89

ISRA International Journal of Islamic Finance • Vol. 5 • Issue 1 • 2013

* Suhaili Alma’amun is Senior Lecturer, Faculty of Economics and Business,

Universiti Kebangsaan Malaysia (National University of Malaysia) and a member

of the Research Center for Islamic Economics and Finance (EKONIS-UKM). She

can be contacted at [email protected].

WASIYYAH (ISLAMIC WILL) WRITING

SERVICE IN MALAYSIA:

AN INVESTIGATION OF THE SUPPLY

CHANNEL

Suhaili Alma’amun*

Abstract

Islamic estate planning has not been given much attention in Islamic

finance until recently. This paper attempts to shed light on the wasiyyah

(Islamic will) writing service in Malaysia―the main instrument for

Islamic estate planning―within the context of wealth management

and financial planning in general. The paper seeks to obtain direct

information from the supply side regarding the operational structure

and product detail of the wasiyyah writing service in Malaysia. The

paper discusses the nature and operation of the wasiyyah writing

providers, their qualifications, and how wasiyyah writing services

vary across providers in terms of their structure, cost and the name

given for the product. It is an explorative and qualitative research

which employs semi-structured interviews with a purposive sampling

of 11 wasiyyah writing providers from Kuala Lumpur and Selangor.

The narrative approach, with thematic analysis, was used to analyze

the data. It argues that, firstly, having a wasiyyah cannot resolve

estate problems. Secondly, wasiyyah has been used as a means to

avoid fara’id (Islamic law of inheritance) ―whereby testators have

been misinformed by wasiyyah writing providers that they can provide

instructions through a wasiyyah on how they wish to distribute their

estates and that such instructions would overrule fara’id. Thirdly, it

has been found that the wasiyyah writing service has become profit

oriented while the delivery of accurate information is of secondary

Wasiyyah (Islamic Will) Writing Service in Malaysia: An Investigation of the Supply Channel

90

ISRA International Journal of Islamic Finance • Vol. 5 • Issue 1 • 2013

importance. This study suggests that some technical aspects of the

wasiyyah writing service should be upgraded; notably, the setting of

minimum qualifications for wasiyyah writing providers; encouraging

product innovation; imposition of a measurement of quality control;

and education of clients. The paper argues for these mechanisms to

be implemented in order to provide a conducive environment for the

industry to grow.

Keywords: Wasiyyah, Islamic will, Islamic bequest, Islamic wealth

management, Islamic estate planning

I. INTRODUCTION

Amanah Raya Berhad (ARB) could be perceived as the pioneer in

offering a comprehensive service of Islamic estate planning products

in Malaysia since 1995.

1

It is well-known as an established and, in

fact, the only public trustee in Malaysia. Nonetheless, the industry

of Islamic estate planning has been growing with the participation

of more players, such as local banks as well as private wasiyyah

(Islamic will) writing service providers including ZAR Perunding

Pusaka, Wasiyyah Shoppe, As-Salihin Trustee Berhad and Amanah

Hibah. The industry offers a range of Islamic estate planning products

specifically designed to suit the objectives of estate planning for

Malaysian Muslims such as wasiyyah (will), hibah (gift), waqf

(charity) and trust account.

The wasiyyah writing service has become part of the Islamic

wealth management industry in Malaysia, aiming to provide a solution

to a key problem―that of the increasing number of frozen estates. It is

noted that income levels and asset possession of Malaysian Muslims

are rising year-on-year and, according to Buang (2008: 555), this is

one of the factors that has contributed to the increasing number of

frozen estates. In 2006, it was estimated that RM 38 billion of estates

left by the deceased were still frozen (Ahmad and Laluddin, 2010:

1 It used to be one of the government agencies formerly known as Jabatan Pemegang

Amanah Raya dan Pegawai Pentadbir Pusaka Malaysia founded in 1921 (Bakar,

2006: 133).

Suhaili Alma’amun

91

ISRA International Journal of Islamic Finance • Vol. 5 • Issue 1 • 2013

31; Mujani, Abdul Rashid, Wan Hussain and Yaakub, 2012: 326;

2011: 196). This figure did not include unclaimed monies in various

agencies such as ARB, the Employee Provident Fund (EPF) and

other financial and banking institutions (Ahmad and Laluddin, 2010:

31; Mujani et al., 2012: 196). From the government’s point of view,

this represents losses in revenue from land tax, estimated at RM 200

million (Ahmad and Laluddin, 2010: 31). More recent data reveals

that the total value of frozen estates rose to RM 45 billion in 2012

(Shahrul Anuar, 2012). It should be noted that these figures do not

segregate the value of frozen estates belonging to Muslims and non-

Muslims in Malaysia. However, Muhamad (2007: 63) argued that 90

percent of the applications for estate administration and settlement

come from the Muslims.

2

These alarming statistics indicate the importance of expeditiously

providing Muslim society with the right tools to solve the problems

associated with wealth management. Undoubtedly, this is the role that

Islamic estate planning is intended to play through the mechanism

of wasiyyah. Following concerns arising from the recent emerging

growth of the wasiyyah writing service in Malaysia, an investigation

into the supply side of wasiyyah by means of semi-structured

interviews was undertaken. This paper is divided into five sections.

The introduction briefly discusses the wasiyyah writing service and

its significance in Malaysia. Section II provides the literature review

on the wasiyyah writing service in Malaysia. Section III explains

the methodology and data collection employed in this study while

the findings are discussed in Section IV. Section V concludes the

discussion and provides some recommendations.

II. LITERATURE REVIEW

The present state of affairs of frozen estates in Malaysia is due to

the inefficiency of process of estate administration and settlement in

2 This trend does not match the race ratio between Malays and non-Malays, of which

45 per cent of the total Malaysian population are non-Muslims. It also does not

support Muhamad’s (2007) earlier view that non-Muslims are more likely to utilize

the function of will in their estate planning.

Wasiyyah (Islamic Will) Writing Service in Malaysia: An Investigation of the Supply Channel

92

ISRA International Journal of Islamic Finance • Vol. 5 • Issue 1 • 2013

Malaysia. Alma’amun (2010) and Muhamad (2007: 65) argued that

the root of the problem is the system itself in that dying intestate

(i.e. not having made a will) and testate (i.e. having made and left a

valid will) are dealt with under different pieces of legislation and by

different authorized bodies. Alma’amun (2010) claimed that such a

system does not guarantee a smooth process of estate administration

and settlement. Muhamad (2007: 65) expressed concern that the

various regulations and the existence of various bodies to address

estate matters inevitably lead to the overlapping of the power of

duties and to public confusion with regard to the responsibilities of

the authorized bodies. He contended that some cases were initially

brought to the wrong authority before subsequently being transferred

to the right institution, reflecting the inefficiency of the estate

distribution system in Malaysia.

Alma’amun (2010) argued that the whole process starts with

the determination of whether the deceased died intestate or testate.

Accordingly, small intestate matters

3

are handled by the Department

of Director General of Lands and Mines after a petition is lodged

by any person claiming to have an interest in the estate. When there

is an intestate case of more than RM 2 million, the matter goes to

the High Court. An administrator is required to obtain a Letter of

Administration in the case of an intestate of more than RM 2 million.

In the absence of a wasiyyah, heirs must provide two sureties for

estates where the value is more than RM 2 million. However, if the

deceased dies testate, regardless of whether the value of the property

is less or more than RM 2 million, the matter will go to the High

Court. Under such circumstance, the executor is required to obtain

a Grant of Probate. The Syariah Court only has rights in this matter

to determine the eligible heirs and certify their shares by issuing the

inheritance certificate (Abdul Rahman, 2007: 21-22, 25; Marican,

2008: 18; Administration of Islamic Law (Federal Territories) Act

1993 (Act 505) & Rules, 2006: 22-23; Small Estates (Distribution)

Act 1955 (Act 98), Regulations & Order, 2011: 9).

3 A small estate is defined as: “an estate of a deceased person consisting wholly or

partly of immovable property situated in any state and not exceeding two million

ringgit in total value.” (Small Estates (Distribution) Act 1955 (Act 98), Regulations

& Order, 2011: 8).

Suhaili Alma’amun

93

ISRA International Journal of Islamic Finance • Vol. 5 • Issue 1 • 2013

It should be noted that the period of extracting a Grant of Probate for

testate estates is six months less than the period for extracting a Letter

of Administration for intestate estates, meaning that the testate estate

is unfrozen faster and can be transferred to the heirs for utilization

quicker (Hassan and Yusop, 2006: 154; Hassan, 2005: 79-80). On

the other hand, some intestate cases may take about three to ten years

to be settled and it is possible for them to stretch longer than twenty

years (Yaacob, 2006: 172-173).

In addition to these, ARB has the authority to administer the

movable estate of the deceased where the value is not more than RM

600,000―whether a person dies testate or intestate. Such estate has to

go through different procedures depending on its value. If the value

does not exceed RM 50,000, ARB will issue the Order and deliver it

to the heirs. On the other hand, if the value exceeds RM 50,000 but

is less than RM 600,000, a Declaration will be issued and afterwards

the assets will be pooled together. After the net value of the estate

has been determined, ARB will proceed with the distribution of the

estate according to the Islamic law of inheritance (ARB, 2006: 41;

Abdul Rahman, 2007: 21; Public Trust Corporation Act 1995 (Act

532), 2008: 82-83; Yaacob, 2006: 173-174).

In addition to the inefficiency of the system, as mentioned above,

problems could arise because of the human and cost factors. The

former refer to the issues caused by heirs; namely, the absence of

consensus among the heirs; the issue of untraceable heirs; lack of

knowledge regarding the estate administration and settlement process;

refusal of some heirs to continue the process of administration of

the estates if many barriers arise during the process; and some heirs

hold to the old perception that estates (especially houses and lands)

cannot be sold to facilitate their distribution (Muhamad, 2007: 66-69;

Hassan, 2008: 28-29). With regard to the cost factors, issues arise

when the estate administration and settlement cannot be continued

due to the high cost borne by the heirs (Yaacob, 2006: 174-175).

Yaacob (2006) further stated that the cost element may play a part

in the delay of the settlement, especially when the value of estate

is substantial. Beneficiaries who claim the estates are required to

present two guarantors, and each of them should possess properties

of equal value to the estates. Most of the time, they fail to meet this

requirement and the High Court will appoint the ARB to administer

Wasiyyah (Islamic Will) Writing Service in Malaysia: An Investigation of the Supply Channel

94

ISRA International Journal of Islamic Finance • Vol. 5 • Issue 1 • 2013

the estates, with the agreement of the heirs. It is thus very clear that

leaving a wasiyyah helps heirs from experiencing extensive estate

administration procedures and thus minimizes hassles. Therefore,

drawing up a properly designed wasiyyah and appointing an executor

could be seen as the essential components of Islamic estate planning

as they are the main procedures a Muslim should take care of before

proceeding with other means of estate planning.

Previous studies provide limited information on the structure

of the wasiyyah products offered in Malaysia. The literature review

shows that the term wasiyyah has multiple definitions among

wasiyyah writing providers in Malaysia. A wasiyyah which functions

as ‘a document of the appointment of an executor’ has been given

different names by different wasiyyah writing providers. Most

of them use the terminology wasiyyah to refer to the document of

the appointment of an executor. However, ZAR Perunding Pusaka

(Hassan, 2005: 80) differentiates its products as follows: “The

document to appoint an executor is called the ‘Wisoyah Document’

or ‘Islamic Will Document’ while the wasiyyah document is called the

‘Islamic Bequest Document’.”

This is because it believes that the correct terminology to be used

for the document to appoint an executor is wisoyah while wasiyyah

actually carries the meaning of a bequest (Hassan, 2005: 80).

The process of making a wasiyyah at ARB begins with a basic

wasiyyah at a cost of RM 350. Thereafter, a comprehensive wasiyyah

is completed by the testator at no cost. The difference between

both wasiyyahs is that the comprehensive wasiyyah is more

detailed in terms of clauses, mentioning the client’s specific assets,

instructions for distribution and bequests,

4

while the basic wasiyyah

contains a mere declaration of the appointment of ARB as the executor

(ARB, n.d.).

The issue regarding the viability of the wasiyyah product has also

been observed in previous studies. While wasiyyah could be the best

solution for the Malaysian Muslims’ estate problems, ironically, not

4 A bequest is defined as a testamentary power in which the transfer of a gift only

becomes effectual upon the death of the testator and it is subjected to two principal

restrictions, namely, the amount allowed to the bequeath is limited to one-third and

it is only allowed to be given to the non-heirs (Coulson, 1971: 215- 218; Marican,

2008: 132; Tanzil-ur-Rahman, 1980: 175).

Suhaili Alma’amun

95

ISRA International Journal of Islamic Finance • Vol. 5 • Issue 1 • 2013

all wasiyyah writing providers agree with this contention. Without

denying the function of wasiyyah, ZAR Perunding Pusaka and

Wasiyyah Shoppe are among those who hold different opinions

when it concerns the most efficient method a Malaysian Muslim

should use to distribute his/her estate. ZAR Perunding Pusaka is

of the view that the only remedy to the Malaysian Muslim’s estate

problem is through the Islamic law of inheritance or succession

(commonly referred to as fara’id). It suggests that having a thorough

understanding of the fara’id concept, knowing the quantum of share

that each eligible heir is entitled to and incorporating fara’id into

the estate planning will definitely solve the problems (Hassan, 2008:

33). In contrast, Wasiyyah Shoppe believes hibah is the most efficient

way for someone to ensure that his/her estate is distributed according

to his/her intentions upon death (Sabirin, 2009: 60).

5

This is because

wasiyyah is said not to be able to meet the same objective since any

wishes made by Muslims in their wasiyyah which violate the fara’id

rules can only be executed upon the consent of their heirs.

III. METHODOLOGY AND DATA COLLECTION

This research is explorative in nature on the ground that it is conducted

on a new issue through data collection. Semi-structured interviews

were conducted with the wasiyyah writing service providers in Kuala

Lumpur and Selangor from April to June 2009 and last updated in

April 2012. The semi-structured interview questions included general

questions about the profile of the wasiyyah writing providers and their

product details. Data was collected from 11 wasiyyah writing agents

who agreed to be interviewed. They represented several key wasiyyah

writing providers in Malaysia: ARB, As-Salihin Trustee Berhad,

ZAR Perunding Pusaka, Wasiyyah Shoppe and CIMB Investment

5 It is noted that Wasiyyah Shoppe has a different idea when it comes to the best

solution for estate planning. In Malaysia, hibah is not necessarily made via waÎiyyah.

Hibah made via waÎiyyah is subject to waÎiyyah restriction and it does not give full

freedom to the giver. Hence, clients are advised to make a direct hibah prior to death

(where the hibah recipient receives the hibah on the spot) or trust hibah (declaration

made prior to death but the hibah recipient will only get the property upon the death

of the giver).

Wasiyyah (Islamic Will) Writing Service in Malaysia: An Investigation of the Supply Channel

96

ISRA International Journal of Islamic Finance • Vol. 5 • Issue 1 • 2013

Bank Berhad. In addition to the service providing companies, one

interviewee was a lawyer with both Islamic law and conventional

law expertise who offered a wasiyyah writing service independently

through his law firm.

Semi-structured interviews were used in related studies by Shafii

(2007), who collected data from financial planners in Malaysia, and

Finch and Mason (2000), who collected data from solicitors and will

advisers. Shafii (2007) aimed at obtaining the financial planners’

views on the financial planning behaviour in Malaysia in terms of

the household demand for financial assets, while Finch and Mason

(2000) were interested in discovering the perspectives of solicitors

and will advisers on the process of making a will and its relationship to

kinship. Therefore, whenever necessary, this study took into account

both studies when designing the questions for the interview session.

In relation to the sampling of the semi-structured interviews, the

study used purposive sampling. Wasiyyah writing providers selected

for the interview were those well known professionals who were

believed to possess the needed facts as well as those who could give

the information sought via in-depth investigation. Most of them

were those who had written much about Islamic estate planning in

magazines, books and conference papers. The small number of the

interviewees was not a matter of concern as, according to Sekaran

(2003: 296), the semi-structured interview uses a small sample size

because of its intensive nature.

Data from the semi-structured interviews was analyzed using

the narrative approach with a thematic analysis. This method of

analysis was chosen on the grounds that it mainly places emphasis

on the content of the response by maintaining the language used by

the respondent as far as possible. Main themes were constructed from

the answers provided; then they were segregated into several sub-

themes. Such technique helped to analyze these responses in detail

by placing those of a similar nature under a common theme (Bryman,

2008: 553–555 and 560). The narrative technique was also used in

Finch and Mason (2000).

Suhaili Alma’amun

97

ISRA International Journal of Islamic Finance • Vol. 5 • Issue 1 • 2013

IV. FINDINGS

A. Nature and Operational Structure of the

Wasiyyah Writing Providers

The nature and operational structure of wassiyah writing providers

were derived based on the interviewees’ explanations of their

products, their relationship with their clients and their observations

on the companies’ status (i.e., whether they were independent

companies, parent companies or had business links or collaborations

with other wasiyyah writing providers). This is deemed an important

finding of this study.

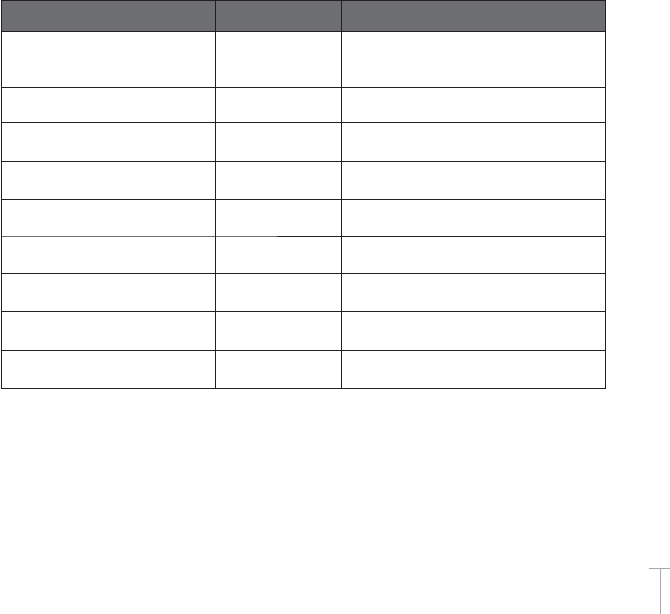

In particular, the observations on the companies’ status provided

insight on whether wasiyyah writing providers adopted a single

approach or a variety of approaches, had different target groups, and

provided a limited or a wide range of Islamic estate planning products

in addition to the wasiyyah writing service. Table 1 provides details

on the companies interviewed and focuses on the approach adopted

regarding their wassiyah products.

Table 1: Details of the Wasiyyah Writing Providers

Company

Number of

Interviewee(s)

Nature of the Company

ZAR Perunding Pusaka 1

Offers its own Islamic estate planning

products; deals with other big wasiyyah

writing providers if requested by its clients

Moreclass (M) Sdn. Bhd. 2

Corporate agent of ARB and As-Salihin

Trustee Berhad

Wasiyyah Shoppe (Bandar Baru

Bangi, Selangor Branch)

1

Has its own Islamic estate planning

products

CIMB Investment Bank Berhad 2

Bank offers its own Islamic estate planning

products

El Hegira Management Services 1

Corporate agent of As-Salihin Trustee

Berhad

Warisan Mukmin 1

Corporate agent of ARB and offers its own

Islamic estate planning products

Asset Protection Advisory Service 1

Deals with other wasiyyah writing

providers as requested by its clients

ARB 1

Offers its own Islamic estate planning

products

Shahriman & Associates 1

Offers its own Islamic estate planning

products

Wasiyyah (Islamic Will) Writing Service in Malaysia: An Investigation of the Supply Channel

98

ISRA International Journal of Islamic Finance • Vol. 5 • Issue 1 • 2013

From Table 1, it can be seen that Zar Perunding Pusaka, Wasiyyah

Shoppe, CIMB Investment Bank Berhad, ARB and Shahriman &

Associates had their own structures of wasiyyah products. The rest

of the wasiyyah writing providers actually adopted the approach of

selling the wasiyyah products offered by the parent companies and

earning commissions thereon. As such, they represented the corporate

agents of the parent companies and were bound by their policies

and terms and conditions. Collaborations with more than one parent

company enabled them to offer more wasiyyah products at different

costs to their clients.

With regard to ARB, the connection between its operational

structure and the increasing number of wasiyyahs made with ARB

recently was verified. The interviewee at ARB confirmed that banks,

acting as corporate agents of ARB, bundled up the ARB wasiyyah

product with their other financial products such as the loan package

and, in this way, they were the largest contributors to the increasing

number of wasiyyahs made with ARB. Table 2 shows the number of

wills and wassiyahs made at ARB.

Table 2: Number of Wills/ Wasiyyahs at ARB

Year Muslims (Wasiyyahs) Non-Muslims (Wills)

Pre-1980 - 1,024

1980–1997 - 646

1998–2000 13 281

2001 1 108

2002 4 110

2003 131 223

2004 217 607

2005 670 931

2006 8,250 1,499

2007 11,522 2,643

2008 121,771 11,615

2009 135,262 12,342

2010 165,794 15,256

2011 127,346 12,718

Jan 2012 8,474 911

Sources: Omar (2006: 17), Omar (2009: 3) and Omar (2012)

We asked the interviewees from CIMB Investment Bank Berhad

to confirm whether they had appointed corporate agents as ARB

had. However, their statements suggested that they did not prefer

the approach employed by ARB. According to the corresponding

interviewee, their distribution channels were as follows: “We have

Suhaili Alma’amun

99

ISRA International Journal of Islamic Finance • Vol. 5 • Issue 1 • 2013

specific channels in tackling clients. We do have freelancers but we

do not have independent agents.”

Since the interviewee also mentioned that the majority of the

clients were high-net-worth individuals and the products offered

were tailor-made to their needs, we concluded that CIMB Investment

Bank Berhad had a different operational structure because it had

different target groups of clients, which required a certain level of

exclusiveness to be maintained.

B. Qualifications to Operate as Wasiyyah Writing Providers

The wasiyyah writing providers were not required to obtain a

particular professional certificate in the related field. Nonetheless,

big wasiyyah writing companies provided their partners with the

necessary training courses, which could be obligatory or voluntary.

As can be seen in Table 3―which summarises the profiles of the

wasiyyah writing providers―two interviewees (18.2 per cent)

attended courses organized by ARB, four interviewees (36.4 per

cent) attended courses organized by As-Salihin Trustee Berhad, while

one interviewee attended courses run by Wasiyyah Shoppe. It was

perhaps not surprising that people with a law background operated as

wasiyyah writing providers on the grounds that wasiyyah is closely

related to the SharÊÑah (Islamic law) and civil law under Malaysian

legislation. In this study, three of the interviewees (27.3 per cent)

possessed a law background.

A small number of the wasiyyah writing providers also had extra

professional qualifications as they were involved in other activities

besides the wasiyyah writing service. Three of them (27.3 per cent)

were Certified Financial Planners (CFP); two had an Investment

Advisory License/Investment Representative License (IAL/IRL);

two were Registered Financial Planners (RFP); two were Fellow

Chartered Financial Practitioners (FChFP) (18.2 per cent for each);

one had a STEP (The Society of Trust and Estate Practitioners)

Certificate in Trusts and Estates; and one was a member of the

Malaysian Financial Planning Council (MFPC).

This study also sought information regarding the interviewees’

knowledge on the subjects of wasiyyah and Islamic estate concepts

and products. None of them considered themselves as ‘not really

Wasiyyah (Islamic Will) Writing Service in Malaysia: An Investigation of the Supply Channel

100

ISRA International Journal of Islamic Finance • Vol. 5 • Issue 1 • 2013

familiar’ with those three particular subjects. More than half of them

rated themselves as well versed, and only a few said that they had

basic knowledge on the subjects.

Table 3: Profiling Wasiyyah Writing Providers

Frequency Percent

Qualification Certified Financial Planner (CFP) 3 27.3

Investment Advisory License (IAL)/Investment

Representative Licence (IRL)

2 18.2

Registered Financial Planner (RFP) 2 18.2

Fellow Chartered Financial Practitioner (IFPC) 2 18.2

Other

Attended a course/courses run by ARB 2 18.2

Possess law background 3 27.3

Certificate of Islamic Estate Planner from As-

Salihin Trustee Berhad

4 36.4

Certificate in Foundation of Trust and Estate

Practitioners (STEP)

1 9.1

Attended courses, 23 modules, run by the Wasiyyah

Shoppe

1 9.1

Member of Institute of Professional Will writers,

UK & Member of Malaysian Financial Planning

Council (MFPC)

1 9.1

Relationship with

clients

Less than a year 3 27.3

More than a year and continuous 8 72.7

Knowledge on Islamic

estate planning concepts

Possess understanding of the basics of the particular

concepts

2 18.2

Well-versed 9 81.8

Knowledge on Islamic

estate planning products

Possess understanding of the basics of the particular

products

1 9.1

Well versed 10 90.9

Knowledge on wasiyyah

Well versed 11 100

It would be interesting to further discuss whether a particular

qualification should be made compulsory in order to be qualified as a

wasiyyah writing provider. If the current practice is continued, it will

be difficult to overcome problems such as wasiyyah writing providers

providing poor service quality and misleading information about

wasiyyah to their clients. Perhaps setting a minimum qualification,

such as obtaining a relevant certificate by attending courses run by

the big wasiyyah writing providers, should be imposed temporarily;

but coming up with a regulated procedure is also crucial at this

stage. Even though there are no specific requirements imposed at the

moment, wasiyyah writing providers should make the first move to

acquire qualifications in the related fields of wasiyyah. Having extra

qualifications such as Islamic Financial Planner (IFP) and Certified

Financial Planner (CIF) is an added advantage which can increase

Suhaili Alma’amun

101

ISRA International Journal of Islamic Finance • Vol. 5 • Issue 1 • 2013

the potential of wasiyyah writing providers to provide Islamic estate

planning services beside the wasiyyah product. As such, they would

be able to establish a long-term relationship with their clients and

provide them with other needed Islamic estate planning products

after their clients have benefited from the wasiyyah writing service.

As can be noted from Table 3, the majority of the interviewees

(90.9 per cent) maintained a relationship with their clients for more

than a year and perceived the relationship as a continuous one. This

was closely related to the operational structure within which wasiyyah

writing providers work. Wasiyyah writing providers who operated as

partners or agents to parent companies had a duty to get as many

clients as they could as well as the motivation to earn commissions.

Further inquiries after the wasiyyah was completed would thus be

directly conveyed to their parent companies. However, they would

have a longer relationship if their clients wanted other estate planning

products and if they were appointed as executors.

6

C. Different Terminologies used for Wasiyya

among Wasiyyah Writing Providers

A divergence of opinions was observed regarding the true meaning

of wasiyyah in the interviews. It should be noted that only the

interviewees from ZAR Perunding Pusaka and Wasiyyah Shoppe

raised this issue. We discussed this issue by breaking down the

wasiyyah products according to the purpose for which the wasiyyah

is made, as below:

i. Document for the Purpose of the Appointment

of an Executor (WaÎÊ)

Terminologies used for the ‘document for the appointment of

an executor’ varied among the wasiyyah writing providers as

6 These were observed from their responses as follows: “We contact our clients to

offer them other wealth management products upon the making of waÎiyyah”; “If

we are not appointed as an executor, the relationship is less than a year. If we are

appointed as an executor, then the relationship is more than a year and continuous.”

Wasiyyah (Islamic Will) Writing Service in Malaysia: An Investigation of the Supply Channel

102

ISRA International Journal of Islamic Finance • Vol. 5 • Issue 1 • 2013

they differed in defining the word wasiyyah. The corresponding

interviewee explained the significance of the document, as follows:

“The first document that Muslims should prepare is the

wiÎÉyah document; the appointment of the waÎÊ [is] to

expedite the estate distribution process…”

Wasiyyah Shoppe also stressed that the term wasiyyah means

‘bequest’ and that it was not the terminology that should be used

when referring to the appointment of an executor in a will. In this

case, the study managed to clarify the issue of the disparate use of

the wasiyyah and wiÎÉyah terminologies for the appointment of the

executor. These findings are also addressed in Abdullah (2005: 131-

132) and Harun (1994: 17). Their contentions imply that wiÎÉyah or

wisoyah is a trusteeship, a correct terminology to represent an Islamic

will which contains the appointment of an executor. A wasiyyah,

however, is actually a bequest. However, Marican (2008: 117) points

out that the Malaysian expression of wasiyyah is ‘wasiat’. Such

expression has different implications depending on how an individual

interprets it. When it carries the meaning of a bequest, people do not

see any reason for them to leave a ‘wasiat’ to non-heirs if the potential

estates to be left were enough for the needs of the family (Hassan

and Yusop, 2006: 154). Accordingly, Wasiyyah Shoppe preferred to

name the document for such purpose as ‘Document of Appointment

of Executor’. This was reflected in one of the interviewee’s response,

as follows: “Wasiyyah (as referred to bequest making) only can be

executed with the consent of the heir.”

We suggest that in order to avoid confusion, the wasiyyah

product should be classified according to the purpose it is made for

(as presented in Tables 4 and 5). Hence, wasiyyah writing providers

should clearly state the purpose of the document to the clients

prior to the process of drawing up their wasiyyah and should avoid

confusing them with different terminologies. Clients could possibly

seek necessary clarification from the wasiyyah writing providers

(or the latter could inform them), and most importantly, they should

understand that wasiyyah in the Malaysian practice should not be

perceived as making a bequest solely but it is meant for speeding

up the process of estate administration and settlement. Since the rest

Suhaili Alma’amun

103

ISRA International Journal of Islamic Finance • Vol. 5 • Issue 1 • 2013

of the wasiyyah writing providers maintained the term wasiyyah

to represent an Islamic will, for the rest of the discussion the term

wasiyyah will be used.

ii. Document for the Purpose of Making a Bequest Allocation

Allocation for bequest could be included and mentioned in the client’s

wasiyyah (either in the basic or comprehensive wasiyyah depending

on the respective wasiyyah writing provider that the client chooses

to draw up the will) at an extra charge or at no additional fee. All the

information about the wasiyyah product according to the purpose it is

made (which was gathered from the interviews) is compiled in Tables

4 and 5.

Wasiyyah (Islamic Will) Writing Service in Malaysia: An Investigation of the Supply Channel

104

ISRA International Journal of Islamic Finance • Vol. 5 • Issue 1 • 2013

Amanah Raya Berhad

(ARB)

ZAR Perunding

Pusaka

As-Salihin Trustee

Berhad

7

Warisan Mukmin

Wasiyyah Shoppe,

Bandar Baru Bangi

Branch

BIMB

CIMB Malaysia

Berhad

Asset Protection

Advisory Service

SharÊÑah Solicitor,

Shahriman &

Associates

Basic wasiyyah (RM

350) in which clients

agree to:

- Appoint ARB as

their executor.

- Distribute estate

according to

fara’id.

After a client writes a

basic wasiyyah, ARB

will register his/her

name

And ask them to make

a comprehensive

wasiyyah at no

additional fee (if he/

she has any special

requests or instructions

to make).

Executor must be

ARB itself. ARB will

carry out the estate

distribution process

upon the death of the

testator, and charges

depend on the estate’s

value.

Known as

Wisoyah

document (RM

350)

Executor will be

another party, not

ZAR Perunding

Pusaka.

- Basic wasiyyah

(RM 560).

- Writing,

custody annual

safekeeping costs

are included in the

price. Additional

cost imposed for

executorship.

- Cost of a

comprehensive

wasiyyah varies.

Lifetime custody

at additional cost

only offered to

those who opt for

comprehensive

wasiyyah.

- Upon the death

of the testator, the

estate distribution

process will

be carried out

(Charges vary

between 1%–2%

depending on the

estate’s value and

type.

Same as ARB

(Partner of ARB).

But for the

comprehensive

wasiyyah to be

completed, ARB

will contact the

corresponding

client.

Known as the

Document of

Appointment of

Executor (Free of

charge provided that

clients subscribe

for the estate

management product

that will charge the

clients as follows):

Estate >RM600,000

= RM400 for 17

years

Estate <RM600,000

= RM150 for 17

years

Executor either AM

Trustee Berhad or

any family member.

No charge paid

by the heirs upon

the death of the

testator for the estate

distribution process

because the testator

has subscribed to the

estate management

product of this

company during his/

her lifetime.

Same as ARB

(Partner of ARB).

But for the

comprehensive

wasiyyah to be

completed, ARB

will contact the

corresponding

client.

Basic wasiyyah

(From RM 390,

charge for the

writing of the

wasiyyah).

Comprehensive

wasiyyah (from

RM 500; the

highest charge

so far has been

RM 1,000)

Plus the

following cost:

Appointment

of CIMB as

executor= RM

200

Lifetime

custody=

RM 500

Executor is

either CIMB

itself or other

parties.

A complete

consultation on

estate planning

(RM 6,000).

Then clients

would be

proposed the best

products that

suit them, taking

into account the

clients’ demands.

These can be

ARB’s, As-

Salihin

Trustee Berhad’s

or other overseas

estate planning

provider’s

products

(charges vary).

Regardless of the

content of the

wasiyyah:

Writing = RM

200

Safekeeping cost

= RM 250

Upon the

death of the

testator, this

wasiyyah writing

provider can

carry out estate

distribution

process (1% and

up to 5% of the

estate’s value.

There were some

cases where

clients could not

afford to pay a

high fee; this

wasiyyah writing

provider charged

them below RM

1,000.

Table 4: Products for the Purpose of the Appointment of an Executor (Wasi)

7 Information gathered from Moreclass (M) Sdn. Bhd., El Hegira Management Services, Asset Protection Advisory Service

Suhaili Alma’amun

105

ISRA International Journal of Islamic Finance • Vol. 5 • Issue 1 • 2013

Table 5: Products for the Purpose of Making Bequests

Amanah Raya

Berhad (ARB)

ZAR Perunding

Pusaka

As-Salihin Trustee

Berhad

8

Warisan

Mukmin

Wasiyyah Shoppe (Information

gathered from Leena Fauziah

& Associates and Wasiyyah

Shoppe, Bandar Baru Bangi

Branch)

BIMB

CIMB Malaysia

Berhad

Asset Protection

Advisory Service

SharÊÑah

Solicitor,

Shahriman&

Associates

Included in the

comprehensive

wasiyyah.

In wasiyyah

document (RM500).

Can be either in basic

or comprehensive

wasiyyah.

Included in the

comprehensive

wasiyyah.

This is included in the

estate management product

which is subscribed to by

the client.

Included in the

comprehensive

wasiyyah.

Can be either

in basic or

comprehensive

wasiyyah.

Included in

a complete

consultation on

estate planning as

requested by the

client (RM6,000)

Included in

the wasiyyah.

8 Information gathered from Moreclass (M) Sdn. Bhd., El Hegira Management Services, Asset Protection Advisory Service

Wasiyyah (Islamic Will) Writing Service in Malaysia: An Investigation of the Supply Channel

106

ISRA International Journal of Islamic Finance • Vol. 5 • Issue 1 • 2013

D. Varying Wasiyyah Products across

Wasiyyah Writing Providers

A few wasiyyah writing providers maintained a certain level of

exclusiveness with respect to their wasiyyah products. This correlated

with the operational structure in which the wasiyyah writing providers

worked. Hence, the way the wasiyyah was drawn up and the cost of

the products varied across wasiyyah writing providers in Malaysia.

With regard to the content of wasiyyah, some wasiyyah writers, to

a large extent, gave clients full authority to appoint anybody or any

trustee company as an executor. On the other hand, ARB did not give

their clients any option in the matter, requiring them to appoint ARB

itself as the executor.

A practical piece of advice from one interviewee was very

helpful with regard to the selection and appointment of the trustee.

He said that clients should also consider naming two trustees in their

wasiyyah. This was because by appointing a single trustee, heirs

would have no other option than to wait for the estate distribution

process to be sorted out, whether the process was fast or slow.

We went through the document of appointment of an executor

prepared by this corresponding interviewee and made a comparison

with the wasiyyah document by ARB. The latter stated that the

client agreed to appoint ARB as the executor. On the other hand,

the document of appointment of an executor by this corresponding

interviewee was different because the client had freedom to appoint

anybody as the executor. This portrayed that each wasiyyah writing

provider had a different policy regarding the wasiyyah document

and the appointment of the executor. This interviewee believed that

the clients should consider several factors which relate to the estate

distribution process upon their death before finalizing their selection

of the wasiyyah writing provider. These included costs that the

clients’ heirs had to bear and the process that they would go through.

In this respect, it was noted that cost of writing a wasiyyah varied

across the wasiyyah writing providers, starting from as low as RM 200.

Wasiyyah Shoppe offered this service at no cost, provided that the

clients subscribed to its estate management product, for which an

annual fee applied. Over and above that, other costs such as custody

and safekeeping costs were imposed by certain wasiyyah writing

Suhaili Alma’amun

107

ISRA International Journal of Islamic Finance • Vol. 5 • Issue 1 • 2013

providers. Wasiyyah writing providers which were appointed as

trustees would carry out the estate distribution process upon the death

of the clients. The cost paid for such purpose was generally between

1% and 2% of the total value of the estate. Again, Wasiyyah Shoppe

was the exception; its clients’ heirs did not have to pay for the estate

distribution process because the clients themselves had subscribed to

the estate management product during their lifetime.

As far as wasiyyah writing is concerned, the difference between

an expensive and a lower cost service rests on the exclusiveness of the

wasiyyah, implying that people pay more for a tailor-made wasiyyah

service and for special consultation. Over and above, it was observed

that there is a sort of trade-off between the price of wasiyyah writing

paid right away with the price of the estate distribution process paid

later, implying that paying more for a written wasiyyah now could

mean paying less for the estate distribution process and vice versa.

Some wasiyyah writing providers are transparent with regard to

the additional costs the clients have to bear such as the cost of the

appointment of the executor and the safekeeping cost. By contrast, a

few of them do not disclose this to their clients unless the clients raise

the issue themselves. Perhaps those who charge their clients slightly

more at the beginning of the process of wasiyyah writing will charge

the clients’ heirs less for the estate distribution process afterwards.

However, this circumstance is not always necessarily the case.

We are also of the opinion that the commission paid to the partner

of the wasiyyah writing provider is also part of the cost, which means

that the clients pay a slightly higher price for a written wasiyyah.

It should be noted that the issue regarding fees was raised by

Shafii (2007: 268-269), who contended that giving some economic

incentives―such as a certain amount of commission―is common

practice for certain financial planners who have entered into contracts

with financial service providers to sell their products. She however

claimed that the economic rewards can affect the professionalism

of the financial planner. Financial planners might tend to sell the

financial products that offer them the highest amount of commission

rather than recommend to their clients the best solution that suits their

financial objectives and position.

Wasiyyah (Islamic Will) Writing Service in Malaysia: An Investigation of the Supply Channel

108

ISRA International Journal of Islamic Finance • Vol. 5 • Issue 1 • 2013

E. Wasiyyah Not a Solution to Estate Problems

One interviewee did not agree that wasiyyah could solve the estate

problems in Malaysia. This is due to the restriction imposed on

wasiyyah in which a testator cannot simply make instructions to

distribute the estate according to his/her wishes in a manner that non-

Muslims are allowed to do. For Muslims, wasiyyah containing any

instructions that violate fara’id rules

7

which have been prescribed

in the Qur’an (4:11-12 and 176) can only be executed upon the

consent of the eligible heirs. Since the freedom of determining the

estate distribution upon the death is limited, hibah is perceived to be

the best solution. In addition, he also did not consider wasiyyah to

represent a document which expedites the estate administration and

settlement process―which should be the main reason of making a

wasiyyah as demanded by the Malaysian legislation. These opinions

were reflected in his response below:

“[…] giving a wrong perception about wasiyyah; making

wasiyyah can solve the estate problems. This is totally

wrong. In reality, in Malaysia that is not necessarily the case.

Because wasiyyah can be proceeded only with the heirs’

consent. If one of them did not agree, then the wasiyyah is

null and void. Estate problems can be solved only through

hibah.”

The fact that some interviewees preferred other products instead

of wasiyyah raises concern about the viability of the wasiyyah

product. From our point of view, the variety of products in addition

to wasiyyah writing is a unique feature of Islamic estate planning

in Malaysia. However, the difference in opinions among wasiyyah

writing providers on the wasiyyah product―such as preference for

hibah instead of wasiyyah―inevitably affects the viability of the

wasiyyah product. This is an important finding as it implies that the

other products are either complementary to wasiyyah or a substitute

for it. When a particular wasiyyah writing provider believes that

wasiyyah is more efficient, then clients are suggested to draw up their

9 Such as making equal distribution of estates or giving a bequest of more than one-

third out of the net estate value.

Suhaili Alma’amun

109

ISRA International Journal of Islamic Finance • Vol. 5 • Issue 1 • 2013

wasiyyah as soon as possible; but if the wasiyyah writing provider

believes hibah is more efficient in solving the estate problem, then it

will promote hibah to its clients.

This finding indicates that wasiyyah has a limited role in

comprehensively solving the estate problems. The planning of an

estate for a particular Muslim in Malaysia requires proper wealth

management and estate planning products and services. It is not

simply about making a wasiyyah. Making a written wasiyyah which

is admitted to probate could be the minimum effort that any Muslim

individual in Malaysia should make with the aim of solving the most

common problem―a frozen estate. If a person wants a complete

solution that goes beyond this, then the estate planning process should

involve other products to manage the different arising problems.

F. Wasiyyah used to Avoid Fara’id

One interviewee pointed out that the concept of fara’id as representing

the pillar of Islamic estate planning seemed to have been given lower

importance in the current approach adopted by wasiyyah writing

providers. In some cases, people have been misinformed by the

wasiyyah writing providers that they could let their heirs know how

they wanted their estates to be distributed in the wasiyyah. This kind

of misinformation led Muslims to assume that they were also able to

make distribution in a similar way as non-Muslims. Therefore, this

practice led people to draw up a wasiyyah not to speed up the estate

distribution process but with the intention of avoiding fara’id. These

responses, based on observations on the current practice among

wasiyyah writing providers, reflect this finding:

“Those who make a wasiyyah must understand fara’id, the

value of fara’id. I do not agree that people have been told by

the wasiyyah writing providers that they can let their heirs

know how they want their estates to be distributed in the

wasiyyah. These wasiyyah writing providers after all do not

explain about fara’id at all unless they are asked.”

Wasiyyah (Islamic Will) Writing Service in Malaysia: An Investigation of the Supply Channel

110

ISRA International Journal of Islamic Finance • Vol. 5 • Issue 1 • 2013

“The problems are people do not make a wasiyyah to speed

up the estate distribution process and make a wasiyyah with

the wrong assumption that we can make distribution just

like other non-Muslim people do if all heirs agreed. For me,

fara’id is the pillar of the Islamic estate planning.”

This finding establishes that wasiyyah cannot be used to avoid fara’id

and thus deny the rights of the heirs. This finding in turn raises two

key points: (i) to what extent other means of estate distribution can

be used to avoid fara’id; and (ii) whether it is ethical to use them for

such purpose. This is not an issue if the wasiyyah is used to express

the testator’s intention of equal estate distribution. However, the

main problem with Malaysian Muslims’ culture is that they believe

such wasiyyah is mandatory and overrides fara’id. This perception

misleads them to another incorrect perception―that a wasiyyah

can be used to avoid fara’id. It should, however, be noted that the

enforcement of such wasiyyah is subject to the heirs’ consent.

V. CONCLUSION AND RECOMMENDATIONS

Recently, researchers have shown particular interest in exploring

and analysing a new area of Islamic finance, namely Islamic

estate planning. This study endeavours to delve into the extensive

investigation on wasiyyah―a subset of Islamic estate planning―with

the aim of obtaining information regarding the wasiyyah products

from the supply channel. It was found that there has been positive

evolution in the Islamic estate planning service in Malaysia such that

the Muslim society is offered a wide range of products at various

costs for individuals to choose from.

It is a fact that a conducive environment is necessary for the

steady growth of the industry, to increase competition and to spur

product innovations. First and foremost, what the industry requires

is appropriate statutory regulation of the wasiyyah writing providers.

There is a need to differentiate the wasiyyah writing providers from

Islamic estate planners. A standard qualification has been set up by

the authorized bodies such as Financial Planning Association of

Malaysia (FPAM) for individuals who want to operate as certified

Suhaili Alma’amun

111

ISRA International Journal of Islamic Finance • Vol. 5 • Issue 1 • 2013

Islamic estate planners. However, the same standard procedures are

absent in the case of wasiyyah writing providers. Currently, ARB,

As-Solihin Trustee Berhad dan Wasiyyah Shoppe are running a series

of short-courses independently for their wasiyyah writing providers.

Therefore, it is recommended that the government and the industry

reach a consensus on standardizing the qualification requirement.

It is observed that the multiple definitions of wasiyyah among

wasiyyah writing providers shape the variation of the wasiyyah

products in Malaysia. Such arguments have sparked controversies

in the industry, and as a result, many alternative terms have been

suggested for ‘wills’ for Muslims; for example, ‘Islamic wills’,

‘wisoyah’ and ‘Document of the Appointment of Executor’, alongside

wasiyyah. However, our stand is that wasiyyah should be viewed as a

‘will’ in which the appointment of an executor is the most important

content if the goal of the estate planning is to expedite the estate

claims.

We are also concerned with the issue of cost transparency and are

of the opinion that wasiyyah writing providers should provide their

clients with the detailed costs involved, starting from the wasiyyah

writing process, custody and safekeeping fees and other additional

charges imposed upon the death of the testator. Consumers are

increasingly turning to the multiple sources available in the market

other than solicitors to make their wasiyyah. With many wasiyyah

writing providers to choose from, this study suggests a proactive

solution of appointing a single registry for wasiyyah. It is deemed that

ARB can act as this registry considering its vast experience in the field.

It should be noted that this will assist in providing standardization

and enhancing people’s perception of the wasiyyah writing service.

It is possible that there would be a conflict of interest among

wasiyyah writing providers as they compete in attracting clients. Mere

profit seeking would inevitably worsen this conflict of interest among

the wasiyyah writing providers, affect their social responsibility and

jeopardize the quality of the service offered. Indeed, profit seeking

among corporate agents without placing adequate emphasis on the

education of clients is not a conducive environment for the industry

to prosper. Delivering knowledge and increasing awareness should

be set as a priority for wasiyyah writing providers in order to promote

a positive attitude towards wasiyyah. To ensure better quality control,

Wasiyyah (Islamic Will) Writing Service in Malaysia: An Investigation of the Supply Channel

112

ISRA International Journal of Islamic Finance • Vol. 5 • Issue 1 • 2013

it may be proposed that the partnership license of a wasiyyah writing

provider be terminated if the quality of service is relatively poor.

Wasiyyah writing providers play a pivotal role in educating their

clients on the nature of and reasons for wasiyyah writing. As such,

the provision of invalid information that encourages clients to make

a wasiyyah in order to avoid fara’id is a key concern of the industry.

This can negatively affect the quality of the service. It is therefore

important that the wasiyyah writing providers provide accurate

information to the public on the Islamic estate planning process and

explain the concept and significance of wasiyyah to clients before

the latter decide to draw up a wasiyyah. Therefore, even though the

wasiyyah writing service has grown rapidly recently in Malaysia,

there are still many issues that need to be addressed in the future, and

educating the public should be considered one of the priorities of the

industry.

Suhaili Alma’amun

113

ISRA International Journal of Islamic Finance • Vol. 5 • Issue 1 • 2013

References

Abdullah, M. A. (2005). The Concept of Tarikah in the Islamic Law of Succession

with Special Reference to the Practices of the Civil Courts and the Syariah

Courts in Malaysia. Unpublished PhD Thesis, Durham University.

Abdul Rahman, M. F. (2007). Bagaimana Mengurus Harta Pusaka. Kuala Lumpur:

Professional Publishing Sdn. Bhd.

Administration of Islamic Law (Federal Territories) Act 1993 (Act 505) & Rules

(2006). Selangor: International Law Book Services.

Ahmad, M. Y. and Laluddin, H. (2010). Pengurusan Harta Pusaka: Permasalahan

Sikap Masyarakat Islam di Malaysia dan Penyelesaiannya Menurut Perspektif

Islam. Shariah Law Reports. Vol 4, pp. 30–54.

Alma’amun, S. (2010). Islamic Estate Planning: Malaysian Experience. Kyoto

Bulletin of Islamic Area Studies. Vol. 3, No. 2, pp. 165-185.

Amanah Raya Berhad (2006). Estate Administration: Procedure of Amanah Raya

Berhad. New Straits Times. pp. 41.

Amanah Raya Berhad (n.d.). Individual Clients. Available at http://www.arb.com.

my/foryou.html#3. Accessed on 28 November 2008.

Bakar, H. (2006). Pengalaman Amanah Raya Berhad (ARB) dalam Pentadbiran

Harta Amanah Orang Islam. In Mahamood, S. M. (Ed.). Harta Amanah Orang

Islam di Malaysia Perspektif Undang-Undang dan Pentadbiran. pp. 133-147.

Kuala Lumpur: University Malaya.

Bryman, A. (2008). Social Research Methods. Third Edition. Oxford: Oxford

University Press.

Buang, A. H. (2008). Appreciation of Syariah Principles in Property Management in

Contemporary Malaysia Society. Jurnal Syariah. Vol. 16, pp. 555–566.

Coulson, N. J. (1971). Succession in the Muslim Family. London: Cambridge

University Press.

Finch, J. and Mason, J. (2000). Kinship and Inheritance in England. London:

Routledge.

Harun, M. F. (1994). Masalah Wasiat dan Fara’id. Second Edition. Johor, Malaysia:

Universiti Teknologi Malaysia.

Hassan, A. A. (2005, February). Islamic Will Explained. Personal Money. pp. 79-80.

Hassan, A. A. (2008, November). Penulisan Wasiat: Bolehkah Ia Menghindarkan

Harta Pusaka Menjadi Harta Puaka. Majalah Kefahaman Islam VISI. pp. 25-33.

Hassan, A. A. and Yusop, Y. (2006). Perancangan Harta di ZAR Perunding Pusaka

Sdn. Bhd.. In Mahamood, S. M. (Ed.). Harta Amanah Orang Islam di Malaysia

Perspektif Undang-Undang dan Pentadbiran. pp. 149-170. Kuala Lumpur:

Universiti Malaya.

Marican, P. (2008). Islamic Inheritance Laws in Malaysia. Second Edition. Kuala

Lumpur: Malayan Law Journal Sdn. Bhd.

Muhamad, A. (2007). Ke Arah Penyelesaian Harta Pusaka Kecil Yang Lebih

Bersepadu, Cekap dan Cemerlang. In Konvensyen Perwarisan Harta Islam. pp.

62-85. Kuala Lumpur: Amanah Raya Berhad.

Mujani, W. K., Abdul Rashid, R., Wan Hussain, W. M. H. and Yaakub, N. I. (2012).

Gift Inter Vivos For Charged Property. The Social Sciences. Vol. 7, No. 2,

pp.196–199.

Omar, R. (2006). The Role of ARB in Estate Planning. Paper presented at the Seminar

on Wealth Management Re-Engineering Tomorrow’s Challenges. Organised by

the Faculty of Finance and Banking, Universiti Utara Malaysia (UUM) on 28-

29 June 2006, Paradise Sandy Beach Resort, Penang.

Wasiyyah (Islamic Will) Writing Service in Malaysia: An Investigation of the Supply Channel

114

ISRA International Journal of Islamic Finance • Vol. 5 • Issue 1 • 2013

Omar, R. (2009). Wasiat: Tool For Islamic Estate Planning as Practiced at Amanah

Raya Berhad. Paper presented at the IFWMI Intellectual Discussion on Islamic

Finance and Wealth Management. Organised by the Islamic Finance and Wealth

Management Institute (IFWMI), Universiti Sains Islam Malaysia (USIM) on 27

May 2009, USIM, Negeri Sembilan.

Omar, R. (2012). Wasiat: Tool For Islamic Estate Planning as Practiced at Amanah

Raya Berhad. Paper presented at the Seminar of the Islamic Estate Planning

IFWMI. Organised by the UCSI University on 16 February 2012, UCSI, Kuala

Lumpur.

Public Trust Corporation Act 1995 (Act 532) (2008). Selangor: International Law

Book Services.

Sabirin, A. (2009). Hibah: Cara Paling Berkesan Bahagikan Harta. Usahawan

Sukses. pp. 60-61.

Sekaran, U. (2003). Research Methods For Business: A Skill Building Approach.

Fourth Edition. United States: John Wiley & Sons.

Shafii, Z. (2007). The Life-cycle Hypothesis, Financial Planning and the Household

Demand for Financial Assets: An Analysis of the Malaysian Experience.

Unpublished PhD Thesis, Durham University.

Shahrul Anuar, S. (2012). Harta pusaka tak diwasiat RM45 bilion. Available at http://

www.bharian.com.my/bharian/articles/HartapusakatakdiwasiatRM45bilion/

Article/index_html. Accessed on 13 November 2012.

Small Estates (Distribution) Act 1955 (Act 98), Regulations & Order (2011).

Selangor: International Law Book Services.

Tanzil-ur-Rahman (1980). A Code of Muslim Personal Law. Volume 2. Pakistan:

Islamic Publishers.

Yaacob, O. (2006). Pembentukan Trust Hibah Sebagai Alternatif Perancangan Harta.

In S. M. Mahamood (Ed.), Harta Amanah Orang Islam di Malaysia Perspektif

Undang-Undang dan Pentadbiran. pp. 171-207. Kuala Lumpur: Universiti

Malaya.