David Bowman, Senior Associate Director

Board of Governors of the Federal Reserve

This information is provided for illustrative and educational purposes only. The views expressed in this presentation are solely those of the author and do not necessarily

represent those of the Federal Reserve, the Alternative Reference Rates Committee or its members or ex officio members.

Templates for Using SOFR

SOFR has a number of characteristics that LIBOR and

other similar rates like LIBOR that are based on

wholesale term unsecured funding markets do not:

• It is a rate produced by the Federal Reserve Bank

of New York (FRBNY) for the public good;

• It is derived from an active and well-defined

market with sufficient depth to make it

extraordinarily difficult to ever manipulate or

influence;

• It is produced in a transparent, direct manner and

is based on observable transactions, rather than

being dependent on estimates, like LIBOR, or

derived through models; and

• It is derived from a market that was able to

weather the global financial crisis and that the

ARRC credibly believes will remain active enough in

order that it can reliably be produced in a wide

range of market conditions.

However, SOFR is also new, and many are unfamiliar

with how to use it.

0

100

200

300

400

500

600

700

800

Secured

Overnight

Financing Rate

(SOFR)

Overnight

Bank Funding

Rate

Effective

Federal Funds

Rate

3-month T-bills 3-month GSIB

wholesale

funding

3-month AA

nonfinancial

CP

3-month A2/P2

nonfinancial

CP

Daily Volumes in U.S. Money Markets

Billions USD

$754 billion

$197 billion

$79 billion

Est. $13 billion

$1.1 billion

$343 million

$132 million

The Secured Overnight Financing Rate (SOFR)

Source: ARRC Second Report

2

4/16/2019

SOFR is published on every U.S.

business day at approximately

8:00am EST. Because the Fed has

the ability to correct and republish

this rate until 2:30pm New York

City Time each day, users may wish

to reference the rate after this

time (e.g. 3:00pm)

The SOFR rate published on any

day represents the rate on repo

transactions entered into on the

previous business day and the date

associated with each rate reflects

the date of the underlying

transactions rather than the date

of publication.

SOFR Publication

SOFR is published on the Federal Reserve Bank of New York’s

website (https://apps.newyorkfed.org/markets/autorates/sofr)

every U.S business day at approximately 8am EST. FRBNY’s

revision policies state that SOFR may be revised up to 2:30pm

EST.

SOFR is also available on Bloomberg and Reuters and can

additionally be accessed through an API offered by FRBNY

(https://www.newyorkfed.org/markets/effr-obfr)

The rate published each day represents the rates on overnight

repo transactions that were entered in to the previous business

day and that are to be repaid on the current business day. So, for

example, on April 16, the rate for transactions entered in to on

April 15 would be published.

This is similar to how the effective federal funds rate (EFFR) and

risk-free rates (RFRs) in other jurisdictions are published.

SOFR Published around 8am the next business day

SONIA Published at 9am the next business day

TONA Published at 10am the next business day

ESTER Will be published at 9am the next business day

SARON Published at 6pm the same business day

Table 3: The Publication Timing of the RFRs

3

0

1

2

3

4

5

6

7

1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018

Three Month Compounded Effective Fed Funds Rate (EFFR) and

SOFR/Primary Dealer Survey Data

Quarterly Compound SOFR

Quarterly Compound EFFR

Percent

Source: FRBNY; staff calculations

SOFR Data

• FRBNY, in cooperation with the Office of Financial

Research, began publishing SOFR on April 3, 2018.

• Prior to the start of official publication, FRBNY

released data from August 2014 to March 2018

representing modeled, pre-production estimates

of SOFR that are based on the same basic

underlying transaction data and methodology that

now underlie the official publication.

(https://www.newyorkfed.org/newsevents/speeches/2017/fr

o171108)

• FRBNY has also separately released a much longer

historical data series based on primary dealers'

overnight Treasury repo borrowing

activity. (https://www.newyorkfed.org/markets/opolicy/op

erating_policy_180309)

• A forthcoming note I have written argues that the

historical survey data is an adequate proxy for

SOFR for risk modelling or other purposes

4

Three Key Basic Choices in Determining How to Use SOFR:

• Averaging: Compound or Simple

Compound averaging is used in OIS swaps and some futures. However, many loan and FRN systems currently use simple

averaging, largely because of historical precedent. There is some basis between the two types of averaging, although it is

generally small. Use of simple averaging may be an expedient to begin using SOFR, but most ARRC members tend to feel that

moving toward compounding over time is sensible since it better interest reflects the time value of money.

• Payment Notice: In Advance, In Arrears, or Hybrid

An in advance payment structure based on SOFR would reference an average of the overnight rates observed before the

current interest period began, while an in arrears structure would reference an average of the rates over current the interest

period and would only be fully known at the end of the interest period. An average overnight rate in arrears will reflect what

actually happens to interest rates over the period and will therefore fully hedge interest rate risk in a way that LIBOR or a

SOFR-based forward-looking term rate will not.

• Underlying Market: SOFR (U.S. Treasury Repo Market) or SOFR Derivatives (SOFR futures or OIS)

The U.S. Treasury Repo Market underlying SOFR is already deep and highly liquid. SOFR futures and OIS are growing but still at

early stages and are not yet deep or highly liquid enough to produce a robust, IOSCO-compliant rate). Many market

participants would prefer term rates based on derivatives, but at the same time, the ARRC and the FSB have warned that

people should not simply wait for term rates and that those who are able to move to SOFR should seek to do so if they can.

5

For derivatives, it is fairly clear that the market will be based on compound SOFR in arrears. For cash products, ARRC Working Groups

have so far gravitated toward four basic models of SOFR use:

• Published Simple or Compound Average of SOFR Set in Advance

Should require few or no changes to existing systems to use.

• Published Forward-Looking Term SOFR set in Advance

These rates may not come until 2021, but they should require few or no changes to existing systems to use.

• Simple Average of SOFR Set in Arrears

Would require few or manageable changes to existing systems to use

• Compound Average of SOFR Set in Arrears

Will require more changes to existing systems to use.

The Different Potential Versions of SOFR-Based Rates

6

Published SOFR Averages

1

1.5

2

2.5

3

3.5

Jan-18 Apr-18 Jul-18 Oct-18 Jan-19

Recent Movements in SOFR versus Averaged SOFR

SOFR

1-Month Average SOFR

3-Month Average SOFR

6-Month Average SOFR

Percent

Source: Federal Reserve Bank of New York; Federal Reserve Board staff calculations

• The Federal Reserve Bank of New York has

indicated that it plans to publish averages of

SOFR in the first half of next year.

• Averages of SOFR show very little or no impact

from these kinds of temporary, day-to-day

volatility that can be seen in overnight SOFR

around year/quarter-ends.

• A 3-month average of SOFR is less volatile than

3-month LIBOR, even over the last year end.

• FRBNY has not stated whether it will publish

compound or simple averages, but the

differences between the two choices would

typically be small.

• Further details on the average rates that FRBNY

would produce should follow, but from an

systems perspective, using these rates in

advance would be easily implemented.

0

2

4

6

8

10

12

2000 2002 2004 2006 2008 2010 2012 2014 2016 2018

Historical Basis Between Compound and Simple SOFR (bp)

Monthly Quarterly Semiannual

7

1.5

1.7

1.9

2.1

2.3

2.5

2.7

Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 Mar-19 Apr-19 May-19

Comparing an Indicative SOFR Term Rate to EFFR OIS

3-Month Indicative SOFR Forward-Looking Term Rate

3-Month EFFR OIS

Source: Federal Reserve Bank of New York, CME, Bloomberg, and Federal Reserve staff calculations

Percent

• Federal Reserve staff members are

producing “indicative” forward-looking

term rates that are not meant to be used in

contracts and are not IOSCO compliant, but

may help provide a sense as to how the

term rates will behave (a link to this data,

which are periodically updated, is on the

ARRC’s website).

• The forward-looking term rates that the

ARRC envisions will effectively be segments

of the SOFR OIS curve, and as such should

behave much like EFFR OIS rates do today.

• The forward-looking term rates should also

be tightly linked to compound averages of

SOFR, just as EFFR OIS rates are tightly

linked to compound averages of EFFR.

Forward-Looking Term Rates

0

1

2

3

4

5

6

2001 2003 2005 2007 2009 2011 2013 2015 2017

Comparing EFFR OIS and Compounded Averages of EFFR

3-Month OIS

3-Month Compound Average

Percent

Source: Federal Reserve Bank of New York, Bloomberg; Federal Reserve Board staff calculations

8

Monthly SOFR Futures and a number of SOFR FRNs are based on simple averages of

SOFR in Arrears. FRN issuance systems had already been developed for the effective fed

funds rate based on simple interest, making it easier for initial SOFR FRNs to use simple

interest.

Loan systems that use overnight LIBOR, Prime, or the effective fed funds rate based on

simple interest are also already frequently in place if not all that regularly used.

Simple Averages of SOFR in Arrears

9

Three-month SOFR futures, SOFR OIS, and some recent SOFR FRNs are based on compounded averages of SOFR in

Arrears, but in general these systems are not yet in place for cash products

Where

d

b

= the number of business days in the interest period

d

c

= the number of calendar days in the interest period

r

i

= the interest rate applicable on business day i

n

i

= the number of calendar days for which rate r

i

applies (on most days, n

i

will be 1, but on a Friday it will generally be 3,

and it will also be larger than 1 on the business day before a holiday). This can also be stated as the number of

calendar days from and including business day i to but excluding the following business day.

N = the market convention for quoting the number of days in the year (in the United States, the convention is N = 360)

And i represents a series of ordinal numbers representing each business day in the period.

This term is to annualize

the compounded rate

Compound Averages of SOFR in Arrears

This term is to translate

the annualized overnight

rate Into an effective

daily/next business day

rate

10

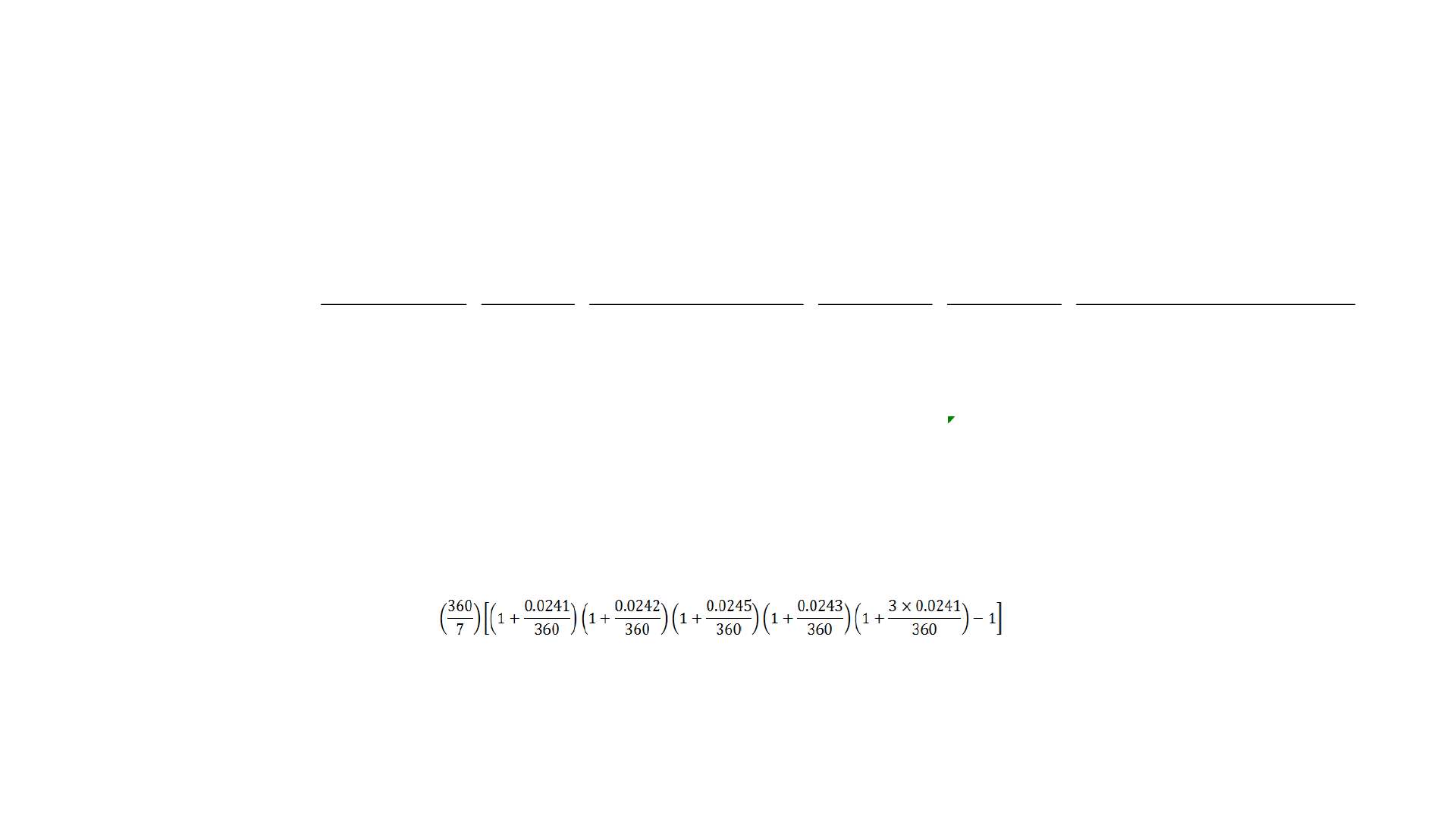

Secured Overnight

Financing Rate

(Percent, Annualized)

Number of

Days Rate is

Applied

Effective Rate

(Not Annualized)

Principle

Principal +

Accumulated

Interest

Interest Charge for Next Business

Day

(Effective Rate*(Principal+Accumulated

Interest))

Monday, Jan 7, 2019 2.41 1 0.0241/360 = 0.006694% $1,000,000.00 $1,000,000.00 $66.94

Tuesday, Jan 8, 2019 2.42 1 0.0242/360 = 0.006722% $1,000,000.00 $1,000,066.94 $67.23

Wednesday, Jan 9, 2019 2.45 1 0.0245/360 = 0.006806% $1,000,000.00 $1,000,134.17 $68.06

Thursday, Jan 10, 2019 2.43 1 0.0243/360 = 0.006750% $1,000,000.00 $1,000,202.23 $67.51

Friday, Jan 11, 2019 2.41 3 3*0.0241/360 = 0.020083% $1,000,000.00 $1,000,269.74 $200.89

Monday, Jan 14, 2019 --- --- --- $1,000,000.00 $1,000,470.63

Payment Due

Monday, Jan 14, 2019

$1,000,470.63

Annualized Compound Rate of Interest:

= (360/7)*(.047064%) = 2.4204%

Compound Interest on a One-Week SOFR Loan of $1 Million Drawn on Jan 7, 2019

An Example of the ISDA Compound Average Formula

11

An Index would compound daily SOFR every day., similar to a price-level index It could serve as a trusted key allowing

desired.

Or, recursively

Taking the ratio of two Index values automatically calculates compounded interest over the period between the two dates

-1

Making Compound Calculations Easier – a SOFR Compound Index

12

Deciding Which Segments to Compound

One issue is whether to compound any margin or to only compound the rate and add margin separately

• Compound both rate and margin:

Pros: Economically pure – in theory, both rate and margin should compound

Cons: Harder to calculate, cannot rely on an Index to compound both rate and margin, will have some basis

relative to OIS

• Compound rate but not margin

Pros: Easy to calculate, can rely on an Index to compound the rate, will be fully hedged relative to OIS

Cons: Not economically pure

ARRC Working Groups have gravitated toward compounding the rate but not margin

13

Models for Using RFRs in Arrears

The FSB and National Working Groups are looking at several models for using overnight risk-free

rates in cash products. There are several different variants of both in Arrears and in Advance

conventions, as well as potential hybrid conventions that attempt to bridge the difference between

the two by allowing for advance notice while also allowing for complete or almost complete hedging

of contemporaneous rate movements.

• In Arrears

o Plain: Used averaged rate over current interest period, paid on last day of the period (day T)

o Payment Delay: Use averaged rate over current interest period, paid k days after day T (Note: ISDA’s

conventions for SOFR swaps use a 1-day payment delay)

o Lookback: Use averaged rate over current interest period lagged k days (a 3-5 day lookback has been used

in SONIA FRNs)

o Lockout: Use averaged rate over current period with last k rates set at the rate for day T-k (a 3-5 day

lockout has been used in most SOFR FRNs).

14

Day 1

(First Day of

Interest Period)

Day 2 … Day T-2 Day T-1

Day T

(Last Day of

Interest Period)

Day T+1

(First Day of

Next Period)

Day T+2

SOFR for

Day 1

Published

SOFR for

Day T-3

Published

SOFR for

Day T-2

Published

SOFR for

Day T-1

Published

SOFR for

Date T

Published

Plain Arrears

Use SOFR for

Day 1

Use SOFR for

Day 2

…

Use SOFR for

Day T-2

Use SOFR for

Day T-1

Use SOFR for

Day T

Payment Due

Use SOFR for

Day 1

Use SOFR for

Day 2

…

Use SOFR for

Day T-2

Use SOFR for

Day T-1

Use SOFR for

Day T

Payment Due

Use SOFR for

Day 1

Use SOFR for

Day 2

…

Use SOFR for

Day T-2

Use SOFR for

Day T-1

Use SOFR for

Day T-1

Payment Due

Use SOFR for

Day 0

Use SOFR for

Day 1

…

Use SOFR for

Day T-3

Use SOFR for

Day T-2

Use SOFR for

Day T-1

Payment Due

Models for Using SOFR in Arrears

Arrears with

Payment

Delay

Arrears with

1-Day

Lockout

Arrears with

1-Day

Lookback

OIS generally settle at

T+2

15

Convention #1: A lookback uses the rate from k days ago to calculate today’s interest owed. For example, in a 2-day lookback, if

today were Friday, one would use Wednesday’s rate in calculating today’s interest. A narrow definition might be taken to imply

that you should apply Friday’s weighting (n

i

= 3 since Friday covers three calendar days until payment is due) to Wednesday’s rate,

but a more sensible reading would be to apply Wednesday’s weighting to Wednesday’s rate, which has been called an

“observation shift”

Lookback (narrowly defined):

Lookback with observation period shift:

A lookback/observation shift will be fully hedged relative to OIS while a lookback with no observation shift will have some basis.

Convention #2: Is using the SOFR rate published today for the business day’s rate a lookback? The SOFR rate published today

represents that market rate for borrowing on the previous business day to be repaid today, and FRBNY post it as the rate for the

previous business day. OIS markets would not refer to this as a lookback, and some recent FRNs have taken the same convention,

but some of the early FRN issuances did call this a 1-day lookback. The payments and when they are to be made regardless, but

potential differences in what constitutes a lookback can cause confusion if not understood.

A Few Convention Issues for Lookback Structures

16

Pure Arrears:

Payment Delay:

Lookback (narrowly defined):

Lookback with observation period shift:

Payment Delay with interest period shift:

Lockout:

For Those Who Like Math

17

In Arrears: Lockout Versus Lookback

Payment Delays or Lookbacks with observation shift are consistent with ISDA compounding definitions and

more easily hedged and does not skip any interest days. A lockout does skip some days and has some basis to

the In Arrears model used in OIS swaps (below), On the other hand, for most of the interest period, the daily

interest rate will correspond to the most recent published value of the RFR, which may be important to certain

investors who do not have hedging needs.

-15

-10

-5

0

5

10

15

20

25

2000 2002 2004 2006 2008 2010 2012 2014 2016 2018

Basis between Quarterly Compounded 3-day Lockout vs Pure Arrears (bp)

18

Most cash product

issuances have used in

Arrears frameworks,

but there have been a

wide array of choices

between lookbacks,

payment delays, and

lockouts as well as

compounding versus

simple averaging.

Models of In Arrears (Continued)

SOFR FRNs SONIA FRNs

Swiss Working Group

FRN

Recommendations

OIS

In Arrears/In Advance

In Arrears In Arrears In Arrears In Arrears

Averaging

Generally simple

average, but several

recent issuances have

used compound

averages

Compound Average Compound Average Compound Average

Payment Delay

Generally none

(Payment due next

business day after

Accrual Period ends),

although one recent

issuance employed a

payment delay except

for the final payment

None (Payment due

next business day

after Accrual Period

ends)

None (Payment due

next business day

after Accrual Period

ends)

One business day

(Payment due two

business days after

accrual period ends)

Lookback

0-2 business days 5 business days 3-5 business days None

Lockout/Suspension Period

Generally 2 business

days

None

None

None

Comparing Typical Conventions for RFR-Based FRNs and OIS

19

In Arrears/In Advance (continued)

The amount of basis between In Advance and In Arrears depends on the frequency of interest periods. With a

one-month reset, the basis is comparable to the amount of basis between simple and compound averaging.

Even at 3- or 6-month resets the basis is limited and averages out to zero over longer periods of time.

-60

-50

-40

-30

-20

-10

0

10

20

30

40

1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012

Basis Spread between in Advance and In Arrears 5-Year Loan with Monthly

Payments (bp)

1MonthSpread 3MonthSpread 6MonthSpread

20

Hybrid Models

Hybrid Models mix an in Advance payment structure with in Arrears accrual of principal/interest owed:

Principal Accrual: Payments set In Advance, principal and interest accrue In Arrears

Interest Rollover: Payments set In Advance, any missed interest relative to In Arrears is rolled over

into the next payment period.

Either of the Hybrid Models can substantially further cut the basis relative to a pure In Arrears baseline, even for a

product with a less frequent reset such as 5/1 ARM, while still allowing borrowers to know their payments at the

start of the interest period

-10

-8

-6

-4

-2

0

2

4

6

8

10

1983 1986 1989 1992 1995 1998 2001 2004 2007 2010

Comparing Bases to In Arrears for the Hybrid 5/1 Mortgage Models

Principal Adjutments

Interest Rollover

Basis Points

Source: Federal Reserve Bank of New York, Haver; Federal Reserve Board staff calculations

21

Hybrid Models (cont’d)

These models don’t materially alter the cumulated payments that a borrower would make relative

to a basic Last Reset In Advance Product. They could be fairly easy to incorporate in to some

business loans, and from a systems perspective, all that would be needed is the ability for systems

to accrue interest and billing or principal accumulation accordingly.

40%

50%

60%

70%

80%

90%

100%

110%

1983 1986 1989 1992 1995 1998 2001 2004 2007 2010

Comparing Cumulated Payments due on Hybrid Models and an In Advance Mode in a 5/1 ARMl

Last Reset 6M Principal Adjustment Interest Rollover

Percent of Loan Amount

Source: Federal Reserve Bank of New York, Haver; Federal Reserve Board staff calculations

22

Questions?

23