IDBI ASSET MANAGEMENT LIMITED

(CIN: U65100MH2010PLC199319)

Annual Report

2015-16

Date of AGM:

30

th

August, 2016

Place of AGM:

24

th

Floor, Small Conference Room, IDBI Tower, Cuffe Parade, Mumbai - 400 005.

IDBI Asset Management Limited

CIN: U65100MH2010PLC199319

Registered ofce: IDBI Tower, WTC Complex, Cuffe Parade, Colaba, Mumbai - 400 005.

Corporate ofce: 5

th

Floor, Mafatlal Centre, Nariman Point, Mumbai - 400 021.

IDBI Asset Management Limited

1

Annual Report 201

5-16

E

XECUTIVE DIRECTOR

Shri Sarath

Sarma

COMPANY SECRETARY

Shri Manesh G. Jiandani (FCS 7360)

CHIEF FINANCIAL OFFICER

Shri Amit Bhavsar

(FCA108590)

COMPLIANCE OFFICER

Shri A. Jayadevan

REGISTERED OFFICE: CORPORATE OFFICE:

IDBI Tower, WTC Complex, 5

th

Floor, Mafatlal Centre,

Cuffe Parade, Mumbai 400 005. Nariman Point, Mumbai 400 021.

Tel: (022) 66442800, Fax: 66442801

Website: www.idbimutual.co.in

Email: [email protected]

STATUTORY AUDITORS SECRETARIAL AUDITORS

C.R. Sagdeo & Co. G. Sreenivasa Rao

Chartered Accountants, GSR & Co.,

306, 3

rd

oor, Mayuresh Cosmos Company Secretaries,

CBD Belapur, Sectior 11, Plot 37, Flat No. A-2, 2

nd

Floor, Sai Niranthara,

Navi Mumbai - 400 614. No.14/23, Nagarjuna Nagar, 1

st

Street,

Rangarajapuram, Kodambakkam,

Chennai - 600 024.

IDBI ASSET MANAGEMENT LIMITED

(CIN: U65100MH2010PLC199319)

CORPORATE INFORMATION

BOARD OF DIRECTORS

(as on 30

th

August, 2016)

Shri Kishor P. Kharat (07266945) – Chairman

Shri. A L Bongirwar (00660262) – Nominee Director

Shri. Jayant N. Godbole (00056830) – Independent Director

Lt. Gen. Mukesh Sabharwal (retd.) (05155598) – Independent Director

Ms. Geeta P. Shetti (02948958) – Independent Director

Shri. A. V. Rammurty (00050455) – Independent Director

Shri.

Dilip K Mandal(03313130) - MD & CEO

AUDIT COMMITTEE

(as on 30

th

August, 2016)

Ms. Geeta P. Shetti (02948958) – Independent Director (Chairperson)

Shri. Jayant N. Godbole (00056830) – Independent Director

Lt. Gen. Mukesh Sabharwal (retd.) (05155598) – Independent Director

Shri. A. V. Rammurty (00050455) – Independent Director

NOMINATION AND REMUNERATION COMMITTEE

(as on 30

th

August, 2016)

Shri. Jayant N. Godbole (00056830) – Independent Director (Chairman)

Shri. A L Bongirwar (00660262) – Nominee Director

Lt. Gen. Mukesh Sabharwal (retd.) (05155598) – Independent Director

Ms. Geeta P. Shetti (02948958) – Independent Director

Shri. A. V. Rammurty (00050455) – Independent Director

IDBI ASSET MANAGEMENT LIMITED

CIN: U65100MH2010PLC199319

Registered Office: IDBI Tower,WTC Complex, Cuffe Parade, Mumbai 400 005

Corporate Office: 05th Floor, Mafatlal Centre, Nariman point, Mumbai 400 021

Tel: (022) 66442800, Fax: 66442801,

Website: www.idbimutual.co.in, Email: manesh.jiandani@idbimutual.co.in

NOTICE OF THE SIXTH ANNUAL GENERAL MEETING

Notice is hereby given that the Sixth Annual General Meeting of the members of M/s. IDBI

Asset Management Limited will be held at short notice in the Small Conference Room of IDBI

Bank Limited on the 24

th

floor at IDBI Tower, Cuffe Parade, Mumbai- 400005 on Tuesday, the

30

th

day of August 2016 at 5.30 P M, to transact the following Ordinary and Special Business:

A. Ordinary Business

1. Item no 1: Adoption of Financial Statements

To receive, consider and adopt the Audited Financial Statements of the Company

consisting of Balance Sheet as at 31

st

March, 2016, the statement of Profit and Loss,

Cash Flow Statement for the year ended on 31

st

March, 2016 and the reports of the

Board of Directors' and the Statutory Auditors' and the comments of the Comptroller

& Auditor General of India thereon.

2. Item no 2:To fix the remuneration of the Statutory Auditors.

To consider and, if thought fit, to give your assent or dissent to the following

Resolution, with or without modifications, as an Ordinary Resolution:

RESOLVED THAT the Board of Directors of the Company be and are hereby

authorized to decide, negotiate and finalise the remuneration of the Statutory

Auditors of the Company as appointed by the Comptroller and Auditor-General of

India pursuant to the provisions of Section 139(5) and other applicable provisions, if

any, of the Companies Act, 2013, up to an amount as may be recommended by the

Audit Committee and at the discretion of the Board, for the year 2016-17.

IDBI ASSET MANAGEMENT LIMITED

CIN: U65100MH2010PLC199319

Registered Office: IDBI Tower,WTC Complex, Cuffe Parade, Mumbai 400 005

Corporate Office: 05th Floor, Mafatlal Centre, Nariman point, Mumbai 400 021

Tel: (022) 66442800, Fax: 66442801,

Website: www.idbimutual.co.in, Email: manesh.jiandani@idbimutual.co.in

B. Special Business

4. Item no 3:Confirmation of appointment of Shri Kishor Piraji Kharat (07266945) as

Director and as Chairman of the Board.

To consider and, if thought fit, to give your assent or dissent to the following Resolution,

with or without modifications, as an Ordinary Resolution:

“RESOLVED THAT in accordance with Section 161 and other applicable provisions of the

Companies Act, 2013 and the Rules made thereunder (including any statutory modification(s) or

re-enactment thereof), and in terms of the Articles of Association of the Company and as per

IDBI Bank Letter no 194/S&AIC/IAML dated August 24, 2015, Shri Kishor Piraji Kharat

(07266945), who was appointed as an Additional Director of the Company, Nominated by IDBI

Bank Limited, by the Board of Directors by passing resolution in the meeting held on October

28, 2015, effective from October 28 2015, and was elected as the Chairman of the Board

consequent to amendment carried out in clause 173 of the Articles of Association on approval

from Shareholders in the Extra ordinary General Meeting held on December 30, 2015 and who

holds office upto the date of this Annual General Meeting pursuant to Section 161 of the

Companies Act, 2013, and Article 179 of the Articles of Association of the Company, be and is

hereby appointed as a Director of the Company and Chairman of the Board, Nominated by IDBI

Bank Limited, whose period of office shall not be liable to determination for retirement by

rotation.”

5. Item no 4:Confirmation of appointment of Shri Abhay Laxman Bongirwar (DIN:

00660262) as Nominee Director, liable to retire by rotation.

To consider and, if thought fit, to give your assent or dissent to the following Resolution,

with or without modifications, as an Ordinary Resolution:

“RESOLVED THAT in accordance with Section 161 and other applicable provisions of the

Companies Act, 2013 and the Rules made thereunder (including any statutory modification(s) or

re-enactment thereof), and in terms of the Articles of Association of the Company and as per

IDBI Bank Letter no 82/SAIC/Nominee Dated July 14, 2016, Shri Abhay Laxman Bongirwar

(DIN: 00660262), who was appointed as a Nominee Director (Additional Director) of the

Company, Nominated by IDBI Bank Limited, by the Board of Directors by passing resolution by

circulation (received assent of all directors on 30

th

July 2016) and subsequently ratified at the

meeting held on 30

th

August 2016, effective from July 30 2016, pursuant to Articles 171(b), 173

and 179 of the Articles of Association of the Company and Section 161 of the Companies Act,

IDBI ASSET MANAGEMENT LIMITED

CIN: U65100MH2010PLC199319

Registered Office: IDBI Tower,WTC Complex, Cuffe Parade, Mumbai 400 005

Corporate Office: 05th Floor, Mafatlal Centre, Nariman point, Mumbai 400 021

Tel: (022) 66442800, Fax: 66442801,

Website: www.idbimutual.co.in, Email: manesh.jiandani@idbimutual.co.in

2013, and who holds office upto the date of this Annual General Meeting pursuant to Section

161 of the Companies Act, 2013, and Article 179 of the Articles of Association of the Company,

be and is hereby appointed as a Director of the Company, Nominated by IDBI Bank Limited,

whose period of office shall be liable to determination by retirement by rotation.”

Item no 5: Confirmation of appointment of Shri Dilip Kumar Mandal (03313130) as

Director and also appointment as Managing Director & CEO, not liable to retire by

rotation.

To consider and, if thought fit, to give your assent or dissent to the following Resolution,

with or without modifications, as an Special Resolution:

“RESOLVED THAT in terms of Articles 175, 176 of the Articles of Association of the Company and

in terms of sections 2(94), and 203, 188 and other applicable provisions, if any, of the

Companies Act, 2013, read with Schedule V to the Companies Act, 2013 and the Rules made

thereunder (including any statutory modification or re-enactment thereof), if applicable, Shri

Dilip Kumar Mandal (03313130), who was appointed as an Additional Director of the Company

by the Board of Directors at its meeting held on August 30, 2016, effective from August 22,

2016, pursuant to Articles 171(b) and 179 of the Articles of Association of the Company and

Section 161 (1) of the Companies Act, 2013, and who holds office upto the date of this Annual

General Meeting pursuant to Section 161(1) of the Companies Act, 2013, and Article 179 of the

Articles of Association of the Company, be and is hereby appointed as Director on the Board

w.e.f August 22, 2016 and as the Managing Director and Chief Executive Officer (MD & CEO) of

the Company, on deputation from IDBI Bank Limited, with effect from August 30, 2016 for a

period of 1 year, subject to further extension by IDBI Bank Ltd, on such terms and conditions

including remuneration as contained in the Letter no HRD 4465/Nominee dated August 12,

2016 issued by IDBI Bank Ltd and as disclosed in the Explanatory Statement to this Resolution

who shall not be liable to retire by rotation.

RESOLVED FURTHER THAT Shri Dilip Kumar Mandal (03313130) shall not be entitled to receive

any remuneration from the Company except for the remuneration and Performance Linked

Incentive specified/allowed by IDBI Bank under the Letter no HRD 4465/Nominee dated August

12, 2016 read with the Deputation Policy of IDBI Bank Limited for the services to be rendered

by him in his capacity as Managing Director & Chief Executive Officer (MD & CEO) of the

Company.

RESOLVED FURTHER THAT the Board of Directors of the company is hereby authorized to

extend the period of appointment of Shri Dilip Kumar Mandal (03313130), if so desired by the

Board, but not more than 5 years, at the expiry of the one year period from 01st September

2017.

IDBI ASSET MANAGEMENT LIMITED

CIN: U65100MH2010PLC199319

Registered Office: IDBI Tower,WTC Complex, Cuffe Parade, Mumbai 400 005

Corporate Office: 05th Floor, Mafatlal Centre, Nariman point, Mumbai 400 021

Tel: (022) 66442800, Fax: 66442801,

Website: www.idbimutual.co.in, Email: manesh.jiandani@idbimutual.co.in

RESOLVED FURTHER THAT that the Board of Directors of the Company be and is hereby

authorised to vary the terms of appointment including remuneration within the overall limits

prescribed under the Companies Act, 2013 and Schedules thereto on the basis of advice given

by IDBI Bank Limited from time to time and to do all such acts, deeds, matters and things as

may be considered necessary, desirable or expedient to give effect to this Resolution”

Item no 6:Authorisation for Related Party Transactions

To consider and, if thought fit, to give your assent or dissent to the following Resolution,

with or without modifications, as a Special Resolution:

RESOLVED THAT in terms of provisions of Section 188 and other applicable provisions of the

Companies Act 2013 read with rule 15 of the Companies (Meeting of the Board and its powers)

Rules 2014 and other applicable rules notified under the act, as amended from time to time, the

members of the Company hereby approves the continuation of existing contracts of the Company

and further hereby authorize the ACB/Board to approve and enter into fresh/ renew contracts and

arrangements with related parties including sub delegation thereof to a director/committee of

Directors as it may think fit including granting of omnibus approval in compliance with and as

per limits specified in Section 177 of the Companies Act 2013, for a value not exceeding Rs. 12

crore for each contract and/or arrangement whether entered into in ordinary course of business or

not and/or whether at arm’s length price or not or at such price with the recommendation and

approval of the Audit Committee to the Board of Directors of the Company for their approval,

without any further reference to the shareholders.

“RESOLVED FURTHER THAT the Board shall have the authority and power to accept any

modification in the proposal as may be required at the time of according / granting their

approvals, consents, permissions and sanctions to such contracts or arrangements proposed to be

entered with the related parties and as agreed to by the Board

“RESOLVED FURTHER THAT for the purpose of giving effect to the above resolution, the

Board, be and is hereby authorized to do all such acts, deeds, matters and things and execute

such deeds, documents and agreements, as they may, in their absolute discretion, deem

necessary, proper or desirable and to settle or give instructions or directions for settling any

questions, difficulties or doubts that may arise and to give effect to such modifications, changes,

variations, alterations, deletions, additions as regards the terms and conditions, as it may, in its

absolute discretion, deem fit and proper in the best interest of the Company, without requiring

any further approval of the members and intent that the members shall be deemed to have given

their approval thereto expressly by the authority of this resolution

“RESOLVED FURTHER THAT the Board be and is hereby authorized to delegate all or any of

the above powers, herein conferred, to a Director/duly constituted committee of Directors to give

effect to the aforesaid Resolutions.”

IDBI ASSET MANAGEMENT LIMITED

CIN: U65100MH2010PLC199319

Registered Office: IDBI Tower,WTC Complex, Cuffe Parade, Mumbai 400 005

Corporate Office: 05th Floor, Mafatlal Centre, Nariman point, Mumbai 400 021

Tel: (022) 66442800, Fax: 66442801,

Website: www.idbimutual.co.in, Email: manesh.jiandani@idbimutual.co.in

Item no 7:Amendment in Articles of Association

To consider and, if thought fit, to give your assent or dissent to the following Resolution,

with or without modifications, as a Special Resolution:

“RESOLVED THAT pursuant to the provisions of Section 14 of the Companies Act, 2013 and in

order to comply with the provisions of the Companies Act, 2013 read with the provisions of the

SEBI (MF) Regulations 1996, the Articles of Association of IDBI Asset Management Ltd. be

and are hereby altered

by deleting the existing Article 173 and substituting with the following Article

“Article 173

“The Chairman or MD & CEO of the IDBI Bank Limited, as may be nominated from time to

time by IDBI Bank Limited, shall be the Chairman of the Board.”

For and on behalf of the Board of Directors

Place : Mumbai CS Manesh Jiandani (FCS 7360)

Date : Company Secretary

IDBI Asset Management Limited

CIN no: U65100MH2010PLC199319

NOTES:

• MEMBER ENTITLED TO ATTEND AND TO VOTE AT THE MEETING IS

ENTITLED TO APPOINT A PROXY TO ATTEND AND VOTE ON A POLL ON HIS

BEHALF AND THAT THE PROXY NEED NOT BE A MEMBER OF THE

COMPANY. PROXY FORMS IN ORDER TO BE EFFECTIVE,SHOULD BE DULY

COMPLETED & AFFIXED WITH REVENUE STAMP AND MUST BE RECEIVED

BY THE COMPANY AT ITS REGISTERED OFFICE NOT LESS THAN 48 HOURS

BEFORE THE COMMENCEMENT OF THE MEETING.

• Members/proxies should bring the attendance slip duly filled in for attending the meeting.

• The relevant explanatory statements pursuant to Section 102(1) of the Companies Act,

2013 in respect of business under item no. 2 to 6 are attached herewith.

• Members/Proxies/Representatives are requested to bring the attendance slip enclosed to

the annual report /notice for attending the meeting.

• Corporate members intending to send their authorized representative(s) to attend the

meeting are requested to send a certified copy of the Board Resolution authorizing their

representative to attend and vote on their behalf at the meeting.

IDBI ASSET MANAGEMENT LIMITED

CIN: U65100MH2010PLC199319

Registered Office: IDBI Tower,WTC Complex, Cuffe Parade, Mumbai 400 005

Corporate Office: 05th Floor, Mafatlal Centre, Nariman point, Mumbai 400 021

Tel: (022) 66442800, Fax: 66442801,

Website: www.idbimutual.co.in, Email: manesh.jiandani@idbimutual.co.in

EXPLANATORY STATEMENT PURSUANT TO THE PROVISIONS OF SECTION 102

Item no 2:

In terms of section 139(5) of the Companies Act 2013, the Company is subjected to Audit by

Comptroller and Auditor General of India (C&AG). The accounts of the Company are required

to be audited by Statutory Auditors appointed by the C&AG. These Auditors shall hold office till

the conclusion of the AGM and as per the directions of the C&AG from time to time. The

Company has approached C&AG for appointment of the Statutory Auditors for the Financial

Year 2016-17. The C&AG has vide letter no CA/V/COY/Central Government,IDBIAS(1)/360

dated 13

th

July 2016 appointed M/s C R Sagdeo & CO. Chartered Accountants Navi Mumbai as

Statutory Auditor for the FY 2016-17.

The remuneration of the Statutory Auditors are required to be fixed by the Company in General

Meeting or in such manner as the Company in General Meeting may determine. The members

are requested to authorise the Board of Directors to fix the remuneration payable to the Statutory

Auditors based on recommendation of the Audit Committee of the Board. Therefore, it is

proposed that by passing ordinary resolution under section 139 of the Companies Act, 2013, the

ACB/Board may be authorised to negotiate and finalize the remuneration, the other terms and

conditions and remuneration of the Statutory Auditors etc. The Ordinary Resolution as contained

at Item No.2 of the AGM Notice is accordingly proposed to be passed by the shareholders.

None of the Directors and Key Managerial Personnel of the Company and their relatives is

concerned or interested, financial or otherwise, in the resolution set out at Item No. 2.

Item no 3:

IDBI Bank Limited, in terms of Article 171 (b) of the Articles of Association of the Company,

Vide letter no.194/S&AIC/IAML dated August 24, 2015 had advised appointment of Shri Kishor

Piraji Kharat (07266945), MD & CEO, IDBI Bank Ltd, as Director and as Chairman on the

Board of IDBI AML.

Accordingly, the Board of Directors, in accordance with Article 179 of the Articles of

Association of the Company and Section 161 of the Companies act 2013, had in its meeting held

on October 28, 2015 appointed Shri Kishor Piraji Kharat (07266945) as an Additional Director

of the Company with effect from October 28, 2015. Shri Kishor Piraji Kharat (07266945) was

elected as Chairman of the Board w.e.f. December 30, 2015 on approval of amendment in the

Articles of Association of your Company in the EGM held on December 30, 2015

Brief Profile of Shri Kishor Piraji Kharat (07266945):

Shri Kishor Piraji Kharat (07266945)is the Chairman of IDBI Asset Management Ltd. and

Managing Director and Chief Executive Officer of IDBI Bank Ltd. Prior to joining IDBI Bank,

he served as Executive Director at Union Bank of India and held charge of Priority Sector

Finance, MSME and Financial Inclusion. He has over 38 years of experience in the Banking and

IDBI ASSET MANAGEMENT LIMITED

CIN: U65100MH2010PLC199319

Registered Office: IDBI Tower,WTC Complex, Cuffe Parade, Mumbai 400 005

Corporate Office: 05th Floor, Mafatlal Centre, Nariman point, Mumbai 400 021

Tel: (022) 66442800, Fax: 66442801,

Website: www.idbimutual.co.in, Email: manesh.jiandani@idbimutual.co.in

Financial Services sector. In a career spanning 37 years with Bank of Baroda, Shri. Kharat held

several distinguished positions in the Bank's hierarchy in the areas including Credit, International

business, Information Technology and general administration in India as well as overseas. Shri.

Kharat established the foreign subsidiary of Bank of Baroda in Trinidad & Tobago, West Indies

and was its Managing Director for more than three years. He was also a founding member of

India Trinidad & Tobago Chambers of Commerce & Industry. During the period that Shri Kharat

was General Manager, Financial Inclusion Vertical, he was a key driver of major Financial

Inclusion initiatives where he had worked closely with RBI as well as the Government of India.

His Directorships in other Companies areas under :

Organization Name Any

association

with the

sponsor

Position

held

IDBI Bank Limited

Sponsor Managing Director & CEO

IDBI Capital Market Services

Limited

Wholly Owned

Subsidiary

Non Executive Chairman

Export Import Bank of India

No Director and Member of Audit

Committee

IDBI Trusteeship Services

Limited

Wholly Owned

Subsidiary

Non Executive Chairman

IDBI Intech Limited

Wholly Owned

Subsidiary

Non Executive Chairman

IDBI Federal Life Insurance

Company Limited

Joint Venture Non Executive Chairman

Entrepreneurship Development

Institute of India

Yes President of Governing Council

Stressed Asset Stabilisation

Fund

Yes Chairman and Executive Trustee

Under Section 161(1) of the Companies Act, 2013 read with Article 179 of the Articles of

Association of the Company, Shri Kishor Piraji Kharat (07266945) holds office only up to the

date of this Annual General Meeting of the Company.

IDBI ASSET MANAGEMENT LIMITED

CIN: U65100MH2010PLC199319

Registered Office: IDBI Tower,WTC Complex, Cuffe Parade, Mumbai 400 005

Corporate Office: 05th Floor, Mafatlal Centre, Nariman point, Mumbai 400 021

Tel: (022) 66442800, Fax: 66442801,

Website: www.idbimutual.co.in, Email: manesh.jiandani@idbimutual.co.in

MCA has vide circular dated 05

th

June 2015 notified that amongst other exemptions, Section 160

(notice of member signifying his intention to propose appointment of a candidate as Director and

deposit of Rs. 1 Lakh thereof) is not applicable to Government Companies . Since your company

is a Government Company within the definition of Section 2(45) of the Companies Act 2013,

Section 160 is not applicable to your Company.

Shri Kishor Piraji Kharat (07266945) does not receive any remuneration, benefits, or

commission from the Company.

Shri Kishor Piraji Kharat (07266945) does not hold by himself any shares in the Company.

The Board considers that the appointment of Shri Kishor Piraji Kharat (07266945) as a Director

of the Company would be of immense benefit to the Company. Accordingly, the Board of

Directors recommends his appointment as a Director of the Company who shall not be liable to

determination for retirement by rotation.

Except Shri Kishor Kharat (DIN: 07266945) Chairperson, being MD & CEO of IDBI Bank

Limited Shri Abhay Laxman Bongirwar (00660262) and Shri Dilip Kumar Mandal (03313130),

being an appointee, none of the Directors and Key Managerial Personnel of the Company and

their relatives is concerned or interested, financial or otherwise, in this resolution set out at Item

No. 3.

Item no 4:

IDBI Bank Limited, in terms of Article 171 (b) of the Articles of Association of the Company,

Vide letter no.82/S&AIC/Nominee/IAML dated July 14, 2016 had advised appointment of Shri

Abhay Laxman Bongirwar (00660262), ED IDBI Bank Ltd, as Director on the Board of IDBI

AML nominated by IDBI Bank Limited.

Accordingly, the Board of Directors had, by way of circular resolution, which was ratified in the

meeting held on 30

th

August 2016 appointed Shri Abhay Laxman Bongirwar (00660262) as an

Additional Nominee Director of the Company with effect from July 30, 2016.

Brief Profile of Shri Abhay Laxman Bongirwar (00660262):

Shri. Abhay Bongirwar, Executive Director at IDBI bank, has more than 32 years of experience

in areas like Infrastructure finance, project appraisal, recovery, retail banking, investment

banking, corporate advisory, debt Syndication, CDR etc.

He is a seasoned banker with special expertise in infrastructure & structured finance and

business turnarounds with growth orientation through quick decisions and need based delegation.

He has financed projects in almost all the sectors including Road, Power (incl. renewal energy,

generation, transmission, distribution), Telecom, Satellite communication, Oil & Gas, Shipping,

steel, solid waste management, cement etc.

IDBI ASSET MANAGEMENT LIMITED

CIN: U65100MH2010PLC199319

Registered Office: IDBI Tower,WTC Complex, Cuffe Parade, Mumbai 400 005

Corporate Office: 05th Floor, Mafatlal Centre, Nariman point, Mumbai 400 021

Tel: (022) 66442800, Fax: 66442801,

Website: www.idbimutual.co.in, Email: manesh.jiandani@idbimutual.co.in

He is also closely working with state govt for social development projects in areas like rural

development, renewable energy, smart cities, solar pumps etc. Presently, as ED at IDBI, he had

been involved in appraisal and funding of more than 40+ cases involving investment of more

than Rs.75,000 cr. with debt of approx. Rs.17,000 cr.

Earlier, As MD & CEO of IDBI Capital (subsidiary of IDBI Bank), he turnaround the business

& competitive position of IDBI Capital at a growth rate of more than 200% with increase in

profit before tax from Rs.5 cr to Rs. 50 cr. in 3 years and handled 83 Corporate Debt

Restructuring proposals of more than Rs.1,61,000 cr. capturing more than 50% market share in

CDR handling. As regional head at infra group at IDBI, he handled 2/3 of IDBI's infra finance

portfolio of more than 33000 cr. As zonal head of Pune region, he was also directly involved in

merger of people, processes and business of 30 branches of IDBI Ltd, IDBI Bank, United

Western bank and increased business at a growth rate of 125% in 2 years from Rs. 126 cr. to

Rs.637 cr.(debt). Between 1997-2001, handled project appraisal and sanction of Power projects

of more than 10,000 MW. During post liberalisation era, raised more than Rs. 4000 cr through

32 public issues through Merchant Banking activities.

His Directorships in other Companies areas under :

Organization Name Any

association

with the

sponsor

Position

held

IDBI Bank Limited

Sponsor Executive Director

Maharashtra State Board of

Technical Education

No Member of Governing Council

Under Section 161(1) of the Companies Act, 2013 read with Article 179 of the Articles of

Association of the Company, Shri Abhay Laxman Bongirwar (00660262) holds office only up to

the date of this Annual General Meeting of the Company.

MCA has vide circular dated 05

th

June 2015 notified that amongst other exemptions, Section 160

(notice of member signifying his intention to propose appointment of a candidate as Director and

deposit of Rs. 1 Lakh thereof) is not applicable to Government Companies . Since your company

is a Government Company within the definition of Section 2(45) of the Companies Act 2013,

Section 160 is not applicable to your Company.

Shri Abhay Laxman Bongirwar (00660262) does not receive any remuneration, benefits, or

commission from the Company.

IDBI ASSET MANAGEMENT LIMITED

CIN: U65100MH2010PLC199319

Registered Office: IDBI Tower,WTC Complex, Cuffe Parade, Mumbai 400 005

Corporate Office: 05th Floor, Mafatlal Centre, Nariman point, Mumbai 400 021

Tel: (022) 66442800, Fax: 66442801,

Website: www.idbimutual.co.in, Email: manesh.jiandani@idbimutual.co.in

Shri Abhay Laxman Bongirwar (00660262) does not hold by himself any shares in the

Company.

The Board considers that the appointment of Shri Abhay Laxman Bongirwar (00660262) as a

Director of the Company would be of immense benefit to the Company. Accordingly, the Board

of Directors recommends his appointment as a Director of the Company who shall not be liable

to determination for retirement by rotation.

Except Shri Kishor Kharat (DIN: 07266945) Chairperson, being MD & CEO of IDBI Bank

Limited Shri Abhay Laxman Bongirwar (00660262) and Shri Dilip Kumar Mandal (03313130),

being an appointee, none of the Directors and Key Managerial Personnel of the Company and

their relatives is concerned or interested, financial or otherwise, in this resolution set out at Item

No. 4.

Item no 5:

IDBI Bank Limited, In terms of Article 171 (b) of the Articles of Association of the Company,

Vide Letter no HRD 4465/Nominee dated August 12, 2016 had advised appointment of Shri

Dilip Kumar Mandal (03313130) CGM IDBI Bank Ltd, as MD & CEO on the Board of IDBI

AML.

Accordingly, the Board of Directors had, in its meeting held on August 30,2016 appointed Shri

Dilip Kumar Mandal (03313130) as an Additional Director of the Company with effect from

August 22, 2016 and subject to necessary approvals as the “Managing Director & CEO” of the

Company for initial period of one year but not more than five years, with effect from August 30,

2016, as may be advised by IDBI Bank Limited form time to time.

Shri Dilip Kumar Mandal (03313130) is a graduate from IIT Kharagpur and a Post graduate

from IIFT, New Delhi. He has over 30 years experiences in different fields of financial services

viz. project finance, credit appraisal and monitoring, private equity funding, NPA resolution,

loan syndications, retail banking etc. He has extensive knowledge in project financing of

different industries viz. Steel & metal, oil and gas, shipping, sugar, hotel & hospitality sector,

consumer electronics, tele-communications, transport and infrastructures projects like power,

roads, ports etc.

Before joining IDBI AMC, he was working with IDBI Bank Ltd. as CGM & Zonal Head of

Retail Banking Group, covering the states of Odisha, Chattisgarh & Jharkhand based at

Bhubaneswar.

IDBI ASSET MANAGEMENT LIMITED

CIN: U65100MH2010PLC199319

Registered Office: IDBI Tower,WTC Complex, Cuffe Parade, Mumbai 400 005

Corporate Office: 05th Floor, Mafatlal Centre, Nariman point, Mumbai 400 021

Tel: (022) 66442800, Fax: 66442801,

Website: www.idbimutual.co.in, Email: manesh.jiandani@idbimutual.co.in

His Directorships in other Companies areas under :

Organization Name Any

association

with the

sponsor

Position

held

GTL Limited Financed by sponsor Nominee Director of IDBI Bank

Limited.

Under Section 161(1) of the Companies Act, 2013 (corresponding to Section 260 of the

Companies Act, 1956) read with Article 179 of the Articles of Association of the Company, Shri

Dilip Kumar Mandal (03313130) holds office only up to the date of this Annual General Meeting

of the Company.

MCA has vide circular dated 05

th

June 2015 notified that amongst other exemptions,Section 197

(with respect to Managerial Remuneration), Section 160 (notice of member signifying his

intention to propose appointment of a candidate as Director and deposit of Rs. 1 Lakh thereof) is

not applicable to Government Companies . Since your company is a Government Company

within the definition of Section 2(45) of the Companies Act 2013, Section 197 and Section 160

is not applicable to your Company.

The appointment was made pursuant to intimation by IDBI Bank Limited Vide Letter no HRD

4465/Nominee dated August 12, 2016

The appointment of Shri Dilip Kumar Mandal (03313130) is appropriate and in the best interest

of the Company.

The approval of the members is being sought to the terms, conditions and stipulations for the

appointment of Shri Dilip Kumar Mandal (03313130) as the Managing Director & CEO and the

remuneration payable to him. The terms and conditions proposed (fixed by IDBI Bank Limited

vide Letter no HRD 4465/Nominee dated August 12, 2016 and approved by the Nomination and

Remuneration Committee on 26

th

August 2016 and by Board of Directors at their meeting held

on 30

th

August, 2016) are keeping in line with the remuneration package that is necessary to

encourage good professional managers with a sound career record to important position as that of

the Managing Director & CEO.

The material terms of appointment and remuneration as contained in the Deputation Order are

given below: -

1. Period of Deputation

The officer will be on deputation with the IDBI Mutual Fund (IDBI MF) initially for a period of

1 year, extendable for a total period of 3 years subject to annual review. Extension beyond three

IDBI ASSET MANAGEMENT LIMITED

CIN: U65100MH2010PLC199319

Registered Office: IDBI Tower,WTC Complex, Cuffe Parade, Mumbai 400 005

Corporate Office: 05th Floor, Mafatlal Centre, Nariman point, Mumbai 400 021

Tel: (022) 66442800, Fax: 66442801,

Website: www.idbimutual.co.in, Email: manesh.jiandani@idbimutual.co.in

years would be considered depending on the merit of the case and with the approval of the

Competent Authority. But in no case, the total period of deputation shall exceed five years.

2. Pay and Allowances while on deputation

2.01. During the period of deputation, the officer can either; a. Continue to draw the pay,

allowances and other facilities as per IDBI Bank’s scale b. Opt for the pay, allowances and other

facilities as applicable to the post in IDBI MF

(The above option should be exercised within 6 months of the deputation)

2.02. In case, the officer opts to draw the pay and allowances as applicable in IDBI Bank, he will

be entitled for deputation allowance @ 7.75% of the basic pay (subject to a maximum of

Rs.2500/- p.m. in case deputation is at same location or Rs.5,000/- p.m. in case of deputation at

different location) in addition to his normal pay and allowances. In addition, the officer will also

be eligible for performance linked-incentive, if any, payable to the employees of

the IDBI MF, as approved by the Board of IDBI MF. IDBI MF will seek approval/ confirmation

of IDBI Bank Limited for payment of performance-linked incentive.

2.03. If the officer opts for drawal of pay and allowances as prevalent in IDBI MF, which has to

be done within 6 months of the deputation, the officer would be required to resign/opt for

voluntary retirement from IDBI Bank’s service.

The option at Clause 2.01.a. as exercised would remain valid for the remaining period of

deputation.

3. Residential Accommodation

IDBI MF shall provide the officer with housing accommodation against surrender of the entire

house rent allowance admissible to the officer under the IDBI Bank’s Rules. If the officer does

not avail of residential accommodation, he will be eligible for house rent allowance as per IDBI

Bank’s Rules, if he opts for the Bank’s pay and allowances. In case IDBI MF is unable to

provide accommodation, and the officer continues to stay in the accommodation provided by the

Bank, standard rent as per rules shall be paid by IDBI MF to IDBI Bank Ltd during the period of

deputation.

4. Relocation Expenses

In case IDBI MF decides to transfer the officer out of his present centre of posting during the

term of deputation, IDBI MF shall bear the transfer-related expenses and other allowances in

respect of the officer and his family as per his entitlement under IDBI Bank’s Rules. Similarly,

on repatriation to IDBI Bank Ltd, IDBI MF shall bear all expenses for relocating the officer to

any centre as indicated by IDBI Bank Ltd at that time. Pay and allowances during joining time

while reporting to and on repatriation will be borne by IDBI MF, as per the rules of IDBI Bank

Ltd.

IDBI ASSET MANAGEMENT LIMITED

CIN: U65100MH2010PLC199319

Registered Office: IDBI Tower,WTC Complex, Cuffe Parade, Mumbai 400 005

Corporate Office: 05th Floor, Mafatlal Centre, Nariman point, Mumbai 400 021

Tel: (022) 66442800, Fax: 66442801,

Website: www.idbimutual.co.in, Email: manesh.jiandani@idbimutual.co.in

5. Traveling and Halting Allowance

For the journeys, if any, performed by the officer while on duty with the IDBI MF, traveling and

halting allowances will be paid to him by IDBI MF, as per the rules of IDBI Bank Ltd.

6. Pension Fund

IDBI MF will be required to remit to IDBI Bank Ltd. the following amounts, before the 5th of

every month

(a) 10% of the officer’s pay in IDBI Bank Ltd. towards employee’s subscription to the IDBI

Bank Ltd. Employees’ Provident Fund and Voluntary Subscription, if any, to the extent of 15%

of Basic Pay to be recovered from the officer out of his salary; and

(b) 2.7 times of the Provident Fund contribution of the officer, being the employer’s

contribution towards Pension Fund on monthly basis.

(c) In case of IDBI MF is not remitting the amount as per clause (a) & (b) contribution to IDBI

Bank Ltd., such period of service on deputation with IDBI MF will not be counted for

computation of pension in respect of such officers.

7. Leave Salary Contribution

IDBI Bank Ltd will bear the cost of leave (other than casual leave) availed of by the officer

under the leave Rules of IDBI Bank Ltd. IDBI MF will make a monthly contribution of 12.5% of

the officer's total emoluments (including Deputation Allowance) while on deputation towards his

leave salary. The contribution will be required to be remitted to IDBI Bank Ltd on a monthly

basis, before the 5th of every month.

8. Leave Encashment Facility

The officer will be entitled to leave encashment facility as per IDBI Bank’s Rules.

9. Leave Fare Concession

The officer is eligible to avail of leave fare concession once in a financial year under IDBI Bank

Ltd Rules and IDBI MF will pay at the end of the deputation period the cost of this facility in

proportion to the period of deputation, to IDBI Bank Ltd.

10. Gratuity

IDBI MF will pay contribution towards gratuity @ one month's pay admissible to the officer in

IDBI Bank Ltd for each completed year of service and proportionately for part thereof, to IDBI

Bank Ltd, at the end of the deputation period.

11. Insurance Cover

The officer is covered under the Group Personal Accident Insurance Scheme for Rs.4,00,000/-

taken by the Bank. The annual premium and such further premia during the period of his

deputation that would be paid by IDBI Bank Ltd in his case would be reimbursable to the Bank

IDBI ASSET MANAGEMENT LIMITED

CIN: U65100MH2010PLC199319

Registered Office: IDBI Tower,WTC Complex, Cuffe Parade, Mumbai 400 005

Corporate Office: 05th Floor, Mafatlal Centre, Nariman point, Mumbai 400 021

Tel: (022) 66442800, Fax: 66442801,

Website: www.idbimutual.co.in, Email: manesh.jiandani@idbimutual.co.in

by IDBI MF. The said premium will be recovered from IDBI MF, at the end of the deputation

period.

12. Remittances to the Bank

BO will be required to remit to IDBI Bank Ltd all of the Officer's dues to the Bank in respect of

recovery of various loans and advances availed of by him from IDBI Bank Ltd in the manner

provided under the facility, during his deputation period.

13. Other benefits

The officer will be entitled for all benefits as eligible to the officers in his grade in the Bank, if

he opts for pay and allowances of IDBI Bank Ltd.

14. Residuary matters

a) All claims made by the Officer in respect of item nos. 3, 4 & 12 above will be reimbursed by

the IDBI MF, in consultation with IDBI Bank Ltd.

b) Requests for facilities at serial nos. 7 & 8 above are to be forwarded to IDBI Bank Ltd for

settlement.

c) All remittances and referrals regarding facilities may be made to The Deputy General

Manager, Administration & Premises Department, IDBI Bank Ltd, WTC Complex, Cuffe

Parade, Mumbai – 400005.

d) Any other remittances the Officer may like to send out of his salary to the Bank may be

arranged by the IDBI MF, as per the Officer’s advice.

e) Any other matter/facility not covered by these terms and conditions shall be referred to IDBI

Bank Ltd for a decision.

In view of the provisions of Sections 203 and any other applicable provisions of the Companies

Act, 2013, the Board recommends the Special Resolution set out at item no. 5 of the

accompanying Notice for the approval of the Members.

Copy of the terms and conditions referred to in the Resolution would be available for inspection

without any fee by the members at the Registered Office of the Company during normal business

hours on any working day, excluding Saturday, upto and including the date of the Annual

General Meeting.

Shri Dilip Kumar Mandal (03313130) does not hold by himself or for any other person on a

beneficial basis, any shares in the Company.

The Board considers that the appointment of Shri Dilip Kumar Mandal (03313130) as a Director

of the Company would be of immense benefit to the Company.

Accordingly, the Board of Directors recommends his appointment as a Director of the Company

who shall not be liable to determination by retirement of directors by rotation.

IDBI ASSET MANAGEMENT LIMITED

CIN: U65100MH2010PLC199319

Registered Office: IDBI Tower,WTC Complex, Cuffe Parade, Mumbai 400 005

Corporate Office: 05th Floor, Mafatlal Centre, Nariman point, Mumbai 400 021

Tel: (022) 66442800, Fax: 66442801,

Website: www.idbimutual.co.in, Email: manesh.jiandani@idbimutual.co.in

Except Shri Kishor Kharat (DIN: 07266945) Chairperson, being MD & CEO of IDBI Bank

Limited Shri Abhay Laxman Bongirwar (00660262) and Shri Dilip Kumar Mandal (03313130),

being an appointee, none of the Directors and Key Managerial Personnel of the Company and

their relatives is concerned or interested, financial or otherwise, in this resolution set out at Item

No. 5.

Item no 6

IDBI Asset Management Limited (IDBI AMC), is a Subsidiary of IDBI Bank Ltd. IDBI AMC

has been appointed as Investment Manager for IDBI Mutual Fund by IDBI MF Trustee

Company Limited vide Investment Management Agreement dated 20th February 2010. As per

the agreement the Company is required to manage the funds, ensure compliance with regulations

and accounting of transactions of schemes, formalize, float and launch new schemes with

approval of Trustees, to inter alia issue, sell units of Mutual fund, to invest in securities as per

scheme(s) investment objective on behalf of Mutual Fund, to declare and pay dividend,

calculation of NAV, appointment of intermediaries.

Thus in order to ensure smooth operations of the Company, IDBI AMC has entered into various

contracts which includes contracts entered into with related parties prior to the commencement

of the Companies Act 2013 as well as the contracts entered during the year with the approval of

the ACB/Board as per the authorization given by the members in the last AGM which are in the

ordinary course of business and to support the operations of the Company.

IDBI Asset Management Limited currently has the following contracts entered with the related

parties

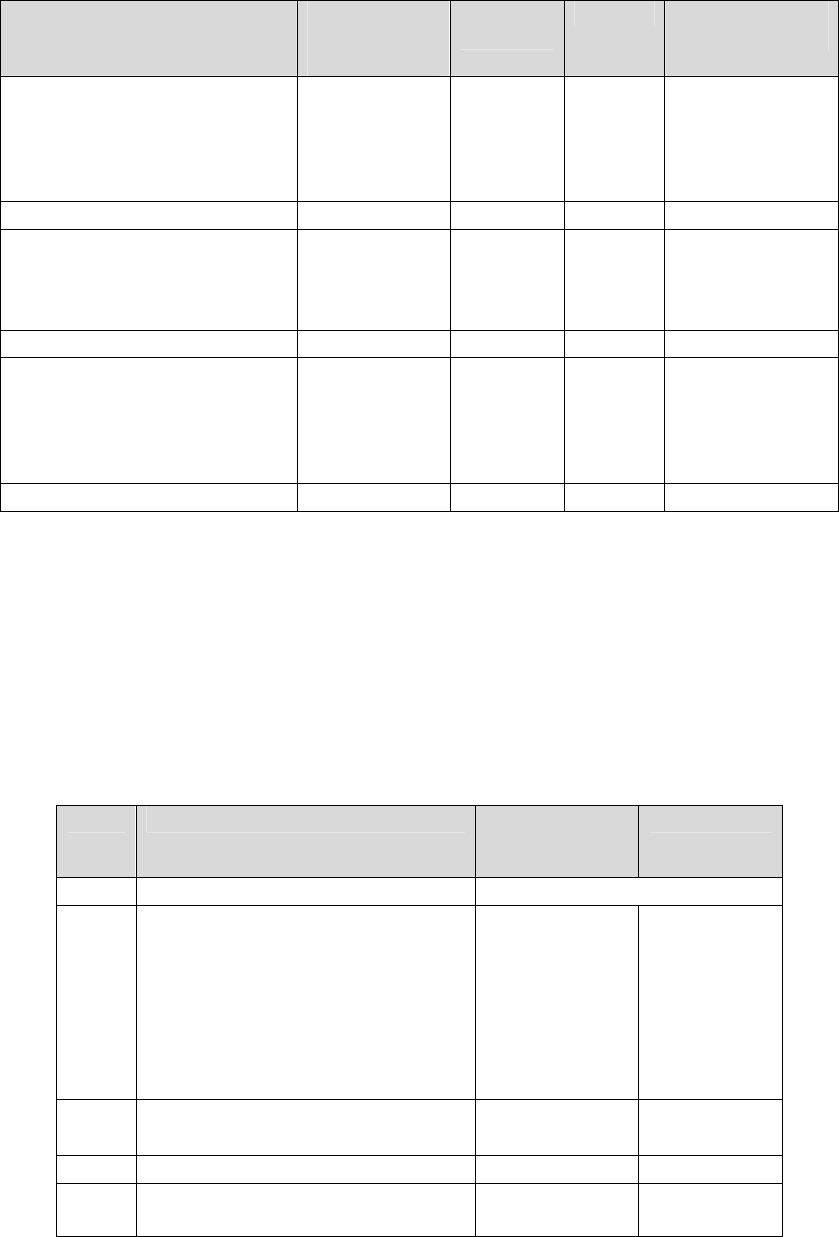

A B C D E

Sr.

no

Name of

party

Name of

Director or

Key

Managerial

Personnel

who is

related of

any

Nature of

Relationship

Nature, material

terms, monetary

value and

particulars of the

contract or

arrangement

Whether in

ordinary

course of

business and at

arms length

price

1 IDBI Federal Shri Kishor

P Kharat –

Chairman

Group

Company

Group Insurance

Continuing and

renewed every year

by paying premium

All employees of

IDBI Asset

Management Ltd.

In ordinary

course of

business and at

market price

IDBI ASSET MANAGEMENT LIMITED

CIN: U65100MH2010PLC199319

Registered Office: IDBI Tower,WTC Complex, Cuffe Parade, Mumbai 400 005

Corporate Office: 05th Floor, Mafatlal Centre, Nariman point, Mumbai 400 021

Tel: (022) 66442800, Fax: 66442801,

Website: www.idbimutual.co.in, Email: manesh.jiandani@idbimutual.co.in

from their date of

commencement of

service until

leaving

service,

but no later than

the normal

retirement age of

60 years.

Limit is Rs.

56,56,854 for all

existing and new

employees of IDBI

Asset Management

Ltd. basic death

benefit 3 times of

CTC and

Accidental death

benefit equal to

basic sum assured

subject to

maximum Rs.

50,00,000/- as per

member schedule

SUM Insured : Rs.

50,44,47,539

Premium paid Rs.

3,65,047

4. IDBI Capital

Market

Services

Limited

Shri Kishor

P Kharat –

Chairman

Group

Company

Distribution

brokerage as per

board approved

Compensation

Structure.

Total paid during

FY 2015-16: Rs.

1,79,094

In ordinary

course of

business and at

competitive

price

5 IDBI Bank

Limited

Shri Kishor

P Kharat –

Chairman

Holding

Company

Distribution

brokerage as per

board approved

Compensation

Structure.

In ordinary

course of

business and at

competitive

price

IDBI ASSET MANAGEMENT LIMITED

CIN: U65100MH2010PLC199319

Registered Office: IDBI Tower,WTC Complex, Cuffe Parade, Mumbai 400 005

Corporate Office: 05th Floor, Mafatlal Centre, Nariman point, Mumbai 400 021

Tel: (022) 66442800, Fax: 66442801,

Website: www.idbimutual.co.in, Email: manesh.jiandani@idbimutual.co.in

Total paid during

FY 2015-16: Rs.

4,80,00,000/-

6 IDBI Bank

Limited

Shri Kishor

P Kharat –

Chairman

Holding

Company

Rent

IDBI AMC has

been provided

premises at 13

locations IDBI

AMC on leave and

Licence basis.

Office Space is

being provided

within the office

premises of IDBI

Bank.

Total paid during

FY 2015-16: Rs.

2,07,00,000/-

In ordinary

course of

business and at

competitive

price

7 IDBI Bank

Limited

Shri Kishor

P Kharat –

Chairman

Holding

Company

Salary of deputed

employees

Salary of

1) Shri S N Baheti

MD & CEO

2) Shri Manesh

Jiandani Company

Secretary

The salaries are

paid to employees

by IDBI Bank and

which is

reimbursed by

IDBI AMC.

In ordinary

course of

business and

IDBI Bank

salary

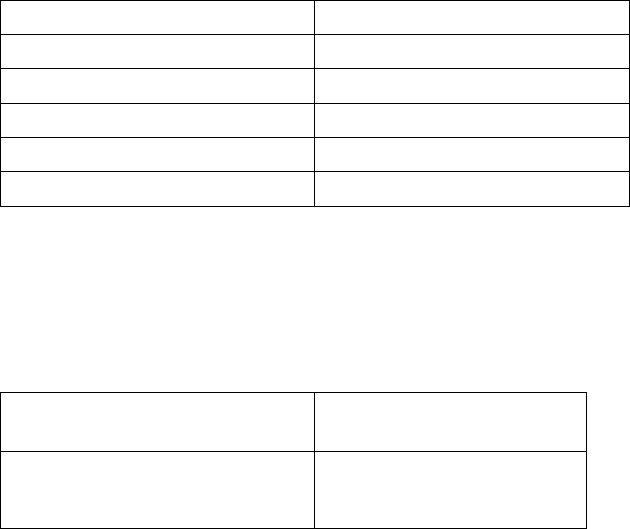

8 IDBI Bank

Limited

Shri Kishor

P Kharat –

Chairman

Holding

Company

Other Services

such as

1) To provide cash

management

services

CMS agreement

dated 19th March

2010, duration is in

perpetuity unless

terminated

in ordinary

course of

business and at

arm’s length

IDBI ASSET MANAGEMENT LIMITED

CIN: U65100MH2010PLC199319

Registered Office: IDBI Tower,WTC Complex, Cuffe Parade, Mumbai 400 005

Corporate Office: 05th Floor, Mafatlal Centre, Nariman point, Mumbai 400 021

Tel: (022) 66442800, Fax: 66442801,

Website: www.idbimutual.co.in, Email: manesh.jiandani@idbimutual.co.in

Flat charges of Rs.

25,000/- + Cheque

return charges of

Rs. 30/- per cheque

return + courier

charges of Rs.

400/- per pick up

point per month

within city limits

and at actual

outside city limits

2) Direct Debit

Facility

To collect

applications of SIP

from investors

along with

Authorization to

IDBI Bank to

directly debit the

account of the

investor for

monthly/quarterly

investment in

Mutual Fund

scheme of IDBI

MF

One time charge of

Rs. 10/- per

mandate

Ongoing charges of

Rs. 3/- per

transactions

Cancellation

charges of Rs. 10/-

per mandate/SI

3) Line of Credit

Facility of Rs. 1500

crore for IDBI MF

IDBI ASSET MANAGEMENT LIMITED

CIN: U65100MH2010PLC199319

Registered Office: IDBI Tower,WTC Complex, Cuffe Parade, Mumbai 400 005

Corporate Office: 05th Floor, Mafatlal Centre, Nariman point, Mumbai 400 021

Tel: (022) 66442800, Fax: 66442801,

Website: www.idbimutual.co.in, Email: manesh.jiandani@idbimutual.co.in

1) To provide a

facility to IDBI

Mutual Fund

(though IDBI

Asset

Management

Limited) of

providing credit

facility to meet

liquidity gap on

account of

redemptions of

debt and liquid

fund schemes.

Overdraft and

intra day

facility

Rate of Interest: at

BBR rate payable

monthly

Documentation and

out of pocket

charges at actual

Repayment on

Demand

2) In built CMS

intra day

Facility

To meet intra-day

mismatches

Rate of Interest:

MIBOR + 100bps

or BBR + 450 bps

whichever is higher

if it becomes intra

day

IDBI ASSET MANAGEMENT LIMITED

CIN: U65100MH2010PLC199319

Registered Office: IDBI Tower,WTC Complex, Cuffe Parade, Mumbai 400 005

Corporate Office: 05th Floor, Mafatlal Centre, Nariman point, Mumbai 400 021

Tel: (022) 66442800, Fax: 66442801,

Website: www.idbimutual.co.in, Email: manesh.jiandani@idbimutual.co.in

3) LER – Treasury

Limit

LER Limit of Rs.

10 lacs

Commission as

decided by IDBI

Treasury and

Documentation and

out of pocket

charges at actual

For the above

facility to pay IDBI

Bank Rs. 10 lacs

upfront with

applicable taxes

4) Other banking

services

provided from

time to time

including

NEFT, Demat

etc

9 IDBI MF

Trustee

Company

Limited

Group

Company

Scheme expenses

Investment

Manager to IDBI

Mutual Fund and

manage affairs and

operations of the

Fund. The

Company has

entered into an

Investment

Management

agreement with

IDBI AMC.

Scope of work

To manage the

In ordinary

course of

business

IDBI ASSET MANAGEMENT LIMITED

CIN: U65100MH2010PLC199319

Registered Office: IDBI Tower,WTC Complex, Cuffe Parade, Mumbai 400 005

Corporate Office: 05th Floor, Mafatlal Centre, Nariman point, Mumbai 400 021

Tel: (022) 66442800, Fax: 66442801,

Website: www.idbimutual.co.in, Email: manesh.jiandani@idbimutual.co.in

funds, ensure

compliance with

regulations and

accounting of

transactions of

schemes, formalize,

float and launch

new schemes with

approval of

Trustees, to issue

sell units of Mutual

fund, to invest in

securities as per

investment

objective on behalf

of Mutual Fund, to

declare and pay

dividend,

calculation of

NAV, appointment

of intermediaries

Scheme overlap

expenses

Secretarial &

accounting service

expenses:

Certain common

expenses incurred

by AMC such as

Rent, Electricity,

Maintenance

relating to Mumbai

office premises and

also a portion of

salary expenses for

the services

rendered by AMC.

Out of the above

common expenses

IDBI AMC charges

5% to MF Trustee

Co

IDBI ASSET MANAGEMENT LIMITED

CIN: U65100MH2010PLC199319

Registered Office: IDBI Tower,WTC Complex, Cuffe Parade, Mumbai 400 005

Corporate Office: 05th Floor, Mafatlal Centre, Nariman point, Mumbai 400 021

Tel: (022) 66442800, Fax: 66442801,

Website: www.idbimutual.co.in, Email: manesh.jiandani@idbimutual.co.in

The Services of

around 12 officials

are being used for

MF Trustee Co

related work as MF

Trustee Co. does

not have any

employee on its

roles. These AMC

officials take care

of the work relating

to secretarial

matters, conducting

of meetings, ROC

work, accounts/tax

matters, SEBI

compliance etc..

IDBI AMC is

charging 1% of

salary expenses

which would work

out to Rs. 12 lakh

p.a.

The above contracts or arrangements have been entered into by the Company in the ordinary

course of business and at competitive rates. The contracts referred to above are existing contracts

and are continuing in nature.

IDBI Asset Management Limited has in pipeline the following contracts to be entered with the

related parties

A B C D E

Sr.

no

Name of

party

Name of

Director or

Key

Managerial

Personnel

who is

related of

any

Nature of

Relationship

Nature, material

terms, monetary

value and

particulars of the

contract or

arrangement

Whether in

ordinary

course of

business and at

arms length

price

1

IDBI Bank

Limited

Shri Kishor

P Kharat –

Chairman

Holding

Company

IDBI Bank has in

co-ordination with

IDBI AMC has

launched a Reward

No

IDBI ASSET MANAGEMENT LIMITED

CIN: U65100MH2010PLC199319

Registered Office: IDBI Tower,WTC Complex, Cuffe Parade, Mumbai 400 005

Corporate Office: 05th Floor, Mafatlal Centre, Nariman point, Mumbai 400 021

Tel: (022) 66442800, Fax: 66442801,

Website: www.idbimutual.co.in, Email: manesh.jiandani@idbimutual.co.in

and Recognition

programme for

their NISM

Certified Branch

employees, Branch

Heads and

Regional Heads for

FY 2016-17 titled

as “Gurukul

Learning

Programme”. This

programme has

been launched on

10

th

June 2016 till

31

st

March 2017.

1) Qualification

norms:

a. Eligible

Scheme: IDBI

Top 100 Equity

Fund, IDBI

Diversified

Equity Fund,

IDBI Equity

Advantage

Fund and any

other launch of

actively

managed

Equity fund

during the FY

2016-17.

b. Identification

of branch staff

for eligbility,

as per their

employee code

mentioned in

sub-Agent

code / Branch

Code of the

Application.

IDBI ASSET MANAGEMENT LIMITED

CIN: U65100MH2010PLC199319

Registered Office: IDBI Tower,WTC Complex, Cuffe Parade, Mumbai 400 005

Corporate Office: 05th Floor, Mafatlal Centre, Nariman point, Mumbai 400 021

Tel: (022) 66442800, Fax: 66442801,

Website: www.idbimutual.co.in, Email: manesh.jiandani@idbimutual.co.in

c. Branches to

quote EUIN

number on the

form.

d. To be eligible

employee has

to qualify in

both the

criteria’s as

given in

Annexure –I.

e. Only first

installment of

SIP will be

counted in

lumpsum

criteria

f. SIP mobilized

should have a

minimum

period of 3

years, with

minimum SIP

amount of Rs.

1000/-

g. All staff in this

campaign to be

NISM

Certified

h. For Lumpsum

the fund should

remain

invested for

atleast 12

months, in the

above

mentioned

eligible

schemes.

i. No switch-in

within equity

scheme will be

allowed.

IDBI ASSET MANAGEMENT LIMITED

CIN: U65100MH2010PLC199319

Registered Office: IDBI Tower,WTC Complex, Cuffe Parade, Mumbai 400 005

Corporate Office: 05th Floor, Mafatlal Centre, Nariman point, Mumbai 400 021

Tel: (022) 66442800, Fax: 66442801,

Website: www.idbimutual.co.in, Email: manesh.jiandani@idbimutual.co.in

j. Switch-in only

from IDBI

Liquid Fund,

IDBI Ultra

Short Term

Fund and IDBI

Short Term

Fund is

allowed into

actively

managed

equity schemes

or any other

fund notified

by IDBI AMC

k. Contest is

based on Net

sales model.

Any interim

redemptions

during the

contest period

will have

negative credit

towards

mobilization

Based on the

qualitfication

criteria as defined

by IDBI Bank in

consultation with

IDBI AMC, the

IDBI AMC shall be

rewarding the

branch staff,

Branch Heads and

Regional Heads by

nominating for a

education

programme based

on their qualifying

criteria as per

IDBI ASSET MANAGEMENT LIMITED

CIN: U65100MH2010PLC199319

Registered Office: IDBI Tower,WTC Complex, Cuffe Parade, Mumbai 400 005

Corporate Office: 05th Floor, Mafatlal Centre, Nariman point, Mumbai 400 021

Tel: (022) 66442800, Fax: 66442801,

Website: www.idbimutual.co.in, Email: manesh.jiandani@idbimutual.co.in

above levels. IDBI

Bank shall

recognize their

branch staff,

Branch Heads and

Regional Heads

based on their

qualifying criteria

as per above levels.

Since the current Turnover of the Company as on 31st March 2016 is Rs. 47,16,48,731 and the

net worth as on 31

st

March 2016 is Rs. 96,90,05,974, the value of certain existing contracts

exceed the limits provided under Section 188 read with rule 15 of Companies (Meetings of the

Board and its Powers) Rules 2014 as amended by MCA circular no GSR 590(E) dated 14

th

August 2014.

The Company was not required to seek approval of the shareholders under the erstwhile

Companies Act 1956 for contracts entered into ordinary course of business. However, with the

applicability of the new Companies Act 2013 w.e.f. 01

st

April 2014 such contracts come under

purview of the Related Party Transactions and require approval of the shareholders on and from

the Financial year 2014-15 in terms of the limits prescribed under the rules as a percentage of

networth/Turnover of the Company.

Hence, It is proposed to the members to authorize the ACB/Board of the Company to approve

the proposals for entering into further contracts as may be required and to authorize the Board of

Directors with powers to enter into contracts for a value not exceeding Rs. 10 crore for each such

contract or arrangement which whether in ordinary course of business or not and/or at arm’s

length or not and to do all such acts, deeds, matters and things and execute such deeds,

documents and agreements, as they may, in their absolute discretion, deem necessary including

sub delegating the authority to a Committee of Directors and/or to authorize MD & CEO or any

other Director as it may deem fir to enter into such contracts and arrangements with prior

approval of the board.

The extent of interest and concern of the Directors and Key Managerial Personnel of the

Company and their relatives, financial or otherwise, in the resolution set out at Item No. 5 have

been disclosed above

Item no 6: Shri Kishor Piraji Kharat (07266945) was appointed as Additional Director w.e.f

October 28, 2015, on advise from IDBI Bank Limited, by the Board and was elected as

Chairman w.e.f. December 30, 2015 on approval of amendment in the Article 173 of the Articles

of Association of the Company in the EGM held on December 30, 2015.

IDBI ASSET MANAGEMENT LIMITED

CIN: U65100MH2010PLC199319

Registered Office: IDBI Tower,WTC Complex, Cuffe Parade, Mumbai 400 005

Corporate Office: 05th Floor, Mafatlal Centre, Nariman point, Mumbai 400 021

Tel: (022) 66442800, Fax: 66442801,

Website: www.idbimutual.co.in, Email: manesh.jiandani@idbimutual.co.in

The amended Articles of Association of the Company under article no 173 reads as under

“Article 173

“The Chairman of the Board shall be the Chairman/ MD & CEO of the IDBI Bank Limited as

may be nominated from time to time.”

Though the intention for the above amendment was to appoint Shri Kishor Piraji Kharat

(07266945) as Chairman of the Board by including MD & CEO apart from Chairman in the

above clause and facilitate the Company to appoint a director as Chairman of the Board as per

nominations given by IDBI Bank from time to time.

However, it was felt that the above amended clause could be interpreted otherwise, hence to

provide more clarity to the actual process, the above clause is being revised and substituted with

the below clause

“Article 173

“The Chairman or MD & CEO of the IDBI Bank Limited, as may be nominated from time to

time by IDBI Bank Limited, shall be the Chairman of the Board.”

The Company needs to amend the above Article with the approval of the shareholders so as to

include MD & CEO apart from Chairman and facilitate the Company to appoint a director as

Chairman of the Board as per nominations given by IDBI Bank from time to time.

It is therefore proposed to pass the Special Resolution contained under Item No.6 of the Notice

for amending the Articles of Association providing for the above in terms of Section 14 of the

Companies Act, 2013.

It may be mentioned that no Director or Key Managerial Personnel of IDBI AMC or their

relative is, whether directly or indirectly, concerned or interested, financial or otherwise, in the

passing of aforesaid Special Resolution.

IDBI ASSET MANAGEMENT LIMITED

CIN: U65100MH2010PLC199319

Registered Office: IDBI Tower,WTC Complex, Cuffe Parade, Mumbai 400 005

Corporate Office: 05th Floor, Mafatlal Centre, Nariman point, Mumbai 400 021

Tel: (022) 66442800, Fax: 66442801,

Website: www.idbimutual.co.in, Email: manesh.jiandani@idbimutual.co.in

Route map for the venue of AGM (from Churchgate Station)

Route map for the venue of AGM (from CST Station)

1

DIRECTOR’S REPORT

The Directors take immense pleasure in presenting the Sixth Annual Report on the business and

operations of the Company together with the Audited Financial Statements along with the Report

of Auditors for the Financial Year ended March 31, 2016

.

I. FINANCIAL SUMMARY AND HIGHLIGHTS

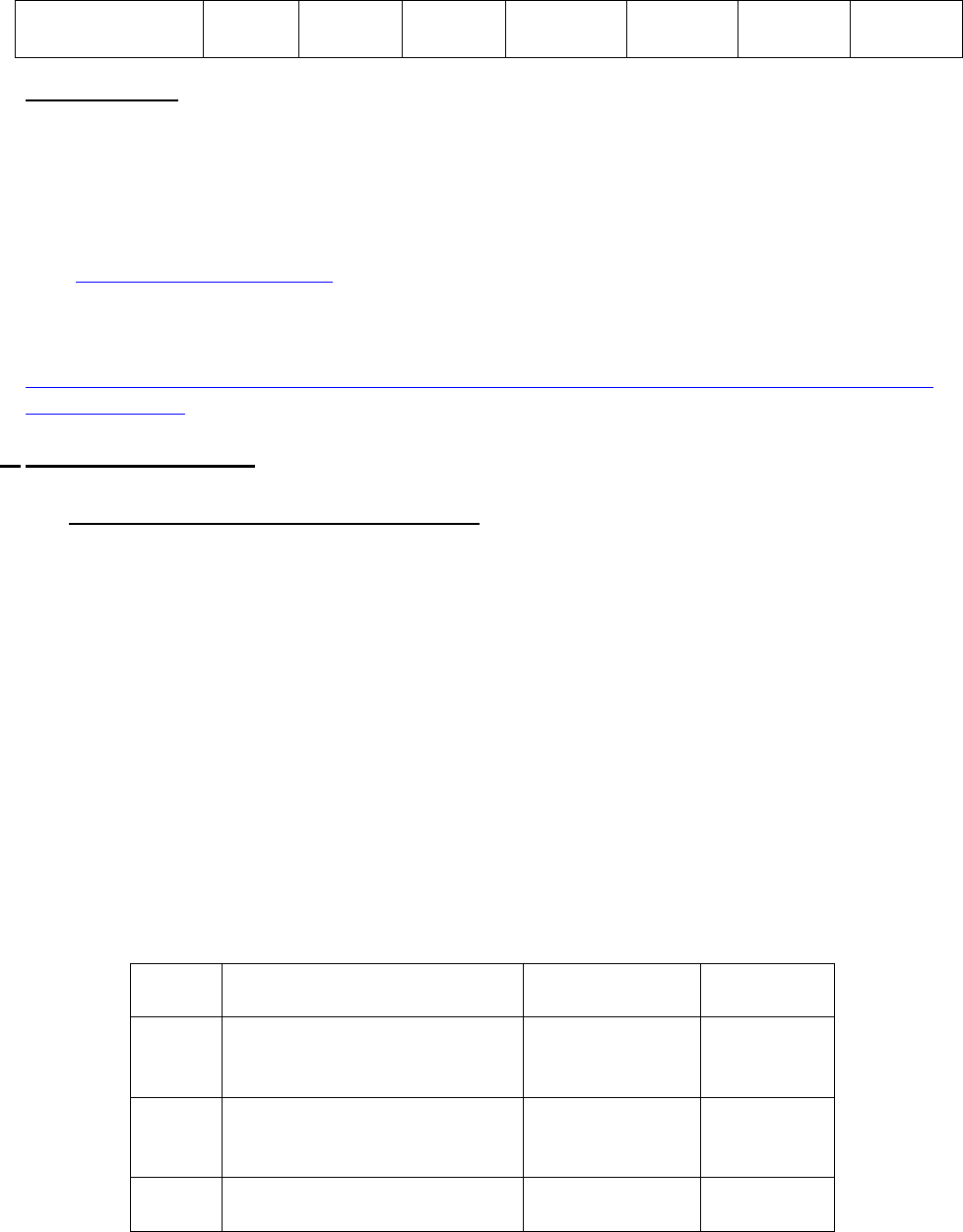

During the year 2015-16, total income of IAML was Rs. 47.16 crores as compared to 29.92 crores

during FY 2014-15.

The Company’s Financial Performance for the Financial Year 2015-16 are summarized

below

(Rs in crores)

PARTICULARS

2015 – 16 2014 - 15

Total Income

47.16

29.92

Profit/(Loss) before Tax

(5.47)

(21.77)

Less : Deferred Tax

9.22

(1.04)

Profit/(Loss) after Taxes (PAT)

3.47

(20.73)

Balance brought forward from earlier period/Loss

(106.31)

(85.58)

Amount available for Appropriation

Nil

Nil

Balance/(Loss) to be carried forward

(102.83)

(106.31)

Net worth

96.90

91.97

II. STATE OF THE COMPANY’S AFFAIRS

IDBI Asset Management Limited (IAMC) was incorporated in the year 2010 with the principal

activity to act as Investment manager to IDBI Mutual Fund. The company aims to promote

financial inclusion by assisting common man in making informed investment choices through

mutual funds.

IAML currently manages 16 schemes including two passive equity, four active equity, six debt,

one Gold ETF, one FOF (Gold), one gilt and one liquid scheme. F.Y 15-16 is the sixth year of

operation. The Average Assets under Management (AAUM) for the FY 15 -16 is Rs 6,835 crores.

The highest AUM managed during the year was Rs 8,402 crore.

AMC’s revenue from operations has grown up from Rs 26.20 crore (FY 14-15) to Rs.39.74 crore

(FY 15-16) i.e an increase of 52%. Also there is significant growth of other income from Rs 3.72

crore (FY 14-15) to Rs.7.79 crore (FY 15-16). Net management fee (gross management fee

charged to the schemes less payment made to the distributors and other direct business expenses)

for the FY 2015-16 was Rs. 13.54 crore as compared to a negative of Rs.52 lakhs during previous

FY 2014-15. IAML had incurred net losses to the tune of Rs 20.73 crore during FY 2015 and has

registered a profit after tax of Rs. 3.47 crore in FY 2016. We have pursued a policy for

2

aggressively increasing the actively managed equity funds AUM which turn out to be more

profitable assets over a period of time and also add to the enterprise value. The Accumulated losses

as at March 31, 2016 stood at Rs. 102.83 crores

IDBI AML will be focusing on AUM growth and profitability by strengthening IDBI MF presence

in T-15 cities, activating of OBST channel of IDBI Bank ,activating online channels and moving to

paperless transactions, having Bank & MF software integration, increasing Mutual Fund

transaction through IDBI Net banking, focusing on 500 business potential branches, renewing

tapping of retail customers for SIP business, deepening corporate client relationships for AUM and

payroll SIP and using IDBI bank ATMs, Website and E-lounges for transaction and product brand

building and visibility.

Net management fee (gross management fee charged to the schemes less payment made to the

distributors and other direct business expenses) for the FY 2015-16 was Rs.1,354 lakh as

compared to a negative to the extent of Rs.52 lakh during previous FY 2014-15 due to the increase

in upfront payments incurred for moblising actively managed equity funds, AUM of which has

increased from Rs.142 crore average for March 2014 to Rs.672 crore for March 2015.

The AMC incurred net profit after tax of Rs. 3.47 crore during FY 2016 as compared to net loss of

Rs.20.73 crore during FY 2015.

Business Environment

The global economy in FY 2015-16 showed a modest recovery, primarily led by the US. This

prompted the Fed to announce the first rate hike of 25bps after seven years of accommodative

monetary policy. The Euro zone on the other hand continued with its monetary easing programme,

in order to provide a further fillip to the weak recovery seen in the region. Japan has also

intensified its monetary expansion programme in order to boost inflation and economic growth.

The Indian economy started FY2015-16 on a positive note with a better than expected GDP

projection of 8.5%, based on a new series, and a much awaited rate cut of 25bps just before the

start of the financial year. The positive outlook did not last, as early predictions of a weak

monsoon for the second consecutive year dampened sentiments. Crop losses arising out of the

unseasonal rainfall and hailstorms also added to the concerns. However, these concerns did not

significantly dent growth during the year, as the country was aided by falling oil and other

commodity prices, which helped the Government lower its subsidy bill, thereby achieving the

fiscal deficit target, and also helped improve corporate margins.

India’s GDP grew at a healthy 7.6% in FY16, up from 7.2% a year ago. The full-year growth was

fuelled by a 7.9% growth rate in the fourth quarter of FY16. The fourth quarter GDP growth rate

was in fact the fastest in the world for that quarter thus giving a clear indication that the economy

3

is slowly but surely on a recovery path. Agriculture grew by 1.2%, manufacturing by 9.3% and

financial sector by 10.3% in FY16. The government has pegged growth in FY17 at 7-7.75%. The

CPI for FY16 was at 5.18% down from 5.25% in FY15, while WPI for the year was at -0.91%

compared to -2.33% at the end of FY15. During FY16, RBI reduced rates (both repo and reverse

repo) by 75bps while the statutory liquidity ratio (SLR) was kept unchanged at 21.5%.

India also managed to meet its fiscal deficit target at 3.9% of GDP for FY16, aided primarily by

lower oil and commodity prices. This was a significant improvement over 4.1% in FY15 and 4.7%

in FY14. For FY17, the government has set a fiscal deficit target of 3.5% of GDP. India’s current

account deficit for FY16 is also expected to have shrunk to ~1% of GDP in FY16 compared to a

deficit of 1.3% of GDP in fiscal 2015. India’s trade deficit also narrowed to $118.5bn for the fiscal

2016 compared to $137.95 bn in the previous year helped mainly by lower oil prices.

The government, in its second year, continued with its goal to bring about a quick and concrete

turn-around in the economy. The government launched a number of schemes like UDAY, Make in

India and Start up India, among others, in order to provide a boost to manufacturing, attract

investments and revive the distressed state electricity boards. The Union Budget of 2016 was also

oriented towards enhancing infrastructure growth in the country.

Foreign Institutional Investors (FIIs) were net sellers in FY16 of $2.5 billion versus being net

buyers of ~$2.7 billion in fiscal 2015. There was a net outflow of $2 billion in equity markets and

$0.5billion in debt markets during the year. The rupee depreciated by 6% during the year, from

Rs.62.49 per US dollar to Rs. 66.25 per US dollar, partly owing to a strengthening of the US dollar

against major currencies

Mutual Fund Industry

The mutual fund industry witnessed another year of growth with the overall Asset Under

Management has grown from Rs.10,82,757 crores as at end March 2015 to Rs.12,32,824 crore as

of March 31, 2016, registering a growth of around 14%. The industry witnessed a new milestone

when the assets under management crossed Rs. 13,00,000 Crores during the year. The industry

witnessed healthy net inflows into equity oriented and balanced schemes to the tune of more than

Rs.93,700 Crores and addition of more than 47 lakh folios. Retail participation in mutual fund

products saw a healthy rise during the FY with the retail AUM around 50% of total AUM of the

industry at Rs. 622,000 Crores.

The year 2015-16 witnessed credit crisis in the economy. Considering the same, SEBI tightened

investment norms for debt and liquid funds. It rationalised a few investments based on credit

rating of issuers. In addition, SEBI increased disclosure requirements in relation to brokerages and

commission.

4

Change in the nature of Business if any

Your Company was incorporated with the principal activity to act as Investment manager to IDBI

Mutual Fund vide Investment Management Agreement dated 20

th

February 2010 entered into by

IDBI MF Trustee Company Limited (Trustees to IDBI Mutual Fund). Your Company has carried

on the same business activity during the Financial Year 2015 -16.

III. Compliance with Net worth Requirements

SEBI had, vide its circular dated May 06, 2014, revised the minimum net worth criteria for Mutual

Funds from Rs. 10 Crores to Rs. 50 Crores by amending the relevant Regulation 21 of SEBI (MF)

Regulations, 1996.

Your Company complies with the minimum net worth requirements of Rs. 50 Crore as prescribed

by SEBI. The net worth of your Company for the year ended March 31, 2016 was Rs. 96.90

Crores.

IV. TRANSFER TO RESERVE AND DIVIDEND

During the current year, there being losses before tax, the Company has not transferred any amount

to General Reserve and has decided not to declare any dividend for the year.

V. FOREIGN EXCHANGE EARNINGS AND OUTGO

During the Financial Year under review, your Company has incurred expense in foreign exchange

to the tune of Rs. 3,32,530/- towards overseas travelling expenses.

VI. MATERIAL CHANGES AND COMMITMENTS IF ANY, AFFECTING THE FINANCIAL

POSITION OF THE COMPANY WHICH HAVE OCCURRED BETWEEN THE END OF THE

FINANCIAL YEAR OF THE COMPANY TO WHICH THE FINANCIAL STATEMENTS

RELATE AND THE DATE OF THE REPORT

The financials of your Company are audited and adopted in the month of April each year so as to

facilitate IDBI Bank Limited, Holding Company (shareholding 66.67%) and IDBI Capital Market

Services & Securities Limited (Formerly known as IDBI Capital Market Services Ltd)

(CIN

U65990MH1993GOI075578) (shareholding 33.33%) in consolidation of financials of IDBI AMC

with that of their financials. While the Financials of the IDBI MF Schemes are audited and adopted

in the month of June each year so as to provide the Annual report along with financials to the unit

holders of the schemes latest by 31st July each year, as per SEBI mandate. IDBI AMC receives

Management fees from IDBI MF Schemes at a predefined rate and frequency from IDBI MF

schemes as per the SEBI Regulations and Investment Management Agreement dated 26

th

February

2010 entered into with IDBI MF Trustee Company Limited.

5

During the FY 2015-16, while finalizing the IDBI MF Scheme accounts, a difference in

management fees as per the Books of AMC (IDBI Asset Management Ltd) and as per the scheme

books (IDBI Mutual Fund Schemes) to the tune of Rs.1,78 879/- was identified. While the

difference of Rs 1,12,616/- out of Rs.1,78 879/- was on account of past year adjustment done by

the statutory auditor of the Mutual Fund Schemes after the books of AMC has been finalised and

adopted by the Board of IDBI AMC and the difference of Rs 66,263/- was on account of shortfall

in one of the scheme arising while rounding off difference of NAV, i.e. IDBI REGGS scheme at

the time of maturity. As rectificatory measure IDBI AMC has paid less amount of Management

Fees to the tune of Rs. 1,12,616/- in FY 2015-16, since, the same was paid in FY 2014-15. Since,

difference of amount of Rs. 66,263/- was on account of shortfall in one of the scheme arising while

rounding off difference of NAV, i.e. IDBI REGGS scheme, no amount has been paid to IDBI

AMC.

As a way forward to avoid such differences to occur in future, an audit of IDBI MF Schemes

would be conducted by the Statutory Auditor of IDBI MF Schemes with respect to the

Management fees paid to IDBI AMC, during the said FY, before the Close of the Accounts of

IDBI AMC so as to ensure reconciled figures between the two accounts.

No other material changes and commitments have occurred after the close of the year till the date

of this Report, which affect the financial position of the Company.

VII. BOARD OF DIRECTORS

Your Company’s Board of Directors is broad-based and its constitution is governed by the

provisions of SEBI (MF) Regulations 1996 as amended from time to time, the Companies Act

2013 as amended or re-enacted and then in force and the Articles of Association of your Company.

The Board functions directly as well as through various Board-level Committees constituted to

provide focused governance in your Company’s important functional areas.