State of Vermont

Agency of Transportation

Department of Motor Vehicles

120 State Street

Montpelier, Vermont 05603-0001

dmv.vermont.gov

802.828.2071 IRP

802.828.2070 IFTA

Page 1

VP-181 01/2024 MTC

TABLE OF CONTENTS

Contents

Vermont Apportioned Registration Plan (IRP)................................................................................................... 2

International Fuel Tax Agreement (IFTA) ......................................................................................................... 2

Performance Registration Information Systems And Management (PRISM) .................................................... 3

Commercial Vehicle Registration Process .......................................................................................................... 3

Vermont Apportioned Registration Summary .................................................................................................... 3

Who Should Obtain Apportioned Registrations And Exemptions ..................................................................... 3

Exemptions: ........................................................................................................................................................ 4

Established Place Of Business ............................................................................................................................ 4

Registrant From Non-Member Jurisdiction ........................................................................................................ 5

License Plates: .................................................................................................................................................... 5

Jurisdiction Percent Of Total Mileage X Full Year Fees .................................................................................... 5

Owner-Operator Vehicles ................................................................................................................................... 6

General Information On Applications ................................................................................................................ 7

Guideline For Applying For Apportioned Registration In Vermont ................................................................ 11

Trip Permits And Temporary Authority ........................................................................................................... 13

Hunter Permit/Unladen Weight Permit ............................................................................................................. 13

Replacement Credentials .................................................................................................................................. 14

Audits And Record Requirements .................................................................................................................... 14

Appendix A - Definitions.................................................................................................................................. 17

Appendix B - IRP Jurisdiction Maximum Weights .......................................................................................... 22

International Fuel Tax Agreement (IFTA) ....................................................................................................... 25

Tax Exempt Gallons Are Subject To Vermont Sales Tax ................................................................................ 29

How Vermont Taxes Diesel Fuel ...................................................................................................................... 31

Vermont Diesel Fuel Refunds ........................................................................................................................... 32

Non-Taxable Fuel Allowances ......................................................................................................................... 32

Page 2

Vermont Apportioned Registration Plan (IRP) &

International Fuel Tax Agreement (IIFTA) Introduction

The International Registration Plan (IRP) is a registration reciprocity agreement between all jurisdictions

(except Alaska & Hawaii) of the United States and Canadian provinces for payment of registration fees for

highway transport vehicles. The fee is based on fleet distance operated in member jurisdictions.

The unique feature of this plan is that even though license fees are paid to member jurisdictions in which fleet

vehicles are operated, only one state issues the plate and cab card for each fleet vehicle when registered under

the plan. A fleet vehicle is an apportionable vehicle and this vehicle, so far as registration is concerned, may

be operated both interstate and intrastate.

The International Fuel Tax Agreement (IFTA) is an agreement among jurisdictions for the uniform collection

and distribution of fuel tax revenues. Jurisdictions continue to set their own tax rates according to local and

state highway construction and maintenance needs, and are only required to notify other base jurisdictions of

the proper tax rates to collect.

The purpose of this manual is to present general information about the IRP & IFTA and your responsibilities

as a participant in these programs. This manual does not replace the law, regulations, or administrative

documents under which the IRP & IFTA programs are administered, nor does it constitute a legal interpretation

of the Intermodal Surface Transportation Efficiency Act of 1991 or any other legislation or state or federal

law.

Vermont’s Motor Carrier One-Stop Shop

Vermont’s Motor Carrier One-Stop Shop is located at 120 State Street, Montpelier, Vermont.

Employees can assist you with:

All applications and tax forms needed

All required decals, permits, and credentials

Information on the status of your tax accounts

Oversize/Overweight Permits

IRS Form 2290 – Federal Heavy Vehicle Use Tax

You can access the Motor Carrier One-Stop Shop in person, or:

Phone: IRP (802) 828-2071

IFTA (802) 828-2070

Oversize (802) 828-2064

Email: [email protected]

Fax: IRP/IFTA (802) 828-5919

Oversize (802) 828-5418

Websites: Vermont DMV dmv.vermont.gov

IRP, Inc. irponline.org

IFTA, Inc. iftach.org

Page 3

Performance Registration Information Systems and Management (Prism)

Commercial Vehicle Registration Process

The IRP registration process provides the framework for PRISM. The registration process serves two

basic functions: First, it establishes a system for identifying the carrier responsible for the safe operation of

trucks. Second, the use of registration denial and suspension provides a powerful incentive for unsafe carriers

to improve their safety performance.

The USDOT number is used to identify both the motor carrier responsible for safety and the individual vehicle

registrant (if different). The carrier’s safety fitness is checked prior to issuing vehicle registrations. Unfit

carriers may be denied the ability to register their vehicles.

Carriers, registrants, and owner-operators are given information on safety performance. Concerned personnel

can take steps to improve carrier safety. If an owner-operator or a registrant leases to an unsafe motor carrier,

the owner-operator or registrant is notified of the carrier’s MCSIP status.

Vermont Apportioned Registration Summary

Vermont became a member of the International Registration Plan (IRP) effective with the 1988 registration

year. The IRP is a program for apportioned registration, based on mileage for commercial vehicles engaged

in interstate operations. This is applicable for Vermont based carriers going into jurisdictions that are members

of the International Registration Plan as well as for carriers based in these jurisdictions who operate in

Vermont.

It is the purpose of this program to promote and encourage the fullest possible use of the highway system by

authorizing the proportional registration of fleets of vehicles and the recognition of vehicles proportionally

registered in other jurisdictions, thus contributing to the economic and social development and growth of the

jurisdiction.

Under the program the interstate carrier is required to file an application with the jurisdiction in which the

carrier is based. The base jurisdiction issues a base “apportioned” license plate and cab card. The base plate

and cab card are the only registration credentials required to qualify the carrier to operate interstate for

intrastate in member jurisdictions.

Apportioned Registration Does Not:

• Waive, or exempt a truck operator from, obtaining authority from any State/Province in which the

apportioned vehicle travels (either inter or intra); or

• Waive, or replace the requirements of the International Fuel Tax Agreement (IFTA); or

• Waive, or exempt the payment or reporting of other taxes (income tax, sales tax, etc.); or

• Allow registrants to exceed the maximum length, width, height or axle limitations; or

• Allow registrants to violate “bridge laws”, or

• Waive, or exempt the payment or reporting of, the Federal Heavy Vehicle Use Tax (Form 2290)

Who Should Obtain Apportioned Registrations and Exemptions

You must register your fleet apportionally if the fleet travels in Vermont and in at least one other any other

IRP jurisdictions and:

Page 4

• Is used for the transportation of persons for hire or is designed, used, or maintained primarily for the

transportation of property, and

• Is a power unit having two axles and a gross weight or registered weight in excess of 26,000 pounds;

or

• Is a power unit having three or more axles regardless of weight and/or is used in combination when

the weight of such combination exceeds 26,000 pounds gross vehicle weight.

• Is a commercial vehicle operating intrastate in 2 or more jurisdictions regardless of weight (Picking

up and/or delivering in a foreign jurisdiction)

• Charter Bus

Vehicles, or combination thereof, having a gross vehicle weight of 26,000 pounds or less and two axle

vehicles may be apportion registered at the option of the registrant.

26,000 pounds = 11,793.401 Kilograms

In Vermont the only fleet vehicles that must obtain apportioned registrations, are the power units and

that is generally true of other jurisdictions.

Exemptions:

The following vehicles are exempt from the apportioned registration program:

1. Government owned vehicles.

2. Recreational vehicles (defined as a vehicle used for personal pleasure or personal travel).

3. Vehicles operating with a restricted plate** that has time (less than a year registration), geographic

area, mileage or commodity restrictions.

** In Vermont, vehicles operating with a restricted plate are exempt from the IRP requirements. Plates

considered restricted in Vermont may not be recognized as so in other jurisdictions. If leaving the State of

Vermont or purchasing a vehicle outside of Vermont for delivery to Vermont, and displaying a dealer plate,

you must contact each state in which you anticipate travel in order to determine if they honor Vermont's dealer

plate. Numerous jurisdictions do not honor dealer plates if the vehicle is hauling a load.

Established Place of Business

“Established Place of Business” means a physical structure located within the Base Jurisdiction that is owned

or leased by the Applicant or Registrant and whose street address shall be specified by the Applicant or

Registrant. This physical structure shall be open for business and shall be staffed during regular business hours

by one or more persons employed by the Applicant or Registrant on a permanent basis (i.e., not an independent

contractor) for the purpose of the general management of the Applicant’s or Registrant’s trucking-related

business. The Applicant or Registrant need not have land line telephone service at the physical structure.

Records concerning the Fleet shall be maintained at this physical structure (unless such records are to be made

available in accordance with the provisions of Section 1035). The Base Jurisdiction may accept information it

deems pertinent to verify that an Applicant or Registrant has an Established Place of Business within the Base

Jurisdiction.

Page 5

Business location will be verified by providing one or more of the following in the fleet registrant’s name:

• Copy of most recent Electric Bill

• Copy of most recent Rental Receipt/Lease Agreement

• Copy of previous year Federal or State Tax Return

The trucking-related business within the base jurisdiction must constitute more than just credentialing, distance

and fuel reporting, and/or answering a telephone. Employees in the permanent employment of the registrant,

not contractual labor, must be performing the trucking-related duties. A jurisdiction may require whatever

information the jurisdiction deems pertinent to show that the registrant has an established place of business

within the jurisdiction and that all proper fees and taxes are paid.

Registrant from Non-Member Jurisdiction

Carriers based in any jurisdiction that is not a member of the IRP, and who have been registering vehicles in

any jurisdiction under the basing point, allocation or proration, may declare the member jurisdiction where the

most distance have been operated as a base jurisdiction for purposes of this agreement until such time as the

registrant’s base jurisdiction becomes a member of this agreement.

License Plates:

The concept of one license plate and one cab card means, that only one legal registration will be required.

The state of Vermont will be issuing two license plates each bearing the same registration number. They are

to be attached to the front and back of Vermont base registered power units.

Enforcement personnel in all jurisdictions will be aware that both plates are required for a vehicle to be legally

registered.

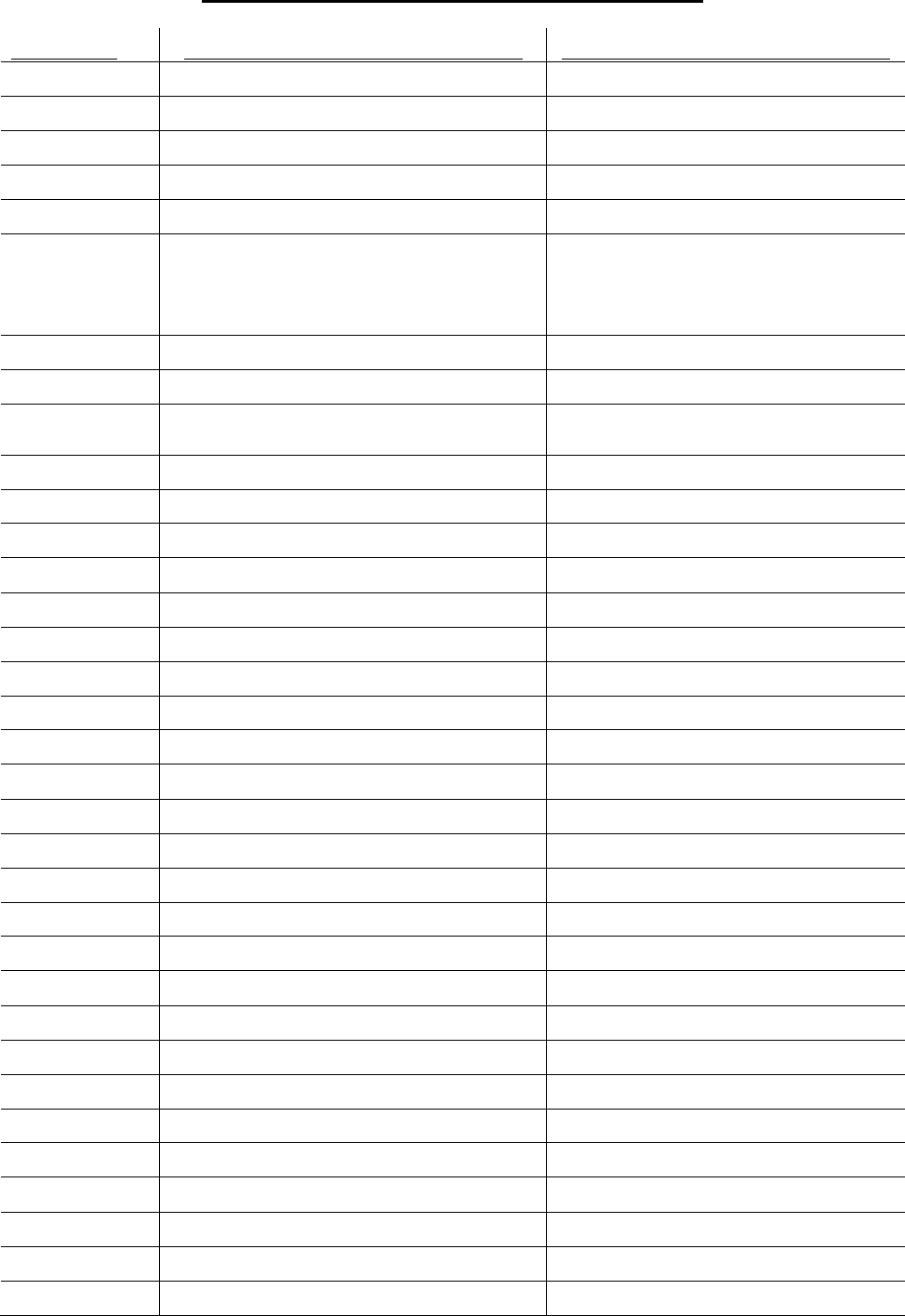

Sample Fee Apportionment

To give a very simplified example of how registration fees are apportioned, we’ll take a tractor/trailer (Vermont

based for hire operator), which operates in Vermont, Connecticut, New Hampshire, New York and

Pennsylvania. The total preceding year mileage for the tractor/trailer combination was 100,000 miles, with an

exact 20,000 miles in each jurisdiction. Under apportioned registration, the license fee will be computed as

follows:

Jurisdiction Percent of Total Mileage x Full Year Fees

Jurisdiction

Mileage

(by Jurisdiction)

Apportion Fees

Connecticut

20,000

20%

$1,360.00

$272.00

New York

20,000

20%

$ 840.00

$168.00

New Hampshire

20,000

20%

$ 630.86

$126.18

Pennsylvania

20,000

20%

$1.125.00

$225.00

Vermont

Totals

20,000

20%

$1,639.00

$327.80

100,000

100%

$5,594.86

$1,118.98

Page 6

Owner-Operator Vehicles

Proportional registration for owner-operators may be accomplished in one of the following procedures:

1. The owner-operator (lessor) may be the registrant and the vehicle may be registered in the name of the

owner-operator. The allocation of fees shall be according to the operational records of the owner operator.

The plate and cab card shall be the property of the lessor. A copy of the lease agreement must be remitted

with your IRP applications.

2. The lessee may be the registrant at the option of the lessor and the vehicle may be registered by the carrier,

but in both the owner-operator’s name and that of the carrier as lessee, with allocations of fees according

to the records of the carrier. The plates and cab cards shall be the property of the lessee. A copy of the

lease agreement must be remitted with your IRP applications.

Lessee Motor Carrier as Registrant

The lessee motor carrier may be registrant at the option of the owner operator, and the vehicle may be registered

by the motor carrier, but in both the owner-operator’s name and that of the motor carrier as lessee. The

allocation of fees shall be according to the records of the motor carrier. The identification plates and cab cards

shall be the property of the lessee motor carrier and may reflect both the owner-operator’s name and that of

the motor carrier as lessee. Should an owner-operator, registered in this manner, leave the fleet of the lessee

motor carrier, the lessee motor carrier may proceed in accordance with Article VII of the IRP Agreement.

Registration Responsibility

The lessee motor carrier, except as provided for service representatives in Sections 1200 & 1202, is responsible

for the vehicle’s proper registration. However, a lessor may be an apportioned registrant and may lease a

vehicle to another apportioned registrant lessee. The lessor shall report the leased vehicle’s total distance on

the lessor’s distance schedule.

Household Goods Carrier

“Household Goods Carrier” means a carrier handling (i) personal effects and property used or to be used in a

dwelling, or (ii) furniture, fixtures, equipment, and the property of stores, offices, museums, institutions,

hospitals, or other establishments, when a part of the stock, equipment, or supply of such stores, offices,

museums, institutions, including objects of art, displays, and exhibits, which, because of their unusual nature

or value, requires the specialized handling and equipment commonly employed in moving household goods.

Buses

• Common carriers of passengers must apportion register, including buses used exclusively for charter.

• The registrant shall file an application for apportioned registration with the base jurisdiction

Rental Fleet

“Rental Fleet” means Vehicles the Rental Owner designates as a Rental Fleet and which are offered for rent

with or without drivers.

Rental Owner

“Rental Owner” means someone who rents Vehicles to others with or without drivers.

Page 7

Rental Vehicle

“Rental Vehicle” means a Vehicle of a Rental Fleet.

General Information on Applications

Initial application forms for apportioned registration are available from the Department of Motor Vehicles,

Commercial Vehicle Operations – IRP Unit, 120 State Street, Montpelier, VT 05603-0001.

Vermont is required to ensure that there has been continuous registration from base to base for all new

registrations when the applicant is changing base jurisdiction. Prior to licensing new carriers, Vermont must

verify that there are no outstanding registration fees in another jurisdiction for a previous registration year;

also if the carrier has operated previously in another jurisdiction, the actual distance must be reported rather

than allowing the carrier to estimate. Fees must be paid for all months including those in a grace period from

another jurisdiction. The IRP registration is valid for one year and expires on the last day of the previous

month of the original registration. Renewal notices will be sent a month prior to the expiration date.

The Following Forms Must Be Completed:

1. Vermont Schedule A/E (Registrant info, vehicle description, jurisdictions & weight requested).

2. Vermont Registration Application VD-119

Forms and instructions can be found at dmv.vermont.gov. The Average per Vehicle Distance (APVD) chart

can be obtained by contacting the IRP Office at 802-828-2071.

The applicant is responsible for properly completing all forms necessary to register a vehicle under the

apportioned registration program. If required information is missing from submitted applications, the applicant

will be contacted or the application will be returned.

All applications for apportioned registration will be processed through the Vermont Department of Motor

Vehicles, IRP Unit, 120 State, Montpelier, VT 05603-0001. Other transactions required for apportioned

registration such as Purchase and Use Tax and application for Vermont Title will also be processed by the IRP

Unit.

Please do not send fees for apportioned registration with the application. Vermont will send a billing

invoice for payment due. This will ensure correct payment, avoid over or under payment, and will speed the

mailing of credentials to the applicant. It is possible to obtain an IRP registration at the Commercial Vehicle

Counter in Montpelier but the processing time may be one hour or more.

Completing the registration process by mail is highly recommended, but if you do come to Montpelier it will

take time to complete the registration, please be prepared to wait.

Even though an application has been filed, a vehicle is not legal to operate in Vermont or other IRP jurisdictions

without a trip permit or temporary authorization, in lieu of the permanent registration credentials. Information

concerning trip permits and temporary registration can be found in the “Temporary Registration Section” of

the manual.

Page 8

US DOT Number

The US DOT number is an identification number issued to motor carriers, registrants and shippers by the

United States Department of Transportation.

Federal Employee Id Number (TIN)

The Federal ID Number is the number issued to your business by the IRS. Are you required to have a TIN?

This information can be obtained through the IRS web site at irs.gov/businesses

Federal Heavy Vehicle Tax

Under the provision of the Surface Transportation Assistance Act of 1982 (Federal Law), effective January,

1985, the United States Internal Revenue Service now requires all states to verify proof of payment or

exemption from the Federal Heavy Vehicle Use Tax before registering vehicles at 55,000 lb or more GVW

(gross vehicle weight).

Proof of payment, as prescribed by the Secretary of Treasury, shall be Form 2290, Schedule 1, validated by

the Internal Revenue Service. Please note that Schedule 1 will only accommodate 21 motor vehicles. If the

fleet is more than 21 vehicles, the Schedule 1 form should make reference to the “attached list”. In this instance

the fleet owner will be permitted to attach to the validated Schedule 1 a separate list of vehicles to be registered

including the vehicle identification number, taxpayers name and Employee Identification number. If the

number of vehicles in total column of Part II of Schedule 1 is more than 9, attached listings are acceptable and

must be validated by the IRS.

If you have not received a validated Schedule 1 (Form 2290) by the time you wish to register, you may present

the following three documents: a photocopy of Form 2290, a photocopy of the Schedule, and a photocopy of

both sides of your check that has been canceled or validated by the IRS.

Or to reduce the burden on taxpayers the Internal Revenue Service has authorized the Vermont

Department of Motor Vehicles to accept Heavy Vehicle Use Tax Returns (Form 2290). On behalf of the

IRS, Vermont DMV will accept the form 2290 with required fees, which will be forwarded to the IRS. DMV

will accept a copy of this form 2290 as proof of tax paid. Separate checks made payable to the US Treasury

must be submitted. The receipt and transmission of Forms 2290 reduces taxpayer burden by providing them

with the opportunity to register vehicles prior to the filing of the related Form 2290 with the IRS. There is an

informational handout available at DMV, which can be provided upon request.

Your application will not be processed unless accompanied by the required proof of payment or exemption

from payment of the Federal Heavy Vehicle Use Tax. If you have questions concerning the Heavy Vehicle

Use Tax contact your local office of the United States Department of Treasury, Internal Revenue Service.

Vermont Purchase & Use Tax

All vehicles being registered in the State of Vermont are subject to a 6% Purchase and Use Tax. Vehicle

Registration, Tax and Title Application Form (VD-119), must be submitted with the application for IRP

registration. There is a maximum Purchase and Use Tax of $2,486.00 on trucks registered over 10,099 lbs.

The 6% Purchase and Use Tax is imposed on new and transfer transactions. The tax is based on the purchase

price or actual value of the purchased vehicle whichever is higher, minus the value of any trade-in vehicle or

other credit. Credit for trade-in, insurance settlement, or private sale is allowable if the time between date of

sale and date of purchase does not exceed 3 months.

Page 9

If you are registering a vehicle that was registered in another state, you will be allowed the trade-in credit,

regardless of when the trade-in occurred. You must provide proof of ownership of the traded vehicle, such

proof being a registration certificate or title in your name; or a copy of the Bill of Sale showing the purchase

of the new/current vehicle and the trade-in value given on the old vehicle.

Vermont Title Requirements

The State of Vermont will title all vehicles except trailers with empty weight of 1,500 lb. or less, mopeds,

motorcycles with engines smaller than 300 cubic centimeters, and tractors with registered weight of 5,099 lb.

or less. If a lien holder is indicated, the Title Certificate will be sent to the lien holder rather than the owner.

The new title will be mailed to the owner/lien holder within 6 weeks of application. The fee for a Vermont

Title is $42.00 plus $14.00 per lien.

The manufacture’s Statement of Origin or Original titles are acceptable supporting documents to submit with

the Application for Vermont Title Certificate. A copy of a title is not acceptable.

Mandatory Insurance and Inspection

No motor vehicle shall be operated in Vermont without liability insurance in force. Persons convicted of

operating or permitting operation of a motor vehicle without liability insurance will be fined $162.00 and

assessed two points on their driver’s license. The Commissioner of Motor Vehicles shall require proof of

insurance coverage to satisfy any claim for damages, by reason of personal injury to or death of any person,

of at least $25,000 for one person and $50,000 for two or more persons killed or injured and $10,000 for

damages to property in any one accident. An insurance ID card must be carried in the vehicle. Insurance

coverage will be verified during initial and annual inspection of vehicle.

All vehicles must be inspected within 15 days of initial registration in the State of Vermont at a licensed

Inspection Station and annually thereafter.

Additions and Deletions

Supplemental Application

A registrant may, after filing an original application, add vehicles to a fleet, delete vehicles, or change vehicle

weights by filing a Supplemental Application, (Form C/E) in the same manner as the original. These forms

should be filed within 72 hours after a vehicle has been added or deleted from the fleet so that proper credentials

can be issued and credits given. Vehicles may also be transferred from one fleet owned by the registrant to

another fleet owned by the registrant.

Registration fees for supplemental applications are calculated from the date of addition or increase, prorated

by full month, according to the existing expiration date of the fleet. When a Supplemental Application is filed

to add a unit and delete a similar unit, the registrations fees will be credited from the deleted unit for a $25.00

transfer fee plus any fees due other jurisdictions. However, if a Supplemental Application is not filed within

ten days after a new unit receives a temporary registration, the carrier may be subject to a penalty. Additions

and deletions must be filed on the same supplement for credit to be given.

To obtain credit for registration fees, the cab card for the deleted vehicle must be returned with the

Supplemental Application.

A refund for a deleted vehicle may be obtained only when credentials are returned unattached within 30 days

of issue and no temporary registration was issued, a $5.00 administrative fee will be required. A refund for

Page 10

remaining registration fees from a deleted vehicle may only be obtained if the vehicle is wrecked or destroyed

and replaced by an additional vehicle to which the proportional registration can be transferred. No refund is

given if the vehicle is stolen, sold, retired, or a lease is broken, and the vehicle is not replaced. A credit will be

given if the vehicle is replaced by an addition to a fleet on the same supplement. Any balance remaining from

an Add-Delete transaction will be refunded to the carrier. Any additional fees due will be billed to the carrier.

A $25.00 transfer fee will also be due for the Add-Delete Transaction.

If a vehicle is replacing a vehicle presently part of the fleet and the vehicles are of like gross weight, no

additional registration fee is due for most jurisdictions. Some jurisdictions do not allow transfer credit. If the

additional vehicle is of greater gross weight than the vehicle removed from the fleet, additional registration

fees are due, based upon the difference between the registration fees applicable for the two gross weights and

the difference multiplied by your distance percentage. A transfer fee of $25.00 will also be charged. The cab

card for the deleted vehicle must be returned with the supplement or certification that the credentials have been

destroyed lost or stolen. The supplement cannot be processed until this old card or certification is received.

The new vehicle CANNOT be operated on the transferred license until the new cab card is in the vehicle,

except by temporary authorization.

Credit will not be allowed for any vehicle, which is not permanently removed from the fleet. A vehicle

removed for repair or rebuilding is not considered “permanently” removed. Upon audit, if vehicle deleted are

found to be still operating, additional moneys will be due the state.

A registrant may use a Supplemental Application to increase the registered weight of a vehicle. Fees are

calculated from the date of increase prorated by full month. Credit from a deleted vehicle may be applied to

increase the weight of another fleet vehicle with any remaining credit being refunded.

The registered weight of a vehicle may be decreased, but NO credit or refund is given for fees paid.

A registrant may transfer a vehicle from one fleet to another fleet. Credit for fees paid for the transferred

vehicle may remain with the old fleet or be transferred to the new fleet with any balance being refunded.

Additional registration fees may occur as a result of the fleet-to-fleet transfer, due to the difference in fleet

mileages.

Because of the registration system requirements, different transactions cannot be combined on one

supplemental application. A separate supplemental form should be used for each of the following:

1. To show deletions only

2. To show additions only

3. To show Adds-Deletes (one vehicle being added for a vehicle being deleted)

4. For increasing and decreasing weights

5. To transfer and change weight

6. To correct or change a lessor, unit number, VIN, year, Make, etc.

A fleet-to-fleet transfer will require more than one Supplemental Application.

When a vehicle is sold, the apportioned license plates must be removed from the vehicle. A Supplemental

Application must be filed with the IRP Unit, with the original cab card attached. The license plates must be

returned unless the registration is being transferred to another vehicle within 72 hours.

Again, when the vehicle is junked or destroyed, the license plate must be removed from the vehicle. The

Supplemental Application must be filed with the IRP Unit with the original cab card of the junked or destroyed

vehicle attached or certification that the cab card has been destroyed, and the license plate returned unless

being transferred.

Page 11

Guideline for Applying for Apportioned Registration in Vermont

1. Obtain and complete the necessary forms (VT Schedule A/E, VT Registration Application VD-119)

from the IRP Unit of the Vermont Department of Motor Vehicles.

2. Provide proof of Established Place of Business.

3. Check each vehicle to be sure it meets the following pre-registration requirements.

a) If the vehicle is presently titled in any state; the title must be submitted

b) If the vehicle is new, include the Manufacturer’s Statement of Origin with either Schedule A/E or

C/E and a completed Vermont registration application VD-119.

c) If the vehicle is a newly acquired used vehicle include the previous title signed over to the new

owner and bill(s) of sale if necessary and a completed VD-119.

d) For each application submitted, a $42.00 title fee must be sent plus a $14.00 fee for each lien holder

to be listed on the title.

e) Payment of Vermont Purchase and Use Tax of 6% or a claim that the vehicle is exempt from

Purchase and Use Tax must accompany the Schedule A/E for each vehicle not previously registered

in your name in Vermont. Form VD-119, Vermont Vehicle Registration Tax & Title Application

should be used.

f) Send no payment for registration fees. The IRP Unit of the Vermont Department of Motor Vehicles

will bill you for registration fees. All registration fees for apportioned registrations require payment

in cash, check, credit card or money order. Do not send cash through the mail. All fees must be

made payable in U.S. funds.

g) Federal Heavy Vehicle Use Tax (HVUT) – Proof of compliance with this tax will be required prior

to registration renewal, if registered weight of the vehicle is 55,000 lbs. or more.

h) Federal Employee Identification Number (TIN) issued by the IRS is required. Are you required to

have a TIN? This information can be obtained through the IRS web site at www.irs.gov/businesses

i) US DOT number, the identification number issued to motor carriers, registrants and shippers,

issued by the Department of Transportation must be indicated.

Renewal Applications

To renew a fleet:

Motor carriers registered in the state of Vermont under IRP apportioned registration program will receive a

computer produced listing of each fleet at renewal time. This listing is used to renew your registration on

existing vehicles in each fleet.

IRP registrations must be renewed annually. All necessary forms will be sent to you prior to the expiration.

Page 12

Forms should be completed and returned as soon as possible to ensure completion of the registration process.

Applications must be legible and must contain correct information or they will be returned to the registrant

without being processed.

Renewal Listing – Schedule A/E

Each vehicle, which was registered in Vermont at the time the listing was produced, will be listed in order by

equipment numbers beginning at the top of Schedule A/E, Page 1. Information on each vehicle can be verified

as correct, delete, or changed as directed. Please send proof of payment of Heavy Vehicle Use Tax on any

vehicle 55,000 lbs. or over.

Please use Renewal Listing – Schedule C/E to list any new vehicle that you may be adding at the time of

renewal. Return plates and cab cards for vehicles, which you have deleted from the renewal application. If

credentials have been lost or destroyed you must complete the certification for Lost or Destroyed IRP

Credentials.

Renewal Listing – Schedule B (Distance Report)

Complete the computer generated Distance Schedule B. The total fleet distance will be the distance generated

by power units, which were part of the apportioned fleet.

Distance from any power unit either added or deleted from the IRP fleet shall be the distance generated by the

power unit while the vehicle was part of the fleet during the reporting period and should be included in the

total distance.

It is very important to list all jurisdictions accurately on the original or computer printed renewal

because as under the rules of IRP, once a percentage has been established we cannot adjust it. Therefore,

any additions of states later must be charged at a rate exceeding 100%.

RENEWALS MAILING CHECKLIST

HAVE YOU:

Verified information and noted any changes and inserted the correct information. Use Schedule C/E to

add vehicles.

Completed Schedule B, Distance Schedule. Write the fleet and account number on all applications and

any other correspondence or documents submitted.

Enclosed proof of Heavy Vehicle Use Tax paid. (IRS Form 2290)

Verified Federal Employee Identification Number (FEIN/TIN)

Verified US DOT # and indicated who is responsible for vehicle safety.

Updated US DOT information, form MCS-150, for all DOT #’s associated with your fleet, within the

past designated period.

Retain a copy for your records

Mail To:

Vermont Department of Motor Vehicles

Commercial Vehicle Operations – IRP Unit

120 State Street

Montpelier, Vermont 05603-0001

Page 13

PLEASE REMEMBER:

The information you write on an application must be clear and understandable to the IRP Processing Unit.

IRP Applications may be obtained on the DMV website or through the Montpelier office.

Trip Permits and Temporary Authority

Trip Permits

Trip permits will be required of Vermont based registrants who are eligible for apportioned registration when

entering any IRP jurisdiction unless they have an apportioned registration.

With a trip permit, and provided you meet other requirements of the member jurisdiction, your vehicle is

entitled to be operated intrastate and interstate for the period allowed under such permit. Trip permits require

a USDOT number.

Out of state vehicle, eligible for apportioned registration and not apportioned with Vermont will be required

to purchase a 72 hour trip permit for a fee of $15.00 plus additional permit service fees.

Trip permits may be obtained online at

vermont.gov/DMV/irp

IRP – Temporary Registration Authorization

A Temporary Registration Authorization may be obtained by a Vermont based carrier to add a vehicle to an

existing fleet for a fee of $15.00.

Temporary authorization constitutes registration of the vehicle and obligates the carrier to complete the

registration of the vehicle. A Supplemental Application (Schedule C/E) for permanent apportioned registration

must be filed prior to issuance of the temporary authority.

Temporary apportioned registration authorization allows a Vermont based fleet vehicle to operate in the listed

jurisdictions and at the listed weights for a period of 45 days pending issuance of permanent IRP registration.

Prior to issuing a temporary IRP Registration, tax, title, and registration fees must be paid. Application for

Temporary authorization may be obtained from the Department of Motor Vehicles, IRP Unit 120 State Street

Montpelier Vermont 05603-0001.

Hunter Permit/Unladen Weight Permit

An owner-operator may obtain a temporary registration known as a "Hunter Permit" when not operating as a

lessor and searching for a carrier with whom they may lease. The Hunter Permit authorizes operation of an

unloaded vehicle by the owner-operator for a period of not longer than 30 days. Prior to hauling a load with

the vehicle, it must be properly registered. Hunter Permits will only be issued to Vermont based carriers.

Page 14

Replacement Credentials

Lost, stolen, or damaged IRP apportioned registration credentials may be replaced by filing Vermont Form

VP-169, Application for Replacement Credentials together with the required fees. Application can be obtained

online (dmv.vermont.gov) or from the Montpelier office.

REPLACEMENT CREDENTIALS

Plate - $15.00 one plate / $29.00 two plates

Cab Card - $20.00

Make checks payable in US funds to the Vermont Department of Motor Vehicles. Please do not send cash in

the mail.

The application must include an adequate statement of circumstances of the loss. The application must be

signed and dated or it will be returned.

Lost or Destroyed IRP Credentials Certification

When withdrawing, deleting, transferring your IRP registration, you must return the IRP Plates and Cab Card.

In the event that the IRP Plates and/or Cab Card has been lost or destroyed, you must apply for replacement

IRP credentials.

Enforcement

1. Vermont credentials (cab card and apportioned license plates (2) with validation stickers) must be on the

registered vehicle on the first day of the registration month.

2. Vermont carriers going into other jurisdictions should learn the requirements of those states or provinces

before entering. A vehicle operating in a jurisdiction without being properly registered may be required

to pay double the fee for full registration in that jurisdiction or other penalties may be imposed. For your

information, a list of all foreign jurisdictions and their telephone numbers may be found at

www.IRPonline.org.

3. Enforcement personnel look to the cab card for verification that vehicles are properly registered and

registration fees have been paid to the base jurisdiction. This cab card must be carried in the vehicle

described and must not be mutilated or altered in any way. Enforcement personnel in some jurisdictions

will consider the cab card void if there is even the slightest irregularity, so each cab card should be

carefully examined upon receipt and protected while in the operator’s possession.

NOTE: Enforcement personnel will be noting the vehicle identification number (VIN) on the vehicle

itself and on the cab card. Exercise extreme care in listing those numbers correctly on your application

for apportioned registration. (Schedule A/E and C/E).

Audits and Record Requirements

Audits

Apportioned carriers shall be required to preserve the “Operational Records” on which the registration

application is based, plus the operational records for the three prior distance-reporting periods. Notice of intent

to audit will be given to the carrier. Authenticity of distance and registration will be verified and assessment

Page 15

made for any deficiency found due. Any apportioned carrier, who refuses to comply with the distance-

reporting requirement, shall not be entitled to apportioned registration privileges.

In the event that the registrant’s operational records are not located in the base jurisdiction or are not made

available in the base jurisdiction and it becomes necessary for the base jurisdiction to send auditors to the place

where such records are normally kept, the base jurisdiction may require the registrant to reimburse the base

jurisdiction for per diem and travel expense of its auditors incurred in the performance of such audit.

Upon audit, the Commissioner shall assess for any deficiency found to be due. No assessment for deficiency

or claim for credit may be made for any period for which records are no longer required.

Assessments based on audit, interest on assessments, refunds, or credits on any other amounts including

auditor’s per diem and travel shall be made in accordance with the statute of each jurisdiction involved with

such audit of a registrant.

Every effort will be made by the audit staff of the Vermont Department of Motor Vehicles to schedule the IRP

registration audit in conjunction with an International Fuel Tax Agreement Audit to avoid duplication of effort

by all parties.

Records

Operational records must be kept by the registrant that documents distance traveled in each jurisdiction and

total distance traveled. An acceptable source document to verify fleet distance is some type of “Individual

Vehicle Distance Record” (I.V.D.R.) which must include the following basic information:

1. Date (Starting and Ending).

2. Trip origin and destination.

3. Route of Travel.

4. Beginning and ending odometer or hubometer reading of the trip.

5. Total trip distance (including all movement, loaded, empty, deadhead and/or bobtail miles).

6. Distance traveled by jurisdiction

7. Unit number or vehicle identification number.

8. Vehicle Fleet number

9. Registrant’s name.

10. Trailer number

11. Driver’s signature and/or name.

An I.V.D.R. must be completed for each movement of a vehicle. Registrants must be able to explain any

unaccounted time lapse of vehicle movement. Any “off road” distance must be accounted for and supporting

documents available (trip permit, daily driver logs, etc.)

Computer printouts and monthly reports such as fuel reports are merely recaps and are not acceptable at face

value. These must be supported by an I.V.D.R. in order to be of any use during an audit. Trip leases during

the distance reporting period should be attached to the I.V.D.R. Total distance operated under trip permits

should be included.

Registrants must accumulate I.V.D.R.s and prepare a monthly recap in which miles are broken down by unit

and by state. From this the yearly recap can be prepared.

All registrants are liable for the proper maintenance of their distance records. Odometer/hubometer readings

are mandatory and must be in proper working order. Distance records are required to be maintained as follows:

Page 16

Distance records supporting the current registration year and the three previous registration years must be

available for audit. Any registrant failing to maintain adequate records for a unit or units qualified in

registrant’s fleet during the reporting period must provide evidence of non-use or the registrant is subject to

additional registration fees. Inadequate records will result in the assessment of additional fees (20% for

the first finding of inadequate records, 50% for the second and 100% for the third offense). The carrier

may also be prohibited from obtaining apportioned registrations for one year.

Total fleet distance includes all distances operated in all jurisdictions (state and provinces) and this distance

shall conform to the following definition:

Total fleet distance shall mean the distance generated by any truck or truck-tractor, which was part of the

apportioned fleet during the reporting period preceding the year for which the registration is sought. The total

distance to be reported for any truck or truck-tractor, which was deleted from or added to the proportional fleet

during the distance-reporting period, shall be only the distance generated by such vehicle while it was part of

the proportional feet during the reporting period.

Total distance in relation to trailers or semi-trailers, which are part of a proportional fleet, shall mean the

distance generated by the power units of the fleet.

Page 17

Appendix A - Definitions

Apportionable Fee

Any periodic recurring fee required for licensing or registering vehicles,

such as, but not limited to, registration fees, license or weight fees.

Apportionment

Percentage

The ratio of the distance traveled in the Member Jurisdiction by a Fleet

during the Reporting Period to the distance traveled in all Member

Jurisdictions by the Fleet during the Reporting Period, calculated to six

decimal places, rounded to five decimal places, and multipl

ied by one

hundred.

Apportionable Vehicles

Any vehicle, except recreational vehicles, vehicles displaying restricted

plates, city pick up and delivery vehicles, and Government owned vehicles,

used or intended for use in two or more member jurisdictions that allocate

or proportionally register vehic

les and used for the transportation of

persons for hire or designed, used or maintained primarily for the

transportation of property and;

1.

Is a power unit having two axles and a gross vehicle weight or

registered gross vehicle weight in excess of 26,000 pounds or

11,793.401 kilograms; or

2. Is a power unit having three or more axles, regardless of weight; or

3. Is used in combination, when the weight of such combination exceeds

26,000 pounds or 11,793.401 kilograms gross vehicle weight.

Axle

An assembly of a vehicle consisting of two or more wheels whose centers

are in one horizontal plane by means of which a portion of the weight of a

vehicle and its load, if any, is continually transmitted to the roadway. For

purpose of registration, an “axle” is any such assembly whether or not it is

load bearing only part of the time. For example, a single unit truck with a

steering axle and two axles in a rear-axle assembly is an apportionable

vehicle even though one of the rear axles is so-called “dummy”, “drag”,

“tag”, or “pusher” type axle.

Axle Weight

The weight transmitted to the surface by one axle or a combination of axles

in a tandem assembly.

Base Jurisdiction

The Member Jurisdiction, selected in accordance with Section 305, to

which an Applicant applies for apportioned registration under the Plan or

the Member Jurisdiction that issues apportioned registration to a Registrant

under the Plan.

Base Plate

The plate issued by the base jurisdiction and the only registration

identification plate issued for the vehicle by any member jurisdiction. Base

plate shall be identified by having the word “APPORTIONED”, APP” or

“PRP”and the jurisdiction’s name on the plate.

Bus

A vehicle designed for carrying more than 10 passengers and used for

the transportation of persons

Cab Card

A registration card issued by the Base Jurisdiction for a vehicle of an

apportioned fleet, which identifies the vehicle, base plate, registered weight

by jurisdiction and showing the jurisdiction where the vehicle is properly

registered.

Page 18

Carrier

An individual, partnership, or corporation engaged in the business of

transporting goods or persons.

Chartered Party

A group or person who, pursuant to a common purpose and under a single

contract, and at a fixed charge for the vehicle in accordance with the

carrier’s tariff, lawfully on file with the Interstate Commerce Commission,

have acquired the exclusive use of a passenger-carrying motor vehicle to

travel together as a group to a specified destination or for a particular

itinerary, either agreed upon in advance or modified by the chartered group

after having left the place of origin.

Combination

A power unit used in combination with trailers and semi-trailers.

Commercial Vehicle

Any vehicle operated for the transportation of persons or property in

furtherance of any commercial or industrial enterprises – for hire or not for

hire.

Commissioner

The jurisdiction official in charge of registration of vehicles. In Vermont

this is the Commissioner of the Department of Motor Vehicles.

Credentials

The cab card and apportioned plate issued for vehicles registered under the

apportioned registration program.

Established Place of

Business

A physical structure located within the Base Jurisdiction that is owned or

leased by the Applicant or Registrant and whose street address shall be

specified by the Applicant or Registrant. This physical structure shall be

open for business and shall be staffed during regular business hours by one

or more persons employed by the Applicant or Registrant on a permanent

basis (i.e., not an independent contractor) for the purpose of the general

management of the Applicant’s or Registrant’s trucking-related business

(i.e., not limited to credentialing, distance and fuel reporting, and answering

telephone inquiries). The Applicant or Registrant need not have land line

telephone service at the physical structure. Records concerning the Fleet

shall be maintained at this physical structure (unless such records are to be

made available in accordance with the provisions of Section 1035). The

Base Jurisdiction may accept information it deems pertinent to verify that

an Applicant or Registrant has an Established Place of Business within the

Base Jurisdiction.

Federal Employee ID

(FEIN or TIN)

The number issued to your business by the IRS

Fifth Wheel

A device used to connect a truck tractor or converter dolly to a semi-trailer.

Fleet

An apportionable vehicle or group of apportionable vehicles traveling in

the same set of IRP states

ICC

An abbreviation for the United States Interstate Commerce Commission

Page 19

Hunter Permit / Unladen

Weight Permit

A permit issued to owner-operators to allow the movement of an unloaded

vehicle that does not have a current registration.

International

Registration Plan

An agreement between member jurisdictions for prorating fees between

jurisdictions based on distance traveled by a fleet in each jurisdiction.

Interstate Operations

Vehicle movement between or through two or more jurisdictions.

Intrastate Operations

Vehicle movement from one point within a jurisdiction to another point

within the same jurisdiction.

I.V.D.R.

Individual Vehicle Distance Record

Jurisdiction

A state, territory or possession of the United States, the District of

Columbia, or a province of Canada.

Lease

A written document vesting exclusive possession, control of and

responsibility for the operation of the vehicle to the lessee for a specific

period of time.

Lessee

A person, firm or corporation which has the legal possession and control of

a vehicle owned by another under the terms of a lease agreement.

Lessor

A person, firm or corporation which under the terms of a lease, grants the

legal right of possession, control of and responsibility for the operation of

the vehicle to another person, firm or corporation.

Long Term Lease

A lease which covers 30 days or more.

Member Jurisdiction

States of the United States and Provinces of Canada, which are members

of the IRP.

Motor Carrier

An individual, partnership, or corporation engaged in the transportation of

goods or person.

Operational Records

Documents supporting distance traveled in each jurisdiction and total

distance traveled such as fuel reports, trip sheets and logs.

Power Take-Off (PTO)

Equipment

Vehicle-mounted equipment that is powered by the main engine that also

propels a motor vehicle. Examples of PTO equipment are trash

compactors, concrete mixers, sewage pumps, and conveyors or other

loading/unloading devices on vehicles.

PRISM

Performance Registration Information Systems and Management

Page 20

Preceding Reporting

Year

July 1 –June 30 period, which immediately precedes the registration, or

license year for which proportional registration is sought.

Private Carrier

A person, firm or corporation which utilizes its own trucks to transport its

own freight.

Proportion

A part, share, etc., in its relation to the whole (same meaning as apportion

which means to divide and distribute proportionally).

Recreational Vehicle

A vehicle used for personal pleasure or personal travel by an individual or

family and not in connection with any commercial endeavor.

Reciprocity

Exemption from further registration by a bilateral jurisdiction of an

apportionable vehicle properly registered under the agreements

Registrant

A person, firm or corporation in whose name or names a vehicle is properly

registered.

Registration Year

The twelve-month period during which the registration plates issued by the

base jurisdiction are valid

according to the laws of the base jurisdiction.

The Vermont registration year is staggered.

Rental Fleet

Vehicles the Rental Owner designates as a Rental Fleet and which are

offered for rent with or without drivers.

Reporting Period

The period of twelve consecutive months immediately prior to July 1 of the

calendar year immediately preceding the beginning of the Registration

Year for which apportioned registration is sought. If the Registration Year

begins on any date in July, August, or September, the Reporting Period

shall be the previous such twelve-month period.

Residence

Applicant or a Registrant as a resident of a Member Jurisdiction

Restricted Plate

One that has time (less than a registration year), geographic area, distance

or commodity restriction (example – Farm Plate, Dealer Plate).

Road Tractor – (Mobile

Home Toter)

Every motor vehicle designed and used for drawing other vehicles and not

so constructed as to carry any load thereon either independently or any part

of the weight of a vehicle or load so drawn.

Semi-Trailer

A vehicle without motive power designed for carrying person or property

and for being drawn by a motor vehicle and so constructed that some part

of its weight, and that of its load, rests upon or is carried by the towing

vehicle.

Service Representative

One who furnishes facilities and services including sales, warehousing,

motorized equipment and drivers under contract or other arrangements to a

carrier for transportation of property by a household goods carrier.

Page 21

Short Term Lease

A lease which covers less than 30 days.

Total Distance

All distance operated by a Fleet of Apportioned Vehicles. Total Distance

includes the full distance traveled in all Vehicle movements, both

interjurisdictional and intra-jurisdictional, and including loaded, empty,

deadhead, and bobtail distance. Distance traveled by a Vehicle while under

a trip Lease shall be considered to have been traveled by the Lessor’s Fleet.

Tractor

A motor vehicle designed and used primarily for drawing other vehicles

but not so constructed as to carry a load other than a part of the weight of

the vehicles and load so drawn.

Trailers

non-powered units

Trip Permit

A temporary permit issued by a jurisdiction in lieu of regular apportioned

registration.

Truck

Every motor vehicle designed, used or maintained primarily for the

transportation of property.

Truck Tractor

A motor vehicle designed and used primarily for drawing other vehicles

but so constructed as to carry a load other than a part of the weight of the

vehicle loads drawn.

US DOT Number

The US DOT number is issued to motor carriers, registrants and shippers

by the United State Department of Transportation.

Utility Trailer

A full trailer or semi-trailer constructed solely for the purpose of carrying

property and not to exceed 6,000 lbs. (2,721.554 kilograms)

Page 22

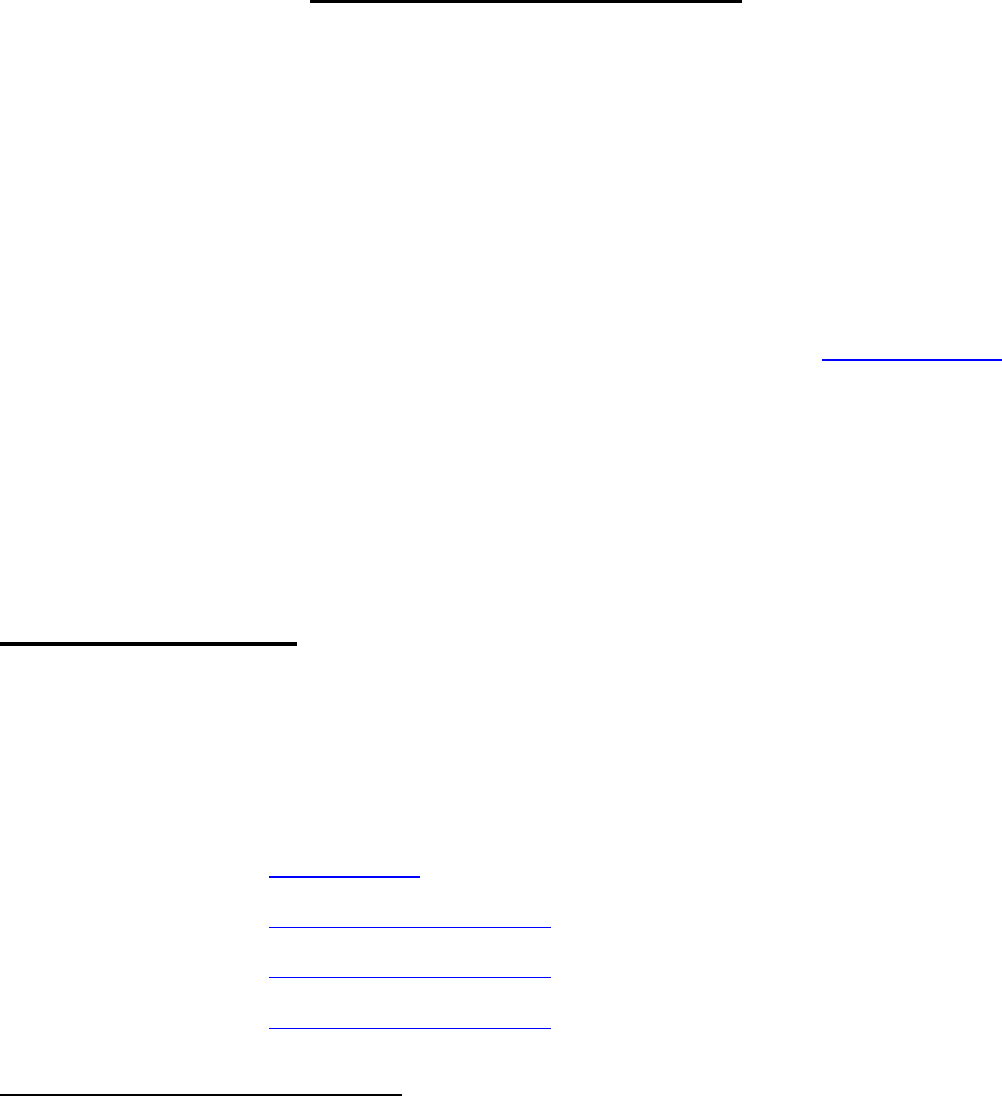

APPENDIX B - IRP Jurisdiction Maximum Weights

Jurisdiction

Maximum Operating Weight (in lbs.)

Maximum Cab Card Weight (in lbs.)

Alabama

80000

Alberta

139992

139992

Arizona

80000

80000

Arkansas

80000

80000

California

80000

80000

Colorado

85000

80000 (82000 if vehicle contains an

alternative fuel system and operates on

alternative fuel or both alternative fuel

and conventional fuel)

Connecticut

Delaware

80000

80000

District of

Columbia

80000

80000

Florida

80000

80000

Georgia

80000

80000

Idaho

129000

129000

Illinois

80000

80000

Indiana

80000

80000

British Columbia

139994

139994

Iowa

Kansas

85500

85500

Kentucky

80000

80000

Louisiana

88000

88000

Maine

100000

100000

Manitoba

139994

139994

Maryland

80000

80000

Massachusetts

Michigan

160001

160001

Minnesota

80000

Mississippi

80000

80000

Missouri

80000

80000

Montana

138000

138000

Nebraska

94000

94000

Nevada

129000

80000

New Brunswick

New Hampshire

80000

80000

New Jersey

80000

80000

New Mexico

86400

80000

Page 23

Jurisdiction

Maximum Operating Weight (in lbs.)

Maximum Cab Card Weight (in lbs.)

New York

80000

Newfoundland

and Labrador

North Carolina

80000

80000

North Dakota

105500

105500

Ohio

80000

80000

Oklahoma

90000

90000

Ontario

139992

139992

Oregon

105500

105500

Pennsylvania

80000

80000

Prince Edward

Is.

137788

137788

Rhode Island

80000

80000

Saskatchewan

139994

139994

Nova Scotia

137788

137788

Quebec

South Carolina

80000

80000

South Dakota

Tennessee

80000

80000

Texas

80000

80000

Utah

129000

80000

Vermont

80000

80000

Virginia

80000

80000

Washington

105500

105500

West Virginia

80000

80000

Wisconsin

80000

80000

Wyoming

117000

117000

Page 24

Page 25

International Fuel Tax Agreement (IFTA)

The International Fuel Tax Agreement is an agreement among jurisdictions for the uniform collection and

distribution of fuel tax revenues. Jurisdictions continue to set their own tax rates according to local and state

highway construction and maintenance needs, and are only required to notify other base jurisdictions of the

proper tax rates to collect.

The purpose of this publication is to present general information about the IFTA and your responsibilities as a

participant in the program. This booklet does not replace the law, regulation, or administrative documents

under which the IFTA program is administered, nor does it constitute a legal interpretation of the Intermodal

Surface Transportation Efficiency Act of 1991 or any other legislation or state or federal law.

For further information about IFTA or application assistance contact: Vermont Department of Motor

Vehicles, Commercial Vehicle Operations at (802) 828-2070 or visit our web site dmv.vermont.gov

OR WRITE TO:

VT Department of Motor Vehicles

CVO Unit – IFTA

120 State Street

Montpelier, VT 05603-0001

IFTA INC. Links

The International Fuel Tax Association Inc. (IFTA Inc.) is a nonprofit corporation organized under the laws

of the State of Arizona. It is an association of all of the member jurisdictions that have entered into the

International Fuel Tax Agreement. IFTA, Inc. serves as a repository of information for IFTA. This includes

jurisdiction contact lists, information on jurisdiction fuel tax rates, and IFTA newsletters. The IFTA Articles

of Agreement, Procedures Manual, and Audit Manual are also maintained and updated by IFTA, Inc.

IFTA Inc. Home Page www.iftach.org

Articles of Agreement www.iftach.org/manual1.php

Procedures Manual www.iftach.org/manual1.php

Audit Manual www.iftach.org/manual1.php

IFTA LICENSING REQUIREMENTS

Any person based in a member jurisdiction operating a qualified motor vehicle(s) in two or more member

jurisdictions is required to license under this Agreement.

To license under the IFTA in Vermont a carrier must meet all of the following requirements:

Your qualified motor vehicle(s) is registered in Vermont and travel in two or more jurisdictions.

(See definition of qualified motor vehicle next page)

Page 26

You have an established place of business in Vermont from which you maintain operational control of

your vehicle fleet.

You maintain records of your qualified motor vehicle(s) in Vermont or will make your records available

to officials or agents of the Commissioner of Motor Vehicles for audit purposes.

Your qualified motor vehicles travel in Vermont and at least one other IFTA member jurisdiction.

QUALIFIED MOTOR VEHICLES

“Qualified Motor Vehicle” means a motor vehicle used, designed, or maintained for transportation of person

or property and:

1. Having two axles and a gross weight or registered gross vehicle weight exceeding 26,000 pounds or

11,797 kilograms; or

2. Having 3 or more axles on the power unit regardless of weight; or

3. Is used in combination, when the weight of such combination exceeds 26,000 pounds or 11,797

kilograms gross vehicle or registered gross vehicle weight.

“Qualified Motor Vehicle” does not include recreational vehicles.

Recreational Vehicle means vehicles such as motor homes, pickup trucks with attached campers, and buses

when used exclusively for personal pleasure by an individual. In order qualify for a recreational vehicle, the

vehicle shall not be used in connection with any business endeavors.

General Provisions:

A. The IFTA license and decals are valid for the calendar year only and must be renewed annually.

There is a grace period until the last day of February for all vehicles with previous year expired

decals with accounts that are in good standing.

B. IFTA tax return periods are concurrent with the calendar quarter periods of January 1

st

– March 31

st

;

April 1

st

– June 30

th

; July 1

st

– September 30

th

and October 1

st

- December 31

st

.

C. Payment of taxes must accompany the quarterly return or it will be returned and considered not filed.

D. It is the responsibility of the base jurisdiction to perform all tax audits. Another jurisdiction may re-

examine a base jurisdiction’s audit finding if the member jurisdiction reviews the audit work papers

and within 45 days of receipt of the audit findings by the member jurisdiction, notifies the base

jurisdiction of any errors found during such review and of its intention to conduct the re-examination.

Such re-examination by a member jurisdiction must be based exclusively on the audit sample period

utilized by the base jurisdiction in conducting its audit.

Application for IFTA License:

The application form (VP-211) for an IFTA License or replacement license, may be obtained from the

Vermont Department of Motor Vehicles, Montpelier VT or by accessing our web site at dmv.vermont.gov.

1. All applications must be COMPLETE or they will be returned for completion before processing.

Page 27

2. Any person obtaining an IFTA license will be required to furnish their DOT #, federal employer

identification number, or in the case of sole proprietorship, their social security number.

IFTA License:

A. One (1) International Fuel Tax License will be issued and is valid for the current calendar year. The

license is to be reproduced by the licensee and a copy placed in each qualified motor vehicle of the

licensee’s fleet that has valid IFTA decals.

B. Failure to be in possession of a copy of the fuel tax license can either result in the purchase of a trip

permit, issuance of a citation, or both.

C. A duplicate of a lost or destroyed IFTA license may be obtained by submitting an application to the

Department of Motor Vehicles, Commercial Vehicle Operation Unit, 120 State Street Montpelier VT

05603-0001.

IFTA Decal:

1. Two International Fuel Tax Agreement (IFTA) decals are issued for each qualified motor vehicle in

the fleet. The decals must be placed on the exterior portion of both sides of the cab. In the case of

transporters, manufacturers, dealers, or drive away operations, the decals need not be permanently

affixed, but may be temporarily displayed in a visible manner on both sides.

2. Failure to display the decals in the required location will either result in the purchase of a trip permit,

the issuance of a citation, or both.

3. An application is required when requesting additional or replacement decals. When requesting

replacement decals, the damaged decals must be returned with your request or a statement indicating

why they cannot be.

4. The number of decals requested must coincide with the number of vehicles that are being permitted.

Requests for “extra” decals will be denied.

5. Decals cannot be transferred between motor vehicles.

6. The license and decal(s) qualifies the licensee to operate in all IFTA member jurisdictions without

further licensing or identification requirements in regard to motor fuel use taxes.

Additional Highway Use Fees

Kentucky, New Mexico, New York, and Oregon have a highway use fee in addition to the fuels tax.

If you travel in one of these four states, you must file its highway use fee reports in addition to filing your

Vermont IFTA return. Some or all of your vehicle distance will be reported on both the IFTA return and that

state’s highway use fee report. For additional information, contact jurisdictions directly.

Bonding:

1. A license is not required to post a bond to obtain an IFTA license.

Page 28

2. A bond may be required when a licensee fails to file timely fuel tax returns, fails to remit required taxes

with the return(s) or when an audit indicates existing problems that could jeopardize the interest of

contracting members of IFTA. The minimum bond will be at least two times the tax liability, or $500.00,

whichever is greater. The bond will be retained for a minimum of three years following the last return

violation at which time the bond will be refunded.

Tax Reporting:

1. The Department furnishes returns at least thirty (30) days prior to the due date of the return.

2. Returns shall include the following information:

a. Total distance traveled during the return period by qualified motor vehicles in the licensee’s fleet

regardless of whether the distance is taxable or nontaxable by jurisdiction;

b. Total number of gallons of motor fuel used by the licensee in the operation of qualified motor

vehicles;

c. In-jurisdiction distance traveled by qualified motor vehicles within each member jurisdiction;

d. Gallons of taxable motor fuel consumed within each member jurisdiction;

e. Any additional information that may be required by the Department.

3. Returns are required even though no operations were conducted during the return period.

4. Returns are required even though no taxable fuel was used.

5. The prior year IFTA license is valid through February, (only with prior year decal) and a return is

required through the 1

st

Quarter, even if the IFTA license has not been renewed.

6. Returns must be signed and dated or it will be considered incomplete. The return will be returned for

a signature and date, which could result in the return being received late and interest being assessed.

7. Failure to receive a return does not relieve the licensee from the obligation of submitting a return.

Contact the Department for replacement.

Filing the Return:

1. Returns shall be considered received:

a. On the date shown by U.S. Postal Service or Delivery Service cancellation dates stamped on the

envelope containing the return, properly addressed to the Department of Motor Vehicles, postage

meters are unacceptable;

b. On the date it was mailed if satisfactory proof is presented to the Department of Motor Vehicles

to establish the date it was mailed;

c. On the date that is was delivered to a designated employee of the Department of Motor Vehicles,

if hand delivered.

Page 29

Interest Provisions:

A. A tax return must be federally postmarked no later than midnight on the last day of the month following

the close of the return period. If delivery to the post office is on the returns due date, the envelope

should be hand canceled by the postmaster to ensure timeliness.

B. If the last day of the month falls on a Saturday, Sunday or a Legal Holiday, the next business day shall

be considered the final filing date.

C. The base jurisdiction shall assess interest on all delinquent taxes due each jurisdiction as follows:

The interest rate changed on July 1, 2013 due to an amendment to the IFTA Articles of Agreement.

Effective July 1, 2013, interest is set at an annual rate of two (2) percentage points above the

underpayment rate established under section 6521(a)(2) of the Internal Revenue Code, adjusted on an

annual basis of January 1 of each year. Interest is computed at 1/12 this annual rate per month or part

of a month.

D. Interest shall be calculated from the date tax was due for each month or fraction thereof until paid.

Measurements:

Licensees based in Vermont are required to report in U.S. measurements. Tax rates will be converted using

the following factors, and will be computed to the nearest one-tenth of a cent:

One Liter = .2642 Gallons One Gallon = 3.785 Liters

One Mile = 1.6093 One Kilometer = .62137 Miles

ALL TAX RATES ON THE RETURNS HAVE ALREADY BEEN CONVERTED TO U.S. FUNDS

Closing an IFTA Account:

To close an IFTA account you must submit a written request, return your IFTA credentials and IFTA decals.

All quarterly fuel taxes must be filed and paid in full prior to completely closing the account

Tax Exempt Distance

The licensee is required to obtain the definition of tax-exempt distance from each jurisdiction or by accessing

the IFTA website.

Tax Exempt gallons are subject to Vermont Sales Tax

Net Payment

When filing a tax return, an overpayment generated in one jurisdiction will be applied to the taxes owed another

jurisdiction and the net tax owed is to be remitted on their return to Vermont.

Operating Privileges

A notice of suspension will be sent to a licensee who has not filed a written appeal within a thirty (30) day

period from notification of delinquency.

Noncompliance with record keeping requirements may also be cause for suspension/revocation of the license.

Page 30

License Responsibilities:

A. Record Retention

All data concerning the audit must be documented in sufficient detail to support the IFTA returns filed.

The data must be retained for four years (16 quarters) plus the time period included by waivers or

jeopardy assessments.

B. Records Maintenance

An acceptable distance accounting system is an essential ingredient in compiling the data necessary to

complete the IFTA returns. A licensee’s system, at minimum, must include the distance and date for

each trip for each vehicle, and be recapitulated in monthly fleet summaries. Supporting documentation

should include the following information:

1. Date of Trip (starting and ending)

2. Trip Origin and destination.

3. Route of travel (may be waived by base jurisdiction).

4. Beginning and ending odometer or hub odometer reading of trip

5. Total trip distance.

6. Distance by jurisdiction

7. Unit number or vehicle identification number.

8. Vehicle fleet number.

9. Registrant’s name.

The licensee must maintain complete records, supported by fuel receipts, of all fuel purchases as filed. Fuel

purchases will consist of gasoline, diesel, kerosene, gasohol, liquid petroleum gas, compressed natural gas, or

other fuel types. Separate totals must be compiled for each fuel type. Fuel purchased as storage fuel or over

the road purchases are to be accounted for separately.

Storage fuel is normally delivered into fuel storage facilities maintained by the licensee; fuel tax is due at the

time of delivery. The licensee must retain copies of all delivery tickets and/or receipts.

Bulk fuel inventory reconciliation’s must be maintained. In the case of withdrawals from bulk storage, records