The Opportun

Wahlers, Kristen

NBER WORKING PAPER SERIES

HOW DID COVID-19 AND STABILIZATION POLICIES

AFFECT SPENDING AND EMPLOYMENT?

A NEW REAL-TIME ECONOMIC TRACKER BASED ON PRIVATE SECTOR DATA

Raj Chetty

John N. Friedman

Nathaniel Hendren

Michael Stepner

The Opportunity Insights Team

Working Paper 27431

http://www.nber.org/papers/w27431

NATIONAL BUREAU OF ECONOMIC RESEARCH

1050 Massachusetts Avenue

Cambridge, MA 02138

June 2020

A preliminary draft of this paper was previously circulated as “Real-Time Economics: A New

Platform to Track the Impacts of COVID-19 on People, Businesses, and Communities Using

Private Sector Data.” We thank Gabriel Chodorow-Reich, Jason Furman, Xavier Jaravel,

Lawrence Katz, Emmanuel Saez, Ludwig Straub, and Danny Yagan for helpful comments. We

also thank the corporate partners who provided the underlying data used in the Economic

Tracker, who as of this version include: Affinity Solutions (especially Atul Chadha and Arun

Rajagopal), Burning Glass (especially Anton Libsch and Bledi Taska), Earnin (especially Arun

Natesan and Ram Palaniappan), Homebase (especially Ray Sandza and Andrew Vogeley), Intuit

(especially Christina Foo and Krithika Swaminathan), Womply (especially Toby Scammell and

Ryan Thorpe), and Zearn (especially Billy McRae and Shalinee Sharma). We are very grateful to

Ryan Rippel of the Gates Foundation for his support in launching this project and to Gregory

Bruich for early conversations that helped spark this work. The work was funded by the Chan-

Zuckerberg Initiative, Bill & Melinda Gates Foundation, Overdeck Family Foundation, and

Andrew and Melora Balson. The project was approved under Harvard University IRB 20-0586.

†The Opportunity Insights Economic Tracker Team consists of Matthew Bell, Gregory Bruich,

Tina Chelidze, Lucas Chu, Westley Cineus, Sebi Devlin-Foltz, Michael Droste, Shannon Felton

Spence, Dhruv Gaur, Federico Gonzalez, Rayshauna Gray, Abby Hiller, Matthew Jacob, Tyler

Jacobson, Margaret Kallus, Laura Kincaide, Cailtin Kupsc, Sarah LaBauve, Maddie Marino, Kai

Matheson, Kate Musen, Danny Onorato, Sarah Oppenheimer, Trina Ott, Lynn Overmann, Max

Pienkny, Jeremiah Prince, Daniel Reuter, Peter Ruhm, Emanuel Schertz, Kamelia Stavreva,

James Stratton, Elizabeth Thach, Nicolaj Thor, Amanda Wahlers, Kristen Watkins, Alanna

Williams, David Williams, Chase Williamson, Shady Yassin, and Ruby Zhang.

NBER working papers are circulated for discussion and comment purposes. They have not been

peer-reviewed or been subject to the review by the NBER Board of Directors that accompanies

official NBER publications.

© 2020 by Raj Chetty, John N. Friedman, Nathaniel Hendren, Michael Stepner, and The

Opportunity Insights Team. All rights reserved. Short sections of text, not to exceed two

paragraphs, may be quoted without explicit permission provided that full credit, including ©

notice, is given to the source.

How Did COVID-19 and Stabilization Policies Affect Spending and Employment? A New

Real-Time Economic Tracker Based on Private Sector Data

Raj Chetty, John N. Friedman, Nathaniel Hendren, Michael Stepner, and The Opportunity

Insights Team

NBER Working Paper No. 27431

June 2020

JEL No. E0,H0,J0

ABSTRACT

We build a publicly available platform that tracks economic activity at a granular level in real

time using anonymized data from private companies. We report daily statistics on consumer

spending, business revenues, employment rates, and other key indicators disaggregated by

county, industry, and income group. Using these data, we study the mechanisms through which

COVID-19 affected the economy by analyzing heterogeneity in its impacts across geographic

areas and income groups. We first show that high-income individuals reduced spending sharply

in mid-March 2020, particularly in areas with high rates of COVID-19 infection and in sectors

that require physical interaction. This reduction in spending greatly reduced the revenues of

businesses that cater to high-income households in person, notably small businesses in affluent

ZIP codes. These businesses laid off most of their low-income employees, leading to a surge in

unemployment claims in affluent areas. Building on this diagnostic analysis, we use event study

designs to estimate the causal effects of policies aimed at mitigating the adverse impacts of

COVID. State-ordered reopenings of economies have little impact on local employment. Stimulus

payments to low-income households increased consumer spending sharply, but had modest

impacts on employment in the short run, perhaps because very little of the increased spending

flowed to businesses most affected by the COVID-19 shock. Paycheck Protection Program loans

have also had little impact on employment at small businesses. These results suggest that

traditional macroeconomic tools – stimulating aggregate demand or providing liquidity to

businesses – may have diminished capacity to restore employment when consumer spending is

constrained by health concerns. During a pandemic, it may be more fruitful to mitigate economic

hardship through social insurance. More broadly, this analysis illustrates how real-time economic

tracking using private sector data can help rapidly identify the origins of economic crises and

facilitate ongoing evaluation of policy impacts.

Raj Chetty

Department of Economics

Harvard University

Littauer 321

Cambridge, MA 02138

and NBER

John N. Friedman

Department of Economics

Robinson Hall

Brown University

Providence, RI 02912

and NBER

Nathaniel Hendren

Harvard University

Department of Economics

Littauer Center Room 235

Cambridge, MA 02138

Michael Stepner

Harvard University

1280 Massachusetts Avenue

Cambridge, MA 02138

The Opportunity Insights Team

1280 Massachusetts Avenue

Box #201

Cambridge, MA 02138

Economic Tracker and Dowloadable Data is available at www.tracktherecovery.org

I Introduction

Since the pioneering work of Kuznets (1941), macroeconomic policy decisions have been made on

the basis of data collected from recurring surveys of households and businesses conducted by the

federal government. Although such statistics have great value for understanding the economy,

they have two limitations that have become apparent during the COVID-19 pandemic. First, such

data are typically available only at a low frequency with a significant time lag. For example,

disaggregated quarterly data on consumer expenditures are typically available with a one year lag

in the Consumer Expenditure Survey (CEX). Second, such statistics typically cannot be used to

assess granular vari at ion across geographies or subgroups; due to limitations in sample sizes, most

statistics are typically reported only at t he national or state level and breakdowns by subgroups or

sectors are often unavailable.

In this paper, we address these challenges by building a new, freely accessible platform that

tracks economic activ i ty at a high-frequency, granular level using anonymized and aggregat ed data

from private companies. Combining data from credit card processors, payroll firms, and financial

services firms, we construct statistics on consumer spending, employment rates, business revenues,

job postings, and other key indicators described in detail in Section II below. We report these

statistics in real time using an automated pipeline that ingests data from businesses an d reports

statistics publicly on the data visualization platform, typically less than seven days after the relevant

transactions occur. We present fine disaggregations of the data, reporting each statistic by county

and by industry and, where feasibl e , by initial (pre-crisis) income level and business size.

Many firms alread y analyze their own data internally to infor m business decisions and some firms

have begun sharing aggregated data with policymakers and researchers during the current crisis.

Our contribution is to (1) combine these disparate data sources into a single, publicly accessible

platform that el i mi nat es the need to write contract s with specific companies to access relevant d at a;

(2) systematize these data sources by documenting the samples they cover and benchmarking them

to existing publi c series; and (3) provide the combined series in an interactive data visualization

tool that facilitates comparisons across outcomes, areas, and subgroups.

Unlike official gover nment statistics, which are based on sampling frames designed to provide

representative information, our statistics reflect the behavior of the clients of the firms from which

we obtain data. To mitigate selection biases that can arise from this approach, we use data from

companies that have large samples (e.g., at least one million i nd i vi d ual s) , span well-defined sectors

1

or subgroups (e.g., small businesses, bottom-income-quintile worker s) , and track publicly available

benchmarks in hist or i cal data. Although there is no guarantee that the statistics from such data

sources cap t u re total economic activity accurately, we believe they contain useful information be-

cause the shocks induced by major crises such as COVID-19 are large rel at i ve to plausible biases

due to non-representative sampling, as shown e.g., by Aladangady et al. (2019) and Dunn, Hood,

and Driessen (2020).

We use these new data to analyze the economic impacts of the coronavirus pandemic (COVID-

19). Government statistics show that COVID led to a very sharp reduction in GDP and an

unprecedented surge i n unemployment. Our goal is to demonst r ate how the publicly available

data we have constructed can shed light on the sources of these macroeconomi c changes in near-

real-time, in particular by disaggregating these changes across subgroups and areas. We therefore

base all of our analysis purel y on the statistics th at we release publicly rather than the underlying

(confidential) microdata that we obtain from data partners.

National accounts data reveal that most of the reduction in GDP came from a r ed uc t ion in con-

sumer spendi ng (rather than business investment, government purchases, or exports). We therefore

begin our analysis by examining the drivers of changes in consumer spending, focusing in particular

on credit and debit card spending. We first establish that card spendin g closely tracks historical

benchmarks on retail spendin g and services, which together constitute a large fraction of the re-

duction in total spending in the national accounts. We then show that the vast majority of the

reduction in consumer spending in th e U.S. came from reduced spending by high-income house-

holds. As of June 10, more than half of the total reduction in card spending since January had

come from households in the top quartile of the income distribution; only 5% had come from house-

holds in the bottom income quarti l e.

1

This is both because the rich account for a larger share of

total spending to begin with and b ecau se high-in come househol d s reduced their spending by 17%,

whereas low-income households reduced their spendi n g by only 4% as of June 10.

Most of the reduction in spending is accounted for by reduced spending on goods or services

that require in-person physical interaction and thereby carry a risk of COVID infection, such as

hotels, transportation, and food services, consistent with the findin gs of Alexander and Karger

1. We impute income as the median household income (based on Census data) in the cardholder’s ZIP code. We

verify the quality of this imputation procedure by showing th a t our estimates of the gap in spending reductions by

income group are aligned with those of Cox et al. (2020), who observe in c o me directly for JPMorgan Chase clients,

as of mid-April 2020, the la st date available in their series. We find that spending levels of low-income households

increased much more sharply than those of high-income households since mid-Ap ril largely as a result of stimulus

payments.

2

(2020). The composition of spendin g cuts – with a large reduction in services – di↵ers sharply

from that in pr i or recessions, where service spending was essentially unchanged and durable goods

spending fell sharply. Zooming into specific subcategories, we find that spending on luxury goods

that do not require physical contact – such as landscaping services or home swimming pools – did

not fall, while spending at salons an d restaurants plummeted. Businesses that o↵er fewer in person

services, such as fin anci al and professional services firms, also experienced much smaller losses.

The fact that spending fell in proportion to the degree of physical exposure required across sectors

suggests that the reduction in spending by the rich was driven primarily by heal th concerns rather

than a reduction in income or wealth. In d eed, the incomes of the rich have fallen relatively l i t t le

in this recession (Cajner et al. 2020). Consistent with the centrality of health concerns, we find

that the reductions in spending and time spent outside home were larger in high-income, high-

density areas with higher rates of COVID infection, perhaps because high-income individuals can

self-isolate more easily (e.g., by substituting to remote work). Together, these results suggest that

consumer spending in the pandemic fell because of changes in firms’ ability to supply certain goods

(e.g., restaurant meals that carry no health risk) rather than because of a reduction in purchasing

power.

2

Next, we turn to the impacts of the consume r spending shock on businesses. To do so, we exploit

the fact that many of the sect ors in which spending fell most are non-tradable goods produced by

small local businesses (e.g., restaurants) who serve customers in their local area. Building on the

results on the heterogeneity of the spending shock, we use di↵erences in average incomes and rents

across ZIP codes as a sou rce of vari at i on in the spending shock that businesses face. This geographic

analysis is useful both from the perspective of understanding mechanisms and because prior work

shows that geography plays a central role in the impacts of economic shocks due to low rates of

migration that can lead to hysteresis in local labor markets (Austin, Glaeser, and Summers 2018,

Yagan 2019).

Small business revenues in the most a✏uent ZIP codes in large cities fell by more than 70%

between March and l at e April, as compared with 30% in the least a✏uent ZIP codes. These

reductions in revenue resulted in a much higher rate of small business closure in high-rent, high-

income areas within a given county than in less a✏uent areas. This is particularly the case for

2. This explanation may appear to be inconsistent with the fa ct that the Consumer Price Index (CPI) shows

little increase in inflation, given that one would expect a su p p ly shock to increase prices. However, the CPI likely

understates inflation in the current crisis because it does not capture the extreme shifts in the consumption bundle

that have occurred as a result of the COVID crisis ( Cavallo 2020).

3

non-tradable goods that require physical interaction – e.g., restaurants and accommodation services

– where revenues fell by more than 80% in the most a✏uent neighborhoods in the country, such as

the Upper East Side of Manhattan or Palo Alto, California. Small busi nesses that provide fewer

in-person serv ices – such as financial or professional services firms – experience much smaller losses

in revenue even in a✏uent areas.

As businesses lost revenue, they passed the incidence of the shock on to their employees. Low-

wage hourly workers in small businesses in a✏uent areas are especially likely to have lost their jobs.

In the highest-r ent ZIP codes, more than 65% of workers at small businesses were laid o↵ within

two weeks after the COVID cr i si s began; by contrast, in the lowest-rent ZIP codes, fewer than 30%

lost their jobs. Workers at larger firms and in tradable sectors (e.g., manufacturing) were much

less likely to lose their jobs than those working in small busi nesses producing non-tradable goods,

irrespective of their geographic location. Job postings also fell much more sharply in more a✏uent

areas, particularly for lower-ski l led positions. As a result of these changes in the labor market,

unemployment cl ai ms surged even in a✏uent counties, which have generally h ad relatively low

unemployment rates i n prior recessions. For example, more than 15% of r esid ents of Santa Clara

county – the richest county in the United States, located in Si l i con Valley – filed for unemployment

benefits by May 2. Perhaps because they face higher rates of job loss and worse future employment

prospects, low-income individuals working in more a✏uent areas cut their own spending much more

than low-income individuals working in less a✏uent areas.

In summary, the initial impacts of COVID-19 on economi c activity appear t o be largely driven

by a reduction in spending by higher-income i nd i v id u als due to health concerns, which i n turn

a↵ected businesses that cater to the rich – e.g., small businesses in a✏uent areas – and ultimately

reduced the incomes and expenditure levels of low-wage employees of those businesses. In the final

part of the paper, we analyze the impacts of three major policy e↵orts that were enacted in an

e↵ort t o break this chain of events and mitigate the economic impacts of the crisis: st ate -or de r ed

reopenings, stimulus payments to households, and loans to small businesses.

3

Reopenings of economies had modest impacts on economic activity. Spending and employment

remained well below baseli n e levels even after reopenings, and in particular did not rise more

rapidly in states that reopen ed earlier relative to comparable states that reopened later. Spending

3. Of course, this set of policies is by no means exhaustive: a vast set of other policy e↵orts ranging from changes

in monetary policy to various state-level programs were also undertaken in response to the crisis. We focus on these

three policies because they illustrate th e ways in which the new high- frequ en c y da ta we have assembled can be used

for real-time policy analysis, and we hope that future work will use these data to analyze other policies.

4

and employment also fell well before state-level shutdowns were implemented, consistent with other

recent work examining data on hours of work and movement patterns (Bart i k et al. 2020, Villas-

Boas et al. 2020).

Stimulus payments provided through the CARES Act increased spending among low-income

households sharply, nearly restori n g their spending to pre-COVID levels as of May 10, consistent

with evidence from Baker et al. (2020). Most of this increase in spending was in sectors that require

limited physical interaction. Purchases of durable goods surged, while consumpti on of in-person

services ( e. g. , restaurants) increased very little. As a result, very little of the in cr eas ed spending

flowed to businesses most a↵ected by the COVID-19 shock, such as small businesses in a✏uent areas

– potentially limiting the capacity of the stimulus to increase economic activity and employment

in the communities where job losses were largest.

Loans to small businesses as part of the Paycheck Protection Program (PPP) also have had

little impact on employment rates at smal l businesses to date. Employment rates at small firms

in the hardest-hit sectors trended similarly to those at larger firms that were likely to be ineligible

for PPP loans, and remained far below baseline levels as of May 30. These results suggest that

providing liquidi ty itself may be inadequate to restore employment at small businesses, at least in

the short run.

4

In su m, our analysis suggests that the p ri mar y barrier to economic activity is d epr essed con-

sumer spending due to the threat of COVID-19 itself as opposed to government restrictions on

economic activ i ty, inadequate income among consumers, or a lack of liquidity for firms. Hence,

the only path to full economic r ecovery in the long ru n may be to restore consumer confidence

by addressing the virus itsel f (e.g., Allen et al. 2020, Romer 2020). Traditional macroeconomic

tools – stimulating aggregate demand or providing liquidity to businesses – may have dimi ni sh ed

short-run impact s in an environment where consumer spending is fundamentally constrained by

health concerns.

In t h e meantime, it may be more fruitful to approach this economic crisis from the lens of

providing social insurance to reduce hardship rat h er than stimulus to increase economic activity.

Rather than attempt to put workers back to work in sectors where spending is temporarily depressed

because of health concerns, it may be best to focus on mitigating income losses for those who have

4. The PPP also includes price incentives to rehire workers in t h e form of loan forgiveness for firms that emp loy

the sa me number of workers as of June 30 as they did in February. Firms may rehire workers in light of this incentive

in the coming month, a possibility that can be evaluated in real time using the data in the tracker. What is clear at

this sta g e is that liquidity itself – absent this price incentive or fundamental changes in the public health situation –

appears to be insufficient to restore employment to pre-recession levels.

5

lost their jobs, consistent with the normative p red i ct i ons of the theoretical framework developed by

Guerrieri et al. (2020). For i nst an ce, providing su pport to workers who have lost their jobs (e.g.,

via the unempl oyment benefit system) may be preferable t o stimulus payments to all households,

irrespective of their employment situat ion . O ur findings also suggest that may be useful to consider

additional place-based assistance tar get ed at low-income individuals in areas that have su↵ered the

largest losses – such as a✏uent, urban areas – sin ce historical experience suggests that relatively

few people move to other labor markets to find new jobs after recessions (Yagan 2019).

Of course, all of these results could change over time: the recession may turn into a more

traditional economic shock with Keynesian spillove rs across a wider set of sectors and areas as

time passes, in which case tools such as stimulus and liquidity could become much more impactful

(Guerrieri et al. 2020). The tracker constructed her e can be used to monitor the changing dynamics

of the crisis and evaluate policy impacts on an ongoi n g basis.

Our work builds on and contributes to a rapidly evolving literature on the economic impacts of

COVID-19 as well as a long literature in macroeconomics on the measurement of economic activity

at business cycle frequencies. Several recent papers have used private sector data analogous to

what we assemble here to analyze consumer spending (e.g., Baker et al. 2020, Chen, Qian, and

Wen 2020, Cox et al. 2020), busines s revenues (e.g., Alexander and Karger 2020), labor market

trends (e.g., Bartik et al. 2020, Cajner et al. 2020, Kurmann, Lal´e, and Ta 2020, Kahn, Lange, and

Wiczer 2020), and social distancing (e.g., Al l cot t et al. 2020, Chiou and Tucker 2020, G oldf ar b and

Tucker 2020, Mongey, Pilossoph, and Weinberg 2020). These papers have identified a number of

important results consistent with our findings, such as concentrated impacts on spending in certain

industries such as food and accommodation; social distancing that is a result of voluntary choices

rather than legislation; and large employment losses for low-income workers. Each of these papers

analyzes a subset of data sources, obtained through a data us e agreement with the relevant firm.

By combining these and other datasets and benchmarking them to national aggregates, we are able

to trace th e macroeconomic impacts of the COVID shock from consumer spending to businesses

to labor markets. More generally, by integrating these datasets into a unified, freely accessible

platform, we eliminate the need for researchers or local policymakers to obtain specific permissions

to use confidential data from companies. We demonstrate that it is feasible to construct aggregates

from these data that protect privacy wh i le providing sufficient granularity for economic analysis in

real time, thereby providing a new tool for economic policy analy si s in this crisis and beyond.

The paper is organi zed as follows. The next secti on describes the dat a we use to construct

6

the economic tracker. In Section 3, we analyze the e↵ects of COVID-19 on spending, revenue,

and employment. Section 4 analyzes the impacts of policie s enacted to mitigate COVID’s impacts.

Section 5 conclud es. Technical details on data, methods, and supplementary analyses are available

in an online appendix.

II Data and Methods

We use anonymized data from several private companies to construct indices of spending, em-

ployment, and other metrics. In this section, we describe how we construct each series. To facilitate

comparisons between series, we adopt the following set of principles when constru ct in g each series

(wherever feasible given data availability constraints).

First, the central challenge in using private sector data to measure economic activity is that

they capture information exclusively about the customers e ach company serves, and thus are n ot

necessarily representative of the full population. Instead of attempting to adjust for this non-

representative sampling, we characterize the portion of the economy that each series captures by

comparing the characteristics of each sample we use to national benchmarks.

5

Second, we clean each series to remove artifacts that arise from changes in the data providers’

coverage or systems. For instance, firms’ clients often change discretely, sometimes leading to

discontinuous jumps in series, particularly in small cells. We systematically search for large jumps

in series (e.g., >80%), seek to understand their root causes, and address such discontinuities by

imposing continuity as described below.

Third, many series exhibit substantial periodic fluctuations across days. We add ress such fluc-

tuations through aggregation, e.g. repor ti n g 7-day moving averages to smooth daily fluctuat i ons.

Certain seri es – most notably consumer spending and business revenue – exhibit strong weekly fluc-

tuations that are autocorrelated across years (e.g., a surge i n spen d in g around the holiday season).

We de-seasonalize such series by normalizing each week’s value in 2020 relative to corresponding

values for the same week in 2019 in our baseli ne analysis, but also report raw values for 2020 for

researchers who prefer to make al ter n at ive seasonal adjustments.

Fourth, to protect confidentiality of business market shares, we do not report levels of the series.

5. An alternative approach is to reweight samples based on observable characteristics – e.g., industry – to match

national benchmarks. We do not pursue such an approach here because t h e samples we work with track relevant

national benchmarks – at least for the scale of shocks induced by the COVID crisis – with ou t such reweighting.

However, the disagg reg a ted data we report by industry and county can be easily reweighted as desired in fut u re

applications.

7

Instead, we report indexed values that show percentage changes relative to mean values in January

2020.

6

We also suppress small cel l s and exclude outliers to protect the pr i vacy of individuals and

businesses, with thresholds that vary across datasets as described below.

Finally, we seek to release data series at t he highest possible frequency. To limi t revisions, we

permit a sufficient lag t o adjust for reporting delays (typically one week). We disaggregate each

series by two-digit NAICS industry code; by county, metro area, and state; and by income quartile

where feasible.

7

We now describe each of the s er i es in turn, discussing the raw data sources, constructi on of key

variables, and cross-sectional compari sons to publicly available benchmarks.

8

All of the data series

described below can be freely downloaded from the Economic Tracker website: www.tracktherecovery. or g.

II.A Consumer Spending: Affinity Solutions

We measure consumer spending using aggregated and anonymized consumer purchase data collected

by Affinity Solutions Inc, a company that aggregat es consumer credit and debit card spending

information to support a variety of financial service products.

We obtain raw data f r om Affinity Solutions at the county -by-ZIP code income quartile-by-

industry-by-day level starting from January 1, 2019. Industries are defined by grouping together

similar merchant category codes. ZIP code income quart i les are constr u ct ed at the national level

using Census data on population and median household income by ZIP. Cells with fewer than five

unique card transactions are masked.

The raw data include several discontinuous breaks caused by entry or exit of credit card providers

from the sample. We identify these breaks using data on the total number of active cards in the

cell. We then estimate the discontinuous level shift in spending resulting from the break (using

a standard regression discontinuity estimator) . At the state level (including Washington, DC),

we adjust the series within each cell by adding the RD estimate back to the raw data t o obtain

a smooth series. At the county-level, there is too much noise to implement a reliable correction,

so we exclude counties that exhibi t such breaks from the sample. After cl ean i ng the raw data in

6. We always norm after summing to a given cell (e.g. geographic unit, industry, etc.) rather than a t the firm or

individual level. This d o lla r- weighted approa ch overweights bigger firms and higher-income individuals, but leads to

smoother series and is arguably more relevant for certain macroeconomic policy question s (e.g., changes in aggregate

spending).

7. We construct metro area values for large metro areas using a county to metro area crosswalk described in t h e

App endix.

8. We benchmark trends in each series over t ime to publicly-available data in the context of our analysis in the

next section.

8

this manner, we construct daily values of the consumer spending series using a seven-day moving

average of the current day and pr evi ou s six days of spending. We then seasonally adjust the series

by dividing each calendar date’s 2020 value by its corresponding value from 2019.

9

Finally, we index

the seasonally-adjusted series relative to pre-COVID-19 spending by divid i ng each day’s value by

the mean of the seasonally-adjusted seven-day moving average from January 8-28.

Comparison to QSS and MRTS. Total debit and cr ed it card spending in the U.S. was $7.08

trillion in 2018 (Board of Governors of the Federal Reserve System 2019), approximately 50% of

total personal consumption expenditures recorded in national accounts. Affinity Solutions captures

nearly 10% of debit and credit card spending in the U. S. To assess which categories of spending

are covered by the Affinity data, Appendix Figure 1 compares the spending distributions across

sectors to spending captur ed in the nationally representative Quarterly Services Survey ( QS S ) and

Monthly Retail Trade Survey (MRTS). Affinity has broad c overage across industries. However,

as expected, it over-represents categories where credit and debit cards are used for purchases. In

particular, accommodation and food services and clot h i ng are a greater share of the Affinity data

than financial services and motor vehicles. We therefore view Affinity as providing st at i st i cs that

are representative of total card spending (but not total consumer spending). We assess whether

Affinity captures changes in card spendi n g aroun d th e crisis in Section 3.1 below.

II.B Small Business Revenue: Womply

We obtain data on small business transactions and revenues from Wompl y , a company that aggre-

gates data from several cr edi t card p r ocessors to provide analytical insights to small businesses and

other clients. In contrast to the Affinity series on consumer spending, which is a cardholder-based

panel covering total spending, Womply is a firm-based panel covering total re venues of small busi-

nesses. The key distinction is that location in Womply refers to the location where the business

transaction occurred as opposed to the location where the cardholder lives.

We obtain raw data on smal l business transactions and revenues from Womply at the ZIP-

industry-day level starting from J anuary 1, 2019.

10

Small businesses are defined as businesses

with annual revenue below Small Business Administration thresholds. To reduce the influ ence of

outliers, firms outsi d e twice the interquartile ran ge of firm annual revenue wi t hi n this samp l e are

excluded and th e sample is further limited to firms with 30 or more t r ansact i on s in a quar t er and

9. We divide the daily value for February 29, 20 2 0 by the average value between the February 28, 2019 and March

1, 2019.

10. We crosswalk Womply’s transaction categories to two - d igit NAICS codes using an internally generated Womply

category-NAICS crosswalk, and then aggregate to NAI CS supersectors.

9

more than one transaction in 2 out of the 3 months.

We aggregate these raw data to f orm two publicly available series at the county by industry level:

one measuring total small business revenue an d another measuring the number of small businesses

open. We measure small business revenue as the sum of all credits ( generally purchases) minus

debits (generally returns). We define smal l businesses as being open if t hey have a tran sacti on in

the last three days. We exclude counties with a total average revenue of less than $250,000 during

the pre-COVID-19 period (January 4-31) .

For each series, we construct daily values in exactly the same way that we constructed the

consumer spending series. We first take a seven-day moving average, then seasonally adju st by

dividing each calendar date’s 2020 value by its corresp ond i ng value fr om 2019. Finally, we index

relative to pre-COVID-19 by dividing the series by its average value over January 4-31.

Comparison to QSS and MRTS. Ap pendi x Figure 1 shows the distribu t i on of revenues observed

in Womply across industries in comparison to national benchmarks. Wompl y revenues are again

broadly distributed across sectors, particularly those where card use is common. A larger share of

the Womply revenue data come from industries that have a larger sh are of smal l bu si nesses, such as

food services, professional services, and other servi ces, as one would expect given that the Womply

data only cover small busi nesses.

II.C Employment a nd Earnings: Earnin and Homebase

We use two data sources to obtain information on employment and earnings for low-income workers:

Earnin and Homebase.

Earnin is a financial man agement application that provides its members with access to their

income as they earn it. Workers sign up for Earnin individually usin g a cell phone app, which records

payroll information from bank accounts. Many l ower-income workers across a wide spectrum of

firms – ranging from the largest firms and government employers in the U.S. to small businesses –

use Ear ni n ; we discuss the characteristics of these workers further below. We obtai n raw data from

Earnin at the paycheck level with information on home ZIP, workplace ZIP, industry and firm size

decile from January 2020 to present.

11

We restrict this sample to workers who are paid on a weekly

or bi -weekly paycycle. We then use these data to measure employment and earnings for low-income

employees. We assign workers to locations using their workplace ZIP codes. We suppress esti mat es

for ZIP codes with fewer than 50 worker-days observed in Ear ni n over the period January 4-31.

11. We map each firm to a NAICS code using firm na mes and a custom-built crosswalk con stru c t ed by Digital

Divide Data. We o b t a in data on firm sizes from Reference USA.

10

Homebase provides scheduling tools for small businesses (on average, 8.4 employees) such as

restaurants (64% of employees f or whom sectoral data are available) and retail stores (15% of

employees for whom sectoral dat a are available). Unlike Earnin, Homebase provides a complete

roster of workers at a given firm, but only covers workers at small businesses. We obtain de-

identified individual-l evel data on hours and total pay for empl oyees at firms that contract with

Homebase at the establishment-worker-day level, starting on January 1, 2018. We restrict this

sample to non-salaried employees. We th en form each aggregate series at the county and industry

level, assigning location based on t h e ZIP code of establishment. To protect confidentiality, we

suppress estimates for cells with fewer than 10 Homebase clients in January 2020.

In both datasets, we measu r e total employment as a seven-day moving average of total number

of active employees, expressed as a percentage change relati ve to January 4-31, and total earnings

using a seven-day moving average of earnings div i ded by the average daily total earnings between

January 4-31. In the Homebase data, employment and earnings are observed on a daily basis. In

the Earnin data, where we observe paychecks, we distribute each worker’s earnings at the end of

their pay period over each day in their pay period, and assume that workers are employed over

their full pay period.

We also observe wages in both datasets. In the Homebase data, we measur e hourl y wage rates

using the change in the first reported hourly wage rate in the current week and the average reported

wage between January 4-31, 2020, divided by that average. In the Earnin data, where we do not

observe in di vi d ual identifiers, we measure wages as the seven-day moving average of daily mean

wages, expressed as a percentage change from daily mean wages between January 4-31.

Comparisons to OES and QCEW. Ap pendi x Figure 2 compares the industry composition of the

Earnin and Homebase samples to nationally representative statistics from the Quarterly Census

of Employment and Wages (QCEW). The Earnin sample is fairly representative of th e broader

industry mix in the U.S., although high-skilled sectors (such as professional services) are under-

represented. Homebase has a much larger shar e of workers in food services, even relative t o small

establishments (those with fewer than 50 employees) in the QCEW, as expected given its client

base.

Overall, annualizing January earnin gs would imply median earnings of roughly $23K per year

($11-12 per hour). In Appendix Table 1, we compare the median wage rates of workers in Earnin

and Homebase to nationally representative statistics from the BLS’s Occupational Employment

Statistics. Workers enrolled in Earn in have median wages that are at roughly t h e 10th percentile of

11

the wage distribution within each NAICS code. The one exception is the foo d and drink industry,

where the median wages are close to the popul at i on median wages in that industry (reflecting that

most workers in food services earn r el ati vely l ow wages). Homebase exh i bi t s a similar pattern, wi t h

lower wage rates compared to industry averages, excep t in sectors that have low wages, such as

food services and retail.

We conclude based on these comparisons that Earnin and Homebase provide statistics that

may be representative of low-wage (bottom-quintile) workers. Earnin provides data covering such

workers in all industries, whereas Homebase is best interpreted as a series that reflects workers in

the restaurant and retail sector.

II.D Job Postings: Burning Glass

We obtain data on job postings from 2007 to present from Burning Glass Technologies.Burning

Glass aggregates nearly all job s posted online from approximately 40,000 online job boards in the

United States. Burning Glass then removes duplicate posti ngs across sites and assigns attributes

including geographic locations, required job qualifications, and indust ry.

We obtain raw data on job postings at the industry-week-job qualification-county level from

Burning Glass. Industry is defined using select NAICS supersectors, aggregated from 2-digit NAICS

classification codes assigned by a Burning Glass algorithm. Job qualifications are defined us-

ing ONET Job Zones. These job zones are mutually exclu sive categories that cl assi fy j obs into

five groups: needing little or no preparation, some preparat i on, medium preparation, consider-

able preparation, or extensive preparation. We also obtain analogous data broken by educational

requirements (e.g., high school degr ee , col lege, et c. ) .

Comparison to JOLTS. Burn i ng Glass data have been used extensively in prior research in

economics; for instance, see Hershbein and Kahn (2018) and Deming and Kahn (2018). Carnevale,

Jayasundera, and Repnikov (2014) compare the Burning Glass data to government stati st i cs on job

openings and characterize the sample in detail. In Appendix F i gu re 3, we compare the distribution

of industries in the Burning Glass data to nationally representative statistics from the Bureau of

Labor Statistics’ Job Openings and Labor Market Turnover Survey (JOLTS) in January 2020. In

general, Burning G lass is well aligned across industries with JOLTS, with the one exception that

it under-covers government job s. We therefore view Burning Glass as a sample representative of

private sector jobs in the U.S.

12

II.E Education: Zearn

Zearn is an education nonprofit that partners with schools to provide a math program, typically used

in classrooms, that combines in-person instruction with digital lessons. Many schools continued

to use Zearn as part of their math curr i cul u m after COVID-19 induced schools to shift to remote

learning.

We obtain data on the number of students using Zearn Math and the number of lessons they

completed at the school -gr ade-week level. The data we obtain are masked such that any county

with fewer than two dist ri ct s, fewer th an three scho ol s, or fewer than 50 students on average using

Zearn Math during the p r e-period is excluded. We fill in these masked county statistics with the

commuting zone mean whe never possible. We winsorize values reflecting an increase of greater than

300% at the school l e vel. We exclude schools who did not use Zearn Math for at least one week

from January 6 to February 7 and schools that never have more than five students using Zearn

Math during our analysis period. To reduce the e↵ects of school breaks, we replace the value of

any week for a gi ven school that reflects a 50% decrease (increase) greater than the week before or

after it with the mean value for the t hr ee rel evant weeks.

We measure online math participation as the number of students using Zearn Math in a given

week. We measure student progress in math using the number of lessons completed by students

each week. We aggregate to the county, state, and national level, in each case weighting by the

average number of students using the platform at each school during the base period of January

6-February 7, and we normal i ze rel at ive to this base period to construct the indices we report.

Comparison to American Community Survey. In Appendix Table 2, we assess the representa-

tiveness of the Zearn data by comparing the demographic characteristics of the schools for which we

Zearn data (based on the ZIP codes in which they are located) to the demographic characteristics

of K- 12 students in the U.S. as a whole. In general, the distri bu t ion of income, education, and race

and ethni city of the schools in the Zearn sample is similar to that in the U.S. as a whole su ggest i ng

that Zearn likely provides a fairly representative picture of online learning for public school students

in the U.S.

II.F Public Data Sources: UI Records, COVID-19 Incidence, and Google

Mobility Reports

Unemployment Benefit Claims. We collect county-level data by week on unemployment insurance

claims starting in January 2020 from state government agen ci es since no weekly, county-level na-

13

tional data exist. Location is defined as the county where the filer resides. We use the i ni t i al claims

reported by states, which sometimes vary in their exact definitions (e.g., including or excluding

certain federal programs). In some cases, st at es only publish monthly dat a. For these cases, we

impute the weekly values from the m onthly values using the distribution of the weekly state claims

data from the Depar t ment of Labor (described below). We construct an unemployment claims

rate by dividing t h e total number of claims filed by the 2019 Bureau of Labor Statistics labor

force estimates. Note that county-level data are availabl e for 22 states, incl ud i ng the District of

Columbia.

We also report weekly unemp l oyment insurance claims at the state level from the Office of

Unemployment Insurance at the Department of Labor. Here, location is defined as the state liable

for the benefits payment, regar d less of the filer’s residence. We report both new unemployment

claims and total employment claims. Total claims ar e the count of new claims p lu s the count of

people receiving unemployment insurance benefit s in t he same period of eligibi l ity as when they

last received the benefits.

COVID-19 Data. We report the number of new COVID-19 cases and deaths each day using

publicly available dat a from the New York Times available at the county, state and national l evel.

12

We also report daily state-level data on the number of tests performed per day per 100,000 people

from the COVID Tracking P r oject.

13

For each measure - cases, deaths, and tests – we report two

daily series per 100,000 people: a seven-day moving average of new d ail y totals and a cumulative

total through the given date.

Google Mobility Reports.Weusedata from Google’s COVID-19 Community Mobility Reports to

construct measures of daily time spent at parks, retail and recreation, grocery, transit locations, and

workplaces.

14

We report t hese values as changes rel at i ve to the me di an value for the corresponding

day of the week during the five-week period from January 3rd - February 6, 2020. Details on place

types and additional information about data collection is available from Google.Weusetheseraw

series to form a measure of time spent outside home as follows. We first use the American Time

Use survey to measure the mean time spent inside home (excluding time asleep) and outside home

in January 2018 for each day of the week. We then multiply time spent inside home in January

12. See the New York Times data description for a complete discussion of method o lo g y and definitions. B ec a use

the New York Times groups all New York City counties as one entity, we instead use case and death data from New

York City Department of Health data for counties in New York City.

13. We use the Census Bureau’s 2019 population estimates to define population when normalizing by 100,000 people.

We suppress data where new counts are negative due to adjustments in official statistics.

14. Google Mobility trends may not precisely reflect time spent at locations, but rather “show how visits and length

of stay at di↵erent places change compared to a baseline.” We call this “time spent at a location” for brevity.

14

with Google’s percent change in ti me spent at residential locations to get an estimate of time spent

inside the home for each date. The remainder of waking hours in the day provides an estimate

for time spent outside the home, which we report as changes relative to the mean values for the

corresponding day of the week in January 2018.

III Economic Impacts of COVID-19

In this sect i on , we analyze the economic impacts of COVID-19, both to shed light on the

COVID crisis itself and to demonst r at e the utility of privat e sector data sources assembled above

as a complement to national accounts data in tracking economic activity.

To st r uct u r e our analysis, we begin from national accounts data released by the Bureau of

Economic Analysis (2020). GDP fell by $247 billion (an annualized rate of 5%) from the fourth

quarter of 2019 to the first quarter of 2020, shown by the first bar in Figure 1a. GDP fell primar i l y

because of a reduction in personal consumption expenditures (consumer spending), which fell by

$230 billion.

15

Government purchases did not change significantly, while net exports increased

by $65 billion and private investment fell by $90 billion.

16

We therefore begin our analysis by

studying the determinants of this sharp reduction in consumer spending. We then turn to examine

downstream i mpact s of the reduction in consumer spending on busin ess activity and the labor

market.

III.A Consumer Spending

We analyze consume r spending using data on aggregate credit and debit card spending. National

accounts data show that spending that is well captured on credit and debit cards – essentially all

spending excluding housing, healthcare, and motor vehicles – fell by approximately $138 billion,

comprising roughly 60% of the total reduction in personal consumption expenditures.

17

15. GDP is released at a quarterly level in the U.S. The redu c t io n in consumer spending occurred in the last two

weeks of March (Figure 2 below); hence the first quarter GDP estimates capture about one-sixth of the reduction in

spending due to the COVID shock.

16. Most of the reduction in private investment was driven by a reductio n in inventories and equipment investment in

the transportation sector, both of which are plausibly a response to reductions in current and anticipated consumer

spending. The increase in net exports was driven primarily by a reduction in imports, with a la rg e reduc t io n in

imports of travel and transporation services in particular, again reflecting a change in domestic consumer spending

behavior.

17. The rest of the reduction is largely acc o u nted for by healthca re and motor vehicle expen d itu res; housing expen-

ditures did not change significantly. We view the incorporation of da ta sources to study these other major components

of spendin g as an important direction for future work; however, we believe that the mechanisms discussed below may

apply at least qualitatively to those sectors a s well.

15

Benchmarking. We begin by assessing whether th e credit card data track patterns in corre-

sponding spending categories in the national accounts. Figure 1b plots spending on retail services

(excluding auto-related expenses) in the Affinity Solutions credit card data alongside the Monthly

Retail Trade Survey (MRTS), one of the main i n pu t s used to construct the national accounts. Both

series are indexed to have a value of 1 in January 2020; each point shows the level of spending in

a given month divided by spending in January 2020. Fi gur e 1c replicates Figure 1b for spending

on food services. In both cases, the credit/debit card spending series closely tracks the inputs

that make up the nati onal accounts. In particular, both series show a rapid drop in f ood services

spending in March and April 2020 and a smal l er drop in retail spending, along with an increase

in May. Given that credit card spendin g data closely tracks the MRTS at the national level, we

proceed to use it to disaggregate the national series in several ways to understand why cons ume r

spending fell so sharply.

Heterogeneity by Income. We begin by examining spending changes by household income. We

do not directly observe car dh ol der s’ incomes in our data; instead, we pr oxy for cardholders’ incomes

using the median household income in the ZIP code in which they live (based on data from the

2014-18 American Community S u rvey). ZIP-codes are strong predictors of income because of the

degree of segregation in most American cities; however, they are not a perfect proxy f or in come

and can be prone to bias in certain applications, particularly when studyin g tail outcomes (Chetty

et al. 2020). To evaluate the accuracy of our ZIP code imputation p rocedure , we compare our

estimates to those of Cox et al. (2020), who observe cardholder i ncome d ir ect l y based on checking

account data for clients of JPMorgan Chase. Our estimates are closely aligned with those estimates,

suggesting that the ZIP code proxy is reasonably accurate in this applicat i on .

18

Figure 2a plots a seven-day moving average of total daily card spending for households in the

bottom vs. top quartile of ZIP codes based on medi an household income.

19

The solid line shows

data from January to May 2020, while the dashed line shows data for the same days in 2019 as a

reference. Spending fell sharply on March 15, when the National Emergency was declared an d the

threat of COVID became widely d i scussed in the United States. Spending fell from $7. 9 billion

18. Cox et al. (2020) report an eight percentage point (pp) larger decline in spending for the highest inc o me quartile

relative to the lowest income quartile in the second week of April. Our estimate of the gap is also eight pp at that

point, althoug h the levels of the declines in our data are slightly smaller in magnitude for b o th groups. The JPMorgan

Chase data cannot themselves be used for the analysis t h a t follows because there are no publicly available a g g reg a ted

series based on those data at present.

19. We estimate total card spend in g by multiplying the raw totals in t h e Affinity Solutions data by the ratio of

total spending on the categories shown in the last bar of Figure 1a in PCE to total spending in the Affinity data in

January 2020.

16

per day in February to $5.4 billion per day by the end of March (a 31% redu ct i on) for high-income

households; the corresponding change for low-income households was $3.5 billion to $2.7 billion

(a 23% reduction). Because high-income household s both cut spending more in percentage terms

and accounted for a larger share of aggregate spending to begin with, they account for a much

larger share of the decline in total spendi n g in the U.S. than low-income households. We estimate

that as of mid-April, top-quartile households accounted for 39% of the aggregate spending decline

after the COVID shock, while bottom-quartile households accou nted for only 13% of the decline.

This gap grew even l ar ger after stimulus payments began in mid-April. By mid June, top-quartile

households accounted for over half of the tot al spending decline in the U.S. and were still spending

15% less than their January levels, whereas bottom-quarti l e households were spending almost the

same amount they were i n 2019. This heterogeneity in spending changes by income is much larger

than that observed in previous recessions (Petev, Pistaferri, and Eksten 2011, Figure 6) and plays

a central role in understanding the downstream impacts of COVID on businesses and the labor

market, as we show below.

Heterogeneity Across Sectors. Next, we disaggregate the change in total spending across cate-

gories to understand why households cut spending so rapidly. In particular, we seek to distinguish

two channels: reductions in spending due to loss of income vs. fears of contracting COVID.

The left bar in Figure 2b plots the share of the total decline in spending from the pre-COVID

period to mid-Apr i l accounted for by various categories. Nearly three-fourths of the reduction in

spending comes from reduced spending on goods or services that requ i re in-person contact (and

thereby carry a risk of COVID i n fect i on ) , such as hotels, transport at i on, and food services.

20

This

is particularly striking given th at these goods accounted for only one-third of total spending in

January, as shown by the right bar in Figure 2b.

Next, we zoom in to specific subcategories of spending that di↵er sharpl y in the degree to which

they require physical i nteraction in Figure 2c. Spending on l ux u ry goo d s such as installation of h ome

pools and land scap in g services – which do not require in-person contact – increased slightly after

the COVID shock; by contrast, spending on restaurants, beauty shops, and airli nes all plummeted

sharply. Consistent with these substitution patterns, spending at online retailers increase sharply:

online purchases comprised 11% of retail sales in 2019 vs. 22% i n April and M ay of 2020 (Mastercard

2020).

21

A conventional reduction in income or wealth would typically reduce spending on all goods

20. The relative shares of spending reductions across categories are similar for low- and high-income h o u seh o ld s

(Appendix Figure 4); what d i↵ers is the level of sp en d in g reduction, as discussed above.

21. We are unable to distinguish online and in-store transactions in the Affinity Solutions data.

17

as predicted by their Engel curves (income elasticities); the fact that t h e spending r edu ct i ons vary so

sharply across goods that di ↵er in terms of their health risks lends further support to the hypothesis

that it is health concerns rather than a lack of purchasing power that drove spendin g redu ct i ons.

These patterns of spending reduct i ons are particularly remarkable when contrasted with those

observed in prior recessions. Figure 2d compares the change in spending across categories in

national accounts data in the COVID recession and the Great Recession in 2009-10. In the Great

Recession, nearly all of the reduction in consumer spending came from a reduct i on in spending on

goods; spending on services was almost unchanged. In the COVID recession, 67% of the reduction

in total spending came from a reduction in spending on services, as anticipated by Mathy (2020).

Heterogeneity by COVID Incidence. To further evaluate the role of health concerns, we next

turn to directly examine the association between incidence of COVID across areas and changes in

spending. Figure 3a presents a binned scatterplot of changes in spending from January to April

vs. the rate of detected COVID cases by county. To construct this figure, we divide the x variable

(COVID cases) into 20 bins, each of which contain 5% of the p opu l at ion , and plot the mean value

of the x and y variables within each bin. Areas with higher rat es of COVID infection experience

significantly larger declines in spendin g, a relationship that holds conditional on controls for median

household income and state fixed e↵ects (Appendix Figure 5).

22

To examine the mechanism driving these spending reductions more directly, in Figure 3b, we

present a binned sc at ter pl ot of the amount of time spent outside home (using anonymized cell

phone data from Google) vs. COVID case rates, separately for low- and high-income counties

(median household income in the bottom vs. top income quartile). In both sets of areas, there

is a strong negative relationship: people spend considerably less time outside home in areas with

higher rates of COVID infection. The reduction in spending on services that requi r e physical, in-

person interaction (e.g., restaurants) is mechanically related to t h is simple but important change

in behavior.

At all levels of COVID infection, higher-income households spend less time outside. Figure 3c

establishes this point more directly by showing that time spent outside home fall s monotonically

with househ ol d income across the distribution. These results help explain why th e rich reduce

spending more, especially on goods that require in-person interaction: high-income people appar-

ently self-isolate more, perhaps by working remotely or because they have larger living spaces.

22. Note that there is a substantial reduction in spending even in areas without high rates of realized COVID

infection, which is consistent with widespread concern about the disease even in areas where outbreaks did not

actually occur at high rat es.

18

In sum, disaggregat ed data on consumer spending reveals that sp end ing in the initial stages of

the pandemic fell primarily because of health concerns rather than a loss of current or expected

income. Indeed, income losses were relatively modest because relatively few high-income individu al s

lost their jobs (Cajner et al. 2020) and lower-income households who experienced job loss had their

incomes more than replaced by unemployment benefits (Ganong, Noel, and Vavra 2020). As a

result, national accounts data actually show an increase in total income of 13% from March to

April 2020. This result implies that the central channel emphasized in Keynesian models that

have guided policy responses to prior recessions – a fall in aggregate demand due to a lack of

purchasing power – has been less important in the early stages of the pandemic, partly as a result

of policies such as increases in unemployment benefits that o↵set lost earnings. Rather, the key

driver of residual changes in aggregate spending is a contraction in firms’ ability to supply certain

goods, namely services that carry no health risks. We now show that this novel source of spendi n g

reductions leads to a distinct pattern of downstream impacts on businesses and the labor market,

potentially calling for di↵erent p ol i cy responses th an in prior recessions.

III.B Business Revenues

We now turn to examine how reductions in consumer spending a↵ect bu si ness activity. Conceptu-

ally, we seek to understand how a change in revenue for a given firm a↵ects its deci sion s: whether to

remain open, how many employees to retai n, what wage rates to pay them, how many new people

to hire. Ideally, one would analyze these impacts at the firm level, examining how the customer

base of a given firm a↵ected its revenues and employment decisions. Lacking firm-level data, we use

geographic variation as an i n st ru ment for the spending shocks that firms face. The moti vation for

this geographical approach is that spending fell primarily among high-income households in sectors

that require in-person interaction, such as restaurants. M ost of t hese goods are non-tradab le p r od-

ucts produced by small local busi n esses who serve customers in their local area.

23

We therefore use

di↵erences in average incomes and rents across ZIP codes as a sou r ce of variation in the magnitude

of the spending shock that small businesses face.

24

23. 56% of workers in food and accommodation services and retail (two major non-tradeable sectors) work in

establishments with fewer than 50 employees.

24. We focus on small bu sin esses because their customers are typically locat ed near the business itself; larger

businesses’ customers (e.g., large retail chains) are more dispersed, making the geographic lo ca t io n of the business

less relevant. One cou ld also in principle use other groups (e.g., sectors) instead of geogra p hy as instruments. We

focus primarily on geographic variation because the granularity of the data by ZIP cod e yields much sharper varia t io n

than what is available across sectors and arg u a b ly yields comparisons across more similar firms (e.g., restaurants in

di↵erent neighborhoods rather than airlines vs. manufacturing).

19

Benchmarking. We measure small business revenues using data from Womply, which records

revenues from credit card transactions for small bu sin esses (as defined by the Small Business Ad-

ministration). Bu si ness revenues in Womply clos el y track patterns in the Affinity total spending

data, especially in sectors with a large share of small businesses, such as food and accommodation

services (Appendix Figure 6).

25

Heterogeneity Across Areas. We begin our analysis of the Womply data by examining how

small business revenues changed in low- vs. high-income ZIP codes from a baseline period prior

the COVID shock (January 5 to March 7, 2020) to the weeks immediately after the COVID shock

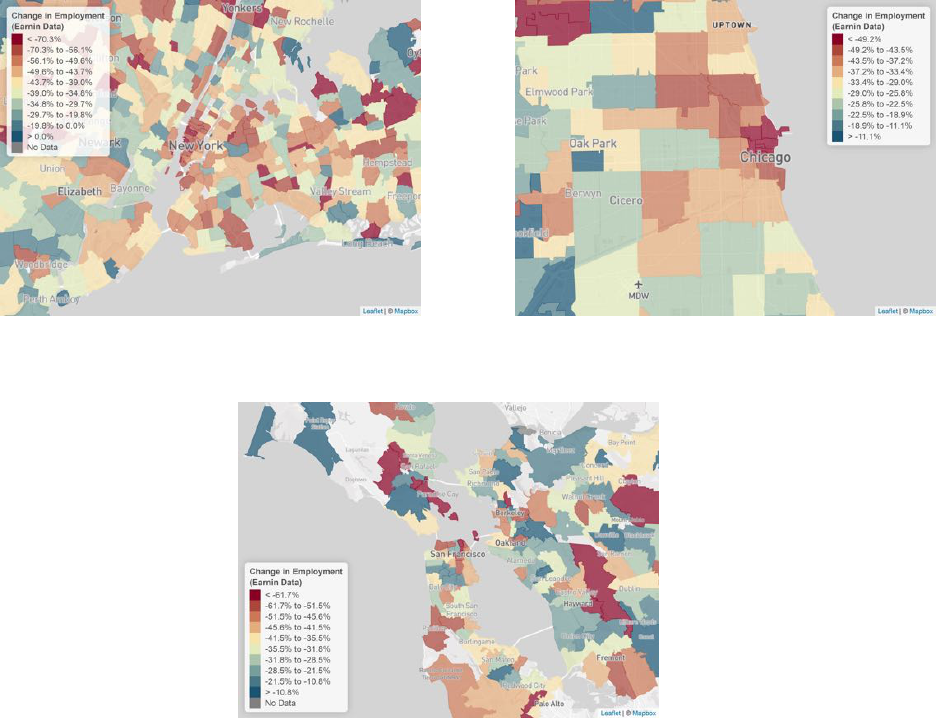

before the stimulus program began (March 22 to April 20, 2020). Figure 4 maps the change in

small business revenue by ZIP code in three large metro areas: New York City, San Francisco,

and Chicago (analogous ZIP-level maps for other cities are available here). There is substantial

heterogeneity in revenue declines across areas. For example, average revenue declines ran ge from -

87% (or below) in the lowest-income-decile of ZIP codes to -12% (or above) in the top-income-d eci le

in New York City.

26

In all three cities, revenue losses are largest in the most a✏uent parts of the city. For example,

small business lost 73% of t hei r revenue in the Upper East Side in New York, compared with 14%

in the East Bronx ; 67% in Lincoln Park vs. 38% in Bronzeville on the South Side of Chicago; and

88% in Nob Hill vs. 37% in Bayview in San Francisco. Revenue losses are also large in the central

business districts in each city (lower Manhattan, th e Loop in Chicago, the Financial District in

San Francisco), likely a direct consequence of the fact that many workers who used to work in

these areas are now working remotely. But even with in predominantly residential areas, businesses

located in more a✏uent neighborhoods su↵ered much larger revenue losses, consistent with the

heterogeneity in spending reductions observed in the Affinity data.

27

More broadly, cities that

have experienced the largest declines in small business revenue on average tend to be a✏uent cities

– such as New York, San Francisco, and Boston (Table 1, Appendix Figure 8).

Figure 5a generalizes these examples by presenting a bin ned scatter plot of percent changes in

small business revenue vs. median household incomes, by ZIP code across the entire country. We

observe much larger reductions in revenue at local small businesses in a✏uent ZIP codes. In the

25. In sectors that have a bigger share o f large businesses – such as retail – the Womply small business series exhibits

a larger decline during the COVID crisis than Affinity (or MRTS). This pattern is precisely a s expected given other

evidence that consumers shifted spendin g toward large online retailers such as Ama z on (Alexander and Karger 2020).

26. Very little of this variation is due to samp lin g error: the reliability of these estimates across ZIP codes within

counties exceeds 0.8, i.e., more than 80% of the variance within each of these maps is due to signal rather tha n noise.

27. We find a similar pattern wh en controlling for di↵erences in indu stry mix across areas; for instance, the maps

look very similar when we focus solely on small businesses in food and accommodation services (Appendix Figure 7).

20

richest 5% of ZIP codes, small business revenues fell by 60%, as comp ared with 40% in the poorest

5% of ZIP codes.

28

As di scussed above, spending fell most sharply not just in high-income areas, but particularly

in high-income areas with a high rate of COVID infection. Data on COVID case rates are not

available at the ZIP code level; however, one well established pr ed ict or of the rate of spread of

COVID is population density: the infection spreads more rapidly in dense areas. Figure 5b shows

that small business revenues fell more heavily in more densely populated ZIP codes.

29

Figure 5c combines the income and popul at ion density mechanisms by plott i n g revenue changes

vs. median rents (for a two bedr oom apartment) by ZIP code. Rents are a simple measure of the

a✏uence of an area that combine income and population density: the highest rent ZIP codes tend

to be high-income, dense areas such as Manhattan. Figure 5c shows a particularly steep gradient

of revenue changes with respect to rents: revenues fell by less than 30% in the lowest-rent ZIP

codes, compared with more than 60% in the hi gh est-r ent ZIP codes. This relationship is essentially

unchanged when controlling for worker density in the ZIP code and county fixed e↵ects (Appendix

Table 3).

In Figure 5d, we ex ami ne heterogeneity in this relationship across sectors that require di↵erent

levels of physical interaction: food and accommodation servi ces and retail trade (which largely

require in-person interaction) vs. finance and professional services (which largely can be conducted

remotely). Revenues fall much more sharply for food and retail in higher-rent areas; in contrast,

there is essentially no relationship between rents and revenue changes for finance and professional

services. These findings show that businesses that cater in person to the rich are those that lost

the most businesses. Naturally, many of those businesses are located in high-income areas given

people’s preference for geographic proximity in consuming services.

As a result of this sharp loss in revenues, small businesses in high-rent areas are much more

likely to close entirely. We measure closure in the Womply data as reporting zero credit card

revenue for t h r ee days in a row. Appendix Figure 10 shows that 55% of small businesses in the

highest-rent ZIP codes closed, compared with 40% in the lowest rent ZIP codes. The extensive

28. Of course, households do not restrict their spending solely t o businesses in their own ZIP code. An alternative

way to establish this result at a broader geography is to relate small business revenue changes to the degree of income

inequality across counties. Counties with higher Gini coefficients experienced large losses of small business revenue

(Appendix Figure 9a). This is particularly the case among co u nties with a large top 1% income share (Appendix

Figure 9b). Poverty rates are not strongly associated with revenue losses at the county level (Appendix Figure 9c),

showing t h a t it is the presence of the rich in particular (as opp o sed to the middle class) that is most predictive of

economic impacts on local b u sinesses.

29. Consistent with this pattern, t o ta l spending levels and time spent out sid e also fell much more in h ig h population

density areas.

21

margin of business closure accounts for most of the decline in total revenues.

Because businesses located in high-r ent areas lose more revenue in p er centage ter ms and tend

to account for a greater share of total revenue to b egi n with, they account for a very large share of

the total loss in small bu si ness revenue. More than half of the total loss in small business revenues

comes from business located in the top-quartile of ZIP codes by rent; only 8% of the revenue loss

comes from businesses located in th e bottom quartile. We now examine how the incidence of this

shock is passed on to their employees.

III.C Impacts on Employment Rates and Low-Income Workers

We analyze t he impacts of the COVID shock on employment using data from two sources: Earnin,

which provides data on hours, wages, and employment rates for l ow-wage ( bottom quintile) worker s

across a broad range of industries and Homebase, which provides analogous data for hourly workers

in small businesses, especially restaurants and retail shops.

Benchmarking. As with the other series analyzed above, we begin by benchmarking changes in

these series to nationally representative benchmarks. Figure 6a pl ot s employment rates from the

nationally representative Current Employment Statistics for all workers alongside the overall Earnin

series and Homebase series. We also include the National Employment Report from ADP, a l arge

payroll processor that covers nearly 20% of employment in th e U.S. The ADP data are reweighted

to provide estimates t h at are intended to rep r esent all workers in the U.S. Cajner et al. ( 2020)

use ADP data to report est imat es of the decline in employment by worker wage quintile, showing

that employment rates fell much more sharply for lower-wage workers. We plot the estimate they

report for workers in the bottom quintile as of April 11 in Figure 6a. Consistent wi t h the findings of

Cajner et al. (2020), the CES and ADP series for all workers exhibit smaller declines in employment

rates than the series that focuses on low-wage (bottom quintile) workers. The ADP estimate for

low-wage workers is roughly aligned wit h decline observed in Earnin. However, Homebase exhibits

a much larger decline th an Ear ni n .

The di↵erences between trends in the Homebase data and other series is largely explai n ed by

di↵erences in industry and size composi t i on . Figure 6b est abl i sh es this result by replicating Figure

6a for workers in Accommodation and Food Serv i ces.

30

The Earnin series an d overal l ADP series

are very closely al i gn ed here, consistent with the fact that workers in the food services sector tend

to have low wage rates (Appendix Table 1). When we further restrict Earnin to small firms – with

30. Since estimates for Accommodation and Food Services are unavailable in ADP’s National Employment Report,

we use their Leisure and Hospita lity Series.

22

less than 50 employees, comparable to the typical sizes of firms in the Homebase data – we find

closer alignment between the Earnin and Homebase data in terms of the magnitude of decline in

employment.

31

Based on t h is benchmarking exercise, we conclude that Earnin provides a good representation

of employment rates for low-wage workers across sectors, wh i l e Homebase provides estimates that

are representative of workers at small businesses, particularl y in restaurants (who comprise 64% of

workers in the Homebase d at a for whom sectoral data ar e available). We therefore use Earnin as

our primar y dataset for analyzi n g labor market outcomes for low-income workers, and supplement

it with Homebase to look more closely at workers in rest aur ants.

Consistent with t he results of Bartik et al. (2020), we find that wage rates have remained

unchanged through the COVID shock for workers who retained their jobs. Additionally, changes i n

employment rates are virtually identical to changes in hours because the ex t e ns ive margin accounts

for the vast majority of hours r edu ct i ons. As a result, the employment changes in Figure 6 are

almost identical to observed changes in workers’ hours and ear ni n gs (Ap pendi x F igu r e 11).

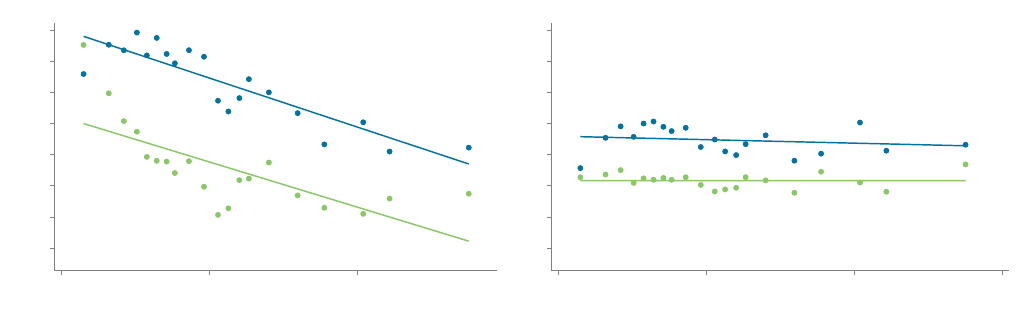

Heterogeneity Across Areas. We now use the Earnin and Homebase data to examine the drivers

of empl oyment losses for low-wage workers. Building on the approach developed above, we focus on

geographic heterogenei ty in spending reductions and the resulting revenu e losses faced by business.

Figure 7 presents maps of changes in hours of work for small- and mid-size businesses (fewer than

500 employees) in th e Earnin data by ZIP code in New York, S an Francisco, and Chicago (analogous

ZIP-level maps for other cities are available here).

32

The patterns closely mirror those observed

for business revenues above, with a wide range of variation across ZIP codes. Hours of work fel l