Regional trade agreements (RTAs) can have

positive or negative effects on trade depending

on their design and implementation. Analysis

in this chapter confirms that gains from a pref-

erential trade agreement cannot be taken for

granted; moreover, even in agreements with

positive impacts on average incomes, not all

members are assured of increases. The inter-

esting policy question then is not whether

RTAs are categorically good or bad, but what

determines their success?

The broader policy context in which an

RTA is designed and implemented is crucial.

Agreements that have been designed to com-

plement a general program of economic re-

form have been most effective in raising trade.

When RTAs have tended to be fruitless, it is

often because of the lack of a coherent pro-

gram of reform.

For an RTA itself, the most important

ingredient for success is low trade barriers

with all global partners. Most-favored-nation

(MFN; i.e., nondiscriminatory) liberalization,

which creates more trade, is the fastest and

most efficient way to increase intraregional

trade. In addition, agreements that minimize

excluded products expand the scope for posi-

tive net benefits through competition and

trade creation.

Recent research has added nonrestrictive

rules of origin to the list of successful factors;

local firms must be able to effectively source

materials at the lowest cost. Such rules of ori-

gin are an essential element of agreements that

expand both regional exports and exports to

the rest of the world.

1

RTAs can be a springboard to global mar-

kets, but here too, low MFN trade barriers are

necessary for success. RTAs can help countries

integrate with global markets, but no agree-

ment provides guarantees, so design and im-

plementation matter.

The Impact of RTAs on

Merchandise Trade and Incomes

RTAs cover much more than trade barriers

RTAs have increasingly been designed to cover

much more than formal trade policies (see

chapter 2), and RTAs are signed for a variety

of reasons. The impact of these agreements on

trade determines the extent to which broader

political and social objectives are achieved. It

is difficult to identify an agreement that has

fostered wider political objectives without

achieving economic integration. It is clear that

the political context and broad economic en-

vironment in which integration takes place are

crucial for determining the trade impact. Suc-

cess derives from a strong willingness to liber-

alize and to accept the subsequent economic

adjustments, accompanied by intense mutual

economic dialogue and communication and

genuine efforts toward mutual understanding.

Severe macroeconomic disturbances and a tur-

bulent investment climate can easily disrupt

trade and derail an agreement.

57

Regional Trade Agreements:

Effects on Trade

3

The simplest measure of integration is the

trend in the share of imports from regional part-

ners in the total imports of a region. Successful

regional agreements might be expected to in-

crease trade between partners relative to those

countries’ trade with the rest of the world. But

three important caveats need to be understood.

First, successful regional integration is typ-

ically accompanied by reductions in tariffs for

all partners. Hence, regional trade shares may

not rise even though the volume of regional

trade is increasing. Second, regional trade

agreements that provide for the removal or

reduction in trade costs other than those asso-

ciated with formal trade policies (such as im-

proved customs procedures), may stimulate

trade from all sources. Third, many agree-

ments cover nontrade issues such as invest-

ment, services, and labor, and these can have

important consequences for growth and

incomes. These are analyzed in subsequent

chapters, but it is important to bear in mind

here that an agreement may be successful even

if the propensity for members to trade among

themselves does not increase markedly.

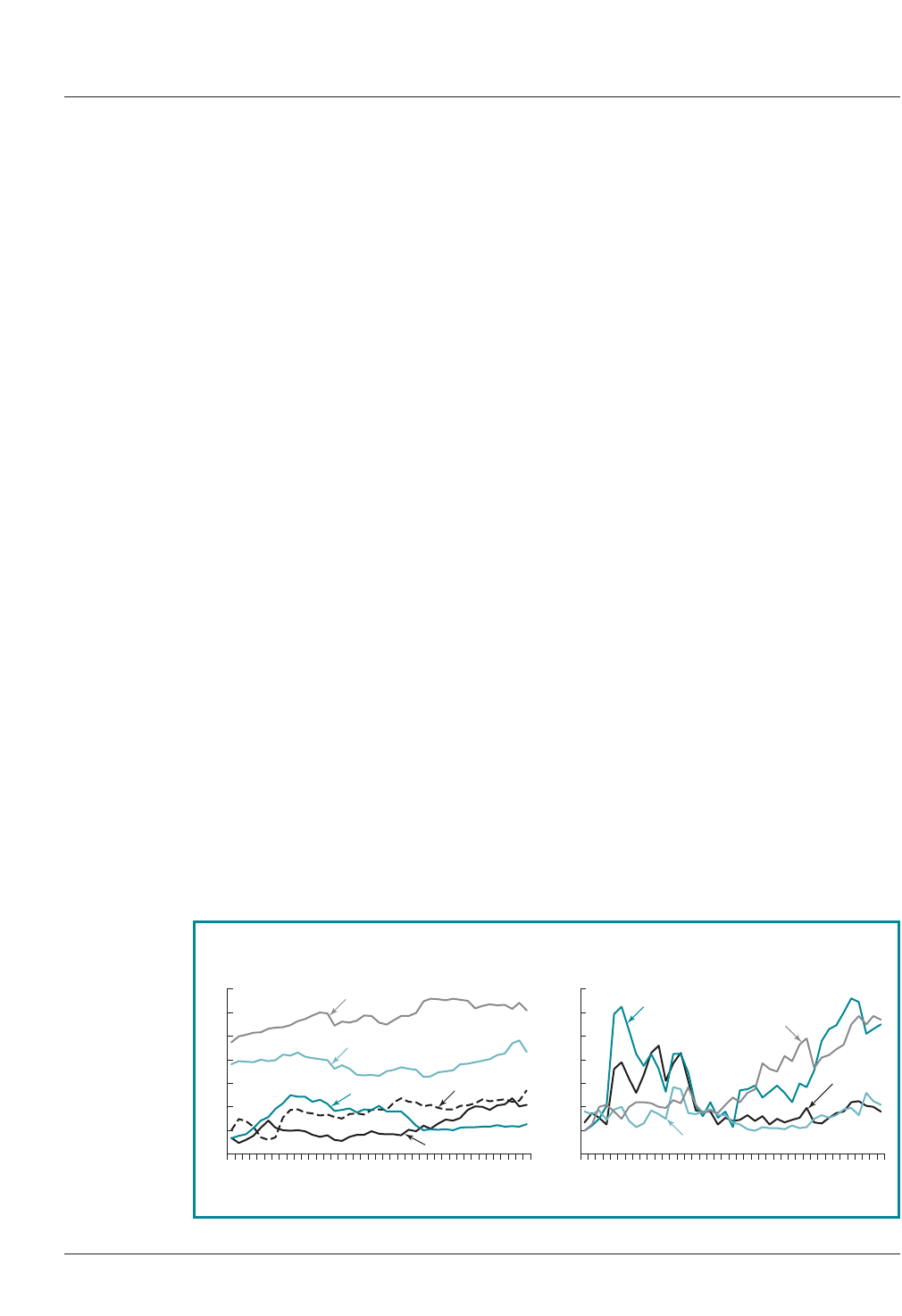

Trade performance in several regional trade

agreements shows that the increase in intra-

regional trade shares of agreements signed in

the 1990s has been substantial (figure 3.1).

The share of intra-NAFTA (North America

Free Trade Agreement) trade rose from less

than 35 percent in the late 1980s to almost

50 percent in 1999. Over the same period, the

importance of trade between MERCOSUR

members doubled from 10 to 20 percent.

For many of the agreements signed in the

1990s, intra-regional trade shares were

growing strongly before the agreements were

signed (NAFTA, MERCOSUR, SAPTA,

SADC). There may have been some anticipa-

tion effect in the year or two before signing, but

this doesn’t explain trend increases in shares

commencing five or more years previous, as in

the case of MERCOSUR. In many cases this in-

crease in regional trade reflects the impact of

unilateral, multilateral, as well as regional trade

liberalization and the fact that agreements

often follow growing trade relationships.

In Africa, the picture is mixed. The extent

of regional integration among the Common

Market for Eastern and Southern Africa

(COMESA) members has been relatively static

over the past two decades. In contrast the

share of intra-area trade has increased sub-

stantially for Economic Community of West

African States (ECOWAS) since the early

1980s and for SADC since the late 1980s. In

East Asia, a region that has experienced sub-

stantial economic progress over the past 20

years, there has been little increase in intra-

regional trade shares.

Given these disparate results, it is necessary

to go beyond simple trade shares to identify

the economic impact of regional trade

GLOBAL ECONOMIC PROSPECTS 2005

58

Figure 3.1 Evolution of the share of intra-regional imports in total imports, 1960–2000

Percent Percent

0

10

20

30

40

60

50

70

ASEAN

MERCOSUR

CACM

NAFTA

EC

1960

1964

1968

1972

1976

1980

1984

1988

1992

1996

2000

1960

1964

1968

1972

1976

1980

1984

1988

1992

1996

2000

0

2

4

6

8

12

SADC

ECOWAS

COMESA

10

14

SAPTA

Source: World Bank staff.

REGIONAL TRADE AGREEMENTS:EFFECTS ON TRADE

59

Revised

1991

Ye a r of

entry

into

force

1994

Ye ar of entry

into force

1992

ASEAN intra

Ye ar of entry

into force

1975

Ye a r of

entry

into

force

1994

Ye a r of

entry

into

force

1991

ASEAN extra

0

2

4

6

10

14

12

8

16

CACM intra

CACM extra

0

5

10

15

20

30

35

25

40

ECOWAS intra

ECOWAS extra

0

5

10

15

20

25

30

35

COMESA intra

COMESA extra

Figure 3.2 The ratio of external and intra-regional trade to GDP

Percent

ASEAN

0

5

10

15

20

35

30

25

50

40

45

1960

1964

1968

1972

1976

1980

1984

1988

1992

1996

2000

Percent

CACM

1960

1964

1968

1972

1976

1980

1984

1988

1992

1996

2000

Percent

COMESA

1960

1964

1968

1972

1976

1980

1984

1988

1992

1996

2000

Percent

ECOWAS

1960

1964

1968

1972

1976

1980

1984

1988

1992

1996

2000

0

2

4

6

10

14

12

8

16

Percent

MERCOSUR

1960

1964

1968

1972

1976

1980

1984

1988

1992

1996

2000

Percent

NAFTA

1960

1964

1968

1972

1976

1980

1984

1988

1992

1996

2000

NAFTA intra

NAFTA extra

0

1

2

3

4

5

6

7

MERCOSUR intra

MERCOSUR extra

Original

Source: World Bank staff.

1961

agreements. Because a decline in the share of

extra-regional trade in total trade will be of

less significance if the total value of trade is

increasing, a logical (and commonly used)

measure is the share of extra- and intra-

regional trade in regional GDP (figure 3.2).

With the exception of MERCOSUR, all

regions that have experienced an increasing

share of intra-regional trade in total trade

have also seen the ratio of extra-regional

trade in GDP increase. The Association of

Southeast Asian Nations (ASEAN) is an

GLOBAL ECONOMIC PROSPECTS 2005

60

interesting example. The share of intra-

regional trade remained fairly flat during the

1990s. However, the ratios of intra-ASEAN

trade to GDP and ASEAN imports from the

rest of the world to GDP have both increased

strongly. ASEAN appears to have been very

successful.

In general, this suggests that external open-

ness and the expansion of intra-regional trade

go together. To take this analysis a little further,

we plot the estimated relationship between an-

nual changesin intra-regional trade and annual

changes in the total volume of world trade, and

we find a positive association in all cases (fig-

ure 3.3). Although crude, this analysis suggests

that the successful expansion of trade among

the members of a regional trade agreement

tends to be associated with increasing extra-

regional imports as a share of GDP and with

the growth of world trade.

2

Do regional trade agreements

stimulate trade?

The analysis just discussed provides useful in-

formation, but it does not directly measure

the impact of regional trade agreements. To

isolate the role of policy—that is, RTAs—

from other factors influencing trade patterns

requires more sophisticated economic

modeling. Different, yet complimentary,

approaches are available that we can crudely

separate into ex ante general equilibrium sim-

ulation studies and ex post econometric

analyses by using the gravity model (box 3.1).

The broad results

3

from general equilib-

rium exercises are that, first, excluded

countries almost always lose. Second, for de-

veloping countries the bottom line determi-

nant of positive income effects is the increase

in market access. Third, in Free Trade Areas

(FTAs) each country can always lower its tar-

iff to ensure gains. This may be more difficult

in a customs union. Finally, regional trade

agreements are typically expected to create

more trade than they divert, although this is

not always the case.

These points are highlighted in figure 3.4,

which summarizes model estimates of the im-

pact of Chile signing FTAs with different re-

gional groupings. Excluded countries lose in

every case. Chile loses from an FTA with

MERCOSUR. FTAs with larger markets

bring bigger gains for Chile but also tend to

entail larger losses for excluded countries.

Large northern countries gain little from

FTAs with substantially smaller southern

partners.

A number of analysts have concluded that

the numerous estimates from the gravity

model generally support the contention that

Annual growth of intra-regional exports (percent)

ECOWAS

SADC

COMESA

MERCOSUR

ASEAN

NAFTA

Annual growth of intra-regional exports (percent)

Figure 3.3 Intra-regional trade grows faster when world trade growth is positive

051015 20 25

Annual growth of world exports (percent)

5

0

5

10

10

15

20

25

30

35

051015 20 25

Annual growth of world exports (percent)

10

5

0

5

15

20

25

30

35

40

CACM

Source: World Bank staff.

REGIONAL TRADE AGREEMENTS:EFFECTS ON TRADE

61

A. Simulation studies: Looking forward to potential

gains

The ex ante studies are based on a specific general

equilibrium model structure that allows a rich analy-

sis of the impact of RTAs at both the aggregate and

sectoral levels. A key strength of this approach is its

ability to highlight which sectors may expand and

which may contract in the face of given resource

constraints. The richness of the model structure,

however, requires that many key parameters be

selected, (often on the basis of an extensive literature

search), with others being derived by a process of

calibration to a single base- year observation; that is,

the remaining parameters are derived such that the

model replicates the situation in the base year. To a

large extent the results of the impact of RTAs are

determined by the choice of value for key relevant

parameters (in this case the price elasticity of

demand for exports). Also, given that parameters are

chosen and not estimated, the statistical properties of

the results are unknown.

The characterization of RTAs is often simple,

with most studies focusing on the removal of tariffs

but ignoring issues such as the rules of origin, prod-

uct exclusions, and services. These simulation exer-

cises answer the question, “What would be the im-

pact of the preferential removal of tariffs against a

limited set of trade partners, given the assumed

model structure?” But they do not tell us whether

particular agreements have actually created or

diverted trade.

B. Econometric studies using the gravity model:

Looking back at actual performance

The gravity model provides a useful framework

for assessing the impact of policy variables on the

behavior of bilateral flows between countries. Its

name is derived from its passing similarity to

Newtonian physics, in that flows between two

countries increase in proportion to their economic

mass (as measured by GDP) and are constrained by

Box 3.1 A primer on modeling of RTAs

the friction between them (due to trade and other

costs, which is proxied by distance). It is also com-

mon to use so-called dummy variables to capture ge-

ographical effects (such as whether the two countries

share a border, or if a country has access to the sea),

cultural and historical similarities (such as if two

countries share a language or were linked by past

colonial ties), and regional integration (such as be-

longing to a free trade agreement or sharing a com-

mon currency). A disadvantage of using dummy vari-

ables is that they may capture the impact of a range

of other effects that occurred during the same time

period as the RTA. For example, most applications

do not distinguish the extent of multilateral trade lib-

eralization. Ideally, specific trade policy variables

would be included in the estimating equations, such

the level of multilateral and preferential tariffs. How-

ever, the complexity of preferential trade arrange-

ments precludes such an approach. A notable excep-

tion is the study done by Estevadeordal and

Robertson (2004), who included a measure of prefer-

ential tariffs in their analysis of the impacts of RTAs

on regional trade in Latin America.

Although widely used because of its empirical

success, the gravity model had lacked rigorous theo-

retical underpinnings and was long criticized for

being an ad hoc model. Recent theoretically

grounded gravity equations are derived from models

with strong constraints on preferences and technol-

ogy, which undermines a straightforward interpreta-

tion of some of the estimated coefficients. Anderson

and van Wincoop (2004) provide a good overview of

this debate. Another weakness of many applications

of the gravity model is the proxying of trade costs by

distance, and the implicit assumption that cargoes

traveling 1,000 miles in Africa face exactly the same

trade costs as similar cargoes traveling 1000 miles in,

say, Europe.

Sources: Inter-American Development Bank 2002 and Bank staff.

RTAs create trade.

4

This merits further analy-

sis. Differing studies have produced sharply

different results for the same agreement. For

example, Bayoumi and Eichengreen (1997)

find no evidence of trade diversion from

enlargement of the European Union (to in-

clude Greece, Portugal, and Spain), whereas

Wei and Frankel (1995) find “massive trade

diversion.” One way to digest this contradic-

tory literature is to combine and assess these

results in a single statistical analysis, called

meta-analysis (box 3.2). This meta-analysis of

the literature on the impact of regional trade

agreements on intra- and extra-regional trade

indicates that although agreements typically

have a positive impact on intra-regional trade,

their overall impact is uncertain. Actual

experience reinforces that there can be no

presumption that a preferential trade agree-

ment will be trade creating.

Do regional trade agreements benefit

all members?

The attention in most of the econometric stud-

ies is on the impact of particular RTAs. Few

studies have sought to estimate the impact of

RTAs on individual members. This is despite

the fact that studies of agreements that failed

in the 1960s typically identify the lack of

mechanisms for redistribution in the presence

of asymmetric impacts as a crucial factor cre-

ating political tension and undermining com-

mitment to the agreement (Greenaway and

Milner 1990). We estimated gravity equations

that identify impacts for individual members

for each of 17 different regional trade agree-

ments to determine whether the statistical evi-

dence suggests that the agreement has created

trade, diverted trade, or had no significant net

effect on trade for each country.

For none of the agreements do we find un-

ambiguous evidence of a net trade-creating

effect extending to all members.

5

Thus even if

an agreement as a whole creates trade, it is

important that there are mechanisms to ensure

that all members benefit.

Regional trade agreements and exports to

the world

So far the analysis has concentrated on

whether increases in intra-regional trade fol-

lowing the signing of a RTA are associated

with falling imports from the rest of the world

relative to a scenario in which the RTA was

not signed. It is equally important to ask how

regional agreements can be used as part of a

broad approach to openness and especially

whether they can provide a springboard to

global markets for local exporters.

Applying the gravity model with an addi-

tional variable to capture overall exports of a

member of a particular set of RTAs, we can

assess whether these countries tend to export

proportionately more than would “normally”

be the case for a similar country that was not

party to the agreements.

6

These results, based on a sample period of

1948 to 2000, show that different agreements

are associated with different propensities

for higher-than-“normal” overall exports

(figure 3.5). AFTA, EC, GCC, MERCOSUR,

NAFTA, and SACU all appear to export signif-

icantly more than they would have done in the

absence of the agreement. The countries that

comprise these regional groups appear to have

adopted policies that led them to be more

export-oriented than they otherwise would

have been. We cannot say, however, that it was

the RTA alone that led to these policies. The

variables that pick up changes in trade flows

may be capturing the effects of unilateral and

multilateral trade policies. Other agreements—

CEMAC, CIS, COMESA, EAC, ECOWAS,

and WAEMU—show a propensity to export

significantly less than “normal.” The Andean

Community and SADC appear to export less

when the whole sample period is considered,

but not when the analysis is confined to the

more recent sub-period, from 1980 to 2000. In

GLOBAL ECONOMIC PROSPECTS 2005

62

Change in welfare ($)

NAFTA

Nafta

Mercosur

Nafta

Mercosur

EU

Figure 3.4 Simulated welfare impact of

various FTAs involving Chile

1000

1000

0

500

500

1500

2000

2500

Other

included

Chile

Sum for excluded

Mercosur

Source: Harrison et al (2004).

that period, the Andean Community also

appears to have been more export-oriented

than they otherwise would have been, perhaps

reflecting substantial trade policy revisions.

Most of the agreements in which export

propensities are lower also appear to generate

fewer imports than would “normal” countries

not participating in the agreements (CEMAC,

CIS, COMESA, EAC, WAEMU). At the same

time, those agreements that appear to be more

export-oriented tend to be more open to im-

ports (AFTA, EC, GCC, MERCOSUR since

1980, NAFTA, SACU). In many cases, there

has been a strong impact on intra-regional

trade. In general, members of regional agree-

ments that have been relatively open to im-

ports have shown higher propensities to export

to the global market than would otherwise be

expected. Elsewhere, intraregional trade has

been initiated, but imports have been diverted

and exports suppressed.

The potential gains from larger markets

and higher growth

Trade of RTA members will be affected

through the changes in trade policies that take

place, but will also change if there is an im-

provement in technology, higher investment,

and a higher rate of growth. By crudely using

dummy variables, gravity models provide a

REGIONAL TRADE AGREEMENTS:EFFECTS ON TRADE

63

M

eta-analysis provides a means of assessing and

combining empirical results from different

studies. The approach takes as individual observa-

tions the point estimates of relevant parameters from

different studies. This set of observations is then used

to test the hypothesis that the relevant coefficient is

statistically different from zero. Here we are con-

cerned with two parameters. The first measures the

impact of the agreement on total imports (which we

label overall impact); a negative value for this para-

meter suggests that for the agreement concerned, the

level of trade between a member and any other coun-

try is less than the normal level of trade that one

could expect. Thus a negative value is evidence of

trade diversion. The second parameter captures the

impact of a regional trade agreement on the level of

trade between partners (internal impact). In our

analysis we have included 254 estimates of overall

impact and 362 estimates of internal impact from

Box 3.2 Regional trade agreements in gravity models:

A meta-analysis

17 research studies. The table below reports the

mean value of the overall and internal impacts, the

standard deviation, the number of statistically signifi-

cant estimates, and the total number of estimates of

each impact.

Of the estimates of the overall impact, 76 percent

are statistically significant, 42 percent are negative

and significant, and 34 percent are positive and sig-

nificant. For the internal impact, 66 percent of the

estimates are statistically significant, 54 percent are

positive and significant, and only 12 percent are neg-

ative and significant. The mean estimate of the over-

all impact is negative. The most robust estimates of

the overall impact are negative. The mean value of

the internal impact is positive. For both parameters

there is a high degree of variance about the mean

values. Within this analysis the estimates of 19 re-

gional agreements were assessed; 10 exhibited on

average net trade diversion.

Summary of the estimates by regional trade agreement

Overall impact Internal Impact

Mean Standard Significant Total Mean Standard Significant Total

Value error estimates estimates value error estimates estimates

Total 0.31 1.12 194 254 0.79 1.30 238 362

Source: World Bank staff.

measure of RTAs, which catches all of these

factors through their impact on trade but can-

not distinguish the precise mechanisms. Com-

plementary approaches look at the impact of

RTAs on these other factors.

Berthelon (2004), using cross-country regres-

sions to estimate the effects of RTAs on growth

during 1960–99, found that RTAs that enlarged

the market substantially had substantial posi-

tive effects on growth. The results suggest, for

example, that the FTA signed between Chile

and the EU might be expected to increase the

growth rate in Chile by 0.6 percentage points

and in the EU by 0.005 percentage points. The

larger market permits wider competition, larger

scales, and greater specialization, all of which

increase productivity and growth. South-South

agreements face an uphill struggle in two re-

spects: they generally entail much smaller mar-

kets, and they have less scope for realizing the

gains from comparative advantage that differ-

ent factor intensities would otherwise bring.

RTAs can also affect growth through tech-

nological transfer. Trade raises total factor

productivity by providing access to a wider

and more advanced range of technologies. The

productivity of an importing country can in-

crease through the importation of intermedi-

ate goods, which as a result of R&D in the

exporting country, are either new and/or of

better quality relative to existing products. In

this way a country that is open to trade can

benefit from R&D activities undertaken over-

seas. RTAs will have a positive effect if they

stimulate imports from technological leaders.

On the other hand, if the trade agreement

leads to trade diversion away from more

technologically advanced sources of inputs,

then there could be a negative impact on

productivity growth.

Schiff and Wang (2003) found that, for Mex-

ico, trade with NAFTA partners had a large and

positive impact on Mexico’s total factor pro-

ductivity (TFP), while trade with the rest of the

GLOBAL ECONOMIC PROSPECTS 2005

64

4 2 02468

Estimated exponential impact on trade

Note: The bars show the magnitude of the dummy variables capturing respectively the extent to which intraregional trade, overall

imports, and overall exports differ from the “normal” levels predicted by the gravity model on the basis of economic size, proximity,

and relevant institutional and historical variables, such as a common language.

10

Figure 3.5 RTAs that divert imports tend to export less to global markets

GCC

AFTA

Overall exports

Overall imports

Intra-regional trade

ANDEAN

CEMAC

Mercosur

SADC

SAPTA

CIS

EAC

WAEMU

COMESA

CACM

ECOWAS

EC

NAFTA

SACU

Source: World Bank staff.

OECD did not. They suggest that this is because

Mexico not only benefited from the content of

trade with the NAFTA partners, the country

also experienced closer contact and more infor-

mation exchanges, especially among subcon-

tracting firms, which are more integrated into

the production networks of their Northern part-

ners than was the rest of the OECD. They simu-

late the impact of NAFTA as a consequence and

find that it has led to a permanent increase in

TFP in Mexican manufacturing of between

5.5 percent and 7.5 percent.

In a later study, Schiff and Wang (2004)

look at the dynamic impact of North-South

trade on technology diffusion to Korea,

Mexico, and Poland from the EU, Japan, and

North America. Using industry level data,

they found that technology diffusion and

REGIONAL TRADE AGREEMENTS:EFFECTS ON TRADE

65

The European Union and agriculture

The founding treaty (the Treaty of Rome), and subse-

quent replacements, commit the European communi-

ties to “the harmonious development of world trade,

the progressive abolition of restrictions on interna-

tional trade, and the lowering of customs barriers.”

The European Union (EU) has failed to meet these

objectives for agricultural products. There is little

doubt that EU agricultural policy has been the source

of considerable disharmony among trading partners.

Movement of Moldovan wine through Ukraine

Moldova is a major producer of wine. Although it

has a free trade agreement with Russia, its main

market, it costs more to ship a case of wine from

Chisinau to Moscow than from Australia to Moscow

(UNECE 2003). Why? Moldovan wine must pass

through Ukraine, usually by rail. Although the two

countries are party to the CIS free trade agreement,

which provides for fair treatment in transit, the

Ukrainian authorities, in addition to imposing delays

and requiring unofficial payments, recently intro-

duced an additional requirement that bulk wines

must be transported in specially heated railway

wagons, although a clear rationale for this is difficult

to ascertain (World Bank 2004).

ASEAN and exclusions from preferences

ASEAN members initially were allowed to exclude

certain products from tariff reduction, a right that

they exercised liberally. In many cases the tariff

reductions offered were of very limited value to other

members. Thailand’s offers, for example, included

wood products that it did not import and that other

members did not produce. Malaysia’s list of products

Box 3.3 Implementation matters

for tariff cuts included a number of rubber products

of which it was a major exporter. Indonesia, which

lies on the equator, offered a 10 percent cut in the

duty on snow plows (Balasubramanyam 1989).

More recently, the trade elements of the agreement

have been intensified with the launching of the AFTA

(ASEAN Free Trade Area), the aim being to create a

genuine free trade area. In 1995 the deadline for

fully implementing AFTA was reduced from 15 to

10 years, although there has been some backsliding

recently from agreed tariff-reduction schedules.

SADC and rules of origin

SADC initially agreed to simple, general, and consis-

tent rules of origin similar to those of neighboring

and overlapping COMESA. The initial rules required

either a change of tariff heading, a minimum of

35 percent of value-added within the region, or a

maximum import content of 60 percent of the value

of total inputs. Subsequently, however, the rules were

revised to include more restrictive sector- and

product-specific rules. The requirement concerning

change of tariff heading has been supplanted by de-

tailed technical-process requirements, a much higher

domestic value added requirement, and lower

permitted import contents. The rules became much

more similar to those of the EU and of NAFTA,

reflecting in part the influence of the recently negoti-

ated EU-South Africa agreement and the rules of

origin governing EU preferences to ACP countries

(Flatters and Kirk 2003). This example illustrates

how sectoral interests and misperceptions of the role

and impact of rules of origin can undermine RTAs.

Source: World Bank staff.

productivity gains tend to be regional. A

possible reason for this being that knowledge

diffusion is also governed by close contacts

and the hands-on relationships that are more

likely with neighbors. Nevertheless, for all

countries the biggest impact of trade on

TFP can be guaranteed by removing trade

barriers on knowledge-intensive goods from

all countries.

Ingredients of Success

Open regions do better

RTAs are only effective for developing coun-

tries if implemented in conjunction with more

comprehensive domestic reforms. At the same

time, a successful RTA will contribute to the

overall economic impact of that reform pro-

gram. In Europe, the eight Central and East-

ern European countries that recently joined

the EU experienced strong growth in trade

and investment inflows during the 1990s; yet

two countries in the region, Bulgaria and

Romania, having almost identical trade agree-

ments with the EU but much less extensive do-

mestic reform programs, saw a much weaker

trade and investment response. Regional inte-

gration initiatives in Latin America in the

1990s have been much more effective than

early efforts, reflecting broad and credible

structural reforms in many countries (Devlin

and French-Davis 1999). Given this context,

there are a number of key features of RTAs

that are likely to contribute to favorable trade

outcomes.

The external trade regime is a crucial de-

terminant of the success of RTAs for several

reasons. First, trade diversion tends to fall

with the level of the external tariffs main-

tained by member countries after they form a

preferential trade agreement. The negative

effects of trade diversion are offset or over-

come if the preferential removal of trade bar-

riers against some countries is accompanied

by a degree of liberalization to all countries,

whether undertaken unilaterally or through

multilateral negotiations. If a country that en-

ters into a free trade agreement increases its

imports from all countries, not just its

partners in the agreement, then it will experi-

ence an improvement in economic welfare.

Therefore, countries forming preferential

trade areas should simultaneously reduce the

level of external protection facing nonmember

trading partners. Risks of trade diversion are

particularly high in the newly proposed South

Asian Free Trade Area (SAFTA); (figure 3.6).

Second, where there are asymmetries in the

level of external protection, it is important

that the high-duty country reduce tariffs to

avoid an adverse terms-of-trade shock. This is

particularly relevant for developing countries

seeking to sign agreements with the EU or the

United States. In developed countries where

tariffs on manufactured products are rather

low (and high-duty agricultural products are

typically excluded from regional preferences),

trade diversion and trade creation are less

likely to be significant. Thus with no trade

being created in the developed market, the de-

cline in domestic sales by firms in the high-

tariff developing country may not be offset by

a rise in exports to the developed country.

Overall, the demand for goods produced in

the high-tariff country may fall, and its terms

of trade could worsen.

Third, low MFN tariffs (and nonrestrictive

rules of origin) ensure that producers within

the regional trade agreement will have access

to competitively priced inputs. In today’s

GLOBAL ECONOMIC PROSPECTS 2005

66

051015 20

Average tariff

Note: Tariffs are import-weighted at the country level to

arrive at PTA averages.

Source: UN TRAINS, accessed through WITS.

25

Figure 3.6 Not all regions are open

SAPTA

COMESA

ECOWAS

EAC

MERCOSUR

AFTA

NAFTA

SADC

globalized market, policies that significantly

raise the input costs of producers will con-

strain their exports to both regional and

global markets. Regional integration is more

likely to be successful if it is achieved on the

basis of strong competition and ease of access

to low-cost inputs.

Trade liberalization is a crucial mechanism

for increasing competition in domestic mar-

kets. Where it is not politically feasible to

open up broadly to all external suppliers, a re-

gional approach can provide a stepping stone

toward the benefits of comprehensive liberal-

ization. However, it is important to take the

second step: Even in a large region such as the

EU, competition from within the region has

been found to be much weaker than that pro-

vided by external imports. Jacquemin and

Sapir (1991), for example, found that profit

margins in European countries were signifi-

cantly dampened by external imports but not

by intra-regional imports. And collusive

agreements are more difficult to enforce for

companies based in distant locations. Firms

that face little competition in local and re-

gional markets will have low incentives to

achieve the efficiency necessary to compete in

world markets.

Clearly RTAs may affect the setting of ex-

ternal tariffs. This is true by definition in the

case of a customs union and indirectly true in

the case of a free trade area. Recent research

finds that World Trade Organization (WTO)

members do not appear to have more liberal

external trade policies than non-WTO mem-

bers (Rose 2004), and that membership in a

RTA has, on average, no clear effect on a coun-

try’s trade policy (Nitsch and Sturm 2003).

Foroutan (1998), on the other hand, concludes

that countries in effective regional groupings,

distinguished by the growth of intra-area

trade, have undertaken more far-reaching

trade liberalization. However, there are cases

of liberalizing countries that did not belong to

an RTA and of countries in an effective RTA

that did not liberalize trade policy. The conclu-

sion is that the acceptance of a liberal trade

policy may be a requirement for the survival

and deepening of a meaningful RTA, whereas

belonging to a regional scheme constitutes nei-

ther a necessary nor a sufficient condition for

an open and liberal trade regime.

In the 1960s and 1970s, preferential agree-

ments among developing countries were typi-

cally accompanied by high external tariff bar-

riers as part of an import substitution strategy.

In contrast, agreements among more devel-

oped countries in the same period were more

often associated with declining external barri-

ers. For example, the simple average external

tariff of the original six members of the Euro-

pean Union fell from 13 percent in 1958 to

6.6 percent after the Kennedy Round of Gen-

eral Agreement on Tariffs and Trade (GATT)

negotiations. Agricultural products were ex-

cluded from these reductions, reflecting their

exclusion from GATT negotiations until the

Uruguay Round. The failure to reduce agricul-

tural tariffs in Europe led to substantial trade

diversion in agriculture with significant wel-

fare losses for European consumers, especially

the poorest, and a considerable hardship for

poor farmers in developing countries.

Many developing countries have since re-

duced external tariff barriers both unilaterally

and through multilateral negotiations. As a

result, recent preferential agreements among

many developing countries have been intro-

duced or revamped with lower external barri-

ers. This is particularly true in Asia and Latin

America, where preferential and MFN tariffs

declined in tandem after 1985, so that margins

of preference remained stable or were slightly

compressed (figure 3.7).

Paper agreements are not enough

Important aspects in the assessment of RTAs

are whether their members have implemented

their objectives under the agreement and the

extent to which the objectives in the agree-

ment have been met. Often the objectives in an

agreement are defined by foreign ministers or

even prime ministers, while the way that those

objectives are to be carried out is determined

later in negotiations between ministries. If tar-

iff concessions are subsequently negotiated

REGIONAL TRADE AGREEMENTS:EFFECTS ON TRADE

67

GLOBAL ECONOMIC PROSPECTS 2005

68

Average tariff rates (percent)

Note: MFN tariffs represents the simple average of the

most-favored-nation tariffs applied by the following 11 Latin

American countries (based on country averages): Argentina,

Bolivia, Chile, Colombia, Ecuador, Mexico, Paraguay, Peru,

Uruguay, and Venezuela. Preferential tariffs represent the

average preferential tariff that each country applies to the

other countries in this sample under different regional trade

agreements. Calculations include only ad valorem tariffs.

Source: Estevadeordal and Robertson 2004.

MFN and preferential tariff liberalization

Latin America, 1985–1997

19971985 1987 1989 19931991 1995

Figure 3.7 Preferential tariffs in tandem

with all tariffs in Latin America

0

20

10

30

40

50

Preferential

tariffs

MFN tariffs

sector by sector or item by item, the process

becomes cumbersome and open to capture by

domestic interests. The distinction is often

made between agreements that reduce duties

only on products specified in a positive list

and other agreements, typically more liberal,

implemented on the basis of a negative list of

products excluded from tariff reduction.

Sectoral accords within RTAs can curb

market forces and limit the benefits from

competition. For example, Ozden and Parodi

(2003) found that the auto agreement embed-

ded in MERCOSUR between Argentina and

Brazil compelled companies in both countries

to balance trade, ensuring that production

would not be reallocated to the lowest cost

producer (Brazil); this move secured the

support of the companies for the agreement.

Because a new entrant would have to build

plants in both countries (not just one), the

agreement acted as a barrier to competition

that favored insiders.

North-South agreements appear to have a

better track record than South-South agree-

ments. The comprehensive tariff objectives of

most North-North agreements signed before

the mid-1980s were implemented on or ahead

of schedule (table 3.1). In contrast, South-

South agreements reached during this

period—most based on limited positive lists of

products for tariff liberalization—had a very

weak record of implementation. The delays in

implementing initial regional tariff commit-

ments “generally reflected a basic incompati-

bility between the inward-oriented develop-

ment strategies of most members and regional

liberalization”(De la Torre and Kelly 1992).

A larger number of South-South agree-

ments signed or substantially revised in the

late 1980s and early 1990s have sought a

much broader degree of internal tariff liberal-

ization, have been more effective in imple-

menting agreed-on tariff reductions, and have

tended to reduce external tariffs. For exam-

ple, the GCC, launched in 1982, was origi-

nally intended to become a free trade area—a

goal achieved by 1983. By the late 1980s,

however, the objective evolved into formation

of a customs union, which was established in

2003 (see World Bank 2003). However,

table 3.1 also reports that substantial prob-

lems with implementation remain in many of

the regional agreements involving developing

countries.

Nonrestrictive rules of origin are integral

to success

Preferential rules of origin are integral to pref-

erential trade agreements. However, it has be-

come increasingly clear that rules of origin

can be designed in a way that restricts trade

beyond what is necessary to prevent trade

deflection or the transshipment of products

from third countries through a member for

the purpose of obtaining preferential duties.

In addition, the proliferation of free trade

agreements with accompanying rules of origin

is increasing the burdens on customs services

in many countries, and these burdens have

consequent implications for trade.

Table 3.1 Implementation of tariff commitments by type of agreement, 1960–1999

Agreement Objective on intra-bloc tariffs Implementation record

North-North agreements reached

from 1960–89

ANZERTA (signed 1983) Eliminate all tariffs by 1988 On schedule

European Economic Eliminate all tariffs by 1968 Ahead of schedule

Community (signed 1957)

U.S.-Canada FTA (1988) Eliminate all tariffs by 1999 Ahead of schedule

EFTA (1960) Eliminate all tariffs on manufactures by mid 1967 On schedule

South-South agreements, 1960–89

Andean Pact (1969) Eliminate tariffs on positive list Postponed several times

Central American Common Elimination of tariffs Initially on schedule, most duties

Market (1960) removed in the early 1970s, but

restrictions reintroduced in the 1980s

EAC (1967–1977) Establishment of a common market The Community was dissolved

Latin American Integration Liberalization of common lists of products by 1972 Common lists not liberalized on

Association schedule

ECOWAS Tariff liberalization by 1990 Progress negligible

ASEAN (1967) FTA based on positive lists Repeatedly postponed

GCC (1982) FTA Virtual elimination of all tariffs in 1983

South-South agreements, 1990–99

AFTA (1992) Gradual reduction of tariffs over 12–15 years Liberalization took place ahead of

according to member-specific schedules original schedule

CACM—Revised (1991) Customs union Implementation postponed; progress

uneven among members

GCC Customs union begins in 2003; completed by 2005 Customs union established on schedule

COMESA Progressive tariff elimination to be completed Implementation varies by country, 9

by 2000 out of 20 members have moved to

duty-free trade

MERCOSUR Elimination of all tariffs by 1995 All lines, with the exception of sugar

and automobiles, have been liberalized

SAPTA Limited tariff concessions from a country-specific No formal schedules have been adopted

positive list

SADC Tariff liberalization by 2008, with sensitive lists Implementation delayed in some sectors

eliminated by 2012 due to lack of agreement on rules of

origin

CEMAC (1999) Economic Union Tariffs liberalized according to schedule

in nearly all lines

WAEMU (2000) Economic and monetary union Tariff liberalization mostly on schedule

North-South agreements, 1990–99

Europe Agreements Country-specific tariff removal schedules in Bulgaria mostly on schedule, Romania

(Bulgaria, Romania) preparation for the EU membership continues to have some unresolved

issues

NAFTA Tariff elimination in stages to be complete by 2008 On schedule

EU-Mexico Progressive tariff elimination by 2010 On schedule

EU-South Africa FTA establishment by 2012 Partial implementation pending

official ratification

U.S.-Chile Progressive tariff elimination by 2015 N/A

Source: World Bank staff.

REGIONAL TRADE AGREEMENTS:EFFECTS ON TRADE

69

In general, the rules of origin in North-

South agreements are more restrictive than

those adopted by South-South agreements

(Figure 3.8). A feature of both EU and NAFTA

agreements is the high degree of variation in

rules of origin across product categories. Dif-

ferent rules are specified for different products:

sometimes the rule may be a change of tariff

heading, sometimes a change of tariff chapter;

for other products there will be a value-added

requirement; and in others the rules of origin

may specify a particular technical process.

The amount of the required value added

can vary across products. The change of tariff

Anson and others (2004) and Carrere and

de Melo (2004) estimate that the administra-

tive costs of providing the documentary evi-

dence to support the certificate of origin under

NAFTA are in the region of 1.8 percent of the

value of exports. The distorted impact of the

rules, resulting from the need to use local and

higher cost inputs to qualify, may be equiva-

lent to an average duty of around 4.3 percent.

Thus, restrictive rules of origin can very easily

wipe out any margin of preference generated

by a trade agreement. Other things being

equal, compliance costs are lowest for rules in-

volving a change of tariff heading, followed by

value-added rules. Rules requiring a specific

technical process have the highest compliance

costs.

Estevadeordal and Suominen (2004)

introduce a synthetic measure of the

restrictiveness of rules of origin (the basis for

figure 3.8) into a standard gravity model of bi-

lateral trade flows. Their econometric analysis

leads them to conclude that restrictive prod-

uct-specific rules of origin undermine overall

trade between preferential partners and that

provisions such as cumulation

7

and de minimis

rules,

8

which increase the flexibility of apply-

ing a given set of processing requirements,

boost intraregional trade. Applied at the sec-

toral level, this approach yields support for the

hypothesis that the restrictiveness of rules of

origin for final goods stimulates trade in inter-

mediate products between preferential part-

ners and diverts trade away from nonmem-

bers. Cadot and others (2002) find that for

sectors where tariff cuts are larger than aver-

age, the rules of origin are more restrictive and

the rate of use of preferences by Mexican ex-

porters lower than average. They conclude

that rules of origin are the “prime culprit” for

the very modest impact of NAFTA on Mexican

exports identified by other researchers.

Deeper agreements can lead to larger trade

and income effects

In principle, agreements that address a wider

range of barriers can have a greater impact on

trade flows and incomes.

GLOBAL ECONOMIC PROSPECTS 2005

70

classification can be used to provide a positive

test of origin by stating the tariff classification

of imported inputs that can be used in the

production of the exported good. Or it may

be defined to provide a (more restrictive) neg-

ative test by stating cases where a change of

tariff classification will not confer origin. For

example, in the EU rules of origin, bread, bis-

cuits, and pastry products (heading 1905 of

the Harmonized System) can be made from

imported products of any other tariff heading

except those of chapter 11, which includes

flour, the basic input to these products.

Specifying rules of origin on a product by

product basis offers opportunities for sectoral

interests to influence the specification of the

rules in a protectionist way. The outcome of

highly detailed product-specific rules of origin

is typically a complex set of rules, which can

be highly restrictive. Box 3.5 provides an ex-

ample of the sort of complexity that can arise.

Many agreements involving developing coun-

tries, on the other hand, tend to specify gen-

eral rules that apply to all products. The

AFTA, COMESA, and ECOWAS, for exam-

ple, have a single value-added rule applicable

to all products.

Index of restrictiveness

Note: Higher values of the index equal more restrictive

rules of origin [derived from Estevadeordal and Suominen

(2004)].

NAFTA

EU-Mexico

EU-Chile

SADC

Chile-CACM

AFTA

COMESA

ECOW

AS

Figure 3.8 Rules of origin in North–South

agreements are more restrictive than in

South–South agreements

0

2

1

3

5

4

6

REGIONAL TRADE AGREEMENTS:EFFECTS ON TRADE

71

Subsequent chapters elaborate on the po-

tential economic impacts of dealing with

many of the regional agreement issues intro-

duced in chapter 2. Here we simply ask

whether deeper agreements have a signifi-

cantly greater impact on aggregate merchan-

dise trade than more narrow trade agree-

ments. Two studies

9

assume a productivity

H

ere is an example of what rules of origin look

like; the following pertains to men’s or boys’

overcoats made of wool (HS620111).

A change to subheading 620111 from any other

chapter, except from heading 5106 through 5113,

5204 through 5212, 5307 through 5308 or

5310 through 5311, Chapter 54 or heading 5508

through 5516, 5801 through 5802 or 6001

through 6006, provided that: The good is both

cut and sewn or otherwise assembled in the

territory of one or more of the Parties.

The basic rule of origin stipulates change of chap-

ter but then provides a list of headings and chapters

from which inputs cannot be used. Thus in effect,

the overcoat must be manufactured from the stage of

wool fibers forward, because neither imported

woolen yarn (HS5106-5110) nor imported woolen

fabric (HS5111-5113) can be used. However, the

rule also states that imported cotton thread

(HS5204) or imported thread of man-made fibers

(HS54) cannot be used to sew the coat together. This

rule in itself is very restrictive; however, the rule is

further complicated by requirements relating to the

visible lining:

Except for fabrics classified in 54082210,

54082311, 54082321, and 54082410, the fabrics

identified in the following subheadings and head-

ings, when used as visible lining material in cer-

tain men’s and women’s suits, suit-type jackets,

skirts, overcoats, car coats, anoraks, windbreak-

ers, and similar articles, must be formed from

yarn and finished in the territory of a party: 5111

through 5112, 520831 through 520859, 520931

through 520959, 521031 through 521059,

521131 through 521159, 521213 through

521215, 521223 through 521225, 540742

through 540744, 540752 through 540754,

540761, 540772 through 540774, 540782

Box 3.4 Restrictive rules of origin under

NAFTA—the case of clothing

through 540784, 540792 through 540794,

540822 through 540824 (excluding tariff item

540822aa, 540823aa or 540824aa), 540832

through 540834, 551219, 551229, 551299,

551321 through 551349, 551421 through

551599, 551612 through 551614, 551622

through 551624, 551632 through 551634,

551642 through 551644, 551692 through

551694, 600110, 600192, 600531 through

600544 or 600610 through 600644.

This stipulates that the visible lining used must be

produced from yarn and finished in either party’s

location. This rule may well have been introduced to

constrain the impact of the tolerance rule, which

would normally allow 7 percent of the weight of the

article to be of nonoriginating materials. In overcoats

and suits, the lining is probably less than 7 percent

of the total weight. Finally, it is interesting to note

that the rules of origin also provide very specific

exemptions for materials that are in short supply or

are not produced in the United States. In this regard,

the rule reflects firm-specific lobbying to overcome

the restrictions of these rules of origin when the orig-

inal NAFTA rules were defined. The most extreme

example is the following, where the apparel will be

deemed eligible for tariff preferences if assembled

from imported inputs of:

Fabrics of subheading 511111 or 511119, if

hand-woven, with a loom width of less than

76 cm, woven in the United Kingdom in accor-

dance with the rules and regulations of the Harris

Tweed Association, Ltd., and so certified by the

Association.

Clearly, the job of the relevant official to check

consistency and compliance with such rules is not a

simple one.

Source: World Bank staff.

GLOBAL ECONOMIC PROSPECTS 2005

72

response to trade liberalization when other

measures are included and ascribe the results

to the deep integration measures. The calcula-

tions of these ex ante simulation studies illus-

trate the potential that deeper agreements

may hold when they produce a productivity

response, with changes in trade flows and in-

comes being a multiple of that under pref-

erential tariff removal. However, because

this result is inevitable from the way that

deeper integration is modeled (i.e., inducing

economy-wide increases in productivity),

these results from one or another deep inte-

gration measure should be seen as indicative

of potential rather than evidence of success.

Ex post exercises based on the gravity

model will tend to capture all of the policy re-

lated impacts of a regional trade agreement

on trade, not just the removal of trade policy

variables. Several authors have tried to

capture in an index the differences of depth

between agreements; it is then used as the

dummy variable in the gravity model to cap-

ture the impact of RTAs [Li (2000), Adams

and others (2003)]. However, this approach

presents the issue of how to weight different

policy measures—for instance, should ser-

vices liberalization get more weight than cus-

toms cooperation? Thus the value of the

index would be dependent on the subjective

weights that are assigned. The weights chosen

by Adams and others lead to EFTA being

ranked as much more restrictive than the An-

dean Pact or NAFTA. Further, many agree-

ments appear extensive on paper but have

accomplished little in practice.

Extensive monitoring of agreements

is crucial to ensure effective

implementation

In order to assess the impact of RTAs, infor-

mation is needed on the extent to which the

agreement’s provisions are being implemented

and how they are affecting decisions by pro-

ducers and consumers. Given the need for

monitoring, an implementation scorecard

would be useful—such an approach has been

adopted by the EU Commission which, as

part of its monitoring of the implementation

of the single market, has introduced the

“Single Market Scoreboard” (box 3.5). In

addition to providing vital information, the

scorecard is useful as a disciplinary measure—

to shame governments with a record of poor

implementation into action and to empower

governments with good records of implemen-

tation to challenge those members who are

not meeting their commitments.

More extensive monitoring could make an

important contribution to the implementation

of many trade agreements. Lack of effective

implementation has been a major factor lim-

iting the impact of many trade agreements in

Africa, South America, South Asia, North

Africa, and the CIS.

Conclusions: Preferential Trade

Agreements and Economic

Development

T

his review of the experience of preferen-

tial trading agreements over the past 40

years offers the following conclusions:

• There is no strong evidence to support

the claim that a preferential trade agree-

ment will be net trade creating or that all

members will benefit. Positive outcomes

depend on design and implementation.

• When embedded in a consistent and

credible reform strategy, the key deter-

minant of regional trade agreements’

success is low levels of external trade

barriers. While many developing coun-

tries have reduced tariffs, they remain

high in many countries and regions, and

the risk of trade diversion remains sig-

nificant. Further reductions in applied

MFN tariffs will be required to ensure

that regional agreements are beneficial

for those participating in them and to

minimize the impact on the countries

that are left out.

•Trade agreements that provide for com-

prehensive liberalization of trade across

REGIONAL TRADE AGREEMENTS:EFFECTS ON TRADE

73

all major sectors and nonrestrictive rules

of origin are more likely to be successful.

Agreements that devote considerable re-

sources to negotiating limited positive

lists or large negative lists and detailed

product specific rules of origin limit the

scope for gains.

•Effective implementation is crucial to pos-

itive outcomes, yet implementation is

compromised by proliferation. If different

T

he Single Market Scoreboard measures (1) the

extent to which Single Market directives have

been transposed into national law by each member

state, (2) the average time it takes each member to

transpose directives, and (3) the extent to which

members are cooperating with enforcement and

problem solving. This analysis by the European

Commission is supported by regular surveys of busi-

nesses and individuals on perceptions of the Single

Market and where it is not working. The Commis-

sion also monitors differences in prices of identical

goods for indications that integration is leading to

convergence.

The left figure below shows the implementation

deficit for each member; that is, the proportion of

directives that have not been notified as having been

transposed into national law. The figure shows a

Box 3.5 Monitoring implementation of preferential trade

agreements: “Single Market Scoreboard” in the European

Union

substantial improvement in implementation since

1997; it also shows that the original six members of

the EU and Greece are currently the worst offenders.

Effective monitoring of implementation also requires

that clear targets be established. In 2001, the EU

Heads of State established an interim target of a

1.5 percent implementation deficit. As of July 2004,

only five members had achieved this target.

A further measure of implementation is the extent

to which agreed-on rules are being properly applied.

In Europe, the Commission is charged with monitor-

ing when Single Market rules are not being applied

correctly; the Commission also takes infringement

cases against member countries that are breaking EU

laws. In terms of the number of infringement cases

open in May 2004, Italy and France are the worst

offenders (lower right figure).

Percentage rate of nonimplementation

Source: http://europa.eu.int/comm/internalmarket/score/index

en.htm#score.

Italy

Spain

Germany

France

Greece

Belgium

Ireland

UK

Netherlands

Aus

tria

Portugal

Luxembourg

Sweden

Finland

Denmark

Single Market Scoreboard

0

4

2

6

10

8

12

Open infringement case (May 2004)

Italy

Spain

Germany

Fra

nce

Greece

Belgium

Ireland

UK

Netherlands

Aus

tria

Por

tugal

Luxembourg

Sweden

Finland

Denmark

0

60

40

80

20

120

100

160

140

b. EU law breakers

a. Implementation of single market directives by EU members

1997

2004

agreements have different product cover-

age, different liberalization schedules,

and different rules of origin, the ability of

agencies such as customs to apply the

agreements is severely undermined. The

capacity to effectively implement is a

crucial issue that countries should con-

sider before signing an RTA.

• Monitoring can play an important role

in providing for effective implementa-

tion, but often there is insufficient moni-

toring as well. Technical reviews are fre-

quently not done, and when reports are

made, senior officials fail to act on their

recommendations.

Notes

1. Flatters and Kirk (2003).

2. The conclusion is unchanged if intra-EU and

intra-NAFTA trade are excluded from the total of

world exports.

3. Drawn from Burfisher and others (2004) and

Harrison and others (2004).

4. For example, Ghosh and Yamarik (2004) sug-

gest that “a consensus has emerged among researchers

that RTAs are trade creating.”

5. In this exercise, where the counterfactual is based

on the historical pattern of trade flows, we assess how

the regional trade agreement affected trade flows after

its introduction. As a measure of robustness of the ef-

fects, we used three different estimation methods.

Effects are considered statistically robust only if all

three methods generate a significant impact of the same

sign. The three methods are pooled OLS with robust

standard errors. Thesecond estimation method includes

country-pair fixed effects using a specific OLS method.

The third approach is a pooled Tobit estimation.

6. Here we follow Soloaga and Winters (2001),

who include an additional dummy variable to assess

the impact on the exports of members of regional trade

agreements, although their focus is on the welfare

effects of RTAs. However, here we apply a panel

approach to a sample period of 1948 to 2000, cover-

ing bilateral trade between 178 countries with country-

pair fixed-effects, which a number of authors, although

not all, suggest is the preferred method. We apply the

above equation. The regional dummies are time sensi-

tive; that is, they are relevant only after the agreement

has been signed. Using a different estimation tech-

nique, such as Tobit and OLS, and a different sample

period can lead to different results for a particular

agreement but the overall conclusion remains firm.

7. The basic rules of origin define the processing that

has to be done in the individual beneficiary or partner to

confer origin. Cumulation is an instrument allowing pro-

ducers to import materials from a specific country or re-

gional groupof countries withoutundermining the origin

of the final product. In effect the imported materials from

the identified countries are treated as being of domestic

origin ofthe country requesting preferential access.There

are three types of cumulation, bilateral, diagonal (or par-

tial), and full. The most basic form of cumulation is bi-

lateral cumulation, which applies to materials provided

by either of two partners of a preferential trade agree-

ment. In this case originating inputs, that is materials,

which have been produced in accordance with the rele-

vant rules of origin, imported from the partner, qualify as

originating materials when used in a country’s exports to

that Partner. Second, there can be diagonal cumulation

on a regional basis so that qualifying materials from any-

where in the specified region can be used without under-

mining preferential access. Finally, there can be full cu-

mulation whereby any processing activities carried out in

any participating country in a regional group can be

counted as qualifying content regardless of whether the

processing is sufficient to confer originating status to the

materials themselves. Under full cumulation all of the

processing carried out in participating countries is as-

sessed in deciding whether there has been substantial

transformation. Hence, full cumulation provides for

deeper integration among participating countries.

8. De Minimis or tolerance rules allow a certain

percentage of nonoriginating materials to be used

without affecting the origin of the final product. Thus,

the tolerance rule can act to make it easier for products

with nonoriginating inputs to qualify for preferences

under the change of tariff heading and specific manu-

facturing process rules. This provision does not affect

value added rules.

9. For example, Hoekman and Konan (1999) find

that a free trade agreement between the European

Union and Egypt limited to goods (but with substantial

progress on removing regulatory barriers) could raise

welfare by around 4 percent while an agreement that

reduced barriers to services in Egypt could raise

economic welfare by over 13 percent. Similarly,

Brenton, Tourdyeva, and Whalley (2002) find that an

EU-Russia FTA limited to tariff removal would in-

crease welfare by around one-tenth of one percent

while a comprehensive agreement removing technical

barriers to trade and barriers to trade in services would

raise welfare by more than 13 percent.

References

Adams, Richard, Philippa Dee, Jyothi Gali, and Greg

McGuire. 2003. The Trade and Investment Ef-

GLOBAL ECONOMIC PROSPECTS 2005

74

REGIONAL TRADE AGREEMENTS:EFFECTS ON TRADE

75

fects of Preferential Training Arrangements—Old

and New Evidence. Productivity Commission

Staff Working Paper, Canberra, Australia.

Anson, Jose, Olivier Cadot, Antoni Estevadeordal,

Jaime de Melo, Akiko Suwa-Eisenmann,

and Bolorma Tumurchudur. 2004. Rules of Ori-

gin in North-South Preferential Trading Arrange-

ments with an Application to NAFTA. Research

Unit Working Paper 0406, Laboratoire d’E-

conomie Appliquee, INRA, Paris.

Balasubramanyam,V. N. 1989. ASEAN and Regional

Trading Co-operation in Southeast Asia. In

Economic Aspects of Regional Trading Arrange-

ments, eds. D. Greenaway, T. Hyclak, and R. J.

Thornton. London: Harvester Wheatsheaf.

Berthelon, Matias. 2004. Growth Effects of Regional

Integration Agreements. Processed.

Brenton, Paul, Natalia Tourdyeva, and John Whalley.

2002. Economic Impact of a FTA between Russia

and the EU: Numerical Simulations Using a

General Equilibrium Trade Model. Report pre-

pared for the European Commission, Brussels.

Brenton, Paul, and H. Imagawa. 2004. Rules of Ori-

gin, Trade and Customs. In The Customs Mod-

ernisation Handbook, ed. L. De Wulf, and

J. Sokol. Washington, DC: World Bank.

Burfisher, Mary, Sherman Robinson, and Karen

Thierfelder. 2004. Regionalism: Old and New,

Theory and Practice. Forthcoming in Agricul-

tural Policy Reform and the WTO: Where Are

We Heading? eds. G. Anania, M. E. Bohman,

C. A. Carter, and A. F. McCalla. Cheltenham,

UK: Edward Elgar.

Cadot, O., J. de Melo, A. Estevadeordal, A. Suwa-

Eisenmann, and B. Tumurchudur. 2002. Assess-

ing the Effect of NAFTA’s Rules of Origin.

Processed.

Carrere, Celine. 2004. “Revisiting Regional Trading

with Proper Specification of the Gravity Model.”

European Economic Review (forthcoming).

Carrere, Celine, and Jaime De Melo. 2004. “Are Dif-

ferent Rules of Origin Equally Costly? Estimates

from NAFTA.” CEPR Discussion Paper

No. 4437. London.

De la Torre, A., and M. Kelly. 1992. Regional Trade

Agreements. Occasional Paper 93, Washington,

DC: IMF.

Devlin, R., and A. Estevadeordal. Forthcoming. Trade

and Cooperation: A Regional Public Goods Ap-

proach. In Regional Public Goods: From Theory

to Practice, eds. A. Estevadeordal, Brian Frantz,

and Tam R. Nnguyen. Washington, DC: Inter-

American Development Bank.

Devlin, R. and R. French-Davis. 1999. Towards and

Evaluation of Regional Integration in Latin

America in the 1990s. The World Economy 22:

261–90.

Estevadeordal, A., and R. Robertson. 2004. Do Pref-

erential Trade Agreements Matter for Trade? In

Integrating the Americas: FTAA and Beyond,

eds. A. Estevadeordal, D. Rodrik, A. M. Taylor,

and A. Velasco. Cambridge, MA: Harvard Uni-

versity Press.

Estevadeordal, A., and K. Suominen. 2004. Rules of

Origin: A World Map and Trade Effects. In The

Origin of Goods: Rules of Origin in Preferential

Trade Agreements, eds. A. Estevadeordal,

O. Cadot, A. Suwa-Eisenmann, and T. Verdier.,

DC: Inter-American Development Bank.

Evenett, S. J., and W. Keller. 2002. On Theories Ex-

plaining the Success of the Gravity Equation.

Journal of Political Economy 110 (2).

Foroutan, Faezeh. 1998. Does Membership in a

Regional Preferential Arrangement Make a

Country More or Less Protectionist? The World

Economy 21(2):305–35.

Flatters, F., and R. Kirk. 2003. Rules of Origin as

Tools of Development? Some Lessons from

SADC. Paper presented at INRA conference on

Rules of Origin, Paris, May 2003.

Ghosh, S., and S. Yamarik. 2004. Are Regional Trad-

ing Arrangements Trade Creating? An Applica-

tion of Extreme Bounds Analysis. Journal of

International Economics 63: 369–95.

Glick, Reuben, and Andrew Rose. 2002. “Does a

Currency Union Affect Trade? Time Series Evi-

dence.” European Economic Review 46:

1125–51.

Greenaway, David, and Chris Milner. 1990.

South–South Trade Theory, Evidence, and Pol-

icy. The World Bank Research Observer 5(1):

47–68.

Harrison, Glenn W., and David G. Tarr. 2003. Rules

of Thumb for Evaluating Preferential Trading

Arrangements: Evidence from Computable

General Equilibrium Assessments. The Policy

Research Working Paper 3142, World Bank,

Washington, DC.

Hoekman, Bernard, and Denise Eby Konan. 1999.

Deep Integration, Nondiscrimination, and Euro-

Mediterranean Free Trade. Policy Research

Working Paper 2130, World Bank, Washington,

DC.

IADB (Inter-American Development Bank). 2002. Be-

yond Borders: The New Regionalism in Latin

America. Washington, DC: IADB.

Li, Quan. Institutional Rules of Regional Trade Blocs

and Their Impact on Trade. Processed.

Ozden, Caglar, and Francisco Parodi. 2003. Customs

Union and Foreign Investment: Theory and

Evidence from Mercosur’s Auto Industry. Work-

ing Paper, Emory University.

Palmeter D. 1997. Rules of Origin in Regional Trade

Agreements. In Regionalism and Multilateralism

after the Uruguay Round: Convergence, Diver-

gence, and Interaction, eds. P. Demaret, J.F. Bellis,

and G. Garcia Jimenez. Brussels: European In-

teruniversity Press.

Pelkmans, J., and Brenton, P. 1999. Bilateral Trade

Agreements with the EU: Driving Forces and