Report on the Activities of the

Texas Comptroller of Public Accounts

INTERNAL AUDIT DIVISION | FISCAL 2021

Glenn Hegar Texas Comptroller of Public Accounts

Submitted to

Governor’s Oce, Budget and Policy Division

Texas Comptroller of Public Accounts

Legislative Budget Board

State Auditor’s Oce

Oct. 29, 2021

INTERNAL AUDIT ANNUAL REPORT FOR FISCAL 2021

TEXAS COMPTROLLER OF PUBLIC ACCOUNTS | I

Table of Contents

I. Compliance with Texas Government Code Section 2102.015:

Posting the Internal Audit Plan, Internal Audit Annual Report

and Other Audit Information on the Website

..............................................................1

II. Internal Audit Plan for Fiscal 2021 .........................................................................2

III. Consulting Services and Non-audit Services Completed ...................................................4

IV. External Quality Assurance Review (Peer Review) ..........................................................6

V. Internal Audit Plan for Fiscal 2022 .........................................................................7

VI. External Audit Services Procured in Fiscal 2021 ...........................................................12

VII. Reporting Suspected Fraud and Abuse ...................................................................14

TEXAS COMPTROLLER OF PUBLIC ACCOUNTS | 1

INTERNAL AUDIT ANNUAL REPORT FOR FISCAL 2021

I. Compliance with Texas Government Code Section 2102.015:

Posting the Internal Audit Plan, Internal Audit Annual Report

and Other Audit Information on the Website

The Texas Comptroller of Public Accounts (Comptroller’s oce) has developed a process to follow in order to ensure com-

pliance with the provisions of Texas Government Code Section 2102.015. Specically, within 30 days of approval by the

Comptroller, the approved Internal Audit Annual Audit Plan, as provided by Texas Government Code Section 2102.008, was

posted on the Comptroller’s oce internet website (https://comptroller.texas.gov/transparency/reports/cpa-operations/).

In addition, the Internal Audit Annual Report, as required by Texas Government Code Section 2102.009, will be posted on

the Comptroller’s oce internet website.

In accordance with Texas Government Code Title 5 Open Government Ethics Chapter 552 Public Information Subchapter C

Information Excepted from Required Disclosure, the Internal Audit Division will not release any condential or sensitive

information protected by this exception. Any information not protected by this or another applicable exception that is determined

to be condential in nature will be specically designated as such in accordance with State Auditor’s Oce (SAO) guidelines. No

information contained in the agency’s Internal Audit Annual Audit Plan or Internal Audit Annual Report is excepted from public

disclosure under Chapter 552

.

Texas Government Code Section 2102.015 also requires state agencies to update the posting required under this section

to include:

•

A detailed summary of the weaknesses, deciencies, wrongdoings or other concerns, if any, raised by the audit plan

or annual report.

•

A summary of the action taken by the agency to address the concerns, if any, that are raised by the audit plan or

annual report.

To ensure compliance, reports on the implementation status of audit recommendations are posted on the Comptroller’s

oce internet website (https://comptroller.texas.gov/transparency/reports/cpa-operations/), unless excepted from public

disclosure.

TEXAS COMPTROLLER OF PUBLIC ACCOUNTS | 2

INTERNAL AUDIT ANNUAL REPORT FOR FISCAL 2021

II. Internal Audit Plan for Fiscal 2021

Fiscal 2021 Audits Status

Audit of Managing Electronic File Transfers Completed

Report Title: An Internal Audit Report on the Audit of Managing

Electronic File Transfers

Report No.: 96-1841

Report Date: March 2021

Audit of Administration of the Statewide Historically

Underutilized Business (HUB) Program

Completed

Report Title: An Internal Audit Report on the Audit of Administration

of the Statewide HUB Program

Report No.: 96-1846

Report Date: June 2021

Audit of Bankruptcy Billings and Collections Completed

Report Title: An Internal Audit Report on the Audit of Bankruptcy

Billings and Collections

Report No.: 96-1851

Report Date: August 2021

Audit of Cash and Securities Management Completed

Report Title: An Internal Audit Report on the Audit of Cash and

Securities Management

Report No.: 96-1852

Report Date: August 2021

Audit of Crude Oil and Natural Gas (CONG), Tobacco,

Amusement and Agriculture (AG)

In progress. Fieldwork phase.

Audit of Texas Bullion Depository In progress. Reporting phase.

Audit of Business Operations Information Technology* In progress. Reporting phase.

*This scal year, the Internal Audit Division absorbed the Texas Treasury Safekeeping Trust Company (TTSTC) audit function.

Audits of the TTSTC are incorporated into the Internal Audit Division’s Fiscal 2022 Internal Audit Annual Audit Plan. The Fiscal

2021 Internal Audit Annual Report includes audits completed at the TTSTC.

TEXAS COMPTROLLER OF PUBLIC ACCOUNTS | 3

INTERNAL AUDIT ANNUAL REPORT FOR FISCAL 2021

Fiscal 2020 “In Progress” Audits Status

Audit of Agency Governance Processes Completed

Report Title: An Internal Audit Report on the Audit of Agency

Governance Processes

Report No.: 96-1847

Report Date: July 2021

Audit of Agency Procurement Process Completed

Report Title: An Internal Audit Report on the Audit of the Agency

Procurement Process

Report No.: 96-1844

Report Date: June 2021

Audit of Alternative Investments* Completed

Report Title: Alternative Investments Audit Report as of

December 31, 2019

Report Date: Dec. 8, 2020

Audit of Accounting and Trust Operations* Completed

Report Title: Accounting and Trust Operations Audit Report as of

April 30, 2020

Report Date: Jan. 28, 2021

Audit of Administrative Operations* Completed

Report Title: Administrative Operations Internal Audit Report as of

July 31, 2020

Report Date: Jan. 29, 2021

Audit of BidTex* Completed

Report Title: BidTex Audit Report as of May 31, 2020

Report Date: Jan. 29, 2021

Audit of Custody Settlement* Completed

Report Title: Custody Settlement Internal Audit Report as of

March 31, 2020

Report Date: Jan. 29, 2021

*This scal year, the Internal Audit Division absorbed the TTSTC audit function. Audits of the TTSTC are incorporated into the

Internal Audit Division’s Fiscal 2022 Internal Audit Annual Audit Plan. The Fiscal 2021 Internal Audit Annual Report includes

audits completed at the TTSTC.

TEXAS COMPTROLLER OF PUBLIC ACCOUNTS | 4

INTERNAL AUDIT ANNUAL REPORT FOR FISCAL 2021

III. Consulting Services and Non-audit Services Completed

Report

Number

Report

Date

Report

Name

High-Level Objective(s)

Observations/Results and

Recommendations

N/A N/A N/A Web Application Modern-

ization and Optimization

Project (WAMO)

This ongoing consulting engagement provides

high-level monitoring of the WAMO Project and

review of contract deliverables.

N/A N/A N/A Information Protection Poli-

cies and Standards (IPPS)

Consulted with Information Security on

enforcement of the IPPS. Attended IPPS Review

Committee meetings.

N/A N/A N/A Special Investigations Investigations were conducted and appropriate

actions were taken to respond to hotline com-

plaints received from the SAO.

N/A N/A N/A ServiceNow Governance,

Risk and Control (GRC) Pilot

Project

Participated in a workgroup for implementing

an agency-wide governance, risk management

and compliance tool. The objective of this project

was to review the GRC module of ServiceNow to

determine if it is a suitable application to use in

the agency’s enterprise risk management and risk

assessment process.

N/A N/A N/A High-dollar Refund Approval

Memo Project (Big Money

Memo Special Project)

Assessed the proposed changes to automate

the processing of the “Big Money Memo.” The

overall objective of this consulting service was

to evaluate the eciency and eectiveness of

the internal controls over the big money memo

process and to determine whether the paper

form of the memo could be eliminated without

diminishing internal controls.

N/A N/A N/A Information Technology

Steering Committee (ITSC)

This ongoing consulting engagement provides

for Internal Audit to serve in an advisory capac-

ity to the ITSC that guides and directs eorts to

align Information Technology (IT) investments

with the needs of the divisions.

N/A N/A N/A Review of Property Tax Data

Analysis

Internal Audit performed a limited process

review of the procedures supporting the

Property Tax Assistance Division’s (PTAD), Data

Analysis’ key process in accordance with Texas

Government Code 403.302(h).

Internal Audit recommended that PTAD

enhance its review process to ensure that

management identifies a secondary reviewer

on audits.

N/A N/A N/A Informal Review of Enforce-

ment Division Taxpayer

Receipt Process

Worked with the Enforcement Division to assess

the impact of providing taxpayer receipts with-

out their signature included.

TEXAS COMPTROLLER OF PUBLIC ACCOUNTS | 5

INTERNAL AUDIT ANNUAL REPORT FOR FISCAL 2021

Report

Number

Report

Date

Report

Name

High-Level Objective(s)

Observations/Results and

Recommendations

N/A N/A N/A Unclaimed Property ITSC

Project Proposal

Worked with Unclaimed Property to develop

an ITSC project proposal that will automate the

return warrant process by harnessing the power

of our Enterprise Content Management System.

N/A N/A N/A External Auditor Liaison Performed liaison activities with external

auditors (i.e. SAO and Clifton Larson Allen LLP),

conducting audits at the Comptroller’s oce.

TEXAS COMPTROLLER OF PUBLIC ACCOUNTS | 6

INTERNAL AUDIT ANNUAL REPORT FOR FISCAL 2021

I V. External Quality Assurance Review (Peer Review)

Overall Opinion

It is our opinion that the Texas Comptroller of Public Accounts Internal Audit Division receives a rating of “Pass/Generally

Conforms” and is in compliance with the Institute of Internal Auditors (IIA) International Standards for the Professional Prac-

tice of Internal Auditing and Code of Ethics, the United States Government Accountability Oce (GAO) Government Auditing

Standards, and the Texas Internal Auditing Act (Texas Government Code Chapter 2102). This opinion, which is the highest

of the three possible ratings, means that policies, procedures and practices are in place to implement the standards and

requirements necessary for ensuring the independence, objectivity and prociency of the Internal Audit Division.

The Internal Audit Division is independent, objective and able to render impartial and unbiased judgments. Sta members

are qualied, procient and knowledgeable in the areas they audit. Individual audit projects are planned using risk assess-

ment techniques; audit conclusions are supported by working papers and ndings and recommendations are communicat-

ed clearly and concisely. The Internal Audit Division is well managed, has eective relationships with the Comptroller and

the Deputy Comptroller and is well respected and supported by management. Surveys and interviews conducted during the

quality assurance review indicate the Internal Audit Division is integrated into the agency and is a useful part of its opera-

tions. In addition, audit processes and report recommendations add value and improve the agency.

The Internal Audit Division has reviewed the peer review team’s results and has accepted them to be an accurate representa-

tion of the Internal Audit Division’s operations.

Acknowledgments

We appreciate the courtesy and cooperation extended to us by the Internal Audit Division director, Internal Audit Division sta,

Deputy Comptroller, Comptroller and division and executive management who participated in interviews. We would also like to

thank each person who completed a survey for the quality assurance review. The feedback from the surveys and the interviews

provided valuable information regarding the operations of the Internal Audit Division and its relationship with management.

Signature on File

7/9/2020

Katie Fitch, CPA Date

Senior Internal Auditor

Depar

tment of Public Safety

SAIAF Peer Review Team Member

Signature on File

7/9/2020

Steven Clark Date

Internal Auditor

Department of Public Safety

SAIAF Peer Review Team Member

Signature on File

7/9/2020

John Rivers, MBA, CIA, CISA, CGAP, CRMA Date

Audit Coordinator

Department of Family and Protective Services

SAIAF Peer Review Team Leader

TEXAS COMPTROLLER OF PUBLIC ACCOUNTS | 7

INTERNAL AUDIT ANNUAL REPORT FOR FISCAL 2021

V. Internal Audit Plan for Fiscal 2022

Fiscal 2022 Audits

Project Title Division Area

Project

Hours

Audit of Agency Batch Processing

Information Technology Infrastructure - Distributed Services -

Batch Processing

900

Audit of Unclaimed Property Claims

Processing

Information Technology Contract Claims 1,250

Audit of Texas SmartBuy Administration

and Support

Statewide Procurement Data Management, Analytics and

Technology

1,080

Audit of Enforcement Collections

Processes

Enforcement Field Operations Headquarters Support

- Collection Training Technical Support

Headquarters Support - Systems

Administration

1,950

Audit of Incoming Mail, Edit and Image

Processing

Revenue Processing Incoming Mail, Edit and Image

Processing - Image Processing

Incoming Mail, Edit and Image

Processing - Incoming Mail

1,600

Audit of Taxpayer Audits and Refund

Verications

Audit Field Oces 1,550

Audit of External Investments*

TTSTC External

Investments

External Investments 760

Audit of TTSTC Billings Process*

TTSTC Finance Financial Accounting and Reporting 410

Total Fiscal 2022 Audit Hours 9,580

*This scal year, the Internal Audit Division absorbed the TTSTC audit function. Audits of the TTSTC are incorporated into the

Internal Audit Division’s Fiscal 2022 Internal Audit Annual Audit Plan. The Fiscal 2021 Internal Audit Annual Report includes

audits completed at the TTSTC.

TEXAS COMPTROLLER OF PUBLIC ACCOUNTS | 8

INTERNAL AUDIT ANNUAL REPORT FOR FISCAL 2021

Fiscal 2021 Audits in Progress

Project Title Division Area

Project

Hours

Audit of CONG, Tobacco,

Amusement

and AG

Account Maintenance CONG, Tobacco, Amusement and AG:

- Tobacco, Amusement and AG/Timber

- CONG Exemptions and Credits

- CONG Refunds and Collections

- Tobacco, Amusement and AG/Timber

985

Audit of Texas Bullion Depository

Texas Bullion Depository Texas Bullion Depository 730

Audit of Business Operations

Information Technology*

TTSTC Trust Company Business Operations

Information Technology

400

Audit of Cash and Securities

Management

Treasury Operations Cash and Securities Management -

Cash Management Program

Cash and Securities Management - Funds Transfer

60

Audit of Bankruptcy Billings and

Collections

Revenue Accounting Miscellaneous Taxes, Fund Reconciliations,

Bankruptcy and Liens - Bankruptcy and Liens

20

Total Fiscal 2021 Audits-

in-Progress Hours

2,195

*This scal year, the Internal Audit Division absorbed the TTSTC audit function. Audits of the TTSTC are incorpo-

rated into the Internal Audit Division’s Fiscal 2022 Internal Audit Annual Audit Plan. The Fiscal 2021 Internal Audit

Annual Report includes audits completed at the TTSTC.

The scal 2022 Audit of Texas SmartBuy Administration and Support, Audit of External Investments and Audit of

the TTSTC Billings Process address contract management. Contract management is also addressed in the Audit of

Texas Bullion Depository, an in-progress audit for scal 2021.

TEXAS COMPTROLLER OF PUBLIC ACCOUNTS | 9

INTERNAL AUDIT ANNUAL REPORT FOR FISCAL 2021

Special Projects/Management Requests

Project Title

Project

Hours

Follow Ups 320

Client Assist (Internal/External) 10

Fiscal 2021 Internal Audit Annual Report 10

Fiscal 2023 Risk Assessment 590

Fiscal 2022 Audit Plan Monitoring 120

TeamMate Maintenance 80

Internal Audit SharePoint Maintenance 40

TeamMate Template Revision 50

Quality Assurance Reporting 20

IT Steering Committee 10

Internal Audit Handbook Review 50

IT Audit Template 100

Special Investigations 0

External Peer Reviews 0

ServiceNow GRC Project 0

Process Reviews 990

Internal Audit Awareness 50

TTSTC Board/Committee Meetings 60

Special Projects/Management Requests Carry Forward

Fiscal 2022 Risk Assessment 50

Other Requests/Unallocated Hours 295

Total Special Projects/Management Requests 2,845

TEXAS COMPTROLLER OF PUBLIC ACCOUNTS | 10

INTERNAL AUDIT ANNUAL REPORT FOR FISCAL 2021

Summary of Hours

Summary Total Hours

Total Fiscal 2022 Audits 9,580

Total Fiscal 2021 Audits in Progress 2,195

Total Special Projects/Management Requests 2,845

Direct Audit Hours

14,620

Indirect Hours

6,260

Total Hours 20,880

The Internal Audit Division (Division) developed the Internal Audit Plan for scal 2022 in accordance with the Texas Internal

Auditing Act (Act). The Act requires that the Division conduct an annual risk assessment and develop the Internal Audit Plan

based on the results of the annual risk assessment. The risk assessment is based upon 710 key processes reported through

the Enterprise Risk Management Program. The Division analyzed and assessed the risks to those key processes by using the

self-assessment module of the Division’s TeamMate audit software, supplemental risk questionnaires and interviews with

executive management and division directors and used the results to conduct our annual risk assessment for scal 2022. We

considered risks related to contract management [Texas Government Code Section 2102.005(b)] and information technology

[Title 1 Texas Administrative Code Chapter 202 (Information Security Standards)] in our risk-assessment process by obtaining

probability, impact and monitoring risk-level ratings for applicable agency key processes through the TeamRisk self-assess-

ments. We reviewed these risk-level ratings further and adjusted, as needed, based on auditor judgment in the TeamRisk

auditor assessment worksheet.

TEXAS COMPTROLLER OF PUBLIC ACCOUNTS | 11

INTERNAL AUDIT ANNUAL REPORT FOR FISCAL 2021

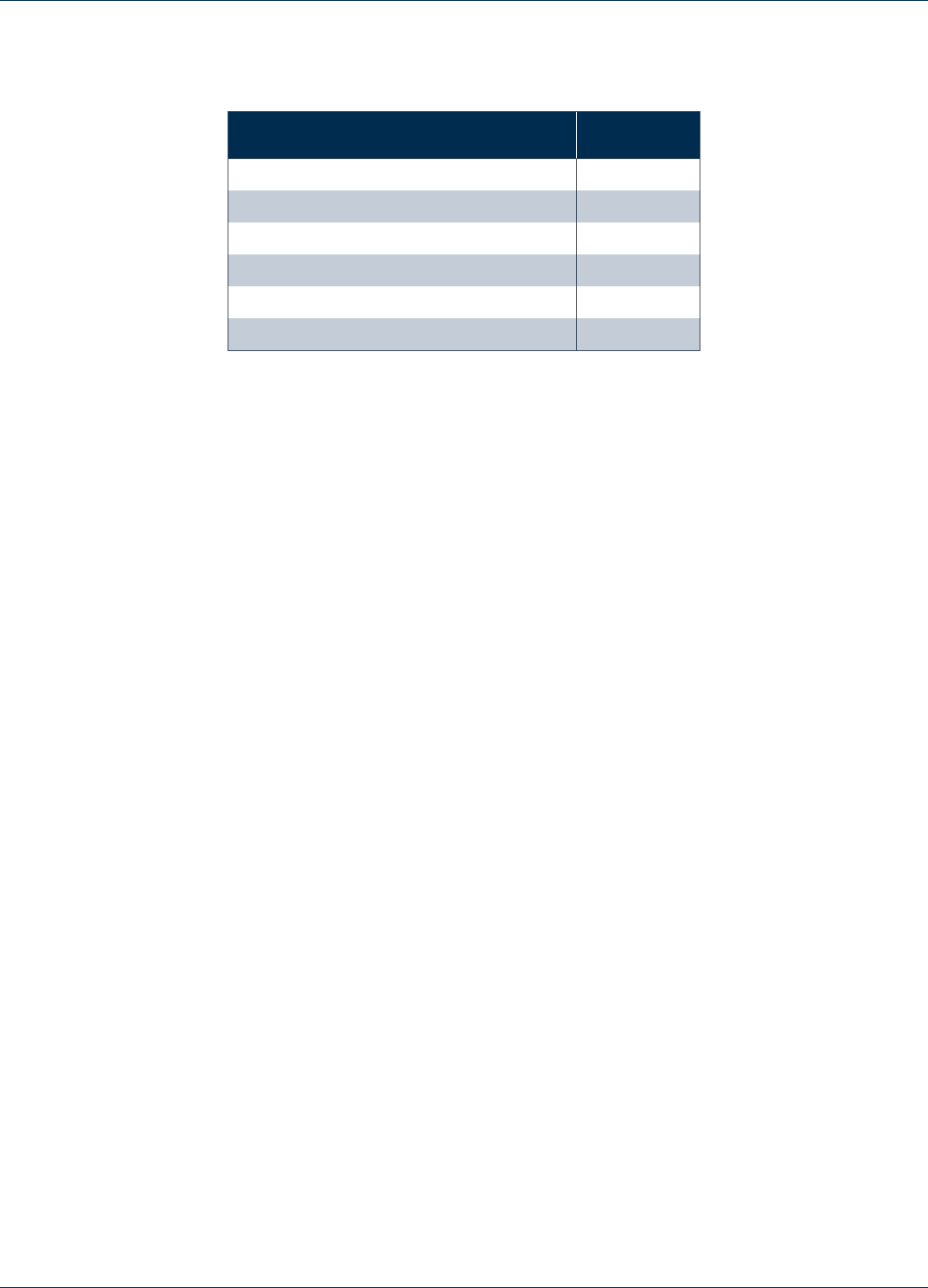

Risk Factors and Weights

Risk Factor Risk Weight

Control Environment 15.00%

Risk and Monitoring 20.00%

Dollar Value of Transactions 15.00%

Reliance on Third Parties 10.00%

Organizational Changes 5.00%

Legislative Interest 5.00%

Condential Information 10.00%

Management Concern 10.00%

Information Systems 10.00%

The risk assessment identied 59 high-risk, 634 medium-risk and 17 low-risk key processes. To provide coverage for all high

risks, we propose the following:

•

Fourteen key processes will be covered in six audits.

•

Five key processes will be covered in ve process reviews.

•

Seven key processes will be covered as part of scal 2022 Internal Control Risk Assessment (ICRA) workshops.

•

Six key process will be covered in two scal 2021 carryover audits.

•

Twenty-seven key processes were covered in previously conducted audits.

In scal 2022, the Division hired an internal auditor for the TTSTC. This auditor is dedicated to performing audits of the TTSTC.

Two TTSTC audits are planned for this scal year. Additionally, ICRA workshops are planned for all TTSTC teams to gather key

processes and identify risk and controls. This information will be used to integrate identied TTSTC key processes into the

agency’s annual risk assessment process

TEXAS COMPTROLLER OF PUBLIC ACCOUNTS | 12

INTERNAL AUDIT ANNUAL REPORT FOR FISCAL 2021

VI. External Audit Services Procured in Fiscal 2021

Name of External Auditor Services Provided

Date of Service

(Report Date)

RSM US LLP Financial audit of the programs of the Texas

Prepaid Higher Education Tuition Board

Report dated Dec. 17,

2020 for scal 2020

Audit Services, U.S. LLC Audit Services for Unclaimed Property Fiscal 2021 to current

Discovery Audit Services Audit Services for Unclaimed Property Fiscal 2021 to current

EECS, LLC Audit Services for Unclaimed Property Fiscal 2021 to current

Innovative Advocate Group Audit Services for Unclaimed Property Fiscal 2021 to current

Kelmar Associates, LLC Audit Services for Unclaimed Property Fiscal 2021 to current

Kroll Government Solutions Audit Services for Unclaimed Property Fiscal 2021 to current

Treasury Services Group Audit Services for Unclaimed Property Fiscal 2021 to current

RSM US LLP Audit of FY20 Financial Statements of Texas

Treasury Safekeeping Trust Company (TTSTC)

Dec. 15, 2020

RSM US LLP Attestation of Compliance with TTSTC Incentive

Compensation Plan

Dec. 15, 2020

RSM US LLP Audit of FY20 Financial Statements of State

Water Implementation Fund for Texas (SWIFT)

Dec. 7, 2020

RSM US LLP Attestation of Compliance with Investment

Policy of SWIFT

Dec. 7, 2020

RSM US LLP Audit of FY20 Financial Statements of Texas Local

Government Investment Pool (TexPool)

Nov. 5, 2020

RSM US LLP Audit of FY20 Financial Statements of Texas Local

Government Investment Pool Prime (TexPool

Prime)

Nov. 5, 2020

RSM US LLP Audit of 2020 Financial Statements of Tobacco

Settlement Permanent Trust Fund

March 15, 2021

RSM US LLP Attestation of Compliance with Investment

Policy of Tobacco Settlement Permanent Trust

Fund

March 15, 2021

RSM US LLP Attestation of Compliance with Distribution

Policy of Tobacco Settlement Permanent Trust

Fund

March 15, 2021

KPMG LLP System and Organization Controls (SOC 1) Re-

port on the Texas Comptroller of Public Accounts’

Description of its Centralized Accounting Payroll/

Personnel System and the Suitability of the

Design and Operating Eectiveness of Controls

Oct. 15, 2021

TEXAS COMPTROLLER OF PUBLIC ACCOUNTS | 13

INTERNAL AUDIT ANNUAL REPORT FOR FISCAL 2021

Name of External Auditor Services Provided

Date of Service

(Report Date)

Abdessamad Ait Ali/State Sales Tax Consulting, LLC

Alejandro C. Gonzales, Jr.

Anna Tarver/Hive City Financial Consulting, LLC

Antonio V. Concepcion

Brenda Lynn Tschirhart

Cindy Alvarez

Cindy H. Coats, CPA

Cindy Reed, CPA/State Tax Consulting, LLC

Dale Ruzicka/State Tax Consulting, LLC

Dan A. Northern

Delores A. Nornberg

Dibrell P. Dobbs

Dixie Smith, CPA/State Tax Consulting, LLC

Fabian Avina

Flor H. Holmes

Frank Castro/Texas Tax Consulting Group LC

Homer Max Wiesen, CPA

Jody Sue Loudermilk

Jose (Joe) Granados/JPG-EJG, LLC

Judy Hannah

Julie R. Ortiz, CPA

Karina Guadalupe Goulet/KGVG Advisors, LLC dba

Texas Tax Specialist

Khristina Mitchell/Khrista Marque, LLC

L. C. Gordon, Jr./Taygor Associates, LLC

Lisa Loughney

Marina Roy Buenaventura, CPA

Michelle Duplechain

Michiell Stites

Paul Hernandez

Ramiro J. Garza

Raymond Franco/State and Local Tax Group LLC

Robert Hant Fabyan, CPA/RFabyan Consulting LLC

Sean J. Lomonaco

Stephanie (Clark) Jackson

Sylvia Villanueva Flaherty

Trevor Garrett/Garrett State Tax Service Inc.

Vernice Seriale, Jr.

Wayne A. Powe

Wayne Wharton/State and Local Tax Group LLC

Yunping Hu

Sales and Use Tax examination services Fiscal 2021

Sept. 1, 2020 through

Aug. 31, 2021

TEXAS COMPTROLLER OF PUBLIC ACCOUNTS | 14

INTERNAL AUDIT ANNUAL REPORT FOR FISCAL 2021

VII. Reporting Suspected Fraud and Abuse

The Comptroller’s oce has taken several measures to address the potential misuse or misappropriation of state resources.

The Comptroller’s oce has also taken action to implement the requirements to report suspected fraud, waste and abuse

involving state resources directly to the SAO.

Actions taken to implement the requirements of:

•

Fraud Reporting Sec. 7.09 page IX-37 the General Appropriations Act (86th Legislature) and Section 7.09, page IX-38

the General Appropriation Act (87th Legislature)

The Comptroller’s office internet website contains a Report Fraud link when the Contact link at the bottom of the page is

selected (https://comptroller.texas.gov/). This webpage explains how to report fraud involving state resources to the

SAO. The SAO’s phone number for reporting fraud, 800-TX-AUDIT (892-8348), and a link to the SAO’s Fraud website,

https://sao.fraud.texas.gov/, are included in the information provided on the Reporting Fraud page.

The Comptroller’s oce intranet website contains a State Auditor’s Fraud website link at the bottom of the page, which

directs users to the SAO’s Investigations and Audit Support page. This webpage provides information and instructions on

reporting fraud, waste or abuse to the SAO. The SAO’s hotline number for reporting fraud, 800-TX-AUDIT (892-8348); a link

to the SAO’s form for reporting fraud, waste or abuse and instructions on submitting reports of fraud, waste or abuse by

email, mail or facsimile are found on this webpage.

The Employee Handbook of the Comptroller’s oce, Chapter 15: Compliance and Risk Assessment – Policy Prohibiting Fraud,

Waste, Theft, and Abuse, includes information on how to report suspected fraud involving state funds to the SAO by calling

800-TX-AUDIT (892-8348) or by making a report online (https://sao.fraud.texas.gov/). The same Employee Handbook includes

a requirement that all employees complete fraud awareness training and complete an acknowledgment form each scal year.

The Comptroller’s oce Internal Audit Division website also contains links and contact information that include the SAO’s phone

number for reporting fraud, 800-TX-AUDIT (892-8348); the link to the SAO’s Fraud website (https://sao.fraud.texas.gov/); the link

to the SAO Fraud Reporting Form (https://sao.fraud.texas.gov/ReportFraud/); the link to the GAO’s FraudNET (http://www.gao.

gov/about/what-gao-does/fraudnet) and the GAO’s toll-free number, 800-424-5454, and fax number, 202-512-2841, as well as

the email address (fraudnet@gao.gov).

•

Texas Government Code Section 321.022. Coordination of Investigations

The Comptroller’s oce has established the “Policy Prohibiting Fraud, Waste, Theft and Abuse” and is committed to preventing

fraud, waste, theft and abuse by its employees and any consultant, vendor, contractor, outside agency or person in dealings

with the agency or the state of Texas.

Each employee is required to report any suspected fraud, theft, waste or abuse to the agency. An employee may make a report

to his or her supervisor, directly to the Ethics Ocer or through the internal Employee Hotline by calling (toll free) 833-227-

0772, emailing employee[email protected].gov and/or faxing 512-936-0696.

Employees can report suspected fraud, waste and abuse involving state funds to the SAO by calling 800-TX-AUDIT (892-8348)

or by making a report online at https://sao.fraud.texas.gov/.

TEXAS COMPTROLLER OF PUBLIC ACCOUNTS | 15

INTERNAL AUDIT ANNUAL REPORT FOR FISCAL 2021

The Ethics Ocer receives allegations of suspected fraud, waste, theft and abuse. The Ethics Ocer may collect additional

information from the employee or other person making the report and will make a preliminary determination whether the

allegations should be investigated by the Criminal Investigations Division, Internal Audit, Human Resources, the Ethics Ocer,

some combination of these or another appropriate person or entity.

The Anti-Fraud Coordinator will report any nding of fraud to the SAO as required.

Report on the Activities of the Texas Comptroller of Public Accounts

Internal Audit Division | Fiscal 2021

Publication #96-1814

Oct. 29, 2021