In pursuit of impact

Mission-led businesses

November 2016

Contents

Executive summary 1

Outline of methodology and headline gures 6

Exploring mission-led businesses: 10

How are businesses committing to mission?

Exploring mission-led businesses: 19

What are the key insights into mission-led businesses?

Conclusion: Looking ahead 27

Appendix A: Methodology: Sizing the mission-led business market 32

Appendix B: Methodology: Proling mission-led businesses 37

Appendix C: Example set of mission-led businesses 45

Executive summary

This research

was jointly

commissioned

by the Oce

for Civil Society

and Innovation

and Big Society

Capital to provide

a snapshot of

the volume and

characteristics

of mission-led

businesses in

the UK.

Notes: (1) OCSI formerly sat in the Cabinet

Oce, and is now part of the Department for

Culture, Media & Sport. (2) Deloitte Millennial

Survey 2016. (3) Deloitte Culture of Purpose

2014. (4) Edelman Global Barometer, 2016.

Purpose of the report

In March 2016, the Oce for Civil Society and Innovation (OCSI)

1

launched a

review of mission-led business in the UK. Mission-led businesses are for-prot

businesses which make a powerful commitment to social impact outside the

traditional social sector legal forms.

The review was launched in response to emerging business and market trends

that reect the growing role for mission-led businesses in the wider market.

Thesetrends include:

Increasing expectations for business to adopt a responsible role in

wider society. For example, nine out of ten millennials believe that the

success of a business should be measured by more than just its nancial

performance;

2

Employees becoming more optimistic about businesses that make

acommitment external to themselves. One survey indicates that workers

are twice as likely to be optimistic about businesses with a strong sense

of purpose. These businesses are considered more likely to be resilient to

future shocks and “able to stay ahead of industry disruptions”;

3

and,

The digital economy creating greater transparency, ensuring trust in

business becomes ever more important at a time when public trust in

business is at an all time low. In a global survey, only half the public “trust

institutions to do what’s right”.

4

This research was jointly commissioned by OSCI and Big Society Capital (BSC)

who both recognise the need for additional research to learn more about

those businesses that explicitly seek to make a wider impact on society, in

order to consider how best to support them. It seeks to build on a body of

existing literature, including the G8 Mission Alignment Group Report ‘Prot-with-

Purpose Businesses’, to develop new, independent, primary research that can

provide a snapshot of the volume and characteristics of mission-led business

in the UK. This research is intended to provide initial insights that can inform

policy makers, support BSC in their role as market builders, further the wider

conversation on social investment and provide a platform for future research

and study.

1

In pursuit of impact | Mission-led businesses

Notes: (1) Prot-with-purpose businesses,

G8 Subject Paper of the Mission Alignment

Working Group, September 2014. (2) See Call

for Evidence:, Cabinet Oce, 2016.

Building a denition of mission-led business

We recognise that this is a complex and developing topic. Mission-led businesses

exist within a wide spectrum of businesses and social sector organisations.

Forthe purpose of this research, we have sought to dene mission-led

business in terms of their motivations and corporate form, in order to examine

the characteristics of these organisations and get a sense of the scale of this

movement. So, whilst many other organisations may be ‘mission-led’ (e.g.

community interest companies (CICs), charities) they are not the focus of this

particular report.

This report sets out an approach for dening and identifying businesses that

have no legal restrictions on their prot distribution but which have a genuine

commitment to wider social and environmental impact. As an emerging business

trend, it is too early to describe this as a clear ‘sector’ or ‘market’. It is better

described as a movement or an approach to business where social impact is

seen as a critical driver of value creation. The wider ‘social impact’ movement

goes beyond the denition of mission-led business used in this paper.

To identify and explore mission-led businesses, a set of denitional criteria were

developed with government ocials, Big Society Capital and an expert Deloitte

advisory panel. This denition of mission-led businesses is consistent with the

denition of ‘prot-with-purpose businesses’ in the G8 Social Impact Taskforce

paper

1

and as set out in the terms of the Mission-led Business Review.

2

The rst element of the identication approach was a clear ‘gateway’. To be

considered ‘mission-led’ a business must clearly declare its intent to be so.

Oncethrough this gateway, four critical questions were applied:

What is the strength of strategic commitment to a social or environmental

mission?

How central is the mission to the core business model – does it reect the

core commercial activity and shape prot distribution?

Does the way the business is governed and operated reect the mission?

Does the business publicly position itself as mission oriented?

It is acknowledged that this is “an” approach rather than “the” approach. Whilst

the research helps to progress our understanding of these business trends,

more can be done to rene the approach and build out the necessary data sets

to develop a more complete understanding of this movement.

This report sets

out an approach

for dening

and identifying

businesses that

have no legal

restrictions

on their prot

distribution

but which

have a genuine

commitment

to wider social

impact.

2

In pursuit of impact | Mission-led businesses

The approach we have taken

The research adopts two complementary approaches: (i) a statistical estimate

of the size and scale of mission-led businesses within the overall market and;

(ii) a review of key characteristics of an example set of businesses that meet

the criteria, extracted from a larger set of businesses identied as potentially

mission-led sourced from existing literature and expert interviews.

i. To capture a statistical estimate of the volume of mission-led businesses

within the overall market, a random sample of over 500 businesses was

drawn from a database of UK private sector businesses. The sample was

split to assess those businesses with nancial information and those

without. This enabled a more precise estimate of overall turnover and

workforce. The two samples were assessed against the criteria and brought

together to provide total estimates for mission-led business volume,

turnover and workforce. Whilst these estimates are statistically robust,

the size of the sample meant that this approach was limited in its ability to

generate more specic insights.

ii. A second, complementary approach was used to generate more detailed

insight on the characteristics of mission-led businesses. Insights were

generated through an analysis of an example set of 250 businesses that

were extracted from an examination of over 1,000 businesses that had

been identied as potentially mission-led from existing literature and expert

interviews. Over 30 interviews were also conducted in order to gain further,

detailed insight.

In both cases, each business was rst passed through an ‘assessment gateway’

to identify whether it declared a credible intent to contribute to a wider social or

environmental mission. Once through this gateway, the business was assessed

against a series of weighted criteria, associated with the key tests of a mission-

led business. These weightings were developed pragmatically. For example,

whilst reporting against mission would be a strong indicator of commitment,

many businesses assessed were too small or too young to have developed a

reporting capability, and thus, whilst important, the weighting of this criteria was

balanced with other core factors across the tests. Future research could ex

these weightings and assumptions to test how they impact outcomes.

3

In pursuit of impact | Mission-led businesses

Notes: (1) Informed by BIS Business

Population Estimates 2015. (2) See page 23

Key ndings

Mission-led businesses cover a wide range of industries, sizes and social/

environmental focuses. The research suggests that they already account for

4.3% of turnover in the UK private sector. This is comparable to the size of the

SME market in the Transportation and Storage sector.

1

Whilst many mission-led businesses have been around for a long time, most

are youthful and this, together with the many trends driving the importance of

corporate purpose, suggests that these businesses are growing in volume.

Mission-led businesses, in general, exemplify comparatively strong diversity

ofleadership.

The research conrms evidence that had previously been anecdotal:

Mission-led businesses tend to be more prevalent in sectors which have

a more obvious relationship with socio-economic good.

This generally

enables closer committment to mission across the core business model and

operations and more closely aligns mission, growth incentives and investor

interests;

Older mission-led businesses tend to be larger organisations, often with an

international focus and strong impact reporting, but alignment between

mission and their core product or service may be more nuanced; and,

Younger mission-led businesses are more likely to use innovative

business models and to have a mission that is core to the business model,

commensurate with being ‘born mission-led’. These businesses also tend to

be smaller, locally-focused, have less mature reporting structures, and where

founder run tend to have limited succession planning.

A sixth of businesses in the example set articulatecommitmentto mission in key

governing documents, and the majority of businesses tended to have ‘atter’

leadership structures.

Mission-led businesses in the consumer sector tend to be larger than

inothersectors,which could suggest that consumer-facing companies are more

likely to ‘repurpose’ as mission-led.

There is growing evidence that the benets for businesses of committing to

positive social impact are wide-ranging and every business interviewed felt

that their mission had been a competitive advantage in terms ofattractingand

retaining employees and building relationships with clients.

Mission-led

businesses cover

a wide range

of industries,

sizes and social/

environmental

focuses. The

research

suggests that

they already

account for 4.3%

of turnover in the

UK private sector.

4

In pursuit of impact | Mission-led businesses

Recommendations

This report examines the role of mission in catalysing mutual benets for both

business and society. Mission can drive scale and sustainability in business,

which in turn reinforces and extends the impact of mission.

There is a new and vital opportunity to support the growing inuence of mission.

Start-ups and existing businesses can be encouraged to adopt a mission.

Businesses can be supported to take forward impact reporting and make

quantiable mission-oriented commitments. Mission-led businesses can be

oered help to bolster their commercial expertise and manage competitive

challenges.

To make the most of this opportunity, there should be, in the short and medium

term, enhanced private or public provision of:

Access to advice and networks to share learning and support decision

making, both among mission-led businesses and between mission-led

businesses and inuential, less mission oriented businesses. This could help

foster ecosystems of mutually supportive businesses who are motivated in

similar ways; and help mission-led businesses better manage growth and

leadership transition;

More accessible and more standardised impact reporting, with access to

research, tools and resources to enable this; and

Some form of recognition for mission-led businesses that would support and

incentivise further growth.

Finally, this report sets out a range of areas for further research, including

further representative sampling, the changing role of mission over the business

life cycle and the importance of long-term planning in ensuring the sustainability

and success of mission-led businesses.

5

In pursuit of impact | Mission-led businesses

Outline of

methodology and

headline gures

6

Identifying mission-led businesses

Mission-led businesses have been identied using a gateway

and series of tests that seek to assess both the mission of the

business and the way in which the business is designed to

deliver on that mission

Key characteristics of a mission-led business

A number of denitions exist in the market for businesses with commitment to broader

impact. These range from ‘social enterprises’ to ‘for-benet companies’ to ‘purpose driven

businesses’, among others.

1

The core denition of a ‘mission-led business’, as expressed through the initial Mission-led

Business Review Call for Evidence,

2

refers to a business that:

• Can fully distribute its prots, with no legal restrictions on prot distribution either through

aprot lock or through legal form (e.g. CICs);

• Identies an intention to have a positive social or environmental impact as a central

purpose of its business;

• Makes a long-term or binding commitment to deliver on that intention through its business

and operations; and

• Reports on its social impact to its stakeholders.

To fully embody this denition, an exemplar mission-led business will have both a mission

that specically targets social or environmental impact and an organisation that is designed

to support this. This includes its strategy, governance, operations (including interaction

with key stakeholders e.g. employees, customers, suppliers, community, owners), investor

relations and reporting.

Challenges to identication

Mission-led businesses can be found across the market. However they are dicult to identify

given the lack of standardised identifying characteristics, the presence of many younger

mission-led businesses that may not have fully congured their organisation or developed

reporting, and the limited availability of external data that can be used to assess the smaller

and medium sized businesses.

Approach

Given these challenges, the approach chosen to identify mission-led business is highly

pragmatic, and relies on publicly available information for eciency. The criteria chosen build

on the criteria described in the Call for Evidence and the G8 subject paper.

3

The approach introduces an ‘assessment gateway’. This recognizes the central requirement

that to be ‘mission-led’ a business must declare an intention to contribute to a social or

environmental mission. Subsequently, four tests are applied to assess the quality of this

intent and the degree to which the business is aligned behind the intent.

Notes: (1) Existing denitions can be found

through Social Enterprise UK, GameChangers

500, Blueprint for Better Business, Deloitte

US Social Impact. (2) Mission-led Business

Review: Call for Evidence, May 2016 (3) Prot-

with-purpose businesses, G8 Subject Paper

of the Mission Alignment Working Group,

September 2014.

An exemplar

mission-led

business will

have both a

mission that

specically

targets social or

environmental

impact and an

organisation that

is designed to

support this.

7

In pursuit of impact | Mission-led businesses

For the purposes of this report, we have analysed an example

set of mission-led businesses across four areas: intent, business

model, governance and operations, and external perception.

The four tests used in the identication and assessment of mission-led businesses

The nature of the ‘commitment’ to mission has been assessed through four weighted tests,

developed from existing research and expert interviews, workshops and validation.

1

Those

passing a threshold level of commitment have been identied as mission-led businesses.

Intent

What is the

strength of

strategic

commitment to

a social or

environmental

mission?

Business Model

How central is the

mission to the core

business model

– does it reect the

core commercial

activity and shape

prot distribution?

Governance

and Operations

Does the way the

business is

governed and

operated and the

key stakeholders

engaged reect

the mission? Does

the business

report on impact?

External

Perception

Does the business

publicly position

itself as mission

oriented?

Mission-led business

denition

Notes: (1) See Appendix A for more details on

developing the denition, assessment criteria

and assessment approach.

8

In pursuit of impact | Mission-led businesses

Market size

Mission-led businesses in the UK private sector are estimated

to constitute 2.7% of business volume, 4.3% of the economy

and 4.5% of the workforce.

Understanding mission-led businesses

Whilst many businesses will declare commitment to a ‘mission’ of some kind, these include

types of mission that are not socially or environmentally focused (e.g.customer service or

innovation), and many organisations that are not truly guided by their mission.

Some businesses, however, are genuinely guided by a social or environmental mission and

are suciently committed to be considered a mission-led business.

Random sampling of businesses in the UK, followed by application of the gateway criteria

andassessment against the four tests, provides an estimate of the size and scale of the

‘market’ of mission-led businesses (see Appendix A).

1

Notes: (1) Estimates for turnover informed

by BIS Business Population Estimates 2015.

Estimates for workforce informed by UK

Labour Market: August 2016, ONS Statistical

release. For further notes on methodology

and assumptions see Appendix A.

A random

sampling

approach

provided an

estimate for

the size and

scale of the

‘market’ of

mission-led

businesses in

the UK.

123,000 mission-led businesses

2.7% of business volume

£165 billion turnover

4.3% of the economy

1.4 million employees

4.5% of the workforce

9

In pursuit of impact | Mission-led businesses

Exploring mission-

led businesses:

How are businesses

committing to

mission?

10

Exploring the characteristics

of mission-led businesses

The gateway criteria of a mission-led business have been

applied to a long list of candidate businesses to create an

example set. The four tests then have been used to examine

the mission-led business ‘market’.

Understanding the four tests

In this section, an example set of mission-

led businesses is explored through the four

tests using publicly available information.

Allbusinesses included pass the initial

gateway criteria: being for-prot companies

with a social or environmental intent.

The example set was developed from

acandidate list of over 1,000 companies.

The diagram on the right shows the

contribution of each test to the overall score

(out of 10). A company must score >5 to be

classied as a mission-led business. Tests

were dened for this report in consultation

with advisors as described in Appendix

B and are made up of sub-dimensions as

shown on the right.

The initial gateway is wider than the

G8 study which looks for long-term

commitment (e.g. through evidence in

articles) which may be less present in

established businesses looking to transition

to being mission-led.

The insights and trends explored using the

example set provide some insight into the

characteristics of the wider mission-led

business ‘market’. Further sample-based

research would be required to develop

statistically representative data.

Intent

• existence of a

central mission of

the organisation

integration into

overall business

strategy

• a long-term

commitment to the

mission

• mission

description*

• mission scale and

mission type*

Business Model

• use of core

operating assets to

further mission

• prot distribution

strategy

• alignment of

investor interests*

External Perception

• press reports and awards

• brand perception*

Governance

and Operations

• governance

structure

• mission integration

into operations

(including

stakeholder

engagement) and

ways of working

• alignment of impact

initiatives with

mission

• impact reporting

• female and minority

leadership*

• decision-making

processes*

Mission-led business

denition

1

100%

Notes: *captured as a sub-

dimension but did not contribute

to scoring as inappropriate or

due to lack of publicly available

information. (1) See Appendix B

for more details on developing the

denition.

40%

25%

20%

15%

11

In pursuit of impact | Mission-led businesses

Intent:

Mission type and scale

Mission-led businesses in the example

set dier in mission type, with the

majority focusing on social issues and a

quarter focusing on environmental issues.

Intent is the most critical test in dening

and identifying a mission-led business and

features in the gateway for analysis; stated

intent to deliver a social or environmental

outcome as a core purpose is a necessary,

if not sucient, feature of amission-led

business.

1

Mission description

Mission-led businesses refer to their mission

in dierent ways, there is no common

taxonomy. Where Spacehive talk about

‘mission’, Unicorn Grocery oer ‘Principles of

Purpose’ and Mediae describe their ‘goals’.

Across these businesses each of these terms

establish a similar imperative for action.

Other mission-led businesses incorporate

mission into their description of themselves.

For example, “We at Happiness Works are

passionate about creating a better world of

work. We believe if more people genuinely

enjoyed their work then everyone would

benet, including employees, customers

and shareholders.”

Mission type

Mission-led businesses have ambitions

across a variety of areas. Of the example

set, 53% are explicitly focused on social

issues and 26% on the environment

andsustainability.

Mission scale

The majority of mission-led businesses

(72%) have a narrowly focused mission on

an issue limited to a particular beneciary

group or geography.

2

These organisations

are more likely to have educational and

community goals, often linked to specic

locations. For example, Settle Hydro is a

community-owned hydroelectric scheme

which aims to benet the local community

by providing green electricity and using

prots to support local projects.

Mission-led businesses with a broadly

focused mission are more likely to be

international and have a mission related to

the environment. Examples include Elstat

which is a refrigeration company aiming to

reduce energy consumption and carbon

emissions, and Seawater Greenhouse which

uses seawater and sunlight to provide

sustainable agriculture solutions in

inhospitable climates.

Notes: (1) Intent accounts for 40% of the

overall mission-led business score, broken

down into ‘Integration into Strategy’ (80%)

as measured by inclusion of mission

into strategic documents and degree to

which mission is integrated within the

overall business strategy, and ‘Long-term

commitment (20%) as dened through

strategy documentation. (2) Narrowly focused

missions refer to missions that are focused on

a more specic goal for a smaller community,

whereas broadly focused missions relate

to grander goals for larger populations.

(3)Growing the social impact market includes:

support for other social enterprises and

third sector organisations, and support

for businesses/public bodies to develop

social impact; Community support includes:

Housing, Support for vulnerable groups

e.g. children and the elderly, Improving the

local community; Environment includes:

Carbon reduction, Waste reduction/recycling,

Sustainable growth

If a business is

founded with a

mission inherent

to its identity,

that mission

is unlikely to

change. However,

some businesses

transition

to become

a mission-

led business

once they are

established.

Number of mission-led businesses

Intent type

1

0

20

40

60

80

Support small

businesses

Other

Employability

Education

Healthcare

Community

support

3

Growing the

social impact

market

Environment

65

53

36

26 26

21

15

8

12

In pursuit of impact | Mission-led businesses

Intent:

Score range

Mission-led businesses in the example set identify and commit

to a social/environmental purpose. This purpose is typically

reected in their strategy and committed to through a long-

term target or goal.

The strength of Intent was assessed against

two sub-dimensions: the integration of

mission into business strategy and long-

term commitment to the mission.

Integration of mission into business

strategy

The majority of these mission-led

businesses (65%) are perceived to have

strong integration of mission into business

strategy.

Oomph! is one example of a business

with this strong level of integration. With

a mission to improve the health and well-

being of older adults, their strategy focuses

explicitly on improving training for care

sta in order to enable them to conduct

exercises and activities for elderly patients

in care homes.

In contrast, one hotel qualies as a mission-

led business but has a less direct alignment

between its mission and its strategy.

Their mission suggests a commitment

to sustainable development of the local

environment and community. Whilst this

mission forms a strong feature of their

business model and operations, the

strategic direction of the business is focused

on growing a chain of hotels.

Long-term commitment

The majority of mission-led businesses

have a long-term commitment to mission

reected in their public documents,

although only half (49%) make a specic

measurable commitment. For example,

ClimateCare commits to cutting 20 million

tonnes of CO

2

and improving the lives of 20

million people by 2020. Of the remainder,

most (49% of total) make commitments that

are less specic or short to medium term.

Intent scores

40% of mission-led businesses in the

example set achieved the maximum score

for Intent and gained top scores for both

sub-dimensions. For example, Traidcraft is a

leading fair trade organisation dedicated to

ghting poverty through trade.

As shown in the graph above, 27% of

qualifying mission-led businesses have a

weaker

1

Intent score with low scores across

this test. Despite getting a low score in the

most critical category, these businesses

still qualied as mission-led businesses by

scoring well in other tests and passing the

gateway criteria.

The majority of

these mission-led

businesses (65%)

are perceived

to have strong

integration

of mission

into business

strategy.

Notes: (1) Weaker Intent scores= 3.12 or

less, strong Business Model scores= 2 or

more, strong Governance and Operations

scores=1.5 or more and strong External

Perception scores=0.75

Number of mission-led businesses

Intent score (/4)

0

20

40

60

80

100

120

43.63.523.23.123.042.722.64

Intent scoring

13

In pursuit of impact | Mission-led businesses

Business model

The majority of mission-led businesses in the example set

accomplish their mission through the core commercial activity

of the company, particularly those within the healthcare and

energy sectors.

The business model is the second most

important test in determining whether or

not a company is a mission-led business

and considers the degree to which core

commercial activities support the mission.

1

Relationship of core commercial

activity to mission

The relationship of the core commercial

activity to the mission is determined by

considering the alignment of products

and services to the mission and how the

company uses core operating assets

to achieve the mission. The majority of

mission-led businesses (56%) in the example

set an aim to accomplish their mission

through use of core business operating

assets.

For example, MicroEnsure has a business

model that directly addresses its mission

to support people in emerging markets

through improved access to insurance. It

oers new forms of protection for its target

audience across micro-health, political

violence, crop and mobile insurance.

A working farm that we assessed, in

contrast, looks to achieve its mission

through activities adjacent to its core dairy

business. Alongside production and sales

of cheese and butter, the farm is dedicated

to a mission of sustainability, harnessing

natural resources to source electricity and

gas from solar and biogas, generated from

farm and dairy waste.

Mission-led businesses which use core

operating assets to deliver their mission

are more likely to be younger businesses,

incorporated in the past decade and in the

energy or healthcare sectors.

Other mission-led businesses look to

achieve their mission outside core business

activities and are more likely to be over

10years old.

They are also more likely to be in the business

services, TMT or consumer business sectors,

where the business model may not directly

lend itself to furthering a social mission.

Notes: (1) Business Model accounts for 25% of the overall mission-led business score, subdivided into

‘Core commercial activity/assets used for impact’ (60%), which assesses the use of core operating assets

as a proxy for the relationship of the core commercial activity to the mission and ‘Prot distribution

strategy’ (40%) as reported on company websites or annual reports. (2) Only sectors with 10 or more

mission-led businesses shown. Business services includes consulting, advisory, legal, marketing, and

other business support services.

Number of mission-led businesses

Business Model score (/2.5)

0

20

40

60

80

100

120

2.52.0521.61.551.51.11.050.6

Business Model scoring

Mission-led businesses (%)

0%

20%

40%

60%

80%

100%

EnergyHealthcare and

Life Sciences

Financial

services

EducationConsumer

business

TMTBusiness

services

Relationship of core operating assets to mission by sector

2

Independent

Integrated

Core

14

In pursuit of impact | Mission-led businesses

Business model:

Prot and nance

Nearly a fth of mission-led businesses in the example set

publicise a commitment to use prots to further their mission,

either through reinvestment or distribution to philanthropic

organisations. Interviews highlight the importance of having

investors that support the social or environmental mission.

Prot distribution strategy

Whilst mission-led businesses are, by this

report’s denition, for-prot enterprises,

distributing their prot as a contribution to

a social or environmental mission can be an

indicator of the strength of their commitment

to mission.

The majority of businesses in the example

set don’t publicly describe the distribution of

their prots. However, 19% oered a public

commitment to either reinvest prots to

further serve their mission or to distribute

a proportion of prots to philanthropic

organisations.

For example, Mzuribeads is an ethical bead

company which aims to provide sustainable

income for the Ugandan community. It

invests prots to further its mission by

establishing training programmes for women

in the co-operative to become future leaders

of the business.

GiveMeTap strives for everyone to have access

to clean water. The company sells water

bottles and reports that 20% of revenue from

each bottle sold goes to the company’s water

project fund and gives ve years of clean

water to a person in Africa.

Some mission-led businesses (14%) have

an explicit aliation with a charitable

foundation. These may be external to the

company, for example, Olleco supports the

charity ‘Hospitality Action’ which helps people

in the hospitality industry. Other mission-led

businesses have their own charitable trusts,

for example, Recycling Lives and Talentino have

their own registered charities which support

their missions.

Alignment of investor interests

For 70% of businesses in the example set,

investor interests are clearly aligned with

mission interests in that increasing impact is

likely to go hand in hand with better nancial

returns.

In the remainder of cases, investors’ nancial

interests are only somewhat aligned with

mission interests. For example, if the

business donates a xed sum to charity each

year or carries out mission-related activities

that are independent of the core business,

growth is not necessarily commensurate with

a positive impact on the mission.

Mission-led businesses with aligned investor

interests achieve a greater average mission-

led business score overall (7.4) compared to

those without (6.5).

Those in the TMT sector are less likely to

have investor interests aligned with mission

interests, while those in Healthcare and

Lifesciences, and Financial Services are more

likely to be aligned.

“ Ensuring that

you have the

right investors

on board can

be key to the

success of an

organisation,

as the wrong

investors can

sometimes

compel a

business to

abandon or

deprioritise their

mission.”

Investment group working with

mission-led businesses

15

In pursuit of impact | Mission-led businesses

Governance and operations

A sixth of businesses in the example set incorporate

commitment to mission in key governing documents and over

a third explicitly mention how the mission is embedded across

their operations.

A fth of the overall mission-led business

score depends on Governance and

Operations.

1

This test quanties how the

mission is integrated into both governance

structure and operations.

Governance structure

The extent to which mission has been

integrated into the governance structure

of a business has been assessed through

reference to publicly available governing

documents.

2

Of the example set of mission-

led businesses, 16% embed the mission into

their articles of association.

The articles of association of Unforgettable,

for example, state: “the company’s purpose

is the Social Mission, which is to improve the

quality of life of all those living with dementia

and other neurodegenerative diseases by

creating the world’s best marketplace for

dementia products and services”.

Integration of mission into operations

According to company websites, 36% of

mission-led businesses explicitly consider

their mission across operating layers,

including their back oce and supply

chain as well as customer service. For

example, Cafeology’s mission is to be

a 100% ethical business. They ensure

products they sell have Fairtrade, Soil

Association and Rainforest Alliance marks

and they have direct links with producers in

Central America and Africa. Suppliers and

subcontractors are selected, in part, on their

adherence to ethical purchasing principles.

For 56% of businesses in the example set

the mission is not explicitly mentioned in

relation to operations in publicly available

documents, but the company implies that

the mission is considered at all levels of the

business. For example, the set of mission-

led businesses includes a law rm which

provides advice to charities and social

enterprises. One of its pledges is to consider

the wider environmental and ethical

implications of actions at all times. This

promise implies some level of integration

into operations.

Notes: (1) Governance and Operations accounts

for 20% of the overall mission-led business score,

subdivided into ‘Governance structure’ (20%),

primarily assessed using articles of association,

‘Mission integration in operations and ways of

working’ (20%), ‘Impact activities integrated with

mission’ (30%) and ‘Impact measurement’ (5%

for any measure, 5% for quantitative measures)

all assessed using company websites. (2) Largely

through Companies House.

Number of mission-led businesses

Governance and Operations scoring (/2)

0

5

10

15

20

25

30

Governance and Operations scoring

0.56

0.74

0.84

0.94

1

1.04

1.16

1.2

1.26

1.3

1.34

1.38

1.42

1.48

1.52

1.58

1.62

1.7

1.8

1.9

16

In pursuit of impact | Mission-led businesses

Governance and operations:

Impact reporting and leadership

Most businesses in the example set report on the extent to

which they have achieved mission-related impact, but less than

a third report this quantitatively.

Impact measurement

65% of mission-led businesses in the

example set report their social or

environmental impact publicly, whether

in an annual report or on a website. It is

less common to quantify social impact

(beyond nancial performance), with 32%

of all mission-led businesses reporting

quantitative measures.

For example, Enworks’ mission is to improve

the environment and economy by engaging

businesses in environmentally sustainable

business practice. They provide both

quantitative and qualitative measures of the

cumulative savings clients have achieved

with their help e.g. 13 million cubic meters

ofwater.

An example of a mission-led business that

does not quantify its social impact is one

which enables property guardianships

between landlords and people committed to

voluntary work, giving them a cheaper place

to live. Their website includes testimonials

and case studies but does not currently oer

a quantication of social impact.

Notes: (1) Contribution of women-led and MEG-

led businesses to the UK non-nancial economy,

2014, Department for Business, Innovation

andSkills.

Mission-led businesses that provide

quantitative reports are more likely to be

older and larger. Only 15% of mission-led

businesses that are less than three years old

report quantitatively compared to 56% of

mission-led businesses aged over 30 years.

Impact initiatives

The majority of mission-led businesses (62%)

in the example set conduct corporate social

responsibility activities (such as volunteering

or fundraising) that are directly aligned to

their mission.

Social Bite, a sandwich business which aims

to solve social problems, aligns all impact-

related activities to its mission to solve

these issues. Prots either go to charities

supporting homeless people or to feed 150

homeless people a day. Customers can

also buy food for a local homeless person

to collect later. The Social Bite Academy

provides support to homeless people who

want to nd employment.

Decision-making processes

The mission-led businesses interviewed

tend to have more informal hierarchies

within their organisations, with ‘atter’

leadership structures designed to make

sta accountable for the mission. Exemplar

mission-led businesses use impact reporting

not just to appeal to clients but as part

of their strategic and decision making

processes.

Leadership and equality

35% of mission-led businesses in the

example set are led by women or minority

ethnic groups. This can be compared to

levels in the broader SME market where 20%

of businesses are estimated to be majority

led by women and 6% minority ethnic group

led.

1

Furthermore, mission-led businesses

that are led by women or ethnic minorities

achieve a greater mission-led business score

than those that are not (7.3 vs 7.0).

Mission-led businesses

Age Age

0%

20%

40%

60%

80%

100%

31+21-3011-206-103-50-231+21-3011-206-103-50-2

Quantitative impact reporting Any impact reporting

No

Yes

17

In pursuit of impact | Mission-led businesses

External perceptions

Nearly half the businesses in the example set have been

recognised for their social or environmental impact through

awards or inclusion on sustainable business lists.

The nal test of a mission-led business is

the way it positions itself publicly and if it

portrays itself as ‘mission-led’. A proxy for

this is external perception and whether the

business is recognised as being socially or

environmentally driven.

Press reports and awards

Inclusion on a social award or impact list was

used as a proxy for consumer recognition

of the social or environmental impact made

by businesses. 51% of the example set of

mission-led businesses were included on one

or more lists such as the FTSE4Good UK 50,

GameChangers 500 or NatWest SE100.

Brand perception

In the case of some larger companies, the

mission is recognised as part of the brand

e.g. The Body Shop and Patagonia, measured

through social media reviews and other

customer inputs.

Mission-led businesses

interviewed indicated

that being identied

as mission-led had a

universally positive

impact on their

business in terms of

customer or client

perception.

Notes: (1) External Perceptions accounts

for 15% of the overall mission-led business

score and is made up of 10% for presence

on each of these lists: FTSE4Good UK 50,

GameChangers 500, Guardian Sustainable

Brands, NatWest SE100, Global 100 Most

Sustainable Companies, B-Corps; and 40% for

presence on any other list or award.

Examples of social and environmental impact awards

11% of mission-led businesses in the example set

e.g. Good Energy, Paramo, Winnow, Neighbourly

The Guardian

Sustainable Business

Awards 2016

4% of mission-led businesses in the example set e.g. Cause4,

Patients Know Best, Social Stock Exchange, Mustard Seed

2% of mission-led businesses in the example set

e.g. Developing Youth Practice, Policy in Practice

11% of mission-led businesses in the example set

e.g. Mazuma Mobile, Kiwi Power, Seawater Greenhouse

Number of mission-led businesses

External Perception score (/1.5)

0

20

40

60

80

100

120

1.50.90.750.60.450.30.150

External Perception scoring

18

In pursuit of impact | Mission-led businesses

Exploring mission-

led businesses: What

are the key insights

into mission-led

businesses?

19

Size and mission-led

scores

The majority of businesses in the

example set are small businesses; small

businesses typically have a greater

commitment to mission than the larger

businesses proled.

Mission-led businesses were classied

according to size by the BEIS denition,

i.e. small businesses have <50 employees,

medium businesses 50-249 and large

businesses 250+ employees. The small

businesses gure also includes companies

that do not report employee data, which is

not a requirement for this classication.

Behaviour of smaller mission-led

businesses

There are a large number of small businesses

in the example set. Smaller mission-led

businesses tend to have a higher score in the

mission-led business assessment, suggesting

that a smaller business is better able to

maintain a focus on mission.

Smaller mission-led businesses are also likely

to have the following characteristics:

• Adoption of a local or national focus for

their mission, while larger mission-led

businesses are more likely to have a broad

international focus;

• Be younger companies, less than 5 years

of age, while the majority of large and

medium mission-led businesses were over

10 years old; and

• Have a mission that is core to their

commercial activities, while larger

businesses are more likely to have

mission-oriented activities which are

adjacent to their core business model.

1

This may be because larger, older

businesses have transitioned into

mission-led businesses while smaller

businesses in the set are more likely

to have been founded as mission-led

businesses.

Smaller

mission-led

businesses

tend to have a

higher score in

the mission-led

business

assessment,

suggesting that a

smaller business

is better able to

maintain a focus

on mission.

Notes: (1) For example, a water and waste

management company aims to work in

a sustainable manner and support local

community and environment

Number of mission-led businesses

Average (RHS)

Mission-led business score

0

50

100

150

200

250

LargeMediumSmall

Mission-led business numbers and score by size

6.80

6.85

6.90

6.95

7.00

7.05

7.10

7.15

208

19

23

20

In pursuit of impact | Mission-led businesses

Leading sectors

Key sectors represented across the example

set of mission-led businesses include:

• Business services;

• Technology; and

• Consumer Business.

The highest proportion of mission-led

businesses in the example set is in business

services. This implies a close relationship

between providing support to other

institutions and to wider society. This trend

may also reect the business development

incentive for businesses in this sector to be

a part of mission-led business networks and

promote themselves publicly.

Mission-led businesses in some sectors are

likely to have related missions.

For example, 70% of mission-led businesses

in the Healthcare and Lifesciences sector

have a Healthcare related mission, and

85% of Energy businesses have an

environmental mission. Where a sector has

a natural relationship with socio-economic

good, mission-led business scores tend to

be higher.

A higher proportion of the mission-led

businesses analysed from Consumer

Business or Energy sectors were larger

businesses compared to those in other

sectors. This suggests that established

businesses in these sectors may nd it

easier to transition to become mission-led.

For example, Seacourt is a printing company

that was established in 1946 but fty years

later realised the signicant environmental

damage the traditional printing industry

caused. It is now a green printing company

that uses waterless printing technology.

Leadership by a woman or ethnic minority

is more common in mission-led businesses

in some sectors, such as the Education and

Healthcare and Life Sciences sectors. This

reects trends in the wider SME market.

1

The highest

proportion of

mission-led

businesses in

the example set

is in business

services.

Sector and mission-led scores

Mission-led businesses can be found in a wide range of sectors.

The most commonly represented in the example set are

business services, technology and consumer business.

Notes: Business proportions by sector are not

intended to be statistically representative of

the larger economy, as gures above refer to

proled businesses and are not statistically

representative of the population. (1) Small

Business Survey, Department for Business

Innovation & Skills, 2014. (2) Business

services includes consulting, advisory, legal,

marketing, and other business support

services e.g.

Futerra

, a change consultancy

and

Policy in Practice

, a consultancy that

aims to make government policy simple to

understand

Number of mission-led businesses

Mission-led business score

0

10

20

30

40

50

60

70

Agriculture

Transport

and Logistics

Construction

Arts and

Creative

Retail

Tourism

and Leisure

Other

Manufacturing

Real estate

Energy

Healthcare and

Life Sciences

Financial

services

Education

Consumer

business

TMT

Business

services

2

Mission-led business numbers and score by sector

4.0

4.5

5.0

5.5

6.0

6.5

7.0

7.5

8.0

Average (RHS)

21

In pursuit of impact | Mission-led businesses

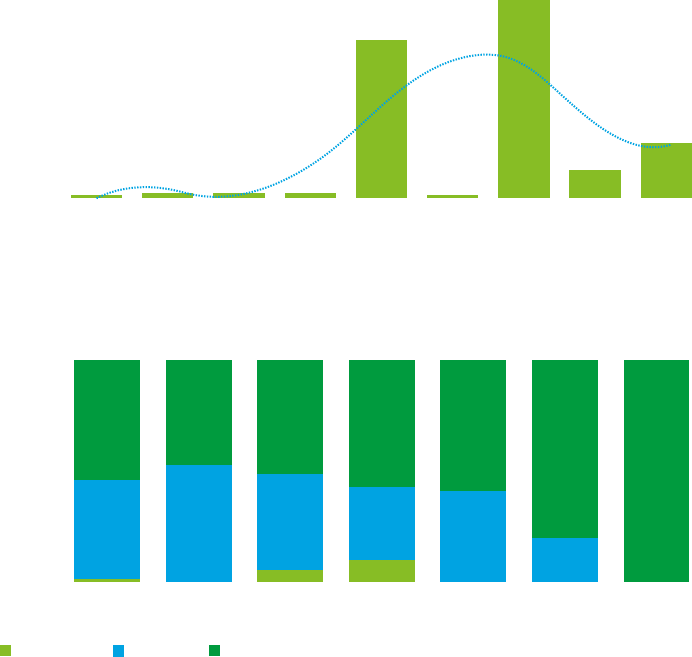

Age and mission-led

scores

The majority of businesses in the

example set have been incorporated

since 2010, with only a small minority

having been incorporated over

30yearsago.

Younger mission-led businesses

The majority of businesses in the example

set entered the market over the last 15

years, with the majority of those proled

launched between 2010 and 2015. Potential

reasons for this development are broad,

ranging from increased awareness and

cultural recognition of ‘mission’ to increased

support from government.

Interviews suggest that there may be a

point of ‘peak maturity’ for mission-led

businesses, after which it is harder to

maintain focus on mission and original goals

as investors and leadership change.

This is indicated by high scores for

businesses between 21-30 years old and

low scores for businesses over 30 years old.

Interviews also suggest founders typically

neglect succession planning which may

contribute to this dynamic.

Younger mission-led businesses have

arange of particular characteristics:

• Younger mission-led businesses are more

likely to be smaller businesses, while

businesses over 20 years old are more

likely to be medium and large businesses;

• Younger mission-led businesses are less

likely to report quantitatively on impact

(see page 17). Interviews suggest that this

is because they are challenged in terms of

both capital and capacity; and,

• Younger mission-led businesses are more

likely to have a mission that is core to the

business model. This implies that they

are established as mission-led businesses

and are structured to focus on the mission

(see page 20).

“ As time goes

by, it becomes

harder for

mission-led

businesses to

retain long-

term mission

and original

governance

structure,

particularly

with changes in

ownership and

investors.”

Consultant to a large mission-led

business

Number of mission-led businesses

Age

Mission-led business score

0

10

20

30

40

50

60

70

80

31+21-3011-206-103-50-2

Mission-led business size and scores by years since incorporation date

6.6

6.7

6.8

6.9

7.0

7.1

7.2

7.3

7.4

7.5

Small

Medium

Large

Average (RHS)

22

In pursuit of impact | Mission-led businesses

Geographical focus

andmission-led scores

Nearly 70% of businesses in the example

set operate at a national level and a fth

have an international focus.

Geographic breakdown

The majority of the example set of mission-

led businesses proled have a national focus

(68%). Proled businesses operate across all

areas of the UK although interviews indicate

that networks tend to be London-centric.

A signicant proportion have an

international focus (20%), often distributing

prots to mission-oriented activities abroad,

for example Falcon Coees supports coee

farmers in rural communities across the

world and Climate KIC supports innovation in

dealing with climate change in Europe.

A smaller group of mission-led businesses

have a regional or a local focus, engaging

a local population in their mission through

business activities.

Businesses with a local focus are more likely

to have:

• Slightly stronger commitment to mission

than those with a broad remit across

national and international markets. This

may indicate that businesses nd it easier

to commit to a mission if it is narrower in

geographical scope; and

• A mission dedicated to educational and

community goals. Regional businesses

are similar in mission motivation to local

businesses, but are also more likely to

support small businesses. Internationally-

focused businesses are more likely to have

an environmental goal as their mission.

“ The share of

conversation

around

networks and

policy-making

is very London-

centric. As a

business based

outside London,

we were

denitely at a

disadvantage

as the network

for social

organisations is

patchy outside

of London.”

Mission-led business based in

Birmingham

Notes: The stated geographical operating

area of businesses was used to categorise

their geographic footprint. Local refers to

mission-led businesses that operate on a

city or town level (or below) e.g. Leeds, while

regional refers to rms operating in a larger

area but not on a national level e.g. South

ofEngland

Mission-led business footprint (by volume)

Local

Regional

National International

4% 8% 68% 20%

23

In pursuit of impact | Mission-led businesses

Corporate form

Mission-led businesses can take any

legal form that enables prot distribution

and often choose to be private limited

companies in order to have more control

over their business.

Legal type

The majority of the example set of mission-

led businesses proled are private limited

companies (82%). A small proportion

are public limited companies (PLCs; 5%).

PLCsare more likely to have a mission with

an international focus than private limited

companies.

The 12 public limited companies span

a range of sectors such as Consumer

Business (e.g. The Body Shop), Energy

(e.g.ITM Power) and Financial Services

(e.g.Unity Trust Bank).

Other corporate forms include

co-operatives (e.g. The Southern

Co‑operative), limited liability partnerships

(e.g.Empower Community Management

LLP), and unincorporated associations

(e.g.Vandanamu Ethical Cottons).

Exclusions to legal type

As enterprises with the freedom to make

and distribute prot, mission-led businesses

are by this report’s denition organisations

with legal structures that are not charities,

CICs or CLGs.

This is not to say that companies with these

legal structures do not have a mission or

that it does not lead their actions, indeed in

most cases, they are “mission-led”, but they

are not the particular focus of this report or

the broader Mission-led Business Review.

“ We chose to

be a private

limited company

because we

want to create a

drive for change

and enable

people to help

themselves

while doing

business,

instead of just

giving them

resources with a

more charitable

model.”

‘Other’ includes co-operatives, limited liability

partnerships, partnerships, unincorporated

associations, unknown.

Private limited Public limited Other

82%

of mission-led

businesses are

private limited

companies

24

In pursuit of impact | Mission-led businesses

Innovation

Mission-led businesses incorporated

in the last three years tend to have

innovative business models.

Of the example set of mission-led

businesses, 34% have an innovative

business model, dened in this context

as one that behaves in a fundamentally

dierent way to other businesses operating

in their sector.

For example, 2JEvents is a venue and events

management company that proactively

supports local schools by facilitating hire of

school facilities.

Use of an innovative business model

is much more prevalent in younger

organisations, and ranges from 55% in those

under three years old to 6% in those over

30years old.

A higher proportion of mission-led

businesses in Energy (69%), TMT (55%)

and Healthcare and Life Sciences (55%)

sectors have innovative business models.

Similarly, ahigher proportion of mission-

led businesses with a Healthcare related

mission are innovative (54%).

1

Mission-led businesses have dierent goals

from the broad swathe of their competitors,

encouraging if not demanding creative and

innovative approaches to the market.

“ We aim not

just to have a

mission but

to be actively

disruptive in the

space with our

solutions for the

issues we are

trying to tackle.”

Award-winning mission-led business

Notes: (1) Healthcare related missions include

Healthcare and Improving physical and

mental wellbeing

Proportion of mission-led businesses

with innovative business models

34%

with innovative

business model

Mission-led businesses

0%

20%

40%

60%

80%

100%

31+21-3011-206-103-50-2

Mission-led businesses with innovative business models by age

Age

Yes

No

25

In pursuit of impact | Mission-led businesses

Developing a mission

Businesses take dierent paths to becoming mission-led.

Somebegin with mission as a core objective, while others

transition to adopt a mission at a later stage.

Mission-led business

at incorporation

Businesses that set

up with the purpose

of achieving social or

environmental impact.

Transitioning into a

mission-led business

Businesses that develop

a social or environmental

mission some time after

formation.

Fully realised

mission-led business

Businesses functioning

successfully along multiple

tests – e.g. balancing

nancial goals, impact

reporting, long-term focus.

“ The mission can and

should evolve as the

organisation grows.”

Law rm working

towards social impact

“ Many organisations

nd impact

reporting particularly

challenging, but agree

it is necessary to

measure success.”

Multiple sources,

e.g. investment

group for mission-

led businesses and

equivalents

“ It can be dicult

for organisations

to maintain their

long-term mission,

particularly with

changes in ownership

and investment.”

Multiple sources,

e.g. Chambers of

Commerce

“ Better access to advice

and networks of similar

organisations can be key for

business success.”

Multiple sources,

e.g.funding group for

mission-led businesses

andequivalents

“ Businesses can

nd a diculty with

short-term trade-os

when running the

business.”

Network for

mission-led

businesses

andequivalents

“ Employees and leadership

are key in driving a business

to be more mission-led.”

Network for mission-led

businesses and equivalents

26

In pursuit of impact | Mission-led businesses

Conclusion: Looking

ahead

27

Mission as virtuous circle

Benets of mission

The benets of business commitment to

mission are deep and wide ranging.

• Business support can be transformational,

for the environment, local communities

or wider society. For example, Neighbourly

has facilitated the pledging of nearly £4m

to social organisations and causes.

• Mission can also drive business success.

Every business interviewed said they felt

their mission had been a competitive

advantage, in terms of attracting and

retaining high-quality employees, and

dierentiation to clients. Mission can thus

also contribute to success by reducing risk

and increasing sustainability. Mission-led

businesses appear to be at least as large

on average as other businesses, and a

growing body of literature points to the

tangible impact of mission for business

growth.

1

• Today’s economy rewards businesses

which have a holistic look at their role

in society. Where companies exist not

just to make a prot, but to add value

to customers, partners, shareholders,

employees, and suppliers, they are able

toscale and achieve sustainability.

In turn, as mission-led businesses grow as

businesses, their ability to have a greater

impact grows too.

Key policy challenges

Policy makers are looking to encourage

more businesses to make a commitment to

social and environmental impact and to help

sustain and scale mission-led businesses.

Insights generated from proling and

interviews with mission-led businesses

point to a range of critical challenges for the

future in three broad stages of the business

life-cycle:

1. Creation: How can we support new

start-ups to commit to a social or

environmental mission? What support

is required?

2. Sustaining: How can we help mission-led

businesses retain their commitment

tomission?

3. Scaling: How can we support mission-

led businesses to grow in a fast-moving

business environment?

Where

companies

exist not just to

make a prot,

but to add value

to customers,

partners,

shareholders,

employees, and

suppliers, they

are able toscale

and achieve

sustainability.

Notes: (1) 22 Research studies proving the ROI of

sustainability, Sustainable Brands, 2016

Commitment to a mission can drive both

social/environmental impact and growth

of the business. In turn, these benets

reinforce the mission which continues to

drive benets, forming a virtuous circle.

Drives

Reinforces

Mission Success (Scale &

Sustainability)

28

In pursuit of impact | Mission-led businesses

Key challenges faced by mission-led

businesses

Notes: (1) The Public Services (Social Value) Act requires people who commission public services to think about how

they can also secure wider social, economic and environmental benets. (2) The Scale-Up Report on UK Economic

Growth, Sherry Coutu CBE, 2014

The creation, sustaining, and scaling of mission-led businesses

in the UK is important to further develop the virtuous circle, but

businesses face a number of challenges at these stages.

• Creating new mission-led businesses: Businesses that did not have access to quality advice often

chose their legal structure randomly. Almost universally, businesses interviewed felt that being located

outside London was a disadvantage to gaining advice critical at these early stages.

• Existing businesses wishing to adopt a mission: Those familiar with the sector suggested that

leadership and employee sentiment were the most inuential factors in whether a business was able

totransition into being mission-led, and many large companies struggled with this transition.

• Monitoring and reporting impact: Mission-led businesses described impact reporting as a challenge

in interviews, particularly for smaller and newer businesses. This was reected in the proling where

only 32% reported quantitative measures of impact and younger businesses were even less likely

toreport quantitatively, (15% of those <3 years old).

• Maintaining a long-term strategic commitment to mission: Not all mission-led businesses think

about their long-term goals and sustainability, and advisors warned that ‘mission-drift’ was a major risk

many mission-led businesses faced. Only half of the mission-led businesses in the denitional analysis

publicised a specic long-term commitment to mission.

• Improving the eciency, and eectiveness of mission-led businesses, particularly in terms of

nancial sustainability: Mission-led businesses can struggle with nancial sustainability. Financial

challenges can be contributed to if the business turns down opportunities that do not t the company

mission or values. Some mission-led business founders also stated that they come from a public sector

or charity background and did not necessarily have the right nancial or business experience, which

can be particularly disadvantageous when a business is trying to grow.

• Dierentiating mission-led businesses from non-mission-led businesses to customers:

Aidingmission-led businesses in building public awareness of their model and their support

requirements is important, as mission-led businesses (particularly those in more conservative sectors)

have faced signicant challenges on this front. The scale of the sized mission-led business ‘market’

suggests that there is huge potential for increased recognition. The Social Value Act

1

is seen to be

good in theory, but mission-led businesses often face challenges in application. Many suggested that

commissioners continue to choose their preferred suppliers and nd ‘work-arounds’.

• Supporting scale-ups: A subset of mission-led businesses are scaling rapidly and require specic

support such as accessing talent, developing leadership, increasing customer sales, accessing nance

and accessing infrastructure. This support may come from ecosystems being set up by the Scale-Up

Institute around the country.

2

Creation

Sustaining

Scaling

29

In pursuit of impact | Mission-led businesses

Possible responses

In order to address the challenges faced by mission-led

businesses, a number of possible solutions would be helpful to

businesses across specic support, advice, tools andregulation.

Source: All content drawn from interview inputs

and example set analysis

Support and advice

Good advice and access to networks are

invaluable to a mission-led business’s

success, particularly at the early stages.

Providing this access to businesses outside

of London is necessary to bridge the current

information gap. Areas that these networks

and advice must address are:

• Good nancial advice: This is necessary

to help mission-led businesses nd

investors aligned to their mission goals.

Analysis shows that those mission-led

businesses with aligned investor interests

tend to score higher, suggesting they

are more nancially successful. Training

and advice on nancial planning is also

important, as a number of mission-led

business founders have no prior business

experience. Advice about the implications

of choice of corporate form was also

considered to berequired.

• Development networks and advisors:

Mission-led businesses felt that access

to networks of mission-led businesses

similar in mission or size was the most

helpful in tackling business challenges.

Alternatively, pairing smaller mission-led

businesses with those that are larger

could aid them in specic scaling

challenges and impact reporting. Being

part of incubators, accelerators, or

receiving advice from larger rms (e.g.

the Deloitte Social Pioneers Programme)

was also rated as highly valuable to the

development of a mission-led business.

We also heard from businesses like Rubies

in the Rubble that sector networks can be

more helpful than mission-led business

networks.

• Long-term sustainability: Mission-led

businesses that are most successful in

thinking about long-term sustainability are

exible in their operations, continuing to

evolve and adapt their approach to issues

based on the needs of the market, while

being true to the spirit of the mission.

Advice on sustainability should cover

succession planning for founders.

The prevailing view is that it is easier for

well established businesses to gain access

to advice and networks. This may suggest

mentorship programmes and alliances

between large and smaller businesses could

be eective and could provide advantages

to both.

Tools and regulation

Interviews and incorporation dates of

mission-led businesses suggest that trends

in the market are changing, both in terms

of consumers and employees recognising

mission-led businesses and wanting to be

associated with them. Several mission-led

businesses such as Reason Digital, Cause4

and Pop Up Business School said that despite

turning down opportunities not matching

their mission and reducing the potential

short term revenues, they felt that abiding

by the mission had been advantageous in

the longer term.

Interviews with mission-led businesses

suggest that they feel existing regulation is

sucient in meeting their needs, and that

adding anything further would only ‘box

businesses in’. Useful tools and applications

of regulation would include:

• Standardising impact reporting: Several

impact reporting frameworks are being

developed in order to help businesses

have more standardised ways of reporting

their impact, particularly by using real-time

data. Organisations such as Neighbourly,

Social Value UK, Reason Digital and others

have worked on this. Whilst complex,

standardising and increasing access to

these tools for all mission-led businesses

is critical.

• Online resources available nationwide:

Some businesses suggested that online

access to tools and advice could be useful

in bridging the network gap for businesses

outside London.

• Applying the Social Value Act:

Stronger application of the Social Value

Act by commissioners would help

give mission-led businesses a greater

competitive advantage, and help the act

achieve its intentions to increase social

and environmental impact.

30

In pursuit of impact | Mission-led businesses

Areas for further research

This report characterises the mission-led business market

and provides a foundation for further research into this area,

particularly in quantifying sub-segments of the market and

investigating challenges that mission-led businesses face.

Impact reporting

Mission-led businesses vary widely in the

degree to which they report their impact,

and quantitative reporting is particularly

rare for younger businesses. Interviewed

mission-led businesses highlight logistical

and nancial diculties in establishing

reporting mechanisms, particularly in early

stages. Certain tools and frameworks have

already been developed to assist businesses

with these, but determining where they are

available is the rst step in standardising

the process and making it accessible to

allbusinesses.

Transitions to mission-led businesses

Some businesses transitioned to become

mission-led businesses once they were

already established, rather than being

incorporated with the mission already

in mind. A sub-set of these businesses

could be identied and studied to explore

the reasons behind the transition, the

challenges faced and how it has aected the

business. It may be that more businesses

would consider transitioning to become

mission-led businesses if there is particular

support available, or if the benets of doing

so are clear.

Mission sustainability and mission drift

Interviews and examination of the example

set suggest that as mission-led businesses

grow they risk losing focus on their mission

(see page 22), experiencing “mission drift’.

Further research is required to determine

whether this is a common problem and

what type of support might mitigate this risk.

Other businesses

Many businesses have material social

impact but don’t meet our criteria for

mission-led business. These could be

investigated further and characterised.