ARKANSAS

Motor Vehicle

and

Traffic Laws

and

State Highway

Commission

Regulations

Issued by Authority of

the Arkansas State Highway and Transportation Department

and the Department of Finance and Administration

Formerly published by LexisNexis

2017 EDITION

ARKANSAS

Motor Vehicle and Traffic Laws

and

State Highway Commission

Regulations

2017 Edition

Issued by Authority of

the Arkansas State Highway and Transportation Department

and the Department of Finance and Administration

Formerly published by LexisNexis

ISBN: 978-1-64130-063-6

© 2017 by the State of Arkansas.

All rights reserved.

Blue360° Media, LLC

2750 Rasmussen Rd., Suite 107

Park City, Utah 84098

1-844-599-2887

www.blue360media.com

Product Number 2094022

(Pub. 20940)

This publication is dedicated to the hard-working

ȱȱĜȱȱȱȱȱ

¢ȱ¢ȱȱȱȱȱȱ¢ǯ

ǯřŜŖǯ

To contact Blue360° Media, LLC, please call: 1-844-599-2887

Press 1 for sales.

Press 2 for questions on a publication.

Press 3 for questions about your invoice or to speak with a billing

representative.

Arkansas State Highway

and Transportation

Department

Director of Highways and Transportation

Scott Bennett

Deputy Director Chief Operating Officer

Lorie Tudor

Arkansas State Highway Commission

Dick Trammel, Chairman, Rogers

Tom Schueck, Vice Chairman, Little Rock

Robert S. Moore, Jr., Arkansas City

Alec Farmer, Jonesboro

Philip Taldo, Springdale

Department of

Finance and Administration

Director

Larry Walther

Administrator, Office of Motor Vehicles

Wayne Hamric

Foreword

This digest of statutes and official regulations governing use of public highways,

roads, and streets in Arkansas and control of motor vehicles and operators

permitted on these facilities is published as a service in the public interest. A safer,

more convenient, and more orderly utilization of Arkansas’s highway, road, and

street systems is the objective.

Sections relating to administration of motor vehicles — registration, licenses,

titles, equipment, vehicle operator licensing, and collection of motor vehicle fees and

taxes — outline responsibilities of the Department of Finance and Administration.

Sections relative to administration of highways, roads, and streets and regulation of

weights, size, and movements of traffic thereon set forth powers, duties, and

functions of the State Highway and Transportation Department.

The Arkansas GeneralAssembly requires these two state agencies to: (a) interpret

and disseminate statutory requirements in these two areas, (b) develop and

promulgate policies complementary to these codes, and (c) prepare, publish, and

enforce through proper channels, the regulations required by these codes.

Questions regarding application or interpretation of laws and regulations should

be addressed to the appropriate State agency.

v

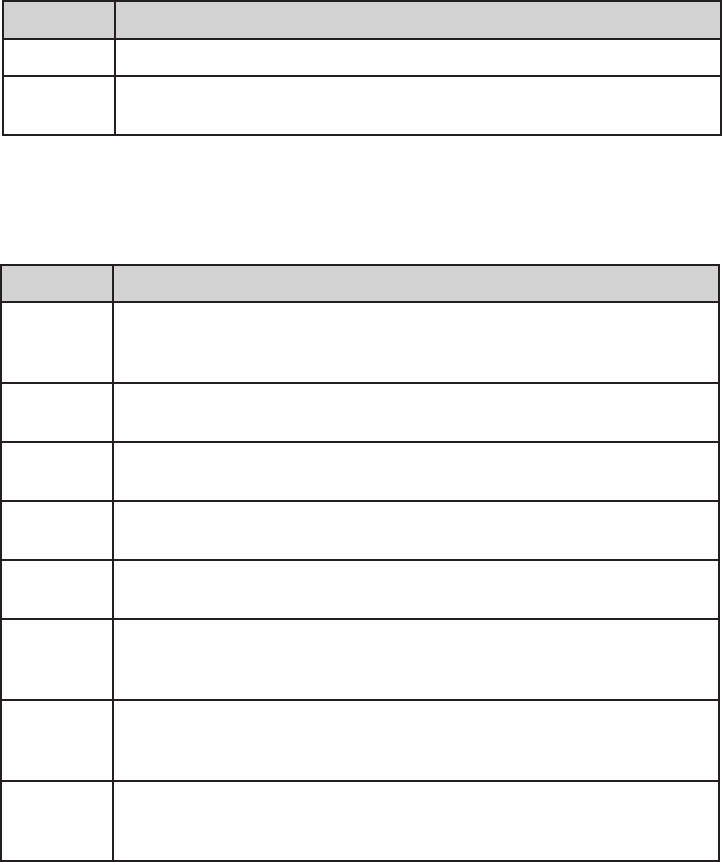

/ŵƉŽƌƚĂŶƚZĞƐŽƵƌĐĞƐĨƌŽŵƚŚĞůƵĞϯϲϬΣDĞĚŝĂKĸĐĞƌ^ĞƌŝĞƐ

Pub. # Featured Law Enforcement Titles

27900

dĂĐƟĐĂů^ƉĂŶŝƐŚĨŽƌ>ĂǁŶĨŽƌĐĞŵĞŶƚĂŶĚϵϭϭŽŵŵƵŶŝĐĂƟŽŶƐ͕^ĞĐŽŶĚ

ĚŝƟŽŶǁŝƚŚͲZKD

Jose Blanco

30181

ŽƵƌƚƌŽŽŵ^ĞĐƵƌŝƚLJĨŽƌ:ƵĚŐĞƐ͕KĸĐĞƌƐ͕ĂŶĚŽƵƌƚWĞƌƐŽŶŶĞů

Judge Richard Carter & Constable Randy Harris

32850

dŚĞ/ĚĞĂůŵƉůŽLJĞĞ;'ƵŝĚĞƚŽWĞƌƐŽŶĂůŝƚLJdĞƐƟŶŐͿ

Donald J. Schroeder & Frank Lombardo

33404

dŚĞƌƵŐĂŶĚůĐŽŚŽů/ŵƉĂŝƌĞĚƌŝǀĞƌǁŝƚŚĞŽŽŬ

:ĞīĞƌƐŽŶ>ĂŶŬĨŽƌĚ

36699

DĂŶĂŐĞŵĞŶƚĂŶĚ^ƵƉĞƌǀŝƐŝŽŶŽĨ>ĂǁŶĨŽƌĐĞŵĞŶƚWĞƌƐŽŶŶĞů͕&ŝŌŚĚŝƟŽŶ

Donald J. Schroeder & Frank Lombardo

37500

<ϵKĸĐĞƌ͛Ɛ>ĞŐĂů,ĂŶĚŬ͕^ĞĐŽŶĚĚŝƟŽŶǁŝƚŚϮϬϭϲ^ƚĂƚĞͲƚŽͲ^ƚĂƚĞ

ĂƐĞ^ƵŵŵĂƌŝĞƐĂŶĚͲZKD

<ĞŶtĂůůĞŶƟŶĞ

37590

KĸĐĞƌ͛Ɛ^ĞĂƌĐŚĂŶĚ^ĞŝnjƵƌĞ,ĂŶĚŬ͕&ŽƵƌƚŚĚŝƟŽŶǁŝƚŚϮϬϭϲ

^ƚĂƚĞͲƚŽͲ^ƚĂƚĞĂƐĞ^ƵŵŵĂƌŝĞƐĂŶĚͲZKD

John A. Stephen

74892

ƌŝŵŝŶĂůWƌŽĐĞĚƵƌĞĨŽƌ>ĂǁŶĨŽƌĐĞŵĞŶƚĂŶĚƌŝŵŝŶĂů:ƵƐƟĐĞWƌŽĨĞƐƐŝŽŶĂůƐ͕

dǁĞůŌŚĚŝƟŽŶǁŝƚŚͲZKD

Larry E. Holtz

dŽŽƌĚĞƌ͕ƉůĞĂƐĞǀŝƐŝƚ͗www.blue360media.com

KƌĐĂůů͗ϭͲϴϰϰͲϱϵϵͲϮϴϴϳĞdžƚ͗ϭ

/ŵƉŽƌƚĂŶƚZĞƐŽƵƌĐĞƐĨŽƌƌŬĂŶƐĂƐ>ĂǁŶĨŽƌĐĞŵĞŶƚKĸĐĞƌƐ

Pub. # Featured Law Enforcement Titles

20916 ƌŬĂŶƐĂƐƌŝŵŝŶĂůĂŶĚdƌĂĸĐ>ĂǁDĂŶƵĂů

20940

ƌŬĂŶƐĂƐDŽƚŽƌsĞŚŝĐůĞĂŶĚdƌĂĸĐ>ĂǁƐĂŶĚ^ƚĂƚĞ,ŝŐŚǁĂLJŽŵŵŝƐƐŝŽŶ

ZĞŐƵůĂƟŽŶƐ

vi

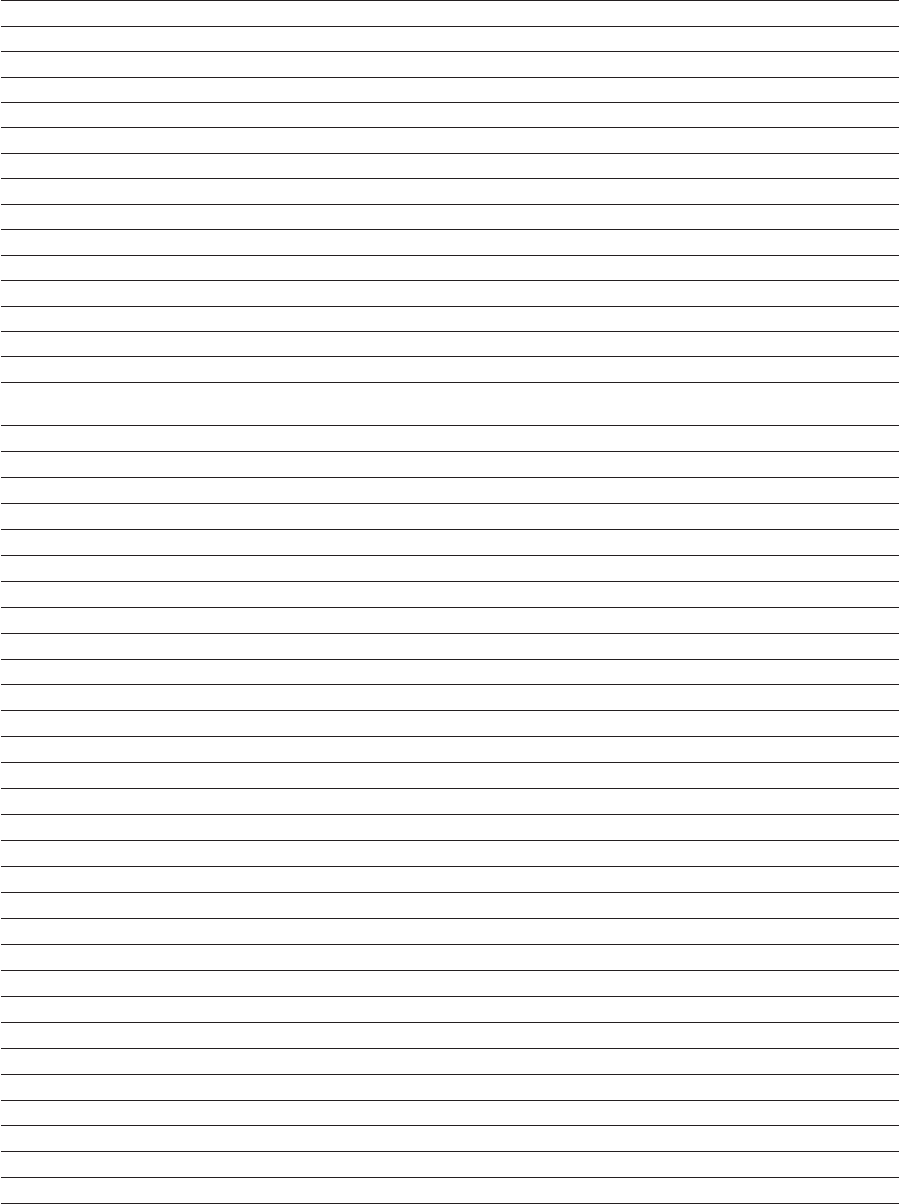

Table of Contents

Page

Table of Sections Affected ................................................................................ xv

Title 5. Criminal Offenses.

Subtitle 1. General Provisions.

Chapter 4. Disposition of Offenders.

Subchapter 2. Fines, Costs, and Restitution, § 5-4-203 ................................ 1

Subtitle 3. Offenses Involving Families, Dependents, Etc.

Chapter 27. Offenses Against Children or Incompetents.

Subchapter 5. Fraudulent Identification Documents for Minors, § 5-27-504 ....... 1

Subtitle 4. Offenses Against Property.

Chapter 36. Theft.

Subchapter 1. General Provisions, § 5-36-108 ........................................... 1

Chapter 38. Damage or Destruction of Property.

Subchapter 2. Offenses Generally, § 5-38-203 ............................................ 1

Subtitle 6. Offenses Against Public Health, Safety or Welfare.

Chapter 64. Controlled Substances

Subchapter 7. Provisions Relating to the Uniform Controlled Substances Act,

§ 5-64-710 .................................................................... 2

Chapter 65. Driving or Boating While Intoxicated.

Subchapter 1. General Provisions, §§ 5-65-101 to 5-65-123 ........................... 3

Subchapter 2. Chemical Analysis of Body Substances, §§ 5-65-201 to 5-65-208 ... 12

Subchapter 3. Underage Driving or Boating under the Influence Law, §§ 5-65-301

to 5-65-311 .................................................................... 16

Subchapter 4. Administrative Driver’s License Suspension, §§ 5-65-401 to

5-65-403 ....................................................................... 20

Chapter 67. Highways and Bridges, §§ 5-67-101 to 5-67-107 ............................... 24

Chapter 71. Riots, Disorderly Conduct, Etc.

Subchapter 2. Offenses Generally, §§ 5-71-214, 5-71-218 .............................. 26

Chapter 73. Weapons.

Subchapter 1. Possession and Use Generally, §§ 5-73-128, 5-73-130 ................. 26

Chapter 77. Official Insignia.

Subchapter 2. Emergency Lights and Law Enforcement Insignia Sales,

§§ 5-77-201 to 5-77-205 .................................................... 28

Subchapter 3. Blue Light Sales, § 5-77-301 .............................................. 29

Title 6. Education.

Subtitle 2. Elementary and Secondary Education Generally.

Chapter 18. Students.

Subchapter 2. Attendance, § 6-18-222 ..................................................... 30

Chapter 19. Transportation, §§ 6-19-107 to 6-19-109, 6-19-113, 6-19-118 to 6-19-120 31

Chapter 21. School Property and Supplies.

Subchapter 7. School Motor Vehicle Insurance Act, §§ 6-21-701 to 6-21-711 ....... 33

Subtitle 4. Vocational and Technical Education.

Chapter 51. Vocational and Technical Schools.

Subchapter 1. General Provisions, § 6-51-101 ........................................... 35

Title 8. Environmental Law.

Chapter 6. Disposal of Solid Wastes and Other Refuse.

Subchapter 4. Litter Control Act, §§ 8-6-401 to 8-6-418 ................................ 36

vii

Page

Title 9. Family Law.

Subtitle 2. Domestic Relations.

Chapter 14. Spousal and Child Support.

Subchapter 2. Enforcement Generally, § 9-14-239 ...................................... 41

Title 12. Law Enforcement, Emergency Management, and Military Affairs.

Subtitle 2. Law Enforcement Agencies and Programs.

Chapter 8. Department of Arkansas State Police.

Subchapter 1. General Provisions, §§ 12-8-106, 12-8-107, 12-8-116 .................. 43

Chapter 12. Crime Reporting and Investigations.

Subchapter 2. Arkansas Crime Information Center, §§ 12-12-201, 12-12-207,

12-12-208 ...................................................................... 44

Subtitle 4. Military Affairs.

Chapter 62. Military Personnel.

Subchapter 4. Privileges, §§ 12-62-407 to 12-62-410, 12-62-414 ...................... 45

Subtitle 5. Emergency Management.

Chapter 79. Arkansas Hazardous and Toxic Materials Emergency Notification Act,

§§ 12-79-101 to 12-79-106 ......................................................... 46

Title 14. Local Government.

Subtitle 3. Municipal Government.

Chapter 54. Powers of Municipalities Generally.

Subchapter 14. Miscellaneous Regulations, § 14-54-1410 .............................. 48

Title 16. Practice, Procedure, and Courts.

Subtitle 2. Courts and Court Officers.

Chapter 10. General Provisions.

Subchapter 3. Uniform Filing Fees and Court Costs, § 16-10-305 ................... 48

Title 19. Public Finance.

Chapter 6. Revenue Classification Law.

Subchapter 8. Special Revenue Funds Continued, § 19-6-832 ........................ 49

Title 20. Public Health and Welfare.

Subtitle 2. Health and Safety.

Chapter 14. Individuals with Disabilities.

Subchapter 3. Rights Generally, § 20-14-306 ............................................. 50

Chapter 17. Death and Disposition of the Dead.

Subchapter 5. Anatomical Gifts Generally, § 20-17-501 ................................ 50

Chapter 32. Disposal of Commercial Medical Waste, §§ 20-32-101 to 20-32-112 ........ 50

Title 21. Public Officers and Employees.

Chapter 9. Liability of State and Local Governments.

Subchapter 3. Liability of Political Subdivisions, § 21-9-303 .......................... 53

Title 23. Public Utilities and Regulated Industries.

Subtitle 1. Public Utilities and Carriers.

Chapter 11. Establishment and Organization of Railroads.

Subchapter 1. General Provisions, § 23-11-101 .......................................... 54

Chapter 12. Operation and Maintenance of Railroads.

Subchapter 2. Roadbeds and Rights-of-Way, § 23-12-201 .............................. 54

Subchapter 3. Crossings and Switches, §§ 23-12-301, 23-12-304 ..................... 54

Subchapter 10. Railroad Safety and Regulatory Act of 1993, §§ 23-12-1001 to

23-12-1008 ................................................................... 55

Chapter 13. Motor Carriers.

Subchapter 1. General Provisions, §§ 23-13-101, 23-13-102 ........................... 57

Subchapter 2. Arkansas Motor Carrier Act, §§ 23-13-202 to 23-13-208, 23-13-217,

23-13-222, 23-13-225, 23-13-228 to 23-13-230, 23-13-233, 23-13-234,

23-13-236, 23-13-253 to 23-13-265 ........................................ 57

Subchapter 4. Passengers [Repealed] ...................................................... 68

Subchapter 7. Transportation Network Company Services Act, §§ 23-13-701 to

23-13-722 ...................................................................... 68

viiiTABLE OF CONTENTS

Page

Chapter 16. Miscellaneous Provisions Relating to Carriers.

Subchapter 3. Uninsured Motorist Liability Insurance, § 23-16-302 ................ 75

Subtitle 3. Insurance.

Chapter 79. Insurance Policies Generally.

Subchapter 3. Minimum Standards — Commercial Property and Casualty Insur-

ance Policies, §§ 23-79-311, 23-79-312 ................................... 75

Chapter 89. Casualty Insurance.

Subchapter 2. Automobile Liability Insurance Generally, §§ 23-89-209, 23-89-212,

23-89-214 to 23-89-216 ...................................................... 76

Subtitle 4. Miscellaneous Regulated Industries.

Chapter 112. Arkansas Motor Vehicle Commission Act.

Subchapter 1. General Provisions, § 23-112-107 ......................................... 77

Subchapter 3. Licensing and Regulation, §§ 23-112-315, 23-112-317 ................ 79

Subchapter 6. Used Motor Vehicle Buyers Protection, § 23-112-612 ................. 80

Subchapter 9. Recreational Vehicle Special Events, §§ 23-112-901 to 23-112-905 80

Title 26. Taxation.

Subtitle 5. State Taxes.

Chapter 52. Gross Receipts Tax.

Subchapter 3. Imposition of Tax, §§ 26-52-301, 26-52-302, 26-52-310 to 26-52-313 81

Subchapter 4. Exemptions, § 26-52-401 ................................................... 87

Subchapter 5. Returns and Remittance of Tax, §§ 26-52-510, 26-52-513, 26-52-519,

26-52-521 ...................................................................... 93

Chapter 53. Compensating or Use Taxes.

Subchapter 1. Arkansas Compensating Tax Act of 1949, § 26-53-126 ............... 98

Chapter 55. Motor Fuels Taxes.

Subchapter 1. General Provisions, § 26-55-101 .......................................... 99

Title 27. Transportation.

Subtitle 1. General Provisions.

Chapter 2. Hazardous Materials Transportation Act of 1977, §§ 27-2-101, 27-2-103 to

27-2-105 ................................................................................. 99

Subtitle 2. Motor Vehicle Registration and Licensing.

Chapter 13. General Provisions, §§ 27-13-101 to 27-13-104 ................................ 100

Chapter 14. Motor Vehicle Administration, Certificate of Title, and Antitheft Act.

Subchapter 1. General Provisions, §§ 27-14-101 to 27-14-104 ........................ 101

Subchapter 2. Definitions [Repealed] ...................................................... 103

Subchapter 3. Penalties and Administrative Sanctions, §§ 27-14-301 to 27-14-314 103

Subchapter 4. Office of Motor Vehicle, §§ 27-14-401 to 27-14-414 .................... 106

Subchapter 5. Commission for Reciprocal Agreements, §§ 27-14-501 to 27-14-505 109

Subchapter 6. Registration and License Fees, §§ 27-14-601 to 27-14-613 ........... 110

Subchapter 7. Registration and Certificates of Title, §§ 27-14-701 to 27-14-727 ... 121

Subchapter 8. Liens and Encumbrances, §§ 27-14-801 to 27-14-807 ................. 131

Subchapter 9. Transfers of Title and Registration, §§ 27-14-901 to 27-14-917 ..... 132

Subchapter 10. Permanent Automobile Licensing Act, §§ 27-14-1001 to 27-14-1021 138

Subchapter 11. Special Personalized Prestige License Plates, §§ 27-14-1101 to

27-14-1104 ................................................................... 142

Subchapter 12. Permanent Trailer Licensing Act of 1979, §§ 27-14-1201 to

27-14-1218 ................................................................... 143

Subchapter 13. Trucks and Trailers, §§ 27-14-1301 to 27-14-1306 ................... 145

Subchapter 14. Buses, §§ 27-14-1401 to 27-14-1404 .................................... 146

Subchapter 15. Taxicabs, §§ 27-14-1501, 27-14-1502 ................................... 147

Subchapter 16. Manufactured Homes and Mobile Homes, §§ 27-14-1601 to

27-14-1604 ................................................................... 148

Subchapter 17. License Plates for Manufacturers, Transporters, and Dealers,

§§ 27-14-1701 to 27-14-1709 ............................................. 150

Subchapter 18. Vehicles in Transit to Dealers, §§ 27-14-1801 to 27-14-1808 ....... 155

ix TABLE OF CONTENTS

Page

Subchapter 19. Transporting of Motor Homes by Manufacturers, §§ 27-14-1901 to

27-14-1905 ................................................................... 156

Subchapter 20. Licensing of Dealers and Wreckers, §§ 27-14-2001 to 27-14-2003 157

Subchapter 21. Drive-out Tags, §§ 27-14-2101 to 27-14-2105 ......................... 158

Subchapter 22. Theft of Vehicles and Parts, §§ 27-14-2201 to 27-14-2212 .......... 158

Subchapter 23. Disclosure of Damage and Repair on the Certificate of Title,

§§ 27-14-2301 to 27-14-2308 ............................................. 160

Subchapter 24. Temporary Registration Exemption [Repealed] ....................... 163

Chapter 15. Registration and Licensing — Special Uses.

Subchapter 1. General Provisions, §§ 27-15-101, 27-15-102 ........................... 163

Subchapter 2. Handicapped Persons Generally [Repealed] ............................ 164

Subchapter 3. Access to Parking for Persons with Disabilities Act, §§ 27-15-301 to

27-15-317 ...................................................................... 164

Subchapter 4. Disabled Veterans — In General [Repealed] ............................ 171

Subchapter 5. Disabled Veterans — License for Furnished Automobiles [Repealed] 171

Subchapter 6. Disabled Veterans — World War I [Repealed] .......................... 171

Subchapter 7. Disabled Veterans — Nonservice Injuries [Repealed] ................. 171

Subchapter 8. Medal of Honor Recipients [Repealed] ................................... 171

Subchapter 9. Purple Heart Recipients [Repealed] ...................................... 171

Subchapter 10. Ex-Prisoners of War [Repealed] .......................................... 171

Subchapter 11. Military Reserve [Repealed] .............................................. 172

Subchapter 12. United States Armed Forces Retired [Repealed] ...................... 172

Subchapter 13. Public Use Vehicles — Local Government [Repealed] ............... 172

Subchapter 14. Public Use Vehicles — State Government [Repealed] ............... 172

Subchapter 15. Public Use Vehicles — Federal Government [Repealed] ............ 172

Subchapter 16. Members of General Assembly [Repealed] ............................. 172

Subchapter 17. Game and Fish Commission [Repealed] ................................ 172

Subchapter 18. Volunteer Rescue Squads [Repealed] ................................... 173

Subchapter 19. Religious Organizations [Repealed] ..................................... 173

Subchapter 20. Youth Groups [Repealed] .................................................. 173

Subchapter 21. Orphanages [Repealed] .................................................... 173

Subchapter 22. Historic or Special Interest Vehicles, §§ 27-15-2201 to 27-15-2209 173

Subchapter 23. Antique Motorcycles, §§ 27-15-2301 to 27-15-2307 .................. 175

Subchapter 24. Amateur Radio Operators, §§ 27-15-2401 to 27-15-2405 ........... 177

Subchapter 25. Pearl Harbor Survivors [Repealed] ..................................... 177

Subchapter 26. Merchant Marine [Repealed] ............................................. 177

Subchapter 27. Firefighters [Repealed] .................................................... 178

Subchapter 28. Special License Plates for County Quorum Court Members

[Repealed] ................................................................... 178

Subchapter 29. Special Collegiate License Plates [Repealed] .......................... 178

Subchapter 30. Special Civil Air Patrol License Plates [Repealed] ................... 178

Subchapter 31. Search and Rescue Special License Plates, §§ 27-15-3101 to

27-15-3103 ................................................................... 178

Subchapter 32. Ducks Unlimited [Repealed] ............................................. 179

Subchapter 33. World War II Veterans, Korean War Veterans, Vietnam Veterans,

and Persian Gulf Veterans [Repealed] .................................. 179

Subchapter 34. Additional Game and Fish Commission Plates [Repealed] ......... 179

Subchapter 35. Committed to Education License Plates [Repealed] .................. 179

Subchapter 36. Armed Forces Veteran License Plates [Repealed] .................... 179

Subchapter 37. Special Retired Arkansas State Trooper License Plates [Repealed] 179

Subchapter 38. Distinguished Flying Cross [Repealed] ................................. 179

Subchapter 39. Choose Life License Plate [Repealed] ................................... 179

Subchapter 40. Miscellaneous, §§ 27-15-4001 to 27-15-4004 .......................... 180

Subchapter 41. Susan G. Komen Breast Cancer Education, Research, and Aware-

ness License Plate [Repealed] ............................................ 180

xTABLE OF CONTENTS

Page

Subchapter 42. Division of Agriculture License Plate [Repealed] ..................... 180

Subchapter 43. Constitutional Officer License Plate [Repealed] ...................... 180

Subchapter 44. African-American Fraternity and Sorority License Plate [Repealed] 180

Subchapter 45. Boy Scouts of America License Plate [Repealed] ..................... 181

Subchapter 46. Arkansas Cattlemen’s Foundation License Plate [Repealed] ....... 181

Subchapter 47. Organ Donor Awareness License Plate [Repealed] ................... 181

Subchapter 48. Operation Iraqi Freedom Veteran License Plate [Repealed] ........ 181

Subchapter 49. In God We Trust License Plate, §§ 27-15-4901 to 27-15-4908 ..... 181

Subchapter 50. Operation Enduring Freedom Veteran License Plate [Repealed] .. 183

Subchapter 51. Arkansas State Golf Association License Plate, §§ 27-15-5101 to

27-15-5106 ................................................................... 183

Subchapter 52. Arkansas Fallen Firefighters’ Memorial Special License Plate,

§§ 27-15-5201 to 27-15-5206 ............................................. 184

Subchapter 53. Realtors License Plate [Repealed] ....................................... 185

Chapter 16. Driver’s Licenses Generally.

Subchapter 1. General Provisions, §§ 27-16-101 to 27-16-104 ........................ 185

Subchapter 2. Definitions [Repealed] ...................................................... 186

Subchapter 3. Penalties, §§ 27-16-301 to 27-16-306 .................................... 186

Subchapter 4. Office of Driver Services, §§ 27-16-401 to 27-16-404 .................. 187

Subchapter 5. Administration Generally, §§ 27-16-501 to 27-16-509 ................ 188

Subchapter 6. Licensing Requirements, §§ 27-16-601 to 27-16-606 .................. 191

Subchapter 7. Application and Examination, §§ 27-16-701 to 27-16-706 ............ 193

Subchapter 8. Issuance of Licenses and Permits, §§ 27-16-801 to 27-16-816 ....... 196

Subchapter 9. Expiration, Cancellation, Revocation, or Suspension, §§ 27-16-901

to 27-16-915 ................................................................... 205

Subchapter 10. Special Provisions Regarding Chauffeurs [Repealed] ................ 210

Subchapter 11. Driver’s License Security and Modernization Act, §§ 27-16-1101 to

27-16-1112 ................................................................... 210

Subchapter 12. Arkansas Voluntary Enhanced Security Driver’s License and Iden-

tification Card Act, §§ 27-16-1201 to 27-16-1213 ..................... 214

Subchapter 13. Arkansas Emergency Contact Information System [Effective until

January 29, 2018], §§ 27-16-1301 to 27-16-1309 ..................... 218

Subchapter 13. Emergency Contact Information System Act [Effective January 29,

2018], §§ 27-16-1301 to 27-16-1309 ..................................... 219

Chapter 17. Driver License Compact, §§ 27-17-101 to 27-17-106 .......................... 220

Chapter 18. Driver Education Program, §§ 27-18-101 to 27-18-111 ....................... 222

Chapter 19. Motor Vehicle Safety Responsibility Act.

Subchapter 1. General Provisions, §§ 27-19-101 to 27-19-107 ........................ 224

Subchapter 2. Definitions, §§ 27-19-201 to 27-19-214 .................................. 225

Subchapter 3. Penalties and Administrative Sanctions, §§ 27-19-301 to 27-19-307 227

Subchapter 4. Administration, §§ 27-19-401 to 27-19-408 ............................. 228

Subchapter 5. Accident Reports, §§ 27-19-501 to 27-19-510 ........................... 229

Subchapter 6. Security Following Accident, §§ 27-19-601 to 27-19-621 ............. 230

Subchapter 7. Proof of Future Financial Responsibility, §§ 27-19-701 27-19-721 235

Chapter 20. Operation of Motorized Cycles and All-Terrain Vehicles.

Subchapter 1. Motorcycles, Motor-Driven Cycles, and Motorized Bicycles,

§§ 27-20-101 to 27-20-120 ................................................. 240

Subchapter 2. Three-Wheeled, Four-Wheeled, and Six-Wheeled All-Terrain Vehi-

cles, §§ 27-20-201 to 27-20-208 ........................................... 245

Subchapter 3. Autocycles Act, §§ 27-20-301 to 27-20-308 .............................. 246

Chapter 21. All-Terrain Vehicles, §§ 27-21-101 to 27-21-109 ............................... 247

Chapter 22. Motor Vehicle Liability Insurance.

Subchapter 1. General Provisions, §§ 27-22-101 to 27-22-111 ......................... 250

Subchapter 2. Arkansas Online Insurance Verification System Act, §§ 27-22-201 to

27-22-212 ...................................................................... 254

xi TABLE OF CONTENTS

Page

Chapter 23. Commercial Driver License.

Subchapter 1. Arkansas Uniform Commercial Driver License Act, §§ 27-23-101 to

27-23-131 ...................................................................... 258

Subchapter 2. Commercial Driver Alcohol and Drug Testing Act, §§ 27-23-201 to

27-23-211 ...................................................................... 278

Chapter 24. Special License Plate Act of 2005.

Subchapter 1. General Provisions, §§ 27-24-101 to 27-24-111 ......................... 281

Subchapter 2. Military Service and Veterans, §§ 27-24-201 to 27-24-215 ........... 282

Subchapter 3. Public Use Vehicles — Local Government, §§ 27-24-301 to 27-24-306 287

Subchapter 4. Public Use Vehicles — State Government, §§ 27-24-401, 27-24-402 289

Subchapter 5. Public Use Vehicles — Federal Government, § 27-24-501 ........... 289

Subchapter 6. Nominal Fee Plates, §§ 27-24-601 to 27-24-612 ....................... 289

Subchapter 7. Members of the General Assembly, §§ 27-24-701 to 27-24-706 ...... 291

Subchapter 8. Constitutional Officers, §§ 27-24-801 to 27-24-804 .................... 293

Subchapter 9. Arkansas State Game and Fish Commission, §§ 27-24-901 to

27-24-907 ...................................................................... 294

Subchapter 10. Colleges, Universities and Arkansas School for the Deaf,

§§ 27-24-1001 to 27-24-1010 ............................................. 295

Subchapter 11. Agriculture Education, §§ 27-24-1101 to 27-24-1108 ................ 298

Subchapter 12. African-American Fraternities and Sororities, §§ 27-24-1201 to

27-24-1209 ................................................................... 300

Subchapter 13. Public and Military Service Recognition, §§ 27-24-1301 to

27-24-1316 ................................................................... 302

Subchapter 14. Special Interest License Plates, §§ 27-24-1401 to 27-24-1427 ..... 307

Subchapter 15. Street Rod Special License Plates, §§ 27-24-1501 to 27-24-1505 .. 317

Subchapter 16. Department of Parks and Tourism, §§ 27-24-1601 to 27-24-1603 318

Subchapter 17. Conservation Districts, §§ 27-24-1701 to 27-24-1704 ................ 319

Chapters 25-31. [Reserved] ........................................................................ 320

Subtitle 3. Motor Vehicles and Their Equipment.

Chapter 34. Child Passenger Protection Act, §§ 27-34-101 to 27-34-108 ................. 320

Chapter 35. Size and Load Regulations.

Subchapter 1. General Provisions, §§ 27-35-101 to 27-35-113 ......................... 322

Subchapter 2. Weights and Dimensions, §§ 27-35-201 to 27-35-213 ................. 325

Subchapter 3. Manufactured Homes and Houses, §§ 27-35-301 to 27-35-310 ...... 336

Chapter 36. Lighting Regulations.

Subchapter 1. General Provisions, §§ 27-36-101, 27-36-102 ........................... 339

Subchapter 2. Lighting Requirements Generally, §§ 27-36-201 to 27-36-224 ....... 339

Subchapter 3. Lights for Emergency Vehicles, §§ 27-36-301 to 27-36-306 .......... 347

Chapter 37. Equipment Regulations.

Subchapter 1. General Provisions, §§ 27-37-101 to 27-37-103 ........................ 348

Subchapter 2. Safety and Emergency Equipment, §§ 27-37-201 to 27-37-206 ..... 348

Subchapter 3. Glass and Mirrors, §§ 27-37-301 to 27-37-307 ......................... 350

Subchapter 4. Tires, §§ 27-37-401, 27-37-402 ............................................ 353

Subchapter 5. Brakes, §§ 27-37-501 to 27-37-503 ....................................... 353

Subchapter 6. Mufflers, §§ 27-37-601, 27-37-602 ........................................ 354

Subchapter 7. Mandatory Seat Belt Use, §§ 27-37-701 to 27-37-707 ................ 355

Subchapter 8. Eric’s Law: The Nitrous Oxide Prohibition Act, §§ 27-37-801 to

27-37-803 ...................................................................... 356

Chapter 38. Automotive Fluids Regulation.

Subchapter 1. Antifreeze, §§ 27-38-101 to 27-38-105 ................................... 356

Subchapter 2. Brake Fluid [Repealed] ..................................................... 357

Chapters 39-48. [Reserved] ........................................................................ 357

Subtitle 4. Motor Vehicular Traffic.

Chapter 49. General Provisions.

Subchapter 1. Title, Applicability, and Construction Generally, §§ 27-49-101 to

27-49-114 ...................................................................... 357

xiiTABLE OF CONTENTS

Page

Subchapter 2. Definitions [Repealed] ...................................................... 361

Chapter 50. Penalties and Enforcement.

Subchapter 1. General Provisions, §§ 27-50-101, 27-50-102 ........................... 362

Subchapter 2. Enforcement Generally, §§ 27-50-201 to 27-50-205 ................... 362

Subchapter 3. Offenses and Penalties Generally, §§ 27-50-301 to 27-50-311 ....... 363

Subchapter 4. Additional Penalty, §§ 27-50-401 to 27-50-408 ......................... 366

Subchapter 5. Traffic Citations, §§ 27-50-501 to 27-50-505 ............................ 367

Subchapter 6. Arrest and Release, §§ 27-50-601 to 27-50-612 ........................ 368

Subchapter 7. Trial and Judgment, §§ 27-50-701, 27-50-702 .......................... 371

Subchapter 8. Convictions, §§ 27-50-801 to 27-50-805 .................................. 371

Subchapter 9. Central Driver’s Records File, §§ 27-50-901 to 27-50-912 ............ 372

Subchapter 10. Reports of Accidents, §§ 27-50-1001 to 27-50-1007 .................. 374

Subchapter 11. Abandoned Vehicles, §§ 27-50-1101 to 27-50-1103 ................... 375

Subchapter 12. Removal or Immobilization of Unattended or Abandoned Vehicles,

§§ 27-50-1201 to 27-50-1221 ............................................. 378

Chapter 51. Operation of Vehicles — Rules of the Road.

Subchapter 1. General Provisions, §§ 27-51-101 to 27-51-104 ........................ 391

Subchapter 2. Speed Limits, §§ 27-51-201 to 27-51-217 ................................ 392

Subchapter 3. Driving, Overtaking, and Passing, §§ 27-51-301 to 27-51-311 ...... 395

Subchapter 4. Turning, Stopping, and Signaling, §§ 27-51-401 to 27-51-405 ....... 398

Subchapter 5. Intersections, §§ 27-51-501 to 27-51-503 ................................ 399

Subchapter 6. Stops and Yielding, §§ 27-51-601 to 27-51-604 ......................... 399

Subchapter 7. Railroad Grade Crossings, §§ 27-51-701 to 27-51-706 ................ 400

Subchapter 8. Streetcars, §§ 27-51-801 to 27-51-803 ................................... 402

Subchapter 9. Emergency Vehicles, §§ 27-51-901 to 27-51-906 ....................... 402

Subchapter 10. School Buses, §§ 27-51-1001 to 27-51-1005 ........................... 404

Subchapter 11. Church Buses, §§ 27-51-1101 to 27-51-1104 ........................... 405

Subchapter 12. Pedestrians, §§ 27-51-1201 to 27-51-1205 ............................. 406

Subchapter 13. Stopping, Standing, or Parking, §§ 27-51-1301 to 27-51-1309 ..... 406

Subchapter 14. Miscellaneous Rules, §§ 27-51-1401 to 27-51-1409 .................. 408

Subchapter 15. Paul’s Law: To Prohibit Drivers from Using a Wireless Communi-

cations Device While Operating a Motor Vehicle, §§ 27-51-1501 to

27-51-1506 ................................................................... 410

Subchapter 16. Fewer Distractions Mean Safer Driving Act, §§ 27-51-1601 to

27-51-1610 ................................................................... 411

Subchapter 17. Electric Bicycle Act, §§ 27-51-1701 to 27-51-1706 .................... 412

Chapter 52. Traffic-Control Devices.

Subchapter 1. General Provisions, §§ 27-52-101 to 27-52-111 ......................... 414

Subchapter 2. Uniform System, §§ 27-52-201 to 27-52-206 ............................ 417

Chapter 53. Accidents.

Subchapter 1. General Provisions, §§ 27-53-101 to 27-53-105 ........................ 418

Subchapter 2. Accident Reports, §§ 27-53-201 to 27-53-211 ........................... 419

Subchapter 3. Investigations, §§ 27-53-301 to 27-53-307 .............................. 421

Subchapter 4. Damage Claims, §§ 27-53-401 to 27-53-405 ............................ 423

Chapter 54. Nonresident Violator Compact, § 27-54-101 .................................... 423

Chapters 55-63. [Reserved] ........................................................................ 426

Subtitle 5. Highways, Roads, and Streets.

Chapter 64. General Provisions.

Subchapter 1. Miscellaneous Provisions, §§ 27-64-101 to 27-64-104 ................. 426

Subchapter 5. Arkansas Highway Financing Act of 2011, §§ 27-64-501 to 27-64-514 428

Chapter 65. Arkansas Department of Transportation — State Highway Commission,

§§ 27-65-101 to 27-65-145 ......................................................... 432

Chapter 66. Establishment and Maintenance Generally.

Subchapter 5. Protection of Road Surfaces, §§ 27-66-501 to 27-66-507 .............. 441

xiii TABLE OF CONTENTS

Page

Chapter 67. State Highway System.

Subchapter 1. General Provisions, §§ 27-67-101 to 27-67-103 ........................ 443

Subchapter 2. Highway Designation, Construction, and Maintenance,

§§ 27-67-201 to 27-67-228 ................................................. 443

Subchapter 3. Acquisition, Condemnation, and Disposition of Property,

§§ 27-67-301 to 27-67-323 ................................................. 452

Chapter 68. Controlled-Access Facilities, §§ 27-68-101 to 27-68-111 ...................... 458

Chapter 73. Highway Safety.

Subchapter 1. General Provisions, §§ 27-73-101, 27-73-102 ........................... 460

Subchapter 2. Flashing Lights Near Highways, §§ 27-73-201 to 27-73-206 ........ 460

Subchapter 3. Notice of Smoke Obstructing Highway, §§ 27-73-301, 27-73-302 ... 461

Subtitle 6. Bridges and Ferries.

Chapter 85. General Provisions, § 27-85-101 .................................................. 462

Subtitle 7. Watercourses and Navigation.

Chapter 101. Watercraft.

Subchapter 3. Motorboat Registration and Numbering, §§ 27-101-301 to

27-101-313 .................................................................... 462

Arkansas State Highway Commission Regulations ................................................. 469

Index ......................................................................................................... 479

xivTABLE OF CONTENTS

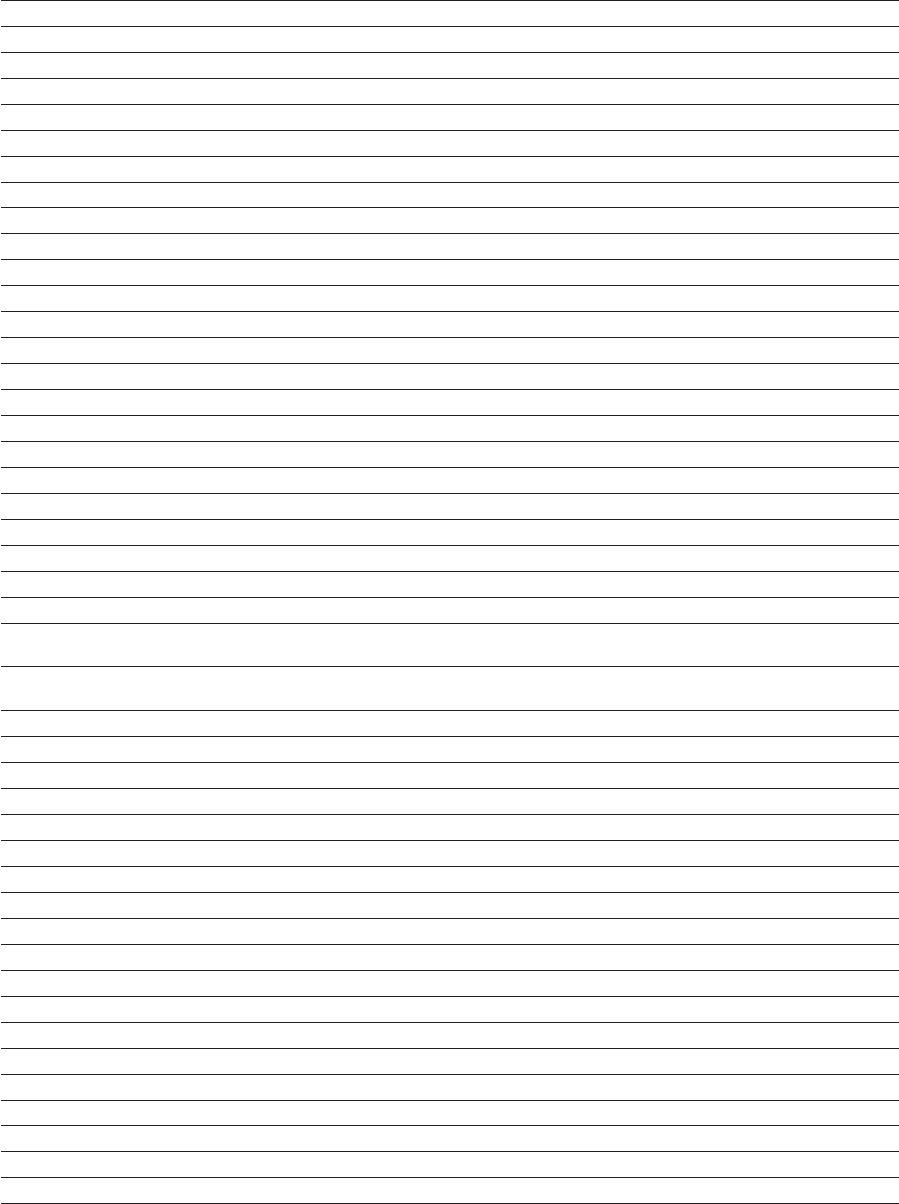

Table of Sections Affected

Section

Affected Effect Act No. Bill Section

5-65-104 ....................... Amended .......... 913 ................. HB 1289 ................. 18

5-65-104 ....................... Amended .......... 1094 ............... HB 1268 ................... 1

5-65-109 ....................... Amended .......... 913 ................. HB 1289 ................. 19

5-65-111 ....................... Amended .......... 333 ................. HB 1320 ................... 4

5-65-111 ....................... Amended .......... 1032 ............... HB 1668 ................... 1

5-65-115 ....................... Amended .......... 913 ................. HB 1289 ................. 20

5-65-118 ....................... Amended .......... 1094 ............... HB 1268 ................... 2

5-65-118 ....................... Amended .......... 1094 ............... HB 1268 ................... 3

5-65-121 ....................... Amended .......... 913 ................. HB 1289 ................. 21

5-65-202 ....................... Amended .......... 1031 ............... HB 2248 ................... 1

5-65-204 ....................... Amended .......... 1031 ............... HB 2248 ................... 2

5-65-204 ....................... Amended .......... 1031 ............... HB 2248 ................... 3

5-65-205 ....................... Amended .......... 333 ................. HB 1320 ................... 5

5-65-205 ....................... Amended .......... 1031 ............... HB 2248 ................... 4

5-65-208 ....................... Amended .......... 1031 ............... HB 2248 ................... 5

5-65-307 ....................... Amended .......... 913 ................. HB 1289 ................. 22

5-65-309 ....................... Amended .......... 1031 ............... HB 2248 ................... 6

5-65-402 ....................... Amended .......... 1031 ............... HB 2248 ................... 7

5-65-402 ....................... Amended .......... 1031 ............... HB 2248 ................... 8

5-71-218 ....................... New ................ 849 ................. HB 1922 ................... 1

5-77-201 ....................... Amended .......... 439 ................. HB 1385 ................... 1

5-77-202 ....................... Amended .......... 439 ................. HB 1385 ................... 2

5-77-205 ....................... Amended .......... 439 ................. HB 1385 ................... 3

6-21-711 ....................... Repealed .......... 3SS 2 .............. SB 10 ...................... 3

16-10-305 ..................... Amended .......... 583 ................. HB 1420 ................... 3

19-6-832 ....................... New ................ 3SS 1 .............. HB 1009 ................. 13

20-32-105 ..................... Amended .......... 707 ................. SB 589 .................... 62

23-11-101 ..................... Amended .......... 707 ................. SB 589 .................. 153

23-13-102 ..................... Amended .......... 707 ................. SB 589 .................. 182

23-13-203 ..................... Amended .......... 707 ................. SB 589 .................. 183

23-13-207 ..................... Amended .......... 707 ................. SB 589 .................. 184

23-13-208 ..................... Amended .......... 707 ................. SB 589 .................. 185

23-13-222 ..................... Amended .......... 707 ................. SB 589 .................. 198

23-13-229 ..................... Amended .......... 707 ................. SB 589 .................. 203

23-13-230 ..................... Amended .......... 707 ................. SB 589 .................. 204

23-13-233 ..................... Amended .......... 707 ................. SB 589 .................. 206

23-13-234 ..................... Amended .......... 707 ................. SB 589 .................. 207

23-13-720 ..................... Amended .......... 707 ................. SB 589 .................. 232

23-13-720 ..................... Amended .......... 954 ................. HB 1573 ................... 1

23-112-107 .................... Amended .......... 707 ................. SB 589 .................. 266

26-52-301 ..................... Amended .......... 141 ................. HB 1162 .................. 15

26-52-301 ..................... Amended .......... 141 ................. HB 1162 .................. 16

26-52-302 ..................... Amended .......... 141 ................. HB 1162 .................. 17

26-52-401 ..................... Amended .......... 141 ................. HB 1162 .................. 22

26-52-401 ..................... Amended .......... 141 ................. HB 1162 .................. 23

26-52-401 ..................... Amended .......... 141 ................. HB 1162 .................. 24

26-52-401 ..................... Amended .......... 141 ................. HB 1162 .................. 25

26-52-401 ..................... Amended .......... 141 ................. HB 1162 .................. 26

xv

Section

Affected Effect Act No. Bill Section

26-52-401 ..................... Amended .......... 141 ................. HB 1162 .................. 27

26-52-401 ..................... Amended .......... 141 ................. HB 1162 .................. 28

26-52-401 ..................... Amended .......... 141 ................. HB 1162 .................. 29

26-52-521 ..................... Amended .......... 141 ................. HB 1162 .................. 39

26-52-521 ..................... Amended .......... 141 ................. HB 1162 .................. 40

26-52-521 ..................... Amended .......... 141 ................. HB 1162 .................. 41

27-2-103 ....................... Amended .......... 707 ................. SB 589 .................. 314

27-2-105 ....................... Amended .......... 707 ................. SB 589 .................. 315

27-14-101 ..................... Amended .......... 448 ................. HB 1483 ................... 1

27-14-104 ..................... New ................ 448 ................. HB 1483 ................... 2

27-14-201 ..................... Repealed .......... 448 ................. HB 1483 ................... 3

27-14-202 ..................... Repealed .......... 448 ................. HB 1483 ................... 3

27-14-203 ..................... Repealed .......... 448 ................. HB 1483 ................... 3

27-14-204 ..................... Repealed .......... 448 ................. HB 1483 ................... 3

27-14-205 ..................... Repealed .......... 448 ................. HB 1483 ................... 3

27-14-206 ..................... Repealed .......... 448 ................. HB 1483 ................... 3

27-14-207 ..................... Repealed .......... 448 ................. HB 1483 ................... 3

27-14-208 ..................... Repealed .......... 448 ................. HB 1483 ................... 3

27-14-209 ..................... Repealed .......... 448 ................. HB 1483 ................... 3

27-14-210 ..................... Repealed .......... 448 ................. HB 1483 ................... 3

27-14-211 ..................... Repealed .......... 448 ................. HB 1483 ................... 3

27-14-212 ..................... Repealed .......... 448 ................. HB 1483 ................... 3

27-14-213 ..................... Repealed .......... 448 ................. HB 1483 ................... 3

27-14-214 ..................... Repealed .......... 448 ................. HB 1483 ................... 3

27-14-215 ..................... Repealed .......... 448 ................. HB 1483 ................... 3

27-14-216 ..................... Repealed .......... 448 ................. HB 1483 ................... 3

27-14-305 ..................... Amended .......... 532 ................. HB 1691 ................... 4

27-14-402 ..................... Amended .......... 448 ................. HB 1483 ................... 4

27-14-403 ..................... Amended .......... 448 ................. HB 1483 ................... 4

27-14-404 ..................... Amended .......... 448 ................. HB 1483 ................... 4

27-14-405 ..................... Amended .......... 786 ................. HB 1657 ................... 1

27-14-406 ..................... Amended .......... 786 ................. HB 1657 ................... 1

27-14-407 ..................... Amended .......... 786 ................. HB 1657 ................... 1

27-14-410 ..................... Amended .......... 448 ................. HB 1483 ................... 5

27-14-411 ..................... Amended .......... 448 ................. HB 1483 ................... 5

27-14-412 ..................... Amended .......... 448 ................. HB 1483 ................... 5

27-14-414 ..................... Repealed .......... 1016 ............... HB 2193 ................... 1

27-14-505 ..................... New ................ 997 ................. HB 1683 ................... 2

27-14-601 ..................... Amended .......... 707 ................. SB 589 .................. 322

27-14-601 ..................... Amended .......... 707 ................. SB 589 .................. 323

27-14-602 ..................... Amended .......... 448 ................. HB 1483 ................... 6

27-14-602 ..................... Amended .......... 532 ................. HB 1691 ................... 5

27-14-603 ..................... Amended .......... 448 ................. HB 1483 ................... 6

27-14-606 ..................... Amended .......... 532 ................. HB 1691 ................... 6

27-14-611 ..................... Amended .......... 707 ................. SB 589 .................. 324

27-14-612 ..................... Amended .......... 331 ................. HB 1038 ................... 1

27-14-613 ..................... New ................ 532 ................. HB 1691 ................... 7

27-14-701 ..................... Amended .......... 448 ................. HB 1483 ................... 7

27-14-705 ..................... Amended .......... 448 ................. HB 1483 ................... 8

27-14-713 ..................... Amended .......... 448 ................. HB 1483 ................... 9

27-14-721 ..................... Amended .......... 448 ................. HB 1483 ................. 10

27-14-722 ..................... Amended .......... 448 ................. HB 1483 .................. 11

27-14-806 ..................... Amended .......... 448 ................. HB 1483 ................. 12

27-14-806 ..................... Amended .......... 687 ................. SB 749 ..................... 1

xviTABLE OF SECTIONS AFFECTED

Section

Affected Effect Act No. Bill Section

27-14-906 ..................... Amended .......... 448 ................. HB 1483 ................. 13

27-14-907 ..................... Amended .......... 448 ................. HB 1483 ................. 14

27-14-1002 .................... Amended .......... 448 ................. HB 1483 ................. 15

27-14-1005 .................... Amended .......... 532 ................. HB 1691 ................... 8

27-14-1018 .................... Amended .......... 532 ................. HB 1691 ................... 9

27-14-1202 .................... Amended .......... 448 ................. HB 1483 ................. 16

27-14-1403 .................... Amended .......... 707 ................. SB 589 .................. 325

27-14-1602 .................... Amended .......... 384 ................. SB 277 ..................... 1

27-14-1703 .................... Amended .......... 448 ................. HB 1483 ................. 17

27-14-1705 .................... Amended .......... 1119 ................ SB 510 ..................... 2

27-14-1705 .................... Amended .......... 1119 ................ SB 510 ..................... 3

27-14-2302 .................... Amended .......... 651 ................. SB 334 ..................... 1

27-14-2305 .................... Amended .......... 651 ................. SB 334 ..................... 2

27-15-302 ..................... Amended .......... 799 ................. HB 1882 ................... 1

27-15-304 ..................... Amended .......... 799 ................. HB 1882 ................... 2

27-15-305 ..................... Amended .......... 799 ................. HB 1882 ................... 3

27-15-305 ..................... Amended .......... 799 ................. HB 1882 ................... 4

27-15-307 ..................... Amended .......... 799 ................. HB 1882 ................... 5

27-15-308 ..................... Amended .......... 799 ................. HB 1882 ................... 6

27-15-310 ..................... Amended .......... 799 ................. HB 1882 ................... 7

27-15-312 ..................... Amended .......... 799 ................. HB 1882 ................... 8

27-15-315 ..................... Amended .......... 799 ................. HB 1882 ................... 9

27-15-317 ..................... New ................ 1003 ............... HB 2069 ................... 1

27-15-4902 .................... Amended .......... 913 ................. HB 1289 ................ 130

27-15-4904 .................... Amended .......... 913 ................. HB 1289 ................ 131

27-16-101 ..................... Amended .......... 448 ................. HB 1483 ................. 18

27-16-104 ..................... New ................ 448 ................. HB 1483 ................. 19

27-16-201 ..................... Repealed .......... 448 ................. HB 1483 ................. 20

27-16-202 ..................... Repealed .......... 448 ................. HB 1483 ................. 20

27-16-203 ..................... Repealed .......... 448 ................. HB 1483 ................. 20

27-16-204 ..................... Repealed .......... 448 ................. HB 1483 ................. 20

27-16-205 ..................... Repealed .......... 448 ................. HB 1483 ................. 20

27-16-206 ..................... Repealed .......... 448 ................. HB 1483 ................. 20

27-16-207 ..................... Repealed .......... 448 ................. HB 1483 ................. 20

27-16-303 ..................... Amended .......... 448 ................. HB 1483 ................. 21

27-16-508 ..................... Amended .......... 915 ................. HB 2090 ................... 1

27-16-509 ..................... Amended .......... 448 ................. HB 1483 ................. 22

27-16-509 ..................... Amended .......... 448 ................. HB 1483 ................. 23

27-16-509 ..................... Amended .......... 448 ................. HB 1483 ................. 24

27-16-601 ..................... Amended .......... 557 ................. SB 428 ..................... 1

27-16-604 ..................... Amended .......... 448 ................. HB 1483 ................. 25

27-16-701 ..................... Amended .......... 806 ................. HB 2172 ................... 1

27-16-701 ..................... Amended .......... 806 ................. HB 2172 ................... 2

27-16-702 ..................... Amended .......... 448 ................. HB 1483 ................. 26

27-16-706 ..................... Amended .......... 490 ................. HB 1670 ................... 2

27-16-801 ..................... Amended .......... 448 ................. HB 1483 ................. 27

27-16-801 ..................... Amended .......... 448 ................. HB 1483 ................. 28

27-16-801 ..................... Amended .......... 448 ................. HB 1483 ................. 29

27-16-801 ..................... Amended .......... 460 ................. SB 147 ..................... 1

27-16-801 ..................... Amended .......... 460 ................. SB 147 ..................... 2

27-16-801 ..................... Amended .......... 460 ................. SB 147 ..................... 3

27-16-801 ..................... Amended .......... 557 ................. SB 428 ..................... 2

27-16-801 ..................... Amended .......... 557 ................. SB 428 ..................... 3

27-16-801 ..................... Amended .......... 976 ................. SB 679 ..................... 1

xvii TABLE OF SECTIONS AFFECTED

Section

Affected Effect Act No. Bill Section

27-16-801 ..................... Amended .......... 1012 ............... HB 2203 ................... 1

27-16-808 ..................... Amended .......... 915 ................. HB 2090 ................... 2

27-16-815 ..................... New ................ 366 ................. SB 266 ..................... 1

27-16-816 ..................... New ................ 1012 ............... HB 2203 ................... 2

27-16-901 ..................... Amended .......... 448 ................. HB 1483 ................. 30

27-16-902 ..................... Amended .......... 131 ................. HB 1147 ................... 1

27-16-1105 .................... Amended .......... 1012 ............... HB 2203 ................... 3

27-16-1213 .................... Repealed .......... 464 ................. SB 359 ..................... 1

27-16-1301 .................... Amended .......... 626 ................. HB 1656 ................... 1

27-16-1302 .................... Amended .......... 626 ................. HB 1656 ................... 2

27-16-1303 .................... Amended .......... 626 ................. HB 1656 ................... 3

27-16-1304 .................... Amended .......... 626 ................. HB 1656 ................... 3

27-16-1305 .................... Amended .......... 626 ................. HB 1656 ................... 4

27-16-1306 .................... Amended .......... 626 ................. HB 1656 ................... 5

27-16-1307 .................... Repealed .......... 626 ................. HB 1656 ................... 6

27-16-1308 .................... Amended .......... 626 ................. HB 1656 ................... 7

27-16-1309 .................... Amended .......... 626 ................. HB 1656 ................... 8

27-18-111 ..................... New ................ 490 ................. HB 1670 ................... 3

27-20-101 ..................... Amended .......... 956 ................. HB 2185 ................... 1

27-20-119 ..................... Repealed .......... 689 ................. SB 365 ..................... 1

27-20-301 ..................... Amended .......... 689 ................. SB 365 ..................... 2

27-20-303 ..................... Amended .......... 689 ................. SB 365 ..................... 3

27-20-306 ..................... Amended .......... 689 ................. SB 365 ..................... 4

27-20-307 ..................... Amended .......... 689 ................. SB 365 ..................... 5

27-21-102 ..................... Amended .......... 272 ................. HB 1148 ................... 1

27-21-109 ..................... Amended .......... 272 ................. HB 1148 ................... 2

27-21-109 ..................... Amended .......... 272 ................. HB 1148 ................... 3

27-22-201 ..................... New ................ 1016 ............... HB 2193 ................... 2

27-22-202 ..................... New ................ 1016 ............... HB 2193 ................... 2

27-22-203 ..................... New ................ 1016 ............... HB 2193 ................... 2

27-22-204 ..................... New ................ 1016 ............... HB 2193 ................... 2

27-22-205 ..................... New ................ 1016 ............... HB 2193 ................... 2

27-22-206 ..................... New ................ 1016 ............... HB 2193 ................... 2

27-22-207 ..................... New ................ 1016 ............... HB 2193 ................... 2

27-22-208 ..................... New ................ 1016 ............... HB 2193 ................... 2

27-22-209 ..................... New ................ 1016 ............... HB 2193 ................... 2

27-22-210 ..................... New ................ 1016 ............... HB 2193 ................... 2

27-22-211 ..................... New ................ 1016 ............... HB 2193 ................... 2

27-22-212 ..................... New ................ 1016 ............... HB 2193 ................... 2

27-23-103 ..................... Amended .......... 463 ................. SB 358 ..................... 1

27-23-103 ..................... Amended .......... 463 ................. SB 358 ..................... 2

27-23-108 ..................... Amended .......... 922 ................. HB 1923 ................... 1

27-23-110 ..................... Amended .......... 463 ................. SB 358 ..................... 3

27-23-114 ..................... Amended .......... 463 ................. SB 358 ..................... 4

27-23-120 ..................... Amended .......... 707 ................. SB 589 .................. 326

27-23-122 ..................... Amended .......... 707 ................. SB 589 .................. 327

27-24-206 ..................... Amended .......... 573 ................. HB 1569 ................... 1

27-24-206 ..................... Amended .......... 573 ................. HB 1569 ................... 2

27-24-208 ..................... Amended .......... 965 ................. HB 2039 ................... 1

27-24-211 ..................... Amended .......... 493 ................. HB 1137 ................... 1

27-24-402 ..................... Amended .......... 707 ................. SB 589 .................. 328

27-24-703 ..................... Amended .......... 448 ................. HB 1483 ................. 31

27-24-1306 .................... Amended .......... 800 ................. HB 1921 ................... 1

27-24-1315 .................... Repealed .......... 1050 ............... SB 677 ..................... 2

xviiiTABLE OF SECTIONS AFFECTED

Section

Affected Effect Act No. Bill Section

27-24-1413 .................... Repealed .......... 928 ................. SB 379 ..................... 2

27-24-1426 .................... New ................ 928 ................. SB 379 ..................... 1

27-24-1427 .................... New ................ 1050 ............... SB 677 ..................... 1

27-35-102 ..................... Amended .......... 619 ................. HB 1998 ................... 2

27-35-112 ..................... Amended .......... 998 ................. HB 1867 ................... 1

27-35-206 ..................... Amended .......... 650 ................. SB 415 ..................... 1

27-35-208 ..................... Amended .......... 619 ................. HB 1998 ................... 3

27-35-208 ..................... Amended .......... 619 ................. HB 1998 ................... 4

27-35-210 ..................... Amended .......... 650 ................. SB 415 ..................... 2

27-35-210 ..................... Amended .......... 707 ................. SB 589 .................. 329

27-35-210 ..................... Amended .......... 1085 ............... HB 2211 ................... 1

27-35-301 ..................... Amended .......... 707 ................. SB 589 .................. 330

27-35-303 ..................... Amended .......... 707 ................. SB 589 .................. 331

27-35-304 ..................... Amended .......... 707 ................. SB 589 .................. 332

27-35-305 ..................... Amended .......... 707 ................. SB 589 .................. 333

27-35-306 ..................... Amended .......... 707 ................. SB 589 .................. 334

27-35-307 ..................... Amended .......... 707 ................. SB 589 .................. 335

27-35-308 ..................... Amended .......... 707 ................. SB 589 .................. 336

27-35-309 ..................... Amended .......... 707 ................. SB 589 .................. 337

27-36-201 ..................... Repealed .......... 448 ................. HB 1483 ................. 32

27-36-202 ..................... Repealed .......... 448 ................. HB 1483 ................. 32

27-36-203 ..................... Repealed .......... 448 ................. HB 1483 ................. 32

27-36-208 ..................... Amended .......... 816 ................. SB 349 ..................... 1

27-36-212 ..................... Repealed .......... 448 ................. HB 1483 ................. 33

27-36-306 ..................... Amended .......... 816 ................. SB 349 ..................... 2

27-37-201 ..................... Repealed .......... 448 ................. HB 1483 ................. 34

27-37-202 ..................... Amended .......... 707 ................. SB 589 .................. 338

27-37-202 ..................... Amended .......... 793 ................. HB 2188 ................... 1

27-37-301 ..................... Repealed .......... 448 ................. HB 1483 ................. 35

27-38-201 ..................... Repealed .......... 448 ................. HB 1483 ................. 36

27-38-202 ..................... Repealed .......... 448 ................. HB 1483 ................. 36

27-38-203 ..................... Repealed .......... 448 ................. HB 1483 ................. 36

27-38-204 ..................... Repealed .......... 448 ................. HB 1483 ................. 36

27-49-109 ..................... Amended .......... 793 ................. HB 2188 ................... 2

27-49-111 ..................... Amended .......... 956 ................. HB 2185 ................... 2

27-49-113 ..................... New ................ 816 ................. SB 349 ..................... 3

27-49-114 ..................... New ................ 448 ................. HB 1483 ................. 37

27-49-201 ..................... Repealed .......... 448 ................. HB 1483 ................. 38

27-49-202 ..................... Repealed .......... 448 ................. HB 1483 ................. 38

27-49-203 ..................... Repealed .......... 448 ................. HB 1483 ................. 38

27-49-204 ..................... Repealed .......... 448 ................. HB 1483 ................. 38

27-49-205 ..................... Repealed .......... 448 ................. HB 1483 ................. 38

27-49-206 ..................... Repealed .......... 448 ................. HB 1483 ................. 38

27-49-207 ..................... Repealed .......... 448 ................. HB 1483 ................. 38

27-49-208 ..................... Repealed .......... 448 ................. HB 1483 ................. 38

27-49-209 ..................... Repealed .......... 448 ................. HB 1483 ................. 38

27-49-210 ..................... Repealed .......... 448 ................. HB 1483 ................. 38

27-49-211 ..................... Repealed .......... 448 ................. HB 1483 ................. 38

27-49-212 ..................... Repealed .......... 448 ................. HB 1483 ................. 38

27-49-213 ..................... Repealed .......... 448 ................. HB 1483 ................. 38

27-49-214 ..................... Repealed .......... 448 ................. HB 1483 ................. 38

27-49-215 ..................... Repealed .......... 448 ................. HB 1483 ................. 38

27-49-216 ..................... Repealed .......... 448 ................. HB 1483 ................. 38

27-49-217 ..................... Repealed .......... 448 ................. HB 1483 ................. 38

xix TABLE OF SECTIONS AFFECTED

Section

Affected Effect Act No. Bill Section

27-49-218 ..................... Repealed .......... 448 ................. HB 1483 ................. 38

27-49-219 ..................... Repealed .......... 448 ................. HB 1483 ................. 38

27-50-201 ..................... Amended .......... 707 ................. SB 589 .................. 339

27-50-202 ..................... Amended .......... 707 ................. SB 589 .................. 340

27-50-203 ..................... Amended .......... 446 ................. HB 1642 ................... 1

27-50-203 ..................... Amended .......... 707 ................. SB 589 .................. 341

27-50-204 ..................... Amended .......... 448 ................. HB 1483 ................. 40

27-50-204 ..................... Amended .......... 707 ................. SB 589 .................. 342

27-50-205 ..................... Amended .......... 446 ................. HB 1642 ................... 2

27-50-205 ..................... Amended .......... 448 ................. HB 1483 ................. 41

27-50-205 ..................... Amended .......... 707 ................. SB 589 .................. 343

27-50-306 ..................... Amended .......... 714 ................. SB 702 ..................... 6

27-50-307 ..................... Amended .......... 448 ................. HB 1483 ................. 42

27-50-408 ..................... Amended .......... 707 ................. SB 589 .................. 344

27-50-906 ..................... Amended .......... 466 ................. SB 360 ..................... 1

27-50-1202 .................... Amended .......... 953 ................. HB 1999 ................... 1

27-50-1202 .................... Amended .......... 953 ................. HB 1999 ................... 2

27-50-1203 .................... Amended .......... 953 ................. HB 1999 ................... 3

27-50-1203 .................... Amended .......... 953 ................. HB 1999 ................... 4

27-50-1203 .................... Amended .......... 953 ................. HB 1999 ................... 5

27-50-1212 .................... Amended .......... 707 ................. SB 589 .................. 345

27-50-1221 .................... New ................ 953 ................. HB 1999 ................... 6

27-51-201 ..................... Amended .......... 1097 ............... HB 2057 ................... 1

27-51-202 ..................... Amended .......... 793 ................. HB 2188 ................... 3

27-51-203 ..................... Repealed .......... 1097 ............... HB 2057 ................... 2

27-51-204 ..................... Amended .......... 707 ................. SB 589 .................. 346

27-51-204 ..................... Amended .......... 1097 ............... HB 2057 ................... 3

27-51-207 ..................... Amended .......... 707 ................. SB 589 .................. 347

27-51-210 ..................... Amended .......... 707 ................. SB 589 .................. 348

27-51-213 ..................... Amended .......... 707 ................. SB 589 .................. 349

27-51-217 ..................... New ................ 714 ................. SB 702 ..................... 7

27-51-301 ..................... Amended .......... 707 ................. SB 589 .................. 350

27-51-305 ..................... Amended .......... 797 ................. HB 1754 ................... 1

27-51-310 ..................... Amended .......... 707 ................. SB 589 .................. 351

27-51-905 ..................... New ................ 448 ................. HB 1483 ................. 39

27-51-906 ..................... New ................ 793 ................. HB 2188 ................... 4

27-51-1001 .................... Amended .......... 398 ................. HB 1144 ................... 2

27-51-1303 .................... Amended .......... 707 ................. SB 589 .................. 352

27-51-1408 .................... New ................ 797 ................. HB 1754 ................... 2

27-51-1409 .................... New ................ 816 ................. SB 349 ..................... 4

27-51-1501 .................... Amended .......... 706 ................. SB 374 ..................... 1

27-51-1503 .................... Amended .......... 706 ................. SB 374 ..................... 2

27-51-1504 .................... Amended .......... 706 ................. SB 374 ..................... 3

27-51-1506 .................... Amended .......... 706 ................. SB 374 ..................... 4

27-51-1602 .................... Amended .......... 707 ................. SB 589 .................. 353

27-51-1607 .................... Amended .......... 706 ................. SB 374 ..................... 5

27-51-1701 .................... New ................ 956 ................. HB 2185 ................... 3

27-51-1702 .................... New ................ 956 ................. HB 2185 ................... 3

27-51-1703 .................... New ................ 956 ................. HB 2185 ................... 3

27-51-1704 .................... New ................ 956 ................. HB 2185 ................... 3

27-51-1705 .................... New ................ 956 ................. HB 2185 ................... 3

27-51-1706 .................... New ................ 956 ................. HB 2185 ................... 3

27-52-103 ..................... Amended .......... 816 ................. SB 349 ..................... 5

27-52-110 ..................... Amended .......... 707 ................. SB 589 .................. 354

xxTABLE OF SECTIONS AFFECTED

Section

Affected Effect Act No. Bill Section

27-52-111 ..................... Amended .......... 707 ................. SB 589 .................. 355

27-53-102 ..................... Amended .......... 615 ................. SB 363 ..................... 1

27-53-104 ..................... Amended .......... 615 ................. SB 363 ..................... 2

27-53-105 ..................... Amended .......... 615 ................. SB 363 ..................... 3

27-53-207 ..................... Amended .......... 618 ................. HB 1997 ................... 1

27-53-207 ..................... Amended .......... 707 ................. SB 589 .................. 356

27-53-211 ..................... Amended .......... 618 ................. HB 1997 ................... 2

27-53-211 ..................... Amended .......... 707 ................. SB 589 .................. 357

27-53-304 ..................... Amended .......... 707 ................. SB 589 .................. 358

27-64-101 ..................... Amended .......... 707 ................. SB 589 .................. 359

27-64-103 ..................... Amended .......... 707 ................. SB 589 .................. 360

27-65-102 ..................... Amended .......... 707 ................. SB 589 .................. 361

27-65-103 ..................... Amended .......... 707 ................. SB 589 .................. 362

27-65-107 ..................... Amended .......... 707 ................. SB 589 .................. 363

27-65-122 ..................... Amended .......... 707 ................. SB 589 .................. 364

27-65-123 ..................... Amended .......... 707 ................. SB 589 .................. 365

27-65-129 ..................... Amended .......... 707 ................. SB 589 .................. 366

27-65-130 ..................... Amended .......... 707 ................. SB 589 .................. 367

27-65-134 ..................... Amended .......... 707 ................. SB 589 .................. 368

27-65-135 ..................... Amended .......... 707 ................. SB 589 .................. 369

27-65-136 ..................... Amended .......... 707 ................. SB 589 .................. 370

27-65-137 ..................... Amended .......... 707 ................. SB 589 .................. 371

27-65-138 ..................... Amended .......... 707 ................. SB 589 .................. 372

27-65-139 ..................... Amended .......... 707 ................. SB 589 .................. 373

27-65-140 ..................... Amended .......... 450 ................. HB 1641 ................... 1

27-65-140 ..................... Amended .......... 707 ................. SB 589 .................. 374

27-65-141 ..................... Amended .......... 707 ................. SB 589 .................. 375

27-65-142 ..................... Amended .......... 707 ................. SB 589 .................. 376

27-65-143 ..................... Amended .......... 707 ................. SB 589 .................. 377

27-65-144 ..................... Amended .......... 707 ................. SB 589 .................. 378

27-65-145 ..................... New ................ 705 ................. SB 605 ..................... 3

27-66-102 ..................... Amended .......... 707 ................. SB 589 .................. 379

27-66-501 ..................... Amended .......... 707 ................. SB 589 .................. 380

27-66-501 ..................... Amended .......... 707 ................. SB 589 .................. 381

27-66-601 ..................... Amended .......... 707 ................. SB 589 .................. 382

27-67-202 ..................... Amended .......... 707 ................. SB 589 .................. 383

27-67-203 ..................... Amended .......... 707 ................. SB 589 .................. 384

27-67-204 ..................... Amended .......... 707 ................. SB 589 .................. 385

27-67-204 ..................... Amended .......... 956 ................. HB 2185 ................... 4

27-67-210 ..................... Amended .......... 707 ................. SB 589 .................. 386

27-67-211 ..................... Amended .......... 789 ................. HB 1302 ................... 1

27-67-213 ..................... Amended .......... 707 ................. SB 589 .................. 387

27-67-215 ..................... Amended .......... 707 ................. SB 589 .................. 388

27-67-216 ..................... Amended .......... 707 ................. SB 589 .................. 389

27-67-217 ..................... Amended .......... 707 ................. SB 589 .................. 390

27-67-219 ..................... Amended .......... 707 ................. SB 589 .................. 391

27-67-220 ..................... Amended .......... 707 ................. SB 589 .................. 392

27-67-221 ..................... Amended .......... 707 ................. SB 589 .................. 393

27-67-222 ..................... Amended .......... 707 ................. SB 589 .................. 394

27-67-223 ..................... Amended .......... 707 ................. SB 589 .................. 395

27-67-224 ..................... Amended .......... 707 ................. SB 589 .................. 396

27-67-225 ..................... Amended .......... 707 ................. SB 589 .................. 397

27-67-226 ..................... New ................ 451 ................. HB 1054 ................... 2

27-67-227 ..................... New ................ 810 ................. HB 2179 ................... 1

xxi TABLE OF SECTIONS AFFECTED

Section

Affected Effect Act No. Bill Section

27-67-228 ..................... New ................ 1070 ............... SB 632 ..................... 2

27-67-303 ..................... Amended .......... 707 ................. SB 589 .................. 398

27-67-306 ..................... Amended .......... 964 ................. HB 2093 ................... 1

27-67-311 ..................... Amended .......... 707 ................. SB 589 .................. 399

27-67-316 ..................... Amended .......... 707 ................. SB 589 .................. 400

27-67-318 ..................... Amended .......... 707 ................. SB 589 .................. 401

27-67-321 ..................... Amended .......... 707 ................. SB 589 .................. 402

27-67-321 ..................... Amended .......... 1036 ............... HB 2182 ................... 1

27-67-322 ..................... Amended .......... 1036 ............... HB 2182 ................... 2

27-67-322 ..................... Amended .......... 1036 ............... HB 2182 ................... 3

27-67-323 ..................... Repealed .......... 1036 ............... HB 2182 ................... 4

27-85-101 ..................... Amended .......... 707 ................. SB 589 .................. 430

xxiiTABLE OF SECTIONS AFFECTED

Arkansas Motor Vehicle and Traffic Laws

and State Highway Commission Regulations

TITLE 5

CRIMINAL OFFENSES

SUBTITLE 1. GENERAL

PROVISIONS

CHAPTER 4

DISPOSITION OF OFFENDERS

SUBCHAPTER 2 — FINES, COSTS, AND

RESTITUTION

5-4-203. [Repealed.]

Publisher’s Notes. This section, concerning consequences of