costs Associated with Line-of-Credit Arrangements

Objective

Background

Rules

REVIEW QUESTIONS

SUGGESTED SOLUTIONS

ASU 2015-04: Compensation—Retirement Benefits (Topic 715) Practical Expedient for the

Measurement Date of an Employer’s Defined Benefit Obligation and Plan Assets

Objective

Background

Scope

Rules

Disclosures

Transition

ASU 2015-05: Intangibles—Goodwill and Other Internal-Use Software (Subtopic 350-40) Customer’s

Accounting for Fees Paid in a Cloud Computing Arrangement

Objective

Background

Definitions

Rules

Transition

REVIEW QUESTIONS

SUGGESTED SOLUTIONS

Glossary

Chapter 2: Significant GAAP Changes in 2016 and Beyond

FASB Starts Up Financial Performance Reporting Project

REVIEW QUESTIONS

SUGGESTED SOLUTIONS

The Gradual Demise of Company Pension Plans

REVIEW QUESTIONS

SUGGESTED SOLUTIONS

International Accounting Standards Convergence

3

FASB issues ASU 2016-01: Financial Instruments—Overall

REVIEW QUESTIONS

SUGGESTED SOLUTIONS

FASB Issues New Lease Standard – ASU 2016-02

REVIEW QUESTIONS

SUGGESTED SOLUTIONS

Big GAAP – Little GAAP

Going Concern Assessment by Management – ASU 2014-15

Sustainability Standards – a Hot Issue

REVIEW QUESTIONS

SUGGESTED SOLUTIONS

Deferred Income Taxes and Other Tax Matters

Accounting, Auditing and Tax Issues Related to Marijuana

REVIEW QUESTIONS

SUGGESTED SOLUTIONS

Glossary

Final Exam

4

Field of study:

Accounting

Level of knowledge:

Overview

Prerequisite:

Basic understanding of U.S. GAAP

Advanced Preparation:

None

Recommended CPE hours:

7

Course qualification:

Qualifies for both NASB QAS and Registry CPE

credit based on a 50-minute per CPE hour

measurement

CPE sponsor information:

NASBA Registry Sponsor Number: 138298

5

LEARNING ASSIGNMENTS and OBJECTIVES

As a result of studying this assignment, you should be able to meet the objectives listed below.

1. Review the materials.

2. Study the Review Questions and Suggested Solutions from the course

3. Answer the Review Questions and compare your answers to the Suggested Solutions

After reading Chapter 1 FASB'S Simplification Initiative, you will be able to:

Recognize how to amortize debt issuance costs under ASU 2015-03

Recall selected items that must be disclosed under ASU 2015-03

Identify how to implement ASU 2015-03 with respect to debt issuance costs

Recognize an example of a cloud computing arrangement

Recall how to account for internal-use software

Identify criteria that must be met to treat software as internal-use software

After reading Chapter 2 Significant GAAP Changes in 2016 and Beyond, you will be able

to:

Recognize some of the implications that might occur if there is a drastic change in the format

of financial statements

Identify a reason why U.S. convergence with international standards has not occurred

Recognize a financial statement element that is eliminated by ASU 2016-01

Identify a key change made by the lease standard

Recall how to recognize a lease liability under the lease standard

Identify how a lease asset is recognized under the lease standard

Recognize how existing leases are accounted for under the lease standard

Identify one of the challenges a company may have with using the AICPA’s FRF for SMEs

Recognize a key difference IFRS and IFRS for SMEs

Identify the period of time for which an entity’s management must perform its evaluation of

going concern under ASU 2014-15

Recognize how a nonpublic entity with no uncertain tax positions liability should handle the

disclosure of the number of years open for examination

6

Chapter 1: FASB'S Simplification Initiative

I. Background

In 2014, the FASB added to its agenda a project to simplify many of the existing accounting

standards. The project, referred to as the Simplification Initiative, represents a narrowly focused

initiative to simplify and improve accounting standards by issuing a series of new accounting

standards. A – a

According to the FASB, the intent is to improve or maintain the usefulness of the information

that is reported to third parties while also reducing the cost and complexity of applying the

standards.

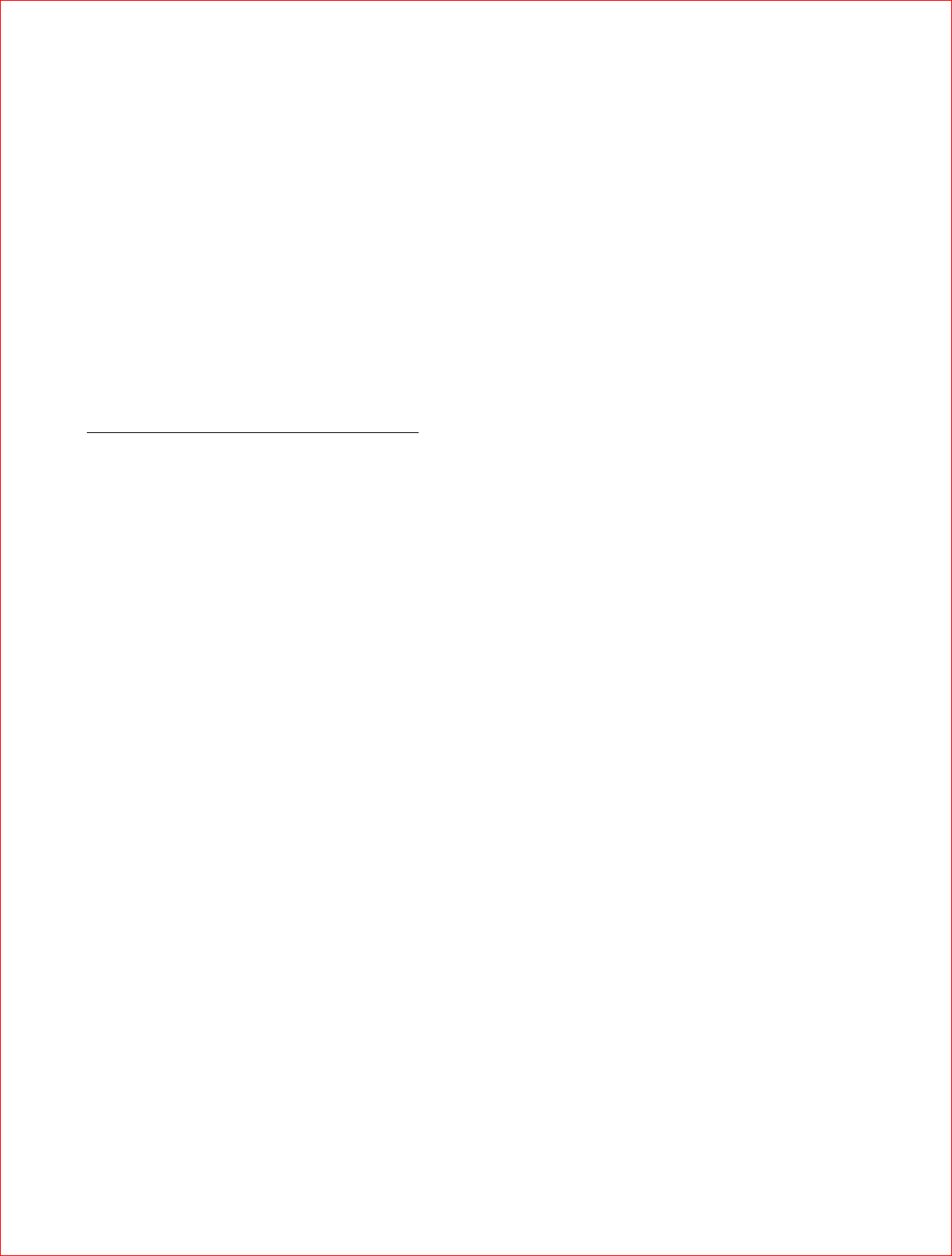

To date, the scope of the projects found in the Simplification Initiative follows:

Status of Projects Under FASB's Simplification Initiative

Project

Description

Status

Development stage

entities

Removes the requirement for

specific disclosures related to a

development stage entity.

Completed in June 2014 with issuance

of ASU 2014-10, Development Stage

Entities (Topic 915): Elimination of

Certain Financial Reporting

Requirements, Including an

Amendments to Variable Interest

Entities Guidance in Topic 810,

Consolidation

Extraordinary items

Eliminates the presentation of

extraordinary items in GAAP.

Completed in January 2016 with

issuance of ASU 2015-01, Income

Statement- Extraordinary and Unusual

Items (Subtopic 225-20) Simplifying

Income Statement Presentation by

Eliminating the Concept of

Extraordinary Items

Simplification of

measurement of

inventory

Simplifies the measurement of

inventory.

Inventory is measured at the

lower of cost and net realizable

value (estimated selling price

less reasonably costs of

completion, disposal and

transportation).

The requirement to consider

replacement cost and lower of

cost or market is eliminated for

Completed in July 2015 with the

issuance of ASU 2015-11: Inventory

(Topic 330) Simplifying the

Measurement of Inventory

7

FIFO and average cost

inventories.

Presentation of debt

issuance costs

Requires debt issuance costs to

be presented on the balance

sheet as a reduction of the debt

balance and not as an asset.

Completed in April 2015 with issuance

of ASU 2015-03, Interest- Imputation

of Interest (Subtopic 835-30):

Simplifying the Presentation of Debt

Issuance Costs

Fees paid in a cloud

computing arrangement

Clarifies whether fees paid in a

cloud computing arrangement

represent a software license or a

service contract.

Completed in April 2015 with issuance

of ASU 2015-05, Intangibles-

Goodwill and Other- Internal-Use

Software (Subtopic 350-40):

Customer’s Accounting for Fees Paid

in a Cloud Computing Arrangement

Measurement date of

defined benefit pension

plan assets

Aligns the measurement date of

defined benefit plan assets with

the date that valuation

information is provided by third-

party service provides.

Permits the entity to measure

defined benefit plan assets and

obligations using the month-end

that is closest to the entity’s

fiscal year-end and apply that

method consistently from year to

year and to all plans if an entity

has more than one plan.

Completed in April 2015 with issuance

of ASU 2015-04, Compensation-

Retirement Benefits (Topic 715):

Practical Expedient for the

Measurement Date of an Employer’s

Defined Benefit Obligation and Plan

Assets

Accounting for income

taxes

Balance Sheet Classification of

Deferred Taxes: Classifies all

deferred tax assets and liabilities

as noncurrent on the balance

sheet.

Completed in November 2015 with the

issuance of ASU 2015-17- Income

Taxes (Topic 740) Balance Sheet

Classification of Deferred Taxes

Business combinations

Requires that an acquirer

recognize adjustments to

provisional amounts that are

identified during the

measurement period in the

reporting period in which the

adjustment amounts are

determined.

Requires that the acquirer

record, in the same period’s

financial statements, the effect

on earnings of changes in

depreciation, amortization, or

other income effects, if any, as a

result of the change to the

Completed in September 2015 with the

issuance of ASU. 2015-Business

Combinations (Topic 805) Simplifying

the Accounting for Measurement-

Period Adjustments

8

provisional amounts, calculated

as if the accounting had been

completed at the acquisition

date.

Balance sheet

classification of debt

Would simplifies the

presentation of debt on the

balance sheet as current or long-

term based on the contractual

terms of the debt arrangement

and an organization's current

compliance with debt covenants

Pending

Accounting for income

taxes

Intra-Entity Asset Transfers:

Would eliminate the prohibition

on the recognition of income

taxes for transfers of assets from

one jurisdiction to another.

Pending

Stock-based

compensation

Would make some narrow

simplifications and

improvements to the accounting

for stock compensation to

employees.

Pending

Equity method

Would eliminate the requirement

that an entity account for the

difference between the cost of an

investment and the amount of

the underlying equity in net

assets of an investor as if the

investee were a consolidated

subsidiary and related

disclosures.

Would eliminate the requirement

that an entity retroactively adopt

the equity method if an

investment that was previously

accounted for on a method other

than equity method becomes

qualified to use the equity

method due to an increase in the

percentage ownership.

Pending

9

ASU 2015-03: Interest—Imputation of Interest (Subtopic 835-30)

Simplifying the Presentation of Debt Issuance Costs

Issued: April 2015

Effective date: ASU 2015-03 is effective as follows:

1. For public business entities, for financial statements issued for fiscal years beginning after

December 15, 2015, and interim periods within those fiscal years

2. For all other entities, for financial statements issued for fiscal years beginning after

December 15, 2015, and interim periods within fiscal years beginning after December 15,

2016. Early application is permitted for the financial statements that have not been

previously issued.

I. Objective

The ASU is being issued as part of the FASB's Simplification Initiative. The objective of the

Simplification Initiative is to identify, evaluate, and improve areas of generally accepted

accounting principles (GAAP) for which cost and complexity can be reduced while maintaining

or improving the usefulness of the information provided to users of financial statements.

II. Background

Existing GAAP

Debt issuance costs are generally considered to be specific third-party incremental costs that are

directly attributable to issuing a debt instrument, either in the form of:

Issuing bonds

Closing a bank or private loan

Such costs may include:

Legal fees

Commissions or financing fees

Appraisal costs

Accounting and auditing fees

Points

Title insurance

Any other costs incurred in order to complete specific financing

10

Debt issuance costs generally exclude internal general and administrative costs and overhead of

the borrowing entity.

Under existing GAAP prior to the effective date of ASU 2015-03, debt issuance costs are:

Capitalized as an asset on the balance sheet, and

Amortized to interest expense using the effective interest method.

Note: Although GAAP requires amortizing debt issuance costs using the effective interest

method, most companies amortize these costs on a straight-line basis because the difference is

not usually material.

Existing GAAP treats debt discounts and premiums as a direct reduction in the carrying amount

of the underlying debt, while premiums are direct increases in that debt.

Thus, under existing GAAP, debt issuance costs are treated differently than debt discounts and

premiums.

For years, there has been criticism about the accounting treatment of debt issuance costs. Some

critics have stated that such costs should not be capitalized as an asset because the costs provide

no future economic benefit to the entity.

Going back as far as 1985, the FASB agreed that the recording of debt issuance costs as an asset

was flawed and should be changed.

In 1985, the FASB noted in paragraph 237 of Concept Statement No. 2:

"Debt issue cost is not an asset for the same reason that debt discount is not—it

provides no future economic benefit. Debt issue cost in effect reduces the proceeds

of borrowing and increases the effective interest rate and thus may be accounted for

the same as debt discount. However, debt issue cost may also be considered to be an

expense of the period."

Now, thirty years later, the FASB has decided to take action to rectify the balance sheet

classification of debt issuance costs.

FASB makes a change

In August 2014, the FASB added to its agenda a project with the objective of simplifying the

presentation of debt issuance costs. At a meeting, the FASB tentatively decided to require that

debt issuance costs be presented in the balance sheet as a direct deduction from the debt liability.

In October 2014, the FASB issued a proposed ASU entitled, Interest—Imputation of Interest

(Subtopic 835-30): Simplifying the Presentation of Debt Issuance Cost.

11

In April 2015, the FASB issued a final statement as ASU 2015-03.

In leading up to the issuance of ASU 2015-03, the FASB had received comments that companies

have different balance sheet presentations for debt issuance costs and debt discount and premium

which creates unnecessary complexity in practice. Most companies, however, present debt

issuance costs as a separate asset named deferred charges. Such a presentation has caused

challenges in practice for several reasons:

Presenting a deferred charge differs from International Financial Reporting Standards

(IFRS), which require that transaction costs be deducted from the carrying value of the

financial liability and not recorded as separate assets.

The requirement to recognize debt issuance costs as deferred charges conflicts with the

guidance in FASB Concepts Statement No. 6, Elements of Financial Statements, which

states that debt issuance costs are similar to debt discounts and in effect reduce the

proceeds of borrowing, thereby increasing the effective interest rate. Concepts Statement

6 further states that debt issuance costs cannot be an asset because they provide no future

economic benefit.

As a result, to simplify presentation of debt issuance costs, ASU 2015-03 changes current

practice as follows:

a. Debt issuance costs related to a recognized debt liability must now be presented in the

balance sheet as a direct deduction from the carrying amount of that debt liability,

consistent with debt discounts. Presenting the costs as an asset is no longer permitted.

b. Amortization of debt issuance costs using the effective interest method and report the

amortization as part of interest expense.

The recognition and measurement guidance for debt issuance costs is not affected by ASU 2015-

03.

III. Definitions

ASU 2015-03 provides the following definition that is used throughout the ASU.

Public Business Entity

A public business entity is a business entity meeting any one of the criteria below. Neither a not-

for-profit entity nor an employee benefit plan is a business entity.

It is required by the U.S. Securities and Exchange Commission (SEC) to file or furnish

financial statements, or does file or furnish financial statements (including voluntary

filers), with the SEC (including other entities whose financial statements or financial

information are required to be or are included in a filing).

12

It is required by the Securities Exchange Act of 1934 (the Act), as amended, or rules or

regulations promulgated under the Act, to file or furnish financial statements with a

regulatory agency other than the SEC.

It is required to file or furnish financial statements with a foreign or domestic regulatory

agency in preparation for the sale of or for purposes of issuing securities that are not

subject to contractual restrictions on transfer.

It has issued, or is a conduit bond obligor for, securities that are traded, listed, or quoted

on an exchange or an over-the-counter market.

It has one or more securities that are not subject to contractual restrictions on transfer,

and it is required by law, contract, or regulation to prepare U.S. GAAP financial

statements (including footnotes) and make them publicly available on a periodic basis

(for example, interim or annual periods). An entity must meet both of these conditions to

meet this criterion.

An entity may meet the definition of a public business entity solely because its financial

statements or financial information is included in another entity’s filing with the SEC. In that

case, the entity is only a public business entity for purposes of financial statements that are filed

or furnished with the SEC.

IV. Rules

1. ASU 2015-03 does not apply to the following:

a. The amortization of premium and discount of assets and liabilities that are reported at fair

value, and

b. The debt issuance costs of liabilities that are reported at fair value.

2. The following elements shall be reported in the balance sheet as a direct deduction from the

face amount of a note:

a. The discount or premium resulting from the determination of present value in cash or

noncash transactions, and

b. Debt issuance costs related to a note (NEW)

Note: The ASU states that similar to a discount or premium resulting from the determination

of present value in cash or noncash transactions, debt issuance costs are not an asset or

liability separable from the note that gives rise to it.

3. The discount, premium, or debt issuance costs shall not be classified on the balance sheet

as a deferred charge or deferred credit.

4. Amortization of discount or premium and debt issuance costs shall be reported as follows on

the income statement:

13

a. Amortization of discount or premium: As interest expense in the case of liabilities or as

interest income in the case of assets.

b. Amortization of debt issuance costs: As interest expense.

5. An entity shall disclose the following on the financial statements or in the notes to the

statements:

a. A description of a note (receivable or payable) which shall include the effective interest

rate.

b. The face amount of the note.

Observation: According to the FASB, to simplify the presentation of debt issuance costs, the

amendments in the ASU require that debt issuance costs related to a recognized debt liability be

presented in the balance sheet as a direct deduction from that debt liability, consistent with the

presentation of a debt discount. This presentation is consistent with the guidance in Concepts

Statement 6, which states that debt issuance costs are similar to a debt discount and in effect

reduce the proceeds of borrowing, thereby increasing the effective interest rate.

Concepts Statement 6 further states that debt issuance costs are not assets because they provide

no future economic benefit.

The presentation required by ASU 2015-03 is now consistency with IFRS, which requires that

transaction costs be deducted from the carrying value of the financial liability and not recorded

as separate assets.

The FASB also notes that it considered requiring that debt issuance costs be recognized as an

expense in the period of borrowing, which is one of the options to account for those costs in

Concepts Statement 6. The other option considered was to account for those costs as a valuation

account presented as a deduction from the face amount of debt, which is the same as the guidance

in ASU 2015-03. The FASB rejected the alternative to expense debt issuance costs in the period

of the borrowing. Instead, it chose to treat such costs as a reduction in the debt balance, with

increases the effective interest rate on the debt.

How should costs incurred before funding of the note be accounted for?

Debt issuance costs consist of specific third-party incremental costs that are directly attributable

to issuing a debt instrument, whether a bank loan or a bond issuance.

Those costs usually include legal fees, commissions, points, appraisal costs, title insurance, and

other costs required to obtain the funding.

14

Such costs exclude internal general and administrative costs and overhead of the borrowing

entity.

A key element of debt issuance costs is that such costs are directly incurred as part of the issuing

of financing. For a traditional bank loan, most of those costs are typically presented on the

settlement statement, but may expand to include the borrower's attorney's fees and other

professional fees incurred to obtain the specific financing.

The question is whether debt issuance costs include costs incurred before the debt is closed and

recorded such as legal and accounting costs, and other fees incurred to search for financing

among several alternatives.

Example 1: Company X is looking for a $2 million bank loan. X hires its lawyers and several

brokers to search for financing alternatives and gets several proposals. X incurs $25,000 in fees

for the search. None of proposals result in financing.

Several months later, X finally obtains financing from a source unrelated to the payment of the

$25,000 in fees.

Should X capitalize the $25,000 as part of the $2 million financing as a debt issuance cost, or

should X expense the $25,000 as period costs?

In ASU 2015-03, the FASB notes that the ASU guidance is limited to debt issuance costs which

are costs incurred with third parties directly related to the closing on specific debt.

The FASB observed that costs may be incurred before an associated debt liability is recorded on

the financial statements (for example, the costs are incurred before the proceeds are received on

a debt liability or costs incurred in association with undrawn line of credit). In ASU 2015-03,

the FASB did not provide explicit guidance in circumstances in which costs are incurred and the

proceeds have not yet been received such as legal fees incurred to search out banks for financing

alternatives.

The FASB also stated that the recognition and measurement guidance in other Codification

Topics that require debt issuance costs to be accounted for differently from debt discount has a

different underlying basis. The guidance in the amendments in ASU 2015-03 is limited to

clarifying whether the debt issuance costs are the debtor’s assets.

ASU 340-10-S99-1, references SEC guidance found in SAB Topic 5.A. Expenses of Offering,

and does provide some guidance as to how to account for expenses incurred prior to a debt

funding or the search for funding.

The SAB offers the following facts:

Facts: Prior to the effective date of an offering of equity securities, Company Y incurs certain

expenses related to the offering.

15

Question: Should such costs be deferred?

Interpretative Response: Specific incremental costs directly attributable to a proposed or actual

offering of securities may properly be deferred and charged against the gross proceeds of the

offering. However, management, salaries or other general and administrative expenses may not

be allocated as costs of the offering and deferred costs of an aborted offering may not be deferred

and charged against proceeds of a subsequent offering. A short postponement (up to 90 days)

does not represent an aborted offering.

Although the SAB does focus on costs incurred with respect to an equity transaction, its

application does parallel the issue as to how to account for costs incurred to obtain financing

prior to funding, such as costs to search for such financing that does not come to fruition.

What the SAB does state is that costs incurred for aborted funding should not be deferred so that

such costs must be expensed as incurred. Thus, costs incurred to search for financing among

alternatives should be expensed if one chooses to follow the SAB guidance.

Going back to Example 1, because the $25,000 of fees relate the search for funding that did not

occur, those costs should be expensed and should not be included as part of debt issuance costs

related to the ultimate receipt of $2 million of funding.

How should debt issuance costs be amortized under ASU 2015-03?

ASU 2015-03 does not change the way in which debt issuance costs are amortized. All it does

is address how it is presented on the balance sheet.

Thus, companies will continue to amortize debt acquisition costs using the effective interest

method, with any amortization recorded as part of interest expense.

Entry:

dr

cr

Interest expense

XX

Debt issuance costs

XX

Interest expense

XX

Note payable (principal)

XX

Cash

XX

16

Presentation of ASU 2015-03:

Current liabilities:

Current portion of long-term debt

XX

Long-term debt:

Note payable

XX

Less debt issuance costs

(XX)

Long-term debt, less debt issuance costs

XX

Is a company permitted to amortize debt issuance costs on a straight-line basis?

GAAP requires that the effective interest method should be used to amortize debt issuance costs

to interest expense. Yet, many companies choose to amortize such costs on a straight-line basis

for simplicity, arguing that there is not a material difference between interest expense computed

on a straight-line versus effective interest method.

Is the straight-line method appropriate?

ASC 835-30-35-4, Interest, Imputation of Interest, Subsequent Measurement, states the

following:

"Other methods of amortization may be used if the results obtained are not materially

different from those that would result from the interest method."

Thus, entities may use the straight-line method as long as the resulting amortization charged to

interest is not materially different from the result that would be obtained if the effective interest

method were used. For most companies, particularly nonpublic entities, debt issuance costs are

not significant relative to financing obtained. In such instances, use of the straight-line method

should be acceptable.

How does an entity amortize debt issuance costs related to a line of credit or demand loan?

ASC 470-50-40-21 addresses financing costs when there is a modification to or exchange of a

line of credit or revolving debt arrangement.

If the borrowing capacity of a new arrangement is greater than or equal to the borrowing capacity

of the old arrangement, the following rules apply:

Any fees paid to the creditor, any unamortized deferred costs from the previous

arrangement, and any third-party costs incurred are combined and treated as being new

debt issuance costs associated with the new line of credit.

17

Those new debt issuance costs are amortized over the term of the new arrangement.

Typically, a line of credit is extended for one year at a time. That means that for a one-

year line of credit, any debt issuance costs should be amortized over the one year term.

How does ASU 2015-03 impact the disclosure of the effective interest rate?

Many practitioners may not be aware that existing GAAP requires disclosure of the effective

interest rate on debt.

ASC 835-30-45-2 state the following:

"The description of the note shall include the effective interest rate."

For most entities, unless they have non-interest bearing debt, the nominal contract rate is the

same or similar to the effective interest rate. Thus, disclosure of the nominal rate generally

suffices the satisfy disclosure of the effective interest rate.

That conclusion changes under ASU 2015-03. With the presentation of debt issuance costs as a

reduction in the loan balance, the effective interest rate increases.

Consider the following short-cut calculation.

Facts:

Company X borrows $5,000,000 with interest fixed at 6% per year and a five year term.

Annual interest is $300,000 ($5,000,000 x 6%).

In borrowing the $5,000,000, X incurs $150,000 in debt issuance costs consisting of

points, legal fees, appraisal fees, etc.

Using a short-cut approach, the effective interest rate is computed as follows:

Gross proceeds

$5,000,000

Debt issuance costs

(150,000)

Net funds received

$4,850,000

Annual interest

$300,000

Effective interest rate

6.19%

18

Should X disclose both the 6% nominal contract rate and the effective rate of 6.19%?

The technical answer is "yes." However, for most businesses involved in traditional financing

(e.g., bank loans), deferred issuance costs are not more than 2 to 3% of the loan amount. Thus,

the net proceeds received are not significantly lower than the gross loan amount.

When computing the effective rate versus the contract rate, the difference is insignificant. Using

the previous example, an effective interest rate of 6.19% versus 6% contract rate is not material.

So, what is the answer?

The author suggests using generic language to address the fact that ASU 2015-03 might result

there being a difference between the effective and nominal interest rate. Below the author inserts

into a disclosure language "Interest

NOTE X: LONG-TERM DEBT:

Long-term debt consists of a $5,000,000 term loan with fixed interest payable

monthly at 6% per annum, which approximates the effective interest rate. The

loan is secured by certain equipment and personally guaranteed by company

shareholders. The entire principal balance due on December 31, 20X11.

If, in rare instances, the effective rate is significantly higher than the nominal contract rate, the

disclosure can be changed as follows:

NOTE X: LONG-TERM DEBT:

Long-term debt consists of a $5,000,000 term loan with fixed interest payable

monthly at 6% per annum (effective interest rate of 6.55%). The loan is secured

by certain equipment and personally guaranteed by company shareholders. The

entire principal balance due on December 31, 20X11.

19

Presentation- ASU 2015-03:

Example 1:

Facts:

Company X borrows $10 million from a local bank. X incurs $200,000 of debt issuance

costs for legal fees, appraisals, and points related to closing the $10 million loan.

X has other long-term debt obtained years ago with a balance of $5 million. There are no

remaining debt issuance costs related to that loan.

The $10 million loan closes and is funded on December 31, 20X6.

X is issuing financial statements for the year ended December 31, 20X6.

Assume there is no current portion of debt for simplicity purposes.

Conclusion:

X must present the $200,000 of debt issuance costs as a reduction in the $10 million loan

outstanding in accordance with ASU 2015-03.

There are two approaches to the presentation on the balance sheet:

Presentation 1: Debt issuance costs are presented separately from the gross amount of the

debt:

Long-term debt:

Principal amount

$15,000,000

Less unamortized debt issuance costs

(200,000)

Total long-term debt

$14,800,000

Presentation 2: Debt issuance costs presented net:

Long-term debt:

[$15,000,000 face amount, less unamortized debt issuance

costs of $200,000]

$14,800,000

20

Sample Disclosure:

NOTE 10: LONG-TERM DEBT

At December 31, 20X6, the company had the following long-term debt:

Principal

Unamortized

debt issuance

costs

Term loan: Interest only payable monthly at 6% per

annum, which approximates the effective interest rate.

The loan is secured by certain equipment and personally

guaranteed by company shareholders. The entire principal

balance due on December 31, 20X11.

$10,000,000

$200,000

Term loan: Interest only payable monthly at 4.5% per

annum, secured by qualifying inventories and trade

receivables, and personally guaranteed by company

shareholders. Principal balance is due on July 31, 20X9.

5,000,000

0

$15,000,000

$200,000

Example 2:

Same facts as Example 1 except that the company's $5,000,000 loan has a $300,000 discount

that was calculated at inception based on an imputed rate of 7%.

Presentation 1: Discount and debt issuance costs are presented separately from the gross

amount of the debt:

Long-term debt:

Principal amount

$15,000,000

Less unamortized discount and debt issuance costs

(500,000)

Total long-term debt

$14,500,000

Presentation 2: Debt issuance costs presented net:

Long-term debt:

[$15,000,000 face amount, less unamortized discount and debt

issuance costs of $500,000]

$14,500,000

21

Sample Disclosure:

NOTE 10: LONG-TERM DEBT

At December 31, 20X6, the company had the following long-term debt:

Principal

Unamortized

discount and

debt issuance

costs

Term loan: Interest only payable monthly at 6% per

annum, which approximates the effective interest rate.

The loan is secured by certain equipment and personally

guaranteed by company shareholders. The entire principal

balance due on December 31, 20X11.

$10,000,000

$200,000

Term loan: Interest only payable monthly at 4.5% per

annum, secured by qualifying inventories and trade

receivables, and personally guaranteed by company

shareholders. Principal balance is due on July 31, 20X9.

[Discount is based on imputed interest rate of 7%]

5,000,000

300,000

$15,000,000

$500,000

How should debt issuance costs be accounted for on the statement of cash flows?

In accordance with ASC 230, Statement of Cash Flows, debt issuance costs should be accounted

for as follows:

1. When the debt issuance costs are incurred, they are presented in financing activities as a

reduction of the net proceeds received from the new financing.

2. When the debt issuance costs are amortized to interest expense, the amortization is an

adjustment to cash from operating activities.

Example: On January 1, 2016, Company X borrows $2,000,000 and incurs $50,000 of debt

issuance costs, resulting in net proceeds of $1,950,000.

In 2016, X amortizes the $50,000 of costs over five years ($10,000 per year), on a straight-line

basis, which approximates the effective interest method.

Conclusion: The 2016 statement of cash flows is presented as follows:

22

Operating activities:

Net income

$XX

Adjustments:

XX

Depreciation and amortization

XX

Change in receivables, payables, inventories

XX

Change in debt issuance costs

10,000

Net cash from operating activities

XX

Financing activities:

Net proceeds from long-term debt, net of debt acquisition costs

1,950,000

What was the Private Company Council's opinion of ASU 2015-03?

According to the FASB, most of the PCC members were against the issuance of ASU 2015-03.

Although the objectives of the PCC are consistent with those of the FASB in its Simplification

Initiative, in theory, the PCC should have little impact on the FASB choosing its Simplification

Initiative.

According to the FASB, during the exposure process, a majority of the Private Company Council

members and certain other respondents that focus on private companies stated that they disagree

with the guidance in ASU 2015-03.

The PCC members asserted that:

1. The face amount of borrowings is the most relevant amount for the users of private

company financial statements.

2. Requiring the amount of borrowing to be presented net of the debt issuance costs could

be misleading to users of private company financial statements and would be a significant

change for private company preparers.

The Private Company Council presented two alternatives for the FASB to consider for private

companies.

Option 1: Retain current GAAP by recording debt issuance costs as assets, or

Option 2: Expense debt issuance costs

There were mixed views from Private Company Council members on the alternatives. According

to the FASB, the PCC members were split between the two options.

Finally, the FASB rejected both of the PCC recommendations for several reasons:

23

a. Different guidance for public business entities and for private companies would not meet the

objective of this project, which is to simplify GAAP.

b. Retaining current GAAP would contradict the guidance in Concepts Statement No. 6 in that

debt issuance costs are not an asset.

c. Disclosure of the face amount of the debt either on the balance sheet or in the notes, does

provide users information about the debt.

IV. Implementation of ASU 2015-03

1. ASU 2015-03 is effective as follows:

a. For public business entities, for financial statements issued for fiscal years beginning after

December 15, 2015, and interim periods within those fiscal years.

b. For all other entities, for financial statements issued for fiscal years beginning after

December 15, 2015, and interim periods within fiscal years beginning after December 15,

2016.

2. Earlier application of the ASU is permitted for the financial statements that have not been

previously issued.

3. An entity shall apply the ASU retrospectively to all prior periods presented.

a. Prior year's balance sheet is restated to reflect the change.

4. An entity shall disclose in the first fiscal year after the entity's adoption date, and in the

interim periods within the first fiscal year, the following:

a. The nature of and reason for the change in accounting principle

b. The transition method

c. A description of the prior-period information that has been retrospectively adjusted

d. The effect of the change on the financial statement line item (that is, the debt issuance

cost asset and the debt liability).

Example: At December 31, 2015, Company X has the following related to its long-term debt:

Other assets:

Debt issuance costs

$100,000

Long-term debt:

Term loan

$5,000,000

24

The term loan requires annual principal payments of $200,000 plus interest at 6% per annum.

X adopts ASU 2015-03 effective January 1, 2016.

X amortizes debt issuance costs on a straight-line basis which approximates the result if the

effective interest method had been used.

In 2016, X issued comparative financial statements for 2015 and 2016.

Conclusion: X should apply the ASU retrospectively by restating 2015 which is presented

comparatively with 2016.

In addition, in 2016, X must disclose the following information:

a. The nature of and reason for the change in accounting principle

b. The transition method

c. A description of the prior-period information that has been retrospectively adjusted

d. The effect of the change on the financial statement line item (that is, the debt issuance

cost asset and the debt liability).

Disclosures: (2016)

NOTE 1: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Debt issuance costs:

Debt issuance costs incurred in connection with the issuance of long-term debt are capitalized

and amortized to interest expense over the term of the debt using the straight-line method,

which approximates the effective interest method. The unamortized amount is presented as a

reduction of long-term debt on the balance sheet.

NOTE 5: CHANGE IN ACCOUNTING FOR DEBT ISSUANCE COSTS

Effective January 1, 2016, the company adopted Accounting Standards Update (ASU) No. 2015-

03: Interest—Imputation of Interest (Subtopic 835-30), Simplifying the Presentation of Debt

Issuance Costs. ASU 2015-03 requires that the company change the presentation of debt

issuance costs on the company's financial statements. Under the new method, effective January

1, 2016, debt issuance costs are presented as a reduction of long-term debt instead of being

presented as an asset on the company's balance sheet. The December 31, 2015, balance sheet has

been restated to reclassify $100,000 of debt issuance costs from long-term assets to a reduction

of $5,000,000 of long-term debt.

On the December 31, 2016 balance sheet, debt issuance costs in the amount of $80,000 are

presented as a reduction of $5,000,000 of long-term debt.

25

NOTE 8: LONG-TERM DEBT

At December 31, 2016 and 2015, the company had the following long-term debt:

2016

2015

Term loan: Annual principal payments are due in the

amount of $200,000, plus interest payable monthly at 6%

per annum, which approximates the effective interest

rate. The loan is secured by certain equipment and

personally guaranteed by company shareholders. The

entire principal balance is due on December 31, 2020.

$4,800,000

$5,000,000

Unamortized debt issuance costs

(80,000)

4,720,000

(100,000)

4,900,000

Less current portion (1)

180,000

180,000

Long-term debt

$4,540,000

$4,720,000

(1): Calculation: Principal payments ($200,000), less $20,000 amortization of debt issuance costs equals $180,000 current

portion of long-term debt.

A summary of the annual maturities of long-term debt for each of the five years subsequent to

2016 follows:

Year

Annual

Maturity (2)

2017

$200,000

2018

200,000

2019

200,000

2020

200,000

2021

200,000

Beyond 2021

3,800,000

$4,800,000

(2): Annual maturities are computed exclusive of the debt issuance costs

-end of disclosures-

The restated balance sheet is presented below:

26

Company X

Balance Sheet

December 31, 2016 and 2015

2016

2015

Other assets:

REMOVED

0

0

Current liabilities:

Current portion of long-term debt

180,000

180,000

Long-term debt:

Face amount, less unamortized debt issuance costs

4,540,000

4,720,000

How should the debt issuance costs be treated for tax purposes?

For years, companies amortized debt issuance costs on a straight line basis for tax purposes.

Those rules changed with the introduction of Reg. sec. 1.446.5 which now requires that debt

issuance costs be amortized using the constant yield method as defined by Reg 1.1272-1(b).

Under the constant yield method, the debt issuance costs are treated as if they adjusted the yield

on the debt and decreased the issue price of the debt. Thus, the debt issuance costs increase or

create original issue discount (OID).

Reg 1.1272.1 provides the authority for computing the portion of debt issuance costs amortized

to interest under the constant yield method. There is also a de minimis rule that can be used.

In looking at the constant yield method, it is similar to use of the effective interest method.

27

ASU 2015-15: Interest—Imputation of Interest (Subtopic 835-30)

Presentation and Subsequent Measurement of Debt Issuance Costs

Associated with Line-of-Credit Arrangements

Amendments to SEC Paragraphs Pursuant to Staff Announcement at

June 18, 2015 EITF Meeting August 2015

Issued: August 2015

Effective date: ASU 2015-05 follows the effective date of ASU 2015-03 and is effective as

follows:

1. For public business entities, for financial statements issued for fiscal years beginning after

December 15, 2015, and interim periods within those fiscal years

2. For all other entities, for financial statements issued for fiscal years beginning after

December 15, 2015, and interim periods within fiscal years beginning after December 15,

2016. Early application is permitted for the financial statements that have not been

previously issued.

I. Objective

ASU 2015-15 is issued as part of the FASB's Simplification Initiative. The objective of the

Simplification Initiative is to identify, evaluate, and improve areas of GAAP for which cost and

complexity can be reduced while maintaining or improving the usefulness of the information

provided to users of financial statements.

The objective of ASU 2015-15 is to provide guidance as to the presentation of debt issuance

costs related to line-of-credit arrangements.

II. Background

On April 7, 2015, the FASB issued ASU 2015-03, Interest—Imputation of Interest (Subtopic

835-30): Simplifying the Presentation of Debt Issuance Costs, which requires entities to present

debt issuance costs related to a recognized debt liability as a direct deduction from the carrying

amount of that debt liability.

The guidance in ASU 2015-03:

Addresses how to account for outside costs related to term debt.

Does not address how to present costs incurred to secure revolving lines of credit, which

at inception, are not associated with an outstanding loan balance.

28

As a result, there have been questions as to whether ASU 2015-03 applies to costs incurred to

secure a line of credit instead of a term loan.

Given the lack of guidance, the SEC was asked to rule as to how debt issuance costs related to

line-of-credit arrangements should be presented on the balance sheet.

On June 18, 2015, the SEC issued an SEC Staff Announcement.

ASU 2015-15 adds to GAAP the paragraphs in the SEC Staff Announcement at the June 18,

2015 Emerging Issues Task Force (EITF) meeting about the presentation and subsequent

measurement of debt issuance costs associated with line-of-credit arrangements.

III. Rules

1. The SEC rules that debt issuance costs related to a line-of-credit arrangement are not within

the scope of ASU 2015-03.

a. An entity is not required to present such costs as a reduction of the debt outstanding under

the ASU 2015-03 rules.

2. The SEC staff would not object to such costs being handled as follows:

a. Defer the costs and present debt issuance costs as an asset and

b. Amortize the deferred debt issuance costs ratably over the term of the line-of-credit

arrangement, regardless of whether there are any outstanding borrowings on the line-of-

credit arrangement.

Observation: ASU 2015-03 requires debt issuance costs related to debt obtained to be presented

on the balance sheet by netting such deferred costs against the debt to which such costs relate.

Yet, the SEC concluded that similar costs incurred for a line of credit can be presented as an

asset and amortized over the term of the credit arrangement, regardless of whether the line of

credit has a balance outstanding.

The logic behind permitting the costs related to a line of credit to be presented as an asset is that

such costs represent costs incurred for an entity to retain the benefit of being able to access

capital over the contractual term regardless of whether the line of credit is accessed. Conversely,

debt issuance costs related to actual debt obtained represent the transaction costs incurred to

complete the actual loan and receive the funding.

29

REVIEW QUESTIONS

Under the NASBA-AICPA self-study standards, self-study sponsors are required to present

review questions intermittently throughout each self - study course. Additionally, feedback must

be given to the course participant in the form of answers to the review questions and the reason

why answers are correct or incorrect.

To obtain the maximum benefit from this course, we recommend that you complete each of the

following questions, and then compare your answers with the solutions that immediately follow.

These questions and related suggested solutions are not part of the final examination and will

not be graded by the sponsor.

1. Don Trump CPA is working on debt issuance costs for his client, Kelly Clinic who just

obtained a five-year loan from a local bank. Which of the following is considered a debt

issuance cost:

a. Kelly Clinic’s various overhead costs

b. General and administrative costs of Kelly Clinic

c. Legal costs incurred to close the loan

d. Accounting fees for Don’s year-end review engagement

2. Bernard Sanders CPA is performing a review engagement on Clinton Inc. Bernie has to

determine how to present debt issuance costs on Clinton’s balance sheet under ASU 2015-

03. How does ASU 2015-03 require Clinton’s debt issuance costs to be presented:

a. Such costs are not presented on the balance sheet because they must be expensed

b. Presented as an asset and amortized

c. Presented as a direct deduction from the face amount of the note

d. Shown as part of other comprehensive income in stockholder’s equity

3. Nick’s Foods seeks financing to expand its operations. Nick’s spends approximately

$100,000 on seeking funding. Ultimately, Nick’s attempts fail and no financing is obtained.

How should Nick account for the $100,000 spent to seek financing that does not come to

fruition:

a. Capitalize the costs as deferred issuance costs and amortize them

b. Capitalize the costs as deferred costs and amortize them if and when future financing is

obtained

c. Expense the costs

d. Net the costs against existing financing that exists

4. Company X has recorded debt issuance costs and has to decide how to account for them once

capitalized. Which is the manner in which X may account for the costs:

a. Amortize the costs on a straight-line basis under all circumstances

b. Not amortize the costs

c. Amortize the costs using the interest method

d. Depreciate them

30

5. Company X receives a new loan of $5,000,000 and incurs $100,000 of debt issuance costs.

How should the transaction be presented on the statement of cash flows:

a. The $5,000,000 is recorded in financing activities while the $100,000 is presented in

investing activities

b. The transaction is disclosed only

c. The net proceeds of $4,900,000 is presented in financing activities

d. The $5,000,000 is presented in investing activities while the $100,000 is an adjustment

in operating activities

6. Company Z obtains a line of credit from a local bank and incurs debt issuance costs associated

with obtaining the line of credit. The line of credit is open for one year and Z has not accessed

the line. Z expects that the bank will automatically renew the line from year to year for at

least five years. How should Z account for the debt issuance costs:

a. Expense the costs unless Z uses the line

b. Capitalize the costs and amortize them over one year

c. Capitalize the costs but not amortize them because the line has not been used

d. Capitalize the costs and amortize them over five years

31

SUGGESTED SOLUTIONS

1. Don Trump CPA is working on debt issuance costs for his client, Kelly Clinic who just

obtained a five-year loan from a local bank. Which of the following is considered a debt

issuance cost:

a. Incorrect. Overhead costs are not considered debt issuance costs because they are not

directly attributable to a specific loan.

b. Incorrect. General and administrative costs of Kelly Clinic should not be considered part

of debt issuance costs because they are not attributable to Kelly obtaining the specific

bank loan. Debt issuance costs are those costs that relate to a specific loan.

c. Correct. Because legal costs are incurred to close the company’s specific loan, those

costs are considered part of debt issuance costs.

d. Incorrect. Accounting fees related to the specific debt obtained would be part of debt

issuance costs but those fees related to the year-end review engagement are not directly

attributable to obtaining the specific debt and, therefore, are not part of debt issuance

costs.

2. Bernard Sanders CPA is performing a review engagement on Clinton Inc. Bernie has to

determine how to present debt issuance costs on Clinton’s balance sheet under ASU 2015-

03. How does ASU 2015-03 require Clinton’s debt issuance costs to be presented:

a. Incorrect. Such costs are not expensed as incurred and therefore are presented on the

balance sheet, making the answer incorrect.

b. Incorrect. Previous rules have required such costs to be presented as an asset and

amortized. ASU 2015-03 no longer permits debt issuance costs to be presented as an

asset making the answer incorrect.

c. Correct. A key change made by the ASU is that debt issuance costs must be

presented as a direct deduction from the face amount of the note, and not presented

as an asset.

d. Incorrect. Nothing in the ASU permits the debt issuance costs to be presented as a

component of other comprehensive income in stockholder’s equity.

3. Nick’s Foods seeks financing to expand its operations. Nick’s spends approximately

$100,000 on seeking funding. Ultimately, Nick’s attempts fail and no financing is obtained.

How should Nick account for the $100,000 spent to seek financing that does not come to

fruition:

a. Incorrect. Because the financing was aborted, such costs should not be capitalized as the

costs do not relate to any particular debt obtained.

b. Incorrect. Costs associated with unsuccessful or aborted funding should not be capitalized

under any circumstances because such costs did not result in the entity successfully

obtaining financing.

c. Correct. There is existing guidance that states that costs of an aborted offering may

not be deferred. Thus, expensing such costs is the appropriate action.

d. Incorrect. Netting such costs against other existing financing makes no sense because

such costs did not result in new financing. Debt issuance costs relate to obtaining specific

financing should not be capitalized and netted against old, existing financing.

32

4. Company X has recorded debt issuance costs and has to decide how to account for them once

capitalized. Which is the manner in which X may account for the costs:

a. Incorrect. Using the straight-line basis is permitted only if the results obtained are not

materially different from the results if the interest method had been used. Thus, using the

straight-line method in all circumstances is not correct.

b. Incorrect. GAAP requires the costs to be amortized making the answer incorrect.

c. Correct. GAAP requires that debt issuance costs be amortized using the interest

method.

d. Incorrect. Debt issuance costs represent an intangible asset which is amortized, not

depreciated.

5. Company X receives a new loan of $5,000,000 and incurs $100,000 of debt issuance costs.

How should the transaction be presented on the statement of cash flows:

a. Incorrect. ASC 230 does not allow debt issuance costs to be presented in investing

activities, making the answer incorrect.

b. Incorrect. ASC 230 does not provide for the issuance of debt to be disclosed only as there

is a flow of cash in the transaction.

c. Correct. ASC 230 states that debt issuance costs should be shown as a reduction of

net proceeds received from the financing, which, in this case, would result in

$4,900,000 presented in financing activities.

d. Incorrect. Per ASC 230, the $100,000 is not shown separately from the net proceeds

received from the financing, making the answer incorrect.

6. Company Z obtains a line of credit from a local bank and incurs debt issuance costs associated

with obtaining the line of credit. The line of credit is open for one year and Z has not accessed

the line. Z expects that the bank will automatically renew the line from year to year. How

should Z account for the debt issuance costs:

a. Incorrect. The costs are capitalized, not expensed, under ASU 2015-15, regardless of

whether the line is used or not.

b. Correct. ASU 2015-15 states that such costs should be amortized over the term of

the line, which is one year.

c. Incorrect. ASU 2015-15 provides that such costs should be amortized making the answer

incorrect.

d. Incorrect. The costs are amortized over the term of the line, which is one year, not five

years.

33

ASU 2015-04: Compensation—Retirement Benefits (Topic 715)

Practical Expedient for the Measurement Date of an Employer’s

Defined Benefit Obligation and Plan Assets

Issued: April 2015

Effective date: ASU 2015-03 is effective as follows:

a. For public business entities, for financial statements issued for fiscal years beginning after

December 15, 2015, and interim periods within those fiscal years. Early adoption is

permitted.

b. For all other entities, for financial statements issued for fiscal years beginning after

December 15, 2016, and interim periods within fiscal years beginning after December

15, 2017. Early adoption is permitted.

I. Objective

ASU 2015-04 is issued as part of the FASB's Simplification Initiative. The objective of the

Simplification Initiative is to identify, evaluate, and improve areas of GAAP for which cost and

complexity can be reduced while maintaining or improving the usefulness of the information

provided to users of financial statements.

The objective of ASU 2015-04 is to provide a practical expedient that permits an entity

(employer) to measure defined benefit plan assets and obligations using the month-end that is

closest to the entity’s fiscal year-end and apply that practical expedient consistently from year

to year.

II. Background

Existing GAAP requires an employer that sponsors one or more defined benefit plans to record

on its balance sheet the funded status of the plan.

ASC 715, Compensation-Retirement Benefits, states:

1. If the projected benefit obligation exceeds the fair value of the plan assets, the employer

is requires to record in its balance sheet a liability equal to the unfunded projected benefit

obligation (e.g., the funding shortfall).

2. If, instead, the fair value of the plan assets exceeds the projected benefit obligation, the

employer is required to record on its balance sheet an asset representing the overfunded

projected benefit obligation.

34

ASC 715 requires the employer to measure the fair value of defined benefit plan assets as of the

date of its year-end statement of financial position, except in the following cases:

a. The plan is sponsored by a subsidiary that is consolidated using a fiscal period that differs

from its parent’s fiscal period.

b. The plan is sponsored by an investee that is accounted for using the equity method of

accounting and using financial statements of the investee for a fiscal period that is different

from the investor’s fiscal period.

For entities with a fiscal year-end that does not coincide with a month-end, it often is more

difficult to measure plan assets as of the date of the balance sheet when information about the

fair value of plan assets obtained from third parties is reported as of the month-end.

There are instances in which the reporting entity (employer) has a fiscal year-end that differs

from a month-end.

A reporting entity with a fiscal year-end that does not coincide with a month-end may incur more

costs than other entities when measuring the fair value of plan assets of a defined benefit pension

or other postretirement benefit plan.

The primary reason is due to the fact that:

Information about the fair value of plan assets obtained from a third-party service provider

typically is reported as of the month-end, and then,

That information is adjusted to reflect the fair value of plan assets as of the fiscal year-end.

On October 14, 2014, the FASB issued an exposure draft of a proposed Accounting Standards

Update, Compensation—Retirement Benefits (Topic 715): Practical Expedient for the

Measurement Date of an Employer’s Defined Benefit Obligation and Plan Assets.

The exposure draft was followed up with the April 2015 issuance of the final statement in the

form of ASU 2015-04.

ASU 2015-04 states that for an entity with a fiscal year-end that does not coincide with a month-

end, the ASU offers a solution by permitting the entity to measure both the defined benefit plan

assets and obligations using the month-end that is closest to the entity’s fiscal year-end and apply

that practical expedient consistently from year to year. The practical expedient should be applied

consistently to all plans if an entity has more than one plan.

The ASU also requires disclosure the accounting policy election and the date used to measure

defined benefit plan assets and obligations if the entity elects to measure the assets and liabilities

based on the month end that is closest to the entity's fiscal year end.

35

The ASU reflects a change from the employer's perspective. Employee benefit plans are not

within the scope of ASU 2015-04.

III. Scope

1. ASU 2015-04 applies to employers who sponsor defined benefit pension plans.

2. The ASU does not apply to employee benefit plans.

IV. Rules

Defined benefit pension plans

1. If an employer’s fiscal year-end does not coincide with a month-end, the employer may

measure plan assets and benefit obligations using the month-end that is closest to the

employer’s fiscal year-end.

a. The election shall be applied consistently from year to year and consistently to all of its

defined benefit plans if an employer has more than one defined benefit plan.

2. If an employer measures plan assets and benefit obligations in accordance with (1) above,

and a contribution or significant event caused by the employer (such as a plan amendment,

settlement, or curtailment that calls for a remeasurement) occurs between the month-end date

used to measure both plan assets and benefit obligations and the employer’s fiscal year-end,

the employer shall adjust the fair value of plan assets and the actuarial present value of

benefit obligations so that those contributions or significant events are recognized in the

period in which they occurred.

a. An employer shall not adjust the fair value of plan assets and the actuarial present value

of benefit obligations for other events occurring between the month-end date used to

measure plan assets and benefit obligations and the employer’s fiscal year-end that may

be significant to the measurement of defined benefit plan assets and obligations, but are

not caused by the employer (for example, changes in market prices or interest rates)

3. If a significant event caused by the employer (such as a plan amendment, settlement, or

curtailment) that requires an employer to remeasure both plan assets and benefit obligations

does not coincide with a month-end, the employer may remeasure plan assets and benefit

obligations using the month-end that is closest to the date of the significant event.

a. If an employer remeasures plan assets and benefit obligations during the fiscal year in

accordance with paragraph (3) above, the employer shall adjust the fair value of plan

assets and the actuarial present value of benefit obligations for any effects of the

significant event that may or may not be captured in the month-end measurement (for

example, if the closest month-end is before the date of a partial settlement, then the

measurement of plan assets may include assets that are no longer part of the plan).

36

b. An employer shall not adjust the fair value of plan assets and the actuarial present value

of benefit obligations for other events occurring between the month-end date used to

measure plan assets and benefit obligations and the employer’s fiscal year-end that may

be significant to the measurement of defined benefit plan assets and obligations, but are

not caused by the employer (for example, changes in market prices or interest rates).

Observation: The FASB decided to simplify current requirements and reduce costs for

entities that have a fiscal year-end that does not coincide with a month-end by permitting

those entities to measure defined benefit plan assets and obligations as of the month-end

that is closest to their fiscal year-end. The FASB concluded that for entities that elect

this accounting policy, the defined benefit obligation also should be measured as of the

same date used to measure plan assets so that each reflects economic conditions and

assumptions as of the same point in time.

Defined Benefit Plans- Other Postretirement

1. If an employer’s fiscal year-end does not coincide with a month-end, the employer may

measure plan assets and benefit obligations using the month-end that is closest to the

employer’s fiscal year-end.

a. The election shall be applied consistently from year to year and consistently to all of its

defined benefit plans if an employer has more than one defined benefit plan.

2. If an employer measures plan assets and benefit obligations in accordance with (1) above,

and a contribution or significant event caused by the employer (such as a plan amendment,

settlement, or curtailment that calls for a remeasurement) occurs between the month-end date

used to measure plan assets and benefit obligations and the employer’s fiscal year-end, the

employer shall adjust the fair value of plan assets and the actuarial present value of benefit

obligations so that those contributions or significant events are recognized in the period in

which they occurred.

a. An employer shall not adjust the fair value of plan assets and the actuarial present value

of benefit obligations for other events occurring between the month-end date used to

measure plan assets and benefit obligations and the employer’s fiscal year-end that may

be significant to the measurement of defined benefit plan assets and obligations, but are

not caused by the employer (for example, changes in market prices or interest rates)

3. If a significant event caused by the employer (such as a plan amendment, settlement, or

curtailment) that requires an employer to remeasure both plan assets and benefit obligations

does not coincide with a month-end, the employer may elect to remeasure plan assets and

benefit obligations using the month-end that is closest to the date of the significant event.

a. If an employer remeasures plan assets and benefit obligations during the fiscal year in

accordance with paragraph (3) above, the employer shall adjust the fair value of plan

37

assets and the actuarial present value of benefit obligations for any effects of the

significant event that may or may not be captured in the month-end measurement (for

example, if the closest month-end is before the date of a partial settlement, then the

measurement of plan assets may include assets that are no longer part of the plan).

b. An employer shall not adjust the fair value of plan assets and the actuarial present value

of benefit obligations for other events occurring between the month-end date used to

measure plan assets and benefit obligations and the employer’s fiscal year-end that may

be significant to the measurement of defined benefit plan assets and obligations, but are

not caused by the employer (for example, changes in market prices or interest rates).

V. Disclosures

1. The ASU adds the following disclosures for an employer that sponsors one or more defined

benefit pension plans or one or more defined benefit other postretirement plans, if:

a. An employer's fiscal year-end does not coincide with a month-end, and

b. The employer elects to determine the measurement date of plan assets using the month

end that is closest to the employer's fiscal year-end.

Public entities:

1. The accounting policy election to measure plan assets and benefit obligations using the

month-end that is closest to the employer's fiscal year-end and the month-end measurement

date.

2. If the employer contributes assets to the plan between the measurement date and its fiscal

year-end.

a. The employer shall not adjust the fair value of each class of plan assets for the effects of

the contribution.

b. The employer shall disclose the amount of the contribution to permit reconciliation of

the total fair value of all the classes of plan assets to the ending balance of the fair value

of plan assets.

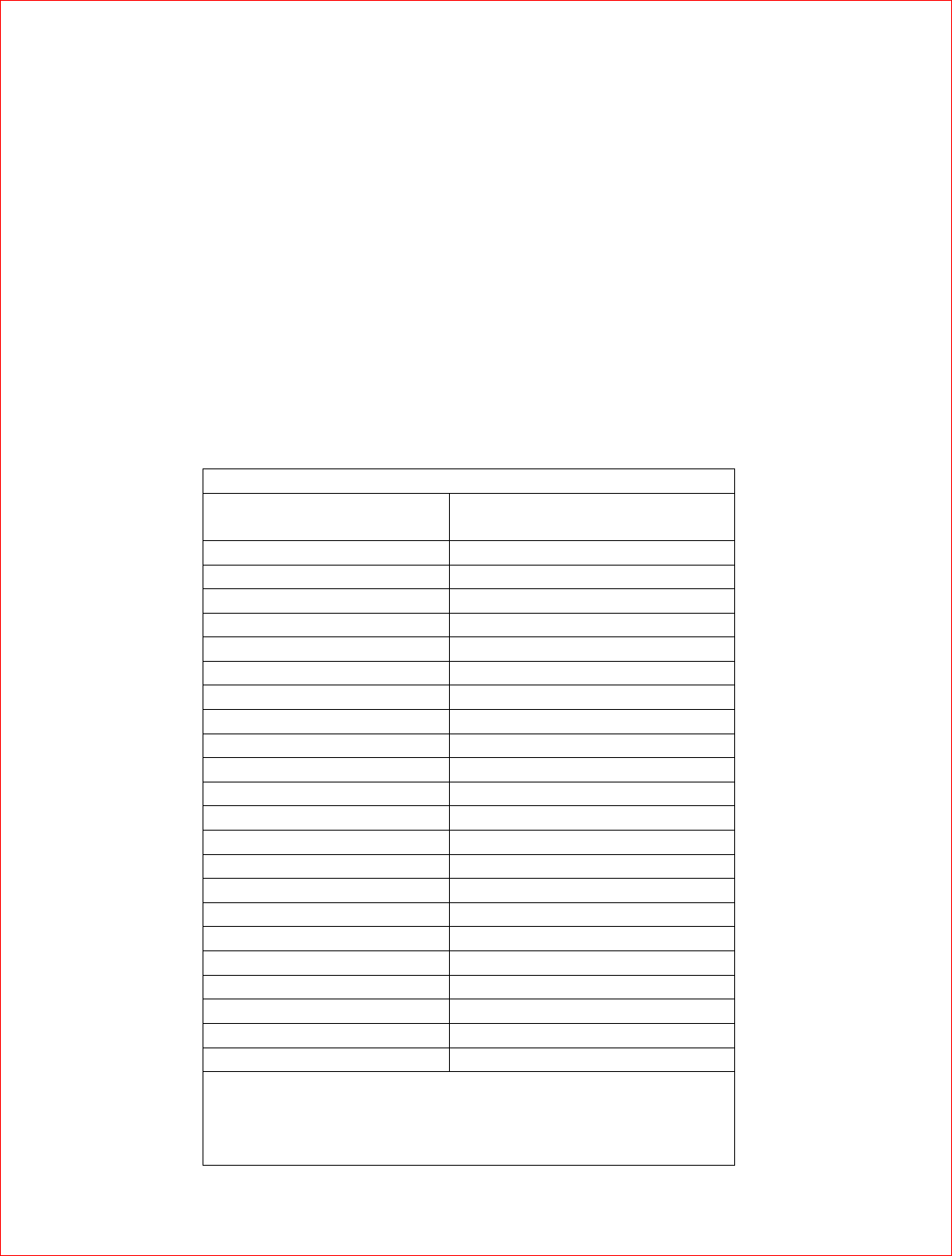

Following is an example of how the contributions might be shown in a disclosure:

38

Fair Value Measurements at

February 3, 20X5

Asset Class

Total

Quoted

prices in

Active

Markets

(Level 1)

Significant

observable

inputs

(Level 2)

Significant

unobservable

inputs

(Level 3)

Cash

$XX

$XX

$ -

$ -

Equity securities- U.S. companies

XX

XX

XX

XX

Mortgage-backed securities

XX

-

XX

XX

Assets at fair value at measurement date of 1-31-X5

XX

$XX

$XX

$XX

Contributions after measurement date

XX

Total assets reported at 2-3-X5

$XX

Source: ASU 2015-04, as modified by the author.

Nonpublic entities:

1. The accounting policy election to measure plan assets and benefit obligations using the

month-end that is closest to the employer's fiscal year-end and the month-end measurement

date.

2. If the employer contributes assets to the plan between the measurement date and its fiscal

year-end.

a. The employer shall not adjust the fair value of each class of plan assets for the effects of

the contribution.

b. The employer shall disclose the amount of the contribution to permit reconciliation of

the total fair value of all the classes of plan assets to the ending balance of the fair value

of plan assets.

39

Following is an example of how the contributions might be shown in a disclosure:

Fair Value Measurements at

February 3, 20X5

Asset Class

Total

Quoted

prices in

Active

Markets

(Level 1)

Significant

observable

inputs

(Level 2)

Significant

unobservable

inputs

(Level 3)

Cash

$XX

$XX

$ -

$ -

Equity securities- U.S. companies

XX

XX

XX

XX

Mortgage-backed securities

XX

-

XX

XX

Assets at fair value at measurement date of 1-31-X5

XX

$XX

$XX

$XX

Contributions after measurement date

XX

Total assets reported at 2-3-X5

$XX

Source: ASU 2015-04, as modified by the author.

VI. Transition

1. ASU 2015-03 is effective as follows:

a. For public business entities, for financial statements issued for fiscal years beginning after

December 15, 2015, and interim periods within those fiscal years. Early adoption is

permitted.

b. For all other entities, for financial statements issued for fiscal years beginning after

December 15, 2016, and interim periods within fiscal years beginning after December 15,

2017. Early adoption is permitted.

2. The ASU shall be applied prospectively.

3. An entity shall provide the transition disclosure required by paragraph 250-10-50-1(a) in

the period the entity adopts ASU 2015-04.

40

ASU 2015-05: Intangibles—Goodwill and Other Internal-Use Software

(Subtopic 350-40) Customer’s Accounting for Fees Paid in a Cloud

Computing Arrangement

Issued: April 2015

Effective date: ASU 2015-05 is effective as follows:

For public business entities, the ASU is effective for annual periods, including interim periods

within those annual periods, beginning after December 15, 2015.

For all other entities, the ASU is effective for annual periods beginning after December 15, 2015,

and interim periods in annual periods beginning after December 15, 2016. Early adoption is

permitted for all entities.

I. Objective

ASU 2015-05 is issued as part of the FASB's Simplification Initiative. The objective of the

Simplification Initiative is to identify, evaluate, and improve areas of GAAP for which cost and

complexity can be reduced while maintaining or improving the usefulness of the information

provided to users of financial statements.

The objective of ASU 2015-05 is to provide guidance to customers about whether a cloud

computing arrangement includes a software license.

II. Background

Currently, GAAP does not include specific guidance about a customer’s accounting for fees paid

in a cloud computing arrangement.

Examples of cloud computing arrangements include:

Software as a service

Platform as a service

Infrastructure as a service, and

Other similar hosting arrangements.

The FASB received input from stakeholders that the absence of explicit guidance has resulted in

some diversity in practice and has created unnecessary costs and complexity to evaluate the

accounting for those fees.

41

As a result of input, the FASB added guidance to Subtopic 350-40, Intangibles—Goodwill and

Other—Internal-Use Software, to assist entities in evaluating the accounting for fees paid by a

customer in a cloud computing arrangement.

The larger question is whether customer fees paid in a cloud computing arrangement represent

a license to use software or fees for a service contract.

ASC 350-40-05-2, Intangibles-Goodwill and Other- Internal-Use Software, defines internal-use

software as having both of the following characteristics:

a. The software is acquired, internally developed, or modified solely to meet the entity's

internal needs, and

b. During the software's development or modification, no substantive plan exists or is being

developed to market the software externally.

ASC 350-40-35-4 states that internal-use software licensed or acquired is amortized on a

straight-line basis unless another systematic or rational basis is more representative of the

software's use.