8

th

International Conference on Islamic Economics and Finance

1

Financial Performance of Islamic and Conventional Banks in Pakistan: A

Comparative Study

Sanaullah Ansari

1

Atiqa Rehman

This study was conducted to compare the financial performance of Islamic and

Conventional banks to facilitate depositors, bank managers, shareholders,

investors and regulators by providing true picture of financial position of

Islamic and Conventional banks in Pakistan. Financial ratios were estimated

from annual reports and financial statements i.e. Income statement and Balance

sheet for the period of 2006 to 2009. Eighteen financial ratios were estimated to

measure these performances in term of profitability, liquidity, risk and solvency,

capital adequacy, deployment and operational efficiency. Independent sample t-

test and ANOVA was used to determine the significance of mean differences of

these ratios between and among banks. The study concluded that Islamic banks

proved to be more liquid, less risky and operationally efficient than

conventional banks.

Key Words: Islamic banks, conventional banks, financial performance, Pakistan

1 Introduction

1.1 Background of the paper

Islamic banking having distinct modes of operations as compared to conventional banks has

been started in the 1970s to address the problem of Riba. The committed and resourceful

individuals, professional bankers, Islamic economists and religious scholars are attributed to

be pioneer of Islamic banking. Its philosophies and principles are, however, not new having

been outlined in the Holy Qur’an and the Sunnah of Prophet Muhammad (p.b.u.h.) more than

1,400 years ago. The emergence of Islamic banking is often related to the revival of Islamic

financial system which is totally usury (Riba) free. There was no initial working model to act

upon, except the thought that interest-based banking might be replaced by banking on the

basis of profit-and-loss sharing. The basic purpose of Riba-free financial system was the

elimination of all interest based transactions. Effort for the establishment of this system took

place when the financial system at large, as also the regulatory environment, was Riba-based.

At the start Riba free financial institute were established through private parties but soon

things began to change in the late seventies and in the early eighties when Iran, Sudan,

Pakistan and Malaysia realized the need to develop Riba-free financial system in all these

countries (Ahmad, 1991).

Islamic banking started with the establishment of two financial institutions in Mit-Ghamr in

the Nile Delta and in Karachi from 1963-1967. The progress was made in this movement by

the establishment of full- fledged Islamic bank with the name of Dubai Islamic Bank in 1965.

By the end of 1996, the number of Islamic financial institutions reached to 166 in at least 34

Muslim and non-Muslim countries. Islamic banking got popularity in 1970s (Chapra, 2001).

1

Shaheed Zulfikar Ali Bhutto Institute of Science & Technology (SZABIST), Islamabad, Pakistan.

E: Sanaullah@szabist-isb.edu.pk

Center for Islamic Economics and Finance, Qatar Faculty of Islamic Studies, Qatar Foundation

2

Islamic banks are now operating and providing Islamic banking services in more than 60

countries of the world (Aggarwal, Rajesh and Tarik, 2000).

There are more than 300 Islamic financial institutions all over the world with investment

funds in excess of $400 billion (El-Qorchi, 2005).The Islamic banking industry’s world-wide

annual growth rate is more than 16%. Islamic banking has also gained approval by

international financial institutions (IFI), professional bankers and the academic world. Islamic

banking has successfully established its identity and performing its operations distinct from

its conventional counterparts. Islamic banking in the modern world, generally aims to

promote and develop the application of Islamic principles, law and traditions to transactions

of financial, banking and related business affairs. Islamic banks, by doing so, will safeguard

the Islamic communities and societies from activities that are forbidden in Islam (Tahir,

2003).

Pakistan is an ideological state and was created in the name of Islam in 1947. By the time,

Islamic banking is becoming more popular in Pakistan due to its Riba free products. Many

efforts are being made by State Bank of Pakistan to make this system workable and

successful as compare to conventional banking. SBP developed a Three-step strategy to

fulfill this purpose. The first step is to setup exclusive Islamic banks. In the second step

existing conventional banks is permitted to have Islamic Banking subsidiaries. Third step of

this strategy is the establishment of stand alone branches by existing commercial banks. The

State Bank also appointed Shariah board to regulate and approve guidelines for the emerging

Islamic banking industry. Being a Muslim country there is huge scope for Islamic and

Modaraba

banking system in the country. The country's first full -fledged Islamic Bank,

which is Meezan Bank licensed by SBP in 2002, is a successful business enterprise and a

premier one. It has been very careful in its expansion drive. National Bank of Pakistan has

started Mudaraba banking and trying its level best to enhance its profitability and

accommodate the general masses. Muslim Commercial Bank (MCB), Faysal Bank and Al-

Meezan banks are also in the Islamic banking field. Pak-Kuwait Investment Company

Limited, which is one of the country's premiere joint venture financial institutions, is

launching the first ever Islamic Insurance Company in Pakistan. There is huge market of

Islamic banking in the country (Khan, 2004).

Presently, there are six full-fledged Islamic banks operating in Pakistan. These banks with

their year of incorporation are:

1. AlBaraka Islamic Bank Pakistan (1991)

2. Meezan Bank Limited (2002)

3. BankIslami Pakistan Limited (2003)

4. Dubai Islamic Bank Pakistan Limited (2005)

5. Emirates Global Islamic Bank Limited (2007)

6. Burj Bank Limited (2007)

1.2 Significance of the paper

Financial Institutions are very important for every economy because they are the most

contributing factor to keep economies on the path of economic growth and development.

Financial ratios are the indicator of financial health of organization. Ratio analysis is not only

important for depositors but also for management to improve organization future

performance. The purpose of the study is to provide full picture of banks financial position to

investors, management and shareholders .The another purpose of research is to make people

8

th

International Conference on Islamic Economics and Finance

3

aware of Islamic banks financial position and to make comparison of performance of Islamic

and Conventional banks in order to identify, which one has, better financial position.

2 Literature Review

Previous studies on the empirical investigation of the financial institutions operating on the

interest-free principles are very limited. The existing ones are mostly descriptive, and focus

on the simple financial ratios. Although few empirical studies are available which have

undertaken a comparative analysis and explored the performance of the Islamic and

conventional banks among these, Moin (2008), Samad (2004), Samad and Hassan (1999) and

Iqbal (2001) got great importance.

The performance of first Islamic bank in Pakistan i.e. Meezan bank was compared with group

of 5 conventional banks. The study evaluated the performance in terms of profitability,

liquidity, risk, and efficiency for the period of 2003-2007. Twelve financial ratios such as

Return on Asset (ROA), Return on Equity (ROE), Loan to Deposit ratio (LDR), Loan to

Assets ratio (LAR), Debt to Equity ratio (DER), Asset Utilization (AU), and Income to

Expense ratio (IER) were used as variables to assess banking performances. T-test and F-test

were used to measure the significance difference of these Performances. The study found that

MBL is less profitable, more solvent (less risky), and also less efficient comparing to the

average of the 5 Conventional banks. However, there was no significant difference in

liquidity between the two sets of bank (Moin, 2008). Islamic bank business development

framework is not working efficiently as compare to conventional banks (Farrukh, 2006).

Metwally (1997) evaluated the performance of 15 interest-free banks and 15 conventional

banks in terms of liquidity, leverage, credit risk, profitability and efficiency. He concluded

that the two groups of banks may be differentiated in terms of liquidity, leverage and credit

risk, but not in terms of profitability and efficiency. Interest-free banks rely more heavily on

their equity in loan financing and face more difficulties in attracting deposits than interest-

based banks. Interest-free bank hold a higher Cash/deposit ratio because they tend to be

relatively more conservative in using their loanable funds and lack lending opportunities. The

profit/loss sharing principle has made it difficult for interest-free banks to finance personal

loans and pushed interest-free banks to channel a greater proportion of their funds to direct

investment (using Musharaka and Mudaraba tools of finance). Both banks offer their

depositors similar returns and direct the largest proportion of their funds towards the

financing of durables. Interest-free banks rely heavily on the Murabaha mode of finance

which is like interest charge and based on the use of a mark-up. These performance measures

were analyzed by Samad (2004) to compare the performance of Bahrain Islamic and

conventional banks. He used studet-t test and found similar results in respect of profitability

and risk while no difference was found in liquidity of two banks.

Samad and Hassan (1999) evaluated the intertemporal and interbank performance of Islamic

bank Islam Malaysia Berhad (BIMB) for the period 1984-1997 by using same performance

measures and found that in inter-temporal comparison Islamic bank BIMB's made

(statistically) significant progress in profitability while the BIMB risk increased. In interbank

comparison the study found that BIMB is relatively more liquid and less risky compared to a

group of 8 Conventional banks. A study conducted on five Islamic banks from MENA region

analyzed their financial statements over the period 1993 – 2002 found that liquidity risk

arises because of pre mature withdrawal by account holders due to a mismatch between

investor’s expectations of return and the actual return. Therefore Islamic banks are required

Center for Islamic Economics and Finance, Qatar Faculty of Islamic Studies, Qatar Foundation

4

to keep adequate cash or cash equivalents to meet the demand. They identified the other

reasons of liquidity risk can be the lack of confidence on the banking system, reliance on few

large depositors, reliance on current accounts and restrictions of Islamic banks on sales of

debt. The profitability of Islamic banks is low due to short term investments and low equity

base (Badr-El-Din, Ibrahim and Vijaykumar, 2003). In case of Islamic banks, short term Debt

financing includes Murabaha, Salam, and Qard fund and long term debt financing includes

Sukuk, leasing

and Istisna. In case of Conventional banks short term debt financing include

treasury bills, trading bonds, short term loan and advances and deposits at other financial

institution that mature within one year. Long term debt financing include non trading bonds

and medium and long term loans (Hussein, 2004).

The Islamic bank Bangladesh, as a case in the region has successfully developed and

employed Islamic modes of banking. The performance of IBBL over the last 16 years has

been continuously increasing. Performance is measured by using some additional variables as

Bank’s deposits, investment, remittances, and foreign exchange business. IBBL overall

performance has been very significant in respect of mobilization of deposits, deployment of

funds, operating results, capital adequacy ratio, provision for bad & doubtful investments,

liquidity, equity, profit paid to depositors, income from ancillary business, payment of

dividend, return on equity and foreign exchange business (Ahmad, Hussain and Hannan,

1999).There are differences between Islamic and conventional banks with respect to

mobilization of deposits and application of funds. In Islamic bank depositor profit is not pre-

determined and principal amount is not guaranteed while Conventional banks have

guaranteed principal and accrued interest (Siddiqui, 2005). One of the major advantages of

opening a PLS savings account with the Islamic bank is that the initial deposit figure to open

a savings account is only Taka 100.00 (2.5 US $) where in any other Commercial banks in

Bangladesh it is not less than Taka 4000 (US $ 100). The Islamic bank invests its funds

mainly under Murabaha, Musharaka, Bai-Muajjal, Hire Purchase and Quard E Hasana mode

of investments. The remarkable advantages of Islamic bank are easy procedure of obtaining

loan and quick action in processing loan activities (Alam, 2000).

Iqbal (2001) made comparison of performance of Islamic banks with conventional banks. He

compared performance of both types of 12 banks of equivalent size during 1990-1998. In

additional to profitability, liquidity, and risk some more variables such as capital adequacy

and deployment efficiency were also studied. The performance of Islamic banks has been

evaluated using both trend and ratio analysis. He concluded that Islamic banks as a group out-

performed the former in almost all areas and in almost all years. He analyzed through ratio

analysis Islamic banks are not suffering from excess liquidity and are more cost effective and

profitable than their Conventional counterparts. Kader, Janbota, Asarpota and Anju (2007)

and Safiullah (2010) found the same results in UAE and Bangladesh respectively. The

conventional banks profitability theories exist in Islamic banking. It is found that

determinants such as capital ratio, liquidity, interest rate and money supply have similar

effect on Islamic banks. Capital ratio, interest rate and inflation are positively related with the

profitability of Islamic banks. However there is negative relationship between market share

and profitability (Haron & Ahmad, 2001).The conventional financing system is concerned

only with the interest rate, while the Islamic financial system provide loan without interest

and collateral or only against an administrative cost ( Arif, 1988; Ayub, 2002). Islamic banks

are certainly more profitable than their conventional peers enjoying the same balance sheet

structure. The main reason for such a difference is that Islamic banks benefit from a market

imperfection. Islamic banks lose on the grounds of liquidity, assets and liabilities

concentrations and operational efficiency (Hassoune, 2002). The net non-interest margin

8

th

International Conference on Islamic Economics and Finance

5

(NIM) another indicator of performance measure indicate that Conventional banks are

operationally efficient than Islamic banks. The profitability of interest-free banks is positively

influenced by high capital and loan-to-asset ratios, favorable macroeconomic conditions, and

negatively to taxes (Hassan & Bashir, 2003).

Hassan (2005) using a panel of interest-free banks from 22 countries, and using multiple

efficiency techniques, found that interest-free banks were relatively less efficient in

containing cost than conventional counterparts in the world but they are efficient in

generating profit. The variable used to measure efficiency were bank size, profitability and

loan to asset ratios. The reason of less efficiency of interest-free banks is that they often face

regulation not favorable to Islamic transactions in most countries.

All above studies conducted in different countries deal with common problem. Most of them

were conducted to analyze the performance of Islamic and conventional banks. All studies

have not same result because of differences in selected time periods, analytical tools and

cultural perspective. It is analyzed through these studies that Islamic banks are more

profitable, more liquid, cost effective, and less risky and have better quality of loan portfolio

and capital adequacy than their conventional counterparts but they loose at the ground of

operational efficiency.

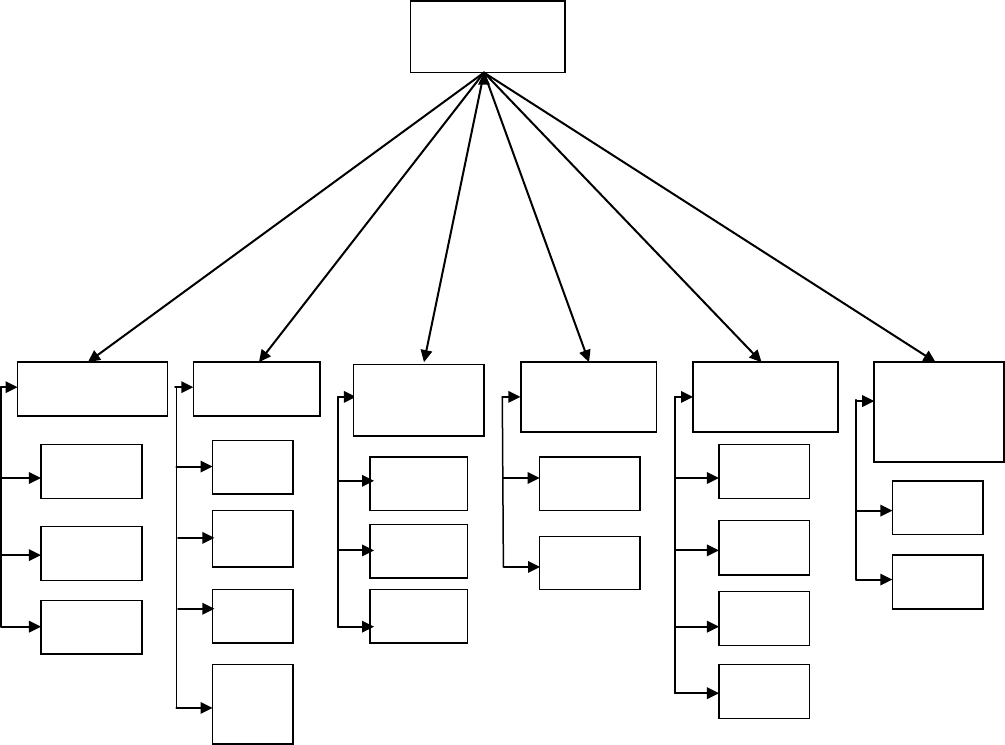

3 Conceptual Framework

Financial

Performance

Profitability

Liquidity

Risk and

solvency

Capital

adequacy

Operational

efficiency

Deploym

ent

efficiency

ROAA

ROAE

PEM

CR

CAR

LDR

NL/

TAR

DER

DTAR

LDR

ELR

CRAR

ILR

NIM

IEDR

CIR

NIE

OOPI

Center for Islamic Economics and Finance, Qatar Faculty of Islamic Studies, Qatar Foundation

6

4 Methodology

4.1 Theoretical Framework

The ratio analysis involves method of calculating and interpreting financial ratios to asses’

bank performance. Financial ratios are the indicator of financial performance of bank. In

order to compare performance of Islamic banks and Conventional banks for the period of

2006-2009 the study uses inter-bank analysis. The study evaluates inter-bank performance of

Islamic and Conventional banks in term of profitability, liquidity, risk and solvency, capital

adequacy, operation and resource allocation efficiency. Financial ratios are applied to

measure these performances. The study uses eighteen financial ratios to evaluate bank

performances. These ratios are grouped under six broad categories.

Profitability Ratios

Profitability ratios measure the managerial efficiency. These ratios use margin analysis and

show the return on assets, deposits, investments, and equity. The higher profitability ratios

are indicator of better performance. Sammad and Hassan (1999) used three profitability ratios

to evaluate the performance of Islamic bank Malaysia. These ratios were Return on average

assets (ROAA), Return on average equity (ROAE), and Profit expense ratio (PEM).This

study uses the same Profitability measure to analyze the performance of banks in Pakistan.

1. Return on average assets (ROAA) = Earnings after tax/Average assets

2. Return on average equity (ROAE) = Earnings after tax/Average equity

3. Profit Expense Margin (PEM) = Profit before tax/operating expense

Liquidity Ratios

Liquidity ratios measure the bank ability to meet its short-term obligations. Banks face

liquidity problem due to excess withdrawal from current and saving account. There are

several measures of liquidity. Iqbal (2001) used current ratio as liquidity measure. Samad &

Hassan (1999) used two more measures which include Loan/deposit ratio (LDR) and Current

asset ratio (CAR) to evaluate the performance of Malaysian Islamic bank during 1984-1987.

Hassan & Bashir (2003) also used Net loans/ total assets ratio as liquidity measurement

indicator. Liquidity position of banks in Pakistan is measured by using four above ratios.

1. Current Ratio (CR) = Cash and account with banks/Total deposits

2. Current Asset Ratio (CAR) = Current asset /Total asset

3. Loan Deposit Ratio (LDR) = Loans/ Deposits

4. Net Loan/ Total Asset Ratio (NLTA) = Net loans/Total assets

Risk and Solvency Ratios

Solvency ratios give a picture of a bank's ability to generate cash flow and pay its long-term

financial obligations. If the total value of bank assets is greater than its equity then the bank is

solvent. Samad & Hassan (1999) used three risks and solvency ratios in their study .These

ratios included Debt equity ratio (DER), Debt to total asset ratio (DTAR) and Loan deposit

ratio (LDR).This study uses the same hold to measure risk and solvency of banks in Pakistan.

The above mention ratios are calculated with the help of following formulas.

1. Debt Equity Ratio (DER) = Total Debt / Shareholder Equity

2. Debt to total asset ratio (DTAR) = Total Debt/ Total asset

3. Loan Deposit Ratio(LDR) = Loans/ deposits

8

th

International Conference on Islamic Economics and Finance

7

Capital Adequacy Ratios

Capital ratios indicate the healthiness of financial institution to shock withstanding losses.

These ratios identify the already existing banking problems. Adverse trends in these ratios

may increase risk exposure and capital adequacy problems. Iqbal (2001) used Capital Asset

Ratio (CAR) as capital adequacy measure. Hassan & Bashir (2003) in addition to CAR used

Equity/Liabilities ratio to measure capital adequacy in their study. This study focused on two

following Capital ratios.

1. Equity/Liabilities ratio = Average equity/ Average liabilities

2. Capital Risk Asset ratio = Total Capital/Risk weighted Assets

Operational Ratios

Operational ratios show how efficient a company is in its operations and use of assets. There

are several ways of measuring operations. Iqbal (2001) used cost to income ratio to evaluate

the operational efficiency of banks. Hassan & Bashir (2003) used thirteen operating ratios to

evaluate operating efficiency of banks in their study. Some ratios used by Hassan & Bashir as

operating ratios other researches used them as profitability ratios. This study also focused

them as profitability measures.

This study uses Net Interest Margin (NIM), Other Opt Income / Average Assets, Non Interest

Exp / Average Assets and Cost income ratio to measure bank efficiency in its operations and

use of assets. The following formulas are given to calculate these ratios

1. Net Interest Margin = Net markup & interest income/Average assets

2. Other Opt Income/Average Assets = Other operating Income

3. Non Interest Expense /Average Assets = Non-interest expenses/ Average Assets

/ Average Assets

4. Cost/Income ratio =

comeinterestinnon&markupNoncomeinterestin&Markup

off writedebts Bad lossesfor provision expense

interest & markup-Non expenseinterest & Markup

−−+

+++

Deployment Ratios

Deployment ratios are used to evaluate how well bank is using its resources. Iqbal (2001)

used two deployment ratios to evaluate the Performance of Islamic and conventional banks in

1990s. This study uses the same deployment ratios to evaluate bank efficiency in resources

allocation.

1. Investment/ Equity & Deposit = Total Investment /Total equity + Total Deposits

2. Investment/ Liabilities = Total Investment /Total Liabilities

Population

The population of this research is Islamic and conventional banks of Pakistan.

Sample

Meezan Bank Limited, Bank Islami Limited and Dubai Islamic Bank Limited are selected as

Islamic banks and Askari Commercial Bank Limited, Atlas Bank Limited and Samba Bank

Limited are selected as Conventional banks.

Center for Islamic Economics and Finance, Qatar Faculty of Islamic Studies, Qatar Foundation

8

Hypothesis

H

1

H

: Islamic banks are less profitable than Conventional banks.

2:

H

Islamic banks liquidity is higher than conventional banks.

3:

H

Islamic banks are less risky than Conventional banks.

4:

H

Islamic banks are well capitalized than Conventional banks.

5:

H

Islamic banks operational efficiency is less than conventional banks.

6:

Islamic banks resource allocation efficiency is less than Conventional banks.

Data Sources

The Audited financial statements i.e. Income Statement and Balance Sheet of both Islamic

and Conventional banks for the period of 2006 -2009 are used for ratio analysis. The ratios

have been calculated with the help of ratio formulae. The other sources used for data

collection are SBP, KSE and business recorder databases.

Data Analysis

Inter-bank comparison or cross-sectional analysis is used to compare the performances of

both banks. Independent Sample t-test and ANOVA is used to determine the significance of

mean differences of these ratios between and among banks. The decision criterion is P value.

If P value is greater than 0.05 we will accept null hypothesis and reject research hypothesis.

5 Data Finding, Analysis and Discussion

This chapter analyzes and discusses the results obtained through financial ratios, Independent

sample t-test and ANOVA. In order to make comparison more reliable, Independent sample

t-test and ANOVA is used. The equality of means of banks is tested through Independent

sample t-test and ANOVA. T-test is used to check the significance of mean differences

between banks and ANOVA is used to check the significance of mean differences among

banks.

Profitability of banks is analyzed by using three profitability measures ROAA, ROAE and

PEM. ROAA is the net earnings per unit of a given asset. ROAE is the net earnings of per

dollar equity capital. PEM is measure of cost efficiency which analyzes the bank efficiency

of making higher profits with given expense. Results show a fluctuating situation in all the

profitability measures of Islamic banks from 2006-2009. There is a declining trend in

Conventional bank’s ROAE from 2006-2009 while ROAA and PEM volatile. It is analyzed

from these figures that the profitability of both banks has increase, decrease trends. Average

profitability ratios ROAA, ROAE and PEM for Islamic bank are -1.49, 1.9 and 2.12

compared to -2.53, -9.58 and -46.13 for Conventional banks. T-test shows that this difference

in profitability performance of two banks is not significant at 5% level of significance.

However, ANOVA shows significance difference among the ROAE and PEM of banks from

2006-2009.

8

th

International Conference on Islamic Economics and Finance

9

T-test of Return on Average Assets (ROAA)

Banks Ratios 2006 2007 2008 2009 Mean SD t-value P-value

IB ROAA -0.08 -0.4 -0.06 -5.43 -1.49 5.33 0.566 0.577

CB ROAA -1.78 -3.07 -2.56 -2.72 -2.53 3.49

ANOVA of Return on Average Assets (ROAA)

Banks N Mean SD F-value P-value

Meezan Bank Limited 4 -2.77 2.54

Bank Islami Limited 4 1.27 0.44

Dawood Islamic Bank 4 0.92 0.68

Askari Commercial Bank Limited 4 -1.02 1.35

Atlas Bank Limited 4 -4.72 8.82

Samba Bank Limited 4 -5.76 2.83

Total 24 -2.01 4.44 2.139 0.107

T-test of Return on Average Equity (ROAE)

Banks Ratios 2006 2007 2008 2009 Mean SD t-value P-value

IB ROAE 0.68 2.58 1.76 2.58 1.9 10.49 1.574 0.130

CB ROAE -4.68 -6.14 -10.3 -17.19 -9.58 22.97

ANOVA of Return on Average Equity (ROAE)

Banks N Mean SD F-value P-value

Meezan Bank Limited 4 14.40 3.44

Bank Islami Limited 4 -3.13 4.36

Dawood Islamic Bank 4 -5.58 7.49

Askari Commercial Bank Limited 4 14.15 10.18

Atlas Bank Limited 4 -19.58 22.21

Samba Bank Limited 4 -23.29 14.23

Total 24 -3.84 18.42 6.966 0.001**

(** Significant at 1%)

T-test of Profit Expense Margin (PEM)

Banks Ratios 2006 2007 2008 2009 Mean SD t-value P-value

IB PEM -8.49 4.4 -0.24 12.83 2.12 48.26 1.860 0.076

CB PEM -21 -61.08 -45.76 -58.68 -46.63 76.9

ANOVA of Profit Expense Margin (PEM)

Banks N Mean SD F-value P-value

Meezan Bank Limited 4 58.63 18.56

Bank Islami Limited 4 -23.83 5.47

Dawood Islamic Bank 4 -28.43 42.01

Askari Commercial Bank Limited 4 45.25 41.24

Atlas Bank Limited 4 -84.54 35.77

Samba Bank Limited 4 -100.60 40.59

Total 24 -22.25 67.54 15.007 0.000**

(** Significant at 1%)

Center for Islamic Economics and Finance, Qatar Faculty of Islamic Studies, Qatar Foundation

10

Overall result shows that profitability performance of Islamic and Conventional banks is not

significantly different so research hypothesis is rejected that Islamic banks are more

profitable than conventional banks. This result is consistent with those of Metwally (1997),

Samad and Hassan (1999) and Samad (2004).

The liquidity position of Islamic and Conventional bank is analyzed through Current ratio,

Current Asset ratio, Loan Deposit ratio and Net Loans to Total Asset ratio. CR indicates the

bank ability to meet its current liabilities. A higher value of CR shows that the bank has more

liquid assets to pay back to its depositors. CAR indicates the percentage of bank liquid assets.

A high CAR is sign of liquidity. LDR measure the degree of bank relines on borrowed funds.

The high figure of LDR shows that bank is more relying on borrowed funds and leads to

illiquidity. Net loans to total assets ratio measures the total loans outstanding as a percentage

of total assets. The higher this ratio indicates that a bank is loaned up and its liquidity is low.

T-test of Current Ratio (CR)

Banks Ratios 2006 2007 2008 2009 Mean SD t-value P-value

IB CR 37.96 26.22 22.89 18.4 26.37 14.46 3.463 0.002**

CB CR 14.07 10.47 10.7 11.07 11.58 3.14

(** Significant at 1%)

ANOVA of Current Ratio (CR)

Banks N Mean SD F-value P-value

Meezan Bank Limited 4 17.50 8.26

Bank Islami Limited 4 40.36 17.16

Dawood Islamic Bank 4 21.25 1.74

Askari Commercial Bank Limited 4 13.51 2.36

Atlas Bank Limited 4 8.88 1.96

Samba Bank Limited 4 12.35 3.36

Total 24 18.97 12.72 7.948 0.000**

(** Significant at 1%)

T-test of Current Asset Ratio (CAR)

Banks Ratios 2006 2007 2008 2009 Mean SD t-value P-value

IB CAR 20.18 19.23 16.64 14.82 17.71 6.43 4.768 0.000**

CB CAR 9.78 7.3 7.39 7.79 8.06 2.8

(** Significant at 1%)

8

th

International Conference on Islamic Economics and Finance

11

ANOVA of Current Asset Ratio (CAR)

Banks N Mean SD F-value P-value

Meezan Bank Limited 4 13.72 5.73

Bank Islami Limited 4 24.27 4.61

Dawood Islamic Bank 4 15.16 3.2

Askari Commercial Bank Limited 4 10.81 1.85

Atlas Bank Limited 4 5.83 1.19

Samba Bank Limited 4 7.55 2.62

Total 24 12.89 6.92 13.764 0.000**

(** Significant at 1%)

T-test of Loan Deposit Ratio (LDR)

Banks Ratios 2006 2007 2008 2009 Mean SD t-value P-value

IB LDR 69.38 57.89 59.98 55.03 60.57 13.26 -1.407 0.173

CB LDR 68.92 55.96 83.18 72.22 70.07 19.28

ANOVA of Loan Deposit Ratio (LDR)

Banks N Mean SD F-value P-value

Meezan Bank Limited 4 60.62 14.34

Bank Islami Limited 4 48.40 6.31

Dawood Islamic Bank 4 72.68 2.46

Askari Commercial Bank Limited 4 72.02 5.09

Atlas Bank Limited 4 83.14 21.43

Samba Bank Limited 4 55.06 18.58

Total 24 65.32 16.90 3.685 0.018*

(* Significant at 5%)

T-test of Net Loan/Total Assets Ratio (NL/TA)

Banks Ratios 2006 2007 2008 2009 Mean SD t-value P-value

IB NL/TA 40.29 44.05 45.74 44.18 43.56 12.08 -0.880 0.388

CB NL/TA 45.11 39.42 56.93 52.11 48.39 14.65

ANOVA of Net Loan/Total Assets Ratio (NL/TA)

Banks N Mean SD F-value P-value

Meezan Bank Limited 4 47.97 9.53

Bank Islami Limited 4 31.05 6.69

Dawood Islamic Bank 4 51.67 8.81

Askari Commercial Bank Limited 4 57.66 4.24

Atlas Bank Limited 4 54.86 14.21

Samba Bank Limited 4 32.66 8.16

Total 24 45.98 13.36 6.263 0.002**

(** Significant at 1%)

Result shows that there is declining trend in CR and CAR of Islamic banks while LDR and

NL/TAR ratio volatiles. There is rise and fall condition in all the liquidity measure of

Conventional banks. However the values of CR and CAR are higher for Islamic bank during

Center for Islamic Economics and Finance, Qatar Faculty of Islamic Studies, Qatar Foundation

12

whole selected period. This shows that Islamic bank has more liquid asset to meet its current

liabilities. Islamic bank average CR and CAR are 26.37 and 17.71 as compared to 11.58 and

8.06 for Conventional banks and this mean difference is statistically significant at 1% level of

significance.

Islamic bank average LDR and NL/TA ratio are 60.57 and 43.56 as compared to 70.07 and

48.39 for Conventional banks. This mean difference between two banks is not significant at

5% level of significance. ANOVA shows significant mean difference in LDR and NLTA

ratio of banks at 5% and 1% respectively. LDR and NL/TA ratio are in the favor of Islamic

banks. These ratios are lower for Islamic banks, the lower these ratios it is considered better.

These ratios show that Islamic banks do not rely more on borrowed funds and their

percentage of assets tied up in loan is lower than conventional banks. These results are

consistent with those of Metwally (1997), Hassan (1999), Iqbal (2001), Badr-El-Din, Ibrahim

and Vijaykumar (2003) and Kader. Janbota, Asarpota and Anju (2007). Overall results of

liquidity ratios support the hypothesis that Islamic banks are more liquid than conventional

banks.

The reasons of Islamic bank high liquidity are firstly they do not have enough investment

opportunities. Secondly, they are bound by religion and are allowed to invest only in Sharia

approved projects. Thirdly, they rely more on their equity in making loans so they lack

lending opportunities.

T-test of Debt Equity Ratio (DER)

Banks Ratios 2006 2007 2008 2009 Mean SD t-value P-value

IB DER 30.82 14.69 22.65 32.84 25.24 36.86 -2.659 0.014*

CB DER 97.67 56.95 83.46 70.15 77.06 56.53

(* Significant at 5%)

ANOVA of Debt Equity Ratio (DER)

Banks N Mean SD F-value P-value

Meezan Bank Limited 4 72.14 24.04

Bank Islami Limited 4 3.09 1.25

Dawood Islamic Bank 4 0.52 1.03

Askari Commercial Bank Limited 4 131.18 10.99

Atlas Bank Limited 4 79.05 55.88

Samba Bank Limited 4 20.95 19.13

Total 24 51.15 53.65 15.360 0.000**

(** Significant at 1%)

8

th

International Conference on Islamic Economics and Finance

13

T-test of Debt to Total Assets Ratio (DTAR)

Banks Ratios 2006 2007 2008 2009 Mean SD t-value P-value

IB DTAR 3.49 1.36 2.00 2.54 2.35 3.08 -3.080 0.005*

CB DTAR 12.71 5.4 9.47 7.96 8.89 6.68

(* Significant at 5%)

ANOVA of Debt to Total Assets Ratio (DTAR)

Banks N Mean SD F-value P-value

Meezan Bank Limited 4 6.09 2.48

Bank Islami Limited 4 0.87 0.46

Dawood Islamic Bank 4 0.09 0.18

Askari Commercial Bank Limited 4 8.40 1.10

Atlas Bank Limited 4 12.69 9.91

Samba Bank Limited 4 5.56 5.46

Total 24 5.62 6.08 3.938 0.014*

(* Significant at 5%)

Three Risk and solvency measure DER, DTAR and LDR have been used to evaluate the

riskiness of banks. DER measures the bank ability to absorb financial shocks. DTAR is the

indicator of bank financial strength to pay its debtors. There is rise and fall condition in all

risk measures of both Islamic and Conventional banks during whole selected period. Average

DER, DTAR and LDR for Islamic bank are 25.24, 2.35 and 60.57 as compared to 70.07, 8.89

and 51.90 for their Conventional counterpart. Independent Sample t-test and ANOVA

supports that the mean difference of DER and DTAR is statistically significant at 5% level of

significance. The lower risk and solvency ratios are good and show low riskiness of bank. All

risk and solvency indicator shows lower percentage of risk for Islamic banks as compared to

Conventional banks. It is analyzed from these results that Islamic bank are less risky than

Conventional banks. It is concluded that Islamic banks ability to absorb financial shocks and

their financial strength to pay their debtor is higher than Conventional banks. These results

are consistent with Moin (2008), Sammad (2004) and Hassan (1999).

T-test of Equity/Liabilities Ratio (ELR)

Banks Ratios 2006 2007 2008 2009 Mean SD t-value P-value

IB ELR 57.6 30.9 22.3 16.8 31.89 27.27 1.160 0.259

CB ELR 16.1 23.5 25 21.5 21.53 14.67

ANOVA of Equity/Liabilities Ratio (ELR)

Banks N Mean SD F-value P-value

Meezan Bank Limited 4 9.18 1.11

Bank Islami Limited 4 51.30 33.29

Dawood Islamic Bank 4 35.20 20.31

Askari Commercial Bank Limited 4 6.88 0.30

Atlas Bank Limited 4 21.03 5.84

Samba Bank Limited 4 36.68 12.73

Total 24 26.71 22.06 4.217 0.010*

(* Significant at 5%)

Center for Islamic Economics and Finance, Qatar Faculty of Islamic Studies, Qatar Foundation

14

T-test of Capital Risk Assets Ratio (CRAR)

Banks Ratios 2006 2007 2008 2009 Mean SD t-value P-value

IB CRAR 15.13 24.68 22.73 31.55 23.52 15.63 -0.285 0.779

CB CRAR 18.79 33.8 25.21 25.02 25.7 21.49

ANOVA of Capital Risk Assets Ratio (CRAR)

Banks N Mean SD F-value P-value

Meezan Bank Limited 4 11.47 1.59

Bank Islami Limited 4 39.99 16.98

Dawood Islamic Bank 4 19.11 4.84

Askari Commercial Bank Limited 4 10.31 1.23

Atlas Bank Limited 4 14.99 8.67

Samba Bank Limited 4 51.82 15.42

Total 24 24.61 18.41 11.271 0.000**

(** Significant at 1%)

Capital adequacy of banks is measured with the help of Equity/Liability and Capital risk asset

ratios. Islamic and Conventional bank capital adequacy ratios show increase and decrease

trends. When average Capital ratios are compared for Islamic and Conventional banks it is

analyzed that Islamic bank have higher Equity liability and lower Capital risk asset ratio than

Conventional banks. Islamic bank average capital risk asset ratio and Equity liability ratios

are 23.52 and 31.89 respectively while these ratios for Conventional banks are 25.7 and 21.53

respectively. T-test shows that there is no significant mean difference between these ratios at

5% level; however ANOVA supports significant mean difference among banks at both 5%

and 1% level of significance. Results do not provide any evidence in either way that Islamic

banks are well capitalized. These results do not support the hypothesis that Islamic bank are

better capitalized than their Conventional peers.

T-test of Net Interest Margin (NIM)

Banks Ratios 2006 2007 2008 2009 Mean SD t-value P-value

IB NIM 1.9 3.8 4.8 15.6 6.51 9.52 1.514 0.144

CB NIM 1.2 2.6 2.9 2.5 2.28 1.67

ANOVA of Net Interest Margin (NIM)

Banks N Mean SD F-value P-value

Meezan Bank Limited 4 4.18 0.86

Bank Islami Limited 4 11.50 16.63

Dawood Islamic Bank 4 3.85 2.28

Askari Commercial Bank Limited 4 3.80 0.18

Atlas Bank Limited 4 0.90 0.62

Samba Bank Limited 4 2.15 2.04

Total 24 4.40 7.02 1.144 0.373

8

th

International Conference on Islamic Economics and Finance

15

T-test of Other Operating Income/Average Assets (OOI)

Banks Ratios 2006 2007 2008 2009 Mean SD t-value P-value

IB OOI/AA 0.3 0.6 0.4 0.4 0.39 0.33 -0.273 0.788

CB OOI/AA 0.4 0.9 0.3 0.2 0.44 0.54

ANOVA of Other Operating Income/Average Assets (OOI)

Banks N Mean SD F-value P-value

Meezan Bank Limited 4 0.45 0.34

Bank Islami Limited 4 0.63 0.30

Dawood Islamic Bank 4 0.10 0.12

Askari Commercial Bank Limited 4 0.58 0.68

Atlas Bank Limited 4 0.63 0.55

Samba Bank Limited 4 0.13 0.31

Total 24 0.42 0.44 1.318 0.301

T-test of Non Interest Expenses/Average Assets (NIE)

Banks Ratios 2006 2007 2008 2009 Mean SD t-value P-value

IB NIE/AA 3.2 6.1 5.5 24.9 9.95 17.8 0.917 0.369

CB NIE/AA 4.3 4.2 6.3 6 5.18 2.56

ANOVA of Non Interest Expenses/Average Assets (NIE)

Banks N Mean SD F-value P-value

Meezan Bank Limited 4 3.18 0.38

Bank Islami Limited 4 20.48 30.50

Dawood Islamic Bank 4 6.20 2.82

Askari Commercial Bank Limited 4 2.75 0.45

Atlas Bank Limited 4 5.15 2.65

Samba Bank Limited 4 7.65 0.84

Total 24 7.57 12.69 1.100 0.394

T-test of Cost/Income Ratio (CIR)

Banks Ratios 2006 2007 2008 2009 Mean SD t-value P-value

IB CIR 151.9 92.5 76.5 76.7 99.4 62.52 -1.280 0.214

CB CIR 172.8 129.6 115.6 124.3 135.59 75.37

Center for Islamic Economics and Finance, Qatar Faculty of Islamic Studies, Qatar Foundation

16

ANOVA of Cost/Income Ratio (CIR)

Banks N Mean SD F-value P-value

Meezan Bank Limited 4 65.80 3.08

Bank Islami Limited 4 94.00 5.91

Dawood Islamic Bank 4 138.40 103.52

Askari Commercial Bank Limited 4 74.13 8.18

Atlas Bank Limited 4 143.90 27.65

Samba Bank Limited 4 188.75 105.37

Total 24 117.50 70.20 2.394 0.079

The fifth component of the study is operational ratios. NIM is one indicator of bank

operational efficiency. The higher this ratio it is considered better. Islamic bank NIM

increases from 2006-2009 while there is a fluctuation in Conventional bank NIM. The

average NIM ratio for Islamic bank is 6.51 higher than Conventional bank ratio 2.28. This

mean difference between two banks is not statistically significant at 5% level of significance.

This ratio indicates that Islamic banks has high margin. The average Non Interest

Exp/Average Assets ratios and Other Opt Income/ Average Assets ratio are 9.95 and 0.39 for

Islamic banks as compared to 5.18 and 0.44 for Conventional banks. However, a Cost /

Income ratio is lower for Islamic banks. The lower the cost income ratio it is better. Islamic

Bank Cost/Income ratio 99.40 is lower than Conventional bank 135.59. The mean differences

of these ratios are not significant at 5% level. It is analyzed from overall results that major

operational ratios NIM and Cost income ratios are in favor of Islamic banks and supports the

hypothesis that Islamic banks operational efficiency is better than Conventional banks. These

results are consistent with Ahmad, Hussain and Hannan (1999), Iqbal (2001) and Kader,

Janbota and Asarpota (2007).

The last component of financial performance is deployment ratios. Deployment ratios

measure the resource allocation efficiency. The higher these ratios are considered better.

T-test of Investment/Equity & Deposit Ratio (IEDR)

Banks Ratios 2006 2007 2008 2009 Mean SD t-value P-value

IB IEDR 10.3 20 19 16.8 16.53 7.18 -2.797 0.011*

CB IEDR 26.9 24.5 19.3 25.5 24.03 5.89

(* Significant at 5%)

ANOVA of Investment/Equity & Deposit Ratio (IEDR)

Banks N Mean SD F-value P-value

Meezan Bank Limited 4 16.20 6.14

Bank Islami Limited 4 22.55 7.26

Dawood Islamic Bank 4 10.83 2.63

Askari Commercial Bank Limited 4 23.85 5.03

Atlas Bank Limited 4 21.80 8.28

Samba Bank Limited 4 26.43 4.35

Total 24 20.28 7.48 3.746 0.017*

(* Significant at 5%)

8

th

International Conference on Islamic Economics and Finance

17

T-test of Investment/Liabilities Ratio (ILR)

Banks Ratios 2006 2007 2008 2009 Mean SD t-value P-value

IB ILR 16.1 23.7 21.8 17.6 19.8 9.26 -1.592 0.126

CB ILR 25.7 27.3 21.7 26.6 25.3 7.59

ANOVA of Investment/Liabilities Ratio (ILR)

Banks N Mean SD F-value P-value

Meezan Bank Limited 4 15.58 5.94

Bank Islami Limited 4 30.00 7.24

Dawood Islamic Bank 4 13.83 4.01

Askari Commercial Bank Limited 4 22.05 4.54

Atlas Bank Limited 4 21.48 8.80

Samba Bank Limited 4 32.38 3.54

Total 24 22.55 8.74 6.228 0.002**

(** Significant at 1%)

Islamic bank has lower average deployment ratios than Conventional bank. The average

Investment/ Equity and Deposits and Investment/ Liabilities are 16.53 and 19.80 for Islamic

banks as compared to 24.03 and 25.30 for Conventional banks. This mean difference is

significant at 1% level for Investment / Equity and Deposit ratio; however this mean

difference between banks is not significant for Investment Liabilities ratios. ANOVA

supports significance mean difference for deployment ratios. Results support the hypothesis

that Islamic bank resource allocation efficiency is less than conventional banks. This is

concluded from these results that deployment ratios are in favor of Convention banks and

they make much better use of their resources.

6 Conclusion

A comparative study conducted to examine the performance of Islamic and Conventional

banks in Pakistan found that Islamic banks in Pakistan have better financial performance than

their Conventional counterparts. Profitability measures of performance of ROAA, ROAE and

PEM do not show (statistically) significant difference between the performances of Islamic

and Conventional banks and reject the hypothesis that Islamic banks are more profitable than

Conventional banks. Liquidity measures CR, CAR show that interbank liquidity

performances of Islamic and Conventional banks are statistically different. Islamic banks are

more liquid than Conventional banks in CR and CAR measures. LDR and NL/TA ratios are

lower for Islamic banks which mean that Islamic banks do not rely more on borrowed funds

and their percentage of assets tied up in loan is lower than Conventional banks. The study

found that risk and solvency measures i.e. DER and DTAR show (statistically) significant

difference between the performances of the two banks. Islamic bank financial strength to pay

their debtors is high. These finding support the hypothesis that Islamic banks are less risky

than Conventional banks. Capital adequacy measures do not support the hypothesis that

Islamic banks are well capitalized than conventional bank. Capital adequacy measures of

performance Capital risk asset ratio and Equity/Liabilities ratio shows that mean difference of

the two banks is not statistically different. Operational efficiency measures of both Islamic

and conventional banks do not show (statistically) significant difference between the

performances of both banks. NIM and Cost Income ratios are in the favor of Islamic bank

which shows Islamic bank are more cost effective than their Conventional counterpart and

Center for Islamic Economics and Finance, Qatar Faculty of Islamic Studies, Qatar Foundation

18

reject the hypothesis that Islamic bank’s operationally efficiency is less than their

Conventional counterparts. Deployment ratios are higher for Conventional banks and accept

the hypothesis that Islamic bank resource allocation efficiency is less than Conventional

banks. It is concluded from the overall research that Islamic banks are more liquid, less risky

and operationally efficient than Conventional banks.

7 Suggestions for Further Research

1. Sample size should be increased for the same study. More banks should be taken as a

sample to generalize the result of study on the whole industry.

2. Since Islamic banking are in the introductory phase in Pakistan. There is a strong need

to conduct Performance evaluation studies from time to time so that corrective actions

may be taken accordingly

3. This research provides new avenues for future research. Finding of this study

generate a lot of questions in researchers mind; e.g.

i. Why there is no difference between the profitability of two banks

ii. Why Islamic bank are more liquid than Conventional banks

iii. Why Islamic banks are less risky than Conventional banks

iv. Why operational efficiency of Islamic bank is better than Conventional banks.

References

Aggarwal, Rajesh, K., & Tarik, Y. (2000). Islamic Banks and Investment Financing. Journal

of Money, Banking, and Credit, 32(1), 93-120.

Ahmad, M. F., Hussain, M. S. & Hannan, S.A. (1999). Experiences in Islamic Banking: A

Case Study of Islamic Bank Bangladesh. Dhaka: Institute of Policy Studies.

Ahmad, Z. (1991). Islamic Banking at the Crossroads, A.M. Sadiq, A.H. Pramanik, &

N.M.B.H.N. Hassan, Development and Finance in Islam, Malysia: International Islamic

University press.

Alam, M.N. (2000). Islamic Banking in Bangladesh: A Case Study of IBBL. International

Journal of Islamic Financial Services, 1(4), 28-45.

Ariff, M. (1988). “Islamic Banking.” Asian-Pacific Economic Literature, 2(2), 46-62.

Ayub, M. (2002). Islamic Banking and Finance Theory and Practice. Karachi: Research

Department, State Bank of Pakistan.

Badr-El-Din A., Ibrahim, & Vijaykumar, K.C. (2003). Some Aspects of Liquidity in Islamic

Banks (ISBS) A Case Study of Selected Banks In The Mena Region. Research report 422

sponsored by the ERF Research Program.

Chapra, M. U. (2001). Islamic Banking and Finance: The Dream and the Reality. Journal of

Islamic Banking and Finance, 18(2), 7-39.

El-Qorchi, M. (2005). “Islamic finance gears up”. Finance and Development, 42(4), 46-50.

8

th

International Conference on Islamic Economics and Finance

19

Farrukh, Z. (2006). Corporative Performance of Islamic and Commercial Banks. Karachi:

College of Management Sciences, PAF-Karachi Institute of Economics & Technology.

Haron, S. & Ahmad, N.H. (2001). Conventional Banking Profitability Theories in Islamic

Banking: Some Evidences. Journal of Islamic Banking and Finance, 18(3&4), 122-131.

Hassan, M.K., & Bashir, A.H.M. (2003). Determinants of Islamic Banking Profitability.

Paper presented at the Economic Research Forum (ERF) 10

th

Annual Conference, 16th-18

th

December 2003, Marrakech: Morocco.

Hassoune, A. (2002). Islamic Banks’ Profitability in an Interest Rate Cycle. International

Journal of Islamic Financial Services, 4(2).

Hussein, K.A. (2004). Banking Efficiency in Bahrain: Islamic VS Conventional Banks.

Jeddah: Islamic Research and Training Institute, Islamic Development Bank.

Kader, Janbota M., and Asarpota, Anju, K. (2007). “Comparative Financial Performance of

Islamic vis-à-vis Conventional Banks in the UAE”. Paper presented at 2006-2007 Annual

Student Research Symposium & First Chancellor’s Undergraduate Research Award at UAE

University.

Khan, M. H. (2004). Banking Industry of Pakistan: Performances and Constrains. Retrieved

October 10, 2010, from http://www.mediamonitors.net/biopakbymuhkhan.html

Iqbal, M. (2001). Islamic and Conventional Banking in the 1990s: A Comparative Study. M.

Iqbal, Islamic Banking and Finance: Current Development in Theory and Practice, United

Kingdom: The Islamic Foundation.

Metwally, M.M. (1997). Differences between the Financial Characteristics of Interest-Free

Banks and Conventional Banks. European Business Review, 97(2), 92-98.

Moin, S.M. (2008). Performance of Islamic Banking and Conventional Banking in Pakistan:

A Comparative Study. Skovade: University of Skovade school of technology and society.

Safiullah, M. (2010). Superiority of Conventional Banks & Islamic Banks of Bangladesh: A

Comparative Study. International Journal of Economics and Finance, 2(3).

Samad, A. (2004). “Performance of Interest-free Islamic banks vis-à-vis Interest-based

Conventional Banks of Bahrain”. IIUM Journal of Economics and Management, 12(2), 1-15.

Samad, A. and Hassan, M.K. (1999). The Performance of Malaysian Islamic Bank during

1984-1997: An Exploratory Study. International Journal of Islamic Financial Services, 1(3).

Siddiqui, S.A. (2005). Understanding and Eliminating Riba: Can Islamic Financial

Instruments Be Meaningfully Implemented? Journal of Management and Social Sciences,

1(2), pp.187-203.

Tahir, S. (2003). Current Issues in the Practice of Islamic Banking. Retrieved October 10,

2010 from http://www.sbp.org.pk/departments/ibd/Lecture_8_Related_Reading_1.pdf