A Thesis By

JUAN RUFINO MORGA REYES, 51198208

Master of Public Policy, International Program (MPP/IP)

(Economic Policy, Finance, and Development)

PROFESSOR KONSTANTIN KUCHERYAVYY (PH.D.)

Academic Supervisor

GRADUATE SCHOOL OF PUBLIC POLICY

THE UNIVERSITY OF TOKYO

TOKYO, JAPAN

JUNE 2021

© 2021 Juan Rufino M. Reyes

All Rights Reserved.

DECLARATION

I hereby declare that this thesis is my original work, and I have written it in its entirety.

I have duly acknowledged all the sources of information that have been used in this research.

In addition, this study has not been submitted for any degree or university previously.

(Sgd.)

JUAN RUFINO M. REYES, 51198208

Master of Public Policy, International Program (MPP/IP)

Graduate School of Public Policy

The University of Tokyo

ACKNOWLEDGEMENT

First of all, I would like to express my deepest gratitude to my academic supervisor,

Professor Konstantin Kucheryavyy (Ph.D.), for imparting his knowledge on data science and

providing technical assistance for this research. I appreciate the effort and encouragement you

conveyed during the entire thesis writing process. Thank you for the patience you have shown

and for the remarkable recommendations for this thesis.

I also would like to thank the (1) Joint Japan/World Bank Graduate Scholarship

Program (JJ/WBGSP) for giving me the opportunity and support to study at the most

prestigious university in Japan, The University of Tokyo (UTokyo); and

(2) Bangko Sentral ng Pilipinas (BSP) for allowing me to pursue a degree in the field of

public policy (i.e., economic policy, finance, and development) to become a better central banker

that could contribute to the development of monetary policy in the Philippines.

To the significant contributors of data in this thesis: Mr. Justin Parco of

Investor Relations Office (IRO), colleagues at the Department of Economic Statistics (DES),

and International Operations Department (IOD) of the BSP, I appreciate your generosity in

providing relevant statistics despite your busy schedules. Thank you for your

kind understanding.

Lastly, I am particularly thankful to Ms. Mia Agcaoili, my parents

(Engr. Rico and Marylen Reyes), and my siblings (Ms. Michelle and Ana Reyes) for

their unending love and support. I am forever grateful for your encouragement that

I can produce a study that is timely and relevant. Thank you for believing that this

thesis could be one of the best!

TABLE OF CONTENTS

DECLARATION

ACKNOWLEDGEMENT

TABLE OF CONTENTS

ABSTRACT

ACRONYMS

LIST OF TABLES

LIST OF FIGURES

PART ONE

RESEARCH FRAMEWORK:

BACKGROUND, THEORY, AND METHODOLOGY OF THE STUDY

CHAPTER I: INTRODUCTION

1.1. Background of the Study 2

1.1.1. Economic Nowcasting, Big Data, and Machine Learning 3

1.1.2. The Philippines and Domestic Liquidity 6

1.2. Statement of the Problem 8

1.3. Research Objectives 10

1.4. Significance of the Study 10

1.5. Scope and Limitations 11

1.6. Definition of Terms 12

CHAPTER II: REVIEW OF RELATED LITERATURE

2.1. Primer 14

2.2. Regularization Methods 15

2.3. Tree-Based Methods 19

2.4. The Utilization of Two (2) Machine Learning Methods 23

CHAPTER III: RESEARCH METHODOLOGY

3.1. Primer 26

3.2. Models 26

3.2.1. Benchmark Models 27

3.2.1.1. Autoregressive Models 27

3.2.1.1.1. Autoregressive Integrated Moving Average 27

3.2.1.1.2. Random Walk 28

3.2.1.2. Vector Autoregression 28

3.2.1.3. Dynamic Factor Model 29

3.2.2. Machine Learning Models 30

3.2.2.1. Regularization Methods 30

3.2.2.1.1. Ridge Regression 30

3.2.2.1.2. Least Absolute Shrinkage and Selection Operator 31

3.2.2.1.3. Elastic Net 32

3.2.2.2. Tree-Based Methods 32

3.2.2.2.1. Decision Tree 33

3.2.2.2.2. Random Forest 34

3.2.2.2.3. Gradient Boosted Trees 34

3.3. Nowcast Evaluation Methodology 35

3.4. Research Tool 36

PART TWO

RESEARCH ANALYSIS:

DATA AND EMPIRICAL RESULTS

CHAPTER IV: DATA AND DIAGNOSTICS

4.1. Primer 38

4.2. Data 38

4.2.1. Target Variable 38

4.2.2. Input Variables 38

4.2.2.1. Monetary Indicators 39

4.2.2.2. Financial Indicators 40

4.2.2.3. External Indicators 41

4.2.2.4. Lagged Values of Domestic Liquidity 41

4.3. Averaging and Interpolation 41

4.3.1. Averaging of High Frequency Variables 42

4.3.2. Interpolation of Low Frequency Variables 42

4.4. Diagnostics and Feature Engineering 43

4.4.1. Seasonal Adjustment 43

4.4.2. Logarithmic Transformation 43

4.4.3. Stationarity 43

CHAPTER V: EMPIRICAL RESULTS AND ANALYSIS

5.1. Primer 46

5.2. Calibration and Nowcast Results 46

5.2.1. One-Step-Ahead (Out-of-Sample) via Expanding Window 46

5.2.2. Autoregressive Models 47

5.2.2.1. Model Calibration 47

5.2.2.2. Nowcast Results 49

5.2.3. Dynamic Factor Model 51

5.2.3.1. Model Calibration 51

5.2.3.2. Nowcast Results 52

5.2.4. Machine Learning Models 54

5.2.4.1. Regularization Methods 54

5.2.4.1.1. Model Calibration 54

5.2.4.1.2. Nowcast Results 55

5.2.4.2. Tree-Based Methods 57

5.2.4.2.1. Model Calibration 57

5.2.4.2.2. Nowcast Results 59

5.3. Further Analysis 61

5.3.1. Variable Importance 61

5.3.1.1. LASSO and ENET 61

5.3.1.2. Random Forest and Gradient Boosted Trees 62

PART THREE

FINAL CHAPTERS

CHAPTER VI: CONCLUSION

6.1. Summary and Conclusion 65

CHAPTER VII: RECOMMENDATION

7.1. Potential Actions 69

7.2. Suggestions for Future Research 70

BIBLIOGRAPHY

ANNEXES

Annex A R Studio Packages

Annex B Unit Root Tests for Input Variables

Annex C Optimal Shrinkage Penalty via Ridge Regression

Annex D Optimal Shrinkage Penalty via LASSO

Annex E Optimal Shrinkage Penalty via ENET

Annex F OOB Error of Training Datasets via Random Forest

Annex G Optimal Number of Trees via Gradient Boosted Trees

Annex H Variable Coefficients via LASSO: January to December 2020

Annex I Variable Coefficients via ENET: January to December 2020

ABSTRACT

1

,

2

Domestic liquidity (also known as broad money) is defined as the sum of all

liquid financial instruments held by money-holding sectors that are used as a

medium of exchange in an economy (IMF, 2016). The changes in the overall growth of this

monetary indicator are among the most important dynamics that numerous central banks are

closely monitoring. This is because of its property of being an essential element to the

overall transmission mechanism of monetary policy, particularly the impact of

money supply expansion or contraction on aggregate demand, interest rates, inflation, and

overall economic growth (Mankiw, n.d.).

In the Philippines, data on domestic liquidity is used as a primary component

to formulate monetary policy and utilized as a leading indicator to observe

price and financial stability. However, similar to the concerns regarding the delayed publication

of data or statistical indicators generated by most government offices, data on domestic liquidity

in the said country also suffers from series of lags and revisions. Due to this predicament,

policymakers in the Central Bank of the Philippines or Bangko Sentral ng Pilipinas (BSP)

typically formulate monetary policies and address different economic phenomena (e.g., inflation,

business cycle) using its outdated or lagged values.

The concept of short-

methodologies utilized by numerous institutions (e.g., International Financial Institutions (IFIs),

central banks) to address the aforementioned issues in data publication. This approach,

at present, also became prevalent because of the emergence of big data and machine learning

which augment its overall process (Hassani and Silva, 2015; Richardson et al., 2018).

1

juanrufin[email protected]; juanrufinom[email protected]tokyo.ac.jp

2

The results expressed herein do not represent the views nor opinions of GraSPP, UTokyo, as well as the BSP. Errors and omissions

are sole responsibility of the author.

That being said, this study aims to utilize machine learning algorithms to provide an

optimal model to nowcast the growth of domestic liquidity in the Philippines.

In particular, the following steps are performed to support this objective:

(1) perform one-step-ahead (out-of-sample) nowcasts through regularization

(i.e., Ridge Regression, Least Absolute Shrinkage and Selection Operator (LASSO),

Elastic Net (ENET)) and tree-based methods (i.e., Random Forest (RF),

Gradient Boosted Trees (GBT)); (2) recognize and compare the accuracy of each algorithm

vis-à-vis traditional time series models used in economic forecasting, such as

Autoregressive (AR) Models and Dynamic Factor Model (DFM); and (3) systematically identify

important high-frequency variables (i.e., monetary, financial, external sector) that could

accurately nowcast domestic liquidity in the Philippines.

Based on the conducted recursive nowcasts from January to December 2020,

it was found that machine learning algorithms provide more accurate estimates than the

traditional time series models utilized in this study. This is due from the consistent

monthly estimates with low forecast errors (i.e., Root Mean Square Error, Mean Absolute Error)

that the machine learning algorithms registered. The said quantitative models also registered

precise nowcasts on the months where domestic liquidity growth suddenly expand

(e.g., increased borrowings and deposits of National Government to BSP) due to the impact of

Coronavirus Disease 2019 (COVID-19) in the Philippines. Further, the results indicate that

regularization methods are the most optimal machine learning algorithms to nowcast the

aforementioned monetary indicator.

This study also concludes that using regularization methods, such as

LASSO and ENET, as well as tree-based methods, such as RF and GBT, are useful in

filtering out or identifying important indicators that stipulate parsimonious nowcasting models

with precise results.

Keywords: Domestic Liquidity, Machine Learning, Nowcasting, Philippines

ACRONYMS

ACF Autocorrelation Function

ADB Asian Development Bank

ADF Augmented Dickey-Fuller Test

AIC Akaike Information Criterion

ARC Advance Release Calendar

ARIMA Autoregressive Integrated Moving Average

AT Adaptive Trees

BOP Balance of Payments

BSP Bangko Sentral ng Pilipinas

BVAR Bayesian Vector Autoregression

CBS Central Bank Survey

CDS Credit Default Swap

COVID-19 Coronavirus Disease 2019

CPI Consumer Price Index

DCS Depository Corporations Survey

DES Department of Economic Statistics

DFM Dynamic Factor Model

ENET Elastic Net

EWS Early Warning System

FOF Flow of Funds

FOREX Foreign Exchange Rate

FPI Foreign Portfolio Investment

GBT Gradient Boosted Trees

GDP Gross Domestic Product

HQ Hannan-Quinn Information Criterion

IFI International Financial Institutions

IMF International Monetary Fund

IOD International Operations Department

LASSO Least Absolute Shrinkage and Selection Operator

LIBOR London Interbank Offered Rates

LSM Large-Scale Manufacturing

M1 Monetary Base

M2 M1 and Savings/Time Deposits

M3 Domestic Liquidity

MAE Mean Absolute Error

MAFE Mean Absolute Forecast Error

MFSM Monetary and Financial Statistics Manual

MSFE Mean Squared Forecast Error

NG National Government

NGA National Government Agencies

ODC Other Depository Corporations

OLS Ordinary Least Squares

OOB Out-of-Bag Error

PACF Partial Autocorrelation Function

PBS Philippine Banking System

PHIREF Philippine Interbank Reference Rate

PP Philipps-Perron Test

RF Random Forest

RMSE Root Mean Square Error

RSS Residual Sum of Squares

RW Random Walk

SARIMA Seasonal Autoregressive Integrated Moving Average

SIBOR Singapore Interbank Offered Rates

VAR Vector Autoregression

WB World Bank Group

WEO World Economic Outlook

WMOR Weighted Monetary Operations Rate

YOY Year-on-Year

LIST OF TABLES

Table 1.1 Depository Corporations Survey (Date Accessed: 10 April 2021)

Table 4.1 Summary Statistics of Domestic Liquidity in the Philippines

Table 4.2 List of Data

Table 4.3 Unit Root Tests for Domestic Liquidity in the Philippines

Table 5.1 RMSE of Autoregressive Models

Table 5.2 MAE of Autoregressive Models

Table 5.3 RMSE of DFM

Table 5.4 MAE of DFM

Table 5.5 RMSE of Ridge Regression, LASSO, and ENET

Table 5.6 MAE of Ridge Regression, LASSO, and ENET

Table 5.7 RMSE of RF and GBT

Table 5.8 MAE of RF and GBT

Table 5.9 Variable Coefficients via LASSO and ENET (Jan.-Feb. 2020)

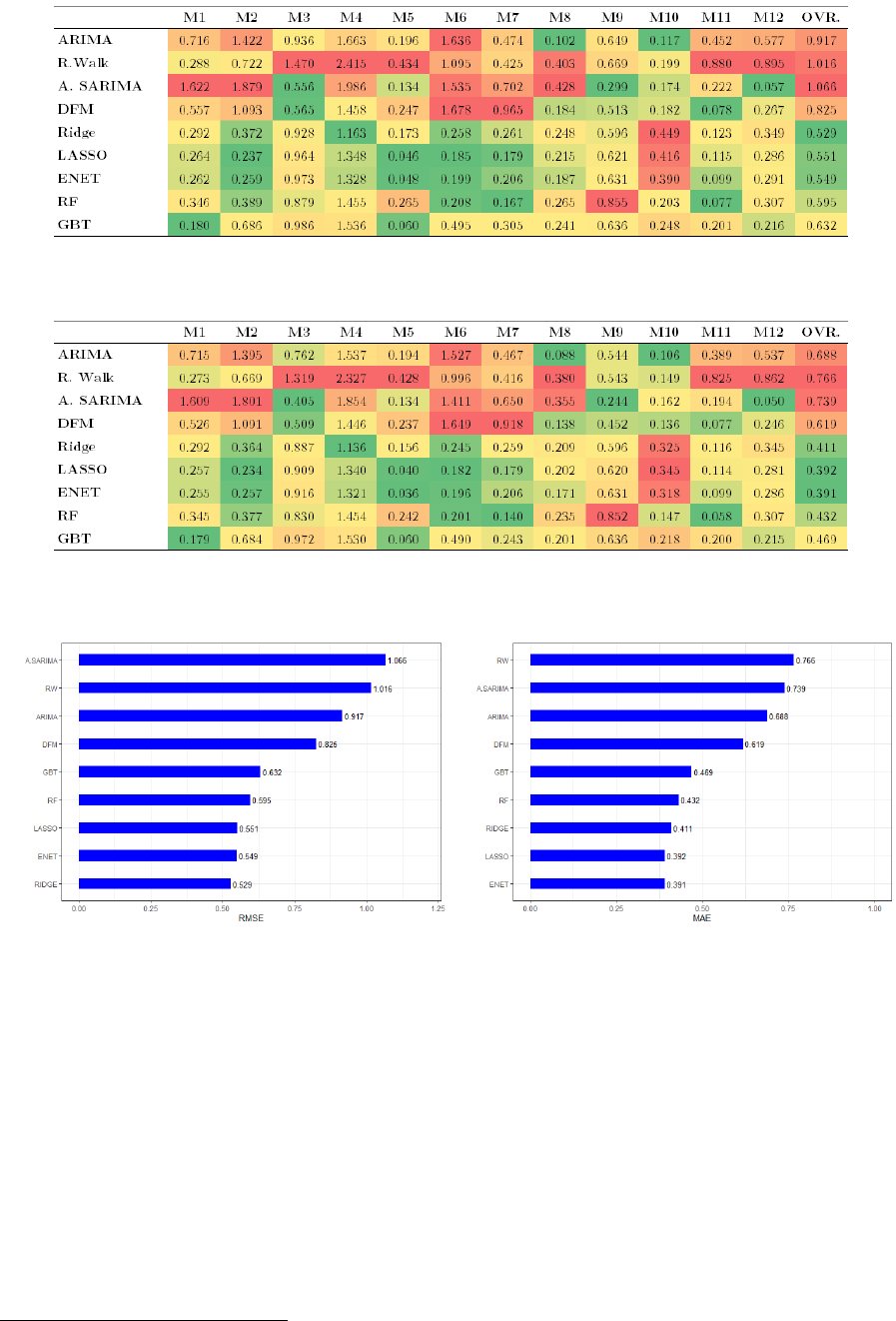

Table 6.1 RMSE of Benchmark and Machine Learning Models (Summary)

Table 6.2 MAE of Benchmark and Machine Learning Models (Summary)

LIST OF FIGURES

Figure 3.1 Decision Tree Growing Process

Figure 3.2 Expanding Window Process

Figure 4.1(a) Domestic Liquidity in the Philippines (Levels, in Million PHP)

Figure 4.1(b) Domestic Liquidity in the Philippines (Growth Rate, in Percent)

Figure 4.2(b) Domestic Liquidity in the Philippines (Growth Rate, in First Diff.)

Figure 4.3 Research Workflow Diagram

Figure 5.1(a) ACF of M3 (Seasonally Adjusted)

Figure 5.1(b) PACF of M3 (Seasonally Adjusted)

Figure 5.2 Residual Plot for ARIMA (4,1,1)

Figure 5.3 Autoregressive Model Nowcasts vs. Actual M3 Growth (in Percent)

Figure 5.4 Eigenvalues of Input Variables via Factor Analysis

Figure 5.5 DFM Nowcasts vs. Actual M3 Growth (in Percent Diff.)

Figure 5.6(a) Overall RMSE of Autoregressive Models and DFM

Figure 5.6(b) Overall MAE of Autoregressive Models and DFM

Figure 5.7 Optimal Shrinkage Penalty via Ridge Regression

Figure 5.8 Regularization Nowcasts vs. Actual M3 Growth (in Percent Diff.)

Figure 5.9(a) Overall RMSE of Benchmark Models and Regularization Methods

Figure 5.9(b) Overall MAE of Benchmark Models and Regularization Methods

Figure 5.10 OOB Error of Training Datasets via Random Forest

Figure 5.11 Optimal Number of Trees via Gradient Boosted Trees

Figure 5.12 Tree-Based Method Nowcasts vs. Actual M3 Growth (in Percent Diff.)

Figure 5.13(a) Overall RMSE of Benchmark Models and Tree-Based Methods

Figure 5.13(b) Overall MAE of Benchmark Models and Tree-Based Methods

Figure 5.14 Node Impurity via Random Forest

Figure 5.15 Variable Importance Plot via Gradient Boosted Trees

Figure 6.1 Overall Forecast Errors of Benchmark and Machine Learning Models

- this page left intentionally blank -

1

CHAPTER I: INTRODUCTION

CHAPTER II: REVIEW OF RELATED LITERATURE

CHAPTER III: RESEARCH METHODOLOGY

2

Chapter I:

INTRODUCTION

1.1. Background of the Study

Understanding the current condition of their respective economy is essential

for every policymaker around the world. Therefore, timely announcements of various

macroeconomic indicators (e.g., monetary, national accounts) are important for them to be able

to monitor the current growth of different economic sectors comprehensively (e.g., households,

other depository corporations) as well as to formulate and implement strong policy

(e.g., fiscal, monetary) responses. Proponents of high-quality public data management,

such as the International Monetary Fund (IMF), argued that having reliable and sensible

datasets are essential to depict the overall condition of an economy and to strictly monitor

if any negative externalities could cause a financial crisis. Hence, numerous government offices

(e.g., central banks, finance ministries) are transforming their approach to ensure that

macroeconomic indicators are published in a timely and consistent manner

(Carriere-Swallow and Haskar, 2019).

Adopting these data management principles, however, cannot be easily implemented in

every country. This is because of the tedious and complicated processes that each

government office must perform to produce numerous macroeconomic indicators promptly.

The proper classification of accounts, changes in the overall compilation framework, and

inevitable delays in receiving input documents are among the few reasons that coerced the

delay in publishing data at the national level (Dafnai and Sidi, 2010;

Chikamatsu et al., 2018). Recent studies discussed that national government agencies (NGAs)

and central banks from different advanced (e.g., United States (US), Japan, New Zealand) and

emerging economies (e.g., Israel, Lebanon) had encountered this difficulty

(Dafnai and Sidi, 2010; Bragoli and Modugno, 2016; Chikamatsu et al., 2018;

Richardson et al., 2018). Due to this predicament, policymakers from these countries are forced

3

to formulate policies and address several economic phenomena (e.g., inflation, business cycle)

using non-related, outdated, or lagged datasets (Richardson et al., 2018).

To systematically address this concern, short-

of the recently introduced methodologies by different International Financial Institutions (IFIs),

NGAs, and central banks. This is because of its strong capacity to observe the overall state of

an economy or any target variable of interest using conventional and unconventional data

as well as high-frequency indicators that are usually published at an earlier date (Tiffin, 2016).

Due to the difficulty in producing official macroeconomic indicators on a real-time basis,

nowcasting has been the alternative approach used by said institutions to systemically

estimate the official figure of a specific set of information before it becomes available

Asian Development Bank (ADB) are

among the IFIs that conducted comprehensive studies regarding the use of nowcasting in

different fields of study (e.g., economics, finance). Meanwhile, central banks of Indonesia, Israel,

Japan, and New Zealand are among the well-known institutions that attempted to use the said

concept to estimate the short-run growth of their respective Gross Domestic Product (GDP) and

Consumer Price Index (CPI).

3

1.1.1. Economic Nowcasting, Big Data, and Machine Learning

For the past years, predicting the overall growth of an economy, the progress of a

particular economic sector, and the transmission mechanism of policies are commonly performed

through economic forecasting using time series analysis. This approach has been the traditional

forecasting methodology under the field of economics (or econometrics) because numerous studies

have already established its capacity to provide a clear and substantial outlook of different

macro and socioeconomic indicators, such as GDP, CPI, and poverty incidence, among others.

Aside from this, the said approach is frequently used by various well-known institutions to

estimate the dynamic effects of policy implementation on the overall economic growth of their

3

See Dafnai and Sidi (2010), Chikamatsu et al. (2018), Richardson et al. (2018), and Tamara et al. (2020).

4

respective country. Among the numerous time series models used in economic forecasting are

Autoregressive (AR), Vector Autoregressive (VAR), and Dynamic Factor Models (DFM).

4

However, in most cases, time series models used in economic forecasting are

highly dependent on the timeliness of data or information. Therefore, any delay in the

publication process of the explanatory variable(s) included in a particular forecasting model

could hamper the attempt to predict the future condition of the target output.

For instance, to predict the GDP for Q2:2020 using a simple AR(1) model, its figure as of

end-Q1:2020 is strongly needed.

5

However, in a typical situation, the publication of GDP for

Q1:2020 is not released exactly at the end of said period. The latest figures are typically posted

one (1) or two (2) months after the reference date (e.g., GDP for Q2:2020 is published in

August 2020, rather than end-June 2020).

6

Therefore, an individual or institution that aims to

forecast the economic growth for Q2:2020 using an AR(1) model should wait until the GDP as

of end-Q1:2020 is published.

This concern was one of the main reasons that pushed numerous individuals and

institutions to adopt the concept of nowcasting in the field of economics. This is because of its

capacity to exploit multiple real-time data or information (e.g., daily financial data,

survey results) to accurately estimate the present, near future, and recent past of a particular

macro or socioeconomic variable l., 2013, Chikamatsu et al., 2018;

Richardson et al., 2018). For example, to predict the current state of an economy,

high-frequency data or information (e.g., trade balances, financial data) that signals the current

GDP can be utilized before associated official GDP figures are published (Tiffin, 2016).

Moreover, since most conventional macroeconomic indicators are published with lags and

frequent revisions, nowcasting became an essential tool for policymakers to minimize the

usual approach of addressing different economic phenomena using non-related, outdated, or

lagged data (Richardson et al., 2018).

4

See Hang (2010), Ikoku (2014), Doguwa and Alade (2015), and Rajapov and Axmadjonov (2018).

5

Autoregressive Model of Order 1 or AR(1) model is defined as .

6

Depending on the statistical calendar (or advance release calendar) of a specific country.

5

The stu

In particular, the authors mentioned that:

Nowcasting is relevant in economics because key statistics on the

present state of the economy are available with a

significant delay. This is particularly true for those collected

on a quarterly basis, with GDP being a prominent example.

For instance, the first official estimate of GDP in the United States

or in the United Kingdom is published approximately

one month after the end of the reference quarter.

In the Euro area, the corresponding publication lag is two (2) to

three (3) weeks longer. Nowcasting can also be meaningfully applied

to other target variables revealing particular aspects of the state of

the economy and thereby followed closely by markets (p. 2).

Aside from the institutional concern, another factor that contributed to the emergence

of nowcasting is the recent trend in the use of big data and machine learning.

7

,

8

The rise of these concepts improved the overall effectiveness of nowcasting in the

field of economics because of two (2) particular reasons. The first reason is that the former has

a strong potential to provide complementary information with respect to the macroeconomic

data that government offices usually published (Baldacci et al., 2016). Meanwhile, the latter has

the capacity to utilize the immense amount of data or information that the former concept

provided (Hassani and Silva, 2015; Richardson et al., 2018). In addition to economics, conducting

nowcasting through big data and machine learning is also performed by different individuals and

institutions in the fields of energy, medicine, and population dynamics. This is because the said

approach was found to be an essential tool to have an accurate short-term forecast,

7

Big data is defined as large datasets that can be examined computationally to observe different patterns, trends, among others .

8

Machine learning refers to the use of computer system, algorithms, and/or statistical models to analyze and draw conclusions from

patterns in data.

6

which further improves the decision-making as well as policy formulation and implementation of

individuals or institutions under these fields (Hassani and Silva, 2015).

1.1.2. The Philippines and Domestic Liquidity

Domestic liquidity is defined as the total amount of money available in an economy that

is usually determined by a central bank and banking system (Mankiw, n.d. p. 623).

9

In particular, as stated under the Monetary and Financial Statistics Manual (MSFM) of the

IMF, the said monetary indicator is the sum of all liquid financial instruments held by

money-holding sectors, such as Other Depository Corporations (ODCs). It can be categorized as

a particular commodity that is widely accepted as (1) medium of exchange and

(2) close substitute for the medium of exchange that has a reliable store value

(IMF, 2016 p. 180).

10

,

11

The change in the overall growth of this monetary indicator is one of the most important

dynamics that most central banks are closely monitoring. Mainly because it is an

essential element to the transmission mechanism of monetary policy, particularly the

impact of money supply expansion or contraction on aggregate demand, interest rates,

inflation, and overall economic growth. For this reason, policymakers in different central banks

passionately observe its current and future development to formulate an effective and timely

monetary policy response, especially when there are seen predicaments that require them to

adjust policy rates and the overall monetary base (Mankiw, n.d.).

Similar to its role in every economy across regions, domestic liquidity likewise holds a

critical function in the economy of the Philippines. Both the level and growth of said

monetary indicator are usually being monitored by its central bank otherwise known as the

9

The words domestic liquidity, broad money, money supply, money demand, and M3 are interchangeably used in this paper.

10

The MFSM is the official guideline of IMF member countries in compiling and presenting monetary statistics.

11

ODCs refers to financial corporations (other than the central bank) that incur liabilities included in domestic liquidity

(IMF, 2016 p. 405).

7

Bangko Sentral ng Pilipinas (BSP) because it is also primarily used as the measurement of

liquidity in the country, input for early warning system (EWS) models on the macroeconomy,

and principal data to formulate and implement monetary policy, among others.

12

Money supply in the Philippines has a similar structure with most countries with

fractional-reserve banking systems (e.g., US, Japan).

13

Mainly because bank reserves,

currency deposits (or monetary base), and other liquid financial instruments are likewise its

main components. In particular, based on the Depository Corporations Survey (DCS) conducted

by the BSP, broad money in the said country is mainly composed of currency in circulation and

transferable deposits (M1), other deposits such as savings and time deposits (M2), and

deposit substitutes such as debt instruments (BSP, 2018).

14

On a monthly basis, the BSP announces the current level and growth of broad money in

the Philippines. However, for the said monetary indicator to be released in a timely manner,

the said institution needs to strictly ensure that the monthly submission of bank reports

(e.g., balance sheets, income statements) is observed promptly. Since the

Philippine Banking System (PBS) is characterized as a fractional-reserve banking system,

the balance sheets of the BSP together with the ODCs are necessary to be consolidated to

calculate M3 in a given period.

Therefore, in order for the BSP to achieve its primary mandate in having price and

financial stability in the Philippines, timely and reliable data on money supply which highly

requires the overall position (e.g., assets, liabilities) of the BSP and ODCs is critical to support

the overall monetary policy formulation and implementation in the said country.

12

See BSP DCS Frequently Asked Questions (FAQs).

13

Fractional-reserve banking system refers to a system in which banks retain a portion of their overall deposits on reserves

(Mankiw, n.d. p. 620).

14

The DCS is a consolidated report based on the balance sheets of BSP and ODCs, such as universal and commercial banks,

thrift banks, rural banks, non-stock savings and loan associations, non-banks with quasi-banking functions.

8

1.2. Statement of the Problem

As mentioned in the previous section, delay in data publication is one of the

most common difficulties that government institutions encounter. This scenario, unfortunately,

is also observed in producing domestic liquidity statistics in the Philippines. Even though the

BSP met the deadline to announce its latest available figure based on their

advance release calendar (ARC), the publicly shared data on M3 are not based on

real-time position. As seen in Table 1, despite retrieving the DCS last 10 April 2021, the latest

available domestic liquidity statistics was based on its level and growth as of end-February 2021

(e.g., current release has four (4) to six (6) weeks lags).

Table 1.1: Depository Corporations Survey

(Date Accessed: 10 April 2021)

Source: BSP

Aside from this concern, the official data on money supply also suffers from series of

revisions. Based on the publication policy of the BSP, the latest statistical reports

(which includes the DCS) are treated as preliminary information (Table 1).

9

The initial publication is revised within two (2) months to reflect changes (if any) on the reports

submitted by the banks under its jurisdiction.

15

This procedure is also applicable to the other

key statistical indicators being produced by the said institution, such as the

balance of payments (BOP) and flow of funds (FOF), to name a few. However, in some cases,

the preliminary and revised data have significant numerical discrepancies.

Drawing upon this background, this study aims to address these issues and concerns by

investigating the use of different machine learning algorithms to predict the real-time growth of

broad money in the Philippines. This approach particularly intends to formulate an

accurate quantitative model that the BSP can sustainably use to estimate

domestic liquidity in the said country using regularization and tree-based methods.

For this reason, the overarching research question for this study is:

WHAT IS THE OPTIMAL MACHINE LEARNING ALGORITHM TO ACCURATELY

NOWCAST THE GROWTH OF DOMESTIC LIQUIDITY IN THE PHILIPPINES?

The study also intends to answer these sub-research questions that could further

strengthen the overall finding(s):

a. Does the use of machine learning algorithms improve the overall accuracy in

predicting the real-time growth of domestic liquidity in the Philippines?

b. What are the substantial advantages of using machine learning algorithms vis-à-vis

traditional time series models (e.g., Autoregressive Models, Dynamic Factor Model)

in predicting the current growth of domestic liquidity in the Philippines?

c. By using a wide range of high-frequency monetary, financial, and external sector

indicators as explanatory variables, what are the critical factors that should be

included in the nowcasting model to comprehensively explain and predict the

real-time growth of domestic liquidity in the Philippines?

15

See DCS revision policy https://www.bsp.gov.ph/SitePages/Statistics/Financial%20System%20Accounts.aspx?TabId=2.

10

1.3. Research Objectives

To comprehensively answer the abovementioned research questions, this study aims to

achieve the following objectives:

a. To develop/formulate an accurate nowcasting model that could be used as a

primary method in predicting the real-time growth of money supply in the

Philippines.

b. To strongly utilize various key monetary, financial, and external sector indicators as

input variables.

c. To conduct one-step-ahead (out-of-sample) nowcasts using time series models and

machine learning algorithms.

d. To investigate the performance and accuracy of each time series model and

machine learning algorithm in obtaining nowcasts.

e. To determine the advantages and disadvantages (if any) of using machine learning

algorithms to determine the current state of domestic liquidity in the said country.

1.4. Significance of the Study

For the past years, there was an increasing number of scholars in the field of economics

that showed their interest in using nowcasting as a primary approach to determine the real-time

growth of numerous macroeconomic indicators. Most of these studies are focused on formulating

quantitative models using different time series and machine learning algorithms that could

accurately estimate the movement of numerous macro and socioeconomic indicators using

conventional and unconventional data or information.

In the case of the Philippines, the studies of Rufino (2017), Mapa (2018), and

Mariano and Ozmucur (2015; 2020) already established the use of different

mixed frequency models and machine learning algorithms to nowcast GDP and inflation.

However, none of these published studies have explored the usefulness of nowcasting in

11

monetary policy, particularly in using different machine learning algorithms to estimate the

growth of broad money in the said country.

Due to this literature gap, the researcher sees the following reasons wherein this study is

considered as timely and relevant:

a. The output of this study could serve as a primary tool of the BSP to accurately

nowcast the growth of domestic liquidity, which is considered one of the most critical

inputs for monetary policy formulation (e.g., reserve requirements,

open market operations) in the Philippines.

b. Machine learning algorithms utilized in this study can be replicated to nowcast the

different key economic indicators produced by the said institution

(e.g., balance of payments, financial soundness indicators) and other NGAs within

the country.

c. The result of this study could be a valuable input to the current nowcasting

initiatives performed by the BSP, such as GDP and inflation nowcasting,

among others.

d. The determinants identified as principal components in this study could be used as

additional leading indicators of domestic liquidity growth in the Philippines.

e. Through this study, recommendations can be crafted to mainstream and integrate

big data and machine learning in the monetary policy formulation and

implementation of the BSP.

f. This study could also strengthen the growing body of literature regarding the

application of time series and machine learning models in economic forecasting.

1.5. Scope and Limitations

Although this paper intends to provide a comprehensive analysis in establishing a model

to conduct short-term forecasting or nowcasting using machine learning algorithms, the following

are the scope and limitations of this study:

12

a. The main objective of this study is to nowcast the growth of domestic liquidity (M3)

in the Philippines. Therefore, its monetary aggregate components, such as

narrow money (M1) and other deposits included in broad money (M2), are not

individually analyzed.

b. The benchmark models used in this study are limited to (1) Autoregressive (AR)

such as Autoregressive Integrated Moving Average (ARIMA) and Random Walk

Models as well as (2) Dynamic Factor Model (DFM).

16

c. To conduct domestic liquidity nowcasting using machine learning algorithms,

the models used in this study are limited to (1) Regularization Methods, such as

Ridge Regression, Least Absolute Shrinkage and Selection Operator (LASSO), and

Elastic Net and (2) Tree-Based Methods, such as Random Forest and

Gradient Boosted Trees.

d. The study initially aims to incorporate numerous variables that can represent

different sectors of the economy (e.g., central bank, financial sector) in the

Philippines. However, the final indicators used in the different nowcasting models

became limited due to (1) data confidentiality, (2) access restrictions, and

(3) time constraints.

e. Due to the limited availability of data (especially data on the explanatory variables),

the overall timeframe of this study is restricted from January 2008 to December 2020

(mixed of daily, weekly, monthly frequency).

1.6. Definition of Terms

The following terms, which are frequently cited in this study, are defined operationally

or derived from official or technical sources:

Autoregressive (AR) Model a time series model whose current value strongly depends

linearly on its current value and an unpredictable disturbance (Wooldridge, 2012 p. 844).

16

Vector Autoregression (VAR) is used as part of DFM.

13

Big Data large datasets that can be examined computationally to observe

different patterns, trends, among others.

Central Bank an institution responsible for the conduct of monetary policy

(Mankiw, n.d. p.618).

Domestic Liquidity the total amount of money available in an economy that is usually

determined by a central bank and banking system (Mankiw, n.d. p. 623).

Liquidity refers to the assets that can be exchanged in a rapid manner without affecting

its overall price (IMF, 2016).

Machine Learning use of computer systems, algorithms, and statistical models to

analyze and conclusions from patterns in data.

Monetary Policy refers to the management of money supply and interest rates

(Mishkin, n.d. p. 10).

Other Depository Corporations (ODCs) financial corporations (other than the

central bank) that incurs liabilities included in domestic liquidity (IMF, 2016 p. 405).

Time Series Data refers to any data or information that is collected over time

(Wooldridge, 2012 p. 859).

Vector Autoregressive (VAR) Model a model for two (2) or more time series.

Each variable is modeled as a linear function of past values of all variables,

plus disturbances that have zero (0) means given all past values of the observed variables

(Wooldridge, 2012 p. 860).

14

Chapter II:

REVIEW OF RELATED LITERATURE

2.1. Primer

Nowcasting became one of the alternative methodologies used by numerous

institutions to predict the recent developments of various macroeconomic indicators

(e.g., Gross Domestic Product (GDP), inflation) and potential transmission mechanisms of

fiscal or monetary policies. This quantitative approach transpired because most

economic indicators published by government offices (e.g., national government agencies

(NGAs), central banks) tend to suffer from lags and revisions. Hence, numerous

nowcasting exercises are recently conducted to eliminate the practice of using non-related,

outdated, or lagged datasets in addressing different predicaments in an economy, such as

hyperinflation, unemployment, among others (Richardson et al., 2018).

Aside from this concern, the popularity of nowcasting is strongly enhanced by

the recent emergence of big data and machine learning. This is due to the potential of the

former concept to provide complementary information, such as high-frequency data

concerning the macroeconomic data that government offices usually published

(Baldacci et al., 2016). In contrast, the latter concept has the capacity to accurately provide

estimates despite having an immense amount of data or information in a nowcasting model

(Hassani and Silva, 2015; Richardson et al., 2018).

That being said, to strengthen the foundation of this research, previous studies

that conducted nowcasting through the use of big data (or high-frequency data)

and different machine learning algorithms are discussed in this chapter.

However, this literature review mainly focuses on the studies that used

(1) regularization methods (i.e., Ridge Regression, Least Absolute Shrinkage and

Selection Operator, Elastic Net) and (2) tree-based methods (i.e., Random Forest,

15

Gradient Boosted Trees) as their primary or secondary approach to nowcast different

macroeconomic variables and other statistical indicators.

2.2. Regularization Methods

Regularization methods are among the prevalent machine learning algorithms used to

conduct nowcasting. This is because regression models under its purview almost have similar

characteristics with the Ordinary Least Squares (OLS) to fit a linear model (James et al., 2013;

Tiffin, 2016). Compared to OLS, however, each of these methods has the characteristic to

constrain its coefficient estimates to significantly reduce their variance with the intention to

improve the overall model fit (James et al., 2013). In other words, Ridge Regression,

Least Absolute Shrinkage (LASSO), and Elastic Net (ENET) have the capacity to provide better

forecast output because it reduces model complexity by incorporating penalties to its

coefficient(s) which then address the issue of bias-variance tradeoff.

17

This approach is called

shrinkage in machine learning literature (Tiffin, 2016; Richardson et al., 2018).

The studies of Tiffin (2016), as well as Dafnai and Sidi (2010), are among the

well-known studies in the field of economics that managed to use regularization methods as an

approach to conduct nowcasting. Both of these studies attempted to formulate

nowcasting models that could accurately estimate the GDP growth in Lebanon and Israel,

respectively. Due to the data publication lags that both countries experienced, these authors

similarly agreed that there was a need to conduct an approach wherein the current status of

economic growth can be immediately determined to improve policy decisions. Their attempt to

formulate nowcasting models also aimed to address the difficulty of their stakeholders from the

domestic (e.g., NGAs, central banks) and international (e.g., International Financial Institutions

(IFIs), bilateral partners) landscape in assessing the overall economic health of their respective

countries (Tiffin, 2016; Dafnai and Sidi; 2010).

17

Bias-variance tradeoff is a central concept in forecasting and machine learning (Bolhuis and Rayner, 2020 p. 5). This refers to the

balance between interpretability and flexibility of a (supervised) machine learning model (James et al., 2013).

16

To meet these objectives, the aforementioned authors used high-frequency data or

information as explanatory variables to their corresponding GDP nowcasting models.

Tiffin (2016) used nineteen (19) monthly macroeconomic variables (e.g., customs revenue,

tourist arrivals) to observe economic growth in Lebanon.

18

Using the aforementioned

data through regularization methods, the author found that ENET is the most suitable

machine learning algorithm to predict the short-run economic development of Lebanon.

Mainly because its in-sample and out-of-sample nowcasting results managed to systematically

On the other hand, Dafnai and Sidi (2010) used one hundred forty (140) domestic indicators

and fifteen (15) global indicators as input variables to nowcast the GDP in Israel.

19

The authors similarly found that ENET is the most comprehensive regularization method to

nowcast the economic growth in said country. Compared to other regularization methods used

in their study, Dafnai and Sidi (2010) argued that ENET is the only regularization method that

successfully captured the timing and magnitude of the economic cycle in Israel while only

generating a low Mean Absolute Forecast Error (MAFE).

Hussain et al. (2018) also performed nowcasting using the aforementioned

machine learning algorithms. This study, however, intended to predict the short-run growth of

Large-Scale Manufacturing (LSM) in Pakistan. The authors decided to conduct this research

because the official GDP data in the said country also encounters publication lag.

Therefore, since LSM is published on a monthly basis and strongly depicts the significant

economic activities in Pakistan, predicting its current state could be a valuable tool for the

-changing domestic and

global economic condition (Hussain et al., 2018).

Given this objective, Hussain et al. (2018) also used high-frequency data or information

as explanatory variables to nowcast the aforementioned indicator. This includes

monthly indicators regarding financial markets, confidence surveys, interest rate spreads, credit,

18

See Page 10 of Tiffin (2016).

19

See Annex of Dafnai and Sidi (2010).

17

and the external sector in Pakistan.

20

Using these data as inputs to their regularization methods,

the authors concluded that Ridge Regression, LASSO, and ENET methods are comprehensive

quantitative tools in predicting the overall growth of LSM. This is because all three (3)

machine learning algorithms scrupulously tracked the overall growth, trends, and

cyclical movement of LSM with small forecast error. Comparing each method,

Hussain et al. (2018) found that LASSO rendered the most accurate nowcasting result since it

comprehensively traced the trends and cycle of LSM in Pakistan while having the lowest RMSE.

The Dynamic Factor Model (DFM) used in the study of said authors provided the smallest

forecasting error in nowcasting the trend. However, it presented inconsistent estimates in

predicting the overall growth and cycle of said macroeconomic indicator (Hussain et al., 2018).

The aforementioned machine learning algorithms were likewise used by

Cepni et al. (2018) as well as Ferrara and Simoni (2019). These authors utilized the said methods

to formulate models that could accurately nowcast the GDP of emerging economies

(i.e., Brazil, Indonesia, Mexico, South Africa, Turkey) and the United States (US), respectively.

Similar to the previous studies discussed in this section, numerous high-frequency data or

information were used as explanatory variables to nowcast the economic growth of said countries.

Cepni et al. (2018), in particular, utilized country-specific (1) macroeconomic indicators such as

industrial production, demand, and consumption indices and (2) survey data from

21

On the other hand, Ferrara and Simoni (2019)

used a large set of data from Google (e.g., Google Trends) to nowcast GDP in the US.

22

The former authors notably used LASSO to augment the nowcasting activity done through

DFM. Meanwhile, the latter authors utilized Ridge Regression and compared it with their

bridge equation benchmark model since numerous variables were included in their model.

Both studies concluded that these machine learning models are

convenient and comprehensive quantitative approaches to predict GDP in the short run

20

See Page 13 of Hussain et al. (2018).

21

See Page 2 of Cepni et al. (2018).

22

See Page 7 of Ferrera and Simoni (2019).

18

accurately. This is because Ridge Regression and LASSO each have the capacity to filter out

the insignificant variables, which could provide a parsimonious set of nowcasting models with

precise results (Cepni et al., 2018; Ferrara and Simoni, 2019).

The use of nowcasting is not only popular to estimate future values of different

macroeconomic indicators, such as GDP. Recent studies showed that this quantitative approach

could also be used to predict firm-level and sectoral data. The paper of Fornano et al. (2017)

was among the few studies that fall under this category. In particular, the authors applied the

three (3) regularization methods to nowcast the turnover indices growth of the main economic

sectors (e.g., services, manufacturing) in Finland.

23

Individual results of these methods were

compared with traditional time series models, such as Autoregressive Integrated Moving Average

(ARIMA), to estimate their respective prediction accuracy. Based on the conducted analysis,

Fornano et al. (2017) found that these machine learning algorithms outperformed ARIMA in

predicting the turnover indices growth of all sectors in Finland. This is because Ridge Regression,

LASSO, and ENET provided low Mean Squared Forecast Errors (MSFE) compared to the said

time series benchmark (Fornano et al., 2017).

Aside from predicting macroeconomic and firm-level indicators, nowcasting was also

utilized in the field of energy and medicine. The papers of Ziel (2020) as well as

Lan and Subramanian (2019) were among the studies in these fields that used

regularization methods to conduct nowcasting. In particular, the former author used

the said quantitative approach to predict the current state of electricity or power consumption

in Europe. Meanwhile, the latter authors applied the said concept to formulate a

nowcasting model to estimate the recent dengue occurrence in Puerto Rico and Peru.

Both of the authors mentioned that their attempt to estimate these

circumstances was due to the increasing concerns regarding publication lag on the official data

of electricity consumption and dengue occurrence in Europe as well as Puerto Rico and Peru,

23

See Page 5 of Fornano et al. (2017).

19

respectively. This is because different stakeholders strongly use the two (2) indicators for

economic and public health reasons (Ziel, 2020; Lan and Subramanian, 2019).

To perform their corresponding nowcasting exercise, these authors likewise use

high-frequency data or information. Ziel (2020) makes use of daily energy load values provided

by the European Transmission System Operators (TSO) from 2014 to 2019, while

Lan and Subramanian (2019) employed climatic variables and data from Google Trends as

explanatory variables.

24

,

25

Based on their analysis, both authors concluded that

regularization methods could accurately nowcast the two (2) aforementioned circumstances

with ease. This is because the machine learning algorithms used in their respective model could

handle and incorporate a large number of predictors with a low level of Mean Absolute Error

(MAE) and RMSE. Ziel (2020), as well as Lan and Subramanian (2019), specifically found that

Ridge Regression and LASSO are the most accurate regularization models to nowcast electricity

consumption in Europe and dengue occurrence in Puerto Rico and Peru, respectively.

2.3. Tree-Based Methods

Aside from regularization methods, numerous studies also introduced the use of

tree-based methods to conduct nowcasting. The said approach is one of the well-known options

to perform nowcasting through machine learning algorithms. This is because of its

strong capacity, similar to regularization methods, in being flexible and interpretable.

26

However, in contrast to Ridge Regression, LASSO, and ENET, tree-based methods strongly

involve stratifying or segmenting the predictor space into a number of simple regions.

In order to make a prediction for a given observation, the mean or mode of the training

observation is typically used in the region to which it belongs (James et al., 2013 p. 303).

24

See Page 8 of Ziel (2020).

25

See Page 5 of Lan and Subramanian (2019).

26

Similar to regularization methods, tree-based methods in machine learning also address the issue of bias-variance tradeoff.

20

recognized studies

that used tree-based methods to predict economic growth. These authors, in particular, utilized

Random Forest (RF) algorithm to forecast the short-term GDP growth in Europe.

The analysis of said authors was complemented by the numerous datasets under the

European Union Business and Consumer Survey to strongly utilize the capacity of said machine

learning model in handling a large number of input variables with robust prediction accuracy.

27

Using the aforementioned data through RF, the

said approach is a well-performing machine learning algorithm to predict the short-term growth

of GDP in Europe. This is because RF provided more accurate estimates than the projections

registered by the traditional time series model, such as the Autoregressive (AR) Model,

to forecast the said macroeconomic indicator. In particular, forecasting the GDP in Europe using

the said tree-based approach only generated an MSE of 0.43 while the AR produced 0.64.

The authors also cited that RF is an effective tool to create a parsimonious model.

Since the aforementioned had identified which among the predictive variables included in their

This approach was similarly performed under the study of

Adriansson and Mattson (2015). The authors, in particular, used the concept of

GDP growth of Sweden. To attain this objective, these authors similarly used a large amount

of survey dataset to predict the said macroeconomic variable. The data or information under the

Economic Tendency Survey conducted by the National Institute of Economic Research (NIER)

were mainly used as explanatory variables in their forecasting model using RF.

28

This survey consists of different confidence indicators and questions to private firms and

households regarding their economic outlook and perception of economic activity in the said

country (Adriansson and Mattson, 2015).

27

28

See Page 5 of Adriansson and Mattson (2015).

21

Using these data as inputs for their tree-based method nowcasting,

Adriansson and Mattson (2015) found that RF provides a better prediction performance against

the ad hoc linear model and AR model in forecasting the GDP growth of Sweden.

RF had the most precise forecasting results since it has the lowest RMSE of 0.75 compared to

the 0.79 and 0.95 of the two (2) time series benchmark models, respectively

(Adriansson and Mattson, 2015). Therefore, similar to the recommendation of

udy of Adriansson and Mattson (2015) proposed that

RF is a valuable quantitative approach that could bring forecasting improvements when applied

to economic time series data.

Aside from RF, Adaptive Trees (AT) which is highly based on Gradient Boosted Trees

(GBT) was also utilized as a primary machine learning model to conduct forecasting.

This is because of its strong capacity to deal with nonlinearities and structural changes,

among others (James et al., 2013; Woloszko, 2020). The paper of Woloszko (2020) was one of

the recent studies that specifically used AT to provide three (3)- to twelve (12)-months ahead

GDP growth forecast to the Group of Seven (G7) countries.

29

In this study, the author employed

country-specific information (e.g., expectation surveys, consumer confidence) and

macroeconomic data (e.g., housing prices, employment rate) as explanatory variables to the

tree-based forecasting model.

30

Based on the conducted forecast simulations, Woloszko (2020) similarly concluded that

the said machine learning algorithm is a valuable tool in economic forecasting.

This was attributable to the accurate prediction results it generates compared to the traditional

time series models. In contrast to AR models, the 3- and 6-months ahead GDP growth forecast

for the US, United Kingdom (UK), France, and Japan using AT displayed lower RMSEs.

The authors, however, found that this level of accuracy was only applicable in short-run

forecasting. This is because the forecasting results of AT became uninformative after they used

it to conduct the one (1)-year-ahead forecast. Due to this reason, Woloszko (2020) argued that

29

Canada, however, was not included in the analysis of Woloszko (2020).

30

See Page 11 of Woloszko (2020).

22

despite having the advantage to handle a large number of variables in economic forecasting,

AT might not be a suitable model to predict long-run effects.

Other empirical studies both utilized RF and GBT as machine learning algorithms to

forecast economic growth. Among these were the papers of Boluis and Rayner (2020) as well as

Soybilgen and Yazgan (2021). In particular, these authors used the said methods to forecast the

GDP growth in Turkey and the US, respectively. Similar to the previous studies discussed in

this section, the studies of these authors also aim to determine the most optimal

tree-based method to predict economic growth using high-frequency data or information.

The study of Boluis and Rayner (2020) used two hundred thirty-four (234) country-specific and

global indicators from Haver Analytics. This includes macroeconomic indicators regarding the

financial, labor, and external sectors.

31

Meanwhile, Soybilgen and Yazgan (2021) utilized more

than one hundred (100) financial and macroeconomic variables, which include data on the labor

market, money and credit, and stock market, among others.

32

Using the aforementioned input variables, Boluis and Rayner (2020) as well as

Soybilgen and Yazgan (2021) concluded that the tree-based methods provide

superior forecasts compared to benchmark models, such as DFM and linear models.

This is because RF and GBT produced lower forecast errors against the benchmark models.

Boluis and Rayner (2020) mentioned that the RMSE of RF was 1.26 while GBT produced 1.29.

Both of these results were lower compared to the benchmark linear model, which registered an

RMSE of 1.66. Likewise, Soybilgen and Yazgan (2021) discussed that, compared to the DFM,

the tree-based methods provided the lowest average RMSE and MAE.

33

Aside from their outstanding individual accuracy, these authors also cited that RF and GBT

have the strength to predict economic volatility and the capacity to determine which among the

variables included in the forecasting model are the most essential.

31

See Tables A5.1 and A5.2, Pages 24-25 of Boluis and Rayner (2020).

32

See Appendix 1, Page 23 of Soybilgen and Yazgan (2021).

33

See Table 1 and 2, Page 13 of Soybilgen and Yazgan (2021).

23

2.4. The Utilization of Two (2) Machine Learning Methods

Several studies also attempted to utilize the strengths of both regularization and

tree-based methods to perform nowcasting. Authors of these studies have considered this

research approach because most of them intended to distinguish the accuracy of each

machine learning method to nowcast or forecast the growth of a specific macroeconomic indicator

or the possible impact of policy implementation (Richardson et al., 2018; Tamara et al., 2020;

Aguilar et al. 2019).

One of the studies that fall under this category is the research produced by

Richardson et al. (2018). In particular, the authors attempted to use both regularization and

tree-based methods to formulate a model that can precisely nowcast the GDP in New Zealand.

The objective of this study was drawn from the difficulty of their policymakers in addressing

various economic vulnerabilities. This is because policy formulations in the said country are

highly dependent on the non-related, outdated, or lagged data (Richardson et al., 2018).

Given this scenario, Richardson et al. (2018) used a number of real-time vintages of a

range of macroeconomic and financial market statistics as explanatory variables to their

simulated nowcasting models. This includes data from business surveys, consumer and

producer prices, and general domestic activity production, among others.

34

By using these as

inputs for the different machine learning algorithms, Richardson et al. (2018) concluded that

regularization or tree-based approach could be used as a primary methodology to nowcast the

economic growth in New Zealand. Mainly because the RMSE and Mean Absolute Deviation

(MAD) of these machine learning algorithms are lower than the traditional time series models

used to forecast the GDP in the said country. However, comparing these methods,

Richardson et al. (2018) argued that LASSO (0.45) had the lowest average forecast errors.

35

34

See Page 8 of Richardson et al. (2018).

35

Richardson et al. (2018) also found that Support Vector Machines (SVM) and Neural Network (NN) both have low forecast errors

compared to AR and BVAR.

24

The authors also found that GBT (0.47) and Ridge Regression (0.57) provided lower RMSE

compared to Bayesian VAR (BVAR) model (0.61).

This research methodology is also utilized under the study of Tamara et al. (2020).

These authors used regularization and tree-based methods to nowcast the GDP growth in

Indonesia. Similar to the objective of Richardson et al. (2018), Tamara et al. (2020) conducted

this research to provide accurate estimates on the output growth of the said country.

This is because the quarterly data of GDP for Indonesia is released with five (5) weeks lag after

the end of reference (Tamara et al., 2020).

Based on this objective, Tamara et al. (2020) used eighteen (18) predictor variables

in their model. These data are comprised of quarterly macroeconomic

(e.g., consumption expenditure, current account) and financial market statistics

(e.g., change in stocks).

36

Using these indicators as explanatory variables, the authors concluded

that regularization and tree-based methods precisely estimate the short-run growth of GDP in

Indonesia. Mainly because these machine learning algorithms reduce the average forecast errors

at thirty-eight (38) to sixty-three (63) percent (on average) relative to the AR benchmark.

Tamara et al. (2020) also found that the forecasted values using these methods could produce a

similar pattern close to the actual values. However, comparing these methods, the authors cited

that RF (1.27) and ENET (1.31) have the lowest average forecast errors.

The potential of regularization and tree-based methods was also used to provide

estimates on global poverty. The paper of Aguilar et al. (2019) utilized these machine learning

algorithms to formulate a quantitative model to improve the accuracy of the current poverty

nowcasting model of the World Bank (WB). Remarkably, the authors applied LASSO, RF, and

GBT to predict the mean welfare and back out poverty rates. This study was drawn to have a

more reliable and cost-effective method to predict the current state of poverty across regions

(Aguilar et al., 2019).

36

See Appendix of Tamara et al. (2020).

25

Taking this into consideration, Aguilar et al. (2019) used similar datasets utilized under

the current forecasting model of WB to predict the current level and growth of global poverty.

These datasets include macroeconomic and social indicators, which were extracted from the

World Economic Outlook (WEO) database and World Development Indicators (WDI).

37

Using these as inputs, the authors found that using regularization and tree-based methods to

nowcast the said indicator decreased the overall nowcast error by 5.7 percent from

2.8 percentage points (Aguilar et al., 2019). However, Aguilar et al. (2019) argued that despite

having accurate estimates, LASSO, RF, and GBT only provide minor improvement vis-à-vis the

current method used by the WB to nowcast global poverty.

37

See Page 6 of Aguilar et al. (2019).

26

Chapter III:

RESEARCH METHODOLOGY

3.1. Primer

The overall methodology of this study is comprehensively discussed in this chapter.

In particular, each section presents detailed information about (1) benchmark models,

(2) machine learning algorithms, (3) nowcast evaluation methodology, and (4) statistical tool or

software used to formulate a nowcasting model that aims to accurately estimate the growth and

development of domestic liquidity in the Philippines.

3.2. Models

Time series models and machine learning algorithms are utilized to support the

main objective of this research systematically. The former models are used as benchmarks since

these are the most commonly used econometric models to predict the current and future growth

of a particular macroeconomic indicator or economic phenomenon. Meanwhile, the latter

algorithms are used as the alternative quantitative methods to nowcast domestic liquidity growth

in the Philippines. This approach is conducted because of two (2) main reasons. The first reason

is to establish which quantitative models could accurately estimate the real-time growth of said

monetary indicator. Another reason is to determine the strength of machine learning algorithms

to precisely nowcast vis-à-vis traditional time series models.

Drawing upon this background, the properties of each time series and machine learning

models which are utilized in this study are comprehensively discussed in this chapter.

The former includes traditional forecasting models such as (1) Autoregressive Model

(e.g., Autoregressive Integrated Moving Average and Random Walk) and

(2) Vector Autoregression, and (3) Dynamic Factor Model. On the other hand,

the latter models are comprised of (1) Regularization Methods such as

Ridge Regression, Least Absolute Shrinkage and Selection Operator, and Elastic Net,

27

as well as (2) Tree-Based Methods such as Decision Trees, Random Forest, and

Gradient Boosted Trees.

3.2.1. Benchmark Models

3.2.1.1. Autoregressive Models

Autoregressive (AR) models are the most frequently used approach to predict the growth

and development of a particular macroeconomic indicator or scenario. Mainly because of its

strong ability to perform forecasting despite using a single time series. Numerous studies argued

that AR models are highly utilized in time series forecasting because of their simple but

powerful method in using past values to identify the future growth and development of a

particular indicator (Meyler et al. 1998; Medel and Pincheira, 2015).

3.2.1.1.1. Autoregressive Integrated Moving Average

There are various AR models that are specifically used depending on the nature of a

time series. The Autoregressive Integrated Moving Average (ARIMA) is one of the general

models under this approach. This univariate time series model is frequently used in most

forecasting studies when a specific time series data is non-stationary, previous values are

significant to predict its current state, or errors are autocorrelated. This is because ARIMA can

be interpreted as a filter that aims to separate the signal from the noise, and the signal is then

generalized into the future to acquire forecasts (Nau, 2014). The general forecasting equation

using ARIMA is structured as follows:

Under equation 3.1, represents the order of the autoregression, which includes the

overall effect(s) of past values into consideration. The notation , on the other hand, denotes

the order of the moving average, constructing the error of ARIMA as a linear combination of

28

the error values observed at the previous time points in the past (Meyler et al. 1998;

Fan, 2019 pp. 10-11).

3.2.1.1.2. Random Walk

Another popular univariate model used in economic forecasting is the Random Walk.

The property of this time series model is quite similar to ARIMA. Mainly because the two (2)

models similarly use the previous data points as a reference of the future trend of a specific

time series. However, compared to ARIMA, the Random Walk model assumes that the

next step is only decided by the last data point and takes an independent random step away

(Fan, 2019 p. 11-12). This univariate model is also utilized if a particular time series is

non-stationary.

38

,

39

The general forecasting equation using Random Walk is written below:

In equation 3.2, the and represents the observations of the time series and is

the white noise with zero mean and constant variance (Fan, 2019 p.12).

3.2.1.2. Vector Autoregression

Using univariate models as a principal approach to forecast a particular time series data

has a limitation. This is their characteristic to heavily rely on previous data points to forecast a

particular indicator. In other words, when ARIMA or Random Walk are used as a

forecasting technique, other determinants that could influence the growth and development of

an indicator are not being strongly considered.

To address this concern, most studies in the field of economics used multivariate

time series models such as Vector Autoregression (VAR). The superiority of this algorithm

38

Random walk is similar with ARIMA(0,1,0) model.

39

Random walk is a prevalent forecasting model for non-stationary time series data such as foreign exchange rates (FOREX).

29

against univariate time series models has been proven and established over time.

This is because it has the capability to create structural equations with other influential features

and incorporate two (2) or more time series to forecast the growth and development of a

particular indicator. Hence, compared to ARIMA or Random Walk, VAR can be

considered as a comprehensive forecasting model. The general form of VAR model with

deterministic term and exogenous variable can be expressed as:

Under equation 3.3, denotes matrix of other deterministic terms as such linear

time trend or seasonal dummy variables and represents matrix of stochastic

exogenous components. The notations and are the parameter matrices

(Fan, 2019 p. 12-13).

3.2.1.3. Dynamic Factor Model

The Dynamic Factor Model (DFM) is also a prevalent choice for most econometricians

that aim to predict the future growth of a particular macroeconomic variable with the use of

numerous explanatory variables. This is because it has the capacity to handle

large datasets with no practical or computational limits (Stock and Watson, 2016).

Mariano and Ozmucur (2020) also mentioned that DFM is a valuable tool to forecast a

specific indicator with numerous explanatory variables because it addresses the difficulty of

getting convergence in a state-space framework.

Compared to VAR, where the set of variables can be immediately included in the model,

the DFM first reduces the dimension of these datasets by summarizing the information available

into a small number of common factors. Each of the variables is represented as the common and

idiosyncratic components. The former is constructed with a linear combination of the

common factors that could explain the main part of the variance of the time series,

30

while the latter contains the remaining variable-specific information (Fan, 2019 p. 13).

The DFM can be expressed as:

Under Equation 3.4, notation represents the vector of observed time series variables

depending on a reduced number of latent factors and idiosyncratic component

The denotes the lag polynomial matrix, which represents the vector of dynamic

factor loading (Stock and Watson, 2016; Fan, 2019).

3.2.2. Machine Learning Models

3.2.2.1. Regularization Methods

As discussed in the previous chapter, regularization methods are among the well-known

machine learning algorithms used to conduct nowcasting. This is because their individual

properties have a strong resemblance with the characteristics of Ordinary Least Squares (OLS)

in fitting a linear model (James et al., 2013; Tiffin, 2016). However, in contrast with OLS,

regularization methods constrain its coefficient estimates to significantly reduce their variance

with the intention to improve the overall model fit (James et al., 2013).

3.2.2.1.1. Ridge Regression

One of the regularization methods used in nowcasting is Ridge Regression.

This regularization method is very similar to least squares. Mainly because it also aims to obtain

coefficients that fit the data well by making the residual sum of squares (RSS) as small as

possible. However, the said approach seeks to minimize a second term called shrinkage penalty

which is small when the regression coefficients are close to zero (Tiffin, 2016 p. 7)

(Equation 3.5).

31

Equation 3.5 depicts the RSS and penalty term on the said regularization method.

The notation represents the total number of observations included in the model, while is the

number of candidate predictors. The essential factor in this equation is the tuning parameter ,

which controls the relative impact of the regression coefficient estimates

(James et al., 2013 p. 215). When , the penalty has no effect, and Ridge Regression

produces estimates similar to OLS estimates. However, as , the impact of

shrinkage penalty increases, and the coefficient estimates approach to zero (0) (Tiffin, 2016).

3.2.2.1.2. Least Absolute Shrinkage and Selection Operator

Another form of regularization method is the Least Absolute Shrinkage and

Selection Operator (LASSO). Similar to Ridge Regression, LASSO also includes a

penalty term to its RSS (Equation 3.6).

In contrast with the former regularization method, which only shrinks all of its

coefficients towards zero (0) but not set any of them exactly to zero (0), LASSO forces its

coefficients to be precisely equal to zero (0) when tuning the parameter is adequately large

(James et al., 2016).

40

Therefore, due to its substantial penalty, the main advantage of LASSO

over Ridge Regression is its ability to select important variables and produce a parsimonious

model with fewer predictors.

40

Except if the penalty of Ridge Regression is .

32

3.2.2.1.3. Elastic Net

Numerous studies also used Elastic Net (ENET) as their primary approach to

perform nowcasting to maximize the strengths of the two (2) aforementioned methods.

41

ENET is a form of regularization method that contains both properties of Ridge Regression and

LASSO (Equation 3.7).

In particular, this regularization method utilizes the penalty strength of Ridge Regression

and LASSO by selecting the best predictors to provide parsimonious models while still identifying

groups of correlated predictors. The respective weights of the two (2) penalties are determined

through the additional tuning parameter (Richardson et al., 2018).

3.2.2.2. Tree-Based Methods

Numerous studies also utilized tree-based methods as a primary approach to conduct

nowcasting. These studies particularly used Random Forest and Gradient Boosting Trees

because it has a strong resemblance with regularization methods, which are popular for their

capacity to address bias-variance tradeoff that provides an intuitive and easy-to-implement way

of modeling non-linear relationships.

However, in contrast with Ridge Regression, LASSO, and ENET, these methods are

considered non-parametric models that do not require the underlying relationship between the

dependent and independent variables (Fan, 2019). Tree-based methods involve stratifying or

segmenting the predictor space into a number of simple regions. Therefore, in order to make a

41

See the studies of Tiffin (2016), Richardson et al. (2018), and Tamara et al. (2020).

33

prediction for a given observation, tree-based methods utilize the mean or mode of training

observation in the region to which it belongs (James et al., 2013 p. 303).

3.2.2.2.1. Decision Tree

Decision Tree is the fundamental structure of any tree-based machine learning method,

which can be used for classification and regression problems (James et al., 2013; Fan, 2019).

Basically, this approach divides categorical (e.g., name, address) or continuous (e.g., level,

growth rate) data into two (2) classes in a systematic manner in order to reduce the prediction

error of the target variable of interest. This procedure is repeated until the number of training

samples at the branch exceeds the minimum node size (Figure 3.1). The algorithm, afterward,