Most Serious Problems — Statutory Notices of Deficiency198

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case Advocacy Appendices

MSP

#13

STATUTORY NOTICES OF DEFICIENCY: The IRS Fails to Clearly

Convey Critical Information in Statutory Notices of Deficiency,

Making it Difficult for Taxpayers to Understand and Exercise

Their Rights, Thereby Diminishing Customer Service Quality,

Eroding Voluntary Compliance, and Impeding Case Resolution

RESPONSIBLE OFFICIALS

Ken Corbin, Commissioner, Wage and Investment Division

Mary Beth Murphy, Commissioner, Small Business/Self-Employed Division

Douglas O’Donnell, Commissioner, Large Business and International Division

David Horton, Acting Commissioner, Tax Exempt and Government Entities Division

Donna Hansberry, Chief, Office of Appeals

TAXPAYER RIGHTS IMPACTED

1

The Right to Be Informed

The Right to Quality Service

The Right to Pay No More Than the Correct Amount of Tax

The Right to Challenge the IRS’s Position and Be Heard

The Right to Appeal an IRS Decision in an Independent Forum

The Right to a Fair and Just Tax System

DEFINITION OF PROBLEM

The statutory notice of deficiency (SNOD) notifies the taxpayer that there is a proposed additional tax

due, identifying the type of tax, and period involved, and that the taxpayer has the right to bring suit in

the United States Tax Court before assessment and payment.

2

The taxpayer has 90 days (or 150 days if

the taxpayer resides outside the United States) to petition the U.S. Tax Court.

3

If the taxpayer does not

petition the Tax Court, after the 90 (or 150) days expire, the IRS will assess the tax, send the taxpayer

a tax bill, and start collections.

4

The notice of deficiency is the taxpayer’s “ticket” to the Tax Court, the

only pre-payment judicial forum where the taxpayer can appeal an IRS decision. The SNOD is critical

to many low income and middle income taxpayers because generally without it they would be required

to pay the tax first and go to refund fora, such as federal district courts or the United States Court

of Federal Claims, in order to challenge the tax adjustment in an independent judicial forum. The

notice also provides due process, as part of procedural justice, to taxpayers, especially those who cannot

afford representation.

5

Approximately 69 percent of cases in Tax Court are brought by unrepresented

1

See Taxpayer Bill of Rights (TBOR), www.TaxpayerAdvocate.irs.gov/taxpayer-rights. The rights contained in the TBOR are

also codified at Internal Revenue Code (IRC) § 7803(a)(3).

2

IRC §§ 6212(a), 6213(a); Internal Revenue Manual (IRM) 4.8.9.8, Preparing Notices of Deficiency (July 9, 2013).

3

IRC § 6213(a).

4

IRC § 6212(a); IRM 4.8.9.8, Preparing Notices of Deficiency (July 9, 2013).

5

See Most Serious Problem: Pre-trial Settlements in the U.S. Tax Court: Insufficient Access to Available Pro Bono Assistance

Resources Impedes Unrepresented Taxpayers from Reaching a Pre-trial Settlement and Achieving a Favorable Outcome, infra.

Taxpayer Advocate Service — 2018 Annual Report to Congress — Volume One 199

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case AdvocacyAppendices

taxpayers, and that percentage increases to 91 percent among cases where the deficiency for a tax year is

$50,000 or less and the taxpayer elects small tax case (S Case) procedures.

6

In fiscal year (FY) 2017, the IRS issued more than 2.7 million of the four types of SNODs that are

separately tracked (called the “3219 SNODs”), as shown on Figure 1.13.1.

7

There were only about

27,000 docketed cases in Tax Court that year, however, suggesting that less than one percent of

taxpayers who received a SNOD filed a petition with the Tax Court.

8

The IRS tracks the income level

of taxpayers receiving three of the 3219 SNODs, excluding the SNODs issued to those who did not

file a return.

9

The majority of these three types of 3219 SNODs (called Non-Automated Substitute

for Return or Non-ASFR SNODs) were issued to low income taxpayers. Nearly 59 percent of those

receiving a Non-ASFR SNOD make less than $50,000 per year.

10

Yet low income taxpayers, who may

be eligible for representation through Low Income Taxpayer Clinics (LITCs), are less likely to petition

the Tax Court.

11

In FY 2018, the median total positive income (TPI) for individuals who did not

petition the Tax Court in response to a SNOD issued after an audit was about $24,000.

12

The National Taxpayer Advocate is concerned that the lack of taxpayers’ responses to SNODs may be,

in part, due to faulty design and poor presentation of information in the notices, making it difficult for

taxpayers to understand critical information and exercise their rights. We have identified the following

issues pertaining to IRS SNODs:

SNODs do not alert taxpayers of their rights and the consequences for not exercising them;

SNODs do not sufficiently apply plain writing principles, nor incorporate behavioral research

insights, as directed by the Plain Writing Act and Executive Order 13707; and

The IRS continues to omit Local Taxpayer Advocate (LTA) information required by law on

certain SNODs, thereby violating taxpayer rights.

6

American Bar Association (ABA), Section of Taxation, Comment Letter on the Tax Court Rules of Practice and Procedure

Relating to the Appearance and Representation before the Court 2 (Oct. 3, 2018), https://www.americanbar.org/content/

dam/aba/administrative/taxation/policy/100318comments.pdf. The small tax case criteria are provided in IRC § 7463.

7

Although there are many versions of the Statutory Notice of Deficiency (SNOD), the four types being referenced are:

CP 3219A, LTR 3219, LTR 3219C, and LTR 3219N, as discussed below.

8

IRS Office of Chief Counsel, ABA Report, Tax Section, Court Procedure Committee 12 (Sept. 30, 2017) (providing the

sources of cases petitioned to the Tax Court for fiscal year (FY) 2017) (on file). Some of the SNODs issued in FY 2017

would not have resulted in docketed cases before FY 2018. In addition, some cases docketed in FY 2017 could have

resulted from SNODs issued in an earlier year.

9

We can also determine the income of other taxpayers who received a SNOD after an audit—even if we do not know

which type of SNOD they received — because these cases are tracked on the Compliance Data Warehouse (CDW) Audit

Information Management System (AIMS) Closed Case Database, and we can obtain the taxpayer’s income from the

Individual Returns Transaction File (IRTF) F1040 table.

10

CDW Notice Delivery System (NDS) Notice Table (Dec. 11, 2018); IRTF Form 1040 Table (Dec. 11, 2018). Due to the lapse

in appropriations, the IRS did not provide a timely response to our request to verify these figures during the TAS Fact Check

process.

11

See Most Serious Problem: Pre-trial Settlements in the U.S. Tax Court: Insufficient Access to Available Pro Bono Assistance

Resources Impedes Unrepresented Taxpayers from Reaching a Pre-trial Settlement and Achieving a Favorable Outcome, infra.

In order to qualify for assistance from an Low Income Tax Clinic (LITC), generally a taxpayer’s income must be below 250

percent of the current year’s federal poverty guidelines, based on family size and with income adjustments for Hawaii and

Alaska. IRC § 7526(b)(1)(b)(ii). As of January 2018, 250 percent of the federal poverty level was $51,950 for a family of

three. See IRS Pub. 3319, Low Income Taxpayer Clinics (LITC) Grant Application Package and Guidelines 45-46 (May 2018).

12

CDW AIMS Closed Case Database (Dec. 11, 2018); IRTF F1040 table (Dec. 11, 2018). In computing this income level, TAS

excluded accounts for which the IRS had no record of the taxpayer’s income in any of the prior three tax years. The IRS

had such records for more than 90 percent of these accounts. Total positive income (TPI) is the taxpayer’s income from

all sources before adjusting for deductions and exemptions. Due to the lapse in appropriations, the IRS did not provide a

timely response to our request to verify these figures during the TAS Fact Check process.

Most Serious Problems — Statutory Notices of Deficiency200

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case Advocacy Appendices

ANALYSIS OF PROBLEM

Background

Generally, taxpayers self-assess taxes when filing their income tax returns. However, the IRS may

determine that a taxpayer owes additional tax and may request additional information or select the

taxpayer’s return for an audit.

13

If the taxpayer and the IRS cannot agree on the alleged tax liability in

connection with an audit, document matching (e.g., after issuance of a CP 2000), or appeals process, the

IRS will issue a notice of deficiency.

14

When the IRS issues a SNOD, the taxpayer has 90 days to file

a petition in Tax Court.

15

No assessment of any tax or collection through levy or proceeding in court

may begin until after the notice has been mailed and this 90-day period has expired.

16

When a taxpayer

timely files a petition with the Tax Court, no assessment or collection is allowed until the Tax Court

enters a final decision.

17

If the taxpayer files a petition with the Tax Court, the Tax Court provides support and special

procedures for unrepresented taxpayers. In accordance with IRC § 7463, the Tax Court offers

simplified and expedited procedures for tax disputes involving amounts of $50,000 or less. For example,

if a taxpayer elects small tax case status, and the case goes to trial, under Rule 174 of the Tax Court

Rules and Procedure, the trial will be conducted as “informally as possible consistent with orderly

procedure”

18

and “any evidence deemed by the Court to have probative value shall be admissible.”

19

Neither briefs nor oral arguments will be required unless the court otherwise directs.

20

The tax assessment is an important administrative act because it sets the stage for the IRS to start

collecting unpaid tax balances using methods such as seizure and levy of a taxpayer’s property.

21

The

Supreme Court explained the significance of the assessment in Bull v. United States: “The assessment is

given the force of a judgment, and if the amount assessed is not paid when due, administrative officials

may seize the debtor’s property to satisfy the debt.”

22

If, after the IRS issues a series of notices and the

taxpayer does not dispute the IRS collection actions by requesting a hearing or paying the tax, the IRS

may file a lien or levy the taxpayer’s property, including the taxpayer’s bank accounts or wages.

23

13

See IRC 7602(a); see also IRS Publication 556, Examination of Returns, Appeal Rights, and Claims for Refunds (Rev. Sept.

2013).

14

IRM 11.4.2.7.4, CP 2000 (Oct. 5, 2006). The CP 2000 notice is issued to taxpayers proposing an adjustment to their tax

account based on disparities found between the taxpayers return and information returns.

15

IRC §§ 6212, 6213. If the notice is addressed to a person outside the United States, the taxpayer has 150 days to file a

petition in the Tax Court.

16

See IRC § 6213(a). However, if collection of an unassessed liability is in jeopardy, the IRS may make an immediate

assessment and pursue collection without the need to follow normal assessment and collection procedures. As soon as

a “jeopardy assessment” is made, the tax, penalties, and interest become due and payable. IRC §§ 6851, 6861. See

also IRC §§ 6201-6207, 6303(a). If no petition is filed with the Tax Court, upon the expiration of the 90-day period, the

IRS will assess the tax liability. Within 60 days of making the assessment, the IRS must provide the taxpayer notice of the

assessment and demand for payment.

17

See IRC §§ 6213(a), 7481.

18

Rule 174(b), Tax Court Rules and Procedure.

19

Id.

20

Rule 174(c), Tax Court Rules and Procedure.

21

IRC §§ 6320, 6330.

22

Bull v. United States, 295 U.S. 247, 259-260 (1935). See also IRC § 6321.

23

The IRS must issue a Notice of Federal Tax Lien after filing a federal tax lien and provide taxpayers with the right to a

hearing under IRC § 6320. The IRS must also give notice to the taxpayer before issuing a levy under IRC § 6330. See also

IRC § 6331.

Taxpayer Advocate Service — 2018 Annual Report to Congress — Volume One 201

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case AdvocacyAppendices

Thus, it is critical that taxpayers dispute the tax before the 90 days expires if they disagree with the IRS’s

proposed assessment. Otherwise, once the tax is assessed, the IRS will start collecting the liability. In

most cases, for taxpayers to challenge the tax in an independent judicial forum, they must pay the tax

and then request a refund.

24

This option is costly and unfeasible for some taxpayers.

As noted above, available data suggest that less than one percent of the taxpayers, who receive one of the

four types of SNODs separately, file a petition with the Tax Court. Other taxpayers are not availing

themselves of a fundamental taxpayer right—the right to appeal an IRS decision in an independent forum.

They may not be availing themselves of their rights because the SNODs do not effectively communicate

the information needed for taxpayers to understand their rights, the relevant tax issues, nor how to

respond.

The most commonly issued SNODs are the 3219 SNODs.

25

The 3219 SNODs include:

CP 3219A, Automated Underreporter (The IRS issues CP 3219A when the taxpayer’s return

information does not match third-party information sent to the IRS.);

LTR 3219, Correspondence Exam (The LTR 3219, which is mailed from the IRS Service Center,

is issued after a correspondence exam where there is no agreement between the IRS and the

taxpayer.);

LTR 3219C, Automated Questionable Credit (The LTR 3219C is issued to taxpayers who may

have false wages or withholding, or who are being denied refundable credits.);

26

and

LTR 3219N, Automated Substitute for Return (ASFR) (The LTR 3219N is issued to assess tax

against those who have unfiled returns.).

27

24

In order to bring a refund suit, the taxpayer must first file a claim for refund with the IRS and, upon its denial by the IRS or

the IRS’s failure to act within six months, the taxpayer must then file a suit for refund in the district courts or the U.S. Court

of Federal Claims. See IRC § 7422. In certain cases, audit reconsideration is available to eligible taxpayers who have a tax

balance and can provide new documents to the examination division. IRM 4.13.1.2, Definition of an Audit Reconsideration

(Dec. 16, 2015). Under IRC § 6330 (c)(2)(b), taxpayers may challenge a tax liability at a collection due process hearing.

Specifically, the taxpayer may also raise at the hearing challenges to the existence or amount of the underlying tax liability

for any tax period if the taxpayer did not receive a statutory notice of deficiency for the tax liability or did not otherwise

have an opportunity to dispute the tax liability (e.g., if the SNOD was not sent to the last known address). See also Most

Serious Problem: Collection Due Process Notices: Despite Recent Changes to Collection Due Process Notices, Taxpayers Are

Still at Risk for Not Understanding Important Procedures and Deadlines, Thereby Missing Their Right to an Independent Hearing

and Tax Court Review, infra. For a proposal that would allow taxpayers to file suit in a United States District Court or in the

United States Court of Federal Claims without first paying an assessment in full, see Legislative Recommendation: Fix the

Flora Rule: Give Taxpayers Who Cannot Pay the Same Access to Judicial Review as Those Who Can, infra.

25

IRS response to TAS information request (Dec. 12, 2018).

26

IRM 25.25.7.4, Taxpayer Responses (Aug. 23, 2018).

27

IRM 3.10.72-2, Correspondex C Letters – Routing Guide (Jan. 1, 2018); Exhibit IRM. 3.10.72-3, Computer Paragraph (CP)

Notices – Routing Guide (Jan. 1, 2018).

The notice of deficiency is the taxpayer’s “ticket” to the Tax Court, the only

pre-payment judicial forum where the taxpayer can appeal an IRS decision.

Most Serious Problems — Statutory Notices of Deficiency202

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case Advocacy Appendices

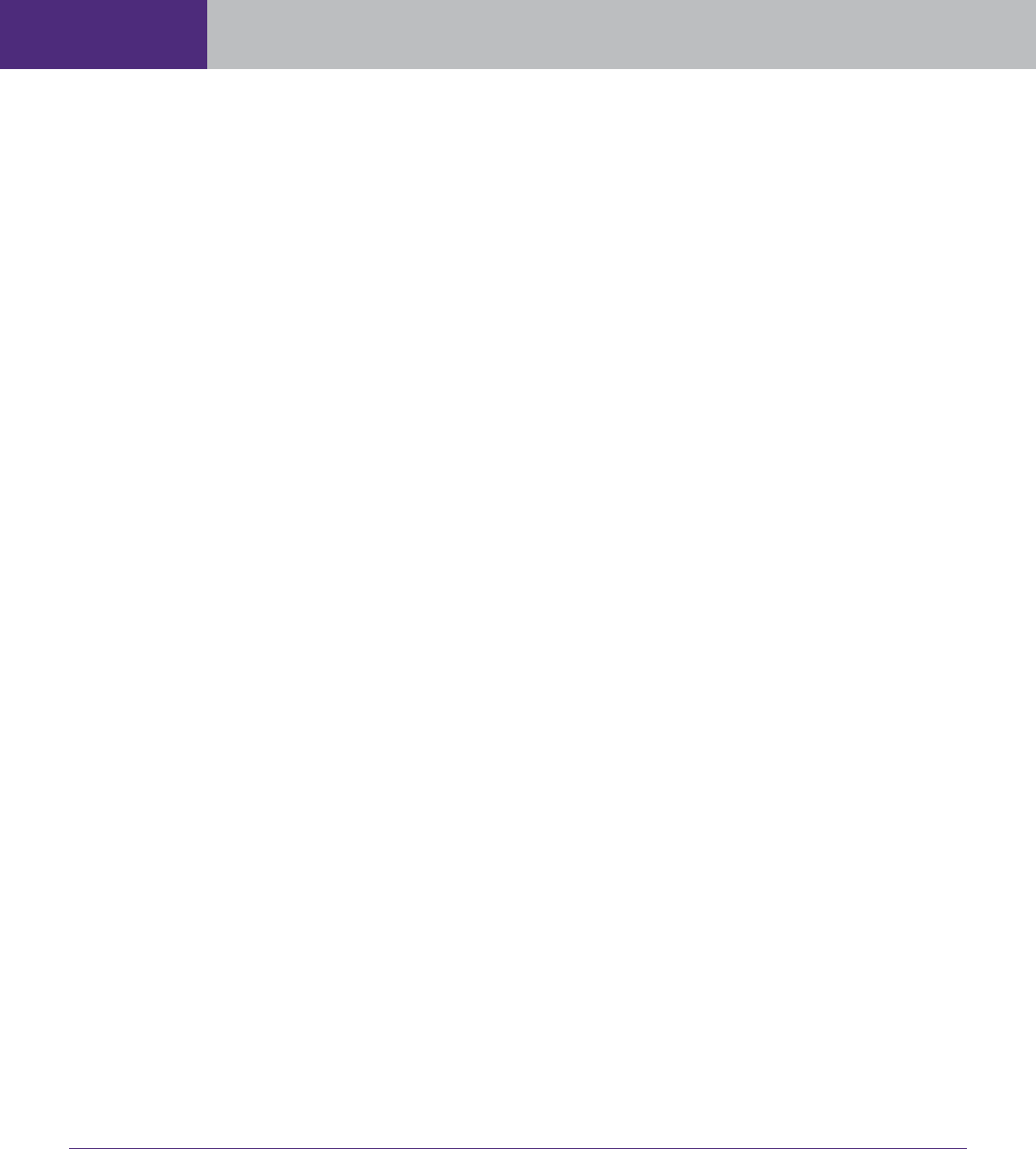

FIGURE 1.13.1, Number of 3219 SNODs Mailed Over Past Five Years

28

FY 2013 FY 2014 FY 2015 FY 2016 FY 2017

CP 3219A

1,898,982 2,697,153 2,580,817 2,151,790 2,208,720

LTR 3219

1,664,838 523,635 617,170 463,748 463,067

LTR 3219C

31,156 38,891 37,791 34,562 15,186

LTR 3219N

149,901 175,183 192,481 13,570 32,204

Total 3,744,877 3,434,862 3,428,259 2,663,670 2,719,177

As shown in Figure 1.13.2, about 59 percent of all those receiving Non-ASFR SNODs make less than

$50,000 per year, while only 41 percent have incomes between $50,000 and one million dollars per year.

Clearly, the majority are issued to low income taxpayers.

FIGURE 1.13.2

29

Distribution of Taxpayers with Non-ASFR SNODs

by Total Positive Income (TPI) in TY 2017

<$25,000

$25,000-

$50,000

$50,000-

$100,000

$250,000-

$500,000

$100,000-

$250,000

$500,000-

$1,000,00

0

>$1,000,00

0

29.1%

(341,800)

30.4%

(357,429)

22.8%

(267,914)

14.1%

(165,941)

0.3%

(3,540)

2.6%

(30,207)

0.7%

(8,455)

The income distribution of taxpayers petitioning or not petitioning the Tax Court after an audit in

response to a SNOD also indicates that lower income taxpayers are less likely to petition the Tax

Court. The median TPI for those individuals who did not petition the Tax Court was nearly $24,000,

30

whereas, the median TPI for those who did petition the Tax Court during that same period was slightly

over $72,000.

31

A more detailed breakdown of these income distributions as reflected on Figures 1.13.3

and 1.13.4, show the same thing.

28

IRS response to TAS information request (Dec. 12, 2018).

29

CDW Notice Delivery System NDS Notice table (Dec. 11, 2018); CDW AIMS Closed Case Database (Dec. 11, 2018); IRTF

F1040 table (Dec. 11, 2018). These figures are based on the total number of CP 3219A, LTR 3219, and LTR 3219C. They

do not include the LTR 3219N, which is issued in the Automated Substitute for Return (ASFR) Program. Due to the lapse

in appropriations, the IRS did not provide a timely response to our request to verify these figures during the TAS Fact Check

process.

30

CDW AIMS Closed Case Database and FY 2018 IRTF F1040 table. Due to the lapse in appropriations, the IRS did not

provide a timely response to our request to verify these figures during the TAS Fact Check process.

31

Id.

Taxpayer Advocate Service — 2018 Annual Report to Congress — Volume One 203

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case AdvocacyAppendices

FIGURE 1.13.3, Distribution of Taxpayers Petitioning the Tax Court After an Audit in

Response to SNODs in FY 2018

32

FY 2018 Percentage

Total Positive Income < $25k 20.5%

Total Positive Income ≥ $25k and < $50k 16.3%

Total Positive Income ≥ $50k and < $100k 25.1%

Total Positive Income ≥ $100k and < $250k 25.7%

Total Positive Income ≥ $250k and < $500k 5.8%

Total Positive Income ≥ $500k and < $1M 3.0%

Total Positive Income ≥ $1M 3.5%

Total 100.0%

Figure 1.13.3 shows that most, or 63 percent, of individual taxpayers who filed petitions in FY 2018

after an audit in response to a SNOD, had incomes of at least $50,000. In contrast, only a minority or

37 percent had incomes below $50,000.

FIGURE 1.13.4, Distribution of Taxpayers Not Petitioning the Tax Court After an Audit in

Response to SNODs in FY 2018

33

FY 2018 Percentage

Total Positive Income < $25k 52.6%

Total Positive Income ≥ $25k and < $50k 22.4%

Total Positive Income ≥ $50k and < $100k 16.7%

Total Positive Income ≥ $100k and < $250k 7.3%

Total Positive Income ≥ $250k and < $500k 0.7%

Total Positive Income ≥ $500k and < $1M 0.2%

Total Positive Income ≥ $1M 0.1%

Total 100.0%

Figure 1.13.4 shows that the majority, or 75 percent, of individual taxpayers who did not file petitions in

FY 2018 after an audit in response to a SNOD, had TPI of less than $50,000. These taxpayers may not

realize they may be eligible for free representation at the Tax Court by LITCs.

34

Alternatively, they may

not understand the SNODs they have received from the IRS.

32

CDW AIMS Closed Case Database, Petitioned Cases, FY 2018 (Dec. 11, 2018). This figure shows the subset of petitions

following an audit (and appeal, if any) and case closure. It does not include petitions following more automated procedures

(e.g., AUR and ASFR). Due to the lapse in appropriations, the IRS did not provide a timely response to our request to verify

these figures during the TAS Fact Check process.

33

Id. Due to the lapse in appropriations, the IRS did not provide a timely response to our request to verify these figures during

the TAS Fact Check process.

34

See Most Serious Problem: Pre-Trial Settlements in the U.S. Tax Court: Insufficient Access to Available Pro Bono Assistance

Resources Impedes Unrepresented Taxpayers from Reaching a Pre-trial Settlement and Achieving a Favorable Outcome, infra.

Most Serious Problems — Statutory Notices of Deficiency204

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case Advocacy Appendices

SNODs Do Not Alert Taxpayers of Their Rights and the Consequences for Not Exercising

Them

In 2008, the IRS embarked on a major initiative to improve the clarity, accuracy, and effectiveness

of its taxpayer correspondence.

35

The Taxpayer Communications Task group (TACT), with the

aid of Siegel+Gale (now Siegelvision), conducted a review of taxpayer correspondence. Siegel+Gale

concluded that “the differences among many letters reflected internal IRS structure, as opposed to

taxpayer needs.”

36

The IRS developed a new framework for IRS letters based on suggestions from both

IRS employees and stakeholders. SNODs, however, continue to fail in conveying critical information

necessary for taxpayers to understand their obligations and rights, and to take appropriate action.

We have selected the CP 3219A SNOD to examine because it comprises over 80 percent of the 3219

SNODs, as depicted in Figure 1.13.1.

37

The CP 3219A SNOD fails to adequately inform taxpayers

of their rights and protections with regard to the IRS’s actions. Notably, while the IRS has a Spanish

version of the notice, it does not have SNODs available in other major world languages.

38

Moreover,

there is no mechanism whereby a taxpayer can proactively request a Spanish-language SNOD. Instead,

he or she must contact the IRS upon receiving the English-language SNOD and request a Spanish-

language one. This request does not toll the running of the 90-day period to petition the Tax Court.

39

35

See Siegel+Gale, 2A Report: Analysis of the IRS Correspondence System; Taxpayer Communications Taskgroup (TACT) Charter

(Nov. 2008).

36

Siegel+Gale, Case study, Internal Revenue Service, Making Paperwork Less Taxing, https://www.siegelgale.com/wp-content/

uploads/2011/05/Case-Study-IRS.pdf (last visited Jan. 29, 2018). Accord Siegel+Gale, 2A Report: Analysis of the IRS

Correspondence System; Taxpayer Communications Taskgroup (TACT) Charter 8 (Nov. 2008) (noting “some notices do not

clearly provide the taxpayers with the information needed to respond.”).

37

CDW Notice Delivery System NDS Notice table. See Exhibit IRM 3.10.72-3, Computer Paragraph (CP) Notices – Routing

Guide (Jan. 1, 2018). As noted above, the CP 3219A, also known as an Automated Under Reporter (AUR) SNOD, is issued

when the taxpayer’s return information does not match third party information sent to the IRS, such as wage and income

information from employers and financial institutions. Due to the lapse in appropriations, the IRS did not provide a timely

response to our request to verify these figures during the TAS Fact Check process.

38

For further discussion on the National Taxpayer Advocate’s efforts to address the IRS’s lack of access to multilingual notices,

see National Taxpayer Advocate 2011 Annual Report to Congress 137-150 (Most Serious Problem: Foreign Taxpayers Face

Challenges in Fulfilling U.S. Tax Obligations). The National Taxpayer Advocate has long highlighted the lack of forms and

publications for taxpayers with limited English proficiency. See, e.g., National Taxpayer Advocate 2017 Annual Report to

Congress 181-194 (Most Serious Problem: Individual Taxpayer Identification Numbers (ITINs): The IRS’s Failure to Understand

and Effectively Communicate With the ITIN Population Imposes Unnecessary Burden and Hinders Compliance); National Taxpayer

Advocate 2011 Annual Report to Congress 273-283 (Most Serious Problem: Introduction to Diversity Issues: The IRS Should

Do More to Accommodate Changing Taxpayer Demographics); National Taxpayer Advocate 2008 Annual Report to Congress

141-157 (Most Serious Problem: Access to the IRS by Individual Taxpayers Located Outside the United States); and National

Taxpayer Advocate 2006 Annual Report to Congress 222-247 (Most Serious Problem: Correspondence Delays).

39

Although the IRS provides various telephone prompts in several different languages, if a taxpayer calls in a language other

than Spanish and the IRS assistor cannot understand the taxpayer’s question, the IRS instructs assistors to tell callers they

are attempting to contact interpreters. IRM 3.42.7.14.4, Over the Phone Interpreter Service (OPI) (June 1, 2018) discusses

the IRS Language Service webpage with resources for limited English proficiency (LEP) taxpayers and provides nine

telephone prompts in various foreign languages. When the interpreter service is unable to provide an interpreter, assistors

are directed to apprise the interpreter vendor using a “feedback form;” however, the IRM provides no mechanism for IRS

assistors to follow up with the non-English speaking taxpayer. Further, IRS assistors are told if a taxpayer is calling in a

language other than Spanish and assistors cannot understand the taxpayer, assistors should instruct the caller to call back

with an interpreter. See IRM 21.3.10.5(7), Transfers and/or Referrals (Oct. 1, 2018).

Taxpayer Advocate Service — 2018 Annual Report to Congress — Volume One 205

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case AdvocacyAppendices

FIGURE 1.13.5, Excerpt of Statutory Notice of Deficiency CP 3219A

Department of the Treasury

Internal Revenue Service

Notice

CP3219A

Tax year

Notice date

Social security number

AUR control number

To contact us

Last date to petition

Tax Court

Page 1 of 9

Continued on back...

Notice of Deficiency

Proposed increase in tax and notice of your right to challenge

We have determined there is a deficiency

(increase) in your income tax based on

information we received from third parties

(such as employers or financial institutions) that

doesn’t match the information you reported on

your tax return. See below for an explanation of

how this increase was calculated. This letter is

your NOTICE OF DEFICIENCY, as required by

law.

Summary of proposed changes

If you disagree

You have the right to challenge this

determination in U.S. Tax Court. If you choose

to do so, you must file your petition with the

Tax Court by March 5, 2018. This date can’t be

extended.

See below for details about how and

where to file a petition

.

If you agree

You can pay now or receive a bill.

See the

section below titled “If you agree with the

proposed changes, you can pay now or receive

a bill.”

If you want to resolve this matter with the IRS

You may be able to resolve this matter without going to the U.S. Tax Court if you

contact us directly.

See the “You may be able to resolve your dispute with the IRS”

section below.

If you want assistance

You may be able to receive assistance from a Low Income Taxpayer Clinic or from the

Taxpayer Advocate Service.

See the “Additional information” section below.

You have the right to petition the

Tax Court

You have the right to challenge our deficiency determination, including penalties, before

making any payment by filing a petition with the U.S. Tax Court. You must file your

petition within 90 days (or 150 days if the notice is addressed to a person outside of the

United States) from the date of this letter, which is . The Tax Court

can’t consider your case if the petition is filed late. If you decide to file a petition, send

that petition to the following address:

United States Tax Court

400 Second Street, NW

Washington, DC 20217

2

1

3a

3b

3c

3d

Most Serious Problems — Statutory Notices of Deficiency206

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case Advocacy Appendices

The 3219A SNOD

40

suffers from the following issues:

1. Title of Notice: “Notice of Deficiency, Proposed Increase in Tax.” This title should clearly and

simply explain the purpose of the notice in plain language. However, the IRS uses technical

terms, such as deficiency.

41

A better title could be: “The IRS Will Increase Your Tax After 90

Days Unless You Disagree and Use Your Right to Petition the Tax Court. This is Your Legal

Notice, a Notice of Deficiency.” This title still references the legal concept of “deficiency” but

clearly explains to the taxpayer why they need to read the content of the notice.

2. Purpose of Notice: This section should explain, in plain language, the purpose of the

SNOD. For example, this section could state: “We have determined you owe more tax

based on information we received from your employer or financial institution. The attached

summary shows in detail, the basis for the tax increase. You have the right to challenge the IRS

determination, without paying the tax first, by petitioning the U.S. Tax Court by [fill in date]. If

you miss this deadline or fail to pay the tax, the IRS will then assess the tax and begin collection,

including garnishing your wages or placing a lien on your property. If you need help in preparing

a petition, you may be eligible for assistance from Low Income Taxpayer Clinics (LITC), which

represent low income taxpayers who need help in resolving a tax dispute and are unable to afford

to hire representatives to advocate on their behalf before the IRS or the courts.”

3. Actions Required: Here, the IRS structures its options without regard to taxpayer rights and

protections.

42

The choices are not only confusing to taxpayers, but also undermine critical

taxpayer rights, including the right to be informed, the right to pay no more than the correct amount

of tax, and the right to a hearing in an independent forum. Based on the number of “ifs,” there

appear to be four options: [a], [b], [c], and [d]. In reality, the taxpayer has two choices—either

to agree or to disagree with the proposed increased tax. Instead, the SNOD should present

options for taxpayers, such as:

If you disagree, you can petition the Tax Court by [fill in deadline]. If you agree, you

can sign the waiver and pay now, or wait for an IRS bill.

4. Help: This section should explain the assistance available to taxpayers. Although the notice

includes information about LITCs and TAS, it could state: “If you need help, including

understanding this notice, you can contact a Low Income Taxpayer Clinic, a Local Taxpayer

Advocate, the United States Tax Court website, or the IRS.” More detailed information

concerning each of these resources could go on page two of the SNOD.

5. Consequences for Failing to Act: The consequences for a taxpayer failing to respond is provided

on the third page and should instead be clearly spelled out on the first page. This section could

instead state: “If you do not petition the Tax Court by [fill-in deadline], you will lose your chance

40

The complete AUR SNOD is located at IRS website, https://www.irs.gov/pub/notices/cp3219a_english.pdf (last visited Feb.

2, 2019).

41

IRC § 6211(a). See also Iva W. Cheung, Plain Language to Minimize Cognitive Load: A Social Justice Perspective, 60 IEEE

TransacTIons on Prof. comm. 448, 454 (2017) (“Applying plain-language principles is an evidence based way to reduce

cognitive load. Minimizing cognitive load increases the likelihood that people with heavy mental burdens will read and

understand the communication.”). See also Literature Review: Improving Notices Using Psychological, Cognitive, and

Behavioral Science Insights, infra.

42

MDRC, News from the BIAS Project, BEhavIoral Buzz, Sept. 2015, at 1. “Research has shown that simplifying forms and

providing information can increase take-up of government programs. Making messages clearer and easier to understand

and streamlining choices can reduce procrastination and make it easier for clients to complete complex paperwork. Clear

instructions, few required fields, and visual prompts that draw the eye to key information are examples of techniques than

can improve applications and make it less likely that these forms are barriers to service receipt.” See also Literature

Review: Improving Notices Using Psychological, Cognitive, and Behavioral Science Insights, infra.

Taxpayer Advocate Service — 2018 Annual Report to Congress — Volume One 207

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case AdvocacyAppendices

to dispute the tax in court without paying the tax first. If the tax is not paid, the IRS will assess

the tax and begin collection, including garnishing your wages or placing a lien on your property.”

6. Organization and Design: The SNOD’s content should be structured to guide taxpayers in

understanding the IRS’s proposed action, the taxpayer’s rights and obligations, and the assistance

available to them. The IRS should use the following principles:

Organize the content so that it flows logically;

Break content into short sections that reflect natural stopping points; and

Write headings that help readers anticipate what will follow.

43

Moreover, the CP 3219A SNOD refers taxpayers to the IRS website’s web page, “Understanding Your

CP 3219A Notice,” which also presents confusing information. For example, the web page states the

following:

If you don’t agree with the changes and have additional information for us to consider, mail

or fax the information with the Form 5564 to the address or fax number on the notice.

(Emphasis added.)

The IRS confuses taxpayers by advising taxpayers to use the same form, Form 5564, Notice of

Deficiency-Waiver, both when they agree with the tax changes and when they disagree with the tax

changes. In addition, if taxpayers disagree with the tax changes and submit the Form 5564 with

additional information, and the IRS does not resolve their tax issue, they risk missing the Tax Court

filing deadline.

44

In redesigning the SNOD, the IRS should include the Tax Court website and telephone number, as

well as a copy of IRS Publication 4134, Low Income Taxpayer Clinic List. Furthermore, the IRS should

develop and train its employees to educate taxpayers who call the IRS telephone number listed in the

SNOD about the Tax Court petition process. IRS employees should emphasize the importance and

necessity of filing a petition with the Tax Court, as well as guide taxpayers through the Tax Court

petition filing process when taxpayers express that they do not agree with the tax adjustments. Most

importantly, IRS employees should make referrals to TAS and LITCs because of the urgency of pending

Tax Court petition filing deadlines.

43

Center for Plain Language, Five Steps to Plain Language, https://centerforplainlanguage.org/learning-training/five-steps-

plain-language/ (last visited Oct. 2, 2018).

44

See IRS website at https://www.irs.gov/individuals/understanding-your-cp3219a-notice (last visited Dec. 13, 2018).

Most Serious Problems — Statutory Notices of Deficiency208

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case Advocacy Appendices

SNODs Do Not Sufficiently Apply Plain Writing Principles nor Incorporate Behavioral

Research Insights as Directed by the Plain Writing Act and Executive Order 13707

To improve the IRS notice clarity, the National Taxpayer Advocate has included a literature review

in this year’s report that discusses plain language principles and behavioral science research methods.

The literature review explores what influences people’s decision making, including small changes in

language, choice architecture, as well as the salience and framing of information.

45

Under the Plain Writing Act of 2010, federal agencies are required to use clear, concise, and well-

organized government communication the public can understand.

46

Additionally, federal agencies are required to consider employing behavioral science research to improve

how its information is presented.

47

Specifically, federal agencies are to consider how the content, format,

timing, and medium by which information is conveyed to the public affects comprehension and action

by individuals.

48

The National Taxpayer Advocate believes the IRS should redesign notices of deficiency, using plain

language principles and behavioral science methods, to clearly convey the proposed tax increase to

taxpayer’s account, to emphasize the taxpayer’s right to challenge the IRS’s determination before the Tax

Court, and to obtain assistance from LITCs and TAS.

In addition, the IRS should collaborate with TAS and stakeholders, especially the Taxpayer Advisory

Panel (TAP) and LITCs, in designing the SNOD. The redesign process should consist of the IRS

conducting a pilot of several SNODs, including its current notices and rights-based prototypes, and

measuring such attributes as: (1) the petition rate of each notice; (2) the TAS contact rate for each

notice; (3) the IRS contact rate for each notice; and (4) the downstream consequences of each notice

(e.g., disposition of cases, such as whether the taxpayer settled, conceded, or prevailed in Tax Court and

whether the taxpayer’s deficiency decreased or the taxpayer requested an audit reconsideration).

45

See Literature Review: Improving Notices Using Psychological, Cognitive, and Behavioral Science Insights, infra.

46

5 U.S.C. § 301; 3 C.F.R. 13707.

47

3 C.F.R. 13707; see Memorandum from Executive Office of the President, Office of Science and Technology Policy to the

Heads of Executive Departments and Agencies, RE: Implementation Guidance for Executive Order 13707: Using Behavioral

Science Insights to Better Serve the American People (Sept. 15, 2016).

48

Id. See also Literature Review: Improving Notices Using Psychological, Cognitive, and Behavioral Science Insights, infra.

Taxpayer Advocate Service — 2018 Annual Report to Congress — Volume One 209

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case AdvocacyAppendices

The IRS Continues to Omit LTA Information Required By Law on Certain SNODs, Thereby

Violating Taxpayer Rights

The Internal Revenue Service Restructuring and Reform Act of 1998 (RRA 98),

49

codified at 26 U.S.C.

§ 6212(a), requires the IRS to provide notice of the taxpayer’s right to contact the local office of the

taxpayer advocate and the location and phone number of the appropriate office.

50

TAS offices are now

aligned with the taxpayer population by ZIP code, so the IRS can easily identify the correct office for

inclusion in the notices.

If the taxpayer contacts the LTA before the 90 days expires, some examples of how an LTA could assist

these taxpayer include:

TAS may be able to have the SNOD rescinded on the grounds that the IRS has not responded to

the taxpayer’s documents or addressed documentation sent in by the taxpayer;

TAS may be able to have the IRS review the taxpayer’s documents quickly in order to resolve the

case within 90 days;

TAS may be able to explain to the taxpayer the IRS’s proposed action and if they disagree with

the IRS, provide guidance in filing a petition with the Tax Court;

TAS may also explain to the taxpayer the basis for the IRS action and if the taxpayer agrees, TAS

will have educated the taxpayer and enhanced future compliance; and

TAS may provide contact information for LITCs and encourage taxpayers to seek assistance.

In the twenty years since Congress enacted this requirement, the National Taxpayer Advocate has

raised this issue in several congressional reports, and TAS has worked extensively with the IRS to ensure

the service is complying with the law.

51

Since 2015, TAS has partnered with the Office of Taxpayer

Correspondence to update notices with the required LTA information.

Several notices, however, still do not include the required information.

52

The IRS has informed TAS

that because its notice-producing systems are old and inflexible, adding the LTA information to these

notices is impossible.

53

Instead, the IRS has included reference to the Taxpayer Bill of Rights (TBOR),

TAS, the TAS website, and the TAS toll-free phone number in notices. While this is important

information, it does not meet the statutory requirement, which was established at the same time

49

Pub. L. No. 105-206, 112 Stat. 703 (1998).

50

26 U.S.C. § 6212(b). See also Most Serious Problem: Collection Due Process Notices: Despite Recent Changes to Collection

Due Process Notices, Taxpayers Are Still at Risk for Not Understanding Important Procedures and Deadlines, Thereby Missing

Their Right to an Independent Hearing and Tax Court Review, infra. Although there is no legislative history available to explain

why Congress felt that notices of deficiency should include a mention of TAS, the Joint Committee on Taxation’s explanation

of the IRS Restructuring and Reform Act of 1998 sections that created the position of the National Taxpayer Advocate,

indicate that Congress envisioned the newly created National Taxpayer Advocate playing an important role in “preserving

taxpayer rights and solving problems that taxpayers encounter in their dealings with the IRS.”

51

See National Taxpayer Advocate 2016 Annual Report to Congress 36 (Special Focus: IRS Future State: The National Taxpayer

Advocate’s Vision for a Taxpayer-Centric 21st Century Tax Administration); National Taxpayer Advocate 2014 Annual Report

to Congress 237-244 (Most Serious Problem: Statutory Notices of Deficiency: Statutory Notices of Deficiency Do Not Include

Local Taxpayer Advocate Office Contact Information on the Face of the Notice).

52

For example, the following letters still lack LTA information: Letter 3219-C, Notice of Deficiency; Letter 1753, Notice of Excise

Tax Change; Letter 531-A, 90-Day Letter Form 1040; Letter 1120, Discrepancy Adjustments; and Letter 531-B, 90-Day Letter;

Form 5330, Return of Excise Taxes Related to Employee Benefit Plans; and Form 990-T, Exempt Organization Business Income

Tax Return.

53

Email from Wage and Investment Division (W&I) (Oct. 24, 2018) (on file with TAS).

Most Serious Problems — Statutory Notices of Deficiency210

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case Advocacy Appendices

Congress required the National Taxpayer Advocate to maintain at least one local office in each state.

54

Without knowing that local assistance is available, a taxpayer may not call a national toll-free number

or visit an internet site. In addition, the TAS website may not be easily accessible to the 11 million

taxpayers who never use the internet, the 14 million without internet access at home, or the 41 million

taxpayers without broadband access.

55

While the TAS national toll-free number is included in notices,

that number is not staffed by TAS employees. Moreover, taxpayers need to know that they can talk

with someone who is located in the same locale or community, and has knowledge of the underlying

economic conditions that may affect their cases.

56

The failure of the IRS to in include LTA information on its notices of deficiency harms taxpayers and

violates taxpayers’ right to be informed and right to a fair and just tax system.

57

CONCLUSION

Despite the IRS’s efforts over the past ten years, the IRS has not designed its SNODs from a taxpayer

rights perspective. SNODs fail to alert taxpayers of the IRS’s proposed action and its consequences,

such as levying the taxpayer’s property. Moreover, current SNODs fail to clearly convey taxpayers’

obligations and rights and the free resources available to help them understand the SNOD and respond

to the IRS. To be most effective, SNODs need to emphasize the taxpayer’s right to obtain assistance

through TAS and LITCs, right to object to the IRS’s decision before an independent forum, and right

to representation, if eligible. As described in the literature review compiled by TAS, the IRS should

use plain language principles and behavioral insights to redesign SNODs in collaboration with TAS

and stakeholders. Because of the sheer number of SNODs being sent to low income taxpayers and the

number of taxpayers who do not petition the Tax Court in response to a SNOD, it is critical that the

IRS make the SNOD redesign a priority.

54

See IRC 7803(c). The National Taxpayer Advocate has the responsibility of appointing Local Taxpayer Advocates and making

available at least one such advocate for each state.

55

See National Taxpayer Advocate 2017 Annual Report to Congress vol. 2 63 (Research Study: A Further Exploration of

Taxpayers’ Varying Abilities and Attitudes Towards IRS Options for Fulfilling Common Taxpayer Service Needs).

56

See National Taxpayer Advocate 2016 Annual Report to Congress 86-97 (Most Serious Problem: Geographic Focus: The

IRS Lacks an Adequate Local Presence in Communities, Thereby Limiting Its Ability to Meet the Needs of Specific Taxpayer

Populations and Improve Voluntary Compliance); National Taxpayer Advocate 2016 Annual Report to Congress vol. 2 102-122

(Literature Review: Geographic Considerations for Tax Administration).

57

See TBOR, www.TaxpayerAdvocate.irs.gov/taxpayer-rights. The rights contained in the TBOR are also codified in

IRC § 7803(a)(3).

Taxpayer Advocate Service — 2018 Annual Report to Congress — Volume One 211

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case AdvocacyAppendices

RECOMMENDATIONS

The National Taxpayer Advocate recommends that the IRS:

1. Redesign the notices of deficiency, using plain language principles and behavioral science

methods, to clearly convey the taxpayer’s proposed tax increase, his or her right to challenge

the IRS’s determination before the Tax Court, and his or her ability to obtain TAS or LITC

assistance.

a. Collaborate with the TAS and stakeholders, especially the TAP and LITCs, in designing

the SNOD.

b. Conduct a pilot of several SNODs, including current notices and rights-based prototypes,

to measure: (1) the petition rate of each notice; (2) the TAS contact rate for each notice;

(3) the IRS contact rate for each notice; and (4) the downstream consequences of each

notice (e.g., disposition of cases, such as whether the taxpayer settled, conceded, or prevailed

in Tax Court and whether the taxpayer’s deficiency decreased or the taxpayer requested an

audit reconsideration).

2. Develop and train IRS employees in best practices for assisting taxpayers who call the IRS in

response to a SNOD, to include having IRS employees remind and guide taxpayers in filing Tax

Court petitions.

3. Facilitate the process for petitioning the Tax Court by including with the notice of deficiency the

Tax Court website and telephone number, as well as a copy of IRS Publication 4134, Low Income

Taxpayer Clinic List.

4. Include the Local Taxpayer Advocate’s contact information on the face of the notices, specifically

on Letters 3219-C, 1753, 531-A, and 531-B.

a. If the IRS is unable to update computer programming to provide the telephone number and

address information of LTAs pursuant to IRC § 6212(a) during the current year, include

Notice 1214,

58

listing all LTA office contact information, when mailing letters 3219-C,

1753, 531-A, and 531-B.

b. Develop a timeline to secure and allocate funding to implement the necessary IRS system

upgrades to allow for the programming of LTA addresses and contact information on the

face of letters 3219-C, 1753, 531-A, and 531-B, as required by law.

58

Notice 1214, Helpful Contacts for your “Notice of Deficiency” (Jan. 2018).