Airport Economics

2023 Report

A comprehensive view of the

industry’s financial performance

2 2023 ACI Airport Economics Report

Airports Council International (ACI) advances the collective interests and acts as the

voice of the world’s airports and the communities they serve and promotes professional

excellence in airport management and operations.

DISCLAIMER

No subscriber or other reader should act on the basis of any information contained in this

publication without referring to applicable laws and regulations and/or without obtaining

appropriate professional advice. Although every effort has been made to ensure accuracy,

ACI shall not be held responsible for loss or damage caused by errors, omissions,

misprints or misinterpretation of the contents hereof, including for contributions provided

by third parties. Furthermore, ACI expressly disclaims all and any liability to any person,

whether a purchaser of this publication or not, in respect of anything done or omitted, and

the consequences of anything done or omitted, by any such person through reliance on

the contents of this publication.

No part of this publication may be reproduced, recast, translated, reformatted, or

transmitted in any form by any means, electronic or mechanical, including photocopying,

recording or use of any information storage and retrieval system, without prior written

permission from ACI.

Airport Economics Report

(2023)

Copies of this publication are available from:

Publications Department

ACI World

800 rue du Square Victoria

Suite 1810, PO Box 302

Montreal, Quebec H4Z 1G8

Canada

Email: [email protected]

Web: store.aci.aero

ISBN: 978-1-990290-44-2

©2023 Airports Council International. All rights reserved.

32023 ACI Airport Economics Report

Acknowledgements

ACI World extends its gratitude to all airport operators that contributed detailed nancial

data in a timely manner as it allows us to produce accurate airport economic indicators

and analyses. The lists of the contributing operators and airports that have made this

report possible are included in the annex.

ACI World would also like to acknowledge the valuable input from colleagues in ACI

regional ofces on earlier drafts of the Airport Economics Survey on which this report is

based. We also thank the regional ofces for collaborating with airports on the collection

of nancial and related economic data.

ACI World contributors

ACI World Airport Economics Report: Catherine Joyal, Senior Data Analyst, Airport

Economics; Patrick Lucas, Vice President, Economics; Aram Karagueuzian, Director,

Trafc and Economic Statistics; Carlos Charpenel, Director, Economic Policy

ACI World Airport Economics KPIs: Catherine Joyal, Senior Data Analyst, Airport

Economics (lead); Aram Karagueuzian, Director, Trafc and Economic Statistics; Patrick

Lucas, Vice President, Economics, ACI World

Editorial management and project coordination: Sabrina Guerrieri, Interim Director,

Publications and Communications; Gabriela Arrieta, Publications Coordinator

2023 ACI World Airport Economics Report

A comprehensive view of the industry’s financial performance

4 2023 ACI Airport Economics Report

Contents

Message from the Director General .............................................................. 6

Report methodology .......................................................................................7

Sample and coverage ................................................................................... 7

Financial year 2021 ...................................................................................... 8

Estimation and simulation ............................................................................. 9

International comparability ............................................................................ 9

1. Global Analysis ......................................................................................... 10

1.1 The global economy ............................................................................. 10

1.2 Air transport demand ............................................................................ 12

1.2.1 Passenger trafc ......................................................................... 12

1.2.2 Air cargo trafc ............................................................................ 14

2. Airport Revenues ...................................................................................... 16

2.1 The airport industry .............................................................................. 16

2.2 Aeronautical revenues ......................................................................... 21

2.3 Non-aeronautical revenues .................................................................. 26

3. Airport Costs ............................................................................................. 31

3.1 Operating costs .................................................................................... 33

3.2 Capital costs ........................................................................................ 35

3.3 Economies of scale—cost structure by airport size .............................. 37

4. Airport Financial Performance ................................................................ 40

4.1 Margins: operating surplus and net prot ............................................. 43

4.2 Return on invested capital .................................................................... 44

4.3 Comparative returns ............................................................................. 46

4.4 Airport nancial performance and airport size ...................................... 47

5. Look Ahead ............................................................................................... 49

52023 ACI Airport Economics Report

List of charts and tables

Table A: Data coverage

Chart A: Distribution of passenger trafc coverage by nancial year

Chart 1: Global economic growth (year-over-year % change in GDP, 2019–2024)

Chart 2: Evolution of global airport passenger trafc (billion passengers, 2015–2022)

Chart 3: Passenger trafc growth rates by region (2020/2019 and 2021/2019)

Chart 4: Evolution of global airport cargo trafc (million tonnes, 2015–2022)

Chart 5: Distribution of airport revenues by key source (2019, 2020, and 2021)

Chart 6: Evolution of industry total revenue (million US$) and year-over-year % growth (2015–2021)

Chart 7: Evolution of total revenue per passenger and year-over-year % growth (US$, 2015–2021)

Chart 8: Distribution of global airport revenues (2019, 2020, and 2021)

Table 1: Estimated industry revenues and costs (million US$, 2021)

Chart 9: Distribution of aeronautical revenue sources (2019, 2020, and 2021)

Chart 10: Year-over-year % change in selected aeronautical revenue sources (2021/2020)

Chart 11: Year-over-year % change in selected aeronautical revenue sources (2020/2019 and 2021/2019)

Chart 12: Ratio of aircraft-related to passenger-related revenues by region (2021)

Chart 13: Ratio of aircraft-related to passenger-related revenues (2015–2021)

Chart 14: Distribution of non-aeronautical revenue by source (2019, 2020, and 2021)

Chart 15: Year-over-year % change in selected non-aeronautical revenues (2021/2020)

Chart 16: Year-over-year % change in selected non-aeronautical revenues (2020/2019 and 2021/2019)

Chart 17: Distribution of non-aeronautical revenue by region (% of total non aeronautical revenue, 2021)

Table 2: Year-over-year % change in selected non-aeronautical revenues (2021/2020)

Chart 18: Evolution of total industry costs and year over year growth (million US$, 2015–2021)

Chart 19: Distribution of airports’ total costs (2019, 2020, and 2021)

Chart 20: Evolution of total industry costs per passenger and year-over-year % growth (US$, 2015–2021)

Chart 21: Distribution of operating expenses (2019, 2020, and 2021)

Chart 22: Year-over-year % change in selected operating expense categories (2021/2020)

Chart 23: Year-over-year % change in selected operating expense categories (2020/2019 and 2021/2019)

Chart 24: Distribution of capital costs (2019, 2020, and 2021)

Chart 25: Year-over-year % change in capital costs (2020/2019, 2021/2020, 2021/2019)

Chart 26: Distribution of airports’ total costs by airport size (2021)

Chart 27: Total cost per passenger by airport size (2019, 2021)

Chart 28: Evolution of unit revenues costs per passengers (2014–2021, indexed 2014=100)

Chart 29: Evolution of aeronautical and non-aeronautical revenue per passenger vs. operating expenses

and capital costs per passenger (US$, 2015–2021)

Chart 30: Debt-to-EBITDA ratio (2015–2021)

Chart 31: Operating surplus and net prot margins (2015–2021)

Chart 32: Return on invested capital—advanced versus emerging economies (2019, 2020, and 2021)

Chart 33: ROA, ROCE, and ROIC by airport size (2021)

Chart 34: Share of loss-making airports by airport size (2019, 2020, and 2021)

Chart 35: Share of loss-making airports by airport size excluding non-operating revenues (2019, 2020,

and 2021)

Chart 36: Medium-term global passenger trafc projection (indexed, 2019 = 100, as of February 2023)

6 2023 ACI Airport Economics Report

Message from the Director General

Dear Colleagues and Industry Partners,

It is my pleasure to present the 2023 ACI Airport Economics Report. The report

provides a comprehensive analysis of the economic performance of airports

around the world and offers valuable insights into the challenges and opportunities

facing the industry. ACI’s publication features data for the 2021 nancial year,

gathered from over 1,000 airports of all sizes and business models, representing

82% of the world’s pre-pandemic trafc.

The past year has been a challenging one for the aviation industry, with the

ongoing global health crisis causing signicant disruptions to air travel and

economic activity. Despite this, airports have continued to play a vital role in the

global economy, serving as critical infrastructure for the movement of people and

goods.

This year’s report presents an overview of the industry’s nancial recovery trends

across the world as we come out of the pandemic. The data supporting the

summaries and commentary is available in the 2023 Airport Key Performance

Indicators, which provides insight into areas, such as nancial and employee

performance, xed-asset productivity, and airport operations, and includes 53

detailed statistical tables.

I would like to acknowledge and thank all the airports that submitted data while

continuing to struggle with the lasting effects from the ongoing health crisis. This

data is crucial for our industry and for our advocacy efforts.

I hope that the insights and data in this report provide valuable guidance to

navigate the path to recovery. Together, we can continue to support the growth

and development of the global aviation ecosystem.

Sincerely,

Luis Felipe de Oliveira

Director General

ACI World

72023 ACI Airport Economics Report

Report methodology

Sample and coverage

The key performance indicators (KPIs) and the contents of this report are based

on an annual survey that generated responses from 1,087 airports for the 2021

nancial year. Together, these airports handled over 7 billion passengers or about

82% of worldwide passenger trafc in 2019.

The objectives of the sampling were three-fold. The rst objective was to maximize

participation and coverage of the world’s top airports in terms of passenger and

cargo trafc. The second objective was to increase the participation of airports

with lower trafc levels to introduce analytical variation and rigour to the dataset.

Finally, we regarded regional representation as a vital component in presenting a

global picture of the industry. Simulations were conducted based on the sample

to produce an accurate distribution of trafc across the world’s regions.

In terms of the actual number of participating airports, Asia-Pacic represents

the largest portion of the sample (330), followed by Europe (260), North America

(225), Latin America-Caribbean (189) and Middle East (19). Table A below

provides a breakdown of the report’s coverage. Regarding airport size categories,

airports were classied as per their 2019 passenger trafc to ensure continuity

within a group: 268 airports are in the less than 1m category; 179 airports are in

the 1–5m category; 96 airports are in the 5–15m category; 33 airports are in the

15–25m category; 29 airports are in the 25–40m category; and 40 airports are

in the over 40m category. Some operators provided aggregate data for multiple

airports, but these responses were treated differently; included in analyses by

region but excluded from the analyses by airport size category.

When collecting the data, each individual airport’s submission was analyzed

for consistency and coherence across each indicator in the Airport Economics

Survey. Various quality indicators were used to detect any outliers or anomalies

in the dataset. Statistical quality control was conducted in consultation with airport

data providers as needed.

8 2023 ACI Airport Economics Report

Financial year 2021

To facilitate the collection of nancial data, the following periods are included in

the 2021 nancial year as submitted by the airports: Q2 2020 – Q1 2021, Q3

2020 – Q2 2021, Q4 2020 – Q3 2021, calendar year 2021, Q2 2021 – Q1 2022,

Q3 2021 – Q2 2022.

Although the majority of the sample reported their nancial data in the calendar

year, there are discrepancies between regions in terms of nancial year reporting.

Notably, in North America, 32% of the sample in terms of passenger trafc ended

their nancial year in June 2021. In Africa, 16% of the sample ended their nancial

year in March 2021 and 23% of the sample ended their nancial year in June

2021.

When interpreting the results, it is crucial to understand where airports stand in

their recovery of passenger trafc in relation to their nancial year. For example,

an airport in the United States may have seen a growth of 67% of in passenger

trafc over the calendar year 2021 and at the same time, a decrease of 52% in

passenger trafc over their nancial year 2021, starting July 2020 and ending in

June 2021. This is also true for Africa and Asia-Pacic.

Table A: Data coverage

Region

Number of

participating airports

Passenger*

trafc covered 2019

Africa

Asia-Pacic

Europe

Latin America-Caribbean

Middle East

North America

World

64

330

260

189

19

225

1087

66%

82%

76%

74%

52%

99.6%

82%

<1m

1–5m

5–15m

15–25m

25–40m

>40m

268

179

96

33

29

40

27%

39%

57%

58%

74%

74%

* Passenger trafc refers to arriving, departing and transit passengers

92023 ACI Airport Economics Report

Estimation and simulation

In certain instances where data was not readily available for the reference period,

various techniques were used to estimate missing data. Depending on the

variable being analyzed and the availability of past time series data, econometric

techniques or other simulation methods were used to estimate missing data.

International comparability

Individual airport nancial data was submitted in 61 different currency

denominations and converted into US dollars (US$) using ofcial exchange rates

determined by the foreign exchange market and/or national authorities. The

exchange rate was calculated as an annual average based on monthly averages

and expressed as local currency units relative to the US dollar.

The nancial gures for the previous year (2020) were adjusted by the ination

rate, dened as the change in average consumer prices. This mitigates currency

uctuations through 2020 and 2021 and allows the comparability and accuracy of

US$ amounts across the two years.

Both ination and exchange rates were obtained from the International Monetary

Fund’s (IMF) World Economic Outlook Databases and International Financial

Statistics.

Africa Asia-Pacific Europe Latin America

-Caribbean

Middle East North America World

Q3 2021 - Q2 2022 Q2 2021 - Q1 2022 Calendar year 2021

Q4 2020 - Q3 2021 Q3 2020 - Q2 2021 Q2 2020 - Q1 2021

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Chart A:

Distribution of passenger trafc coverage by nancial year

Source: ACI World 2023 Airport Key Performance Indicators

10 2023 ACI Airport Economics Report

1. Global Analysis

1.1 The global economy

After the 2020 slump produced by the COVID-19 pandemic, economic activity

swiftly recovered in 2021 and 2022. People and businesses were able to adapt to

a new reality dominated by looming uncertainty. This condition is set to persist in

the short-term as there are numerous obstacles for the global economy, such as

high ination, supply-chain disruptions and geopolitical conicts.

The International Monetary Fund (IMF) estimates growth of 3.4% in 2022 for

the world’s Gross Domestic Product (GDP) (Chart 1). One factor contributing to

this growth is the continued rollout of vaccines for COVID-19 and the alleviation

of travel restrictions. As more and more people are vaccinated, restrictions on

travel and commerce have been lifted, leading to an increase in global trade

and economic activity. This is an essential factor for air travel to be able to fully

deploy its multiplier effect, especially when trafc to and from major airport hubs

is untapped.

Economic recovery in emerging markets outpaced that of advanced economies.

For instance, the IMF estimates GDP growth for emerging markets in 2022 was

3.9%, compared with 2.7% for advanced economies. This is due in part to the fact

that many emerging markets were not as severely impacted by the pandemic as

advanced economies and therefore were able to keep steady levels of growth.

Despite this positive pace of recovery, there are still risks to the global economy.

The most obvious manifestation of such risks is the signicant increase in ination

across many economies. G20 countries registered an 8.6% ination rate for

2022, for instance. The interplay between geopolitical conicts and rising prices

remains a top threat to the global economy. Many analysts suggest that the

ination rate has already peaked and will subside in 2023 based on aggressive

monetary tightening by central banks. Although higher interest rates help to

cool aggregate demand and ensure price stability, it may induce an economic

slowdown. Aviation is very much linked to such macroeconomic factors. As with

any other good or service, the impact of prices and disposable income remain

important determinants of air transport demand. Thus, uncertainty regarding a

full recovery of the aviation industry remains omnipresent, especially in the near

term.

112023 ACI Airport Economics Report

World Advanced economies Emerging markets and developing economies

2.8%

-3.0%

6.2%

3.4%

2.9%

3.1%

1.4%

1.7%

-4.4%

5.4%

2.7%

1.2%

3.6%

-1.9%

6.7%

3.9%

4.0%

4.2%

2019 2020 2021 2022* 2023* 2024*

Chart 1:

Global economic growth

(year-over-year % change in GDP, 2019–2024)

*Projected

Source: International Monetary Fund (IMF), World Economic Outlook Database (2022)

Overall, the global economy had a rapid recovery in 2022 after the pandemic-

induced crisis. The speed of recovery for 2023 and beyond still depends on

several factors with a number of market pendulums moving in opposite directions

creating a level of uncertainty. On the one hand, the possible contraction in GDP

or slowdown in growth in major economies coupled with the rise in airfares due

to higher jet fuel prices weigh negatively on demand, representing a downside

risk for the industry in 2023. This could dampen or delay the recovery from the

COVID-19 pandemic and a return to 2019 passenger trafc volumes. On the

other hand, a strong labor market and the re-opening of China, the second

biggest aviation market after the United States, represents an important boost to

global passenger trafc. Even with the ongoing presence of COVID-19 variants

and the recent imposition of travel restrictions and testing requirements on

travellers departing China by several countries, the re-opening of China’s borders

represents an overall gain for domestic and international travel.

12 2023 ACI Airport Economics Report

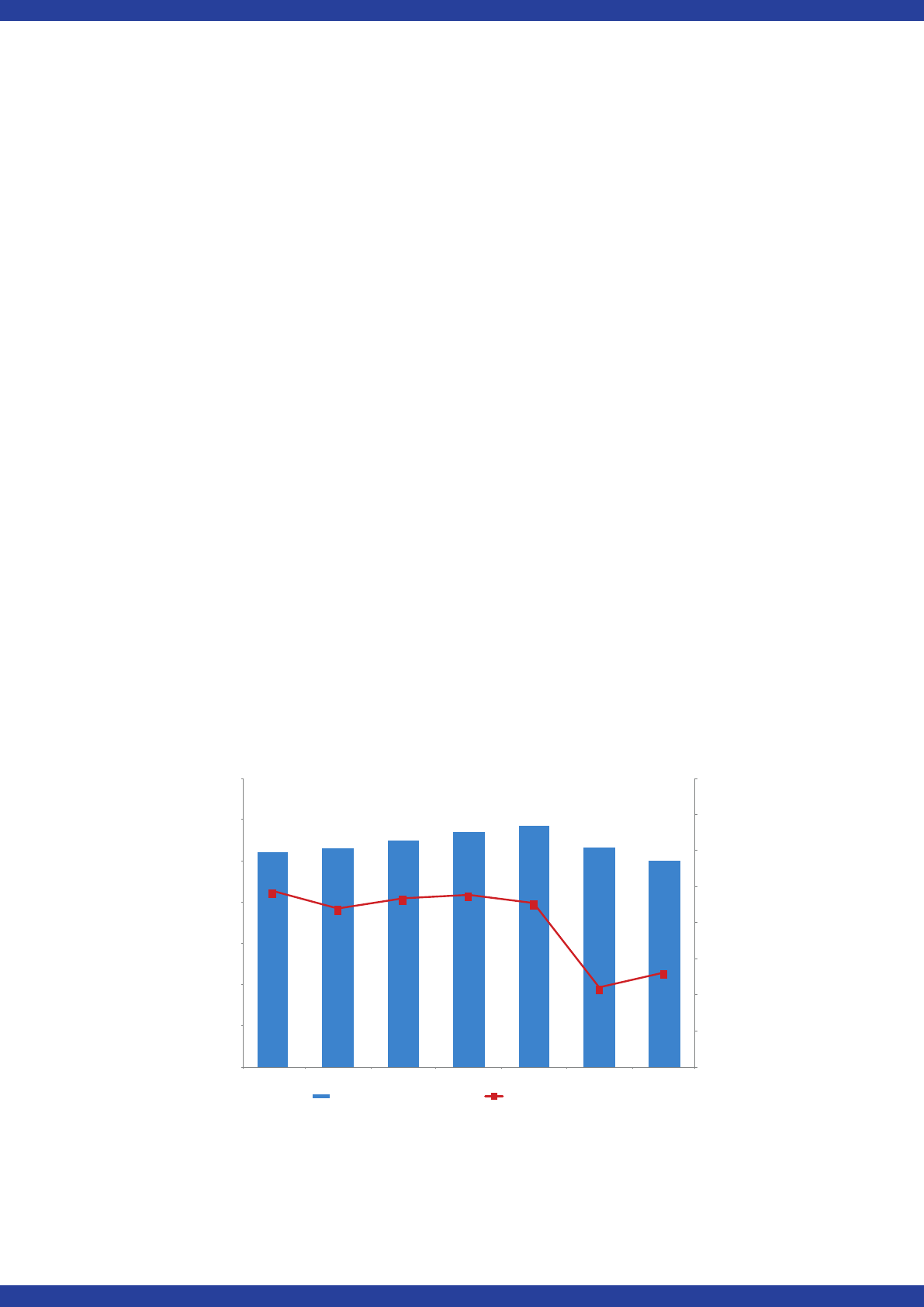

Chart 2:

Evolution of global airport passenger trafc

(billion passengers, 2015–2022*)

* Preliminary gures

Source: ACI World Annual Trafc Database

Year-over-year % change

Total passengers Year-over-year % change

7.3

7.7

8.3

8.9

9.2

3.6

4.6

6.6

6.4% 6.5%

7.5%

6.4%

3.5%

-60.7%

28.4%

42.0%

-70.0%

-50.0%

-30.0%

-10.0%

10.0%

30.0%

50.0%

70.0%

0

1

2

3

4

5

6

7

8

9

10

2015 2016 2017 2018 2019 2020 2021 2022*

Total airport passenger traffic (billion passengers)

1.2 Air transport demand

1.2.1 Passenger trafc

Global passenger trafc continues a steady recovery after the worst crisis in its

history. During 2021, passenger trafc grew 28.4% compared with 2020, the

equivalent of 1.0 billion passengers (Chart 2). This trend continued during 2022,

with an estimated increase of 42.0% compared with 2021. This is one of the most

signicant increases of the last decade, but still leaves the industry 2.6 billion

passengers behind its 2019, pre-pandemic level. In 2022, passenger trafc was at

72% of 2019 levels.

132023 ACI Airport Economics Report

Recovery has been heterogenous across the globe. For instance, Asia-Pacic

lagged as China’s sizable aviation market experienced international travel

restrictions during 2021 and 2022. However, as China lifted travel restrictions in

early 2023, growth in the Asia-Pacic region picked up as the Beijing, Guangzhou

and Shanghai hubs resumed their role as major trafc connectors. This situation

is shared by some of the major European and Middle Eastern hubs, as their high

dependency on international connections has prevented them from achieving

pre-pandemic trafc volumes.

North America has seen the best recovery levels worldwide with passenger trafc

reaching 66% of 2019 levels during 2021 (Chart 3). A swift vaccine distribution,

the easing of travel restrictions, and a solid domestic market fostered the return

of North American travellers to the skies for both leisure and business purposes.

Latin America-Caribbean and Africa also posted strong numbers for 2021 and

were 37% and 49% below 2019 trafc levels respectively by the end of the year.

These two regions have beneted from a growing low-cost carrier industry that

promotes the swap from road to air travel.

Chart 3:

Passenger trafc growth rates by region

(2020/2019 and 2021/2019)

Africa Asia-Pacific Europe Latin America-

Caribbean

Middle East North America

2020/2019 % Change

2021/2019 % Change

-66%

-54%

-69%

-60%

-67%

-61%

-49%

-56%

-56%

-37%

-58%

-34%

Source: ACI World Annual Trafc Database

14 2023 ACI Airport Economics Report

Chart 4:

Evolution of global airport cargo trafc

(million tonnes, 2015–2022*)

* Preliminary gures

Source: ACI World Annual Trafc database

Year-over-year % change

Total cargo Year-over-year % change

106.1

110.3

118.8

122.9

120.1

108.6

125.3

115.9

2.6%

4.0%

7.7%

3.4%

-2.2%

-

9.6%

15.4%

-7.5%

-15.0%

-10.0%

-5.0%

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

0

20

40

60

80

100

120

140

2015 2016 2017 2018 2019 2020 2021 2022*

Total airport cargo traffic in metric tonnes (million tonnes)

1.2.2 Air cargo trafc

Air cargo had its best year in history in 2021, with 125.3 metric tons transported

through airports worldwide (Chart 4). Unlike passenger trafc, cargo trafc was not

heavily affected by international travel restrictions. Even with the reduced capacity

due to less passenger plane belly cargo, air cargo kept growing as it positioned

itself as the fastest and most reliable transportation option. Additionally, disruptions

to maritime transportation promoted the move to air cargo for many products and

industries. Another key element for air cargo during 2021 was e-commerce, with

companies demanding more capacity to transport parcels. Air cargo volume had an

estimated decrease of 7.5% during 2022, partially due to adverse macroeconomic

conditions and increases in oil prices.

152023 ACI Airport Economics Report

Methodological note:

Figures in Charts 2, 3 and 4 represent the most comprehensive sample

of airports for which annual trafc data for the year 2021 was collected.

These charts are taken from the ACI 2021 World Annual Trafc Report. The

subsequent analyses of revenues, costs and other economic indicators

are based on a smaller sample of airports, as per Table A above. Hence,

readers are advised against reconciling global trafc data with sample-

specic economic analyses.

16 2023 ACI Airport Economics Report

2. Airport Revenues

2.1 The airport industry

Revenues derived from passengers are the main source of funds for airports

around the world, and 2021 was no different. Given the high correlation between

airport revenues and passenger trafc, the implosion in passenger trafc—

resulting from international travel restrictions—had a direct impact on airport

revenues, forcing airports to nd such additional sources of capital as issuing

debt and equity.

Before the pandemic, there was a solid balance between aeronautical and non-

aeronautical revenues. Annual growth rates for both revenue sources were at an

average of about 5% for the 10 years preceding the pandemic. As passenger trafc

was disrupted, revenue growth stopped, and the distributional balance between

aeronautical and non-aeronautical revenues was broken. Since cargo trafc was

the only source of revenues that remained stable, aeronautical revenues gained

more importance due to the constant ow of cargo aircraft landing and parking

charges.

Another key factor that served as a lifeline for multiple airports worldwide is non-

operating revenue. This category comprises interest income, subsidies, grants,

asset divestments and other related non-operating items. Non-operating revenues

experienced some growth as several legislations around the world approved crisis

support packages to help airports cope with the massive decrease in passenger

trafc though this was not uniform across regions.

In 2021, aeronautical revenue was the largest source of income for airports,

representing 50% of the total (up 2 percentage points from 2020), whereas non-

aeronautical revenues made up 34%, down 5 percentage points from 2020. Non-

operating revenue represented 16% in 2021, up 2 percentage points from 2020,

mainly due to the aforementioned grants, subsidies and other pandemic-related

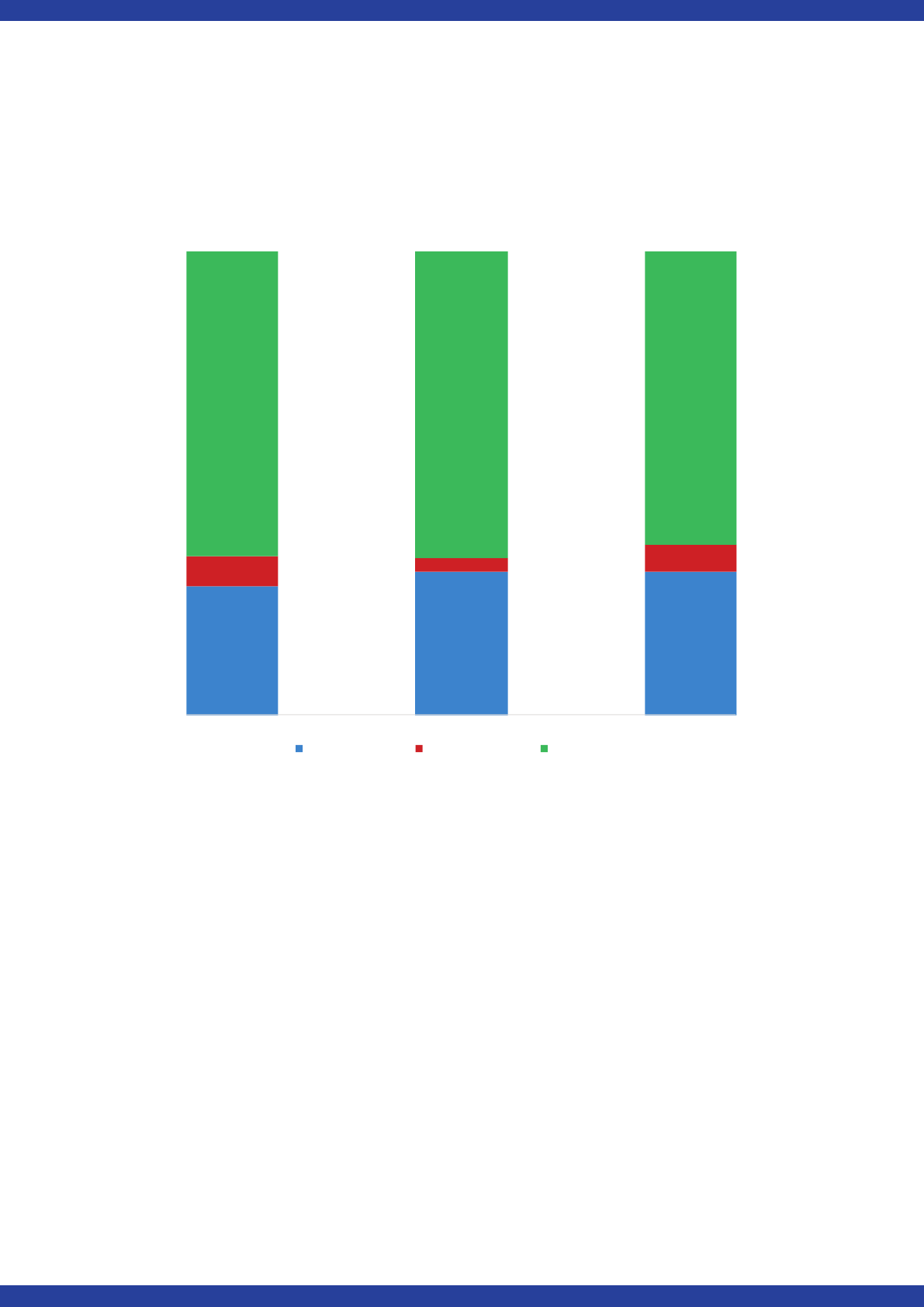

help packages (Chart 5).

172023 ACI Airport Economics Report

40%

39%

34%

6%

14%

16%

54%

48%

50%

2019 2020 2021

Non-aeronautical Non-operating Aeronautical

Source: ACI World Airport Economics Database

In 2021, total airport revenue amounted to US$85.5 billion, down US$0.4 billion

from 2020 and signicantly down from US$158.6 billion in 2019 (Chart 6). This

represents a decrease of 0.4% compared with 2020, and a decrease of 43%

compared with 2019. Though trafc showed signs of a recovery, airport revenues

decreased marginally in 2021, mainly due to the decreases in non-aeronautical

revenues as relief measures from airports to commercial concessionaires went

into effect.

Prior to the pandemic, per passenger revenue was falling slightly due to the rapid

expansion in passenger trafc during the 2010s. In 2021, revenue per passenger

surpassed pre-pandemic levels reaching a decade-high number (Chart 7). This

increase was mainly due to a collapsing trafc base as part of the denominator.

Chart 5:

Distribution of airport revenues by key source

(2019, 2020, and 2021)

18 2023 ACI Airport Economics Report

Chart 6:

Evolution of industry total revenue (million US$)

and year-over-year % growth (2015–2021)

Chart 7:

Evolution of total revenue per passenger

and year-over-year % growth (US$, 2015–2021)

Source: ACI World Airport Economics Database

Note: Previous years’ data was adjusted to present value according to the level of ination. Time series represent

real values with 2021 being the base year.

Source: ACI World Airport Economics Database

Note: Previous years’ data was adjusted to present value according to the level of ination. Time series represent

real values with 2021 being the base year.

Total industry revenue (millions US$) Year-over-year % growth

Year-over-year % change

$133,397

$141,138

$149,920

$156,369

$158,600

$85,900

$85,500

6.0%

5.8%

6.2%

4.3%

1.4%

-43.0%

-0.4%

-50.0%

-40.0%

-30.0%

-20.0%

-10.0%

0.0%

10.0%

20.0%

30.0%

40.0%

50.0%

$-

$20,000

$40,000

$60,000

$80,000

$100,000

$120,000

$140,000

$160,000

$180,000

2015 2016 2017 2018 2019 2020 2021

Total airport industry revenue (millions US$)

Year-over-year % change

Total revenue per passenger Year-over-year % change

$22.12

$21.07

$20.89

$20.63

$19.87

$23.49

$25.32

-10.6%

-4.7%

-0.9%

-1.3%

-3.7%

18.2%

7.8%

-20.0%

-15.0%

-10.0%

-5.0%

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

$-

$2

$4

$6

$8

$10

$12

$14

$16

$18

$20

$22

$24

$26

$28

2015 2016 2017 2018 2019 2020 2021

Total revenue per passenger (US$)

192023 ACI Airport Economics Report

Chart 8:

Distribution of global airport revenues (2019, 2020, and 2021)

Source: ACI World Airport Economics Database

In terms of revenue share by region, North America remained the top region

worldwide during 2021 with 32% of total revenues (Chart 8). Government grants

in the United States through the CARES Act, coupled with a solid domestic

market, were key factors behind North America’s prime positioning. A stronger

intra-European travel market allowed Europe to follow closely with 32% of

total revenues, a recovery of 4 percentage points from 2020. Asia-Pacic fell 4

percentage points from 2020 to 2021, the 21% share of revenues largely a result

of international travel restrictions prevalent in China. The Latin America-Caribbean

region had strong results, however, due to rapidly recovering passenger trafc

and expansion in the low-cost carrier market and achieved an 8% share of total

airport revenue in 2021. Finally, the Middle East and Africa remained stable with

a 5% and 2% share respectively.

Africa Asia-Pacific Europe Latin America-Caribbean Middle East North America

2%

2%

2%

26%

25%

21%

6%

6%

8%

35%

28%

32%

9%

4%

5%

22%

34%

32%

2019 2020 2021

158.6b $US

85.5b $US

85.9b $US

20 2023 ACI Airport Economics Report

Table 1: Estimated industry revenues and costs (million US$, 2021)

Africa 1,400 -30.8% 900 -27.4% 400 -36.7% 100 -34.8%

Asia-Pacic 18,200 -16.9% 7,700 -15.6% 8,700 -20.7% 1,800 19.1%

Europe 27,500 17.0% 14,500 24.3% 11,300 5.9% 1,700 6.5%

Latin America-Caribbean 6,500 27.2% 4,300 40.2% 1,900 18.1% 300 -1.8%

Middle East 4,400 18.1% 2,300 24.6% 1,900 15.2% 200 -1.8%

North America 27,500 -3.9% 13,300 -3.1% 7,500 -11.7% 6,700 -0.5%

World 85,500 -0.4% 43,000 3.2% 31,700 -7.7% 10,800 2.6%

Operating

expenses

2018/2017

% change Capital costs

2018/2017

% c%hange

Total cost

(operating +

capital costs)

2018/2017 %

change

Africa 1,200 -8.2% 700 -6.7% 1,900 -9.1%

Asia-Pacic 16,600 -2.8% 8,600 -4.6% 25,100 -3.4%

Europe 21,000 -8.8% 13,200 -12.1% 34,200 -10.1%

Latin America-Caribbean 3,500 15.6% 2,300 -14.6% 5,800 -3.2%

Middle East 3,800 7.1% 2,800 -2.0% 6,600 3.0%

North America 13,600 -12.3% 12,500 -1.7% 26,100 -7.6%

World 59,700 -6.7% 40,100 -6.8% 99,700 -6.9%

Region

Total

revenue

2021/2020

% change

Aeronautical

revenue

2021/2020 %

change

Non-aero-

nautical

revenue

2021/2020 %

change

Non-operating

revenue

2021/2020

% change

Source: ACI World 2023 Airport Key Performance Indicators

Region

Operating

expenses

2021/2020

% change

Capital

costs

2021/2020 %

change

Total cost

(operating

+ capital

costs)

2021/2020 %

change

The recovery of airport revenues varied throughput the world and is correlated

to the recovery of passenger trafc. Overall, during nancial year 2021, airport

revenues saw a small decrease of 0.4% compared with 2020 (Table 1). The

Latin America-Caribbean region had the largest revenue increase with a 27.2%

change year over year, due to the expansion of low-cost carriers and relaxation

of international travel restrictions. The Middle East followed with an increase of

18.1%, as the main hubs in the region started to recover connectivity. Europe

was able to bounce back 17.0%, supported by strong intra-European travel to

leisure destinations. North America had a stable result with a decrease of 3.9%

compared with 2020. Lastly, Asia-Pacic saw the result of the travel restrictions

in China manifested in a 16.9% decrease in revenues, while Africa had a 30.8%

decrease as the region’s international travel markets suffered and vaccination

rates among the African population lagged.

212023 ACI Airport Economics Report

2.2 Aeronautical revenues

Aeronautical revenues are generated from an array of charges and fees that are

levied on users and passengers of airport facilities and services.

These revenues play a crucial role in the development and maintenance of

airport infrastructure. They are used to upgrade and modernize facilities in line

with sustainability goals, to improve safety and security measures and to adopt

new technologies and services. This ensures that airports can meet the growing

demand for travel and provide passengers with a smooth and efcient experience.

Aircraft operators, both commercial airlines and general/business aviation,

typically pay charges for the use of airside infrastructure (including runways,

taxiways, aprons, parking stands and airbridges) at airports. These charges are

usually based on an aircraft weight formula. They can also vary depending on

the length of time an aircraft is parked. Meanwhile, passengers typically pay

charges for the use of passenger processing facilities, including terminals, ground

access to terminals and security services. These charges are normally collected

by aircraft operators on behalf of airports to avoid delays and bottlenecks in

facilitation. Passenger-related charges are accrued on a per-passenger basis.

Finally, a transfer charge may be levied on passengers transferring to other

aircraft.

Prior to the pandemic, many airports moved toward charging systems that aim

to accommodate and satisfy airline customers by rebalancing the scale between

aircraft-related charges and passenger-related charges, depending on the

specic requirements and local circumstances. This move took place in a context

of increased competition, capacity constraints and congestion, especially at many

of the world’s major airports.

Chart 9 provides a detailed breakdown of global aeronautical revenues. As shown,

passenger charges continue to be the largest source of aeronautical revenue

for airports at 31%, followed by landing charges at 24% and terminal rentals at

18%. Due to the steep decline in passenger volume, passenger-related revenues

have not been able to fully recover their pre-pandemic share of total aeronautical

revenues and in 2021 were still 13 percentage points behind their 2019 level.

The share of terminal rentals

1

paid by airlines for space utilization almost doubled

in 2020 and now accounts for 18% of global aeronautical revenue, though this

revenue source is mainly limited to North America.

1

The Federal Aviation Administration (FAA) classies terminal rentals as passenger/airline

aeronautical revenues.

22 2023 ACI Airport Economics Report

Chart 9:

Distribution of aeronautical revenue sources (2019, 2020, and 2021)

When looking at individual aeronautical revenue sources, passenger charges

were able to recover 4% in 2021, having drastically fallen during the pandemic.

The remainder of aeronautical charges followed a positive path alongside trafc

recovery, the only exception being terminal rentals, which fell 6%.

Chart 10 summarizes growth rates for the major sources of aeronautical revenue.

Chart 10:

Year-over-year % change in selected aeronautical revenue sources

(2021/2020)

* Airport improvement fees.

** Passenger facility charges.

*** Includes miscellaneous passenger-related, aircraft-related, cargo-related charges, and all

other unidentied charges of aeronautical nature.

Source: ACI World Airport Economics Database

* Airport improvement fees.

** Passenger facility charges.

Source: ACI World 2023 Airport Key Performance Indicators

Landing charges Passenger charges (AIF* and PFC** included)

Terminal rentals Security charges Other***

22%

25%

24%

44%

31%

31%

12%

20%

18%

8%

6%

5%

15%

19%

21%

2019

2020

2021

Terminal

rentals

Parking

charges

Landing

charges

Passenger charges

(AIF* and PFC**

included)

Security

charges

Boarding bridge

charges

Ground handling

charges

4%

24%

15%

10%

5%

10%

-6%

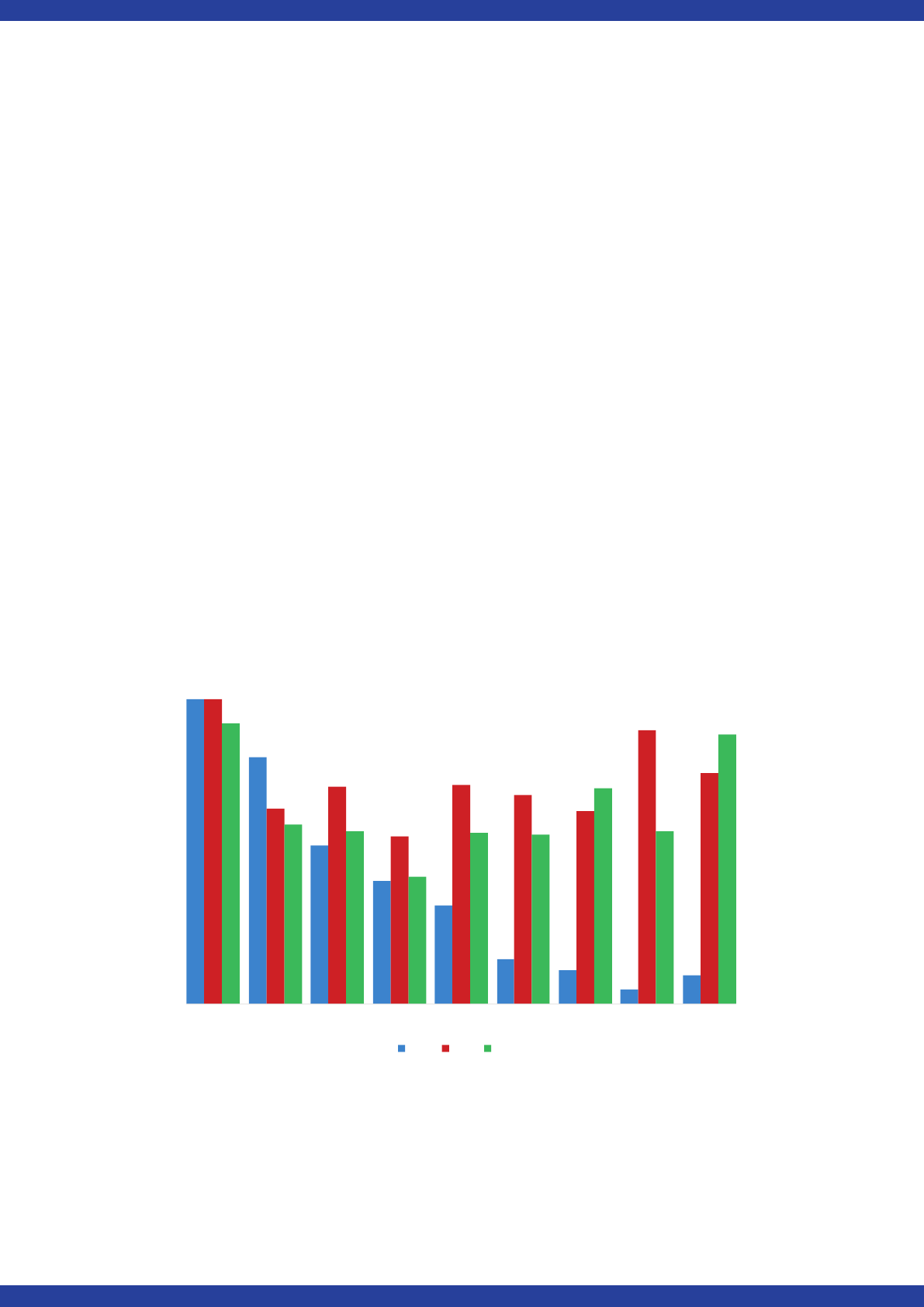

232023 ACI Airport Economics Report

Except for the United States, where the Passenger Facility Charge (PFC) limits the

collection of PFC fees to US$4.50 for every departing passenger at commercial

airports controlled by public agencies, many airports emphasise generating

revenues by charging passengers as opposed to aircraft operators. The ratio of

passenger-related versus aircraft-related revenue reveals this emphasis. As was

the case prior to the pandemic, the Middle East, Latin America-Caribbean and

Africa recorded the highest proportion of revenue coming from passenger-related

charges in 2021 (Chart 12).

Globally, in 2021, 43% of airport revenues was passenger-related, 38% was

aircraft-related, and 19% was terminal rentals. When looking at the regional

difference, most airport revenues in North America were terminal rentals. In

Africa, Europe, Latin America-Caribbean and the Middle East, the percentage

of passenger-related revenues was much higher, between 60% and 82%. Asia-

Pacic continued to record a more balanced ratio of revenues from aircraft-related

charges and passenger-related charges.

* Airport improvement fees.

** Passenger facility charges.

Source: ACI World 2023 Airport Key Performance Indicators

Chart 11:

Year-over-year % change in selected aeronautical revenue sources

(2020/2019 and 2021/2019)

2021/2019

2020/2019

-

63%

-

59%

-

50%

-

50%

-

39%

-

19%

-

17%

-

65%

-

61%

-

58%

-

55%

-

42%

-

29%

-

14%

Parking

charges

Terminal

rentals

Landing

charges

Passenger

charges (AIF* and

PFC** included)

Security

charges

Boarding bridge

charges

Ground handling

charges

24 2023 ACI Airport Economics Report

Chart 12:

Ratio of aircraft-related to passenger-related revenues by region

(2021)

Over the years, there was a reliance on passenger-based revenues, comprising

about 55%–56% of airport aeronautical revenues. The pandemic-related decrease

in passenger trafc disrupted this norm. Despite the sharp decline in landing

charges due to the pandemic, there were still air cargo operations. Thus, the

relative share of aircraft-related revenues has been more signicant since 2020

compared with passenger-related revenue. In 2021, passenger-based and aircraft-

related revenues had similar shares at 43% and 38% respectively (Chart 13).

Aircraft-related revenues* Terminal rentals** Passenger-related revenues***

32%

55%

39%

17%

29%

37%

38%

1%

4%

0.4%

1%

0.8%

41%

19%

67%

41%

60%

82%

70%

22%

43%

Africa Asia-Pacific Europe Latin America-

Caribbean

Middle East North America World

* Landing charges, parking charges, boarding bridge charges, noise and environmental charges,

navaid charges and all other aircraft-related charges.

** Terminal rentals are mainly limited to North America. The Federal Aviation Administration (FAA)

classies terminal rentals as passenger airline aeronautical revenues.

*** Passenger charges (including AIF and PFC charges), security charges, transfer/transit charges

and all other passenger-related charges.

Source: ACI World 2023 Airport Key Performance Indicators

252023 ACI Airport Economics Report

Aircraft-related revenues* Terminal rentals** Passenger-related revenues***

34%

32%

33%

34%

33%

39%

38%

11%

11%

12%

11%

11%

20%

19%

56%

56%

55%

56% 56%

41%

43%

2015 2016 2017 2018 2019 2020 2021

Chart 13:

Ratio of aircraft-related to passenger-related revenues

(2015–2021)

* Landing charges, parking charges, boarding bridge charges, noise and environmental charges,

navaid charges and all other aircraft-related charges.

** Terminal rentals are mainly limited to North America. The Federal Aviation Administration (FAA)

classies terminal rentals as passenger airline aeronautical revenues.

*** Passenger charges (including AIF and PFC charges), security charges, transfer/transit charges

and all other passenger-related charges.

Source: ACI World Airport Economics Database

26 2023 ACI Airport Economics Report

2.3 Non-aeronautical revenues

Because aeronautical revenues are insufcient to cover the full cost of the

infrastructure and other services, it is important to diversify the airport portfolio

of activities and revenues to offer passengers, customers and local business

communities a wide range of services.

Consequently, revenue sources on the commercial side of the airport business

(i.e., non-aeronautical revenues) tend to be more diverse than traditional

aeronautical revenue streams. In normal times, these non-aeronautical revenues

constitute a vital component of an airport’s income statement and its bottom

line. Such sources of revenue also tend to generate higher net prot margins

than aeronautical revenues. Not only do non-aeronautical sources of revenue

provide diversication of airport income streams but also they serve as an

additional cushion during economic downturns. Nevertheless, the decreased ow

of passengers also affected non-aeronautical revenues. The fact is that these

revenues depend on passenger trafc and is one of the reasons why the industry

was forced into survival mode during the crisis.

Non-aeronautical revenue may be derived from rents charged to concessionaires

offering a wide range of services to passengers, including car parks within the

airport boundary, retail, banking, advertising and car rental facilities on the airport

site. It may also relate to revenue from rents for ofce accommodation on airport

land, either in the form of rents for ofces built by the airport operator or rents for

airport land leased to third parties on which ofces or other facilities have been

built. Other minor sources of non-aeronautical revenue may include such various

charges as those for third-party employee security passes, pass-through charges

for utilities consumption or access charges for public transport operators.

Chart 14 provides the global breakdown of non-aeronautical revenue by source.

The pandemic shifted the balance for non-aeronautical activities, giving less

weight to passenger-dependent sources, such as retail concessions, which fell

from 26% in 2019 to 13% in 2021. On the other hand, property and real estate

revenue has gained 10 percentage points since 2019 to become the largest

source, accounting for 25% of all non-aeronautical revenues. This increase is

partly due to the role the cargo industry has played during the pandemic, with

freight forwarders and cargo handling companies continuing to lease space for

their operations within airports’ grounds. Finally, car parking remained stable

as the North America domestic market provided a steady source of income

throughout the pandemic.

272023 ACI Airport Economics Report

Although passenger trafc partially recovered in 2021, there were multiple non-

aeronautical revenue sources that experienced further declines compared with

2020. For instance, revenue from retail concessions fell 36% as many airports

implemented support measures to help retailers cope with the crisis (Chart 15).

Similarly, advertising and food and beverage had declines of 22 and 17 percentage

points respectively due to their high dependency on passenger trafc. The best

performing category was fuel and oil, mainly due to the increase in crude oil

prices that has a direct impact on variable fees paid to airports

Chart 14:

Distribution of non-aeronautical revenue by source

(2019, 2020, and 2021)

* Includes revenue from airport-operated parking lots and car parking concessions revenue

** Includes revenue from other unspecied concessions, revenue from other unspecied activities

undertaken by an airport and other unspecied non-aeronautical activities

Source: ACI World Airport Economics Database

Retail concessions Property and real estate revenue or rent Car parking*

Rental car concessions Food and beverage Fuel and oil

Other non-aeronautical revenue**

26%

17%

13%

15%

25%

25%

21%

19%

20%

6%

8%

9%

6%

5%

5%

3%

3%

2%

23%

24%

26%

2019

2020

2021

28 2023 ACI Airport Economics Report

Non-aeronautical revenues have recovered slower than aeronautical revenues.

Chart 16 illustrates the lasting impact the pandemic has had on several non-

aeronautical categories. A key factor behind this is the incentives many airports

have provided to commercial operators, such as rent reductions and discounts.

Two major categories feeling the effect of the incentives are retail concessions

and food and beverage, which are still 65% and 53% behind their 2019 levels.

Chart 15:

Year-over-year % change in selected non-aeronautical revenues

(2021/2020)

* Includes revenue from airport-operated parking lots and car parking concessions revenue

Source: ACI World 2023 Airport Key Performance Indicators

-36%

-22%

-17%

-9%

-5%

-

3%

0.3%

4%

6%

Retail

concessions

Advertising Food and

beverage

Property and

real estate

revenue or rent

Car parking* Aviation

catering

service

Utility

recharges

Rental car

concessions

Fuel and oil

292023 ACI Airport Economics Report

Property and real estate has become the most important non-aeronautical revenue

category for Asia-Pacic (44%), Middle East (28%), Europe (27%) and Africa

(22%) (Chart 17). The resilience of this category during the pandemic—mostly

fueled by cargo-related businesses—has been a key lifeline for many airports

worldwide. North America continues to lead the world in car parking revenue. Car

parking generates 36% of non-aeronautical revenue in the region, more than four

times the share of Africa (8%) and Asia-Pacic (7%).

In terms of regional changes by category year over year, Africa and Asia-Pacic

both struggled with a 63% reduction in retail concessions revenue from 2020

to 2021 (Table 2). Likewise, North America and Europe experienced decreases

of 34% and 8% respectively in this category. The Latin America-Caribbean

region had a strong year during 2021, however, with increases of 34% for retail

concessions, 28% for food and beverage, and 36% for car parking due to growing

demand for air travel and the removal of travel restrictions.

* Includes revenue from airport-operated parking lots and car parking concessions revenue

Source: ACI World Airport Economics Database

Chart 16:

Year-over-year % change in selected non-aeronautical revenues

(2020/2019 and 2021/2019)

2020/2019

2021/2019

-65%

-64%

-53%

-49%

-43%

-42%

-31%

-25%

-12%

-75%

-63%

-56%

-51%

-53%

-56%

-28%

-24%

-20%

Retail

concessions

AdvertisingFood and

beverage

Property and

real estate

revenue or rent

Car parking*Aviation

catering

service

Utility

recharges

Rental car

concessions

Fuel and oil

30 2023 ACI Airport Economics Report

Table 2:

Year-over-year % change in selected non-aeronautical revenues

(2021/2020)

Source: ACI World 2023 Airport Key Performance Indicators

Region

Retail

concessions

Food and

beverage

Car

parking

Property and

real estate

revenue or rent

Rental car

concessions

Africa -61% -13% -58% -28% -73%

Asia-Pacic -63% -42% -19% -21% -32%

Europe -9% -8% 33% -1% 13%

Latin America-Caribbean

35% 30% 39% 0.4% 54%

Middle East -4% -30% 16% 17% -53%

North America -36% -24% -14% -1% 3%

Chart 17:

Distribution of non-aeronautical revenue by region

(% of total non-aeronautical revenue, 2021)

* Includes revenue from airport-operated parking lots and car parking concessions revenue

** Includes revenue from other unspecied concessions, revenue from other unspecied activities

undertaken by an airport and other unspecied non-aeronautical activities

Source: ACI World Airport Economics Database

18%

15%

18%

17%

22%

5%

3%

2%

5%

6%

2%

7%

8%

7%

15%

9%

9%

37%

23%

44%

27%

15%

28%

12%

2%

0.6%

3%

7%

1%

21%

46%

32%

31%

46%

37%

18%

Africa

Asia-Pacific

Europe

Latin America

-Caribbean

Middle East

North America

Retail concessions Food and beverage Car parking*

Property and real estate revenue or rent Rental car concessions Other non-aeronautical revenue**

312023 ACI Airport Economics Report

3. Airport Costs

Airports are infrastructure intensive businesses—the cost structure is

characterized by prominent xed costs. The maintenance and operation of airport

components, such as runways, taxiways, aprons, parking stands and terminal

buildings, necessitate high xed costs. Above operating expenses, airports must

expand and invest in sustainable solutions to respond to air transport demand.

In 2021, total airport costs were US$99.7 billion, down from US$106.4 billion

in 2020 (Chart 18). After adjusting for ination, the evolution of industry costs

prior to the pandemic reveals modest growth levels over the period 2015–2019.

Prior to the pandemic, airport costs grew at a slower pace than global air trafc

demand. This growth in costs was broken in 2020 as airports implemented cost

saving strategies in response to the COVID-19 crisis. In 2021, total airport costs

decreased 6.9% while global air transport demand measured by passenger trafc

increased 28.4%.

The controlled growth in costs between 2015–2019 and the decrease in costs in

2020–2021 demonstrate the sustainable cost management strategy implemented

by the industry. Being infrastructure intensive and having high xed costs does

limit the ability of airports to reduce costs, however.

Chart 18:

Evolution of total industry costs and year-over-year % growth

(million US$, 2015–2021

Source: ACI World Airport Economics Database

Note: Previous years’ data was adjusted to present value according to the level of ination. Time

series represent real values with 2021 being the base year.

Total industry costs (millions US$) Year-over-year % growth

Year-over-year % change

$104,100

$106,100

$109,700

$113,900

$117,000

$106,400

$99,700

4.3%

2.0%

3.4%

3.8%

2.7%

-9.0%

-6.9%

-20.0%

-15.0%

-10.0%

-5.0%

0.0%

5.0%

10.0%

15.0%

20.0%

$-

$20,000

$40,000

$60,000

$80,000

$100,000

$120,000

$140,000

2015 2016 2017 2018 2019 2020 2021

Total airport industry costs (millions US$)

32 2023 ACI Airport Economics Report

Even though total airport costs have dropped in absolute terms, costs on a per-

passenger basis have increased as passenger trafc is signicantly below its

2019 level.

As shown in Chart 20, the cost per passenger was steadily decreasing until 2020

and has been rising since. As passenger trafc returns, the cost per passenger

should slowly return to pre-COVID levels.

Chart 19:

Distribution of airports’ total costs

(2019, 2020, and 2021)

Total airport costs can be divided between operating expenses and capital costs.

Operating expenses made up 60% of total costs in 2021, up from 59% of total

costs in 2020, the remaining 40% being allocated to capital costs, down from

41% in 2020 (Chart 19). The largely xed nature of capital costs resulted in these

higher shares for 2020 and 2021 compared with 2019.

65%

59% 60%

35%

41% 40%

2019 2020 2021

Operating expenses Capital costs

Source: ACI World Airport Economics Database

332023 ACI Airport Economics Report

3.1 Operating costs

Personnel continue to represent the largest component of operating expenses,

accounting for 36%. Contracted services, which are activities outsourced to third

parties, represent the second-largest component. These services account for

26% of operating expenses (Chart 21).

The extent to which an airport chooses to operate essential services using its

own employees (insourcing) or to contract services to third parties (outsourcing)

inevitably affects the proportions of its costs in these two main operating expense

categories. The combined share of the two labour-related cost categories—

personnel expenses and contracted services—has remained by far the largest

cost centre for airports, at around 62% of total operating expenses.

Chart 20:

Evolution of total industry costs per passenger and year-over-year

% growth (US$, 2015–2021)

Source: ACI World Airport Economics Database

Note: Previous years’ data was adjusted to present value according to the level of ination. Time

series represent real values with 2021 being the base year.

Total cost per passenger Year-over-year % change

Year-over-year % change

Total revenue per passenger (US$)

$17.35

$16.40

$15.60

$15.39

$14.85

28.91

-12.3%

-5.5%

-4.9%

-1.3%

-3.6%

92.3%

1.3%

-20.0%

0.0%

20.0%

40.0%

60.0%

80.0%

100.0%

$-

$5

$10

$15

$20

$25

$30

$35

2015 2016 2017 2018 2019 2020 2021

$28.55

34 2023 ACI Airport Economics Report

Compared with 2020, personnel expenses declined 10% (Chart 22), as many airports

reduced their Full Time Equivalent (FTE) in response to the trafc decline. General

and administration expenses dropped 15% while materials, equipment supplies,

communications, utility, energy, waste, contracted services and maintenance

decreased between 2% and 7%. Insurance, claims, and settlements increased 3%.

Chart 21:

Distribution of operating expenses

(2019, 2020, and 2021)

* Other category includes unidentied expenses incurred in carrying out an airport’s day-to-day

activities and normal business operations.

Source: ACI World Airport Economics Database

Personnel expenses Contracted services General and administration expenses

Communications, utilities, energy and waste Materials, equipment, supplies

34%

37%

36%

26%

25%

26%

4%

4%

4%

7%

7%

7%

3%

4%

4%

6%

6%

7%

5%

3%

4%

15%

14%

10%

2019

2020

2021

Maintenance (excluding contracted

services)

Lease, rent, concession fee payments Other*

Chart 22:

Year-over-year % change in selected operating expense categories

(2021/2020)

Source: ACI World 2023 Airport Key Performance Indicators

-15%

-10%

-7%

- 5%

-5%

-2%

1%

3%

General and

administration

expenses

Personnel

expenses

Communications,

utilities, energy

and waste

Materials,

equipment,

supplies

Contracted

services

Maintenance

(excluding

contracted

services)

Lease, rent,

concession

fee payments

Insurance,

claims,

settlements

352023 ACI Airport Economics Report

Looking at operating expenses throughout the pandemic, lease, rent and concession

fee payments were low compared with 2019 as certain COVID-19 relief measures

remained in place. More importantly, airports reduced costs for all categories in which

they have some control (Chart 23). However, with the return of trafc, it is expected

that personnel expenses, maintenance, utilities, energy, waste, and other expenses

will rise due to higher utilization rates across airports.

3.2 Capital costs

Capital costs have a signicant impact on airports’ bottom lines. They include

interest on outstanding debt and depreciation on airport infrastructure. When

capital costs are taken into consideration within the overall cost structure, the

signicant weighting of depreciation as part of capital costs relative to operating

expenses is indicative of the role that xed assets and infrastructure play in the

overall accounting of airports’ costs.

Depreciation, which is the cost of a xed asset allocated over time, makes up

as much as 63% of capital costs and more than one quarter of all costs and

expenses incurred by a typical airport. Chart 24 shows the breakdown of capital

costs for 2021, 2020 and 2019.

Source: ACI World Airport Economics Database

Chart 23:

Year-over-year % change in selected operating expense categories

(2020/2019 and 2021/2019)

2020/2019

2021/2019

-48%

-23%

-23%

-20%

-20%

-14%

-11%

8%

-49%

-27%

-36%

-23%

-31%

-18%

-20%

23%

Lease, rent,

concession

fee payments

Materials,

equipment,

supplies

General and

administration

expenses

Contracted

services

Maintenance

(excluding

contracted

services)

Communications,

utilities,

energy and

waste

Personnel

expenses

Insurance,

claims,

settlements

36 2023 ACI Airport Economics Report

28%

31% 31%

7%

3%

6%

66%

66%

63%

2019 2020 2021

Interest expenses Other capital costs Depreciation/amortization

Source: ACI World Airport Economics Database

In 2020, capital costs rose 9% compared with 2019, driven by the increase in

depreciation and other capital costs, including impairment. In 2021, capital costs

decreased 7%. Nonetheless, interest expenses increased 4% in 2020, followed

by 3% in 2021 as airports took on more debt to nance diverse aspects of the

business. In comparison with 2019, interest expenses have increased 9% in two

years. Depreciation, meanwhile, increased 2% in the same period (Chart 25).

Chart 24:

Distribution of capital costs

(2019, 2020, and 2021)

372023 ACI Airport Economics Report

2020/2019 2021/2020 2021/2019

8.8%

4.1%

7.8%

- 6.7%

3.3%

-1.5%

3.3%

8.9%

1.5%

Capital cost Interest expense Depreciation/amortization

Source: ACI World Airport Economics Database

Chart 25:

Year-over-year % change in capital costs

(2020/2019, 2021/2020, 2021/2019)

3.3 Economies of scale—cost structure by airport size

As shown in Chart 26, the fraction of total cost apportioned to depreciation tends

to be greater for smaller airports. On the other hand, larger airports have higher

interest expenses. Interest expense is often referred to as the cost of capital or

the cost to nance certain airport activities or expansion. Airports serving larger

markets often depend on bond markets and other instruments to nance or expand

operations. As a result, the interest paid on those debt instruments represent a

more signicant proportion of capital costs. Smaller airports frequently rely on

subsidies to nance their operations or nancial shortfall beyond revenue.

38 2023 ACI Airport Economics Report

65%

60% 60%

55% 55% 55%

32%

31%

23%

26%

31%

25%

3%

6%

12%

18%

11%

17%

1%

2%

5%

1%

3% 3%

<1m

1–5m 5–15m 15–25m 25– 40m

>40m

Operating expense Depreciation/amortization Interest expenses Other capital costs

* Size categories based on 2019 passenger trafc

Source: ACI World 2023 Airport Key Performance Indicators

Airports’ average total costs tend to decline as their market size expands, as xed

costs are spread over an expanding throughput. Chart 27 shows that for small

airports, total cost per passenger exceeded US$20 in 2019 and is in the region

of US$13–US$16 per passenger for other airports. As trafc fell away during the

pandemic, larger airports found themselves having to support infrastructures

meant to welcome millions of passengers with a fraction of those numbers. As

shown in Chart 27, airports with over 40 million passengers in 2019 saw the

largest increase in total cost per passenger with a 141% increase between 2019

and 2021.

Chart 26:

Distribution of airports’ total costs by airport size*

(2021)

392023 ACI Airport Economics Report

* Size categories based on 2019 passenger trafc

Source: ACI World 2023 Airport Key Performance Indicators

Chart 27:

Total cost per passenger by airport size*

(2019, 2021)

20.82

13.44

13.31

13.00

13.71

16.01

29.94

22.88

24.29

24.01

23.25

38.51

<1m

1– 5m 5 –15m 15 – 25m 25 – 40m

>40m

2019 2021

40 2023 ACI Airport Economics Report

4. Airport Financial Performance

Measuring protability is a complex task for the airport industry because of the

diversity of capital structures. Though some airports are listed on stock exchanges

across the globe, the highest proportion is government owned. An estimated

majority (86%) of the 4,300 airports with scheduled trafc are public, in that they

are owned by a government or governmental entity. The ACI inventory of privatized

airports (2018) reveals that over 650 commercial airports have private sector

participation. Although these account for an estimated 14% of airports worldwide,

they handle over 40% of global trafc. Consequently, the measurement of airport

nancial performance and the subsequent interpretation of economic indicators

must consider institutional objectives, in both national and local contexts. Some

airports are geared toward maximizing returns for investors or shareholders, but

others are mandated purely to recover the costs they incur in providing airport

services and infrastructure.

Any discussion about airport revenue and protability would be incomplete without

considering the role played by economic regulation. An airport’s capacity to

generate revenue is a function of throughput and its market characteristics, but

this capacity varies depending on the jurisdiction in which an airport operates.

Not only do airport managers face multifaceted challenges in the areas of safety,

security and the environment but also they must comply with economic regulations

that govern the pricing of airport services. Airport economic regulations governing

revenues, particularly those relating to airport charges, exert a direct impact on

airport nancial performance and protability.

As trafc declined due to the COVID-19 pandemic, airports’ ability to collect those

charges decreased proportionally. With less exibility in operating expenditures,

coupled with capital costs that are largely xed, the crisis posed an important

challenge for airport operators.

Airport operators have a strong incentive to spread out costs by expanding

trafc to achieve economies of scale. Independently of capacity and regulatory

constraints, this also permits revenues to be generated at given trafc levels at a

point where either a return on investment is achieved or, at the very least, the costs

of operating an airport are covered.

With restrictions on travel and the collapse in air transport demand, airport

operators did not have sufcient trafc to drive down per trafc unit costs and

achieve economies of scale, or to generate signicant aeronautical or commercial

revenues to cover costs and to service debt levels.

412023 ACI Airport Economics Report

Historically, prior to the pandemic unit revenues and unit costs would move in

tandem with each other. Despite the decrease in total costs, in 2020 and 2021, the

average cost per passenger has exceeded the average revenue per passenger

(Charts 28 and 29). That is, unit costs far exceeded unit revenues. Even so,

many airport operators provided relief measures to their tenants and users

of infrastructure despite the shortfall. A survey of ACI member airports on their

COVID-19 response in terms of aeronautical charges indicates that a vast majority

of airports (68%) have implemented some form of discount or incentive to their

charges specically to address pandemic problems and the recovery.

Chart 28:

Evolution of unit revenues costs per passengers

(2014–2021, indexed 2014=100)

Source: ACI World Airport Economics Database

Total revenue per passenger Total cost per passenger

60

80

100

120

140

160

180

2014 2015 2016 2017 2018 2019 2020 2021

42 2023 ACI Airport Economics Report

Chart 29:

Evolution of aeronautical and non-aeronautical revenue per

passenger vs. operating expenses and capital costs per passenger

(US$, 2015–2021)

* Landing charges, parking charges, boarding bridge charges, noise and environmental charges,

navaid charges and all other aircraft-related charges

** Passenger charges (including AIF and PFC charges), security charges, transfer/transit charges

and all other passenger-related charges

Source: ACI World Airport Economics Database

The impact of the COVID-19 outbreak on airport trafc has caused investors to

re-evaluate the risk of airports. The future of airport businesses and the timing

and extent of trafc recovery remain uncertain. Changes in the structure and

composition of travel demand (e.g., slower and possibly permanently reduced

business demand) and shifts in market structure and general economic conditions

must also be considered.

As a result, many airports have had their credit ratings downgraded. There is

evidence that asset betas (a measure of market risk) of listed airport companies

show a marked increase since the start of the pandemic.

3.64

3.44

3.42 3.31

3.18

3.85

4.47

5.83

5.81 5.85

5.72

5.44 4.18

5.11

2.90

2.73

2.55

2.48

2.37

3.29

3.07

8.26

7.84

7.72

7.61

7.55

8.64

8.63

1.48

1.25

1.36

1.51

1.33

3.53

4.04

10.70

10.06

9.84

9.67

9.48

16.30

17.22

6.65

6.34

5.76

5.72

5.37

12.25

11.70

2015 2016 2017 2018 2019 2020 2021

Aircraft related revenues* Passenger related revenues**

Other aeronautical revenues

Non-aeronautical revenues Non-operating revenues Operating expenses

Capital Cost

432023 ACI Airport Economics Report

Chart 30:

Debt-to-EBITDA ratio (2015-2021)

Acceptable debt levels vary from one jurisdiction to the next due to differing

ownership, nancing structures and legal considerations. Global debt-to-EBIDTA

(earnings before interest, tax, depreciation and amortization) levels have

consistently oscillated in the realm of 5:1 for many years, though a declining

trend was observed in the years prior to the pandemic. But the revenue shortfall

during the pandemic has meant that debt-to-EBIDTA ratios have exceeded 13:1,

requiring airports to request debt relief or to renance existing debt at higher costs

(Chart 30).

4.91

4.55

4.59

4.19

4.39

15.53

13.64

2015 2016 2017 2018 2019 2020 2021

Source: ACI World Airport Economics Database

4.1 Margins: operating surplus and net prot

An airport’s operating surplus (EBITDA) serves as a measure for investors

and airport managers to assess the overall nancial performance of an airport

company.

Additionally, the net prot (or loss) is dened as the difference between total

revenue (aeronautical, non-aeronautical and non-operating revenues) and total

costs (operating expenses, capital costs and taxes). Because this gure is the

result of an airport’s operations for any given period, it effectively summarizes in

a single measure the management’s ability to run the business.

In 2021, the operating surplus of the airport industry was 32%, for a net prot

margin of -13% (up from -21% in 2020, but still down 18 percentage points

compared with 2019) (Chart 31).

44 2023 ACI Airport Economics Report

4.2 Return on invested capital

Return on invested capital (ROIC) is a measure that combines almost every

element of an airport’s income statement and balance sheet. It is a robust

measure of protability, because within a single measure not only does it consider

the effective management of total revenues and total costs in a nancial year

but also it takes invested capital into account. From an investor’s perspective,

ROIC measures the payment that both debt and equity holders would receive by

providing their capital. In the case of equity holders, ROIC is the return for bearing

the equity risk. When examined through the lens of this measure, actual returns

are considerably lower across the industry compared with net prot margins.

Because of the dramatic drop in trafc and aeronautical and non-aeronautical

revenues during the COVID-19 crisis, it could take years to restore the nancial

health of individual airports and the sector in general. Because airports have

become more vulnerable, their risk prole has deteriorated, resulting in a higher

cost of capital. Debt or equity investors will factor in a risk premium to nance

airport operations and capital expenditures (CAPEX) to the same degree as

before. They will require the risk gap to be bridged via higher retained earnings or

equity capital or will charge higher lending rates.

Chart 31:

Operating surplus and net prot margins

(2015–2021)

Source: ACI World Airport Economics Database

50%

51%

50%

51%

50%

28%

32%

17%

22%

21%

21%

19%

-21%

-13%

-50%

-40%

-30%

-20%

-10%

0%

10%

20%

30%

40%

50%

0%

10%

20%

30%

40%

50%

60%

2015 2016 2017 2018 2019 2020 2021

Net profit margin

EBITDA margin

Operating surplus margin (EBITDA) Net profit margin

452023 ACI Airport Economics Report

4.8%

-3.2%

-1.9%

6.8%

-2.4%

-3.5%

5.3%

-3.1%

-2.2%

2019 2020 2021

Advanced economies Emerging and developing economies World

* Return on invested capital excluding non-operating income

Source: ACI World 2023 Airport Key Performance Indicators

Chart 32:

Return on invested capital*—advanced versus emerging economies

(2019, 2020, and 2021)

Previous studies have pointed to the global airport industry weighted average

cost of capital (WACC) being in the realm of 6% to 8% with some stability over

the last decade. It is important to note that WACC varies according to jurisdiction,

nancing structure, market conditions, trafc risk and political risk depending on

where airport operators and investors place their capital investments, to name but

a few dimensions.