4377761v1/014918

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

Marc M. Seltzer (54534)

SUSMAN GODFREY L.L.P.

1901 Avenue of the Stars, Suite 950

Los Angeles, CA 90067

Tel: 310-789-3100

Fax: 310-789-3150

Email:

mseltzer@susmangodfrey.com

Scott Martin

Irving Scher

HAUSFELD LLP

33 Whitehall Street, 14

th

Floor

New York, NY 10004

Tel: (646) 357-1100

Fax: (212) 202-4322

Email: smartin@hausfeld.com

Email: ischer@hausfeld.com

[Additional Counsel Listed in

Signature Block]

Interim Class Counsel

Howard Langer

Edward Diver

Peter Leckman

LANGER GROGAN AND DIVER PC

1717 Arch Street, Suite 4130

Philadelphia, PA 19103

Tel: 215-320-5660

Fax: 215-320-5703

Email: hlanger@langergrogan.com

IN THE UNITED STATES DISTRICT COURT

FOR THE CENTRAL DISTRICT OF CALIFORNIA

IN RE: NATIONAL FOOTBALL

LEAGUE SUNDAY TICKET

ANTITRUST LITIGATION

Case No. ML 15-02668-BRO (JEMx)

CLASS ACTION

CONSOLIDATED AMENDED

COMPLAINT FOR DAMAGES

AND DECLARATORY AND

INJUNCTIVE RELIEF

PURSUANT TO SECTIONS 1

AND 2 OF THE SHERMAN ACT

THIS DOCUMENT RELATES TO:

ALL ACTIONS

Case 2:15-ml-02668-PSG-JEM Document 163 Filed 06/24/16 Page 1 of 59 Page ID #:1427

2

4377761v1/014918

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

Plaintiffs Ninth Inning Inc. dba The Mucky Duck, 1465 Third Avenue

Restaurant Corp. dba Gael Pub, Robert Gary Lippincott, Jr., and Michael Holinko,

by and through their attorneys, complain and allege as follows. All allegations

herein, except for those relating to the Plaintiffs themselves, are based on

information and belief.

INTRODUCTION

1. The 32 professional football teams (“Teams”) that compete in the

National Football League (“NFL”) have agreed among themselves, and with

DirecTV, and in concert with others, to eliminate all competition in the

broadcasting and sale of live video presentations of professional football games,

including specifically for purposes of this complaint, the broadcasting and sale of

DirecTV’s NFL Sunday Ticket service to residential and commercial subscribers as

described below.

1

As the Supreme Court has observed, each team “is a substantial,

independently owned, and independently managed business,” competing with its

rivals “not only on the playing field, but to attract fans, for gate receipts and for

contracts with managerial and playing personnel,” as well as “in the market for

intellectual property.” American Needle, Inc. v. NFL, 560 U.S. 183, 196-97 (2009)

(“American Needle”). Yet rather than compete in the multibillion-dollar football

broadcasting market, they have joined forces to restrict supply and raise prices.

1

Within this overall market is a submarket of “out-of-market” NFL games played

on Sunday afternoon and not broadcast on CBS, Fox, or formerly on NBC within

the viewer’s local television market. This distinct product, called the “NFL Sunday

Ticket” or “Sunday Ticket”, has been trademarked by Defendants and is recognized

by them as a separate product from NFL games broadcast on Fox, CBS, NBC,

ESPN, and the NFL Network.

Case 2:15-ml-02668-PSG-JEM Document 163 Filed 06/24/16 Page 2 of 59 Page ID #:1428

3

4377761v1/014918

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

2. It has been clear for more than half a century that such agreements

unreasonably restrain trade. In 1953, the United States Department of Justice

(“DOJ”) sued the NFL and its teams, alleging among other things that a far more

limited agreement—an agreement merely prohibiting teams from broadcasting

within 75 miles of another team’s city when that team was playing a televised game

away from home—was illegal under the Sherman Act. See

United States v. NFL,

116 F. Supp. 319 (E.D. Pa. 1953) (“NFL I”). The United States District Court for

the Eastern District of Pennsylvania readily agreed that that agreement was an

unjustified attempt to “enable the clubs . . . to sell monopoly rights” and “an

unreasonable and illegal restraint of trade.”

Id. at 326-27.

3. In 1961, the court applied this ruling to prevent the joint selling of

broadcast rights. United States v. NFL, 196 F. Supp. 445 (E.D. Pa. 1961)

(“NFL

II”). In response to this ruling, the NFL lobbied for and obtained a carefully limited

antitrust exemption that allows a league of professional football clubs to jointly sell

or transfer sponsored telecasting rights. This bill, known as the Sports Broadcasting

Act of 1961 (“SBA”) (

15 U.S.C. § 1291), exempted only “the free telecasting of

professional sports contests,” as former NFL Commissioner Pete Rozelle

(“Rozelle”) “[a]bsolutely” recognized. Congress expressly left the holdings of NFL

I in place (

15 U.S.C. § 1292), and provided no exemption for pay, cable and

satellite television distribution.

4. For some time after the SBA’s passage, the NFL and its Teams were

content to abide by its limits and jointly produce only free sponsored telecasts,

available to anyone with a television and a set of rabbit ears (or the modern

equivalent, a digital antenna). As cable and satellite television began to present

Case 2:15-ml-02668-PSG-JEM Document 163 Filed 06/24/16 Page 3 of 59 Page ID #:1429

4

4377761v1/014918

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

lucrative opportunities, however, the Teams chose not to compete in this new

sphere. Instead, they agreed to forgo all competition and sell their valuable products

only jointly, throttling the supply of professional football telecasts in violation of

the holdings of NFL I and II, and outside the carefully limited exemption of the

SBA.

5. No other major sports league in America has such a drastic, total

elimination of competition in the broadcasting of its games. While Major League

Baseball (“MLB”), the National Hockey League (“NHL”), and the National

Basketball Association (“NBA”) have each allocated markets geographically and

pooled so-called out-of-market rights, none has agreed to centralize control and sale

of all broadcast rights.

2

6. The anticompetitive effects of this agreement are clear and significant.

The agreement has restricted the availability of live video presentations of regular

season NFL games. The Teams have agreed not to avail themselves of cable,

satellite, or Internet distribution channels individually. In the absence of an

agreement, each team would have an incentive to distribute its games nationally in

these channels. Given the relatively low cost of internet streaming and satellite and

cable television carriage, each team acting independently would offer their games at

a competitive price to anybody in the country who wanted to watch that particular

team.

7. Instead, however, the Teams have all forgone this option in favor of

creating a more lucrative monopoly. The Teams have agreed to make an offering

2

Although not at issue here, these agreements are themselves anticompetitive and

illegal under the antitrust laws. See generally

Laumann v. NHL, 56 F. Supp. 3d 280,

297-302 (S.D.N.Y. 2014).

Case 2:15-ml-02668-PSG-JEM Document 163 Filed 06/24/16 Page 4 of 59 Page ID #:1430

5

4377761v1/014918

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

called “NFL Sunday Ticket” (also referred to herein as “Sunday Ticket”) the only

way to view games other than the limited selection of games broadcast through

sponsored telecasts (or, as discussed below, the cable channels ESPN and NFL

Network) in any given area. Sunday Ticket bundles all other games into one

package, sold jointly by the NFL to DirecTV and then by DirecTV to commercial

and residential subscribers.

8. The NFL Sunday Ticket is an out-of-market sports package that carries

all NFL Sunday afternoon games produced by Fox and CBS (except those broadcast

on local CBS and Fox affiliates). Sunday Ticket appeals to NFL fans with loyalties

to teams located throughout the United States and fans who want to watch more

than the six games that the NFL allows to be broadcast by television networks each

week. Additionally, commercial subscribers—primarily bars and restaurants—

generate a substantial share of their overall revenue by having the capability to

televise multiple professional football games simultaneously in order to attract a

diverse range of fans to their establishments on Sunday afternoons during the fall

NFL football season. Indeed, DirecTV specifically markets the NFL Sunday Ticket

to restaurants and bars, including, for example, through advertising such as: “Turn

your business into the neighborhood’s go-to spot with the undisputed leader in

sports” and “[o]nly DIRECTV has the sports packages you need to attract fans of

every stripe with NFL SUNDAY TICKET 2015 . . . .”

9. This scheme restricts competition and harms Sunday Ticket

purchasers. First, the total elimination of competition allows the NFL, its Teams,

and DirecTV to charge supracompetitive monopoly prices, rather than the prices

that would exist if the 32 teams were competing for interest and distribution in a

Case 2:15-ml-02668-PSG-JEM Document 163 Filed 06/24/16 Page 5 of 59 Page ID #:1431

6

4377761v1/014918

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

free market. Second, Class members must pay for access to all 32 teams’ out-of-

market games, even if they are only interested in viewing one or two teams’ games.

10. This exclusive deal, along with other contractual arrangements

between the NFL, its member teams, and DirecTV, as well as Fox, ESPN, CBS, and

NBC (collectively, the “Networks”), results in the blackout or unavailability of out-

of-market games, except through the bundled NFL/DirecTV Sunday Ticket. These

arrangements result in substantial injury to competition, including through

eliminating distribution of out-of-market games through competing Multichannel

Video Programing Distributor (“MVPD”) platforms, such as the Dish Network,

Comcast Corporation (“Comcast”), and Spectrum Cable (formerly Time Warner

Cable); reducing game offerings and package mixes; and imposing

supracompetitive pricing for consumers. The supracompetitive price for NFL

Sunday Ticket now exceeds $120,000.00 per year for the largest commercial

subscribers. As DirecTV says on its own website: “Only DIRECTV brings you

every play of every out-of-market game, every Sunday. Get the action on your TV

with NFL SUNDAY TICKET.”

11. Thus, DirecTV’s arrangement with the NFL allows the Defendants to

restrict the output of, and raise the prices for, the live broadcast of NFL Sunday

afternoon out-of-market games. Each NFL member team owns the initial rights to

the broadcast of its own games. However, the teams have collusively agreed to

grant the NFL the exclusive right to market games outside of each team’s respective

home market. But for the NFL teams’ agreements in which DirecTV and others

have joined, teams would compete against each other in the market for NFL football

programming, which would induce more competitive pricing and content.

Case 2:15-ml-02668-PSG-JEM Document 163 Filed 06/24/16 Page 6 of 59 Page ID #:1432

7

4377761v1/014918

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

12. In addition to allowing Defendants to charge supracompetitive prices

for Sunday Ticket, this scheme increases the market share and value of NFL regular

season games broadcast by the Networks and the NFL Network. By limiting the

availability of competing products, this scheme drives up the market share and

value of the broadcasts by the Networks, the NFL Network, and DirecTV. This

allows these broadcasters to increase revenues of all parties to the scheme.

13. DirecTV has willfully joined, encouraged, and entrenched the Teams’

conspiracy. It contracted with the NFL to make Sunday Ticket exclusive to

DirecTV, so that no other cable or satellite distributor could sell it. In doing so, it

required that the NFL and its Teams preserve their anticompetitive agreement not to

compete with one another. DirecTV’s agreement to carry Sunday Ticket and not to

deal individually with NFL teams is premised upon the continued existence of the

anticompetitive agreement not to create and distribute individual team telecasts. As

explained below, the Teams, in affirming the NFL’s successive agreements with

DirecTV, have mandated that nothing in the NFL’s contracts with the Networks

shall in any way impede the exclusive deal between the DirecTV and the NFL.

14. This exclusive distribution arrangement is unique among American

sports. Of the four major professional sports in this country—baseball, basketball,

hockey, and football—the only one with an exclusive out-of-market broadcasting

arrangement is the NFL/DirecTV Sunday Ticket. Major League Baseball (“MLB”),

the National Basketball Association (“NBA”), and the National Hockey League

(“NHL”) all distribute live out-of-market games through multiple MVPDs,

including, for example, DirecTV, the Dish Network, and InDemand (which

originated as a consortium of Comcast, Cox Communications and Time Warner

Case 2:15-ml-02668-PSG-JEM Document 163 Filed 06/24/16 Page 7 of 59 Page ID #:1433

8

4377761v1/014918

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

Cable). As a result, DirecTV does not charge nearly as much for access to MLB

Extra Innings, NBA League Pass, and NHL Center Ice, which provide access to

more games per week over a longer season than the NFL.

15. Similarly, outside the United States, the NFL distributes Sunday Ticket

through numerous distributors, or even offers the games online without tying them

to an MVPD subscription. In Canada, the NFL Sunday Ticket is distributed on a

non-exclusive basis through the following MVPDs: Shaw Cable; Shaw Direct;

TELUS; Optik TV; TELUS Satellite TV; Bell TV; Access Communications;

Cogeco Cable; EastLink Cable; Rogers Cable; Vidéotron; Westman

Communications; MTS; and SaskTel.

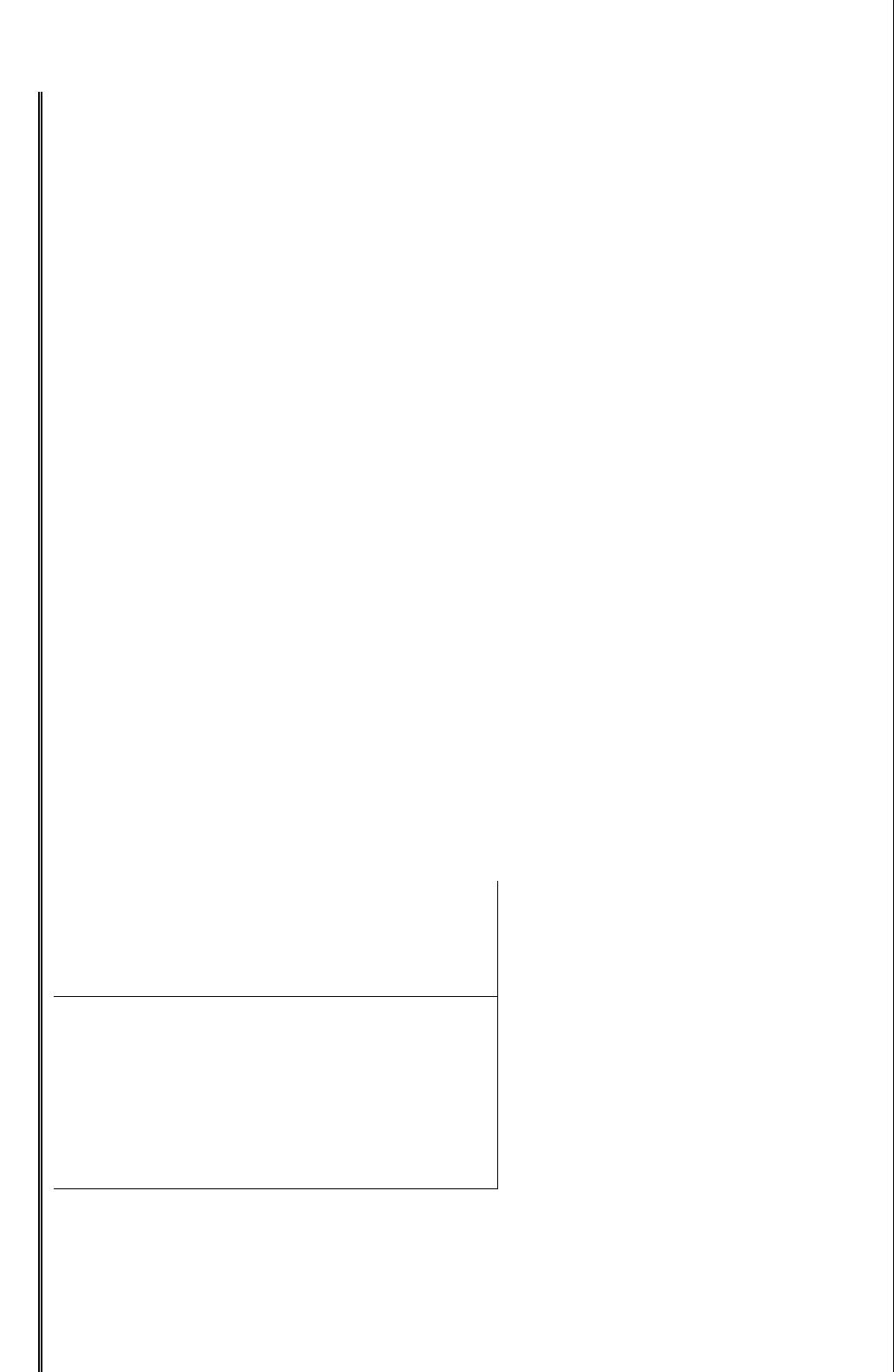

16. A bar or restaurant with a fire code occupancy between 51-100 paid

$2,314.00 for Sunday Ticket in 2015 (in addition to television package subscription

charges, high-definition access fees, and other charges). And the price for Sunday

Ticket is higher the larger the establishment’s Fire Code Occupancy (“FCO”) (also

known as “EVO”—Estimated Viewing Occupancy). The largest establishments—

like Nevada hotels—are charged more than $120,000 per year for Sunday Ticket, as

reflected in the following pricing chart from DirecTV (which also shows the pricing

differential between the exclusive NFL Sunday Ticket and the non-exclusive MLB

Extra Innings package):

NFL Sunday Ticket

MLB E

xtra Innings

Case 2:15-ml-02668-PSG-JEM Document 163 Filed 06/24/16 Page 8 of 59 Page ID #:1434

9

4377761v1/014918

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

EVO

1

-PAY

3

-PAY

5

-PAY

1

-PAY

3

-PAY

1

-50

1,458.00

486.00

291.60

595.00

198.33

51

-100

2,314.00

771.33

462.80

805.00

268.33

101

-150

4,630.00

1,543.33

926.00

1,120.00

373.33

151

-200

1,600.00

533.33

201

-350

6,479.00

2,159.67

1,295.80

2,080.

00

693.33

351

-500

9,258.00

3,086.00

1,851.60

2,400.00

800.00

501

-750

10,419.00

3,473.00

2,083.80

2,800.00

933.33

751

-1000

13,888.00

4,629.33

2,777.60

1001

-1500

20,832.00

6,944.00

4,166.40

3,600.00

1,200.00

1501

-2000

27,774.00

9,258.00

5,554.80

20

01-5000

57,864.00

19,288.00

11,572.80

4,800.00

1,600.00

5001

-10000

N/A

34,138.33

20,483.00

6,000.00

2,000.00

10000+

N/A

40,965.00

24,579.00

8,800.00

2,933.33

17. Sunday Ticket prices for residential subscribers are also far higher than

they would be in a competitive market. The exclusive distribution arrangement

agreed upon by the NFL and DirecTV has resulted in Sunday Ticket prices to

residential consumers that substantially exceed the price for Sunday Ticket prices in

Canada, where no exclusivity exists. As an example, for 2015, Sunday Ticket

pricing in the United States was fixed at $251.94 for the basic package and $353.94

for the “Max” package. By contrast, in Canada, where there is no exclusivity

MVPDs offered Sunday Ticket for approximately $199.00 in Canadian dollars

Case 2:15-ml-02668-PSG-JEM Document 163 Filed 06/24/16 Page 9 of 59 Page ID #:1435

10

4377761v1/014918

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

($155.22 in U.S. dollars)

or less.

3

And certain other Canadian cable providers

bundle the out-of-market games of the NBA, NHL, MLB and the NFL and in 2015

charged a C$35.95 (U.S. $28.04) monthly fee for access to all of them.

18. DirecTV’s ability to offer NFL Sunday Ticket on an exclusive basis is

material to its operations. Indeed, DirecTV’s merger with AT&T, which was

consummated in July of 2015, depended, in substantial part, on continued

exclusivity of this service. As DirecTV noted in a filing with the Securities and

Exchange Commission (“SEC”) on December 3, 2014, “[p]ursuant to the Merger

Agreement, AT&T had the right to terminate the Merger Agreement or not

consummate the Merger if we failed to enter into a contract with the NFL providing

for exclusive distribution rights for the NFL Sunday Ticket service.”

19. Given these three sources of supracompetitive pricing and unlawfully

protected market power—the agreement not to compete; the agreement to allow

only purchases of a bundle of all 32 teams; and the agreement to sell certain games

exclusively through DirecTV—it is no surprise that Defendants are able to charge

exorbitant prices to Plaintiffs and other class members.

20. The agreements challenged in this complaint drastically curb output,

reduce choice, and increase price. They unreasonably restrain trade in violation of

Section One of the Sherman Act (15 U.S.C. § 1

), and allow the NFL to unlawfully

monopolize the market for live video presentation of professional football games in

violation of Section Two of the Sherman Act (

15 U.S.C. § 2). Accordingly,

Plaintiffs, on behalf of themselves and others similarly situated, seek injunctive

3

This calculation is based on the assumption of an exchange ratio of a Canadian

Dollar to U.S. Dollar conversion ratio of .78, the reported average by U.S. Forex for

the period from January 1, 2015 – December 31, 2015. See www.usforex.com.

Case 2:15-ml-02668-PSG-JEM Document 163 Filed 06/24/16 Page 10 of 59 Page ID

#:1436

11

4377761v1/014918

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

relief putting an end to this anticompetitive scheme and damages to compensate the

Classes for the supracompetitive overcharges they have paid.

JURISDICTION AND VENUE

21. Plaintiffs bring this action pursuant to Section 16 of the Clayton Act

(15 U.S.C. § 26

), for a violation of Sections 1 and 2 of the Sherman Act (15 U.S.C.

§§ 1-2). This Court has subject matter jurisdiction over those claims pursuant to 28

U.S.C. §§ 1331 and 1337.

22. Venue is proper pursuant to 28 U.S.C. § 1391 and 15 U.S.C. § 22. The

Defendants transact business in this District, and are subject to personal jurisdiction

here.

23. Members of the Classes were injured in this District and DirecTV is

headquartered in this District.

PARTIES

A. Plaintiffs

24. Plaintiff Ninth Inning Inc. dba The Mucky Duck (“Mucky Duck”) is a

pub located in San Francisco, California. Mucky Duck has purchased the Sunday

Ticket from DirecTV in order to attract patrons to its establishment on Sunday

afternoons during the NFL’s professional football season.

25. Plaintiff 1465 Third Avenue Restaurant Corp. dba Gael Pub (“Gael

Pub”) is a pub located in New York, New York. Gael Pub has purchased the

Sunday Ticket from DirecTV in order to attract patrons to its establishment on

Sunday afternoons during the NFL’s professional football season.

Case 2:15-ml-02668-PSG-JEM Document 163 Filed 06/24/16 Page 11 of 59 Page ID

#:1437

12

4377761v1/014918

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

26. Plaintiff Robert Gary Lippincott, Jr. (“Lippincott”) is a resident of

Healdsburg, California. Lippincott signed up for Sunday Ticket in order to watch

out-of-market Sunday afternoon NFL games.

27. Plaintiff Michael Holinko (“Holinko”) is a resident of Belle Mead,

New Jersey. Holinko signed up for Sunday Ticket in order to watch out-of-market

Sunday afternoon NFL games.

B. Defendants

28. Until 2015, the NFL was an unincorporated association of 32

American professional football teams in the United States. Each of the 32 NFL

member teams, headquartered in various cities across the country, is separately

owned and operated, acting in its own economic self-interest and competing in most

respects with one another.

29. The 32 Teams are owned and operated by the following entities, each

of which is a defendant in this action:

NFL Defendant Team Owner

State of

Organization

Team Name (City)

Arizona Cardinals, Inc.

Arizona

Arizona Cardinals

Atlanta Falcons Football Club LLC

Georgia

Atlanta Falcons

Baltimore Ravens Li

mited Partnership

Maryland

Baltimore Ravens

Buffalo Bills, Inc.

New York

Buffalo Bills

Panthers Football LLC

North Carolina

Carolina Panthers

Chicago Bears Football Club, Inc.

Delaware

Chicago Bears

Cincinnati Bengals, Inc.

Ohio

Cincinnati Bengals

Cle

veland Browns LLC

Delaware

Cleveland Browns

Case 2:15-ml-02668-PSG-JEM Document 163 Filed 06/24/16 Page 12 of 59 Page ID

#:1438

13

4377761v1/014918

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

Dallas Cowboys Football Club, Ltd.

Texas

Dallas Cowboys

Denver Broncos Football Club

Colorado

Denver Broncos

Detroit Lions, Inc.

Michigan

Detroit Lions

Green Bay Packers, Inc.

Wisconsin

Green Bay Packers

Hou

ston NFL Holdings LP

Delaware

Houston Texans

Indianapolis Colts, Inc.

Delaware

Indianapolis Colts

Jacksonville Jaguars Ltd.

Florida

Jacksonville Jaguars

Kansas City Chiefs Football Club, Inc.

Texas

Kansas City Chiefs

Miami Dolphins, Ltd.

Florida

Miami

Dolphins

Minnesota Vikings Football Club LLC

Minnesota

Minnesota Vikings

New England Patriots, LP

Delaware

New England Patriots

New Orleans Louisiana Saints LLC

Texas

New Orleans Saints

New York Football Giants, Inc.

New York

New York Giants

New York

Jets Football Club, Inc.

Delaware

New York Jets

Oakland Raiders LP

California

Oakland Raiders

Philadelphia Eagles Football Club, Inc.

Delaware

Philadelphia Eagles

Pittsburgh Steelers Sports, Inc.

Pennsylvania

Pittsburgh Steelers

San Diego Chargers Foot

ball Co.

California

San Diego Chargers

San Francisco Forty Niners Ltd.

California

San Francisco 49ers

Football Northwest LLC

Washington

Seattle Seahawks

The Rams Football Company LLC

Delaware

St. Louis Rams

Buccaneers Limited Partnership

Delaware

Tampa

Bay

Buccaneers

Tennessee Football, Inc.

Delaware

Tennessee Titans

Case 2:15-ml-02668-PSG-JEM Document 163 Filed 06/24/16 Page 13 of 59 Page ID

#:1439

14

4377761v1/014918

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

Washington Football Inc.

Maryland

Washington Redskins

30. In or about 2015, the NFL incorporated as the National Football

League, Inc., and has its headquarters at 345 Park Avenue, 7

th

Floor, New York, NY

10154. On information and belief, NFL Enterprises LLC was organized to hold the

broadcast rights of the 32 NFL Teams and license them to MVPDs and other

broadcasters, including DirecTV. NFL Enterprises LLC is also located at 345 Park

Avenue, 7

th

Floor, New York, NY 10154.

31. Through the NFL, the 32 Teams do cooperate in some respects,

including by setting game rules and a game schedule, and dividing their member

teams into geographic territories. The teams have also agreed to allow the NFL to

negotiate on their behalf television contracts with national broadcasters, including

for the broadcast of each Team’s games outside its home territory. These include

the Sunday Ticket package sold only through DirecTV.

32. In

American Needle, Inc. v. National Football League, 560 U.S. 183

(2010) (“American Needle”), the United States Supreme Court unanimously

rejected the NFL's claim that an agreement regarding the joint marketing of club-

owned intellectual property was the decision of a “single entity”—the league—not

subject to section 1 of the Sherman Act (

15 U.S.C. §1). The Court reaffirmed lower

court decisions that sports leagues are subject to the antitrust laws and that league

owners must refrain from agreements that unreasonably restrain trade. The Court

also reaffirmed its own decision in

National Collegiate Athletic Ass’n v. Board of

Regents, 468 U.S. 85 (1984), which held that the hallmark of an unreasonable

Case 2:15-ml-02668-PSG-JEM Document 163 Filed 06/24/16 Page 14 of 59 Page ID

#:1440

15

4377761v1/014918

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

restraint is one that raises price, lowers output, or renders output unresponsive to

consumer preference.

33. This complaint uses the term “NFL” to refer collectively (unless

otherwise indicated) to the 32 Teams, National Football League, Inc., and NFL

Enterprises, LLC.

34. Defendant DirecTV Holdings LLC is a Delaware Limited Liability

Company and has its principal place of business at 2230 East Imperial Highway, El

Segundo, California. It is the U.S. operating arm of DirecTV, Inc. and describes

itself as “a leading provider of digital television entertainment in the United States.”

It claims that “[a]s of December 31, 2014, [it] had approximately 20.4 million

subscribers.”

35. DirecTV, LLC is a California Limited Liability Company that has its

principal place of business at 2230 East Imperial Highway, El Segundo, California.

DirecTV, LLC issues bills to its subscribers.

36. This Complaint uses the term “DirecTV” to refer collectively to these

two DirecTV entities.

TRADE AND COMMERCE

37. The NFL is by far the most significant provider of professional football

in the United States. The three most recent Super Bowls have been the three most-

watched programs in U.S. history. The 2015 Super Bowl was the most-watched

program ever, with 114.4 million viewers.

38. In a July 2015 analysis, Bloomberg estimated that the NFL receives

about $6 billion annually in total television revenue from all sources. In 2011, the

NFL negotiated nine-year extensions of its existing broadcast deals with Fox, CBS

Case 2:15-ml-02668-PSG-JEM Document 163 Filed 06/24/16 Page 15 of 59 Page ID

#:1441

16

4377761v1/014918

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

and NBC, running through the 2022 season. According to an August 27, 2014

Bloomberg report, ESPN, Fox, CBS and NBC pay $1.9 billion, $1.1 billion, $1

billion and $950 million per year, respectively, for the right to broadcast NFL

games. The Wall Street Journal reported in September of 2014 that CBS paid $300

million for the right to telecast NFL “Thursday Night Football” for one year.

39. The commerce between the NFL and DirecTV is equally lucrative. In

October of 2014, it was announced that DirecTV and the NFL entered into a new

telecasting deal reportedly worth $1.5 billion annually for the next eight years, a

deal that will bring $8 billion more to the NFL (extending over four additional

years) than its last deal with DirecTV. Through these and other contractual deals,

the NFL, its member teams and DirecTV engage in interstate commerce and in

activities substantially affecting interstate commerce, and the conduct alleged herein

substantially affects interstate commerce.

CLASS ACTION ALLEGATIONS

40. Plaintiffs bring this action on behalf of themselves and as a class action

under Fed. R. Civ. P. 23(b)(2)

(for injunctive relief) and (b)(3) (for damages) on

behalf of all persons who fall within the definition of either of the following two

Classes (collectively, the “Classes”):

All DirecTV commercial subscribers that purchased the NFL Sunday

Ticket from DirecTV, or its subsidiaries, at any time between June 17,

2011 and the present (“Commercial Class”). The Commercial Class

excludes the Defendants and any of their current or former parents,

subsidiaries or affiliates. The Commercial Class also excludes all

judicial officers presiding over this action and their immediate family

members and staff, and any juror assigned to this action.

All DirecTV residential subscribers that purchased the NFL Sunday

Ticket from DirecTV, or its subsidiaries, at any time between June 17,

2011 and the present (“Residential Class”). The Residential Class

Case 2:15-ml-02668-PSG-JEM Document 163 Filed 06/24/16 Page 16 of 59 Page ID

#:1442

17

4377761v1/014918

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

excludes the Defendants and any of their current or former parents,

subsidiaries or affiliates. The Residential Class also excludes all

judicial officers presiding over this action and their immediate family

members and staff, and any juror assigned to this action.

41. The Commercial Class is represented by Plaintiffs Mucky Duck and

Gael Pub.

42. The Residential Class is represented by Plaintiffs Lippincott and

Holinko.

43. DirecTV has sold its Sunday Ticket service to members of the Classes

across the nation during the relevant period. Defendants have charged

supracompetitive prices for that service.

44. Due to the nature of the trade and commerce involved, the Classes

consist of many thousands of members. The exact number and their identities are

known to DirecTV.

45. The Classes are so numerous that joinder of all members is

impracticable.

46. There are questions of law and fact common to the Classes, including:

a. Whether the NFL and its Teams engaged in a contract,

combination, or conspiracy to reduce output and/or fix, raise,

maintain or stabilize prices of live video presentations of regular

season NFL games by agreeing that all video presentations

would be licensed exclusively by the NFL;

b. Whether Defendants have engaged in and are continuing to

engage in a contract, combination, or conspiracy among

themselves to fix, raise, maintain or stabilize prices of video

Case 2:15-ml-02668-PSG-JEM Document 163 Filed 06/24/16 Page 17 of 59 Page ID

#:1443

18

4377761v1/014918

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

presentations of live Sunday NFL games by eliminating

competition among presenters of out-of-market NFL games;

c. Whether Defendants have engaged in and are continuing to

engage in a contract, combination, or conspiracy among

themselves to fix, raise, maintain or stabilize prices of the

Sunday Ticket by preventing any competitor from offering

competing products;

d. The effect of Defendants’ agreements on the prices of Sunday

Ticket in the United States during the class period;

e. The effect of Defendants’ agreements on the retransmission

consent and affiliate fees for the carriage of NFL games to

MVPDs;

f. The effect of Defendants’ agreements on the subscription fees

charged by MVPDs that carry the Networks that air NFL games;

g. The identities of the participants in the conspiracy;

h. The duration of the conspiracy and the acts performed by

Defendants in furtherance of it;

i. Whether the alleged conspiracy violated Section 1 of the

Sherman Act, 15 U.S.C. § 1

;

j. Whether the alleged conspiracy violated Section 2 of the

Sherman Act, 15 U.S.C. § 2

;

k. Whether the conduct of Defendants caused injury to the

Plaintiffs and the other members of the Classes; and

l. The appropriate measure of damages.

Case 2:15-ml-02668-PSG-JEM Document 163 Filed 06/24/16 Page 18 of 59 Page ID

#:1444

19

4377761v1/014918

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

47. Plaintiffs and the Classes were, during the Class period, commercial or

residential subscribers to DirecTV who also purchased the Sunday Ticket package.

Their respective claims are typical of the particular Class that they seek to represent,

and the named Plaintiffs will fairly and adequately protect the interests of the

particular Class that they seek to represent.

48. Plaintiffs are represented by counsel who are competent and

experienced in the prosecution of antitrust and class action litigation.

49. Given the high cost of establishing that Defendants’ agreements

violated the antitrust laws (including, but not limited to, substantial expert witness

costs and attorneys’ fees), a class action is the only economically feasible means for

any Plaintiff to enforce their statutory rights.

50. The prosecution of separate actions by individual members of the

Classes would also create a risk of inconsistent or varying adjudications,

establishing incompatible standards of conduct for Defendants.

51. The questions of law and fact common to the members of the Classes

predominate over any questions affecting only individual members, including legal

and factual issues relating to liability and damages.

52. A class action is superior to other available methods for the fair and

efficient adjudication of this controversy. The Classes are readily ascertainable and

are ones for which records exist. Prosecution as a class action will eliminate the

possibility of duplicative litigation. Treatment as a class action will permit a large

number of similarly situated persons to adjudicate their common claims in a single

forum simultaneously, efficiently, and without the duplication of effort and expense

Case 2:15-ml-02668-PSG-JEM Document 163 Filed 06/24/16 Page 19 of 59 Page ID

#:1445

20

4377761v1/014918

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

that numerous individual actions would engender. This class action presents no

difficulties in management that would preclude maintenance as a class action.

FACTUAL ALLEGATIONS

A. Relevant Market

53. The relevant geographic market for both Classes is the United States.

The relevant product market for both Classes is the live video presentations of

regular season NFL games that includes a distinct submarket for “out-of-market”

games as described above. The national broadcast rights to select packages of

games are negotiated by the NFL with networks CBS, NBC, ESPN and Fox. In

addition to broadcasts of these games, the market includes broadcast rights for out-

of-market games, such as those carried in the NFL Sunday Ticket package.

Broadcasts of other sports or other content do not compete with broadcasts of NFL

games. Moreover, NFL games broadcast locally on CBS and Fox on Sunday

afternoons are distinct from the multi-game offering provided by Sunday Ticket

specifically because the local games are different from the multi-game offering

provided by Sunday Ticket, which caters to fans that are not located within the

geographical confines of their favorite teams’ home territories.

54. New entrants that would dilute the market power over NFL video

broadcasts created by the collusive agreements at issue here are extremely unlikely.

New entry would require the creation of a new professional league playing

American football. Such an undertaking would be enormously expensive, and—

based on history—very unlikely to succeed. Even if a new entrant did appear, and

even if it were sufficiently successful to sustain itself, it is unlikely that the resulting

Case 2:15-ml-02668-PSG-JEM Document 163 Filed 06/24/16 Page 20 of 59 Page ID

#:1446

21

4377761v1/014918

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

video product would compete sufficiently with the NFL’s broadcasts to dissipate

the NFL’s monopoly power.

55. In the 95 years since the NFL’s formation in 1920, there have only

been a few noteworthy attempts at entry into the market for American football

games. Three times, once each in the 1920s, 1930s, and 1940s, an entity calling

itself the American Football League was formed, briefly operated and then failed. In

1960 another entry attempt, also under the name of the American Football League,

operated independently for nine years before merging with the NFL in 1970.

56. The United States Football League (“USFL”) was founded in 1982 but

disbanded in 1986. It sued the NFL for monopolization and won a jury verdict.

USFL v. NFL, 842 F.2d 1335 (2d Cir. 1988)

. There have also been failed attempts

to start and sustain a women’s football league and various minor leagues or talent

development leagues. The closest thing to a successful entry is the Arena Football

League, which plays a substantially different type of football—indoor football. The

Arena Football League (“AFL”) began play in 1987 and continued through the 2008

season. The league was reorganized in 2010 and continues today. However, the

games of the AFL are played in spring and summer to avoid competition with NFL

football broadcasts. In addition, AFL produces an altogether different sport, with a

different fan base, that does not compete substantially with the NFL for a broadcast

audience.

57. By contrast, NFL Teams are well established and immensely popular,

with 32 regionally diverse teams in or near almost every major population center in

the United States. NFL Teams reside within 18 of the 25 most populous

metropolitan areas, dramatically limiting the locations and audiences available to

Case 2:15-ml-02668-PSG-JEM Document 163 Filed 06/24/16 Page 21 of 59 Page ID

#:1447

22

4377761v1/014918

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

new teams or leagues. During the NFL’s long history not one of the few sporadic

attempted entries has been successful at competing for NFL football broadcast

audiences. It is virtually impossible that a new league will form to compete away

the NFL’s monopoly power.

58. The NFL’s monopoly power will only be tempered if the underlying

collusive agreement, which created the monopoly power, is broken up through

antitrust authority, or if the exclusive deals that propagate that monopoly power are

replaced by non-exclusive licenses.

59. The value of the monopoly power that DirecTV exercises as a result of

its exclusive deal with the NFL is illustrated by the recent contract extension with

the NFL and the recent acquisition of DirecTV by AT&T. As Forbes noted in an

October 1, 2014 article:

DirecTV has renewed its agreement with the National Football League

for another 8 years. However, this time around, the price is increased

by 50% to around $1.5 billion a year. This is very expensive and far

more than $1 billion that CBS, NBC and Fox pay for their respective

NFL coverage. The satellite company offers to its subscribers the

popular NFL Sunday Ticket, a sports package that broadcasts NFL

regular season games that are not available on local affiliates. Aided by

the NFL, DirecTV has managed to attract customers even at times

when other pay-TV operators were losing subscribers. The extended

deal with the NFL will aid to the overall subscriber growth for the

company. Moreover, the agreement was of key importance for

DirecTV, as its proposed merger with AT&T to some extent was

dependent on this deal.

Indeed, AT&T’s $48.5 billion offer to purchase DirecTV contained a clause

allowing AT&T to cancel the deal if DirecTV loses its exclusive contract for

Sunday Ticket. That clause provided: “[t]he parties also have agreed that in the

event that DirecTV’s agreement for the ‘NFL Sunday Ticket’ service is not renewed

Case 2:15-ml-02668-PSG-JEM Document 163 Filed 06/24/16 Page 22 of 59 Page ID

#:1448

23

4377761v1/014918

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

substantially on the terms discussed between the parties, the Company [AT&T] may

elect not to consummate the Merger.” Of course, DirecTV renewed its contract with

the NFL for Sunday Ticket and the merger with AT&T was consummated in June

of 2015.

B. Relevant History of NFL Broadcasting Agreements

60. Television coverage of NFL games began in 1939, with regular

broadcasting beginning after World War II. By 1950, Teams in Los Angeles and

Washington, D.C. had negotiated contracts for all of their games to be televised,

with many other teams following suit over the course of the 1950s.

61. As these early clubs worked to get their nascent broadcasting contracts

in place, they jointly agreed to restrict broadcasting competition. As of 1953,

Article X of the NFL’s by-laws prohibited any Team from broadcasting its games

within 75 miles of another team’s home city if that second team was either playing

a game at home or playing a game on the road and broadcasting it back home.

These restrictions “effectively prevent[ed] ‘live’ broadcasts or telecasts of

practically all outside games in all the home territories.”

NFL I, 116 F. Supp. at

321.

4

62. The DOJ sued to enjoin enforcement of Article X, contending that it

was illegal under 15 U.S.C. §1.

63. The United States District Court for the Eastern District of

Pennsylvania considered the competitive effects of the restriction. After noting that,

at that time, “less than half the clubs over a period of years are likely to be

4

“Outside games” were defined as games “played outside the home territory of a

particular home club and in which that home club [was] not a participant.” Id.

Case 2:15-ml-02668-PSG-JEM Document 163 Filed 06/24/16 Page 23 of 59 Page ID

#:1449

24

4377761v1/014918

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

financially successful” and some teams were “close to financial failure,” it found

that “[r]easonable protection of home game attendance [was] essential to the very

existence of the individual clubs” and that prohibiting broadcasting of outside

games while a team was playing a home game was reasonable. Id. at 323-25

.

64. At the same time, the court in NFL I rejected the argument that Teams

could legally agree not to broadcast in each other’s territories when the local team

was not playing a home game, which “obvious[ly] . . . cannot serve to protect game

attendance.” Id. at 326

. Rather, it found that “the testimony of defendants’ witnesses

consistently indicates that the primary reason for the restrictions in this situation

actually is to enable the clubs in the home territories to sell monopoly rights to

purchasers of television rights to [their] away games.”

Id. (footnote omitted). It

therefore held this restriction to be illegal. Id. at 327. It similarly condemned a

provision prohibiting radio broadcasts of outside games, finding that even when

teams were playing at home there was no evidence of “any significant adverse

effect on gate attendance” but only an enhancement of “the value of such rights to

purchasers.”

Id.

65. In the years following this ruling, NFL Teams expanded their

broadcasting output. By 1960—just a decade after the first clubs obtained

distribution for all of their games—most NFL teams were broadcasting their entire

seasons, and Sunday games were available on every national network.

66. Despite this growing success, the NFL and the Teams were not

satisfied with competitive results. Instead, they determined that they could make

significantly more money by pooling and thus monopolizing their rights, allowing

them both to demand higher rights fees from networks and offer networks the

Case 2:15-ml-02668-PSG-JEM Document 163 Filed 06/24/16 Page 24 of 59 Page ID

#:1450

25

4377761v1/014918

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

ability to be the sole source of NFL games. The Teams therefore transferred their

rights to the NFL, which then sold to CBS “the sole and exclusive right to televise

all League games.” NFL II, 196 F. Supp. at 446

.

67. The United States District Court for the Eastern District of

Pennsylvania again had no trouble finding that “the member clubs of the League

have eliminated competition among themselves in the sale of television rights to

their games.” Id. at 447

. It therefore found the CBS contract to violate its judgment

in NFL I and prohibited the enforcement of the contract. Id.

68. The NFL next turned to Congress, lobbying for an antitrust exemption

that would overturn NFL II and allow them to pool their rights for the purpose of

selling games to over-the-air networks that were available to all viewers for free.

This lobbying resulted in the passage of the SBA, which exempted from the

Sherman Act

any agreement by or among persons engaging in or conducting the organized

professional team sport[] of football . . . , by which any league of clubs

participating in professional football . . . contests sells or otherwise transfers

all or any part of the rights of such league’s member clubs in the sponsored

telecasting of the game[] of football . . . engaged in or conducted by such

clubs.

15 U.S.C. § 1291

. As discussed in greater detail below, the exemption provided by

the SBA does not extend to cable, satellite or pay-per-view telecasts.

69. The NFL and its Teams were content to abide by this limitation for

some 25 years, broadcasting on as many as three free, over-the-air networks

simultaneously. Once again, however, the lure of increased revenues proved

irresistible. With the growth of cable television—which, unlike the sponsored

telecasts envisioned by the SBA, are available only to paying subscribers—and its

Case 2:15-ml-02668-PSG-JEM Document 163 Filed 06/24/16 Page 25 of 59 Page ID

#:1451

26

4377761v1/014918

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

lucrative subscriber base, the NFL and its Teams chose to ignore the limitations on

the exemption they had received in the SBA and instead to sell their horizontally-

pooled rights to cable networks.

70. In 1987, ESPN became the first cable broadcaster of NFL games—

games that were subject to the same restrictive horizontal agreement that had

previously been used only to arrange the publicly available sponsored telecasts.

71. As a result of the NFL and its Teams’ output restrictions, consumers in

any given area had no authorized means of watching most regular season NFL

games, despite the increasing capacity to distribute the games and the decreasing

cost of doing so. Instead, they were artificially limited to those few games, usually

no more than four or five per week (and no more than two at any given time), that

the Networks and the NFL chose to broadcast in their area. This artificially

constrained output created a large, unserved demand for the inaccessible games,

leading to a surge in piracy of distant feeds in the 1980s.

72. The NFL wanted to cut down on this piracy (which, though it fueled

interest in football, did not directly profit the NFL or its Teams) and capitalize on

the pent-up demand created by the horizontal supply restriction, but without

forgoing its monopoly control of all broadcast rights. In 1987, it developed a plan

that prefigured the modern Sunday Ticket package: market an encrypted package of

all games that could be viewed by consumers who purchased a decoder.

73. According to sports journalist Gregg Easterbrook, CBS opposed the

idea, fearing that the dilution of their ratings would decrease their advertising

revenue, and this plan was not implemented as originally conceived.

Case 2:15-ml-02668-PSG-JEM Document 163 Filed 06/24/16 Page 26 of 59 Page ID

#:1452

27

4377761v1/014918

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

74. In December of 1993, however, Fox outbid CBS for broadcast rights,

removing an important obstacle to the planned package. At the same time, the

advent of direct-broadcast satellite television service (“DBS”) made distribution of

all games easy and inexpensive. Those early DBS providers could carry a larger

number of channels than contemporaneous cable providers without running into

capacity constraints. (Capacity constraints are no longer a significant factor for

either DBS or cable providers.)

75. For the 1994 season, the NFL bundled together a package of games

that could be sold nationwide, allowing the NFL and its Teams to offer a single,

monopolized product containing the various products they would otherwise sell

individually. This package would become the product known today as Sunday

Ticket.

76. DirecTV, the second commercial DBS provider in America, also

launched in 1994, just a few months before the NFL season began. It contracted

with the NFL to license Sunday Ticket exclusively, making it the only source for

the vast majority of regular season NFL games in any part of the country. Since

then, DirecTV has successfully convinced the NFL to continue licensing Sunday

Ticket exclusively, even though the technological impediments to carriage by cable

providers or on the Internet have long since faded away.

77. Even with CBS temporarily out of the picture,

5

the NFL still

encountered resistance from its other broadcast networks. Moreover, it could not

create Sunday Ticket without the Networks’ agreement to provide their feeds of

games to DirecTV. Some of the networks demanded concessions and limitations on

5

CBS resumed broadcasting NFL games in 1998.

Case 2:15-ml-02668-PSG-JEM Document 163 Filed 06/24/16 Page 27 of 59 Page ID

#:1453

28

4377761v1/014918

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

Sunday Ticket in exchange. In 2003, News Corporation, the parent of Fox, acquired

34% of DirecTV that it then transferred to the Fox Entertainment Group.

According to Gregg Easterbrook (“Easterbrook”), a reporter at ESPN, Fox insisted

that Sunday Ticket subscribers be capped at one million annually. Easterbrook also

reported that, while this cap has increased over the years, it remained an express or

implied obligation.

78. The NFL’s own resolutions attached to its 2006 Constitution and By-

Laws underscore the significance of these agreements. NFL 2003 Resolution BC-1

contains this clause:

It is hereby Resolved that the League concurs in the Broadcasting

Committee’s approval of the DirecTV Agreement, with the

Broadcasting Committee to ensure that, during the term of the

DirecTV Agreement, no network television agreement containing

provisions that would interfere with or preclude NFL Enterprises’

performance of the DirecTV Agreement shall be executed.

79. Similarly, NFL Resolution 2004 BC-3 contains this clause:

Be it Resolved that the League concurs in the Broadcasting

Committee’s approval of the DirecTV Agreement and directs the

Broadcasting Committee to ensure that, during the term of the

DirecTV Agreement, no network television agreement containing

provisions that would interfere with or preclude NFL Enterprises’

performance of the DirecTV Agreement [sic].

80. It is fundamental to carrying out the exclusive deal between the NFL

and DirecTV that the latter has access to the feeds of Sunday afternoon NFL games

televised by CBS and Fox.

Case 2:15-ml-02668-PSG-JEM Document 163 Filed 06/24/16 Page 28 of 59 Page ID

#:1454

29

4377761v1/014918

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

C. The NFL’s Current Broadcast Rights Agreements

81. As noted above, the NFL’s 32 member Teams have given the league

authority to negotiate pooled rights television deals on their behalf, in exchange for

an equal share of the resulting revenues.

82. Regular season NFL games are currently broadcast in two principal

ways.

i. Over-the-Air and Cable Broadcasts

83. First, as they have done since 1987, the NFL and its Teams sell their

pooled rights to over-the-air and cable networks. Currently, they contract with five

networks: the over-the-air networks NBC, Fox, and CBS; the subscription network

ESPN; and the NFL’s own subscription network, NFL Network. When the NFL

most recently negotiated these contracts, in 2011, it was reported that the deals

lasted at least eight years and until 2022 in some cases, and totaled some $27 billion

in licensing fees.

84. During the regular season, most games take place on Sunday

afternoons at approximately 1 p.m. or 4:25 p.m. Eastern time. These games are split

between CBS and Fox, with CBS holding the exclusive rights to broadcast

American Football Conference (“AFC”) games and Fox the exclusive rights to

broadcast National Football Conference (“NFC”) games. In most weeks, there are

between eleven and thirteen Sunday afternoon games. In addition, the NFL

typically schedules one game on Sunday, Monday, and Thursday nights. These

night games are licensed exclusively to NBC, ESPN, and the NFL Network,

respectively, for national distribution. For the Sunday afternoon games, CBS and

Fox, in consultation with the NFL, determine which games will be broadcast in

Case 2:15-ml-02668-PSG-JEM Document 163 Filed 06/24/16 Page 29 of 59 Page ID

#:1455

30

4377761v1/014918

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

which locations. Typically, each network makes only one game available in any

given location at a time. Each week, one network has the rights to air one game in

each timeslot, while the other network may air a game only in one timeslot. For

example, in a given week, CBS would choose one AFC game to make available in a

given location at 1 p.m. and one to make available at 4:25 p.m. Fox would have the

right to air NFC games in only one timeslot in a week that CBS was permitted to

show two games. On another week, CBS’s and Fox’s roles would be reversed, with

Fox broadcasting two games and CBS broadcasting one. League rules further limit

the games available in a market in which a team is playing a Sunday afternoon

game, such that under certain circumstances only one other game will be available.

85. Thus, in any location in America, there are no more than two regular-

season games available on television at any given time—even though there may be

as many as seven games being played simultaneously, by fourteen teams. In total,

no more than three NFL Sunday afternoon games are typically shown in a given

location, despite as many as thirteen games being played on Sunday afternoon.

86. This ensures that no more than six games will be broadcast on

television in any given week, thereby lessening the competition that each

broadcaster would face from fourteen or fifteen games to five. A primary purpose of

the restrictions is to make the rights to the games more valuable to broadcasters,

which allows them to earn more money from the telecasting of NFL games.

Broadcasters are able to charge more to advertisers and more to MVPDs (in the

form of affiliation fees or retransmission consent fees).

87. This effect is particularly pronounced for the Sunday afternoon games

broadcasted by CBS and Fox. In a competitive market, up to seven games would be

Case 2:15-ml-02668-PSG-JEM Document 163 Filed 06/24/16 Page 30 of 59 Page ID

#:1456

31

4377761v1/014918

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

broadcast simultaneously (which would still be significantly less than the number of

college football games that are typically broadcast at the same time). This would

represent a massive increase in consumer choice—but would give CBS and Fox

direct competitors that would reduce their ratings and revenue. Keeping those

games off regular television and restricting them only to DirecTV subscribers who

are willing to pay for the supracompetitively priced Sunday Ticket increases

consumer costs and limits consumer choice.

88. The participation of cable networks ESPN and NFL Network

exacerbates the anticompetitive harms wrought by the agreements. Because of the

reduced competition in the broadcasting and sale of live video presentations of

professional football games, ESPN and NFL Network are able to charge

inordinately large subscription fees to MVPDs, which are then passed on to

consumers. In part due to the exclusivity it has purchased from the NFL and its

members, ESPN is the single most expensive cable channel in the United States.

Indeed, according to a 2014 Wall Street Journal analysis, ESPN cost $6.04 a month

on average, more than four times as much as the second-most expensive national

channel, TNT, which cost just $1.48 a month. MVPDs’ robust profit margins

confirm that this exorbitant price is passed on to consumers.

ii. DirecTV and NFL Sunday Ticket

89. Beginning in 1994, pursuant to its exclusive agreement with the NFL,

DirecTV offered its subscribers access to the Sunday afternoon games that were not

otherwise available in their market via national broadcasts. These subscribers could

purchase NFL Sunday Ticket, a premium subscription-based package that provides

Case 2:15-ml-02668-PSG-JEM Document 163 Filed 06/24/16 Page 31 of 59 Page ID

#:1457

32

4377761v1/014918

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

access to all Sunday afternoon games broadcast on Fox and CBS, or their

predecessors.

90. Through its exclusive agreement with the NFL, DirecTV today takes

the live game telecast feeds produced by CBS and Fox and redistributes them

without alteration to NFL Sunday Ticket subscribers via DirecTV channels. NFL

Sunday Ticket subscribers can thus access all Fox or CBS games.

91. Defendants have colluded to sell the out-of-market NFL Sunday

afternoon games only through DirecTV. Such an arrangement eliminates

competition in the distribution of out-of-market Sunday afternoon games and

requires anyone wishing to view these games to subscribe to DirecTV and purchase

NFL Sunday Ticket (or, in limited circumstances, purchase from DirecTV a Sunday

Ticket live streaming package) at a supracompetitive price created by the exclusive

NFL/DirecTV distribution agreement.

92. The contracts between the NFL and DirecTV are negotiated on behalf

of the league and then ratified by vote of the members of the league. For example,

in the 2003 Resolution BC-1, attached as an addendum to the 2006 version of the

NFL’s Constitution and Bylaws, the league members ratified the proposed

agreement between NFL Enterprises LLC and DirecTV whereby the latter could

telecast out-of-market NFL regular season games during the 2003-08 football

seasons. Similarly, in 2004 Resolution BC-3, also attached as an addendum to the

2006 version of the NFL’s Constitution and Bylaws, the members of the league

ratified the “NFL Sunday Ticket rights agreement” between NFL Enterprises and

DirecTV for the 2006-10 football seasons. Subsequent extensions or renewals of the

agreements between the NFL and DirecTV have been similarly ratified.

Case 2:15-ml-02668-PSG-JEM Document 163 Filed 06/24/16 Page 32 of 59 Page ID

#:1458

33

4377761v1/014918

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

93. The exclusive nature of the NFL’s contractual and other arrangements

with DirecTV prevents other MVPDs or, indeed, the individual clubs in the league,

from offering broadcasts of out-of-market games in competition with each other and

with DirecTV. This anticompetitive effect implicates blackouts of out-of-market

games, both broadly and as discussed in the NFL’s Constitution and Bylaws. For

example, NFL Bylaw 10.2(a) imposes the following blackout restriction on

televised games: “[n]o club shall cause or permit a game in which it is engaged to

be telecast into any area included within the home territory of any other club on the

day that such other club is engaged in playing a game at home….” As a result of

bylaws of this type, out-of-market games—as defined in the deal between the NFL

and DirecTV—are unavailable to commercial and residential subscribers except

pursuant to the anticompetitive conditions imposed upon them by Defendants. But

for these conditions, commercial and residential subscribers would have more

choices to access out-of-market games at lower prices.

94. As explained previously, DirecTV’s exclusive arrangement with the

NFL results in NFL Sunday Ticket subscribers paying a higher price for NFL

Sunday Ticket (and other access charges) than they otherwise would pay if the

agreements were negotiated competitively.

95. For example, on December 11, 2002, when the NFL’s first contract

with DirecTV for NFL Sunday Ticket expired, the cable MVPD consortium

InDemand presented a letter proposal to former NFL Commissioner Paul Tagliabue

offering $400 million to $500 million annually for the nonexclusive rights to carry

Sunday Ticket. “We’re prepared to accept a license fee around those levels for a

three- to five-year term,” wrote Stephen A. Brenner, the president of InDemand, at

Case 2:15-ml-02668-PSG-JEM Document 163 Filed 06/24/16 Page 33 of 59 Page ID

#:1459

34

4377761v1/014918

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

the time. However, within hours of receiving the proposal, the NFL announced a

five-year exclusive renewal with DirecTV.

96. In October of 2014, DirecTV renewed its exclusive agreement with the

NFL. The renewal requires DirecTV to pay the NFL an average of $1.5 billion per

year for eight years in return for the exclusive right to rebroadcast NFL Sunday

afternoon games on Defendants’ NFL Sunday Ticket service.

97. The NFL directly promotes Sunday Ticket as a special product on its

website. It states:

Get in the game with NFL SUNDAY TICKET.

Only on DIRECTV.

Only DIRECTV brings you every out-of-market game live, every

Sunday. Get the 2015 season at no extra charge when you subscribe

today! Or up your game to NFL SUNDAY TICKET MAX and get live

games anywhere you go, real-time highlights, the RED ZONE

CHANNEL®, DIRECTV FANTASY ZONE CHANNEL™, and

NFL.com fantasy, all on your laptop, tablet, phone, or game console.

98. The NFL’s webpage then advertises the full-season rates for Sunday

Ticket, states that “[b]lackout rules and other conditions apply,” and provides a link

to DirecTV’s website for additional information.

D. The Challenged Agreements Harm Competition

99. The NFL and its Teams’ agreement to pool broadcasts is a classic

horizontal supply restriction. Bedrock economic principles teach that a horizontal

agreement by 32 market participants not to compete, but rather to sell their products

collectively, will reduce output, raise prices, and harm consumers.

100. This harm is evident in many forms. First, the availability of football

broadcasts on standard over-the-air and cable channels is vastly lower than it would

Case 2:15-ml-02668-PSG-JEM Document 163 Filed 06/24/16 Page 34 of 59 Page ID

#:1460

35

4377761v1/014918

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

otherwise be. NFL football has the highest ratings of all sports programs. Yet only

two or three Sunday afternoon games are available to fans. By contrast, NCAA

football, whose similar restraints were found to violate the antitrust laws by the

Supreme Court, is now available on dozens of different networks on Saturday

afternoons, with no limit on the number of games aired at the same time.

101. Second, the output of NFL broadcasts, considered on a per-game basis,

is half the output of the other major American sports leagues.

6

In the NHL, NBA,

and MLB, where teams are allowed to negotiate with broadcasters, teams typically

produce two broadcasts per game, each with distinct characteristics appealing to

different consumers. In the NFL, by contrast, the NFL and the Networks that carry

NFL games create just one broadcast for each game.

102. Unsurprisingly, these supply restrictions come with correspondingly

astronomic prices. For the 2015 season, DirecTV and the NFL charged as much as

$359 for a full season of Sunday Ticket to individual subscribers, and anywhere

from $1,458 to more than $120,000 for commercial subscribers. Sunday Ticket

prices increase nearly every year; for example, between the 2014 and 2015 seasons,

DirecTV and the NFL increased prices roughly 11.5%.

103. But for the anticompetitive agreements, each Team would create its

own broadcasts and sell those broadcasts in a competitive marketplace. This would

naturally force prices down at the same time it increased output. A bundle of games,

whether sold as Sunday Ticket or in another form, would continue to be profitable

enough that the Teams would have an incentive to continue offering it—but its

6

On an absolute basis, the disparity is even greater, but this is because the NFL

season has roughly 10-20% as many games as the other leagues.

Case 2:15-ml-02668-PSG-JEM Document 163 Filed 06/24/16 Page 35 of 59 Page ID

#:1461

36

4377761v1/014918

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

prices would necessarily decrease in the face of nationwide competition from

individual Teams.

104. The contrast between NFL radio broadcasting and NFL television

broadcasting illustrates this harm. NFL Teams negotiate individual radio

broadcasting contracts, rather than consolidating all broadcasting in the NFL itself.

Each Team produces (or contracts with a third party to produce) its own radio

broadcast of its games, so that a fan of each Team in a game can consume a

broadcast catering to that fan base. As a result, there are at least twice as many NFL

radio broadcasts as there are television broadcasts. The Team or its radio partner

licenses those broadcasts to multiple radio stations—many of which broadcast the

game free on the Internet nationwide. Thus, despite there being less demand for

radio broadcasts, the NFL and its Teams produce more output and make it more

broadly available—a disparity that can only be explained by the anticompetitive

effect of the horizontal restraint on television broadcasting.

105. The NFL and its Teams’ agreement to sell the bundled games through

an exclusive distributor significantly exacerbates the anticompetitive effect of the

agreements. By licensing their artificial, highly valuable monopoly to DirecTV

exclusively—rather than offering it through multiple distributors as they do outside

the United States and as all other sports leagues do—the NFL and its Teams not

only increase prices and restrict availability for Sunday Ticket, but they distort