Nebraska Homestead Exemption Information Guide, January 28, 2013, Page 1

InformatIon GuIde

January 2013

Overview

The Nebraska homestead exemption program is a property tax relief program for three categories

of homeowners:

A. Persons over age 65;

B. Qualieddisabledindividuals;or

C. Qualiedtotallydisabledveteransandtheirwidow(er)s.

There are income limits and homestead value requirements for all categories, except for a disabled

veteranorwidow(er)whosehomehasbeensubstantiallycontributedtobytheDepartmentofVeterans

Affairs(DVA).Theincomelimitsareonaslidingscale.

This information guide includes examples for these categories of homeowners. Examples 1 through 4

pertaintopersonsoverage65;andexamples5through8pertaintobothqualieddisabledindividuals

andqualiedtotallydisabledveteransandtheirwidow(er)s.

The State of Nebraska reimburses counties and other governmental subdivisions for the reduction in

tax revenue as a result of approved homestead exemptions.

This information guide may change with updated information or added examples. The

Department recommends you do not print this guide. Instead, sign up for the subscription

service at www.revenue.ne.gov to get updates on your topics of interest.

Terms

Deductible Medical and Dental Expenses.Deductiblemedicalanddentalexpensesarethoseincurredandpaidby

the claimant, spouse, and any owner/occupant. These expenses must be more than 4% of the calculated household

income prior to deducting the medical expenses.

Theallowedmedicalanddentalexpensesaretheout-ofpocket(non-reimbursed)costsof:

v Health insurance premiums; and

v Goods and services that restore or maintain health which were purchased from a licensed health practitioner

or licensed health care facility.

Insulin and prescription medicine may be included, but nonprescription medicine cannot be included.

Homestead. A homestead is the residence or mobile home, and up to one acre of land surrounding it, actually

occupied by a person who is the owner of record from January 1 through August 15 in each year. Property held in the

name of an entity such as a corporation, partnership, or limited liability company will not qualify.

Household Income.Householdincomeisthetotalofthepreviousyear’sfederaladjustedgrossincome(AGI),plus:

96-299-2009 Rev. 1-2013 Supersedes 96-299-2009 Rev. 1-2012

nebraska Homestead exemptIon

Nebraska Homestead Exemption Application or Certification of Status, Form 458

For filing after February 1, 2013, and by July 1, 2013.

Nebraska Homestead Exemption Information Guide, January 28, 2013, Page 2

v Social Security or railroad retirement income;

v AnyNebraskaadjustmentsincreasingfederalAGI(line12oftheNebraska Individual Income Tax Return,

Form 1040N,ledwhenreportingNebraskaincometax);and

v Interest and dividends from Nebraska and its subdivisions’ obligations;

of the claimant, spouse, and all other persons who own and occupy the homestead; minus deductible

medical expenses.

Filing Status. Marital status information is required to determine the income limits used to calculate the percentage

of relief, if any. Marital status may be either “married” or “single.”

v Usethemarriedstatusifafederaltaxreturnwasledusingoneofthemarriedstatuses,orwouldhavebeen

ledasmarriedifataxreturnwasrequired.“Closelyrelated”meanstheapplicantiseitherabrother,sister,

parent, or child of another other owner-occupant.

v Usethesinglestatusifafederaltaxreturnwasledusingthesingleorheadofhouseholdstatus,orwould

havebeenledassingleorheadofhouseholdifataxreturnwasrequired.

Owner-Occupant. An owner-occupant is the owner of record or surviving spouse in the current year only; the

occupant purchasing and in possession of a homestead under a land contract; one of the joint tenants, or tenants in

common;orabeneciaryofatrustthathasanownershipinterestinthehomestead.

Qualifying Disabilities for Individuals. The qualifying disabilities are:

v A permanent physical disability and loss of the ability to walk without the regular use of a mechanical aid

or prosthesis;

v Amputation of both arms above the elbow; or

v A permanent partial disability of both arms in excess of 75%.

NOTE:AnindividualwhoqualiesforSocialSecuritydisabilitydoesnot automatically qualify for the Nebraska

Homestead Exemption.

Veteran. A veteran is a person who has been on active duty in the armed forces of the U.S., or a citizen of the U.S. at

the time of service with military forces of a government allied with the U.S., during the following date ranges:

v April 6, 1917 to November 11, 1918;

v December7,1941toDecember31,1946;

v June 25, 1950 to January 31, 1955;

v February28,1961andAugust5,1964(intheRepublicofVietnam);

v August 5, 1964 to May 7, 1975;

v August 25, 1982 to February 26, 1984;

v December20,1989toJanuary31,1990;

v Persian Gulf War beginning August 2, 1990; and

v Global War on Terror beginning September 14, 2001.

A veteran must have received an honorable discharge or general discharge under honorable conditions.

A. Persons Over Age 65 (Reg. 45-002.11)

To qualify for a homestead exemption under this category, an individual must:

v Be 65 or older before January 1st of the application year;

v Own and occupy the homestead January 1 through August 15; and

v Have qualifying household income – see Table I.

Nebraska Homestead Exemption Information Guide, January 28, 2013, Page 3

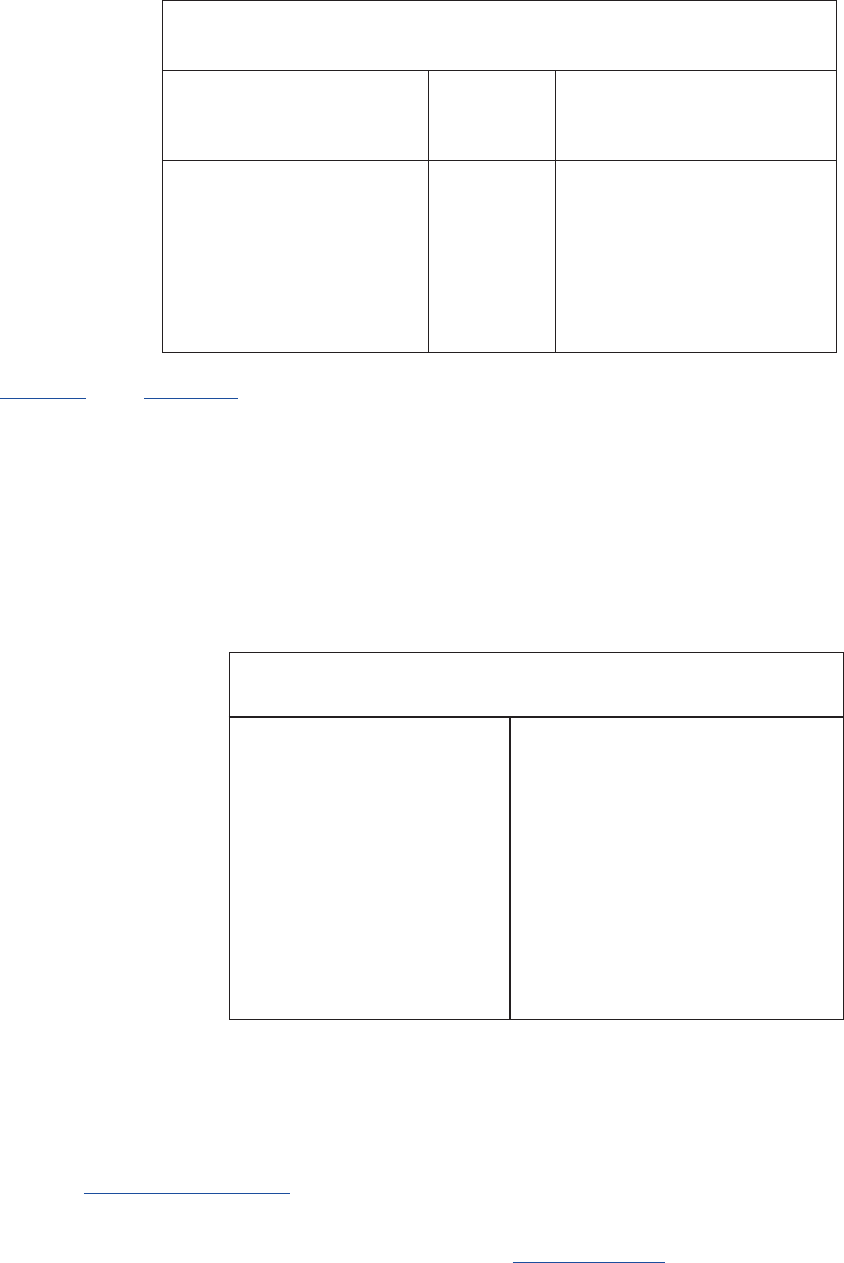

Table I

Homestead Exemption For Persons Over Age 65

Income Percentage Income

Limit of Relief Limit

Single Married

$ 0 — $26,500.99 100% $ 0 — $31,000.99

26,501 — 27,900.99 85 31,001 — 32,700.99

27,901 — 29,200.99 70 32,701 — 34,400.99

29,201 — 30,600.99 55 34,401 — 36,000.99

30,601 — 32,000.99 40 36,001 — 37,700.99

32,001 — 33,400.99 25 37,701 — 39,300.99

33,401 and over 0 39,301 and over

A Form 458 and a Schedule ImustbeledwiththecountyassessorafterFebruary1andbyJune30eachyear.

Failuretoproperlylewithinthistimeframewillresultindisapprovalofthehomesteadexemptionfortheyear.

Maximum Exempt Amount. The percentage of exemption relates to the assessed value of the homestead. The

maximum exempt amount is the taxable value of the homestead up to $40,000 or 100% of the county’s average

assessed value of single family residential property, whichever is greater.

Maximum Value. To be eligible, the maximum assessed value of the homestead is $95,000, or 200% of the average

assessed value of single family residential property in the county, whichever is greater. The exempt value will be

reduced by 10% for every $2,500 that the assessed value exceeds the maximum value. If the assessed valuation

exceeds the maximum value by $20,000 or more, the homestead is not eligible for exemption.

Table II

Maximum Exempt Value Reductions

Homestead Valuations Reduce Exempt

Exceeds Maximum By: Amount by:

$ 0 — $2,499 0%

2,500 — 4,999 10

5,000 — 7,499 20

7,500 — 9,999 30

10,000 — 12,499 40

12,500 — 14,999 50

15,000 17,499 60

17,500 — 19,999 70

$20,000ormore 100%(noexemptionallowed)

In the following examples the assessed value, the average value, the maximum value, and the

maximum exempt amount can be obtained from the county assessor.

Example 1 – Not eligible for a homestead exemption.

If the assessed valuation exceeds the maximum value by $20,000 or more, the homestead is not eligible for

exemption. Regulation 45-003.01B

The scenario –

v Themaximumvalueofanassessedhomestead(Reg. 45-002.08A)inthiscountyis$95,000.

v Mrs. Green’s homestead in this county has an assessed value of $150,000.

The exemption calculations –

v The assessed value of the homestead exceeds the maximum value in the county by more than $20,000

($150,000-$95,000=$55,000overthemaximumvalue).

Conclusion – Mrs. Green’s homestead is not eligible for a homestead exemption.

Nebraska Homestead Exemption Information Guide, January 28, 2013, Page 4

Example 2 – Over age 65 category, maximum value reduction.

The maximum value of the homestead is the greater of $95,000, or 200% of the county’s average assessed value of a

single-family residential property. Regulation 45-002.08A

The scenario –

v Mr.Doeis88 years old and married.

v The assessed value of his homestead is $202,000.

v The average value of a single-family residential property in this county is $97,500.

v Household income is $28,000.

The exemption calculations –

v Themaximumvalueis$195,000($97,500x200%=$195,000,whichisgreaterthan$95,000).

v Since the assessed value of this homestead is $202,000, its value is $7,000 over the maximum amount

($202,000-$195,000).

v According to Table II,thismeansthattherewillbea20%reductionof$19,500($97,500x20%).

v ThemaximumexemptvalueofMr.Doe’shomesteadis$78,000($97,500-$19,500).

v Mr.Doe’shouseholdincomeof$28,000meansheiseligiblefor100%relief(accordingto

Table Iabove).

v Theincomepercentage($78,000x100%)resultsinahomesteadexemptionvalueof$78,000.

Conclusions –

v The total taxable value of the homestead (afterapplyingtheexemption)is $124,000

($202,000 - $78,000).

v The county property tax rate is calculated on the taxable value of $124,000 to determine the amount of

propertytaxthatisdueonMr.Doe’shomestead.

Example 3 – Over age 65, no maximum value reduction.

The maximum exempt amount is the greater of the taxable value of the homestead up to $40,000, or 100% of the

county’s average assessed value of a single family residential property. Regulation 45-002.04

The scenario –

v Ms.Doeis72 years old and single.

v The homestead assessed value is $100,000.

v The average value of a single family residential property in this county is $75,000.

v Household income is $29,000.

The exemption calculations –

v The maximum value of the homestead is the greater of $95,000, or 200% of the county’s average

assessed value of a single family residential property. In this case, the maximum value amount is

$150,000($75,000x200%=$150,000,whichisgreaterthan$95,000).

v The homestead assessed value is $100,000, which is less than the maximum value of $150,000, so no

reduction is necessary.

v The maximum exempt value of the homestead is the greater of $40,000 or 100% of the county average

assessed value of a single family residential property in the county. In this case, the maximum exempt

amountis$75,000($75,000x100%=$75,000,whichisgreaterthan$40,000).

v Ms.Doe’shouseholdincomelevelof$29,000meanssheiseligiblefor55%reliefofherhomestead’s

maximumexemptvalue(accordingtotheTable Iabove).Thehomesteadexemptionis$41,250

($75,000x55%).

Conclusions –

v The total taxable value of the homestead (afterapplyingtheexemption)is $58,750

($100,000 - $41,250).

Nebraska Homestead Exemption Information Guide, January 28, 2013, Page 5

v The county property tax rate is calculated on the taxable value of $58,750 to determine the amount of

propertytaxthatisdueonMs.Doe’shomestead.

Example 4 – Over age 65, no maximum value reduction, assessed value is less than the maximum

exempt value in the county.

The maximum exempt amount is the lesser of the taxable value of the homestead; or the greater of $40,000 or 100%

of the county’s average assessed value of a single family residential property. Regulation 45-002.04A

The scenario –

v Mrs. White is 68 years old and married.

v The homestead assessed value is $35,000.

v The average value of a single family residential property in this county is $35,000.

v Household income is $32,000.

The exemption calculations –

v Themaximumexemptamountis$35,000(becausethisislessthan$40,000).

v Themaximumvalueis$95,000(200%oftheaveragevalue,$35,000=$70,000,whichislessthan

$95,000).Thereisnomaximumvaluereductionbecausethehomestead’svalueislessthan$95,000.

v Mrs. White’s household income level of $32,000 means she is eligible for 70% relief of her homestead’s

maximumexemptvalue(accordingtoTable Iabove).Thehomesteadexemptionis$24,500

($35,000x70%).

Conclusions –

v The total taxable value of the homestead (afterapplyingtheexemption) is $10,500

($35,000 - $24,500).

v The county property tax rate is calculated using the taxable value of $10,500 to determine the amount of

property tax that is due on Mrs. White’s homestead.

B. Qualified Disabled Individuals (Reg. 45-002.12)

An individual with a qualifying disability must:

v OwnandoccupythehomesteadJanuary1throughAugust15(Reg.45-002.05);

v Have qualifying household income – Table III (Reg. 45-002.12);and

v File a Form 458 and an income statement with the county assessor after February 1 and by June 30 each

year.Withintherstyear,acompletedPhysician’sCerticationofDisabilityforHomesteadExemption,

Form458B(whichmaybeobtainedfromthecountyassessor),mustbeledwiththeForm458.If

Form458Bisnotledwiththecountyassessor,theindividualwilllosethehomesteadexemptionforthat

year(Reg. 45-004.01).

C. Qualified Totally Disabled Veterans and Their Widow(er)s

To qualify for a homestead exemption under this category, there are three possible classes for veterans’ exemptions.

1 AwartimeveteranreceivingcompensationfromtheU.S.DepartmentofVeteransAffairs(DVA)becauseofa100%

disability that was service-connected.

The veteran must also:

v Own and occupy the homestead January 1 through August 15;

v Have qualifying household income – see Table III; and

v File a Form 458 and an income statement with the county assessor after February 1 and on or before June 30

eachyear.Withintherstyear,aveteranmustalsoincludeacerticationfromtheDVA.Ifacertication

fromtheDVAisnotledwiththecountyassessor,theveteranwilllosethehomesteadexemptionfor

that year.

Nebraska Homestead Exemption Information Guide, January 28, 2013, Page 6

2 A wartime veteran totally disabled by a nonservice-connected illness or accident.

The veteran must also:

v Own and occupy the homestead January 1 through August 15;

v Have qualifying household income – see Table III; and

v File a Form 458andanincomestatement.AlsoincludeacompletedPhysician’sCerticationofDisability

forHomesteadExemption,Form458B,oracerticationofdisabilityfromtheDVA.Allformsmustbe

ledwiththecountyassessorafterFebruary1andbyJune30eachyear.IfForm458Bisnotledwiththe

county assessor, the veteran will lose the homestead exemption for that year.

3 AveteranwhosehomeissubstantiallycontributedtobytheDVA.Thishomesteadis100%exemptregardlessof

homestead value and income level.

The veteran must also:

v Own and occupy the homestead January 1 through August 15; and

v FileaForm458andincludeacerticationfromtheDVAwiththecountyassessorafterFebruary1andon

orbeforeJune30eachyear.IfForm458Bisnotledwiththecountyassessor,theveteranwilllosethe

homestead exemption for that year.

Widow(er)s of a Veteran. Ahomesteadexemptionisavailabletotheunremarriedwidow(er)of:

1 Any veteran who died because of a service-connected disability;

2 A servicemember whose death while on active duty was service-connected;

3 A servicemember who died while on active duty during wartime; or

4 AveteranwhoreceivedcompensationfromtheDVAbecauseofa100%disabilitythatwasservice-connected.

Thewidow(er)must:

v Own and occupy the homestead January 1 through August 15;

v Have household income in accordance with Table III; and

v File a Form 458 and an income statement with the county assessor after February 1 and on or before June 30

eachyear.Withintherstyear,acerticationfromtheDVAmustbeincludedwiththeForm458.Failureto

do so will result in disapproval of the homestead exemption for that year.

Awidow(er)shomethatreceivedsubstantialcontributionsfromtheDVAis100%exempt,regardlessofhomestead

value and income level.

Thewidow(er)must:

v Own and occupy the homestead January 1 through August 15; and

v File a Form 458 with the county assessor after February 1 and on or before June 30 each year and include

a certication from the DVA. Failure to do so will result in disapproval of the homestead exemption for

that year.

Nebraska Homestead Exemption Information Guide, January 28, 2013, Page 7

Table III

Homestead Exemption For Qualifying Disabled

Individuals, And Qualifying Disabled

Veterans And Their Widow(ers)

Income Percentage Income

Limit of Relief Limit

Single Married

$ 0 — $29,800.99 100% $ 0 — $34,100.99

29,801 — 31,200.99 85 34,101 — 35,700.99

31,201 — 32,600.99 70 35,701 — 37,400.99

32,601 — 33,900.99 55 37,401 — 39,000.99

33,901 — 35,300.99 40 39,001 — 40,700.99

35,301 — 36,700.99 25 40,701 — 42,400.99

36,701 and over 0 42,401 and over

In the following examples the assessed value, the average value, the maximum value, and the

maximum exempt amount can be obtained from the county assessor.

Maximum Exempt Amount. The percentage of exemption relates to the assessed value of the homestead.The

maximum exempt amount is the taxable value of the homestead up to $50,000 or 120% of the county’s average

assessed value of single family residential property, whichever is greater.

Maximum Value. To be eligible, the maximum assessed value on the homestead is $110,000 or 225% of the average

assessed value of single family residential property in the county, whichever is greater. The exempt value will be

reduced by 10% for every $2,500 that the assessed value exceeds the maximum value. If the assessed valuation

exceeds the maximum value by $20,000 or more, the homestead is not eligible for exemption.

Example 5 – Not eligible for a homestead exemption.

If the assessed valuation exceeds the maximum value by $20,000 or more, the homestead is not eligible for

exemption. Regulation 45-003.01B

The scenario –

v Themaximumvalueofanassessedhomestead(Reg. 45-002.08B)inthiscountyis$225,000.

v The homestead has an assessed value of $250,000.

The exemption calculations –

v The assessed value of the homestead exceeds the maximum value in the county by more than $20,000

($250,000-$225,000=$25,000overthemaximumvalue,whichisgreaterthan$20,000).

Conclusion – The homestead is not eligible for a homestead exemption.

Example 6 – Disability, maximum exempt value reduction.

The maximum value is the greater of the taxable value of the homestead up to $110,000, or 225% of the county’s

average assessed value of a single-family residential property. Regulation 45-002.08B

The scenario –

v Mr. Jones is married.

v Household income is $30,000.

v The homestead assessed value is $350,000.

v The average value of a single-family residential property in this county is $180,000($150,000x120%).

The exemption calculations –

v Themaximumvalueis$337,500($150,000x225%=$337,500,whichisgreaterthan$110,000).

v Since the assessed value of this homestead is $350,000, it is $12,500 over the maximum amount

($350,000-$337,500).

Nebraska Homestead Exemption Information Guide, January 28, 2013, Page 8

v According to Table II, this means that there will be a 50% maximum exempt value reduction or $90,000

($180,000x50%).

v Themaximumexemptvalueofthehomesteadiscalculatedtobe$90,000($180,000-$90,000).

v Mr. Jones’ household income level of $30,000 means he is eligible for 100% relief of his homestead’s

maximumexemptvalue(accordingtotheTable III).Thehomesteadexemptionis$90,000

($90,000x100%).

Conclusions –

v The total taxable value of the homestead (afterapplyingtheexemption)is $260,000

($350,000 - $90,000).

v The county property tax rate is calculated on the taxable value of $260,000 to determine the amount of

property tax that is due on Mr. Jones’ homestead.

Example 7 – Disability, no maximum value reduction, percentage qualification.

The maximum exempt amount is the greater of the taxable value of the homestead up to $50,000, or 120% of the

county’s average assessed value of a single family residential property. Regulation 45-002.04B

The scenario –

v Mr. Smith is single.

v Household income is $33,500.

v The homestead assessed value is $100,000.

v The average value of a single-family residential property in this county is $62,500.

The exemption calculations –

v Maximumvalueis225%oftheaverageassessedvalueinthecounty($62,500x225%=$140,625);Mr.

Smith’s homestead’s assessed value is $100,000 which is below the maximum value, so no reduction

is necessary.

v The maximum exempt value of the homestead is the greater of $50,000 or 120% of the county average

assessed value of single-family residential property in the county. In this case, the maximum exempt

amountis$75,000($62,500x120%=$75,000,whichisgreaterthan$50,000).

v Mr. Smith’s household income level of $33,500 means he is eligible for 40% relief of his

homestead’smaximumexemptvalue(accordingtoTableIII).Thishomesteadexemptionis$30,000

($75,000x40%).

Conclusions –

v The total taxable value of the homestead(afterapplyingtheexemption)is $70,000

($100,000 - $30,000).

v The county property tax rate is calculated on the taxable value of $70,000 to determine the amount of

property tax that is due on Mr. Smith’s homestead.

Example 8 – Disability, no maximum value reduction.

The maximum exempt amount is the greater of the taxable value of the homestead up to $50,000, or 120% of the

county’s average assessed value of a single-family residential property. Regulation 45-002.04B.

The scenario –

v Mrs.Doeismarried.

v Household income is $33,500.

v The homestead assessed value is $45,000.

v The average value of a single-family residential property in this county is $40,000.

Nebraska Homestead Exemption Information Guide, January 28, 2013, Page 9

The exemption calculations –

v The maximum value is the greater of $110,000 or 225% of the county average assessed value of a

single-familyresidentialpropertyinthecounty.Inthiscase,themaximumvalueis$110,000(since

$40,000x225%=90,000,whichislessthan$110,000).

v Since the assessed value of this homestead is $45,000, its value is less than $110,000, so no reduction

is necessary.

v The maximum exempt value of the homestead is the lesser of the taxable value of the homestead

($45,000),or120%ofthecounty’saverageassessedvalueofasingle-familyresidentialproperty.

($40,000x120%=$48,000).$45,000islessthan$48,000,soitisthemaximumexemptvalue.

v Mrs.Doe’shouseholdincomelevelof$33,500meanssheiseligiblefor85%reliefofherhomestead’s

maximumexemptvalue(accordingtoTable III).Thehomesteadexemptionis$38,250($45,000x85%).

Conclusions –

v The total taxable value of the homestead(afterapplyingtheexemption)is $6,750

($45,000 - $38,250).

v The county property tax rate is calculated on the taxable value of $6,750 to determine the amount of

propertytaxthatisdueonMrs.Doe’shomestead.

Income Information

Determination of Income Levels. To determine the income level of the applicant, the income reported on the

Nebraska Schedule Iledwiththeapplication,theincometaxreturnsledbytheapplicant,andtheincome

documents provided by the IRS, the Social Security Administration, and the Railroad Retirement Board will

be reviewed.

v Passiveincome(forexample,capitalgains,interest,dividends,retirementbenets,pensions,IRAwithdrawals)

is included as household income.

v If the names of any children or other individuals are on the deed as owners and they occupy the homestead,

their income will be considered in determining eligibility. For owner-occupants who are closely related, the

income levels for married claimants are used. “Closely related” means the applicant is either a brother, sister,

parent, or child of another other owner-occupant.

v SocialSecurityretirementincomemustbeincludedwhetherornotanincometaxreturnisled.Medicare

premiumsmaynotbesubtractedfromSocialSecurityincome.However,MedicarePartBandPartDpremiums

are allowable medical expenses.

Errors in Reporting Income and/or Medical Expenses. If an error in reporting income and/or medical expenses

isdiscovered,theTaxCommissionermustbenotiedwithinthreeyearsafterDecember31oftheapplicationyear

tohaveahomesteadexemptionreconsidered.Ifincometaxreturnswereled,theincometaxreturnsmustalsobe

amendediftheitembeingchangedisincludedonthereturns.Theapplicantwillbenotiedofincomediscrepancies

resulting in an erroneous homestead exemption. The applicant will receive a corrected statement for the appropriate

property tax due, plus possible interest and penalty, payable to the county treasurer.

If the Tax Commissioner approves a homestead exemption based on amended household income, a refund of any

taxes paid will be issued by the county treasurer in the county where the taxes were paid.

One-time Increases in Income. Income which exceeds the statutory limit will result in the loss of the homestead

exemptionforoneyear. However,anewapplicationmaybeledthefollowingyear.

Using the Previous Year’s Income to Determine Homestead Exemption Eligibility. County assessors must

completetheircurrentyear’srealestatetaxlists,includinghomesteadexemptions,byDecember1;butthecurrent

year’s income tax information is not reported until the following April 15.

Appeal of a Denied Homestead Exemption Application.

v Ifawrittenrejectionnoticefromthecountyassessorisreceived,anappealmaybeledwiththecountyboard

of equalization within 30 days of the date the notice is received.

Nebraska Homestead Exemption Information Guide, January 28, 2013, Page 10

v If a denial notice from the Tax Commissioner is received, a hearing with the Tax Commissioner may be requested

bylingawrittenprotestwiththeNebraskaDepartmentofRevenuewithin30daysofreceiptofthenotice.The

protest must state the reasons for the appeal; the name and address of the applicant; and a request for relief.

Appeal of the Denied or Reduced Homestead Exemption Application Based on the Assessed Valuation of the

Homestead.Toappealtheassessedvaluationofthehomestead,timelylea PropertyValuationProtest,Form422,

with the county clerk. Refer to the instructions for Form 422 for additional information. If the protest is successful,

the homestead exemption will be automatically reconsidered.

Disqualication of the Homestead Exemption. If an owner does not qualify for an exemption, tax on the property

willbedueinfull.AtaxstatementwillbesentfromthecountyinDecember.Anewapplicationmaybeledthe

following year.

Transfer of a Homestead Exemption if a New Homestead is Purchased. A transfer is allowed under the

following conditions:

v Anapplicationforexemptionoftheoriginalhomesteadisledinatimelymanner;

v A new homestead is purchased between January 1 and August 15th, and the new homestead is occupied by

the applicant by August 15th; and

v An Application for Transfer, Form 458T,mustbeledwiththecountyassessorbyAugust15;or

v Ifthenewhomesteadispurchasedinadifferentcounty,theForm458Tmustbeledwiththenewcounty

assessor by August 15.

Life Estate. If an applicant deeds the homestead to another party, but retains a life estate, that applicant is considered

an owner.

Nursing Home Resident. The occupancy requirements will continue to be met during a nursing home stay

provided that:

v The owner intends to return to the residence or mobile home;

v The furnishings are left in place; and

v The residence or mobile home is not sold, leased, or rented.

Death of Applicant. If the applicant is single and dies prior to August 16th, the exemption is removed because the

January 1 through August 15 occupancy requirement is not met. If the applicant is married, the spouse and minor

childrencontinuetobenetfromthehomesteadexemptionforthatyearonly.Thespousemustqualifyandlean

application the following year to continue to receive a homestead exemption.

Multiple Unmarried Owner/Occupants Living in One Homestead. If two eligible persons who are not married

qualifyforanexemptionforthesameproperty,itisnecessaryforbothtoletheForm 458 with the county to

protect the exemption in case one of the applicants dies.

Spouses Owning Two Residences or Mobile Homes. Spouses owning two residences or mobile homes may not

receive two homestead exemptions, unless each spouse lives in his or her own separate residence or mobile home. In

this case, both spouses’ incomes are combined to determine eligibility. In most cases, the residence or mobile home

chosen as the primary residence or mobile home will be the homestead property.

Payment of Property Tax When a Homestead Exemption is Granted. When an exemption is granted, the

taxpayer’s obligation is met by the State paying the tax directly to the county treasurer.

Help Prevent Homestead Exemption Fraud. If you know or suspect an individual is receiving a homestead

exemption illegally, you may report it anonymously by calling 888-475-5101. All information will

remaincondential.

Nebraska Homestead Exemption Information Guide, January 28, 2013, Page 11

Resource List:

Regulations:

v Homestead Exemption Regulations Chapter 45

Statutes:

v Neb.Rev.Stat.§77-3501Denitions,wherefound

v Neb.Rev.Stat.§77-3501.01Exemptamount,dened

v Neb.Rev.Stat.§77-3501.02Closelyrelated,dened

v Neb.Rev.Stat.§77-3502Homestead,dened

v Neb.Rev.Stat.§77-3503Owner,dened

v Neb.Rev.Stat.§77-3504Householdincome,dened

v Neb.Rev.Stat.§77-3505Qualiedclaimant,dened

v Neb.Rev.Stat.§77-3505.01Married,dened

v Neb.Rev.Stat.§77-3505.02Maximumvalue,dened

v Neb.Rev.Stat.§77-3505.03Single,dened.

v Neb.Rev.Stat.§77-3505.04Single-familyresidentialproperty,dened.

v Neb.Rev.Stat.§77-3505.05Medicalcondition,dened.

v Neb. Rev. Stat. § 77-3506.02 County assessor; duties

v Neb. Rev. Stat. § 77-3506.03 Exempt amount; reduction; when; homestead exemption; limitation

v Neb.Rev.Stat.§77-3507Homesteads;assessment;exemptions;qualiedclaimants;basedonincome

v Neb. Rev. Stat. § 77-3508 Homesteads; assessment; exemptions; individuals; based on disability and income

v Neb. Rev. Stat. § 77-3509 Homesteads; assessment; exemptions; certain veterans or unremarried widow or

widower; percentage of exemption

v Neb. Rev. Stat. § 77-3509.01 Transfer of exemption to new homestead; procedure

v Neb. Rev. Stat. § 77-3509.02 Transfer of exemption to new homestead; disallowance for original

homestead; county assessor; duties

v Neb. Rev. Stat. § 77-3509.03 Homesteads; exemptions; property tax statement; contents

v Neb. Rev. Stat. § 77-3510 Homesteads; exemptions; transfers; claimants; forms; contents; county assessor;

furnish;condentiality

v Neb. Rev. Stat. § 77-3511 Homestead; exemption; application; execution

v Neb.Rev.Stat.§77-3512Homestead;exemption;application;whenled

v Neb.Rev.Stat.§77-3513Homestead;exemption;lingrequirements;notice;contents

v Neb.Rev.Stat.§77-3514Homestead;exemption;certicationofstatus;notice;failuretocertify;

penalty; lien

v Neb.Rev.Stat.§77-3514.01Homestead;exemption;lateapplicationorcerticationbecauseofmedical

condition;ling;form;countyassessor;powersandduties;rejection;notice;hearing

v Neb. Rev. Stat. § 77-3515 Homestead; exemption; new owner of property; when claimed

v Neb. Rev. Stat. § 77-3516 Homestead; exemption; application; county assessor; duties

Nebraska Homestead Exemption Information Guide, January 28, 2013, Page 12

v Neb. Rev. Stat. § 77-3517 Homestead; application for exemption; county assessor; Tax Commissioner;

duties; refunds; liens

v Neb. Rev. Stat. § 77-3519 Homestead; exemption; county assessor; rejection; applicant; complaint; contents;

hearing; appeal

v Neb. Rev. Stat. § 77-3520 Homestead; exemption; Tax Commissioner; rejection or reduction; petition;

contents; hearing; appeal

v Neb. Rev. Stat. § 77-3521 Tax Commissioner; rules and regulations

v Neb.Rev.Stat.§77-3522Violations;penalty

v Neb. Rev. Stat. § 77-3523 Homestead; exemption; county treasurer; certify tax revenue lost within county;

reimbursed; manner; distribution

v Neb.Rev.Stat.§77-3524Homestead;exemption;categories;DepartmentofRevenue;maintainstatistics

v Neb.Rev.Stat.§77-3526Paraplegic,multipleamputee;terms,dened

v Neb. Rev. Stat. § 77-3527 Property taxable; paraplegic veteran; multiple amputee; exempt; value; transfer of

property; effect

v Neb. Rev. Stat. § 77-3528 Property taxable; paraplegic; multiple amputee; claim exemption

v Neb. Rev. Stat. § 77-3529 Homestead; exemption; application; denied; other exemption allowed

www.revenue.ne.gov/PAD

888-475-5101 or 402-471-6185

Nebraska Department of Revenue, PO Box 94818, Lincoln, Nebraska 68509-4818

You may also contact your county assessor.