FISCAL YEAR

2022/2023

THIRD QUARTER BUDGET REPORT

P

repared by:

EXECUTIVE OFFICE

COUNTY OF RIVERSIDE

STATE OF CALIFORNIA

Fiscal Year 2022/23 Third Quarter Report

May 23, 2023

Members of the Board of Supervisors:

At third quarter, the county’s financial position remains unchanged compared from the midyear report.

While we are showing no change in projected discretionary revenue, our revenues are still anticipated to

be significantly higher than they were at the time of the adopted budget.

General Fund

Projected Year-end Financial Position Fiscal Year 2022/23

As of Third Quarter

($ in Millions)

This report includes several adjustments to department budgets which will increase their departmental

revenue or use of their respective reserves to balance these costs. There are several adjustments totaling

$2.6 million that will reduce general fund contingency from $10 million to $7.4 million.

As of this report, the near-term outlook appears stable, however challenges are looming in years to come.

While we continue to project increased revenues compared to the adopted budget, it should be noted that

the pace of growth is slowing down significantly while costs continue to rise to maintain the status quo, let

alone increase service levels. Additionally, the need to maintain or replace our aging facilities adds

financial pressure, and to begin to address these issues, the Executive Office has been working with

County departments in identifying strategic financial priorities and capital improvement projects. This

initiative will be a continuous effort for our office and the county departments.

I

n closing, I want to thank our departments for their continued efforts to meet the needs of our constituents

while working to build resilient and fiscally sound operations.

IT IS RECOMMENDED that the Board of Supervisors:

Receive and file the Fiscal Year 2022/23 Third Quarter Report and approve the recommendations as set

forth therein.

Respectfully,

J

effrey A. Van Wagenen, Jr.

County Executive Officer

Adopted Budget First Quarter Midyear Third Quarter

$368 $464 $464 $464

1,013 1,076 1,102 1,102

1,013 1,013 1,029 1,029

- 63 73 73

Beginning FY 22/23, Reserves

Discretionary Revenue Less:

Net County Cost

Net Savings from Operations

Transfer to CIP

- (16) - -

Ending FY 2022/23 Reserves $368 $511 $537 $537

County of Riverside Fiscal Year 2022/23 Third Quarter Budget Report 1

TABLE OF CONTENTS

BUDGET OUTLOOK ......................................................................................................... 2

Discretionary Revenue Projections ............................................................................................ 2

Prop 172 Revenue ....................................................................................................................... 2

Property Taxes ............................................................................................................................. 3

Prop. 172 Public Safety Sales Tax ............................................................................................... 3

Interest Earnings .......................................................................................................................... 4

Long-Range Budget Schedule ................................................................................................... 5

CURRENT BUDGET STATUS .............................................................................................. 6

A

PPROPRIATIONS FOR CONTINGENCY .......................................................................................... 6

SUMMARY

OF BUDGET ADJUSTMENT RECOMMENDATIONS ............................................... 7

F

INANCE & GOVERNMENT SERVICES .......................................................................................... 10

Assessor Clerk-Recorder .......................................................................................................... 10

Auditor Controller ...................................................................................................................... 10

Executive Office ........................................................................................................................ 10

Executive Office – Countywide Oversight Board Reimb Fund .............................................. 12

Executive Office – Court Reporting .......................................................................................... 12

Executive Office - Developer Agreement Fees ..................................................................... 12

H

UMAN SERVICES ..................................................................................................................... 12

Department of Public Social Services...................................................................................... 12

I

NTERNAL SERVICES ................................................................................................................... 13

Facilties Management .............................................................................................................. 13

Human Resources ..................................................................................................................... 15

Riverside County Information Technology .............................................................................. 16

O

FFICE OF ECONOMIC DEVELOPMENT ........................................................................................ 16

Community Facility District (CFD) ............................................................................................ 16

County Service Area ................................................................................................................. 17

P

UBLIC SAFETY ......................................................................................................................... 17

District Attorney ......................................................................................................................... 17

Fire Department ......................................................................................................................... 18

Sheriff .......................................................................................................................................... 18

P

UBLIC WORKS AND COMMUNITY SERVICES ................................................................................ 20

Animal Services ......................................................................................................................... 20

Flood Control and Water Conservation District ...................................................................... 21

Regional Parks and Open Space District ................................................................................ 21

R

EGISTRAR OF VOTERS .............................................................................................................. 22

R

IVERSIDE UNIVERSITY HEALTH SYSTEM ........................................................................................ 22

Public Health (RUHS-PH) ............................................................................................................ 22

RUHS Medical Center (RUHS-MC) ............................................................................................ 23

ATTACHMENT A SUMMARY OF RECOMMENDATIONS

ATTACHMENT B HDL MARCH 2023 ECONOMIC FORECAST

Budget Outlook

2 Fiscal Year 2022/23 Third Quarter Budget Report County of Riverside

BUDGET OUTLOOK

Discretionary Revenue Projections

Overall, projected discretionary revenue estimates are up $88.4 million from adopted

budget projections. Highlights of the county’s key general-purpose revenues are noted

below.

Prop 172 Revenue

The projected Prop 172 revenue continues with gradual growth mostly due to online shop-

ping strength. This trend is expected to continue through FY 2022/23.

General Fund Projected Discretionary Revenue

(in millions)

Adopted Budget

Current Quarter

Estimate

Variance

Propert

y

Taxes $459.4 $477.6 $18.2

Motor Vehicle In Lieu 325.2 334.5 9.3

RDA Residual Assets 47.8 56.1 8.3

Tax Loss Reserve Overflow 20.0 20.0 -

Fines and Penalties 15.9 16.5 0.6

Sales & Use Taxes 42.9 54.0 11.1

Tobacco Tax 11.5 11.5 -

Documentar

y

Transfer Tax 19.4 20.8 1.4

Franchise Fees 6.9 8.4 1.5

Interest Earnings 11.0 45.0 34.0

Misc. State 4.9

5.0 0.1

Federal In-Lieu 3.5 4.0 0.5

Rebates & Refunds 7.1 6.6 (0.5)

Other (Prior Year & Misc.) 25.8 29.7 3.9

Operatin

g

Transfers In 12.0 12.0 -

Total $1,013.3 $1,101.7 $88.4

Prop 172 Projected Revenue

(in millions)

Adopted Budget

Current Quarter

Estimate

Variance

Prop. 172 Public Safety Sales Tax

$284.1

$297.4 $13.3

Budget Outlook

County of Riverside Fiscal Year 2022/23 Third Quarter Budget Report 3

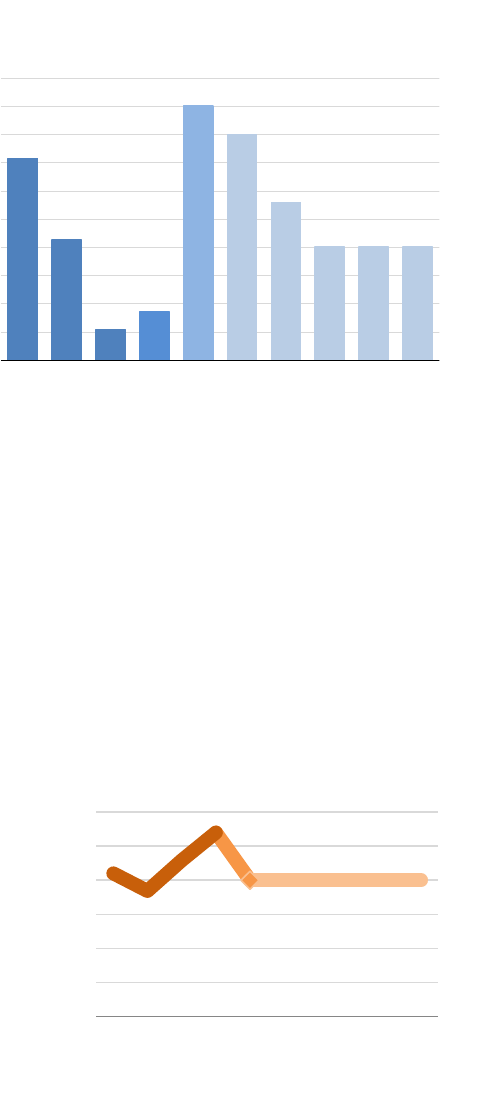

Property Taxes

Property tax revenue and motor vehicle fee

revenue received in-lieu of property taxes,

were both budgeted based on 9% growth in

assessed values. Property tax revenue and

motor vehicle in-lieu are up by $18.2 million,

and $9.3 million respectively from the

adopted budget.

Sales and Use Taxes

In this report, the county’s current sales and

use tax projections assume an increase of

$11.1 million from the adopted budget. Most

sales tax categories are still strong. The pro-

jected increase is mostly due to updated pro-

rata factors for the statewide sales tax pool

of revenue. It is anticipated that increases

will start leveling off in FY 2023/24.

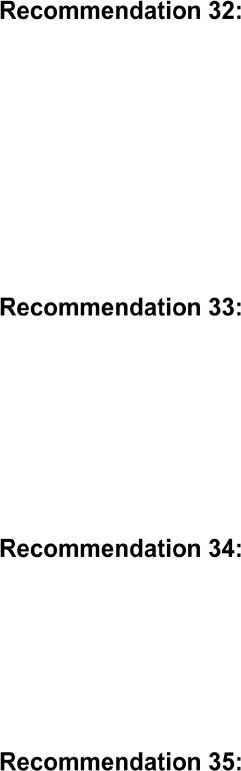

Prop. 172 Public Safety Sales Tax

The county’s Prop. 172 public safety sales

tax revenue is affected both by changes in

the overall statewide pool of revenue as

well as changes in the county’s pro rata

share of that pool relative to other partici-

pants.

Due to an increase in the pro rata share of

the statewide pool, the county benefited

greatly. As of this report, HdL Companies

is projecting FY 2022/23 ending revenue to

be $297.4 million, an increase of $13.3 mil-

lion from adopted budget projections.

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

18/19

19/20

20/21

21/22

22/23

23/24

24/25

25/26

26/27

27/28

Property Taxes & Motor Vehicle In-

lieu (in millions)

Property Taxes Motor Vehicle In-lieu

$0

$5

$10

$15

$20

$25

$30

$35

$40

$45

$50

$55

$60

18/19

19/20

20/21

21/22

22/23

23/24

24/25

25/26

26/27

27/28

Sales & Use Tax Revenue

$0

$50

$100

$150

$200

$250

$300

$350

18/19

19/20

20/21

21/22

22/23

23/24

24/25

25/26

26/27

27/28

Prop 172

Revenue Trend

Budget Outlook

4 Fiscal Year 2022/23 Third Quarter Budget Report County of Riverside

Interest Earnings

The Treasurer’s estimate for FY 2022/23

County General Fund (GF) interest

earnings will remain $45 million. The es-

timate incorporates interest earnings

results for the first three quarters and

other factors such as the projected

General Fund balances in the

Treasurer-Tax Collector’s Pooled

Investment Fund (TPIF), as well as

current and projected levels of interest

rates.

The Federal Open Market Committee

(FOMC) increased the FED funds target

rate range by a quarter of a percent to

4.75% - 5.00% on March 22, 2023. An

additional rate hike is expected within the forecast horizon. The maturity composition of

the TPIF will affect how fast recent rate increases or any additional rate changes translate

to the TPIF earnings. A significant deviation on the expected General Fund balances

would have a strong effect on the actual earnings.

Overall, the risk to the FY 2022/23 earnings estimate is positively biased. Future years

are estimated to taper off. The Treasurer-Tax Collector will continue to monitor the earn-

ings projections and will inform budget staff of any significant changes.

Teeter Tax Losses Reserve Fund (TLRF) Overflow

The Teeter Plan provides for a tax distribution

procedure by which secured roll taxes are dis-

tributed to taxing agencies within the County

included in the Teeter Plan based on the tax

levy, rather than on the basis of actual tax col-

lections. In return, the county retains the ac-

tual taxes received, plus penalties and inter-

est on delinquent taxes. The TLRF captures

revenues and expenditures associated with

the program. Revenue exceeding financing

costs and the necessary tax loss reserve is

discretionary revenue released to the general

fund annually. The annual release is in ac-

cordance with the revenue and taxation code,

and consistent with prudent risk management. The TLRF revenue has remained at $20

million, the same from the adopted budget projections.

$0

$5

$10

$15

$20

$25

$30

18/19

19/20

20/21

21/22

22/23

23/24

24/25

25/26

26/27

27/28

Millions

Actual TLRF Overflow Transfer

$0

$5

$10

$15

$20

$25

$30

$35

$40

$45

$50

18/19

19/20

20/21

21/22

22/23

23/24

24/25

25/26

26/27

27/28

General Fund Interest Earnings

Budget Outlook

County of Riverside Fiscal Year 2022/23 Third Quarter Budget Report 5

Long-Range Budget Schedule

Following are key dates, which remain subject to change as necessary and appropriate:

May 30, 2023 - Clerk of the Board to publish a budget hearing notice stating that

the FY 2023/24 Recommended budget is available to members of the public.

June 12 thru June 13, 2023 (as necessary) - Presentation of the FY 2023/24

Recommended Budget, opening of budget hearings, and approval of the budget.

June 27, 2023 - Approval of FY 2023/24 Adopted Budget

These dates have been coordinated to work with the Board’s approved 2023 meeting

calendar.

Current Status

6 Fiscal Year 2022/23 Third Quarter Budget Report County of Riverside

CURRENT BUDGET STATUS

APPROPRIATIONS FOR CONTINGENCY

Contingency covers urgent, unforeseeable events such as revenue shortfalls,

unanticipated expenditures, uncorrectable budget overruns and mission-critical issues at

the Board’s discretion. The adopted budget appropriated $20 million for contingency.

This report contains a contingency reduction of $2.6 million. The total net reduction for

the year will be $12.6 million, taking the contingency level to $7.4 million, as summarized

in the table below.

Use of General Fund Appropriations for Contingency

Use of General Fund Appropriations for Contingency

Cost

Adjustment

Revenue

Adjustment

Total

Adjustment

Balance

Available

Adopted Budget Balance: $20,000,000

Adjustments to date:

7/12/22 Item 3.35 Executive Office-Fentanyl awareness outreach/mar-

keting campaign.

288,255

(288,255)

11/1/22 Item 3.21 DPSS-Salary adjustments to selected positions. 1,937,070

(1,937,070)

1st Qtr. Rec #1 EO-General Fund Contributions - Increase County's

share of LAFCO operational costs.

39,732 (39,732)

1

st

Qtr. Rec #3 Executive Office-Increase in legal costs. 184,000 (184,000)

1st Qtr. Rec #5 Treasurer-Tax Collector – Encumbrance from prior

year.

36,574 (36,574)

1st Qtr. Rec #8 Purchasing-Add two positions as part of the depart-

ment's reorganization.

120,000 (120,000)

1

st

Qtr. Rec #11 District Attorney-Encumbrance from prior year. 1,857,340 (1,857,340)

11/29/22 Item 3.40

Public Defender -SB 483 Resentencing Unit. 1,084,065 (1,084,065)

12/6/22 Item 3.3 EO-Add two positions to oversee the implementation

of the initiatives being put in place for Protection of

Vulnerable Children and Adults.

200,000

(200,000)

1/24/23 Item 3.8

A

uditor Controller - Cash over/shortage. 623 (623)

1/24/23 Item 3.39 DPSS-To establish a Workload Management Team

to provide additional temporary staffing.

448,000

(448,000)

2/28/23 Item 3.31 DPSS-CalWORKs assistance caseload increase. 1,250,000

(1,250,000)

4/18/23 Item 3.8 EO-Fireworks Safety & Enforcement Action Plan. 150,000

(150,000)

5/9/23 Item 2.28 Correctional Health - To meet Gray Case Remedial

Plan.

2,347,611

(2,347,611)

Total adjustments as of May 9, 2023 9,943,270 -

(9,943,270) 10,056,730

Actions Recommended in this report:

3

rd

Qtr. Rec #3 EO-To transfer TOT to March JPA per sharing

agreement.

289,228 (289,228)

3

rd

Qtr. Rec #6 EO-To transfer TOT to Code Enforcement. 600,000 (600,000)

3

rd

Qtr. Rec #8 EO-Court Reporting Transcripts payments. 270,000 (270,000)

3

rd

Qtr. Rec #42 Registrar of Voters-Payment for contractual agree-

ment.

1,473,901 (1,473,901)

3

rd

Quarter Report total 2,633,129 (2,633,129)

Total Adjustments to Contingency 12,576,399 (12,576,399)

Contingency balance $7,423,601

Current Status

County of Riverside Fiscal Year 2022/23 Third Quarter Budget Report 7

SUMMARY OF BUDGET ADJUSTMENT RECOMMENDATIONS

Rec.

No. Departments Adjustment Description

General

Fund/NCC

Increase in

Estimated

Departmental

Revenues

3

EO - GF Contributions to

Other Funds

Transfer of funds to the March JPA for the TOT

sharing agreement.

$ 289,228

6

EO-GF Contributions to

Other Funds

Transfer of Short-term Rental TOT revenues to

Code Enforcement.

600,000

8 EO – Court Reporting

Increase in requests for court ordered court report-

ing transcripts.

270,000

42 Registrar of Voters

Increase state funds for 75% reimbursement for

payment of election services contractual agreement.

1,473,901 4,421,703

Budget Adjustments

Rec.

No. Departments Adjustment Description

Increase in

Estimated

Departmental

Revenues

Estimated

Use of

Fund

Balance

1 Assessor Clerk-Recorder

Transfer of funds from Conversion to Modernization

Fund.

1,896.373

2 Auditor-Controller

Adjustment to report 3

rd

Quarter Discretionary Reve-

nue projections in financial system.

48,363,905

4 Executive Office

State funds for one-time Alcohol Monitoring profes-

sional services.

300,787

5

EO – Matured Financing

Program

Transfer of rent payments to CIP fund for future

courthouse maintenance projects.

3,000,000

7

EO – Countywide Over-

sight Board

Increase in expenses to be reimbursed by depart-

ment for services.

11,226

9 EO – DA Fees

Transfer of funds to departments for payment or re-

imbursement of authorize DA Fees eligible projects.

175,000

10 DPSS

State and Federal funds for increased IHSS Individ-

ual Provider Services benefit rates.

3,000,000

11 DPSS

State and Federal funds for anticipated increased to

Categorical Assistance services expenses.

6,800,000

12 Facilities Management

Recognition of partial reimbursement received for

Idyllwild Community Center

3.100

13 Facilities Management

Increased revenues to cover rood repairs at Indio

Fairgrounds-Shalimar Building

175,000

14 Facilities Management

Transfer of fund balance to Community and Recrea-

tional Centers department.

347,951

Current Status

8 Fiscal Year 2022/23 Third Quarter Budget Report County of Riverside

Rec.

No. Departments Adjustment Description

Increase in

Estimated

Departmental

Revenues

Estimated

Use of

Fund

Balance

15 Facilities Management

Transfer of budget between department ID’s – No

impact to budget

N/A

16 Facilities Management

Transfer of funds to commence with improvement

project for Lakeland Village and Perret Park.

157,262

17 Facilities Management

Allocation of ARPA funds for approved projects for

improvements and expansions of Lakeland Village,

Good Hop and Mead Valley Parks/Community Cen-

ters.

2,250,000

18 FM – Real Estate

Increase revenues to commence tenant improve-

ments for Sheriff’s South Corona-Lake Matthews

Office.

4,735,180

19 Human Resources

Increased requests for Employee and Labor relation

services.

700,000

20 Human Resources Increase in Delta Dental PPO claim expenditures. 1,000,000

21 Human Resources

Increase in Local Advantage Plus Dental claim ex-

penditures.

200,000

22 Human Resources Increase in Long-Term Disability claims 1,200,000

23 Human Resources

Increase in Short-Term Disability admin fees and

claims.

30,000

24 Human Resources

Increase in professional services fees for increased

Workers Compensation claim review.

500,000

25

RCIT – Geographical Info

System

Increase in retirement payoffs and software costs. 186,000

26 Information Technology

Increase in costs for the PeopleSoft Financial up-

grade project.

1,600,000

27 CFD Administration

Transfer of CSA Admin funds to establish CFD Ad-

ministration budget.

388,917

28 CFD Administration

Transfer of fund balance from CSA Admin to CFD

Admin.

592,896

29 CSA 149 Road repairs due to storm damage. 70,000

30 District Attorney

Recognize funding from State Asset Forfeiture

funds, Real Estate Fraud and various Auto Insur-

ance Fraud funds.

538,052

31

Fire Protection – Contract

Services

Additional city partner funding for increased county

positions for contract services.

650,000

32 Sheriff

Reallocation of department funding to cover two

emergency Coroner projects.

577,188

33 Sheriff Federal grant funds for purchase of PSEC radios. 186,218

34 Sheriff

Recognize Insurance Proceed revenue from used

vehicle auctions.

1,280,873

Current Status

County of Riverside Fiscal Year 2022/23 Third Quarter Budget Report 9

Rec.

No. Departments Adjustment Description

Increase in

Estimated

Departmental

Revenues

Estimated

Use of

Fund

Balance

35 Sheriff

Federal funds for reimbursement of salaries for pa-

trol services.

1,853,264

36 Sheriff

Allocation of CIP funds for the first claims for various

approved projects.

2,116,850

37 Animal Services Increase to insurance and carpool costs. 363,846

38 Flood Control

Increase in staffing costs and software acquisitions

and upgrades.

500,000

39

Parks – MSHCP Reserve

Management

RCA funds for additional patrolling and crowd con-

trol on RCA lands in anticipation for wildflower su-

perbloom.

70,000

40 Parks – Park Residences

Increased costs for unforeseen repairs for the care-

taker residences.

25,000

41

Parks- Park Acq. And Dev.

Fund

Reducing appropriations and estimated revenues

for projects approved for ARPA funds.

(2,500,000)

43 Registrar of Voters

State funds for the mailing of vote-by-mail ballots

services.

2,000,000

44 RUHS – Public Health

Authority to purchase assets and vehicles – No Im-

pact to budget

N/A

45 RUHS

Increase appropriations for Medical Center for Psy-

chiatrist services in accordance with new State cost

report requirements.

35,000,000

All budget adjustment recommendations are shown in attachment A and all position requests are shown in attachment B,

both following the department summaries.

Additional Assets

Rec.

No.

Departments Request

44 RUHS – Public Health 2 Forklifts, 2 medical freezers and laboratory equipment.

Current Status

10 Fiscal Year 2022/23 Third Quarter Budget Report County of Riverside

F

INANCE

&

G

OVERNMENT

S

ERVICES

Assessor Clerk-Recorder

The County Clerk-Recorder is requesting an appropriation transfer from the Conversion Fund

to Modernization Fund to properly align the department’s expenses with applicable funding

sources.

That the Board of Supervisors approve and direct the Auditor Control-

ler to make budget adjustments to transfer appropriations from the County Clerk-Recorder

Conversion Fund to the Modernization Fund by $1,896,373.

Auditor Controller

Working with the Executive Office it has been determined that the third quarter projections for

discretionary revenue should be updated in the financial system, PeopleSoft to better align

the year-end financial statements. The budget adjustments requested in this report are based

on projections of the Auditor Controller by analyzing three quarters of receipts and projecting

year-end results. These projections are reported in the quarterly reports but have never been

adjusted in the financial system.

In the past, adjustments were not made in the financial system resulting in large variances

from the adopted budget to ending balances. It is now requested to make the adjustments to

align the financial system with the projection in the RIVCOBudget system.

That the Board of Supervisors approve and direct the Auditor-Control-

ler to make budget adjustments increasing estimated revenues for the Auditor Controller by

$48,363,905.

Executive Office

On July 26, 2022, the Board of Supervisors approved a Second Amendment to an agreement

originating in 2007 with March Joint Powers Authority (JPA) for revenue sharing. The JPA is

to receive the sales and use tax and franchise fee revenue collected in the March JPA area

up to $750,000. On top of that, they are to receive transient occupancy tax (TOT) generated

in that area. The Executive Office is requesting a third quarter budget adjustment in the

amount of $289,228 to make the TOT payment to March JPA for the remainder of the year.

These costs are 100% funded through tax revenue generated in the March JPA area.

That the Board of Supervisors approve and direct the Auditor-Control-

ler to make budget adjustments increasing appropriations for the Non-Executive Office Oper-

ations by $289,228 and decreasing appropriations for Appropriations for Contingency by

$289,228.

The Executive Office is requesting a budget adjustment to fund one-time costs of $300,787

for Alcohol Monitoring professional services, which is 100% funded by AB1869 State Reve-

nue. There is no impact to net county cost as a result of the requested budget adjustment.

Current Status

County of Riverside Fiscal Year 2022/23 Third Quarter Budget Report 11

That the Board of Supervisors approve and direct the Auditor-Control-

ler to make budget adjustments increasing appropriations and estimated revenues for the

Non-Executive Office Operations by $300,787.

Matured Financing was established to record the transactions of matured or defeased bonds

and financings. The 2002 County of Riverside Taxable Certificates of Participation (2002

COP), and the 2014 County of Riverside Asset Leasing (CORAL) Lease Revenue Bonds are

matured/defeased bonds with lease agreements with the United States of America through

its General Services Administration for the use of the U.S. District Court, and the Bankruptcy

Court respectively. This fund records the revenue from the lease payments of the U.S. District

Court and Bankruptcy Court, and the expenditures associated with leasing the property (ser-

vices, utilities, maintenance, and other obligations) during the lease term.

In order to restrict the lease payments for the expenditures associated with the lease agree-

ment, a budget adjustment is needed to transfer the cash balance of this fund to the Capital

Improvement Fund.

That the Board of Supervisors approve and direct the Auditor-Control-

ler to make budget adjustments increasing appropriations and estimated revenues for River-

side County Executive Office by $3,000,000.

On October 18, 2022, Agenda Item 3.52, Ordinance No. 927.1 - Regulating Short Term Rent-

als and Incorporating by Reference the Abatement and Cost Recovery Procedures of Ordi-

nance No. 725 and Ordinance No. 671.22 - Consolidated Fees for Land Use and Related

Functions, were approved. Ordinance 927.1 is intended to provide additional protection and

safeguards to communities from potential impacts related to Short-Term Rentals. Ordinance

671.1 which increased short term rental application fees is intended to provide an ongoing

funding source for Code Enforcement’s efforts related to Short Term Rental inspections and

management of the program.

As a result, the Executive Office was directed to set aside 50% of the increase in Transient

Occupancy Tax (TOT) generated by Short Term Rentals (using FY2021/22 as a baseline) to

further fund ongoing Code Enforcement activities associated with enforcement of Ordinance

927.1. The Executive Office is currently working with the Office of the Treasurer Tax Collector

to determine the FY2023/24 increase in TOT to support Code Enforcement’s efforts. The

amount is estimated at $600,000, accordingly an increase in NCC is being requested to

properly remit the funds from the general fund to Code Enforcement’s designated fund for

FY2023/24.

That the Board of Supervisors approve and direct the Auditor-Control-

ler to make budget adjustments increasing appropriations for the EO-General Fund Contribu-

tions to Other Funds department and decreasing appropriations for Appropriations for Con-

tingency by $600,000.

Current Status

12 Fiscal Year 2022/23 Third Quarter Budget Report County of Riverside

Executive Office – Countywide Oversight Board Reimb Fund

The Countywide Oversight Board (COB) of the County of Riverside was formed in 2018 pur-

suant to Health and Safety Code 34179. It was created to oversee the wind-down activities

of the various Successor Agencies throughout the County pursuant to Health and Safety Code

section 34180 and to direct successor agencies in certain other actions pursuant to Health

and Safety Code section 34181. On May 19, 2022, board members of the COB approved the

fiscal year 2022-23 budget. A budget adjustment is needed to bring the original budgeted

amounts to the approved budget.

That the Board of Supervisors approve and direct the Auditor-Control-

ler to make budget adjustments increasing appropriations and estimated revenues for the

Countywide Oversight Board by $11,226.

Executive Office – Court Reporting

The Executive Office Court Reporter Transcripts Department ID has experienced an unantic-

ipated increase in the requests for court ordered court reporter transcripts. The Executive

Office is requesting NCC of $270,000 to cover the anticipated transcribing services costs for

the remainder of the fiscal year.

That the Board of Supervisors approve and direct the Auditor-Control-

lers to make budget adjustments increasing appropriations by $270,000 for the Non-Executive

Office Operations and decreasing appropriations for Appropriations for Contingency by

$270,000.

Executive Office - Developer Agreement Fees

Developer Agreements (DA) are legal contracts between the County and a developer pursu-

ant to Government Code section 65864 et seq. DA fees are no longer collected by the County.

However, in order to spend the remaining balance in the fund, a budget adjustment is needed

to process payments and reimbursements to other County departments for the various pro-

jects authorized by the Board of Supervisors that are funded by DA fees.

That the Board of Supervisors approve and direct the Auditor-Control-

ler to make budget adjustments increasing appropriations for the Mitigation Project Operation

by $175,000.

H

UMAN

S

ERVICES

Department of Public Social Services

The In-Home Supportive Services (IHSS) Individual Providers (IP) Services under the Depart-

ment of Public Social Services (DPSS) is projecting expenditures to be over the adopted

budget by $3,000,000. The increase is related to the new approved MOU agreement with

United Domestic Workers Union (UDW), which increased the health benefits contribution from

$0.57 per hour to $0.71 per hour and increased the life insurance to $0.03 per hour effective

May 2023. The increases in the MOU were approved by the Board of Supervisors on February

Current Status

County of Riverside Fiscal Year 2022/23 Third Quarter Budget Report 13

28, 2023 (item 3.25) and DPSS also received confirmation that the State approved the in-

creases.

That the Board of Supervisors approve and direct the Auditor-Con-

troller to make budget adjustments increasing appropriations and estimated revenues for the

Department of Public Social Services – Mandated Client Services by $3,000,000.

The Department of Public Social Services anticipates an increase in categorical assistance

expenditures through the current fiscal year in the amount of $6,800,000. The Foster Care,

Emergency Assistance and Adoptions Assistance program expenditures are projected to be

over the adopted budget by approximately $3,500,000. In addition, KinGap, CAPI and ARC

assistance payment are projected to exceed the budgeted amounts by approximately

$3,300,000 combined due to an increase in caseloads.

That the Board of Supervisors approve and direct the Auditor-Con-

troller to make budget adjustments increasing appropriations and estimated revenues for the

Department of Public Social Services-Categorical Aid by $6,800,000.

I

NTERNAL

S

ERVICES

Facilties Management

The Facilities Management Community and Recreational Centers Division commenced a

Community Center Operation Agreement by and between the County of Riverside and Idyll-

wild Community Center. The agreement allows Idyllwild Community Center to use the facility

as a Community Center. Operator’s Reimbursement Fund for Idyllwild Community Center is

$180,000 annually. Due to a partial reimbursement in FY 21/22, the Community Center

Budget will have an excess of revenue in FY 22/23. A budget adjustment is requested to

increase appropriations for Contributions from Other County Funds and Project Cost Ex-

pense.

That the Board of Supervisors approve and direct the Auditor-Con-

troller to make budget adjustments increasing appropriations and estimated revenues for the

Facilities Management - Community and Recreational Centers by $3,100.

The Facilities Management Community and Recreational Centers Division commenced im-

provement Projects at the Indio Fairgrounds-Shalimar Building for Roof Repairs. A budget

adjustment is requested to increase appropriations for Interfund Expense-Building Improve-

ments Projects.

That the Board of Supervisors approve and direct the Auditor-Con-

troller to make budget adjustments increasing appropriations and increasing estimated reve-

nue for the Facilities Management - Community and Recreational Centers by $175,000.

To consolidate Facilities Management Department ID’s, Facilities Management combined de-

partment ID 7201400000 - FM-Desert Expo with department ID 7201300000 FM-Community

and Recreational Centers. To inactivate fund and department ID for Desert Expo a budget

Current Status

14 Fiscal Year 2022/23 Third Quarter Budget Report County of Riverside

adjustment is being requested to transfer balance back to the general fund.

That the Board of Supervisors approve and direct the Auditor-Con-

troller to make budget adjustments increasing appropriations for the Facilities Management -

Desert Expo Center by $347,951.

In an effort to consolidate community and recreational centers into on Department ID, Facili-

ties Management is closing the Desert Expo department ID 7201400000 and transferring NCC

allocation to the FM-Community and Recreational Centers department ID 7201300000. The

budget adjustment is to decrease the contributions from other county funds and to the inactive

Desert Expo special revenue fund.

That the Board of Supervisors approve and direct the Auditor-Con-

troller to make budget adjustments decreasing appropriations for Contribution to Other Funds

by $1,444,500 and decreasing estimated revenues for Facilities Management - Community

and Recreational Centers by $1,444,500.

The Facilities Management Lakeland Village Recreational Centers Division commenced im-

provement Projects at Lakeland Village and Perret Park including gate and fence repair, con-

crete pads for trash cans, shade structures, and sidewalk repairs. A budget adjustment to

transfer revenues from Community and Recreational Centers will cover the improvement

costs associated with the budget adjustment requesting an increase to revenues and appro-

priations for Interfund Exp-Bldg. Improvements to Lakeland Village Recreational Centers.

That the Board of Supervisors approve and direct the Auditor-Con-

troller to make budget adjustments increasing appropriations and estimated revenues for the

Facilities Management Community and Recreational Centers by $157,262 and increasing ap-

propriations and estimated revenues for the Facilities Management Lakeland Village Recrea-

tional Centers by $157,262.

Facilities Management Pass-Thru Department commenced projects related to improvements

and expansions at the Lakeland Village, Good Hope and Mead Valley Parks/Community Cen-

ters under the Neighborhood Revitalization ARPA funding category. Based on Board Item 3.2

on 12/13/22, Facilities Management is authorized to increase appropriations and revenues

from the approved ARPA Funding.

That the Board of Supervisors approve and direct the Auditor-Con-

troller to make budget adjustments increasing appropriations and estimated revenues for the

Facilities Management Pass-Thru by $2,250,000.

Facilities Management Real Estate Division commenced tenant improvement project at the

new Sheriff’s South Corona-Lake Mathews Office, including full interior improvements and

adding an interrogation room. A budget adjustment is requested to increase appropriations

for Tenant Improvements.

That the Board of Supervisors approve and direct the Auditor-Con-

troller to make budget adjustments increasing appropriations and estimated revenue for the

Current Status

County of Riverside Fiscal Year 2022/23 Third Quarter Budget Report 15

Facilities Management - Real Estate by $4,735,180.

Human Resources

Human Resources has experienced multiple requests from varying internal County depart-

ments for increased additional arbitration, professional services, and training materials.

Employee Relations and Labor Relations have seen an overall increase in costs as compared

to this time last fiscal year. Arbitration Services expenditures will be monitored for further ac-

tivity and trending analysis, currently requesting a budget adjustment to increase revenue and

expenditures as it relates to arbitration services and learning development subscriptions. To

assist RUHS with fully expending grant funding, Human Resources Learning & Organizational

Development has procured for additional licenses which require an amendment to the current

agreement, not previously budgeted

That the Board of Supervisors approve and direct the Auditor-Con-

troller to make budget adjustments increasing appropriations and estimated revenues for Hu-

man Resources by $700,000.

HR-Delta Dental PPO budget is performing higher than expected for this point in the fiscal

year at 95%. Claims expenditures are higher than member premium collections. This program

offered premium price reductions and increased benefits to all members, causing a quarterly

budget adjustment to ensure enough appropriations to expense current year projected costs.

This program is currently utilizing accumulated fund balance reserves to cover operations.

That the Board of Supervisors approve and direct the Auditor-Con-

troller to make budget adjustments increasing appropriations for Human Resources – Delta

Dental PPO by $1,000,000.

HR-Local Advantage Plus Dental budget is performing higher than expected for this point in

the fiscal year at 82%. Claims expenditures are higher than member premium collections.

This program offered premium price reductions and increased benefits to all members, caus-

ing a quarterly budget adjustment to ensure enough appropriations to expense current year

projected costs. This program is currently utilizing unrestricted reserves to cover operations.

That the Board Supervisors approve and direct the Auditor-Controller

to make budget adjustment increasing appropriations for Human Resources- Local Ad-

vantage Plus Dental by $200,000.

HR-LTD Disability Insurance budget is trending higher according to expectations (91%). LTD

claims are higher this year than the same time last fiscal year causing the need for additional

appropriations to ensure adequate funding. On January 1, 2023, a rate adjustment caused

an anticipated increase in revenue for the residual of the fiscal year, while recent union nego-

tiations and reclassing specific County positions to different disability categories has caused

overspending in this fund.

That the Board of Supervisors approve and direct the Auditor-Con-

Current Status

16 Fiscal Year 2022/23 Third Quarter Budget Report County of Riverside

troller to make budget adjustments increasing appropriations and estimated revenues for Hu-

man Resources- Long Term Disability Insurance by $1,200,000.

HR-STD Disability Insurance budget is trending higher than expectations (80%). STD Insur-

ance admin fees and claims projecting higher than expected, while recent union negotiations

and reclassing specific County positions to different disability categories has caused over-

spending in this fund.

That the Board of Supervisors approve and direct the Auditor-Con-

troller to make budget adjustments increasing appropriations and estimated revenues for Hu-

man Resources-STD Disability Insurance by $30,000.

HR Workers Compensation experienced an increase in Workers Comp claims resulting in

increased professional services for the claim review process. Currently, Professional Services

has spent $715,000 compared to $43,000, this time last fiscal year 03/31/2022. This program

is currently utilizing unrestricted reserves to cover operations.

That the Board of Supervisors approve and direct the Auditor-Con-

troller to make budget adjustment increasing appropriations for Human Resources-Workers

Compensation by $500,000.

Riverside County Information Technology

RCIT anticipates exceeding appropriations due to an increase in retirement payoffs and Soft-

ware increases. These increases will be offset using the restricted fund balance. RCIT antic-

ipates exceeding appropriations due to an increase in software, mainly the PeopleSoft Finan-

cial upgrade to version 9.2. The increase will be offset by Capital Asset Reserve funding.

That the Board of Supervisors approve and direct the Auditor-Con-

troller to make the budget adjustments increasing appropriations for the RCIT-Geographical

Information System Fund by $186,000.

That the Board of Supervisors approve and direct the Auditor-Con-

troller to make the budget adjustments increasing appropriations for Riverside County Infor-

mation Technology by $1,600,000.

O

FFICE OF

E

CONOMIC

D

EVELOPMENT

Community Facility District (CFD)

CFD Administration Fund 20605-991000 is a newly created fund intended to track CFD ad-

ministrative revenue, expense, and cash separately from the CSA Administration budget unit.

This proposed adjustment will create the remaining current year budget for CFD Admin Fund

20605.

That the Board of Supervisors approve and direct the Auditor-Con-

troller to make budget adjustments increasing appropriations and estimated revenues for the

Community Facility District Administration by $388,917.

Current Status

County of Riverside Fiscal Year 2022/23 Third Quarter Budget Report 17

County Service Area

CSA Administration Fund 23010-915202 requires appropriations increase of $592,896 to

cover a one-time transfer of Community Facilities District (CFD) administration funds previ-

ously received in the CSA Administration budget unit. In February 2023, new CFD Admin-

istration Fund 20605 was created to better track CFD revenues collected at various points

during establishment of CFDs, and expenditures incurred during administration of the various

CFD budget units. This one-time transfer will move administrative funds currently held as fund

balance within the CSA Administration budget unit to the newly created CFD Administration

fund.

That the Board of Supervisors approve and direct the Auditor-Con-

troller to make budget adjustments increasing appropriations for CSA Administration and es-

timated revenues for the Community Facility District Administration by $592,896.

County Service Area 149 – Wine Country

CSA 149 requires budget adjustment to increase appropriations by $70,000 to cover road

repairs due to damage caused by recent rainstorms.

That the Board of Supervisors approve and direct the Auditor-Con-

troller to make budget adjustments increasing appropriations for CSA 149 by $70,000.

P

UBLIC

S

AFETY

District Attorney

The District Attorney’s Office is requesting a net increase in appropriations and estimated

revenues of $538,052 in the third quarter report as result of various state, federal and other

restricted resources. There is no impact to the net county cost as a result of the following

adjustments:

Fund 11019 DA Vehicle Theft Allocation – Net Increase of $170,000

The Department anticipates increased personnel effort(s) to address Vehicle Theft and this

adjustment simply provides the additional funding to continue to perform and reimburse for

the work. This effort is funded by vehicle license fees and this entry makes the funds available

to spend from the restricted sub fund.

Fund 11041 Real Estate Fraud Prosecution – Net Increase of $205,000

The Real Estate Fraud sub fund is made available to investigate and prosecute victims of

property crimes and is funded by County filing fees. This adjustment makes additional funding

available for additional staffing needs this year.

Fund 11118 Auto Insurance Fraud – Net Increase of $70,159

Current Status

18 Fiscal Year 2022/23 Third Quarter Budget Report County of Riverside

The Auto Insurance Fraud subfund is made available by the California Dept of Insurance. This

entry is to increase the original budget to match the additional funds awarded to the depart-

ment after the original award was made. This was as a result of the approval of rollover funding

from the California Dept. of Insurance.

Fund 11156 Auto Insurance Fraud Urban – Net Increase of $54,224

The Auto Insurance Fraud-Urban sub fund is made available by the California Dept of Insur-

ance. This entry is to increase the original budget to match the additional funds awarded to

the department after the original award was made. This was as a result of the approval of

rollover funding from the California Dept. of Insurance.

Fund 11158 Workers Compensation Insurance Fraud – Net Increase of $38,669

The Workers Compensation Insurance sub fund is made available by the California Dept of

Insurance. This entry is to increase the original budget to match the additional funds awarded

to the department after the original award was made. This was as a result of the approval of

rollover funding from the California Dept. of Insurance.

That the Board of Supervisors approve and direct the Auditor-Con-

troller to make budget adjustments increasing appropriations and estimated revenues for the

District Attorney by $538,052.

Fire Department

The Fire Department will meet its NCC budgetary targets for FY 2022/23. The Department

requests a budget adjustment related to our city partner contracts. Over the course of the

fiscal year, several of our city partners funded additional county positions a part of their fire

contract services. The Department is requesting a budget adjustment for the expense and

funding of these additional positions. The Fire Department will meet its NCC budgetary tar-

gets for FY 2022/23.

That the Board of Supervisors approve and direct the Auditor-Con-

troller to make budget adjustments increasing appropriations and estimated revenues for the

Fire Protection Contract Services by $650,000.

Sheriff

The Sheriff Support Division is requesting a budget transfer between orgs to cover additional

costs for the Coroner and CAC divisions. This request will not impact the department net

county cost as a result of the following adjustments:

Sheriff’s Department- CAC 060 – Net Increase of $121,024

Riverside County Sheriff’s Department provides safety to all occupants of the Riverside

County Administrative Center, including the Board of Supervisors, elected officials, county

employees, and members of the public. The contract for private security guards within the

building had a mid-year rate increase.

Current Status

County of Riverside Fiscal Year 2022/23 Third Quarter Budget Report 19

Sheriff’s Coroner 100 – Net Increase of $456,164

The Riverside County Sheriff’s Coroner Division is requesting a budget adjustment to move

appropriations to cover two emergency projects. The morgue refrigeration unit is failing and

requires a complete system replacement. The second project is the replacement of an indus-

trial power switch supplying power to critical areas of the Coroner East building.

That the Board of Supervisors approve and direct the Auditor-Con-

troller to make budget adjustments increasing appropriations for the Sheriff Department by

$577,188.

The Riverside County Sheriff’s Patrol Division is requesting a budget adjustment in the

amount of $186,218 for the purchase of PSEC radios funded by the Homeland Security OES

Grant. This grant was accepted by the Riverside County Board of Supervisors on M.O. 3.25

(9/21/21), a portion of these funds were spent on PSEC’s ISSI Connection to San Bernardino

County and CalOES has approved that the remaining $186,218 to be used by the division to

purchase new PSEC radios.

That the Board of Supervisors approve and direct the Auditor-Con-

troller to make budget adjustments increasing appropriations and estimated revenues for the

Sheriff Department-Patrol by $186,218.

The Riverside County Sheriff’s Patrol Division is requesting a budget adjustment in the

amount of $1,280,873 to recognize Insurance Proceed revenue received from used vehicle

auctions. This revenue has posted to the division and offsets the costs to maintain and replace

the division’s fleet.

That the Board of Supervisors approve and direct the Auditor-Con-

troller to make budget adjustments increasing appropriations and estimated revenues for the

Sheriff Department-Patrol by $1,280,873.

The DOJ State Criminal Alien Assistance Program reimbursement was delayed for the previ-

ous year due to the change in presidential administration. The program reimburses a portion

of salaries to the county for incarcerating certain convicted undocumented aliens.

That the Board of Supervisors approve and direct the Auditor-Con-

troller to make budget adjustments increasing appropriations and estimated revenues for the

Sheriff Department-Corrections by $1,853,264.

The Riverside County Sheriff’s Department for various divisions is requesting a net increase

in appropriations and estimated revenues of $2,211,685 as a result of claims for Capital Im-

provement Program (CIP) Fund reimbursements as approved by the BOS on M.O. 3.24

(4/4/23). Claims were submitted to the Executive Office for posted expenses on approved

CIP projects. There is no impact to the net county cost as a result of the following adjustments:

Sheriff’s Support 020 – Net Increase of $249,830

Current Status

20 Fiscal Year 2022/23 Third Quarter Budget Report County of Riverside

The Riverside County Sherriff Support Division is requesting a budget adjustment for the first

monthly claim for Capital Improvement Program (CIP) Fund reimbursement.

Sheriff’s Patrol 030 – Net Increase of $322,967

The Riverside County Sherriff Patrol Division is requesting a budget adjustment for the first

monthly claim for Capital Improvement Program (CIP) Fund reimbursement.

Sheriff’s Correction 040 – Net Increase of $1,570,226

The Riverside County Sheriff’s Correction Division is requesting a budget adjustment in for

the first monthly claim for Capital Improvement Program (CIP) Fund reimbursement.

An additional $3,356,264 in appropriations will be needed for project expenses that will occur

before the end of the fiscal year. A claim will be summited for the additional expenses when

actual costs occur. The request to move $3,356,264 from Appropriation 1 to Appropriation 4

will allow purchase orders to be issued to continue our Department’s CIP projects.

Sheriff’s Ben Clark Training Center 070 – Net Increase of $40,778

The Riverside County Sheriff’s Ben Clark Training Center Division is requesting a budget ad-

justment for the first monthly claim for Capital Improvement Program (CIP) Fund reimburse-

ment.

Sheriff’s Coroner 100 – Net Increase of $27,884

The Riverside County Sheriff’s Coroners Division is requesting a budget adjustment for the

first monthly claim for Capital Improvement Program (CIP) Fund.

That the Board of Supervisors approve and direct the Auditor-Con-

troller to make budget adjustments increasing appropriations and estimated revenues for the

Sheriff Department by $2,211,685.

P

UBLIC

W

ORKS AND

C

OMMUNITY

S

ERVICES

Animal Services

Riverside County Department of Animal Services is currently operating within the approved

budget. The department is requesting two budget adjustments as follows:

The first adjustment will move appropriations from the Programs budget to the Administration

budget in the amount of $165,000. This appropriation transfer covers the shortages created

at the beginning of the fiscal year as Animal Services moved several positions from the Pro-

grams budget – 4202600000 and placed the expenses in the Administration budget –

4201600000.

The second budget adjustment will increase appropriations and estimated revenue in all three

Current Status

County of Riverside Fiscal Year 2022/23 Third Quarter Budget Report 21

departmental budgets by $363,846. The increase will help cover higher than anticipated in-

surance and carpool costs.

That the Board approve and direct the Auditor-Controller to make

budget adjustments increasing appropriations and estimated revenues for the Animal Ser-

vices Department by $363,846.

Flood Control and Water Conservation District

The requested budget adjustment will increase appropriations within the Flood Control and

Water Conservation District Data Processing Fund 48080. The adjustment is necessary for

the District to accommodate increased salaries and benefits costs associated with an increase

in staffing and unanticipated costs associated with software acquisitions and upgrades.

That the Board of Supervisors approve and direct the Auditor-Con-

troller to make budget adjustments increasing appropriations for the Flood Control and Water

Conservation District – Data Processing Fund by $500,000.

Regional Parks and Open Space District

The District’s MSHCP Reserve Management program was approved funding from RCA for

additional patrolling and crowd control at RCA lands in anticipation of wildflower superbloom.

A budget increase is needed to reflect the approved funding.

That the Board of Supervisors approve and direct the Auditor Con-

troller to increase appropriations and estimated revenues for the Regional Park and Open

Space District-MSHCP Reserve Management by $70,000.

The Park Residences fund is used to maintain, repair and improve caretaker residences at

our park sites. A budget increase is required to finish the tenant improvements needed for the

residences to be ready for occupancy. This will also cover any unforeseen repairs for the

remainder of the year.

That the Board of Supervisors approve and direct the Auditor Con-

troller to increase appropriations for the Regional Park and Open Space District-Park Resi-

dences Utilities and Maintenance by $25,000.

During the budget development for FY2022-23, the District budgeted for American Rescue

Plan Act (ARPA) projects in our capital improvement fund 33120 as project costs will be re-

imbursed through the ARPA fund 21735. However, in October 2022, the Executive Office

established a budget for Parks within the ARPA fund for all our approved projects. The District

is requesting a budget decrease in fund 33120 for the remainder of the year.

That the Board of Supervisors approve and direct the Auditor Con-

troller to make budget adjustments for the Regional Park and Open Space District – Park Acq.

And Dev. DIF Fund by $2,500,000.

Current Status

22 Fiscal Year 2022/23 Third Quarter Budget Report County of Riverside

R

EGISTRAR OF

V

OTERS

The Registrar of Voters is requesting a budget adjustment to increase both expenditures and

revenue to cover contract payments for election services and will meet the State reimburse-

ment cutoff date. The State of California will reimburse 75% of the election services contract.

The department is requesting additional NCC from the general fund contingency for the 25%

portion that will not be reimbursed by the State of California.

That the Board of Supervisors approve and direct the Auditor-Con-

troller to make budget adjustments increasing appropriations by $5,895,604 and estimated

revenues by $4,421,703 for the Registrar of Voters and decreasing appropriations for Appro-

priations for Contingency by $1,473,901.

In addition, the Registrar of Voters is requesting a budget adjustment to cover expenses re-

lated to mailing all voters the vote-by-mail ballots. The State of California will reimburse 100%

of the costs by the end of the fiscal year.

That the Board of Supervisors approve and direct the Auditor-Con-

troller to make budget adjustments increasing appropriations and estimated revenues for the

Registrar of Voters by $2,000,000.

R

IVERSIDE

U

NIVERSITY

H

EALTH

S

YSTEM

Public Health (RUHS-PH)

Since January 2020, RUHS-Public Health has led the COVID-19 response efforts. As we are

now in the recovery phase, with the federal Public Health Emergency to expire in May 2023,

we are in a better position to transition away from the emergency phase, ensuring our County

becomes more resilient to any future emergencies and/or challenges. Addressing COVID-19

remains a public health priority; however, our focus will be on improving standards of care

and services for the constituents of Riverside County. The department is closely monitoring

all expenditures and anticipates ending the fiscal year within budget targets.

A budget adjustment is requested to increase budget capacity for the purchase of equipment

for the RUHS-PH Laboratory to test for pathogens like SARS-CoV2 and other emerging dis-

eases to provide surveillance and detect outbreaks in the community and for two (2) large

medical freezers to increase storage capacity of specimens and reagents for SARS-CoV2

testing.

In addition, the department requests to increase budget capacity for the purchase of two (2)

forklifts for the RUHS-PH Warehouses. One forklift will be replacing a recently retired aging

asset and the other additional forklift is needed due to the increased workload and demand of

the warehouse operations.

That the Board of Supervisors 1) approve and direct the Auditor-Con-

troller to make budget adjustments for RUHS-Public Health by $297,000 and 2) approve and

Current Status

County of Riverside Fiscal Year 2022/23 Third Quarter Budget Report 23

authorize the purchase of two forklifts.

RUHS Medical Center (RUHS-MC)

The requested budget adjustment will increase appropriation two within the Riverside Univer-

sity Health System Medical Center – department 4300100000, fund 40050. The adjustment

is necessary to transition expenditures related to psychiatrists from RUHS Behavioral Health

to the Medical Center in accordance with new State cost report requirements. No additional

expenditures, revenue, or NCC are required.

That the Board of Supervisors approve and direct the Auditor-Con-

troller to increase appropriations and estimated revenues for the RUHS by $35,000,000.

Fund Dept ID Account Amount

11076 1200200000 County Clerk-Recorder 523230 Miscellaneous Expense 1,896,373

11076 1200200000 County Clerk-Recorder 370100 Unassigned Fund Balance (1,896,373)

11077 1200200000 County Clerk-Recorder 523230 Miscellaneous Expense (1,896,373)

11077 1200200000 County Clerk-Recorder 370100 Unassigned Fund Balance 1,896,373

Fund Dept ID

Account Amount

10000 1300100000 Auditor-Controller 700020 Prop Tax Current Secured 5,941,859

10000 1300100000 Auditor-Controller 701020 Prop Tax Current Unsecured 1,198,177

10000 1300100000 Auditor-Controller 704000 Prop Tax Current Supplemental 2,522,300

10000 1300100000 Auditor-Controller 705000 Prop Tax Prior Supplemental (649,354)

10000 1300100000 Auditor-Controller 710020 Sales & Use Taxes 11,124,760

10000 1300100000 Auditor-Controller 714000 Non Commn Aircraft (64,578)

10000 1300100000 Auditor-Controller 715070 RDV Prty Tax, LMIH Resdul Asts 8,274,755

10000 1300100000 Auditor-Controller 750200 CA-Motor Vehicle In-Lieu Tax 9,788,940

10000 1300100000 Auditor-Controller 752800 CA-Homeowners Tax Relief (17,948)

10000 1300100000 Auditor-Controller 752820 CA-Suppl Homeowners Tax Relief 17,991

10000 1300100000 Auditor-Controller 753620 CA-Mandate Reimbursement 63,689

10000 1300100000 Auditor-Controller 764500 Federal In Lieu Taxes 532,566

10000 1300100000 Auditor-Controller 781000 Contractual Revenue-RDV 9,020,360

10000 1300100000 Auditor-Controller 781100 El Sobrante Land Fill 428,379

10000 1300100000 Auditor-Controller 781140 Unclaimed Money 152,031

10000 1300100000 Auditor-Controller 781170 Restitution 29,978

10000 1300100000 Auditor-Controller 370100 Unassigned Fund Balance 48,363,905

Fund Dept ID Account Amount

10000 1102900000 Non-EO Operations 536200 Contrib To Other Non-Co Agcy 289,228

10000 1102900000 Non-EO Operations 370100 Unassigned Fund Balance (289,228)

10000 1109000000 Approp For Contingency-General 581000 Approp For Contingencies (289,228)

10000 1109000000 Approp For Contingency-General 370100 Unassigned Fund Balance 289,228

Fund Dept ID Account Amount

10000 1102900000 Non-EO Operations 525440 Professional Services 300,787

10000 1102900000 Non-EO Operations 755850 CA - AB 1869 Backfill 300,787

Fund Dept ID Account Amount

10000 1110000000 RiversideCnty Executive Office 551100 Contribution To Other Funds 3,000,000

10000 1110000000 RiversideCnty Executive Office 741300 Lease To Non-County Agency 3,000,000

Attachment A Summary of Recommendations

Recommendation 1: That the Board of Supervisors approve and direct the Auditor-Controller to make budget

adjustments to transfer appropriations from the County Clerk-Recorder Conversion Fund to the Modernization Fund by

$1,896,373.

Recommendation 2: That the Board of Supervisors approve and direct the Auditor-Controller to make budget

adjustments increasing estimated revenues for the Auditor-Controller by $48,363,905.

Recommendation 3: That the Board of Supervisors approve and direct the Auditor-Controller to make budget

adjustments increasing appropriations for the Non-Executive Office Operations by $289,228 and decreasing

appropriations for Appropriations for Contingency by $289,228.

Recommendation 4: That the Board of Supervisors approve and direct the Auditor-Controller to make budget

adjustments increasing appropriations and estimated revenues for the Non-Executive Office Operations by $300,787.

Recommendation 5: That the Board of Supervisors approve and direct the Auditor-Controller to make budget

adjustments increasing appropriations and estimated revenues for Riverside County Executive Office by $3,000,000.

A-1

Attachment A Summary of Recommendations

Fund Dept ID Account Amount

10000 1101000000 Contribution To Other Funds 551100 Contribution To Other Funds 600,000

10000 1101000000 Contribution To Other Funds 370100 Unassigned Fund Balance (600,000)

10000 1109000000 Approp For Contingency-General 581000 Approp For Contingencies (600,000)

10000 1109000000 Approp For Contingency-General 370100 Unassigned Fund Balance 600,000

Fund Dept ID Account Amount

11186 1111200000 Countywide OB Reimb Fund 523350 Administrative Expense 3,515

11186 1111200000 Countywide OB Reimb Fund 525020 Legal Services (4,000)

11186 1111200000 Countywide OB Reimb Fund 525500 Salary/Benefit Reimbursement 11,711

11186 1111200000 Countywide OB Reimb Fund 777520 Reimbursement For Services 11,226

Fund Dept ID Account Amount

10000 1104300000 Court Reporting Transcripts 524720 Court Reporter Fees 270,000

10000 1104300000 Court Reporting Transcripts 370100 Unassigned Fund Balance (270,000)

10000 1109000000 Approp For Contingency-General 581000 Approp For Contingencies (270,000)

10000 1109000000 Approp For Contingency-General 370100 Unassigned Fund Balance 270,000

Fund Dept ID Account Amount

30500 1103500000 Mitigation Project Operation 551100 Contribution To Other Funds 175,000

30500 1103500000 Mitigation Project Operation 322103 Rst For Capital Project subfunds (175,000)

Fund Dept ID Account Amount

10000 5100200000 Mandated Client Services 530440 Client Services 3,000,000

10000 5100200000 Mandated Client Services 750700 CA-Public Asst Program 1,300,000

10000 5100200000 Mandated Client Services 761000 Fed-Publ Assistance Programs 1,700,000

Fund Dept ID Account Amount

10000 5100300000 Categorical Aid 530480 Categorical Assistance 6,800,000

10000 5100300000 Categorical Aid 750700 CA-Public Asst Program 2,000,000

10000 5100300000 Categorical Aid 750740 CA-DPSS Realignment 2,500,000

10000 5100300000 Categorical Aid 761000 Fed-Publ Assistance Programs 2,300,000

Recommendation 11: That the Board of Supervisors approve and direct the Auditor-Controller to make budget

adjustments increasing appropriations and estimated revenues for the Department of Public Social Services-Categorical

Aid by $6,800,000.

Recommendation 6: That the Board of Supervisors approve and direct the Auditor-Controller to make budget

adjustments increasing appropriations for the EO-General Fund Contributions to Other Funds department and decreasing

appropriations for Appropriations for Contingency by $600,000.

Recommendation 7: That the Board of Supervisors approve and direct the Auditor-Controller to make budget

adjustments increasing appropriations and estimated revenues for the Countywide Oversight Board by $11,226.

Recommendation 8: That the Board of Supervisors approve and direct the Auditor-Controllers to make budget ad-

justments increasing appropriations by $270,000 for the Non-Executive Office Operations and decreasing appropriations

for Appropriations for Contingency by $270,000.

Recommendation 9: That the Board of Supervisors approve and direct the Auditor-Controller to make budget

adjustments increasing appropriations for the Mitigation Project Operation by $175,000.

Recommendation 10: That the Board of Supervisors approve and direct the Auditor-Controller to make budget

adjustments increasing appropriations and estimated revenues for the Department of Public Social Services – Mandated

Client Services by $3,000,000.

A-2

Attachment A Summary of Recommendations

Fund Dept ID Account Amount

10000 7201300000 FM-Community & Rec. Centers 528500 Project Cost Expense 3,100

10000 7201300000 FM-Community & Rec. Centers 790600 Contrib Fr Other County Funds 3,100

Fund Dept ID Account Amount

10000 7201300000 FM-Community & Rec. Centers 537320 Interfnd Exp-Improvements Bldg 175,000

10000 7201300000 FM-Community & Rec. Centers 741000 Rents 175,000

Fund Dept ID Account Amount

22200 7201400000 FM-Desert Expo Center 521420 Maint-Field Equipment 85

22200 7201400000 FM-Desert Expo Center 522310 Maint-Building and Improvement 20

22200 7201400000 FM-Desert Expo Center 522320 Maint-Grounds 310

22200 7201400000 FM-Desert Expo Center 551000 Operating Transfers-Out 347,536

22200 7201400000 FM-Desert Expo Center 350100 AFB For Program Money (347,951)

Fund Dept ID Account Amount

10000 1101000000 Contribution To Other Funds 551100 Contribution To Other Funds (1,444,500)

10000 1101000000 Contribution To Other Funds 370100 Unassigned Fund Balance 1,444,500

10000 7201300000 FM-Community & Rec. Centers 790600 Contrib Fr Other County Funds (1,444,500)

10000 7201300000 FM-Community & Rec. Centers 370100 Unassigned Fund Balance (1,444,500)

Fund Dept ID Account Amount

10000 7201300000 FM-Community & Rec. Centers 551100 Contribution To Other Funds 157,262

10000 7201300000 FM-Community & Rec. Centers 790600 Contrib Fr Other County Funds 157,262

21830 7201200000 FM-Lakeland Village Rec. Ctrs 525320 Security Guard Services 16,000

21830 7201200000 FM-Lakeland Village Rec. Ctrs 537320 Interfnd Exp-Improvements Bldg 141,262

21830 7201200000 FM-Lakeland Village Rec. Ctrs 790600 Contrib Fr Other County Funds 157,262

Fund Dept ID Account Amount

21735 7200800000 FM-Department Pass-Thru 528500 Project Cost Expense 250,000

21735 7200800000 FM-Department Pass-Thru 542040 Buildings-Capital Projects 2,000,000

21735 7200800000 FM-Department Pass-Thru 763520 Fed-American Rescue Plan Act 2,250,000

Recommendation 12: That the Board of Supervisors approve and direct the Auditor-Controller to make budget

adjustments increasing appropriations and estimated revenues for the Facilities Management Community and

Recreational Centers by $3,100.

Recommendation 13: That the Board of Supervisors approve and direct the Auditor-Controller to make budget

adjustments increasing appropriations and increasing estimated revenue for the Facilities Management Community and

Recreational Centers by $175,000.

Recommendation 14: That the Board of Supervisors approve and direct the Auditor-Controller to make budget

adjustments increasing appropriations for the Facilities Management - Desert Expo Center by $347,951.

Recommendation 15: That the Board of Supervisors approve and direct the Auditor-Controller to make budget

adjustments decreasing appropriations for Contribution to Other Funds by $1,444,500 and decreasing estimated revenues

for Facilities Management - Community and Recreational Centers by $1,444,500.

Recommendation 16: That the Board of Supervisors approve and direct the Auditor-Controller to make budget

adjustments increasing appropriations and estimated revenues for the Facilities Management Community and

Recreational Centers by $157,262 and increasing appropriations and estimated revenues for the Facilities Management

Lakeland Village Recreational Centers by $157,262.

Recommendation 17: That the Board of Supervisors approve and direct the Auditor-Controller to make budget

adjustments increasing appropriations and estimated revenues for the Facilities Management Pass-Thru by $2,250,000.

A-3

Attachment A Summary of Recommendations

Fund Dept ID Account Amount

47220 7200400000 FM-Real Estate 522410 Maint-Tenant Improvement 4,735,180

47220 7200400000 FM-Real Estate 781360 Other Misc Revenue 4,735,180

Fund Dept ID Account

Amount

10000 1130100000 Human Resources 525440 Professional Services 400,000

10000 1130100000 Human Resources 527860 Training-Materials 300,000

10000 1130100000 Human Resources 778280 Interfnd -Reimb For Service 400,000

10000 1130100000 Human Resources 778340 Interfnd -Training 300,000

Fund Dept ID Account Amount

45860 1130600000 Delta Dental PPO 534240 Dental Claims 1,000,000

45860 1130600000 Delta Dental PPO 380100 Unrestricted Net Assets (1,000,000)

Fund Dept ID Account Amount

45900 1132600000 Local Advantage Plus Dental 534240 Dental Claims 200,000

45900 1132600000 Local Advantage Plus Dental 380100 Unrestricted Net Assets (200,000)

Fund

Dept ID Account Amount

45980 1131400000 Long Term Disability Insurance 520940 Insurance-Other 1,200,000

45980 1131400000 Long Term Disability Insurance 781220 Contributions & Donations 1,200,000

Fund Dept ID

Account Amount

46060 1131200000 STD Disability Insurance 525440 Professional Services 15,000

46060 1131200000 STD Disability Insurance 534260 Disability Claims 15,000

46060 1131200000 STD Disability Insurance 781220 Contributions & Donations 30,000

Fund Dept ID Account Amount

46100 1130800000 Workers Compensation 525440 Professional Services 500,000

46100 1130800000 Workers Compensation 380100 Unrestricted Net Assets (500,000)

Recommendation 24: That the Board of Supervisors approve and direct the Auditor-Controller to make budget

adjustment increasing appropriations for Human Resources-Workers Compensation by $500,000.

Recommendation 23: That the Board of Supervisors approve and direct the Auditor-Controller to make budget

adjustments increasing appropriations and estimated revenues for Human Resources-STD Disability Insurance by

$30,000.

Recommendation 18: That the Board of Supervisors approve and direct the Auditor-Controller to make budget

adjustments increasing appropriations and estimated revenue for the Facilities Management - Real Estate by $4,735,180.

Recommendation 19: That the Board of Supervisors approve and direct the Auditor-Controller to make budget

adjustments increasing appropriations and estimated revenues for Human Resources by $700,000.

Recommendation 20: That the Board of Supervisors approve and direct the Auditor-Controller to make budget

adjustments increasing appropriations for Human Resources – Delta Dental PPO by $1,000,000.

Recommendation 21: That the Board Supervisors approve and direct the Auditor-Controller to make budget adjustment