Presale:

GM Financial Automobile Leasing Trust 2021-2

May 13, 2021

Preliminary Ratings

Class Preliminary rating Type Interest rate(i)

Preliminary amount

(mil. $)

Expected legal final

maturity date

A-1 A-1+ (sf) Senior Fixed 210.00 May 20, 2022

A-2 AAA (sf) Senior Fixed 390.00 July 20, 2023

A-3 AAA (sf) Senior Fixed 390.00 May 20, 2024

A-4 AAA (sf) Senior Fixed 111.43 May 20, 2025

B AA+ (sf) Subordinate Fixed 59.44 May 20, 2025

C AA- (sf) Subordinate Fixed 55.34 May 20, 2025

D A+ (sf) Subordinate Fixed 34.17 Sept. 22, 2025

Note: This presale report is based on information as of May 13, 2021. The ratings shown are preliminary. Subsequent information may result in

the assignment of final ratings that differ from the preliminary ratings. Accordingly, the preliminary ratings should not be construed as

evidence of final ratings. This report does not constitute a recommendation to buy, hold, or sell securities. (i)The actual coupons of these

tranches will be determined on the pricing date.

Profile

Expected closing date May 26, 2021.

Collateral Auto lease receivables.

Sponsor, servicer, and administrator AmeriCredit Financial Services Inc., doing business as GM Financial, a wholly owned

subsidiary of General Motors Financial Co. Inc. (BBB/Negative/--).

Issuer GM Financial Automobile Leasing Trust 2021-2.

Titling trust ACAR Leasing Ltd.

Depositor GMF Leasing LLC.

Indenture trustee, administrative

agent, and collateral agent

Wells Fargo Bank N.A. (A+/Stable/A-1).

Owner trustee Wilmington Trust Co.

Lead underwriter SG Americas Securities LLC.

Presale:

GM Financial Automobile Leasing Trust 2021-2

May 13, 2021

PRIMARY CREDIT ANALYST

Linda Yeh

New York

+ 1 (212) 438 2520

linda.yeh

@spglobal.com

SECONDARY CONTACT

Jennie P Lam

New York

+ 1 (212) 438 2524

jennie.lam

@spglobal.com

www.standardandpoors.com May 13, 2021 1

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer

on the last page.

2646535

Credit Enhancement Summary(i)

GMALT

2021-2 2021-1(ii) 2020-3

Rating

Class A A-1+ (sf)/AAA (sf) -- A-1+ (sf)/AAA (sf)

Class B AA+ (sf) -- AA+ (sf)

Class C AA- (sf) -- AA- (sf)

Class D A+ (sf) -- A+ (sf)

Subordination (%)

Class A 10.90 10.90 10.90

Class B 6.55 6.55 6.55

Class C 2.50 2.50 2.50

Class D N/A N/A N/A

Overcollateralization (%)

Initial 8.50 8.50 8.50

Target(iii) 10.00 10.00 11.00

Reserve account (%)

Initial 0.50 0.50 0.75

Target 0.50 0.50 0.75

Total initial hard credit enhancement (%)

Class A 19.90 19.90 20.15

Class B 15.55 15.55 15.80

Class C 11.50 11.50 11.75

Class D 9.00 9.00 9.25

Total target hard credit enhancement (%)(iv)

Class A 21.40 21.40 22.65

Class B 17.05 17.05 18.30

Class C 13.00 13.00 14.25

Class D 10.50 10.50 11.75

Discount rate (%) 6.50 6.50 6.75

Estimated excess spread per year (%)(v) 4.88 -- 4.88

Initial aggregate securitization value ($) 1,366,536,472 1,639,803,596 1,748,871,718

Total securities issued ($) 1,250,380,000 1,500,420,000 1,600,220,000

(i)All percentages are based on the initial aggregate securitization value. (ii)Not rated by S&P Global Ratings. (iii)For series 2020-3, the target

overcollateralization of 11.00% of the initial receivables will decrease to 10.00% after the class A-2-B notes are fully paid off. (iv)For series

2020-3, the total target credit enhancement will step down by 100 basis points in each rating category after the class A-2-B notes are fully paid

off. (v)The estimated annual excess spread reflects pre-pricing coupon guidance for series 2021-2 and 2020-3. GMALT--GM Financial

Automobile Leasing Trust. N/A--Not applicable.

www.standardandpoors.com May 13, 2021 2

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer

on the last page.

2646535

Presale: GM Financial Automobile Leasing Trust 2021-2

Rationale

The preliminary ratings assigned to GM Financial Automobile Leasing Trust 2021-2's (GMALT

2021-2's; the issuer's) asset-backed notes series 2021-2 reflect:

- The availability of approximately 28.2%, 23.8%, 19.6%, and 16.9% credit support for the class

A, B, C, and D notes, respectively, in the form of 10.90%, 6.55%, and 2.50% subordination for

the class A, B, and C notes, respectively; 8.50% initial overcollateralization, growing to a target

of 10.00%; the nonamortizing 0.50% reserve account; and excess spread (all percentages are

expressed as a percentage of the initial securitization value).

- Our expectation that under a moderate 'BBB' stress scenario, all else being equal, our

preliminary ratings on the class A notes would not be lowered and the ratings on the class B, C,

and D notes would remain within one rating category of the assigned preliminary ratings. These

rating movements are consistent with the credit stability limits specified by section A.4 of the

Appendix contained in S&P Global Ratings Definitions (see "S&P Global Ratings Definitions,"

published Jan. 5, 2021).

- The transaction's credit enhancement in the form of subordination, a nonamortizing reserve

account, nonamortizing overcollateralization that builds to target level as a percentage of the

initial aggregate securitization value, and excess spread (see the Credit Enhancement

Summary table above).

- The timely interest and full principal payments by the notes' legal final maturity dates made

under cash flow scenarios that we stressed for credit and residual losses, which are consistent

with the preliminary ratings assigned to the notes.

- The credit quality of the underlying collateral, which consists of auto lease receivables that

have a weighted average FICO score of 776.

- Our view of the transaction's base residual which includes Automotive Lease Guide's (ALG)

forecast of each vehicle's residual value at lease inception and of current residuals.

- The sufficiency of historical residual retention values of the leased vehicles in the pool and

relative comparison to ALG's residual value forecasts.

- The diversified mix of leased vehicle models in the pool.

- The diversified timing of the lease pool's residual maturities.

- Our view of the transaction's payment and legal structures.

S&P Global Ratings believes there remains high, albeit moderating, uncertainty about the

evolution of the coronavirus pandemic and its economic effects. Vaccine production is ramping up

and rollouts are gathering pace around the world. Widespread immunization, which will help pave

the way for a return to more normal levels of social and economic activity, looks to be achievable

by most developed economies by the end of the third quarter. However, some emerging markets

may only be able to achieve widespread immunization by year-end or later. We use these

assumptions about vaccine timing in assessing the economic and credit implications associated

with the pandemic (see our research here: www.spglobal.com/ratings). As the situation evolves,

we will update our assumptions and estimates accordingly.

www.standardandpoors.com May 13, 2021 3

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer

on the last page.

2646535

Presale: GM Financial Automobile Leasing Trust 2021-2

Transaction Overview

GMALT 2021-2 is GM Financial's second publicly placed auto lease term securitization this year

and its 22nd overall auto lease term transaction. It is also the 16th auto lease transaction from GM

Financial that we have rated.

The receivables backing the GMALT 2021-2 pool will consist of the monthly lease payments and

base residual values (as defined in the Residual Value section) of a pool of lease contracts

originated by GM dealers. The leased vehicles will consist primarily of new GM-brand passenger

cars, sport utility vehicles (SUVs), crossover utility vehicles (CUVs), and light-duty trucks. As with

prior GMALT securitizations, series 2021-2 includes nonamortizing subordination for the senior

notes, a nonamortizing reserve account amount, and an initial overcollateralization with a

nonamortizing target level.

The issuing trust will issue four class A notes, as well as class B, C, and D notes. All classes of

notes will pay a fixed rate of interest.

Changes From The Series 2021-1 and 2020-3 Transactions

There were no material changes in credit enhancement from GMALT 2021-1, which we did not

rate.

Credit enhancement changes from GMALT 2020-3, which is the last GMALT transaction we rated,

include:

- The nonamortizing reserve account amount decreased to 0.50% of the initial aggregate

securitization value from 0.75%. However, the reserve account amount is consistent with series

2020-1 and prior GMALT transactions.

- The discount rate decreased to 6.50% from 6.75%.

Notable changes in the collateral composition and structure from series 2021-1, which we did not

rate, include the following:

- The weighted average seasoning decreased to 11.8 months from 13.0.

- The percentage of cars decreased to 5.7% from 6.2%.

- The percentage of leases with an original term of 36 months or less is 53.1%, an increase from

51.2%.

- The percentage of leases with an original term between 37-48 months is 46.9%, a decrease

from 48.8%.

Notable changes in the collateral composition and structure from series 2020-3 include the

following:

- The weighted average seasoning decreased to 11.8 months from 12.7 months.

- The percentage of cars decreased to 5.7% from 6.1%.

- The percentage of leases with an original term of 36 months or less was 53.1%, a decrease from

55.7%.

- The percentage of leases with an original term between 37-48 months was 46.9%, an increase

from 44.3%.

www.standardandpoors.com May 13, 2021 4

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer

on the last page.

2646535

Presale: GM Financial Automobile Leasing Trust 2021-2

Overall, we believe the series 2021-2 pool's credit quality is generally comparable to the series

2021-1 and 2020-3 pools. We lowered our expected cumulative net credit loss to 0.70% from

0.80% for 2020-3, reflecting, in our view, the strong credit performance of prior GMALT

transactions and the strong credit characteristics of series 2021-2 similar to prior GMALT

transactions.

Our 'AAA', 'AA+', 'AA-', and 'A+' stressed credit losses are approximately 3.5%, 3.2%, 2.6%, and

2.3%, respectively, of the securitization value.

Our 'AAA', 'AA+', 'AA-', and 'A+' residual haircuts for the GMALT 2020-3 pool are approximately

28.1%, 24.8%, 20.4%, and 19.1%, respectively, of the pool's aggregate undiscounted base

residual value. In deriving our residual stress, we considered the base residual value of the leased

vehicles in the pool compared to its historical retention values. We also considered the pool's

residual maturity profile, the vehicle concentration, the vehicle segment concentration, the

consistency of ALG's residual forecasts regarding the historical retention values of General Motors

Co. (GM) vehicles (Chevrolet, GMC, Cadillac, and Buick), and our economic and industry outlooks.

Our total stressed losses (credit and residual) are approximately 22.8%, 19.9%, 15.9%, and 14.6%

for the 'AAA', 'AA+', 'AA-', and 'A+' rated notes, respectively, as a percentage of the initial

aggregate securitization value. In our view, the credit enhancement outlined above and in the Cash

Flow Modeling section provides adequate support for our assigned preliminary ratings.

Legal Structure

GM Financial makes loans to ACAR Leasing Ltd. (the titling trust), which allows the titling trust to

purchase leases and leased vehicles from GM dealers. The leased vehicles are titled in the titling

trust's name.

On the series 2021-2 transaction's closing date, the titling trust will issue an exchange note (the

series 2021-2 exchange note) to GM Financial that is secured by the series 2021-2 designated

pool of leases and the related leased vehicles. GM Financial will sell the exchange note to GMF

Leasing LLC, the depositor, in a true sale. The depositor will then transfer and assign the exchange

note to GMALT 2021-2, a newly formed Delaware statutory trust and the issuing entity, in

exchange for the asset-backed notes, which will represent the issuing entity's obligations (see

chart 1). The issuing entity will pledge and assign the exchange note to the indenture trustee,

which will hold a first-priority, perfected security interest in the exchange note for the series

2021-2 noteholders' benefit. GM Financial is the servicer for the leases and the related leased

vehicles held by the titling trust and will continue to service them under GMALT 2021-2.

www.standardandpoors.com May 13, 2021 5

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer

on the last page.

2646535

Presale: GM Financial Automobile Leasing Trust 2021-2

Chart 1

In rating this transaction, S&P Global Ratings will review the legal matters that it believes are

relevant to its analysis, as outlined in its criteria.

Pension Benefit Guaranty Corp. (PBGC) Risk

GM Financial uses a collateral agent, Wells Fargo Bank N.A., to hold a security interest in all newly

originated leases and leased vehicles for GM Financial's and the exchange noteholders' benefit.

The security interest in the leases is perfected by filings under the Uniform Commercial Code, and

the security interest in the leased vehicles is perfected by a notation on each vehicle's certificate

of title under state motor vehicle registration laws.

S&P Global Ratings expects to receive an opinion of counsel to the issuer, subject to customary

assumptions and qualifications, to the effect that the collateral agent's security interest in the

leases and leased vehicles would be before a lien in favor of PBGC and the notice of which will be

filed after the series 2021-2 notes are issued. A PBGC lien could be imposed against the assets of

any member of the GM-controlled group in the event of unpaid minimum contributions to a

www.standardandpoors.com May 13, 2021 6

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer

on the last page.

2646535

Presale: GM Financial Automobile Leasing Trust 2021-2

defined benefit pension plan required by law or if an underfunded defined benefit pension plan

terminates.

Payment Structure

On each payment date, the servicer is entitled to receive its fee of 1.00% per annum for its

performance during the previous collection period. In addition, on each payment date before the

notes have been accelerated following an event of default, the indenture trustee will make

distributions from available funds according to the payment priority shown in table 1. Principal on

the notes will be paid sequentially.

Table 1

Payment Waterfall (Before Acceleration Following An Event Of Default)

Priority Payment

1 To any successor servicer, unpaid transition fees up to $200,000; to the indenture and owner

trustees, fees, expenses, and indemnities up to $100,000 and $100,000, respectively, per year; and

to the asset representations reviewer, up to $200,000 per year.

2 Interest on the class A notes, pari passu.

3 Principal on the class A notes, sequentially, until the class A note balance reaches parity with the

aggregate securitization value as of the end of the previous collection period.

4 The remaining principal balance of any class A notes on their respective final scheduled

distribution date.

5 Interest on the class B notes.

6 Principal on the class A and B notes until their combined note balance reaches parity with the

aggregate securitization value as of the end of the previous collection period.

7 The remaining principal balance of the class B notes on their final scheduled distribution date.

8 Interest on the class C notes.

9 Principal on the class A, B, and C notes until their combined note balance reaches parity with the

aggregate securitization value as of the end of the previous collection period.

10 The remaining principal balance of the class C notes on their final scheduled distribution date.

11 Interest on the class D notes.

12 Principal on the class A, B, C, and D notes until their combined note balance reaches parity with the

aggregate securitization value as of the end of the previous collection period.

13 The remaining principal balance of the class D notes on their final scheduled distribution date.

14 The noteholders' principal distributable amount (the paydown of the pool over the current

collection period), paid sequentially.

15 The reserve account, up to its required level.

16 Pay principal to achieve the target overcollateralization.

17 Any unpaid fees and expenses due to the successor servicer, indenture and owner trustees, and

asset representations reviewer.

18 All remaining amounts to the certificateholder.

On each payment date after a monetary event of default occurs, after the acceleration of the notes

following an event of default, or after the liquidation of the trust estate, the indenture trustee will

distribute the available funds according to the payment priority shown in table 2.

www.standardandpoors.com May 13, 2021 7

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer

on the last page.

2646535

Presale: GM Financial Automobile Leasing Trust 2021-2

Table 2

Payment Waterfall (After Acceleration Following An Event Of Default)

Priority Payment

1 Any amounts due and owing to any successor servicer, the indenture and owner trustees, and

the asset representations reviewer, without regard to any caps.

2 To the class A noteholders, the note interest amounts, pro rata.

3 To the class A-1 noteholders, the outstanding principal amount of the class A-1 notes until paid

in full and then, pro rata to the class A-2, A-3, and A-4 noteholders, the outstanding principal

amount of each class until paid in full.

4 To the class B noteholders, the note interest amounts.

5 To the class B noteholders, the outstanding principal amount of the class B notes until paid in

full.

6 To the class C noteholders, the note interest amounts.

7 To the class C noteholders, the outstanding principal amount of the class C notes until paid in

full.

8 To the class D noteholders, the note interest amounts.

9 To the class D noteholders, the outstanding principal amount of the class D notes until paid in

full.

10 To the noteholders, any other amount due and owing under the program documents and not

previously distributed.

11 All remaining amounts to the certificateholder.

Managed Portfolio

As of March 31, 2021, GM Financial's total U.S. portfolio of retail lease contracts consisted of

1,320,394 contracts totaling approximately $40.3 billion, an approximately 5% decline from a year

earlier (see table 3). Since 2012, GM Financial's lease portfolio has experienced strong growth,

more than doubling each year between 2012 and 2015, with steady growth continuing through

2018. Since 2018, GM Financial's auto lease portfolio has slowly declined year-over-year. Total

30-plus-day delinquencies and repossessions decreased to 0.42% and 0.23%, for the three

months ended March 31, 2021, from 0.86% and 0.26%, respectively, a year earlier. Net losses as a

percentage of average value of leases outstanding also decreased, to 0.04% from 0.08%.

Since 2015, GM Financial has realized greater residual retention on returned vehicles over ALG's

estimate as shown by the gains experienced each year.

Table 3

Total Managed Portfolio

Three months ended

March 31 Year ended Dec. 31

2021 2020 2020 2019 2018 2017 2016 2015

Lease contracts

outstanding (mil. $)

40,344.43 42,621.01 40,240.80 43,106.15 44,995.57 38,016.40 35,658.15 20,367.58

Avg. dollar amount of

leases outstanding

(mil. $)

40,371.56 42,901.78 41,262.96 44,100.38 45,091.84 39,672.89 29,232.37 13,050.07

www.standardandpoors.com May 13, 2021 8

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer

on the last page.

2646535

Presale: GM Financial Automobile Leasing Trust 2021-2

Table 3

Total Managed Portfolio (cont.)

Three months ended

March 31 Year ended Dec. 31

2021 2020 2020 2019 2018 2017 2016 2015

No. of contracts

outstanding

1,320,394 1,450,295 1,332,475 1,473,651 1,573,913 1,346,532 1,212,137 692,596

30-plus-day

delinquencies (%)(i)

0.42 0.86 0.67 1.03 1.30 1.44 1.25 1.28

Repossessions (%)(i) 0.23 0.26 0.98 1.25 1.59 1.80 1.03 0.60

Net losses (%)(ii) 0.04 0.08 0.23 0.33 0.27 0.28 0.23 0.17

Vehicles returned to

GMF (%)(iii)

62.01 74.71 65.99 74.65 76.51 93.38 68.83 69.00

Total loss/(gain) on

ALG residuals on

vehicles returned to

GMF (%)(iv)

(20.27) (7.49) (12.52) (7.61) (13.02) (7.96) (6.29) (8.96)

(i)As a percentage of the number of contracts outstanding. (ii)As a percentage of the average value of leases outstanding, annualized. (iii)As a

percentage of the number of contracts scheduled to terminate. (iv)As a percentage of ALG's residual value of returned vehicles sold by GMF.

GMF--GM Financial Co. Inc. ALG--Automotive Lease Guide.

Securitization Performance

GM Financial's paid-off series 2014-1 through 2018-1 experienced cumulative net credit losses in

the range of 0.05%-0.34%, while the most recently paid-off series 2018-2 and 2018-3 experienced

cumulative net credit gains of 0.08% and 0.10%, respectively (see chart 2). All the paid-off series

have experienced cumulative residual gains in the range of 3.44%-8.28% on vehicles returned and

sold as a percentage of the initial base residual (see chart 3).

www.standardandpoors.com May 13, 2021 9

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer

on the last page.

2646535

Presale: GM Financial Automobile Leasing Trust 2021-2

Chart 2

Chart 3

Series 2019-1 to 2020-3, which have seven to 26 months of performance data, are currently

experiencing credit gains and realizing residual gains as returned vehicles continue to maintain

higher values than the initial forecasts (see charts 4 and 5). The cumulative residual gains are as a

www.standardandpoors.com May 13, 2021 10

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer

on the last page.

2646535

Presale: GM Financial Automobile Leasing Trust 2021-2

percentage of the transactions' initial base residual value.

S&P Global Ratings did not rate series 2014-1, 2014-2, 2015-1, 2016-3, 2017-3, and 2021-1.

Chart 4

Chart 5

www.standardandpoors.com May 13, 2021 11

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer

on the last page.

2646535

Presale: GM Financial Automobile Leasing Trust 2021-2

On Nov. 9, 2020, we lowered our credit loss expectation for series 2019-1, 2019-2, and 2019-3 due

to the strong credit loss experience observed and either raised or affirmed our outstanding ratings

(see table 4 and "Six Ratings Raised, 11 Affirmed On Three GM Financial Automobile Leasing Trust

Series," published Nov. 9, 2020).

Table 4

Collateral Performance (%)

As of the April 2021

distribution date

Series Month

Pool

factor

Current CNL

loss/(gain)(i)

Original

lifetime CNL

exp.

Revised

lifetime CNL

exp.(ii)

Current cumulative

residual loss/(gain)(iii)

2019-1 26 25.27 (0.13) 0.80 0.30 (7.55)

2019-2 24 33.75 (0.11) 0.80 0.40 (6.07)

2019-3 20 45.80 (0.17) 0.80 0.50 (4.58)

2020-1 14 65.33 (0.11) 0.80 -- (2.67)

2020-2 10 82.98 (0.04) 0.80 -- (0.62)

2020-3 7 87.03 (0.04) 0.80 -- (0.49)

(i)Percentage of the initial aggregate securitization value. (ii)As of November 2020. (iii)Percentage of the initial aggregate base residual value.

CNL--Cumulative net loss.

Collateral Analysis

The GMALT 2021-2 pool consists of 50,797 auto lease receivables with an aggregate securitization

value of $1,366,536,472. The weighted average FICO score is 776, and the weighted average

seasoning is 11.8 months (see table 5). The leased pool consists of 100% new vehicles and is well

diversified in vehicle model mix, with the top five vehicle models accounting for approximately

46% of the securitization value, or 48% of the undiscounted base residual. Passenger cars

account for approximately 6% of the pool, and SUVs and CUVs make up approximately 71%.

Leases with an original term of 25-36 months is approximately 49% of the securitization value.

Leases with an original term of 37-48 months is approximately 47% of the securitization value.

However, most of those leases (83%) have an original term of 37-42 months.

According to GM Financial, the GMALT 2021-2 lease pool does not include any leases that were

deferred as of the cutoff date, including those deferred in connection with the COVID-19

pandemic.

Table 5

Original Pool Characteristics

GMALT

2021-2 2021-1(i) 2020-3 2020-2 2020-1 2019-3 2019-2 2019-1

No. of leases 50,797 63,387 69,502 53,180 55,703 45,277 56,694 55,040

Aggregate

securitization

value ($)

1,366,536,472 1,639,803,596 1,748,871,718 1,373,635,168 1,366,219,095 1,093,238,377 1,366,625,322 1,332,675,534

Avg.

securitization

value ($)

26,902 25,870 25,163 25,830 24,527 24,146 24,105 24,213

www.standardandpoors.com May 13, 2021 12

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer

on the last page.

2646535

Presale: GM Financial Automobile Leasing Trust 2021-2

Table 5

Original Pool Characteristics (cont.)

GMALT

2021-2 2021-1(i) 2020-3 2020-2 2020-1 2019-3 2019-2 2019-1

Base residual

value ($)

1,007,438,849 1,208,172,876 1,302,507,950 957,427,059 1,008,368,821 810,791,750 1,009,711,895 989,423,236

Avg. base

residual

value ($)

19,833 19,060 18,741 18,004 $18,103 $17,907 17,810 17,976

Base residual

value as a %

of the

aggregate

securitization

value

73.7 73.7 74.5 69.7 73.8 74.2 73.9 74.2

Base residual

value as a %

of MSRP

48.0 46.7 46.4 44.6 45.5 45.7 45.4 45.4

New vehicles

(%)

100 100 100 100 100 100 100 100

Vehicle types (%)

Car 5.7 6.2 6.1 5.6 7.9 10.7 12.3 13.7

CUV 59.9 62.4 63.1 61.2 59.2 58.1 53.6 52.5

SUV 11.5 9.8 9.0 10.8 11.3 11.4 12.7 12.7

Truck 22.9 21.6 21.8 22.5 21.6 19.8 21.4 21.1

Brand (%)

Chevrolet 54.5 53.8 54.7 51.4 56.3 56.3 56.9 54.3

GMC 18.8 19.2 19.8 19.1 19.2 19.2 19.9 19.9

Cadillac 18.4 17.5 16.4 19.7 15.7 15.4 14.3 16.1

Buick 8.3 9.5 9.0 9.8 8.9 9.1 8.9 9.7

Top five by vehicle series (% of base residual)

Silverado=

15.2

Equinox=14.9 Equinox=16.2 Equinox=19.1 Equinox=18.2 Equinox=19.0 Equinox=17.1 Equinox=15.2

Equinox=13.5 Silverado=14.0 Silverado=

13.7

Silverado=14.3 Silverado=13.7 Silverado=12.4 Silverado=13.5 Silverado=14.1

Traverse=7.0 Traverse=6.9 Traverse=8.0 XTS=6.7 Traverse=8.1 Traverse=7.9 Traverse=7.5 Traverse=7.1

Blazer=6.5 XT5=5.9 XT5=6.0 Terrain=6.5 XT5=6.5 Terrain=6.6 Terrain=6.6 XT5=6.7

Sierra=5.8 Sierra=5.6 Terrain=5.7 Traverse=5.7 Terrain=5.9 XT5=6.4 XT5=5.7 Terrain=6.2

Total 48.0 47.3 49.6 52.2 52.5 52.2 50.4 49.3

Weighted avg.

original term

(mos.)

37.5 38 37.3 38.0 37 37 37 37

Weighted avg.

remaining

term (mos.)

25.7 25 24.6 27.5 24 24 24 24

www.standardandpoors.com May 13, 2021 13

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer

on the last page.

2646535

Presale: GM Financial Automobile Leasing Trust 2021-2

Table 5

Original Pool Characteristics (cont.)

GMALT

2021-2 2021-1(i) 2020-3 2020-2 2020-1 2019-3 2019-2 2019-1

Weighted avg.

seasoning

(mos.)

11.8 13 12.7 10.5 13 13 13 13

Original lease term (%)

Less than

or equal

to 36

mos.

53.1 51.2 55.7 27.4 52.7 53.8 50.4 51.9

37-48

mos.

46.9 48.8 44.3 72.6 47.3 46.2 49.6 48.1

49-60

mos.

-- -- -- -- -- -- -- --

Weighted

avg. FICO

score

776 775 776 771 773 774 763 775

Top four state concentrations (%)

MI=24.4 MI=24.2 MI=25.1 MI=18.4 MI=23.9 MI=23.5 MI=21.8 MI=22.2

NY=14.7 NY=14.8 NY=15.0 NY=14.6 NY=14.7 NY=15.0 NY=14.8 NY=14.4

FL=8.4 OH=8.1 OH=8.4 FL=9.2 OH=8.0 OH=7.7 OH=7.7 OH=7.5

OH=7.3 FL=7.6 FL=7.0 OH=8.6 FL=7.1 FL=7.1 FL=7.4 CA=7.0

(i) Not rated by S&P Global Ratings. GMALT--GM Financial Automobile Leasing Trust.

Residual Value

The series 2021-2 pool will be secured by the series 2021-2 exchange note, which is backed by a

pool of leases (and the related leased vehicles) with a securitization value totaling $1,366,536,472.

The leases' securitization value is the sum of the present value of each lease's remaining monthly

lease payment and the related leased vehicle's base residual value (both discounted at the higher

of 6.50% and the contract annual percentage rate). Each leased vehicle's base residual value will

equal the lowest of:

- The contract residual value set by GM Financial;

- The residual value estimate established by ALG at the lease contract's inception; and

- ALG's current residual value estimate (mark-to-market).

The contract residual value is the residual value that is assigned to the vehicle at the lease's

inception (as stated in the lease contract), which, in turn, determines the monthly payments for

the individual lease. The contract residual value is typically set higher than ALG's residual value at

lease inception (a process called lease subvention) to reduce the lease payments the lessee owes

under the lease contract. The base residual value provides a more conservative estimate of the

vehicle's future value, which helps mitigate the noteholders' exposure to the losses associated

with lease subvention.

www.standardandpoors.com May 13, 2021 14

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer

on the last page.

2646535

Presale: GM Financial Automobile Leasing Trust 2021-2

ALG's current mark-to-market residual value estimates resulted in a positive drift or increase in

residual value of approximately 1.1% from its forecasted value at lease inception for the GMALT

2021-2 lease pool. We do not give any credit to the positive drift, based on the definition of the

base residual value, which takes the lower of contract, ALG at origination, and ALG

mark-to-market. GMALT 2021-2 pool's undiscounted base residual value is 73.7% of the pool's

securitization value, which is in line with series 2021-1 but slightly lower than the series 2020-3's

undiscounted base residual value of 74.5% of the securitization value at the transaction's closing.

Collateral Residual Timing

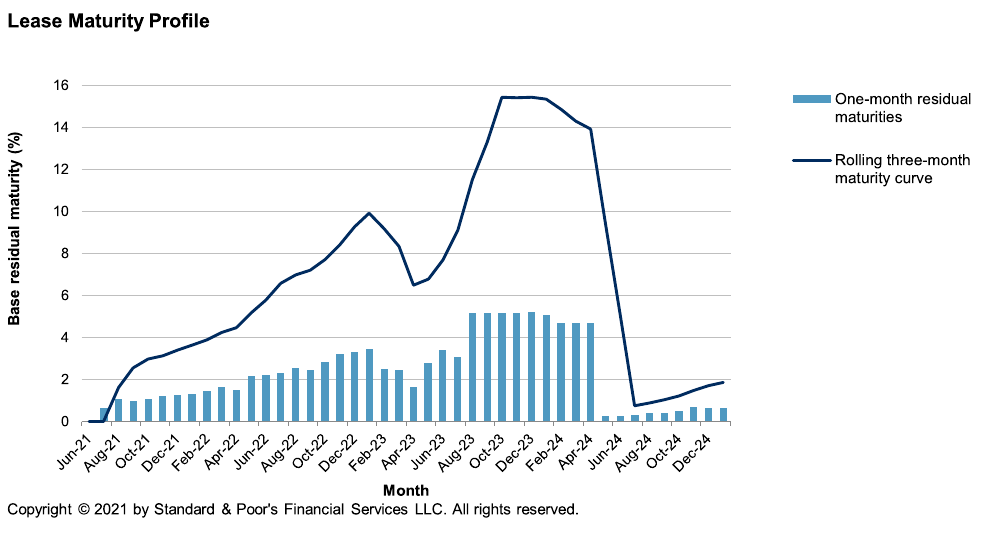

The leases in the GMALT 2021-2 pool are scheduled to mature as shown in table 6.

Table 6

GMALT 2021-2 Lease Maturity Profile By Year(i)

Year (%)

2021 5.96

2022 26.48

2023 44.77

2024 22.18

2025 0.61

(i)Percentage of the aggregate undiscounted base residual value. GMALT--GM Financial Automobile Leasing Trust.

The pool is diversified in terms of monthly residual maturities. Leases will mature each month

beginning in July 2021 (see chart 6). Residual maturities in the pool exceed 5.0% in August 2023,

September 2023, October 2023, November 2023, December 2023, and January 2024. The highest

percentage of base residual maturities in any three- and six-month period is approximately 15%

and 31% in December 2023 and January 2024, respectively. Approximately 6% of the residuals are

scheduled to mature in 2021 and 68% scheduled to mature in 2023-2025. This back-end risk is

mitigated by our residual stresses and the transaction's sequential payment structure, in which

the overcollateralization target and reserve account target amounts will not amortize until all of

the notes are paid in full.

www.standardandpoors.com May 13, 2021 15

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer

on the last page.

2646535

Presale: GM Financial Automobile Leasing Trust 2021-2

Chart 6

S&P Global Ratings' Expected Credit And Residual Losses

GMALT 2021-2 has two principal risk components: credit and residual risks.

Credit risk

The obligor's credit profile determines the credit risk. To derive the base-case credit loss for the

series 2021-2 transaction, we examined the static pool losses on GM Financial's lease portfolio

originations segmented by credit profile (prime and nonprime) and by credit profile and lease term

as well as credit loss performance of prior GMALT securitizations. We considered the GMALT

2021-2 pool's collateral credit quality, GM Financial's overall managed portfolio performance,

collateral and performance comparisons with peers, and current macroeconomic factors. Based

on this information, we expect the GMALT 2021-2 pool's cumulative net credit loss will be 0.70%

of the pool's securitization value, down from 0.80% for series 2020-3, the last GMALT transaction

we rated.

Residual risk

In our analysis of the series 2021-2 pool's base residual value, we considered the following

factors:

- The base residual value derivation and whether any adjustments are necessary;

- The historical stability of retention values of GM's vehicle models at lease return;

www.standardandpoors.com May 13, 2021 16

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer

on the last page.

2646535

Presale: GM Financial Automobile Leasing Trust 2021-2

- The consistency and accuracy of ALG's historical forecasts versus the actual historical used

vehicle values;

- Availability and sufficiency of historical vehicle model residual realization data;

- Diversification of the lease pool by residual maturities, vehicle models, and vehicle type

segmentation;

- Inclusion of any new or discontinued models; and

- Our macroeconomic outlook.

Base haircut. According to our auto lease criteria, we first applied an initial haircut to the series

2021-2 pool's base residual value commensurate with each rating scenario as shown in table 7.

Table 7

Base Residual Haircut

Scenario (preliminary rating)

AAA (sf) AA+ (sf) AA- (sf) A+ (sf)

Base haircut as a % of undiscounted base residual value. 26.0 23.0 18.8 17.7

Excess concentration haircut. In addition to the aforementioned base haircut, we applied a

haircut to the amount of nondefaulted lease residuals exceeding the concentration limits

applicable to the benchmark pool (excess concentrations) as outlined in our auto lease criteria.

The haircut applied to excess concentrations commensurate with each rating scenario is shown in

table 8.

Table 8

Additional Excess Concentration Haircut(i)

Scenario (preliminary rating)

AAA (sf) AA+ (sf) AA- (sf) A+ (sf)

Haircut applied to the excess concentration as a % of the undiscounted

base residual value.

13.0 11.5 9.5 9.0

Total excess concentration for the GMALT 2021-2 pool is approximately 16.0% (see table 9).

Excess concentrations related to monthly residual maturities are minimal, amounting to 0.8%.

Segment excess concentration related to SUVs and trucks is approximately 7.2%. There is also an

excess concentration of 8.1% as a result of the new and discontinued models exceeding the 10.0%

threshold. The pool is well diversified by vehicle model; therefore, we did not apply an additional

haircut on it.

The 16.0% total excess concentration is multiplied by the relevant haircut to arrive at the

additional haircut percentage at each rating category.

Table 9

Benchmark Pool Excess Concentrations

GMALT 2021-2

Pool

Benchmark pool

concentration limit

Excess

concentration

One-month maturity exceeding the benchmark (% of undiscounted base residual)

August 2023 5.2 5.0 0.2

www.standardandpoors.com May 13, 2021 17

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer

on the last page.

2646535

Presale: GM Financial Automobile Leasing Trust 2021-2

Table 9

Benchmark Pool Excess Concentrations (cont.)

GMALT 2021-2

Pool

Benchmark pool

concentration limit

Excess

concentration

September 2023 5.1 5.0 0.1

October 2023 5.1 5.0 0.1

November 2023 5.1 5.0 0.1

December 2023 5.2 5.0 0.2

January 2024 5.1 5.0 0.1

Individual model (top model = Silverado) (%) 15.2 20.0 0.0

Full-size and mid-size SUVs, full-size pickup

trucks, and vans (%)

37.2 30.0 7.2

Compact and hybrid cars (%) 4.1 30.0 0.0

New and discontinued models (%) 18.1 10.0 8.1

Total excess concentration (%) -- -- 16.0

GMALT--GM Financial Automobile Leasing Trust.

Speculative-grade manufacturer haircut. When determining the stress that applies to the

adjusted base residual value, we take into account the auto manufacturer's creditworthiness. Our

auto lease criteria apply haircuts to the base residual value of the vehicles produced by

manufacturers with speculative-grade issuer credit ratings (i.e., 'BB+' or lower).

GM is the manufacturer of the leased vehicles backing the GMALT 2021-2 pool. The current

long-term issuer credit rating on the company is 'BBB'. Based on the current issuer credit rating

on GM, we did not apply a speculative-grade manufacturer haircut to the series 2021-2

transaction.

Low diversification haircut. For pools with low diversification, as described in our auto lease

criteria, we will apply a low diversification haircut factor of 1.25x in addition to the aforementioned

haircuts. Our auto lease criteria describe the six conditions for which, if met by the securitized

lease pool, we would apply this type of haircut. These conditions are:

- More than 20% of the residuals mature in any one month;

- More than 50% of the residuals mature in any three months;

- The pool contains three or fewer individual models;

- The pool contains more than 75% of full-size and mid-size SUVs, full-size pickup trucks, and

full-size vans combined;

- The pool contains more than 75% of compact and hybrid cars combined; and

- The pool contains more than 20% of new and discontinued models combined.

The GMALT 2021-2 pool does not meet any of these six conditions; therefore, we did not apply the

low diversification haircut.

After analyzing the GMALT 2021-2 lease pool, applying the relevant residual value haircuts, and

assessing stressed return rates of 100.0%, 97.5%, 93.3%, and 91.7% at the 'AAA', 'AA+', 'AA-', and

www.standardandpoors.com May 13, 2021 18

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer

on the last page.

2646535

Presale: GM Financial Automobile Leasing Trust 2021-2

'A+' rating levels, respectively (representing the loss frequency on non-defaulted leased vehicles

of 93.0%, 93.7%, 94.9%, and 95.3%, respectively), our stressed residual loss under each rating

scenario is shown in table 10.

Table 10

Stressed Residual Loss

Scenario (preliminary rating)

AAA (sf) AA+ (sf) AA- (sf) A+ (sf)

Residual haircut as a % of undiscounted base residual 26.0 23.0 18.8 17.7

Additional excess concentration haircut (%)(i) 2.1 1.8 1.5 1.4

Total residual haircut as a % of base residual value 28.1 24.8 20.4 19.1

Total residual haircut as a % of securitization value 19.3 16.7 13.3 12.3

(i)The excess concentration haircuts are derived by multiplying the total excess concentration calculated in table 9 by each of the rating

category haircuts shown in table 8.

Cash Flow Modeling

We tested GMALT 2021-2's proposed structure using cash flow scenarios to determine if the

credit enhancement level was sufficient to pay timely interest and principal in full by the notes'

legal final maturity dates under our stress scenarios.

We modeled the transaction to simulate a stress scenario commensurate with the assigned

preliminary ratings. We assumed a 100.0%, 97.5%, 93.3%, and 91.7% vehicle return rate on the

nondefaulting leases at the 'AAA','AA+', 'AA-', and 'A+' rating levels, respectively, together with no

prepayments. The results show that the preliminary rated notes are enhanced to the degree

necessary to withstand a level of stressed credit and residual losses that is consistent with the

assigned preliminary ratings (see table 11).

Table 11

Cash Flow Assumptions And Results

Class

A B C D

Scenario (preliminary rating) AAA (sf) AA+ (sf) AA- (sf) A+(sf)

Cumulative net loss (%) 0.7 0.7 0.7 0.7

Cumulative net loss timing (mos.) 12/24/36 12/24/36 12/24/36 12/24/36

Cumulative net loss (%) 40/80/100 40/80/100 40/80/100 40/80/100

Voluntary prepayments (%) 0.0 0.0 0.0 0.0

Recoveries (%) 50.0 50.0 50.0 50.0

Recovery lag (mos.) 4 4 4 4

Residual haircut

Total residual haircut as a % of the undiscounted base

residual value

28.1 24.8 20.4 19.1

Total residual haircut as a % of the securitization value 19.3 16.7 13.3 12.3

Total residual haircut as a % of the MSRP 13.5 11.9 9.8 9.2

www.standardandpoors.com May 13, 2021 19

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer

on the last page.

2646535

Presale: GM Financial Automobile Leasing Trust 2021-2

Table 11

Cash Flow Assumptions And Results (cont.)

Class

A B C D

Vehicle return rate (%) 100.0 97.5 93.3 91.7

Residual realization lag (mos.) 2 2 2 2

Result

S&P Global Ratings' stressed credit and residual loss as a

% of the securitization value

22.8 19.9 15.9 14.6

Approximate credit enhancement available based on S&P

Global Ratings' credit stress and break-even residual

stress as a % of the securitization value

28.2 23.8 19.6 16.9

MSRP--Manufacturer's suggested retail price.

Sensitivity Analysis

In addition to running stressed cash flows to analyze the amount of credit and residual losses

GMALT 2021-2 can withstand, we ran a sensitivity analysis on both scenarios to determine how

credit and residual losses, which are in line with a moderate stress scenario, or a 'BBB' rating

stress, could affect our ratings on the notes (see chart 7).

Under a moderate 'BBB' stress scenario, all else being equal, we expect our preliminary ratings on

the class A notes would not be lowered and the ratings on the class B, C, and D notes would

remain within one rating category of the assigned preliminary ratings. These rating movements are

consistent with the credit stability limits specified by section A.4 of the Appendix contained in S&P

Global Ratings Definitions (see "S&P Global Ratings Definitions," published Jan. 5, 2021). This

indicates that we will not assign a preliminary 'AAA (sf)' or 'AA (sf)' rating if we believe the rating

would decline by more than one rating category in the first year during a moderate stress scenario,

and we will not assign a preliminary 'A (sf)' rating if we believe that the rating would decline by

more than two rating categories in the first year.

www.standardandpoors.com May 13, 2021 20

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer

on the last page.

2646535

Presale: GM Financial Automobile Leasing Trust 2021-2

Chart 7

Money Market Tranche Sizing

The proposed money market tranche (the class A-1 notes) has a 12-month legal final maturity

date (May 20, 2022). To test whether the money market tranche can be repaid by month 11, we ran

cash flows using assumptions to delay the principal collections during the 11-month period. In our

cash flow run, we assumed zero defaults and a zero absolute prepayment speed on all leases. We

also stressed the recognition of the monthly lease payments and base residual amounts by

applying a one- and two-month lag, respectively. Based on our stressed cash flow runs, less than

11 months of collections would be sufficient to pay off the money market tranche.

Legal Final Maturity

To test the legal final maturity dates set for the longer-dated tranches (classes A-2 through C), we

determined the date on which the respective notes were fully amortized in a zero-loss,

zero-prepayment scenario, and then added six months to the result. We also verified that the

notes were paid off in our rating-specific stressed cash flow scenarios by their legal final maturity

dates. For the longest-dated security, class D, we added seven months to the tenor of the pool's

latest-maturing receivable to accommodate any lease term extensions and residual realization on

the receivables. In each cash flow scenario, we confirmed there is sufficient credit enhancement

both to cover losses and to repay the related notes in full by their legal final maturity date.

www.standardandpoors.com May 13, 2021 21

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer

on the last page.

2646535

Presale: GM Financial Automobile Leasing Trust 2021-2

Environmental, Social, And Governance (ESG)

Our rating analysis considers a transaction's potential exposure to ESG credit factors. For the Auto

ABS sector, we view the exposure to environmental credit factors as above average, to social

credit factors as average, and to governance credit factors as below average (see "ESG Industry

Report Card: Auto Asset-Backed Securities" published March 31, 2021).

In our view, the exposure to ESG credit factors in this transaction is in line with our sector

benchmark. Environmental credit factors are generally viewed as above average given that the

collateral pool primarily comprise vehicles with internal combustion engines (ICE), which create

emissions of pollutants including greenhouse gases. While the adoption of electric vehicles and

future regulation could in time lower ICE vehicle values, we believe that our current approach to

evaluating recovery and residual values adequately account for vehicle values over the relatively

short expected life of the transaction. As a result, we have not separately identified this as a

material ESG credit factor in our analysis.

GM Financial

GM Financial is a wholly owned subsidiary of General Motors Financial Co. Inc. (BBB/Negative/--),

which is a wholly owned subsidiary of General Motors Holdings LLC, which is, in turn, a wholly

owned subsidiary of GM (BBB/Negative/--). GM is a U.S. corporation that globally produces

passenger cars, CUVs, SUVs, and heavy-, medium-, and light-duty trucks. GM Financial is a

Delaware corporation formed on July 22, 1992. It is headquartered in Fort Worth, Texas.

GM Financial offers lease financing products for new GM vehicles through its regional credit

centers and dealer relationship managers and has active dealer agreements with the vast majority

of GM dealerships. The dealers originate leases that conform to GM Financial's credit policies, and

GM Financial then purchases and services the leases and the associated leased vehicles,

generally without recourse to the dealers.

Related Criteria

- Criteria | Structured Finance | General: Global Framework For Payment Structure And Cash

Flow Analysis Of Structured Finance Securities, Dec. 22, 2020

- Criteria | Structured Finance | Legal: U.S. Structured Finance Asset Isolation And

Special-Purpose Entity Criteria, May 15, 2019

- Criteria | Structured Finance | General: Counterparty Risk Framework: Methodology And

Assumptions, March 8, 2019

- Criteria | Structured Finance | General: Incorporating Sovereign Risk In Rating Structured

Finance Securities: Methodology And Assumptions, Jan. 30, 2019

- General Criteria: Methodology For Linking Long-Term And Short-Term Ratings, April 7, 2017

- Criteria | Structured Finance | General: Global Framework For Assessing Operational Risk In

Structured Finance Transactions, Oct. 9, 2014

- General Criteria: Global Investment Criteria For Temporary Investments In Transaction

Accounts, May 31, 2012

- Criteria | Structured Finance | ABS: Revised General Methodology And Assumptions For Rating

www.standardandpoors.com May 13, 2021 22

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer

on the last page.

2646535

Presale: GM Financial Automobile Leasing Trust 2021-2

U.S. ABS Auto Lease Securitizations, Nov. 29, 2011

- General Criteria: Principles Of Credit Ratings, Feb. 16, 2011

- Criteria | Structured Finance | ABS: General Methodology And Assumptions For Rating U.S. Auto

Loan Securitizations, Jan. 11, 2011

- Criteria | Structured Finance | General: Methodology For Servicer Risk Assessment, May 28,

2009

- Criteria | Structured Finance | ABS: Assessing The Risk Of Pension Plan Terminations On U.S.

Auto Lease Securitizations, Aug. 17, 2004

Related Research

- Bulletin: General Motors Co. Rating Headroom Improves After Reiterated 2021 Guidance Amid

Headwinds, May 5, 2021

- Economic Research: U.S. Real-Time Data: Fertile Ground For A Continued Recovery, April 30,

2021

- SF Credit Brief: Loan Deferrals In U.S. Auto Loan ABS Reach Their Lowest Levels Since

COVID-19 Began; Deeper Dive Into Charge-Offs On Extended Loans, April 27, 2021

- Economic Research: U.S. Biweekly Economic Roundup: The Recovery Accelerates Amid

Consumer, Housing, And Industrial Gains, April 23, 2021

- Economic Research: U.S. Markets See Inflationary Ghosts; Macroeconomic Signs Disagree,

April 12, 2021

- Global Economic Outlook Q2 2021: The Recovery Gains Traction As Unevenness Abounds,

March 31, 2021

- ESG Industry Report Card: Auto Asset-Backed Securities, March 31, 2021

- Credit Conditions North America Q2 2021: As Outlook Brightens, Risks Remain, March 30, 2021

- Economic Outlook U.S. Q2 2021: Let The Good Times Roll, March 24, 2021

- Economic Research: Orderly Global Reflation Will Support The Recovery From COVID-19, March

22, 2021

- U.S. Auto Loan ABS Is Navigating Through COVID-19 With Better-Than-Expected Performance,

Feb. 10, 2021

- Global Structured Finance 2021 Outlook: Market Resilience Could Bring Over $1 Trillion In New

Issuance, Jan. 8, 2021

- Six Ratings Raised, 11 Affirmed On Three GM Financial Automobile Leasing Trust Series, Nov. 9,

2020

- General Motors Co. 'BBB' Rating Affirmed And Removed From CreditWatch; Outlook Negative,

Aug. 11, 2020

- Global Structured Finance Scenario And Sensitivity Analysis 2016: The Effects Of The Top Five

Macroeconomic Factors, Dec. 16, 2016

www.standardandpoors.com May 13, 2021 23

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer

on the last page.

2646535

Presale: GM Financial Automobile Leasing Trust 2021-2

S&P may receive compensation for its ratings and certain credit-related analyses, normally from issuers or underwriters of securities or from obligors.

S&P reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are made available on its Web sites,

www.standardandpoors.com (free of charge), and www.ratingsdirect.com and www.globalcreditportal.com (subscription), and may be distributed

through other means, including via S&P publications and third-party redistributors. Additional information about our ratings fees is available at

www.standardandpoors.com/usratingsfees.

S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective

activities. As a result, certain business units of S&P may have information that is not available to other S&P business units. S&P has established

policies and procedures to maintain the confidentiality of certain non-public information received in connection with each analytical process.

Credit-related and other analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and

not statements of fact. S&P's opinions, analyses and rating acknowledgment decisions (described below) are not recommendations to purchase,

hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security. S&P assumes no obligation to

update the Content following publication in any form or format. The Content should not be relied on and is not a substitute for the skill, judgment and

experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions. S&P does not act

as a fiduciary or an investment advisor except where registered as such. While S&P has obtained information from sources it believes to be reliable,

S&P does not perform an audit and undertakes no duty of due diligence or independent verification of any information it receives. Rating-related

publications may be published for a variety of reasons that are not necessarily dependent on action by rating committees, including, but not limited

to, the publication of a periodic update on a credit rating and related analyses.

To the extent that regulatory authorities allow a rating agency to acknowledge in one jurisdiction a rating issued in another jurisdiction for certain

regulatory purposes, S&P reserves the right to assign, withdraw or suspend such acknowledgment at any time and in its sole discretion. S&P Parties

disclaim any duty whatsoever arising out of the assignment, withdrawal or suspension of an acknowledgment as well as any liability for any damage

alleged to have been suffered on account thereof.

Copyright © 2021 Standard & Poor's Financial Services LLC. All rights reserved.

No content (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part

thereof (Content) may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval

system, without the prior written permission of Standard & Poor's Financial Services LLC or its affiliates (collectively, S&P). The Content shall not be

used for any unlawful or unauthorized purposes. S&P and any third-party providers, as well as their directors, officers, shareholders, employees or

agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P Parties are not

responsible for any errors or omissions (negligent or otherwise), regardless of the cause, for the results obtained from the use of the Content, or for

the security or maintenance of any data input by the user. The Content is provided on an “as is” basis. S&P PARTIES DISCLAIM ANY AND ALL EXPRESS

OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR

USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT'S FUNCTIONING WILL BE UNINTERRUPTED OR THAT THE

CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no event shall S&P Parties be liable to any party for any direct,

indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without

limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of the Content even if advised

of the possibility of such damages.

Standard & Poor’s | Research | May 13, 2021 24

2646535

Presale: GM Financial Automobile Leasing Trust 2021-2