I

(Resolutions, recommendations and opinions)

RECOMMENDATIONS

EUROPEAN SYSTEMIC RISK BOARD

RECOMMENDATION OF THE EUROPEAN SYSTEMIC RISK BOARD

of 21 March 2019

amending Recommendation ESRB/2016/14 on closing real estate data gaps

(ESRB/2019/3)

(2019/C 271/01)

THE GENERAL BOARD OF THE EUROPEAN SYSTEMIC RISK BOARD,

Having regard to the Treaty on the Functioning of the European Union,

Having regard to Regulation (EU) No 1092/2010 of the European Parliament and of the Council of 24 November 2010

on European Union macroprudential oversight of the financial system and establishing a

European Systemic Risk

Board

(

1

), and in particular Ar

ticle 3(2)(b), (d) and (f) and Articles 16 to 18 thereof,

Having r

egard to Decision ESRB/2011/1

of the European Systemic Risk Board of 20 January 2011 adopting the Rules

of Procedure of the European Systemic Risk Board

(

2

), and in particular Ar

ticles 18 to 20 thereof,

Whereas:

(1) The im

plementation of a

framework for monitoring developments in the real estate sector for financial stability

purposes requires the regular collection and distribution at Union level of comparable country data so that real

estate-related risks across Member States can be more accurately assessed and the use of macroprudential policy

instruments can be compared, with the aim of addressing real estate-related vulnerabilities.

(2) Recommendation ESRB/2016/14 of t

he European Systemic Risk Board (

3

) aimed t

o harmonise the definitions

and

indicators used for monitoring residential real estate (RRE) and commercial real estate (CRE) markets and

address existing gaps in the availability and comparability of data on RRE and CRE markets in the Union.

(3) Regulation (EC) No 223/2009 of t

he

European Parliament and of the Council (

4

) and Commission

Decision 2012/504/EU (

5

)

set out the legal framework for European statistics. In view of the experience of the

Community statistical authority, which is the Commission (Eurostat), in providing high quality data for Europe

with the aim of enabling and facilitating comparisons between countries, the Commission’s (Eurostat) contribu

tion to the framework set out in Recommendation ESRB/2016/14 is deemed by

the European Systemic Risk

Board (ESRB) to be of particular importance in order to facilitate the collection by national macroprudential

authorities of data on the indicators on the physical CRE market. The availability of such data would in turn

expedite the implementation of a risk monitoring framework by national macroprudential authorities in order to

eff

ectively monitor the CRE market, and thereby facilitate the identification of risks to financial stability arising

(

1

)

OJ L 331, 15.12.2010, p. 1.

(

2

)

OJ C 58, 24.2.2011, p. 4.

(

3

)

Recommendation ESRB/2016/14 of the European Systemic Risk Board of 31 October 2016 on closing real estate data gaps (OJ C 31,

31.1.2017, p. 1).

(

4

)

Regulation (EC) No 223/2009 of the European Parliament and of the Council of 11 March 2009 on European Statistics and repealing

R

egulation

(EC, Euratom) No 1101/2008 of the European Parliament and of the Council on the transmission of data subject to statis

tical confidentiality to the Statistical Office of the European Communities, Council Regulation (EC) No 322/97 on Community Statis

tics, and Council Decision 89/382/EEC, Euratom establishing a Committee on the Statistical Programmes of the European Communi

ties (OJ L 87, 31.3.2009, p. 164).

(

5

)

Commission

Decision 2012/504/EU of 17 September 2012 on Eurostat (OJ L 251, 18.9.2012, p. 49).

13.8.2019

EN

Official Journal of the European Union C 271/1

from the physical CRE market. For this reason, it is therefore considered crucial to establish a

common mini

mum framework for the collection of the database which is required by national macroprudential authorities in

order to effectively monitor the physical CRE market. The need for such a harmonised framework becomes even

more apparent when the significant volume of cross-border CRE financing is taken into account. In this respect,

a new recommendation, designed to promote a common minimum framework for the development, production

and dissemination of the relevant harmonised indicators, should be added to Recommendation ESRB/2016/14.

In order to ensure the consistency and the quality of the relevant statistical data and to minimise the reporting

burden, the Commission (Eurostat) should also develop and promote statistical standards, methods and proce

dures for the collection of the required statistical data.

(4) Under Article 2 of Council Regulation (EU) No 1096/2010

(

6

)

, the ECB is required to ensure the secretariat of the

ESRB and thereby to provide analytical, statistical, logistical and administrative support to the ESRB. In addition,

under Article 5.3 of the Statute of the European System of Central Banks and of the European Central Bank, the

ECB is required to contribute to the harmonisation, where necessary, of the rules and practices governing the

collection, compilation and distribution of statistics in the areas within its fields of competence. In this respect, it

is important to ensure close cooperation and appropriate coordination between the European Statistical Sys

tem

(

7

)

and the European System of Central Banks (ESCB). To that end, and in accordance with Article 6(3) of

Regulation (EC) No 223/2009, the ongoing consultation activities and the cooperation between the Commission

(Eurostat) and the ECB are deemed to be of particular importance for the purpose of developing the required

statistical standards, methods and procedures.

(5) The statistical work most recently carried out by the ESCB Statistics Committee – assisted by its Real Estate Task

F

or

ce – on the sources of data on indicators related to the financing of CRE and RRE has highlighted the need

for amendments to certain definitions in order to facilitate the monitoring activities of the national macropru

dential authorities. While it is acknowledged that Regulation (EU) 2016/867 of the European Central Bank

(

8

),

which

introduced the AnaCredit project, cannot be relied on alone to fulfil the data needs of national macropru

dential authorities, the definitions of commercial real estate and of residential real estate in Recommendation

ESRB/2016/14 should nevertheless be amended in order to align them more closely with the broader definitions

used in Regulation (EU) 2016/867 in order to facilitate the required financial stability analyses and allow for

a full comparability across countries.

(6) However, amendments t

o

definitions set out in Recommendation ESRB/2016/14 should not prevent national

macroprudential authorities from making use of additional real estate indicators and breakdowns which, based

on the definitions and metrics of those national macroprudential authorities, take into consideration the speci

ficities of their national CRE and RRE markets and are relevant from the financial stability perspective. This

would also ensure adherence by national macroprudential authorities to the principle of proportionality as pro

vided for in Recommendation ESRB/2016/14.

(7) Recommendation ESRB/2016/14 r

equests addressees to report to the ESRB and the Council on the actions

under

taken in response to that Recommendation, or to adequately justify any inaction, in compliance with the

timelines set out in the Recommendation. In this respect, the addressees have made progress towards implement

ing Recommendation ESRB/2016/14 within the recommended timelines. However, the work of some national

macroprudential authorities has been delayed by practical issues, such as the need to establish reporting struc

tures, to identify data sources and to address issues related to the confidentiality of data.

(8) In order to ensure the implementation of Recommendation ESRB/2016/14,

it is therefore necessary to extend

certain deadlines set forth therein. Extending these deadlines will provide national macroprudential authorities

with more time to sort out the abovementioned practical issues. The lack of commonly agreed working defini

tions is of particular concern as regards the relevant indicators on the physical CRE market, and, together with

operational constraints on data availability, makes it difficult to accurately assess and compare risks across

national markets. Therefore the deadlines for implementation of Recommendation ESRB/2016/14 in relation to

t

hose indicators for which national macroprudential authorities do not have the relevant information should be

extended further, in order to allow sufficient time for the development of the necessary definitions and for data

collection.

(

6

)

Council Regulation (EU) No 1096/2010 of 17 November 2010 conferring specific tasks upon the European Central Bank concerning

t

he

functioning of the European Systemic Risk Board (OJ L 331, 15.12.2010, p. 162).

(

7

)

The

European Statistical System (ESS) is the partnership between the Community statistical authority, which is the Commission (Euro

stat), and the national statistical institutes (NSIs) and other national authorities responsible in each Member State for the development,

production and dissemination of European statistics.

(

8

)

R

egulation (EU) 2016/867 of the European Central Bank of 18 May 2016 on the collection of granular credit and credit risk data

(ECB/2016/13) (OJ L 144, 1.6.2016, p. 44).

C 271/2

EN

Official Journal of the European Union 13.8.2019

(9) The Gener

al Board does not consider that the extension of certain deadlines established in Recommendation

ESRB/2016/14 will jeopardise the orderly functioning of the financial markets. Additionally, the General Board

does not consider that such an extension would consequently lead to the possibility that addressees might not

implement Recommendation ESRB/2016/14.

(10) The ESRB also ac

knowledges that further technical guidance and work on the target definitions and indicators

may be required in order to accommodate the specificities of markets or market segments, as well as to ensure

the statistical quality of the data. Further amendments to Recommendation ESRB/2016/14 may therefore also be

necessary to address future developments regarding those target definitions and indicators.

(11) Therefore, Recommendation ESRB/2016/14 should be amended accordingly,

HAS ADOPTED THIS RECOMMENDATION:

AMENDMENTS

Recommendation ESRB/2016/14 is amended as follows:

1. in Section 1, paragraph 1 of Recommendation C i

s replaced by the following:

‘

1. National macroprudential authorities are recommended to implement a risk monitoring framework for their

domestic CRE sector. For this purpose, the following set of indicators is recommended for effective monitoring

of risks arising from the CRE market:

Indicators on the physical CRE market:

(a) price index;

(b) rental index;

(c) rental yield index;

(d) vacancy rates;

(e) construction starts;

Indicators on the financial system’s CRE credit exposures:

(f) CRE lending flows (including CRE property under development or construction);

(g) flows of non-performing CRE loans (including CRE property under development or construction);

(h) flows of loan loss provisions on CRE lending (including CRE property under development or construction);

(i) flows of loan loss pr

ovisions on lending for CRE property under development or construction (as part of

CRE lending);

(j) CRE lending stocks (including CRE property under development or construction);

(k) stocks of non-performing CRE loans (including CRE property under development or construction);

(l) stocks of loan loss pr

ovisions on CRE lending (including CRE property under development or

construction);

(m) stocks of lending for CRE property under development or construction (as part of CRE lending);

(n) stocks of non-per

forming loans for CRE property under development or construction (as part of CRE

lending);

(o) stocks of loan loss pr

ovisions on lending for CRE property under development or construction (as part of

CRE lending).

Indicators on CRE lending standards:

(p) weighted average of the LTV-O for the flows of CRE loans;

13.8.2019

EN

Official Journal of the European Union C 271/3

(q) weighted average of the current loan-to-value ratio (LTV-C) for the stocks of CRE loans;

(r) weighted a

verage of the interest coverage ratio at origination (ICR-O) for the flows of CRE loans and

weighted average of the current interest coverage ratio (ICR-C) for the stocks of CRE loans;

(s) weighted average of the debt service coverage ratio at origination (DSCR-O) for the flows of CRE loans and

weighted average of the current debt service coverage ratio (DSCR-C) for the stocks of CRE loans.

The information on these indicators should relate to credit providers on a solo basis and should be sufficiently

representative of the domestic CRE market.’;

2. in Section 1, paragraph 2 of Recommendation D is replaced by the following:

‘2. National macroprudential authorities are recommended to monitor risks in relation to the different indicators

on the basis of the following information as specified in Templates A, B and C of Annex III to this

Recommendation:

(a) For the price index, rental index, rental yield index, vacancy rates and construction starts, national macro

prudential authorities should consider a breakdown by:

— property type;

— property location.

(b) For f

lows and stocks of valuation adjustments on CRE investments, national macroprudential authorities

should consider a breakdown by:

— property type;

— property location;

— investor type;

— investor nationality.

(c) For CRE lending f

lows and stocks and for each of the breakdowns of lending to CRE (including CRE prop

erty under development or construction) – i.e. lending for property held by owners for the purpose of

conducting their business, purpose or activity, either existing or under construction; lending for rental hous

ing; lending for income-producing real estate (other than rental housing); lending for CRE property under

development; and lending for social housing – national macroprudential authorities should consider

a further breakdown by:

— property type;

— property location;

— lender type;

— lender nationality.

(d) For flows and stocks of non-performing CRE loans and for each of the breakdowns of non-performing CRE

loans

(including CRE property under development or construction) – i.e. lending for property held by own

er

s for the purpose of conducting their business, purpose or activity, either existing or under construction;

lending for rental housing; lending for income-producing real estate (other than rental housing); lending for

CRE property under development; and lending for social housing – national macroprudential authorities

should consider a further breakdown by:

— property type;

— property location;

— lender type;

— lender nationality.

C 271/4

EN

Official Journal of the European Union 13.8.2019

(e) For f

lows and stocks of loan loss provisions on CRE lending and for each of the breakdowns of loan loss

provisions on CRE lending (including CRE property under development or construction) – i.e. lending for

property held by owners for the purpose of conducting their business, purpose or activity, either existing or

under construction; lending for rental housing; lending for income-producing real estate (other than rental

housing); lending for CRE property under development; and lending for social housing – national macro

prudential authorities should consider a further breakdown by:

— property type;

— property location;

— lender type;

— lender nationality.

The breakdo

wns as referred to in points (a) to (e) above are to be considered as the recommended minimum.

National macroprudential authorities may add additional breakdowns as they may deem necessary for financial

stability purposes.’;

3. in Section 1, the following Recommendation is added:

‘

Recommendation F – Establishment of a common minimum framework for the physical commercial real

estate market

1. The Commission (Eur

ostat) is recommended to propose Union legislation establishing a common minimum

framework for the development, production and dissemination of a database on indicators on the physical CRE

market referred to in paragraphs (a) to (e) of sub-recommendation C(1).

2. The Commission (Eurostat) is also recommended to develop and promote statistical standards, sources, methods

and pr

ocedures for developing the database on the indicators on the physical CRE market referred to in para

graphs (a) to (e) of sub-recommendation C(1), in particular to ensure the quality of this set of indicators and

minimise the reporting burden.’;

4. Section 2(1)(1) is amended as follows:

(a) point (3) is replaced by the following:

‘“buy-to-let housing or pr

operty” means any RRE directly owned by a natural person primarily for letting to

tenants;’;

(b) point (4) is replaced by the following:

‘

“commercial real estate” (CRE) means any income-producing real estate, either existing or under development,

including rental housing; or real estate used by the owners of the property for conducting their business, pur

pose or activity, either existing or under construction; that is not classified as RRE; and includes social housing.

If a property has a mixed CRE and RRE use, it should be consider

ed as different properties (based for example

on the surface areas dedicated to each use) whenever it is feasible to make such breakdown; otherwise, the

property can be classified according to its dominant use;’;

(c) point (5) is replaced by the following:

‘

“commercial real estate (CRE) loan” means a loan extended to a legal entity aimed at acquiring income-produc

ing real estate (or set of properties defined as income-producing real estate), either existing or under develop

ment, or real estate used by the owners of the property for conducting their business, purpose or activity (or set

of such properties), either existing or under construction, or secured by a commercial real estate property (or

set of commercial real estate properties);’;

(d) the following point (16a) is inserted:

‘

“income-producing property under development” means all property under construction and intended to pro

vide, upon completion, an income to its owner in the form of rents or profits from its sale, but does not

include buildings being demolished or sites being cleared for possible development in the future;’;

13.8.2019

EN

Official Journal of the European Union C 271/5

(e) point (32) is replaced by the following:

‘

“owner occupied housing or property” means any residential real estate owned by a natural person for the

purpose of providing shelter to its owner;’;

(f) point (34) is deleted;

(g) the following point (36a) is inserted:

‘

“rental housing” means any real estate which is owned by legal entities primarily for letting to tenants;’

(h) point (38) is replaced by the following:

‘“residential real estate” (RRE) means any immovable property available for dwelling purposes, either existing or

under construction, acquired, built or renovated by a natural person, including buy-to-let housing. If a property

has a mixed use, it should be considered as different properties (based for example on the surface areas dedi

cated to each use) whenever it is feasible to make such breakdown; otherwise, the property can be classified

according to its dominant use;’;

(i) point (39) is replaced by the following:

‘“residential real estate (RRE) loan” means a loan to a natural person secured by a residential real estate property,

independent of the purpose of the loan;’;

5. Section 2(3) is replaced by the following:

‘

3. Timeline for the follow-up

Addressees are requested to report to the ESRB and the Council on the actions taken in response to this Rec

ommendation, or adequately justify any inaction, in compliance with the following timelines.

1. Recommendation A

(a) By 31 December 2019, national macroprudential authorities are requested to deliver to the ESRB and

the Council an interim report on the information already available, or expected to be available, for the

implementation of Recommendation A.

(b) By 31 December 2020, national macr

oprudential authorities are requested to deliver to the ESRB and

the Council a final report on the implementation of Recommendation A.

2. Recommendation B

(a) By 31 December 2019, national macroprudential authorities are requested to deliver to the ESRB and

the Council an interim report on the information already available, or expected to be available, for the

implementation of Recommendation B.

(b) By 31 December 2020, national macroprudential authorities are requested to deliver to the ESRB and

the Council a final report on the implementation of Recommendation B.

3. Recommendation C

(a) By 31 December 2019, national macroprudential authorities are requested to deliver to the ESRB and

the Council an interim report on the information already available, or expected to be available, for the

implementation of Recommendation C.

(b) By 31 December 2021, national macr

oprudential authorities are requested to deliver to the ESRB and

the Council a final report on the implementation of Recommendation C.

(c) Where national macr

oprudential authorities do not have the relevant information in relation to those

indicators referred to in points (a) to (e) of Recommendation C(1), those authorities are requested to

deliver to the ESRB and the Council a final report on the implementation of Recommendation

C in

r

elation to those indicators at the latest by 31 December 2025.

4. Recommendation D

(a) By 31 December 2019, national macr

oprudential authorities are requested to deliver to the ESRB and

the Council an interim report on the information already available, or expected to be available, for the

implementation of Recommendation D.

C 271/6

EN

Official Journal of the European Union 13.8.2019

(b) By 31 December 2021, national macr

oprudential authorities are requested to deliver to the ESRB and

the Council a final report on the implementation of Recommendation D.

(c) Where national macr

oprudential authorities do not have the relevant information in relation to those

indicators referred to in point (a) of Recommendation D(2) as specified in Template A of Annex III to

this Recommendation, those authorities are requested to deliver to the ESRB and the Council a final

report on the implementation of Recommendation D in relation to those indicators at the latest by

31 December 2025.

5. Recommendation E

(a) By 31 December 2017, t

he ESAs are requested to define a template for the publication of data on the

exposures of the entities under the scope of their supervision to each of the national CRE markets in the

Union.

(b) By 30 June 2018, t

he ESAs are requested to publish the data referred to in point (a) as at 31 December

2017.

(c) Starting on 31 March 2019, the ESAs are requested to publish on an annual frequency, the data referred

t

o in point (a) as at 31 December of the preceding year.

6. Recommendation F

(a) By 31 December 2021, t

he Commission (Eurostat) is requested to deliver to the ESRB and the Council

an interim report containing a first assessment of the implementation of Recommendation F.

(b) By 31 December 2023, t

he Commission (Eurostat) is requested to deliver to the ESRB and the Council

a final report on the implementation of Recommendation F.’;

6. Annex I is replaced by Annex I to this Recommendation;

7. Annex II is replaced by Annex II to this Recommendation;

8. Annex III is replaced by Annex III to this Recommendation;

9. Annex IV is replaced by Annex IV to this Recommendation;

10. Annex V is replaced by Annex V to this Recommendation.

Done at Frankfurt am Main, 21 March 2019.

The Head of the ESRB Secretariat,

on behalf of the General Board of the ESRB

Francesco MAZZAFERRO

13.8.2019

EN

Official Journal of the European Union C 271/7

ANNEX I

Annex I to Recommendation ESRB/2016/14 is replaced by the following:

‘ANNEX I

COMPLIANCE CRITERIA FOR THE RECOMMENDATIONS

1. Recommendation A

National macroprudential authorities will be deemed to comply with Recommendations A(1) and A(2), where they:

a) assess whether the relevant indicators on lending standards for RRE loans are considered or implemented in the risk

monit

oring framework of the RRE sector in their jurisdiction;

b) assess progress on the use of the indicators specified in Recommendation A(1) for such monitoring;

c) assess the extent to which the information, already available or expected to be available in the future, on the relevant

indicat

ors is sufficiently representative of current lending standards in their RRE loan market;

d) assess whe

ther buy-to-let housing represents a significant source of risks stemming from the domestic real estate

sector or constitutes a significant share of the stock or flows of total RRE lending;

e) in cases where buy

-to let housing is considered a significant source of risks stemming from the domestic real estate

sector or constitutes a significant share of the stock or flows of total RRE lending, assess progress on the use of the

indicators for risk monitoring specified in Recommendation A(2).

National macroprudential authorities will be deemed to comply with Recommendations A(3) and A(4) where they:

a) ensure t

he adoption of the methods specified in Annex IV for the calculation of the indicators listed in Recommen

dations A(1) and A(2);

b) in cases where ano

ther method is used in addition to that specified in Annex IV for the calculation of the relevant

indicators, report on the method’s technical features and its effectiveness in monitoring risks arising from the RRE

sector;

c) ensure t

hat the relevant indicators listed in Recommendations A(1) and A(2) are used to monitor risks in the RRE

sector at least annually.

2. Recommendation B

National macroprudential authorities will be deemed to comply with Recommendations B(1) and B(2), where they:

a) assess pr

ogress on the monitoring of the univariate distribution and the selected joint distributions of the relevant

indicators as specified in Template A of Annex II;

b) assess pr

ogress on the use of the information specified in Recommendation B(2) and in Template A of Annex II as

a guidance to monitor the relevant risks.

In cases wher

e buy-to-let housing is considered a significant source of risks stemming from the domestic real estate

sector or constitutes a significant shar

e of the stock or flows of total RRE lending, national macroprudential authorities

will be deemed to comply with Recommendation B(3) where they:

a) assess pr

ogress on the separate monitoring of the relevant indicators for buy-to-let housing and owner occupied

properties;

b) assess pr

ogress on the monitoring of the relevant data broken down by the dimensions as specified in Templates

A and B of Annex II.

C 271/8

EN

Official Journal of the European Union 13.8.2019

3. Recommendation C

National macroprudential authorities will be deemed to comply with Recommendations C(1) and C(2) where they:

a) assess whether the relevant indicators for domestic CRE exposures are considered or implemented in the risk moni

toring framework for the CRE sector in their jurisdiction;

b) ensure inclusion in t

he risk monitoring framework of the indicators on the physical CRE market, the indicators on

financial system credit exposures and the indicators on lending standards;

c) assess whether investments represent a significant source of financing for the domestic CRE sector;

d) in cases where in

vestments are considered a significant source of financing for the domestic CRE sector, assess

progress on the use of the additional indicators for risk monitoring specified in Recommendation C(2);

e) assess progress on the use of the indicators specified, at a minimum, in Recommendation C(1) and, where applicable,

in

Recommendation C(2);

f) assess whether the information on these indicators (already available or expected to be available) is sufficiently repre

sent

ative of the domestic CRE market.

National macroprudential authorities will be deemed to comply with Recommendations C(3) and C(4) where they:

a) ensure the adoption of the methods for the calculation of the indicators listed in Recommendation C(1) and Recom

mendation

C(2) as specified in Annex V and, where appropriate for CRE, in Annex IV;

b) in cases where ano

ther method is used in addition to that specified in Annex IV and Annex V for the calculation of

the relevant indicators, report on the method’s technical features and its effectiveness in monitoring risks arising

from the CRE sector;

c) ensure t

hat the indicators listed in Recommendation C(1) are used to monitor developments in the CRE sector at

least quarterly for indicators on the physical CRE market, lending flows (including flows of non-performing loans

and loan loss provisions) and the corresponding lending standards, and at least annually for stocks of loans (includ

ing stocks of non-performing loans and loan loss provisions) and the corresponding lending standards;

d) in cases wher

e investments are considered a significant source of financing for the domestic CRE sector, ensure that

the indicators listed in Recommendation C(2) are used to monitor developments in the CRE sector at least quarterly

for investment flows (including valuation adjustments on investments) and at least annually for stocks of investments

(including valuation adjustments on investments).

4. Recommendation D

National macroprudential authorities will be deemed to comply with Recommendation D where they:

a) assess progress in monitoring the relevant indicators as specified in Templates A, B and C of Annex III;

b) assess pr

ogress on the use of the relevant information as specified in Recommendation D(2) and indicated in Tem

plates A, B and C of Annex III as a guidance to monitor the relevant risks;

c) in cases where in

vestments are considered a significant source of financing for the domestic CRE sector, assess

progress on the use of the relevant information as specified in Recommendation D(3) and indicated in Template B of

Annex III as a guidance to monitor relevant risks;

d) in cases where additional indicat

ors are used to monitor developments in the CRE sector, report on the additional

information used for monitoring risks.

13.8.2019

EN

Official Journal of the European Union C 271/9

5. Recommendation E

The ESAs will be deemed to comply with Recommendation E where they:

a) define a template for the publication of data on the exposures of the entities under the scope of their supervision to

eac

h national CRE market in the Union;

b) publish at leas

t annually aggregated data collected under existing reporting requirements on the exposures of the

entities under the scope of their supervision to each national CRE market in the Union.

6. Recommendation F

The Commission (Eurostat) will be deemed to comply with Recommendation F where:

a) based on t

he suitability of the definitions and breakdowns for the relevant indicators on the physical CRE market

which are currently used within Member States, it proposes Union legislation establishing a common minimum

framework for the development, production and dissemination of a database on the relevant indicators with the aim

of harmonising such indicators;

b) it ensures the alignment of the proposed legislation with the indicators and their definitions, as used for supervisory

or

financial stability purposes, so as to avoid an unjustified increase in the burden on reporting entities;

c) it ensures t

he quality of the relevant indicators on the physical CRE market by developing statistical standards,

sources, methods and procedures for developing the database on the relevant indicators;

d) it ensures that the implementation of the developed statistical standards, sources, methods and procedures relating to

t

he database on the relevant indicators on the physical CRE market does not lead to an unjustified increase in the

burden on reporting entities;

e) it pr

omotes the implementation of the statistical standards, sources, methods and procedures developed for the pro

duction of the database on relevant indicators on the physical CRE market.’.

C 271/10

EN

Official Journal of the European Union 13.8.2019

ANNEX II

Annex II to Recommendation ESRB/2016/14 is replaced by the following:

‘ANNEX II

INDICATIVE TEMPLATES FOR INDICATORS ON THE RESIDENTIAL REAL ESTATE SECTOR

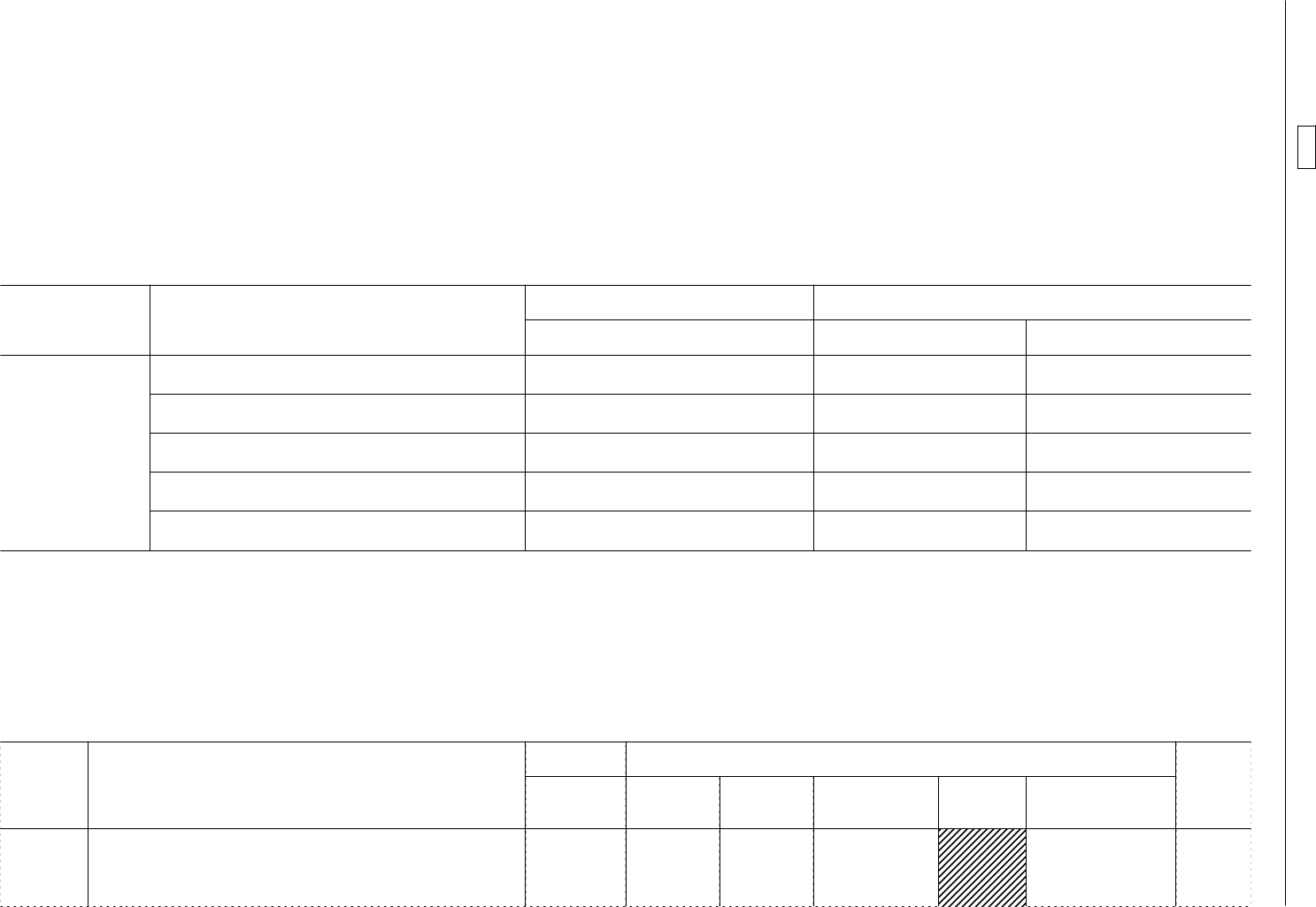

1. Template A: indicators and related breakdowns for RRE loans

Templates for residential real estate

FLOWS = new pr

oduction of RRE loans within the reporting period, as considered by the lender. National macro-prudential authorities which are able to distinguish between

truly new RRE loans and renegotiated loans are provided the option to identify renegotiated loans as a separate breakdown.

STOCKS = Data for the stocks of RRE loans at reporting date (e.g. end of year)

ncu = amount in national currency

# = number of contracts

y = year(s)

Avg = average of the relevant ratio

o/w = of which

UNIVARIATE DISTRIBUTION

Overview of RRE loan portfolio FLOWS Loan-service-to-income at origination (LSTI-O) FLOWS

Loans disbursed

ncu, #

WEIGHTED AVERAGE

Avg (in

%)

o/w buy-to-let

ncu, #

o/w buy-to-let

Avg (in

%)

o/w owner-occupied

ncu, #

o/w owner-occupied

Avg (in

%)

o/w first-time buyers

ncu, #

o/w first-time buyers

Avg (in

%)

o/w loans in foreign currency

ncu, #

o/w loans in foreign currency

Avg (in

%)

o/w fully amortising

ncu, #

o/w fully amortising

Avg (in

%)

o/w partially amortising

ncu, #

o/w partly amortising

Avg (in

%)

o/w non-amortising (*)

ncu, #

o/w non-amortising (*)

Avg (in

%)

13.8.2019

EN

Official Journal of the European Union C 271/11

Overview of RRE loan portfolio FLOWS Loan-service-to-income at origination (LSTI-O) FLOWS

o/w property in individual territories (**)

ncu, #

o/w property in individual territories (**)

Avg (in

%)

o/w ≤ 1y initial interest rate fixation period

ncu, #

o/w ≤ 1y initial interest rate fixation period

Avg (in

%)

o/w ] 1y; 5y] initial interest rate fixation period

ncu, #

o/w ] 1y; 5y] initial interest rate fixation period

Avg (in

%)

o/w ] 5y; 10y] initial interest rate fixation period

ncu, #

o/w ] 5y; 10y] initial interest rate fixation period

Avg (in

%)

o/w > 10y initial interest rate fixation period

ncu, #

o/w > 10y initial interest rate fixation period

Avg (in

%)

o/w renegotiated (optional)

ncu, #

DISTRIBUTION

≤10

%

ncu, #

]10 % ; 20 %]

ncu, #

Loan-to-value at origination (LTV-O)

FLOWS

]20 % ; 30 %]

ncu, #

WEIGHTED AVERAGE

Avg (in

%)

]30 % ; 40 %]

ncu, #

o/w buy-to-let

Avg (in

%)

]40 % ; 50 %]

ncu, #

o/w owner-occupied

Avg (in

%)

]50 % ; 60 %]

ncu, #

o/w first-time buyers

Avg (in

%)

> 60 %

ncu, #

o/w loans in foreign currency

Avg (in

%)

Not available

ncu, #

o/w fully amortising

Avg (in

%)

o/w partially amortising

Avg (in

%)

C 271/12

EN

Official Journal of the European Union 13.8.2019

Loan-to-value at origination (LTV-O)

FLOWS

o/w non-amortising (*)

Avg (in

%)

Debt-service-to-income at origination (DSTI-O)

(OPTIONAL)

FLOWS

o/w property in individual territories (**)

Avg (in

%)

WEIGHTED AVERAGE

Avg (in %)

DISTRIBUTION

DISTRIBUTION

≤ 50 %

ncu, #

≤10 %

ncu, #

]50 % ; 60 %]

ncu, #

]10 % ; 20 %]

ncu, #

]60 % ; 70 %]

ncu, #

]20 % ; 30 %]

ncu, #

]70 % ; 80 %]

ncu, #

]30 % ; 40 %]

ncu, #

]80 % ; 90 %]

ncu, #

]40 % ; 50 %]

ncu, #

]90 % ; 100 %]

ncu, #

]50 % ; 60 %]

ncu, #

]100 % ; 110

%]

ncu, #

> 60 %

ncu, #

> 110 %

ncu, #

Not available

ncu, #

Not available

ncu, #

Current loan-to-value (LTV-C) STOCKS Loan-to-income at origination (LTI-O) FLOWS

WEIGHTED AVERAGE

Avg (in

%)

WEIGHTED AVERAGE

Avg

DISTRIBUTION

DISTRIBUTION

≤ 50 %

ncu, #

≤3

ncu, #

]50 % ; 60 %]

ncu, #

]3 ; 3,5]

ncu, #

13.8.2019

EN

Official Journal of the European Union C 271/13

Current loan-to-value (LTV-C) STOCKS Loan-to-income at origination (LTI-O) FLOWS

]60 % ; 70 %]

ncu, #

]

3,5 ; 4]

ncu, #

]70 % ; 80 %]

ncu, #

]4 ; 4,5]

ncu, #

]80 % ; 90 %]

ncu, #

]

4,5 ; 5]

ncu, #

]90 % ; 100 %]

ncu, #

]5 ; 5,5]

ncu, #

]100 % ; 110 %]

ncu, #

]

5,5 ; 6]

ncu, #

> 110 %

ncu, #

> 6

ncu, #

Not available

ncu, #

Not available

ncu, #

Maturities at origination FLOWS Debt-to-income at origination (DTI-O) FLOWS

WEIGHTED AVERAGE

Avg (years)

WEIGHTED AVERAGE

Avg

DISTRIBUTION

DISTRIBUTION

≤ 5y

ncu, #

≤3

ncu, #

]5y ; 10y]

ncu, #

]3 ; 3,5]

ncu, #

]10y ; 15y]

ncu, #

]

3,5 ; 4]

ncu, #

]15y ; 20y]

ncu, #

]4 ; 4,5]

ncu, #

]20y ; 25y]

ncu, #

]

4,5 ; 5]

ncu, #

]25y ; 30y]

ncu, #

]5 ; 5,5]

ncu, #

]30y ; 35y]

ncu, #

]

5,5 ; 6]

ncu, #

> 35y

ncu, #

]

6,5 ; 7]

ncu, #

Not available

ncu, #

> 7

ncu, #

Not available

ncu, #

C 271/14

EN

Official Journal of the European Union 13.8.2019

JOINT DISTRIBUTION

FLOWS

Loan-service-to-income at origination

(LSTI-O)

FLOWS

Loan-service-to-income at origination

(LSTI-O)

≤30

% ]30 % ; 50 %] >50 %

Initial interest rate fixation period

≤30 % ]30 % ; 50 %] >50 %

LTV-O ≤ 80

%

o/w ≤ 1y

ncu, # ncu, # ncu, #

Maturity at origination

o/w ] 1y; 5y]

ncu, # ncu, # ncu, #

≤ 20y

ncu, # ncu, # ncu, #

o/w ] 5y; 10y]

ncu, # ncu, # ncu, #

]20y ; 25y]

ncu, # ncu, # ncu, #

o/w > 10y

ncu, # ncu, # ncu, #

> 25y

ncu, # ncu, # ncu, #

LTV-O ]80 %-90

%]

Maturity at origination

FLOWS

Debt-to-income at origination (DTI-O)

≤ 20y

ncu, # ncu, # ncu, #

Loan-to-value at origination (LTV-O)

≤ 4 ]4 ; 6] > 6

]20y ; 25y]

ncu, # ncu, # ncu, #

LTV-O ≤ 80 %

ncu, # ncu, # ncu, #

> 25y

ncu, # ncu, # ncu, #

LTV-O ]80 % ; 90 %]

ncu, # ncu, # ncu, #

LTV-O ]90 %-110

%]

LTV-O ]90 % ; 110 %]

ncu, # ncu, # ncu, #

Maturity at origination

LTV-O >110

%

ncu, # ncu, # ncu, #

≤ 20y

ncu, # ncu, # ncu, #

]20y ; 25y]

ncu, # ncu, # ncu, #

> 25y

ncu, # ncu, # ncu, #

13.8.2019

EN

Official Journal of the European Union C 271/15

FLOWS

Loan-service-to-income at origination

(LSTI-O)

LTV-O >110 %

Maturity at origination

≤ 20y

ncu, # ncu, # ncu, #

]20y ; 25y]

ncu, # ncu, # ncu, #

> 25y

ncu, # ncu, # ncu, #

(*) Where relevant, non-amortising loans for which redemption vehicles exist should be identified separately.

(**) RRE loans provided within the domestic financial system of any Member State may be collateralised by RRE property located in foreign territories. A row should be added for every such foreign territory

whic

h is deemed important for financial stability purposes.

2. Template B: indicators and related breakdowns for buy-to-let and owner occupied RRE loans

Additional templates for countries with a significant buy-to-let risk or market

FLOWS = new production of RRE loans within the reporting period, as considered by the lender. National macro-prudential authorities which are able to distinguish between

truly new RRE loans and renegotiated loans are provided with the option to identify renegotiated loans as a separate breakdown.

STOCKS = Data for the stocks of RRE loans at reporting date (e.g. end of year)

ncu = amount in national currency

# = number of contracts

y = year(s)

Avg = average of the relevant ratio

o/w = of which

BUY-TO-LET LOANS

Overview of buy-to-let loans FLOWS Interest coverage ratio at origination (ICR-O) FLOWS

Loans disbursed

ncu, #

WEIGHTED AVERAGE

Avg

o/w first-time buyers

ncu, #

DISTRIBUTION

o/w loans in foreign currency

ncu, #

≤ 100 %

ncu, #

o/w fully amortising

ncu, #

] 100

% ; 125 %]

ncu, #

C 271/16

EN

Official Journal of the European Union 13.8.2019

Overview of buy-to-let loans FLOWS Interest coverage ratio at origination (ICR-O) FLOWS

o/w partially amortising

ncu, #

] 125

% ; 150 %]

ncu, #

o/w non-amortising (*)

ncu, #

] 150

% ; 175 %]

ncu, #

o/w property in individual territories (**)

ncu, #

] 175

% ; 200 %]

ncu, #

o/w ≤ 1y initial interest rate fixation period

ncu, #

> 200 %

ncu, #

o/w ] 1y; 5y] initial interest rate fixation period

ncu, #

o/w ] 5y; 10y] initial interest rate fixation period

ncu, #

o/w > 10y initial interest rate fixation period

ncu, #

Loan-to-rent ratio at origination (LTR-O)

FLOWS

Loan-to-value at origination (LTV-O)

FLOWS

WEIGHTED AVERAGE

Avg

WEIGHTED AVERAGE

Avg (in

%)

DISTRIBUTION

DISTRIBUTION

≤ 5

ncu, #

≤ 50 %

ncu, #

] 5 ; 10]

ncu, #

]50 % ; 60 %]

ncu, #

] 10 ; 15]

ncu, #

]60 % ; 70 %]

ncu, #

] 15 ; 20 ]

ncu, #

]70 % ; 80

%]

ncu, #

> 20

ncu, #

]80 % ; 90 %]

ncu, #

]90 % ; 100 %]

ncu, #

]100 % ; 110 %]

ncu, #

> 110 %

ncu, #

Not available

ncu, #

13.8.2019

EN

Official Journal of the European Union C 271/17

OWNER OCCUPIED LOANS

Overview of owner occupied loans FLOWS Loan-service-to-income at origination (LSTI-O) FLOWS

Loans disbursed

ncu, #

WEIGHTED AVERAGE

Avg (in

%)

o/w first-time buyers

ncu, #

o/w first-time buyers

Avg (in

%)

o/w loans in foreign currency

ncu, #

o/w loans in foreign currency

Avg (in

%)

o/w fully amortising

ncu, #

o/w fully amortising

Avg (in

%)

o/w partially amortising

ncu, #

o/w partly amortising

Avg (in

%)

o/w non-amortising (*)

ncu, #

o/w non-amortising (*)

Avg (in

%)

o/w property in individual territories (**)

ncu, #

o/w property in individual territories (**)

Avg (in

%)

o/w ≤ 1y initial interest rate fixation period

ncu, #

o/w ≤ 1y initial interest rate fixation period

Avg (in

%)

o/w ] 1y; 5y] initial interest rate fixation period

ncu, #

o/w ] 1y; 5y] initial interest rate fixation period

Avg (in

%)

o/w ] 5y; 10y] initial interest rate fixation period

ncu, #

o/w ] 5y; 10y] initial interest rate fixation period

Avg (in

%)

o/w > 10y initial interest rate fixation period

ncu, #

o/w > 10y initial interest rate fixation period

Avg (in

%)

DISTRIBUTION

Current loan-to-value (LTV-C)

FLOWS

≤10

%

ncu, #

WEIGHTED AVERAGE

Avg (in

%)

]10 % ; 20 %]

ncu, #

o/w first-time buyers

Avg (in

%)

]20 % ; 30 %]

ncu, #

C 271/18

EN

Official Journal of the European Union 13.8.2019

Current loan-to-value (LTV-C)

FLOWS

Loan-service-to-income at origination (LSTI-O) FLOWS

o/w loans in foreign currency

Avg (in

%)

]30 % ; 40 %]

ncu, #

o/w fully amortising

Avg (in %)

]40 % ; 50 %]

ncu, #

o/w partially amortising

Avg (in

%)

]50 % ; 60 %]

ncu, #

o/w non-amortising (*)

Avg (in %)

> 60 %

ncu, #

o/w property in individual territories (**)

ncu, #

Not available

ncu, #

DISTRIBUTION

≤ 50 %

ncu, #

]50 % ; 60 %]

ncu, #

Loan-to-income at origination (LTI-O)

FLOWS

]60 % ; 70 %]

ncu, #

WEIGHTED AVERAGE

Avg

]70 % ; 80 %]

ncu, #

DISTRIBUTION

]80 % ; 90 %]

ncu, #

≤3

ncu, #

]90 % ; 100 %]

ncu, #

]3 ; 3,5]

ncu, #

]100 % ; 110 %]

ncu, #

]

3,5 ; 4]

ncu, #

> 110 %

ncu, #

]4 ; 4,5]

ncu, #

Not available

ncu, #

]

4,5 ; 5]

ncu, #

]5 ; 5,5]

ncu, #

]

5,5 ; 6]

ncu, #

> 6

ncu, #

Not available

ncu, #

13.8.2019

EN

Official Journal of the European Union C 271/19

Current loan-to-value (LTV-C) STOCKS

WEIGHTED AVERAGE

Avg (in

%)

DISTRIBUTION

≤ 50 %

ncu, #

]50 % ; 60 %]

ncu, #

]60 % ; 70 %]

ncu, #

]70 % ; 80 %]

ncu, #

]80 % ; 90 %]

ncu, #

]90 % ; 100 %]

ncu, #

]100 % ; 110 %]

ncu, #

> 110 %

ncu, #

Not available

ncu, #

Maturities at origination in years

FLOWS

WEIGHTED AVERAGE

Avg (in years)

DISTRIBUTION

≤ 5y

ncu, #

]5y ; 10y]

ncu, #

]10y ; 15y]

ncu, #

]15y ; 20y]

ncu, #

]20y ; 25y]

ncu, #

]25y ; 30y]

ncu, #

]30y ; 35y]

ncu, #

> 35y

ncu, #

Not available

ncu, #

(*) Where relevant, non-amortising loans for which redemption vehicles exist should be identified separately.

(**) RRE loans provided within the domestic financial system of any Member State may be collateralised by RRE property located in foreign territories. A row should be added for every such foreign territory

whic

h is deemed important for financial stability purposes.’.

C 271/20

EN

Official Journal of the European Union 13.8.2019

ANNEX III

Annex III to Recommendation ESRB/2016/14 is replaced by the following:

‘ANNEX III

INDICATIVE TEMPLATES FOR INDICATORS ON THE COMMERCIAL REAL ESTATE SECTOR

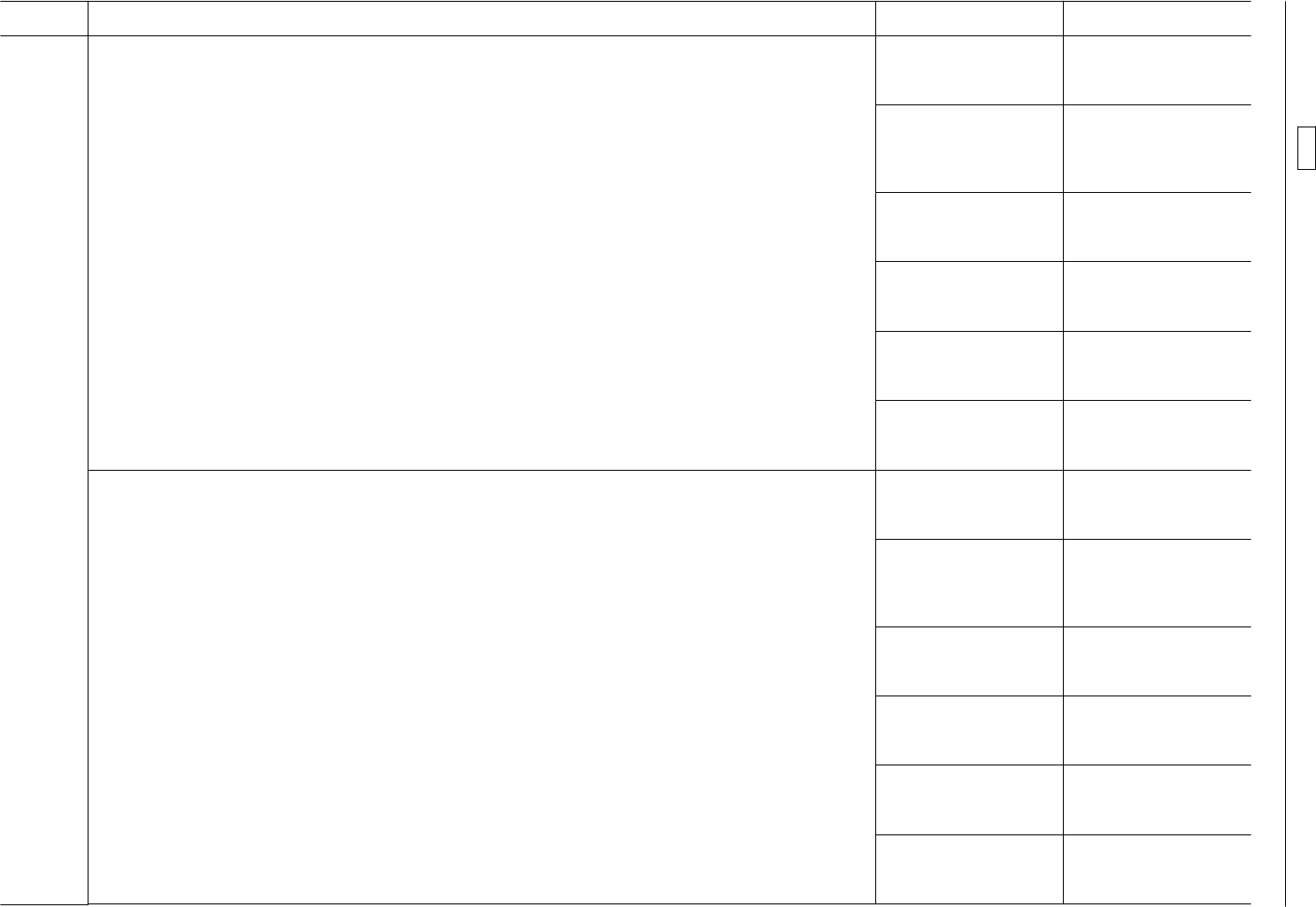

1. Template A: indicators on the physical market

Physical market indicators

Indicator

Breakdown

Frequency

Property type

(

1

) Property location (

2

)

Physical market

CRE price index Quarterly I I

Rental index Quarterly I I

Rental yield index Quarterly I I

Vacancy rates Quarterly R R

Construction starts Quarterly # #

(

1

)

Property type is broken down into office, retail, industrial, residential and other (all domestic market).

(

2

)

Property location is broken down into domestic prime and domestic non-prime.

I = Index

R = Ratio

# = Square metres

2. Template B: indicators on the financial system’s exposures

Exposures indicators

Indicator

Breakdown

Total

Frequency

Property

type

(

1

)

Property

location (

2

)

Investor type (

3

) (

8

)

Lender

type (

4

)

Investor

(

8

) / lender

nationality

(

5

)

Flows (

6

)

Investments in CRE

(

8

)

Quarterly nc nc nc nc nc

— of which direct CRE holdings Quarterly nc nc nc nc nc

13.8.2019

EN

Official Journal of the European Union C 271/21

Indicator

Breakdown

Total

Frequency

Property

type (

1

)

Property

location

(

2

)

Investor type (

3

)

(

8

)

Lender

type (

4

)

Investor (

8

)

/ lender

nationality (

5

)

— of which indirect CRE holdings Quarterly nc nc nc

Valuation adjustments on CRE investments Quarterly nc nc nc nc nc

Lending to CRE (incl. CRE property under development or

constr

uction)

Quarterly nc nc nc nc nc

— of which loans for acquiring property held by owners for

the purpose of conducting their business, purpose or

activity, either existing or under construction

Quarterly nc nc nc nc nc

— of which loans for acquiring rental housing Quarterly nc nc nc nc nc

— of which loans for acquiring income-producing real estate

(other than rental housing)

Quarterly nc nc nc nc nc

— of which loans for acquiring CRE property under

de

velopment

Quarterly nc nc nc nc nc

— of which loans for acquiring property held for social

housing

Quarterly nc nc nc nc nc

Non-performing CRE loans (incl. CRE property under

development or construction)

Quarterly nc nc nc nc nc

— of which loans for acquiring property held by owners for

the purpose of conducting their business, purpose or

activity, either existing or under construction

Quarterly nc nc nc nc nc

C 271/22

EN

Official Journal of the European Union 13.8.2019

Indicator

Breakdown

Total

Frequency

Property

type (

1

)

Property

location

(

2

)

Investor type (

3

)

(

8

)

Lender

type (

4

)

Investor (

8

)

/ lender

nationality (

5

)

— of which loans for acquiring rental housing Quarterly nc nc nc nc nc

— of which loans for acquiring income-producing real estate

(o

ther than rental housing)

Quarterly nc nc nc nc nc

— of which loans for acquiring CRE property under

development

Quarterly nc nc nc nc nc

— of which loans for acquiring property held for social

housing

Quarterly nc nc nc nc nc

Loan loss provisions on CRE lending (incl. CRE property under

development or construction)

Quarterly nc nc nc nc nc

— of which loans for acquiring property held by owners for

the purpose of conducting their business, purpose or

activity, either existing or under construction

Quarterly nc nc nc nc nc

— of which loans for acquiring rental housing Quarterly nc nc nc nc nc

— of which loans for acquiring income-producing real estate

(other than rental housing)

Quarterly nc nc nc nc nc

— of which loans for acquiring CRE property under

development

Quarterly nc nc nc nc nc

— of which loans for acquiring property held for social

housing

Quarterly nc nc nc nc nc

13.8.2019

EN

Official Journal of the European Union C 271/23

Indicator

Breakdown

Total

Frequency

Property

type

(

1

)

Property

location (

2

)

Investor type (

3

) (

8

)

Lender

type (

4

)

Investor

(

8

) / lender

nationality

(

5

)

Stocks (

7

)

Investments in CRE (

8

)

Annually nc nc nc nc nc

— of which direct CRE holdings Annually nc nc nc nc nc

— of which indirect CRE holdings Annually nc nc nc

Valuation adjustments on CRE investments Annually nc nc nc nc nc

Lending to CRE (incl. CRE property under development or

construction)

Annually nc nc nc nc nc

— of which non-performing CRE loans Annually nc nc nc nc nc

— of which loans for acquiring property held by owners for

the purpose of conducting their business, purpose or

activity, either existing or under construction

Annually nc nc nc nc nc

— of which loans for acquiring rental housing Annually nc nc nc nc nc

— of which loans for acquiring income-producing real estate

(o

ther than rental housing)

Annually nc nc nc nc nc

— of which loans for acquiring property held for social

housing

Annually nc nc nc

nc nc

C 271/24

EN

Official Journal of the European Union 13.8.2019

Indicator

Breakdown

Total

Frequency

Property

type (

1

)

Property

location

(

2

)

Investor type (

3

)

(

8

)

Lender

type (

4

)

Investor (

8

)

/ lender

nationality (

5

)

Loan loss provisions on CRE lending Annually nc nc nc nc nc

— of which non-performing CRE loans Annually nc nc nc nc nc

— of which loans for acquiring property held by owners for

t

he purpose of conducting their business, purpose or

activity, either existing or under construction

Annually nc nc nc nc nc

— of which loans for acquiring rental housing Annually nc nc nc nc nc

— of which loans for acquiring income-producing real estate

(o

ther than rental housing)

Annually nc nc nc nc nc

— of which loans for acquiring property held for social

housing

Annually nc nc nc nc nc

Lending to CRE property under development (as part of CRE

lending)

Annually nc nc nc nc nc

— of which non-performing loans Annually nc nc nc nc nc

13.8.2019

EN

Official Journal of the European Union C 271/25

Indicator

Breakdown

Total

Frequency

Property

type (

1

)

Property

location

(

2

)

Investor type (

3

)

(

8

)

Lender

type (

4

)

Investor (

8

)

/ lender

nationality (

5

)

Loan loss provisions on lending to CRE property under

de

velopment

Annually nc nc nc nc nc

(

1

)

Property type is broken down into office, retail, industrial, residential and other, where relevant for the indicator.

(

2

)

Property location is broken down into domestic prime, domestic non-prime, and foreign.

(

3

)

Investor type is broken down into banks, insurance companies, pension funds, investment funds, property companies and others.

(

4

)

Lender type is broken down into banks, insurance companies, pension funds, investment funds, property companies and others.

(

5

)

Nationality is broken down into domestic, European Economic Area and rest of the world.

(

6

)

Flows are on a gross basis for investments, lending and non-performing loans (only new loans/investments are covered without taking into account repayments or reductions on existing amounts).

Flows are on a net basis for valuation adjustments on investments and loan loss provisions.

(

7

)

Stocks data for the stock of CRE investments, valuation adjustments on CRE investments, CRE (non-performing) loans and loan loss provisions on CRE lending at reporting date.

(

8

)

Only in case investments represent a significant share of CRE financing.

nc = Amount in national currency

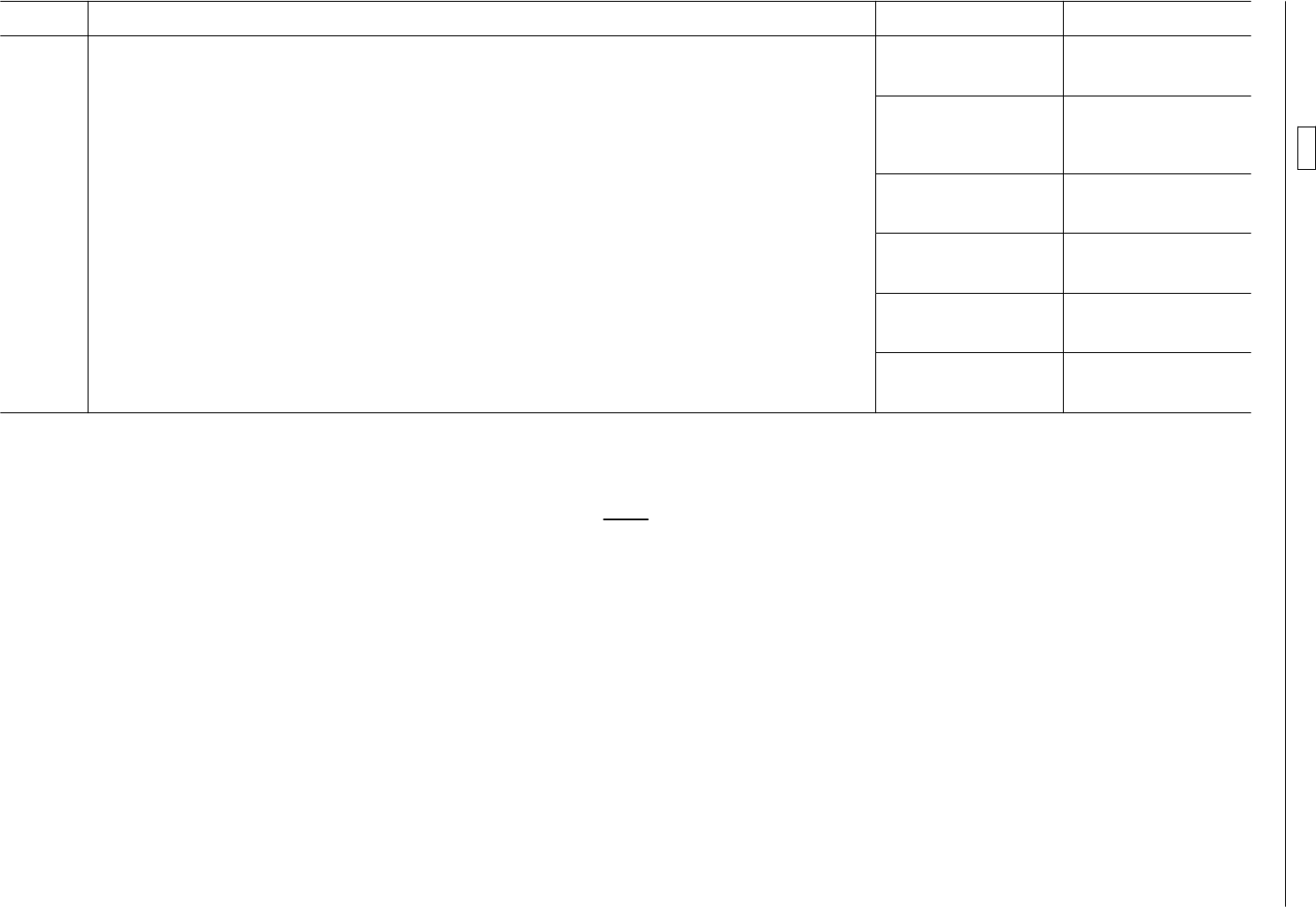

3. Template C: indicators on lending standards

Lending standards indicators (

1

)

Indicator Frequency Weighted average of ratios

Flows (

2

)

Loan-to-value at origination (LTV-O) Quarterly R

— loans for acquiring property held by owners for the purpose of conducting their business, purpose or activity,

eit

her existing or under construction

Quarterly R

— loans for acquiring rental housing

Quarterly R

— loans for acquiring income-producing real estate (other than rental housing)

Quarterly R

— loans for acquiring CRE property under development

Quarterly R

— loans for acquiring property held for social housing

Quarterly R

C 271/26

EN

Official Journal of the European Union 13.8.2019

Indicator Frequency Weighted average of ratios

Interest coverage ratio at origination (ICR-O) Quarterly R

— loans for acquiring property held by owners for the purpose of conducting their business, purpose or activity,

eit

her existing or under construction

Quarterly R

— loans for acquiring rental housing

Quarterly R

— loans for acquiring income-producing real estate (other than rental housing)

Quarterly R

— loans for acquiring CRE property under development

Quarterly R

— loans for acquiring property held for social housing

Quarterly R

Debt service coverage ratio at origination (DSCR-O) Quarterly R

— loans for acquiring property held by owners for the purpose of conducting their business, purpose or activity,

eit

her existing or under construction

Quarterly R

— loans for acquiring rental housing

Quarterly R

— loans for acquiring income-producing real estate (other than rental housing)

Quarterly R

— loans for acquiring CRE property under development

Quarterly R

— loans for acquiring property held for social housing

Quarterly R

13.8.2019

EN

Official Journal of the European Union C 271/27

Indicator Frequency Weighted average of ratios

Stocks (

3

)

Current loan-to-value (LTV-C) Annual R

— loans for acquiring property held by owners for the purpose of conducting their business, purpose or activity,

eit

her existing or under construction

Annual R

— loans for acquiring rental housing

Annual R

— loans for acquiring income-producing real estate (other than rental housing)

Annual R

— loans for acquiring CRE property under development

Annual R

— loans for acquiring property held for social housing

Annual R

Current interest coverage ratio (ICR-C) Annual R

— loans for acquiring property held by owners for the purpose of conducting their business, purpose or activity,

eit

her existing or under construction

Annual R

— loans for acquiring rental housing

Annual R

— loans for acquiring income-producing real estate (other than rental housing)

Annual R

— loans for acquiring CRE property under development

Annual R

— loans for acquiring property held for social housing

Annual R

C 271/28

EN

Official Journal of the European Union 13.8.2019

Indicator Frequency Weighted average of ratios

Current debt service coverage ratio (DSCR-C) Annual R

— loans for acquiring property held by owners for the purpose of conducting their business, purpose or activity,

eit

her existing or under construction

Annual R

— loans for acquiring rental housing

Annual R

— loans for acquiring income-producing real estate (other than rental housing)

Annual R

— loans for acquiring CRE property under development

Annual R

— loans for acquiring property held for social housing

Annual R

(

1

)

Excludes property under development, which can be monitored using the loan-to-cost (LTC) ratio.

(

2

)

Flows data for the new production of CRE loans over the reporting period.

(

3

)

Stocks data for the stock of CRE loans at reporting date.

R = Ratio’

.

13.8.2019

EN

Official Journal of the European Union C 271/29

ANNEX IV

Annex IV to Recommendation ESRB/2016/14 is replaced by the following:

‘ANNEX IV

GUIDANCE ON THE METHODS FOR MEASURING AND CALCULATING THE INDICATORS

This Annex provides high-level guidance on the methods for calculating the indicators used in the Templates of

Anne

x II and, where applicable, also Annex III. Its purpose is not to provide detailed technical instructions for complet

ing the Templates covering all possible cases. Moreover, the guidance should be interpreted as covering target definitions

and target methods, and in some cases divergences might be justified to accommodate for the specificities of markets or

market segments.

1. The loan-to-value ratio at origination (LTV-O)

1. LTV-O is defined as:

LTVO =

L

V

2. For the purpose of the calculation, ‘L’:

(a) Includes

all loans or loan tranc

hes secured by the borrower on the immovable property at the moment of origi

nation (irrespective of the purpose of the loan), following an aggregation of loans ‘by borrower’ and ‘by

collateral’.

(b) Is measured based on disbursed amounts and therefore does not include any undrawn amounts on credit lines. In

the

case of property still being constructed, ‘L’ is the sum of all loan tranches disbursed up to the reporting date,

and LTV-O is computed on the date of disbursement of any new loan tranche

(

1

). Alternatively, if the aforemen

tioned

calculation method is not available or does not correspond to the prevailing market practice, LTV-O can

also be calculated on the basis of the total loan amount granted and the expected value upon completion of the

RRE that is being constructed.

(c) Does not include loans that are not secured by the property, unless the reporting credit provider considers unse

cured

loans part of the housing loan financing transaction, combining both secured and unsecured loans. In that

case, unsecured loans should also be included in ‘L’.

(d) Is not adjusted for the presence of other credit risk mitigants.

(e) Does not include costs and fees related to the RRE loan,

(f) Does not include loan subsidies.

3. For the purpose of the calculation, ‘V’:

(a) Is computed on the basis of the property’s value at origination, measured as the lower of:

1. the transaction value, e.g. as registered in a notarial deed, and

2. the value as assessed by an independent external or internal appraiser.

If only one value is available, this value should be used.

(

1

)

In the case of property still being constructed, the LTV-O at a given point n can be calculated as:

LTVO

n

=

Σ

i=1

n

L

i

V

0

+ Σ

i=1

n

ΔV

i,i−1

Where i = 1, …, n refers to the loan tranches disbursed up to time n, V

0

is the initial value of the real estate collateral (e.g. land) and

ΔV

i,i−1

represents the change in the property’s value that occurred during the periods up to the disbursement of the n-th loan

tranche.

C 271/30

EN

Official Journal of the European Union 13.8.2019

(b) Does not take into account the value of planned renovation or construction works.

(c) In the case of property still being constructed, ‘

V’ accounts for the total value of the property up to the reporting

date (accounting for the increase in value due to the progress of the construction works). ‘V’ is assessed upon

disbursement of any new loan tranche, allowing for the computation of an updated LTV-O.

(d) Is not adjusted for the presence of other credit risk mitigants.

(e) Does not include costs and fees related to the RRE loan.

(f) Is no

t computed as the ‘long-term value’. Whereas the use of the long-term value could be justified by the pro

cyclicality of ‘V’, LTV-O aims at capturing credit standards at origination. Therefore, if, at the moment a RRE loan

is granted and the LTV-O is registered, the ‘V’ did not represent the value of the asset at origination as reported

in the lender’s records, it would not adequately capture the lender’s actual credit policy concerning LTV-O.

4. In addition to calculating the LTV-O in accordance with the method described in paragraphs 2 and 3 above, national

macr

oprudential authorities may also, if they consider it necessary in order to accommodate the specificities of their

markets, also calculate the LTV-O by deducting from the definition of ‘V’ in paragraph 3, the total amount of all

outstanding RRE loans, disbursed or not, that are secured by ‘senior liens’ on the property, instead of including these

loans

in the calculation of ‘L’ as described in paragraph 2.

5. Where t

he loan markets for buy-to-let and owner occupied properties are monitored separately, the definition of

LTV-O applies, subject to the following exceptions:

(a) for buy-to let loans:

— ‘L’ includes onl

y loans or loan tranches, secured by the borrower on the immovable property at the moment

of origination, related to the buy-to-let loan.

— ‘

V’ includes only the value at origination of the buy-to-let property.

(b) for owner occupied loans:

— ‘

L’ includes only loans or loan tranches, secured by the borrower on the immovable property at the moment

of origination, related to the owner occupied loan.

— ‘

V’ includes only the value at origination of the owner occupied property.

6. National macr

oprudential authorities should be attentive to the fact that LTV ratios are procyclical in nature and

should therefore consider such ratios with care in any risk monitoring framework. They could also investigate the

use of additional metrics such as the loan-to-long-term-value, where the value is adjusted according to the long-term

development of a market price index.

2. The current loan-to-value ratio (LTV-C)

1. LTV-C is defined as:

LTVC =

LC

V

C

2. For the purpose of the calculation, ‘

LC’:

(a) Is measur

ed as the outstanding balance of the loan(s) - defined as ‘L’ in Section 1(2) - at the reporting date,

taking into account capital reimbursements, loan restructurings, new capital disbursements, incurred interest,

and, in the case of loans in foreign currencies, changes in the exchange rate.

(b) Is adjust

ed to take account of the savings accumulated in an investment vehicle intended to reimburse the loan

principal. The accumulated savings may be deducted from ‘LC’ only where the following conditions are satisfied:

1) the accumulated savings are unconditionally pledged to the creditor with the express purpose of reimbursing

the loan principal at the contractually anticipated dates; and

13.8.2019

EN

Official Journal of the European Union C 271/31

2) an appr

opriate haircut, determined by the national macroprudential authority, is applied to reflect market

and/or third-party risks associated with the underlying investments.

3. For the purpose of the calculation, ‘VC’:

(a) Reflects t

he changes in the value of ‘V’, as defined in Section 1(3), since the most recent valuation of the prop

erty. The current value of the property should be assessed by an independent external or internal appraiser. If

such assessment is not available, the current value of the property can be estimated using a granular real estate

value index (e.g. based on transaction data). If such a real estate value index is also not available, a granular real

estate price index can be used after application of a suitably chosen mark-down to account for the depreciation

of the property. Any real estate value or price index should be sufficiently differentiated according to the geo

graphical location of the property and the property type.

(b) Is adjusted for changes in the prior liens on the property.

(c) Is computed annually.

4. Where the RRE loan markets for buy-to-let and owner occupied properties are monitored separately, the definition of

L

TV-C applies, subject to the following exceptions:

(a) for buy-to let loans:

— ‘

LC’ includes only loans or loan tranches, secured by the borrower on the immovable property at the moment

of origination, related to the buy-to-let loan.

— ‘

VC’ refers to the current value of the buy-to-let property.

(b) for owner occupied loans:

— ‘

LC’ includes only loans or loan tranches, secured by the borrower on the immovable property at the moment

of origination, related to the owner occupied loan.

— ‘

VC’ includes only the current value of the owner occupied property.

3. The loan-to-income ratio at origination (LTI-O)

1. LTI-O is defined as:

LTIO =

L

I

2. For the purpose of the calculation, ’

L’ has the same meaning as in Section 1(2).

3. For t

he purpose of the calculation, ‘I’ is the borrower’s total annual disposable income as registered by the credit

provider at the moment of the RRE loan origination.

4. In de

termining a borrower’s ‘disposable income’, addressees are encouraged to comply with definition (1) to the

greatest extent possible and with definition (2) as a minimum:

Definition (1): ‘

disposable income’ = employee income + self-employment income (e.g. profits) + income from public

pensions + income from private and occupational pensions + income from unemployment benefits + income from

social transfers other than unemployment benefits + regular private transfers (such as alimonies) + gross rental

income from real estate property + income from financial investments + income from private business or partner

ship + regular income from other sources + loan subsidies – taxes – health care/social security/medical insurance

premiums + tax rebates.

For the purpose of this definition:

(a) ‘

gross rental income from real estate property’ includes both rental income from owned property on which no

RRE loan is currently outstanding and buy-to-let property. The rental income should be determined from the

information that is available to banks or otherwise imputed. If precise information is not available, a best es

ti

mate of rental income should be provided by the reporting institution, and the methodology used to obtain it

should be described;

C 271/32

EN

Official Journal of the European Union 13.8.2019

(b) ‘

taxes’ should include, in order of importance, payroll taxes, tax credits, pension or insurance premiums, if

charged on gross income, specific taxes, e.g. property taxes, and other non-consumption taxes;

(c) ‘

health care/social security/medical insurance premiums’ should include the fixed and compulsory expenditures

that in some countries are made after taxes;

(d) ‘

tax rebates’ should include restitutions from the tax authority that are linked to the RRE loan interest deduction;

(e) ‘

loan subsidies’ should include all public sector interventions aimed at easing the borrower’s debt servicing bur

den (e.g. subsidised interest rates, repayment subsidies).

Definition (2): ‘

disposable income’ = employee income + self-employment income (e.g. profits) – taxes.

5. Where the RRE loan markets for buy-to-let and owner occupied properties are monitored separately, the definition of

L

TI-O applies, subject to the following exceptions:

(a) for buy-to let loans:

— ‘L

’ includes only loans or loan tranches, secured by the borrower on the immovable property at the moment

of origination, related to the buy-to-let loan.

(b) for owner occupied loans:

— ‘

L’ includes only loans or loan tranches, secured by the borrower on the immovable property at the moment

of origination, related to the owner occupied property.

— Where a borrower has bo

th owner occupied loans and buy-to-let loans, only buy-to-let rental income net of

the debt servicing costs on the buy-to-let loans can be used to support the payment of owner occupied loans.

In this case, the first-best definition of ‘

disposable income’ is:

‘

disposable income’ = employee income + self-employment income, e.g. profits + income from public pen

sions + income from private and occupational pensions + income from unemployment benefits + income

from social transfers other than unemployment benefits + regular private transfers, e.g. alimony) + (gross

rental income from real estate property – debt servicing costs on rental property) + income from financial

investments + income from private business or partnership + regular income from other sources + loan sub

sidies – taxes – health care/social security/medical insurance premiums + tax rebates.

4. The debt-to-income ratio at origination (DTI-O)

1. DTI-O is defined as:

DTIO =

D

I

2. For t

he purpose of the calculation, ‘D’ includes the total debt of the borrower, whether or not it is secured by real

estate, including all outstanding financial loans, i.e. g

ranted by the RRE loan provider and by other lenders, at the

moment of the RRE loan origination.

3. For the purpose of the calculation, ‘I’ has the same meaning as in Section 3(4).

5. The loan service-to-income ratio at origination (LSTI-O)

1. LSTI-O is defined as:

LSTIO =

LS

I

2. For t

he purpose of the calculation, ‘LS’ is the annual debt servicing costs of the RRE loan, defined as ‘L’ in

Section 1(2) at the moment of loan origination.

13.8.2019

EN

Official Journal of the European Union C 271/33

3. For the purposes of the calculation, ‘I’ has the same meaning as in Section 3(4).

4. Where the RRE loan markets for buy-to-let and owner occupied properties are monitored separately, the definition of

LSTI-O applies subject to the following exceptions:

(a) for buy-to-let loans:

— ‘