IRS EXEMPT ORGANIZATIONS (TE/GE)

HOSPITAL COMPLIANCE PROJECT

FINAL REPORT

TABLE OF CONTENTS (DETAILED) (pages ii-iv)

I. INTRODUCTION AND SYNOPSIS (pages 1-10)

II. INTERIM REPORT AND ADDITIONAL WORK UNDERTAKEN FOR FINAL

REPORT (pages 11-15)

III. BACKGROUND ON U.S. HOSPITALS AND PRIOR STUDIES (pages 16-21)

IV. DEMOGRAPHICS – PATIENT MIX, REVENUES, EXCESS REVENUES

(pages 22-38)

V. DIFFERENCES IN COMMUNITY BENEFIT REPORTING ACROSS CERTAIN

DEMOGRAPHICS

• By Community Type (pages 39-65)

• By Revenue Size (pages 66-92)

VI. OTHER COMMUNITY BENEFIT REPORTING – BAD DEBT AND

SHORTFALLS, RESEARCH, INCOME AND HEALTH INSURANCE

COVERAGE LEVELS (pages 93-121)

VII. EXECUTIVE COMPENSATION (pages 122-146)

VIII. FORM 990, SCHEDULE H, HOSPITALS (pages 147-151)

IX. SUMMARY OF FINDINGS BY DEMOGRAPHIC

• Narrative Description (pages 152-166)

• Quick Reference Tables (pages 167-168)

X. KEY OBSERVATIONS AND LESSONS LEARNED (pages 169-171)

APPENDICES

A. List of Charts and Tables

B. Form 13790, Compliance Check Questionnaire Tax-Exempt Hospitals

C. Form 990, Schedule H, Hospitals

i

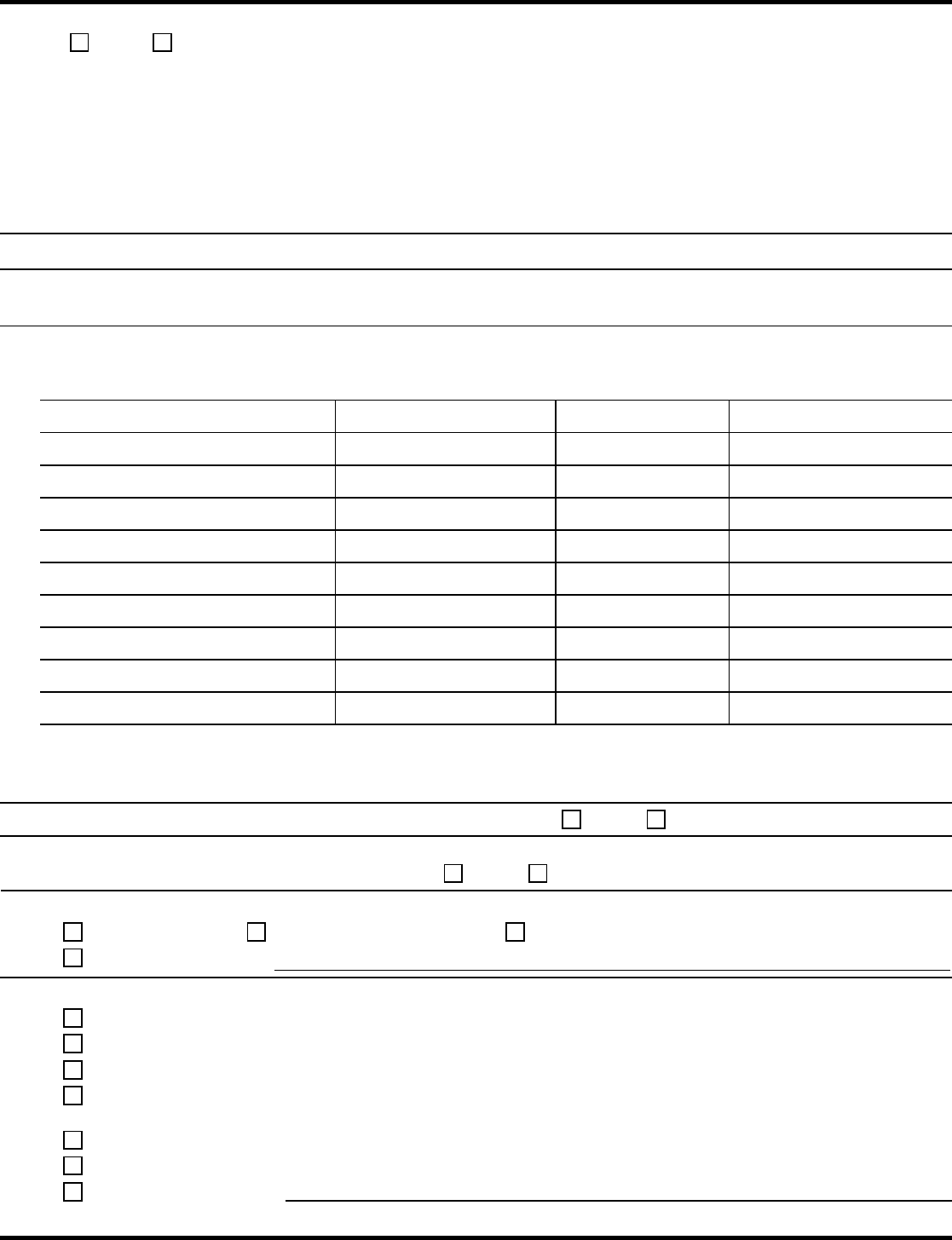

TABLE OF CONTENTS (DETAILED)

I. INTRODUCTION AND SYNPOSIS

A. Introduction and Limitations on Analysis

B. Demographics and Key Findings

C. Summary of Demographics and Community Benefit

1. Patient Mix

2. Community Benefit Expenditures (percentages of total

revenues)

3. Community Benefit Expenditures Mix (uncompensated care,

medical education and training, medical research, community

programs)

4. Uncompensated Care (percentages of total revenues)

5. Comparison of Reported Uncompensated Care and Community

Benefit Expenditures against Specified Percentage of Revenue

Levels

6. Revenues vs. Expenses

D. Executive Compensation

II. INTERIM REPORT AND ADDITIONAL WORK UNDERTAKEN FOR FINAL

REPORT

A. Questionnaire Content Included in Final Report

B. Significant Adjustments to the Interim Report

C. Breakdown of Hospitals by Community Types (High Population, Critical

Access Hospital (CAH), Rural (non-CAH), and Other Urban and

Suburban Hospitals)

D. Breakdown of Hospitals by Revenue Size

E. Hospitals Reporting Largest Amounts of Medical Research

Expenditures

F. Analysis of Bad Debt and Shortfalls as Uncompensated Care

G. Comparison of Reported Community Benefit Expenditures Across

Communities Based on Income and Insurance Coverage Levels

H. Executive Compensation

I. Form 990, Schedule H, Hospitals

III. BACKGROUND ON U.S. HOSPITALS AND PRIOR STUDIES

A. Background on U.S. Hospitals

B. Other Studies on Community Benefit Provided by Nonprofit Hospitals

C. Study on Executive Compensation of Nonprofit Hospitals

IV. DEMOGRAPHICS - PATIENT MIX, REVENUES, EXCESS REVENUES

A. Patient Insurance Coverage

B. Revenues and Excess Revenues By Revenue Size

C. Revenues and Excess Revenues by Community Type

D. Relationship Between Community Type and Revenue Size

E. Groupings by Excess Revenues

ii

V. DIFFERENCES IN COMMUNITY BENEFIT REPORTING ACROSS

CERTAIN DEMOGRAPHICS - COMMUNITY TYPES, REVENUE SIZE

A. Introduction

B. Comparison of Certain Information By Community Type

1. Summary of Key Findings – Community Type

2. Patient Mix (Based on Type of Insurance Coverage) by

Community Type

3. Number and Percentage of Hospitals Reporting Community

Benefit Expenditures, by Expenditure Type within Community

Type

4. Aggregate Uncompensated Care by Community Type

5. Aggregate Medical Research Expenditures by Community Type

6. Aggregate Medical Education and Training Expenditures by

Community Type

7. Aggregate Community Program Expenditures by Community

Type

8. Aggregate Community Benefit Expenditures by Community

Type

9. Aggregate Community Benefit Expenditures as a Percentage of

Revenues

C. Comparisons of Certain Information By Annual Revenue Size

1. Summary of Key Findings – Revenue Size

2. Patient Mix (Based on Type of Insurance Coverage) by

Revenue Size

3. Number and Percentage of Hospitals Reporting Community

Benefit Expenditures, by Expenditure Type within Revenue Size

4. Aggregate Uncompensated Care by Revenue Size

5. Aggregate Medical Research Expenditures by Revenue Size

6. Aggregate Medical Education and Training Expenditures by

Revenue Size

7. Aggregate Community Program Expenditures by Revenue Size

8. Aggregate Community Benefit Expenditures by Revenue Size

9. Aggregate Community Benefit Expenditures as a Percentage of

Revenues

VI. OTHER COMMUNITY BENEFIT REPORTING - BAD DEBT AND

SHORTFALLS, RESEARCH, INCOME AND HEALTH INSURANCE

COVERAGE LEVELS

A. Overview and Summary of Key Findings

B. Hospitals Reporting Largest Amounts of Medical Research

Expenditures

C. Analysis of Bad Debt and Shortfalls as Uncompensated Care

1. Reporting of Shortfalls and Bad Debt by Community Type

2. Reporting of Shortfalls and Bad Debt by Revenue Size

3. Reporting Differences when Shortfalls and Bad Debts are

Included in Uncompensated Care

iii

iv

D. Comparison of Community Benefit Expenditures Across Various

Income and Health Insurance Coverage Levels

1. Overview

2. Community Benefit Expenditures Across Community Per Capita

Income Levels

3. Community Benefit Expenditures Across Community Health

Insurance Coverage Levels

4. Interaction Between Per Capita Income and Health Insurance

Coverage

VII. EXECUTIVE COMPENSATION

A. Overview

B. Summary of Compensation Practices as Reported by Responding

Hospitals

C. Summary of Examinations

1. Overview of Examination Component of the Project

2. Examination Results

VIII. FORM 990, SCHEDULE H, HOSPITALS

A. Overview of Schedule H, Hospitals

B. Description of Schedule H, Parts I through VI

C. Transition Relief

D. Promoting Uniform Reporting through Schedule H

IX. SUMMARY OF FINDINGS BY DEMOGRAPHIC

X. KEY OBSERVATIONS AND LESSONS LEARNED

APPENDICES

A. List of Charts and Tables

B. Form 13790, Compliance Check Questionnaire Tax-Exempt Hospitals

C. Form 990, Schedule H, Hospitals

I. INTRODUCTION AND SYNOPSIS

A. Introduction and Limitations on Analysis

The IRS commenced its Hospital Compliance Project (Project) in May 2006 to

study nonprofit hospitals and community benefit, and to determine how nonprofit

hospitals establish and report executive compensation. The Project involved

mailing out a comprehensive compliance check questionnaire to 544 nonprofit

hospitals and analyzing their responses.

1

The questionnaire (see Appendix B)

requested information regarding the hospital’s activities, governance,

expenditures, and executive compensation practices. The Project also involved

examinations of 20 hospitals regarding executive compensation issues.

The hospitals included in the study represent a modest portion of the nonprofit

hospital sector. See Section III, below, for a discussion of background on U.S.

hospitals and of other recent government reports on community benefit and

executive compensation provided by nonprofit hospitals.

The IRS issued its Interim Report on Hospital Compliance Project on July 19,

2007 (Interim Report). The Interim Report addressed only the community benefit

aspects of the questionnaire and presented data gathered from the questionnaire

responses of 487 hospitals and certain information reported on Forms 990 filed

by responding hospitals. The executive compensation component of the Project

was not addressed in the Interim Report because the examinations were ongoing

at the time of the report’s release.

The Final Report addresses the “next steps” identified in the Interim Report.

These are:

• Analyze the reported data to determine whether differences in reporting,

such as the treatment of bad debt and shortfalls as uncompensated care,

may be isolated and adjusted to allow more meaningful comparisons

across the respondents.

• Obtain additional research and analyze the differences in community

benefit expenditure amounts and types to take into account varying

demographics, such as rural and urban communities and hospitals.

• Test the reported community benefit amounts and types by conducting

data analysis, compliance checks, or examinations of individual hospitals,

and by other means, including with respect to outliers in the reported

data.

1

A copy of the questionnaire is attached as Appendix B. In selecting the hospitals to be

contacted, the IRS queried its files to identify nonprofit hospitals exempt under section 501(c)(3).

From an initial identified universe of approximately 6,000 entities, the IRS selected 544

organizations that it confirmed as hospitals. The IRS sent compliance questionnaire letters to

each of these hospitals, which were of varying sizes and types and were located in different

regions and communities across the United States. Some judgment was used to identify

hospitals which were not uniquely identifiable in the IRS database. The resulting sample may or

may not reflect the nonprofit hospital sector in general.

1

The IRS also indicated it would (1) follow up on the 11 hospitals that did not

respond to the questionnaire; (2) continue its work on the Form 990, Schedule H,

Hospitals;

2

and (3) complete the executive compensation component of the

project.

The IRS continued to study the information provided by the responding hospitals,

and obtained additional information regarding 11 hospitals that initially did not

respond to the questionnaire. The numbers reported in the Interim Report have

been adjusted in the Final Report to reflect this further study and additional

information. Significant adjustments to the data reported in the Interim Report

are listed in Section II, below. The Final Report includes 489 respondent

hospitals that reported community benefit expenditures, but generally

summarizes data for the 485 hospitals that actually provided sufficiently complete

community benefit data. There are other situations in which certain respondents

did not provide sufficient information to permit categorization of all of the

indices/variables considered in this report. Sample sizes will vary as a result.

Throughout the report, certain information was not included or was combined

with other information to prevent potential identification of respondent hospitals.

In addition, because of rounding conventions, some figures may not reconcile

(including that, in some cases, the combined data for individual categories of a

group may be slightly more or less than 100%).

The findings of the Final Report are subject to a number of limitations. Except for

certain compensation data that was reviewed through examinations, the data

reported by the respondents was not independently verified. In addition, the data

reported responds to a single tax year and may not be representative of results

for a different tax year or on an ongoing basis. Results for a different year could

vary significantly depending on a variety of factors, including, for example, the

economic climate. It is also important to note that the percentage of hospitals

included in the various categories used in the report (e.g., community type) may

not be representative of the sector at large. This may have an effect on certain

findings in the report.

The study found significant variations from community benefit reporting that will

be required by the new Form 990 Schedule H beginning with 2009 tax years.

The community benefit expenditures reported by some hospitals appear to

overstate Form 990 reportable community benefit, due to reporting

uncompensated care based on charges rather than on costs, or including bad

debt, Medicare shortfalls, and private insurance shortfalls as community benefit.

On the other hand, exclusion by some hospitals of shortfalls from Medicaid, other

means-tested public programs, or uninsured patients as uncompensated care,

may understate the Form 990 reportable community benefit attributable to those

programs.

2

See Appendix C for a copy of Form 990, Schedule H, released in official form on December 24,

2008.

2

For these and other reasons, the summarized community benefit data is subject

to material limitations, and may not accurately depict the community benefit

actually provided by the respondents or by nonprofit hospitals as a whole.

Notwithstanding these limitations, some interesting findings are suggested in

both the community benefit and compensation areas of the study.

B. Demographics and Key Findings

The hospitals were classified into four community types based on location of the

hospital and in part on Census Bureau data: high population, other urban and

suburban, critical access hospitals, and rural non-critical access hospitals. The

94 hospitals (19%) located in the 26 largest urban areas in the United States

were categorized in the high population category. The other 249 hospitals (51%)

located in Census Bureau urban areas were included in the other urban and

suburban category. The 68 hospitals (14%) designated as critical access

hospitals under federal law were categorized in the critical access hospital (CAH)

category. The 78 hospitals (16%) that are not CAHs and not located in any

Census Bureau urban area were categorized in the rural (non-CAH) category.

The hospitals also were classified by revenue size based on annual revenues as

reported on Forms 990 as follows: (1) under $25 million, 85 hospitals (17%); (2)

$25 million to $100 million, 173 hospitals (36%); (3) $100 million to $250 million,

133 hospitals (27%); (4) $250 million to $500 million, 61 hospitals (13%); and (5)

over $500 million, 36 hospitals (7%). For purposes of this section, reporting of

revenue size categories generally is limited to the smallest and largest

categories, where the differences are most pronounced.

The hospitals also were categorized and examined based on health insurance

coverage and per capita income of the area surrounding the hospital. In addition,

a group of 15 hospitals reporting nearly all (93%) of the reported medical

research expenditures was studied.

1. Diversity of nonprofit hospitals. There was considerable diversity in the

demographics, activities, and financial resources among the respondent

hospitals. The types and amounts of uncompensated care and other community

benefit expenditures varied by the hospitals across revenue size, income and

insurance coverage levels of the surrounding area, and the hospital’s setting

within a rural, suburban, or urban community. In particular, significant

differences were observed between the groups of critical access hospitals and

hospitals in the high population areas, and between the smallest and largest

groups of hospitals based on revenue size (e.g., in general, larger hospitals

reported higher community benefit expenditures and higher excess revenues).

2. Aggregate community benefit

. The average and median percentages of total

revenues reported as spent on aggregate community benefit expenditures were

9% and 6%, respectively, for the overall group. Among the community types,

3

these percentages were lowest for rural hospitals (CAH and non-CAH) and

highest for hospitals in the high population areas. These percentages generally

increased with revenue size. For the group of 15 hospitals reporting

disproportionately large medical research expenditures, the average and median

percentages of total revenues reported as spent on aggregate community benefit

expenditures were both 19%.

3. Types of community benefit. Uncompensated care was the largest reported

community benefit expenditure overall and across all demographics, other than

for the group of 15 hospitals that reported nearly all of the aggregate medical

research expenditures. Overall, the average and median percentages of

uncompensated care as a percentage of total revenues were 7% and 4%,

respectively. Reported uncompensated care expenditures were 56% of

aggregate community benefit expenditures. Medical education and training

expenditures constituted 23% of aggregate reported expenditures, followed by

medical research (15%), and community programs (6%). This mix varied by

community type and revenue size, and as described below, materially changed

when the group of 15 hospitals reporting disproportionately large medical

research expenditures was excluded.

4. Concentration of expenditures in small group of hospitals. Uncompensated

care and aggregate community benefit expenditures were unevenly distributed

among hospitals and concentrated in a relatively small group. The study looked

at reported community benefit compared to certain specified revenue levels.

Overall, 58% of hospitals reported uncompensated care amounts less than or

equal to 5% of total revenues. Overall, 21% of the hospitals reported aggregate

community benefit expenditures less than 2% of total revenues; 47% reported

aggregate community benefit expenditures less than 5% of revenues. Critical

access hospitals and the smallest hospitals generally reported higher

percentages of hospitals below these levels. High population hospitals and the

largest hospitals generally reported lower percentages of hospitals below these

levels.

5. Revenues vs. expenses

. Reported excess revenues (total revenues less

expenses) varied across the demographics. Overall, when data was aggregated

for all hospitals, revenues exceeded expenses by 5%. This percentage was 3%

for the smallest hospitals and increased with revenue size. Among the

community types, critical access hospitals reported the smallest percentage, and

other rural hospitals reported the largest percentage. Overall, 21% of the

hospitals reported a deficit (total expenses greater than total revenues). The

percentage of hospitals reporting deficits varied by community type and revenue

size.

6. Community income and insurance coverage levels. The study did not find a

correlation between community benefit expenditure levels and per capita income

levels of the area surrounding the hospital. The study did, however, observe that

4

community benefit expenditure levels generally increased as uninsured rates of

the area surrounding the hospital increased.

7. Compensation practices. Nearly all hospitals in the study reported complying

with key elements of the rebuttable presumption procedure available to establish

compensation of certain executives and disqualified persons. Based on

traditional risk analysis and the compensation examinations of 20 hospitals, the

study found widespread compliance with the Section 4958 excess benefit

transaction rules. Although many reported compensation amounts appeared to

be high, nearly all amounts reviewed in these examinations were upheld as

established pursuant to the rebuttable presumption process and within the range

of reasonable compensation.

C. Summary of Demographics and Community Benefit

The following summarizes key demographic or community benefit measures.

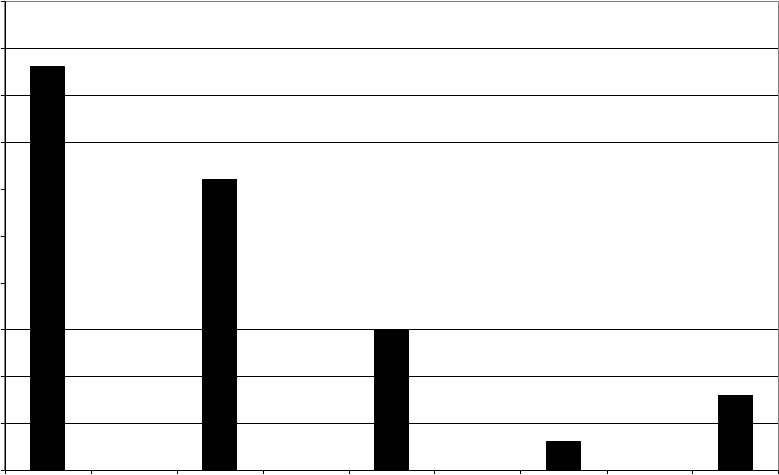

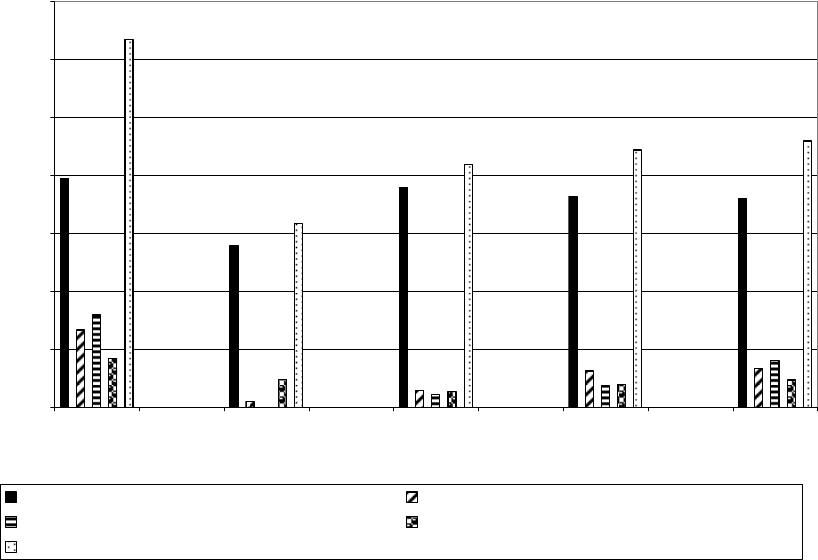

1. Patient Mix

The reported patient mix of the overall group of hospitals showed that the highest

percentage of patients was private insurance patients (43%), followed by

Medicare (31%), Medicaid (15%), uninsured (8%), and other public programs

(3%).

Patient Mix

0%

10%

20%

30%

40%

50%

High-Population Critical Access Rural non-CAH Other Urban &

Suburban

< $25M $500M+

Community Type Revenues

Percentage of Patients

Private Insurance Medicare Medicaid Other Public Uninsured

Critical access hospitals and the smallest hospitals reported the lowest

percentage of private insurance patients and the highest percentage of Medicare

patients. High population hospitals and the largest hospitals had the highest

percentage of Medicaid patients.

5

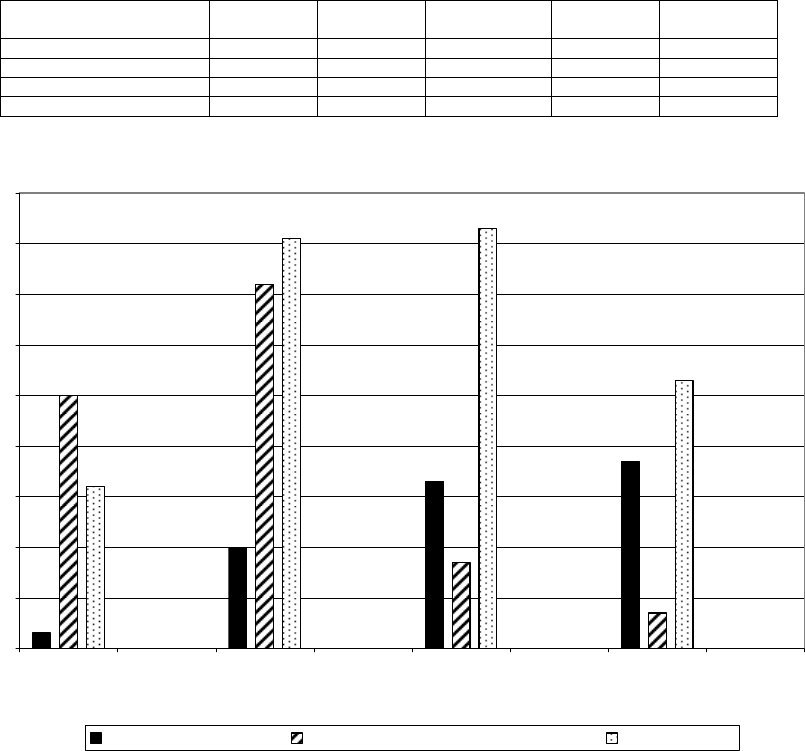

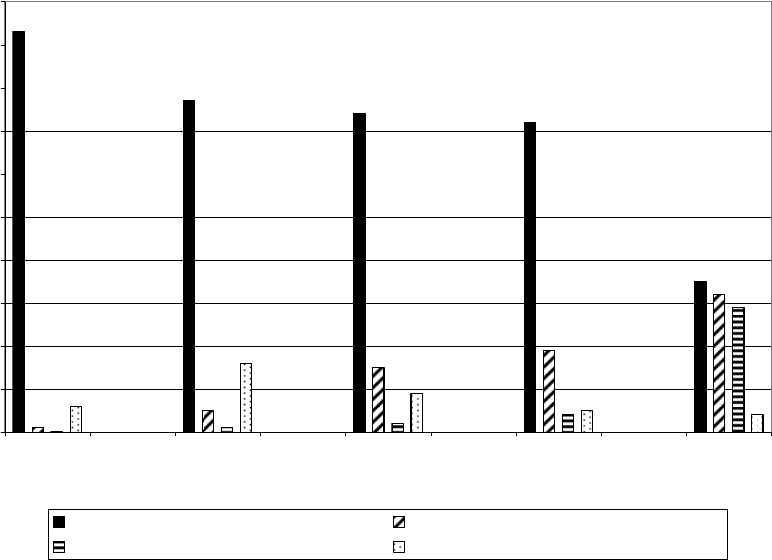

2. Community Benefit Expenditures (percentages of total revenues)

The overall average and median percentages of total revenues reported as spent

on aggregate community benefit expenditures were 9% and 6%, respectively.

These percentages varied across community type and revenue size. Aggregate

community benefit expenditures were not evenly distributed by the hospitals in

the study, but were concentrated in a relatively small number of hospitals. 9% of

the hospitals reported 60% of the aggregate community benefit expenditures;

19% of the hospitals reported 78% of the aggregate community benefit

expenditures.

Community Benefit Expenditures as Percentage of Total Revenues

12.7%

6.3%

8.4%

8.9%

9.9%

9.8%

2.8%

3.2%

5.8%

3.3%

10.5%

19.0%

12.4%

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

20%

High

Population

Critical

Access

Rural non-

CAH

Other Urban &

Suburban

< $25M $500M+ Research

Community Type Revenues

Average

Median

Among community types, the percentages were lowest for critical access

hospitals and highest for high population hospitals. The percentages of total

revenues generally increased with revenue size. The highest reported average

and median percentages were by the group of 15 hospitals that reported nearly

all of the medical research expenditures (referred to as “research hospitals” for

this section).

3. Community Benefit Expenditures Mix (uncompensated care,

medical education and training, medical research, community

programs)

Uncompensated care was the largest component of reported community benefit

for each community type and revenue size category, but the composition varied

across the demographics.

6

Composition of Community Benefit Expenditures

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

High-Population Critical Access Rural non-CAH Other Urban &

Suburban

< $25M $500M+

Community Type Revenues

Percentage of Community Benefit Expenditures

Uncompensated Care Medical Training Medical Research Community Programs

Uncompensated care as a percentage of overall community benefit expenditures

was greatest for CAHs, other rural hospitals, and the smallest hospitals.

Significant variations were observed in reported expenditures for medical

education and training expenditures and medical research across the community

types. Both medical education and training and medical research expenditures

as a percentage of overall community benefit expenditures increased with

revenue size. The inclusion

of bad debt and various

shortfalls impacted the

uncompensated care levels

reported. Overall, and for

each community type and

revenue size, greater

percentages of hospitals

reported including bad debt

and self pay shortfalls in

uncompensated care than

any other types of shortfalls.

The community benefit mix

changed materially when

Communit

y

Benefit Expenditure Mix with Research

Breakout

45%

15%

22%

71%

56%

28%

21%

23%

5%

7%

6%

0% 20% 40% 60% 80% 100%

Research

Hospitals

Hospitals other

than Research

All

Hospitals

% of Total CBE

Medi c al Researc h Uncompensated Care Medical Training Community Programs

7

the group of 15 hospitals that reported nearly all of the medical research

expenditures was removed. The figure above shows the mix for the overall

group, the group of 15 hospitals reporting nearly all of the medical research

expenditures, and the overall group without the 15 hospitals.

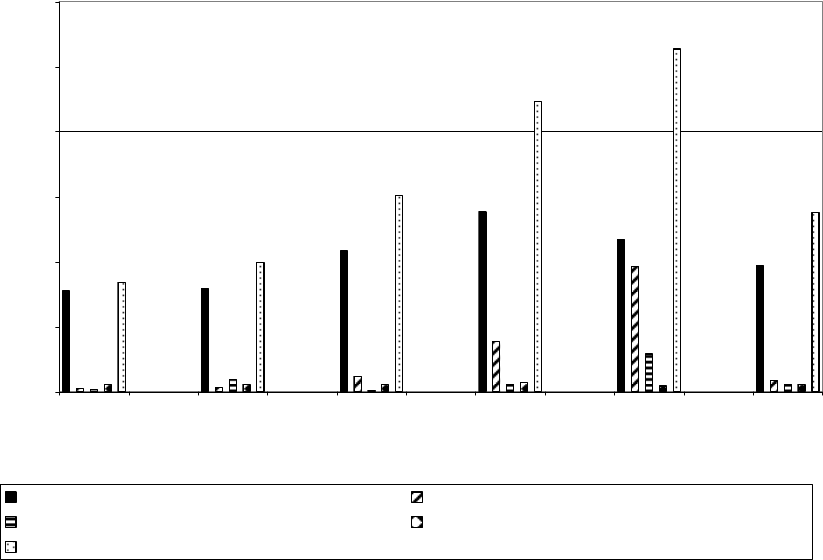

4. Uncompensated Care (percentages of total revenues)

The average and median percentages of total revenues reported as spent on

uncompensated care were 7% and 4%, respectively. Uncompensated care

expenditures were not evenly distributed among the hospitals in the study, but

were concentrated in a relatively small number of hospitals. 14% of the hospitals

reported 63% of the aggregate uncompensated care expenditures; 26% of the

hospitals reported 82% of the aggregate uncompensated care expenditures.

Uncompensated Care as Percentage of Total Revenues

7.9%

5.6%

7.6%

7.3%

9.3%

5.6%

6.2%

4.8%

2.1%

2.7%

4.3%

3.1%

4.7%

3.3%

0%

2%

4%

6%

8%

10%

High

Population

Critical

Access

Rural non-

CAH

Other Urban &

Suburban

< $25M $500M+ Research

Community Type Revenues

Average

Median

Critical access hospitals reported the lowest percentages and high population

hospitals reported the highest percentages among the community types. The

group of smallest hospitals reported the highest average percentage, but the

lowest median percentage, among the revenue size groups.

5. Comparison of Reported Uncompensated Care and Community

Benefit Expenditures against Specified Percentage of Revenue

Levels

The figure below displays the percentage of hospitals with reported community

benefit and uncompensated care expenditures at or less than specified

percentage of revenue levels.

8

Demographic:

% of hospitals with

community benefit

expenditures <2% of

revenues

% of hospitals with

community benefit

expenditures <5% of

revenues

% of hospitals with

uncompensated

care expenditures

≤3% of revenues

% of hospitals with

uncompensated

care expenditures

≤5% of revenues

High population 11% 32% 33% 52%

CAH 39% 61% 59% 67%

Rural – non CAH 31% 57% 52% 65%

Other urban and suburban 17% 46% 39% 55%

Under $25 million 34% 60% 49% 60%

$25 million to under $100 million 30% 56% 49% 61%

$100 million to under $250 million 12% 42% 37% 55%

$250 million to under $500 million * * 34% 49%

Over $500 million * * 33% 60%

Overall 21% 47% 43% 58%

* The two largest revenue sizes were combined to prevent potential identification of respondent hospitals.

In the combined group ($250 million and over), the percentage of hospitals with community benefit

expenditures less than 2% of revenues is 5%, and less than 5% of revenues is 27%.

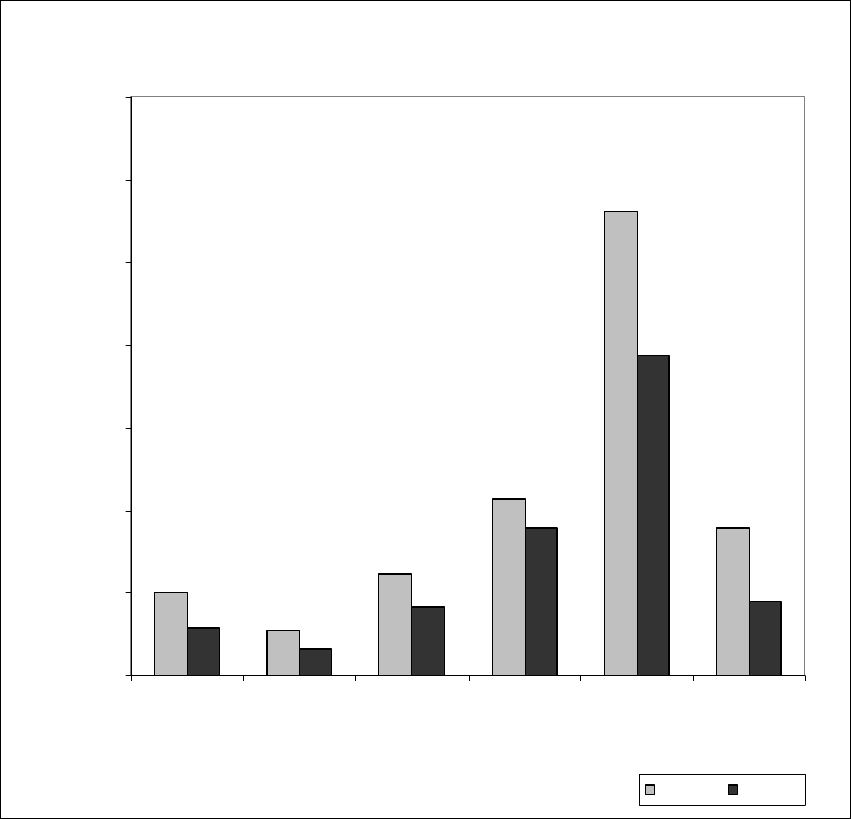

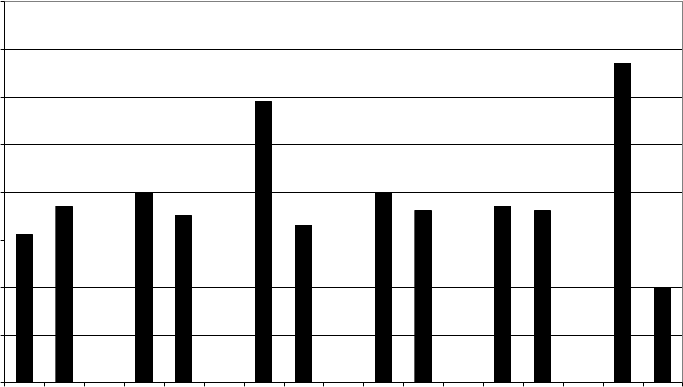

6. Revenues vs. Expenses

79% of the hospitals reported excess revenues (revenues exceeding expenses

as reported on the Form 990), and 21% reported that total expenses exceeded

total revenues (i.e., reported a deficit). The percentage of hospitals that reported

revenue deficits decreased as revenue size increased, and varied across the

community types. CAHs and the smallest hospitals had the highest percentage

of hospitals reporting a deficit.

Distribution of Hospitals by Excess Revenue

26%

10%

15%

19%

15%

20%

22%

22%

14%

21%

13%

19%

31%

34%

58%

39%

36%

51%10%

35%

20%

13%

34%

22%

-40% -20% 0% 20% 40% 60% 80% 100%

High Population

Critical Access

Rural non-CAH

Other Urban & Suburban

< $25M

$250M +

Community TypeRevenues

Percentage of Hospitals

Deficit or 0% Excess Revenues >0% to <2.5% Excess Revenues 2.5% to <5% Excess Revenues ≥5%

← Deficit | Excess →

Overall, excess revenues expressed as a percentage of total revenues was 4.6%

and increased with revenue size. Among community types, critical access

hospitals reported the lowest percentage (4%), and other rural hospitals reported

the highest percentage (6%).

D. Executive Compensation

9

The study’s questionnaire asked various questions regarding each hospital’s

compensation practices. These involved reporting compensation amounts for

the hospital’s officers, directors, trustees, and key employees, as well as

information regarding certain policies and practices used to establish

compensation for such persons. In addition, the study involved the examination

of 20 organizations regarding their executive compensation practices.

In general, the hospitals reported widespread compliance with key indicators of

sound compensation practices, including use of formal written compensation

policies, use of comparability data, approval in advance by persons without a

conflict of interest, and setting compensation within the range of comparability

data. This pattern was reported consistently across the community types and

revenue size categories, and was confirmed in the examinations of the 20

hospitals.

The average and median compensation amounts paid to the top management

official as reported on the questionnaire were $490,000 and $377,000,

respectively. Compensation amounts varied across demographics, but generally

increased as the hospital’s revenue size increased. Generally, rural hospitals

(CAH and non-CAH) paid lower compensation than did urban and suburban

hospitals (high population and other urban and suburban).

For the 20 hospital compensation examinations, the average and median

compensation amounts paid to the top management official were $1.4 million and

$1.3 million, respectively. Because the examined hospitals were selected on the

basis of higher reported compensation amounts, a disparity between the overall

group and the examined hospitals was expected.

10

II. INTERIM REPORT AND ADDITIONAL WORK UNDERTAKEN FOR FINAL

REPORT

A. Questionnaire Content Included in Final Report

The primary focus of the Final Report’s work was to analyze differences in

community benefit expenditures among the respondent hospitals. This Final

Report provides breakdowns by demographics for several of the questionnaire’s

key areas, including aggregate community benefit expenditures, uncompensated

care, medical education and training, medical research, and community

programs. These include the following questions:

• Patients covered by private insurance, Medicare, Medicaid, other public

insurance, no insurance – questions 2 through 7

• Medical research expenditures – questions 21 and 22

• Professional medical education and training – questions 30 and 31

• Uncompensated care – questions 35 through 38, 40

• Community programs – questions 57, 58, 61, 62, 65, 66, 69 through 71

B. Significant Adjustments to the Interim Report

The Interim Report included data comparing various hospital expenses, including

certain community benefit expenditures, as a percentage of total revenue. These

revenue numbers were derived from the organizations’ most recently filed Forms

990 that had been received by the IRS at the time the questionnaire information

for that hospital was being reviewed and analyzed. After the issuance of the

Interim Report, additional Forms 990 for certain of the respondent hospitals were

received by the IRS, allowing the use of revenue information from the tax year to

which the questionnaire’s expense and community benefit expenditure

information pertains. Accordingly, in this Final Report, the total revenue

information is taken from the Form 990 that corresponded to the tax year which

each hospital used to complete the questionnaire.

This adjustment significantly changed some of the calculations of expenses

reported as a percentage of revenue for those hospitals that had a large change

in revenue from the Form 990 for the tax year initially used in the Interim Report.

Changes also resulted from continued analysis of narrative and other information

provided by the responding hospitals and from correcting data entry and

transcription errors.

The most significant changes are described as follows.

1. Average and median annual total revenues of the responding hospitals.

The Interim Report reported average and median annual total revenues of

all of the hospitals in the study as $169 million and $83 million,

respectively. The average and median annual total revenues of all of the

11

hospitals in the study were adjusted upward to $179 million and $89

million, respectively. These upward adjustments in total revenues affected

many of the percentages reported in the Interim Report that used total

revenues in the denominator (e.g., percentage of total revenues spent on

community program expenditures).

2. Patient Mix. The Final Report shows a change in the reported patient

insurance coverage mix from 46% to 43% for private insurance, 46% to

49% for public programs (Medicare, Medicaid, and other public programs),

and 7% to 8% with no insurance coverage.

3. Medical Research. The average of the percentages of total revenues

spent on medical research by these hospitals was adjusted downward

from 8% to 2% while the median decreased from 0.24% to 0.22%.

3

4. Community Programs. The averages and medians of the percentages of

total revenue spent on aggregate community programs, and on the

various components of community programs (e.g., immunization

programs), have been revised. The most significant change was the

downward adjustment of the average percentage of total revenue reported

to have been spent on aggregate community programs from 3.4% to

0.9%.

C. Breakdown of Hospitals by Community Types (High Population, Critical

Access Hospital (CAH), Rural (non-CAH), and Other Urban and Suburban

Hospitals)

To assess differences in community benefit expenditure amounts and types to

take into account varying demographics such as rural, suburban, and urban

communities and hospitals, the Final Report establishes four “community types”

and reports much of the aggregate community benefit expenditure data across

these four community types. These community types attempt to reflect

demographic areas commonly regarded as urban, suburban, and rural.

The hospitals located in rural areas were divided between those that are critical

access hospitals and those that are not critical access hospitals (as described in

more detail below). These groups are referred to as “critical access hospitals” (or

“CAH”) and “rural (non-CAH).” The remaining hospitals were divided into two

groups. Those hospitals located in the 26 largest urban areas in the United

States were categorized in the “high population” category. The other hospitals

located in urban or suburban areas were included in the “other urban and

suburban” category (referred to in the figures as “other”).

Based on the reported data, the 489 hospitals were classified into community

types as follows:

• “High population” – 94 hospitals (19%)

3

A significant component of the downward adjustment in the average is due to the correction of

a data entry and transcription error made during the study.

12

• “Critical access hospitals (CAH)” – 68 hospitals (14%)

• “Rural (non-CAH)” – 78 hospitals (16%)

• “Other urban and suburban” – 249 hospitals (51%).

The community types are defined as follows:

High population. “High population” refers to the hospitals in the study that are

located in the 26 urban areas in the United States that had populations of 1.5

million or more people, based on the 2000 Census. The U.S. Census Bureau

defines an urban area as core census block groups or blocks that have a

population density of at least 1,000 people per square mile, and surrounding

census blocks that have an overall density of at least 500 people per square

mile.

4

Based on this definition, some of the hospitals in this group are located in

what people commonly consider the suburbs of large cities, but other hospitals

located in many large cities are not included in this group.

The urban areas included in the high population community type are displayed in

the map below.

Other urban and suburban. “Other urban and suburban” refers to hospitals that

are located in any Census Bureau urban area that had a population of less than

1.5 million according to the 2000 Census. Accordingly, these hospitals are

located in all the Census Bureau urban areas other than the 26 largest urban

areas included in the high population category.

4

See www.census.gov (http://www.census.gov/geo/www/ua/ua_2k.html).

13

Critical access hospitals (CAHs). “Critical access hospital” refers to all the

hospitals in the study that are designated critical access hospitals by the

Department of Health and Human Services or otherwise under federal law.

CAHs must be certified by the Centers for Medicare & Medicaid Services (CMS),

an agency within the Department of Health and Human Services. A facility that

meets the following criteria may be designated by CMS as a CAH:

5

• Is located in a State that has established with CMS a Medicare rural

hospital flexibility program; and

• Has been designated by the State as a CAH; and

• Is currently participating in Medicare as a rural public, non-profit or for-

profit hospital; or was a participating hospital that ceased operation during

the 10-year period from November 29, 1989 to November 29, 1999; or is a

health clinic or health center that was downsized from a hospital; and

• Is located in a rural area or is treated as rural; and

• Is located more than a 35-mile drive from any other hospital or CAH (in

mountainous terrain or in areas with only secondary roads available, the

mileage criterion is 15 miles); and

• Maintains no more than 25 inpatient beds; and

• Maintains an annual average length of stay of 96 hours per patient for

acute inpatient care; and

• Complies with all CAH Conditions of Participation, including the

requirement to make available 24-hour emergency care services 7 days

per week.

Rural (non-CAH). “Rural (non-CAH)” refers to the hospitals in the study that are

not located in any Census Bureau urban area and are not CAHs. CMS provided

the IRS with a list of rural hospitals that are not CAHs which CMS used in its

Fiscal Year 2009 inpatient prospective payment system (IPPS) proposed rule

impact file. IPPS is used to set payment rates for acute care hospitals that are

not compensated under the CAH system. This CMS list was then compared to

the list of hospitals in the study as a way of confirming these were located

outside of Census Bureau urban areas.

D. Breakdown of Hospitals by Revenue Size

The Final Report provides breakdowns of aggregate information by revenue size,

based on annual revenue as reported in Forms 990. Based on reported data, the

IRS was able to classify 488 hospitals as follows:

• Under $25 million – 85 hospitals (17%)

• $25 million to $100 million – 173 hospitals (36%)

5

See www.cms.hhs.gov (http://www.cms.hhs.gov/CertificationandComplianc/04_CAHs.asp); 42

U.S.C. 1395X(mm); 42 U.S.C. 1395i-4(e); 42 C.R.F. 485.606.

14

• $100 million to $250 million – 133 hospitals (27%)

• $250 million to $500 million – 61 hospitals (13%)

• Over $500 million – 36 hospitals (7%).

E. Hospitals Reporting Largest Amounts of Medical Research Expenditures

The Final Report categorizes a group of 15 hospitals that reported 93% of the

medical research expenditures reported by the respondent hospitals. The report

also summarizes key community benefit expenditure data regarding this group,

and isolates the impact of this group’s medical research expenditures on the

overall group’s reported community benefit expenditures. See Section VI.B,

below.

F. Analysis of Bad Debt and Shortfalls as Uncompensated Care

The Final Report analyzes reporting of bad debt and shortfalls from insurance,

government programs, and uninsured patients, across community types and

revenues sizes. These results are described in Section VI.C, below.

G. Comparison of Reported Community Benefit Expenditures Across

Communities Based on Income and Insurance Coverage Levels

The Final Report analyzes reporting of community benefit expenditures along

certain per capita income and insurance coverage levels to determine whether

reported uncompensated care varied by income and insurance coverage levels

of the communities served by the responding hospitals. See Section VI.D,

below.

H. Executive Compensation

The Final Report summarizes the data provided by the respondent hospitals in

response to the questions contained in Part III – Compensation Practices, of the

questionnaire. In addition, the Final Report summarizes the results of the 20

examinations that addressed certain executive compensation issues. See

Section VII, below.

I. Form 990, Schedule H, Hospitals

The Final Report describes the final Form 990, Schedule H, Hospitals, effective

for 2008 and later tax years, and explains how that schedule addresses many of

the reporting concerns in this study. See Section VIII, below.

15

III. BACKGROUND ON U.S. HOSPITALS AND PRIOR STUDIES

A. Background on U.S. Hospitals

According to the American Hospital Association (AHA), there are 5,708

registered hospitals in the United States.

6

These include 4,897 community

hospitals, which are defined as all nonfederal, short-term general, and other

special hospitals (obstetrics and gynecology; eye, ear, nose, and throat;

rehabilitation; orthopedic; and other individually described specialty services).

7

The community hospitals include the following:

• 2,913 nongovernment nonprofit community hospitals (59% of community

hospitals)

• 873 investor-owned for-profit community hospitals (18% of community

hospitals)

• 1,111 state and local government community hospitals (23% of community

hospitals).

8

AHA reports 1,997 rural community hospitals (41%) and 2,900 urban community

hospitals (59%).

9

In its 2006 report on community benefit, the Congressional

Budget Office reported that 51% of nonprofit hospitals were in large urban areas,

34% were in small urban or suburban areas, and 14% were in rural areas.

10

According to the Congressional Budget Office, the distribution of hospitals across

nonprofits, for-profits and government hospitals “varies markedly by region. In

the Northeast, 89 percent of the hospitals are nonprofits, whereas in the South

only 43 percent of the hospitals are nonprofits. For-profit hospitals are common

in the South and West, but not in the Northeast and Midwest.”

11

This is

consistent with the 2005 GAO report, which reported that “states in the Northeast

6

http://www.aha.org/aha/resource-center/Statistics-and-Studies/fast-facts.html (Fast Facts on US

Hospitals). The information from AHA’s web site was as last updated on November 7, 2008. For

this purpose, a registered hospital is a hospital that satisfies AHA’s criteria for registration as a

hospital facility, including both AHA member hospitals and nonmember hospitals.

7

The remaining 811 non-community hospitals include federal government hospitals, nonfederal

psychiatric hospitals, nonfederal long term care hospitals, prison hospitals, college infirmaries,

and other facilities.

8

This breakdown is similar to that reported by the Congressional Budget Office (CBO) in 2006:

nonprofit hospitals (58%), for-profit hospitals (18%), and government hospitals (24%).

Congressional Budget Office, “Nonprofit Hospitals and the Provision of Community Benefits,”

December 2006, pages 12-13 (Tables 2 and 3). It is also similar to the breakdown reported in

the 2005 United States Government Accountability Office (GAO) report, “Nonprofit, For-Profit,

and Government Hospitals, Uncompensated Care and Other Community Benefits,” May 2005,

page 4 (nonprofit hospitals – 62%, government hospitals – 20%, and for-profit hospitals – 18%).

9

The AHA fact sheet did not describe how the hospitals were classified as rural or urban.

10

Congressional Budget Office, “Nonprofit Hospitals and the Provision of Community Benefits,”

December 2006, page 13.

11

Id. at 12.

16

and Midwest had relatively high concentrations of nonprofit hospitals, whereas in

the South the concentration was relatively low.”

12

The 2006 CBO study also reported the following, based on data from 2003:

13

• Nonprofit hospitals tend to be larger than for-profit hospitals and are more

likely to be teaching hospitals

• Nonprofit hospitals have higher average total assets, fixed assets, net

patient revenues, and operating expenses than both for-profit and

government hospitals

• Nonprofit hospitals have a total margin (3.9%), measured as total

payments from all sources over all costs as a share of payments, that is

somewhat higher than government hospitals (2.9%) but lower than for-

profits (9.1%)

Critical Access Hospitals. The Medicare Rural Hospital Flexibility Program,

created by Congress in 1997, allows certain hospitals to be licensed as critical

access hospitals. Critical access hospitals generally must be located in a rural

area or in an area treated as rural, and satisfy certain specified requirements

allowing them to be designated as such.

14

Under federal law, critical access

hospitals differ from urban and other rural hospitals, both in terms of how they

are reimbursed under Medicare programs and in their organization and

operations.

As of September 2008, there were 1,294 critical access hospitals in 45 states

across the United States.

15

The five states with the greatest number of critical

access hospitals were Kansas (83), Iowa (82), Minnesota (79), Texas (74), and

Nebraska (65). Three heavily populated states – California (27), Florida (11),

and New York (13) – have fewer critical access hospitals. Five states –

Connecticut, Delaware, Maryland, New Jersey, and Rhode Island – did not

participate in federal programs required for critical access designation and did

not have any critical access hospitals in their states.

12

United States Government Accountability Office (GAO) report, “Nonprofit, For-Profit, and

Government Hospitals, Uncompensated Care and Other Community Benefits,” May 2005, page

4.

13

Congressional Budget Office, “Nonprofit Hospitals and the Provision of Community Benefits,”

December 2006, pages 12-14.

14

See Section II.C for a description of the requirements for critical access hospital designation.

15

www.flexmonitoring.org/cahlistRA.cgi (CAH Information). The information described here is as

reported by the Flex Monitoring Team, which consists of the Rural Health Research Centers at

the Universities of Minnesota, North Carolina at Chapel Hill, and Southern Maine. The team

members are recipients of a cooperative agreement award from the Federal Office of Rural

Health Policy to monitor and evaluate the Medicare Rural Hospital Flexibility Program. The

monitoring project assesses the impact of the flexibility program on rural hospitals and

communities and the role of states in achieving overall program objectives, including improving

access to and the quality of health care services; improving the financial performance of critical

access hospitals; and engaging rural communities in health care system development.

17

Unlike other hospitals which are reimbursed under the Medicare prospective

payment system, critical access hospitals receive cost-based reimbursement for

inpatient and outpatient care. These differences may affect financial

performance, and the incentives, financial management, and utilization practices

under the two Medicare payment methods may differ substantially.

16

The Flex Monitoring Team (see footnote 15 for an explanation of the Flex

Monitoring Team) reviews 20 financial indicators in six domains – profitability,

liquidity, capital structure, revenue, cost, and utilization – and prepares annual

reports regarding these indicators for critical access hospitals across the United

States. For example, in its August 2008 report (for 2006), the team reported a

“total margin” (net income divided by total revenue) of 3.6% for critical access

hospitals across the United States;

17

the total margin reported in the team’s

August 2007 report (for 2005) was 2.6%.

18

Profitability varied materially across

the states – for 2005, critical access hospitals in 7 states had aggregate negative

“total margins” and 4 states reported total margins exceeding 5% of total

revenue.

19

For 2006, 4 states reported aggregate negative total margins, and 14

states reported total margins exceeding 5% of total revenue.

20

The Flex

Monitoring Team reports demonstrate that financial performance for critical

access hospitals varies considerably across the various states.

B. Other Studies on Community Benefit Provided by Nonprofit Hospitals

Other recent studies have explored community benefit reporting by nonprofit and

other hospitals. These studies include a 2006 study by the Congressional

Budget Office,

21

and two separate studies by the Government Accountability

Office – one in 2005

22

and the other in 2008.

23

As described below, these

studies generally found that community benefit reporting varied by type of

hospital, and that uncompensated care and community benefit expenditures

often were concentrated in a relatively small number of hospitals, whether

nonprofit, for-profit, or government hospitals.

2005 GAO Report

. In May 2005, the GAO issued a report to the Committee on

Ways and Means, House of Representatives of the United States Congress,

16

Flex Monitoring Team Data Summary Report No. 5, “CAH Financial Indicators Report:

Summary of Indicator Medians by State,” August 2008, page 2.

17

Id. at 4.

18

Flex Monitoring Team Data Summary Report No. 4, “CAH Financial Indicators Report:

Summary of Indicator Medians by State,” August 2007, page 4.

19

Id.

20

Flex Monitoring Team Data Summary Report No. 5, “CAH Financial Indicators Report:

Summary of Indicator Medians by State,” August 2008, page 4.

21

Congressional Budget Office, “Nonprofit Hospitals and the Provision of Community Benefits,”

December 2006.

22

United States Government Accountability Office (GAO) report, “Nonprofit, For-Profit, and

Government Hospitals, Uncompensated Care and Other Community Benefits,” May 2005.

23

United States Government Accountability Office (GAO) report, “Nonprofit Hospitals, Variation in

Standards and Guidance Limits Comparison of How Hospitals Meet Community Benefit

Requirements,” September 2008.

18

regarding uncompensated care and other community benefits provided by

nonprofit, for-profit and government hospitals. The study looked at data from 5

states – California, Florida, Georgia, Indiana, and Texas. The study defined

community benefits to include uncompensated care as well as services such as

the provision of health education and medical research. GAO found that

government hospitals generally devoted substantially larger shares of their

patient operating expenses to uncompensated care (defined to include charity

care and bad debt) than did nonprofit and for-profit hospitals.

24

Further, within

each group, the burden of uncompensated care costs was not evenly distributed

among hospitals but instead was concentrated in a small number of hospitals,

meaning that a small number of nonprofit hospitals accounted for substantially

more of the uncompensated care than did other nonprofit hospitals.

25

For all

three groups, the top quarter of hospitals devoted substantially greater

percentages of their patient operating expenses to uncompensated care, on

average, compared with the bottom quarter of hospitals.

26

2006 Congressional Budget Office Report. This study measured the provision of

certain community benefits and compared nonprofit hospitals with for-profit

hospitals. It also examined the provision of community benefits by nonfederal

government hospitals.

The 2006 CBO Report found that although nonprofit hospitals must provide

community benefits in order to receive tax exemptions, there is little consensus

on what constitutes a community benefit or how to measure such benefits.

27

CBO found that, on average, nonprofit hospitals provided higher levels of

uncompensated care (for purposes of this study, the sum of charity care and bad

debt) than did otherwise similar for-profit hospitals, but that among individual

hospitals, the provision of uncompensated care varied widely.

28

Uncompensated

care as a share of hospitals’ operating expenses was much higher at government

hospitals (13.0%) than at either nonprofit hospitals (4.7%) or for-profit hospitals

(4.2%).

29

CBO also found that nonprofit hospitals were more likely than for-profit hospitals

to provide certain specialized services that have been identified by certain

24

United States Government Accountability Office (GAO) report, “Nonprofit, For-Profit, and

Government Hospitals, Uncompensated Care and Other Community Benefits,” May 2005 (What

GAO Found).

25

Id.

26

Id. at 13-14.

27

Congressional Budget Office, “Nonprofit Hospitals and the Provision of Community Benefits,”

December 2006, page 1.

28

Id. at 1-2. CBO observed that uncompensated care, when measured by including bad debt,

has “substantial limitations” as a measure of community benefits, as it does not distinguish

between the provision of charity care for the indigent and bad debt. Id. at 9.

29

Id. at 2.

19

researchers as being generally unprofitable, including emergency room care,

labor and delivery services, burn intensive care, and high-level trauma care.

30

2008 GAO Report. In September 2008, the GAO issued its Report to the

Ranking Member, Committee on Finance, U.S. Senate, regarding community

benefit reporting by nonprofit hospitals.

31

In this study, GAO analyzed federal

and state laws; the standards and guidance from federal agencies and industry

groups; and 2006 data from California, Indiana, Massachusetts, and Texas.

GAO found that the IRS’s community benefit standard allows nonprofit hospitals

broad latitude to determine the services and activities that constitute community

benefit, and that state community benefit requirements that hospitals must meet

to qualify for state tax-exempt or nonprofit status vary substantially in scope and

detail.

32

GAO found that variations in the activities nonprofit hospitals define as

community benefit lead to substantial differences in the amount of community

benefits they report, and that nonprofit hospitals measure costs of these activities

differently, which can lead to inconsistencies in reported community benefits.

33

C. Study on Executive Compensation of Nonprofit Hospitals

2006 GAO Nonprofit Hospital System Survey on Executive Compensation

Policies and Practices. In response to a request by the House Ways and Means

Committee, the GAO surveyed executive compensation issues at selected

private, nonprofit hospital systems to gain an understanding of the policies and

practices related to the salaries, benefits, travel, gifts and entertainment

expenses paid by these hospital systems.

34

The study’s key questions were as

follows:

• What corporate governance structure do selected hospital systems report

as having in place over executive compensation?

• What is the basis for the compensation and benefits earned by, awarded

to, or paid to the executives as reported by selected hospital systems?

• What internal controls do selected hospital systems report as having in

place over the approval, payment, and monitoring of executive travel and

entertainment expenses, gifts, and other perquisites?

35

The GAO found that the hospital systems reported similarities in certain

governance and compensation policies and practices, such as:

30

Id. at 3, 20.

31

United States Government Accountability Office (GAO) report, “Nonprofit Hospitals, Variation in

Standards and Guidance Limits Comparison of How Hospitals Meet Community Benefit

Requirements,” September 2008.

32

Id. (see What GAO Found).

33

Id.

34

United States Government Accountability Office, Nonprofit Hospital Systems, Survey on

Executive Compensation Policies and Practices, June 2006.

35

Id. at 1.

20

• having an executive compensation committee or entire board with primary

responsibility for approving executives’ base salary, bonuses, and

perquisites;

• having a conflict of interest policy that covers members of the executive

compensation committee and compensation consultants; and

• relying upon comparable market data of total compensation and benefits

prior to making compensation determinations.

36

The GAO found, however, that the hospital systems reported a range of practices

with respect to entertainment, travel expenses, payment for perquisites such as

memberships in recreational and social clubs, and audits of perquisites and

entertainment expenses.

37

36

Id. at 2.

37

Id.

21

IV. DEMOGRAPHICS - PATIENT MIX, REVENUES, EXCESS REVENUES

This section provides demographic information for the hospitals included in the

study. Section IV.A reports insurance coverage based on questionnaire

responses. Section IV.B summarizes basic financial information (by revenue

size) of the hospitals that reported revenues and expenses for their Form 990.

Section IV.C provides financial information by community type. Section IV.D

describes the demographic overlap of the community type and revenue size

categories. Section IV.E provides a further breakdown by excess revenue

categories.

A. Patient Insurance Coverage

Based on 480 responses, the average percentage of patients with no insurance

was 8%, with private insurance was 43%, with Medicare was 31%, with Medicaid

was 15%, and with some other form of public insurance was 3%. Figure 1,

below, displays the breakdown.

Figure 1. Average Percentage of Insurance Coverage

43%

31%

15%

8%

3%

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

50%

Private

Insurance

(n=475)

Medicare

(n=474)

Medicaid

(n=474)

Other Public

Insurance

(n=331)

Self Pay

(n=475)

Insurance Type

Average Percentage of Patients

B. Revenues and Excess Revenues By Revenue Size

This section classifies the hospitals into five revenue categories, and reports

revenue, expense, and excess revenue information for these categories. Key

findings of this section include the following:

22

1. The average and median total revenue amounts were $179 million and

$89 million, respectively. The average and median excess revenue

amounts were $8.3 million and $2.5 million, respectively.

2. The largest hospitals reported a disproportionately large percentage of

aggregate total revenues. 7% of all hospitals (those with revenues over

$500 million) reported 40% of aggregate total revenues.

3. Overall, excess revenues as a percentage of total revenues was 4.6%.

Excess revenues as a percentage of total revenues was lowest for the

group of hospitals with revenues under $25 million (3.3%), and increased

with revenue size. Each revenue size category reported an aggregate

excess revenue amount, as well as average and median excess revenue

amounts, greater than zero.

4. 79% of all hospitals reported excess revenues. 39% reported excess

revenues as a percentage of total revenues in the 0% to 5% range. 40%

reported excess revenues as a percentage of total revenues in the over

5% range.

5. 21% of the overall group reported a deficit (total expenses greater than

total revenues) or zero excess revenues. The percentage of hospitals

reporting a deficit or zero excess revenues was greatest for the group of

smallest hospitals (35%) and decreased with revenue size.

The aggregate annual revenues reported on Form 990 by the 488 hospitals was

$87.5 billion. A relatively small number of larger hospitals reported a

disproportionately large portion of the overall reported revenues.

Figure 2, below, shows the distribution of hospitals by annual revenues and

compares the percentages of hospitals in each revenue size group to the

percentages of aggregate revenues reported by each group.

Figure 2. Distribution of Hospitals by Aggregate Annual Revenues

Respondent Profile

Aggregate Reported

Revenue

Annual Revenues

#

% of all

hospitals

$Billion

% of

aggregate

revenue

Under $25M 85 17% $1.2 1%

$25M to under $100M 173 36% $9.8 11%

$100M to under $250M 133 27% $21.0 24%

$250M to under $500M 61 13% $20.8 24%

$500M and over 36 7% $34.7 40%

Total 488 100% $87.5 100%

23

The smallest revenue size comprised 17% of the hospitals, but only 1% of the

aggregate reported revenues. The largest group comprised 40% of aggregate

revenues even though it comprised only 7% of the total number of hospitals.

Figure 3, below, displays total annual revenues, total expenses, and the

excess/deficit revenues (difference between total revenues and total expenses)

as reported on Form 990 for each category. Separate charts are provided below

for total revenues and excess revenues.

Figure 3. Annual Total Revenues, Total Expenses, and Excess/Deficit Revenue by

Revenue Size

Annual Total Revenues Annual Total Expenses Annual Excess/Deficit Revenue

Revenue Size

Aggregate Average Median Aggregate Average Median Aggregate Average Median

(Billion $) (Million $) (Million $) (Billion $) (Million $) (Million $) (Million $) (Million $) (Million $)

Under $25M

(N = 85)

1.224 14.4 15.2 1.184 13.9 15.0 40.6 0.5 0.3

$25M - Under

$100M (N = 173)

9.795 56.6 56.2 9.425 54.5 52.8 370.2 2.1 1.7

$100M - Under

$250M (N = 133)

20.985 157.8 152.2 20.184 151.8 146.9 801.0 6.0 4.9

$250M – Under

$500M (N = 61)

20.829 341.5 330.2 19.903 326.3 310.9 925.9 15.2 16.2

$500M and

Over (N = 36)

34.690 963.6 734.7 32.769 910.3 698.6 1,920.9 53.4 38.3

Overall (N = 488) 87.523 179.4 89.4 83.464 171.0 87.1 4,058.5 8.3 2.5

The average total annual revenue, as reported on the respondents’ Forms 990,

Line 12, was $179 million, and the median was $89 million. Each revenue size

category reported positive numbers for average and median excess revenues.

The charts below display the average and median total revenues and excess

revenue by revenue size category.

24

Figure 4. Average and Median of Annual Total Revenues by Revenue Size

14.4

5

6

.

6

157

.

8

341

.

5

963.

6

1

7

9

.

4

1

5

.2

5

6

.

2

15

2

.

2

3

3

0

.

2

734.7

89.4

0

100

200

300

400

500

600

700

800

900

1,000

1,100

Under $25M (N =

85)

$25M - Under

$100M (N = 173)

$100M - Under

$250M (N = 133)

$250M - Under

$500M (N = 61)

$500M and Over

(N = 36)

All (N = 488)

Revenue Size

Average & Median of Annual Total Revenues (in $ Million)

Average Median

In general, the average and median amounts are relatively close within each of

the different groups. The difference between the average and median for

hospitals with revenues of $500 million and over, however, varies more than for

the others. This indicates that some relatively large hospitals have total

revenues that are much higher than the median total revenues for the $500

million and over group.

25

Figure 5. Average and Median of Annual Excess Revenue

by Revenue Size

0

.

5

2.1

6.

0

1

5.

2

53.4

8.3

0.

3

1.7

4

.

9

1

6.

2

3

8.

3

2

.5

0

10

20

30

40

50

60

Under $25M (N

= 85)

$25M - Under

$100M (N = 173)

$100M - Under

$250M (N = 133)

$250M - Under

$500M (N = 61)

$500M and

Over (N = 36)

All (N = 488)

Revenue Size

Average & Median of Annual Excess Revenue (in $ Million)

Average Median

Figure 6, below, shows the reported aggregate excess revenues as a percentage

of aggregate total revenues for each revenue size category and overall. These

calculations are based on aggregate amounts reported in Figure 3 above. For

example, the overall 4.6% figure represents $4.1 billion of aggregate excess

revenues divided by $87.5 billion of aggregate total revenues.

26

Figure 6. Excess Revenue as a Percentage of Total Revenue

Revenue Size Excess revenue as a percentage of

total revenue

Under $25 million (N = 85) 3.3%

$25 million to $100 million (N = 173) 3.8%

$100 million to $250 million (N = 133) 3.8%

$250 million to $500 million (N = 61) 4.4%

Over $500 million (N = 36) 5.5%

Total (N = 488) 4.6%

The aggregate excess revenue as a percentage of aggregate total revenue

generally increased across the categories, from a low of 3.3% for the under $25

million category to a high of 5.5% for the over $500 million category. The overall

average was 4.6%.

Figure 7, below, shows the distribution of negative/positive excess revenues as a

percentage of revenues.

Figure 7. Distribution of Excess Revenue as a Percentage of Annual Total Revenue by

Revenue Size

Excess Revenues as Percentage of Total Revenues Range

All

0% or Negative

Positive to <

2.5%

2.5% - < 5% 5% - < 10% 10% & Over

% of all % of % of % of % of % of

hospitals revenue revenue revenue revenue revenue

Revenue Size

N

N

size

N

size

N

size

N

size

N

size

Under $25M 85 17 30 35 13 15 11 13 19 22 12 14

$25M - Under

$100M

173 36 39 23 29 17 41 24 43 25 21 12

$100M - Under

$250M

133 27 25 19 30 23 29 22 39 29 10 8

$250M and

Over

97 20 10 10 19 20 18 19 40 41 10 10

All 488 100 104 21 91 19 99 20 141 29 53 11

Figure 7, above, shows that overall 21% of the hospitals reported total expenses

greater or equal to total revenues, and 39% of the hospitals reported excess

revenues as a percentage of total revenues in the range of greater than 0% to

5%. 40% of all hospitals reported excess revenues as a percentage of total

revenues of at least 5%; 11% reported excess revenues of at least 10% of total

revenues.

The percentage of hospitals reporting a deficit or zero excess revenue decreased

as revenue size increased. The $500 million and over revenue size had the

smallest percentage of hospitals reporting zero or a deficit.

38

38

The two largest revenue sizes were combined to prevent potential identification of respondent

hospitals.

27

C. Revenues and Excess Revenues by Community Type

This section classifies the hospitals into four community types, and reports

revenue, expense, and excess revenue information for these categories. Key

findings of this section include the following:

1. Rural hospitals generally reported smaller total revenues and excess

revenues than did other community types. The rural community types had

a disproportionately small percentage of aggregate total revenues (30% of

the hospitals, 10% of aggregate revenues), while the high population

community type had a disproportionately large percentage of aggregate

revenues (19% of hospitals, 41% of aggregate revenues).

2. Each community type reported aggregate excess revenues and average

and median excess revenues as a percentage of total revenues greater

than zero. CAHs reported the smallest average and median total

revenues ($29 million and $20 million, respectively) and the smallest

average and median excess revenue amounts ($1.0 million and $0.5

million, respectively). High population hospitals reported the largest

average and median amounts, both for total revenues ($389 million and

$196 million, respectively) and for excess revenues ($17.5 million and

$4.2 million, respectively).

3. CAHs reported the smallest percentage of excess revenues as a

percentage of total revenues (3.5%); rural (non-CAH) hospitals reported

the largest percentage (6.0%). 34% of CAHs reported a deficit (total

expenses greater than total revenues) or zero excess revenue compared

to 13% for rural (non-CAH) hospitals and 21% overall.

The table below shows the distribution of hospitals and aggregate total revenues

by community types.

Figure 8. Distribution of Hospitals and Total Revenues by Community Type

Respondent Profile

Aggregate Reported

Revenue

Community Type

# % $Billion %

High Population 93 19% $36.2 41%

Rural – CAH 68 14% $2.0 2%

Rural – Non CAH 78 16% $7.3 8%

Other 249 51% $42.1 48%

Total 488 100% $87.5 100%

The rural community types had a disproportionately small percentage of

aggregate total revenues while the high population community type had a

disproportionately large percentage of aggregate revenues. The other urban and

suburban category comprised approximately half of the number of hospitals and

overall reported total revenues.

28

Figure 9, below, includes the aggregate, average and median total revenues,

total expenses, and excess of revenues over expenses by community type.

Figure 10 and Figure 11 display total revenues and excess revenues by

community type.

Figure 9. Annual Total Revenues, Total Expenses, and Excess/Deficit Revenue

by Community Type

Annual Total Revenues Annual Total Expenses Annual Excess/Deficit Revenue

Aggregate

Average Median

Aggregate

Average Median

Aggregate

Average Median

Community

Types

(Billion $) (Million $) (Million $) (Billion $) (Million $) (Million $) (Million $) (Million $) (Million $)

High

Population

(N = 93)

36.184 389.1 195.8 34.557 371.6 196.7 1,627.5 17.5 4.2

Rural - CAH

(N = 68)

1.965 28.9 19.6 1.896 27.9 19.3 69.3 1.0 0.5

Rural - Non

CAH

(N = 78)

7.256 93.0 67.7 6.823 87.5 64.8 433.3 5.6 3.4

Others

(N = 249)

42.117 169.1 113.9 40.189 161.4 109.7 1,928.4 7.7 3.1

Overall 87.523 179.4 89.4 83.464 171.0 87.1 4,058.5 8.3 2.5

29

Figure 10. Average and Median Annual Total Revenue by Community Type

389.1

28.9

93.0

169.1

179.4

195.8

19.6

67.7

113.9

89.4

0

50

100

150

200

250

300

350

400

450

High Population

(N = 93)

CAH (N = 68) Rural - Non CAH

(N = 78)

Others (N = 249) All (N = 488)

Community Type

Average & Median of Annual Total Revenues (in $ Million)

Average Median

The CAHs reported the smallest average and median revenue amounts of any

community type. The average annual total revenue for hospitals in the high

population group is more than double the average annual total revenue for

hospitals in the other urban and suburban category, the next largest group, and

more than double the average annual total revenue for the entire group of

hospitals.

The high population group shows the largest difference between average

revenue and median revenue. This deviation indicates that there are a number

of extremely large hospitals (relative to the others in the group) located in high

population areas.

30

Figure 11. Average and Median Annual Excess Revenue by Community Type

17. 5

1.0

5.6

7.7

8.3

4.2

0.5

3.4

3.1

2.5

0

2

4

6

8

10

12

14

16

18

20

High Population

(N = 93)

CAH (N = 68) Rural - Non CAH

(N = 78)

Others (N = 249) All (N = 488)

Community Type

Average & Median of Annual Excess Revenue (in $ Million)

Average Median

31

As was the case with total revenues, the greatest variation between average and

median excess revenue amounts was with the high population group.

The table below shows the reported excess revenues as a percentage of total

revenues for each community type. These calculations are based on aggregate

amounts reported in Figure 9, above. For example, the overall 4.6% figure

represents $4.1 billion of aggregate excess revenues divided by $87.5 billion of

aggregate total revenues.

Figure 12. Excess Revenue as a Percentage

of Total Revenue by Community Type

Community Type Excess revenues as a percentage

of total revenue

High population (N = 93) 4.5%

Rural - CAH (N = 68) 3.5%

Rural - Non CAH (N = 78) 6.0%

Others (N = 249) 4.6%

All 488 hospitals 4.6%

The overall measure of excess revenues as a percentage of total revenues was

4.6%. All four community types reported revenues greater than expenses for the

year. The CAH community type reported the smallest percentage of excess

revenues as a percentage of total revenues (3.5%) and rural (non-CAH) hospitals

reported the largest percentage (6%). High population and other urban and

suburban hospitals were approximately at the overall percentage.

Figure 13, below, shows the distribution of negative/positive excess revenues as

a percentage of revenues by community type.

Figure 13. Distribution of Excess Revenues as a Percentage of Annual Total Revenue

by Community Type

Excess Revenue as Percentage of Revenue Range

All

0% or Negative Positive to < 2.5% 2.5% - < 5% 5% - < 10% 10% & Over

Community

Type

N

% of all

hospitals

N

% of

community

type

N

% of

community

type

N

% of

community

type

N

% of

community

type

N

% of

community

type

High

Population