2

023

State of the Vacation

Timeshare Industry

UNITED STATES STUDY

2023 EDITION

PREPARED BY

Current at time of printing

2023 SPONSORS

The ARDA International Foundation gratefully acknowledges the

sponsors whose financial contributions made this study possible.

PLATINUM SPONSORS

UNDERWRITER

Capital Vacations

Fidelity Real Estate

Vacatia

Western Alliance Bank

State of the Vacation

Timeshare Industry

UNITED STATES STUDY

2023 EDITION

PREPARED BY

EXECUTIVE SUMMARY ................................................... 5

I. INDUSTRY OVERVIEW ........................................... 7

Size ........................................................................................ 7

Resorts ..................................................................................8

Units and Intervals ..............................................................9

II. INDUSTRY HEALTH ............................................... 12

Overall ................................................................................. 12

III. INDUSTRY SEGMENTS ......................................... 17

Resort Size ......................................................................... 18

Sales Activity ...................................................................... 18

Resort Type ........................................................................ 19

Geographic Region ..........................................................20

Year Resort Opened ........................................................ 21

IV. INDUSTRY OUTLOOK ..........................................22

APPENDICES ....................................................................25

Appendix A

Historical Sales Data .....................................................25

Resorts by State.............................................................25

Percentage of Units by State ......................................25

Appendix B - Timeshare Resort Tracking ..................26

Appendix C - Methodology ...........................................27

Appendix D - Survey .......................................................29

Appendix E - A Brief History of the

U.S. Timeshare Industry ....................... 40

GLOSSARY OF TERMS ...................................................44

EY exists to build a better working world, helping create long-term value for clients, people and society and build trust

in the capital markets. Enabled by data and technology, diverse EY teams in over 150 countries provide trust through

assurance and help clients grow, transform and operate. Working across assurance, consulting, law, strategy, tax and

transactions, EY teams ask better questions to find new answers for the complex issues facing our world today.

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited,

each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not

provide services to clients. Information about how EY collects and uses personal data and a description of the rights

individuals have under data protection legislation are available via ey.com/privacy. EY member firms do not practice law

where prohibited by local laws. For more information about our organization, please visit ey.com.

Use of Information Provided by AIF:

The information provided by the ARDA International Foundation is intended to give the reader general information

regarding the industry and it does not constitute legal or other professional advice. The information should not be relied

upon in making any determinations about a specific matter or issue. If you require counsel on a specific matter or issue,

please contact the appropriate professional.

©Copyright 2023, the ARDA International Foundation. All rights reserved.

No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means

electronic, mechanical or otherwise, including photocopying, distribution by facsimile, re-creation as an electronic

document by computer scan, etc., without securing prior written permission from the ARDA International Foundation.

Send inquiries or requests to reproduce to: ARDA International Foundation, 1201 15th Street NW, Suite 400, Washington,

D.C., 20015.

STATE OF THE VACATION TIMESHARE INDUSTRY: UNITED STATES STUDY 2023 EDITION

State of the Vacation Timeshare Industry

UNITED STATES STUDY 2023 EDITION

EXECUTIVE SUMMARY

5

As noted above, the 2022 U.S. timeshare industry consisted of 1,541 timeshare resorts

with approximately 201,600 timeshare units — an average of 131 units per resort.

Resorts sell each of these timeshare units to consumers in parts or ownership pieces

corresponding to varying amounts of time. Typically, these parts are either weekly

intervals (seven nights worth of vacation time) or points-based. Points represent a

reservation currency for the use of units in nightly or weekly increments - respondents

converted their points into weekly interval equivalents for this study where needed.

Figure ES.1 summarizes industry operating performance for 2022 and shows five-

year performance trends. By most measures 2022 marked the completion of a

return to pre-pandemic levels for the timeshare industry. Sales volume

1

increased by

30% to $10.5 billion in 2022, recovering fully to the level seen before the impacts of

the COVID-19 pandemic. In general, operating performance metrics in 2022 were

near or above 2019 levels. Average occupancy was 77.6%, increasing by more than

4 percentage points from the previous year. By comparison, hotel occupancy was

62.1%

2

in 2022, according to Smith Travel Research. Rental revenues totaled $2.7

billion, increasing by 21% in 2022.

Results contained in this report are primarily sourced from a survey of timeshare resorts, developers, and

management companies. The ARDA International Foundation (AIF) commissioned this survey and Ernst &

Young LLP (EY) conducted the survey on its behalf. EY also reviewed current and previous AIF research to

conduct this analysis. The study focuses on timeshare resorts that sell and maintain interval and points-

based vacation lodging products. It excludes fractional resorts and private residence or destination clubs.

Of the 1,541 identified timeshare resorts, 759 responded — a 49% response rate. Of these 759 responding

resorts, 699 belong to a network of 10 or more resorts, and 60 belong to a network of less than 10

resorts, including 48 single-site resorts. For a full discussion of the methodology used, please see

Appendix C of the report.

The State of the Vacation Timeshare Industry: United States Study 2023

edition provides an overview of important summary information on the

U.S. timeshare industry for the year 2022.

1 All sales discussed in the report are developer sales, unless otherwise noted.

2 STR-TRI Monthly Hotel Review: December 2022, Smith Travel Research. Note this occupancy is based on Smith Travel’s Total

Room Inventory (TRI) calculation which includes rooms taken offline due to COVID-19.

STATE OF THE VACATION TIMESHARE INDUSTRY: UNITED STATES STUDY 2023 EDITION

EXECUTIVE SUMMARY

6

The average maintenance fee billed did not see any negative impacts from the pandemic in 2020, so the change in that

metric was more muted in 2021 and 2022. The average maintenance fee billed increased from $1,120 to $1,170 per

weekly interval, a 5.3% increase. This compares to an 6.5% inflation rate for 2022

3

. The average transaction price

increased to $23,940; this metric tends to fluctuate year over year based on the mix of sales by unit configuration and

brand, but has grown by 37% over the past two years.

FIGURE ES.1

KEY TIMESHARE INDUSTRY TRENDS 2018 TO 2022

Average Maintenance Fee Billed

2021

$1,120

2022

$1,170

2018

$1,000

2019

$1,080

2020

$1,090

Rental Revenue ($B)

2021

$2.2

2022

$2.7

2018

$2.4

2019

$2.5

2020

$1.3

Average Occupancy

2022

77.6%

2018

80.8%

2019

79.3%

2021

73.1%

2020

49.2%

Average Transaction Price

2022

$23,940

2018

$17,930

2019

$18,760

2021

$19,590

2020

$17,460

Sales Volume ($B)

2022

$10.5

2018

$10.2

2019

$10.5

2020

$4.9

2021

$8.1

3 Consumer Price Index: 2022 in Review: The Economics Daily: U.S. Bureau of Labor Statistics (bls.gov)

Industry Overview

CHAPTER ONE

7

STATE OF THE VACATION TIMESHARE INDUSTRY: UNITED STATES STUDY 2023 EDITION

In addition to the timeshare resorts and units noted in Figure 1.1, timeshare owners have

access to inventory that is not traditionally considered as timeshare inventory. For example,

the two major exchange companies (Interval International and RCI) make non-timeshare

accommodations available to their members. They also provide members the opportunity

to trade their resort accommodations or home unit for options such as cruise, golf, and

spa vacations, as well as a variety of leisure experiences such as sporting events, shopping

excursions, etc. In addition, some developers with affiliated hotel brands often make traditional

hotel inventory available to owners who participate in their internal exchange programs.

The AIF’s timeshare database lists 1,541

4

timeshare resorts in the United States.

5

As seen in Figure 1.1, these

1,541 resorts represent approximately 201,600 units. Counting lock-offs

6

as separate units adds

approximately 50,870 units, for a total of 252,470.

This chapter presents an overview of the timeshare industry for 2022,

examining industry size and structure. It includes information on:

• the number, size, and characteristics of resorts,

• unit configurations, and

• interval ownership structures.

4 ARDA International Foundation. Please see Appendix B for more information about the methodology for identifying timeshare resorts.

5 The United States is defined as the continental U.S. plus Alaska and Hawaii in this study.

6 The term “lock-off” refers to a type of vacation ownership unit consisting of multiple living and sleeping quarters, designed so they can

function as two discrete units for purposes of occupancy and exchange.

7 Biennials are vacation ownership products that provide a week’s worth (or points equivalent) of timeshare interest every other year.

Measure 2022

Resorts 1,541

Units 201,600

Average Resort Size 131

Total units including lock-offs 252,470

FIGURE 1.1

INDUSTRY SIZE

Resorts sell each of these timeshare units to consumers in parts or ownership pieces

corresponding to varying amounts of time. Typically, these parts are weekly intervals (seven

nights worth of vacation time), biennials

7

and/or points-based. Points represent a currency

for the use of units in nightly or weekly increments — respondents converted their points into

weekly interval equivalents for this study where possible.

Size

STATE OF THE VACATION TIMESHARE INDUSTRY: UNITED STATES STUDY 2023 EDITION

Figure 1.2 shows a distribution of resorts by development stage,

illustrating the two key industry components. Working with the

AIF, we classified all resorts in the AIF database that belong to a

network of two or more resorts as either in active-sales or not

in active-sales. In general, any resort that had sales activity and/

or was part of a network of resorts with timeshare sales is in

“active-sales”. The active-sales component includes new resorts

and resorts operating under the management of a company that

continues to develop and sell timeshare inventory (“developers”).

Any resorts that reported no sales activity are classified as not

in active-sales. This component consists mainly of resorts that

either operate independently or are associated with a resort

management company. In general, they are not engaged in

significant sales marketing activity, and rely mainly on revenues

derived from maintenance fees, rentals, and ancillary service

operations.

Note that multi-site respondents report their sales data in

aggregate rather than at the resort level — this means that all

resorts in a network of resorts are classified as either in actives-

sales or not in active-sales. Please see Appendix C for a more

detailed explanation of methodology.

Figure 1.3 also compares the results for active-sales and not in active-sales resorts, illustrating that not in active-sales

resorts tend to be older than active-sales resorts. More than 77% of not in active-sales resorts opened in 1985 or before,

compared to 20% of resorts that are still in active-sales. Less than 2% of not in active-sales resorts opened in 2006 or

later, compared to 35% of resorts that are in active-sales.

Figure 1.3 shows the distribution of timeshare resorts by the year that each opened. Approximately 8% of

responding resorts opened in 2016 or later; another 32% opened in 1985 or before. Sixty percent of responding

resorts opened between 1986 and 2015.

Resorts

FIGURE 1.2

RESORTS BY DEVELOPMENT STAGE

Based on assessment of resort sales status by

ARDA – see methodology section for details

Not in

active sales

55%

Active sales

45%

Percent of Percent of resorts Percent of resorts

resorts responding in active-sales not in active-sales

1985 or before 32% 20% 77%

1986-1995 13% 12% 16%

1996-2005 27% 33% 6%

2006-2015 20% 26% 1%

2016+ 8% 9% 0%

Percent of 316 responding resorts

8

— percentages may not add due to rounding

FIGURE 1.3

YEAR RESORTS OPENED

8

CHAPTER ONE 2022 INDUSTRY OVERVIEW

8 Note that the number of respondents varies across questions. To aid interpretability of results, throughout the report we include the number

of respondents to the survey question related to the corresponding table/graphic where appropriate. See Appendix C for a more detailed

explanation of methodology.

STATE OF THE VACATION TIMESHARE INDUSTRY: UNITED STATES STUDY 2023 EDITION

CHAPTER ONE 2022 INDUSTRY OVERVIEW

9

We also asked respondents if any types of units other than timeshare are available for sale or rent at their resort.

As shown in Figure 1.4, some resorts do report offering other types of units, including fractionals, hotels or whole

ownership. In total, 38% of resorts are mixed-use resorts — they reported offering at least one of these choices.

Finally, Figure 1.5 shows which entity employs the resort’s staff. Most resorts report that a separate management

company handles this responsibility.

As shown in Figure 1.6, 30% of resorts reported offering a mobile app to resort owners. The most common

features were accessing a virtual sales presentation, seeing a virtual tour of the resort, and making reservations.

Respondents also reported on temporary resort closures in 2022. Nine resorts were reported as being temporarily

closed as of December 31, 2022, and another 19 were reported as having temporarily closed at some point during

2022 but having re-opened. Ninety percent of those who provided reasons for the temporary closure indicated that the

primary reason was a natural disaster.

Entity Percent

Management company 61%

Resort HOA(s) 28%

Resort developer 6%

Other 5%

Percent of 577 responding resorts —

multiple responses allowed

FIGURE 1.5

ENTITY WHICH EMPLOYS

RESORT STAFF

Percent of

resorts offering

Hotels 20%

Fractional 12%

Whole ownership 9%

Other 1%

Percent of 759 responding resorts —

multiple responses allowed

FIGURE 1.4

MIXEDUSE PROPERTIES

Percent of 759 resorts – numbers

may not add due to rounding

FIGURE 1.6

RESORTS OFFERING A MOBILE APP

Feature %

Virtual sales presentations 74%

Virtual tour of resort 63%

Making reservations 57%

Check in 24%

Access to units 16%

Mobile payment-maintenance fees 9%

Mobile payment-rental fees 8%

Mobile payment-other 8%

Owner community building experience 3%

Other <1%

Percent of 230 respondents – multiple responses allowed

No

70%

Yes

30%

Stand-alone

62%

Mixed Use

38%

Figure 1.9 displays the percent of inventory that is owned by different types of owners. The majority of resorts are

owned by timeshare consumers, referred to as resort owners in the industry. Approximately 16% of intervals are still

owned by a resort developer and approximately 3% of intervals are owned by an HOA.

Percent of Percent of resorts Percent of resorts

resorts responding in active-sales not in active-sales

Intervals owned by owners 81% 82% 67%

Intervals owned by developers 16% 17% 0%

Intervals owned by HOA 3% <1% 33%

Percent of 396 respondents — percentages may not add due to rounding

FIGURE 1.9

PERCENTAGE OF INVENTORY OWNED BY TYPE OF OWNER

Next, we move from a discussion of resort-level data to

results concerning individual units and weekly or points-

based intervals within resorts. Figure 1.8 shows the mix

of units by the number of bedrooms. The two-bedroom

unit is the most common configuration, with 61% of units,

followed by one-bedroom units with 22%. Nine percent

of units have three or more bedrooms; another 7% are

studios.

Units and Intervals

FIGURE 1.8

MIX OF UNITS BY NUMBER OF BEDROOMS

Unit type Count Percent

Studio 15,090 7%

1 bedroom 44,710 22%

2 bedrooms 122,880 61%

3 bedrooms or more 18,910 9%

Total 201,600 100%

Percent of 671 responding resorts – percentages may not

add due to rounding

FIGURE 1.7

TEMPORARY CLOSURES

Expected re-opening date %

1st quarter of 2023 11%

2nd quarter of 2023 56%

3rd quarter of 2023 0%

4th quarter of 2023 11%

2024 or later 22%

*Percent of 9 resorts that are currently

temporarily closed

Length of temporary closure %

Less than one week 8%

1 to 4 weeks 38%

1 to 3 months 42%

More than 3 months 13%

*Percent of 24 resorts that temporarily closed

in 2022, including those who re-opened and

those who remain closed

STATE OF THE VACATION TIMESHARE INDUSTRY: UNITED STATES STUDY 2023 EDITION

10

CHAPTER ONE 2022 INDUSTRY OVERVIEW

Figure 1.7 shows the expected timeframe for re-opening for resorts that are currently closed, and the length of closure

for those who were temporarily closed but have since re-opened. Among those that are currently temporarily closed,

two-thirds expect to re-open in the first half of 2023. It is worth noting that two resorts did not expect to re-open in

2023 at all, demonstrating the severe impact of some of the storm damage experienced by these resorts. Among those

who were temporarily closed at some point in 2022, the most common lengths of time were 1 to 3 months (42% of

respondents) or 1 to 4 weeks (38%).

Again, we compare the results for resorts in active-sales to those for not in

active-sales resorts and see that intervals or interval equivalents are more likely

to be owned by the developer at active-sales resorts, while they are more likely

to be owned by the HOA at not in active-sales resorts.

We also asked respondents to report the percentage of their owners who reside

in the United States and the percentage who reside in some other country. Figure

1.10 shows that respondents reported that 87% of their owners reside in the

United States, compared to 13% of owners who reside in some other country.

Figure 1.11 shows the prevalence of interval types at resorts. Approximately

89% have some form of points-based products, while 79% of respondents have

intervals of the traditional weekly variety; 80% of respondents report offering

biennials. Ninety-three percent of active-sales report offering points-based

products, compare to only 15% of resorts that are not in active-sales. The

percentage of resorts with biennials is also higher among active-sales resorts.

All resorts that are not in active-sales report offering weeks-based products.

Finally, respondents reported information about the legal structures for products at their resorts. Figure 1.12 shows that

deeded or fee-simple real estate is the dominant structure in place for timeshare ownership. As the timeshare industry

continues to mature, traditional weeks may be effectively converted into points-based vacation products. This may be

accomplished by dedicating weeks to established points-based trusts or by simply “overlaying” a points usage option

on top of weekly ownership. This process may result in a gradual shift from week-based inventory to points-based

inventory within the same static pool of inventory over time.

FIGURE 1.10

COUNTRY OF RESIDENCE

FOR TIMESHARE OWNERS

Domestic

87%

International

13%

Percent of 265 respondents

Percent of resorts Percent of resorts Percent of resorts

Interval type responding in active-sales not in active-sales

Points 89% 93% 15%

Weeks 79% 78% 100%

Biennials 80% 83% 24%

Percent of 593 respondents — multiple responses allowed

FIGURE 1.11

TYPES OF INTERVALS

FIGURE 1.12

LEGAL STRUCTURES OF PRODUCTS SOLD

Percent of

resorts responding

Deeded or fee-simple real estate 91%

Interest in a trust 40%

Right to use contractual interest that expires at some future date 34%

Other <1%

Percent of 446 respondents — multiple responses allowed

STATE OF THE VACATION TIMESHARE INDUSTRY: UNITED STATES STUDY 2023 EDITION

CHAPTER ONE 2022 INDUSTRY OVERVIEW

11

STATE OF THE VACATION TIMESHARE INDUSTRY: UNITED STATES STUDY 2023 EDITION

CHAPTER TWO

Industry Health

12

While chapter one provides an overview of industry size, understanding

the health of the industry involves reviewing additional key indicators

such as sales volume, average transaction price, occupancy rates and

maintenance fees.

Figure 2.1 also shows that resort occupancy was nearly 78% in 2022 — a more than 4 percentage point increase from

2021 and close to 2019 levels. The average billed maintenance fees increased by approximately 5% from 2021 to $1,170

per interval. Rentals accounted for another $2.7 billion in industry revenue — a 21% increase from 2021.

The $10.5 billion in sales volume does not include sales for resorts that primarily sell fractional and private residence

clubs (PRC) products. Fractional resorts include an ownership interest that is either a shared equity or club interest

representing a period not fewer than two weeks but usually three weeks or more. Fractional ownership typically offers

additional services, amenities, and flexibility relative to timeshare, so that a bundle of timeshare weeks would not be

considered a fractional interest. PRC products are high-end fractionals. North American

9

sales for fractional and PRC

resorts were $624 million for 2022 as reported in The Shared-Ownership Resort Real Estate Industry in North America

- 2023 Edition, produced by Ragatz Associates.

One practice that has become a staple in the industry is “fee-for-service.” In general, a timeshare company will

provide sales and marketing support, including branding, to a resort they have not developed. The fee-for-service

provider leverages its existing sales infrastructure and brand to improve the resort’s cash flow without the capital risk

of developing the property. Sales related to fee-for-service (FFS) arrangements in 2022 among responding companies

were approximately $1.8 billion

10

, a 64% increase from 2021. There were 67,260 FFS transactions for an average

transaction price of $27,727. Note that these FFS sales are included in the $10.5 billion total timeshare industry sales

volume.

Figure 2.1 summarizes the timeshare

industry’s key 2022 performance metrics.

Resorts completed approximately 439,530

timeshare transactions at an average price

of $23,940 each, yielding a total sales

volume of approximately $10.5 billion. This

represents a 30% increase from last year’s

total of $8.1 billion and more than double

the 2020 total of $4.9 billion.

Overall

Metric 2022

Sales volume $10.5 billion

Number of timeshare transactions 439,530

Sales price per transaction $23,940

Rental revenue $2.7 billion

Occupancy 77.6%

Average maintenance fee per interval or interval equivalent $1,170

FIGURE 2.1

KEY PERFORMANCE METRICS 2022

This chapter includes these metrics, presenting a recent picture of important markers of industry

performance. Throughout the chapter, we compare the performance metrics of active-sales resorts

to resorts that are not in active-sales. 2022 Industry performance reflects a continued recovery from

2020 and the impacts caused by the COVID-19 pandemic – most performance metrics are near or

even above 2019 levels.

9 Includes the Caribbean

10 Note that this number reflects fee-for-service transactions for survey respondents only, and is not a projection to the full U.S. industry.

We asked resorts if they “had any fee-for-service arrangements with other timeshare developers by which those developers are selling

timeshare inventory for your resort”. No respondents who provided sales activity reported having such arrangements, suggesting that fee-

for-service sales are not double-counted by the resort and fee-for-service provider.

STATE OF THE VACATION TIMESHARE INDUSTRY: UNITED STATES STUDY 2023 EDITION

CHAPTER TWOINDUSTRY HEALTH

13

Figure 2.2 shows types of sales channels reported by respondents. Nearly all respondents reported using

telemarketing and in-person sales vehicles (tours). Seventeen percent of respondents reported using online sales

channels, which was consistent with 2021 usage.

11 STR-TRI Monthly Hotel Review: December 2022, Smith Travel Research. Note this occupancy is based on Smith Travel’s Total Room

Inventory (TRI) calculation which includes rooms taken offline due to COVID-19.

Metric 2022

In-person sales presentation (tours): on-site 100%

Telemarketing 98%

In-person sales presentation: off-site 97%

Online 17%

Percent of 390 respondents — multiple responses allowed

FIGURE 2.2

SALES CHANNELS

Average At active-sales At resorts

Guest type occupancy resorts not in active-sales

Owner/owner’s guest 46.9% 47.4% 38.9%

Exchange guest 10.0% 9.3% 23.3%

Renter 14.9% 14.8% 16.5%

Marketing guest 5.7% 6.0% 0.2%

Vacant 22.4% 22.5% 21.1%

FIGURE 2.3

OCCUPANCY BREAKOUTS

Average occupancy based on 664 respondents (including 539 active-sales resorts and 125

not in active-sales resorts), weighted by units - percentages may not add due to rounding.

OCCUPANCY DISTRIBUTION

Occupancy Percent of resorts

level (%) responding

Less than 60 17%

60-69 13%

70-79 18%

80-89 30%

90+ 22%

Percent of 664 respondents, weighted by units

— percentages may not add due to rounding

As noted in Figure 2.1, average annual timeshare resort occupancy was approximately 77.6%. By comparison, total room

inventory (TRI) occupancy at U.S. hotels was 62.1% in 2022

11

. Figure 2.3 shows a more detailed view of occupancy.

Resorts reported their average physical occupancy in each of these categories, meaning that actual guest check-in

occurred.

Resort owners, their guests and exchange participants accounted for approximately 57% of available intervals; renters

accounted for 15%, while marketing guests contributed another 6%. Occupancy for resorts not in active-sales was

higher than for active-sales resorts, mainly due to higher occupancy among exchange guests.

CHAPTER TWO

14

INDUSTRY HEALTH

STATE OF THE VACATION TIMESHARE INDUSTRY: UNITED STATES STUDY 2023 EDITION

As noted in Figure 2.3, renters occupied 15% of timeshare intervals in 2022. Eighty-nine percent of resorts reported

offering some form of rental program. Figure 2.5 shows the types of rental programs offered. Nearly all (92%) resorts

with a rental program offer daily rentals and most offer weekly rentals (89%). These rental programs generally have

rates that vary by season (90%). The majority also offer programs for marketing guests (69%).

MAINTENANCE FEE

DISTRIBUTION

Percent

Maintenance

of resorts

fee responding

Less than $700 9%

$700 to $799 6%

$800 to $899 9%

$900 to $999 19%

$1,000 to $1,099 12%

$1,100 to $1,199 13%

1,200 to 1,299 4%

More than $1,300 28%

The average annual maintenance fee

12

billed was $1,170 per interval. Figure 2.4 shows the average maintenance fees

charged by unit type, and the distribution of maintenance fees by dollar amount. Studio units averaged $740 annually in

maintenance fees, one-bedroom units averaged $930, two-bedroom units averaged $1,150, and three-bedroom units

or larger averaged $1,480 annually. Approximately 9% of resorts have maintenance fees averaging less than $700, while

another 28% have maintenance fees averaging $1,300 or more. Maintenance fees for active-sales resorts average 55%

more than those for resorts that are not in active-sales. Approximately 89% of maintenance fee accounts were current

in 2022.

Figure 2.5 also compares the offerings between resorts that are in active-sales to those that

are not. Programs for marketing guests are much more prevalent among resorts that are still

in active-sales, while monthly rentals are more prevalent among resorts not in active-sales.

12 This is the average maintenance fee billed to owners annually including contributions to reserves but excluding taxes and special

assessments.

Percent of resorts Percent of resorts Percent of resorts

Rental type responding in active-sales not in active-sales

Daily Rentals 92% 96% 83%

Weekly Rentals 89% 87% 94%

Monthly Rentals 24% 20% 34%

Rental rates that vary based on season 90% 91% 90%

Rental programs for marketing guests 69% 89% 15%

Percent of 398 respondents – multiple responses allowe

FIGURE 2.5

TYPES OF RENTAL PROGRAM OFFERED

Average Active-sales Not in active-sales

Unit type maintenance fee resorts resorts

Studio $740 $770 $640

1BR $930 $970 $780

2BR $1,150 $1,200 $840

3BR+ $1,480 $1,570 $940

Average $1,170 $1,270 $820

Averages based on 404 respondents, including 304 active-sales resorts and 100 not in active-sales

resorts — percentages may not add due to rounding

FIGURE 2.4

MAINTENANCE FEE BREAKOUTS

STATE OF THE VACATION TIMESHARE INDUSTRY: UNITED STATES STUDY 2023 EDITION

CHAPTER TWOINDUSTRY HEALTH

15

Figure 2.6 details rental program revenue. Vacationers rented

approximately 11.6 million nights at timeshare properties in

2022 at an average price of $235 per night. This yielded more

than $2.7 billion in timeshare rental revenue for 2022. This

rental revenue increased by 21% from 2021.

Figure 2.7 lists methods used by resorts for publicizing the

availability of rentals at the property. The most commonly

reported are the resort’s website and social media. Seventy-

one percent of resorts report using social media, including

76% of active-sales resorts.

Metric 2022

Total rental revenue $2.7 billion

Total nights rented 11.6 million

Average rental price per night $235

FIGURE 2.6

RENTAL REVENUE

12 STR-TRI Monthly Hotel Review: December 2022, Smith Travel Research. Resort hotel is defined as property located in a resort area or

market where a significant source of business is derived from leisure/destination travel. Examples: Orlando, Lake Tahoe, Daytona Beach,

Hilton Head Island, Virginia Beach.

Percent of resorts Percent of resorts Percent of

Method responding in active-sales sold-out resorts

Resort website 91% 94% 90%

Social media (Facebook, Twitter, etc.) 71% 76% 61%

Television 27% 35% 1%

Paid search/affiliate marketing 26% 34% 0%

Physical bulletin boards at resort 25% 19% 46%

External rental websites (e.g., Redweek.com

or SellMyTimeshareNOW.com) 21% 22% 17%

Timeshare broker and/or broker website 6% 7% 4%

Radio 7% <1% 2%

Newspaper <1% <1% 1%

Other <1% 0% 1%

Percent of 711 respondents – including 541 active-sales resorts and 156 not in active-sales resorts. Multiple responses allowed.

FIGURE 2.7

PUBLICIZING RENTALS

CHAPTER TWO

16

INDUSTRY HEALTH

STATE OF THE VACATION TIMESHARE INDUSTRY: UNITED STATES STUDY 2023 EDITION

Figure 2.8 shows that many resorts also use alternative programs to enhance or augment their product offerings. This

includes 59% of participating resorts that use online travel agencies and 42% that report using partnerships with web-

driven sharing entities such as Airbnb to distribute inventory. Resorts that are in active-sales are more likely to report

using online travel agencies, while those not in active sales are more likely to report partnerships with sharing entities

and travel clubs.

Percent of resorts Percent of resorts Percent of resorts

Entity responding in active-sales not in active-sales

Online travel agencies 59% 61% 52%

Developing partnerships or rental relationships with Airbnb

or other web driven ‘sharing’ entity in order to push inventory 42% 39% 52%

Use of branded or unbranded hotel as a way to extend destinations 40% 54% 0%

Percent of 759 resorts, including 560 active-sales resorts and 199 not in active-sales resorts. Multiple responses allowed.

FIGURE 2.8

ALTERNATIVE PROGRAMS TO ENHANCE/AUGMENT PRODUCT OFFERINGS

Finally, rental revenue is just one type of operating revenue collected by timeshare resorts. Figure 2.9 shows the

percentage of operating revenues collected by resorts across several categories. The predominant source of

operating revenues for resorts is maintenance fees, followed by rentals. Other revenue sources include things such

as housekeeping, food & beverage, and special assessments – none of these categories constituted more than 2% of

revenues collected. Active-sales resorts generally derive a higher share of revenues from maintenance fees than not in

active-sales resorts, while not in active-sales resorts derive a greater percentage of their operating revenue from rentals.

Percent of operating Percent of operating

Percent of revenue - active- revenue - resorts

Category operating revenue sales resorts not in active-sales

Maintenance fees 80% 80% 80%

Rentals 9% 9% 15%

Other 11% 11% 5%

Percent based on 557 respondents — percentages may not add due to rounding.

FIGURE 2.9

OPERATING REVENUE

CHAPTER THREE

Industry Segments

17

STATE OF THE VACATION TIMESHARE INDUSTRY: UNITED STATES STUDY 2023 EDITION

This chapter uses some of the performance metrics reported in

the previous chapter to compare specific industry segments. To

do so, we segment resorts using the following characteristics:

• Average resort size, as measured by the number of units

• Sales activity

• Resort type

• Geographic region

• Year resort opened

For each segment within these classifications, we compare the

following metrics:

• Percent of total resorts

• Resort size, as measured by the average number of units

• Occupancy

• Average maintenance fee billed

We also provide overall averages and totals for comparison purposes. For some segments, not all the

respondents provided information that would allow classification. For example, not all respondents

reported a resort type. Accordingly, in some cases the overall totals and averages may be inconsistent

with the totals and averages for the subgroups

13

.

13 Since the number of resorts in a given industry segment may be quite small, changes in respondent pool can result in even more

pronounced changes in metrics over the prior year – see Appendix C for a discussion of study methodology

The first segmented analysis is resort size, using five categories: 50 units or less, 51-100 units, 101 to 150 units,

151 to 200 units and more than 200 units. While the average resort size is 131 units, 38% of resorts have 50 units

or less, and 20% have more than 200 units. Figure 3.1 shows that the average maintenance fee billed per weekly

interval generally increased with resort size in 2022.

Resort Size

Average

Number Percent Average size Average maintenance fees

of units of resorts (# units) occupancy per interval

Less than 50 38% 28 79.8% $980

51-100 23% 74 79.8% $1,180

101-150 12% 124 76.8% $1,160

151-200 7% 172 80.1% $1,260

More than 200 20% 424 80.7% $1,470

Overall 100% 131 77.6% $1,170

Percent of 682 responding resorts – numbers may not add due to rounding.

FIGURE 3.1

PERFORMANCE BY RESORT SIZE

Average

Percent Average size Average maintenance fees

Sales activity of resorts (# units) occupancy per interval

Not in active-sales resorts 55% 50 78.9% $820

Active-sales resorts 45% 159 77.6% $1,270

Overall 100% 131 77.6% $1,170

Percent of 759 resorts - numbers may not add due to rounding

FIGURE 3.2

PERFORMANCE BY SALES ACTIVITY

Figure 3.2 compares the performance of resorts based on level of sales activity. This table summarizes prior analysis

comparing not in active-sales resorts with active-sales resorts and adds information on resort size. The average

number of units and average billed maintenance fees are both lower for not in active-sales resorts. Active-sales

resorts tend to be newer, and resorts have gotten larger over time, as we show in the appendix on historical results.

Sales Activity

INDUSTRY SEGMENTS

CHAPTER THREE

18

STATE OF THE VACATION TIMESHARE INDUSTRY: UNITED STATES STUDY 2023 EDITION STATE OF THE VACATION TIMESHARE INDUSTRY: UNITED STATES STUDY 2023 EDITION

CHAPTER THREEINDUSTRY SEGMENTS

19

STATE OF THE VACATION TIMESHARE INDUSTRY: UNITED STATES STUDY 2023 EDITION

Average

Percent Average size Average maintenance fees

Type of resorts (# units) occupancy per interval

Beach 27% 108 90.3% $1,240

Rural/Coastal 14% 41 89.0% $990

Country/Lakes 13% 129 76.7% $1,270

Ski 10% 124 89.4% $1,330

Golf 8% 131 86.6% $1,160

Theme Park 6% 418 89.4% $1,310

Island 6% 106 81.7% $1,290

Mountains 5% 59 80.9% $990

Desert 5% 212 82.6% $1,220

Urban 4% 94 83.8% $1,390

Other 2% 152 80.6% $1,210

Overall 100% 131 77.6% $1,170

Percent of 318 responding resorts. Note: “Other” includes Gaming, Waterpark and Other from

Figure 3.3 - numbers may not add due to rounding.

FIGURE 3.4

PERFORMANCE BY RESORT TYPE

Beach resorts are the most common primary resort type; golf is most often available nearby and/or onsite. Resorts

reported six of these vacation experiences available onsite or nearby on average. Other vacation experiences noted

include national and state parks, historic sites, and wooded trails.

Figure 3.4 compares the performance for the most common resort types.

14

Theme park resorts tend to be the largest

resorts, while rural/coastal resorts tend to be the smallest. This year, beach resorts had the highest average occupancy,

and country/lakes resorts had the lowest. Urban resorts had the highest average billed maintenance fees, while rural/

coastal and mountain resorts tied for the lowest.

Respondents

reported the vacation

experience(s) offered

at their resort and/

or nearby. They

also shared which

characteristic best

describes their resort.

Figure 3.3 shows the

results.

Resort Type

FIGURE 3.3

DISTRIBUTION BY RESORT TYPE

What vacation experience does this resort offer?

Which one

Nearby and/or characteristic best

Type Onsite Nearby onsite describes this resort?

Beach 55% 31% 64% 27%

Rural/Coastal 46% 25% 54% 14%

Country/Lakes 21% 51% 57% 13%

Ski 4% 47% 46% 10%

Golf 16% 77% 82% 8%

Theme Park 2% 48% 47% 6%

Island 13% 39% 44% 6%

Mountains 7% 47% 48% 5%

Desert 5% 36% 36% 5%

Urban 37% 18% 42% 4%

Gaming 1% 44% 43% <1%

Waterpark 2% 40% 40% <1%

Other 1% 1% 1% 1%

Percent of 344 responding resorts - percentages may not add due to rounding. For onsite and nearby, multiple

responses allowed.

14 There was insufficient data to report on the other resort types.

INDUSTRY SEGMENTS

CHAPTER THREE

20

STATE OF THE VACATION TIMESHARE INDUSTRY: UNITED STATES STUDY 2023 EDITION

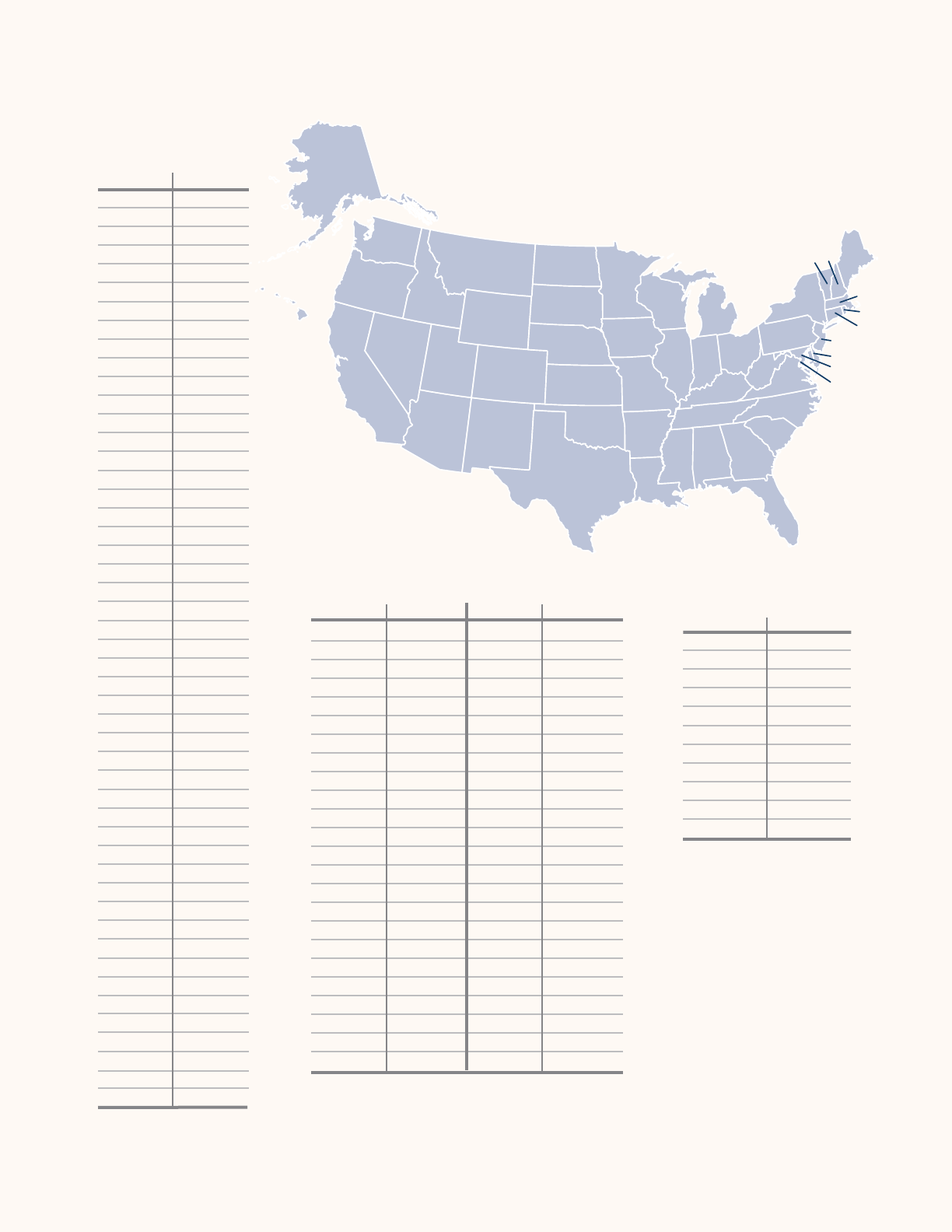

The next segment is geographical region of the country. Florida, California, South Carolina, Hawaii, and Nevada are the

five states with the highest number of timeshare resorts. These states contain nearly half of U.S. timeshare resorts and

nearly two-thirds of all U.S. timeshare units (see Appendix A). The remaining states are grouped in regions, based on the

U.S. Census Bureau’s list of geographic regions. Figure 3.5 shows a list of states represented by each region, and Figure

3.6 compares the performance by region.

Geographic Region

California

Hawaii

Pacific

Mountain

Florida

South Central

South

Carolina

South

Atlantic

Midwest

Northeast

Nevada

Region States

n

Florida FL

n

California CA

n

South Carolina SC

n

Hawaii HI

n

Nevada NV

n

Mountain/Pacific CO, UT, MT, AZ, WY, ID, NM, AK, OR, WA

n

Northeast CT, ME, MA, NH, RI, VT, NJ, NY, PA

n

South Central AL, KY, MS, TN, TX, LA, AR, OK

n

Midwest IL, IN, MI, OH, WI, IA, KS, MN, MO, NE, ND, SD

n

South Atlantic DE, DC, GA, VA, WV, NC, MD

FIGURE 3.5

GEOGRAPHIC REGIONS

STATE OF THE VACATION TIMESHARE INDUSTRY: UNITED STATES STUDY 2023 EDITION

Florida has the most resorts, while Nevada has the largest resorts, and the Northeast region has the smallest. Resorts

in Hawaii had the highest average occupancy, while those in Nevada had the lowest. In 2022 South Carolina had the

highest average billed maintenance fees and Northeast resorts had the lowest average billed maintenance fees.

CHAPTER THREEINDUSTRY SEGMENTS

21

STATE OF THE VACATION TIMESHARE INDUSTRY: UNITED STATES STUDY 2023 EDITION

Average

Percent Average size Average maintenance fees

Region of resorts (# units) occupancy per interval

Florida 24% 169 79.5% $1,250

California 9% 136 84.0% $1,190

South Carolina 7% 152 83.9% $1,290

Hawaii 6% 138 86.5% $1,250

Nevada 4% 234 73.6% $1,130

Mountain/Pacific 16% 107 78.8% $1,130

Northeast 11% 100 83.3% $960

South Atlantic 8% 110 75.4% $1,190

Midwest 8% 124 74.0% $1,170

South Central 7% 149 75.9% $1,210

Overall 100% 131 77.6% $1,170

Percent of 1,541 resorts - percentages may not add due to rounding

FIGURE 3.6

PERFORMANCE BY GEOGRAPHIC REGION

Finally, we compare operating performance based on the year the resort opened. This segment includes four

categories of resorts - those opened 1985 or before, 1986 to 1995, 1996 to 2005 and 2006 or later. The oldest resorts

tended to be the smallest and have lower occupancy and average billed maintenance fees. Interestingly, those built

between 1996-2005 tended to be the largest, as the trend of building larger resorts appears to have diminished since

2005. Average occupancy was highest in resorts built in 2006 or later. The average billed maintenance fee generally

increases in newer resorts.

Year Resort Opened

Average

Year resort Percent Average size Average maintenance fees

opened of resorts (# units) occupancy per interval

1985 or before 32% 113 79.5% $1,020

1986-1995 13% 175 78.8% $1,350

1996-2005 27% 191 83.3% $1,350

2006+ 28% 165 84.0% $1,460

Overall 100% 131 77.6% $1,170

Percent of 316 responding resorts — percentages may not add due to rounding

FIGURE 3.7

PERFORMANCE BY YEAR RESORT OPENED

Average Maintenance Fee Billed

2021

$1,120

2022

$1,170

2018

$1,000

2019

$1,080

2020

$1,090

Rental Revenue ($B)

2021

$2.2

2022

$2.7

2018

$2.4

2019

$2.5

2020

$1.3

Average Occupancy

2022

77.6%

2018

80.8%

2019

79.3%

2021

73.1%

2020

49.2%

Average Transaction Price

2022

$23,940

2018

$17,930

2019

$18,760

2021

$19,590

2020

$17,460

Sales Volume ($B)

2022

$10.5

2018

$10.2

2019

$10.5

2020

$4.9

2021

$8.1

CHAPTER FOUR

Industry Outlook

22

Finally, in this chapter we examine the near-term industry outlook by

observing recent performance trends and expected construction.

Figure 4.1 displays trends for the industry’s five key performance measures over the past five years. It shows the

significant impact of the COVID-19 pandemic on sales volume, average occupancy, and rental revenue in 2020, a

nd the recovery experienced in those measures in 2021 and 2022. Average transaction price and billed maintenance

fees, by contrast, saw little impact from the pandemic. Average transaction price has historically fluctuated year over

year based on the mix of sales by unit configuration, resort type and brand. Maintenance fees have generally risen

year over year to accommodate the increasing costs of maintaining and operating timeshare resorts.

FIGURE 4.1

RECENT PERFORMANCE TRENDS 2018 TO 2022

STATE OF THE VACATION TIMESHARE INDUSTRY: UNITED STATES STUDY 2023 EDITION

STATE OF THE VACATION TIMESHARE INDUSTRY: UNITED STATES STUDY 2023 EDITION

Figure 4.2 shows the change over the past year in key metrics for respondents having multiple resorts and reporting

data in both years. The purpose of this table is to assess industry changes without respect to differences in the

respondent pool year-over-year.

The number of resorts and corresponding number of units was roughly the same between the two years. Total sales

volume increased by nearly 34% for these 2022 respondents – this is slightly higher than the 30% increase in estimated

sales industry-wide. The 22% increase in average sales price per transaction was in line with the industry overall, as were

the 5.3 percentage point increase in occupancy and 4.6% increase in average billed maintenance fees.

Another important indicator of industry outlook is recent and planned construction — both of new resorts and units

added to existing resorts. Respondents reported the number of timeshare units “recently built and planned at this

resort.” Note that “planned” resorts and units include those for which the corporate finance committee has given its

approval and/or financing has been secured and approved by the appropriate entity.

FIGURE 4.2

CHANGES FOR RESPONDENTS PROVIDING DATA IN 2021 AND 2022

Percent

2021 2022 Change change

Number of resorts 661 660 -1 -0.2%

Number of units 91,503 91,163 -340 -0.4%

Total sales ($M) $7,118 $9,523 $2,405 33.8%

Sales price per transaction $19,601 $23,909 $4,308 22.0%

Occupancy 72.3% 77.6% 5.3% 7.4%

Average units 138 138 0 -0.2%

Maintenance fees $1,152 $1,204 $53 4.6%

Note: Numbers may not add due to rounding

Figure 4.3 shows that respondents reported building 132 units in 2022, up from the 31 they reported building in 2021.

Respondents plan to add 208 units in 2023 — this is comprised entirely of units at existing resorts, as opposed to new

resort construction. At the time of the survey, respondents reported plans to add 1,293 units in 2024 and beyond – this

includes 708 units at existing resorts and 585 units at planned new resorts. Finally, respondents also reported plans for

five new resorts (all in 2024 and beyond).

FIGURE 4.3

RESORT AND UNIT CONSTRUCTION

Construction results reported for respondents only - not industry-wide estimates. Based on responses from 3 timeshare

developers and/or single site resorts

Units built 132

Units planned – in the coming year 208

Units planned – more than one year out 1,293

Resorts planned – in the coming year 0

Resorts planned – more than one year out 5

CHAPTER FOURINDUSTRY OUTLOOK

23

Figure 4.4 reports “just-in-time” inventory activity by respondents.

This includes turn-key inventory purchases and buy-backs from

Property Owner Associations. Respondents reported adding 233

units via these methods in 2022, and plan to add 140 in 2023.

They also plan to add 30 in 2024 and beyond.

The level of available timeshare inventory helps drive actual and anticipated timeshare construction. We asked active-

sales respondents to report their total timeshare inventory (in weeks and/or points) and how much of that inventory

was still available for sale. We used these two values to calculate the percent of timeshare inventory available for sale at

active-sales resorts, and then weighted these percentages by the number of timeshare units to calculate an industry-

wide average. Figure 4.5 shows that 19.4% of timeshare inventory at active-sales resorts, on average, is available for sale.

By most measures 2022 marked the completion of a return to pre-pandemic

levels for the timeshare industry. Sales volume and occupancy were at or

near 2019 levels at $10.5 billion, and nearly 78%, respectively. Rental revenue

actually was above 2019 levels at $2.7 billion.

FIGURE 4.4

JUSTINTIME INVENTORY

2022

Just-in-time units added 233

Just-in-time units planned – coming year 140

Just-in-time units planned – more than one year out 30

Just-in-times reported for respondents only - not industry-wide estimates.

Based on responses from 7 timeshare developers and/or single site resorts.

FIGURE 4.5

PERCENT OF EXISTING TIMESHARE

INVENTORY AVAILABLE FOR SALE

AS OF YEAREND 2022

Inventory available

for sale

19.4%

Sold

inventory

80.6%

INDUSTRY OUTLOOK

CHAPTER FOUR

24

STATE OF THE VACATION TIMESHARE INDUSTRY: UNITED STATES STUDY 2023 EDITION

STATE OF THE VACATION TIMESHARE INDUSTRY: UNITED STATES STUDY 2023 EDITION

APPENDIX A

25

Source: Ragatz Associates, American Economics Group and AIF

RI 14

CA

134

HI 98

NV

59

AZ

48

UT

33

CO 76

NM

19

TX 40

OK

1

SD 2

NE 1

MN

11

IA 2

MO

54

AR

10

LA

17

MS

4

AL

7

GA

18

FL

367

SC

110

NC 52

TN 30

KY 3

VA

38

WV

2

OH

1

PA 21

NY

20

CT 1

MA 42

ME

19

NH

27

VT

13

NJ 11

DE 2

MD 15

DC 2

IN

3

IL

5

WI

23

MI

16

WY 4

ID

11

OR 18

WA 24

MT 13

RESORTS BY STATE

State Resorts State Resorts

FL 367

CA 134

SC 110

HI 98

CO 76

NV 59

MO 54

NC 52

AZ 48

MA 42

TX 40

VA 38

UT 33

TN 30

NH 27

WA 24

WI 23

PA 21

NY 20

ME 19

NM 19

GA 18

OR 18

LA 17

MI 16

MD 15

RI 14

MT 13

VT 13

ID 11

MN 11

NJ 11

AR 10

AL 7

IL 5

MS 4

WY 4

IN 3

KY 3

DC 2

DE 2

IA 2

SD 2

WV 2

CT 1

NE 1

OH 1

OK 1

Note: There was not sufficient

response to report the number of

units at the state level for each state.

PERCENTAGE OF

UNITS BY STATE

Percent

State of units

FL 28%

HI 11%

CA 10%

NV 8%

SC 6%

AZ 5%

CO 5%

MO 3%

TN 3%

TX 3%

All others 18%

Year Sales ($B)

1974 $0.1

1975 $0.1

1976 $0.1

1977 $0.3

1978 $0.4

1979 $0.4

1980 $0.5

1981 $0.6

1982 $0.7

1983 $0.8

1984 $0.9

1985 $1.0

1986 $1.0

1987 $1.0

1988 $1.1

1989 $1.2

1990 $1.2

1991 $1.3

1992 $1.4

1993 $1.5

1994 $1.7

1995 $1.9

1996 $2.2

1997 $2.7

1998 $3.1

1999 $3.6

2000 $4.1

2001 $4.8

2002 $5.5

2003 $6.5

2004 $7.9

2005 $8.6

2006 $10.0

2007 $10.6

2008 $9.7

2009 $6.3

2010 $6.4

2011 $6.5

2012 $6.9

2013 $7.6

2014 $7.9

2015 $8.6

2016 $9.2

2017 $9.6

2018 $10.2

2019 $10.5

2020 $4.9

2021 $8.1

2022 $10.5

HISTORICAL

SALES DATA

APPENDIX B

26

STATE OF THE VACATION TIMESHARE INDUSTRY: UNITED STATES STUDY 2023 EDITION

Timeshare Resort Tracking

The study universe in the State of the Vacation Timeshare Industry consists of the latest list of

timeshare resorts in the United States. While there is not a single, mandated registration database

of timeshare properties developed in the U.S., the ARDA International Foundation established an

extensive process to identify existing and planned unique timeshare resorts.

Timeshare resorts are identified through a variety of primary and secondary research, including:

• Company press releases, earnings reports, and websites

• Exchange company directories

• Crittenden Resort Report

• Industry media searches

• General media searches

• Primary survey research which includes a Confirmation Survey

and the State of the Vacation Timeshare Industry survey

Extensive verification is conducted to identify unique timeshare resort properties. The resort

count does not include:

• Emerging vacation ownership product segments – fractional,

private residence clubs, destination clubs, non-equity clubs,

whole-ownership, or condo-hotel resorts

• Club entities that own partial inventory or partial intervals at a

physical timeshare resort

• Vacation exchange rental property at non-timeshare resorts

STATE OF THE VACATION TIMESHARE INDUSTRY: UNITED STATES STUDY 2023 EDITION

APPENDIX C

27

Ernst & Young LLP (EY) designed, built, and distributed a password-secured, web-based survey

questionnaire for data collection at the resort level. Data providers with multiple resorts received a

corresponding version in Microsoft Excel. Individual responses to all questions were kept completely

confidential. Only EY professionals responsible for the survey had access to individual survey responses.

EY used the survey responses to produce most of the estimates detailed in this study — other sources

are cited as appropriate. This study contains estimates of key metrics that provide an overview of the

vacation timeshare industry in the United States. It is not a comment on any individual company, whose

performance may vary from the information included in this study.

All identified timeshare resorts

15

in the United States were sent a survey questionnaire. Of the 1,541

identified timeshare resorts, 759 responded — a 49% response rate. Of these 759 responding resorts, 699

belong to a network of ten or more resorts, while 60 belong to a network of less than ten resorts including

48 single-site resorts. In general, the information in this report includes estimates of industry-wide metrics.

The exceptions are the estimates of construction activity and just-in-time inventory, which are reported

only for those responding to the survey and not extrapolated to the universe of timeshare resorts.

How good are the estimates in this report? There are two primary sources of survey error: sampling and

non-sampling error. Since the entire universe of identified resorts received a survey there is no sampling

error and terms such as precision and confidence are not appropriate. Non-sampling error includes survey

question bias, coverage and measurement error, and non-response. Non-sampling errors are present in

every survey, but can be reduced with proper planning, good execution, and appropriate analysis.

For this survey, EY took the following steps to help reduce non-sampling errors at various stages of the

survey process:

• The AIF annually updates its database of timeshare resorts to help reach all known

timeshare resorts.

• EY conducted a questionnaire review session with experienced survey professionals

and data providers to help clarify the meaning of key terms and new data points.

• The electronic survey questionnaires contain data edit checks designed to

catch questionable responses at the point of data entry. For example, reported

maintenance fees that appear too high based on previous response, or intervals

owned per unit that seem implausible.

• Survey participants receive complimentary copies of the report as an incentive to

respond.

• The AIF and EY conducted calling campaigns and sent electronic reminders to

encourage response.

• EY followed up with respondents on confusing or inconsistent responses.

• EY also compares our results to historical data, expected trends and other AIF

studies such as the annual Financial Performance Study.

Methodology

15 List of timeshare resorts maintained and provided by AIF. Please see Appendix B for more information about the methodology for

identifying timeshare resorts.

APPENDIX C

28

STATE OF THE VACATION TIMESHARE INDUSTRY: UNITED STATES STUDY 2023 EDITION

The overall response rate is the most widely used measure of non-sampling error. The response rate has

increased from 28% in 2005 (the year before EY began conducting the study) to 49% in 2022 and is well

above the current typical response rate for surveys of this type. Our nearly 93% response rate among large

developers (those with ten or more resorts) is very good, and suggests that industry health estimates, such

as sales, are reliable, since these respondents generate most of the industry’s sales. That said, because of

the higher response rates of multi-site respondents, where appropriate, statistical weighting was used to

help offset potential bias in the study respondents. A comparison of the distribution of responding resorts

to the distribution of the universe by state did not reveal any systematic differences.

In general, a higher response rate helps improve the accuracy of estimates, but at the same time the

higher rate can make comparisons to the results of previous years problematic. For example, if new

respondents report relatively low unit counts for their resorts, this will drive the reported average resort

size lower even though the industry may not have lost any units.

Note that the number of respondents varies across questions, since some questions (e.g., those related to

sales activity) are only relevant to certain segments of the timeshare resort population. To aid

interpretability of results, throughout the report we include the number of respondents to the survey

question related to the corresponding table/graphic where appropriate. Also, in some cases, multiple

responses were allowed for a single question – we have indicated such after each figure where

appropriate. Furthermore, in some cases where a single response is required, the percentages in a single

table may not appear to sum to 100% due to rounding – we have also indicated that where appropriate.

Finally, in some cases, percentage changes year over year may be slightly different than expected due to

rounding.

We made an update to the way that we identify resorts that are active-sales vs. not in active-sales, and a

corresponding adjustment to the methodology for estimating industry sales in 2021.

EY worked with the AIF to classify all multi-site data providers as either in active-sales or not in active-

sales. We relied on a few techniques to help us assess sales status.

• Sales data provided from multi-site respondents- if a respondent reported sales data, we

considered resorts in that portfolio to be in active-sales.

• Use of previously reported data, review of company websites and AIF industry knowledge for

non-responding companies – we used this information to classify non-responding multi-site

companies as either in active-sales or not in active-sales.

Finally, we combined this assessment of sales status with the reported sales data of our respondents to

estimate the sales level of non-responding companies.

Special thanks are due to the timeshare industry professionals who

dedicated their time and expertise to the development of the survey

instrument employed to collect data for this report. Also, we truly

appreciate the efforts of resort staff who committed their time and

energy to complete the survey questionnaires.

State of the Vacation Timeshare Industry

UNITED STATES STUDY 2023 EDITION

SURVEY

APPENDIX D

29

STATE OF THE VACATION TIMESHARE INDUSTRY: UNITED STATES STUDY 2023 EDITION

Thank you for participating in the 2023 ARDA International Foundation (AIF) Survey! The following

survey is about timeshare resorts. If you have questions regarding the survey or this website, please

call Joe Callender at 202.327.5692 or email [email protected].

If you submitted a response to us last year, we have used that data to pre-populate fields that are unlikely to change. We hope

this makes this questionnaire easier to complete. Please review the answers in case anything has changed since last year.

WEB ONLY: In some cases, multiple respondents from an organization may be completing this questionnaire. In that case, you

may only be completing specific sections. Using the following table of contents, please de-select any sections which are not

applicable to you before proceeding.

oResort Identification

oResort Characteristics

oOccupancy and Fees

oResort Timeshare Sales

oInventory Management

oResort Construction and Improvements

oTimeshare Rental Programs

1. Are you responsible for providing data for multiple resorts?

oYes — Please contact Joe Callender at 202-327-5692 or Joe.Callender@ey.com if interested

in providing the information below via an Excel spreadsheet for all your resorts.

oNo

2. Resort identifying information

Resort Name ____________________________________________________________________

Address ________________________________________________________________________

City_________________________________________ State _______ Zip Code ______________

3. Contact person (General information for individual completing survey)

First Name _______________________________________________________________________

Last Name _______________________________________________________________________

Title ____________________________________________________________________________

Company Name __________________________________________________________________

Telephone Number ________________________________________________________________

4. Resort management information (Complete only if applicable)

Name of Development Company _____________________________________________________

Name of Management Company _____________________________________________________

RCI Identification Number __________________________________________________________

Interval Identification Number _______________________________________________________

Home Owners Association(s) If multiple HOAs please use a comma to separate ______________________

5. Please indicate any exchange companies with which you are aliated.

I. Resort Identification

Note: Please refer to the glossary for the definition of any underlined terms.

oInterval International

oRCI

oInternal exchange program (the exchange

program operated by your developer or

management company)

o7Across (previously Dial An Exchange)

oArrivia [previously ICE (International Cruise

and Excursion)]

oSFX Preferred Resorts (San Francisco

Exchange)

oOther, specify ____________________

1. At which development stage is this resort currently? (Select one)

Note: If the resort is being built in phases, and a construction phase is complete, the resort should be considered open,

even if a new phase is still under construction.

II. Resort Characteristics

oPlanned [Skip to Q2]

oUnder Construction [Skip to Q2]

oOpen [ANSWER Qa, b, d & f]

oTemporarily Closed [ANSWER Qa & Qc-f]

oPermanently Closed [ANSWER Qa, Qh & Qi]

oConverted to a non-timeshare property [ANSWER Qa, Qh & Qi]

30

a. Please select the year this resort opened. (Only answer if stage above equals Open,

Temporarily closed, Permanently Closed, or Converted to a non-timeshare property) _______________

b. Did the resort temporarily close at any point in 2022 for any of the following reasons?

oCOVID-19 pandemic

oNatural disaster

oOther, specify _____________

oNo, did not temporarily close (Skip to f)

oCOVID-19 pandemic

oNatural disaster

oOther, specify _____________

oLess than one week

o1 to 4 weeks

o1 to 3 months

oMore than 3 months, specify _________

e.

(If temporarily closed in Q1) When do you expect the resort to re-open?

oCOVID-19 pandemic

oNatural disaster

oFinancial restraint

oOther, specify _____________

f.

Are you planning to convert the resort to a non-timeshare property?

i. Please specify a reason why this resort permanently closed or converted to a non-timeshare property

(Only answer if stage above = Permanently Closed or Converted to a non-timeshare property)

c. What is the primary reason for being temporarily closed?

d. How long was the resort temporarily closed/has it been temporarily closed?

5. Who employs your resort’s employees? (Check all that apply)

oResort developer

oResort HOA(s)

oManagement company

oOther, specify____________________

SURVEY

4. Who controls the HOA/POA/COA (owner’s association) at this resort?

oOwners

oDeveloper

3. Are any of the following types of units available for sale/rent at this property?

oFractional

oHotels

oWhole ownership

oSome other type of non-timeshare units (please specify) ________________

oNone of the above — this is a stand-alone/timeshare only property

2. What type of construction is this timeshare property?

oPurpose built

oConversion

STATE OF THE VACATION TIMESHARE INDUSTRY: UNITED STATES STUDY 2023 EDITION STATE OF THE VACATION TIMESHARE INDUSTRY: UNITED STATES STUDY 2023 EDITION

oFirst quarter of this year

o2nd quarter of this year

o3rd quarter of this year

o4th quarter of this year

oNext year or later

g.

Please explain why you are planning to convert the resort to a non-timeshare property.

_______________

h. Please select the year this resort permanently closed or converted to a non-timeshare

property. (Only answer if stage above = Permanently Closed or Converted to a non-timeshare

property)______________

oYes, in 2023 [Answer Qg]

oYes, in 2024 or later [Answer Qg]

oNo

31

SURVEY

STATE OF THE VACATION TIMESHARE INDUSTRY: UNITED STATES STUDY 2023 EDITION

II. Resort Characteristics — continued

6. How many timeshare units does this resort have by size?

If you don’t have a given type of unit, please fill in ‘0’.

NOTE: Please do not include commas when reporting numeric values. (i.e., the amount 1,000 should be reported as 1000.).

Count Lock-os as one unit

_____ Studio

_____ 1BR

_____ 2BR

_____ 3+BR

_____ Total Units

Count Lock-os as separate units

_____ Studio

_____ 1BR

_____ 2BR

_____ 3+BR

_____ Total Units

Total Units as of December 31, 2022

7. Which of the following types of intervals does this resort currently have? (Check all that apply)

oTimeshare points

One or more of the following types of weekly intervals

oTraditional interval weeks (including fixed and floating weeks)

oInterval weeks with the ability to use through a timeshare points system

8. Which of the following special types of intervals does this resort currently have?

oBiennials

oTriennials

oLimited-term vacation products [ANSWER part a]

oOther, please specify ____________________

8a.

What is the length of the term in years? _________

9. Please provide the following information on timeshare inventory at your resort(s):

What percentage of your inventory is owned by owners other than the developer

or HOA? Please include any intervals sold since the resort’s inception, unless they

have been reacquired by the developer or are owned by the HOA

What percentage of your inventory is owned by the HOA?

What percentage of your inventory is owned by is owned by the developer?

Please include any intervals that have never been sold and intervals that have been

reacquired by the developer.

Total

%

As of December 31, 2022

December 31, 2021 _____________________ December 31, 2022 _____________________

10. What was the actual number of owners as of each date?

11. What was the origin distribution of your shared vacation owners in 2022??

%

Domestic ________

International ________

Total 100%

12. What is the approximate distribution of your owner population by age?

% of owners

18 to 24 ________

25 to 34 ________

35 to 44 ________

45 to 54 ________

55 to 64 ________

65+ ________

Total 100%

13. What is the legal structure of the shared vacation ownership products that you sell currently?

(Check all that apply)

oRight to use contractual interest that expires at some future date (generally referred to as a timeshare license

and is not considered a real property interest at the state level) [ANSWER Q13A]

oDeeded or fee-simple real estate (generally referred to as a timeshare estate and would be considered a real

property interest at the state level) [GO TO Q14]

oInterest in a trust (generally includes an owner receiving a beneficial interest in a trust that allows the owner

to use property the is held in the trust for the benefit of the owners. Ownership could be evidenced by a

certificate, deed (in the case of a Florida Land Trust) or other similar document)) [GO TO Q14]

oOther, specify [GO TO Q14] _____________________

a.

If “Right to use contractual interest” was selected above, how long is the contract, membership license

or leasehold, if applicable?

o100+ years

o80-99 years

o60-79 years

o40-59 years

o20-39 years

o10-19 years

o6-9 years

o4-5 years

o2-3 years

o1 year or less

II. Resort Characteristics — continued

32

On-site Nearby

Beach o o

Country/Lakes o o

Desert o o

Gaming o o

Golf o o

Island o o

Rural/Coastal o o

Ski o o

Theme Park o o

Urban o o

Mountains o o

Waterpark o o

Other, specify o o

14. What vacation experience does this resort oer?

(Choose all that apply.)

o Beach

oCountry/Lakes

o Desert

oGaming

oGolf

oIsland

oRural/Coastal

oSki

oTheme Park

oUrban

oMountains

oWaterpark

oOther, specify: ___________

15. Which ONE characteristic best describes this resort? (Please select only one)

SURVEY

16. Do you oer a mobile application to owners and guests to enhance their experience?

o Yes [ANSWER Q16a] o No [GO TO Q17]

16a.

Which of the following features are oered via the mobile application to your guests?

oCheck in

oAccess to units (unlock/lock unit using a phone)

oMaking reservations

oVirtual sales presentation

oVirtual tour of resort (room/resort pictures, videos, etc.)

oMobile payment — maintenance fees

oMobile payment — rental fees

oMobile payment — other, specify

oOwner community building experience

oOther, specify: _______________

STATE OF THE VACATION TIMESHARE INDUSTRY: UNITED STATES STUDY 2023 EDITION STATE OF THE VACATION TIMESHARE INDUSTRY: UNITED STATES STUDY 2023 EDITION

33

SURVEY

STATE OF THE VACATION TIMESHARE INDUSTRY: UNITED STATES STUDY 2023 EDITION

II. Resort Characteristics — continued

o Email [Answer Q18 about Email]

o Phone [Answer Q18 about Phone]

o Owner online forum [Answer Q18 about Owner online forum]

o Social media [Answer Q22 about Social media]

o Other, please specify ________________ [Answer Q18 about Other]

17. How do you communicate with your owners?

o

None

o Hotel

o Condo

o Fractional

o Cruise

o Shopping

o Air travel

o Car rental

o Other, please specify __________________

19. [EXCEL ONLY] What other types of products/services are oered through your internal exchange

programs only?

As needed Weekly Monthly Quarterly Yearly Other

Email

o o o o o o

Phone o o o o o o

Owner online forum o o o o o o

Social media o o o o o o

Other o o o o o o

18. With what frequency do you communicate with your owners?

(Check all that apply)

20. [EXCEL ONLY] How many non-timeshare entities are associated with the internal exchange program?

__________________________

2. What were your maintenance fees billed per unit per interval in 2022, including contributions to reserves

but excluding special assessments and property taxes?

NOTE: Please do not include commas when reporting

numeric values. (i.e., the amount 1,000 should be reported as 1000.)

Maintenance fees billed per unit per interval

Studio __________ 1BR __________ 2BR __________ 3+BR __________

* Points-based developers may calculate weeks on an implied interval week conversion factor based on internal measures. For example,

one approach may be to divide the number of points redeemed during the year by the number of unit weeks occupied; or, developers

that assign values to unit inventory may calculate the implied interval week conversion factor for the system overall.

Please answer the following questions for your timeshare units only.

Owner or owners’ guest __________ __________

Exchange guest __________ __________

Renter __________ __________

Marketing guest (sampler/trial membership, etc.) __________ __________

Vacant __________ __________

Total 100% 100%

Occupancy In 2022

(including rooms taken oine

due to temporary resort

closures for natural disasters

(i.e., hurricanes, fires, etc.)